- Sign in

Bank of America® Travel Rewards Credit Card for Students

We're sorry, this page is temporarily unavailable. We apologize for the inconvenience.

Unavailable

One or more of the cards you chose to compare are not serviced in English.

Continue in English Go back to Spanish

Start building a successful financial future today

while earning unlimited 1.5 points for every $1 you spend on all purchases

Card Details

Unlimited points.

Earn unlimited 1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points as long as your account remains open

Low Introductory APR Offer

0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the intro APR offer ends, a Variable APR that's currently 18.24% to 28.24% will apply. 3% † Intro balance transfer fee for the first 60 days your account is open. After the intro balance transfer fee offer ends, the fee for all future balance transfers is 4%.

25,000 online bonus points offer

25,000 online bonus points if you make at least $1,000 in purchases in the first 90 days of your account opening – which can be redeemed for a $250 statement credit toward travel and dining purchases

No annual fee † and no foreign transaction fees †

Enjoy no annual fee and no foreign transaction fees on purchases while earning points to use for statement credit to pay for flights, hotels, vacation packages, cruises, rental cars or baggage fees, and also at restaurants – including takeout

Establish good credit habits

Easily manage your bank accounts and finances online with Online Banking and our award winning Mobile Banking app that help students stay in control of their finances and make payments

FICO ® Score

Now, you can access your FICO ® Score updated monthly for free, within your Mobile Banking app or in Online Banking. Opt-in to receive your score, the key factors affecting your score, and other information that can help you keep your credit healthy.

Interest Rates & Fees Summary †

Introductory apr.

0% for 15 billing cycles

Applies to purchases and to any balance transfers made within 60 days of opening your account

Standard APR

18.24% - 28.24%

Balance Transfer Fee

After the intro balance transfer fee offer ends, the fee for all future balance transfers is 4%.

† Please see Terms and Conditions for rate, fee and other cost information, as well as an explanation of payment allocation. All terms may be subject to change.

Note: minimum payments are applied to lower-interest balances first. Additional payments are applied to higher-interest balances first.

Earn unlimited 1.5 points for every $1 you spend on all purchases everywhere, every time.

No blackout dates or restrictions and points do not expire as long as your account remains open.

Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

Flexibility to redeem points for a statement credit to pay for flights, hotels, vacation packages, cruises, rental cars or baggage fees, and also at restaurants—including takeout.

Additional Benefits

Better money habits ®.

Learning to handle your credit is a big responsibility. A little knowledge can go a long way with Better Money Habits ® Opens in a new window .

Manage your Finances

Manage your money from almost anywhere. From home, the library and everywhere else, help stay in control of your finances with our award winning Mobile Banking app .

Schedule an appointment

Want to talk to someone one-on-one? No problem. We're here with you every step of the way. Set up an appointment at a time and place that works for you.

Security & Features

Stay protected, contactless chip technology, balance connect ® for overdraft protection, paperless statement option, digital wallet technology, online & mobile banking, account alerts.

Now, when you opt-in you can access your FICO ® Score updated monthly for free, within your Mobile Banking app or in Online Banking. FICO ® Score Program . The FICO ® Score Program is for educational purposes and for your non-commercial, personal use. This benefit is available only for primary cardholders with an open and active consumer credit card account who have a FICO ® Score available. The feature is accessible through Online Banking, the Mobile website, and the Mobile Banking app for iPhone and Android devices. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Data connection required. Wireless carrier fees may apply." data-footnote="ADDITIONAL_BENEFITS_FOOTNOTE_07" aria-label="Footnote 5"> Footnote [5] Learn More about Free FICO Credit Score opens in a new window

Priority code: QAF1UT

Schedule an appointment to apply in person

Connect one on one with a credit card specialist

Best Youth and Student Travel Discount Cards

How to Easily Score Student Discounts as You Travel

Peter Cade/Getty Images

One of the best perks of student travel is having access to thousands of discounts. You'll be able to score cheaper prices on everything from accommodation to flights and entrance fees to tours.

You technically do not have to be a student either. If you're a traveler under the age of 26, you should be eligible for most of the discounts.

And the discounts are not only travel-related, you can have access to discounts on practically everything you can think of. Check out the best card offers out there like the International Student Identity Card, the International Youth Travel Card, the Student Advantage Card, the International Student Exchange Card, and various hostel discount cards.

The International Student Identity Card (ISIC)

Full-time students who are 12 years and older can get their hands on an International Student Identity Card to gain discounts on flights, accommodations, shopping, entertainment, and more.

You can get free travel insurance while traveling outside the U.S. through this card (although it is basic), as well as have the opportunity to make inexpensive international phone calls. This is a huge bonus.

The card, which costs about $25, is good through December 31 each year. It is issued by the International Student Travel Confederation and if you are going to go with only one student discount card, this is the one you should get. For $25 a year, you will definitely make your money back and save several hundreds of dollars if you have a few trips planned.

Check out a full list of discounts you'll be eligible for and learn more about how to get an ISIC card.

The International Youth Travel Card (IYTC)

Also issued by the International Student Travel Confederation, the International Youth Travel is a discount card for travelers under 26 who are not enrolled in a school. You get a wide range of youth travel discounts, not quite as many as the ISIC, but it may be worth having if you plan on traveling. It costs $25 a year and comes with free travel insurance as well.

Check out the list of youth travel discounts you can get with IYTC card and learn more about how to get an IYTC card.

The Student Advantage Card

The Student Advantage Card provides student travel, retail, and entertainment discounts for an annual $22 membership fee (you can add up to three additional years of membership for $10 per year).

As for whether it's worth it, it really does depend on how you'll be traveling. You can gain 15 percent off Amtrak and Greyhound fares, and you get booking fees waived if you use HostelWorld. That all sounds great, but you should bear in mind that you can get a Greyhound student discount without the card and that Amtrak gives the same discount to ISIC cardholders. The main bonus, then, is saving on the HostelWorld booking fee. If you're planning a big trip or lots of travel and staying in hostels, dishing out $22 on the Student Advantage Card could be a good deal. If not, get the ISIC instead.

The International Student Exchange Card (ISE)

The $25 ISE card offers many of the same discounts as the ISIC card. Issued to travelers under 26, the card's "youth" version doesn't offer quite as many discounts as the "student" version, issued to enrolled students. Is it worth it for you? You should take a look at the discounts offered, compare them to those offered by the ISIC, and see which of them will be more valuable to you. If both sound great and can offer you great deals independently, then get both. You can buy the mobile-only membership for $9—which cuts out the need for a physical card. Or, you can get a physical ISE card with a SIM card for international calling for $35 (shipping included).

Hostel Discount Cards

Hostel discount cards offer discounts on some hostel bunk nights and a few additional benefits. Some hostel discount cards offer only to waive online booking fees, which may be covered by the Student Advantage Card. Major hostel outfit Hostelling International has a membership card, which can get you a free night stay and other deals.

How to Land Some Serious Student Travel Discounts

Best Hotel Booking Sites

Get an ISIC Card

Can I Get a Senior Discount on Rail Passes?

Youth Discounts on the Eurail Pass

Tips for Budget Business Travel

Pros and Cons of Discount Bus Travel

Should You Book Your Hostels in Advance?

How to Find Senior Discounts for Budget Travel

About Single Europe Train Tickets

How to Find the Right New York City Gym for You

Best Tour Companies for Singles

5 Ways to Find the Cheapest Train Travel

Best Car Rental Companies of 2024

Calculating the Value of a Frequent Flyer Mile or Hotel Point

How to Finesse a Luxury Vacation for a Lot Less

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards > Reviews

Bank of America® Travel Rewards credit card for Students review 2024: Flexible rewards and no annual fee for students with good credit

Holly Johnson

Robin Saks Frankel

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 1:03 p.m. UTC Feb. 7, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

It’s a tempting option for students who love to travel: a card that offers flat-rate rewards and no annual fee. But applicants need good credit – so good that they may qualify for better travel cards with more perks.

Bank of America® Travel Rewards credit card for Students

Welcome Bonus

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – that can be a $250 statement credit toward travel purchases.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s Take

- Accessible for student applicants.

- Solid rewards of 1.5 points per $1 on purchases.

- No annual fee or foreign transaction fees.

- High APR outside of intro offer.

- Points have lower value if redeemed for cash back.

- Lack of bonus earning categories.

Card Details

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don’t expire as long as your account remains open.

- Use your card to book your trip how and where you want – you’re not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

Why trust our credit card experts

Our team of experts evaluates hundreds of credit cards and analyzes thousands of data points to help you find the best card for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 35+ cards analyzed.

- 6 data points considered.

- 5-step fact-checking process.

Bank of America® Travel Rewards credit card for Students basics

- Annual fee: $0.

- Welcome bonus: 25,000 points after spending $1,000 on purchases in the first 90 days of account opening.

- Rewards: 1.5 points per $1 on purchases.

- APR: 0% intro APR for 15 billing cycles on purchases and balance transfers made in the first 60 days, and then a 18.24% to 28.24% variable APR. A 3% intro balance transfer fee will apply for the first 60 days; then a 4% fee applies to future balance transfers.

- Other perks and benefits: Free FICO Score each month.

- Does the issuer offer a preapproval tool? No.

- Recommended credit score: Good to excellent.

About the Bank of America Travel Rewards credit card for Students

Students who like to travel may be tempted by the Bank of America® Travel Rewards credit card for Students . It has no annual fee, no foreign transaction fees, and it earns 1.5 points per $1 on purchases, with no limits and no expiration dates on its rewards as long as your account remains open. There’s just one caveat: Applicants need good or excellent credit to get approved, which excludes students just starting to build a credit history.

For a travel rewards card it doesn’t offer much flexibility when it comes to point redemption. You can take your earnings as a statement credit to pay for flights, hotels, vacation packages, cruises, rental cars or baggage fees, and also for restaurants — including takeout. Although there are no travel loyalty transfer partners like you’ll find on some of the best travel cards , you won’t have to worry about blackout dates or being limited to booking your travel through Bank of America.

Benefits include a welcome bonus of 25,000 points after spending $1,000 on purchases in the first 90 days of account opening. There’s also a 0% intro APR for 15 billing cycles on purchases and balance transfers made in the first 60 days, and then a 18.24% to 28.24% variable APR. A 3% intro balance transfer fee will apply for the first 60 days; then a 4% fee applies to future balance transfers.

Still, the card lacks some of the perks of other travel cards, like the ability to convert the points to cash back or travel protections, and students with good enough credit to qualify for this card may prefer another with more robust offerings.

- Earn unlimited rewards on all purchases: Cardholders earn a flat 1.5 points per $1 on purchases with no bonus categories or caps to track.

- Avoid interest for more than one year: This card’s introductory APR can yield considerable savings if you decide to carry a balance or use this card to consolidate other debts.

- No annual fee: There’s no cost to own the card.

- No foreign transaction fees: You can use this card for purchases overseas without paying extra surcharges.

- Requires a good to excellent credit score: Many students, still building credit, won’t be able to qualify.

- No bonus categories to help you maximize rewards: This card doesn’t give you the chance to earn more rewards in specific categories like some other cards do.

- Flexible yet limited redemption options for rewards: You can redeem points for travel or dining statement credits, but that’s it.

- High APR after intro offer: This card’s high variable APR will make carrying debt costly over the long run.

Bank of America Travel Rewards credit card for Students Rewards

The card offers an easy-to-track 1.5 points per $1 on purchases. In addition, new cardholders can earn 25,000 points after spending $1,000 on purchases in the first 90 days of account opening. The points can be redeemed for statement credits on travel-related expenses.

Using government data and other publicly available information, we estimate that a student in the U.S. that would be in the market for this card has $12,544 in expenses they are likely to be able to charge to a credit card over the course of a year. Here’s what we estimate you could earn in rewards on that spending using the Bank of America Travel Rewards credit card for Students:

Our average cardholder would earn 18,813 rewards points that are worth $188 in statement credits toward travel or dining purchases, plus the first-year welcome bonus if the spending requirement is met.

Bank of America Travel Rewards credit card for Students APR

The Bank of America Travel Rewards credit card for Students automatically comes with a 0% intro APR for 15 billing cycles on purchases and balance transfers made in the first 60 days, and then a 18.24% to 28.24% variable APR. A 3% intro balance transfer fee will apply for the first 60 days; then a 4% fee applies to future balance transfers.

How the Bank of America Travel Rewards credit card for Students compares to other student credit cards

Bank of america travel rewards credit card for students vs. bank of america® unlimited cash rewards credit card for students.

The Bank of America® Unlimited Cash Rewards credit card for Students comes with many of the same features since it’s offered through the same card issuer, yet it offers cash back instead of flexible travel points. There’s no annual fee and cardholders earn a flat 1.5% cash back on purchases as well as $200 cash rewards bonus after spending at least $1,000 on purchases in the first 90 days of account opening.

This card comes with a 0% intro APR for 15 billing cycles for purchases and any balance transfers made in the first 60 days, then a standard APR of 18.24% to 28.24% variable applies. A 3% intro balance transfer fee will apply for the first 60 days; then a 4% fee applies to future balance transfers. Cash back can be redeemed for statement credits or a deposit or credit into an eligible Bank of America checking or savings account or an eligible Merrill account (including 529 accounts). Cash is the most flexible reward of them all since you can use it for travel or anything else you’d like, making the Bank of America Unlimited Cash Rewards credit card for Students a better option for most.

Bank of America Travel Rewards credit card for Students vs. Capital One Quicksilver Student Cash Rewards Credit Card * The information for the Capital One Quicksilver Student Cash Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Similar to the Bank of America Travel Rewards credit card for Students, the Capital One Quicksilver Student Cash Rewards Credit Card * The information for the Capital One Quicksilver Student Cash Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. doesn’t charge an annual fee, and cardholders earn 10% cash back on Uber & Uber Eats through 11/14/2024, 5% cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on every other purchase. However, unlike the BofA card, the Quicksilver for Students is aimed at those building credit and even offers a preapproval tool before you formally apply. The card also offers some perks including the elevated rewards rate on travel booked through Capital One and 10% cash back on qualifying purchases made through the Uber and Uber Eats apps plus reimbursement for the cost of a monthly Uber One membership through Nov. 14, 2024.

A $50 cash bonus after spending $100 on purchases in the first three months of account opening, and there are no foreign transaction fees.

This card’s rewards also come with several flexible redemption options including cash back, statement credits on your account or gift cards.

Bank of America Travel Rewards credit card for Students vs. Discover it® Secured Credit Card

Maybe you don’t have any credit history at all or have some credit missteps in your history. In that case a secured credit card like the Discover it® Secured Credit Card may be the best bet. There’s no credit history or credit score requirement fand you can check to see if you’re preapproved before applying. The no-annual fee card earns 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and 1% cash back on all other purchases. Discover will automatically match all the cash back earned at the end of the first cardmember year.

The card requires a minimum cash deposit of $200 as collateral, but Discover will review your account starting at seven months to see if you qualify to have your deposit returned to you and your account converted to an unsecured card. Discover will also report your balances and payments to the three main credit bureaus , helping you build credit over time.

Should you get the Bank of America Travel Rewards credit card for Students?

The card earns easy-to-understand rewards, there’s no annual fee and the intro APR offer can be enticing. However, the rewards can only be redeemed for statement credits related to travel or dining. And applicants need a good-to-excellent credit score to qualify for this card – at which point they may qualify for other cards as well, with more robust perks or features.

If you have good enough credit to qualify for this card, seek a more rewarding option. Our list of the best credit cards for students is a good place to start.

Bank of America Travel Rewards credit card for Students summary

Methodology

Our credit cards team has spent hours analyzing hundreds of credit cards. We took a deep dive into the details of each product and that analysis, combined with our years of experience covering credit cards, informed us as we developed these credit card rankings. Factors we considered when we developed our rankings included:

- Annual fees.

- Any other fees, like account opening fees, monthly maintenance fees or credit limit request fees.

- If the card earned any rewards and/or a welcome bonus

- If the card requires a security deposit.

- If the card requires a credit score to apply.

Frequently asked questions (FAQs)

While Bank of America does not list a specific minimum credit score requirement for this card, it’s aimed at those with good or better credit.

Points earned with this card are worth one cent each, so 20,000 points are worth $200 in travel or dining statement credits.

To apply for a Bank of America credit card online, applicants need to be at least 18-years-old, have a valid U.S. Social Security number (SSN) and have a physical address in the U.S. International students who don’t meet these requirements can still apply in person within a Bank of America branch but may require additional credentials like an ITIN.

The Bank of America Travel Rewards credit card for Students does not charge an annual fee.

*The information for the Capital One Quicksilver Student Cash Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Holly D. Johnson is a personal finance expert and award-winning writer who covers a variety of insurance topics as well as general personal finance. In addition to her articles in Forbes, Holly is a featured author for CNN Underscored, Bankrate, Consumer Affairs and other notable publications. Johnson is also the founder of finance website Club Thrifty and the co-author of "Zero Down Your Debt: Reclaim Your Income and Build a Life You’ll Love."

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

You might be a small business owner and not even know it

Credit Cards Jason Steele

Chase Freedom Flex benefits guide 2024

Credit Cards Julie Sherrier

6 ways to maximize the Citi Double Cash Card

Credit Cards Ben Luthi

How to use the Citi trifecta to maximize your rewards

Credit Cards Ryan Smith

Hilton Honors American Express business card unveils new profile, plumps up annual fee

Why my Citi Double Cash Card keeps getting better

Credit Cards Lee Huffman

Is the Citi Premier worth the annual fee?

Credit Cards Juan Ruiz

6 little known perks of the Citi Custom Cash Card

Credit Cards Harrison Pierce

Is the Chase Sapphire Preferred Worth it?

Credit Cards Tamara Aydinyan

Why I got the Citi Custom Cash Card this year instead of another travel rewards card

Credit Cards Kevin Payne

Breeze Airways releases new Breeze Easy credit card with lofty rewards, up to 10 points per $1

Credit Cards Stella Shon

6 little-known perks of the Citi Diamond Preferred Card

Guide to Wells Fargo Rewards: How to earn and redeem points for travel and other uses

Best ways to use Citi ThankYou points

Credit Cards Michael Dempster

Action required: Update your browser

We noticed that you're using an old version of your internet browser to access this page. To protect your account security, you must update your browser as soon as possible. You'll be unable to log in to Discover.com in the future if your browser has not been updated. Learn more in the Discover Help Center

Please Note: JavaScript is not enabled in your web browser. In order to enjoy the full experience of the Discover website, please turn JavaScript on. If JavaScript is disabled, some of the functionality on our website will not work, such as the display of rates and APRs.

- Card Help Center

- Card Smarts

- Banking Help Center

- Home Loans Help Center

- Student Loans Help

- Personal Loans Help

- Gift Card Help

- Search Search Discover When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore by touch or with swipe gestures.

- Log In Opens modal dialog

- Credit Card Products

- Credit Cards by Feature

- Tools and Resources

- All Credit Cards

- Discover it® Cash Back Earn cash back rewards

- Discover it® Student Cash Back Start building credit in college

- Discover it® Student Chrome Earn restaurant & gas rewards as a student

- Discover it® Secured Build or rebuild your credit

- Discover it® Miles Explore with the travel rewards credit card

- Discover it® Chrome Earn restaurant & gas rewards

- NHL Credit Card Represent your team & earn cash back

Cash Back Credit Cards

- Airline Travel Credit Card

- Low Interest Credit Cards

- Balance Transfer Credit Cards

- Credit Cards for College Students

- Credit Cards for No Credit History

- Credit Cards to Build Credit

- No Annual Fee Credit Cards

- Credit Card Interest Calculator

- Respond to Mail Offer

- Check Application Status

- Card Smarts Articles

- - Getting a credit card

- - Using your credit card

- - Credit card rewards

- Free Credit Score for Cardmembers

Credit Cards

Compare and apply for the best discover credit card for you.

Discover credit cards include rewards like cash back or miles so you can pick the best rewards credit card for you.

All with no annual fee

See if you’re pre-approved with no harm to your credit score 7

Discover It ® Cash Back Credit Card

Earn 5% cash back

on everyday purchases at different places you shop each quarter, up to the quarterly maximum when you activate.

Plus, earn 1% cash back on all other purchases.

No annual fee

Unlimited Cashback Match

Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year, automatically. There is no limit to how much we'll match. 1

New Intro APR

x % Intro APR † for x months on purchases and balance transfers and x % Intro Balance Transfer Fee until .

Then x % to x % Standard Variable Purchase APR and up to x % fee for future balance transfers will apply.

Discover It ® Student Cash Back Credit Card

See how we calculate our ratings

Plus, earn 1% cash back on all other purchases.

x % Intro APR † for x months on purchases.

Then x % - x % Standard Variable Purchase APR will apply.

Discover It ® Secured Credit Card

See how we calculate our ratings

Earn 2% Cashback Bonus ®

at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. 2

Plus, earn unlimited 1% cash back on all other purchases.

Build your credit with responsible use. 3

x % Standard

Variable Purchase APR † applies.

Your credit line will equal your deposit amount, starting at $ 200. 4

Discover It ® Student Chrome Credit Card

at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. 2

x % Intro APR † for x months on purchases.

Discover It ® Miles Credit Card

Earn unlimited 1.5x Miles

on every dollar of every purchase — from airfare and hotels to groceries and online shopping.

Unlimited Discover Match ®

We’ll automatically match all the Miles you’ve earned at the end of your first year. 1 There's no signing up, no minimum spending or maximum rewards. Just a Mile-for-Mile match.

x % Intro APR † for x months on purchases and balance transfers. x % Intro Balance Transfer Fee until .

Discover it ® Chrome Gas & Restaurant Credit Card

x % Intro APR † for x months on purchases and balance transfers and x % Intro Balance Transfer Fee until .

NHL ® Discover It ® Credit Card

How to apply for a credit card online

When you consider credit card offers, it's important to know whether you want a card with no annual fee, a balance transfer offer, cash rewards or travel rewards, a 0% introductory APR, enhanced security programs, or other benefits.

Once you know the card features that matter to you, you can review the benefits of each credit card online and pick one most likely to approve someone with your credit score.

You might already be preapproved for a credit card that has everything you want-Discover makes it possible to find out before you submit a credit card application, and checking won't hurt your credit.

Credit Card FAQs

Find information on Discover cards, how to apply for a credit card online, and more.

How can I improve my chances for approvals and higher credit limits when I apply for a credit card?

Credit card companies consider a number of factors in their decision to approve your application, including your credit history and your ability to repay. So they may consider your credit score, income and more. One of the simplest helpful credit habits is to make at least the minimum payment for all of your bills on time every month.

What is a credit limit for a credit card?

Your credit limit is the maximum amount of the revolving line of credit on your card—or the total amount you can use on your card for purchases, balance transfers, etc. When you apply for a credit card, the bank or credit card company uses a variety of information to decide what credit limit they can offer. As you show responsible credit use, credit card issuers may increase your credit card limit.

Is Discover Card accepted everywhere?

Discover is accepted nationwide by 99% of the places that take credit cards. 8 You can earn rewards with Discover when you shop in-store or online, order take-out, and much more.

What are the different types of Discover Cards?

Discover credit cards are available on the Discover it ® platform, a set of common benefits we’re committed to providing to every customer. However, the rewards and some extra benefits vary from product to product to be sure we can give different customers what they need.

Discover it ® Cash Back : earn rewards at different places

Discover it ® Miles : great for vacations or staycations

Discover it ® Chrome Gas & Restaurants : earn rewards on road trips

Discover it ® Secured Credit Card : build your credit history 3

Discover it ® Student Cash Back : students earn rewards at different places

Discover it ® Chrome for Students : students earn rewards at gas stations and restaurants

NHL ® Discover it ® : put your favorite team on your card

What credit score is needed to apply for a Discover Credit Card?

Discover Card credit score requirements vary by product. In general, the standard Discover it ® Card is for people with established credit. But the Discover Secured credit card is built for people looking to build or rebuild their credit with responsible use. 3 No matter what, cardmembers earn Discover Card rewards on every purchase.

How many Discover Cards can you have?

As a Discover ® Cardmember, you can have two different credit cards . Discover credit cards let you earn rewards on each eligible purchase, from cash back rewards to miles for travel and more.

How can I view introductory credit card offers and find the best new credit card offers for me?

You may receive credit card offers in the mail, by email, or online. Compare your offers by rewards, sign-up bonus, benefits, APR (including introductory rates), fees, and credit limits. Look for rewards programs that fit the way you spend. If you know you’ll use the card for groceries, gas, dining, or travel, you may be able to find a card that helps you earn more. And look for a sign-up bonus that doesn’t have a minimum spending amount required to get your extra rewards.

How can I get a new credit card from Discover?

You can apply for Discover credit cards at Discover.com or by calling 1-800-DISCOVER (1-800-347-2683). Select from cash back credit cards or travel credit cards. We also have Discover student cards. All our credit cards earn Discover rewards on every purchase. You’ll need to be 18 or older to apply for a card. If you're not yet 21, you will have to apply online. Discover Secured credit card applicants must also apply online.

How can I apply for a credit card?

How does a credit card work.

A credit card is a revolving loan that you can use to make purchases. Each month you’ll receive a statement telling you how much of the loan you have used and have to pay back. If you pay the statement balance in full by the due date each month, you won't be charged interest on purchases. Otherwise, your APR will apply to your unpaid credit card balance and you’ll have interest charges in your next statement. When you apply for a credit card, the credit card issuer will pull your credit report–which could result in a hard inquiry–as one of the factors they use to decide whether to approve your application. Credit cards often provide rewards on purchases, which is usually a percentage of the amount you spent with the card. A credit card comparison shows you different rewards and benefits and can help you find the credit card that’s best for you.

What’s the easiest Discover Card to get?

There’s no easy credit card to get. Credit card approval isn’t guaranteed and depends on many factors, like your credit history and income. If you have an established credit history and good credit score, you may find you can get approved for many cards. However, if you’re just starting your credit journey or want to rebuild your credit history, 3 a Discover it ® Secured Card may be best for you. Similarly, students with limited or no credit history may find that a Discover student card better fits their financial needs. And remember, every Discover credit card earns rewards on purchases.

What are the benefits of Discover Cards?

Discover offers many benefits across our line of products. All Discover Cards offer rewards, either cash back or Miles, on each eligible purchase. Plus, only Discover automatically gives unlimited Cashback Match to all new cardmembers: we'll automatically match all the cash back you've earned at the end of your first year. 1 Also, Discover has no annual fee on any of our cards. We’re also serious about protecting your personal information, with benefits that include Online Privacy Protection , free Social Security number alerts , $0 Fraud Liability Guarantee , and more.

Why get a credit card?

There are many reasons to get a credit card: you may decide to apply for a credit card for the rewards, APR (including intro rates), or sign-up offers. Or you might want to build your credit history. Some credit cards, like Discover, provide $0 Fraud Liability Guarantee, which means you’re never responsible for unauthorized purchases on your Discover Card account. 5 Also, credit cards often provide extra benefits, like providing helpful alerts on your spending and more.

What is the minimum credit score needed to be approved for a credit card?

Different credit cards require a different credit rating for approval. Some cards are only for people with excellent credit or good credit. Other cards are great if you have fair credit or are building or rebuilding credit. The credit card company will run a credit check as part of its decision to approve your application. It’s a good idea to check your credit score or get a copy of your credit report before applying for a new card.

What should I know before applying online for a credit card?

It’s always good to check if you’re pre-approved to see your likely offers before you apply for a card. You can see if you’re pre-approved with no harm to your credit score, 7 but each full application for a credit card may impact your credit score.

Tools to help you choose the best credit card for you

Are you ready to add a discover credit card to your credit journey.

Learn how and why you may receive pre-approved credit card offers, what to look for, and how you can opt-out of pre-approved credit card offers.

Learn how to apply for a credit card online, increase your chances of approval and protect your personal information while applying for credit cards online.

Find out which credit cards you qualify for by trying an online card pre-approved tool, checking doesn't impact your credit score and can personalize your offer.

Cash Back Credit Cards: Discover it ® Cash Back, Gas & Restaurant Card, NHL ® Discover it ®

Travel Credit Card: Discover it ® Miles

Student Credit Cards: Discover it Student ® Cash Back, Student Chrome Card

Secured Credit Card: Discover it ® Secured credit card

Intro purchase APR is x % for x months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is x % for x months from date of first transfer, for transfers under this offer that post to your account by then the standard purchase APR applies. Standard purchase APR: x % variable to x % variable, based on your creditworthiness. Cash APR: x % variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x % Intro fee on balances transferred by and up to x % fee for future balance transfers will apply. Annual Fee: None . Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

Travel Credit Card

Intro purchase APR is x % for x months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is x % for x months from date of first transfer, for transfers under this offer that post to your account by then the standard purchase APR applies. Standard purchase APR: x % variable to x % variable, based on your creditworthiness. Cash APR: x % variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x % Intro fee on balances transferred by and up to x % fee for future balance transfers will apply. Annual Fee: None . Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

Student Credit Cards

Intro purchase APR is x % for x months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is x % for x months from date of first transfer, for transfers under this offer that post to your account by then the standard purchase APR applies. Standard purchase APR: x % - x % variable, based on your creditworthiness. Cash APR: x % variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x % Intro fee on balances transferred by and up to x % fee for future balance transfers will apply. Annual Fee: None . Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

Secured Credit Card

x % standard variable purchase APR . Intro Balance Transfer APR is x % for x months from date of first transfer, for transfers under this offer that post to your account by then the standard purchase APR applies. Cash APR: x % variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50 . Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x % Intro fee on balances transferred by and up to x % fee for future balance transfers will apply. Annual Fee: None . Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

NHL and the NHL Shield are registered trademarks of the National Hockey League. NHL and NHL team marks are the property of the NHL and its teams. © NHL 2024. All Rights Reserved.

Cashback Match: Only from Discover as of February 2024. We'll match all the cash back rewards you've earned on your credit card from the day your new account is approved through your first 12 consecutive billing periods or 365 days, whichever is longer, and add it to your rewards account within two billing periods. You've earned cash back rewards only when they're processed, which may be after the transaction date. We will not match: rewards that are processed after your match period ends; statement credits; rewards transfers from Discover checking or other deposit accounts; or rewards for accounts that are closed. This promotional offer may not be available in the future and is exclusively for new cardmembers. No purchase minimums.

Discover Match ® : Only from Discover as of February 2024. We'll match all the Miles rewards you've earned on your credit card from the day your new account is approved through your first 12 consecutive billing periods or 365 days, whichever is longer, and add it to your rewards account within two billing periods. You've earned Miles rewards only when they're processed, which may be after the transaction date. We will not match: rewards that are processed after your match period ends; statement credits; rewards transfers from Discover checking or other deposit accounts; or rewards for accounts that are closed. This promotional offer may not be available in the future and is exclusively for new cardmembers. No purchase minimums.

2% Cash Back at gas and restaurants: You earn a full 2% Cashback Bonus ® on your first $1000 in combined purchases at Gas Stations (stand-alone), and Restaurants each calendar quarter. Calendar quarters begin January 1, April 1, July 1, and October 1. Purchases at Gas Stations and Restaurants over the quarterly cap, and all other purchases, earn 1% cash back. Gas Station purchases include those made at merchants classified as places that sell automotive gasoline that can be bought at the pump or inside the station, and some public electric vehicle charging stations. Gas Stations affiliated with supermarkets, supercenters, and wholesale clubs may not be eligible. Restaurant purchases include those made at merchants classified as full-service restaurants, cafes, cafeterias, fast-food locations, and restaurant delivery services. Purchases must be made with merchants in the U.S. To qualify for 2%, the purchase transaction date must be before or on the last day of the offer or promotion. For online purchases, the transaction date from the merchant may be the date when the item ships. Rewards are added to your account within two billing periods. Even if a purchase appears to fit in a 2% category, the merchant may not have a merchant category code (MCC) in that category. Merchants and payment processors are assigned an MCC based on their typical products and services. Discover Card does not assign MCCs to merchants. Certain third-party payment accounts and digital wallet transactions may not earn 2% if the technology does not provide sufficient transaction details or a qualifying MCC. Learn more at Discover.com/digitalwallets . See Cashback Bonus Program Terms and Conditions for more information.

Build credit with responsible use : Discover reports your credit history to the three major credit bureaus so it can help build/rebuild your credit if used responsibly. Late payments, delinquencies or other derogatory activity with your credit card accounts and loans may adversely impact your ability to build/rebuild credit.

Minimum Security Deposit: If approved, you must make a minimum security deposit of $200 (or more, in increments of $100 up to $2,500), which will equal your requested credit limit. Discover will determine your maximum credit limit by your income and ability to pay.

$0 Fraud Liability: An “unauthorized purchase” is a purchase where you have not given access to your card information to another person or a merchant for one-time or repeated charges. Please use reasonable care to protect your card and do not share it with employees, relatives, or friends. Learn more at Discover.com/fraudFAQ .

About product reviews : We calculate the average product rating based on ratings that customers submit. We exclude some reviews from being displayed for reasons such as the customer included profanity, reviewed the wrong product, submitted inappropriate or irrelevant content, or revealed personally identifying information. Reviews are not filtered, edited, or deleted simply because they are negative or are lower rated. If a review is excluded, the associated rating is not calculated in the average product rating.

There is no hard inquiry to your credit report to check if you’re pre-approved. If you’re pre-approved, and you move forward with submitting an application for the credit card, it will result in a hard inquiry which may impact your credit score. Receiving a pre-approval offer does not guarantee approval. Applicants applying without a social security number are not eligible to receive pre-approval offers. Card applicants cannot be pre-approved for the NHL Discover Card.

Acceptance : According to the Feb 2023 issue of the Nilson Report.

The offer you are looking for isn't available, but see below to find the best Discover Card for you right now.

Welcome to ISIC

International student identity card, the isic card is the only internationally accepted student identity card which provides student status verification, thousands of discounts worldwide and access to the global student community..

Making Student Life Better

About ISIC Association

The ISIC Association is the non-profit organisation behind the International Student Identity Card. First created by students in 1953, the ISIC card is now issued to students in 98 countries.

The ISIC Association aims to play a key supporting role in the lives of students globally in helping make their student time easier, more affordable and more enjoyable via facilitating the international recognition of their official student status. The ISIC card has been endorsed by UNESCO since 1968 and is endorsed by a wide range of national governments, ministries of education and tourism, student organisations and universities worldwide.

ISIC Mobile App

Download the ISIC mobile app to access your digital student card whenever you go, explore thousands of ISIC offers and services available worldwide and redeem them instantly. With the ISIC app you can discover discounts around you on the map, get latest news, limited vouchers and more!

No longer a student?

Don’t worry! If you are 30 years old or younger, you are eligible for the International Youth Travel card (IYTC) . With an IYTC card, you’re still part of the ISIC global community and can take advantage of thousands of similar benefits and discounts that the ISIC student card offers.

Full-time teachers or professors can enjoy teacher discounts with the International Teacher Identity Card (ITIC) . The ITIC is an internationally recognised ID card that offers numerous savings, at home and abroad.

Thousands Student Discounts in 98 countries

Join milions of students who already have a valid ISIC card!

Work with us, academic institutions, card issuers, financial institutions, public transport, other cooperation, our strategic partners.

Latest News

EDU Home Website Goes Live: Transforming Student Mobility Experiences in…

The EDU Home project is proud to announce the official launch of its website, www.edu-home.eu, a pivotal moment in its mission towards redefining…

ISIC Welcomes Philips Personal Health to Benefit Network, Empowering Students…

ISIC proudly welcomes Philips Personal Health to our esteemed network, marking a significant movement in our mission to empower students globally. We’re excited…

Introducing a Fresh Perk for ISIC Cardholders: British Council English…

We’re excited to introduce a special opportunity for students worldwide through our partnership with British Council English Online. Whether you’re aiming to enhance…

Choose Local ISIC Website

- Dominican Republic

- Puerto Rico

- United States

Africa, Middle East

- Flag of South Africa South Africa

- United Arab Emirates

- Netherlands

- Switzerland

- United Kingdom

Asia, Oceania

- New Zealand

Our websites may use cookies to personalize and enhance your experience. By continuing without changing your cookie settings, you agree to this collection. For more information, please see our University Websites Privacy Notice .

University Business Services

Travel Services

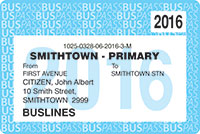

*new* student travel card program.

In an effort to incorporate your feedback and provide an enhanced solution for Student Travel we are excited to announce the new Student Travel Card program and process that will replace the current Student Declining balance card program effective today January 18 th , 2022. Graduate Assistants, Graduate Interns and Post-Docs will continue to use the employee process and the employee Travel cards.

Here are some Key highlights of the new program:

- Students can now use their Student Travel Cards to pay for individual actual meal expenses up to the daily allowable per diem amount if not claiming per diem reimbursement.

- Students can also use their Student Travel Card to pay for other incidental expenses such as Airline Baggage Fees, Ground Transportation, Parking, Car rental gas, etc.

- Student Travel Cards will be valid for 3 years from the original date of issue.

- The Student Travel Card request is initiated via Creating a Travel request in the student’s profile in Concur with the estimated expenses expected to be covered by the Student Travel Card. The Student’s request should not include estimates for Airfare, Car rental or hotel expenses as those will be covered by an Employee using their own employee travel card.

- Students will receive an email with a link to the Student Travel Card training (must be completed at least once per year) and link to complete the Student Travel Card request form that has been initiated from the request submitting in Concur.

- The amounts to be loaded on the Student Travel Card is determined by the estimated expenses entered on the student’s travel request in concur within their own profile. Students will also subsequently submit an expense report in their own profile upon return from the trip to reconcile their Student travel card expenses plus any other out of pocket reimbursements.

- The Student Travel Card will be active for use from the business start date to the business end date of each trip. After the Business end date of the trip the Student Travel Card limit will be reduced to $1.

- When the Student is ready to for funds to be loaded for a new trip, the student will then submit a new Concur Travel Request with the estimates of the expenses expected to be loaded on their Student travel card.

- The student will again receive an email with the Student Travel Card request form, however, this time they must select Update at the top of the form and enter the last four (4) digits of their current Student Travel Card so that the Card will be loaded with the estimate funds for the upcoming trip to be available from the Business Start to Business End dates of the Concur Travel request.

- Employees will purchase Airfare and hotel with their own Employee Travel Cards for students and will direct bill car rental reservations to UConn through Anthony Travel (the employee will also submit a request and subsequent expense report in their own profile for these expenses charged to the employee Travel Card).

- If a student separates from the University prior to the 3 years that the card is valid for use the student must contact the Student Travel Card Administrator to close the Student Travel Card account at [email protected] and reconcile any outstanding Student Travel Card transactions in Concur prior to their departure.

Additional information is available at the links below:

Student Travel Card Information

Creating a Student Travel Request

Creating an Expense report (employee booking will use this for instructions on how to reconcile the Airfare, Hotel and Car rental expenses)

Creating a Student Expense report (students expensing Student travel card transactions and out of pocket reimbursements will use the instructions in this document)

Meals – Individual Actual meal expenses Vs Per diem reimbursement

Young Adult and Student Card

You can get 50% off adult public transport fares with the Young Adult (19-25) or Student Leap Card, and you can also travel around Dublin for just €1 with the TFI 90 minute fare.

- The Young Adult (19-25) Leap Card is currently for all 19-25 year olds.

- The Student Leap Card is for full time third level students who are either 16-18 or 26 years old and above. Eligibility criteria are set out in more detail below.

You must apply online

- If you are a Young Adult (19-25) you need to upload a photo of your passport or driving licence to prove your age. Your card will be posted to your nominated home address.

- If you already have a Young Adult card that was purchased before the 11/01, it will continue to be valid until your 24th birthday. You can apply for a new card before you turn 26, which will then be valid until your 26th birthday.

- If you are a third level Student (16-18 or 26+) you will need show your Student ID and a valid proof of age ID at the nearest Student Leap Card agent to collect your card, after you have applied online.

If you’ve already applied for your card you can check on the order status, here

What services accept Young Adult and Student Leap Cards?

How much does a young adult or student leap card cost, what do i need to apply for a young adult leap card, who is eligible for a student leap card, i’m a 16-18 year old. should i get a student leap card or a child (16-18) card, where to collect your student leap card.

Half price fares apply to single journeys on the TFI network, including:

- Bus Éireann

- Iarnród Éireann (including DART)

- Go-Ahead Ireland

- TFI Local Link services

- Kilkenny City bus

- Route 139 (JJ Kavanagh and Sons)

- Route 197 (Go-Ahead Ireland)

- Route 817 (Bernard Kavanagh & Sons)

- A range of commercial bus operators – Click here for participating commercial bus operators

You must pay a €5 refundable deposit and add a minimum of €5 travel credit when purchasing the card.

Before applying for a Young Adult (19-25) Leap Card make sure you have:

- A valid Passport, Drivers Licence or Learner Permit, other non-standard documents may be accepted, view the full list here

- The ability to enable your camera permissions

- The card applicant is present

- You have payment card details ready

A live selfie is required during the application process to validate the applicant’s likeness against the ID document. This will be the photo used on the card. Once the application is verified we’ll send your card by post, usually within 5 working days.

Students must be able to verify that they meet these criteria:

- Students must have a minimum of 16 hours of lectures/class time per week, and be enrolled in the course for a minimum of 6 months

- Full time foreign students who meet the above criteria are also entitled to apply for the SLC whilst in Ireland

- Students enrolled as trainee Accountants (ACCA, Institute of Chartered Accountants in Ireland), trainee Solicitors registered with the Law Society, full time SOLAS trainees/students and full time PLC students are also considered eligible

- Students of on-line courses are not eligible to apply for the SLC, unless they meet the criteria set out here

- Students may be required to produce further evidence of eligibility (i.e. letter from college/institution)

If you are aged 16-18 and in full-time third level education, you now have a choice of TFI Leap Card types. Usually, can get the cheapest fares with the Child 16-18 Leap Card. However, if you use commercial bus operators you may be better off using a Student Leap Card on their services, as participating operators are giving cheaper student fares.

Child Card 16-18yr old

- Available to all 16-18 year olds

- This card gives the Child fare on eligible public transport services, including: Dublin Bus, Go-Ahead Ireland, Luas, Bus Éireann, TFI Local Link, DART and Commuter Rail

- Card expires on your 19 th birthday

- Card is posted to your address following online application

Student Card

- Available to 16-18 year olds (and 26+) in full-time third level education, including further education and training

- This card gives the Young Adult/Student fare on public transport services, including: Dublin Bus, Go-Ahead Ireland, Luas, Bus Éireann, TFI Local Link, DART and Commuter Rail

- This card also gives 50% off fares on participating commercial bus operators

- Card expires at the start of the following academic year (September)

- Card must be collected at a participating Student Leap Card agent within 14 days of online application, however if you have completed the remote verification process with Trinity SU and have paid the postage fee, you do not need to attend the agent again, your Student Leap Card will be posted to you.

- When collecting your Student Card, you must provide your Student ID as well as a valid proof of age ID .

- If you are within the age of 19-25 after your student card expires, you can apply for a young adult card.

Most people will only choose to get one card but you may apply for both cards depending on your travel needs.

Student Leap Cards must be ordered online . You must then go to one of the following Student Leap Agents to verify you are an eligible student and collect your card. If you cannot locate a Student Leap Card agent near you, please click here for further options.

Using TFI Leap

Leap top up app, replacements and refunds, card and ticket types, leap visitor card.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How a Travel Credit Card Can Be Your Ticket to Big Savings

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Next time you're planning a vacation, a travel credit card could defray some or all of the costs if it packs the right incentives. Typically, cards with higher annual fees provide the most value with perks like ongoing rewards, free checked bags, airport lounge access or other benefits. But even cards with low or no annual fees make it possible to earn some value toward travel, if you can qualify.

These cards generally require good credit (scores of 690 or higher), and even if you're eligible, it's not worth pursuing one if you can't pay off the credit card bill in full every month to avoid steep interest charges. And if you're working toward paying down existing debt, it might not be worth chasing points and miles until you've made progress on that front.

But as long as travel credit cards align with your financial goals, their potential savings merit consideration — even if you travel just once or twice per year. Explore the flexibility of a general-purpose travel credit card to book travel anywhere, or a branded credit card to book travel with a favorite hotel or airline. Either option may offer money-saving benefits toward your next trip.

Valuable features can lower costs

Offers will vary among general-purpose travel credit cards and airline- or hotel-branded credit cards, but some savings opportunities may include:

If a credit card offers a lengthy list of perks, the value can quickly add up. Here are some features to look out for:

A sign-up offer: Travel credit cards generally come with lucrative sign-up offers that let new cardholders earn a pile of points or miles by meeting a minimum spending requirement. It’s easier to snag if you can strategically time a credit card application around planned purchases during a heavy-spend month or season.

Free checked bags: Some airline credit cards offer free checked bags , which can add up to real savings when applied per person on a round trip. This is one way that Doug Figueroa, a content creator at the YouTube channel Zorito y Doug, makes up the cost of the $150 annual fee on an airline credit card. “The savings are $70 round trip per passenger listed in the same reservation,” he says.

TSA or Global Entry credit : Some travel cards issue a credit (up to $100) when you use them to pay for a TSA or Global Entry application fee. These expedited airport security screening programs can save time while traveling.

Travel credits: Depending on the card’s terms, travel credits may be used to save money on a variety of travel expenses like rideshare services, airfare or accommodations.

Airport lounge access: You can skip the pricey airport food with some travel credit cards that offer complimentary airport lounge access . Austin Maxwell, a South Carolina-based content creator at the blog The Maxwells Travel, uses a travel credit card to avoid those costs. “I’m saving $20 to $30 every time I go to the airport because I don’t have to buy food or drinks during a layover or preflight,” he says.

A companion ticket: Some airline credit cards cover the cost of a ticket for a friend or family member. Depending on the card's terms, you may have to pay taxes and fees on the fare, the companion ticket may have an expiration date and/or a spending requirement may apply.

Automatic elite status: You may earn elite status without much effort on some hotel-branded credit cards. Elite status can add up to valuable savings if the program offers free food, bonus points or suite upgrades.

Free nights: If your favorite hotel has a branded credit card that offers annual free night awards, it can stretch your vacation budget.

Protections and other benefits

A travel credit card that offers trip delay or cancellation insurance, lost baggage insurance, rental car coverage or other protections may also be of value to you. To qualify for these benefits you typically need to pay for the trip or covered purchase with the eligible credit card. Read the terms carefully to understand the extent of your coverage.

Figueroa says he saved $90 over three days with his card’s primary rental car coverage on a trip to Miami.

“Once you make the online reservation, you must decline all insurance offered by the rental company and pay for everything with your [card],” he says.

High-value reward redemptions

Points or miles on some travel credit cards might lose value if they are used for non-travel redemptions like cash back, gift cards or other options. Travel redemptions typically offer the best value, and you might squeeze out even more value with a general-purpose travel card that allows points to transfer to airline or hotel partners. It’s a strategy that Maxwell uses often to his advantage.

“It’s even better if there’s a transfer bonus associated with that," he says. "Credit card companies offer transfer bonuses — 15%, 20%, 30% bonus — if you are to transfer points to a specific airline.”

He says he has also transferred points to hotel partners to book hotel rooms with them. “It would be the equivalent of getting a hotel room at $120 that’s actually valued at $500,” he adds.

To determine whether to redeem rewards for travel or transfer them to a partner, compare costs by checking the credit card’s booking platform and the partner’s website. Also factor in whether rewards transfer on at least a 1:1 ratio, meaning that you'll get the equivalent value in points or miles transferred.

On a similar note...

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

How can we help you today?

Popular searches.

- Contactless payments

- Routes and timetables

- Concessions

- School student travel

- Opal Travel app

- Tickets and Opal

- Ticket eligibility

- School students

Apply for a school travel pass or School Opal card

School travel passes can be used for free travel to and from school or TAFE. Depending on where you are travelling, you may receive a free school travel pass, School Opal card or both.

If you have had applied for a student travel pass before you will need a different page:

- If your pass has expired or your details or travel requirements have changed, go to re-apply or update details on a current pass .

- If your application was unsuccessful, find out about requesting a review .

- If your card is damaged, lost or stolen, go to replace a damaged, lost or stolen pass .

Things to know before applying

Applications for next year open at the start of Term 4 this year.

You can apply for free school travel for different modes of transport including train, bus, ferry and light rail using the online form.

You only need to apply:

- if applying for a school travel pass for the first time.

- if requesting an extra pass due to parents living separately.

The student must:

- be a resident of NSW, or an overseas student eligible for free government education.

- be aged 4 years 6 months or older. Pre-school children are not eligible.

- live a minimum distance from your school. The minimum distance varies according to the year or grade the student is enrolled in that calendar year.

Who can get a school travel pass

Kindergarten to year 2 (infants).

- There is no minimum walking distance for these students.