What to expect from China’s travel rebound

Back in 2019, mainland China was the world’s largest outbound travel market with over 150 million outbound travelers. 1 China’s Ministry of Culture and Tourism. Since then, strong COVID-19 safety measures, including quarantine on arrival, have all but eliminated China’s inbound and outbound travel.

China recently announced that quarantines will be removed on arrival from January 8 2023. This is similar to Hong Kong’s announcement in September 2022 that it would drop mandatory quarantine on arrival.

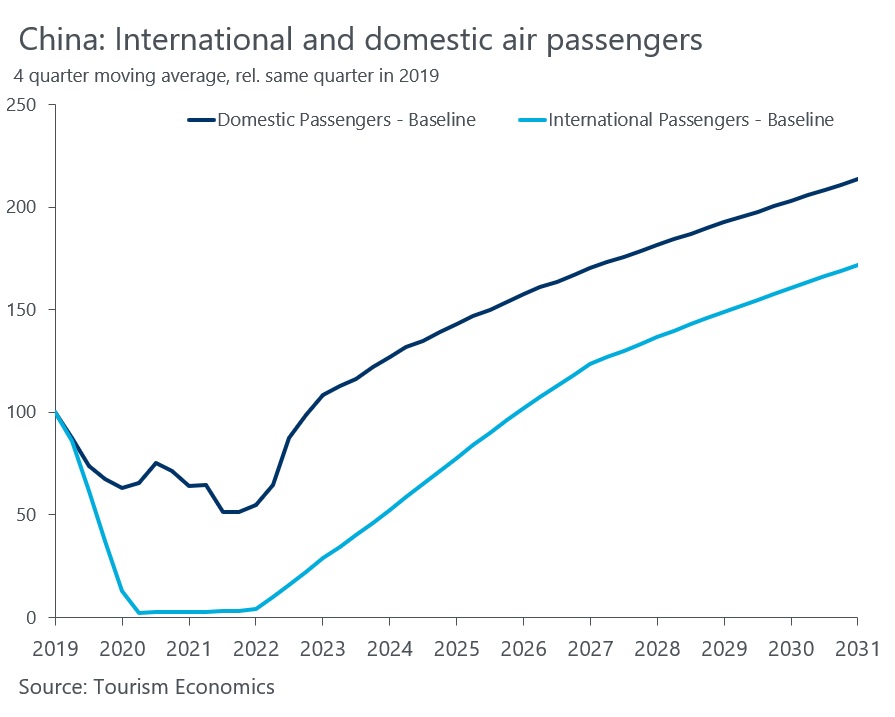

If mainland China’s air travel were to follow Hong Kong’s recovery curve, mainland China would see four million air passengers a month by April 2023, pushing air travel back up to 40 percent of preCOVID-19 levels (exhibit).

This raises two questions: Will mainland China’s rebound look like Hong Kong’s? And, are airlines ready for this demand boom?

Will mainland China’s rebound look like Hong Kong’s?

In all cases, globally, when travel restrictions ease, demand jumps. Travel to visit friends and relatives, to study, and urgent business travel rebound first. Leisure travel for vacations follows quickly afterwards.

Mainland China shares the same wanderlust as Hong Kong. There is massive pent-up demand for international travel of all types. In a recent McKinsey survey, 40 percent of Chinese travelers said they wanted their next trip to be international, with Australia/New Zealand, Southeast Asia, and Japan being the most desired destinations.

However, the resurgence will likely be slightly slower for mainland China than Hong Kong, for four reasons.

First, many travelers—maybe 20 percent—have had passports expire during the COVID-19 period, and China has not been renewing these passports. Renewals are now possible, but the backlog will slow travel’s rebound by a few months.

Second, most destinations require visas for mainland Chinese travelers. Some countries have deliberately restricted issuing these visas, in response to China’s tight inbound visa policy. This is likely to ease now, but again, backlogs will take time to work through. By comparison, most Hong Kong travelers do not need visas. Third, outbound tour groups from the mainland require approval for travelling, which will also take time.

Finally, inbound travel to China will return—but not immediately, given the current COVID-19 waves in the country combined with factors that may deter travelers such as China requiring a PCR test 48 hours before departure.

Put together, we expect a strong rebound, but it may be slightly later than observed in Hong Kong.

Are airlines ready for this demand boom?

The Chinese carriers seem ready for the opening up. Chinese airlines did put some aircraft into long-term storage, but fewer than 100 Chinese widebody aircraft remain in storage. There are over 200 large aircraft that can be reactivated quickly for international flying.

Pilots have been re-trained in expectation for a reopening. In December, the Civil Aviation Administration of China (CAAC) required airlines to give pilots the flying opportunities needed to reactive their licenses by January 6 2023. Few pilots in China left the industry. Airports in China have mostly retained staff. Airlines’ ground operations teams are at more than 90 percent of pre-pandemic size.

International carriers will likely take longer to rebound. Many international airlines continue to have challenges with too few long-haul aircraft. European carriers, for example, retired more than 10 percent of the widebody fleet during the pandemic, and have been caught short with the strong travel rebound. Some airlines, especially US carriers, have shortages of crew and pilots. Many international carriers have hub airport constraints, with some major hubs still struggling to handle pre-COVID-19 levels of demand.

These factors combined imply that international carriers are likely to be slower adding back capacity than the home-based Chinese carriers.

China’s travelers and travel industry welcome the relaxation of restrictions. The next few months will be a scramble to get capacity back in the air. A strong demand recovery, coupled with frictions in bringing back supply, is likely to mean ticket prices into and from China remain elevated for the coming months, until supply can fully come back online. For the longsuffering travel industry, the future is bright at last.

Steve Saxon is a partner in McKinsey’s Shenzhen office.

Explore a career with us

Related articles.

China’s theme parks face a new era

- Work & Careers

- Life & Arts

Blog | 20 Mar 2023

China travel recovery: Timings are clear, but magnitude remains uncertain for 2023

Jessie Smith

Economist, Tourism Economics

The late December announcement of China’s intention to re-open its borders for travel took the international community by surprise, with little time to prepare. Border re-opening fell just before Lunar New Year, which proved to be significantly stronger than the last with domestic travel reportedly at 89% of 2019 levels and an initial surge in both inbound and outbound visits, albeit to levels well below those in 2019. With the Lunar New Year marking the kick-off of China’s re-opening, questions follow about the shape and scale of China’s return to travel across 2023. Some observers expect the rebound to be rapid, but there are reasons to take a more measured view.

We remain cautious in our Global Travel Service (GTS) outlook for China’s outbound travel recovery. For the first half of the year, focus will be on short-haul travel, particularly to Hong Kong, Macau, Thailand, and Japan. Hong Kong International Airport reported a 2,900% YoY increase in passengers in January 2023, following the easing of both its and China’s travel restrictions. Despite this growth, January visits only reached a third of pre-pandemic levels. Moving into the second half of the year we expect a wider-spread, longer-haul recovery.

There are several significant challenges to recovery, and it is possible that travel growth could be even weaker this year than in our conservative baseline outlook. Pre-existing capacity constraints will be worsened by the lack of clear communication around re-opening. The logistics involved with reinstating China to the global travel network takes time, and the lack of warning ensures both a delayed return to travel and some excess demand. In early February Chinese travel agencies resumed overseas package tour sales—a notable portion of pre-pandemic outbound travel—but initial bookings data indicate that demand remains subdued.

Significantly inflated prices, both due to limited flights and higher fuel prices, are perturbing some buyers. We expect supply constraints to loosen across the year, but in the short term some excess demand may arise from a lack of financially viable options for travellers. Higher air travel costs are likely to remain into the medium term as jet fuel costs remain elevated, placing pressure on air fares while many airlines service high debt levels accumulated during the pandemic. Long-haul travel from China to Europe in particular will also face higher costs for some carriers as longer routes may be required to avoid the air space restrictions imposed by Russia. The limited lead time also applies to passport and visa processing, which will constrain the bounce back in demand due to limited application processing capacity, which had been halted for the last three years.

Though household savings have accumulated throughout the pandemic, these are comparatively modest due in part to subdued income growth over the pandemic, capping the rate of consumer-led recovery . This reduced willingness to spend is also coupled with clouded consumer confidence. Although January 2023 held a small increase in Chinese consumer confidence from 2022’s record lows, it still sits well below levels seen in the past 20 years. Alongside a lack of consumer confidence, many individuals in China remain hesitant about travelling internationally, thus some domestic for international travel substitution will continue in the short term.

Chinese outbound travel had seen rapid growth pre-pandemic, attributed to a burgeoning middle-class coupled with falling prices. While the era of lower transport costs appears to be over, the growing wealth across China remains a key feature of its outbound travel growth potential. The key question is how strong the bounce back in Chinese outbound will travel be in 2023. Our upside scenario estimates Chinese outbound travel could reach 48% of 2019 levels in 2023, compared with 64% in our current baseline, amounting to 17.4 million additional Chinese travellers this year. However, as economic forecasts show hampered consumer spending due to low consumer confidence and depressed income growth, outbound travel recovery this year may not be as buoyant as people may hope.

While destinations eagerly await the return of Chinese travellers, outbound travel recovery relies heavily on sentiment change, and cautious behaviour is unlikely to disappear overnight. As one industry expert put it, “People have waited for three years—there is no need to rush.”

+44 1865 268 900

Oxford, United Kingdom

Jessie is an Economist within the Tourism team, publishing research and analysis on tourism and travel trends, with a particular focus on the Americas region. Jessie has also been involved in consultancy projects for a range of clients including Airbnb, Booking.com, and the World Travel and Tourism Council.

Jessie joined Oxford Economics after graduating with a first-class honours degree in Economics from the University of Exeter along with industry experience. After completing her placement year at the Department for Work and Pensions, specialising in Universal Credit strategy around children, Jessie also rebranded the Government economics schools outreach programme, improving the diversity of students studying economics in further education.

You may be interested in

Chloe Parkins with BBC: Paris will benefit from the Olympics, but not immediately during the Games

Despite the excitement and media frenzy surrounding the Paris Olympics, the city has experienced a perhaps unexpected dip in tourism. Chloe Parkins, Senior Economist at Oxford Economics, joined the BBC to shed light on the issue.

CrowdStrike update grounds thousands of flights

On July 19, a faulty update from CrowdStrike's Falcon cybersecurity software caused widespread "Blue Screen of Death" (BSOD) errors on millions of Microsoft Windows devices, severely impacting many industries including air travel.

2024 Paris Olympics: Impact on Tourism and Beyond

The Olympics are set to push Paris ahead of France in terms of recovery, with international arrivals into Paris rising to 15% above 2019 levels.

Select to close video modal

Select to close video modal Play Video Select to play video

Non-Rating Action Commentary

China’s Airports See Strong Recovery on Domestic Air Travel Demand

Mon 24 Apr, 2023 - 1:01 AM ET

Related Content: China Airport Watch: 1Q23 Fitch Ratings-Hong Kong-24 April 2023: The opening up of Chinese aviation markets after the dismantling of Covid-19 restrictions has created an upsurge in demand, boosting passenger traffic significantly in 1Q23, Fitch Ratings says in its first China quarterly airport traffic monitor. Air passenger traffic almost tripled in 1Q23, against 4Q22, recovering to 80% of the 2019 average level, due largely to a strong rebound in domestic passengers, figures showed. Traffic on domestic routes responded rapidly to the easing of restrictions, with a 114% increase in January from December. However, the recovery in international traffic is more tepid and lags behind the domestic surge. Not yet fully resumed overseas routes, residual hesitation on travelling and certain Covid tests in place are still weighing on the international recovery pace. Only 2.24 million international passengers were carried in 1Q23 or 12% of the 2019 level. However, we expect the pent-up demand for travel and gradual opening up of the border will propel a more substantial recovery in the international passenger market in the medium term despite the subdued performance. Cargo traffic usually has lower volumes in the first quarter of the year, due mainly to the disruption of the Lunar New Year with factories closing ahead of the holiday. The softening global economic demand and higher inflation environment also affected the relatively weak cargo performance in 1Q23. Still, unlike passenger traffic, cargo transport displayed great resilience during the pandemic. We expect airport traffic in China will continue to show an uptick in growth through 2023 and move the industry closer to its normalised level. We expect a full-year recovery to 2019 levels by end-2024, based on current projections. The recovery pace will, however, hinge more on the traffic profile, along with individual factors of each airport. For the full report, “China Airport Watch: 1Q23”, please go to www.fitchratings.com or click on the link above. Contact: Zoey Wang Director +852 2263 9859 [email protected] Fitch (Hong Kong) Limited 19/F Man Yee Building, 68 Des Voeux Road, Central Hong Kong, Hong Kong Sunny Huang Director +852 2263 9979 Media Relations: Jack Li, Beijing, Tel: +86 10 5957 0964, Email: [email protected] Wai Lun Wan, Hong Kong, Tel: +852 2263 9935, Email: [email protected] Additional information is available on www.fitchratings.com All Fitch Ratings (Fitch) credit ratings are subject to certain limitations and disclaimers. Please read these limitations and disclaimers by following this link: https://www.fitchratings.com/understandingcreditratings . In addition, the following https://www.fitchratings.com/rating-definitions-document details Fitch's rating definitions for each rating scale and rating categories, including definitions relating to default. Published ratings, criteria, and methodologies are available from this site at all times. Fitch's code of conduct, confidentiality, conflicts of interest, affiliate firewall, compliance, and other relevant policies and procedures are also available from the Code of Conduct section of this site. Directors and shareholders’ relevant interests are available at https://www.fitchratings.com/site/regulatory . Fitch may have provided another permissible or ancillary service to the rated entity or its related third parties. Details of permissible or ancillary service(s) for which the lead analyst is based in an ESMA- or FCA-registered Fitch Ratings company (or branch of such a company) can be found on the entity summary page for this issuer on the Fitch Ratings website. In issuing and maintaining its ratings and in making other reports (including forecast information), Fitch relies on factual information it receives from issuers and underwriters and from other sources Fitch believes to be credible. Fitch conducts a reasonable investigation of the factual information relied upon by it in accordance with its ratings methodology, and obtains reasonable verification of that information from independent sources, to the extent such sources are available for a given security or in a given jurisdiction. The manner of Fitch's factual investigation and the scope of the third-party verification it obtains will vary depending on the nature of the rated security and its issuer, the requirements and practices in the jurisdiction in which the rated security is offered and sold and/or the issuer is located, the availability and nature of relevant public information, access to the management of the issuer and its advisers, the availability of pre-existing third-party verifications such as audit reports, agreed-upon procedures letters, appraisals, actuarial reports, engineering reports, legal opinions and other reports provided by third parties, the availability of independent and competent third- party verification sources with respect to the particular security or in the particular jurisdiction of the issuer, and a variety of other factors. Users of Fitch's ratings and reports should understand that neither an enhanced factual investigation nor any third-party verification can ensure that all of the information Fitch relies on in connection with a rating or a report will be accurate and complete. Ultimately, the issuer and its advisers are responsible for the accuracy of the information they provide to Fitch and to the market in offering documents and other reports. In issuing its ratings and its reports, Fitch must rely on the work of experts, including independent auditors with respect to financial statements and attorneys with respect to legal and tax matters. Further, ratings and forecasts of financial and other information are inherently forward-looking and embody assumptions and predictions about future events that by their nature cannot be verified as facts. As a result, despite any verification of current facts, ratings and forecasts can be affected by future events or conditions that were not anticipated at the time a rating or forecast was issued or affirmed. The information in this report is provided 'as is' without any representation or warranty of any kind, and Fitch does not represent or warrant that the report or any of its contents will meet any of the requirements of a recipient of the report. A Fitch rating is an opinion as to the creditworthiness of a security. This opinion and reports made by Fitch are based on established criteria and methodologies that Fitch is continuously evaluating and updating. Therefore, ratings and reports are the collective work product of Fitch and no individual, or group of individuals, is solely responsible for a rating or a report. The rating does not address the risk of loss due to risks other than credit risk, unless such risk is specifically mentioned. Fitch is not engaged in the offer or sale of any security. All Fitch reports have shared authorship. Individuals identified in a Fitch report were involved in, but are not solely responsible for, the opinions stated therein. The individuals are named for contact purposes only. A report providing a Fitch rating is neither a prospectus nor a substitute for the information assembled, verified and presented to investors by the issuer and its agents in connection with the sale of the securities. Ratings may be changed or withdrawn at any time for any reason in the sole discretion of Fitch. Fitch does not provide investment advice of any sort. Ratings are not a recommendation to buy, sell, or hold any security. Ratings do not comment on the adequacy of market price, the suitability of any security for a particular investor, or the tax-exempt nature or taxability of payments made in respect to any security. Fitch receives fees from issuers, insurers, guarantors, other obligors, and underwriters for rating securities. Such fees generally vary from US$1,000 to US$750,000 (or the applicable currency equivalent) per issue. In certain cases, Fitch will rate all or a number of issues issued by a particular issuer, or insured or guaranteed by a particular insurer or guarantor, for a single annual fee. Such fees are expected to vary from US$10,000 to US$1,500,000 (or the applicable currency equivalent). The assignment, publication, or dissemination of a rating by Fitch shall not constitute a consent by Fitch to use its name as an expert in connection with any registration statement filed under the United States securities laws, the Financial Services and Markets Act of 2000 of the United Kingdom, or the securities laws of any particular jurisdiction. Due to the relative efficiency of electronic publishing and distribution, Fitch research may be available to electronic subscribers up to three days earlier than to print subscribers. For Australia, New Zealand, Taiwan and South Korea only: Fitch Australia Pty Ltd holds an Australian financial services license (AFS license no. 337123) which authorizes it to provide credit ratings to wholesale clients only. Credit ratings information published by Fitch is not intended to be used by persons who are retail clients within the meaning of the Corporations Act 2001. Fitch Ratings, Inc. is registered with the U.S. Securities and Exchange Commission as a Nationally Recognized Statistical Rating Organization (the 'NRSRO'). While certain of the NRSRO's credit rating subsidiaries are listed on Item 3 of Form NRSRO and as such are authorized to issue credit ratings on behalf of the NRSRO (see https://www.fitchratings.com/site/regulatory ), other credit rating subsidiaries are not listed on Form NRSRO (the 'non-NRSROs') and therefore credit ratings issued by those subsidiaries are not issued on behalf of the NRSRO. However, non-NRSRO personnel may participate in determining credit ratings issued by or on behalf of the NRSRO. Copyright © 2023 by Fitch Ratings, Inc., Fitch Ratings Ltd. and its subsidiaries. 33 Whitehall Street, NY, NY 10004. Telephone: 1-800-753-4824, (212) 908-0500. Fax: (212) 480-4435. Reproduction or retransmission in whole or in part is prohibited except by permission. All rights reserved.

Your browser is not supported

Sorry but it looks as if your browser is out of date. To get the best experience using our site we recommend that you upgrade or switch browsers.

Find a solution

- Skip to main content

- Skip to navigation

- More from navigation items

China’s international travel recovery story reveals different paths

By Alfred Chua 2024-08-20T09:33:00+01:00

While air traffic recovery to and from Mainland China has not reached pre-pandemic levels, Chinese carriers have themselves been steadily restoring – even growing – capacity to major markets

It is a common refrain heard in the wake of China’s post-pandemic reopening: full recovery is taking much longer than expected.

Indeed, many had anticipated that Mainland China, the world’s last major economy to drop Covid-19 travel restrictions, would provide a significant boost to international traffic. Yet, months later, airlines held back returning capacity to China, as they lamented the sluggish demand recovery.

Source: NGCHIYUI_Shutterstock

China’s international travel still lags behind pre-Covid levels

However, a closer look at several key markets will reveal that while international capacity has yet to fully recover, it is the Chinese operators who are fervently adding capacity back to market – at the expense of their international counterparts.

In its traffic results for July, China Eastern notes that international capacity is about 3% above that of pre-pandemic 2019. Among its network, Australia, Europe, Southeast Asia and South Korea have already recovered past pre-pandemic levels.

It announced a slew of international routes in July, including new flights between Shanghai and the French city of Marseille, as well as resuming others like Beijing Daxing-Kuala Lumpur, Hangzhou-Ho Chi Minh City and Wuhan-Singapore.

Its two other compatriots – China Southern Airlines and Air China – did not disclose their international capacity recovery statistics.

However, they have indicated that international traffic and capacity have both grown month on month and year on year. Air China, for instance, launched in July flights from Beijing to Dhaka, as well as from Chengdu to Milan.

The three carriers have also seen passenger load factors for their international networks hold steady, even as capacity returns to market.

Apart from the ‘Big Three’, other Chinese carriers have also been adding international capacity. Hainan Airlines has announced a slew of international routes over the past few months, including Shenzhen-Budapest, Haikou-Moscow, as well as Beijing-Tokyo Haneda.

While the Chinese carriers restore their international networks, a different picture emerges among foreign carriers: the past few months have seen the high-profile exit of Qantas from its Mainland China network, as it axed flights between Sydney and Shanghai, blaming low demand.

British Airways in August announced it would be suspending flights from London to Beijing. While the Oneworld carrier did not disclose reasons for the suspension, which kicks in from October, it is the latest European carrier to pare back its Mainland China network as its struggle with not having access to Russian airspace.

The ongoing war in Ukraine has seen European carriers unable to overfly Russia, while their Chinese counterparts are allowed to – effectively shaving off hours of flying and costs.

Virgin Atlantic said it would end flights to Shanghai from October, while Lufthansa warned that competition from Chinese carriers would undercut its profitability.

And then there are flights between the USA and China, where geopolitical tensions between the two superpowers have crimped any prospect of a swift post-pandemic recovery.

Airline Business has analysed schedules data for four geographical markets in September 2024, comparing them against the same month in pre-pandemic 2019.

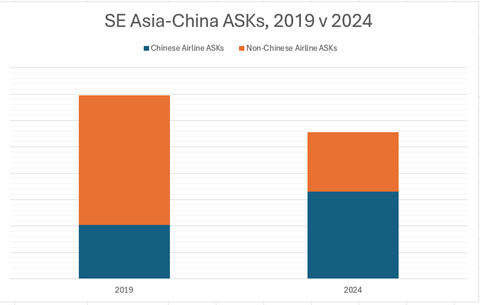

For Southeast Asia, capacity has recovered to around 80% of pre-pandemic levels. However, the data shows a stark change in the proportion of capacity mounted by Chinese and non-Chinese carriers.

Source: Cirium schedules data

September capacity for flights between Southeast Asia and China

Chinese carriers added 63% more capacity in 2024 compared with five years ago, while other carriers saw an overall reduction of 54% in capacity.

Part of that shortfall has to do with the exit of several smaller players, such as Vietnam’s Pacific Airlines, which had a network of points in China from several Vietnamese cities, as well as Thai charter operators like New Gen Airways, which specialised in operations solely to China.

Then there are existing operators who have pared back on their network, like Indonesian low-cost carrier Lion Air and Thailand’s Nok Air.

In contrast, Chinese carriers appear to have moved in to fill some of those gaps. For example, Chongqing-based carrier West Air now has flights to Hanoi and Bangkok from its bases in Chongqing, Hefei and Zhengzhou, something it did not have in 2019.

For Australia, capacity has recovered to around 90% of 2019 levels. However, the exit of Qantas and its low-cost unit Jetstar from the market meant that only Chinese carriers fly between the two countries.

September capacity for flights between Australia and China

Cirium schedules data shows that capacity by the Chinese carriers has grown by about 10% compared to 2019.

Looking farther afield to Western Europe (including the UK), the difference in capacity recovery is starker. Where capacity was spread evenly between Chinese and non-Chinese airlines in 2019, this has tilted significantly towards Chinese operators.

September capacity for flights between Western Europe and China

Indeed, it is also telling that the three largest carriers based on capacity are all Chinese operators now, whereas in 2019, German operator Lufthansa was the third-largest carrier by ASKs. Part of the difference stems from the ban on Russian overflights, which has forced European carriers to rethink their operations to the Chinese mainland.

An interesting trend emerges when looking at the USA-China market: while capacity is still far from pre-pandemic levels, the proportion of US carrier capacity has grown slightly when comparing 2019 and 2024 levels.

The schedules data shows that September 2024’s ASKs are down more than 70% compared to five years ago.

September capacity for flights between the USA and China

In September 2019, US carriers made up about 35% of overall capacity between the USA and China, and that has grown to around 40% for September 2024.

That said, it is clear that Chinese airlines still mount a larger portion of capacity than their US counterparts in both years.

- Asia Pacific

From making its debut as a magazine in 1985 through to its evolution into an online data and analysis tool, Airline Business has forged a reputation for providing high-quality, in-depth coverage of the airline sector’s strategic and economic drivers. Our trusted insight gives users a competitive edge in the global industry.

- Advertise with us

- Announcements

- Terms & Conditions

- Cookie Policy

- Privacy Policy

- Copyright © FlightGlobal

Site powered by Webvision Cloud

Unlock our take on the stories that matter for just £22 a month

Breaking news, expert analysis, member-first insights and commentary on the global aviation industry.

International traffic propels air passenger recovery; China concerns, while Latin America goes crazy

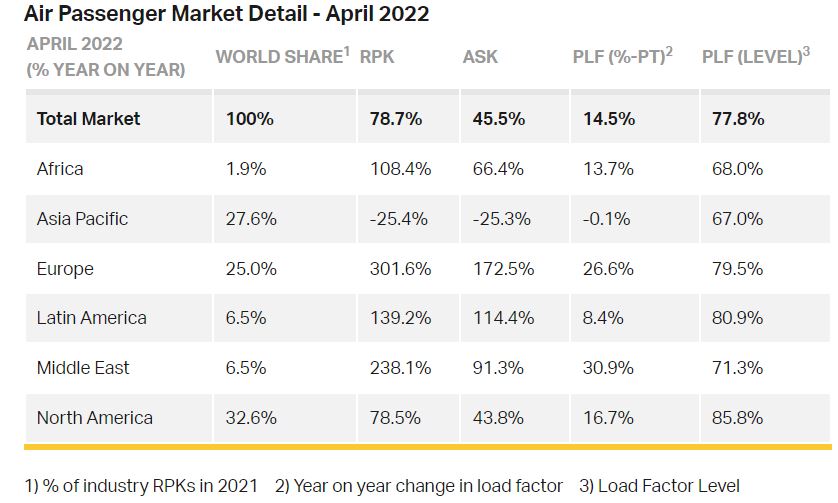

Latest air traffic data from the airline body International Air Transport Association ( IATA ) illustrates that air travel resumed its strong passenger recovery trend in Apr-2022, despite the war in Ukraine and travel restrictions in China .

The Apr-2022 data is "cause for optimism in almost all markets", acknowledges IATA director general Willie Walsh, except in China , which continues to restrict travel severely.

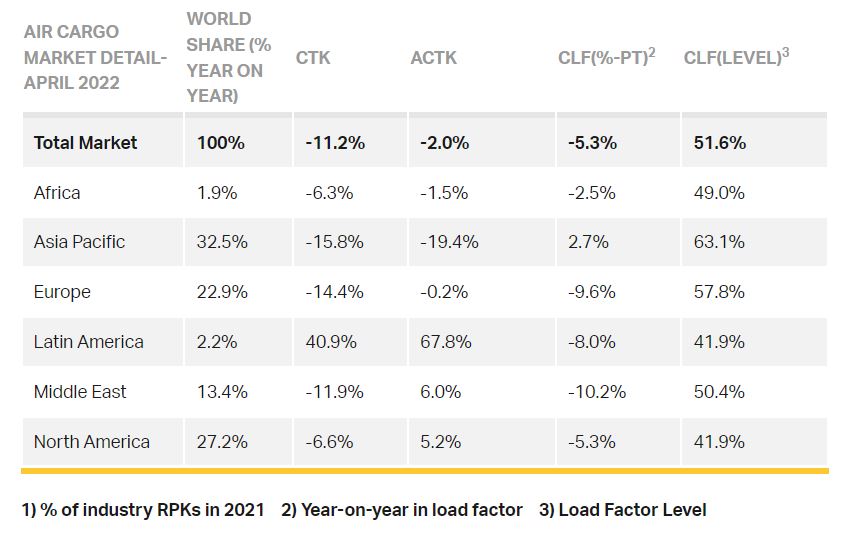

But air cargo statistics do not make for good reading, and often that means those for passengers will soon follow suit.

The Apr-2022 statistics that show cargo volume falls in each of the six world regions, load factor falls in five, and capacity falls in four of them, will hopefully turn out to be a blip.

- Air travel recovery continues to show strong passenger demand, driven by international travel.

- Domestic passenger demand stalls due to strict travel restrictions in China.

- International passenger demand in April 2022 was more than four times higher than the previous year.

- Global air cargo demand decreases in April 2022, influenced by the Omicron variant and the Russia-Ukraine conflict.

- Latin America experiences the highest load factor in passenger travel and shows the strongest performance in air cargo.

- Operational and performance issues in the aviation industry are influenced by continued travel uncertainty and government policy changes.

- Domestic passenger demand recovery stalls due to continuing strict travel restrictions in China .

- International RPKs more than four times higher than last year.

- Fall in global air cargo demand in line with expectations.

- While most regions of the world saw cargo demand and capacity fall, Latin America has excelled itself.

Passenger travel recovery driven by rising international demand

This is being driven primarily by international demand - the lifting of many border restrictions provides a long-expected surge in bookings as people seek to make up for two years of lost travel opportunities.

Total demand for air travel in Apr-2022 (measured in revenue passenger kilometres or RPKs) was up +78.7% compared to Apr-2021, and slightly ahead of Mar-2022's +76.0% year-over-year increase. This was still down -37.2% compared to the same month in 2019, but is an improvement compared to the -41.3% decline for Mar-2022 versus Mar-2019.

Domestic demand recovery stalls due continuing strict travel restrictions in China

Domestic air travel was down -1.0% in Apr-2022 compared to the period a year ago (Apr-2021), which was a reversal from the +10.6% demand rise in Mar-2022.

This, reports IATA , was "driven entirely" by continuing strict travel restrictions in China , where domestic traffic was down -80.8% year-to-year.

Overall, Apr-2022 domestic traffic was down -25.8% versus Apr-2019.

International RPKs more than four times higher than last year 2021

The IATA monthly metrics shows international RPKs rose +331.9% versus Apr-2021, which was an acceleration over the +289.9% rise in Mar-2022 compared to a year ago. The data shows that several route areas are actually above pre-pandemic levels, including Europe - Central America , Middle East - North America and North America - Central America .

Still, Apr-2022 international RPKs were down -43.4% compared to the same month in 2019.

April data 'cause for optimism' in almost all markets, except China

Mr Walsh believes China should learn from the experiences of the rest of the world, which is "demonstrating that increased travel is manageable with high levels of population immunity and the normal systems for disease surveillance".

Two years of border restrictions have not weakened the desire for the freedom to travel

With the northern summer travel season now upon us, the recovery of air travel shows that two years of border restrictions "have not weakened the desire for the freedom to travel", says Mr Walsh. Where it is permitted, demand is rapidly returning to pre-COVID levels, and in some cases exceeding the performance of 2019.

However, the IATA boss notes that it is also evident "that the failings in how governments managed the pandemic have continued into the recovery".

Continued travel uncertainty means air travel recovery now influenced by operational problems

These are now impacting the industry through operational and performance issues.

"With governments making U-turns and policy changes there was uncertainty until the last minute, leaving little time to restart an industry that was largely dormant for two years", explains Mr Walsh. This, he explains, means it is no wonder that we are seeing operational delays in some locations.

"In those few locations where these problems are recurring, solutions need to be found so passengers can travel with confidence", he adds.

Strongest growth in international passenger travel in Europe , but Latin America has highest loads

The regional breakdown in Apr-2022 passenger performance is as follows:

Europe has strongest growth in international travel in Apr-2022

IATA 's Apr-2022 metrics show European airlines' international traffic rose +480.0% versus Apr-2021, which was substantially up over the +434.3% increase in Mar-2022 versus the same month in 2021.

Capacity rose +233.5% and load factor climbed 33.7 percentage points, to 79.4%.

Asia-Pacific leads the rest of the world in Apr-2022 international travel recovery performance

Asia-Pacific airlines saw their Apr-2022 international traffic climb +290.8% compared to Apr-2021, significantly improved on the +197.2% gain registered in Mar-2022 versus Mar-2021.

Capacity rose +88.6% and the load factor was up 34.6 percentage points, to 66.8%, but was still the lowest among regions.

Latin America continues to experience highest load factor across the globe

Latin American airlines reported a +263.2% rise in Apr-2022 traffic compared to the same month in 2021, exceeding the +241.2% rise in Mar-2022 over Mar-2021.

The Apr-2022 capacity rose +189.1% and load factor increased 16.8 percentage points, to 82.3%, which easily was the highest load factor among the regions for the 19th consecutive month.

Middle East , North America and Africa : improving monthly performance in Apr-2022

Middle Eastern airlines had a +265.0% international demand rise in Apr-2022 compared to April-2021, bettering the 252.7% increase in March 2022 versus the same month in 2021.

April capacity rose +101.0% versus the period a year ago (Apr-2021), and load factor climbed 32.2 percentage points, to 71.7%.

North American airlines' Apr-2022 international traffic rose +230.2% versus the 2021 period, slightly above the +227.9% rise in Mar-2022 compared to Mar-2021.

Capacity rose +98.5% and load factor climbed 31.6 percentage points, to 79.3%.

African airlines' international traffic rose +116.2% in April 2022 versus a year ago, an acceleration over the 93.3% year-over-year increase recorded in Mar-2022.

The Apr-2022 capacity was up +65.7% and load factor climbed 15.7 percentage points, to 67.3%.

A positive tide: RPKs, ASKs, change in air passenger load factor and load factor level in Apr-2022

Source: IATA .

Fall in global air cargo demand in line with expectations

IATA reports decreases in global air cargo demand and capacity in Apr-2022, driven by "a challenging operating backdrop" - again caused specifically by the effects of the COVID-19 Omicron variant in Asia and the Russia - Ukraine conflict.

Global demand in Cargo Tonne Kilometres (CTKs) decreased by -11.2% year-on-year in Apr-2022. International CTKs decreased by -10.6%.

Compared to Apr-2019, demand decreased by -1%.

In other words, cargo demand is decreasing at a greater rate compared to last year, when the coronavirus pandemic held a vice-like grip, than compared to the good times benchmark year of 2019.

Capacity also decreased by -2% year-on-year.

Asia recorded the largest regional drops in capacity.

Asia Pacific the worst performing region, while Latin America goes crazy

The regional breakdown in Apr-2022 cargo performance is as follows:

Asia Pacific - the weakest performer

Asia-Pacific airlines saw their air cargo volumes decrease by -15.8% in Apr-2022 compared to the same month in 2021.

This was the weakest performance of all regions, and significantly slower than the previous month (-5.1%).

Airlines in the region have been heavily impacted by lower trade and manufacturing activity due to Omicron-related lockdowns in China . Because of this, available capacity in the region fell -19.4% compared to Apr-2021, which was the largest drop of all regions.

North America - demand down but capacity up, and North America - Europe remains a strong market

North American airlines posted a -6.6% decrease in cargo volumes in Apr-2022 compared to Apr-2021.

Demand in the Asia- North America market declined significantly; however, other key routes such as Europe - North America remain strong.

Capacity was up +5.2% compared to Apr-2021. Several airlines in the region are set to receive delivery of freighters in 2022, which should help address pent-up demand on routes where it is needed.

Europe - 'within- Europe ' market particularly impacted by Ukraine war

European airlines experienced a -14.4% decrease in cargo volumes in Apr-2022 compared to the same month in 2021.

The Within- Europe market fell significantly - down -24.6% month-on-month.

This is attributable to the war in Ukraine . Labour shortages and lower manufacturing activity in Asia due to Omicron also affected volumes.

Capacity fell -0.2% in Apr-2022 compared to Apr-2021.

Middle East - supply chain issues contribute to volumes but capacity increased

Middle Eastern airlines experienced an -11.9% year-on-year decrease in cargo volumes in Apr-2022.

Significant benefits from traffic being redirected to avoid flying over Russia failed to materialise. This is likely due to persisting supply chain issues in Asia.

Capacity was up +6% compared to Apr-2021.

Latin America - the strongest performer; huge increase in flown volume and capacity

Latin American airlines reported an increase of +40.9% in cargo volumes in Apr-2022 compared to the 2021 period.

This was the strongest performance of all regions.

Airlines in this region have shown optimism by introducing new services and capacity, and in some cases investing in additional aircraft for air cargo in the coming months.

Capacity in Apr-2022 was up +67.8% compared to the same month in 2021.

Africa - previous month's growth trend reversed

African airlines saw cargo volumes decrease by -6.3% in Apr-2022 compared to Apr-2021. This was significantly slower than the growth recorded the previous month (+3.1%).

Capacity was -1.5% below Apr-2021 levels.

'We are the champions' - CTKs, change in load factor and load factor level in Apr-2022: Latin America easily lifts the trophy

So while these results vary considerably by region, it is only Latin America that can take any satisfaction from them.

If this data continues to show a decline in the following months then concern will grow about how passenger bookings for the Oct-2021 to Mar-2022 period, and the full year beyond that, might follow suit.

NB. The full reports from IATA are accessible through the CAPA IATA Profile, News section

Want More Analysis Like This?

Why International Airlines Continue To Cut China Flights

- International airlines cut flights to China due to various factors such as weak demand and closed Russian airspace.

- British Airways and Virgin Atlantic are among the airlines discontinuing routes to China after years of service.

- Chinese carriers are expanding overseas as Western carriers reduce flights.

Multiple international airlines have recently announced cuts to their flights to China. Once a highly promising market for global carriers, the Chinese market now seems to be losing its appeal.

Recent examples of airlines cutting flights to China include Singapore Airlines, which suspended service to two Chinese cities this spring, and Australia's Qantas, which suspended its direct Sydney to Beijing service this summer.

Western carriers are also scaling back their routes to China. British Airways announced it would end its Beijing service in late October 2024, while Virgin Atlantic decided to discontinue its flights to China after 25 years of service between the UK and Shanghai. When it comes to American carriers, only United Airlines flies directly to the Chinese capital.

Multiple factors influencing the shift

Each foreign airline that suspended its service to China had its own reasons for doing so. International airlines cited multiple factors, including weak travel demand to China, political tensions, rising costs, the closure of Russia's airspace, and the slow recovery of demand following COVID-19 pandemic suspensions, among other reasons.

The latest update on network cuts to China involves British Airways . After serving the Chinese capital for decades, the carrier will cease all London Heathrow-Beijing flights at the end of October.

This route, which British Airways reinstated in June 2023 after more than three years due to COVID, was operated with the Boeing 777-200ER. While the airline did not provide a detailed explanation for the cut, the need to avoid Russian airspace following the war in Ukraine and low travel demand are likely key factors.

Why British Airways Is Cutting Its London Heathrow To Beijing Route

It follows Virgin Atlantic recently ending Shanghai flights.

The news about British Airways' decision to cut flights to China came soon after Virgin Atlantic announced the halt of its Heathrow (LHR) to Shanghai Pudong (PVG) route. The decision to cease this flight was attributed to complications with not being able to fly through Russian airspace.

Virgin Atlantic Drops Heathrow-Shanghai Flight After 25-Year Run

The airline cited complications with the Russian airspace ban.

When it comes to China-US connections, it is surprising that there are so few direct flights between China's capital and the US. Even more surprising is that United Airlines is the one US airline that currently offers service to Beijing.

In August 2024, only three airlines — Air China , Hainan Airlines, and United Airlines — are scheduled to operate six routes between Beijing and the US, according to Cirium data.

The limited flights between the two countries are partly due to political reasons. In March 2024, the US government raised the weekly flight limit for Chinese airlines from 35 to 50. Although this is an increase, it's still much less than the 150 flights allowed before the pandemic. Despite this, US airlines are only operating 35 return flights a week, according to a Reuters report.

Chinese carriers expanding ops overseas

As foreign carriers reduce their flight capacity to China, Chinese airlines are gaining ground in the international market. This shift is partly because Western carriers are unable to fly through Russian airspace, while Chinese airlines can.

John Grant, senior analyst at OAG, told Reuters that this advantage has lowered costs for Chinese carriers, allowing them to capture a larger share of the international market.

Foreign airlines lose interest in China as domestic carriers expand abroad

- Medium Text

- British Airways suspends London-Beijing route

- Need to bypass Russian airspace hurts many foreign carriers

- Chinese airlines gaining international market share

FOREIGN CARRIERS RETREAT

POLITICAL ISSUES

Sign up here.

Reporting by Lisa Barrington in Seoul; Additional reporting by Ilona Wissenbach in Frankfurt, Rajesh Kumar Singh in Chicago and Joanna Plucinska in London; Editing by Jamie Freed

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Chile's SQM posts 63% slump in profit, expects weak lithium prices to stay

Chile's SQM , the world's second-largest lithium producer, reported a bigger-than-expected 63.2% slide in its quarterly profit on Wednesday due to weak prices of the battery metal, which it expects will continue for the rest of the year.

- Cover Story

Air travel emerges from turbulence of pandemic

Summer peak season reaffirms surge in industry's recovery.

Impact of conflict

In addition to strong growth, a number of foreign carriers recently canceled their international flights that connect overseas cities with Chinese mainland cities and Hong Kong, as they had to reroute flights to bypass the airspaces of Russia, leading to increased flying time and higher fuel costs, the carriers said.

British carrier Virgin Atlantic announced in July that it would suspend its flights that connect Shanghai Pudong International Airport and London Heathrow Airport after operating the route for 25 years. The last round-trip flights will operate on Oct 25 and Oct 26.

As one of the foreign carriers that entered the China market the earliest, Virgin resumed Shanghai-London flights in May 2023 after a hiatus due to the COVID-19 pandemic. The decision to suspend the Shanghai-London route follows the suspension of Virgin's London-Hong Kong route in October 2022 after almost 30 years of operation.

Meanwhile, British Airways said it would temporarily cut the flight frequency of the London-Hong Kong route from two daily flights to one from Oct 27, as the inability to overfly Russia has led to surging operational cost.

British Airways resumed flights connecting London and Shanghai and Beijing last summer after the pandemic. The carrier currently runs daily flights between London and Shanghai, and four times a week to Beijing. The carrier will suspend its Beijing Daxing-London flight from Oct 26.

Currently, eight domestic carriers and two foreign carriers, British Airways and Virgin Atlantic, operate 18 China-UK routes. The Chinese carriers are Air China, China Eastern Airlines, China Southern Airlines, Hainan Airlines, Shenzhen Airlines, Tianjin Airlines, Capital Airlines and Juneyao Airlines, according to Flight Master, a travel services platform in China.

The landscape of competition on the China-Europe air route has undergone significant changes after the pandemic, and the competitive advantage of Chinese carriers has become more prominent.

In the first half of this year, domestic airlines operated 72.2 percent of China-Europe flights, and foreign airlines operated 27.8 percent. Before the pandemic, there was not much difference in the share of such flights, when Chinese carriers made up 52.7 percent, and foreign airlines accounted for 47.3 percent, Flight Master found.

Stargazing event promotes dark sky tourism in Hami

Video game based on classic novel goes viral

China, Fiji agree to strengthen cooperation

Passion for Sinology grows in Kenya

6 things you may not know about End of Heat

China's progress in ecological, biodiversity conservation

- China Daily PDF

- China Daily E-paper

- Israel-Gaza War

- War in Ukraine

- US Election

- US & Canada

- UK Politics

- N. Ireland Politics

- Scotland Politics

- Wales Politics

- Latin America

- Middle East

- In Pictures

- Executive Lounge

- Technology of Business

- Women at the Helm

- Future of Business

- Science & Health

- Artificial Intelligence

- AI v the Mind

- Film & TV

- Art & Design

- Entertainment News

- Destinations

- Australia and Pacific

- Caribbean & Bermuda

- Central America

- North America

- South America

- World’s Table

- Culture & Experiences

- The SpeciaList

- Natural Wonders

- Weather & Science

- Climate Solutions

- Sustainable Business

- Green Living

Cancer doctors and family with dog among Brazil plane crash dead

As investigations continue into the plane crash in Brazil that killed 62 people, more details have emerged about the victims.

Those who died included cancer doctors, a three-year-old child, a lawyer specialising in lawsuits against airlines and a Venezuelan family and their dog, local media have reported.

All bodies have now been recovered from the site of Friday's plane crash in the state of São Paulo.

The twin-engine turboprop was flying from Cascavel in the southern state of Paraná to Guarulhos airport in São Paulo city when it came down on Friday in the town of Vinhedo.

Footage circulating on social media showed a plane descending vertically, spiralling as it fell.

The aircraft crashed in a residential area, but no-one on the ground was injured. Officials said only one home in a local condominium complex was damaged.

Two doctors from the Uopeccan Cancer Hospital in Cascavel, Mariana Belim and Ariane Risso, were among the passengers who died.

They were among eight doctors on their way to attend a medical conference.

Three-year-old Liz Ibba dos Santos, the youngest victim of the disaster, was travelling with her father, Rafael Fernando dos Santos. Her mother, a journalist, was not on the flight.

- All bodies recovered after 62 die in Brazil plane crash

- Plane crash in Brazil's São Paulo state kills all 62 on board

- 'I went to the balcony and saw the plane spinning'

- In pictures: Brazil's deadly plane crash

Other victims included a family returning to their native Venezuela after their dreams of a new life in Brazil were frustrated.

Josgleidys Gonzalez was travelling with her mother, Maria Gladys Parra Holguin, and her young son, Joslan Perez.

According to a family friend writing on social media, the three had left economic hardship in Venezuela and moved to Cascavel, but had been unable to sort out Joslan's documentation, as he was born in Venezuela but grew up in Brazil.

As a result, they were heading back to their homeland to deal with the documentation, and hoped to start a new life in neighbouring Colombia.

Their plan was to change planes in São Paulo and fly to northern Brazil before completing the journey by bus.

A friend of the family, Thaiza Evangelista, told AFP news agency that the family had friends in Colombia that would help them get set up.

Ms Evangelista received a message just as they were about to board the plane - the last she received from Josgleidys.

"I was desperate... the list (of victims) wasn't coming out," she told AFP.

The airline later confirmed Josgleidys, her mother and young son were among the dead.

Their dog, Luna, boarded the plane with them, because Joslan's mother could not stand to see him separated from their pet, said the family friend. The family had the dog vaccinated as required by the airline.

The death toll also included a lawyer, Laiana Vasatta, who worked as a lay judge at the Court of Justice of Paraná and also represented clients in lawsuits against airlines. She posted videos on social media offering consumer guidance.

The state of São Paulo said it concluded its operation to remove the victims' bodies from the crash site on Saturday evening.

It added that the bodies - 34 males and 28 females - were being moved to a police morgue in the city of São Paulo, where they will be identified and released to the families.

The authorities are still trying to determine what caused the plane's dramatic plunge.

Analysis of the plane's flight recorders has already begun and the Brazilian Air Force said a preliminary report would be issued in 30 days.

The plane crash is Brazil's worst since 2007, when a TAM Express plane crashed and burst into flames at São Paulo's Congonhas airport , killing 199 people.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

IMAGES

COMMENTS

The recovery in air travel to and from China is picking up pace in the early months of 2023 as more COVID-19-related restrictions are eased and airlines respond by ramping up services in this market.. The Chinese government raised hopes for reopening international travel in Dec-2022 when it announced its intention to remove a range of entry restrictions.

Hong Kong CNN —. Travelers across Asia Pacific will likely continue to fork out more than usual for flights this year, even as planes return to the skies at a rate not seen since the start of ...

China air travel is likely to rev up its recovery this year, with more direct flights to and from the U.S., the country's aviation regulator said. International flights to and from China are ...

China's international air travel market will extend its recovery, with the nation's aviation regulator expecting the number of weekly flights to hit about 80% of the pre-Covid level by the end ...

If mainland China's air travel were to follow Hong Kong's recovery curve, mainland China would see four million air passengers a month by April 2023, pushing air travel back up to 40 percent of preCOVID-19 levels (exhibit). ... The next few months will be a scramble to get capacity back in the air. A strong demand recovery, coupled with ...

Europe and North America, Asia will drive growth in 2023, helped by the recent reopening in China". For every two seats of airline capacity added worldwide, one is in Asia, according to a report ...

China's rapid unwinding of Covid Zero restrictionshas spurred a sharp recovery in the world's biggest domestic air-travel market, throwing a lifeline to the nation's 'Big Three' airlines ...

China will focus on expanding domestic flights and restoring international air travel in 2023-2025, the country's aviation regulator said on Friday, as it issued a new five-year development plan ...

By Jiahui Huang. China air travel is likely to rev up its recovery this year, with more direct flights to and from the U.S., the country's aviation regulator said. International flights to and ...

3:45. This article is for subscribers only. China's reopening to international travel could propel global air traffic back to pre-pandemic levels as soon as June, one of the world's leading ...

China's domestic air travel has already recovered and will likely extend its growth in 2024, it said. Local travel volume in 2023 rose 1.5% from prepandemic levels, the fastest recovery among ...

Widely watched airfares in China are recovering to pre-pandemic levels as domestic tourists lead a patchy air travel recovery, scattering crumbs of hope to a shattered global travel sector.

The late December announcement of China's intention to re-open its borders for travel took the international community by surprise, with little time to prepare. Border re-opening fell just before Lunar New Year, which proved to be significantly stronger than the last with domestic travel reportedly at 89% of 2019 levels and an initial surge in both inbound and outbound visits, albeit to ...

Global air travel won't recover from the Covid-19 crisis until 2024, the International Air Transport Association (IATA) ... China's airlines are leading the recovery, with traffic down 35.5% ...

Airlines are resuming more flights to mainland China as travel restrictions ease, with China's international capacity surpassing 25% of 2019 levels. ANA, Korean Air, Emirates, and other carriers are increasing their China routes, while SriLankan Airlines and Sydney Airport are seeing improvements in Chinese arrivals. However, uncertainties remain about the pace of recovery and the appetite for ...

China's Airports See Strong Recovery on Domestic Air Travel Demand. Fitch Ratings-Hong Kong-24 April 2023: The opening up of Chinese aviation markets after the dismantling of Covid-19 restrictions has created an upsurge in demand, boosting passenger traffic significantly in 1Q23, Fitch Ratings says in its first China quarterly airport traffic ...

While air traffic recovery to and from Mainland China has not reached pre-pandemic levels, Chinese carriers have themselves been steadily restoring - even growing - capacity to major markets.

China anticipates a record-breaking 700 million air passenger trips in 2024, surpassing the 619.6 million trips reported in 2023. Song Zhiyong, head of the Civil Aviation Administration, announced this projection at the Asia Pacific Summit for Aviation Safety.

Latest air traffic data from the airline body International Air Transport Association illustrates that air travel resumed its strong passenger recovery trend in Apr-2022, despite the war in Ukraine and travel restrictions in China.. The Apr-2022 data is "cause for optimism in almost all markets", acknowledges IATA director general Willie Walsh, except in China, which continues to restrict ...

Passenger air travel may reach 700 million this year, said Beijing's Civil Aviation Administration.

International airlines cited multiple factors, including weak travel demand to China, political tensions, rising costs, the closure of Russia's airspace, and the slow recovery of demand following ...

Chinese airlines including China Southern, China Eastern , opens new tab and Air China , opens new tab in July operated 90% of the number of international flights they were operating in July 2019 ...

Summer peak season reaffirms surge in industry's recovery. By ZHU WENQIAN | China Daily Global | Updated: 2024-08-12 07:27 ... operate 18 China-UK routes. The Chinese carriers are Air China, China ...

China Airline Shares Gain as Air Passenger Traffic Rebounds. The nation's largest three carriers lost 190 billion yuan ($27.7 billion) over the last three years as Covid upended travel, company ...

For over a decade, Tim Walz traveled to and from China. First arriving in the country in 1989, Walz taught at a high school in partnership with a nonprofit program affiliated with Harvard University. During this first trip, Walz was visiting Hong Kong when the Tiananmen Square protests began in April. Those protests ended in June when the ...

Philippine President Ferdinand Marcos Jr. condemned Chinese air force actions in waters of the South China Sea claimed by both countries on Sunday, calling the actions "unjustified, illegal and ...

Those who died included cancer doctors, a three-year-old child, a lawyer specialising in lawsuits against airlines and a Venezuelan family and their dog, local media have reported.

San José Mineta International Airport (IATA: SJC, ICAO: KSJC, FAA LID: SJC), officially Norman Y. Mineta San Jose International Airport, [5] is a city-owned public airport in San Jose, California.Located 3 mi (4.8 km) northwest of Downtown San Jose, the airport serves both the city and the Santa Clara Valley region of the greater Bay Area.It is named after San Jose native Norman Mineta ...

After separating from Kellogg in 2023, Kellanova will become part of Mars Snacking, adding billion-dollar brands Pringles and Cheez-Its to the portfolio.

In China, airline capacity has fallen below pre-pandemic levels for the first time in five weeks. Airlines scheduled 9.8% fewer seats this week than last, according to OAG, reducing capacity to 95 ...