- Travel Planning Guide

United Kingdom Travel Budget - Visit United Kingdom on a Budget or Travel in Style

- Is the United Kingdom Expensive?

- How much does a trip to the United Kingdom cost?

- UK On-Your-Own Itineraries

- Northern Ireland

- UK Hotel Prices

- UK Cities: Hotel Prices by City

- Best Family-Friendly Hotels in the United Kingdom

- Best Hotels for One Week in the United Kingdom

- Best Hotels for First Time Visitors in the United Kingdom

- Best Romantic Hotels for Couples in the United Kingdom

- Best Beach Hotels in the United Kingdom

- Best Pet-Friendly Hotels in the United Kingdom

- Best Hotels for One Night in the United Kingdom

- Best Hotels for Skiing in the United Kingdom

- Best Hotels for Scuba Diving in the United Kingdom

- Best Adults Only Hotels in the United Kingdom

- Best Party Hotels in the United Kingdom

- Best Luxury Hotels in the United Kingdom

- Best Cheap Hotels in the United Kingdom

- Best Hotels for a Weekend Getaway in the United Kingdom

- Best Business Hotels in the United Kingdom

- Hostel Prices & Reviews

- UK Activities

- UK Tour Prices

- The Best Family-Friendly Tours to UK

- The Best Hiking & Trekking Tours in UK

- The Best Historical Tours in UK

- The Best One Week (7-Day) Tours in UK

- The Best 3-Day Tours in UK

- The Best Bicycle Tours in UK

- Tours for Outdoor and Nature Lovers in UK

- The Best Christmas & New Years Tours in UK

- The Best Coach Bus Tours in UK

- The Best Adventure Tours to UK

- The Best Eco Tours in UK

- The Best Sightseeing Tours in UK

- The Best Cultural Tours in UK

- The Best Romantic Tours for Couples in UK

- The Best Tours Under $1000 in UK

- The Best Luxury Tours to UK

- The Best Budget Tours to UK

- The Best Tours for Seniors to UK

- Lake District National Park

- How much does it cost to travel to the United Kingdom? (Average Daily Cost)

- The United Kingdom trip costs: one week, two weeks, one month

How much do package tours cost in the United Kingdom?

Is the united kingdom expensive to visit.

- How much do I need for a trip to the United Kingdom?

- Accommodation, Food, Entertainment, and Transportation Costs

- Travel Guide

How much does it cost to travel to the United Kingdom?

You should plan to spend around $173 (£139) per day on your vacation in the United Kingdom. This is the average daily price based on the expenses of other visitors.

Past travelers have spent, on average for one day:

- $46 (£37) on meals

- $36 (£29) on local transportation

- $190 (£152) on hotels

A one week trip to the United Kingdom for two people costs, on average, $2,427 (£1,948) . This includes accommodation, food, local transportation, and sightseeing.

All of these average travel prices have been collected from other travelers to help you plan your own travel budget.

- Travel Style: All Budget (Cheap) Mid-Range Luxury (High-End)

- Average Daily Cost Per person, per day $ 173 £ 139

- One Week Per person $ 1,214 £ 974

- 2 Weeks Per person $ 2,427 £ 1,948

- One Month Per person $ 5,201 £ 4,175

- One Week For a couple $ 2,427 £ 1,948

- 2 Weeks For a couple $ 4,854 £ 3,897

- One Month For a couple $ 10,402 £ 8,350

Are You an Experienced Traveler?

Help other travelers! Answer a quick question about your past travels. Click here: let's do it!

How much does a one week, two week, or one month trip to the United Kingdom cost?

A one week trip to the United Kingdom usually costs around $1,214 (£974) for one person and $2,427 (£1,948) for two people. This includes accommodation, food, local transportation, and sightseeing.

A two week trip to the United Kingdom on average costs around $2,427 (£1,948) for one person and $4,854 (£3,897) for two people. This cost includes accommodation, food, local transportation, and sightseeing.

Please note, prices can vary based on your travel style, speed, and other variables. If you're traveling as a family of three or four people, the price per person often goes down because kid's tickets are cheaper and hotel rooms can be shared. If you travel slower over a longer period of time then your daily budget will also go down. Two people traveling together for one month in the United Kingdom will often have a lower daily budget per person than one person traveling alone for one week.

A one month trip to the United Kingdom on average costs around $5,201 (£4,175) for one person and $10,402 (£8,350) for two people. The more places you visit, the higher the daily price will become due to increased transportation costs.

Organized tours are usually more expensive than independent travel, but offer convenience and peace of mind that your trip has been planned by a travel expert.

The average price for an organized tour package in the United Kingdom is $284 per day. While every tour varies by total price, length, number of destinations, and quality, this is the daily average price based on our analysis of available guided tours.

- 3-Day Isle of Wight and the Southern Coast Small-Group Tour from London 3 Days - 10 Destinations $ 599

- 4 Day Cornwall, Devon & Stonehenge Small-Group Tour from Bristol 4 Days - 16 Destinations $ 800

Independent Travel

Traveling Independently has many benefits including affordabilty, freedom, flexibility, and the opportunity to control your own experiences.

All of the travel costs below are based on the experiences of other independent travelers.

The United Kingdom is a moderately priced destination to visit. It's about average with most other countries for travel costs. The prices for food, accommodation, and transportation are all fairly reasonable.

Within Europe, which is known to be an expensive region, the United Kingdom is moderately priced compared to the other countries. The overall cost of travel here is comparable to the Netherlands or Denmark.

For more details, see Is the United Kingdom Expensive?

How much money do I need for a trip to the United Kingdom?

The average United Kingdom trip cost is broken down by category here for independent travelers. All of these United Kingdom travel prices are calculated from the budgets of real travelers.

Accommodation Budget in the United Kingdom

Average daily costs.

Calculated from travelers like you

The average price paid for one person for accommodation in the United Kingdom is $95 (£76). For two people sharing a typical double-occupancy hotel room, the average price paid for a hotel room in the United Kingdom is $190 (£152). This cost is from the reported spending of actual travelers.

- Accommodation 1 Hotel or hostel for one person $ 95 £ 76

- Accommodation 1 Typical double-occupancy room $ 190 £ 152

Hotel Prices in the United Kingdom

Looking for a hotel in the United Kingdom? Prices vary by location, date, season, and the level of luxury. See below for options.

Find the best hotel for your travel style.

Actual Hotel Prices The average hotel room price in the United Kingdom based on data provided by Kayak for actual hotel rooms is $113. (Prices in U.S. Dollars, before taxes & fees.)

Kayak helps you find the best prices for hotels, flights, and rental cars for destinations around the world.

Recommended Properties

- Abergavenny Hotel Budget Hotel - Kayak $ 173

- East Horton Farmhouse Luxury Hotel - Kayak $ 114

Local Transportation Budget in the United Kingdom

The cost of a taxi ride in the United Kingdom is significantly more than public transportation. On average, past travelers have spent $36 (£29) per person, per day, on local transportation in the United Kingdom.

- Local Transportation 1 Taxis, local buses, subway, etc. $ 36 £ 29

Recommended Services

- One-Way Taxi Transfer from Stansted Airport to London Viator $ 189

- Windsor Castle - Private Transfer - Pickup & Return Viator $ 291

What did other people spend on Local Transportation?

Typical prices for Local Transportation in the United Kingdom are listed below. These actual costs are from real travelers and can give you an idea of the Local Transportation prices in the United Kingdom, but your costs will vary based on your travel style and the place where the purchase was made.

- Oyster Card £ 27

- Train to Gatwick Airport (2) £ 22

- Toll Way - Mersey tunnel £ 1.70

- Parking £ 1.70

- Parking in Manchester £ 3.00

- City bike hire Liverpool £ 6.00

- Parking £ 2.00

- Ferry to Isle of Wight £ 16

Food Budget in the United Kingdom

While meal prices in the United Kingdom can vary, the average cost of food in the United Kingdom is $46 (£37) per day. Based on the spending habits of previous travelers, when dining out an average meal in the United Kingdom should cost around $19 (£15) per person. Breakfast prices are usually a little cheaper than lunch or dinner. The price of food in sit-down restaurants in the United Kingdom is often higher than fast food prices or street food prices.

- Food 2 Meals for one day $ 46 £ 37

Recommended

- Traditional English Walking Food Tour With London Food Tours Viator $ 95

- Durham Food Tour Viator $ 94

What did other people spend on Food?

Typical prices for Food in the United Kingdom are listed below. These actual costs are from real travelers and can give you an idea of the Food prices in the United Kingdom, but your costs will vary based on your travel style and the place where the purchase was made.

- Lunch for 2 £ 23

- Lunch for 2 £ 46

- Nice lunch at Fleece £ 61

- Coffee (2) £ 4.80

- Turkish Delight £ 1.40

- 2 Coffees and Scones £ 5.80

- Soup at the Pub £ 5.90

- Lunch for 2 £ 17

Water Budget in the United Kingdom

On average, people spend $4.99 (£4.00) on bottled water in the United Kingdom per day. The public water in the United Kingdom is considered safe to drink.

- Water 2 Bottled water for one day $ 4.99 £ 4.00

Related Articles

The united kingdom on a budget.

At A Glance

- London is notoriously expensive. It's easily the cheapest city to fly into, but once you arrive you'll find your money quickly disappears. If you're hoping to keep costs down, spend more time in the other areas around the United Kingdom and less time in London. In the more rural communities you'll find that your expenses are far less.

- The countries that make up the United Kingdom each have their own set of bank holidays. Look at a calender before you schedule your trip to make sure that your vacation does not overlap any of these bank holidays. If it does, you will find that prices are higher and attractions are more crowded.

- There are many discount airlines that fly into and out of London and the United Kingdom. If you book tickets through one of these airlines, make sure that you understand all of the restrictions as well as what's included in the price. Some flights fly into inconvenient airports as well, so confirm that there are transportation connections available to where you need to go.

- If you're traveling by train, there are usually discounts available for children or groups. Also, there are regional railcards available if you plan to take several different trips within the area. Research all of the restrictions on these cards prior to purchasing them. If you do decide to buy single tickets, it is best to buy them in advance when the prices are often lower. Great Britain is an area where you will benefit from having a set schedule and itinerary in advance of your trip.

- There are several different bus companies available throughout the country. The buses are usually of high quality and they generally run on schedule. The more popular bus companies include National Express, Megabus, CityLink, and Dot2Dot. Some companies are focused on specific regions, while other serve the entire country. Some companies are also notoriously cheaper than others.

Top Tourist Attractions

Popular foods, more related articles.

We've been gathering travel costs from tens of thousands of actual travelers since 2010, and we use the data to calculate average daily travel costs for destinations around the world. We also systematically analyze the prices of hotels, hostels, and tours from travel providers such as Kayak, HostelWorld, TourRadar, Viator, and others. This combination of expenses from actual travelers, combined with pricing data from major travel companies, gives us a uniqe insight into the overall cost of travel for thousands of cities in countries around the world. You can see more here: How it Works .

Subscribe to our Newsletter

By signing up for our email newsletter, you will receive occasional updates from us with sales and discounts from major travel companies , plus tips and advice from experienced budget travelers!

Search for Travel Costs

Some of the links on this website are sponsored or affiliate links which help to financially support this site. By clicking the link and making a purchase, we may receive a small commission, but this does not affect the price of your purchase.

Travel Cost Data

You are welcome to reference or display our travel costs on your website as long as you provide a link back to this page .

A Simple Link

For a basic link, you can copy and paste the HTML link code or this page's address.

Travel Cost Widget

To display all of the data, copy and paste the code below to display our travel cost widget . Make sure that you keep the link back to our website intact.

- Privacy / Terms of Use

- Activities, Day Trips, Things To Do, and Excursions

How much does it cost to visit the UK? (Budget planning guide)

By: Author Tracy Collins

Posted on Last updated: August 5, 2023

One of the most important steps when planning your holiday is calculating what you need to budget for your trip. Use my guide and estimate the cost of a trip to the UK including flights, accommodation, transportation, tours and more .

When planning any trip the inevitable question of how much it will cost and what to budget for is a huge consideration for most of us. In this article I will go through the main costs you need to budget for when planning your trip to the UK.

Obviously, individual costs will vary depending on your interests and travel style – Are you travelling solo/with family? Are you a luxury or budget traveller? Are you planning to travel independently or with a tour? Etc

As with my UK trip planner (which helps you to plan your visit step by step) this guide to calculating UK trip costs will help you through the process of budgeting in a systematic manner whether you are a budget traveller or looking to splurge on your trip.

Why not download my printable budget trip planner to use as you work through the article?

UK Travel Planning Podcast

Flights to the uk, average accommodation costs, holiday home rentals in the uk, tickets and passes in london, tours and day trips, additional expenses, visit during the shoulder season, budgeting for popular destinations such as london, conclusion – how much does it cost to visit the uk.

Episode #57 : Insider tips for exploring the UK on a budget

Calculating how much a trip to the UK will cost

If you are flying to the UK from outside of Europe flights will probably be the most expensive part of your trip.

It is worth calculating the cost of your flights as early as possible in the budgeting process. I recommend using Skyscanner to find the average prices for the time of year you are planning to visit.

Enter your departure point and destination into the price tracker on Skyscanner and you will discover the *average prices across the month.

* Please to bear in mind that at present flight prices are best estimates and may be affected by Covid-19.

Accommodation in the UK

There are many accommodation options across the UK to suit all travel styles and budgets.

Accommodation in major cities and popular tourist destinations such as the Cotswolds and the Lake District will generally be more expensive but budget options are available if you book as early as possible.

Expect to pay more for accommodation in London than elsewhere in the UK. I recommend staying within close proximity of the main sights in London even though hotels, Airbnb and apartments may be slightly more expensive.

There is nothing worse than having a long day of sightseeing followed by a commute to accommodation on busy public transport.

Here are the average prices per double room per night depending on your preferences:

- Budget – Less than £65 per night (London £90 + per night)

- Mid-range – £65 – 120 per night (London £120+ per night)

- Luxury – £120+ per night (London £200+ per night)

There are a number of budget chain hotels in the UK which provide excellent accommodation options. These include Travelodge, Premier Inn, Ibis, Z Hotels, Holiday Inn and Novotel.

From cosy cottages in the Cotswolds , to log cabins with hot tubs in the Lake District, to castles in Scotland and luxury apartments in London there are many unique holiday homes available to rent across the UK.

Find the perfect holiday home rental for your stay in my accommodation guides to London , England , Scotland and Wales .

Read – UK Accommodation Guide

Transportation

If you plan to explore the UK there are a variety of transportation options available.

Renting a car is a great way to explore the countryside and areas which have limited or poor public transport options. However don’t forget to consider insurance, petrol, and parking fees when calculating costs.

Average costs for car hire in the UK per week are

- £100 + a week for a small car suitable for 2 people

- £160 + for a mid size car suitable for 4 people

- £250 + per week for a larger car, people carrier or SUV

Check car rental prices with RentalCars.com

Avoid driving in London (limited parking, traffic jams and the Congestion Charge are just a few reasons why)

If you do plan to pick up a hire car after a few days in London it is cheaper to do this at a train station outside of the capital.

Other ways to save money on car rental include hiring the car for a week or more (prices are more expensive for shorter rental periods) and to return the car to the same location. Of course, this is not always possible but it will reduce costs.

Read – Guide to renting a car in the UK – Practical tips and information

If you plan to visit the major cities across the UK travelling by train is an excellent way to get from A-B-C-D. Purchase tickets in advance (bookings open 90 days before the date of travel) or consider purchasing train passes for greater savings.

Check out the TrainLine for prices.

For budget-conscious travellers there are long-distance coach services to all major airports and cities. Do bear in mind that though this may be the cheapest option it is also the slowest.

Transfers from major airports such as from Heathrow into London can be taken by taxi, train or bus with dedicated express trains connecting to local public transport.

For travel around London purchasing a visitor Oyster Card is recommended prior to arrival. An Oyster Card is a reusable electronic ticket that enables access to London transport including the Tube and buses.

Read more about how to get around in London .

Read more – Guide to transportation in the UK

From fish and chips to pub food to 3 Michelin starred restaurants there are options for every budget in the UK!

To maximise your food budget visit markets, tea shops, pubs and fish and chip shops which can all offer reasonably priced food options. We also recommend looking for accommodation with breakfast included or booking an apartment or Airbnb so you can cater for some of the meals yourselves.

Supermarkets such as Sainsburys , Marks & Spencers and Tesco’s offer ‘Meal Deals’ of a sandwich, drink and packet of crisps/chocolate bar or piece of fruit for between £3 – £5.

Chain restaurants such as Nandos, Frankie and Benny’s, Harvester, Brewers Fayre, Bella Italia, Prezzo, Toby Carvery, Wagamama, Pizza Hut and Weatherspoons are found in major cities and are reasonably priced options.

Be careful with drinks though as it can push up costs. Often eateries will have speciality nights – curry/ steak for example with special offers such as 2 for 1 or a free drink.

If enjoying an afternoon tea is on your UK bucket list there are many options to choose from to suit all budgets and tastes.

You will find many different afternoon teas to choose from in London including traditional (The Ritz or Fortnum & Mason), themed (Harry Potter and Charlie and the Chocolate Factory) or afternoon teas with spectacular views (The Shard) Prices vary considerably but expect to pay on average from £40 a head in London

You can read more about different British foods you may co me across in this article.

Average costs

- Pub meal – £7 -11

- Main course in restaurant – £10 to £20

- 3 course meal in a good restaurant – £40 +

Sightseeing expenses

If you are heading to London the good news is that there are lots of free things to do there – many of the world famous museums and art galleries have no admission charges (there may be small fees for specific exhibits) but entry is free.

If you have a long bucket list of sights to see in London it is worth calculating if the London Pass is a cost-effective purchase.

The London Pass includes entry to 80 of London’s main attractions including the Tower of London , the London Eye , Westminster Abbey and the view from the Shard and could save you over 50% on regular gate prices. Pass holders can also skip the queue and avoid long waits for some of the most popular attractions.

Click here to find out how you could save money with the London Pass

There are a myriad of tours to choose from in London to suit all tastes and interests from walking tours, themed tours, tours with a historical focus, foodie tours or general sightseeing tours aimed at first-time visitors .

Costs vary depending on the group size with small group tours prices from £40 – £200 and larger group tours from £15 plus per person.

Private tours of London and attractions are available and can cost anything from £25 per person upwards.

Day tours to popular destinations outside of London such as the Cotswolds , Stonehenge and Oxford vary again in cost depending on distance, the number of places visited, inclusions and group size. Expect to pay approximately £75 + per person for a larger group tour from London (or any other major UK city)

Private day trips to destinations outside London cost from around £500 + for 4 persons.

If you are on a budget costs for tickets, tours and day trips can really mount up. I recommend identifying which places are the most important for you to visit (for every destination you include in your UK itinerary) and calculating and comparing the costs of an organised tour or day trip with regular gate prices or the cost of travelling to the attraction independently.

I recommend taking insurance out as soon as your flights are booked. Not only will insurance provide peace of mind in the event of a trip cancellation but it also ensures you are covered for medical emergencies while away.

Travel insurance may also provide coverage for loss or theft of items, flight delays and even repatriation to your country of origin in the event of a medical emergency.

Obviously the cost of insurance will vary depending on your country of residence, your age, any existing medical conditions and level of cover.

We never travel without insurance. It is just not worth the risk.

Don’t forget to add a few ££’s a day towards some of the additional expenses you can expect.

Adding an extra £5/10 per day to cover these smaller daily costs should cover it.

- Wifi and internet access charges – The cost of accessing wifi will depend on which option you choose – read my detailed guides to the various options for internet access in the UK

- Tipping – Tipping is not expected in bars. Restaurants 10% of the bill is fine if service was not included in the bill. Black cabs round up to the nearest £

- Storing luggage – £5 for up to 24 hours

- Souvenirs – Budget a small amount towards any souvenirs you may wish to purchase.

How to reduce costs when visiting the UK

If you are visiting the UK during the summer (particularly late July and August) expect prices to be higher.

During UK school holidays (one week at the end of May/beginning of June and 6 weeks from July to early September) prices increase and availability may be limited.

Prices fall during the shoulder season March-May and September-October and the weather is generally not too bad (expect showers and sunny spells)

London is an expensive city to visit but there are ways to reduce your costs.

- Purchasing an Oyster Card and using public transportation (which is the easiest, quickest and cheapest way to get around London )

- If you plan to visit a number of popular sights and attractions a London Travel Pass may be the most cost effective way. Read my complete guide to the London Pass and save money when you visit London

- There are lots of free things to do in London including many of the world’s best museums, such as the British Museum or the Natural History Museum. Read more – 32 free things to do in London

- Read my budget guide to London for more tips and suggestions.

- Read my guide to visiting London for first time visitors which includes some essential tips to reduce costs

While everyone’s trip budget will be different depending on the length of your stay, accommodation choices, transportation, travel style etc this budget guide will have given you an idea of the cost of your trip to the UK.

To help you further why not download my UK Budget Planner sheet ? The sheet will enable you to keep track of all your expenses as you plan your trip.

Finding the Universe

Travel tales, photography and a dash of humor

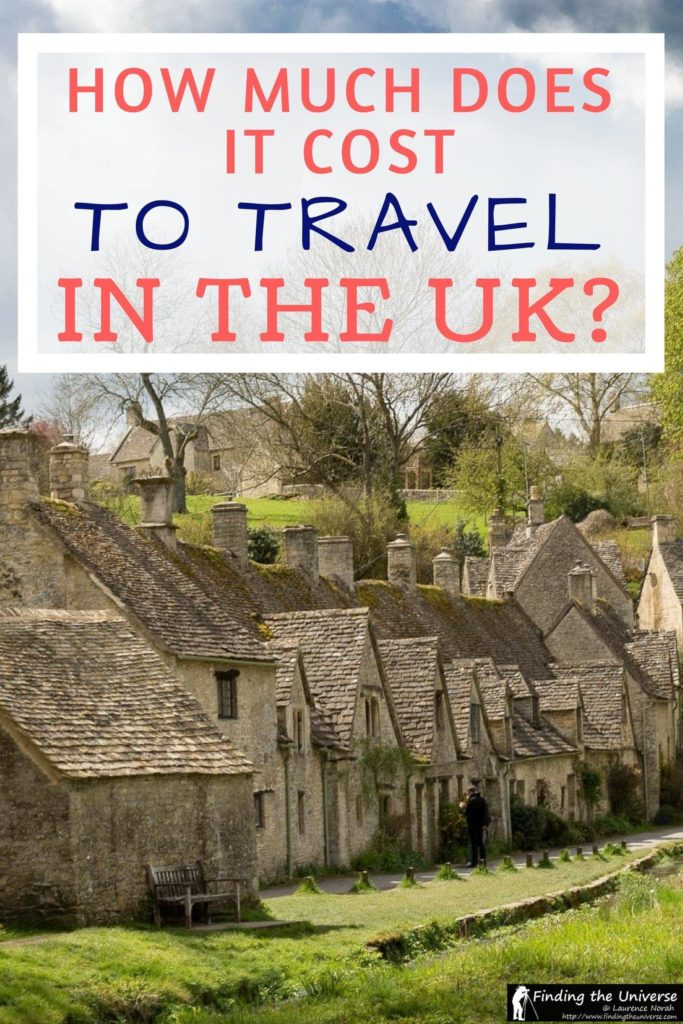

How Much Does it Cost to Travel in the UK?

Last updated: April 19, 2024 . Written by Laurence Norah - 28 Comments

One of the most common questions we’re asked from people who read our UK guides, and in particular our detailed one week and two week UK itinerary posts is: how much does it cost to travel in the UK?

Of course, the answer is – it depends! There are a lot of factors to consider, from your travel style (budget to luxury) through to who you are travelling with (solo, family, group), and the kind of travel you want to do (self-drive, group tour, etc).

Then of course there are the attractions you are interested in visiting, the time of year you visit – there are just so many variables to take into account. Which makes answering the question quite tricky!

But we’re going to tackle it anyway. In this post I’m going to go through all the major costs you need to consider when planning a trip to the UK, and provide budget ranges for each of them.

This should give you some good ideas of what a trip like this might cost. We’ll also provide some money saving tips for each area.

Let’s get started.

In summary, you are looking at between £75 and £200 per day per person for travel in the UK. These costs will of course vary depending on your travel style, sights visited, type of transport used and dining choices.

In this post we’re going to go into detail on the four main cost areas you need to consider when travelling in the UK. These are:

- Accommodation

- Sightseeing

We’re going to look at each of these individually to give you some cost ideas. At the end of the post we’ll then put these together to give ideas of a total trip cost for the UK for a few different travel styles.

1. Transport Costs for Travel in the UK

There are a number of ways to travel in the UK. To start with, there is an excellent public transport network in the UK which includes long distance bus services (also called coaches in the UK), a good passenger rail network and multiple low cost airlines.

Our preferred way of travel in the UK (and abroad), is to self-drive where possible. We find it gives us the greatest flexibility, letting us stop when we want to, and not have to be strict about following a timetable. Of course, depending on the type of trip you want to do, this might not be the best option – if you’re only visiting cities for example, we recommend using public transport to get between them.

Price of Car Rental in the UK

- Budget : £100 – £150 per week for a small car that will fit two people and luggage

- Mid-range: £200 – £300 per week for a mid-range car that will fit four people and luggage

- High-end: £400 – 600 per week for a small SUV or car capable of carrying more than five people

Money Saving Tips for Car Hire in the UK

Book by the week. Most car hire companies offer better rates if you book for a week rather than a few days. Of course, there’s no point booking for a week if you only need the car for a day or two, but you might find that seven days is cheaper than six for example. We have also found that when we book a car for two or three weeks, many hire car companies have given us a free upgrade to say thanks for our custom.

Pick up your hire car on leaving the city. In the UK, there is really no need to have a hire car in a city. UK cities are for the most part easy to get around either on foot, or have excellent public transport networks. Your hire car will likely spend its time costing money in an expensive parking lot. So just book your rental for when you leave the city.

Don’t pick it up at the airport. If you can avoid picking up your hire car at the airport, you will usually save money. Most car hire companies charge higher rates for cars picked up at the airport – it’s a combination of a trapped market and a convenience factor. Compare prices between the airport and the city, and if you can get to the city easily from the airport, and the price is better, do that.

Avoid one-way trips where possible. Most car hire companies will charge you extra if you want to drop the car off in a different place to where you picked it up. We have actually done this many times – the key is to find a car rental company that charges minimal one-way fees. In our experience, Enterprise is pretty good for this.

Don’t forget the fuel costs. Fuel in the UK is relatively expensive compared to somewhere like the USA. Thankfully, the majority of cars are quite fuel efficient and distances aren’t that great. However, fuel prices vary wildly. Generally, the cheapest fuel can be found at supermarkets, such as Asda, Tesco and Sainsbury’s. The most expensive fuel is usually along the motorways, at the service stations.

Avoid additional fees: The way that hire companies bump up their revenues is by charging you for a lot of addons when you come to pick up your car. These can include everything from a GPS unit through to extra insurance cover. Many of these are not truly necessary, and some travellers might find that their credit card already offers things like Collision Damage Waiver insurance. So definitely check in advance what addons you need, so you don’t fall prey to high pressure sales tactics at the rental desk.

Use a comparison service: For car hire, we usually use a comparison search site that lets us compare prices across multiple providers at the same time. We recommend searching for your car rental on Discover Cars here . They compare a range of providers so you can find the best deal for your trip. Just make sure when comparing prices that additional fees like one-way drop offs are covered.

Consider your age: Car hire companies around the world give better rates to what they consider to be more experienced drivers. Younger drivers, particularly those 21 and under, can pay hefty surcharges for car rental. Usually, drivers over 30 get the best rates. If you are travelling in a group of different ages, consider renting the car in the name of the older driver. Just be aware that you might need to pay more to add additional drivers, so be sure that the named driver is happy to do all the driving if necessary.

Price of Public Transport in the UK

Public transport in the UK is difficult to put a price on as there are huge variables depending on where you are going, how far in advance you book, and how you travel (bus, train, plane) – as well as if you choose to travel in standard class or a more premium class.

As an example though, a one way single ticket from London to Edinburgh by train (~4hr 30 min) would cost you around £150. If you book the same trip in advance, you could go on the same journey for as little as £25 one-way.

A similar journey by coach would take between 10 and 15 hours, and cost between £16 and £80.

You could also fly, which would take around an hour of actual flight time (although you would need to factor in the time of getting to and from the airport and check-in). Flights with a budget airline from London to Edinburgh for example start from as little as £13 (with no luggage!), and go up to around £200.

Money Saving Tips for Public Transport in the UK

Book in advance. For planes, buses and coaches, the best prices are available if you book well in advance, and if you can be a little bit flexible with your timings. Avoid travelling at peak times (usually 0630 – 0930 & 1530 – 1830).

Use the right booking site. For train tickets, we recommend The Trainline, which we have found to be the most user friendly option. Opt to pick up your tickets from the station to avoid postal charges, or use their e-ticket option. They also let you book tickets for destinations all across Europe, and so are a handy one stop shop for all your ticket needs.

For long distance buses, there are a number of operators to choose from. The two we would recommend are National Express and Megabus , both of which offer a wide range of routes across the country.

For flights, we suggest a good comparison engine that includes the budget airlines – we recommend Kiwi.com .

Go carry on only. If you choose to fly, packing carry-on only can save you a good amount in baggage fees. Just be aware that UK airlines have different baggage size standards to other airlines around the world, so always check with the airline first.

2. Accommodation Costs for a UK Trip

Accommodation is one of the major costs for any travel, and a UK trip is no different. Of course, the question “how much does accommodation cost in the UK?” is not straightforward, and there are multiple factors to consider – everything from time of year through to the level of comfort and service you need will affect the price.

There are lots of options for accommodation in the UK, so whatever your budget, we are confident you will be able to find something to suit your travel needs.

Our costs are based on two people sharing a private room, but there are other options of course, including dormitory accommodation in hostels, if you are looking to save even more.

Price of Accommodation in the UK

- Budget: £40 – £100 for a budget room for two people, usually this would be an en-suite room. Dorm rooms are also available, think around £25 per bed.

- Mid-range: £100 – £150 would get you a nice room for two in most parts of the country

- High-end: £250+ would normally be the starting point for a room in a luxury property, although deals can be had, see below for more information

Money Saving Tips for Accommodation in the UK

Travel off-peak. If you can travel in the quieter times of year, such as January and February, particularly in less visited parts of the UK, you can score some remarkable deals. For example, we stayed in this luxury hotel near Inverness for £70 per night including breakfast in February. The same room in June is over £300!

Check the hotel website for deals. Whilst we love booking engines for their convenience, sometimes we find that a particular property has a special deal running that’s only available if you check their website. These might be things like three nights for the price of two, or free breakfast if you book direct.

Book online. We use booking.com extensively for our travel accommodation. After making five bookings, we qualified for their extra “Genius” discount, which often scores us an extra 10% off. We also like that they list everything from hostels to apartments to hotels of all categories, making it an excellent one-stop shop for our accommodation needs.

Use Alternative Accommodation Providers . There has been an explosion in options in the accommodation market over the last decade or so. If you’re on a tight budget, definitely consider websites like Couchsurfing. There are lot of options out there to help you find great value accommodation, so take advantage of them. Take a look at our guide to AirBnB Alternatives and holiday accommodation websites for the UK for more inspiration.

3. Food Costs for a UK Trip

The UK used to have a pretty poor reputation when it came to food, but thankfully over the last ten – twenty years this has improved a great deal, and you can now get really fantastic meals as you travel. That said, dining in the UK is not particularly cheap, although there are some ways to reduce the costs.

One thing to note, for US readers in particular, tax is always included in menu prices in the UK, so what you see is what you pay. Service is not included, but tips are appreciated.

Price of Dining in the UK

- Budget: £5 – £10 per person per meal at a fast food restaurant or takeaway style meal

- Mid-range: £10 – £30 per person per meal at a mid-range restaurant or nice pub style meal

- High-end: £35+ per person per meal at a nice restaurant

Money Saving Tips for Dining in the UK

Drink less. Drinking with a meal can really push your budget up. Even soft drinks can be quite expensive in the UK, so if you can stick with tap water with your meal, you can save a fair bit of money.

Find deals. Whilst not as common as say France, you can still find good deals in the UK for dining out. Many restaurants will offer early-bird dining specials for example, for dining at times earlier than usual, such as 5pm – 6.30pm. Others may have special menu deals, where you can get a two or three course meal at a discount at lunchtime.

Fast food. Don’t forget the fast food chains if you’re looking for cheap and easy food on the go. As well as reducing your time spent eating if you’re having a full day of exploring, these can be very cheap. To really save money, skip the extras, and find the really cheap menu items. For example, you can normally buy a single hamburger at McDonald’s for under £1. Two of those and a medium fries will keep you going for a while.

Small cafes. If fast food doesn’t do it for you, consider stopping off at a small cafe. Often attractions have these, as do department stores and other high-street locations. Normally they have a small selection of well priced menu items, such as a soup and a sandwich, or a baked potato with a filling. Usually these meals will come in at under £5 per person.

Supermarket meals. If you’re ok with a cold meal, a reliable cheap option is to get a meal from a supermarket such as Marks and Spencer. These places usually have an extensive range of sandwiches and other snacks, often very well priced. You’ll be able to get a sandwich, snack and a drink for under £5 in most cases. Plus you can then find somewhere pretty to eat it and dine al fresco! Other options for cheap eating include chains like Eat and Pret a Manger, which also offer soups and hot items.

Cook for yourself. To really save money on your food in the UK, you should opt to cook for yourself if you can. Obviously this will need a bit of forward planning, as you’ll need to book accommodation that includes cooking facilities, such as a self-catering holiday cottage, or a hostel with a kitchen. Cooking for yourself can really save you money though.

Eat the included breakfast. If you’re staying at a hotel or bed and breakfast that includes a breakfast (or other meal), make sure you take advantage of it, as that saves you the cost of a meal.

4. Sight-seeing Costs for a UK Trip

Sight-seeing costs in the UK will really vary depending on what you are interested in seeing. There are lots of free attractions, including many museums and outdoor sights, that won’t cost you anything at all.

There are also other trips and activities, such as day trips to specific sights you might want to see (for example Stonehenge from London ) that you will want to book a tour for. If you are thinking about taking a tour, we can recommend Rabbie’s , who offer small group tours in the UK & Ireland. We also recommend Viator who offer a huge range of tours in the UK .

Costs for sight-seeing in the UK

Costs will vary tremendously depending on what you are interested in. Museums and other attractions like stately homes range from free to around £25 per person at the upper end of the scale, although £6 – £12 per person is a more common cost.

Note that many of the major museums in the UK are free, like the Natural History Museum in London, or the National Museum of Scotland, for example.

If you decide to take a tour, the price of these will vary depending on a number of factors. Private tours will cost more than group tours for example, and multi-day tours will be more expensive than day trips.

As a guide, a day trip from London, such as a visit to Stonehenge will cost you between £50 and £110 , depending on duration and inclusions. This price is fairly reflective of day trip prices from cities around the UK – see our guides to day trips from Edinburgh , day trips from Glasgow and day trips from Inverness for more inspiration.

Multi-day group tours will cost more, usually in the region of £75 – £150 for each day of the trip. When comparing tours like this, always check what is included and what isn’t – for example, some tours will include accommodation and attraction entry, and others won’t.

Private multi-day group tours are the most expensive option of all, and you should look to budget in the region of £500 – £1000 per day for this sort of tour, which will usually include the cost of your driver and vehicle, with accommodation costs added on top.

Money Saving Tips for Sight-seeing in the UK

Get a City-based Attractions Pass. If you’re planning on visiting a lot of attractions in the same city, you will probably find that an attractions pass will save you money. For London, we recommend the London Pass (see our review here ). For Edinburgh, there’s a good pass that covers Edinburgh’s royal attractions .

Get a society membership. For certain types of attraction in the UK, such as historical homes and castles, you can save money with a membership to the organisation that manages the properties.

In the UK, there are a number of these, but the key organisations are the National Trust and English Heritage .

For English Heritage, visitors to the UK can purchase either a full year long English Heritage membership or a special English Heritage Overseas Visitors Pass .

The latter pass is specially designed for overseas visitors who might want to visit a few attractions on a visit, but who might not get the full value from a yearlong membership.

For the National Trust, the story is similar. You can either join the National Trust, or get a visitor pass here .

Visit on free Days. Sometimes museums and attractions in the UK will have free days where you can visit for free. Check the attraction’s website or social media accounts for details of when these might be.

Use qualifying concessions. Many attractions offer discounts to different demographics – for example based on your age or eligible military service. It’s always worth checking if you qualify for a discounted price. If so, make sure you carry proof of your eligibility, for example, if it’s an age-based discount, carry official government issued ID like a driving license or passport so you can prove your age.

In Summary: How Much Will a UK Trip Cost you?

Assuming two people are travelling together in the UK, using a hire car to get around and staying in private hotel rooms with en-suite facilities, our suggested costs per person per day would be as follows:

- Budget : £50 – £100

- Mid-range: £100 – £250

- High-end: £300+

So, for a trip like our suggested two week UK itinerary , you would likely be looking at the following total approximate costs for two people for a two week UK trip.

- Car hire: £300 – £600 + fuel (~£100 – £200)

- Accommodation: £700 – £2000+

- Food: £300 – £1000

- Sight-seeing / tours: £200+

- Total: from around £750 per person

Of course, you can spend a little less or a lot more, depending on your travel style, but these ballpark figures should give you an idea of costs.

Also, don’t forget to include any visa costs, travel insurance, additional sightseeing, nice meals out, souvenirs, and of course, the cost of getting to and from the UK.

Further Reading for Planning your UK Trip

Hopefully in this post we’ve answered the question of how much does it cost to travel in the UK. To further help with planning your UK trip beyond the budgeting side, we have a lot more content that we think you will find useful.

- For itinerary ideas covering the whole UK, check out our 1 week and 2 week UK itineraries . These are self-drive itineraries, so do check out our guide to driving in the UK for tips.

- If you’d rather not drive yourself, we have a UK itinerary by public transport

- If you’re heading to Scotland, we have a 7 Day camping itinerary for the North Coast 500 , as well as a detailed North Coast 500 Planning Guide and a guide to our favourite B&B’s on the North Coast 500

- A two day Edinburgh itinerary & 21 Highlights in Edinburgh

- A Two Day Glasgow and Loch Lomond itinerary

- A guide to 10 of the best Stately Homes in England

- For London, we have some detailed itineraries to help you plan your visit. These include a 1 Day London Itinerary , a Two Day London itinerary , a 3 day London Itinerary and a Six Day London itinerary

- The top Harry Potter sites in London

- The Best Photography Locations in London

- Tips on Buying and Using the London Pass

- Our favourite Things to Do in Kensington

- A guide to things to do in Portsmouth

- The Highlights of Oxford

- Things to do in Cambridge

- Visiting Blenheim Palace and the Cotswolds

- 20 Things To Do in Dublin

- A Guide to Touring the Scottish Borders

- If you want a physical (or digital!) book to accompany your travels, then Amazon do a good line in UK Travel Guides , and there is naturally a Lonely Planet and a Rough Guide to the UK available.

And that’s it for our guide to how much it costs to travel in the UK! We hope you found it useful – as always you’re welcome to share your questions and feedback in the comments below.

Enjoyed this post? Why not share it!

There are 28 comments on this post

Please scroll to the end to leave a comment

Toni Hendrix says

7th October 2022 at 12:59 am

Hello, A friend and I are in our 70’s and would like to do a month+ trip perhaps in April-May 2023 so that we can see a bit more, thinking Wales, Scotland, England, Ireland. Sort of a retirement blowout! Have we lost our minds…definitely! We’re debating about various ways to travel, where to stay,etc. One of us has had Covid but no shot and the other has all shots and still got Covid. Do we both need to be vaxed? We both have Donne ancestral research and would like to see castles in our lineage: Compton in Devonshire, Bamburg, Strickland & Devonshire. She has taught school overseas and I have been. flight attendant and done some travel. Hopefully, we can figure out a rational way to do this. Is there any hope? Thank you!

Laurence Norah says

7th October 2022 at 2:23 pm

Sounds like a fun adventure! So currently you don’t need to be vaccinated to travel to the UK. You can see the latest rules here , which you will want to check before you travel. You will also want to check the rules for the country you are traveling from so you can get back home. I’d also add that things can change very quickly, so vaccination requirements for example might be reintroduced if a new strain appears. So if possible being vaccinated might make that easier, because getting a vaccination whilst abroad is likely to be challenging. Whatever you choose though, good insurance is a good idea to cover any eventualities.

I definitely think you can do the trip you mention. Given that your trip is to a few different locations you might find renting and driving a car is going to be the easier option for getting around.

Have a great time!

Ann E. McCollister says

5th February 2022 at 6:36 am

I’m 70 years old, not well off, always wanted to go to UK (England, Ireland, Scotland). Saved $2000 (!), want to make a trip with my 3 sisters before I die. I appreciate all the advice and suggestions you’ve made and will share with my sister’s and investigate further. Cheerio and much thanks, I want to do what YOU do! You needn’t reply but encouragement would help. Afraid my dream won’t be fulfilled. Annie

6th February 2022 at 12:45 pm

It’s lovely to hear from you. I am sure that with your budget the three of you will be able to make the trip happen. There are lots of good value accommodation. I’d recommend looking for good value B&B’s where breakfast is normally included. If you are happy to drive, renting a car between the four of you will be quite inexpensive. Alternatively, we can also recommend the Rabbie’s Tour company – they do really good value tours all around the UK and are a great alternative to driving yourself.

I am very sure you will be able to realise your dream. The main cost is likely to be your flight, but luckily there are lots of routes. I’d suggest signing up for something like Google Flights and their alerts for prices.

I’m also happy to offer more specific input and help if you need it, it’s no trouble at all. If you have any questions, fire away!

21st May 2020 at 4:50 pm

Dear Laurence,

Have you ever balanced the costs (in time and money) of car rental,parking and accomodation in UK?

Car rental is relatively unexpensive compared to public transport and hotels whilst unconvenienlty located accomodation sites tend to be more affordable.

Many times, having a car allowed me to stay on those far away locations and swiftly reach my daily tourist destination by car.

On the other hand, parking availability and costs sometimes bars me from reserving otherwise most convenient accomodation sites.

21st May 2020 at 4:55 pm

I haven’t done the maths precisely. The challenge is that public transport costs can vary hugely, depending on how far in advance you book it. The same ticket booked 8 weeks in advance might cost £20, wheras the same day price might be £200. So if you are able to plan in advance and be flexible with dates and times, it can be more affordable.

We prefer to travel by car if we can though, as it’s just a lot easier for the more remote locations. Public transport in the UK is great for cities and towns, but outside of this you start to rely on slower and less regular local bus routes, which will really slow a trip down. For our UK itineraries, my suggestion is usually to start in London, and to only pick up the hire car after you have done the sightseeing in the city. Outside London, parking is generally a lot easier to find and less expensive.

10th February 2020 at 7:19 am

This is great information! Many thanks. I am planning 19 nights in GB in August with my daughter. We want to drive with a train perhaps from London to Edinburgh. One travel agent here in Australia told me he couldn’t find a hire car company that would add my daughter as a second driver due to her age. She will be 21 with an open licence for more than a year. Surely this is not so!!! Are you able to reassure us that we will both be able to drive?

10th February 2020 at 1:28 pm

Thanks very much! So the legal age for renting a car in the UK is 21, however unfortunately many car hire companies set a minimum age of 25 or 23. This is down to each company having their own policy and approach to risk. However, some companies will rent to drivers at 21, such as Sixt – so it is possible. However, they charge hefty fees for the privilege, of up to £39 per day! I wasn’t able to find any other rental companies, but it’s possible if you contact local smaller car rental agencies that you might be able to find a better deal.

Best of luck, and have a great trip!

Sue Knauf says

13th January 2020 at 4:18 pm

So pleased to have come across your informative website. We (my husband & I) are looking planning a trip to the UK. We prefer rural rather than cities & hope to spend most of our time exploring Scotland (including some of the outer islands) & Ireland. We tend to ‘wing’ our travels rather than be highly organized. Our quandry is whether to hire a car & find accommodation each night or hire a small campervan. I have heard campervans can be a pain on the narrow roads in rural area’s. We are looking to travel probably in July. Would your answer be different if we came in May?

13th January 2020 at 4:27 pm

Lovely to have you here as a reader 🙂

So a smaller campervan will generally be fine as long as you are used to driving a manual vehicle and don’t mind reversing and driving on the left. I believe based on where your e-mail address suggests you are from that neither of these will be an issue for you.

I would say that based on your preference to wing it, that a campervan is going to make more sense. Whilst it will be more expensive than a normal car, you can get smaller vehicles ( Spaceships just launched in the UK with a range of options for example) which should be reasonably priced and easier to manoeuvre. However, the main reason for suggesting this is that winging it in the Scottish Highlands in both May and July can be a risky approach. Accommodation can book out weeks and sometimes months in advance, and not booking ahead definitely runs the very real risk of having to drive for hours to find somewhere to stay (accommodation is spread out and the roads are slow). Combine this with the fact that there are large areas with no cell phone coverage, and this would end up just being a stressful trip.

So for that reason alone, having your own bed is going to be a lot less stressful.

May and July are both popular times. May is usually busier for normal accommodation, whilst July tends to have more families and campers. May is our favourite month to travel in Scotland though, as you can usually avoid the dreaded midge 😉

We have a range of content on Scotland to help with your planning, I’d say our NC500 camping itinerary would be a great starting point.

Let me know if you have any more questions!

Renuka Rajput says

7th January 2020 at 12:51 pm

Hello I am really glad to find your website. We are planning to travel UK in March as planing to few liverpool matches at that time. Will it be good time to travel or will it be too cold to explore tourist destination.

Thanks in Advance.

7th January 2020 at 3:10 pm

Hello Renuka,

I will try to help 🙂 It is hard to answer because everyone has a different definition of cold. If you are coming from a tropical country, then March in the UK might seem cold, however if you are travelling from somewhere like Canada, it will feel warm!

Generally, March should be fine though. Temperatures will likely be between 12C and 16C, which in my opinion is good for sightseeing. March is also a good month as it won’t be too busy with tourists. You will want to bring some warm layers and also either an umbrella or raincoat, as rain is likely. That said, rain is a possibility all year in the UK.

I hope this helps 😀

11th April 2019 at 6:05 am

Hi, really great sharing with much details for travelling in UK. Wonder if you have any suggestions for travel to Manchester and thereabouts?

11th April 2019 at 11:25 am

I haven’t visited Manchester for a while, despite living there for a period many years ago. So I don’t currently have any up to date recommendations, however, we hope to visit Manchester soon and fix that!

Rosemary Anderson says

23rd March 2019 at 6:50 pm

I love your site and have found great ideas for my family’s upcoming trip.

One question: We are doing a home exchange with a family who has offered to let us use their car–which is great. But we have looked (quite a bit!) online, and it seems to be very difficult to get insurance on anything other than a rental car. Do you have any suggestions?

Thanks, Rosemary

23rd March 2019 at 7:10 pm

Hi Rosemary!

Thanks very much 🙂 So this is an interesting question. Normally in the UK the car insurance policy is associated with a specific driver (normally the owner and then any other drivers) rather than some countries where you insure the car and then anyone can drive it.

My initial response is that I’m not sure exactly how you would go about doing this. Based on my experiences driving friends cars in the UK, they have had to ring their insurance to add me as a named driver. However, I don’t know exactly how this works with non-UK licenses, nor do I know how it might affect their insurance should something happen.

I did a search, and whilst this service does exist, it doesn’t seem to cover US license holders, only holders from specific countries like those in the EU, Switzerland, Australia and New Zealand.

The only company I found that does seem to include US drivers was this one: https://www.hertsinsurance.com/walkabout/

I have never used them and I can’t comment on what they cover or if they are any good, but it might be worth a try!

Good luck 🙂

13th January 2019 at 2:36 am

Wow, just found your itinerary and I’m going to follow it, with a couple minor tweaks to the schedule when I go June 1st with my husband and son. Thanks for all the great advice and mapping it out. Mona

13th January 2019 at 9:48 am

Our pleasure Mona – have a great trip, and let us know how it goes!

Paul Gadsdon says

23rd December 2018 at 4:24 pm

You will find UK car hire half the price of the US. You can get a small car for £80 a week

Also dont forget all UK national museums (about 300 or so), are free

23rd December 2018 at 4:32 pm

Thanks for your input! I’ve updated the budget hire car price. I think £100 – £150 is reasonable, I’ve taken a look on various sites and for various dates, and it’s a definite struggle to get a week of car hire with unlimited mileage for much less than that.

I’ll make a point about the free museums too 🙂

Thanks again!

Cheang PY says

26th November 2018 at 2:00 pm

Awfully glad to have found your website. Very informative. 6 of us retirees (age 57-80) are planning to self-drive UK for 2 weeks, visiting Cornwall and Wales. Would like advice on accommodation (homestay/airbnb?), etc. Thank you.

27th November 2018 at 11:21 am

Our pleasure. With a group, an AirBnB or similar would be a great idea, as you can usually get more for your money. Our only advice is to only book places with good reviews. The best option is simply to search a site like AirBnb (we also have a list of Airbnb alternatives here, ) for the dates and number of people for the destinations you want to visit, and work from there.

Have a great trip!

19th January 2019 at 4:14 pm

Thank you for your suggestions. We are also looking at mpv for hire for six. Is it cheaper to get the vehicle at the airport? Thank you.

19th January 2019 at 4:24 pm

My pleasure. If you mean in comparison to booking in advance, I would say in general it will be more expensive booking car hire at the airport.

If you mean will it be cheaper picking up from the airport or from another location, usually it is cheaper to pick up a car from an location different to the airport, as airport car hire is nearly always more expensive than city locations, due to the convenience.

Samara says

29th July 2018 at 9:55 am

Great read! I appreciate the in depth breakdown. Just got to London and am going to be following your 2 week itinerary religiously!

29th July 2018 at 12:28 pm

Thanks very much! Have a great trip – do let us know if you have any questions 🙂

Ryan Smith says

3rd May 2018 at 3:03 pm

Thanks a ton for all the useful information about cost of traveling in UK, it saves me so much time Googling for the guide like this. Thank you 🙂

3rd May 2018 at 7:11 pm

My pleasure – have a wonderful trip!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Let me know when there's a reply to my comment (just replies to your comment, no other e-mails, we promise!)

Subscribe to our monthly Newsletter where we share our latest travel news and tips. This also makes you eligible to enter our monthly giveaways!

We only ask for your e-mail so we can verify you are human and if requested notify you of a reply. To do this, we store your data as outlined in our privacy policy . Your e-mail will not be published or used for any other reason other than those outlined above.

Reimbursements

Employee Travel Expenses in the UK

Business trips are often a welcome change from the daily office routine or working from home. However, they are always associated with costs and subsequent administrative work to settle the corresponding expenses . We provide an overview of what employees need to consider when it comes to travel expenses and how they can best benefit from tax exemption.

What are employee travel expenses?

Travel expenses arise from work-related activities away from the place of residence and the primary place of work. The primary place of work is considered to be the place where the employee works on a regular basis. If companies bear the costs for such business trips by employees, they can be deducted from tax under certain circumstances. If the conditions are met, business trips are exempt from tax. Both the employee and the employer can benefit from this if they provide evidence of the travel costs incurred.

But what kind of costs count as travel expenses? In summary, these are all costs that incur during the trip and serve to ensure its successful completion. This means not only travel costs, but also expenses for food and accommodation to keep up one’s strength. In addition, there are ancillary travel expenses such as parking fees and telephone charges.

Which travel expenses can employees claim?

- public transport

- hotel accommodation

- food, as well as drinks

- congestion and toll charges

- parking fees

- professional telephone calls

- printing costs

If these expenses are incurred during a business trip and for business purposes, they can be exempted from tax. Expenses of a private nature that arise during a business trip, for example from a private visit to a museum, cannot be claimed.

Employee travel expenses reimbursement

If employees want to settle their travel expenses, they have several options. The most profitable one: they forward their travel expenses in full to their employer, submit all the relevant receipts , and the employer transfers the total amount to the employee’s account. The employer can then post the expenses and have them exempted from tax.

In case the employer is reluctant to pay for the employees’ travel expenses, they can reclaim the tax from the government themselves under certain conditions. However, to claim back the tax, HMRC has specified certain rules for employees:

- The travel expenses exclusively incurred for work-related reasons.

- The employee has covered these travel expenses personally.

- The employer does not reimburse the employee for the travel expenses.

- The employer has not provided the employee with a suitable alternative.

- The employee pays taxes.

To benefit from tax exemption on certain expenses, the employee must of course be a taxpayer in the first place. To claim tax exemption for expenses, these must be submitted with supporting documents to HMRC within four years of the end of the tax year in question.

When is the trip a business trip?

To understand under which conditions employees can deduct their travel expenses from tax, it is first necessary to clarify what actually constitutes a business trip – and what does not. For HMRC, there are two permissible types of business travel. Option one: the traveller visits a customer in another city on behalf of the company, for example, to maintain contacts – a time-limited trip that serves a specific purpose. Or the employee travels to a certain location to carry out work: e.g., a construction site or a temporary workplace such as a branch office.

The daily commute from home to the permanent place of work, however, is explicitly not considered a business trip and cannot be recognised for tax purposes. Furthermore, if you do not travel from home to your usual place of work in the morning, but to another place that is the same or a shorter distance away, this travel cannot be exempt from tax either – only business trips that go beyond the usual distance.

Permanent or temporary workplace compared

The duration of the employee’s activity at a specific place of work is the decisive factor for the question whether a trip to work is tax-deductible or not. Commuting to the permanent place of work – for instance, to the office where the employee usually works and which is mostly specified in the employment contract – is not deductible from tax. However, if the employee must work temporarily somewhere else, for example at a branch office in another city, the journey to this place can be claimed for tax purposes. But this only applies for 24 months: if the employee is required to work there for a longer time, the place is considered to be the new permanent place of work.

Reimbursements with Moss: More freedom for your team

When does work from home turn into a permanent workplace?

Since the onset of the corona pandemic in 2020, work from home has become increasingly popular. More and more employers are allowing or even encouraging their employees to work from home. It is becoming very common to let employees choose their preferred place of work themselves. But what does this mean for employees in terms of tax?

It depends: if the employee only works from home because of a personal decision, every trip to the office is considered commuting – and is thus not tax-deductible. But if the employer decides that the employee must work from home – for example, because there is no office at all anymore – the home office is the new permanent workplace. Every trip to another place of work then becomes a business trip and is deductible from tax.

Which travel expenses can be deducted by employees?

Not all kinds of expenses incurred on a business trip are tax-deductible. Private costs arising from a business trip may not be submitted to HMRC. It is not always that easy to distinguish between private and business-related costs – often the transition is fluent. So: what is deductible and when?

The expenses being deductible are:

- work-related travel not to or from the permanent workplace

- dinner and breakfast when a business trip runs overnight

- accommodation costs during a several-day business trip

- food and drink on a business trip; either the actual costs or the fixed rates set by HMRC

- all travel expenses related to official business, such as: public transport, congestion, toll and parking charges, telephone calls, printing costs, etc.

Non-deductible are:

- the regular way to the permanent workplace

- travel expenses not strictly related to work, e.g., the private visit to a museum, a sightseeing tour, or recharging a travel card

- penalty charges, e.g., tickets for illegal parking or speeding

Costs for food

To keep your strength up on a business trip, daily meals obviously play a crucial role. However, when away from home, it is difficult to cook or prepare food on your own, which is why frequent restaurant visits are customary. But: HMRC does not automatically exempt every restaurant visit. Instead, it has set limits up to which the costs can be deducted each day.

The respective limit depends on the length of the journey.

There is also a cap of £5 for breakfast. For dinner after 8pm the cap is £15.

Business travel mileage

If employees use their own vehicle for business travel, they can, up to certain limits, recover the costs from their employer – who in turn can claim them for tax purposes. Employers can pay the so-called “approved amount” without having to report it to HMRC. These payments are referred to as mileage allowance payments.

The approved amount is calculated by multiplying the employee’s annual mileage by the rate applicable to the vehicle. This rate depends on two factors: the type of vehicle and the total number of miles driven on duty.

Up to the approved amount, the employer can bear the employee’s expenses without having to declare this to HMRC. If, on the other hand, more expenses are covered, these additional costs are considered as employee salary and lead to corresponding tax payments.

If the employer does not pay the mileage allowance payments or not the full amount up to the approved level, the employee can claim the difference for tax exemption – also known as mileage allowance relief. In other words: the employee’s business travel mileage is either paid in full by the employer or the employee can claim tax exemption.

Moss: business travel made easy

Those who have completed a business trip do not want to spend a lot of time afterwards settling their travel expenses, submitting applications to their employer, or having to go through the hassle of declaring them in their tax return.

With Moss, there is a way to help employers to make work easier for their employees: through smart expense and invoice management that makes expense reports obsolete. This is because Moss gives employees the freedom to pay for all work-related expenses independently and responsibly during a business trip using a corporate card . Thus, travellers do not have to lay out the costs for accommodation, food, and transport, but can conveniently pay with a real or with a virtual corporate card – with an individual budget limit precisely tailored to the trip.

All receipts from the trip can be uploaded instantaneously via the web or mobile app – and the tedious expense report becomes completely superfluous. This allows employees to focus entirely on their work from the beginning to the end of the trip. It also saves time for the accounting department.

Reimburse with Moss: Give freedom to your team

Employee travel expenses are costs incurred by an employee on a business trip – for example, for means of transport, meals, or accommodation. The trip must be work-related and the external work assignment must not last longer than 24 months. Otherwise, the travel destination is considered a permanent place of work to which a trip is not tax-deductible.

Employees can either have their travel expenses reimbursed by their employer or submit them to the tax authorities themselves to benefit from a tax exemption. To have the costs reimbursed by the employer, all receipts for the trip must be collected and passed on. If the employee pays the costs personally and is indeed a taxpayer, a tax exemption can be claimed from HMRC.

All costs incurred on a business trip for professional reasons can be deducted – from transport costs to toll and congestion charges or parking fees to meals. This also includes overnight stays, charges for business telephone calls, or printing costs.

If employees use their own vehicle on a business trip, they can either have these costs covered by the employer or have them exempted from tax. The annual amount is calculated depending on the number of miles travelled and the type of vehicle.

For a business trip, you can either claim lump sums for meals or the actual costs – but only up to a certain limit. For a journey of 5 hours or more the limit is £5, for 10 hours or more it is £10 and for 15 hours or more it is £25. Breakfast can be deducted at £5 and dinner after 8pm at £15.

A business trip is defined by HMRC either as a short trip with a clear purpose – such as meeting a client somewhere other than the permanent workplace – or a longer trip to another place of work, such as a branch office. However, the maximum length for such external duty is 24 months.

- Latest Posts

Our digital content is for information purposes only and does not constitute legal or tax advice. All content is compiled with the utmost care. However, they do not replace binding advice and are not guaranteed to be correct or complete. We do not assume any liability. For individual advice, please consult a lawyer or tax advisor.

Related Posts

Data Protection | Imprint | Terms & Conditions | Cookie Consent

This card is issued by Transact Payments Limited pursuant to licence by Mastercard International Incorporated. Transact Payments Limited is authorised and regulated by the Gibraltar Financial Services Commission. Mastercard is a registered trademark and the circles design is a trademark of Mastercard International Incorporated.

Save up to 500 Hours on Paperwork 🙌 50% Off for 3 Months. BUY NOW & SAVE

50% Off for 3 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

- Online Accountants

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Track project status and collaborate with clients and team members

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Businesses With Employees

- Businesses With Contractors

- Self-Employed

- Freelancers

- Marketing & Agencies

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- A Beginner’s Guide to MTD

- Reports Library

- FreshBooks vs Quickbooks

- FreshBooks vs Xero

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Help Center

- Business Loan Calculator

- Markup Calculator

- VAT Calculator

Call Sales: +44 (800) 047 8164

- All Articles

- Productivity

- Project Management

- Making Tax Digital

Resources for Your Growing Business

Hmrc travel expenses – guidelines to claim tax in the uk.

Whether you’re flying to a convention or driving to meet a client, there’s a chance you’ll need to spend on travel as a part of your business. In many cases, this business travel qualifies as an eligible expense that you can deduct from your profits when you file your income taxes. By familiarising yourself with the HMRC travel expenses guidelines for employers, employees, and self-employed people, you can make the most of this expense deduction and save your taxes.

Key Takeaways

- Business travel expenses are costs you pay when you travel for work.

- If your travel expenses are exclusively for business, you may be able to claim them as an HMRC expense deduction.

- Eligible expenses include transportation, accommodation, and meals while travelling for business.

- Employers don’t need to pay tax on reimbursements for employee travel expenses for work.

- Employees usually submit a travel expense claim to their employer, then claim any remaining amount from the HMRC.

- Self-employed people can claim travel expenses against their profits on their income taxes.

- Travel to a temporary workplace is eligible for travel expenses, but commuting to a permanent workplace is not.

- In lieu of claiming travel expenses reimbursement with receipts, the HMRC offers a per diem option.

Table of Contents

What are Travel Expenses?

Travel expenses basic rules, travel expenses for employers, travel expenses for employees, travel expenses for the self-employed, what are permanent and temporary workplaces, what are per diem rates, what is the 24-month rule for hmrc, how to claim travel expenses from hmrc, start managing your expenses with freshbooks.

- Frequently Asked Questions

Business travel expenses are costs you’ve incurred while travelling for work. This includes everything from accommodation to meals, so long as the expenses are exclusively related to your business. It’s important to note that there’s a difference between business travel expenses and personal travel expenses—for example, if you add a few days of personal holiday to the end of your work trip, expenses incurred during the personal time won’t be eligible for deduction.

The primary rule for HMRC travel expense deductions is that any costs you claim must be necessary and exclusively for your business. This means that you can’t really claim tax relief for things that are a mix of business and personal or expenses that aren’t necessary for your business. However, so long as your expenses are for the purpose of your work trip, they’ll likely be eligible. Some common eligible HMRC expenses are: