Up Bank Review: Is It The Best International Travel Card?

Are you tired of being hit with unexpected bank fees every time you travel or make an online purchase from abroad? You’re not alone. These seemingly minor fees can quickly add up, putting a strain on your budget and leaving you feeling frustrated. Enter Up Bank – a shining example of the innovative new wave of financial institutions known as neobanks.

Neobanks are digital-only platforms that leverage cutting-edge technology to provide enhanced convenience and savings for their customers. Let’s take a closer look at how Up Bank has disrupted the traditional banking model, particularly when it comes to international fees.

Up Bank: Your Key to Fee-Free Travel

Up Bank is revolutionizing the way people manage their finances while traveling the globe. When it comes to international fees and overseas ATM charges, Up Bank stands out as the smart choice for savvy travelers.

Up Bank’s International Fee Structure

Traditional banks often impose a myriad of fees when you use your card abroad or make online purchases in foreign currencies, siphoning off a percentage of your money with each transaction. This means every swipe or ATM withdrawal overseas can come with an unpleasant surprise fee.

While conventional banks may slap on fees up to 3% of the transaction value for international card usage, you might also encounter hefty $5 charges for each overseas ATM withdrawal, coupled with the 3% transaction fee. Additionally, overseas ATM operators may tack on their own fees. So, a $100 cash withdrawal could end up costing you over $10 in fees alone.

But with Up Bank, it’s a different story – zero international fees . Yes, you read that right – zero fees with Up Bank. It may sound too good to be true, but it’s not. Up Bank makes it easy to save money on your next trip or online shopping spree.

Up Bank’s Approach to International Transactions

Unlike traditional banks that typically add around 3% to the transaction value, Up Bank has abolished overseas transaction fees altogether. No hidden fees, no unexpected markups on exchange rates. With Up Bank, you receive the Mastercard® exchange rate without any additional charges. So, you’re always getting a fair deal on your purchases.

Overseas ATM Withdrawals with Up Bank

When it comes to accessing cash abroad, Up Bank continues to shine. They won’t charge you any ATM fees, regardless of how many times you withdraw money. However, please note that overseas ATM operators may impose their own fees, which are beyond Up Bank’s control.

Opening an Account with Up Bank

Getting started with Up Bank is quick and simple. Just visit their website and click “Join Up!” Their services are not only user-friendly but their website design is sleek and intuitive as well. Sign up using the link below and receive a $9 bonus.

Impressive Features for Discerning Travelers

Up Bank offers a suite of features to help you stay on top of your spending. Their convenient app puts you in control, regardless of the currency you’re using. Up displays your transactions in both Australian dollars and the foreign currency, making it easier to track your expenses while traveling abroad.

Streamlined International Money Transfers

If you need to transfer money abroad, Up Bank has you covered. They are the first Australian bank to partner with Wise, making international money transfers a breeze.

Tips to Avoid Overseas Fees

In addition to choosing Up Bank for your travel needs, here are a few extra tips to help you avoid those pesky overseas fees:

Convert Currency Before Traveling : The simplest way to avoid fees on every transaction is to bring cash in the local currency of your destination. You can convert your Australian dollars to the foreign currency easily online or in-store. Online money exchange services like S Money are often cost-effective and don’t have hidden fees.

Consider Travel Cards: Several travel-specific cards waive international transaction fees, offer competitive currency conversion rates, and provide free ATM withdrawals. Examples include the Wise Travel Card, Revolut, and Travelex Money Card.

With Up Bank, you have an excellent option for spending abroad and online, all while benefiting from their user-friendly app and, most importantly, zero international fees. Now that you’re aware of Up Bank’s fee-free travel perks, it’s time to start planning your next adventure!

When it comes to making the best financial choices for your travel plans, Up Bank might just be your ticket to significant savings.

Share this:

Backpacking is Life

Leave a Reply Cancel reply

Discover more from backpacking guides | travel guides, tips & itineraries | backpacking is life.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

.png)

- Oct 13, 2023

Wise vs Revolut vs Up: Which Is Best For Travel?

Updated: Jan 27

Finding the best international travel card can make a huge difference to your travel budget. It's important to ensure you aren't getting stung with transaction fees and ATM withdrawal fees. Luckily, the rise of neobanks has transformed the way Australians manage their money when travelling overseas. In this article, we'll compare three leading options – Up Bank, Revolut, and Wise – to help you make an informed decision for your next international adventure.

Up Bank: Ultimate Fee-Free

Up Bank has quickly become a favourite among Australian travelers, thanks to its commitment to fee-free transactions and zero ATM withdrawal charges. Bid farewell to unpleasant surprises on your bank statement as Up Bank's user-friendly app and intuitive interface make managing your finances a seamless experience. What sets Up apart is its transparent banking approach, allowing you to view transactions in both Australian dollars and the local currency, simplifying budgeting while abroad. For those seeking a fee-free journey, Up Bank proves to be an invaluable companion.

One of the notable advantages of Up Bank is its dedication to providing a transparent and user-friendly platform. The absence of transaction fees and ATM withdrawal charges means that you can truly enjoy fee-free international spending. The user-friendly app and intuitive interface enhance your overall travel experience, making it easier to manage your money on the go. Moreover, the ability to view transactions in both Australian dollars and the local currency provides a level of transparency that is often lacking in traditional banking.

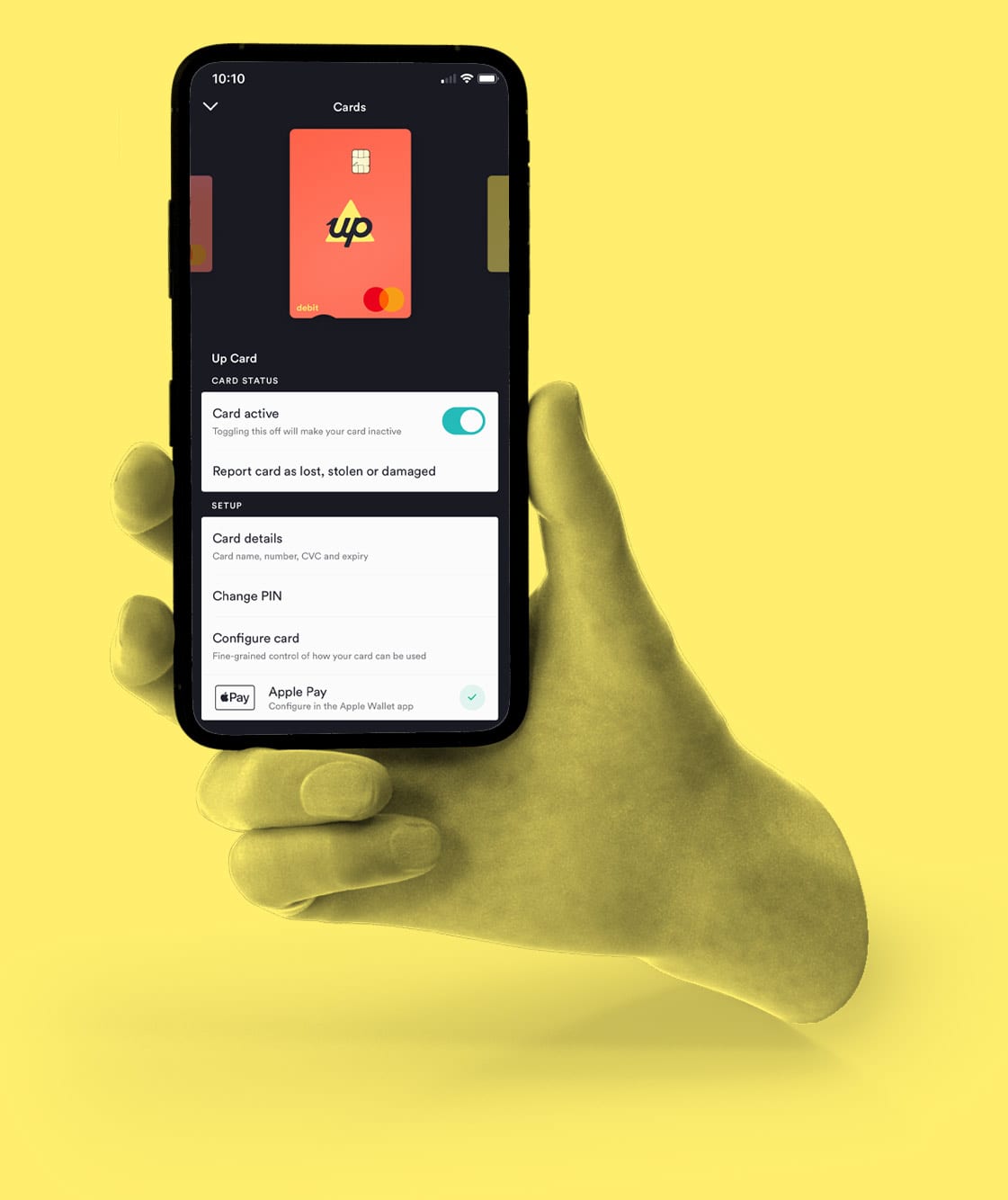

Up Bank stands out as a reliable companion for budget-conscious travelers, offering not only a fee-free experience but also a range of features that make international spending hassle-free. The convenience of managing your money with Up Bank extends to seamless integration with Google/Apple Pay, ensuring you can make secure and convenient transactions wherever you are in the world.

International Transaction Fees: 0%

ATM Withdrawal Fees: Free at most major Bank ATMs

Account Monthly Fee: $0

Physical Card Fee: $0

Google/Apple Pay: Yes

Exchange Rate: Mid-Market

Revolut: The All-in-One Solution

Revolut offers a comprehensive suite of features tailored for global travelers. Beyond fee-free international spending, Revolut provides competitive currency conversion rates, allowing you to hold multiple currencies in a single account. The ability to switch between currencies at real exchange rates translates to substantial savings on conversions. Moreover, Revolut's app features spending analytics and budgeting tools, granting you enhanced control over your financial activities. If you desire a one-stop solution with advanced financial tools, Revolut might be the perfect fit for your international adventures.

Revolut stands out as an all-encompassing solution for the modern traveler. The neobank's commitment to fee-free international spending is complemented by its advantageous currency conversion rates. Holding multiple currencies in a single account provides flexibility, especially for those traveling to destinations with varying currencies.

One of the key features that set Revolut apart is its real exchange rates, ensuring that you get the most value out of your money during currency conversions. The app's spending analytics and budgeting tools further empower you to take control of your finances while on the move. Whether you're a frequent traveler or embarking on a once-in-a-lifetime journey, Revolut's comprehensive features make it a worthy companion.

International Transaction Fees: Free up to $9,000, then 2%

ATM Withdrawal Fees: Free up to $350 per month, then 2% of the transaction amount

Wise (formerly TransferWise): The Pioneer in International Transfers

Renowned for its international money transfer services, Wise facilitates seamless cross-border transactions with minimal fees. While Wise does not offer a conventional bank account, its borderless account feature empowers you to hold multiple currencies and spend abroad using a Wise debit card. The real magic lies in Wise's mid-market exchange rates, ensuring you receive the true currency value without hidden markups. This makes Wise an excellent choice for Australians requiring regular overseas fund transfers.

Wise, formerly known as TransferWise, has earned its reputation as a pioneer in international money transfers. While it doesn't provide a traditional bank account, its borderless account feature opens up a world of possibilities for those needing to manage finances across borders. The ability to hold multiple currencies in one account simplifies transactions during international travels, and the accompanying Wise debit card enhances your spending flexibility.

One of Wise's standout features is its commitment to mid-market exchange rates. Unlike traditional banks that often apply hidden markups, Wise ensures that you get the real value of the currency during transfers. This transparency is particularly beneficial for individuals and businesses involved in frequent international transactions.

International Transaction Fees: From 0.43%

ATM Withdrawal Fees: Free up to $350 per month, then 1.75% of the transaction amount

Physical Card Fee: $10

Comparison at a Glance

Conclusion: choosing the right companion for your journey.

Selecting the ideal neobank for your overseas travels hinges on your specific needs. If fee-free spending and transparent transactions are paramount, Up Bank emerges as the clear winner. For those seeking a comprehensive solution with multiple currencies and advanced financial tools, Revolut stands out. Meanwhile, Wise remains the pioneer in affordable and seamless international transfers.

Whichever neobank you choose, bid farewell to unexpected fees and embrace a world of fee-free, hassle-free banking. Safe travels and happy spending!

Recent Posts

Budget-Friendly Living: Mastering the Art with Comprehensive Money-Saving Hacks for Australians

Budget-Friendly Living: Mastering the Art with Comprehensive Money-Saving Hacks for Australians In the dynamic landscape of Australian living, where the cost of necessities seems to constantly rise, m

Cracking the Credit Score Code: A Comprehensive Guide to Understanding and Improving Your Credit in Australia

In the financial landscape of Australia, your credit score is a critical factor that can significantly impact various aspects of your life, from obtaining loans to securing favourable interest rates.

Global Guide to Skrill Referral Bonuses

- Australia Tourism

- Australia Accommodation

- Australia Bed and Breakfast

- Australia Holiday Rentals

- Australia Flights

- Australia Restaurants

- Australia Attractions

- Australia Travel Forum

- Australia Photos

- All Australia Hotels

- Australia Hotel Deals

- Last Minute Hotels in Australia

- Things to Do

- Restaurants

- Holiday Rentals

- Travel Stories

- Rental Cars

- Add a Place

- Travel Forum

- Travellers' Choice

- Help Centre

Best Travel card for Europe? - UBank/ Up / Revolout / Wise - Australia Forum

- South Pacific

- Australia

Best Travel card for Europe? - UBank/ Up / Revolout / Wise

- Australia Forums

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Holiday Rentals

- South Pacific forums

- Australia forum

Travelling Europe (pound/euro) for two months in a few months and wondering what travel card is best to use for transactions/atms ect? haven't travelled internationally since 2018 and noticed theres quite a few new companies to the market. (I bank with ANZ and I dont believe they have any travel card options)

are the travel cards from UBank/ Up / Revolout / Wise the best to go with regarding reliability/fees and app features? or are there any other companies I should look into?

4 replies to this topic

Look at the CitiBank plus debit master card and the Latitude 28 visa. I used both on our last trip to Europe in 2018 I have found them very good, plus the ING card seems to get favorable comments on the forum for overseas travel.

If you got your list from S money website, it looks to me like they get a kickback for recommending the cards that they do.

Even Canstar looks a bit dodgy in their recommendations, giving recommendations of Bank cards that charge yearly fees for credit cards.

Do your own comparisons, but include HSBC, Citibank, Latitude 28 and ING in your research.

One caveat with the ING card is that they need to know that you are OS and travelling otherwise you may be blocked when using it.

Here’s the link to your previous post asking the same question

https://www.tripadvisor.com.au/ShowTopic-g255055-i120-k14254519-Best_travel_card_to_use_in_Europe-Australia.html#116339875

Did you not like any of the previous answers given??

Asking the same question again doesn't appear to have dredged up anyone who agrees with your options, or anything new.

- ULURU excursions 00:45

- Best tour or activity Uluru 00:43

- Sydney cruise final stop 23:17

- Stopover for 8hrs 22:59

- Where to stay for two nights 22:34

- Campervan Park Details for overnight in Perth 21:35

- Apartment Finger Wharf, Woolloomooloo 19:28

- Car rental after midnight arrival 18:18

- Debit card for travel 16:56

- Recommendations on a hidden gem /Resturant 16:19

- Need help on travel order 15:43

- GBR for non swimmers 15:23

- Sydney steakhouse / restaurants 13:23

- Visiting from New Zealand yesterday

- Accor advantage plus bad experience 76 replies

- 28 Degrees Mastercard 364 replies

- Virgin Australia Mystery Breaks? 132 replies

- Best places to stop on road trip between Adelaide and Perth? 16 replies

- Travel Insurance 33 replies

- 28 Degrees credit card - cash advance ATM fees for Europe 101 replies

- Travelex CashPassport - BEWARE Exchange Rates When Loading 81 replies

- Duty free cigarettes Melbourne airport 6 replies

- OzForex Travel Card Review - BEWARE Rip Off Rates 124 replies

- Best Place to Visit the Great Barrier Reef 11 replies

Australia Hotels and Places to Stay

- Big Things of Australia - by 1TraveltheWorld

- Iconic Pubs and Roadhouses of Australia - by 1TraveltheWorld

- Across the Nullarbor - Ceduna to Norseman By 1TraveltheWorld

- How Big is Australia?

- FAQ - Top Ten Must Sees

- FAQ - BUDGET Travel Tips

- FAQ - DRIVING in Australia

- FAQ - Vehicle RENTAL Tips

- FAQ - Booking hotel ACCOMMODATION

- FAQ - TIPPING in Australia

- Trip Reports - NT

- Trip Reports - QLD

The Best Travel Debit Cards for Australians In 2024

Tom Goward | 27/03/2024

TLDR ; our experts rated Up ($15 free bonus), Ubank ($10 free on with code C7N1TAZ ) & Revolut (Free $15 exclusive Flight Hacks bonus) as the best travel debit cards for 2024.

No matter where you’re going or for how long, making use of a good travel debit card is one of the easiest ways to save money overseas. The problem is that amidst the excitement, the importance of selecting the best travel debit card often slips the minds of many Australians until the eleventh hour. Most novice travellers fail to realise their mistake until arriving home with an overstuffed suitcase and card fees that could’ve been easily avoided.

The harsh reality is that banks and airport currency exchange services will often rip you off, despite their claims of ‘zero fees’ or ‘0% commission’. Think about it, how can an exchange booth afford the insane airport rent if they don’t make a cent from running their business?!

The good news is that Australians have a few brilliant options when it comes time to select a travel money card. While the array of choices can be overwhelming, with a little research and planning, you can save a considerable sum just by using the right card!

WATCH: our video comparing 11 of the most popular travel cards in Australia!

In this post:

What About Prepaid Travel-Branded Cards?

Foreign exchange rates: visa vs mastercard, making a €500 card purchase, withdrawing €500 from an atm, up debit card, ubank debit card, revolut australia, macquarie transaction account, hsbc everyday global account, wise multi-currency account, honourable mentions – best travel debit card, qantas travel money, commbank travel money, travelex money card, nab visa debit, anz plus transaction account, westpac travel money, ing orange everyday, summing up: our expert tips, travel debit cards faqs, global spending: travel debit card 101.

Many amateur travellers will use their day-to-day debit card overseas, simply because it’s easy to use a card that already has your money loaded and ready to go. But before tapping away, it’s important to understand the fees you’ll be in for.

When making international purchases, there are three main fees you should understand;

- International Transaction Rate: Charged when you make a purchase with an overseas merchant, often as a percentage of the total transaction. In Australia, many banks charge a foreign transaction fee of 3% or higher.

- Overseas ATM Withdrawal Fee: Charged for the privilege of withdrawing your own money at an overseas ATM, typically a fixed dollar amount per withdrawal. Sometimes the ATM operator will charge an additional fee for using their ATM. How fun!

- Foreign Exchange Markup: This is where banks are especially sneaky. While you might think you’re getting the real exchange rate, like you’d see searching Google or XE, banks will make up their own rate which includes a hidden fee on top. Of course, you will only be shown the ‘final price’ to hide the fee applied to the real rate.

If you’ve been looking for the perfect card to use overseas, you would have seen big banks and loyalty schemes offering travel money cards. But just because your day-to-day bank offers a dedicated travel card, it doesn’t mean you should get one. In fact, if a card has the word “travel” as part of its name, RUN AWAY while you still can. That is, unless you like being shafted by some of the richest companies in Australia.

Prepaid options like the Commbank Travel Money Card and Qantas Travel Money Card typically offer a portal where you can preload a foreign currency, before arriving at your destination. While it might sound logical to have your money in the correct currency before payment, the fees involved can be astronomical. Despite the promise of “fee-free load options”, there’s almost always a huge foreign exchange markup when you send Australian Dollars to a prepaid card.

The other downside is that you’re forced to lock-in the exchange rate when loading Australian Dollars. While this is marketed as a perk, it’s also a potential disaster if the exchange rate moves against you, after you’ve transferred your entire spending money across. So, unless you have a crystal ball that predicts when the exchange rate is best, I wouldn’t see it as a benefit myself.

Although Visa and Mastercard don’t offer cards themselves, they do have a say in determining the foreign exchange rate you’ll get. While prepaid cards devise their own inflated rates, the best cards, which we will share below, utilise the Visa or Mastercard exchange rate without applying a markup. The difference between the two is almost non-existent, so there is no point in selecting your card based on the payment network.

The table below shows how much Visa and Mastercard offered for 1 AUD as of 27th March 2024. As you can see, the rates are identical, except for JPY where the difference is minuscule anyway.

How Much Can I Save By Using A Good Card?

How much you can save will depend on the fees associated with your day-to-day card, how much you spend and where you spend it. Let’s compare transactions if you were to use the Commbank Travel Money, Qantas Travel Money or Up Debit cards.

The Commbank Travel Money card charges a flat 3% fee for currency conversion on purchases and withdrawals. Qantas Travel Money claims to have “no fee” for purchases in their marketing material, but their foreign exchange rate adds an insane markup.

As an example, say you paid your 500 Euro hotel bill using one of these cards. Based on our testing (on 27th March 2024), Commbank would charge a $24.92 fee, while Qantas slaps a disgusting $47.13 or 5.67% markup on top of the real exchange rate. Remember – the Qantas card has access to Mastercard’s foreign exchange rates, and if they so pleased, could offer the same true fee-free rate as Up’s Mastercard option.

The Commbank Travel Money card charges $3.5 for ATM withdrawals, charged in the currency from which you’re making the withdrawal. Qantas charges a different rate depending on which currency you’re withdrawing, but for Euros, it’s €1.5. Of course, Up doesn’t charge a fee.

As an example, say you need to withdraw 500 Euros from an ATM. The conversion fees are the same as above, but you’d need to pay an additional fee for using the ATM. Keep in mind that the ATM you use could charge its own fee, but this will apply to most cards so it’s the same across the board.

Our Picks: Best Travel Debit Cards In 2024

Now that you understand how critical it is to utilise a good debit card overseas, it’s time to explore the best options for Australian travellers. Not all banks provide the same features, so be sure to shop around and find a good fit for you. We’d also recommend packing at least one backup card in the event your main card becomes lost or stolen.

- Payment Network: Mastercard

- International Transaction Rate: 0%

- Overseas ATM Fee: $0

- Account Fee: $0

Sign-Up Bonus: $15 – For a limited time, you can receive a $10 welcome bonus for becoming an Upsider! Join using our Up Bank invite code to score $15 after joining.

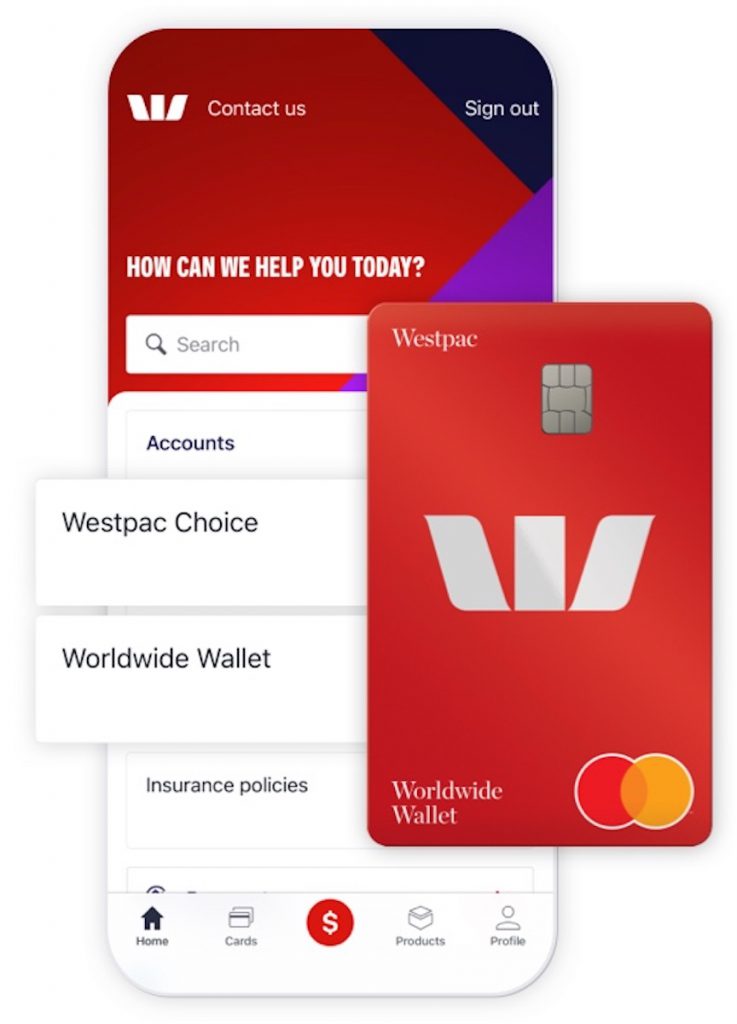

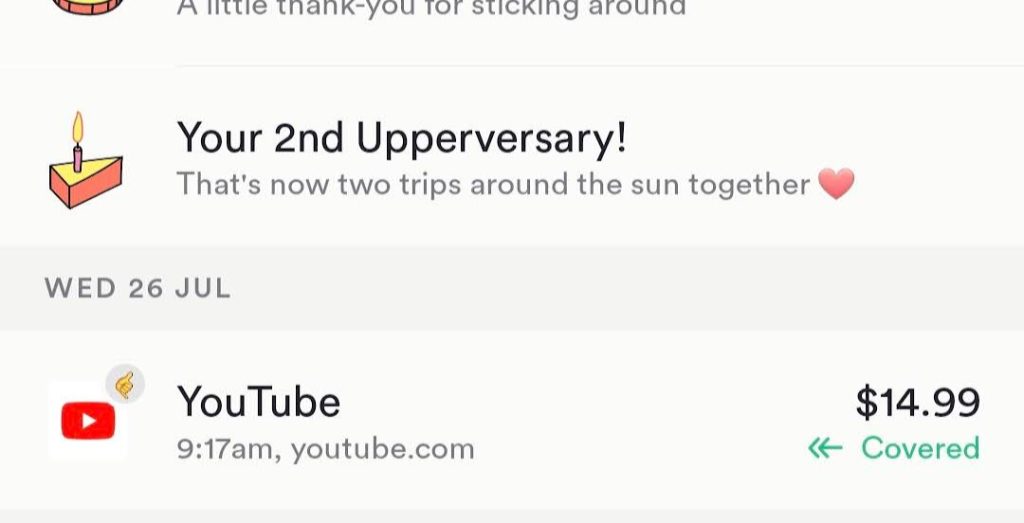

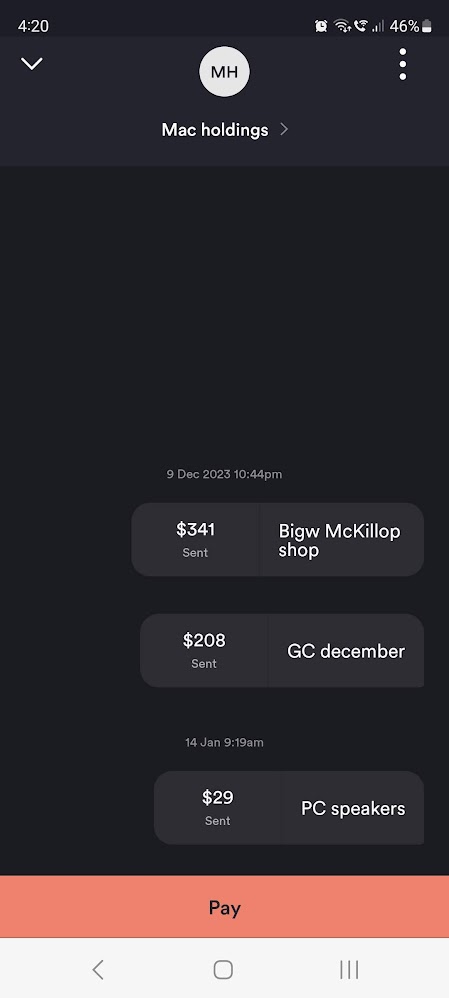

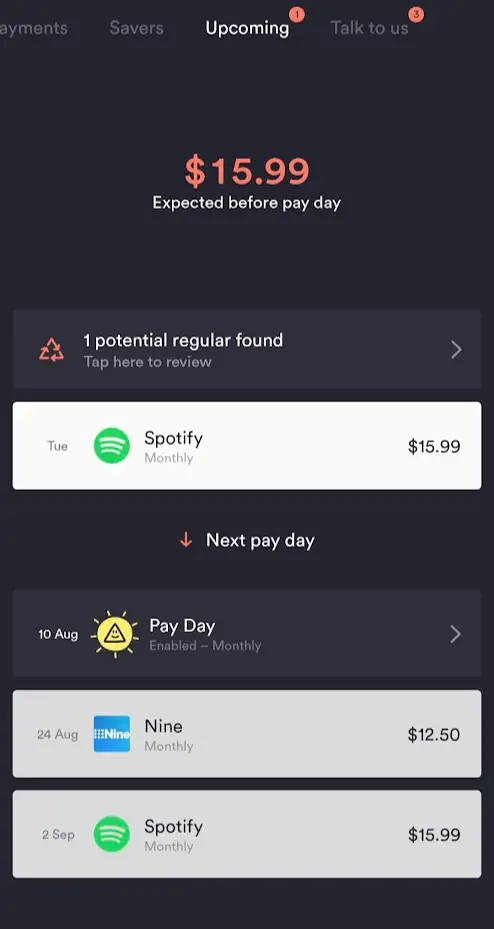

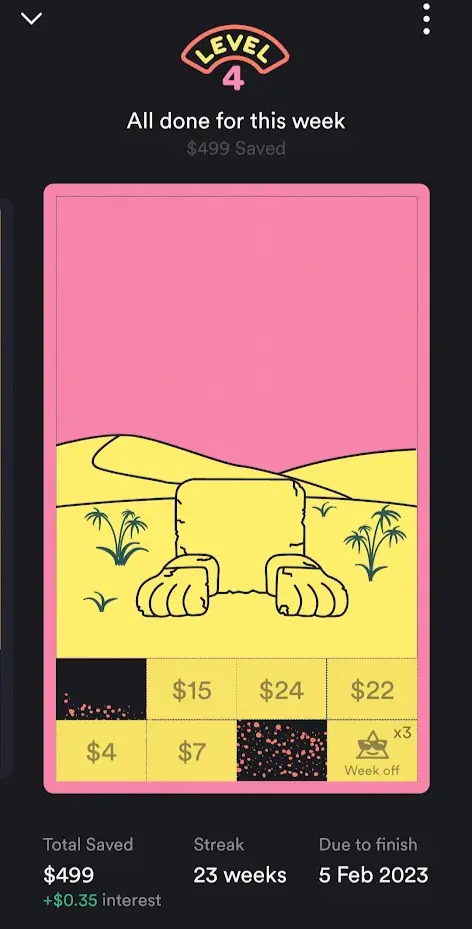

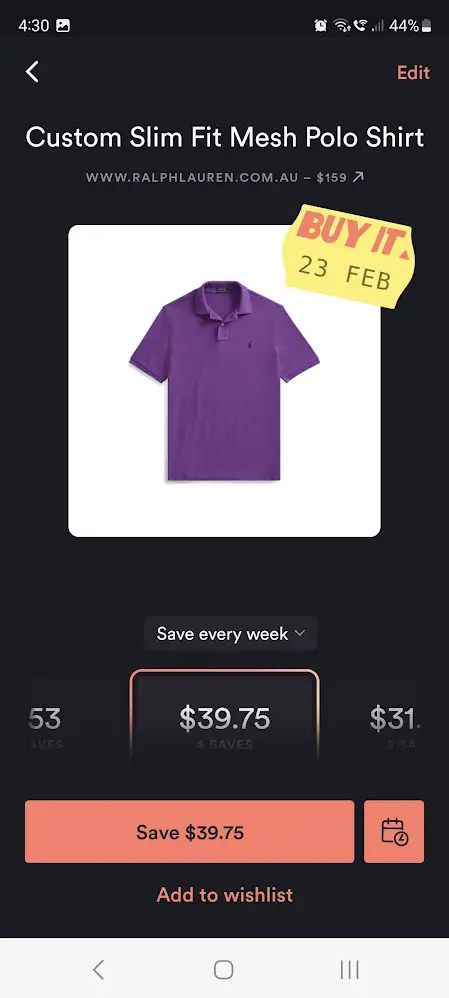

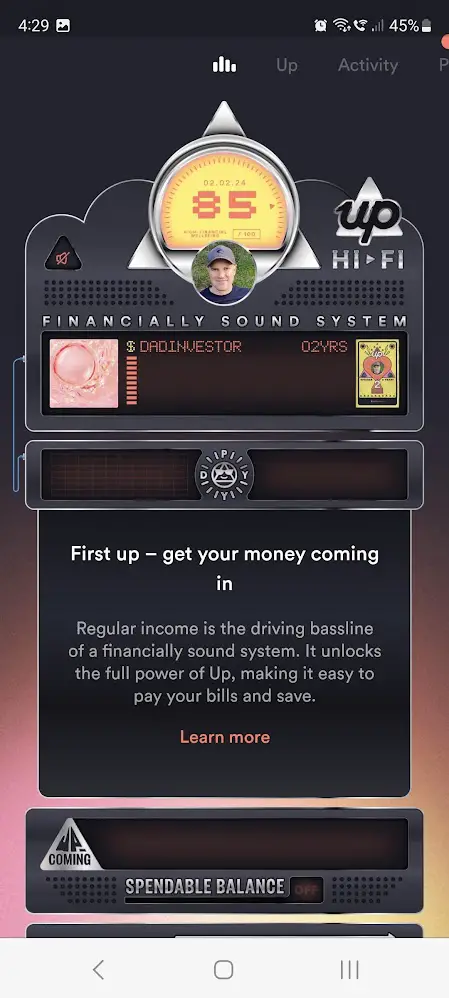

Up is a digital bank (owned by Bendigo & Adelaide Bank) that proves it’s possible to love your bank. Setup is a breeze, and of course, Up charges absolutely nothing when you use an Up Debit card overseas. As a neobank, Up doesn’t have any physical branches, with everything easily handled from within the best banking app I’ve ever used. It’s super clean by design and packed full of useful features like payment splitting, the ability to detect recurring charges, easy payments to friends by name and detailed spending insights.

Want the full story? Check out our detailed Up Debit Card Review !

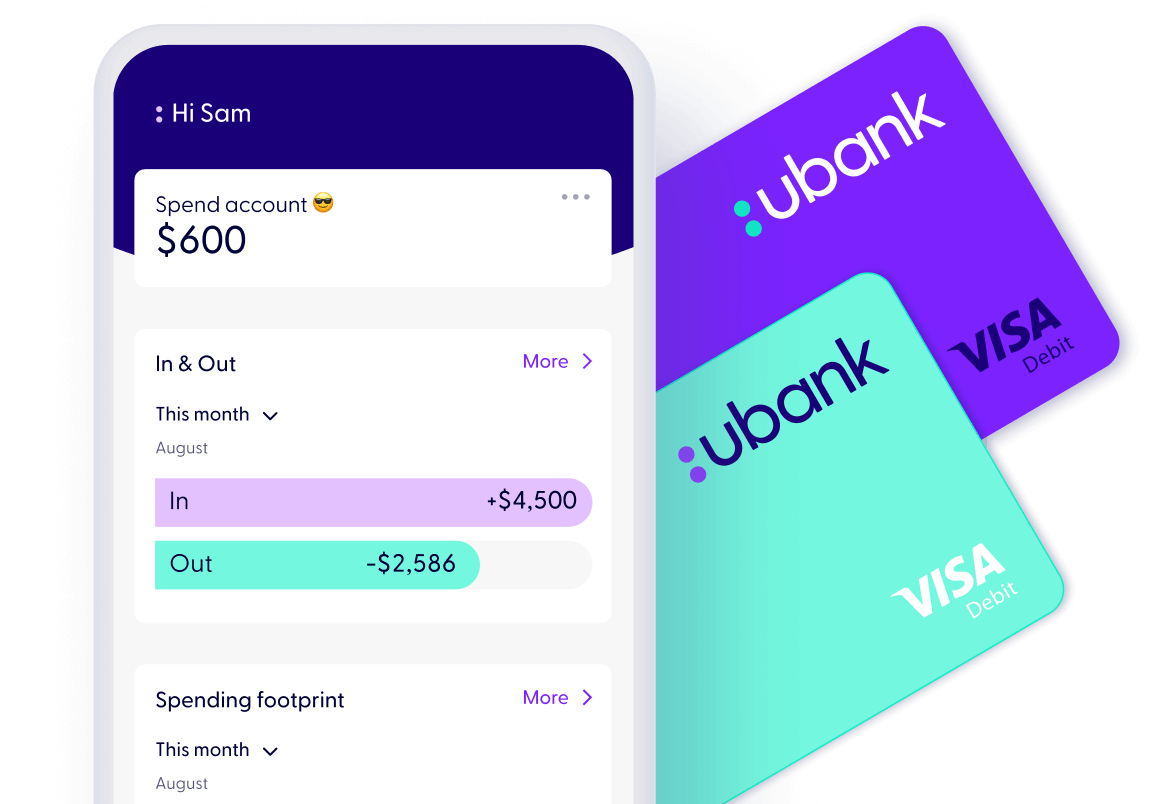

- Payment Network: Visa

Sign-Up Bonus: $10 – For a limited time, you can use our Ubank referral code C7N1TAZ to score $10 in your new Ubank account after making 5 purchases within 30 days of signup.

Ubank is another digital bank with zero fees for using your connected debit card overseas. While the app isn’t quite as fantastic as Up’s offering, Ubank is still a great option. The upside is that Ubank also offers savings accounts that have consistently given some of the highest interest rates in Australia. Not to mention joining takes just a few minutes and they offer a joint account option.

After more info? Read out our complete Ubank Debit Card Review !

- Overseas ATM Fee: $0 ($350-$1400/m fee-free limit based on plan)

- Account Fee: $0-$24.99/month (based on plan)

Sign-Up Bonus: We’ve partnered with Revolut to offer Flight Hacks readers an exclusive $15 in their new account. Join via this link to score $15 after making 1 transaction within 14 days.

Everything money is accessible with Revolut, from spending on your debit card to investing in stocks and EFTs, crypto, gold and silver. From a travel perspective, Revolut offers minimal fees and the ability to preload your card with one of several currencies or spend using AUD at the current exchange rate. SmartDelay also offers complimentary airport lounge passes for you and up to 3 friends when your flight is delayed by more than an hour.

Revolut is also great for those travelling with anyone aged 6 to 17, thanks to the option for parents and legal guardians to create a linked account for their children. The main account holder gains access to a bunch of insights and controls, while under 18’s can spend their own funds with the same money-saving perks as the main account holder.

In Australia, Revolut offers users a free Standard plan, in addition to increased perks on a Premium ($9.99/month) or Metal ($24.99/month) membership. While also including a solid reinforced steel card, the Metal option offers monthly benefits like three fee-free international payments, unlimited fee-free weekday currency exchange and fee-free ATM withdrawals up to $1,400. Not willing to pay for a full year? You can always upgrade for your trip and cancel the plan once you return home.

Ready to learn more? View our Revolut Australia guide !

- I nternational Transaction Rate: 0%

If you’re after a debit card for travel from a big bank, but not quite big enough to rip you off, Macquarie has you covered. Although the app and online banking portal are in desperate need of an update, the product itself is hard to fault.

Macquarie also offers a few perks like a luggage return service that will pester the airline on your behalf, if they mishandle your checked baggage. There is a small service fee for this, but if your bag is not returned within 96 hours, you’ll receive a $100 payout per lost bag. In addition, cardholders have access to a concierge service, card purchase cover and wallet guard cover. Considering this is just a debit card, those are some nice benefits to have up your sleeve.

Deposits made on a Macquarie Transaction Account can also earn interest, up to 4.75% p.a (as of March 2024).

HSBC’s worldwide reach makes its Everyday Global Account an attractive offering. If you need to make an ATM withdrawal, you can visit a HSBC ATM to guarantee zero withdrawal fees around the world! The exception is in Argentina, France, Greece, Mexico, Malta and Turkey where there is a small fee.

There’s an option to buy and transfer between ten currencies (AUD, USD, GBP, EUR, HKD, CAD, JPY, NZD, SGD, CNY), although HSBC does hide a foreign markup here by using their own HSBC Daily Exchange Rate. For the best rate, simply load AUD onto the debit card before spending overseas, where the Visa exchange rate will apply with zero markup.

Plus, if you deposit at least $2,000 into your Everyday Global Account before the last business day of each calendar month, you can earn 2% cashback up to $50 per month. You’ll earn cashback on eligible purchases with Australian merchants under $100, when you spend via payWave, Apple Pay or Google Pay. There are a few transactions that won’t be eligible, including public transport, car parking and vending machines.

- Overseas ATM Fee up to 350 AUD/month: $0

- Overseas ATM Fee over 350 AUD/month: $1.50 ($1.50+1.75% for 3+ withdrawals)

- Card Load Fee: 0% to 2% depending on currency

- Physical Card Fee: $10

Wise (previously Transferwise) used to offer one of the best cards out there, until moving to an overly complex fee structure that feels very ‘banky’. That includes a $10 fee if you’d like a physical debit card, and high fees for withdrawing money overseas, once you go over the small monthly allowance. We do appreciate that those fees aren’t hidden, and you’ll see the exact exchange rate and the Wise fee applied before completing a transfer.

Because they still offer a real mid-market rate and are one of the best options for transferring foreign currency between friends, Wise still makes our list. They also offer a cool virtual card feature, that can be useful for pesky subscriptions or transactions where you want to cancel your card afterwards, without the consequences.

All up, Wise is a solid option if you need to make a bunch of transfers, but one to avoid if you plan on using overseas ATMs.

Keen on Wise? Why not read our Wise Australia review !

We’d be here all day if we reviewed every Aussie debit card with zero foreign transaction fees and fee-free overseas ATM withdrawals. Our guide above covers the best options for most travellers, but there are a few cards that deserve an honourable mention.

- Bankwest Easy Transaction Account

- ME Bank SpendME Transaction Account

- Suncorp Everyday Options Account

Australia’s Worst Travel Debit Cards Revealed

Many big banks and frequent flyer schemes market travel money cards, but often, these come packed with hidden fees that make them completely useless. Unless you enjoy giving away your money (in which case you should send it directly to us), here are some popular options to avoid;

- International Transaction Rate: “free” with hidden markup

- Overseas ATM Fee : approx. $1.95 – $3.00 (varies with currency)

- Card Load Fee: 0.5%

Qantas Travel Money is possibly the worst travel card out there. While advertising zero exchange fees, the ridiculously expensive “Qantas Travel Money Daily Rate” is used when you transfer funds between currencies or make a purchase. For example, in our €500 spend test above, using the Qantas Travel Money would cost a whopping $47.13 more than using a fee-free Up debit card. That’s a hidden markup of 5.67% – and Qantas will still charge an ATM fee!

For international purchases, you can earn 1.5 Qantas Points for every $1 equivalent spent in foreign currency. Even though we love Qantas Points, the insane nearly 6% markup is a complete ripoff and not worth paying to earn points.

- Foreign Exchange Rate: 3%

- Overseas ATM Fee: A$3.50

- Card Load Fee: “free” with hidden markup

Despite its widespread usage, the Commbank Travel Money Card is another terrible option for overseas spending. That popularity comes from Commbank’s extensive customer base within Australia, with many travellers sticking with the one bank, instead of exploring better alternatives. But the thing is, each of the no-fee options listed above can be funded instantly from your existing Commbank account, so there is no upside to using Commbank Travel Money.

While the card itself is free to hold, there’s a 3% conversion fee applied with each transaction made in a different currency. Additionally, you’ll pay $3.50 for every overseas ATM withdrawal. Commbamk becomes an even worse option once you realise how misleading their advertising of “no reload fees” is. While technically true, Commbank makes up its own exchange rate for card loads, which is approximately 4.4% worse than the Visa rate (at the time of writing). Essentially, this translates to a 4.4% fee when loading foreign currency onto the Commbank Travel Money Card.

- Overseas ATM Fee: $5

- In-Store Load Fee: 1.1% or $15 (whichever is higher)

- Online Load Fee: $0

- Inactivity Fee: $4 monthly (once your card is inactive for 12 months)

- Closure Fee: $10

You only have to read the endless list of fees to realise the Travelex Money Card is about as deceptive as it gets. Travelex does offer unlimited fee-free overseas ATM withdrawals, which is nice, but once you realise the other fees that are adding up and decide to close your account – oh wait, there’s a fee for that! You’ll also need to pay Travelex a monthly fee for the privilege of NOT using your card, once it becomes inactive for 12 months.

Travelex’s PDS says their foreign exchange rate is “set and determined by Mastercard”. What they don’t openly admit is that there is a hidden markup, which is easily spotted when you compare the Travelex exchange rate to that offered by Mastercard.

- International Transaction Rate: 3%

When NAB acquired Citibank in Australia, they removed one of the best big-bank travel cards available (the Citibank Saver Plus) and directed new customers to the NAB Visa Debit Card. As far as international spending, this new option is an absolute waste of plastic.

Instead of guaranteed free transitions at Citibank’s enormous overseas ATM network, you’ll get charged $5 at every single overseas ATM – yay! There’s also a juicy 3% international transaction rate, so you’ll pay a fee regardless of how you spend your money overseas.

ANZ Plus is ANZ’s new digital banking service that comes with a transaction account and a linked savings account. ANZ and ANZ Plus are like two peas in a pod, except one pea decided to get a snazzy makeover and call itself ‘Plus’. It’s as if ANZ woke up one day and thought, ‘You know what this bank needs? Another version of itself that’s slightly better but nearly identical’.

In all honesty, ANZ Plus is a solid product to use within Australia, with a cool banking app, competitive interest rate and useful insights to help you save money. But the good news stops there, with ANZ’s better version of itself keeping the fees for international use. You’ll pay $5 for overseas ATM withdrawals and a 3% fee on foreign transactions.

- Foreign Exchange Rate: 0%

- Overseas ATM Fee: approx. $1.50-$3.50 (varies with currency)

As far as big-bank travel cards go, Westpac’s Travel Money Card (also known as the Westpac Worldwide Wallett) isn’t quite as terrible as the rest. Although there are still hidden fees when you load your card, as well as when you withdraw money from an overseas ATM. The only reason we say Westpac’s travel card isn’t as awful is that they use the Mastercard rate when spending in currencies you don’t have loaded, without a markup. But overall, this is still one to avoid.

We used to love ING’s Orange Everyday card for overseas spending. But as the card became more and more popular, ING decided to capitalise by introducing international transaction fees, and then raise them even higher.

You can get all international transaction fees rebated, but you’ll need to make at least 5 eligible purchases and deposit at least $1,000 to one of your personal ING accounts every month. The same can be said for overseas ATM withdrawals, of which the first five fees can be rebated provided you make at least 5 eligible purchases and deposit at least $2,000 to one of your personal ING accounts every month.

Because of this unnecessary step to qualify for zero fees, we no longer recommend the ING Orange Everyday for travel.

With so many fee-free travel debit cards available, there’s no reason why you should pay banks every time you need to spend money overseas. With a little research into a travel debit card that suits you, it’s pretty easy to save thousands in bank fees.

Alongside a fee-free card, be sure to employ these tips when spending overseas;

- Never pay in Australian Dollars: It’s one of the biggest travel card scams out there as merchants will make up their own terrible foreign exchange rate, and then charge a fee on top, to convert the local price to Australian dollars. You’ve probably paid with an EFTPOS machine or used an ATM that asks if you want to pay in AUD instead of the local currency. While it might sound like you’re getting a better deal with Australian dollars, this is almost never the case. Be sure to pay in the local currency, using a fee-free card above.

- Check for fees applied by the ATM: While any good debit card will offer zero ATM fees, that doesn’t stop ATM operators from charging their own fees. The machine should tell you before charging a fee.

- Be prepared with multiple card options: In case your card stops working, is stolen or becomes lost it’s a good idea to have a backup card.

- Use your travel debit card for online purchases: Avoid foreign transaction fees when shopping online with overseas merchants by using your card for travel.

I am going to visit [insert destination] – which card should I use?

The cards we recommend above are great for spending overseas. Be sure to consider the features important to you (eg. no ATM fees) when selecting a card for travel.

Which card uses the best currency conversion rates?

We have compared Visa and Mastercard’s spot rates above – there is little difference. Be sure to use a card that uses these spot rates, without applying a markup.

Can I use any Australian debit card overseas?

Nearly all Australian debit cards with a Visa or Mastercard symbol will work around the globe. There are a few exceptions, for example, many cards are currently blocked within Russia and other regions of conflict.

Should I tell my bank where I’m going?

It’s not something we regularly do, but it doesn’t hurt to notify your bank that you’ll be travelling overseas to avoid international purchases being mistaken for suspicious activity.

Why shouldn’t I transfer a bunch of AUD to the currency I will be spending?

It’s a bad idea to convert money ahead of your trip unless you have a crystal ball and know which way the exchange rate will move. If the exchange rate changes in your favour, you could lose out big time. The most accurate rate is achieved with a fee-free card loaded with AUD, using the payment provider’s spot rate

Can I use any frequent flyer credit card overseas?

While your Australian credit card will work overseas, most will charge a 3% fee when spending in a foreign currency. If your card earns a high number of points per dollar, that fee could be worth paying. It just depends how many points you’re going to get, and what fee you’ll be charged.

Which travel debit card is best for international travel?

The best travel debit card is going to have low or no international transaction fees, as well as the features that best suit you. Be sure to check out the best cards listed in this guide.

Chief Operating Officer & Aviation Nerd at Flight Hacks

Off to Singapore and KL in October, got the BankSA Worldide Wallet card. Unsure whether I’d be better off using a card like the Up debit card instead.

Seems like an “ok” product but they charge for ATM withdrawal, in Europe 2 euros per transaction, 2USD in the US and 1.5GBP in the UK unless you use one of their partner ATMs. I’d say use UP if you’re unsure about whether the ATM you’re about to use is affiliated with Bank SA to save on the fee.

Hi Emmanuel, with the up debit card an u bank card , can you load the money from central america on there to take out? and or can you use the card over there anyway?

No, you can’t. If you want to load a foreign currency, I’d use Revolut or Wise.

Re: unbanked & up – both are digital banks so when I go overseas to Europe how do I notify these digital ‘banking institutions’ of my overseas travel dates so they don’t block my cards?

Hi Jefr, digital bank only means they don’t have a physical branch you can walk into. Personally, I can’t recall the last time I went into a physical bank. As for letting them know you’re travelling, I’ve never done this with either Ubank and Up and have had zero problems. When it comes to fraud, 99% of happens online so they do have a function where you can turn on or off international payments within the app. When you’re traveling and shopping, most of the banks now are smart enough to detect genuine transactions and don’t block you.

I have the Citibank one, it’s fantastic I find. Good rate which I locked in before travel so I know exactly how much I have to spend, I am even in Hawaii at the moment and even though the ATM operator says it charges $4.35USD per withdrawal, my card has not charged it.

I think it’s a mistake to lock in rates before you travel unless you have a crystal ball and know which way the FX market is going to move. Personally, I prefer to convert on the spot which gets you the best rate each time.

Not sure why Wise (previously known as Transferwise) makes on the list but HSBC Everyday Global Account didn’t make the cut. They also offer $0 ATM fees (no cap on withdrawal per month) and 0% overseas transaction fee.

Hi JW, it’s definitely not a complete list and HSBC is a pretty good product as well. I’ve got an HSBC Everyday Global Account but don’t use it because the app is a pain.

how about Bankwest https://www.bankwest.com.au/personal/bank-and-save/bank-accounts/easy

Also not a bad product, does pretty much the same as Up/Ubank etc.

what do you think is the best travel card for Moldova? I know not many people go there, but being a non EU country whose currency isn’t in much demand, I think we get stung when withdrawing from an atm. I’m using the QANTAS travel card. It was many currency wallets, but no Moldovan Leu. In Chisinau, Moldova seems to default to taking US dollars. I get the feeling we are double converting. AUD to USD and then to Leu. Ouch!

Do you know any other alternative?

Hi Ben, one of the debit cards listed here will work just as well. You should never convert money beforehand unless you have a crystal ball and know which way the FX markets will move 😀 The Qantas travel debit card isn’t a great product as they take a much too large percentage on every transaction or conversion you make. I would just use a debit card (or credit card) that doesn’t charge FX and let your bank do the conversion on the spot, much easier.

Thanks for a very interesting article about these attractive products. However, a doubt remains – how do these cards make money out of you? That is, what they do not take with one hand, must be taken by the other.

Hi Tom, most products listed above are not advertised as a “travel card”; why is that you may ask? It’s because the features they offer don’t make them much money, sure they might get a cut from the Mastercard or Visa spot rate but that’s not their main breadwinner. These products offer these specific features in the hope that you will move away from your traditional bank (think Westpac, Commbank, ANZ) and do all your everyday banking with them.

What do you think is better the citibank card, ubank or travelwise? 🙂 Tossing between those 3.

I’d go with Ubank since they are an actual Australian bank and the limits of Transferwise are somewhat limiting (no pun intended). Citi is also good but the app and website are not user friendly IMO. Bonus of Ubank is that they give you $20!

Could you please elaborate more on what the limits are for the Transferwise?

No limits for card payments but there is a very restrictive limit for ATM withdrawals which is $350 a month with max 2 cash out transactions. After that, they charge a fee.

JEN, Citi have withdrawn from the multi currency markets since they where purchased BY NAB. SAD, they were a great card

I have been researching some of the reviews on the cards, some adamantly say don’t use ING because of poor customer support when something goes wrong. Do you know of any that standout as having a good track record for customer support?

I’ve used ING in the past, and didn’t have a bad experience. That said, I’ve never been in a situation where I would need real customer support. For what it’s worth, Up bank has a chat feature within the app so that’s handy when you need a replacement card or something.

Can confirm support is not great, had several issues lately. Call centre times 20-30+ minute wait minimum, which especially sucks while overseas. Need to use Skype, etc or request a call back which can take days. Trying to resolve via messages is useless, appears they are unable to authorise anything this way.

On the plus side only ones that refund ATM fees so unfortunately still recommend them, have saved me a significant amount. Make sure you have several backups, to be honest have all the cards recommended – no fees and no stress if issues occur.

Hey Immanuel, Which is the better of Ubank and Up and why, especially considering you say Mastercard gives better rates than Visa? Thanks in advance!

Also between those and Travelex which I keep reading about?

Maybe times have changed but Travelex offers the worst travel cards/services IMO. As a general rule it’s safe to avoid anything that has the word travel in its name.

I found out that Travelex have competitive rates on their card – and the fees are $0 from our point of view. We can’t protect ourselves from the other side, but at least we can protect ourselves from the Australian point of view.

Plus, you can talk to a physical person in store about it. You can’t do that with the others – I’ve tried wise – and you do a chat – which i hate. I prefer the customer in person approach – especially if things go wrong – you can talk to a person in person and over the phone – and they have toll free numbers around the world for help.

Rates and fees are one thing – BUT HELP AND SUPPORT is a big factor for me when using a Travel card overseas.

Hi Miguel, I would argue the opposite. Travelex makes some of the worst products on the market, that said they do offer convenience (exchange money at the airport). For this, you’re paying a conversion fee of 3.65% (based on the Visa spot rate AUD-USD calculated today), this might not sound like a lot but it’s a rip-off in my book. Up, Ubank, Revolut, Citi Bank, ING etc. offer far superior products with full support (they have a banking license) and best of all they don’t charge fees, on top of that they’re just everyday bank accounts which is an added bonus. The physical people you talk to at Travelex are just salespeople, I’m not sure what sort of support you would need/expect from them? Personally, I carry multiple (free) cards with me so if one gets blocked for whatever reason (which has never happened) I just switch to the other one. Cheers, Immanuel.

Both are pretty much the same, bonus is that you get $20 with Ubank. For rate difference between Visa and MasterCard to matter much you would need to spend a lot of $$, instead, I would prioritise ease of use.

Going to US in 2 weeks. Just wanted to check your advice please. You mentioned “You should never convert money beforehand unless you have a crystal ball and know which way the FX markets will move”. Does this mean I should load up a Ubank Card with AUD and use this for both direct purchases and ATM withdrawals & rely on spot rates? It seems from the discussions above that foreign exchange occur at the UBank end. Is this a correct understanding?

Hi Geoff, your understanding is spot on. Converting currency in advance, hoping you will get a good deal is the equivalent of gambling, nothing wrong with it but the chances you get it right are just as good as the chance of getting it wrong. Ubank is just like any other Australian bank account, free to have money in your account and once you pay with your card it will be converted on the spot by Ubank.

Is there a conversion fee when you buy on the spot with a Ubank or Up card? Also can i book accommodation here in Australia and then just pay at the hotel using the Ubank card and it will just convert with no transaction or conversion fees?

Ubank is an Australian bank, they issue a free debit card (just like any other bank in Australia). You can’t have any currency other than AU$ on it so yes, your account will always have AU$ and it will be converted on the spot to pay for any transaction in any currency that’s supported by Visa, as per our article there’s 0% conversion fee imposed by Ubank (that’s why we like it). The card and bank account have no fees so of course you wouldn’t be charged a fee for booking accommodation using this card either.

Thanks for the article. Do the recommended cards offer travel insurance?

Hi Raymond, for cards with travel insurance you can check out our frequent flyer credit cards here , I can’t think of any debit cards that would offer free travel insurance. Since insurance is very personal, I can’t give you a recommendation as I don’t know your circumstances. However, I can tell you which one I personally use. For me I rely on Amex Business Platinum travel insurance as it’s activated even if I don’t use the card to purchase my flights, it also covers additional card holders so anyone I have listed on my account is automatically covered.

Amex non business credit card don’t give you travel insurance unless u buy your ticket with their card. The issue is if you buy a points flight, which is only technically paying tax, not actual flight, they won’t cover you with travel insurance when u claim as haven’t actually bought a fight. Hard lesson to learn.

ANZ Black or Platinum give you 6 months travel insurance per trip ( including family traveling with you) plus 6 months income protection of $1700/month(may be more $ now, they paid that much in 2017). As long as you spend $250 of your trip eg accommodation on your ANZ card and have a return ticket which can be a points bought one before leaving Australia. Also any auxiliary card holders are entitled to this insurance cover if travelling independently from you. Both my adult children used this to cover them on international trips at great savings. Also earn the most points / $ spend with ANZ black of any credit card except maybe business AMEX card. I never paid for travel insurance and have saved heaps over the years with this. Non cover you for extreme sports though or riding motor bikes if don’t have a bike licence in Australia or illegal to in the country you are riding eg Vietnam. Also can get a certificate prior to leaving saying they are covering you in certain countries of travel if needed.

Hi Immanuel I have a 15 year old daughter going on a 3 month student exchange to Italy at the end of this month. A number of travel websites recommend paying in cash in Italy so regular ATM use will be expected. She will be staying in a smalll village in Tuscany so may not have access to some of the “international/fee-free” ATMs. She will likely be spending around $600 per month (which exceeds some of the monthly fee-free ATM limits). A lot of the recommended debit cards have restrictions for under 18s. What do you recommend for her? Thanks

Hi Stephen, I believe all of these products have an age limit of 16 or older, not sure why but no doubt has something to do with government legislation. What I would do is open an account in your name and just give her the card to use and app login to manage her money. Paying by card is much more popular in Europe now than it ever was and it’s especially usefull when adding the card to a mobile wallet such as iPhone/Samsung etc. Ubank and Up are both very much geared towards young people so I think those would be good options to try out.

Great discussions. Thanks all. How about these cards Westpac – http://www.westpac.com.au/international-travel/travel-money-card/ Commbank Travle money card – https://www.commbank.com.au/travel/travel-money-card.html?ei=prod_TMC

Please advise. Thanks once again.

Westpac is alright but they charge ATM fees so I’d pass for that reason alone. Commbank, avoid unless you want to pay 3% on your transactions. The problem with these cards is that they want you to load it up with foreign currency, however, unless you’re a successful FX trader by profession, the chance of you timing the markets is slim. So essentially you’re gambling on the idea of currency either going up or down, if you were to just let your card convert it on the spot, you would always pay the market price which would then average out over time.

Thanks Immanuel, great discussions. How about wise card and what’s your opinion about it.

Also good but the limits are somewhat prohibitting.

Do you know if you need to convert currency with the Westpac worldwide wallet? I’m travelling to Vietnam and it’s not a listed currency. I would like to withdraw cash.

Hey Mae. Yes, Westpac Worldwide Wallet would require you to convert AUD before using the card, essentially gambling on the exchange rate. While that could work in your favour if the exchange rate worsens, you could also lose out big time. Westpac Worldwide Wallet does not currently support VND. Because of this and the extra fees Westpac charges, you might prefer the UBank or Up cards as mentioned above. Happy travels, Tom.

What is the best travel card for ATM withdrawals. We intend to pay for most things such as meals, taxifares and public transport by cash in the UK and Ireland. Is this the most cost effective method or are we better off just presenting our card when paying for goods and services. TIA

Hi David, Ubank and Up both don’t charge ATM fees so that would be my pick. When paying, it might be easier by card as then you don’t have to convert any leftover currency back but it depends where you go. Small towns in Europe for example sometimes don’t have card facilities so it’s just easier to pay in cash.

Hi Immanuel.

Just confirming, is the link below the ‘travel’ card for UBank, as it is coming up as a ‘transaction’ account rather than ‘travel’ card, so I want to make sure it is the right one?

https://www.ubank.com.au/banking/transaction-account

Any other advice regarding using this card (if the correct one) or UBank’s travel card (please send link) would be greatly appreciated.

Kind regards

Hi Joe, they only have 1 type of account as far as I’m aware. The product isn’t advertised as a “travel card” because they don’t really make money from it. That said, it makes an excellent travel card because it doesn’t charge fees, it’s easy to manage, free and they give you $20 for joining. As previously mentioned, by warry when a product brands itself as “travel” related; there are usually fees associated.

Hi, I was just wondering with up bank do I have to create another account with wise. Just a bit confused. Thanks

Hi, no you don’t unless you plan to send money to family/friends via international transfer. If you just want to use the debit card to pay for stuff and take money out of the ATM, you don’t need to do anything.

Hi Immanuel, Do you know which card would be best to take to Bali? My son will be taking AUD cash as well to change over there for a more favourable rate but lots of cash is a risk.I’ve also heard that ATM’s charge their own fee (randomly) and when making purchases using a credit or debit card a 3% fee is charged. Can you confirm or deny? 🙂 Thanks

Hi Jenny, I wouldn’t take cash, the rate you would get from a vendor will most certainly be worse than what you can get at an ATM. The debit cards listed above such as Up, Ubank etc don’t charge any fees. If an ATM charges you fees, it will always disclose this before you proceed with the transaction, most often it’s a fixed amount. Always use reputable bank ATMs and you will be fine 🙂

Hi Immanuel, thanks for the advice above.

Which is the best card for us?

My partner is heading of the the USA, Canada. Then we are flying across to meet her in Netherlands, then Scotland followed by a trip to Italy for a holiday.

She likes the Wise Travel, I like the Macquarie. I think the limit on withdrawals from atms is a pain in the wise one. She thinks the Wise one has a better currency conversion rate since Macquarie uses Mastercard rate.

What are your thoughts? It’s hard to find detail on ubank and what their currency conversion rate is.

If you plan to use the ATM a lot, I’d stay clear from Wise as they are very limited on withdrawals. If the cards are free, get both that way you always have a backup. Personally, I take an Up debit card and Ubank debit card, if one gets blocked or I lose it somehow I have a backup and it takes seconds to transfer funds from one account to another.

Hi. Just trying to understand how you transfer money if one card has been lost/ stolen, wouldn’t every transaction be blocked ??

You can just lock the card it self. This means you can still use the account.

I just wanted to come here to say thank you Immanuel, so much information – exactly what I wanted to know and have been agonising over! The fact you are still answering the questions a few months after the article was written!

Hey Chantelle, thanks for the kind words! We’re actually planning to add more products to this article soon to expand the comparison for people.

Ditto from me – your info has been really helpful to me to choose the right card for travelling o/s. Just got word from Citibank that they will be closing down their travel card that I have used for last 10 years, so I am in the market for a new one. This article and the follow up discussions have been invaluable. I’m tossing up between UBank & Up Bank. Thanks again for a very informative article and more importantly, the follow up discussions.

Thanks Lisa! Both Ubank and Up are pretty much identical when it comes to real world use. It will come down to which app you find easiest to use. Try them both, it’s free after all 🙂

Totally agree!! How often do we find a site with an article and ability to comment…only to never hear from the author…way too often!

I travel internationally on occasion (Australia bound next month) and I think this discussion is incredibly valuable!! I’ll be getting both Up and Ubank as there is really only an upside to both.

Thanks for the feedback Bryan! When readers take time to comment, we take time to respond. It’s also very useful for others reading this article as it adds information that might not have been clear or mentioned in the main content.

Hi After reading all this I’m still not too sure. I’m traveling to UK and USA in December 22 and have applied for a Revolut card, what do you think? Regards Elly

Hey Elly, Revolut is also really good. You might even want to consider switching to their premium product for the duration of your travel as it might be worth it 🙂

Hi, Interesting article on paying for things overseas! One question/comment. I think it is necessary to advise the bank that your card will being used overseas? Otherwise the bank may put a stop on the account in case it is being used illegally.

Hi Neil, I personally don’t advise them and haven’t experienced any issues (with debit cards that is)

Hi Immanuel, we are travelling to Thailand next year. My sister uses Latitude 28 Degrees Global Platinum Mastercard. Is this any good? Otherwise, I’ll go with the Ubank card. Thanks for some great advice. Regards, Melissa

Yes, it’s good, no FX fees but it’s a credit card so not good if you want to take cash out. Ubank is a debit card/bank account so it’s perfect for taking cash out of ATMs etc.

Hi Just want to which debit card is best for Switzerland? I am traveling from Australia

Hi Ali. Any of the six cards we have listed above will suit your travel to Switzerland.

Im going to europe this year, ill be using card a lot, dont think i need to use atm much. Im considering either UP, wise or NAB platnium. I have considered the NAB platnium because they offer free travel insurance. Do you have any more advice, which would be best for me. Thank you.

Hi Karla, if you plan to use the card a lot it should work out ok since they charge $10 a month account-keeping fee which can be offset by the cashback rebate of up to $10 per month. Just make sure you read the T&C of the insurance to make sure it’d adequate for you.

Hi Immanuel going to Bali and if I get the UBank card do I just put aud in it, and when I pay at restaurants does it just convert to IDR then or do I have to change my Aud to idr.

Hi Chrissie. Good choice! Just load your UBank card with AUD and when you pay it will convert to IDR automatically. Blue skies, Tom.

Hi, thanks for providing such great information it’s really helped narrow down the search for the best debit card to use for our honeymoon. We are travelling to Cancun Mexico and considering either Citibank Plus or HSBC Global account. Do you think we will be fine with these cards?

Hey Adele. HSBC is a good product, although the app needs some serious work. Citi will serve you well along with the other cards listed here. Happy travels, Tom.

Am going on a six month trip – 3 months total in Morocco and Tanzania, and then 3 months in Europe. Am agonising over how to do the money thing – don’t want to carry wads of cash and don’t want to pay loads of fees if I pay by card or make frequent atm withdrawals. Would the Ucard be a good option for me if I just load it up with AUD before I go?

Ubank, Up, Revolut… all good options and will do exactly what you need.

Choosing a card is really hard as the reviews are not that great with any of them. Want to get a card which offers security for my money and easy access to it. I am planning to go to Europe and am worried I wont be able to use my card because its blocked or funds have disappeared (comments in a few google threads). Are all these cards covered by the government guarantee? Are these cards supported by large banks with good customer support should something go wrong?

Many thanks

Hi Diane. We have listed the best cards for travel above, you may wish to consider these for your trip to Europe. Under the Financial Claims Scheme (FCS), deposits of up to $250,000 are protected at licenced banks in Australia. As for the neobanks cards above, Up is backed by Bendigo Bank and UBank by NAB. In my experience, their customer support is fantastic. Cheers, Tom.

Hi Diane. We have compared Visa and Mastercard currency conversion rates above – there is little difference here. As long as you are using a card with zero foreign transaction fees, these are the rates that will apply. Cheers, Tom.

Thank you for the article. My concern is how long will it take for money to be transferred from another bank account onto these Travel Cards so that funds are available? Are you better off getting a travel card from your current bank to get the instant transfer?

Hey Poppy. If your current bank and the the card you will use for travel both support Osko, deposits will be instant. You can check what banks support Osko by clicking here . Cheers, Tom.

Surely ING is worth a mention? As far as I know they’re the only one that offers ATM fee rebates. Unfortunately they’ve recently limited this to 5 per month (whether domestic or international), but depending on the country this could still be worth ~$50. If you only withdraw cash once a week or so while travelling this really isn’t an issue. It’s saved me 100s of dollars in the past while travelling so I’m happy to deal with some sub par support!

Hey Jordan. We did have the ING Orange Everyday card listed when putting this guide together a few years ago. ING was since removed after the benefits became slightly more restrictive, although it’s still a worthy contender for travel. Blue skies, Tom.

We’re going to Argentina in January, which is a money minefield! – with the official dollar rate via banks vs the blue dollar that is worth nearly twice as much when exchanged for USD cash. Apparently the govt is in the process of introducing blue dollar (or better) rates for tourists using foreign cards, so that makes taking a debit card instead of wads of USD cash much more feasible. Are you aware of this? Do you have any advice at all? If not, we’ll take a chance on one of your recommended cards and hope that it works over there. Thank you!

Hi Diane, yes Argentina isn’t your typical country haha the “blue dollar” is the black market exchange rate for USD to the native peso and indeed, you will be much better off bringing USD (make sure you get the newer bills) as everyone in the country wants them. You will still be able to use a debit card at ATMs but when doing so you will convert at the official rate which as you stated is far from favorable. Are you transiting via the USA before getting to Argentina? In this case, I would get USD cash from US ATMs using an Australian debit card, this way you will get the best exchange rate, then take the cash to Argentina and exchange it to Peso on the black market.

Thanks so much for your reply and advice Immanuel. We are flying direct from Sydney to Santiago and from there to Buenos Aires, so no opportunity to use a US ATM I’m afraid. We’ll continue to watch the situation (with a sceptical eye) and assume that USD cash is still the way to go. Sigh.

Hi Diane, if you use Western Union they give you the Blue $ exchange rate. Initially I thought this was only with US $ but according to a discussion on Travel Advisor, it works for other currencies as well. By setting up an account and have Argentina as your home, you can apparently transfer au $ to Pesos while you are in Argentina. Although sometimes hard to find a WU office that hasn’t run out of $, and not always an instant transfer. Apparently you can play around on the WU site to check your exchange rate before doing this. If you already have USD in $100 bills, all very new and clean, you can go to an Arbollito on Florida St and exchange. Remembering the Blue rate does fluctuate.

Cheers Annmarie

link to recent TA conversation if you want to read info https://www.tripadvisor.com.au/ShowTopic-g294266-i977-k13815837-o30-How_to_get_dollar_blue_exchange_rates_through_Western_Union-Argentina.html

Hi there, I am travelling to the UK and Europe for 4 weeks and tossing up between two options which I can’t choose from. Is it better to use a fee free card overseas (Up in particular) and convert on the spot and cop the varying exchange rate, or preload a travel card so I have converted funds, but risk the fees from ATMs and conversion fees when I need to do so? Cheers

Hi Michael. Check out our section on travel-branded cards above. It is just as likely to lock in a bad exchange rate as it is to lock in a good one. It’s up to you, but seeing I don’t hold a crystal ball I avoid gambling on the exchange rate. Once you pay in foreign currency using Up it will be converted to AUD at the current rate with no fees or markup. Cheers, Tom.

Thanks mate, I’ve made the decision to use Up and even going to change my regular banking there cause I love it! Thanks again

Signed up for the U Bank card, used the code – it appears that actually the referrer gets the $20 credit, not the new signed up customer. I used the code C7N1TAZ as mentioned above.

Hey Dinny. To score the $20 you will need to be a brand-new UBank member and make three card purchases. Cheers, Tom.

Hi! Im travelling to the UK and Europe for a month is December and would prefer to use a travel card as opposed to cash. I’ve looked at all of these options but the reviews are a little worrying. Have you used any personally? What would you suggest? Im ideally trying to not spend a whole heap on fees and things and I dont plan on taking much out at an ATM if at all. Also looking for a card that wont cost be a fortune to put the left over money back into my bank account once ive returned. I was originally going to get a qantas card but once again reviews arent very good. Thanks

Hi Hunta. We have tested and would recommend any of the above. Up or UBank might be your easiest option. Cheers, Tom.

Hi there! How about the Macquarie debit card? seems as good as Ubank!

Yes just as good but you don’t get free money for signing up haha! Also, I’m not sure if their application process is as straightforward. Both Up and Ubank instantly activate your digital wallet while you wait for a physical card.

Thanks for the detailed articles team, I’ve always used cash when I travelled in the past but after reading this article I’ll use debit card instead.

Quick question though, would you recommend using Australian credit card overseas? I understand there’re fees (1-5%) but it earn points in return. Still tossing if points are worth the additional fees.

Hi Daniela, most Australian credit cards will charge you a 3% fee on each converted amount. It’s pretty high but if you earn points it can somewhat offset the cost. There are some credit cards that have no fees and earn points but the earn rate is generally pretty bad + they also have annual fees which might outweigh the benefit of saving 3% Macquarie Platinum Qantas, ANZ Travel Adventures, and Bankwest are a few you can look into.

Hi Immanuel, My 15 year old daughter is going to Japan on exchange for a year. I am a bit worried about sending her with a card in my name in case she is questioned (why she has a card in another person’s name). Other kids are going with CommBank as kids 14 and over can use it but I don’t like the sound of their fees. Any suggestions? Thanks

hey Elizabeth, to play it safe you can always have a Commbank account as a backup. Transferring money from Australian banks is instant via Osko so in theory you could give your daughter a card in your name (to take advantage of the low fees) and have a Commbank card as back up if it should be required. That said, you can also use mobile wallets to store Up, Ubank etc for contactless payments, this way the name on the card isn’t shared or displayed.

If I already have a Ubank account (for savings), will this suffice for using on overseas trip? Don’t have a card attached to it, but daresay I could apply for one. Travelling in the new year to UK and France. Thanks

Hi Denise, yes the Up savings account you got now is what you can use overseas. If you don’t have a physical card, you can order it via the app. It usually takes a week or so.

Which is the best card for recieving overseas payments like the japanese yen, etc. ?

Hi Zara. Any of the above cards can receive overseas payments, but Wise was designed especially with regular international payments in mind. Cheers, Tom.

Hi Zara – this is an excellent site and your advice much appreciated. My 19 year old son is going to Japan for working ski holiday next week for 7 weeks. He will need to use cash Yen in most places and hence, a number of ATM withdrawals. From what I read above, he would probably be best off just using his existing Bendigo Bank debit Mastercard – as he can use for payments as well as ATM withdrawals. Do you agree? Thanks in advance – Ian

Hi Ian, Bendigo bank charges 3% on each converted transaction overseas (that’s very high). Since your son is 19, he would be much better off switching to a bank that doesn’t charge those fees. Up bank, Ubank, Revolut, ING etc all offer better banking features and no fees.

Hi Immanuel, I plan to use Macquarie debit card for my upcoming overseas travel. How does Macquarie debit card compare to Citibank? And would Aud convert to other currencies automatically when I pay with my debit card?

Hey Linh. Your Australian Dollars will convert automatically for all cards listed above. Both Macquarie and Citibank offer good products with zero fees, although I’m not a fan of their mobile apps. At least Citi has a worldwide presence. Cheers, Tom.

Hi, I’m travelling to Vietnam, I have the 28 degree MasterCard but need a debit card to withdraw cash. What are your thoughts on Westpac worldwide wallet? I don’t want to lock in a currency.

Hey Mae. I wouldn’t recommend the Westpac Worldwide Wallet as you will pay extra fees compared to any of the cards we have listed above, for no reason. You would also need to lock in the currency, plus the card does not support VND. The 28-degree MasterCard is also one I would avoid, as you can’t make fee-free withdrawals and they apply a markup to overseas transactions. You might prefer the UBank or Up cards as mentioned above. Happy travels, Tom.

Just fyi – ubank is no allowing joint accounts at the moment. Very annoying as all their marketing says they do, but you get to the “new account” section and get a weird error message. Only after 50mins on hold to the call centre did it all become clear.

The argument is that they are being used for phishing which seems odd/unlikely – each of the joint owners need to give over ID but after Optus etc who knows.

I’ll be checking out some of the others – thanks for the tips!

Interesting, I didn’t know! Any benefit to having a joint account?

I’m hoping to take advantage of the exchange rate for japAn before it drops, I have a trip booked in April.

Can you please advise which travel card would be best. I want to transfer $2000 across as a piggy bank. And then continue to use my up account for purchases once this $2000 is gone.

Would it be better to do this or go to a cash exchange in Australia and change money before I leave as a lot of purchases will be in cash?

How do you know the Aussie will drop against the JPY? If you know for sure, why only bet $2,000? Jokes aside, Revolut would be my #1 choice for converting currency.

I feel that when you recommend these cards you take customer service into account. UBank has been in the news of late for poor service and I wouldn’t have believed it unless I experienced this myself. My daughter is in Rome with a UBank card, that we got for her because we read this review. They did an upgrade last night during the early hours of the morning AEDT but that was peak time in Europe. She was not able to use her card and then when they came back online, she still can’t use the card. I was in a queue for over two hours, which is minimum for them, no chat option, which is terrible for a bank. I spoke to someone and they assured me they would fix it and they still haven’t. Luckily her friends are with her and they are paying for her items, but this is a terrible bank it really is. Please factor this into your reviews and don’t worry about the referral fees, think about the people this affects.

Hi Bill. Sorry to hear about your daughter’s poor experience. I have never had an issue using my UBank card overseas, including getting through on the phone. In my experience their customer service is fantastic, but perhaps following the NAB takeover this is no longer the case. Of course, we would always recommend having a few good travel debit cards at hand, in the event that one card is stolen or stops working. Limiting yourself to a single card is undoubtedly risky, hence why we have listed several above. All the best, Tom.

Hi, I’ll be traveling to Germany and Denmark at the start of next year, all of these cards look viable. Is there a specific one that you would recommend…maybe location-wise? Thanks

Hi David. I am a fan of Up Bank for their outstanding customer support and ideal app layout. But yes, all of the above could work for your travels. Cheers, Tom.

Hey Tom, just opened both an Up Bank and Wise account for my Europe trip , thanks for your help there. If I understood correctly, if I tap and buy something with the Up Bank card, it converts the Australian dollar I have in my account at the Mastercard rate and if I tap and buy something using the Wise card, it converts using the Wise Transfer rate? (assuming I haven’t preloaded the Wise card with Euros already)

Hi Tom So is this correct? I miss my choice if card(atm between Up, UBank & Wise) with AUD and use it to pay for things OS (Canada). Therefore I won’t be charged any fees and the money is converted to CAD at the time of transaction? If I choose to withdraw actual cash OS then I may incur a fee of over $350 is withdrawn for the month?

Hi Jo, each card is different: Up, Ubank don’t have withdrawal limits, Wise & Revolut do have limits on free withdrawal, go over and you will incur a fee. Hope that helps?

Hi Immanuel Yes thanks so if I’m mainly using the card as a debit card and not to withdraw cash, then any of those 4 would be ok? If I want to withdraw cash – more than $350 a month- (I’m assuming it’s withdrawn as CAD) then Up & Ubank are best? Is this correct?

Hi, Im going to Europe for 2 months next year which would be the best travel card with the lowest fees? as i will only be using euros and pounds for the trip. My last pre- covid trip I used an ANZ travel card but they dont offer them anymore.

I would go for either Ubank or Up if you want unlimited ATM use with no fees. If you won’t take out much cash but prefer to pay via card, go with Revolut .

Hi Immanual, I’m travelling to Mexico and Hawaii in feb for the whole month and I’m stuck on which card to get. I’m unsure if I should get a prepaid or a debit card. Do you have any tips? I assume in Hawaii I’ll be using eftpos (transaction) more, whereas Mexico I think cash. But I’m really not sure, I’m just going off what people have said in travel blogs. Thanks!

Hi Ava, the answer to your question is in the article, but in short: pre-paid travel cards suck. Get a debit card or if you want to convert currency before your trip, get Revolut. Pro tip: get 2 accounts, that way you have a backup in case you lose a card or it gets blocked.

Can you sign up to revolut as an Australian? I was looking into Up too. What would be better?

I’ve got HSBC, Revolut, Wise and Qantas. Don’t know why people criticise the HSBC website and app, I’ve never had any issues. Exchange rates are pretty good and there’s 2% cashback on paywave purchases under AUD$100 (not sure if this applies OS). Revolut and Wise have the best exchange rates. Revolut Metal plan offers more ATM withdrawals. Lounge access is nothing special (slightly below normal fee unless there’s a +1 hour delay). Wise has no subscription fee. Qantas exchange rates are terrible, points bonus kicks in for overseas spending. I think Wise is the best all-round option if you don’t need many ATM withdrawals.

Hey John. I find the HSBC app outdated and clunky, but if it works for you that’s great. The HSBC 2% cashback will only apply to purchases made in AUD. Personally, I feel Wise and Revolut are far superior as above. Cheers, Tom.