We broke our monthly GMV record by 200% in March 2021 despite pandemic !

Easy-to-use front desk system that facilitates day-to-day hotel operations

Get more direct bookings. Commissions free. Local payment gateways

Self-servicing hotel check-in, check-out and walk-in guest reservation

Probably the most affordable Channel Manager that you have come across

User-friendly website content management system built for hotelier

Try Our Free Trial

Unlock More Value with Softinn today!

Customer Success Stories

You would love to hear how have our customers made a significant difference after using Softinn

Suitable For

Road to automation, reduce unnecessary operational hassle and generate more revenues

Stand out from the other competitors, build a strong online presence

Manage your hotel branches & franchises systematically regardless of the number of properties

All tools and reports that you need to manage properties owned by others

E-book & Offers

More that just an e-book. Tips, tricks and trends are included for knowledge enhancement

One-stop knowledge center for Softinn users from beginners to expert

New to Softinn? Book your slot to join our live training session

We create and curate useful contents about the topics that hoteliers are looking for

We constantly innovate. Read more on our latest product releases & feature updates

Hello from Softinn!

We are hotel technology service provider with a mission to make hoteliers work easier

We do what we do best, make I.T easy for hoteliers

We work and integrate with other amazing companies

Let’s get connected. We are more than happy to talk to you

Be part of our story. We are looking for passionate candidates

- Free Trial

- Login

- Property Management System

- Booking Engine

- Hotel Channel Manager

- Hotel Website CMS

- Hybrid Hotel Kiosk

- Independent & Boutique Hotel

- Hotel Groups

- Resort & Luxury Villa

- Bnb Management

- Knowledge Base

- Blog & Article

- Product Update

- Product Training

- Why Softinn

- Partner & Integration

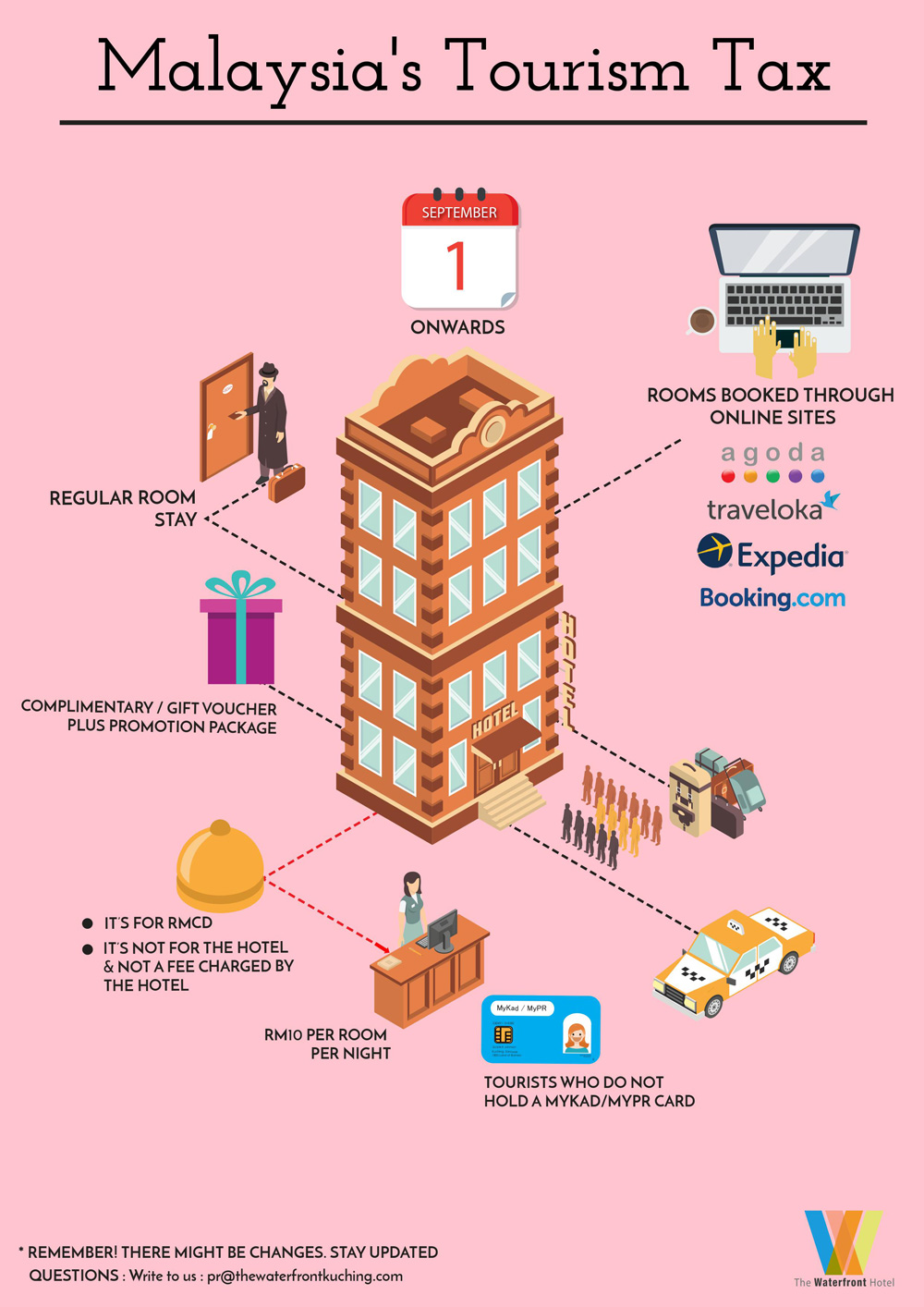

Malaysia Tourism Tax (TTX) 2023: What You Need to Know

In line with the announcement made by the Malaysian government regarding the Tourism Tax , I will talk about a series of questions that are commonly asked by hotel owners or operators, thus helping all of you to find the answers that are related to it.

1. What is a Tourism Tax?

Tourism Tax (TTx) is referred to as a tax charged for all foreign passport holders at accommodations premises collected by the operators effective from 1st September 2017 in Malaysia. It is charged at a fixed rate of RM10.00 per room per night. However, during the Covid-19 pandemic, The Malaysian Government has announced the exemption of the Tourism Tax for all foreign passport holders for hotel stays between 1st March 2020 and 31st December 2021 then further extends to 31st December 2022. Now, the Malaysian government has announced that the Tourism Tax will resume back starting from 1st January 2023.

2. How is the RM10 per room per night applied?

Assuming one room is booked for one night by John (who is a Filipino), the TTx charged to John will be RM10.00 x 1 room x 1 night = RM10.00 In the 2nd Scenario, assuming two rooms were booked by Dianne (who is an Indonesian) for three nights, so the TTx charged to Dianne will be RM10.00 x 2 rooms x 3 nights = RM60.00

3. How is this new to the travel industry starting January 2023?

Since September 2017, a guest who is a foreigner is subject to paying Tourism Tax when staying at any “accommodation premises” in Malaysia; this tax is collected by the operator at the accommodation premises upon check-in, regardless if the booking was made online or walk-in. However, starting from 1st January 2023. For any bookings made through digital platforms that provide reservation services such as booking.com, Agoda, and Expedia, the platform is the one to collect the Tourism Tax directly from the foreign guests when the guest made the booking and payment online through the platform. The digital platform provider shall remit the tax collected to the RMCD. Whereas, for booking that was made online through the platform but payment only upon arrival at the accommodation premises, the TTx shall be collected by the accommodation operator upon guest arrival. The responsibility of remitting the tax collected for this booking shall be by the accommodation operator instead.

We have just received the update that currently, only AGODA will collect the TTx directly from the guest together with the room charges if they made the payment online. Whereas, for other OTAs like Expedia, Booking.com & Traveloka, the TTx will be collected upon check-in by the property operator, UNTIL FURTHER NOTICE.

4. What if the booking has been made before 1st January 2023 for the check-in date after on or 1st January 2023?

If a foreign traveller has made a booking on a digital platform before 1st January 2023, for check-in on or after 1st of January 2023, the Tourism Tax must be collected by the accommodation operator upon guest arrival and the accommodation operator is required to remit the tax to the RMCD.

5. What if my property did not register for TTx?

We advise you to further consult with your business advisor or check with RMCD if you have not registered as a Tourism Tax registrant. Generally, if you are operating accommodation premises of 5 rooms or more, you are liable to be registered. You may also check this website https://www.myttx.customs.gov.my/ to further understand the registration.

6. If a Malaysian with his foreign friend both check into the same room and the booking was made and paid by the Malaysian, is TTx chargeable?

In this case, it is not subject to Tourism Tax because a local stayed and paid for the stay. However, the Tourism Tax is chargeable in the event that the foreigner stays and pays for the stay.

7. If the reservation has been made with full payment together with the TTx for the booking made via OTAs, then the guest request for the cancellation on a non-refundable policy, will the TTx will be refunded?

Unfortunately, we are unsure of this. Do let us know in the comment section if you have more information regarding this. What I can say is, you may refer to the T&C directly from the OTAs.

8. Will TTx subject to SST too?

No. The operator is not allowed to charge SST on the Tourism Tax.

9. Is day use chargeable to TTx?

No, if the day use charge is not equal to the room rate per night.

10. Is a Digital Platform provider compulsory to collect private data such as passport no. or ID no. to ensure nationality?

Yes. The Digital Platform provider should make an appropriate adjustment in its system to capture the information that is to identify the citizenship of the tourists.

11. John makes an accommodation booking online and provides inaccurate information which resulted in TTx not being collec ted. Who wi ll be responsible?

If due diligence has been done to obtain the information required from the tourists, the Digital Platform provider will not be responsible for any inaccurate information provided by the tourist, which may result in the under-collection of TTx.

Check out this video where we answer a frequently asked question regarding the Tourism Tax

That’s all 11 common questions that we heard so far regarding the Malaysia Tourism Tax. Please share this article if you find it useful and drop any questions in the comment sections if you think there are more questions that should be answered.

You're reading a blog compiled by Softinn. We're a hotel-technology company with the mission to make hotelier work easier. Do subscribe if you enjoy reading our blog or you may interact with us on our Facebook Page .

Get Monthly Updates

Other topics, ebooks & resources.

We won't spam your inbox. We promise to send a curated list of posts to your inbox once a month, nothing more.

Start your free trial now

No credit card required

Make hotelier work easier

Softinn builds the next-generation hotel management system for boutique hotels in Asia Pacific.

Term & Services | Privacy Policy

- Hotel Kiosk

- Softinn API

- Hotel Groups & Chains

- BnB Management

- Customer Success Story

- Blog and Articles

- Product Training (Basic)

- Product Training (Advanced)

- Pricing & Plan

© 2013-2023 Softinn Solutions Sdn. Bhd. (1029363-M) All rights reserved. Made with ♥ in Malacca, Malaysia.

RECENTLY PUBLISHED

Popular articles.

- e-Invoicing in Malaysia: A Complete Guide For Your Business

- Malaysia e-Invoicing FAQs: Everything You Need to Know

- Important Terms in Malaysia e-Invoicing

- Reasons for Rejection and Cancellation of e-Invoice in Malaysia

- e-Invoice Exemptions in Malaysia: A Comprehensive Guide

- e-invoice Model in Malaysia: Benefits, Requirements and How to Get Started

- Data Security and Privacy Monitoring in Malaysia: How IRBM Leads the Way

- Transaction Types of e-Invoicing in Malaysia: A Comprehensive Guide

- Steps for submission, validation, and issuance of e-invoices in Malaysia

Malaysia Tourism Tax: What You Need to Know in 2024

Updated on : Mar 11th, 2024

The Malaysian Tourism Tax Bill was passed in the Senate on 27 April 2017 and t he TTx has been in effect since 1 September 2017. All accommodation providers have to collect TTx from tourists staying at their premises. The tax at a rate of MYR10 per room, per night has been required to be collected by the accommodation operator and then paid to the Royal Malaysian Customs Department (RMCD).

The ambit of the law has been significantly widened under the new amendments which were effective from Jan 1, 2023 and now any digital platform whether located in Malaysia or outside Malaysia, on providing services relating to online booking of accommodation in Malaysia shall be liable to be registered for Tourism Tax in Malaysia.

What is Tourism Tax?

Over 42 countries in the world, from Switzerland to Bhutan, impose some form of Tourism Tax. Some examples would be:

- The tourist tax to visit Bhutan is a flat fee of around $250 a day which is highest in the world.

- Switzerland's tourist tax varies depending on the location.

- Japan has a "sayonara tax," where 1,000 yen ($9.25) fee has to be paid by international visitors as they leave the country.

Malaysian tourist tax is a flat rate of MYR10 ($2.45) per person per night.

Who has to pay Tourism Tax?

Foreign tourists i.e. people other than Malaysian citizens or permanent residents have to pay Malaysian Tourism Tax for staying in Malaysia. The payment can be made to the online booking provider instead of paying at the hotel now.

How to Pay?

- Tourists, upon payment to DPSPs (Digital Platform Service Providers) submit proof of TTx payment. In cases where proof is provided, registered operators are relieved from collecting TTx directly from tourists. However, if tourists fail to provide proof, DPSPs must collect the TTx amount and account for it to the RMCD.

- From 2023, DPSPs that facilitate the online booking of accommodations in Malaysia (“online travel platform operators e.g. Airbnb, OYO, etc.”) to collect tourism tax (TTx) and remit the tax to the RMCD.

- The deposit of Tourism tax in Malaysia is completely digital using their customer website MyTTx.

Key Highlights:

- MyTTx is an online submission and payment system for tourism tax (TTx).

- It is available 24 hours daily and accessible anywhere.

- The system can be accessed through any latest browser and is best viewed at 1024 x 768 resolution or higher.

When to Pay?

- Operators have to file a return every three months to account for the tourism tax (“TTX”) received. Note: If the operator is GST registered, the operator must file a tourism tax return in the same taxable period in which the operator files his/her GST returns (i.e. monthly or quarterly).

- The deadline to make payments of tax is clarified by stating that payment is due “not later than” the last day of the month following the end of each taxable period.

Benefits of Malaysian Tourism Tax

Tourism Tax comes with several advantages that contribute to the sustainable development of the tourism industry and the overall growth of local economy.

- Revenue Generation: The primary purpose of the Tourism Tax is to generate revenue for the Government to develop and enhance tourism-related infrastructure and services. This includes the development of tourist attractions, accommodation facilities, transportation networks, and other amenities that enhance the overall visitor experience.

- Promotion of Tourism: The funds from the Tourism Tax can be allocated to marketing and promotional activities aimed at attracting more tourists to Malaysia. This helps in boosting the country's image as a desirable tourist destination on a global scale.

- Cultural Preservation: Tourism Tax revenue can be invested in projects aimed at preserving and promoting Malaysia's rich cultural heritage. This may involve the restoration of historical sites, supporting traditional arts and crafts, and organizing cultural events that showcase the country's diverse cultural tapestry.

- Job Creation: A thriving tourism industry leads to increased demand for services, creating job opportunities across various sectors. The revenue generated from the Tourism Tax indirectly contributes to employment generation, benefiting local communities and individuals.

- Balance Over Tourism: The tax is becoming popular as a tool to battle the pressing issue of over-tourism in countries where both, indigenous nature and culture is at risk. It allows the government to monitor and manage the tourism sector effectively, ensuring compliance with standards and regulations set to maintain the industry's integrity.

TTx is here to stay

As Malaysia continues to position itself as a premier tourist destination, the Tourism Tax plays a pivotal role in sustaining its ecosystem. Navigating TTx is a necessity for a primarily tourist driver economy. It needs involvement of all stakeholders DPSPs, tourists, and the RMCD to make the system better and smoother every day.

Chinese (CN) / 简体中文

Chinese (HK) / 繁體中文(香港)

Chinese (TW) / 繁體中文(台灣)

Japanese / 日本語

Korean / 한국어(대한민국)

Malaysian Tourism Tax FAQs

Home > Partner Help > Your reservations > Malaysian Tourism Tax FAQs

Last updated: 9 months ago | 8 min read time

Malaysian Tourism Tax FAQs (CN)/简体中文

Malaysian Tourism Tax FAQs (HK)/中文 (香港)

Malaysian Tourism Tax FAQs (TW)/繁體中文

Malaysian Tourism Tax FAQs Japanese/日本語

Malaysian Tourism Tax FAQs Korean /한국어(대한민국)

Malaysian Tourism Tax FAQs Thai/ไทย

Malaysian Tourism Tax FAQs (MY)/Malay

This article will explain the Malaysian Tourism Tax and answer FAQs.

- Effective 1st Jan 2023 – 31 Dec 2025, Digital Platform Service Providers (DPSPs or Platform) are liable to collect and charge TTx from any tourists for reservations that are i) made through the DPSP’s platform and ii) where payment is made to a DPSP (such as Agoda) and remit such TTx to the Malaysian Customs Department. If payment of TTx has been made to the platform, then the accommodation premises should not collect the TTx again, provided proof of payment of TTx can be furnished; otherwise the accommodation premises shall collect TTx. For bookings where payment is made to accommodation premises in Malaysia directly (pay at property), it is the accommodation premise’s obligation as a registered operator to collect and remit TTx to Malaysian Customs Department.

- Starting on 1 Jan 2026, the government may choose to alter or continue with these rules.

- For more information, please visit myttx.customs.gov.my .

- a) Malaysian nationals (holders of a MyKad card)

- b) Permanent residents of Malaysia (holders of a MyPR card).

- If the property is listed and booked as one unit, then the Tourism Tax of RM10/room/night will be imposed to the unit only, so for 1 night, the applicable TTx = RM 10.

- If the property is listed on platform as three separate units (one bedroom per listing), then TTx shall be imposed on each of the rooms. So, if three rooms are booked for 1 night, the TTx would be RM 10/room/night x 3= RM 30.

- Q: Will this affect existing bookings, especially for Pay at Hotel existing bookings? A: Guests who are tourists have been subject to pay TTx since September 2017 when staying at any accommodation premises in Malaysia; this is normally collected by the operator i.e. accommodation premises operator. However, starting from 1 Jan 2023 and continuing until 31 Dec 2025, bookings made through platforms providing reservation services such as Agoda are liable to collect and charge TTx for any bookings made on the platform in which the platform collects the payment from bookers. If a traveler has made a booking on Agoda before 1 Jan 2023, and where TTx is applicable, the TTx must be collected by the property and remitted to the RMCD. For bookings of Malaysian properties made on Agoda on and after 1 Jan 2023 and continuing until 31 Dec 2025, Agoda as the platform is required to collect TTx if the payment for the booking is collected by Agoda. Agoda will endeavor to collect TTx on most bookings and issue a document as proof of TTx payment to the booker. However, for Pay Property bookings, TTx needs to be collected by the property from the booked guest at check-in.

- If the payment model “Pay to Agoda”, “Merchant Commission” and TTx applies – TTx is INCLUDED in the price and is collected by Agoda.

- If the payment model is “Pay to Agoda”, “Merchant Commission” and TTx doesn’t apply — TTx is NOT collected.

- If the payment model is “Pay at Hotel” and TTx applies — Malaysia Tourism Tax is INCLUDED in the price and collected by the property.

- If the payment model is “Pay at Hotel” and TTx doesn’t apply — Malaysia Tourism Tax is NOT collected.

- Q: How do I verify that TTx has been collected by Agoda? A: Agoda will issue to bookers proof of TTx collection (if collected by Agoda), unless TTx needs to be collected by the property as explained above.

- Q: My property did not register for Tourism Tax, does this apply to me? A: To determine whether you should be registered for TTx or not, please consult your business advisor or seek RMCD’s further guidance. The exemption from TTx for certain property types (Item 3, Tourism Tax Exemption Order 2017) e.g. homestay/kampungstay operator, operator with 4 accommodation rooms or less, does not apply when the reservation is made through a DPSP’s platform. Even if you are exempt from TTx, TTx would still be applicable when a booking of your property is made on Agoda by a qualified tourist.

- Q: If a tourist books accommodation through Agoda then subsequently extends their stay directly with the accommodation premise operator, who is liable to collect the TTx for the additional stay period? A: For tourists who book accommodation through a platform and extend their stay, the accommodation premise operator will collect any TTx for the additional stay. Platforms such as Agoda should not be liable to collect the TTx for the additional stay period, unless the additional stay period is booked using the online platform. Source: GUIDE ON TOURISM TAX (DIGITAL PLATFORM SERVICE PROVIDER) as of 13 Aug 2021.

- Q: If I have other questions on the Malaysian Tourism Tax, who should I contact? A: Please contact our Accommodation Service Team via the Need Help? button in YCS.

- Q: In case of a dispute by a customer, what should I do and who should I contact? A: Please contact our Accommodation Service Team via the Need Help? button in YCS.

- Q: Upon check in, I found that the guest is a foreign tourist, but the booking was made by a local. In this case, what should I do? Should I collect the tax and remit to RMCD? A: Yes. You should collect the applicable TTx in such case and remit to RMCD.

- Q: Is the guest still entitled to a TTx refund if the booking is non-refundable, but it is a no-show? A: TTx will in all cases be refunded to the booker if the stay at the premise does not take place. For more specific cases see below:

- If a full refund is triggered (cancellation on refundable booking) => Agoda refunds the entire amount. TTx will be refunded in full.

- If a booking is cancelled with 100% charge (cancellation on non-refundable booking) => Agoda keeps the original amount not related to TTx. Payment to the property should not be affected. However, TTx should be refunded to the booker.

- If a booking is cancelled with partial charges=> TTx will be refunded to the booker.

- If the booking is amended => Applicable tourism tax will be recalculated based on the new room nights of the amended booking. The amendment voucher should indicate the new value of tourism tax that has been paid.

Was this article helpful?

Thanks for your feedback!

Your reservations

Managing your reservations

What is the Analytics Center?

What can I do if the guest did not show up (No-Show)?

How do I view booking transactions and past payments for ePass payments?

YCS Availability Center

How do I respond to booking inquires?

What should I do if I can’t accommodate a Property Collect booking?

What is Acknowledge Booking and how can I Acknowledge Booking?

How to handle guest requested changes?

How do I receive confirmation on my reservation?

How do I respond to a special request?

Can I make changes to a reservation?

What should I do if I can’t accommodate a guest?

Where can I see details of my reservations?

Recommended reads

Agoda celebrates Golden Circle Awards across Asia

Agoda celebrates golden circle awards across ....

We're thrilled to share that Agoda has recently hosted the Golden Circle Awards at in Bangkok, Phuket, Hong Kong, Seoul and Tokyo

We're thrilled to share that Agoda has recently hosted the Golden Circle Awards at in Bangkok, Phuke ...

11-Mar-2024

Agoda Partner Appreciation Night – Livestream

Agoda partner appreciation night – live ....

Thank you for joining us for industry insights from Agoda’s leaders!

20-Feb-2024

Protected: Agoda Partner Appreciation Night – Livestream

Protected: agoda partner appreciation night & ....

There is no excerpt because this is a protected post.

14-Feb-2024

Agoda Manila hosts ‘Coffee Session’ for Growth Team

Agoda manila hosts ‘coffee session̵ ....

Agoda Manila hosts 'Coffee Session' for Growth Team Partners

Agoda launches the 3rd edition Eco Deals Program at the ASEAN Tourism – Forum

Agoda launches the 3rd edition eco deals prog ....

Agoda, the global digital travel platform, announced at the ASEAN Tourism Forum (ATF) that it has broadened its collaboration with World Wide Fund for Nature (WWF), expanding its Eco Deals Program to support eight conservation projects across Southeast Asia.

Agoda, the global digital travel platform, announced at the ASEAN Tourism Forum (ATF) that it has br ...

Agoda Manila hosts “Bites & Insights” for Partners

Agoda manila hosts “bites & insigh ....

Partners feast on Bites & Insights in Manila

Agoda Partner Appreciation Night

Join us on 2 February from 18:00 (GMT+7) for industry insights from Agoda’s leaders.

23-Jan-2024

Jet-set into 2024: Agoda shares travel ideas for a year of new discoveries!

Jet-set into 2024: agoda shares travel ideas ....

As the new year begins, Thai travelers may find themselves curating their resolutions list, encompassing a wide range of aspirations from eating healthier and indulging in new experiences to reading more.

As the new year begins, Thai travelers may find themselves curating their resolutions list, encompas ...

More questions?

More support articles available!

Agoda Homes Support

Set up your property with Agoda

Connectivity

Yield Control System (YCS) Extranet

Policy and terms of use

Content Terms

Cookie policy

Terms of use

Agoda Business Partners Privacy Policy

Agoda NHA Host Privacy Policy

Advertise with us

Agoda Media Solutions

All Languages

This site uses cookies to offer you a better browsing experience and understand how you interact with our Site. Find out more on how we use cookies and how you can change your settings here Cookie Policy .

KPMG Personalization

Tourism Tax Policy and Amendments to Service Tax Policy

- Home ›

- Insights ›

Useful resources

- MyTTx Portal – TTx Policy No. 1/2021

- MySST Portal – Service Tax Policy

The Royal Malaysian Customs Department (“RMCD”) has uploaded a Tourism Tax Policy to recap the exemption of Tourism Tax announced by the Government earlier as well as amendments to two Service Tax Policies on its official portal. Please click on the above header links for a copy each of the policies.

Set out below are the salient points:-

Tourism Tax Policy No. 1/2021

- The exemption of Tourism Tax for the period from 1 July 2020 to 30 June 2021 has been further extended until 31 December 2021.

- Accommodation operators are still liable to submit TTx-03 Return to account and pay the Tourism Tax received from foreign tourists for accommodation provided before the exemption period or any Tourism Tax where payment has not been received from tourists within twelve calendar months that become due in the taxable period.

- The amount of Tourism Tax exempted must be stated in Column 7 of the TTx-03 Return i.e. the amount exempted for each night per room.

- During the exemption period, Tourism Tax should be recorded as “exempt” or “NIL” or “RM0.00” in the invoice issued to foreign tourists.

Amendment (No.2) to Service Tax Policy No. 9/2020

- Registered accommodation premise operators are exempted from charging Service Tax from 1 March 2020 to 31 December 2021.

- Service Tax is exempted for services occurring on 31 December 2021 and ending 1 January 2022.

Amendment to Service Tax Policy No. 2/2019

- Subject to meeting conditions, Service Tax exemption on imported taxable services for companies in Labuan effective 1 September 2019 is now extended to 31 December 2021.

Our highlights are intended to provide a general overview of the key proposed tax changes and should not be used or relied upon as a substitute for detailed advice or as a basis for formulating business decisions.

Should you have any questions or require further clarification, please do not hesitate to email or contact any of our Executive Directors, Directors, Associate Directors or Managers whom you are accustomed to dealing with or who are responsible for the tax affairs of your organization.

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

The Straits Times

- International

- Print Edition

- news with benefits

- SPH Rewards

- STClassifieds

- Berita Harian

- Hardwarezone

- Shin Min Daily News

- Tamil Murasu

- The Business Times

- The New Paper

- Lianhe Zaobao

- Advertise with us

5,000 Malaysia hotels start collecting tourism tax of RM10 per room per night from foreigners

PETALING JAYA (THE STAR/ASIA NEWS NETWORK) - Some 5,000 hotels around Malaysia have started implementing the tourism tax for foreigners.

Foreign tourists are charged a flat rate of RM10 (S$3.20) per night per room, while local tourists and permanent residents are exempted from paying the tax.

Malaysian Association of Hotels (MAH) President Sam Cheah Swee Hee said hotel operators started the collection of tourism tax on Friday (Sept 1).

"Not all hotel operators are ready. We will do it manually until the system is ready," he said.

Cheah said hoteliers will submit their collection to the Customs and Excise Department by next month.

The Customs and Excise Department is taking a friendly approach to encourage hotels and lodging operators to register for the tourism tax, said Director-General Datuk Seri Subromaniam Tholasy.

"We will not be harsh as the announcement of the tax came a little late," he added.

The government announced early last month that the tourism tax was to be enforced from Friday.

Subromaniam said the department will try to contact hotel operators who have yet to register, rather than using a harsh approach. The number of registered accommodation providers so far is 5,000, out of the estimated 10,000 establishments nationwide.

"We are giving hotel operators another month. We expect all to register with us by the end of September," he added.

Bernama reported that hoteliers must display the newly introduced Tourism Tax rate separately from the room rates with the implementation of the tax.

Malaysian Association of Hotels (Sarawak Chapter) Honorary Secretary-General John Teo Peng Yew said hotel and resort operators need to adhere to the new ruling following a meeting with the Finance Ministry and the Customs Department recently.

"No exemption for long stay, complimentary stay such as timeshare or loyalty programme and such tax shall be free of GST," he said in a statement here.

Join ST's Telegram channel and get the latest breaking news delivered to you.

Read 3 articles and stand to win rewards

Spin the wheel now

- Money Management

Here’s What You Need To Know About The New Tourism Tax

- Link Copied!

Not too long ago, Malaysians woke up to the fact that come August 1 this year, they’ll have to pay more when putting up a night at a hotel. Enter, the Tourism Tax (TTx).

Like all tax-related matters, the move was greeted with mixed reactions. Singaporeans are unfazed, confident that the stronger Singaporean dollar would mitigate the introduction of the new tourism tax .

Some Malaysians, however, are not as optimistic. In a report, CIMB Research said TTx could hurt hotel owners while the Institute for Democracy and Economic Affairs (Ideas) believed the country’s World Competitiveness rankings will be severely affected , citing the tax’s untimely entry into the tourism market.

The good news is Malaysians are exempted from the tax but foreign tourists will have to pay a flat rate of RM10 per night. So here’s what you need to know about the tax:

Breaking it down

When the Dewan Rakyat approved the Tourism Tax Bill 2017, Tourism and Culture Minister Datuk Seri Mohamed Nazri Aziz said the tax collected would be in the region of RM654.62 million if the overall occupancy rate for the 11 million “room night” in the country would achieve 60%.

What is room night?

Room night, or room/night, is a measure of occupancy where a room is the unit of measure.

This is opposed to bed/night occupancy, where one calculates the number of beds in the entire hotel (a room can have more than one) against the nights each of them are booked.

For example:

A hotel has 10 rooms each with 2 beds. If 5 separate people book 5 rooms for all 30 days in the month of June, the hotel has a room occupancy or room/night occupancy of 50% for April.

But there are 20 beds spread out over these 10 rooms. If these same 5 single and separate people booked the 5 rooms for all of April, the bed/night occupancy would be only 25%, because 5 beds were used out of a possible 20 for June.

Source: Djaunter

Nazri believes that with proper promotion and 80% occupancy rate, RM872.82 million can be collected which could provide a sustainable fund every year to develop the tourism industry and make it more competitive.

According to an early Customs Department circular, the tax is charged at a specific rat, based on hotel ratings. But the government decided to scrap that and announced a flat fee of RM10 a night. Here’s how this differs from the other charges imposed at hotel rooms nationwide:

And, here’s the list of properties exempted from the tax:

- Homestays registered with Ministry Of Tourism and Culture (Motac);

- “Kampungstays” registered with Motac;

- Accommodation premises established and maintained by religious institutions not for commercial purpose; or

- Accommodation premises with less than 10 rooms.

- Accommodation premises operated by the federal government, state government or statutory body for training, educational or accommodation not for commercial purposes.

Credit: Customs Department

So how do we go about this?

So as this affects foreign tourists, let’s see how this affects them. Based on the list above, one caveat about the tax is that it exempts Airbnb properties. So, let’s say you are planning a one-night stay in Tanjung Bungah, Penang, for two people.

Here’s how much you are expected to pay for a 3-star hotel versus an Airbnb unit:

If you stay for a 4-day, 3-night stay, you would be incurring RM745.92 for a short vacation in Penang. Before TTx, the amount would have been RM30 cheaper.

On the other hand, with Airbnb you save RM235.92! But – there’s always a “but” here – before jumping onto the Airbnb website, weigh the pros and cons.

Sometimes Airbnb hosts may not support a self-check-in option, which can lead to a pretty hectic experience. Then, there’s the hassle of getting in touch with your host and dealing with potentially annoyed neighbours, especially if you arrive late at night.

Even parking can be a pain, where in some cases, the owner might allow you to park in his or her slot, but your car will still get clamped due to it being an unregistered vehicle.

Also, not forgetting, a lot of properties do not welcome Airbnb guests. In many residential neighbourhoods, you’ll be greeted with a “No Airbnb Allowed” signage. That can lead to an uncomfortable experience.

As for hotels, though it might be pricier, you can easily check in at any time of the day, you get free breakfast and room service/housekeeping services. For hotels, the service has to be on par with the hotel rating as these forms of accommodation are regulated while Airbnb and the likes aren’t.

Sometimes, depending on the nature of your stay, a hotel spells convenience and that can make or break your getaway or trip.

It’s all about planning

TTx is here to stay. The good part about the tax is that it is a fixed rate, so regardless of your hotel ranking, you only pay a flat fee. The bad part is just the extra fee, on top of all the other surcharges you are expected to pay.

If you are foreign tourist, what you can do to dampen the effects of the tax is to simply plan your vacation better. If you want something a little cheaper, go with Airbnb or a homestay as these are exempted.

If you want comfort and ease of mind, then a hotel is what you need and you’ll just have to pay the tourism tax.

Either way, the important travel axiom stays: you get what you pay for. Happy budgeting!

*This article was updated to reflect the current changes to the Tourism Tax. Earlier, the tax stipulated that everyone, including Malaysians, would need to pay a fixed rate according to hotel rankings. But the Tourism Ministry has revealed that only foreign tourists will be charged a flat rate at hotels nationwide.

Leave your comment

Did you like this article .

You might also like these

What Kind Of Spender Are You?

5 Tax Moves To Make Before 2023 Ends (That Can Boost Your Refunds Next Year)

5 Tips To Combat The Rising Cost Of Living

5 Situations That Contribute To Overspending

How Much Will Chinese New Year Traditions Cost You This Year?

Get even more financial clarity with an iMoney account for FREE

We’ve tailored insightful tidbits just for you.

By signing up, I agree to iMoney’s Terms & Conditions and Privacy Policy

Get free weekly money tips!

Do you really want to leave?

KINIGUIDE | The planned introduction of Tourism Tax on top of the existing six percent goods and services tax (GST) has raised concerns from local industry players and stakeholders.

Tourism and Culture Minister Mohamed Nazri Aziz had from day one defended the move which was introduced with the passing of the Tourism Tax Bill 2017 in the last Parliament session.

In the process, he got into a war of words with a state minister who argued for the deferment of the tax in Sarawak and Sabah, arguing on grounds of the states’ autonomy.

Some parties also insisted that the new tax had caught stakeholders by surprise, prompting Nazri to promise extra incentives to cushion its effects.

Malaysiakini takes a closer look at the debates surrounding the issue.

What is the Tourism Tax?

In simple terms, the Tourism Tax is an additional charge imposed on customers for hotel rooms.

The addition is on top of the existing 10 percent service charge and six percent GST set on room rates.

The Royal Malaysian Customs had said that the Tourism Tax charge will be based on the rating of the accommodation - from five star to unrated.

How much more will a guest have to pay?

The Royal Malaysian Customs listed the taxation rate as follows:

1. Five star: RM20 per room per night 2. Four star: RM10 per room per night 3. One to three star: RM5 per room per night 4. One to three orchids: RM2.50 per room per night 5. Unrated: RM2.50 per room per night

Hold on. How did the 'orchids' come into the picture?

Aside from the internationally recognised star system for hotel rooms, the Tourism and Culture Ministry has also introduced the orchid rating as a classification system for budget accommodation premises which do not meet the requirements of the Star Classification Scheme.

What is the number of rooms we are looking at?

The latest data available from the MyTourismData portal of the Tourism Malaysia website stated that there are 4,799 hotels and 304,721 rooms in the country as of 2015.

The figure would be exponentially larger taking into account the mushrooming of Airbnb concept rooms and homestays.

Nazri had recently said that Airbnb premises with six rooms and more will be required to charge the Tourism Tax.

When is the tax supposed to be implemented?

In short, Aug 1. But there were some confusions on this matter.

In what appears to be the first announcement after the Tourism Tax Bill 2017 was passed, the Royal Customs Department in a circular dated June 6 had said the tax will come into effect on Aug 1.

A local Chinese-daily, however, reported on June 7 that the decision was retracted because the Tourism Tax Bill had supposedly yet to be signed by Yang di-Pertuan Agong Sultan Muhammad V and hence hasn’t been gazetted.

Nazri later said this was not true.

Instead, he said obtaining the Agong’s signature to gazette a new law was only a formality and the government will stick to its original plan which was to start tax collection on July 1.

Since then, Nazri had on June 27 reportedly said that the launch of the Tourism Tax will be deferred to Aug 1, as the government was not yet ready to implement it.

Who will have to pay?

The initial announcement was that the Tourism Tax will be imposed on all guests at all hotel rooms.

Following the outcry, it was however announced that exemptions will be given to all Malaysians staying in hotel rooms below four stars.

All international tourists will still be subjected to the tax.

Aren't the GST and service charge enough? Why the need for more taxes?

Again, in short, the Tourism and Culture Ministry has been subjected to annual federal budget cuts and could benefit from added revenue in the form of additional charges.

In winding up his debate for the Tourism Tax Bill, Nazri had said revenue from the tax would be in the region of RM654.62 million if the overall occupancy rate for the 11 million "room night" (a unit used in the hospitality industry) in the country can achieve 60 percent.

The amount can go as high as RM872.82 million if the occupancy rate reaches 80 percent, he had said.

What will the funds be used for?

According to Nazri, most of it will go towards promoting the tourism industry through Tourism Malaysia.

At a press conference on Thursday, he explained at length on how the Tourism Malaysia annual budget has been slashed to RM110 million, down from RM200 million a decade two decades ago.

Over the past three years, he also cited examples of how promotional funds had affected the number of tourist arrivals to Malaysia.

How many tourists are we looking at exactly?

According to the MyTourismData portal, the figure peaked in 2014 with 27.4 million tourist arrivals and dropped to 25.72 million tourists in 2015.

Nazri had said Tourism Malaysia was working on a RM190 million budget in 2014 but the amount was slashed for 2015.

Last year saw 26.7 million tourists arrivals and the government has set a target of 31.8 million tourists arrivals for this year.

Have all the issues been resolved now?

It was reported on June 5 that the state governments of Sarawak and Sabah have reached a common stand to defer the Tourism Tax until a mechanism on its implementation is achieved.

Among issues discussed include the portion of the tax collection should be shared equally between Sabah, Sarawak and Peninsular Malaysia.

It was also previously reported that prime minister Najib Abdul Razak had met with Sarawak chief minister Abang Johari Openg to discuss the matter.

Is that all?

Nazri had also confirmed that establishments, agencies, and associations with valid contracts involving accommodation fees will be exempted the Tourism Tax until the end of their contracts.

He said the cut-off date for the tax exemption will be on April 1, 2018, as most of these contracts end on March 31.

All new contracts signed after April 1 will have to include the Tourism Tax charge.

This KiniGuide was compiled by Alyaa Alhadjri

- Adults 1 2 3 4 5 6 7 8 9 10

- Children 1 2 3 4 5 6 7 8 9 10

- Frequently Asked Questions

- Deluxe Rooms

- Premier Rooms

- Club Floor Benefits

- Pre Check-in

Meeting & Events

Restaurant & bar.

- Places of Interest

- Perks Just For You

- English (UK)

- tripadvisor

Book Direct for Best Rate

* Example: Contact, team, vision, services, location

- Malaysian Tourism Tax

Dear Valued Guests, following the announcement of the Malaysia Tourism Tax Act 2017, a tourism tax will be imposed by the Royal Malaysian Customs Department. The tax shall be taking effect on 1st September 2017 onwards. Please find below our hotel’s official announcement with regards to the tax and an infographic for your easy understanding. For more information and the latest updates, please visit the following link: http://www.myttx.customs.gov.my/CTTAX/index.html

- Meetings & Events

- Restaurant & Bar

- Tel : +60-82-227-227

- WhatsApp : +6012 880 8189 (For room bookings and room reservation.)

- WhatsApp : +6013 853 9247 (For F&B enquiries.)

- Address : 68 Jalan Tun Abang Haji Openg, 93000 Kuching, Sarawak

- Location Map : Click here

- © 2024 Merdeka Waterfront Hotel Sdn Bhd (967982-P). 版权所有.

- Privacy Policy

- Website Terms & Conditions

- Hotel Policy

- Refund Policy

- A Land of Opportunities

- Sustainability Agenda

- Investment Statistics

- MIDA Insights

- Building Technology

- Life Sciences & Medical Technology

- Chemicals & Advanced Materials

- Machinery & Metal

- Electrical & Electronics

- Paper, Printing and Publishing

- Food Technology

- Transportation Technology

- Wood-Based and Furniture

Business Services

Logistics Services

Education Services

- Oil & Gas

Green Technology

Healthcare Services

Regional Establishment

- Hospitality (Hotels & Tourism)

- Research & Development (R&D)

Other Services

- Investor Highlights

- Setting Up Business

- Business Facilitation

- Annual Media Conference (AMC)

- Announcement/ Media Release

- e-Newsletter

- Featured Articles

- Investment News

- Media Gallery

- Publications

- Advertise with Us

- Our Principles

- Board Members

- Client Charter

- e-Integrity

- Links to Agency Partners

- Procurement

- Forms & Guidelines

- Our Global Offices

- Our State Offices

- Staff Directory

- Government Representatives

- Information Centre

- Enquiry and Client Feedback

- Survey Centre

- e-Participation

This site is mobile responsive

- A Land of Opportunities Reasons to invest

- Sustainability Agenda Commitment towards sustainability

- MIDA Insights Latest news, updates and insights

- Investment Statistics Make informed decisions

- Chemicals & Advanced Materials

- Hospitality (Hotels & Tourism)

- Investor Highlights They came from all over, but made Malaysia their home. Find out more about their investment journey here.

- Setting Up Business Helpful guidelines to get started in Malaysia

- Business Facilitation MIDA offers dedicated support and facilities. Count on us!

- Resources Gain an advantage through our valuable resources including useful links, guides, reports, statistics and publications on choosing Malaysia for your business ventures

Hospitality Sub-sector

Global tourism made a strong recovery in the first half of 2022, with tourist arrivals nearly tripling between January and July compared to the same period globally, according to the United Nations World Tourism Organisation (UNWTO). Around 474 million tourists travelled internationally during this time, up from 175 million in the same months of 2021, marking an almost 60% recovery from pre-pandemic levels.

In Malaysia, the Ministry of Tourism, Arts, and Culture (MOTAC) foresees a two to three-year timeline for international tourist arrivals to return to pre-pandemic levels. This duration allows for a full recovery, assuming resources remain accessible./p>

The Government also introduced a ten-year transformation plan, the National Tourism Policy (NTP) 2020 – 2030, aiming to position Malaysia in the top ten tourist destinations for both arrivals and receipts. Embracing Smart Tourism is a pivotal strategy for sustained competitiveness.

Tourists enjoy the unique culture, food, and biodiversity of Malaysia, with its well-established infrastructure serving a wide range of travellers. For travel advice and business information in Malaysia, visit mysafetravel.gov.my .

Investments Approved in 2022

For more statistics, please click here .

Tourism Recovery Framework (TRF) 2.0 (2022 to 2024)

MOTAC introduced the Tourism Recovery Framework (TRF) 2.0 on June 21, 2022, to fortify and renew the tourism industry. This framework highlights five key strategies, including enhancing tourism and cultural offerings and promoting sustainable, inclusive tourism activities.

Tourist arrivals in Malaysia have exceeded expectations, leading to multiple upward revisions of forecasts. The country is expected to receive 10 million international tourists this year, with tourism receipts estimated at RM26.8 billion. The positive outlook can be attributed to the relaxed conditions for tourist arrivals, which have made Malaysia a hassle-free destination for travelers.

The ringgit’s affordability Is expected to draw more inbound tourists and bolster the economy through foreign currency influx. Malaysia has always been a budget-friendly tourist spot, and with goods and services becoming even more affordable, this trend is likely to continue. Additionally, business tourism will benefit from the lower costs of hosting events such as conferences and trade shows.

Malaysia’s attractive exchange rate is expected to boost tourism for leisure and business. This is likely to strengthen the economy as Malaysia has always been an affordable destination. Goods and services are now even more affordable, benefiting both inbound tourists and business. Hosting conferences and trade shows will also be more affordable, increasing international participation. The government is aiming for hospital revenues from medical tourism to reach RM1.2 billion this year and RM2.4 billion in 2025, according to the Malaysia Healthcare Travel Council (MHTC).

Tourism investments have not kept up with global trends despite an increase in passenger traffic and international travel. Operators are focused on replenishing existing capacity in developed markets and re-evaluating risk exposure in developing economies.

In 2021, 256 tourism projects worth approximately US$9.5 billion (RM45.07 billion) were announced, an 8% decrease compared to the 271 projects worth US$17 billion (RM80.65 billion) announced in 2020.

The National Tourism Policy (NTP) 2020-2030 aims for sustainable and responsible tourism through practices like using solar panels, water-saving, natural materials, and native plants in landscaping. MIDA continues to support these efforts.

Equity Requirement

1 & 2 Star : 100% Malaysian

3 Star : At Least 30% Malaysian

4 & 5 Star : No Equity Restriction

Theme Parks

No Equity Restriction

Convention Centres

Recreational Parks / Other Tourism Projects

At least 49% Malaysian including 30% reserved

Promoted Activities (New Projects)

New projects involving these promoted activities within the tourism industry are eligible for incentives:

Convention Centres

Recreational Parks

Hotels (1- 3 Star)

Other Tourism Projects

Government Support

To boost investor interest, the Government provides tax incentives for tourism projects including hotels, theme parks, convention centres, recreational parks and other tourism projects.

Pioneer Status (PS)

Companies may benefit from Pioneer Status of 70% of the statutory income for each year of assessment of its business operations.

Investment Tax Allowance (ITA)

Companies may benefit from income tax exemption package of 60% allowance on the qualifying capital expenditure incurred within a period of 5 years where the allowance can be used to offset against 70% of the statutory income for each year of assessment of its business operations.

Promoted Activities (Expansion Projects)

Expansion, modernisation and refurbishment projects for the following establishments are eligible for incentives:

Hotels (1-5 Star)

To strengthen the competitiveness of the tourism industry, the Government provides tax incentives for the expansion, modernisation and refurbishment of hotels, theme parks and other tourism projects.

Our Investors’ Highlights

Encore Melaka Impression Series is Southeast Asia’s largest performing arts theatre which offers a 70-min cultural performance that portrays the six centuries of Melaka’s history.

Get Started

Reach our representatives.

Major Services Sub-sectors

Hospitality (Hotels and Tourism)

Oil & Gas

Research & Development (R&D)

Is Malaysia’s Tourism Tax Good Policy?

The tourism tax, which was first introduced in 2017, is currently levied on a flat, RM10-per-night basis for all foreign visitors to Malaysia – and also on some people who aren’t visiting at all!

They say the only sure things in life are death and taxes, and a general disdain for taxation is quite possibly one of the few things nearly all people agree on. But I also think that many, if not most, of us understand why taxes exist. And we accept the imposition of taxes more easily when we see good things arising from their collection.

But it’s a funny old business for sure. I remember many years ago – 1993 to be exact – when my home city of Denver, Colorado was awarded one of two major league baseball expansion teams. For the first two years, the team played in the city’s football stadium since the seasons for the two sports don’t really overlap. The fields for baseball and American football are, of course, completely different, so a lot of adjustments had to be made. Calls quickly began mounting for a dedicated baseball stadium, so accordingly, for the six-county area surrounding Denver, a tiny sales tax increase was proposed to fund the stadium’s costly construction. It was only 0.1% – just 1¢ for every $10 spent, the pitch proclaimed – and voters passed it. A genuinely beautiful new $300 million baseball stadium was built in downtown Denver, just over half funded by that tax, and in April 1995, Coors Field opened with its first game. Now, nearly three decades later, the stadium still stands.

Curiously enough, however, that 0.1% tax increase – ostensibly imposed to fund the construction of Coors Field – also still stands (albeit under a fresh new name). As many governments have discovered, once that magical tap of delicious tax revenue is turned on, it’s really hard to muster up the political will to turn it off.

TAXING THE TOURISTS

The one tax that I would very much like to see shelved here in Malaysia – or at least reviewed and modified – is the loathsome ‘tourism tax.’ Although many municipalities impose such taxes in some form or another, the way in which Malaysia levies it on a nationwide basis could probably use some tweaking.

No matter where you go in the country, no matter the room rate of the lodging in which you stay, a flat RM10 per room, per night tourism tax is levied, and innkeepers are required to collect this charge in full and typically upfront (though not always), separate from the bill paid at check-out. It is loudly and clearly announced, too, often noted on a prominent placard at the front desk: this is a tourism tax. Only Malaysian citizens and permanent residents are exempted. (More on this later.)

Does this not seem a bit unwelcoming and unfriendly, as though tourists are almost being openly penalized for choosing to come to Malaysia and spend their money? Officials have said that “most of the money” collected from this tourism tax, which is a significant haul, is used to further promote the country to other tourists, which just seems… odd. A tourist comes to visit and explore Malaysia and spend their money here, and they are taxed specifically so that more tourists can be enticed to come, and then also get taxed for visiting? To my mind, a country should pay, from its own general budget, for promoting itself overseas, not the tourists who have already chosen to visit.

Think of it in a different way. You go to a restaurant, but before you are taken to your table, a RM5 per dish charge is demanded and collected. It doesn’t matter if your selection costs RM150 or RM20. The same fee applies – RM5 per dish. “What is this for?” you ask. “Well,” they explain, pointing to the sign, “it’s our dining tax. We collect this cash from you, then use it to advertise our restaurant so we can get other diners to come. When they do, we’ll collect the same fee from them, then use that to buy even more advertising.”

Would this not elicit outrage? And wouldn’t most diners simply decide to eat elsewhere next time? I feel this is a pretty fair analogy for Malaysia’s tourism tax.

Does it bring in a lot of money? It surely does – early estimates of over RM100 million per 10% in occupancy rate were floated (e.g., about RM654 million for average nationwide occupancy rate of 60%). But is it good policy? That remains an open question.

Surely there must be a better way. Perhaps a blanket ‘occupancy tax’ that is levied universally , and on a modest percentage basis. Even on its face, this seems more equitable, because while paying an extra RM10 per night at a hotel whose rates start at RM900 might not seem like a big bite, how does that translate to paying the same extra RM10 a night for a room that’s RM80 a night? One guest is paying about 1.1% in tourism tax, while the other is paying 12.5%. Additionally, the tax penalty grows if a tourist stays longer in Malaysia, presumably spending more money and adding to the economy all the while. Seven nights? Well, that’ll be RM70 extra, please.

Tourism industry players ramped up calls in 2018 to abolish the tax , which they said was too “in your face” and counterproductive to the goal of stimulating tourist spending. Agencies and tourism groups decried the charge en masses , saying it was an “ unnecessary burden ” on both tourists and on accommodation operators. Despite months of pleading, however, the government pointedly said it had no intention of removing the controversial tax .

After all, the lucrative tap had been turned on, and just as in Colorado, officials found it much too tantalising to turn off.

BUT IT’S NOT JUST FOR TOURISTS

Possibly the most frustrating thing about this so-called tourism tax is that it is cheerfully imposed on working expats and resident MM2Hers, too – people who are in no way tourists in Malaysia. I’ve lived here for 15 years. I work here, I pay taxes here, I spend money here literally every day, contributing to the country’s economy. And yet, if I travel anywhere within the country, and check in to a hotel, I am asked to pay a tourism tax.

Like several other expats with whom I’ve spoken about the issue, I flatly refuse to pay it, explaining that I am not a tourist, but rather a long-time resident. Of course, I realize it’s not the hotel’s doing, and I tell them that – they’re simply executing Ministry of Tourism policy.

But perhaps it’s time to revisit that policy, and either include residents with long-term visas on the exemption list, or rethink the tourism tax approach altogether. Experts more knowledgeable than I have decried tourism taxes as ‘ bad tax policy ,’ saying that it shifts the cost burden unfairly, creates negative effects on consumers and business owners, and hinders the effective promotion of a destination – exactly the opposite effect intended. One comprehensive study found that a 10% increase in tourism tax resulted in a 5.4% decrease in tourist demand.

Moreover, many municipalities which do impose a tourism tax do so to help fund the infrastructure and attractions that tourists enjoy, preserve the environment, or encourage the development of sustainable tourism practices. Some even use the funds to pay for insurance policies to provide an umbrella of protection for visitors in the event of injury. And of course, in some instances – in this era of growing overtourism – some destinations impose taxes simply to disincentivize visits.

But not many places explicitly levy taxes on tourists for the purpose of funding the destination’s tourism marketing goals! And most places tend to impose these taxes a bit more discreetly or indirectly, working them subtly into international airline fares, occupancy taxes, or such.

TIME FOR A REVIEW?

Thailand, which in February 2023 approved a controversial and deeply unpopular 300-baht ‘tourism fee’ for visitors arriving by air (150 baht for land and sea arrivals), did not announce at the time exactly when it would be implemented. In mid-December 2023, they announced it would be postponed indefinitely, ‘until the industry recovers.’

Maybe a rethink of a policy that explicitly taxes tourists for choosing to come here is worth considering for Malaysia, too – and certainly a reversal of treating and taxing resident expats as tourists is in order.

Or maybe there’s just a better way to implement these taxes. If levied as a much lower, percentage-based occupancy tax across the board, it would not only be fairer, it could potentially even generate more revenue, as nobody would be exempt. And why should they be? After all, a Malaysian who lives in KL and visits Kuching is still very much a tourist. And if the funds are used to bolster and improve tourism facilities and keep places clean and sustainable, then locals derive every bit as much benefit from that as tourists – if not more!

Tourism is too important to Malaysia’s economy to implement flawed or unsustainable policy. The country has an abundance of incredible tourism assets and derives immense benefit from tourism, so it’s clear that adopting well-thought-out approaches to managing the resources and funding their upkeep will always be of critical importance.

Most Popular

TEG Mingle Plus: Join us Poolside at Eastin Hotel!

Burning Up the 5G Superhighway: Malaysia’s Speeds Are Second-Fastest in Asia Pacific

Calling All Expat Entreprenuers!

Here Comes the Year of the Dragon!

Langkawi Wraps Up the 20th Edition of Its International Regatta in Fine Fashion

Refresh Your Music with Heineken!

Forest City’s Parent Company, Country Garden, Likely to Face Trade Suspension in China

StarsInsider

Countries where you pay to be a tourist

Posted: 17 April 2024 | Last updated: 17 April 2024

If you've traveled, you've likely paid a tourist tax before. However, you may have never noticed it, as it's often worked into airline tickets or the taxes you pay at your accommodation. Originally, tourist tax was introduced by certain governments with the aim of tempering over-tourism and generating income from large numbers of travelers entering the destination. Now, the money from the tax also goes to protecting natural resources and maintaining tourism facilities.

Intrigued? Click on to discover the countries that charge a tourist tax.

You may also like:

Austria charges visitors a nightly accommodation tax, which differs depending on the province. In Vienna and Salzburg, around 3.2% is added onto your accommodation bill.

Follow us and access great exclusive content every day

In Brussels, tourist tax varies depending on a hotel's size and rating, and can reach €7.50 (US$8.17) per night. However, it varies from city to city.

You may also like: The creepiest movie characters we love to fear

Bhutan has long been known for its steep tourist taxes and charges. The current daily fee for the majority of visitors is US$100.

Depending on municipality, the tourist tax in Bulgaria ranges from 0.20 lev to 3 lev (US$0.11 to $1.67) a night.

You may also like: Celebrities in the same outfits: Who wore it better?

Most of the Caribbean islands charge a tourist tax. The price ranges depending on the island.

In Saint Lucia, for example, it's around 8%, whereas in the Dominican Republic it's 18%.

You may also like: The dark secrets zoos don't want you to know about

The Croatian tourist tax depends on the season and location, but it's only around €1.33 (US$1.45) per night.

Czech Republic

In Prague, tourist tax typically costs around CZK50 (US$1.97) per night.

You may also like: The most-asked "why" questions on Google

France's taxe de séjour varies depending on city, and tends to be added to your hotel bill per night. The tax is used to maintain tourism infrastructure in popular destinations, such as Paris and Nice.

Germany has a "culture tax," called kulturförderabgabe , and a "bed tax," bettensteuer , in cities including Frankfurt, Hamburg, and Berlin. It tends to be around 5% of your hotel bill.

You may also like: Laugh out loud: The best comedians in history

The price you pay in Greece depends on the standard and size of your accommodation. It tends to be around €4 (US$4.36) per night.

Tourist tax in Hungary only applies in Budapest. Travelers have to pay an extra 4% nightly on the price of their room.

You may also like: Surprising stars you didn't know owned sports teams and leagues

Since January 2024, Iceland has reinstated their tourist tax, which costs US$4.36 per night. It comes after annual tourist numbers reached an estimated 2.3 million per year.

Since February 2024, travelers have to pay 150,000 rupiah (USD$9.59) upon entering Bali.

You may also like: Unmasking the monsters: actors playing cinematic creatures

Italy's tourist tax varies depending on your location. Rome's fee ranges from €3 to €7 (US$3.40 to $7.94) a night, depending on the type of room. In 2024, Venice started charging day-trippers €5 ($5.40) during high season.

Japan has a 1,000 yen (US$9.25) fee, paid by international visitors as they leave the country.

You may also like: Normandy beyond the beaches

Malaysia has a flat-rate tax that it applies to each night you stay, at around US$4.35 a night.

Netherlands

Amsterdam has an overnight tourist tax of 12.5%, making it one of the most expensive in Europe. Furthermore, the city has a tax specific to transit visitors, including people on cruise ships, that charges €14 (US$15.26) per 24-hour period.

You may also like: Stunning nature photographs that look like paintings

New Zealand

Travelers visiting New Zealand have to pay an International Visitor Conservation and Tourism Levy (IVL), which costs US$23.94.

Portugal has a low tourist tax of €2 (US$2.18) per night, which applies to all those over the age of 13. It applies in 13 Portuguese municipalities, including Lisbon and Porto.

You may also like: Evel Knievel: Remembering the motorcycle stunt legend

Bucharest charges a tax of 1% of the hotel's room rate. Major cities charge a city tax, and mountain and sea towns charge a rescue tax.

Slovenia bases its tax on location and hotel rating. In larger cities and resorts, such as Ljubljana and Bled, the fee is higher and only around €3 (US$3.40) per night.

You may also like: Amber Tamblyn, David Cross share how couples therapy helped both on- and off-screen

Several cities in Spain have recently decided to raise the price of their tourist tax, including Barcelona, where the fee is €4 (US$4.54) per night.

Switzerland

Switzerland's tourist tax also varies depending on the location. A common amount is 2.50 Swiss francs (US$2.50) per night.

You may also like: Golf's great celebratory moments

Thailand introduced a tourist tax to the price of flights in April 2022. The fee for all international visitors is 300 baht (US$8.44).

Several states in the US, including California and Texas, have an occupancy tax, which you pay when you book your accommodation.

You may also like: Signs that someone will grow up to be a millionaire

The highest hotel tax in the country is in Houston, where there's a 17% tax on your hotel bill.

Sources: (CN Traveller) (Time Out) (Business Insider)

See also: Where to travel based on your personality type

More for You

Iran warns Israel it will be met with a 'massive and harsh' response

‘Exposés’ of those who sit out boycott violate privacy laws, say lawyers

7 Best Nasi Lemak Berlauk To Try In Klang Valley

Jailed Myanmar leader Suu Kyi moved to house arrest

EPF revamp: Members below 55 will have three accounts

The Affordable Kia EV3 Will Be Released This Year

Scientists find 'vampire' bacteria that has a thirst for HUMAN blood

Reita from Japanese rock band 'The Gazette' dies at age 42

I Tried 11 Fast-Food Cheeseburgers & One Can't Be Beat

PBRS founder Joseph Kurup dies

Is China growing tired of Russia’s war in Ukraine?

Tesla seeks to award Elon Musk $56bn pay package

MBSA Man Takes Private Hospital To Court Over Negligence, Files Claim Of RM55 Million

Powerful earthquake rocks South Australia

Real Madrid exact revenge on Man City to reach UCL semis

Mayim Bialik Says ‘Quiet On Set' Claims Of Abuse Wasn't Only At Nickelodeon | THR News Video

Chinese villagers downplay help for Malay travellers in Perak

Aircrafts that disappeared mysteriously

Dubai underground metro station left significantly underwater following torrential rain

Why this Aussie supermarket is removing ALL its self-service checkouts

Malaysian Budget Hotels to Raise Rates 30%

Alan Woinski

April 15th, 2024

Malaysian budget hotel owners are raising room rates due to increasing operational costs and taxes, amidst pressures from unlicensed accommodations.

- LinkedIn icon

- facebook icon

In the first quarter of the year, the Philippines received nearly 1.6 million international visitors, marking a 21.3% increase compared with 1Q23. The big difference appears to have been the Chinese visitor arrivals, rising by 150% to 109,568. While the percentage increase is no big deal given how 1Q23 had China just converting from their Zero Covid policy to one where their residents were free to resume somewhat normalcy, the results were higher than the DOT projected. Also, China bested Japan which had 105,347 people travel to the Philippines in the quarter. If you combine the two countries, they still did not even come close to the Philippines’ number one source market, South Korea , with 458,619 arrivals, up 26% year on year.

In Malaysia , budget hotel owners need to hike their rates to make up for inflation and other operational costs that are rising. The Vibes reported rates could go up as much as 30% to 40% over the next three months. Added to the pressure is that the sales and services tax has increased to 8% from 6%. The increase in room rates is expected to vary for different budget hotels depending on their ratings. MyBHA said rates right now are RM80-100 per room for a one-star hotel, RM100-150 for two-star and RM200-250 for three-star. Some hoteliers have already raised rates to cover costs. The hoteliers also want the government to help them by curbing the unlicensed accommodation owners which are pressuring the true hoteliers’ businesses.

Thailand’s Prime Minister has proposed the introduction of a Schengen-like visa scheme that would include Thailand and five other Southeast Asian countries – Cambodia , Laos , Malaysia , Myanmar , and Vietnam . The initiative is designed to simplify travel across these nations and is anticipated to attract more long-distance and high-spending tourists. The six countries welcomed about 70 million tourists but Thailand and Malaysia accounted for more than half. The proposed single-visa scheme is aimed at sustaining the long-term growth of the tourism industry with the unified visa expected to simplify travel decisions for long-haul tourists with the visas being extended to 90 days from the standard 30-day limit.

The Ascott Limited , the wholly-owned lodging business unit of CapitaLand Investment , has announced a partnership with Canopy Sands Development Co. Ltd. to manage two properties: Oakwood Bay of Lights Sihanoukville and Summer Bay Beach Club & Cabins by Preference . This is the first-ever collaboration between Ascott and Canopy Sands Development of Cambodia . This would mark the arrival of the second Oakwood property in Cambodia and the introduction of Preference , a brand described as being unique, authentic with allure, to the country. Oakwood Bay of Lights Sihanoukville features 250 rooms while Summer Bay Beach Club & Cabins by Preference comprises 60 quaint cottages.

Robinsons Hotels and Resorts said they are transforming Go Hotel Mandaluyong into a Go Hotels Plus , upgrading its first property in the value essential category. Go Hotels Mandaluyong is the pioneering property of RHR in the value essential category in the Philippines that opened in May 2010. The 222 deluxe and PWD rooms were the first of its kind no-frills hotel. With the brand upgrade, guests can now look forward to an enhanced stay experience, including a more modern and sleek room design as well as a new and spacious lobby. A new room category with a bunk bed for sharing is also now offered for groups on a budget on top of its existing deluxe twin and queen rooms. RHR introduced Go Hotels Plus in 2022 with a refreshed look, upgraded amenities and spaces, while maintaining its affordable rates. The first Go Hotels Plus was opened in Tuguegarao , shortly followed by the opening of the second one in South Luzon , Go Hotels Naga .

The Mohegan INSPIRE integrated casino resort in Incheon , South Korea has opened a new food court with seating for around 1,000 diners. OASIS Gourmet Village is located within the INSPIRE Mall , and opened on March 10th as part of a collaboration with domestic space branding company Glow Seoul . The food court is part of Mohegan trying to finish the IR, opening in late 2023 but the full first phase, at a budget of US$1.6 billion, is still not completed despite being delayed for many years. The soft opening was in November, and casino operations started on March 5th but they still had to complete the retail mall, outdoor experiential space, international food court, immersive content exhibition hall and indoor children’s playground, with the expectations that all this would be complete by mid-2024.

Lemon Tree Hotels Ltd said they opened the Tigerland Safari , at Chitwan in Nepal . This is Lemon Tree’s second property in Nepal after launching a hotel in Kathmandu earlier this month with 102 rooms, a coffee shop, an Asian restaurant and bar and tea lounge. The Tigerland Safari property features 35 cottages, a coffee shop called Citrus Cafe and a banquet space.

BWH Hotels announced the signing of SureStay by Best Western Iconic Suvarnabhumi in Bangkok , Thailand . With this signing, BWH Hotels will offer a comprehensive 13 hotels in the Greater Bangkok region. Situation close to the Bang Na-Trat Expressway , SureStay by Best Western Iconic Suvarnabhumi will offer 198 rooms, a restaurant and an outdoor pool.

Hilton Mauritius Resort & Spa recently completed a renovation to provide an elevated hospitality experience for guests. The hotel has 193 renovated guest rooms including 74 deluxe rooms, 100 grand deluxe rooms, and 18 suites. The accommodation features warm, elegant interiors with views of either the hotel’s palm garden, the new infinity pool or the seaside. The rooms were renovated to create a more modern and contemporary feel. The confirmed connecting rooms are ideal for larger families, friend groups, wedding attendees and other travel parties. The Hilton Mauritius Resort & Spa features six restaurants and bars.

Companies: The Ascott Limited , Best Western Hotels & Resorts , CapitaLand Investment , Go Hotels Plus , Hilton , Hilton Hotels & Resorts , Lemon Tree Hotels , Oakwood , Robinsons Hotels and Resorts , SureStay , The Mohegan Tribal Gaming Authority

Locations: Bangkok , Cambodia , China , Incheon , Laos , Malaysia , Mauritius , Nepal , Philippines , South Korea , Thailand

IHG Hotels & Resorts

Japan Expects Hotel Occupancy Improvement in 2024

April 17th, 2024

Accor Opens World’s Largest Mercure Hotel in Singapore

April 16th, 2024

Best Western Hotels & Resorts

Taylor Swift Concerts Boost Singapore Hotel Performance

April 11th, 2024

Dusit International

Gaming in Thailand Wouldn’t Bring Immediate Benefits to Hotels

April 10th, 2024

Asset World Public Company Limited

Thailand’s PM Pushes for Six-Nation Visa for Southeast Asia

April 9th, 2024

IMAGES

COMMENTS

Kindly be informed that the exemption of tourism tax on foreign tourist staying at a registered accommodation premise will end on 31st December 2022. Accordingly, the imposition of tourism tax on foreign tourist staying at a registered premise will be re-imposed effective from 1st January 2023.

It is charged at a fixed rate of RM10.00 per room per night. However, during the Covid-19 pandemic, The Malaysian Government has announced the exemption of the Tourism Tax for all foreign passport holders for hotel stays between 1st March 2020 and 31st December 2021 then further extends to 31st December 2022.

Malaysia Tourism Tax:Understanding Malaysia's Tourism Tax is essential for foreign travelers. This guide explains what the tax is, how much it costs, and who is exempt. Learn how the tax applies to your hotel stay and ensure a smooth check-in process.

FAQs. Q: What is the Malaysian Tourism Tax? A: The Malaysian Tourism Tax (TTx) is a tax of RM10 per room per night charged on any tourist staying at any accommodation premises within Malaysia, collected by the operator under the Tourism Tax Act 2017 (TTx Act).

Jacie Tan. 7th April 2022 - 2 min read. If you had booked a hotel or visited a tourist attraction in Malaysia during 2021, you could be eligible for an income tax relief of up to RM1,000 on the expenses. As you may recall, the special tourism tax relief that was announced under the Economic Stimulus Package 2020 - originally for March to ...

The Royal Malaysian Customs Department ("RMCD") has uploaded a Tourism Tax Policy to recap the exemption of Tourism Tax announced by the Government earlier as well as amendments to two Service Tax Policies on its official portal. Please click on the above header links for a copy each of the policies. Set out below are the salient points:-

Updated. Sep 02, 2017, 12:27 PM. PETALING JAYA (THE STAR/ASIA NEWS NETWORK) - Some 5,000 hotels around Malaysia have started implementing the tourism tax for foreigners. Foreign tourists...

tourists will be subject to the tourism tax? A3: Tourists are as defined in the Tourism Industry Act 1992 and such tourists will be subject to tourism tax. However, the following tourists will be exempted by the Minister of Finance : - a) a tourist who is a Malaysian national (holds MyKad card); and

1 HOTEL TAMAN CONNAUGHT NO. 17, 17-1 & 17-2, JALAN MENARA GADING 1, TAMAN CONNAUGHT, Wilayah Persekutuan Kuala Lumpur: 24/06/22: 3. 1 MALAYSIA HOTEL Lot S0110-0115, Blok J, One Avenue, Phase 8, Taman Utama, Sabah: 15/12/09: 4. 1 MILLION HOTEL NO 2,6,8,10,12 & 16, Jalan Austin Height 8/6, Taman Mount Austin, Johor: 28/03/16: 5. 101 HOTEL