5 Types of Travel Insurance (And What They Cover) – Real Examples

It’s only natural to embark on your vacation full of excitement and anticipation.

But exploring unfamiliar destinations, immersing yourself in diverse cultures, and creating unforgettable memories can also result in unforeseen circumstances that can quickly ruin your vacation and leave you out of pocket.

This is where travel insurance comes in.

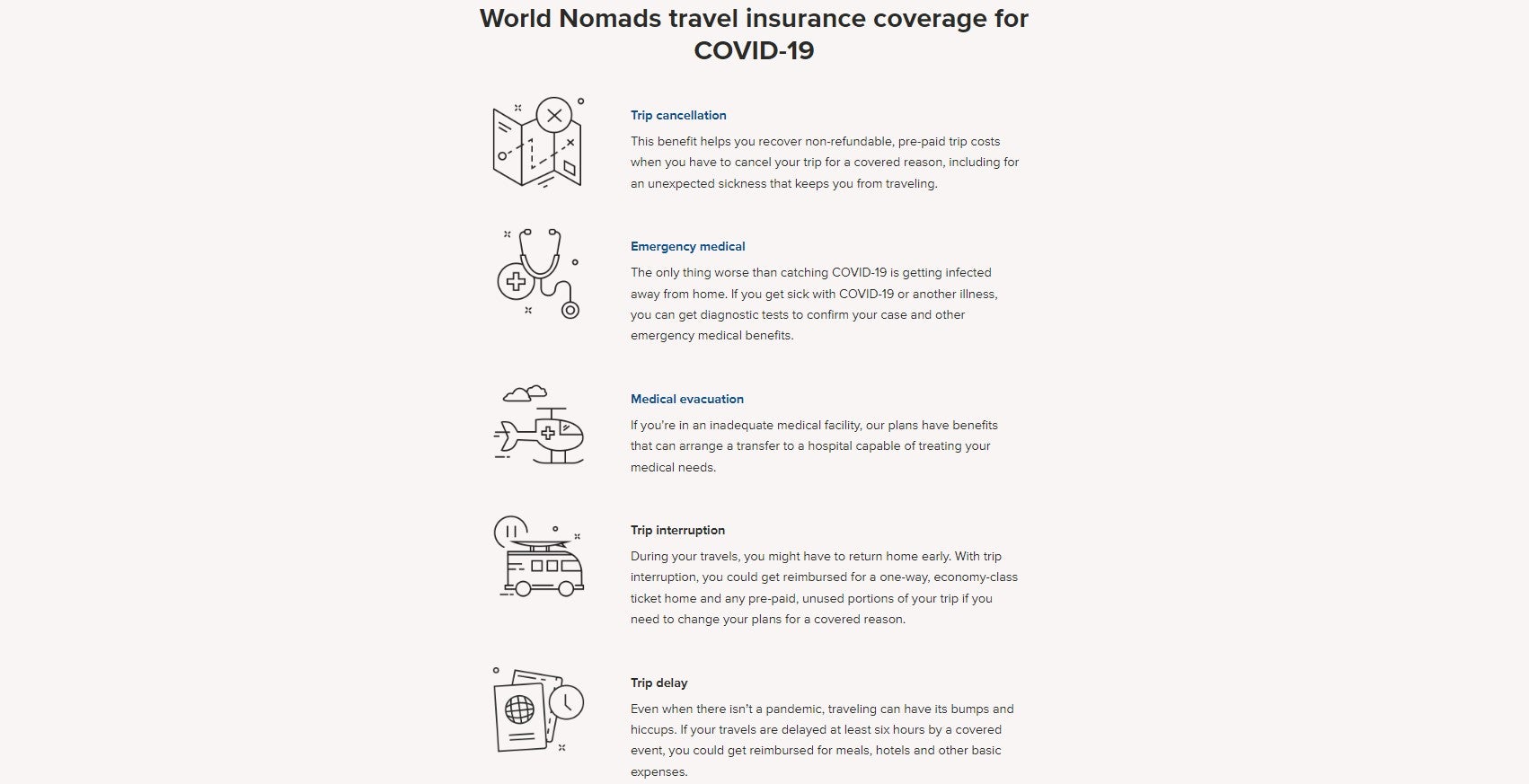

Travel insurance typically covers 5 areas: trip cancellation/interruption insurance, medical insurance, baggage insurance, emergency medical evacuation insurance, and trip delay insurance.

So in this article, we will delve into the world of travel insurance by exploring the different types of coverage options available to you, what each covers, and providing real-life examples, so you can get a better understanding of how the coverage and policies work.

Table of Contents

- 1.1 Canceled or Interrupted Trip Coverage

- 1.2 Real-life Example

- 1.3 Benefits of Canceled or Interrupted Trip Insurance

- 2.1 Real-life Example

- 2.2 Medical Insurance Coverage & Limitations

- 3.1 Real-life Example

- 3.2 Documenting and Protecting Personal Belongings During Travel

- 4.1 Real-life Example

- 4.2 The Value of Emergency Medical Evacuation Insurance

- 5.1 Real-life Example

1. Trip Cancellation/Interruption Insurance

Picture this:

You’ve planned and have been looking forward to your vacation, eagerly counting down the days until you depart. But then, your trips suddenly gets canceled or interrupted.

What do you do now?

Well, thankfully, you have trip cancellation/interruption insurance that will get you your money back.

Canceled or Interrupted Trip Coverage

When unforeseen circumstances force you to cancel or interrupt your trip, this type of insurance can act as a safety net by reimbursing you for non-refundable expenses, such as flights, accommodation, and tours.

This can apply to your trip being canceled or interrupted due to a sudden illness, a family emergency, or an unforeseen event

Real-life Example

Sarah planned a trip to an exotic destination, but just days before she was due to depart, she fell seriously ill and had to be hospitalized. She therefore had to indefinitely postpone her vacation.

Thankfully, Sarah had invested in trip cancellation/interruption insurance. She was able to recoup the non-refundable costs and reschedule her trip once she recovered.

Benefits of Canceled or Interrupted Trip Insurance

- Financial Security: Trip cancellation/interruption insurance ensures that you will get your money back if unforeseen circumstances force you to alter your travel plans. It reimburses you for the expenses you cannot recover otherwise.

- Peace of Mind: We all know that life can be unpredictable, and travel plans can be derailed in an instant. With this type of insurance, you can travel with peace of mind, knowing that if something unexpected occurs, you won’t be out of pocket.

- Flexibility and Freedom: Trip cancellation/interruption insurance can give you the flexibility to reschedule or make alternative arrangements without incurring substantial financial losses.

- Coverage Tailored to Your Needs: As is true with any type of travel insurance, trip cancellation/interruption policies offer varying levels of coverage, so you can choose the one that best aligns with your specific travel plans and finances. Whether it’s a comprehensive policy that covers a wide range of scenarios or a more budget-friendly option, you can find the coverage that suits your needs and budget.

2. Travel Medical Insurance Coverage

When you’re out of the country, it’s likely that your regular health insurance won’t fully cover any medical expenses incurred abroad.

This is where travel medical insurance comes in by offering you coverage for unforeseen medical emergencies.

So whether it’s a sudden illness, accident, or injury, travel medical insurance will ensure that you will receive the care you need without being hit by the burden of exorbitant costs.

Mark, an enthusiastic globetrotter, embarked on a journey to Sydney. One day, while exploring the city, he unexpectedly fell ill and required medical attention.

While he quickly realized the high costs associated with medical care in a foreign country, Mark had fortunately purchased travel medical insurance before his trip, which covered his medical expenses.

Medical Insurance Coverage & Limitations

While travel medical insurance can offer you invaluable protection, there can be some limitations.

- Coverage Details: A policy may cover just one, some, or all of the following: hospitalization, emergency care, medications, and medical evacuation. So it’s important to pay attention to the policy’s maximum coverage limits and exclusions. Not realizing this is one of the most common travel insurance mistakes people make.

- Pre-Existing Conditions: Some travel medical insurance policies have limitations or exclusions regarding pre-existing conditions. To avoid any surprises, make sure that you understand how a policy addresses these conditions.

- Duration and Geographical Limitations: Keep in mind that policies will have varying durations of coverage and could have restrictions on specific destinations or regions. An example is limitations on coverage for high-risk areas or countries with travel advisories.

3. Baggage Insurance Coverage

There’s no faster way to ruin your trip by having your luggage lost, damaged, or even stolen.

This is where baggage insurance coverage comes in handy.

Baggage insurance coverage typically covers expenses related to the replacement or repair of your belongings.

Policies can vary, so coverage may cover all or part of the expenses you incurred due to lost, damaged, or stolen luggage.

Samantha just landed at her dream destination, ready to embark on a week-long adventure. However, as she waited at the baggage claim, she realized her luggage was nowhere to be found.

Panic started to set in, and she worried about what she would do without her belongings.

Unfortunately, travel baggage insurance didn’t make Sarah’s bag suddenly appear, but she was able to file a successful claim to recover the cost of her belongings.

Documenting and Protecting Personal Belongings During Travel

While baggage insurance coverage can protect you from the financial burden of lost, damaged, or stolen luggage, it’s still important to take steps to protect your belongings during travel.

As mentioned, the insurance policy won’t suddenly make your luggage appear.

- Take photos or videos of the contents of your luggage before traveling, especially of any expensive or valuable items you will be traveling with.

- Keep receipts or invoices of expensive items to prove their value.

- Use locks on your luggage to prevent theft and keep your belongings safe.

- Keep your luggage with you whenever possible and don’t leave it unattended.

4. Emergency Medical Evacuation Travel Insurance

While we often envision exciting adventures and memorable experiences when we travel, one of those memorable experiences could be a medical emergency.

Emergency medical evacuation coverage is a type of insurance that provides financial protection and assistance in situations where immediate medical attention is necessary, and evacuation to a more suitable medical facility is required.

Nick, an avid hiker, embarked on a solo trek in a remote mountainous region. While exploring the rugged terrain, he fell and sustained a severe leg injury.

Inevitably, Nick was far away from medical facilities and assistance, but thankfully the emergency medical evacuation coverage he purchased before he left gave him access to essential medical assistance.

A helicopter evacuation from the remote area to a well-equipped hospital was arranged, so Nick could get the medical attention he needed.

The Value of Emergency Medical Evacuation Insurance

The value of emergency medical evacuation insurance soon becomes evident if you travel to remote destinations, where medical facilities are typically scarce or ill-equipped to handle serious medical emergencies.

In these situations, evacuation to a more suitable medical facility becomes essential for proper care and treatment. Not to mention, that transport medical costs can be exorbitant when transporting you out of a remote area.

5. Travel Delay Insurance

When you’re excited about your trip and especially when you have an itinerary you need to stick to, an unexpected delay can certainly throw a wrench into your plans and cause frustration and inconvenience.

That’s where travel delay insurance comes to the rescue by providing coverage for unforeseen circumstances that result in a significant delay during your journey.

These circumstances can include bad weather, airline delays, natural disasters, or even medical emergencies. Necessary expenses incurred during the delay, such as accommodation, meals, and transportation, may all be covered.

John is all set and looking forward to his dream vacation in a tropical paradise.

Unfortunately, his first flight is delayed due to a severe thunderstorm, causing him to miss his connecting flight .

John finds himself stranded at the airport, uncertain about what to do next.

Thankfully, due to the coverage he purchased before he left, John is able to seek immediate assistance from his insurance provider.

They provide him with secure alternative accommodation for the night and cover the costs of his meals and transportation during the unexpected delay.

In conclusion, understanding the 5 main types of travel insurance and what they cover is vital for any traveler.

By evaluating your travel needs and selecting the right coverage, you can embark on your journeys with confidence, knowing that you’re prepared for any unexpected situation that comes your way.

Ella Dunham

Ella Dunham, a Freelance Travel Journalist and Marketing Manager, boasts an impressive career spanning eight years in the travel and tourism sectors.

Honored as one of "30 Under 30" by TTG Media (the world’s very first weekly travel trade newspaper), a "Tour Operator Travel Guru" and "Legend Award" winner, Ella is also a Fellow of the Institute of Travel, a Member of the Association of Women Travel Executives, has completed over 250 travel modules, and hosts travel-focused segments on national radio shows where she provides insights on travel regulations and destinations.

Ella has visited over 40 countries (with 10 more planned this year).

Related Posts:

Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

How to Find the Best Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What travel insurance covers

How much does travel insurance cost, types of travel insurance, how to get travel insurance, what to look for in travel insurance, best travel insurance comparison sites, which insurance company is best for travel insurance, when to skip travel insurance, travel insurance, recapped.

Travel insurance can cover medical expenses, emergencies, trip interruptions, baggage, rental cars and more.

Cost is affected by trip length, pre-existing medical conditions, depth of coverage, your age and add-ons.

You can get it through credit cards or third-party companies, & can shop on travel insurance comparison sites.

Before buying, evaluate risks, know existing coverage, obtain quotes online and review policy details warily.

Skip it if you buy flexible airfare and hotels, already have coverage or only book refundable activities.

Booking travel always carries some degree of uncertainty. Travel insurance provides a safety net so you can step out with confidence. You may not need travel insurance for inexpensive trips, but it can provide a sense of security when you prepay for pricey reservations, a big international trip or travel during cold and flu season, which can be unpredictable.

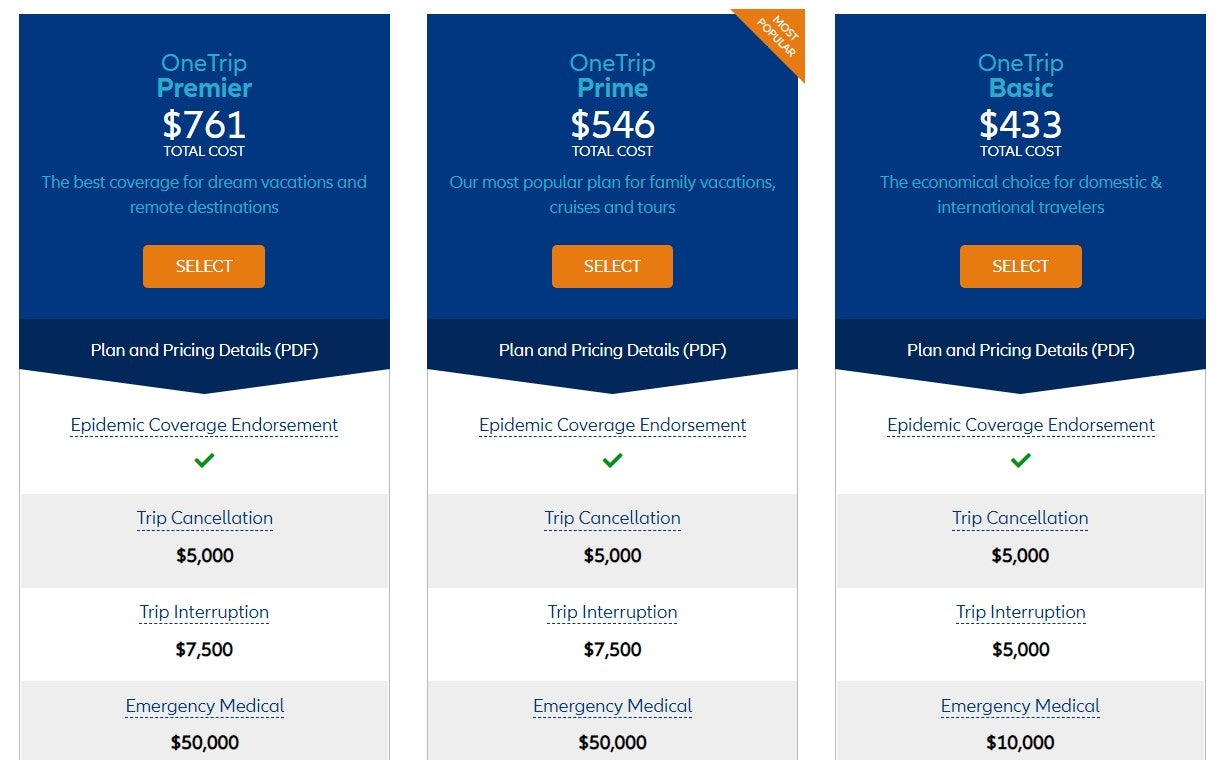

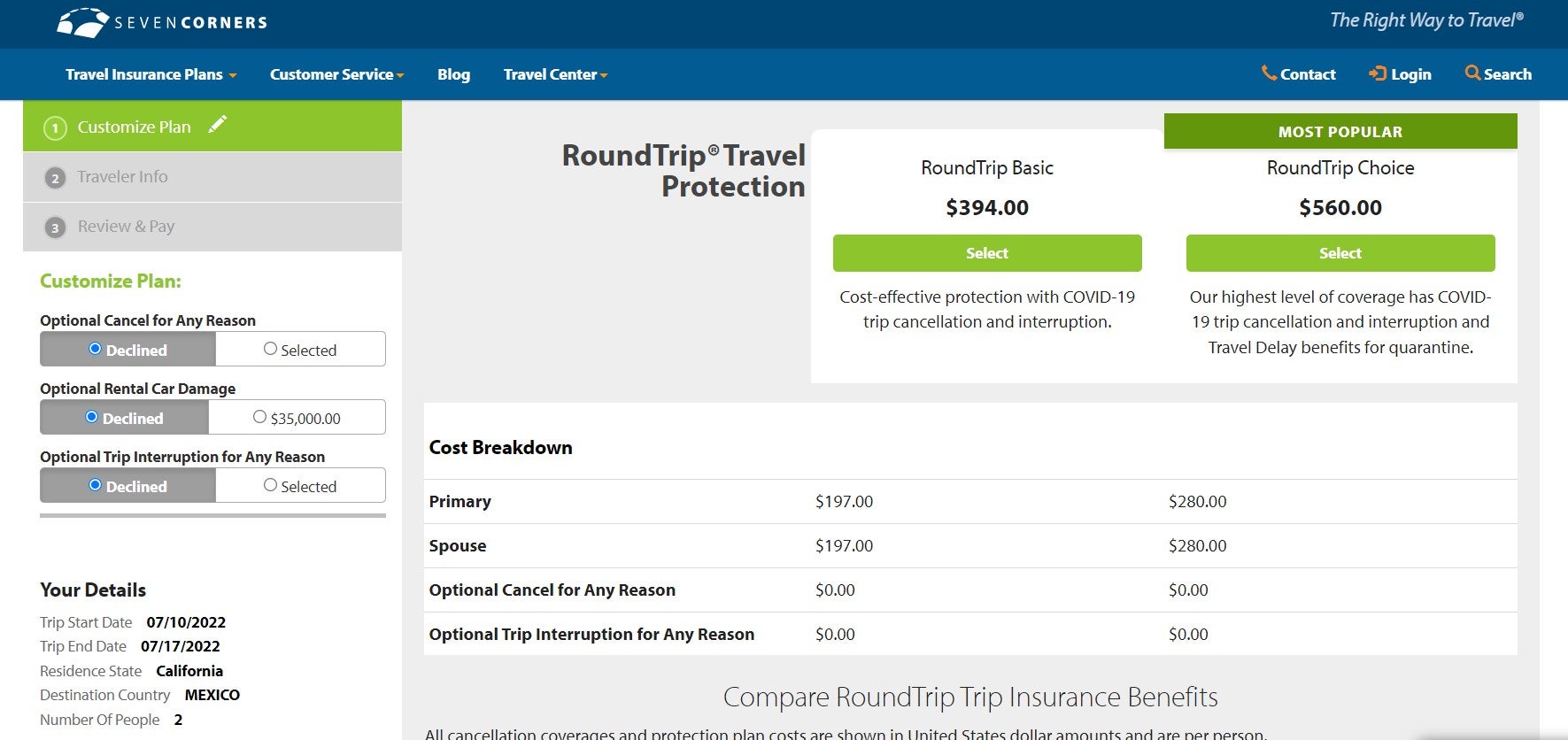

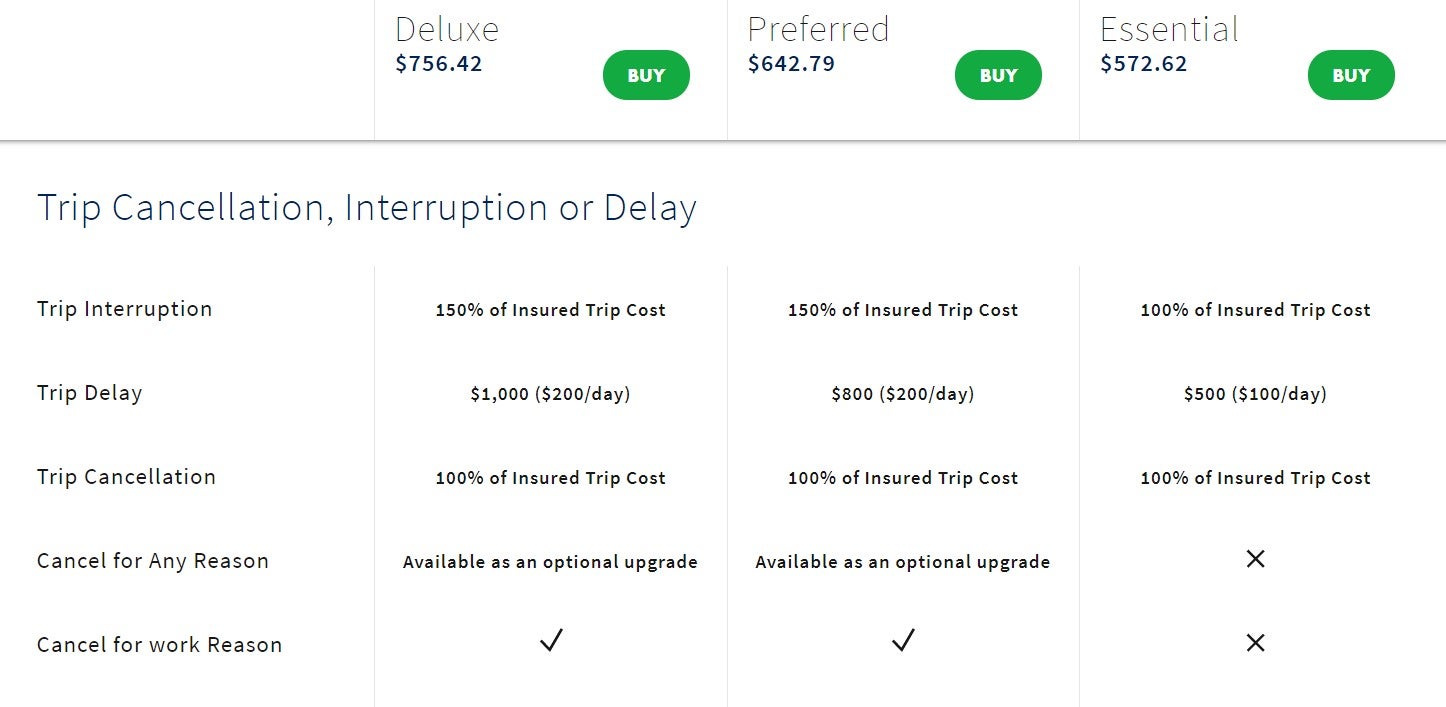

According to insurance comparison site Squaremouth, travelers in 2023 spent an average of $403 for comprehensive coverage, compared to $96 for medical-only policies. Comprehensive plans typically cost between 5% and 10% of the insured trip cost.

Since that price tag is no small amount, it helps to know how to shop smart for travel insurance. Here's how to find the right travel insurance plan for you and your next adventure.

Depending on the type of coverage you’re looking for, the chart below will help you determine what to look for when selecting a policy:

Depending on the policy, travel insurance reimburses you or offers services when something goes awry. There’s even coverage for the worst-case scenario: if you die in an accident while traveling. Accidental death coverage pays your beneficiary a lump sum in that case.

Before you buy, take a little time to get familiar with different types of travel insurance products, how it’s priced, and what it covers and excludes. If you’re traveling during these uncertain times, you’ll want to make sure that the policy you select covers coronavirus-related emergencies. Usually, the more thorough the coverage, the more it will cost.

Travel insurance costs vary depending on:

Length and cost of the trip: The longer and more expensive the trip, the higher the policy cost.

Cost of local health care: High health-care costs in your destination can drive up the price of trip insurance.

Medical conditions you want covered: Conditions you already have will increase the cost of travel insurance coverage.

Amount and breadth of coverage: The more risks a policy covers, the more it will cost.

Your age: Generally the older you are, the higher the price.

Any optional supplement you add to your policy : Cancel For Any Reason , Interrupt For Any Reason and more.

Keep these factors in mind when considering different travel insurance options.

You’ll find a wide selection of travel protection plans when you shop for a policy.

Typically, travel insurance is sold as a package, known as a comprehensive plan, which includes a variety of coverage.

Here are seven of the most common types of travel insurance:

Travel medical insurance

These plans provide health insurance while you’re away from home. Although in some ways these policies work like traditional health plans, generally you cannot use travel health insurance for routine medical events. For example, a routine medical checkup is usually not covered. In addition, these policies often include limitations on coverage and exclusions for pre-existing conditions.

Although most travel insurance plans cover many recreational activities, such as skiing and horseback riding, they often exclude adventure sports, such as skydiving or parasailing, or competition in organized sporting events. You may need to buy a special travel policy designed for adventure or competitive sports.

International travel insurance

Most likely, your U.S.-based medical insurance will not work while you’re traveling internationally, and Medicare does not provide any coverage once you leave the United States outside of a few very specific exemptions. If you plan on traveling abroad, purchasing travel medical insurance could make a lot of sense.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Trip cancellation, interruption and delay

Trip cancellation coverage reimburses you for prepaid, nonrefundable expenses if the tour operator goes out of business or you have to cancel the trip for one of the covered reasons outlined in the policy, such as:

Your own illness.

The illness or death of a family member who’s not traveling with you.

Natural disasters.

Trip interruption insurance covers the nonrefundable cost of the unused portion of the trip if it is interrupted due to a reason outlined in the policy.

Trip delay coverage reimburses you for expenses such as lodging and meals if you’re delayed during a trip (e.g., your flight gets canceled due to weather ).

Many package policies cover all three. These policies are different from the cancellation waivers that cruise lines and tour operators offer, the Insurance Information Institute says. Waivers are cheap, ranging from $40 to $60, and often include restrictions. For example, according to the institute, waivers might not refund your money if you cancel immediately before departure. Waivers are technically not insurance policies.

Some companies offer additional layers of coverage at extra cost. “Cancel For Any Reason” coverage will reimburse a large part of the trip cost, no matter why you back out. And some companies let you pay extra to cover pre-existing conditions if you cancel for medical reasons.

Some insurers and comparison sites let you customize a policy by choosing types of coverage a la carte. For example, TravelInsurance.com is a comparison site that provides quotes from different providers.

Baggage and personal belongings

How does lost luggage insurance work? This coverage reimburses you for baggage and personal belongings that are lost, stolen or damaged during the trip. Some plans also reimburse you for extra expenses if you experience a baggage delay for more than a certain period, such as 12 hours.

Your renters or homeowners insurance may cover personal belongings while you are traveling. It’s best to review your homeowners insurance policy to determine the level of coverage it provides so you do not end up paying for a benefit you already have.

» Learn more: Baggage insurance explained

Emergency medical assistance, evacuation and repatriation

This coverage pays medical expenses if you get sick or injured on a trip . Medical evacuation coverage pays for transporting you to the nearest hospital, and medical repatriation pays for flying you to your home country.

» Learn more: Can I get travel insurance for pre-existing medical conditions?

24-hour assistance

This service is included with many package plans. The insurer provides a 24-hour hotline that you can call when you need help, such as booking a flight after a missed connection, finding lost luggage, or locating a doctor or lawyer.

Generally, travel insurance companies do not cover sports or any activity that can be deemed risky. If you’re thinking of incorporating adventurous activities into your vacation, choose a plan that includes adventure sports coverage.

Most travel insurers cover a wide array of services, but the specific options vary. Some plans include concierge services, providing help with restaurant referrals, tee time reservations and more. Many services also offer information before the trip, such as required vaccinations. The only way to know what’s included is to read the policy.

» Learn more: Should you insure your cruise?

Accidental death and dismemberment insurance

This coverage pays a lump sum to your beneficiary, such as a family member, if you die in an accident while on the trip. Accidental death and dismemberment insurance policies also pay a portion of the sum to you if you lose a hand, foot, limb, eyesight, speech or hearing. Some plans apply only to accidental death in a plane.

This coverage may be duplicative if you already have sufficient life insurance, which pays out whether you die in an accident or from an illness. You may also already have accidental death and dismemberment insurance through work, so it's best to check your policies to ensure you’re not overpaying.

» Learn more: NerdWallet's guide to life insurance

Rental car coverage

Rental car insurance pays for repairing your rental car if it’s damaged in a wreck, by vandals or in a natural disaster. The coverage doesn't include liability insurance, which pays for damage to other vehicles or for the medical treatment of others if you cause an accident and are held responsible.

Ask your car insurance company whether your policy will cover you when renting cars on the trip. U.S. car insurance policies generally don’t cover you when driving in other countries, except Canada.

Car insurance requirements are complex because they vary among countries. You can usually purchase liability insurance from the rental car company. Learn about car insurance requirements by searching for auto insurance by country on the U.S. Embassy website .

» Learn more: Best credit cards for rental car coverage

A note about single vs. long-term policies

Single trip insurance plans are a great option for those going on a single trip for a specific length of time (e.g., a two-week vacation) and then returning home. The price of the policy is usually determined by the cost of the trip.

Long-term travel policies cover you for multiple trips, but there are limitations to how long you can be away from home, if you can return home during your travels and how many trips you can take. In addition, trip cancellation and interruption coverage is either not offered or capped at a dollar amount that can be significantly below the total cost of all the trips taken during the covered period.

Long-term travel insurance plans — often called 'multi-trip' or 'annual travel insurance' — are a suitable option for those who travel often and are satisfied with the amount of trip cancellation coverage for all the trips they take over the duration of the policy.

» Learn more: How annual (multi-trip) travel insurance works

Below, we include how to obtain travel insurance, along with the pros and cons of each option.

Some credit cards offer trip cancellation and rental car insurance if you use the card to book the trip or car.

When you book a trip with your credit card, depending on the card you use, you may already receive trip cancellation and interruption coverage.

» Learn more: 10 credit cards that provide travel insurance

Here are a handful of credit cards that offer varying levels of travel insurance coverage for purchases made with the card.

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Travel accident: Up to $500,000.

• Rental car insurance: Up to $75,000.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Travel accident: Up to $1 million.

• Rental car insurance: Up to the actual cash value of the car.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

Pros: Coverage is free.

Cons: You can’t customize the insurance to meet your needs. Most credit cards offer secondary car rental insurance, which pays for the costs not covered by your regular car insurance plan.

Travel agents and travel reservation sites

You can buy travel insurance when you book your flight, hotel and car rental.

Pros: Buying is as quick and easy as clicking “yes” when you book reservations. Coverage is inexpensive.

Cons: You can’t customize the coverage.

» Learn more: Airline travel insurance vs. independent travel insurance

Travel insurance comparison sites

You can compare different policies and review quotes at once based on the trip search criteria you’ve input into the search form. Examples include marketplaces like Squaremouth or TravelInsurance.com.

Pros: You can choose a policy that fits your needs and compare policies and pricing in one place.

Cons: Comparing multiple policies takes time.

Travel insurance companies

You can purchase travel insurance directly from an insurance provider.

Pros: You can choose a policy that fits your needs. Many travel insurer websites also offer information to help you understand the coverage.

Cons: You’ll need to go to multiple websites to compare coverage and pricing.

» Learn more: The best travel insurance companies right now

Keep these tips in mind when you’re considering a trip insurance policy.

Evaluate the financial risks you face when traveling. Can you bear those costs yourself, or do you want insurance?

Examine what coverage you already have: Does your credit card offer travel insurance? Do you have renters or homeowners insurance to cover belongings? What is the deductible? Will your health plan cover you in all the locations where you travel?

Get quotes for trip insurance online. Choose a package of the benefits you need and compare prices for similar coverage among carriers.

Narrow your choices and then read the policy fine print to understand what’s covered, what’s excluded and the limits on coverage. You may find that the lowest-priced policy is too restrictive and that paying a little more gets you the coverage you need. Or you might find that the cheapest, most basic policy fits the bill.

If you don’t know which provider to go with, it makes sense to browse a list of plans on a travel insurance comparison site. These online marketplaces will often include plans from the best travel insurance companies along with customer reviews.

Squaremouth

Compare plans from more than 30 providers.

Over 86,000 customer reviews of insurers.

Under its Zero Complaint Guarantee, Squaremouth (a NerdWallet partner) will remove a provider if any customer complaint isn't resolved to its satisfaction.

Has a filter option to see policies that provide COVID-coverage.

TravelInsurance.com

Compare plans from 13 providers.

See good and poor customer ratings and reviews for each insurer when you receive quotes.

“Learning Center” includes travel insurance articles and travel tips, including important how-to information.

Quotes provided from each provider include a link to COVID-19 FAQs, making it easy for customers to review what’s covered or not.

InsureMyTrip

Compare plans from more than two dozen providers.

More than 70,000 customer reviews.

“Anytime Advocates” help customers navigate the claim process and will work on behalf of the customer to help with appealing a denied claim.

Includes a link to plans that offer COVID coverage.

Compare plans from 11 providers.

Search coverage by sporting activity, including ground, air and water sports.

Many types of plans available for students, visiting family members, new immigrants, those seeking COVID quarantine coverage and more.

Compare different insurance plans from 35 providers.

Over 5,600 customer reviews on Trustpilot, with an average 4.9 stars out of five.

Formerly known as AardvarkCompare, AARDY includes a “Travel Insurance 101” learning center to help customers understand various policies and benefits.

Quote search results page includes COVID-coverage highlighted in a different color to make it easier for customers to review related limits.

Whether you’re looking for an international travel insurance plan, emergency medical care, COVID coverage or a policy that includes extreme sports, these providers have you covered.

Our full analysis and more details about each organization can be found here: The Best Travel Insurance Companies Today .

Allianz Global Assistance .

Travel Guard by AIG .

USI Affinity Travel Insurance Services .

Travel Insured International .

World Nomads .

Berkshire Hathaway Travel Protection .

Travelex Insurance Services .

Seven Corners .

AXA Assistance USA .

There are a few scenarios when spending extra on travel insurance doesn't really make sense, like:

You booked flexible airline tickets.

Your hotel room has a good cancellation policy.

It's already included in your credit card.

You haven't booked any nonrefundable activities.

» Learn more: When you don't need travel insurance

Yes, especially for nonrefundable trips and travel during the COVID-era. Whether you purchase a comprehensive travel insurance policy or have travel insurance from your credit card, you shouldn't travel without having some sort of travel protection in place to safeguard you and your trip. Travel insurance can protect you in case of an unexpected emergency such as a canceled flight due to weather, a medical event that requires hospitalization, lost luggage and more.

There are many good travel insurance policies out there and a policy that may be great for you may not be good for someone else. Selecting the best plan depends on what coverage you would like and your trip details.

For example, World Nomads offers a comprehensive travel insurance policy that has excellent coverage for adventure sports. Allianz provides coverage for trips of varying lengths of time through its single trip plans and multi-trip plans. Some providers offer add-on options like Cancel For Any Reason travel insurance. If you’re not sure which plan to go with, consider looking at trip insurance comparison sites like Squaremouth or Insuremytrip.

Yes, you can. However, it's better to purchase it sooner rather than later, ideally right after booking your trip because the benefits begin as soon as you purchase a policy.

Let’s say you’re going on a trip in a month and a week before departure, you fall and break your leg. If you’ve purchased a travel insurance policy, you can use your trip cancellation benefits to get your nonrefundable deposit back.

Most comprehensive travel insurance plans offer trip cancellation, trip interruption, emergency medical and dental, medical evacuation, trip delay and lost luggage coverage. Many plans offer COVID coverage, but you’ll always want to check to ensure that the policy you choose provides that benefit if you’re traveling during these times. Some plans may also allow you to add features like Cancel For Any Reason travel insurance.

It depends which credit card you have. Premium travel cards like the Chase Sapphire Reserve® and The Platinum Card® from American Express offer travel insurance benefits if you book a trip using your card or points.

However, the coverage provided by the credit cards is usually lower than if you purchased a standalone policy. Review the travel insurance benefits on your credit card and check that the limits are adequate before foregoing from purchasing a separate plan.

Let’s say you’re going on a trip in a month and a week before departure, you fall and break your leg. If you’ve purchased a travel insurance policy, you can use your

trip cancellation benefits

to get your nonrefundable deposit back.

It depends which credit card you have. Premium travel cards like the

Chase Sapphire Reserve®

The Platinum Card® from American Express

offer travel insurance benefits if you book a trip using your card or points.

Unpredictability is one of the mind-opening joys of travel, but travel insurance should contain no surprises. The time you spend to understand your options will be well worth the peace of mind as you embark on your next adventure.

Whether you’re seeking a single or a long-term policy, each travel insurance option offers different strengths and weaknesses. Choosing the right policy depends on your trip needs, your budget and how important various benefits are to you.

Keep reading

If you want to dig in deeper to world of travel insurance, these resources will point you in the right direction.

What is travel insurance?

How much is travel insurance?

Is travel insurance worth it?

What does travel insurance cover?

Does travel insurance cover COVID?

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Best travel insurance companies of April 2024

Amy Fontinelle

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 8:41 a.m. UTC April 12, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

WorldTrips is the best travel insurance company of 2024 , based on our in-depth analysis of travel insurance policies. Its Atlas Journey Preferred and Atlas Journey Premier plans get 5 stars in our rating because of the extensive coverage they provide for the price. Both plans come with high limits for important benefits such as emergency medical and evacuation, travel delay and missed connections. WorldTrips travel insurance also offers a pre-existing medical condition exclusion waiver if you buy a plan within 21 days of making your first trip deposit.

Best travel insurance of 2024

Why trust our travel insurance experts

Our travel insurance experts evaluate hundreds of insurance products and analyze thousands of data points to help you find the best trip insurance for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Travel insurance quotes comparison

Best travel insurance companies, best travel insurance.

Top travel insurance plans

Average cost, medical limit per person, why it’s the best.

If you’re looking for the best travel insurance for international travel, WorldTrips has two top-rated travel insurance plans in our rating:

- Atlas Journey Preferred provides $100,000 per person in emergency medical benefits as secondary coverage, with the option to upgrade to primary coverage. Primary coverage means you don’t have to first file a medical claim with your health insurance company. Atlas Journey Preferred is also the best travel insurance for cruises with $1 million in coverage for emergency evacuation.

- Atlas Journey Premier costs more but gives you $150,000 in travel medical insurance with primary coverage. This plan is a good option if health insurance for international travel is a priority. It also has $1 million in emergency evacuation coverage.

Pros and cons

- Atlas Journey Preferred is the cheapest of our 5-star travel insurance plans.

- Atlas Journey Premier has $150,000 in primary medical coverage.

- Both plans have top-notch $1 million per person in medical evacuation coverage.

- Each plan includes travel inconvenience coverage of $750 per person.

- 12 optional upgrades, including destination wedding and rental car damage and theft.

- No non-medical evacuation coverage.

Customer reviews

WorldTrips has a rating of 4.27 stars out of 5 on Squaremouth, based on 411 reviews of policies purchased through the travel insurance comparison site since 2008.

Best travel insurance for emergency evacuation

Travel insured international.

Top travel insurance plan

If you’re traveling to a remote area, consider Travel Insured International’s Worldwide Trip Protector. It has the best travel insurance for emergency evacuation of travel insurance policies in our rating. This top travel insurance plan provides up to $1 million in emergency evacuation coverage per person and $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits.

- Only plan in our rating that offers $150,000 in non-medical evacuation coverage.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person is only available for cruises and tours.

Travel Insured International has a rating of 4.39 stars out of 5 on Squaremouth, based on 3,402 reviews of policies purchased on the travel insurance comparison site since 2004.

Best travel insurance for missed connections

If you’re looking for good travel insurance for missed connections , it’s worth considering TravelSafe. Its Classic plan includes $2,500 in missed connection coverage for each person on the plan. Some travel insurance companies only provide missed connection coverage for cruises and tours, but TravelSafe doesn’t impose that restriction.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of our best-rated travel insurance plans.

- No “interruption for any reason” coverage option.

- Weak baggage delay coverage of $250 per person after 12 hours.

TravelSafe has a rating of 4.3 stars out of 5 on Squaremouth, based on 1,506 reviews of policies purchased on the travel insurance comparison site since 2004.

Best trip insurance for traveling with a pet

Go Ready Choice by Aegis has the most affordable travel insurance of the best-rated travel insurance companies in our rating. It’s also the best trip insurance for pet parents , with an optional Pet Bundle add-on that includes pet medical, pet kennel and pet return benefits.

- Cheapest of our best trip insurance plans.

- Optional pet bundle adds pet medical expense and pet return benefits.

- Low emergency medical and evacuation limits.

- Low missed connection benefit of $500 per person for cruises and tours only.

- Low baggage and personal items loss benefit of $500 per person.

Aegis has a rating of 4.06 stars out of 5 on Squaremouth, based on 1,111 reviews of policies purchased on the travel insurance comparison site since 2013.

Best travel insurance for families

Top-scoring plan

Travelex Insurance Services has the best travel insurance for families because you can add kids aged 17 and younger to your Travel Select plan at no additional charge.

- Free coverage for children 17 and under on the same policy.

- Robust travel delay coverage of $2,000 per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Low emergency medical coverage of $50,000 per person.

- Non-medical evacuation is not included.

- Low baggage delay coverage of $200 requires a 12-hour delay.

Travelex has a rating of 4.43 stars out of 5 on Squaremouth, based on 2,048 reviews of policies purchased on the travel insurance comparison site since 2004.

Best travel insurance for add-on coverage options

Travel Guard Preferred from AIG allows you to customize your policy with a host of available upgrades, making it the best traveler insurance for add-on options . These include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings.

There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million. This is a good option if you’re looking for foreign travel health insurance.

See our full AIG travel insurance review

- Bundle upgrades allow you to customize your travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Best travel insurance for cruise itinerary changes

Nationwide’s Cruise Choice plan is good travel insurance for cruises . It has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion.

Cruise Choice also has a missed connections benefit of $1,500 per person after only a 3-hour delay when you’re taking a cruise or tour. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

- Benefits for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Missed connection coverage of $1,500 per person for tours and cruises, after a 3-hour delay.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” upgrade available.

Nationwide has a rating of 4.02 stars out of 5 on Squaremouth, based on 570 reviews of policies purchased on the travel insurance comparison site since 2018.

What is the best travel insurance?

The best travel insurance for international travel is sold by WorldTrips, according to our in-depth trip insurance comparison.

The best travel insurance plan for you will depend on the trip you are planning and the coverage areas that are most important to you.

- Best cruise travel insurance

- Best COVID travel insurance

- Best “Cancel for any reason” travel insurance

- Best senior travel insurance

Best travel insurance for cruises

The best cruise travel insurance is Atlas Journey Preferred sold by WorldTrips . This plan offers solid travel insurance for cruises for a low rate.

Best travel insurance for COVID-19

The best COVID travel insurance is the Trip Protection Basic plan sold by Seven Corners . It is a relatively low cost travel insurance plan with optional “cancel for any reason” coverage that reimburses up to 75% of your prepaid, nonrefundable trip expenses.

Best travel insurance for “cancel for any reason”

The best “cancel for any reason” (CFAR) travel insurance is Seven Corners’ Trip Protection Basic. Adding CFAR coverage to a RoundTrip Basic plan only increases the cost by about 40%, which is lower than other plans we analyzed. For the extra cost, you get coverage of 75% of your prepaid, nonrefundable trip expenses, as long as you cancel at least 48 hours before your scheduled departure.

Best travel insurance for seniors

The best senior travel insurance is the Gold plan sold by Tin Leg . It is an affordable travel insurance plan with travel medical primary coverage of $500,000 and a pre-existing conditions waiver if you insure the full amount of your trip within 14 days of your first trip deposit.

How much is travel insurance?

The average cost of travel insurance is 5% to 6% of your prepaid, nonrefundable trip costs .

How much you pay for travel insurance will depend on:

- The cost of your trip.

- Your destination.

- The length of your trip.

- The ages of travelers being insured.

- Your state of residence.

- The travel insurance policy you choose.

- The total coverage amounts in your policy.

- Any travel insurance add-ons you select.

Here are average travel insurance rates for a 30-year-old female who is insuring a 14-day trip to Mexico.

How much travel insurance should I buy?

Travel insurance companies typically offer several plans with varying maximum limits. The higher the coverage limits, the more you’ll pay for travel insurance.

Squaremouth, a travel insurance comparison site, recommends the following coverage limits for international travel:

- Emergency medical coverage: At least $50,000.

- Medical evacuation coverage: At least $100,000.

If you’re going on a cruise, or to a remote location, Squaremouth recommends:

- Emergency medical coverage: At least $100,000.

- Medical evacuation coverage: At least $250,000.

When evaluating travel insurance plans, our team of insurance analysts considered the best medical travel insurance policies to have at least $250,000 in emergency medical coverage and at least $500,000 in medical evacuation coverage.

When should I buy travel insurance?

The best time to buy travel insurance is within two weeks of making your first nonrefundable travel payment, whether it’s for a plane ticket, hotel stay, cruise or excursion.

Travel insurance costs the same whether you buy it early or last minute, and buying it early has added benefits:

- You may be able to add on “ cancel for any reason” (CFAR) coverage , an upgrade that is typically only available for a limited time after you’ve started paying for your trip.

- You may qualify for a pre-existing medical conditions exclusion waiver, meaning your pre-existing conditions will be covered by travel insurance. This waiver is generally added to your policy automatically, provided you buy the travel insurance within a certain window after your first trip deposit.

- You will be covered over a longer period of time for unforeseen events that could cause you to cancel your trip, such as medical emergencies, inclement weather and natural disasters.

Expert tip: You can buy travel insurance up to the day before you leave on your trip, but waiting may cost you the opportunity to qualify for a pre-existing conditions exclusion waiver or to buy a “cancel for any reason” upgrade.

Where can I buy travel insurance?

You can buy a travel insurance plan:

- Online. Visit a travel insurance company’s website to buy a policy directly or use a comparison website like Squaremouth or Travelinsurance.com to see your options and compare plans. You may also be able to purchase travel insurance online through an airline, cruise, hotel, rental car company or other provider you book a ticket with.

- In person. A travel agent or insurance agent may be able to assist you in buying travel insurance.

Travel insurance trends in 2024

Americans are changing the way they travel and this includes buying travel insurance when they might have skipped it in the past. As spending on trips continues to rise , travelers have more to lose if their plans are disrupted.

Based on travel insurance searches from Jan. 1 to April 1, 2024, here are the main benefits travelers are looking for.

Source: Squaremouth.com

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance of 2024. For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- $3,000, 8-day trip to Mexico for two travelers age 30.

- $3,000, 8-day trip to Mexico for two travelers age 70.

- $6,000, 17-day trip to Italy for two travelers age 40.

- $6,000, 17-day trip to Italy for two travelers age 65.

- $15,000, 17-day trip to Italy for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to France for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to the U.K. for four travelers ages 40, 40, 10 and 7.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

Best travel insurance FAQs

According to our analysis, WorldTrips has the best trip insurance. Two of its plans — Atlas Journey Preferred and Atlas Journey Premier — get 5 stars in our rating.

The best travel insurance policy for you will depend on what type of coverage you need. With so many different policies and carriers, the policy that was best for your friend’s trip to California might not be ideal for your trip to Japan. If you’re looking for the best travel insurance for international travel, you may be willing to pay more for higher coverage levels.

A comprehensive travel insurance plan bundles several types of travel insurance coverage, each with its own limits. To ensure you have adequate financial protection for your trip, your travel insurance policy should include the following travel insurance coverages:

- Trip cancellation . With trip cancellation insurance , you’re covered if you need to call off your trip because of a reason listed in your policy, such as unexpected illness, injury or death of you, a family member or a travel companion, severe weather, jury duty and your travel supplier going out of business.

- Travel delay. Once your trip has started, travel delay insurance reimburses you for unexpected expenses you incur after a minimum delay, such as five hours. It can cover needs like airport meals, transportation and even overnight accommodation.

- Trip interruption. If you need to cut your trip early for a reason listed in your policy, trip interruption insurance can reimburse you for any prepaid, nonrefundable payments you’ll lose by leaving early. It can also pay for a last-minute one-way ticket home.

- Travel medical . Emergency medical benefits are especially important if you need international health insurance for travel outside of the country. Your domestic health insurance may provide limited coverage once you leave the U.S. The best travel medical insurance pays for ambulance service, doctor visits, hospital stays, X-rays, lab work and prescription medication you may require while traveling.

- Emergency medical evacuation. If you’re traveling to a remote area, or planning excursions such as boating to an island, emergency medical evacuation coverage is a good idea. This coverage pays to transport you to the nearest adequate medical facility if you are injured or sick while traveling.

- Baggage delay. After a certain waiting period, such as six or 12 hours, this coverage will reimburse you for necessities you need to buy to tide you over while you wait for your bag to arrive. Be sure to save your receipts and look at your coverage limit, as some caps are low, like $200.

- Baggage loss. Baggage insurance can reimburse you if your bag never arrives, or if your personal belongings are stolen during your travels. Coverage limits apply here, as well as exclusions for certain items such as electronics.

“Typically, travelers are expected to pay their expenses out of pocket, and then file a claim for reimbursement,” said James Clark, spokesperson for Squaremouth. “However, there are medical situations in which a provider may be required to pre-authorize payment to make sure the policyholder receives the treatment they need.”

According to Clark, “Providers can pre-authorize payment for medical care and emergency evacuations. With that said, every circumstance is unique, and providers will handle each situation on a case-by-case basis.”

Travel insurance covers your prepaid, nonrefundable trip costs — as well as extra money you may need to spend due to unforeseen circumstances and emergencies — both before and during your trip.

Travel insurance coverage varies by plan, but in general travel insurance covers costs associated with these problems:

- Bankruptcy of a travel insurance company, such as your airline or tour operator.

- Dangerous weather conditions.

- Delayed and lost luggage.

- Illness or death in your family that requires you to stay home or cut your trip short.

- Illness that needs medical attention.

- Injury requiring medical evacuation.

- Jury duty.

- Travel delays and missed connections.

- Theft of your personal belongings while traveling.

- Unexpected job loss.

Travel insurance policies often exclude or limit “foreseeable” losses. Typical travel insurance exclusions include:

- Accidents or injuries caused by drinking or drug use.

- Canceling your trip because you changed your mind.

- Ending your trip early because you changed your mind.

- Losses caused by intentional self harm, including suicide.

- Losses due to war, civil disorder or riots.

- Medical tourism.

- Medical treatment for pre-existing conditions.

- Mental health care.

- Natural disasters that begin before you buy travel insurance.

- Non-medical evacuation.

- Normal pregnancy.

- Medical treatment related to high-risk activities.

- Routine medical care, such as physicals or dental care.

- Search and rescue.

Your U.S. health insurance may provide little or no coverage in foreign countries. Check with your health insurance company to see if you have any global benefits and ask how they work. If your health care does extend across the border, the benefits it provides abroad may not be the same benefits it provides domestically.

Medicare usually won’t pay for health care outside of the United States and its territories, so older travelers planning an international trip should look into the best senior travel insurance with robust medical benefits.

The best time to buy travel insurance is immediately after booking your trip and making a nonrefundable payment — in other words, as soon as you’re at risk of losing money. This way, you’ll know the total cost that you need to insure and you’ll have the longest window to take advantage of your policy’s benefits if something goes wrong.

You can’t wait until something goes wrong and then buy travel insurance to get reimbursed for your loss. Travel insurance only covers unexpected losses.

Travel insurance companies can decline to cover travel to certain countries. For example, you may find that some trip insurance companies don’t offer coverage to countries with a Level 4: Do Not Travel advisory from the U.S. State Department.

Travel insurance policies also frequently exclude certain risks that you’re more likely to encounter in Level 4 or Level 3 countries. For example, your policy may not cover losses related to declared or undeclared wars or acts of war or losses related to known or foreseeable conditions or events.

Some credit cards , such as the Chase Sapphire Preferred® Card , offer benefits such as trip cancellation and interruption insurance, baggage delay insurance and trip delay reimbursement when you use your card to pay for your trip.

Ask your credit card issuer for your card’s benefits guide to see what coverage you may have. Keep in mind that it may not cover all the risks you want to protect against, such as the cost of international health care or emergency medical evacuation .

Business travel insurance makes sense if you are self-employed and paying for your own travel expenses, or if you are traveling internationally and want medical coverage abroad.

You might also consider buying travel insurance for a business trip if your company won’t cover extra expenses if your flight is delayed or you need to head home early.

Cruise travel insurance can help protect you financially if you need emergency medical care in a remote location, or if a delayed flight causes you to miss embarkation and you need to pay extra to catch up to your cruise.

Experts caution that travel insurance you buy through a cruise line may not be as comprehensive as plans you can buy directly from travel insurance companies.

Some travel insurance plans cover rental cars as an optional upgrade, for an additional cost. The 5-star rated travel insurance companies in our rating offer these optional rental car benefits:

- Travel Insured International — Rental car damage and theft coverage of $50,000.

- WorldTrips — Rental car damage and theft coverage of $50,000 with a $250 deductible.

Travel insurance typically only covers a single trip, although your insured trip can have multiple destinations.

If you’re looking to insure several trips in the same year, annual travel insurance may be a good option for you.

Travel insurance may be required, depending on the country you plan to visit. But it’s smart to consider buying a travel insurance policy for international travel, even when it is not required. A good travel insurance policy can protect you financially if you need emergency medical assistance when traveling, or if you need to cut your trip short and buy a last-minute plane ticket home because an immediate family member is ill.

Wondering if travel insurance is worth it? What travel insurance covers

Editor’s Note: This article contains updated information from previously published stories:

- Spirit Airlines scrubs 60% of its Wednesday flights, says cancellations will drop ‘in the days to come.’

- ‘Just a parade of incompetency’: Spirit Airlines passengers with ‘nightmare’ stories want more than apology, $50 vouchers

- ‘This is not our proudest moment’: Spirit Airlines CEO says more flight cancellations expected this weekend

- Hurricane Irma: Flight cancellations top 12,500; even more expected

- Is an annual travel insurance policy right for you?

- How 2020 and COVID-19 changed travel forever – and what that means for you

- COVID-19 or delta variant have you ready to scrap your trip? Here’s how to cancel like a pro

- Sunday: Snow is over, but flight cancellations top 12,000

- After nearly 13,000 Harvey cancellations, Irma is new threat to airline flights

- What’s the difference between travel insurance and trip ‘protection’?

- How to choose the right travel insurance for your next vacation

- Travel insurance can save the day

- Angry passengers brawl after Spirit cancels flights

- What to do when travel insurance doesn’t work

- How lockdowns, quarantines and COVID-19 testing will change summer travel in 2021

- Travelers will pay and worry more on summer vacation this year. But they won’t cancel

- How to find a hotel with COVID testing and quarantine facilities wherever you travel

- Yearning to travel in 2022? First, figure out your budget – then pick a destination

- Pro tips for surviving a long flight during a pandemic: Get the right mask, bring a pillow

- Want to steer clear of contracting COVID-19 on your next vacation? Follow these guidelines

- Post-pandemic travel: Is it OK to ask another passenger’s vaccine status or request they mask up?

- These days, forgetting these important travel items could cost you thousands of dollars

- International travel hacks: When to book flights and hotels, how to deal with COVID-19 rules

- Traveling post-coronavirus: How do you book your next trip when so much remains uncertain?

- The COVID-19 guide to holiday travel – and the case for why you shouldn’t go this year

- Should you travel during the holidays? Americans struggle with their decision

- ‘There’s still pent-up demand’: What you should know about fall travel

- Planning for life after coronavirus: When will we know it’s safe to travel again?

- ‘Busiest camping season’: Travelers choose outdoor recreation close to home amid COVID-19 pandemic

- Considering a camping trip this summer? Tips to make sure your gear is good to go

- RVing for the first time? 8 tips for newbies I wish I’d known during my first trip

- Five myths about travel agents

- Should I buy travel insurance?

- Is travel insurance stacked against you?

- Five myths about travel insurance and terrorism

- These eight things could get your travel insurance claims rejected

- There’s a good chance that your credit card already gives you some kind of travel insurance coverage

- How to avoid a hotel cancellation penalty

- Change fees and travel insurance continue to rise

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Amy Fontinelle has more than 15 years of experience helping people make informed decisions about their money, whether they’re refinancing a mortgage, buying insurance or choosing a credit card. As a freelance writer trained in journalism and specializing in personal finance, Amy digs into the details to explain the products and strategies that can help (or hurt) people seeking greater financial security and wealth. Her work has been published by Forbes Advisor, Capital One, MassMutual, Investopedia and many other outlets.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

AXA Assistance USA travel insurance review 2024

Travel Insurance Jennifer Simonson

Cheapest travel insurance of April 2024

Travel Insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Outlook for travel insurance in 2024

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

The complete guide to corporate travel policies

Corporate travel policy (+ free template).

?)

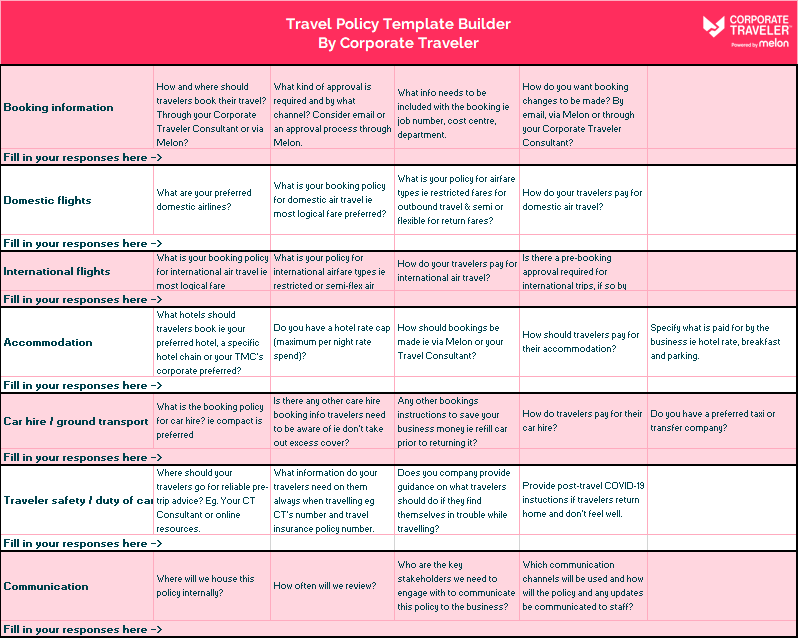

Start writing your own corporate travel policy with our comprehensive template

What’s inside our travel policy template.

- Introduction

- Travel booking process

- Expense categories

- Non-reimbursable purchases

- Expense reporting and reimbursement process

- Travel support, safety and duty of care

Section 1: Introduction

Section 2: travel booking process.

- How to book travel – What is your approved process, method and/or platform for booking business travel? If your company use a platform to enable travelers to book within policy , include the name of your approved booking platform. Otherwise, write out the name and contact details of the company or person they’re supposed to contact in order to request a booking.

- Approval process for senior management - the approval process for c suite and senior members of staff will likely differ from that of other employees. Senior management might require approval from an executive, and executives might require sign-off from other c suite members. All of this must be included in your policy.

- Use of loyalty programs – Many companies don’t allow travelers to collect points for their personal loyalty programs. But if you trust your travelers to do the right thing, you can allow this and include a line in your policy like “Employees may not choose more expensive options only to get loyalty points.”

- Leisure extensions – Sometimes business travelers want to extend their trip into the weekend, or use up some of their vacation days. You should include rules around leisure extensions (or “bleisure”), such as what cost difference is allowable for return flights. It's important to outline what expenses you will cover and what you consider "personal expenses" for "personal travel". Make clear that these are additional costs that do not fall within the ambit of business expenses under your travel policy.

- Traveling with non-employees - travel expenses related to travel with spouses, family members, pets or anyone outside of the company are not normally eligible for reimbursement. These situations can be subject to approval if they are accompanying staff members for business reasons such as attending a conference or for a networking event.

Section 3: Expense categories

Here’s the information to include in each expense category:.

- Approved tool or method for booking

- Preferred vendors (if any)

- Rules on whether or not business class is allowed, such as for flights over a certain duration, or flights taken by employees of a certain seniority level. Highlight whether travelers should go in economy class or business.

- How many days in advance international flights must be booked

- How many days in advance domestic travel must be booked

Accommodation

- Maximum nightly rates per city for hotel rooms

- Preferred vendors and negotiated rate details (if any)

- Rules on standard rooms and upgrades, for example standard rooms are required but room upgrades are allowed if offered at no additional charge

- Reimbursable hotel costs, such as parking

- Rules for booking Airbnb or apartment rentals

Rail travel

- Type of train ticket allowed, such as economy

Taxis and ride-sharing

- When taxis and ride-sharing is allowed, for example when public transportation isn’t viable

- Maximum amount per transaction

Rental and personal car

- Type of rental car class allowed, such as compact or mid-size

- The number of employees expected to share a rental car when traveling together

- How much is reimbursed per mile or kilometer

Conferences & events

- Expense reimbursement process for conference or event registration in cases where it was not pre-paid.

- Process for other conference or event related expenses such as business meals or anything not included in the registration cost.

Food, travel and entertainment

- Reimbursable amount, per breakfast

- Reimbursable amount, per lunch

- Reimbursable amount, per dinner

- Alternatively, a daily maximum or per diem

- Personal meal expenses throughout their trip

- Rules for business meals, such as who approves the amount

- Rules for client entertainment expenses, such as what is allowed

Personal telephone usage

- Cell phone bill amount or percentage that is reimbursable during the weeks that the employee travels. Clarify whether calls for personal reasons will be covered by your company.

- Whether or not personal phone damages or theft are reimbursable during business travel, and if so up to what amount?

Section 4: Non-reimbursable purchases

- In-flight purchases, not airfare

- Excess baggage fees

- Childcare, pet care, and pet boarding

- Costs for family members joining travelers on their trip

- Toiletries or clothing

- Airline club memberships

- Minibar purchases or bar bills

- Laundry or dry cleaning

- Parking fines or traffic violations

- Airline ticket change fees

- First-class rail transportation

- Premium, Luxury or Elite car rentals

- Movies, online entertainment or newspapers

- Spa and health club usage

- Flowers, sweets and confectionery

- Room service

- Additional beds or bedding

- Damage to personal vehicles

- Rental car company insurance

Section 5: Expense reporting and reimbursement process

- What tool to use for expensing

- What items do not need to be added in the expense tool, for example if a trip is booked with your approved booking tool

- Who to submit expense reports to

- What to include in reimbursement requests, such as original receipts

- Deadline for submitting reimbursement requests

- Typical processing time for receiving reimbursement

Section 6: Travel support, safety, and duty of care