Compare our best travel money deals

Get maximum value for your travel money, currency calculator.

Join our personal finance newsletter for top deals and insight

You can unsubscribe at any time - privacy notice .

Today’s best exchange rates

How do you get the best holiday money exchange rate, use our currency converter, high exchange rates, delivery charges, special offers, pros and cons, five golden rules of travel money, 1. know how much cash you'll need.

Carrying around a large amount of cash isn't the safest thing to do. At the same time, not having enough cash can cause a lot headaches too. It's a good idea to take a little more than you think you'll need.

But it's also good sense to have a backup prepaid , debit or travel credit card that you can rely on - assuming you're going to a destination that widely accepts card transactions.

2. Shop around

Not all currency exchange companies are created equal. Some may have good exchange rates, but higher fees. Others may have higher rates, but no fees. You have to make sure which one offers the best value to you.

This is why it’s worth comparing the deals on offer from several companies before ordering your travel money. Factor in the fees and the exchange rate and see where you end up better off. Often the amount of money you're exchanging can be a deciding factor.

3. Don't buy your travel money at the airport

Airport holiday money providers have notoriously high prices because they offer a last-chance solution for those who are just about to board a plane. By planning ahead you can save a small fortune.

4. Don't carry too many large notes

Notes of large denominations can be tricky, as small shops and taxi cabs, which are more likely to require cash, might not have enough change to accept a large note.

Some retailers are also often wary of accepting large notes. Smaller notes and change can also be handy when it comes to tipping or buying small everyday items.

5. Don't use your credit card to buy travel money

Avoid buying foreign currency with a credit card as credit card providers treat the transaction as a 'cash advance' . Not only will you be charged daily interest, you're also likely to be hit with a fee.

Budgeting for your holiday

How much travel money you need to take depends on your plans. You'll need to budget for your holiday to make sure you don't run out of money before the end.

Deciding how much money to take depends on were you're going, whether debit or credit card usage is prevalent, and if you want to have some local currency on hand for emergencies.

Having some cash is extremely important, as there's always a possibility your cards could get declined or blocked for some reason, and it may take some time to resolve the issue.

Also, some countries still rely predominantly on cash transactions, so you should factor that into how much cash you decide to take.

What are the top alternatives to buying travel money?

Travel credit cards.

Travel credit cards - i.e. the ones with no foreign transaction fees - offer two key advantages over travel money:

Great exchange rates - when you spend on a travel credit card you get the Mastercard or Visa exchange rate, which is about the best you can find as a regular consumer

Purchase protection – for purchases costing between £100 and £30,000 you're covered by Section 75 of the consumer credit act , meaning if something goes wrong you can make a claim with your card provider should the vendor fail to pay up

However, not everywhere accepts travel credit cards and using them at a cash machine abroad can come with hefty fees. It can also be easier to overspend on a credit card, leaving you with debts on which interest is charged.

Travel money cards

Currency cards and travel bank accounts let you spend overseas without being charged a foreign transaction fee. Their key strengths are:

Great exchange rates - you card provider will pass on the Mastercard or Visa rate to you without adding extra charges

No charges for ATM use overseas - if you need extra cash on holiday, you can withdraw it without being charged by your provider. Watch out for local ATM fees though, as these might still apply

The downsides include that there can be limits on how much you can withdraw abroad using a travel money card, and that they're not accepted quite as widely as cash. Some travel current accounts also come with fees.

Prepaid travel cards

Prepaid travel cards can be loaded with currency and used abroad without paying foreign exchange fees. You can load a prepaid card with a specific foreign currency or a variety of different currencies, depending on your travel plans. The key advantages are:

Low or no fees to use abroad – prepaid travel card providers charge far less than traditional banks for overseas usage

Safer than carrying cash - you can cancel or freeze the card if it's lost or stolen, protecting your balance

However, you’ll need to watch out for general usage fees, which often apply when you load the card with cash and may also be charged monthly.

Can you get commission-free travel currency?

Yes and no. It depends on how you define it. Commission refers to the service fee that a currency exchange broker charges for exchanging your money.

Many companies advertise 0% commission to exchange money online or on the high street, but, instead of charging commission, they offer a less competitive exchange rate. This is why you need to compare the whole deal rather than just opting for a zero-fee travel money deal.

Are there restrictions on getting currency delivered?

When you buy your currency online, it's normally sent via Royal Mail's Special Delivery service. This means you have to sign for the package. Cash orders that exceed £2,500 will be sent in batches because that's the maximum value that can be insured for each delivery.

Can you get next-day delivery for currency?

Some travel money providers do offer next-day delivery. These brokers send out currency using Royal Mail's Special Delivery Guaranteed by 1pm service.

Our comparison shows which operators offer this option and how much they charge for it. With some companies, you also have the option to pre-order your travel money for collection in person from a local branch, meaning you don't have to pay for delivery.

Will anyone buy my currency back?

If you've got leftover travel money from a trip abroad, you can use a buy-back service to convert it back into pounds.

The buy-back rate tells you how much sterling you'll get back.

Remember to factor in the rate and delivery costs, and compare exchange rates. You can check out the best euro-to-pound exchange rate by looking at our comparison table.

About our comparison

Who do we include in this comparison.

We include every company that gives you the option of buying euros online. Discover how our website works .

How do we make money from our comparison?

We have commercial agreements with some of the companies in this comparison. We get paid commission if we help you take out one of their products or services. Find out more here .

You do not pay any extra and the deal you get is not affected.

Learn more about travel money

About the author

Didn't find what you were looking for?

Below you can find a list of currencies to exchange

Other products that you might need for your trip

We’ve been featured in

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

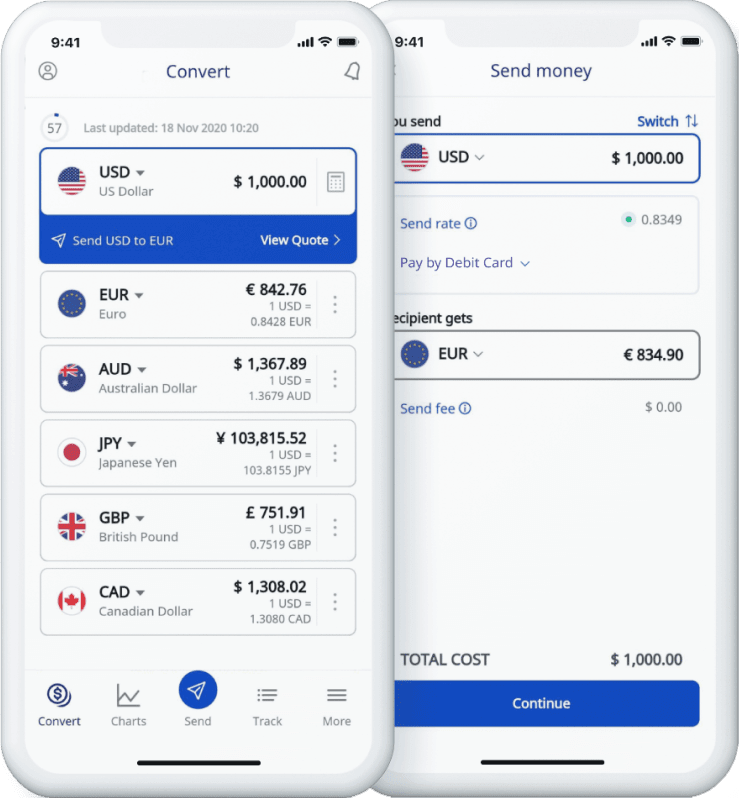

- Money Transfer

- Rate Alerts

Xe Currency Converter

Check live foreign currency exchange rates

Xe Live Exchange Rates

The world's most popular currency tools, xe international money transfer.

Send money online fast, secure and easy. Live tracking and notifications + flexible delivery and payment options.

Xe Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

Xe Rate Alerts

Need to know when a currency hits a specific rate? The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

Xe Currency Data API

Powering commercial grade rates at 300+ companies worldwide

Xe Currency Tools

Recommended by 65,000+ verified customers.

Download the Xe App

Check live rates, send money securely, set rate alerts, receive notifications and more.

Over 113 million downloads worldwide

Daily market updates straight to your inbox

Currency profiles, the original currency exchange rates calculator.

Since 1995, the Xe Currency Converter has provided free mid-market exchange rates for millions of users. Our latest currency calculator is a direct descendent of the fast and reliable original "Universal Currency Calculator" and of course it's still free! Learn more about Xe , our latest money transfer services, and how we became known as the world's currency data authority.

- United States Australia Canada France --> Germany --> Holland --> India Japan --> Ireland --> Malaysia --> Mexico --> New Zealand Philippines --> Singapore Spain --> UAE United Kingdom Other countries Global

- Profile -->

- My Rates -->

- Search Rates

Home Currency Exchange

- Currency Exchange

Buy or Spend which Currency? USD EUR CAD GBP All Currencies

actions right hide768">-->

transfers"> -->

Plane2"> -->, cards"> -->, compare exchange rates, fff500" fill-opacity="0.71"/>, 00f0ff" fill-opacity="0.63"/>.

heading suffix">

How to Save on Currency Exchange and Travel Money

Best Exchange Rates makes it easy to compare retail FX rates from trusted, regulated currency exchange specialists to use when you Travel and Spend abroad.

We show you how to use a multi-currency card or order foreign cash online for better currency exchange rates, convenience and save money for your next trip or overseas online purchase.

Here are a few ways you can save on currency exchange when traveling overseas:

- Compare exchange rates: Shop around to get the best exchange rate. Compare rates from banks, currency exchange offices, and online providers to find the best deal.

- Use a credit card: Credit cards often offer favorable exchange rates, so using one to make purchases in Portugal can save you money. Just be sure to pay off the balance in full each month to avoid interest charges.

- Use a debit card: Debit cards linked to a foreign currency account can also offer good exchange rates. This can be a good option if you don’t have a credit card or don’t want to use one for your trip.

- Avoid exchanging currency at the airport: Currency exchange offices at airports often have lower exchange rates than other options. If possible, wait until you get to your destination to exchange currency.

- Consider using a travel money card: Travel money cards are prepaid cards that you can load with multiple currencies. They can be a convenient and cost-effective way to pay for things while traveling.

- Use ATMs: ATMs often offer competitive exchange rates, and you’ll usually only pay a small fee to your bank for using an ATM abroad. Just be aware of any fees your bank charges for foreign transactions.

- Pay in the local currency: Some merchants may offer to charge you in your home currency instead of the local currency. This is called “dynamic currency conversion.” While it may be convenient, it often results in a less favorable exchange rate for you. It’s usually better to pay in the local currency.

- Best Rate Calculator

- Foreign Transfers

- Large Transfers

- Cross Rate Matrix

- Who We Compare

- Rate Tracker

- Market Update

- Currency Forecasts

- Country guides

- Content Hub

- How-to-Save Guides

- User Forums

- Log in to BER

- Country Sites

- BER.me Profile

- Transfers - Quote

BER is operated by Best Exchange Rates Pty Ltd, a company incorporated under the laws of Australia with company number ABN 68082714841. BER is a comparison website only and not a currency trading platform. BestExchangeRates.com uses cookies. Disclaimer & Terms of Service Privacy

- Home ›

- Travel Money ›

Get the best euro exchange rate

Compare the latest euro exchange rates from the UK's top currency providers

How to get the best euro exchange rate

If you're travelling to Europe, it's important to shop around and compare currency suppliers to maximise your chances of getting a good deal. We can help you to find the best euro exchange rate by comparing a wide range of UK travel money suppliers who have euros in stock and ready to order online now. Our comparisons automatically factor in all costs and commission, so all you need to do is tell us how much you want to spend and we'll show you the top suppliers who fit the bill.

Are you looking to get the best euro exchange rate for your next trip abroad? At Compare Holiday Money, we compare the euro rates from dozens of top UK foreign exchange providers to help you find the most competitive currency deals online and on the high street.

We continuously scan and track the latest euro rates from a wide range of currency providers to help you find the companies offering the best deals. Our clever currency comparisons automatically factor in all costs and charges like delivery fees and commission, so all you need to do is tell us how much you want to spend and we'll show you the best euro rates available to buy online right now.

Compare deals

Some of the best travel money deals are only available when you buy online. By using a comparison site, you're more likely to see the full range of deals on offer and get the best rate.

Some of the best travel money deals are only available from specialist online currency providers who offer better euro rates than high street bureaux de change.

Always place your order online, even if you plan to collect your currency in person. Most supermarkets and high street currency suppliers offer better exchange rates if you order online beforehand.

Most supermarkets and currency suppliers offer better rates if you buy or reserve your currency online. If you're planning to buy euros in store, place your order online beforehand to guarantee the online rate.

Combine orders

If you're travelling with others, consider placing one large currency order instead of buying individually. Many currency suppliers offer enhanced rates that improve as you order more.

You'll often get better rates the more you order. If you're travelling with a group, consider placing one large currency order instead of everyone buying euros individually.

Remember, exchange rates aren't the only important factor when finding the best euro deal. Delivery costs, commission and payment surcharges can all affect the amount of money you'll receive. See our comprehensive euro travel money comparisons to find the absolute best deal with all costs and charges factored in.

Online foreign exchange providers who specialise in travel money usually offer the best euro exchange rates, and you'll get the best deals when you buy online for home delivery. If waiting isn't an option, or if you'd rather buy your euros in person, supermarkets typically offer the best euro rates on the high street - but don't just walk in off the street unannounced. Reserve your euros online (ideally the day before you want to collect them) as most supermarkets offer enhanced exchange rates on their website compared to the rates they advertise in store. By ordering online you'll lock-in the better online rate and can collect your euros in person at a time that's convenient for you.

Euro rate trend

Over the past 30 days, the Euro rate is up 0.84% from 1.1676 on 29 Jul to 1.1774 today. This means one pound will buy more Euros today than it would have a month ago. Right now, £750 is worth approximately €883.05 which is €7.35 more than you'd have got on 29 Jul.

These are the average Euro rates taken from our panel of UK travel money providers at the end of each day. You can explore this further on our British pound to Euro currency chart .

We found 17 foreign exchange providers offering euros today. The table below shows the results ordered by best euro rate, assuming you wanted to buy £750 worth of euros for home delivery.

Remember, exchange rates aren't the only important factor when it comes to getting a good currency deal. Delivery fees, payment surcharges and other hidden costs can all affect the amount of money you'll receive. See our euro travel money comparisons to help you find the best euro rate today.

Timing is key if you want to maximise your euros, but the best time to buy will depend on the current market conditions and your personal travel plans.

If you have a fixed travel date, you should start to monitor the euro rates as soon as possible in the period leading up to your departure so that you've got time to buy when the rate is looking favourable. For example, if the euro rate has been steadily increasing over several weeks or months, it could be a good time to buy while the rate is high.

Some people prefer to buy half of their euros as soon as they've booked their holiday, and the remaining half just before they depart. This can be a good way of maximising your holiday money if the exchange rate continues to rise after you've bought, but will also help to minimise your losses if the rate drops.

You could also consider signing up to our newsletter and we'll email the latest rates to you each month.

If you need your euros sooner and don't have time to wait for the rates to improve, you can still save money by comparing rates from a range of different providers before you buy. Online travel money suppliers usually have better euro rates than high street exchanges, but supermarkets are a good compromise if you want to collect your currency in person and still get a decent rate. Just remember to buy or reserve your euros first before you collect them from the store so you benefit from the supplier's better online rate.

Euro banknotes and coins

Over 340 million people use the euro every day according to the European Central Bank, making it the second most-traded currency in the world after US dollars. Twenty out of 27 EU Member States have adopted the euro as their official currency, and euros are used officially and unofficially in many non-EU countries and territories throughout Europe such as Monaco, San Marino, and Vatican City.

Euros are governed and issued by the European Central Bank which is based in Frankfurt, but the actual production of euro banknotes and coins is handled by various national banks throughout the Eurozone. Spain and Greece are responsible for printing €5 and €10 banknotes, Germany prints €100 notes, and the other EU member states are responsible for printing €20 and €50 notes.

One euro (€) can be subdivided into 100 cents (c). There are seven denominations of euro banknotes in circulation: €5, €10, €20, €50 and €100 which are frequently used, plus €200 and €500 notes which are no longer printed but are still in circulation and remain legal tender. The designs printed on each banknote are intended to be symbolic of the European Union's identity and unity, as well as highlighting the diversity and richness of different European cultures. The front of each banknote features architectural styles from different periods in Europe's history, including Classical, Gothic, Renaissance and modern, while the reverse side features bridges that represent communication and cooperation between the different countries within the European Union.

Euro coins are available in eight denominations: 1c, 2c, 5c, 10c, 20c, 50c, €1 and €2. Each EU member state is responsible for minting its own coins, and can choose their own design for the 'tails' side. For example, German coins feature the 'Bundesadler' or Federal Eagle which has been the German coat of arms since 1950, while French coins depict Marianne; an important symbol of French national identity. Next time you've got a handful of euro coins, take a look at the tails side and see if you can guess which EU country they came from!

There's no evidence to suggest that you'll get a better deal if you buy your euros in Europe. While there may be better exchange rates available in some locations, your options for shopping around may be limited once you arrive, and there's no guarantee the exchange rates will be any better than they are in the UK.

Exchange rates aside, here are some other reasons to avoid buying your euros in Europe:

- You may have to pay commission or other hidden fees to a currency exchange that you wouldn't have paid in the UK

- Your bank may charge you a foreign transaction fee if you use it to buy euros when you're abroad

- It can be harder to spot scammers and fraudulent currency exchanges in Europe

Lastly, it can be handy to have some cash on you when you arrive at your destination so you can pay for any immediate expenses like food, transport and tips. You don't want to be searching for the nearest currency exchange when you've just landed and you're desperate for a cup of tea - or a cocktail!

Twenty out of 27 EU member states have adopted the euro as their official currency. These are: Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain.

The following European countries and territories who are not part of the EU also use the euro as their official currency: Andorra, Kosovo, Monaco, Montenegro, San Marino and Vatican City, French Guiana and Martinique, the Azores, Canary Islands, and Madeira.

Tips for saving money while visiting Europe

The most budget-friendly destinations in Europe are generally those located in the east such as Latvia, Lithuania and Estonia. In contrast: Luxembourg, Ireland and France usually top the list as some of the most expensive holiday destinations. Regardless of where you're planning to visit, you can save money during your trip by following some simple tips:

- Research your accommodation: Hotels can be expensive, so one way of saving money is to look for more budget-friendly accommodation such as hostels, holiday rentals, or even campsites. AirBnB can be an affordable option too, especially if you rent a room instead of an entire apartment; and you'll get to experience what it's like to live like a local. Salud!

- Use public transport: Make the most of any metro systems, buses, or trams to get around instead of relying on private taxis or rental cars. Many European countries also offer national and regional travel passes for public transport which can work out significantly cheaper than buying individual tickets.

- Eat like a local: Opt for local restaurants or street food vendors that offer authentic cuisine at lower prices. Avoid dining at expensive tourist restaurants, and try cooking your own meals if your accommodation has a kitchen. Not only is this a great way to save money, but it can also be a fun cultural experience to shop around in European supermarkets and cook with local ingredients.

- Plan your itinerary: Look out for free attractions such as museums, parks, churches and historical sites, and plan your itinerary around these. Many cities in Europe also offer free walking tours which can be a great way to get an overview of a new location while learning about its culture and history.

- Find discount vouchers: Many tourist attractions and activities offer discount vouchers and codes that can save you money on entry fees and other perks. Look for vouchers online; sign up to newsletters and follow the social media accounts of places you're planning to visit.

- Take cash: Using cash will help you to stick to a budget more easily than paying by card, and you'll also avoid foreign transaction fees. If you do take a card with you, look out for ATMs that are affiliated with your UK bank to avoid ATM fees, and if you're asked whether you want to pay in pounds or euros - always choose euros. If you pay in pounds the merchant can set their own exchange rate which won't be in your favour.

Choosing the right payment method

Sending money to a company you might not have heard of before can be unsettling. We routinely check all the companies that feature in our comparisons to make sure they meet our strict listing criteria, but it's still worth knowing how your money is protected in the unlikely event a company goes bust and you don't receive your order.

Bank transfer

Your money is not protected if you pay by bank transfer. If the company goes bust and you've paid by bank transfer, it's unlikely you'll get your money back. For this reason, we recommend you pay by debit or credit card wherever possible because they offer more financial protection.

Debit cards are the most popular payment method and they offer some financial protection. If you pay by debit card and the company goes bust, you can instruct your bank to make a chargeback request to recover your money from the company's bank. This isn't a legal right, and a refund isn't guaranteed, but if you make a chargeback request your bank is obliged to try and recover your money.

Credit card

Credit cards offer full financial protection, and your money is protected by law under Section 75 of the Consumer Credit Act. Section 75 states that your card issuer must refund you in full if you don't receive your order. Be aware that many credit cards charge a cash advance fee (typically around 3%) for buying currency, so you may have to weigh up the benefits of full financial protection with the extra cost of using a credit card.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

Get the best exchange rates on your travel money

Use our comparison site, our expert tips and country guides to make your money go further

Get the best exchange rates

From Australian dollars to UAE dinars ; get the best travel money deal by comparing the exchange rates from the UK’s top currency brands.

Travel Money Tips

Follow our expert tips when travelling abroad and we guarantee to save you money

Use a travel money comparison site to buy your currency

Always take cash and cards

Check the cost of posting cash to your home vs click and collect

Always understand debit and credit card charges

Always pay in local currency

Check overseas ATM charges before pressing 'enter'

Buy your travel money before you go to the airport

Always ‘haggle’ if you go to a bureau de change

Travel Money Country Guides

If you want to know more about how travel money works for a particular country, see our travel money guides below for some of your favourite destinations.

United States

Frequently asked questions.

What you need to know about using your debit and contactless card abroad

What you need to know about using your credit card abroad

What you need to know about exchange rates

What you need to know about using a pre paid card

- Turkish Lira

- Australian Dollars

- Canadian Dollars

- Polish Zloty

- VIEW ALL CURRENCIES

- canadian dollars

- ALL BUY BACKS

- US Dollar Card

- Multi-currency Card

Compare euro travel money rates

- buy Currency

What Currency do you want to buy?

How much do you want to spend.

Barclays Travel Money is only available to Barclays debit card or Barclaycard holders. Their rates tend to be very poor when compared to other online travel money providers.

Order Limits and Fees

Company Name: Barclays Bank UK PLC

Payment Options: Barclays debit card or Barclaycard

Address: 1 Churchill Place, London E14 5HP

Minimum Order: £50

Maximum Order: £2,500

Minimum order amount for free delivery: £50

Debit Card Charge: NA

Credit Card Charge: NA

Collection available: ✔

What is the Best Euro Exchange Rate Today?

The best place to buy euros today is Covent Garden FX.

The worst exchange rate is 1.1320. The difference between the highest and the lowest exchange rate is 3.26. This means that if you are buying £750 worth of euros you will get €28.58 more euros by buying with the best provider.

This shows you it pays to shop around and get the best euro rates!

Euro exchange rate over the last week.

This shows you the pound sterling to euro exchange rate recorded daily from our UK suppliers over the last week.

In the last 7 days, the exchange rate for euros has risen by 0.82%.

If you were to order £1,000 today you would get €9.60 more euros for your money than last week.

How do we source the data above? We receive rate feeds travel money suppliers and aggreate the data each evening we save the average rate that occured during the day, and also include the current best rate

How to get the best euro exchange rate.

We compare pound to euro rates from many of the UK’s best companies including exclusively online providers as well as some of the well-known high street banks and supermarket travel money services. Our clever algorithms ensure you find the best place to buy euros.

Compare Travel cash is a free compare travel money service that takes the pain and effort out of finding the best exchange rates for buying euro online. Don't forget the price we quote is the price you pay, we calculate the amount including any fees and delivery costs!

Buying Euros online FAQs

Hundreds of customers safely buy euros through online travel money providers sites every day and have a great experience. However, as with ordering anything online, the process is never completely risk-free and you should always take care when transferring money to any company. Compare Travel Cash undertake comprehensive checks on all of our online travel money providers and monitor them to make sure they meet our high standards and continue to do so. Having said that, no company is guaranteed not to come into trouble and we cannot guarantee the solvency of any of the providers listed on our website. We always recommend that you conduct your own research before placing an order with any company.

The Euro , the official currency of the Eurozone, has become a symbol of economic unity and integration across the European Union. Since its introduction in 1999, the Euro has gained widespread acceptance and is used by millions in 19 of the 27 EU member countries.

Euro banknotes come in seven denominations, each featuring unique designs that reflect the architectural heritage of different historical periods. The denominations are 5, 10, 20, 50, 100, 200, and 500 euros. The design of the banknotes incorporates various security elements to prevent counterfeiting while showcasing the rich cultural diversity of the Eurozone.

The front of each banknote features windows and gateways, symbolizing the European spirit of openness and cooperation. The reverse side highlights bridges, representing communication and connections between the people of Europe. Additionally, watermarks, holograms, and other security features make Euro banknotes among the most secure currencies globally.

Euro coins, on the other hand, are issued in eight denominations: 1, 2, 5, 10, 20, and 50 cents, as well as 1 and 2 euros. The common side of all euro coins features a map of Europe, emphasizing the unity of the continent. The national side, however, varies from country to country, showcasing individual cultural and historical symbols.

Euro coins are composed of two alloys – a centre made of nickel brass, nickel, and copper, and an outer ring made of nickel brass. Each denomination has a distinct colour and size, aiding easy identification. The edges of the coins also carry specific grooves or lettering, making them accessible to the visually impaired.

Ensuring the integrity of the Euro currency is of utmost importance. Euro banknotes employ advanced security features such as holograms, watermarks, security threads, and microprinting. These elements make counterfeiting extremely difficult and help maintain confidence in the currency.

The Eurozone also continuously updates its security features to stay ahead of counterfeiters. Technological advancements, including colour-changing ink and enhanced holograms, contribute to the ongoing battle against fraud.

Choose the travel money provider you would like to buy euros from, then:

Not Usually! We constantly update our exchange rates as they change for each supplier, we try to do this in almost real-time, (in normal circumstances not more than 1-minute difference). Also, we sometimes have exclusive offers that you won't find by going direct.

Of course, most companies offer a buyback service for your unused currency! If you want to exchange your leftover euros into pounds you can see the best buy back rate on euros and many other currencies using our buy back comparison tool . Remember most buybacks are only possible for notes, not euro coins.

The euro is the official currency of 19 of the 27 EU member countries. The following countries use the Euro as their single currency: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain. There are also 4 states outside of the EU that use the euro: Andorra, Monaco, San Marino and Vatican City.

Each provider will have different rules on the maximum amount of currency you can buy.

Some providers will allow you to order large amounts, but we suggest you check the terms and conditions before you place an order if you are ordering a large amount.

Also, consider that currently you are only allowed to carry 10,000 euros. If you take more than this you have a legal obligation to inform customs. Note, this amount is per person so if you are travelling with more cash than this you can distribute it to your fellow travellers.

You will only be able to order notes, not coins.

If you require specific denominations consult with the provider first to ensure they offer this service when changing your Pounds to Euros. Most will charge for this, but we find most providers supply a mixed selection of denominations. If a supplier does not specifically offer this service, contact them and ask them if they can provide the Euro denominations you require, they may do this for free depending on their stock levels!

The short answer is, that it is very difficult to time your order of Euros correctly to attain the best exchange rate. There are so many factors affecting the Euro exchange rate it is impossible to pin down a time when rates are best.

The prudent thing to do is to research to find the best Pounds to Euros exchange rate using our comparison engine and obtain the best rate you can on the day you want to buy your currency. If you are short on time and need your currency on a specific date, we suggest buying with time to spare. All providers will use Royal Mail special delivery and in recent times we have seen delays in some cases, so leave as much time as you can to ensure you have your currency comfortably before your departure date.

Buying Euros in Europe is almost always more expensive.

To avoid any surprises and to ensure you have a hassle-free trip we suggest buying Euros before you travel.

Join newsletter

- Best Euro Rate

- Best US Dollars Rate

- Best Turkish Lira Rate

- Best Australian Dollars Rate

- Best Thai Baht Rate

- Best UAE Dirham Rate

- Best Canadian Dollars Rate

- Best Polish Zloty Rate

- Buy Travel Money

- Sell US Dollars

- Sell Turkish Lira

- Sell Australian Dollars

- Sell Thai Baht

- Sell UAE dirham

- Sell Canadian Dollars

- Sell Polish Zloty

- Currency Online Group

- Covent Garden FX

- The Currency Club

- Sterling FX

- Sainsburys Bank

- Post Office

- Marks and Spencer

- Hays Travel

- No1 Currency

- Rapid Travel Money

- Best Supermarket Euros

- Privacy Policy

@2024 Comparison Technology Ltd, 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ | Company Registrtion Number 12065287

- Buy US Dollars

- Buy travel money

- sell unused travel cash

CompareTravelCash.co.uk is a price comparison service that's designed to help you save money – whilst we do our best to ensure the site is 100% up-to-date, we cannot guarantee this. We advise you to carry out your own due diligence before buying or selling travel money.

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

Get competitive rates and 0% commission for your holiday cash

Foreign currency

Find our best exchange rates online and enjoy 0% commission on over 60 currencies. And you can choose collection from your nearest branch or delivery to your home

Go cashless with our prepaid Mastercard®. Take advantage of contactless payment, load up to 22 currencies and manage everything with our app, making travel simple and secure

Order travel money

- UAE Dirham AED

- Australian Dollar AUD

- Barbados Dollar BBD

- Bangladesh Taka BDT

- Bulgarian Lev BGN

- Bahrain Dinar BHD

- Bermuda Dollar BMD

- Brunei Dollar BND

- Canadian Dollar CAD

- Swiss Franc CHF

- Chilean Peso CLP

- Chinese Yuan CNY

- Colombian Peso COP

- Costa Rican Colon CRC

- Czech Koruna CZK

- Danish Kroner DKK

- Dominican Peso DOP

- Fiji Dollar FJD

- Guatemalan Quetzal GTQ

- Hong Kong Dollar HKD

- Hungarian Forint HUF

- Indonesian Rupiah IDR

- Israeli Sheqel ILS

- Icelandic Krona ISK

- Jamaican Dollar JMD

- Jordanian Dinar JOD

- Japanese Yen JPY

- Kenyan Shilling KES

- Korean Won KRW

- Kuwaiti Dinar KWD

- Mauritius Rupee MUR

- Mexican Peso MXN

- Malaysian Ringgit MYR

- Norwegian Krone NOK

- New Zealand Dollar NZD

- Omani Rial OMR

- Peru Nuevo Sol PEN

- Philippino Peso PHP

- Polish Zloty PLN

- Romanian New Leu RON

- Saudi Riyal SAR

- Swedish Kronor SEK

- Singapore Dollar SGD

- Thai Baht THB

- Turkish Lira TRY

- Taiwan Dollar TWD

- US Dollar USD

- Uruguay Peso UYU

- Vietnamese Dong VND

- East Caribbean Dollar XCD

- French Polynesian Franc XPF

- South African Rand ZAR

- Brazilian Real BRL

- Qatar Riyal QAR

Delivery options, available branches and fees may vary by value and currency. Branch rates will differ from online rates. T&Cs apply .

Why get your holiday cash from Post Office?

- Order online, buy in branch, or choose delivery to your home or local branch

- 100% refund guarantee* if your holiday’s cancelled, at the same exchange rate, excluding bank and delivery charges. Just send your receipts and evidence of cancellation to us within 28 days of purchase. *T&Cs apply

- Order euros or US dollars to collect in branch in as little as 2 hours

Euros and US dollars in 2 hours

Click and collect euros and US dollars in 2 hours. Terms and conditions apply

Today’s online rates

Rate correct as of 28/08/2024

Travel Money Card (TMC) rates may differ. Branch rates may vary. Delivery methods may vary. Terms and conditions apply

Safe and secure holiday spending

Manage your holiday funds on a Travel Money Card with our free travel app. Top it up, freeze it, swap currencies, view your PIN and more.

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Need some help?

Travel money card lost or stolen.

Please immediately call: 020 7937 0280

Available 24/7

Travel money help and support

Read our travel money FAQs or contact our team about buying currency online or in branch:

Visit our travel money support page

Other related services

Hoi An in Vietnam is still the best-value long haul destination for UK ...

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

One of the joys of summer are the many music festivals playing across the ...

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

Going on holiday is an exciting time for families. To make sure it stays fun, ...

We all look forward to our holidays. Unfortunately, though, more and more ...

Looking to enjoy the sunshine without breaking the bank? New research from Post ...

Prepaid currency cards are a secure way to make purchases on trips abroad. They ...

Long-haul destinations offer the best value for UK holidaymakers this year, ...

Eastern Europe leads the way for the best value city breaks this year. And ...

Our annual survey of European ski resorts compares local prices for adults and ...

Thinking of heading off to Europe for a quick city break, but don’t want to ...

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

From European hotspots to far-flung destinations, UK travellers are making ...

Kickstarting your festive prep with a short getaway this year? The Post Office ...

Travelling abroad? These tips will help you get sorted with your foreign ...

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

Travel smarter with the Post Office travel app. Paired with a Travel Money ...

Wednesday 28th. August 2024

Follow us on twitter keep an eye on the latest rates & get the latest deals.

Travel Money Finder

Make the most of your travel money, search & compare the best uk foreign currency exchange rates, impartial results from multiple suppliers, up to 80 currencies tracked.

Rates Watch

Wed. 28th. August 2024 11:20pm

GOV.UK Travel Advice

Popular Currencies

Best value bureaux.

Prepaid Currency Cards

Currencies Information

Best Travel Money Exchange Rates Compared & Reviewed

This guide explains the cheapest and most expensive ways to buy travel money. It can help save you money if you are thinking about going abroad and trying to work out the best way to spend while you’re there.

Compare Travel Money Exchange Rates

Commission charges when you buy foreign currency have mostly been phased out. Now most currency operators make money on the difference between the interbank exchange rate and the rate they actually give you.

So the best way to know if you’re getting a good deal is to compare the actual exchange rate you’re getting.

For each of the currency exchange locations below we have used the euro as an example – but where you see a location giving a bad rate (versus the benchmark interbank rate) for euros, you can be pretty much guaranteed you’ll get a bad rate on any other currency at that place too.

Here are the ways to get the most for your money when buying foreign currency, ranked best to worse.

(All exchange rate figures accessed on 31 May 2023.)

What’s in this guide?

1. Currency cards – BEST RATE

Currency cards are debit card-style payment cards designed to be used while you are on holiday or travelling outside the UK to pay for goods and services, usually anywhere you see the Visa or Mastercard symbol. They either come as regular debit cards with travel money functions, or as a separate card that connects to your current account.

Currency cards offer some of the best exchange rates around, and are available from, for example, Starling, Monzo, Revolut , and Curresea.

The euro rates for Monzo and Starling are based on the Mastercard rate so are the same:

- £1 = €1.152 (vs €1.16 inter bank rate)

- On the (free) Curresea Essential plan the euro rate is:

- £1 = €1.152

- On the (paid for) Curresea Elite and Premium Plans the euro rate is:

- £1 = €1.163

- Ease : Currency cards are easy to apply for and usually arrive within a few days. If your bank already offers a travel card service as part of your account you may not even need to apply for a new card. Plus you don’t need to worry about changing up loads of cash before you go away.

- Safety : If you lose cash, it’s usually gone forever. If you lose your currency card you can cancel or freeze it in the app that comes with it to prevent anyone else using your holiday money.

- Virtual wallet: You can add most currency travel cards to your phone’s virtual wallet, so you can still pay if you only have your phone with you.

- Charges : Fees and charges to use your currency card abroad can vary significantly so it’s a good idea to compare different providers before you choose which one to go with. Be aware the card provider – typically either Visa or Mastercard – can add its own fees of 1% to 3% on top of transactions.

- ATM limits : Some card providers limit how much you can withdraw from an ATM in another currency, after which point more charges will kick in.

- No section 75 protection : Debit card payments and purchases are not covered by section 75 of the Consumer Credit Act. But you might be able to make a claim for a refund under a voluntary scheme called ‘chargeback’.

2. Cash point abroad

Withdrawing cash from an ATM abroad can be a good option if you use one of the cards mentioned above, or a travel credit card. They are designed for use while travelling, so give the best rates on foreign exchange, and limit the fees and charges you pay while using them abroad. It is for this reason that cash point abroad is 2nd on this list.

Currensea , for example, as well as offering one of the best exchange rates, allows free ATM withdrawals of up to £500 using its Essential Card (2% fees over), and with its Premium Card (which costs £25 a year) you can make fee free ATM withdrawals up to £500 (1% over).

Just remember – if the ATM tells you a fee applies, always choose to be charged in the local currency of the country you’re in (this also applies to card purchases).

However beware – this is important – if you just take your normal debit card or credit card abroad you can expect high fees from both your bank and the ATM you withdraw cash from every time you use it.

For example, Barclays charges a 2.99% fee for using your standard debit card abroad when making purchases, withdrawing cash or for refunds.

So while you get a pretty decent exchange rate with Barclays (which uses the Visa rate), once the fee is added the real rate is much less. It works out as:

- Visa rate: £1 = €1.161 (vs €1.16 inter bank rate) before charges

- Barclays debit rate after 2.99% fee added £1 = €1.128

- Cheap if you use the right cards: Taking money out at an ATM abroad can be one of the cheapest ways to access cash if you use a card designed for travel that has fee-free options and a good exchange rate (see out Best Rated above).

- Don’t have to carry so much cash : Carrying huge wads of cash is a theft risk. Carrying a couple of cards (one for use and one for back up) is much safer.

- High costs if you use the wrong card : Avoid taking your regular debit or credit card abroad as to use it you will have to pay high fees.

3. Highstreet in the UK

UK highstreets offer a number of exchange rate options, from inside department stores like John Lewis, to specialist foreign exchange rate shops like No1 Currency. The rates will vary from place to place.

At No1 Currency, for example, the online rates are below, although the website says the in store rates may differ from what is advertised.

- £1 = €1.136 (vs €1.16 inter bank rate)

- £100 = €113.67

At John Lewis, on the same day the rate was a little lower.

- £1 = €1.133 (vs €1.16 inter bank rate)

- £100 = €113.38

At Marks & Spencer, the rate was:

- Click & Collect: £1 = €1.138 (vs €1.16 inter bank rate)

- £100 = €113.80

- In-store bureau de change: £1 = €1.119

- £100 = €111.90

At a TUI branch the rate was:

- £1 = €1.139 (vs €1.16 inter bank rate)

- £100 = €113.90

- Click and collect rates : No1 Currency for example gives you a better rate if you order online then pick up in store, rather than have your currency delivered.

- Perks: For example at John Lewis you can earn points when you pay for currency with your Partnership Credit Card.

- Delivery charges : No1 Currency only offers free delivery for orders of £800 or more. At John Lewis the minimum for free home delivery is over £500.

- Minimum orders online: John Lewis, for example, has a £250 minimum for online orders.

4. Online with a supermarket

Most supermarkets sell travel money these days and it can be a convenient way to pick up some currency while you do your weekly shop. You can buy on the day or order online to collect.

As an added bonus, supermarkets offer a better rate on foreign currency for their loyalty card holders, pushing supermarkets up the ranking in terms of rates.

- Standard rate: £1 = €1.130 (vs €1.16 interbank rate)

- £100 = €113

- Tesco Clubcard rate: €1.135

- £100 = €113.50

Sainsbury’s

- £1 = €1.131 (vs €1.16 interbank rate)

- £100 = €113.17

- Sainsbury’s Nectar card rate: €1.1340

- £100 = €113.40

- Loyalty perks and points : Loyalty card holders get better exchange rates, plus you can earn loyalty points when you pay for the currency just like any other purchase.

- Convenience : Order online then pick up when you do your weekly shop.

- Minimum order amounts: For example Tesco has a minimum order amount of £400 worth of currency when you buy online, and a minimum of £500 to have a free home delivery. There is no minimum order amount for Sainsbury’s but a £4.99 fee to have currency bought online delivered at home.

5. Post office

The Post Office is a handy one-stop-shop for lots of holiday related things, from travel insurance to international driving permits, and including travel money. While the Post Office doesn’t offer the best rates on the market, it does have several other advantages that could make it a good option, especially if you are in a hurry.

- £1 = €1.116 (vs €1.16 inter bank rate)

- £100 = €111

- Rate increases : Order online for the best rates on every currency. The more you buy, the better the rate.

- Fast pick up service : You can pick up euros and US dollars from your nearest branch in as little as 2 hours, from selected branches. Order by 2pm (1pm Saturday) to collect the same day, from 2 hours later. Order after 2pm (1pm Saturday) to collect the next working day, from 11am. Or you can choose delivery to your home.

- Refund policy : Will refund 100% of the holiday money you bought if your trip abroad is cancelled

- Queuing : With a number of Post Offices closing, and banks shutting branches that force Post Offices to do more services with less, queues to get you travel money in person can be long.

- Limited currencies: Post Office in my experience don’t carry that much currency and only in a few of the most common types. Beware buying last minute – if you try to just pop in on the day to buy your currency without pre-ordering you may find they have run out, or don’t stock it.

- Buying limits : The minimum you can buy online of a currency is £400 worth, and the maximum is £2,500.

6. At the airport

The only times I have bought currency at the airport it has been out of desperation and from a lack of forward planning – and I have always regretted it. It is typically one of the most expensive (i.e. worst exchange rate) places to buy foreign currency.

But if you’re in a panic because you forgot to get out any cash before your trip, it is at least convenient to be able to grab some foreign currency before your flight.

Two of the most common foreign exchange kiosks you’ll find at UK and global airports are Travelex and Eurochange. The rates below are for their online services – rates in the airport are likely to be worse.

Travelex (online)

- £1 = €1.130 (vs €1.16 inter bank rate)

Eurochange (online)

- £1 = €1.131 (vs €1.16 inter bank rate)

- £100 = €113.10

- Location : If in the rush to get away you forgot to pick up any currency, airport foreign exchange kiosks offer a last minute lifeline.

- Availability of currencies: Because of their location, currency kiosks in international airports tend to be well stocked in multiple currencies, even the less common ones.

- Switching currency : If you are visiting multiple countries on a trip but don’t want to carry large amounts of currency, changing up just what you need at each airport you pass through is an option.

- Expense : You will never get the best foreign exchange rate at an airport.

- Lack of comparison : Even if there is more than one currency store at the airport, they all tend to offer the same rates. Once you’re there you have no other options, you have to take what you can get.

7. Online with a bank

Buying travel money from your local bank might seem like the obvious choice, but surprisingly the rates on offer are likely among the worst you’ll get anywhere in the UK. However the limits on how much you can purchase can be higher (though you won’t get a better rate the more you buy so why bother?)

- £1 = €1.105 (vs €1.16 inter bank rate)

- £100 = €110.51

- £1 = €1.106 (vs €1.16 inter bank rate)

- £100 = €110.67

- High purchase limits : At Barclays, for example, you can order up to £5,000 per person within a 90-day period, and a maximum of £2,500 from that amount can be sent for home delivery to a single residential address.

- Fee free deliveries : HSBC, for example, offers fee-free deliveries on your travel money to HSBC Full and Cash Service branches or to your home. Other banks may charge.

- Limited to customers : You may find you have to be a customer. For example, you’ll need a Barclays debit card or Barclaycard to place your order for currency online there.

- Expensive : Among the worst rates for currency exchange you’ll find anywhere in the UK.

8. Bureau de change abroad – WORST RATE

Bureau de changes abroad are typically in tourist hotspots. And what do we know about tourist hotspots? Rife for pickpockets and overinflated prices. This is the attitude you should take to foreign currency shops in these locations.

One example that proves the ‘expensive option’ point is Ria Money Transfer & Currency Exchange, situated in the busy Plaza de Callao in central Madrid, Spain.

Ria’s exchange rate on 31 May 2023 was:

- £1.00 = €0.99 (vs €1.16 inter bank rate)

Convenient : If you really need cash while you’re abroad, maybe because you’re in a place where your cards are not widely accepted, a local bureau de change may be a lifeline – just expect to pay heavily for that life raft.

- Cost, cost, cost: Buying foreign currency from a currency shop or kiosk in a tourist hotspot (where you are most likely to find them) is an extremely expensive way of getting your hands on cash. Avoid if at all possible.

- Theft risk : Pickpockets may hang around bureau de change just like they hang around ATMs, because they know you have just withdrawn what is probably a large amount of money. Secure your cash hidden away before you leave the kiosk.

Is it still worth getting travel cash ahead of your holidays?

Yes. Absolutely. Cards aren’t accepted everywhere, as I found to my detriment when I arrived in Buenos Aires and tried to take out local currency on my credit card at the foreign exchange desk at the airport.

“Absolutely not possible”, I was told. A combination of a lack of provision to buy currency on credit card there, and the Argentinian peso being just too volatile for credit card providers to let you buy it on their service.

All I had in hard currency was US$100 in Argetininian pesos I had changed in the airport at Rio De Janeiro, Brazil, where I had just come from, and a US$100 bill. Luckily I’d pre-paid my Buenos Aires hotel in advance, and I could easily find restaurants that would accept my credit card. But taxis only took cash, so I spent a lot of time walking – thinking about how I should have brought more pesos with me.

We’ve answered some of the most commonly asked questions when it comes to travel money.

Yes, in most cases. Cash withdrawal fees will probably apply of around 3%, just like they would at home for taking cash out on a credit card, and these will be on top of any currency conversion fees.

Be aware though – in countries with a highly fluctuating exchange rate, like Argentina, you may not be able to buy foreign cash with your credit card (not even at the bureau de change at the airport, for example). You still may be able to pay for goods and services with your credit cards, but check how widely they are accepted before you travel.

Yes, on the whole. When buying travel money online, like with buying anything online, you’re best off sticking to well known brands, whether that be banks, supermarkets, or currency exchange stores.

A large institution or well known brand is less likely to go bust, and that is important because foreign exchange is not a regulated service. This means your cash is not protected if the company you tried to get your foreign currency from closes suddenly.

Yes. Most places that sell you travel money will buy it back from you. But just like when you’re swapping your pounds for foreign currency, when you swap it back you should compare the exchange rates on offer. As a general rule, a location that offers a good rate one way, offers a good rate the other way.

Travel money providers – from the currency shops and bureau de change, to the banks and supermarkets, anywhere basically that sells currency – make money by giving you slightly less than the central banks give them for the foreign money you want to buy.

For example, if a currency provider tells you they will give you €1.131 for every pound you give them, but the central bank rate for euros is €1.157 per pound, the difference is €0.026, which they pocket. This may not sound much, but multiplied over millions of transactions a year, it adds up.

Compare, compare, compare the single unit price – which means the £1 for a €1 rate, or whichever currency you choose, versus the interbank rate, which you can get by just Googling “1 GBP in EUR”.

Places that sell currency, online or in a shop, have to show you the exchange rate for that day. While it’s probably not practical to go traipsing around comparing shops, it’s easy enough to do so online. If you run up against minimum purchase amounts online, still go with the company providing the best rate but visit their location in person.

Also try not to get yourself in a position where you’re desperate to buy foreign currency, either at home or abroad. This means having enough cash on you in remote locations, and tourist hotspots, and before you travel (to avoid the airport currency shops).

Laura Miller has been a financial journalist for more than 10 years, and was on staff at the Telegraph before going freelance in 2019. Her experience includes hosting podcasts and panels, and she writes for the Times and Sunday Times, Daily Mail, Mail on Sunday and the Sun, as well as trade titles. She now lives by the sea in Aberystwyth, west Wales.

You may also be interested in:

Before you go!

Find your perfect account in under 1 minute.

Tell us what is most important to you and we'll match you with expert and user reviews of top rated financial service providers.

Currency exchange solutions

G - TMOZ - C&D Pizza Blog - Desktop Banner CTA (1).png

Why Travel Money

Cheap Holiday Money At Your Fingertips

Find The Best Travel Money Rates

Our rates are updated hourly and sorted by the best currency exchange rates at the moment of inquiry. We pride ourselves on being one of the industry’s most comprehensive and accurate sites, but we recommend double-checking the rates before placing an order.

View Our Top Travel Money Providers:

*These are estimates based on the companies’ public information and our research. For 100% accuracy, you will need to create an account with each company.

View our Per Currency Comparison of Travel Money Rates:

Pound to Euro

Pound to Dollar

Pound to “Aussie” Dollar

Pound to Canadian Dollar

Pound to Turkish Lira

Pound to Costa Rican Colon

Pound to “Kiwi” Dollar

Pound to Sri Lankan Rupee

Pound to Indian Rupee

Pound to Thai Baht

Comparing Travel Money Options: Since 2018

With travel money, finding the best travel money provider for your needs could be complicated. For once, the amount of currency required impacts the rates you are getting. Additionally, some providers are cheaper for particular currency pairs and more expensive for others. Finally, some people value rates, while others care about quality of service and reliability (and are willing to pay more for it).

This is why we have established CompareTravelMoney.net, to provide travellers with all the information they require to make a sober choice. For each currency, we have a separate list of recommended providers with specific rates which apply to the amount you are willing to exchange.

Websites like CompareTravelMoney.net don’t charge money off clients (you will not get better rates by approaching them yourself; on the contrary). We only take a small fee for each client we refer over to a travel money company. In fact, we encourage competitiveness in the niche, and as a whole, what we do helps people get better and better rates each year for their currency.

Happy Travels!

Be sure to read through our About Us and Terms and Conditions . We have covered international money transfers for bank account transfers in a separate guide, but we are unable to present rates from these companies.

Samantha Putterman, PolitiFact Samantha Putterman, PolitiFact

Leave your feedback

- Copy URL https://www.pbs.org/newshour/politics/fact-checking-warnings-from-democrats-about-project-2025-and-donald-trump

Fact-checking warnings from Democrats about Project 2025 and Donald Trump

This fact check originally appeared on PolitiFact .

Project 2025 has a starring role in this week’s Democratic National Convention.

And it was front and center on Night 1.

WATCH: Hauling large copy of Project 2025, Michigan state Sen. McMorrow speaks at 2024 DNC

“This is Project 2025,” Michigan state Sen. Mallory McMorrow, D-Royal Oak, said as she laid a hardbound copy of the 900-page document on the lectern. “Over the next four nights, you are going to hear a lot about what is in this 900-page document. Why? Because this is the Republican blueprint for a second Trump term.”

Vice President Kamala Harris, the Democratic presidential nominee, has warned Americans about “Trump’s Project 2025” agenda — even though former President Donald Trump doesn’t claim the conservative presidential transition document.

“Donald Trump wants to take our country backward,” Harris said July 23 in Milwaukee. “He and his extreme Project 2025 agenda will weaken the middle class. Like, we know we got to take this seriously, and can you believe they put that thing in writing?”

Minnesota Gov. Tim Walz, Harris’ running mate, has joined in on the talking point.

“Don’t believe (Trump) when he’s playing dumb about this Project 2025. He knows exactly what it’ll do,” Walz said Aug. 9 in Glendale, Arizona.

Trump’s campaign has worked to build distance from the project, which the Heritage Foundation, a conservative think tank, led with contributions from dozens of conservative groups.

Much of the plan calls for extensive executive-branch overhauls and draws on both long-standing conservative principles, such as tax cuts, and more recent culture war issues. It lays out recommendations for disbanding the Commerce and Education departments, eliminating certain climate protections and consolidating more power to the president.

Project 2025 offers a sweeping vision for a Republican-led executive branch, and some of its policies mirror Trump’s 2024 agenda, But Harris and her presidential campaign have at times gone too far in describing what the project calls for and how closely the plans overlap with Trump’s campaign.

PolitiFact researched Harris’ warnings about how the plan would affect reproductive rights, federal entitlement programs and education, just as we did for President Joe Biden’s Project 2025 rhetoric. Here’s what the project does and doesn’t call for, and how it squares with Trump’s positions.

Are Trump and Project 2025 connected?

To distance himself from Project 2025 amid the Democratic attacks, Trump wrote on Truth Social that he “knows nothing” about it and has “no idea” who is in charge of it. (CNN identified at least 140 former advisers from the Trump administration who have been involved.)

The Heritage Foundation sought contributions from more than 100 conservative organizations for its policy vision for the next Republican presidency, which was published in 2023.

Project 2025 is now winding down some of its policy operations, and director Paul Dans, a former Trump administration official, is stepping down, The Washington Post reported July 30. Trump campaign managers Susie Wiles and Chris LaCivita denounced the document.

WATCH: A look at the Project 2025 plan to reshape government and Trump’s links to its authors

However, Project 2025 contributors include a number of high-ranking officials from Trump’s first administration, including former White House adviser Peter Navarro and former Housing and Urban Development Secretary Ben Carson.

A recently released recording of Russell Vought, a Project 2025 author and the former director of Trump’s Office of Management and Budget, showed Vought saying Trump’s “very supportive of what we do.” He said Trump was only distancing himself because Democrats were making a bogeyman out of the document.

Project 2025 wouldn’t ban abortion outright, but would curtail access

The Harris campaign shared a graphic on X that claimed “Trump’s Project 2025 plan for workers” would “go after birth control and ban abortion nationwide.”

The plan doesn’t call to ban abortion nationwide, though its recommendations could curtail some contraceptives and limit abortion access.

What’s known about Trump’s abortion agenda neither lines up with Harris’ description nor Project 2025’s wish list.

Project 2025 says the Department of Health and Human Services Department should “return to being known as the Department of Life by explicitly rejecting the notion that abortion is health care.”

It recommends that the Food and Drug Administration reverse its 2000 approval of mifepristone, the first pill taken in a two-drug regimen for a medication abortion. Medication is the most common form of abortion in the U.S. — accounting for around 63 percent in 2023.

If mifepristone were to remain approved, Project 2025 recommends new rules, such as cutting its use from 10 weeks into pregnancy to seven. It would have to be provided to patients in person — part of the group’s efforts to limit access to the drug by mail. In June, the U.S. Supreme Court rejected a legal challenge to mifepristone’s FDA approval over procedural grounds.

WATCH: Trump’s plans for health care and reproductive rights if he returns to White House The manual also calls for the Justice Department to enforce the 1873 Comstock Act on mifepristone, which bans the mailing of “obscene” materials. Abortion access supporters fear that a strict interpretation of the law could go further to ban mailing the materials used in procedural abortions, such as surgical instruments and equipment.

The plan proposes withholding federal money from states that don’t report to the Centers for Disease Control and Prevention how many abortions take place within their borders. The plan also would prohibit abortion providers, such as Planned Parenthood, from receiving Medicaid funds. It also calls for the Department of Health and Human Services to ensure that the training of medical professionals, including doctors and nurses, omits abortion training.

The document says some forms of emergency contraception — particularly Ella, a pill that can be taken within five days of unprotected sex to prevent pregnancy — should be excluded from no-cost coverage. The Affordable Care Act requires most private health insurers to cover recommended preventive services, which involves a range of birth control methods, including emergency contraception.

Trump has recently said states should decide abortion regulations and that he wouldn’t block access to contraceptives. Trump said during his June 27 debate with Biden that he wouldn’t ban mifepristone after the Supreme Court “approved” it. But the court rejected the lawsuit based on standing, not the case’s merits. He has not weighed in on the Comstock Act or said whether he supports it being used to block abortion medication, or other kinds of abortions.

Project 2025 doesn’t call for cutting Social Security, but proposes some changes to Medicare

“When you read (Project 2025),” Harris told a crowd July 23 in Wisconsin, “you will see, Donald Trump intends to cut Social Security and Medicare.”

The Project 2025 document does not call for Social Security cuts. None of its 10 references to Social Security addresses plans for cutting the program.

Harris also misleads about Trump’s Social Security views.

In his earlier campaigns and before he was a politician, Trump said about a half-dozen times that he’s open to major overhauls of Social Security, including cuts and privatization. More recently, in a March 2024 CNBC interview, Trump said of entitlement programs such as Social Security, “There’s a lot you can do in terms of entitlements, in terms of cutting.” However, he quickly walked that statement back, and his CNBC comment stands at odds with essentially everything else Trump has said during the 2024 presidential campaign.

Trump’s campaign website says that not “a single penny” should be cut from Social Security. We rated Harris’ claim that Trump intends to cut Social Security Mostly False.

Project 2025 does propose changes to Medicare, including making Medicare Advantage, the private insurance offering in Medicare, the “default” enrollment option. Unlike Original Medicare, Medicare Advantage plans have provider networks and can also require prior authorization, meaning that the plan can approve or deny certain services. Original Medicare plans don’t have prior authorization requirements.

The manual also calls for repealing health policies enacted under Biden, such as the Inflation Reduction Act. The law enabled Medicare to negotiate with drugmakers for the first time in history, and recently resulted in an agreement with drug companies to lower the prices of 10 expensive prescriptions for Medicare enrollees.

Trump, however, has said repeatedly during the 2024 presidential campaign that he will not cut Medicare.

Project 2025 would eliminate the Education Department, which Trump supports

The Harris campaign said Project 2025 would “eliminate the U.S. Department of Education” — and that’s accurate. Project 2025 says federal education policy “should be limited and, ultimately, the federal Department of Education should be eliminated.” The plan scales back the federal government’s role in education policy and devolves the functions that remain to other agencies.

Aside from eliminating the department, the project also proposes scrapping the Biden administration’s Title IX revision, which prohibits discrimination based on sexual orientation and gender identity. It also would let states opt out of federal education programs and calls for passing a federal parents’ bill of rights similar to ones passed in some Republican-led state legislatures.

Republicans, including Trump, have pledged to close the department, which gained its status in 1979 within Democratic President Jimmy Carter’s presidential Cabinet.

In one of his Agenda 47 policy videos, Trump promised to close the department and “to send all education work and needs back to the states.” Eliminating the department would have to go through Congress.

What Project 2025, Trump would do on overtime pay

In the graphic, the Harris campaign says Project 2025 allows “employers to stop paying workers for overtime work.”

The plan doesn’t call for banning overtime wages. It recommends changes to some Occupational Safety and Health Administration, or OSHA, regulations and to overtime rules. Some changes, if enacted, could result in some people losing overtime protections, experts told us.

The document proposes that the Labor Department maintain an overtime threshold “that does not punish businesses in lower-cost regions (e.g., the southeast United States).” This threshold is the amount of money executive, administrative or professional employees need to make for an employer to exempt them from overtime pay under the Fair Labor Standards Act.

In 2019, the Trump’s administration finalized a rule that expanded overtime pay eligibility to most salaried workers earning less than about $35,568, which it said made about 1.3 million more workers eligible for overtime pay. The Trump-era threshold is high enough to cover most line workers in lower-cost regions, Project 2025 said.

The Biden administration raised that threshold to $43,888 beginning July 1, and that will rise to $58,656 on Jan. 1, 2025. That would grant overtime eligibility to about 4 million workers, the Labor Department said.

It’s unclear how many workers Project 2025’s proposal to return to the Trump-era overtime threshold in some parts of the country would affect, but experts said some would presumably lose the right to overtime wages.

Other overtime proposals in Project 2025’s plan include allowing some workers to choose to accumulate paid time off instead of overtime pay, or to work more hours in one week and fewer in the next, rather than receive overtime.

Trump’s past with overtime pay is complicated. In 2016, the Obama administration said it would raise the overtime to salaried workers earning less than $47,476 a year, about double the exemption level set in 2004 of $23,660 a year.

But when a judge blocked the Obama rule, the Trump administration didn’t challenge the court ruling. Instead it set its own overtime threshold, which raised the amount, but by less than Obama.

Support Provided By: Learn more

Educate your inbox

Subscribe to Here’s the Deal, our politics newsletter for analysis you won’t find anywhere else.

Thank you. Please check your inbox to confirm.

Money blog: Zoopla issues warning to sellers about overpricing homes

The Money blog is a hub for personal finance and consumer news and tips. Today's posts include a word of caution to house-sellers and hotels cancelling bookings on Oasis concert nights. Listen to a Daily podcast episode on the winter fuel allowance as you scroll.

Wednesday 28 August 2024 21:19, UK

- Hotel accused of cancelling bookings on Oasis concert nights - and relisting for higher price

- Capital gains tax rise on way, leading tax firm warns

- Zoopla issues warning to sellers about overpricing homes

- 'Good news for passengers' from Ryanair on fares

Essential reads

- Top chef shares cheap soup recipe - as he picks best budget eats in Kent

- Has the Nike trainer bubble burst?

- Young people doing 'big no-no' with holiday money - here are the golden rules

Tips and advice

- Hidden refund option that could save you hundreds of pounds

- Best mortgage rates for first-time buyers right now

- How to spend less on school uniform

It's taking sellers over twice as long on average to sell their homes when they have to reduce the price than when there's no reduction, according to Zoopla.

The property portal said its latest research shows sellers should be realistic when it comes to pricing up their property if they're serious about moving.

According to Zoopla, it takes 28 days on average to agree a sale where the asking price hasn't been slashed.

But for sellers who've had to lower the price by 5% or more, the typical time to sell goes up to a whopping 73 days.

Around a fifth of homes put up for sale this month had their price cut by 5% or more, Zoopla said.

Executive director Richard Donnell said a rise in the supply of homes meant buyers had greater choice and prices would be kept in check.

But with mortgage rates still high, "buyers have less purchasing power than two to three years ago and remain price sensitive, meaning sellers can't afford to get ahead of themselves on where to set the right price for their home", he said.

Around 10 million people in England and Wales will not receive winter fuel payments this winter.

Under Chancellor Rachel Reeves' plan, only those who receive pension credit or other means-tested benefits will still get the £200-£300 towards the cost of their energy bills.