- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

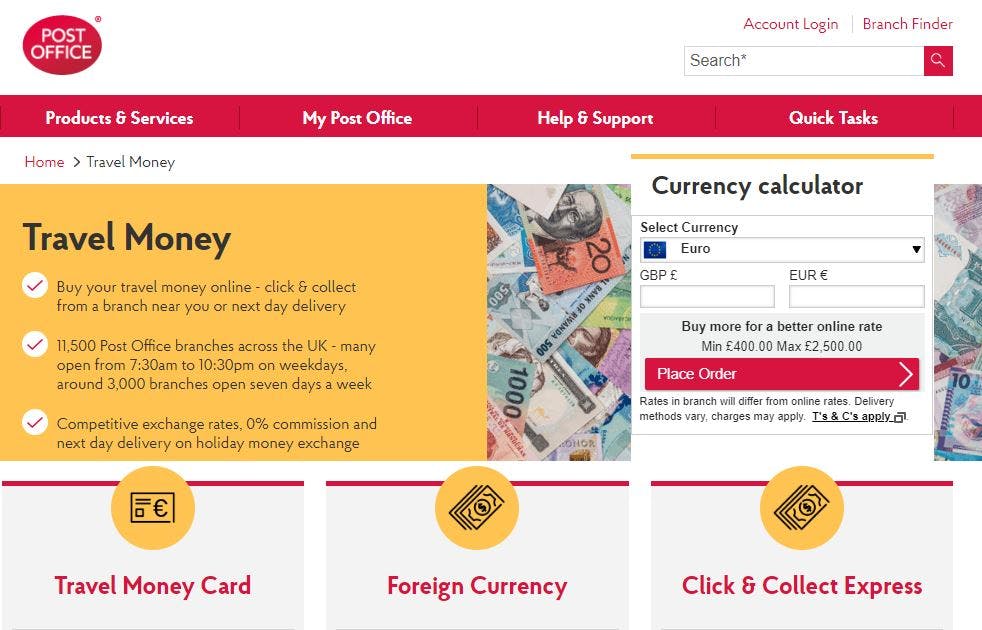

- Travel Money

Get competitive rates and 0% commission for your holiday cash

Foreign currency

Find our best exchange rates online and enjoy 0% commission on over 60 currencies. And you can choose collection from your nearest branch or delivery to your home

Go cashless with our prepaid Mastercard®. Take advantage of contactless payment, load up to 22 currencies and manage everything with our app, making travel simple and secure

Order travel money

- UAE Dirham AED

- Australian Dollar AUD

- Barbados Dollar BBD

- Bangladesh Taka BDT

- Bulgarian Lev BGN

- Bahrain Dinar BHD

- Bermuda Dollar BMD

- Brunei Dollar BND

- Canadian Dollar CAD

- Swiss Franc CHF

- Chilean Peso CLP

- Chinese Yuan CNY

- Colombian Peso COP

- Costa Rican Colon CRC

- Czech Koruna CZK

- Danish Kroner DKK

- Dominican Peso DOP

- Fiji Dollar FJD

- Guatemalan Quetzal GTQ

- Hong Kong Dollar HKD

- Hungarian Forint HUF

- Indonesian Rupiah IDR

- Israeli Sheqel ILS

- Icelandic Krona ISK

- Jamaican Dollar JMD

- Jordanian Dinar JOD

- Japanese Yen JPY

- Kenyan Shilling KES

- Korean Won KRW

- Kuwaiti Dinar KWD

- Cayman Island Dollar KYD

- Mauritius Rupee MUR

- Mexican Peso MXN

- Malaysian Ringgit MYR

- Norwegian Krone NOK

- New Zealand Dollar NZD

- Omani Rial OMR

- Peru Nuevo Sol PEN

- Philippino Peso PHP

- Polish Zloty PLN

- Romanian New Leu RON

- Saudi Riyal SAR

- Swedish Kronor SEK

- Singapore Dollar SGD

- Thai Baht THB

- Turkish Lira TRY

- Taiwan Dollar TWD

- US Dollar USD

- Uruguay Peso UYU

- Vietnamese Dong VND

- East Caribbean Dollar XCD

- French Polynesian Franc XPF

- South African Rand ZAR

- Brazilian Real BRL

- Qatar Riyal QAR

Delivery options, available branches and fees may vary by value and currency. Branch rates will differ from online rates. T&Cs apply .

Why get your holiday cash from Post Office?

- Order online, buy in branch, or choose delivery to your home or local branch

- 100% refund guarantee* if your holiday’s cancelled, at the same exchange rate, excluding bank and delivery charges. Just send your receipts and evidence of cancellation to us within 28 days of purchase. *T&Cs apply

- Order euros or US dollars to collect in branch in as little as 2 hours

Today’s online rates

Rate correct as of 08/04/2024

Travel Money Card (TMC) rates may differ. Branch rates may vary. Delivery methods may vary. Terms and conditions apply

Win £5000 with Post Office Travel Money Card

A chance to win £5000 when you top up a new or existing Travel Money Card*. Offer ends 12 May

*Exclusive to travel money cards. Promotion runs 4 March to 12 May 2024. 1 x £5,000 prize available to be won each week. Minimum equivalent spend of £50 applies.

Stay in control

Manage your holiday essentials together in one place on the move, from your Travel Money Card and travel insurance to extras like airport parking.

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Need some help?

Travel money card lost or stolen.

Please immediately call: 020 7937 0280

Available 24/7

Travel money help and support

Read our travel money FAQs or contact our team about buying currency online or in branch:

Visit our travel money support page

Other related services

Hoi An in Vietnam is still the best-value long haul destination for UK ...

Travelling abroad? These tips will help you get sorted with your foreign ...

We all look forward to our holidays. Unfortunately, though, more and more ...

The nation needs a holiday, and Brits look set to flock abroad this year. The ...

Our annual survey of European ski resorts compares local prices for adults and ...

The nation needs a holiday. And, with the summer season already underway, new ...

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

One of the joys of summer are the many music festivals playing across the ...

Prepaid currency cards are a secure way to make purchases on trips abroad. They ...

For the first time in 16 years of our reports, Lisbon is not only the cheapest ...

Thinking of heading off to Europe for a quick city break, but don’t want to ...

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

Long-haul destinations offer the best value for UK holidaymakers this year, ...

Kickstarting your festive prep with a short getaway this year? The Post Office ...

Discover every bank branch and currency exchange location in the UK.

You are here: Home / Blog / Post Office Travel Money: Exchange rate, Locations and Opening Times

Post Office Travel Money: Exchange rate, Locations and Opening Times

This guide covers all you need if you want to sort your travel money through the Post Office, including a look at how the Post Office exchange rate is calculated, and your options if you want to use the Post Office travel money card.

We’ll also take a look at how Wise and the Wise account can help you cut the costs of spending while you’re abroad, so you can make the most of your holiday.

Post Office exchange rate

Let’s start with the basics. Whenever you’re buying travel money you need to know the exchange rate which will be used to convert your pounds to euros, dollars or whichever other currency you might require.

Unfortunately, figuring out the exchange rates used by different providers can be a tricky affair. You’ll find different banks and currency services use different rates - and some providers like the Post Office also offer different exchange rates depending on the amount you want to convert.

To give an example , let’s look at the Post Office euro exchange rate, as well as the rate to switch to US dollars:

Exchange rates correct at time of research (24th November 2020)

As you can see, you get a progressively better exchange rate, the more you convert. However, it’s not quite that simple. These rates reflect the Post Office travel money online service only. If you’re using a Post Office travel card, or simply walk into a Post Office travel money bureau to switch your cash, you may get a different rate. Post Office branch exchange rates vary from one branch to another , too, depending on where the branch is located and competition.

The range of exchange rates out there is confusing. But the way to know if you’re getting a good deal or not is to compare the exchange rate you’re offered against the mid-market exchange rate for your currency. That’s the rate set by global currency markets, and the ones banks and exchange services get when they buy currency themselves. You can find the mid-market rate online using a Google search or reputable currency converter tool.

If the rate you’re being offered isn’t the same as the live mid-market rate you find online this probably means your provider has added a markup. This is an extra fee and makes it hard to see exactly what you’re paying for your travel money.

Avoid this by choosing a provider like Wise (formerly TransferWise) which uses the mid-market exchange rate with no markups, and charges transparent fees for currency conversion.

Post Office Click and Collect

With Post Office Click and Collect you can order your currency online. You’ll then be able to call into your Post Office exchange bureau to collect your travel money, or have it delivered to your home.

Here are the fees and delivery times for the Click and Collect service - where there is no upfront fee, you may be paying a charge wrapped up in the exchange rate used:

What are the fees for getting travel money with the Post Office?

The Post Office advertises 0% commission - which sounds like the only fee you’ll need to pay is the delivery fee for smaller orders brought to your doorstep.

Many banks and currency services use a sounding headline like ‘zero commission’ or ‘fee free travel money’ - but add a markup to the exchange rates offered to customers instead . This can mean you’re paying more than you think you are for your currency exchange.

Compare the exchange rates you find with the Post Office against the mid-market exchange rate to see if a markup has been added.

Save with Wise when you spend in any currency

A smart way to cut the costs of your travel money is to use Wise.

The simplest way to access great value currency exchange which uses the real mid-market exchange rate with no markup, is to open a free Wise account online.

You can top up your account in pounds and switch to the currency you need using your laptop or mobile device. Simply use your linked Wise debit card Mastercard to spend when you’re overseas - or you can choose to take out local currency using an ATM when you arrive instead.

It’s free to spend any currency you hold using your linked debit card, and you can withdraw up to the currency equivalent of £200 per month from ATMs abroad with no additional Wise fee. It’s simple, cheap and can make it much easier to access and manage your money while you travel.

Post Office travel money products

Here’s a run through of the basic services available from Post Office travel money. It’s worth knowing that not all services are available at all Post Office branches so you’ll need to check your local options online.

1. Post Office Click and Collect

Order up to £2,500 of foreign currency for collection or home delivery. Euros and US dollars can be picked up in as little as 2 hours, with 60 currencies usually available.

2. Post Office foreign exchange

You can buy currency in a Post Office without ordering in advance too - but availability may be limited so it makes sense to check if they’ll have what you need at your local Post Office branch. If your currency is not available immediately you can order for home delivery instead.

3. Post Office Travel Money Card

The Post Office also has a travel money card which lets you top up in 23 different currencies, and spend wherever you see the Mastercard logo. More on that in a moment.

Post Office travel money bureau - exchange locations

You can get a full list of every UK Post Office online - or use the search function which is available on the Post Office Travel Money website .

Post Office foreign currency London

Here are some of the major Post Office locations offering travel money services in central London - find more branches using the branch finder tool on the Post Office website .

Travel money card London

Travel money services are not available at every single Post Office in the UK. For that reason it’s worth checking the options at the branches near you before you head out.

In most cases, major branches offer travel money services as well as the Post Office travel money cards. You can find details about the services on offer by branch using the branch locator on the Post Office travel money website .

Post Office travel money online

Order your travel money online and select whether you want to collect it in branch or have it delivered to your home. You’ll be able to pay online using a card, although there may be additional fees - check with your own card provider.

Does the Post Office offer a travel money card?

You can get a Post Office travel money card, to top up and spend in foreign currencies as you travel. 23 popular currencies are available, so you can top up in pounds and then switch to the currency you need using the Post Office travel money app. The card is accepted anywhere you see the Mastercard logo.

Get your card online and have it delivered to your home, or apply in a Post Office branch for quicker service. You’ll need to take your ID documents along when you do this.

There are also some limits and fees you need to know about. Check out the full details online to see the minimum and maximum top up amounts and balance, as well as the costs when you make an ATM withdrawal. For example , if you withdraw in euros from an ATM there's a EUR2 charge per withdrawal - in USD you’ll pay $2.50 USD per withdrawal.

The Post Office travel money services are convenient and can largely be accessed online - but it’s well worth understanding the fees you’ll pay for getting your foreign currency. Look carefully at the exchange rates you can access through the Post Office, to see if there's a markup added to the mid-market exchange rate for your currency. This is an extra cost which can push the price of your travel money up unexpectedly.

Return to the blog .

English Use arrow key to access related widget.

- Customer Service

- My USPS ›

- Español

Top Searches

Alert: We are currently experiencing issues with some of our applications. We are working to resolve the issues and apologize for the inconvenience.

Alert: USPS.com is undergoing routine maintenance from 10 PM ET, Saturday, March 9 through 4 AM ET, Sunday, March 10, 2024. During this time, you may not be able to sign-in to your account and payment transactions on some applications may be temporarily unavailable. We apologize for any inconvenience.

Alert: Severe weather conditions across the U.S. may delay final delivery of your mail and packages. Read more ›

Alert: USPS.com is undergoing routine maintenance from 11 PM ET, Saturday, March 2 through 4 AM ET, March 3, 2024. During this time, payment transactions on some applications will be temporarily unavailable. We apologize for any inconvenience.

Alert: We are currently experiencing issues with some of our applications. We apologize for the inconvenience.

Alert: Payment transactions on some applications will be temporarily unavailable from 11 PM ET, Saturday, January 6 through 3 AM ET, Sunday, January 7, 2024. We apologize for any inconvenience.

Alert: Some of our applications are undergoing routine maintenance on Monday, October 30 from 10-11 PM ET and may be unavailable. We apologize for any inconvenience.

Alert: Hurricane Idalia is affecting USPS operations in the Southeast U.S. For updates, see our Service Alerts ›

Alert: Some of our applications are undergoing routine maintenance from Saturday, August 26 through Sunday, August 27 and may be unavailable. We apologize for any inconvenience.

Sending Money Internationally

Send money overseas safely with U.S. Postal Service ® international money orders and Sure Money ® (DineroSeguro ® ) wire transfers. You may send money to people or businesses in countries that have agreements with USPS ® . Learn about how much it costs to send an international payment, the maximum amounts you can send, and other requirements.

Send Money Orders within the U.S.

ALERT : On July 14, 2024, USPS will no longer offer the option to send money overseas with USPS ® international money orders and Sure Money ® (DineroSeguro ® ) wire transfers. Domestic money orders are still available. Learn more. ›

ALERT: On July 14, 2024, USPS will no longer offer the option to send money overseas with USPS ® international money orders and Sure Money ® (DineroSeguro ® ) wire transfers. Domestic money orders are still available. Learn more.

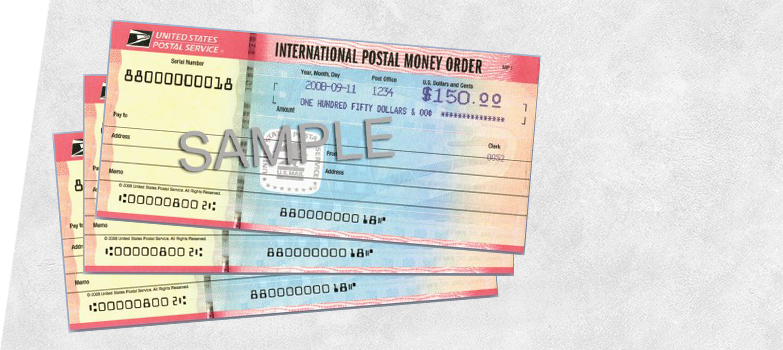

How to Send International Money Orders

International money orders can be purchased at any Post Office ™ location in values up to $700 ($500 for El Salvador and Guyana). An international money order is printed out with only the dollar amount filled in, and all other fields are left blank. As the purchaser, you’ll need to fill in who the money order is payable to.

- Decide on the money order amount.

- Go to any Post Office location .

- Take cash, a debit card, or a traveler’s check. You cannot pay with a credit card.

- Fill out the money order at the counter with a retail associate. NOTE : International money orders are only printed with the dollar amount. Other fields are left blank. You should fill in the "Pay to" field as quickly as possible; otherwise, if the money order is stolen, anyone can cash it and you cannot apply for a refund.

- Pay the dollar value of the money order, the issuing fee of $49.65 , and the processing fee based on country.

- Keep your receipt to track the money order.

- Send the money order via Priority Mail Express International ® , Priority Mail International ® , First-Class Mail International ® , or First-Class Package International Service ® .

Countries That Accept Money Orders (IMM 370)

Receiving Money Orders – How to Spot a Fake

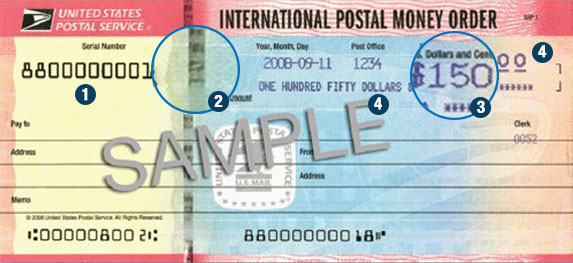

Before accepting a money order, make sure it's real. There are several key things to look at to spot a counterfeit money order.

Examine the Paper

Real USPS ® money orders have specific marks and designs to prevent fraud. If you hold the money order up to the light you should see:

- Watermarks of Ben Franklin on the left side repeat top to bottom (circle 1 on image).

- On the right of the Franklin watermark, a vertical, multicolored thread with the letters “USPS” weaves in and out of the paper to (circle 2 on image).

Check the Dollar Amounts

- If the dollar amount is discolored, it may have been erased, indicating fraud (circle 3 on image).

- Make sure the dollar amount is imprinted twice (circle 4 on image).

- See if the dollar value is too large.

- Domestic money orders cannot be more than $1,000.

- International money orders cannot be more than $700 ($500 for El Salvador or Guyana).

Suspect a Fake?

- If you suspect fraud, call the U.S. Postal Inspection Service at 1-877-876-2455.

- If you think you’ve been given a fake money order, call the Money Order Verification System at 1-866-459-7822.

Check the Status of a Money Order

You can check the status of a money order you've purchased from the U.S. Postal Service at any time by visiting the Money Orders Application . Make sure you have the following information for the postal money order you want to check:

- Serial number

- Post Office number

- Dollar amount

Replacing Lost, Stolen, or Damaged Money Orders

Lost or stolen money orders.

You cannot stop payment on postal money orders, but a lost or stolen money order can be replaced.

- Money order loss or theft may take up to 30 days to confirm.

- Investigating a money order's lost or stolen status may take up to 60 days.

- There is a $36.45 processing fee to replace a lost or stolen international money order.

Requesting a Refund

- Take your money order receipt to any Post Office location .

- Talk to a retail associate at the counter to start a Money Order Inquiry.

- After starting the inquiry, you will be able to check the status of your money order and inquiry progress by visiting the Money Orders Application .

- When your money order is confirmed lost or stolen, we’ll issue you a replacement money order.

Damaged Money Orders

We'll replace money orders that are defective or damaged. Take the damaged money order and your receipt to your local Post Office location to get a replacement.

Sure Money (DineroSeguro)

How it works.

Sending money abroad with a wire transfer is safe and secure through the Sure Money (DineroSeguro) program.

- Participating countries have convenient payout locations.

- Transfers take place during normal business hours at participating branches in the destination country.

- You can send up to $1,500 a day. Before you send money, you must show an acceptable primary ID with a clear photo. See Acceptable IDs & Restrictions

- There are no charges when the money is received.

- Conversion rates are provided at time of purchase.

Participating Countries

Cashing a money order at the post office.

- Do not sign the money order.

- Take a primary photo ID with the money order to any Post Office location.

- Sign the money order at the counter in front of a retail associate.

See additional requirements for money orders made out to organizations, more than one person, and minors.

Cashing Money Orders (DMM 509.3.3)

Charges & Fees

* Charges and fees based on the transaction type.

Call 1-888-368-4669 for more information about Sure Money (DineroSeguro).

1. Effective October 28, 2013, service to Argentina is temporarily suspended. Back ^ 2. Effective August 9, 2017, Payout Agent Bancolombia (BBVA Colombia) is no longer offering Dinero Seguro in Cucuta, Col. Customers can use Banco Davivienda payout agents in Cucuta, or have funds picked up outside the city of Cucuta. Back ^ 3. Effective March 15, 2016, Payout Agent Elektra MEX is no longer offering Dinero Seguro in Chiapas, Mex. Customers can use Bancoppel or Telecom payout agents in Chiapas, or have funds picked up outside the city of Chiapas. Back ^ 4. Effective November 10, 2021, service to Peru is temporarily suspended. Back ^

- Home ›

- Exchange Rates ›

- Post Office

Post Office exchange rates

Today's latest Post Office travel money exchange rates, updated 47 seconds ago at 3:55am

The Post Office have 55 currencies in stock and ready to order now. Buy online and get your currency delivered securely to your door, or collect your order from one of over 11,000 Post Office Bureau de Change branches across the UK.

Jump to section:

- View today's latest Post Office rates

- Compare the Post Office's rates

Travel money order limits and fees

- Post Office reviews

Post Office travel money rates

These are the latest Post Office exchange rates available right now. You must buy or reserve your currency online to guarantee these rates or you may be given a lower rate in-store.

Compare the Post Office's exchange rates

We compare hundreds of exchange rates from dozens of currency suppliers across the UK. Select a currency below to see how the Post Office's rates compare against other providers. Bear in mind that exchange rates aren't the only important factor when it comes to getting the best deal; commission, card surcharges and delivery costs can all affect the final amount of currency you'll receive. You can see the full range of currency deals on offer right now on our travel money comparisons .

The Post Office have a minimum order value of £400 for in-store collection and £400 for home delivery. The maximum amount you can order is £2,500 for collection and £2,500 for delivery. Delivery is free for orders over £500, otherwise a £4.99 delivery charge will apply.

Latest Post Office reviews

Our users have rated the Post Office Poor in 678 reviews. Read more on our Post Office reviews page.

Andrew Maclean

Absolutely shocked that they are willing to leave me homeless in London on my holidays because they blocked my card I have no access to any other funds and they refusing to call me or email me please can someone help me get a phone call from post off [...]

Read the full review

Garth Williams

We have had a PO Travel card for a few years which has worked fine. We are going away on Monday and have put more money on it, but the travel app doesn't work on my Android phone. I have uninstalled it and re-installed it, then it asks me to check my [...]

Angie Mortimer

Here's hoping that you can help me. I have a pre-paid post office card. When she went to use it on Good Friday at a local supermarket, at the check-out she was informed that the card had been blocked. She immediately contacted the post office pre [...]

The euro rate at the Post Office right now is 1.1339. You'll need to buy or reserve your euros online to guarantee this rate; the euro rate offered in your local branch may be lower if you don't order online beforehand.

On average, the Post Office's exchange rates are slightly lower than those offered by other high street brands such as Tesco and John Lewis . Many customers who buy their travel money with the Post Office do so because of the Post Office's brand name and convenient locations - there are over 11,000 Post Office Bureau de Change across the UK - but this convenience comes at a cost in the form of slightly lower exchange rates than those available elsewhere.

If you plan on buying your currency with the Post Office, the golden rule is to always reserve your currency online first so you get their online exchange rate. If you turn up and order over the counter at your local branch, you may be given a much lower rate. Ultimately, if you want the absolute best exchange rate on the market, better currency deals are usually available from other suppliers. Check out our travel money comparisons to find the best currency deals available right now.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

Where Is the Best Place to Exchange Foreign Currency?

When choosing where to exchange currency, don't get caught converting your dollars at unfavorable rates with high currency exchange fees.

Best Place to Exchange Foreign Currency

Getty Images

Plan ahead of time for where you want to exchange foreign currency to avoid inflated exchange rates.

Key takeaways

- Before you leave the country, visit your bank or credit union so you can avoid paying ATM transaction costs and possibly receive a better exchange rate.

- The worst places to exchange your money for another currency are oftentimes the most convenient, like the airport.

- Using your credit cards, prepaid cards or even U.S. dollars for purchases can be good alternatives to exchanging currency.

Before you head off to the airport to catch a flight abroad, find out where to receive the best exchange rate for your money.

Some travelers prefer trading their U.S. dollars for euros or other currencies at their local bank so they have cash to tip taxi drivers or porters at the airport or buy a coffee or lunch. People who are traveling to more than one country with different currencies will find that planning ahead saves you the headache of exchanging money often.

The most expensive, yet most convenient and easily accessible, spots to exchange money include train stations, airports, hotels and tourist areas.

Here are the best places to exchange your money into the local currency before and after your vacation.

Use Phone at the ATM Instead of a Card

Ellen Chang Sept. 12, 2023

Best Place to Exchange Currency Before and After Traveling

The fees may only be a few dollars, but they can add up quickly, especially if you are traveling for more than a few days. Head to your bank or credit union before you leave to avoid paying ATM transaction costs. You may even receive a better exchange rate.

Credit unions and banks will exchange your dollars into a foreign currency before and after your trip when you have a checking or savings account with them. You won't face trying to spend your remaining euros before the end of your trip and can convert them back to dollars when you get home.

Some banks such as Citibank and Bank of America may not charge a fee and will provide options such as conducting the transaction online or even mailing you the currency. If you need amounts of $1,000 or more, most banks require you to pick up the currency in person at a branch.

You can check out the exchange rates online and see which bank is offering the best one.

It's a good idea to call your local bank first to see whether they have the currency you are seeking. Not all branches exchange currency, and exchange rates between banks can vary greatly, says Vaneesha Dutra, an associate professor of finance at Howard University.

"Don't expect to get the exchange rate you saw when you Googled it, as banks add a profit margin to these transactions, which will reduce the actual amount of foreign currency you will receive per U.S. dollar," she says.

How to Exchange Currency

Start by checking with your bank online to see whether the currency you are seeking to exchange is available. If you're traveling to a country that has restrictions on its currency for political or economic issues, your bank may not be able to access the currency. Currency from many African and Eastern European countries can only be exchanged at those countries' banks and ATMs.

Here is a checklist:

- Contact a bank or credit union to make sure it has the currency or will accept foreign currency, and check what the fees are.

- Find exchange rates through your bank, credit union or websites such as xe.com .

- Check the bank's exchange rate to make sure it's fair.

- Arrange for pickup or delivery.

"The saying 'cash is king' certainly holds when traveling abroad," Dutra says. "When you land in Medellin, your taxi driver is going to want Colombian pesos. You will find commerce while abroad fairly manageable if you carry foreign currency and a credit card with favorable travel terms."

Where Else Can You Exchange?

After you've reached your destination, it's a good idea to obtain more cash to pay for shopping and meals at mom-and-pop locales.

Using your bank's ATM, or an ATM in its network, and exchange providers like Travelex are common options. Another option is to use companies such as Wise, which specializes in currency transfers and offers a debit card. The company allows you to keep more than 40 currencies in your account, so if you travel frequently, you can switch to whatever currency you need, says Nicholas Lembo, former global head of above the line marketing and communications at Wise.

Check whether your credit or debit card provider offers additional security features like sending a text message when a transaction is done or requiring additional authorizations when the value of a transaction is higher than normal, says Dirk Schrader, vice president of security research at Netwrix Corporation, a cybersecurity provider.

How Many Bank Accounts Should I Have?

Jessica Merritt Dec. 8, 2023

Banks typically charge either a flat fee or a percentage, such as 1% to 3% of the amount you take out at an ATM in foreign currency. Determine your bank or credit union's policy on reimbursing ATM fees so you can plan ahead.

Download your bank's app ahead of time to help you locate nearby ATMs. Consider taking out a larger amount of cash if your bank charges a higher fee. If you use an ATM that is outside your bank's network, plan on paying extra fees.

Places to Avoid Exchanging Currency

The worst places to exchange your money for another currency are oftentimes the most convenient, such as:

- Airport kiosks.

- Tourist centers.

At those places, the conversion rates are usually not in your favor. Be aware of current exchange rates, especially if you cannot locate a local ATM, says Arica Tomlinson, a category managerof electronic displays and video distribution at GE Healthcare in Milwaukee.

"During a trip to Prague, I attempted to exchange some of my U.S. dollars for the local currency," she says. "For my $100, the currency exchange representative offered me the equivalent to $50 worth of koruna. After my protestations, they offered me an improved rate, but I took my money to a local bank for exchange instead."

If you have to exchange money in another country, plan on paying extra service fees and more for the exchange spread, the rate the business will give you when you are selling your U.S. dollars to them, says Derek Horstmeyer, a finance professor at George Mason University. The exchange spread could be 1% to 2%, he says.

Always be careful using mobile apps to transfer money in foreign countries, particularly apps that rely on texts, since there is the added risk of a potentially untrusted mobile infrastructure, says Sounil Yu, chief information security officer and head of research at JupiterOne, a Morrisville, North Carolina-based provider for cyber asset management and governance. "This is especially true if you are in the Eastern bloc or certain countries in Asia. Also, make sure that you don't download country-specific mobile applications for financial services, as that comes with additional unknown risks. In my opinion, airports are the worst place to exchange money, and banks are the best."

Alternatives to Exchanging Currency

- Credit cards.

- Prepaid cards.

- U.S. dollars.

- Mobile payment providers such as Google Pay, Android Pay or Apple Pay.

Using your credit cards, prepaid cards or even U.S. dollars for purchases can be good alternatives to exchanging currency. Even smaller businesses that are at a street food night market or festival will take electronic payments, and other countries such as Mexico or French Polynesia will accept the U.S. dollar. Your credit card company may also offer good exchange rates – check with it beforehand to see what the rates are. Paying for hotels, restaurants and rental cars with credit cards is often your best bet since they also offer protection on your purchases and additional reward points for transactions at various businesses.

It can be a good strategy to inform your credit card company about your trip when you ask about additional security features, Schrader says.

"Credit card or debit card details are stolen in milliseconds, using compromised ATMs or contactless readers, so a precaution can also be to reduce the limits on your cards for the period of travel, or even apply for an additional card just for the travel," he says.

Many credit or debit cards provide a 0% foreign transaction fee and are a good option to pay for dinner, a museum visit or sporting event tickets.

Using mobile payment providers also can help prevent fraud while you are traveling.

Tags: banking , Travel , currency

Popular Stories

Banking Advice

Best of Banking

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

U.k. Post Office Travel Money & Money Transfer Review: What Are the Rates? How Does It Work? Is It the Best Deal?

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Is UK Post Office the best option for sending money abroad? Compare your options to make sure you get the best exchange rate and lowest fees for your transfer.

What Monito Likes About UK Post Office

- Wide availability across the U.K.

- Variety of services including online and local travel money, wire transfers and travel cards

- Post Office Travel Money services are safe, secure and regulated

What Monito Dislikes About UK Post Office

- Exchange rates are more expensive than the base exchange rate or exchange rates from other providers

- Local bureau de change rates can be more expensive still and you can only get quotes on these rates when you visit or contact a Post Office Travel Money location

Compare UK Post Office to Cheaper Money Transfer Alternatives

Our independent review of post office travel money.

The UK Post office provides several convenient travel money services including foreign currency exchange, online ordering, a travel money card and international transfers to foreign bank accounts.

Post Office Travel Money provides services from more than 11,000 locations across the U.K. Post Office locations are often open for long hours, and around 3,000 branches are open every day. The Post Office offers money conversion services into 80 foreign currencies.

Local Bureau de Change Services From Post Office Travel Money

You can buy and sell travel money directly at a Post Office location using the exchange rate for that Post Office location. These local exchange rates will differ from the Post Office online exchange rates and can be more expensive than from a specialist online currency exchange provider. The Post Office does not provide local exchange rates online although you may be able to get a local exchange rate by calling a specific location. There is no minimum order amount when exchanging money in a Post Office branch.

Online Foreign Currency Services From Post Office Travel Money

You can order your foreign currency online and have it delivered to your home or pick it up from a Post Office location. If you order before 3 PM U.K. time, you will get your money on the next working day. You can get better online exchange rates if you convert larger amounts of money—there’s a minimum value of £400 and a maximum value of £2,500. If you order euros or U.S. dollars, the Post Office Click and Collect Express service means you can pick up your currency from a Post Office branch two hours after you place the order.

Bank Account Wire and Money Transfer Services From Post Office Travel Money

You can send money overseas directly to a foreign bank account by using the Post Office International Payments service. Their wire transfer services are provided by Western Union, which means the beneficiary can choose to pick up money at a Western Union agent location in their own country or have the money transferred into their bank account. Please see our Western Union review for examples of exchange rates, fees and other important information.

Post Office Travel Money Money Card

Post Office Travel Money provides a prepaid Mastercard travel card that you can use to spend money overseas. You can load up to 23 currencies onto the card and use it wherever you see the Mastercard logo. You can manage your travel card through the Post Office Travel mobile app and should activate your card before you leave the U.K. The card is Chip and PIN enabled and also allows contactless payments.

The travel card allows you to load money in the following currencies: Euro (EUR), US Dollar (USD), Australian Dollar (AUD), Canadian Dollar (CAD), Croatian Kuna (HRK), New Zealand Dollar (NZD), Polish Zloty (PLN), Pound Sterling (GBP), South African Rand (ZAR), Swiss Franc (CHF), Thai Baht (THB), Turkish Lira (TRY), UAE Dirham (AED), Czech Koruna (CZK), Japanese Yen (JPY), Hungarian Forint (HUF), Norwegian Krone (NOK), Danish Kroner (DKK), Swedish Kronor (SEK), Chinese Yuan (CNY), Hong Kong Dollar (HKD), Saudi Riyal (SAR) and Singapore Dollar (SGD).

UK Post OfficeFees & Exchange Rates

Post Office Travel Money does charge fees for some specific services, like certain activities on their travel card. In most cases, they make their money on the difference between the “base,” interbank* exchange rate and the exchange rate that they charge to you.

*The interbank rate is also known as the mid-market or standard exchange rate, which is the midpoint between the buying and the selling prices of the two currencies.

Post Office Travel Money Card Fees

Post Office Travel Money charges fees for some services offered through its prepaid money card. The fees we’ve shown below are for cards issued in the U.K. You can find fees for other countries on the Post Office Travel Money website.

- There is a fee of two euros or equivalent to withdraw cash using the card through an ATM or at a physical location

- If your card expires, Post Office Travel Money charges an inactivity fee of £2 per month after 12 months

- A three percent additional charge applies if you use your card to pay in a different currency than the 23 available on the travel card

- If you load U.K pounds onto the card there is a commission of 1.5 percent (min £3, max £50)

Post Office Travel Money Card Limits

Post Office Travel Money does have limits for its prepaid money card.

- You can load between £50 and £5,000 onto the card after you have passed an address verification check

- The maximum amount you can have on your card is £10,000 and you can’t load more than £30,000 in a 12-month period

- The maximum amount you can withdraw in a single transaction is 450 euros or equivalent

Post Office Travel Money Online Fees

If you order online and arrange for the foreign currency to be delivered to your home, there is a delivery fee of £4.99 if you order less than £500, but there is no delivery fee if you order more than that.

The Post Office does state that additional charges may sometimes apply when ordering online, but they do not provide information on how much those charges may be. Here’s what they say on the website, “Any fees relating to commissions, card issuer, or delivery will be displayed during the order process. Please note that your credit card provider may charge a cash advance fee for buying Travel Money. When you place your order you will be given the option to select a preferred delivery date/time. Any additional charges that may be applicable, for example ordering for home delivery on a Saturday, or for home delivery orders under £500, the system will display the fee charged.”

Overseas Money Transfer via Western Union

Post Office Travel Money provides overseas transfers through a partnership with Western Union. Please see our Western Union review .

About Fees Levied by Banks

Certain fees may be levied by banks when you are transferring money to another account. These fees are outside the control of Post Office Travel Money. Circumstances, where banks may charge additional fees, include:

- Wire transfers into or out of sender or beneficiary accounts

- Transfers that are sent via SWIFT or certain other banking protocols

- Beneficiary banks charging a fee to receive a transfer

- Intermediary banks charging fees to process money in transit

These fees could mean that the beneficiary receives less money than stated by Post Office Travel Money due to circumstances beyond Post Office Travel Money’s control. If you want to understand what these extra fees are likely to be, please contact your bank and the beneficiary's bank.

Post Office Travel Money Exchange Rates for Online Travel Money

Post Office Travel Money offers online currency exchange services and makes money on the difference between the exchange rate they offer to customers and the base exchange rate. For example, the base rate to convert U.K pounds into U.S. dollars is 1.23 dollars per pound. Post Office Travel Money offers an exchange rate of 1.181 USD per pound if you’re exchanging £400. That’s a difference of four percent, or £16.

Note that the more money you exchange, the better the exchange rate. Here are some other examples:

Exchanging 400 U.K. Pounds Into Euros

- Base exchange rate, 400 GBP converts to 449 EUR

- Post Office Travel Money exchange rate, 400 GBP converts to 432 EUR

- The Post Office Travel Money exchange rate is 3.8 percent more expensive, or around 15 GBP in exchange rate fees

Exchanging 900 U.K. Pounds Into South African Rands

- Base exchange rate, 900 GBP converts to 16,922 ZAR

- Post Office Travel Money exchange rate, 900 GBP converts to 16,189 ZAR

- The Post Office Travel Money exchange rate is 4.3 percent more expensive, or around 39 GBP in exchange rate fees

Exchanging 1,400 U.K. Pounds Into Swedish Krona

- Base exchange rate, 1,400 GBP converts to 17,003 SEK

- Post Office Travel Money exchange rate, 1,400 GBP converts to 16,145 SEK

- The Post Office Travel Money exchange rate is 5 percent more expensive, or around 70 GBP in exchange rate fees

Exchanging 2,000 U.K. Pounds Into Australian Dollars

- Base exchange rate, 2,000 GBP converts to 3,669 AUD

- Post Office Travel Money exchange rate, 2,000 GBP converts to 3,539 AUD

- The Post Office Travel Money exchange rate is 3.5 percent more expensive, or around 70 GBP in exchange rate fees

Exchanging 2,500 U.K. Pounds Into U.S. Dollars

- Base exchange rate, 2,500 GBP converts to 3,074 USD

- Post Office Travel Money exchange rate, 2,500 GBP converts to 3,012 USD

- The Post Office Travel Money exchange rate is 2 percent more expensive, or around 50 GBP in exchange rate fees

If you’re purchasing currency online or you want to transfer money to an overseas account, you can get better deals by comparing specialist currency exchange providers . Several money exchange services have overall fees of one percent or lower, even when taking into account differences in exchange rates.

All of the Post Office Travel Money exchange rates quoted in this section are based on their online rates for converting money for home delivery or store pickup. Local bureau de change rates may vary and are more expensive than what we quote here. All rates correct as of early October 2019.

Post Office Travel Money Exchange Rates for In-branch Travel Money

Here’s what the Post Office says about its in-branch exchange rates, “Branch exchange rates depend on several factors, eg., branch location, competition, cost of order, convenience, etc. We will always try and offer the best rate, subject to this criteria. As with many retailers, the cheapest order / distribution method is online, where centralised packing costs can be used. This is why online exchanges are invariably better than branch rates.”

Comparing Post Office Travel Money Rates To Other Providers

You can easily compare many money transfer services directly using our comparison tool . There are several new services that it’s worth comparing directly to Post Office Travel Money.

Modern, Mobile-Only Banks

There are several new, mobile-only banks that are becoming more widely available throughout the U.K. and Europe. Providers like N26 , Monese , Revolut , Monzo or Bunq provide a wide variety of financial services to the modern consumer. All of these modern banks provide international travel cards and international money transfer services, and it’s worth comparing them to Post Office Travel Money.

For example, Monzo provides international money transfers through TransferWise, a very popular and trusted currency exchange provider. If you compare sending 1,000 GBP to a Swedish bank account the recipient would get 12,103 SEK with Monzo / TransferWise compared to 11,546 with Western Union, a difference of around five percent or £50.

Specialist Currency Providers for Other Destinations

You may also be able to get a better deal for money transfers when you’re sending money to certain countries. For example, if you’re sending 500 GBP to Saudi Arabia, the beneficiary would get around 2,289 SAR with Xendpay , compared to 2,158 with Post Office Travel Money, a difference of around 5.3 percent or £26.

How Easy Is It To Send Money With UK Post Office

You can find Post Office Travel Money facilities at most Post Office branches and through their website. Their foreign exchange services are quick and convenient. Their wide availability makes them useful for local currency exchanges, although the fees can be high. International money transfers and travel card services from the Post Office provide a range of additional options if you want to send or spend overseas.

Credibility and Security

You can trust the Post Office to provide a safe and secure exchange of foreign currency. Post Office Travel Money offers currency exchange through First Rate Exchange Services Ltd. First Rate Exchange Services Ltd has a Money Service Business licence No.12133160.

Customer Satisfaction

Unfortunately, the Post Office does not score well for customer satisfaction on Trustpilot, achieving a score of just 1.5 out of 5* across 700 reviews. Ninety percent of the reviews said that they were “poor” or “bad” compared to nine percent of reviews that said they were “excellent” or “great.”

*The scores we show here are for the Post Office overall, not specifically for travel money.

There were not many positive reviews of the Post Office Travel Money service, however, some did praise the Travel Money card with reviews like this, “Really easy opening of the Travel money card at the counter, with great face to face friendly service. Next day activation of the card was smooth and excellent telephone customer care service was friendly and helpful. Giving their names and added extra attention by offering to help with 'anything else we can be of service.'”

Issues raised by reviewers that are specific to Post Office Travel Money include unreasonable conversion rates on the travel money card, poor top-up rates, differences between branch and online exchange rates and difficulties with customer service. Here’s a quote from a review about their in-branch exchange rates, “avoid their travel money service like the plague, purchased currency, then checked after only to find I've been levied over 8%, in the exchange rate, they have totally ripped me off, explained to counter clerk wasn't needing money for 2 weeks, but no mention of a better rate, they’ve ripped me off to the tune of 40 pounds more than I could have paid.”

Post Office Travel Money Mobile Applications

Post Office Travel Money provides a mobile app for both iOS and Android devices. The app allows you to:

- Manage your account

- Top up your travel money card

- Check your balance

- Move money between currencies

- Freeze your card

How Post Office Travel Money Works

Post Office Travel Money services work in slightly different ways, depending on what you want to do.

To request currency online you will need to sign up for an account, provide some identification, let them know the currency you need and provide payment.

To request currency locally you will need to visit a Post Office Travel Money location.

To get a Post Office Travel Money card you can sign up online or visit a Post Office location bringing your passport or a U.K. driving license.

If you want to send money overseas to another bank account you will need to:

- Setup an account through the Post Office partnership with Western Union—they will need your name, address, contact details, bank details, and proof of identification.

- Decide the currencies that you want to exchange money between.

- Book a rate through the website.

- Provide details of the sender and receiver of the funds.

- Pay for the transfer.

- Western Union converts the money and deposits it in the beneficiary’s bank account or they may be able to pick it up at an agent location.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Where to Exchange Currency Without Paying Huge Fees

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Nerdy takeaways about where to exchange currency

Before your trip, it's best to exchange money at your bank or credit union, which likely offers better rates and fewer and/or lower fees.

Your bank or credit union may buy back leftover foreign currency in exchange for dollars when you return.

Once you're abroad, use your financial institution's ATMs if possible; they’re the best option for exchanging currency with minimal fees.

Banks and credit unions are generally the best places to exchange currency, with reasonable exchange rates and the lowest fees. Here’s how financial institutions — and a few other places — can help exchange currency near you.

» ALSO : See our list of the best ways to send money internationally

Best place to exchange currency: Your bank or credit union

To get the best currency exchange rates, you’ll want to change money before you leave the country. Before you check out options for where to exchange money near you, figure out what the current exchange rates are by using a trusted source such as Reuters . That way, you’ll know what the going rate is and have an idea of what to expect when comparing exchange rates at banks and currency exchange service providers.

Many banks offer currency exchange to their customers. Though there may be a small fee if you exchange less than a certain amount, your bank or credit union will almost always be the cheapest place to exchange currency.

You may be able to order currency at a branch location, by phone, or online to have it delivered to you or to pick up at a branch. Some currency providers allow you to pick up your funds as soon as the next day, have it delivered within one to three business days or opt for overnight shipping.

» See our picks for the best banks for international travel

Another money-change option: Online currency converters

You can also order through an online currency converter such as Currency Exchange International, which will have the cash delivered to your home. But exchange rates are less favorable, and the delivery charges may eat into your funds.

Where to exchange currency outside the U.S.

Once you’ve reached your destination, avoid airport kiosks or other exchange houses. Your bank's ATM network is likely the best option. You may be able to withdraw cash in the local currency with competitive exchange rates and low fees (1% to 3%).

Use your institution’s app to find an ATM near you. Try to withdraw larger amounts if your bank charges ATM fees. And avoid out-of-network ATMs — in addition to a possible foreign transaction fee, you could end up paying surcharges to your bank and the ATM owner.

» RELATED: See foreign debit card transaction fees by bank

If your bank doesn’t offer in-network ATMs or branches in the countries where you’re traveling, you can use your debit card at a local ATM. Keep in mind that you will typically be charged fees when using a foreign ATM.

» MORE: Learn about foreign transaction fees and how to avoid them

Where to avoid exchanging currency

Whether in the U.S. or at your destination, avoid airport kiosks or other exchange houses if you can. Those should only be used as a last resort, because they typically offer poor exchange rates and high fees, so you’ll get less currency for your money.

Skip currency exchange: Use a credit or debit card

Figure out whether your destination is plastic-friendly. If it is, you can avoid many of these extra travel fees with one of NerdWallet's favorite no foreign transaction fee credit cards or debit cards.

Consider applying for one of these credit cards or debit cards well before you leave (allowing ample time to process your application and receive the card in the mail) so you can use it instead of cash wherever possible. Credit and debit cards can be a safer option than cash; they offer fraud protection and safety features (such as the option to freeze them in case of misplacement), but once cash is lost or stolen, it can be impossible to recover.

Avoid using a credit card at ATMs or you’ll be hit with fees and interest right away for taking a cash advance. When making purchases at the point-of-sale, remember to choose to pay in the local currency rather than in U.S. dollars to avoid currency conversion fees.

» MORE: Foreign transaction fees vs. currency conversion fees

When paying with a credit card abroad, stick to cards that don’t charge a foreign transaction fee. To avoid conversion fees, choose to pay in the local currency rather than U.S. dollars.

⏰ Limited-time offer

SoFi Checking and Savings

NerdWallet rating

Limited-time offer

at SoFi Bank, N.A., Member FDIC

Don’t miss out on a bigger bonus

Get a NerdWallet-exclusive bonus of up to $400 when you open an account and hit $5,000 in direct deposits within 25 days after your first one. That’s $100 more than SoFi’s normal $300 bonus! Select "Learn More" to get started. Expires 4/22/24. Terms apply.

Exchange frequently? Consider a multicurrency account

If you live or work abroad, you might consider getting a multicurrency account. A multicurrency account is usually an account that lets you spend, receive and hold multiple currencies. Fintech companies Wise and Revolut offer multicurrency accounts online and through mobile apps. Read more about how multicurrency accounts work .

The best place to exchange currency at the end of your trip

Again, your bank is probably the best place to exchange currency, but it may not buy back all currency types. If your bank doesn’t accept the foreign currency you want to exchange, you can exchange your money at a currency exchange store or at an airport kiosk, even though you likely won’t get the best rate.

If you can’t sell your foreign currency, you may be able to donate it at the airport or in flight. Ten international airlines participate in UNICEF’s Change for Good program , which takes donations in foreign currency to help improve the lives of children worldwide.

Where to exchange currency: Frequently asked questions

Here are answers to common questions about the best place to get foreign currency.

Where is the best place to exchange currency?

Though there may be a small fee if you exchange less than a certain amount, your bank or credit union will almost always be the best (and cheapest) answer for where to exchange currency .

How do I find a currency exchange near me?

You can find a money exchange near you by searching online for “money exchange” and your ZIP code. You can also reach out to your local bank branch to see if it offers money exchange services.

Where can you exchange currency for free?

Some banks offer free currency exchange to their customers. Note that some financial institutions may charge a fee for exchanging currency unless you’re a premium account holder or are exchanging at least $1,000.

On a similar note...

Find a better savings account

See NerdWallet's picks for the best high-yield online savings accounts.

With $0 min. balance for APY

Up to $300 cash and $100 in rewards points. Terms apply.

Best Travel Money Exchange Rates Compared

This guide explains the cheapest and most expensive ways to buy travel money. It can help save you money if you are thinking about going abroad and trying to work out the best way to spend while you’re there.

Commission charges when you buy foreign currency have mostly been phased out. Now most currency operators make money on the difference between the interbank exchange rate and the rate they actually give you.

So the best way to know if you’re getting a good deal is to compare the actual exchange rate you’re getting.

For each of the currency exchange locations below we have used the euro as an example – but where you see a location giving a bad rate (versus the benchmark interbank rate) for euros, you can be pretty much guaranteed you’ll get a bad rate on any other currency at that place too.

Here are the ways to get the most for your money when buying foreign currency, ranked best to worse.

(All exchange rate figures accessed on 31 May 2023.)

1. Currency cards – BEST RATE

Currency cards are debit card-style payment cards designed to be used while you are on holiday or travelling outside the UK to pay for goods and services, usually anywhere you see the Visa or Mastercard symbol. They either come as regular debit cards with travel money functions, or as a separate card that connects to your current account.

Currency cards offer some of the best exchange rates around, and are available from, for example, Starling, Monzo, Revolut , and Curresea.

The euro rates for Monzo and Starling are based on the Mastercard rate so are the same:

- £1 = €1.152 (vs €1.16 inter bank rate)

- On the (free) Curresea Essential plan the euro rate is:

- £1 = €1.152

- On the (paid for) Curresea Elite and Premium Plans the euro rate is:

- £1 = €1.163

- Ease : Currency cards are easy to apply for and usually arrive within a few days. If your bank already offers a travel card service as part of your account you may not even need to apply for a new card. Plus you don’t need to worry about changing up loads of cash before you go away.

- Safety : If you lose cash, it’s usually gone forever. If you lose your currency card you can cancel or freeze it in the app that comes with it to prevent anyone else using your holiday money.

- Virtual wallet: You can add most currency travel cards to your phone’s virtual wallet, so you can still pay if you only have your phone with you.

- Charges : Fees and charges to use your currency card abroad can vary significantly so it’s a good idea to compare different providers before you choose which one to go with. Be aware the card provider – typically either Visa or Mastercard – can add its own fees of 1% to 3% on top of transactions.

- ATM limits : Some card providers limit how much you can withdraw from an ATM in another currency, after which point more charges will kick in.

- No section 75 protection : Debit card payments and purchases are not covered by section 75 of the Consumer Credit Act. But you might be able to make a claim for a refund under a voluntary scheme called ‘chargeback’.

2. Cash point abroad

Withdrawing cash from an ATM abroad can be a good option if you use one of the cards mentioned above, or a travel credit card. They are designed for use while travelling, so give the best rates on foreign exchange, and limit the fees and charges you pay while using them abroad. It is for this reason that cash point abroad is 2nd on this list.

Currensea , for example, as well as offering one of the best exchange rates, allows free ATM withdrawals of up to £500 using its Essential Card (2% fees over), and with its Premium Card (which costs £25 a year) you can make fee free ATM withdrawals up to £500 (1% over).

Just remember – if the ATM tells you a fee applies, always choose to be charged in the local currency of the country you’re in (this also applies to card purchases).

However beware – this is important – if you just take your normal debit card or credit card abroad you can expect high fees from both your bank and the ATM you withdraw cash from every time you use it.

For example, Barclays charges a 2.99% fee for using your standard debit card abroad when making purchases, withdrawing cash or for refunds.

So while you get a pretty decent exchange rate with Barclays (which uses the Visa rate), once the fee is added the real rate is much less. It works out as:

- Visa rate: £1 = €1.161 (vs €1.16 inter bank rate) before charges

- Barclays debit rate after 2.99% fee added £1 = €1.128

- Cheap if you use the right cards: Taking money out at an ATM abroad can be one of the cheapest ways to access cash if you use a card designed for travel that has fee-free options and a good exchange rate (see out Best Rated above).

- Don’t have to carry so much cash : Carrying huge wads of cash is a theft risk. Carrying a couple of cards (one for use and one for back up) is much safer.

- High costs if you use the wrong card : Avoid taking your regular debit or credit card abroad as to use it you will have to pay high fees.

3. Highstreet in the UK

UK highstreets offer a number of exchange rate options, from inside department stores like John Lewis, to specialist foreign exchange rate shops like No1 Currency. The rates will vary from place to place.

At No1 Currency, for example, the online rates are below, although the website says the in store rates may differ from what is advertised.

- £1 = €1.136 (vs €1.16 inter bank rate)

- £100 = €113.67

At John Lewis, on the same day the rate was a little lower.

- £1 = €1.133 (vs €1.16 inter bank rate)

- £100 = €113.38

At Marks & Spencer, the rate was:

- Click & Collect: £1 = €1.138 (vs €1.16 inter bank rate)

- £100 = €113.80

- In-store bureau de change: £1 = €1.119

- £100 = €111.90

At a TUI branch the rate was:

- £1 = €1.139 (vs €1.16 inter bank rate)

- £100 = €113.90

- Click and collect rates : No1 Currency for example gives you a better rate if you order online then pick up in store, rather than have your currency delivered.

- Perks: For example at John Lewis you can earn points when you pay for currency with your Partnership Credit Card.

- Delivery charges : No1 Currency only offers free delivery for orders of £800 or more. At John Lewis the minimum for free home delivery is over £500.

- Minimum orders online: John Lewis, for example, has a £250 minimum for online orders.

4. Online with a supermarket

Most supermarkets sell travel money these days and it can be a convenient way to pick up some currency while you do your weekly shop. You can buy on the day or order online to collect.

As an added bonus, supermarkets offer a better rate on foreign currency for their loyalty card holders, pushing supermarkets up the ranking in terms of rates.

- Standard rate: £1 = €1.130 (vs €1.16 interbank rate)

- £100 = €113

- Tesco Clubcard rate: €1.135

- £100 = €113.50

Sainsbury’s

- £1 = €1.131 (vs €1.16 interbank rate)

- £100 = €113.17

- Sainsbury’s Nectar card rate: €1.1340

- £100 = €113.40

- Loyalty perks and points : Loyalty card holders get better exchange rates, plus you can earn loyalty points when you pay for the currency just like any other purchase.

- Convenience : Order online then pick up when you do your weekly shop.

- Minimum order amounts: For example Tesco has a minimum order amount of £400 worth of currency when you buy online, and a minimum of £500 to have a free home delivery. There is no minimum order amount for Sainsbury’s but a £4.99 fee to have currency bought online delivered at home.

5. Post office

The Post Office is a handy one-stop-shop for lots of holiday related things, from travel insurance to international driving permits, and including travel money. While the Post Office doesn’t offer the best rates on the market, it does have several other advantages that could make it a good option, especially if you are in a hurry.

- £1 = €1.116 (vs €1.16 inter bank rate)

- £100 = €111

- Rate increases : Order online for the best rates on every currency. The more you buy, the better the rate.

- Fast pick up service : You can pick up euros and US dollars from your nearest branch in as little as 2 hours, from selected branches. Order by 2pm (1pm Saturday) to collect the same day, from 2 hours later. Order after 2pm (1pm Saturday) to collect the next working day, from 11am. Or you can choose delivery to your home.

- Refund policy : Will refund 100% of the holiday money you bought if your trip abroad is cancelled

- Queuing : With a number of Post Offices closing, and banks shutting branches that force Post Offices to do more services with less, queues to get you travel money in person can be long.

- Limited currencies: Post Office in my experience don’t carry that much currency and only in a few of the most common types. Beware buying last minute – if you try to just pop in on the day to buy your currency without pre-ordering you may find they have run out, or don’t stock it.

- Buying limits : The minimum you can buy online of a currency is £400 worth, and the maximum is £2,500.

6. At the airport

The only times I have bought currency at the airport it has been out of desperation and from a lack of forward planning – and I have always regretted it. It is typically one of the most expensive (i.e. worst exchange rate) places to buy foreign currency.

But if you’re in a panic because you forgot to get out any cash before your trip, it is at least convenient to be able to grab some foreign currency before your flight.

Two of the most common foreign exchange kiosks you’ll find at UK and global airports are Travelex and Eurochange. The rates below are for their online services – rates in the airport are likely to be worse.

Travelex (online)

- £1 = €1.130 (vs €1.16 inter bank rate)

Eurochange (online)

- £1 = €1.131 (vs €1.16 inter bank rate)

- £100 = €113.10

- Location : If in the rush to get away you forgot to pick up any currency, airport foreign exchange kiosks offer a last minute lifeline.

- Availability of currencies: Because of their location, currency kiosks in international airports tend to be well stocked in multiple currencies, even the less common ones.

- Switching currency : If you are visiting multiple countries on a trip but don’t want to carry large amounts of currency, changing up just what you need at each airport you pass through is an option.

- Expense : You will never get the best foreign exchange rate at an airport.

- Lack of comparison : Even if there is more than one currency store at the airport, they all tend to offer the same rates. Once you’re there you have no other options, you have to take what you can get.

7. Online with a bank

Buying travel money from your local bank might seem like the obvious choice, but surprisingly the rates on offer are likely among the worst you’ll get anywhere in the UK. However the limits on how much you can purchase can be higher (though you won’t get a better rate the more you buy so why bother?)

- £1 = €1.105 (vs €1.16 inter bank rate)

- £100 = €110.51

- £1 = €1.106 (vs €1.16 inter bank rate)

- £100 = €110.67

- High purchase limits : At Barclays, for example, you can order up to £5,000 per person within a 90-day period, and a maximum of £2,500 from that amount can be sent for home delivery to a single residential address.

- Fee free deliveries : HSBC, for example, offers fee-free deliveries on your travel money to HSBC Full and Cash Service branches or to your home. Other banks may charge.

- Limited to customers : You may find you have to be a customer. For example, you’ll need a Barclays debit card or Barclaycard to place your order for currency online there.

- Expensive : Among the worst rates for currency exchange you’ll find anywhere in the UK.

8. Bureau de change abroad – WORST RATE

Bureau de changes abroad are typically in tourist hotspots. And what do we know about tourist hotspots? Rife for pickpockets and overinflated prices. This is the attitude you should take to foreign currency shops in these locations.

One example that proves the ‘expensive option’ point is Ria Money Transfer & Currency Exchange, situated in the busy Plaza de Callao in central Madrid, Spain.

Ria’s exchange rate on 31 May 2023 was:

- £1.00 = €0.99 (vs €1.16 inter bank rate)

Convenient : If you really need cash while you’re abroad, maybe because you’re in a place where your cards are not widely accepted, a local bureau de change may be a lifeline – just expect to pay heavily for that life raft.

- Cost, cost, cost: Buying foreign currency from a currency shop or kiosk in a tourist hotspot (where you are most likely to find them) is an extremely expensive way of getting your hands on cash. Avoid if at all possible.

- Theft risk : Pickpockets may hang around bureau de change just like they hang around ATMs, because they know you have just withdrawn what is probably a large amount of money. Secure your cash hidden away before you leave the kiosk.

Is it still worth getting travel cash ahead of your holidays?

Yes. Absolutely. Cards aren’t accepted everywhere, as I found to my detriment when I arrived in Buenos Aires and tried to take out local currency on my credit card at the foreign exchange desk at the airport.

“Absolutely not possible”, I was told. A combination of a lack of provision to buy currency on credit card there, and the Argentinian peso being just too volatile for credit card providers to let you buy it on their service.

All I had in hard currency was US$100 in Argetininian pesos I had changed in the airport at Rio De Janeiro, Brazil, where I had just come from, and a US$100 bill. Luckily I’d pre-paid my Buenos Aires hotel in advance, and I could easily find restaurants that would accept my credit card. But taxis only took cash, so I spent a lot of time walking – thinking about how I should have brought more pesos with me.

We’ve answered some of the most commonly asked questions when it comes to travel money.

Yes, in most cases. Cash withdrawal fees will probably apply of around 3%, just like they would at home for taking cash out on a credit card, and these will be on top of any currency conversion fees.

Be aware though – in countries with a highly fluctuating exchange rate, like Argentina, you may not be able to buy foreign cash with your credit card (not even at the bureau de change at the airport, for example). You still may be able to pay for goods and services with your credit cards, but check how widely they are accepted before you travel.

Yes, on the whole. When buying travel money online, like with buying anything online, you’re best off sticking to well known brands, whether that be banks, supermarkets, or currency exchange stores.

A large institution or well known brand is less likely to go bust, and that is important because foreign exchange is not a regulated service. This means your cash is not protected if the company you tried to get your foreign currency from closes suddenly.

Yes. Most places that sell you travel money will buy it back from you. But just like when you’re swapping your pounds for foreign currency, when you swap it back you should compare the exchange rates on offer. As a general rule, a location that offers a good rate one way, offers a good rate the other way.

Travel money providers – from the currency shops and bureau de change, to the banks and supermarkets, anywhere basically that sells currency – make money by giving you slightly less than the central banks give them for the foreign money you want to buy.

For example, if a currency provider tells you they will give you €1.131 for every pound you give them, but the central bank rate for euros is €1.157 per pound, the difference is €0.026, which they pocket. This may not sound much, but multiplied over millions of transactions a year, it adds up.

Compare, compare, compare the single unit price – which means the £1 for a €1 rate, or whichever currency you choose, versus the interbank rate, which you can get by just Googling “1 GBP in EUR”.

Places that sell currency, online or in a shop, have to show you the exchange rate for that day. While it’s probably not practical to go traipsing around comparing shops, it’s easy enough to do so online. If you run up against minimum purchase amounts online, still go with the company providing the best rate but visit their location in person.

Also try not to get yourself in a position where you’re desperate to buy foreign currency, either at home or abroad. This means having enough cash on you in remote locations, and tourist hotspots, and before you travel (to avoid the airport currency shops).

Laura Miller has been a financial journalist for more than 10 years, and was on staff at the Telegraph before going freelance in 2019. Her experience includes hosting podcasts and panels, and she writes for the Times and Sunday Times, Daily Mail, Mail on Sunday and the Sun, as well as trade titles. She now lives by the sea in Aberystwyth, west Wales.

You may also be interested in:

Privacy Overview

Currency Experts

G - TMOZ - C&D Pizza Blog - Desktop Banner CTA (1).png

Why Travel Money

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- National Media Release

CBP Announces Trusted Traveler Programs Fee Changes

WASHINGTON – U.S. Customs and Border Protection (CBP) announced today an upcoming fee change for some of its most popular Trusted Traveler Programs (TTP).