- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to AmEx Platinum Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

When does the AmEx Platinum travel insurance kick in?

Amex platinum travel insurance benefits and limits, how to make an amex travel insurance claim, what if the card’s insurance benefits are insufficient, the platinum card® from american express travel insurance, recapped.

Travel insurance can provide peace of mind when you’re away from home, especially when you’ve spent significant money on your vacation. Although you can choose to buy a separate travel insurance policy, not everyone wants or needs to do so.

Many travel credit cards offer complimentary insurance for a variety of occurrences. The Platinum Card® from American Express offers travel insurance with a suite of benefits for eligible travelers, including coverage for trip interruption, rental car damage and lost luggage.

Let’s take a look at travel insurance on The Platinum Card® from American Express , its limits and the benefits it provides.

» Learn more: What is travel insurance?

So, does The Platinum Card® from American Express have travel insurance? The short answer to this is yes, but you’ll need to meet specific requirements for it to apply.

To get coverage from your card, you’ll need to use it to pay for your trip in its entirety. This is true whether you’re looking to utilize the trip insurance or the rental car insurance — you must pay for the full cost with The Platinum Card® from American Express .

Be aware of coverage limitations if you’re traveling using points or miles. While it’s possible to receive benefits when using your card to pay the taxes and fees on a reward redemption, coverage may not always apply.

You may still be covered for trip interruption, delay, and cancellation insurance when using points or frequent flyer miles.

However, rental car and baggage insurance only apply when you’ve used your card to pay for the full cost of whatever you’re buying — no points allowed. The exception is if you redeem American Express Membership Rewards to pay for some or all of the booking.

» Learn more: How does credit card travel insurance work?

We’ve included a breakdown of all the insurance benefits and other travel protections provided by The Platinum Card® from American Express .

Trip cancellation protection

The trip cancellation insurance you’ll receive will pay for any nonrefundable losses you incur due to a covered event.

Given the current climate, you may also be wondering: does The Platinum Card® from American Express travel insurance cover COVID? It can, depending on the reason you need to cancel. Covered events include quarantine imposed by a physician or illness for you, your family members or a traveling companion.

Other eligible events include a change in military orders, inclement weather or jury duty.

If you need to cancel your trip, AmEx will provide up to $10,000 per trip and a maximum of $20,000 every 12 months. Terms apply.

» Learn more: The guide to American Express travel insurance

Trip interruption coverage

As with trip cancellation protection, trip interruption insurance will reimburse you for nonrefundable losses by a covered event.

If your trip is interrupted, American Express will cover you for prepaid land, air and sea travel bookings you’ve missed. They’ll also pay for the cost of an economy-class ticket on the most direct route to rejoin your covered trip (or take you home).

The maximum benefit you’ll receive is $10,000 per trip and up to $20,000 every 12 months. Terms apply.

Trip delay insurance

As it sounds, trip delay insurance will reimburse you for expenses incurred when your trip doesn’t go as scheduled. In the case of The Platinum Card® from American Express , coverage kicks in after you’ve been delayed by at least six hours for a covered reason.

Covered purchases may include food, toiletries, lodging, medication and other personal use items. You’ll be reimbursed for up to $500 on a covered trip and can make two claims within a 12-month period. Terms apply.

Rental car insurance

The Platinum Card® from American Express provides secondary rental car insurance . This means it’ll kick in after other claims — like those made to your personal insurance — have been paid. To activate coverage, you’ll need to decline the insurance offered by the rental car company.

AmEx will provide up to $75,000 due to damage or theft of the rental vehicle, but be aware that the policy doesn’t provide liability insurance.

It’ll also give you up to $1,000 per person (max of $2,000) for personal property lost in the incident and up to $5,000 for accidental injury. Finally, you’ll receive up to $300,000 for accidental death or dismemberment, though the rates will vary depending on the severity of your injuries.

This rental car insurance is valid worldwide with a few notable exceptions, including Australia, Italy and New Zealand. Terms apply.

» Learn more: Credit cards that provide travel insurance

Baggage coverage

Cardholders and their families are eligible for baggage insurance provided they’ve paid for the fare using The Platinum Card® from American Express . This benefit is only for lost baggage; delayed luggage is not protected.

Coverage limits vary depending on whether you’ve checked your bag or carried it on:

Checked bags: Up to $2,000 per person.

Carry-on: Up to $3,000 per person.

Note also that checked baggage is only covered when you’re actually traveling with a common carrier. Meanwhile, carry-on luggage is also covered when traveling to and from or waiting at the terminal.

There are also specific limits for high-risk items such as jewelry and electronic equipment. For these items, you’ll receive a maximum of $1,000 per person per trip. Terms apply.

» Learn more: Baggage insurance explained

Premium Global Assist

What else does The Platinum Card® from American Express travel insurance cover? Although this last benefit isn’t technically a type of travel insurance, it’s worth including as it can offer help while you travel.

AmEx’s Premium Global Assist hotline is a 24/7 service that can assist you in various ways, such as helping you get a new passport, finding translation services and even arranging for emergency medical evacuation.

Although using Premium Global Assist is free, the services that you may end up using are not necessarily covered by AmEx.

There are exceptions to this — if you need repatriation of mortal remains, emergency medical evacuation or if a child under 16 is left without care, AmEx will provide aid at no additional cost. Terms apply.

To file a claim, you’ll need to contact your benefit administrator. The phone number and timeframe will vary according to the type of insurance you’re using:

Trip cancellation, interruption or delay insurance: Within 60 days, call 844-933-0648.

Baggage insurance: Within 30 days, call 800-228-6855 or online .

Rental car insurance: Within 30 days, call 800-338-1670 or online .

» Learn more: The guide to AmEx Platinum rental car benefits

If The Platinum Card® from American Express travel insurance doesn’t seem like it’ll be enough for your trip, or if its coverage doesn’t include features that you’d like to have, consider purchasing a separate travel insurance policy before you travel.

Several companies allow you to compare various policies for any vacation and modify inclusions as you shop.

» Learn more: How much is travel insurance?

The travel insurance offered by The Platinum Card® from American Express includes some pretty generous benefits for travelers, especially since it’s complimentary (the $695 annual fee notwithstanding). Terms apply.

If you want to take advantage of this insurance, pay for your trip using your AmEx card and double-check any other stated requirements before heading out to ensure coverage.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

10 things to do when you get the Amex Platinum

The Platinum Card® from American Express is one of the best premium rewards cards on the market thanks to its extensive benefits, from lounge access to monthly statement credits. These perks come at a cost, though — the card's annual fee is $695 (see rates and fees ), making it one of the most expensive consumer cards to carry.

If that has you second-guessing whether or not to get the Amex Platinum Card, remember that the potential value of its many benefits can far outweigh that fee if you take full advantage of them.

If you open the Amex Platinum Card or already carry it, here are the 10 best ways to take advantage of all of its perks .

Use the $200 hotel credit

One of the principal benefits of the Amex Platinum is the up-to-$200 annual statement credit on prepaid Fine Hotels + Resorts or The Hotel Collection bookings (the latter has a minimum two-night stay, enrollment is required). The FHR program gets you the following perks:

- Room upgrade upon arrival, when available at check-in

- Daily breakfast for two people

- Guaranteed 4 p.m. late checkout and noon check-in, when available

- An experience credit that usually consists of a property, dining or spa credit

- You'll receive a daily credit when a property includes Wi-Fi in a mandatory resort fee

The Hotel Collection's perks include a room upgrade at check-in when available, up to a $100 hotel credit for qualifying dining, spa and resort activities, and the ability to use Pay with Points on prepaid bookings.

Register for your annual airline fee credit

You'll get an annual up-to-$200 airline fee statement credit for the airline of your choice. Select your desired airline on the Amex website before making a purchase, and you'll get to use the credit for fees such as lounge passes, seat assignments, onboard snacks and checked bags.

Note that the airline credit won't apply for new reservations or taxes and fees on award bookings. Enrollment is required.

Since you only get to pick one airline annually, we recommend choosing one with which you don't already hold elite status. An airline you often fly — but not enough to have elite status — will be a strong contender.

Apply for your Priority Pass membership card

One of the greatest travel perks of the Amex Platinum is its unparalleled lounge access — the best on any premium card available. Here are the lounges that participate in the Amex Global Lounge Collection (enrollment is required):

- Amex Centurion Lounges

- Priority Pass Lounges (request your membership card here )

- Delta Sky Clubs (when flying on Delta the same day)*

- Airspace Lounges

- Escape Lounges

- Plaza Premium Lounges

*Effective February 1, 2025: Eligible Platinum Card Members will receive 10 Visits per Eligible Platinum Card per year to the Delta Sky Club or to Grab and Go when traveling on a same-day Delta-operated flight.

Add your card to your Uber wallet

Amex Platinum cardholders get up to $15 in Uber Cash each month, plus an additional up to $20 in December. While Uber Cash doesn't roll over month to month, that adds up to $200 in Uber Cash each calendar year (for U.S. services). Enrollment is required.

To get your Uber Cash, you need to link your card(s) to your Uber account. To do this, head to your wallet on the Uber app and add your card as a payment method.

Apply for Global Entry and TSA Precheck

When you enroll in these trusted traveler programs with your Amex Platinum Card , you'll get a statement credit for up to $100 to your account to cover the application cost (and again upon renewal) once every four years for Global Entry and up to $85 every 4.5 years for TSA PreCheck.

Sign up for Clear plus

The Amex Platinum also offers a statement credit for a Clear Plus membership , normally costing $189 annually.

Clear Plus has a separate line to handle travelers' identity verification and security screening via a fingerprint or iris scan. Once approved, you're escorted by a Clear Plus employee to the head of the TSA PreCheck line (or regular security line if you don't have PreCheck) to an agent for final approval.

As TSA checkpoint lines continue to lengthen, having both Clear and TSA PreCheck can save you a lot of time at the airport. Enrollment required.

Request hotel elite status

Another perk that comes with being an Amex Platinum cardholder is being eligible for Gold status with both the Hilton Honors and Marriott Bonvoy loyalty programs.

These programs give you perks such as bonus points and potential room upgrades. You can enroll for these on the Amex website .

Sign up for car rental elite status

Elite status can sometimes be the difference between being able to reserve a vehicle or not, depending on where you're trying to rent.

In addition to hotel elite status, carrying the Amex Platinum means you are also eligible for status with the following car rental programs (enrollment is required):

- Avis Preferred Plus

- Hertz Gold Plus Rewards President's Circle

- National Car Rental Emerald Club Executive

You can enroll for each program on the Amex website .

Sign up for a Walmart+ membership

The Amex Platinum also offers an annual up-to-$155 Walmart+ statement credit , which covers the entire cost of a Walmart+ membership ($12.95 plus applicable sales tax) each month; Plus Ups are excluded.

Just charge the membership fee to your card and you'll receive a statement credit each month (subject to auto-renewal).

If you live near a Walmart store, this membership will get you free delivery from that store as quickly as the same day on orders of $35 or more, plus steep discounts on prescriptions. You can also save 5 cents per gallon at Walmart and Murphy gas stations and access member pricing at Sam's Club fuel centers — a great perk with fuel costs steadily rising .

Even if you're not a frequent in-store Walmart shopper, you'll enjoy free next-day and two-day shipping on eligible items from Walmart.com with no minimum purchase required.

Consider these other small-but-mighty benefits

While we've outlined nine of our favorite benefits from the Amex Platinum, there are plenty of other enticing perks worth looking into:

Scoop up your digital entertainment credits

The Amex Platinum offers an up-to-$240 digital entertainment statement credit , broken down to up to $20 in monthly statement credits when you pay for participating subscription services. They include The New York Times, Peacock, Disney+, Hulu, ESPN+, the Disney Bundle and The Wall Street Journal. Enrollment is required.

Treat yourself with an annual up-to $100 statement credit for Saks Fifth Avenue

This Saks Fifth Avenue benefit is broken down to up to $50 in statement credits from January through June and up to $50 from July through December. Enrollment is required.

Fitness lovers, grab this annual $300 statement credit for Equinox

This Equinox credit applies to monthly Equinox All Access, Destination and E by Equinox membership fees as well as for the Equinox+ fitness app. Enrollment is required.

Want an at-home fitness bike? Get a $300 SoulCycle statement credit

If you're in the market for an at-home bike, you can get up to a $300 statement credit when you purchase a SoulCycle bike . While it's unlikely that you would ever buy more than one bike, this statement credit is applicable to up to 15 bikes per year.

You must have an Equinox+ membership to purchase a SoulCycle bike. Enrollment is required.

Add up to three authorized users

You can add authorized users to your Platinum Card for a total of $195 each per year (see rates and fees ), which can really help you maximize the value you're already getting from being a cardholder. Authorized users are eligible for many of the same benefits as the main accountholder, including lounge access, Global Entry/TSA PreCheck reimbursement, hotel elite status and Fine Hotels + Resorts benefits.

However, authorized users don't get their own Uber credit or separate airline incidental credits. Enrollment required for some benefits.

Not just Amazon: Get free two-day shipping at thousands of stores with ShopRunner

You'll get free two-day shipping and free return shipping when you pay for eligible items with your Amex Platinum at participating online stores through the ShopRunner program. You can enroll for the service here .

Bottom line

Yes, the Amex Platinum is not a cheap card to have. But after you take a deep dive into all of the card's benefits, the annual fee may feel less intimidating.

If you can maximize every statement credit on the Amex Platinum, you're looking at a value of easily more than $1,400 annually. Even if you can't use every credit on the card, accessing the Amex Global Lounge Collection alone is key for frequent travelers.

Apply here: The Platinum Card from American Express with 80,000 points after you spend $8,000 on purchases in the first six months of card membership or check the CardMatch tool to see if you're targeted for an up to 125,000 Platinum Card offer. Offers are subject to change at any time.

For rates and fees of the Amex Platinum Card, click here .

Editorial disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

- TechnoFino Community

- Credit Card Reviews

- Best Credit Cards

- Credit Card Perks

- The Clash Of The Cards

- Bank Account

- Debit Card Reviews

- Airline Loyalty Guides

- Hotel Loyalty Guides

- Personal Finance Guides

- Banking Kissa

AMEX Platinum Travel Credit Card Review

AMEX Platinum Travel as the name suggests is a travel-based card for all AMEX enthusiasts. I would call this another no-brainer card from the AMEX stable. I have reviewed the other AMEX cards like AMEX Gold Charge and AMEX MRCC here.

Let’s check out what is so tempting about this card!

- 1 Charges and Welcome Benefits

- 2 Regular Reward Accrual

- 3 Milestone Benefits

- 4 AMEX Reward Multiplier

- 5.1 Statement Credit/ Pay with Points

- 5.2 Travel With Points

- 5.3 Insta Vouchers

- 5.4.1 Airlines Transfer Partners

- 5.4.2 Hotel Transfer Partners

- 6 TechnoFino Maximum

- 7.1 Airport Lounge Access

- 7.2 Fuel Surcharge Waiver

- 7.3 Forex Markup Charges

- 8 Eligibility Criteria

- 9 TechnoFino Recommends

Charges and Welcome Benefits

AMEX doesn’t give you a spends-based fee waiver but you may get a waiver or a retention offer to keep you in the loop. Especially if you hold other AMEX cards then AMEX really values the overall relationship. Even then the rewards of this make up for the fee very easily.

Application through referral is a clear-cut winner due to the extra NIL Joining fees. Check out the link for detailed referral benefits information. You can apply for any of the six AMEX Cards available in India via this link.

If you face any problems in the application process you can contact me on Technofino Community .

You can choose to apply for any AMEX card from the link in the banner. To choose and apply a card of your choice simply click on the View All Cards option and select one. All the information for that particular card is readily available on the website.

Regular Reward Accrual

- *Spends exclude Insurance payments, Utilities and Fuel but are counted for milestone spends.

- Reward points never expire.

- You get to earn MR points even on wallet loads .

Milestone Benefits

- You can get up to 48000 MR points on completing both milestones.

Technofino Tip : Credit of AMEX points on completing the milestones is not automatic. After completion of the first milestone, you will get 7500 MR points automatically and the rest of the points will need to be requested from AMEX and same goes for the 4L milestone.

AMEX Reward Multiplier

AMEX has a Rewards Multiplier portal just like HDFC SmartBuy from where you can purchase gift vouchers or do affiliate shopping and get 3X the usual reward points.

Reward Redemption

Statement credit/ pay with points.

AMEX allows you to take a statement credit on eligible transactions or pay with points on select merchants while entering OTP for your transaction at a value of 25p/point. Most of the new AMEX cardholders use this redemption method but trust me there can’t be a method worse than this to use your MR Points. They are much more valuable than this so kindly ignore these two options.

Travel With Points

Another method to redeem your MR points. With this, you can purchase flights, prepaid hotels, car rentals, and more on AmexTravel. Again this gives you a value of 25p/MR point and is highly not recommended .

Insta Vouchers

AMEX further offers you a huge variety of instant vouchers against your MR points which have different values for different brands.

Clearly, this card is meant for travel only since MR points are better redeemed for Taj Stays Voucher or Marriott Transfer since that is where the value lies.

TechnoFino Tip: Since the MR points are credited into a common pool so if you hold either an AMEX MRCC or an AMEX Gold Charge then you can redeem them for AMEX Gold Collection Vouchers which will you a much better value.

Like redeeming a 24K Taj Voucher will give 58p/MR Point and Amazon Pay/ Flipkart Voucher will give you just 37p/ MR Point.

Transfer Points

Now, this is the hottest redemption option for MR points and if you can play well with this you can yield values of even greater than a rupee per point.

Airlines Transfer Partners

AMEX allows you to transfer points to 8 different airline partners and some of them are so unique that none of the Indian credit cards allows you to transfer points to them like Asia Miles. We have a curated list of all AMEX airline transfer partners here . For booking award tickets using points, you can refer to this post on the TechnoFino Community.

Hotel Transfer Partners

Now, this is the most sought redemption option since anyone with a Platinum or Gold status with Marriott Bonvoy can just extract a value of more than 1Re/MR point by transferring a 1:1 ratio with suite upgrades, Breakfast and lounge access with complimentary drinks are an added plus. Since AMEX is the sole transfer partner to Marriott Bonvoy , many points miners use MR points only for transfer to Marriott.

Other than this you can transfer to Hilton Honors also but the value is not that great as compared to Marriott. We have curated a complete list of AMEX hotel transfer partners h ere .

It takes about 0-5 days to transfer Amex MR Points to various loyalty programs so transfer them well in advance to use them.

TechnoFino Maximum

This card is good for just ₹4L spent in a year and after that, the spending can be put on other cards.

On completing both the milestones you will have 48000 MR points in your kitty along with a Taj Voucher worth ₹10,000.

Now with a value of 50p/MR point when redeemed for travel one would get a ₹34,000 worth (including TAJ voucher) reward value on completing both milestones which converts to an 8.5% reward rate . I mean what more can one ask for? If you are not into travelling and will redeem the points for Flipkart vouchers then the value drops to ₹24,400 and the reward rate comes out to be nearly 6.1% which is also not bad in my opinion.

And if you hold any of the gold collection cards along with this card then with 58p/ MR Point value on a 24K Taj Voucher redemption you can easily earn up to a 9.5% reward rate. Even for cash-back lovers 18,000 worth of cash equivalent Amazon Pay vouchers along with a ₹10K Taj Voucher the reward rate translates into 7%!!!

Other Benefits

Airport lounge access.

You are eligible to access only third-party airport lounges using AMEX Platinum Travel since to access AMEX Proprietary lounges you need to have an AMEX Platinum Charge card.

For International lounges only the Priority Pass membership is complimentary and all access will be chargeable. Also, access is restricted only to primary cardholders.

Fuel Surcharge Waiver

- 0% for HPCL transactions less than ₹5,000,1% fee per transaction is applicable for all HPCL transactions on and above ₹5,000.

- 1% of the transaction value subject to a minimum of ₹10 + applicable taxes, will be charged as a convenience fee at fuel stations operated by the Public Sector Oil Marketing Companies BPCL and IOCL.

- 2.5% of the transaction value subject to a minimum of ₹10 + applicable taxes, will be charged as a convenience fee at fuel stations of all other Oil Marketing Companies (except HPCL, BPCL and IOCL).

Forex Markup Charges

- Forex Markup charges are standard 3.50% + GST.

Eligibility Criteria

- For the AMEX Platinum Travel card an income proof of a minimum gross ₹6LPA is required whether you are salaried or self-employed. AMEX doesn’t process applications on a Card-to-Card basis .

- Your CIBIL score should be a minimum of 750.

- You must have an address proof of any serviceable area.

- Serviceable City List- Guntur, Hyderabad, Krishna, Medak, Rangareddy, Visakhapatnam, Vizianagaram, Chandigarh, Jaipur, Ahmedabad, Gandhinagar, Bardoli, Surat, Vadodara, Ambala, Jhajjar, Panchkula, Bengaluru, Kochi, Bhopal, Indore, Mumbai, Pune, Raigad, Thane, Bhubaneswar, Khurdha, Mohali, Chennai, Coimbatore, Erode, Kanchipuram, Krishnagiri, Salem, Tiruvallur, Gautam Buddha Nagar, Hooghly, Howrah, Kolkata, North 24 Parganas, South 24 Parganas, Delhi, Noida, Ghaziabad, Gurgaon, Faridabad, Vijayawada, Ernakulam, Secunderabad, Aluva, Ropar, Hosur, Sriperumbudur, Tiruppur, Baramati, Navi Mumbai, Lucknow, Trivandrum, Mysuru, Nasik, Nagpur, and Ludhiana.

AMEX has recently started serving the following Tier 2/3 cities as well

Agra, Ajmer, Allahabad, Ambala, Amritsar, Aurangabad, Chittoor, Dehradun, Goa, Guntur, Guwahati, Jodhpur, Kanpur, Kolhapur, Kozhikode, Kurnool, Madurai, Meerut, Patiala, Raipur, Rajkot, Ranchi, Thrissur, Trichy and Udaipur.

Application through referral is a clear-cut winner due to the extra NIL Joining fees. Check out the link for detailed referral benefits information. You can apply for any of the six AMEX Cards available in India via this link. Even better, you can also get another 2000 Bonus MR Points by spending ₹5000 within 90 days of membership.

TechnoFino Recommends

AMEX Platinum Travel is one of their best credit cards which provides an exceptional reward rate of 8.5% and is one of my go-to cards till I complete its milestone for the year. The only issue with AMEX cards is low acceptance but if you swipe your cards in premium places then there is nothing to stop you from clinching all of those milestones.

Isn’t AMEX Platinum Travel a no-brainer for all? Feel free to share your tricks in the comments below.

Chief Editor, TechnoFino. Personal finance nerd! Physics enthusiast and trainer. When not into Physics, he is minting points and hunting for the next best credit card for himself.

- Travel Credit Card

Related Articles

Amex rewards multiplier, sbi miles credit card, sbi miles prime credit card review, 19 comments.

How do you calculate ₹34k value for 48k points and you say 0.5/MR point? Isnt it ₹24k for 48k points. Same with flipkart how do you get ₹26k? 48k points x 0.3/MR point = ₹14.4k

34K Value includes Taj Voucher also. I have slightly tweaked the Flipkart value. Thanks for pointing it out.

How do we request for that extra MR points after reaching the respective milestones? What do we exactly say to the Amex Customer Support for that 100% bonus points on top of the milestone benefit? Will they honour our request or purely at their discretion? Is there any nice way of asking so that our request won’t be turned down.. Thanks for the tip.. A very nicely written article…

“Technofino Tip: Credit of AMEX points on completing the milestones is not automatic. After completion of the first milestone, you will get 7500 MR points automatically and the rest of the points will need to be requested from AMEX and same goes for the 4L milestone.”

I think I got the answer I was looking for, It is there in the T&C/s Plat travel card as a last point..

* Membership Rewards points received on spend milestones is a combination of threshold Membership Rewards points and Bonus Membership Rewards points. You will get your threshold Membership Rewards points once you achieve the spend milestones however, to claim your Bonus Membership Rewards points, please dial the number mentioned at the back of your Card

Great find!

Thanks for confirming…

A question on renewal fee: Do we get any MR points on paying the reweal fee of 5k+GST? Assuming we spent more than 4 lakhs in card memebership year, can we ask for annual fee waiver ( or atelast partial) or any any MR points? Do they generallly consider these kind of requests . Thanks in advance.

No official criteria but unofficially Spend 2L in 60 days and get an annual fee waiver Get an annual fee waiver in lieu of 10K MR points Pay an annual fee and get 15K MR points

Thanks heaps for the insights.

I have now spent 2L within 50 days.. How shall I request for annual fee waiver?

Does this card or any other AMEX card benificial if spends are not that much (6-10k pm) as other card is used as primary because of acceptance?

No this card is useful only if you can spend 4L exact else the reward rate drops drastically.

Does a Amex Platinum Metal card whose yearly fees is close to 70k better than this card or you would rate this card as the best in the segment considering the MR points it is giving.

Hi Bhavye. I follow your blog and I am a big fan of yours. I got my amex platinum travel card yesterday and was thinking of applying for amex mrcc as well based on your recommendation of pooling the points and redeeming for 24 karat gold collection. When enquired at the call centre, to my surprise, the executive said that redemption catalogues of MRCC & Platinum travel are different and one can’t redeem platinum points for 24 karat gold collection. Please suggest.

Hi, it was different for mcc and plat travel, but recently amex started allowing pooling points

Do we earn MR points on rent payment? Is it counted towards milestone? What are the extra charges?

I applied using above link , the application was successful and final screen showed we will call you , however after 1 week there is no call. Pls suggest way forward

Kindly Call AMEX on 1-800-419-2122 or mail them.

Thanks for the detailed review Bhavye! Just a couple of queries:

1. Can the milestone points be redeemed for Air Miles as well? Since in your review and the official website, its only mentioned that the welcome/milestone reward points can be redeemed against Taj voucher (0.5/- per point) or Flipkart voucher (0.3/- per point)

2. Do you have redeemed points for AirMiles? If yes, can you share some details on the same that what exactly is an AirMile in terms of actual value in Rs. This option seems more flexible and lucrative but I cant find its proper details anywhere on the net.

3. I;’m a MRCC holder, and I talked to the customer service today only and he clearly mentioned that I wont be having access to gold collection with my new travel platinum card! :-/

LEAVE A REPLY Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Stay Connected

Latest articles, sbi miles elite credit card review, the postcard hotels & resort: the ultimate guide for indians.

Brett Holzhauer

Content Contributor

14 Published Articles

Countries Visited: 22 U.S. States Visited: 29

Stella Shon

News Managing Editor

88 Published Articles 634 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

![amex platinum travel multiplier Earn 175K Points With New Amex Platinum Card Bonus [Current Public Offer is 80k]](https://upgradedpoints.com/wp-content/uploads/2024/04/Amex-Platinum_hand_holding_Upgraded-Points.jpg?auto=webp&disable=upscale&width=1200)

Option 1: Check On Amex Directly (Try This First)

Option 2. targeted email offers, benefits of the amex platinum card, 1. klm business class from toronto to london in october, 2. 3 nights at the oceana santa monica hotel, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Welcome bonuses are the best way to earn mass amounts of points in a short amount of time. The key to it is to have upcoming purchases you were planning on anyway, so you aren’t forcing yourself to spend money. Or, in my case, I do my best to recruit friends and family to use my card for me.

In any case, The Platinum Card ® from American Express is currently offering one of its best new welcome bonuses for new cardholders.

- The current public offer is: Earn 80,000 points after spending $8,000 on purchases in the first 6 months.

Here’s the scoop on how you can score an elevated 175,000-point welcome bonus offer, where to find it, and how you can potentially redeem this hoard of points.

Targeted offers are discussed in the article below. Please note that these offers are not available to all applicants. Any information related to targeted offers has been collected independently and has not been reviewed or provided by the card issuer.

Amex Platinum Card Welcome Bonus Offer

One of the tricks of the points and miles game is to find offers that may not be directly served to you on the card issuer’s homepage. Sometimes you can find offers that may be slightly higher than others.

However, our writers have seen targeted offers for a solid 175,000-point welcome offer. And the card also comes with an annual fee of $695 ( rates & fees ).

At our valuation , that is a $3,850 value for travel in the first couple of months of holding the card. This doesn’t even take into account the laundry list of benefits the card offers.

First and foremost, you should try applying directly on American Express’ website to find the best possible offers on the Amex Platinum card. By checking directly with American Express first, you may be targeted for a generous welcome offer inviting you to apply.

Another way you can find elevated welcome offers is via targeted emails or mailers. If you want to receive these targeted offers, opt-in to receive New Card and Credit Offers in your Amex account’s General Marketing Email Preferences .

There’s no telling when this offer may go away, so if you’re in the market for a high end card , you may want to jump on this welcome bonus.

The Amex Platinum Card is in a class of its own. It offers a significant amount of benefits for someone looking to have a luxurious touch to their travel experience. But if you can take advantage of enough of the perks (some require prior enrollment), you can potentially make up for the hard expense.

- 5x points for flights booked directly with airlines or AmexTravel.com (up to $500,000 per calendar year) and on prepaid hotels booked with AmexTravel.com.

- Access to 1,400+ lounges Worldwide : Receive access to Centurion Lounges ( U.S. and international locations ), Priority Pass upon enrollment, Escape Lounges – The Centurion Studio Partner , Plaza Premium Lounges , select Virgin Clubhouses , select Lufthansa Lounges when flying with Lufthansa Group the same day, and Delta Sky Clubs when flying with Delta the same day.

- Hotel and rental car elite status and benefits upon enrollment

- $189 CLEAR Plus Credit : Use your card and get up to $189 back per year on your CLEAR Plus membership (subject to auto-renewal).

- Up to $300 Equinox Credit: Upon enrollment, get up to $300 back each year on eligible Equinox memberships when you pay with your card.

- Up to $240 Digital Entertainment Credit : Get up to $20 back each month on eligible purchases made with your card on one or more of the following: Disney+, The Disney Bundle , ESPN+, Hulu , The New York Times, Peacock , and The Wall Street Journal. Enrollment required.

- Up to $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts or The Hotel Collection bookings through AmexTravel.com when you pay with your card. The Hotel Collection requires a minimum 2-night stay.

- Up to $155 Walmart+ Credit : Receive a $12.95 monthly credit toward a Walmart+ membership.

- Global Dining Access by Resy

Maximizing Your Membership Rewards Points

Membership Rewards points are extremely valuable as you can transfer them to a wide array of airline and hotel loyalty programs to book award travel. By transferring your Amex points , you can take advantage of booking your hotel or airfare directly with the airline and take advantage of any status you may have.

Here are 2 examples, among many, that you can redeem those points for valuable travel.

If your inner traveler is pulling you to Europe, you can hop over the pond to London from Toronto in style — KLM business class round-trip will run you 110,000 Flying Blue miles .

Once the points have transferred to your account, you can book the flight by visiting the KLM website. You will be prompted to enter your Flying Blue information. From there, you can redeem your points for the flight itinerary.

Yes, the flight comes with a $752 tax, but the cash price for this flight is over $3,000.

There’s nothing better than a few nights in the shadow of the Santa Monica Pier (my old stomping grounds as a kid). While 3 nights can seem like a less-than-exciting redemption for your Amex points, keep in mind the Oceana Santa Monica hotel can run upwards of $1,000 per night.

The good news is that the three nights will run you roughly 157,000 Amex points, and you will get 315,000 Hilton points as they transfer at a 1:2 ratio. To book this, simply transfer your Amex points directly to your Hilton Honors account.

The Amex Platinum card can be a staple for someone who wants a lifestyle card but doesn’t want to sacrifice the ability to earn valuable rewards.

Sound personal finance decisions should always come before splurging on luxurious travel. But if you can afford it, earn the welcome bonus without overspending, and take advantage of the majority of the benefits, it may be worth applying for.

For rates and fees of The Platinum Card ® from American Express, click here .

Was this page helpful?

About Brett Holzhauer

Brett is a personal finance and travel junkie. Based out of Fort Lauderdale, he’s had over 100 credit cards and earned millions of credit card rewards. He learned the tricks of the trade from his mom, and has taken many steps forward. He wasn’t exposed to much travel as a kid, but now has a goal of reaching 100 countries in his life. In 2019, he sold all of his possessions to become a digital nomad, and he says it was one of the best decisions he ever made. He plans to do it again at some point in his life.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Best Credit Cards

- Lifetime Free

- Forex Credit Cards

- RuPay Credit Cards

- International Travel

- Railway Lounge

- Credit Card Guides

- News & Offers

- Credit Score Guide

- Credit Card Limit

- Lounge Access

American Express Reward Multiplier Offers

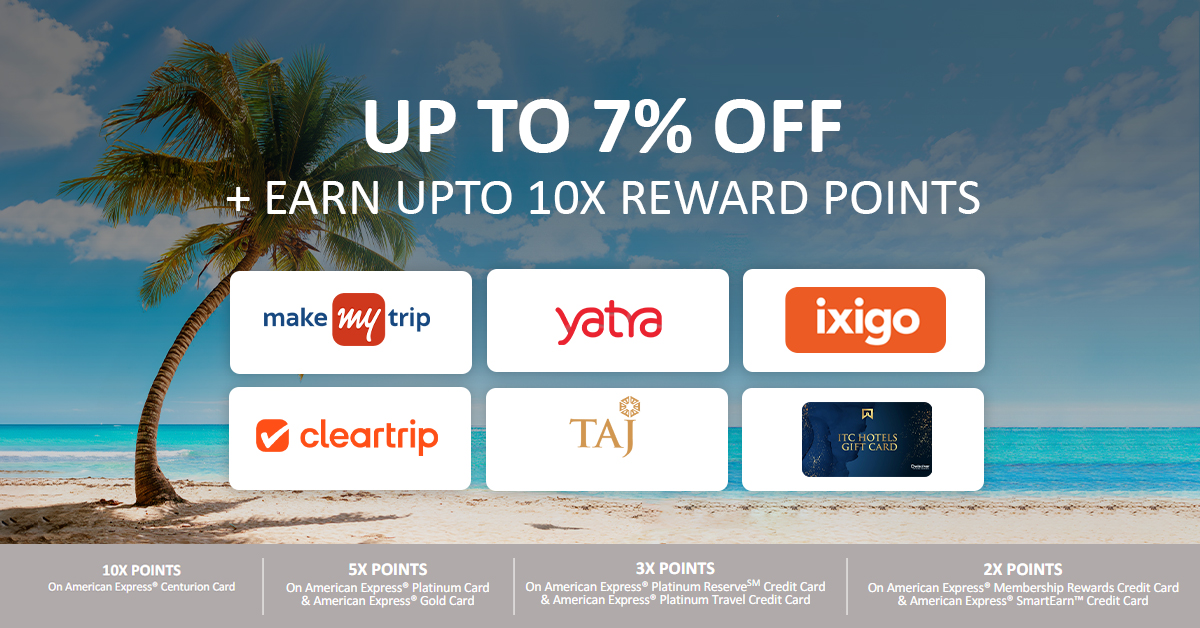

Many top credit card issuers like HDFC Bank and Axis Bank have their reward offers portals like Smartbuy and Grabdeals, where you can get accelerated reward points and massive returns on your transactions at select partner merchants. Similar to these programs, American Express launched their Reward Multiplier program, where you have a chance to earn Membership reward points at an accelerated rate.

Amex Reward Multiplier March 2024 Update

American Express credit card holders will be pleased to know that the renowned international company has added new partners to its already extensive list of partners. Mama Earth, Daily Objects, and Lakme are some of the latest brands where you can now earn accelerated rewards.

Amex Reward Multiplier December 2023 Update

Several new brands have been added as partners on the Amex Reward Multiplier portal, like Dyson, One Plus, HP, Acer, Fiona Diamonds, Malabar Gold, Koskii, Levi, Bath & Beyond, SleepyOwl, Ferns & Petals, and RageCoffee.

Amex Credit Cards Eligible for Reward Multiplier

The following Amex credit cards are eligible to get up to 5x Membership Reward Points on the Reward Multiplier shopping portal.

- American Express Centurion Credit Card

- American Express Platinum Credit Card

- American Express Platinum Reserve Credit Card

- American Express Platinum Travel Credit Card

- American Express Gold Card

- American Express Membership Rewards Credit Card

- American Express SmartEarn Credit Card

All corporate and cobranded cards issued by American Express are not eligible to get accelerated reward points through the Reward Multiplier portal.

Reward Multiplier Benefits

Shopping through the Rewards Multiplier portal will earn you accelerated reward points based on your card. Different cards have different reward multiplication factors. The following table shows the bonus reward points earned by all Amex credit cards –

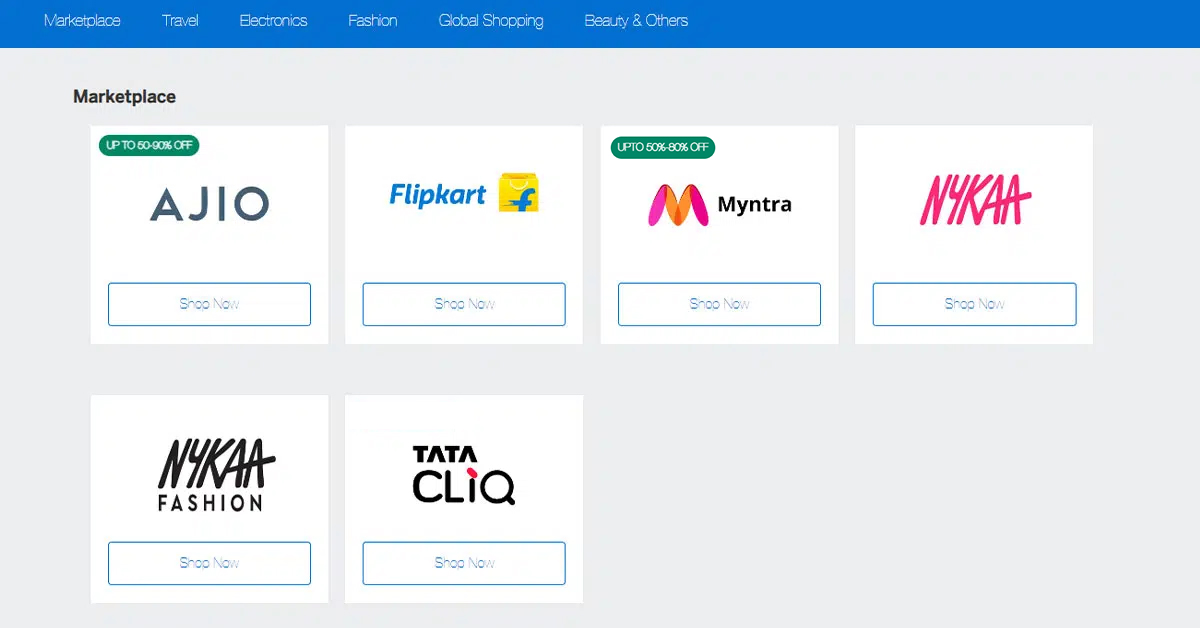

Reward Multiplier – Partner Brands

Amex has partnered with various top brands for the Reward Multiplier portal, and you can earn bonus points when you shop at these brands through the portal. The following are the top brands that American Express has partnered with across different categories –

Marketplace – Flipkart, Myntra, AJIO, Tata Cliq, Nykaa, Nykaa Fashion

Travel – MakeMyTrip, Etihad Airways

Electronics – Apple, Dyson, Croma, OnePlus, Acer, HP, Lenovo, Boat, Norton, Portronics

Fashion – Tanishq, Marks & Spencers, Hidesign, FabIndia, Urbanic, Levis, Jack & Jones, GAS, Kiehl’s, Only, Aldo, Lakme

Global Shopping – FARFETCH, Ubuy, Chic Me

Others– Pepperfry, Durian, Kama, Forest Essentials, Bath & Body Works, Mama Earth, Titan, Fastrack, Cadbury

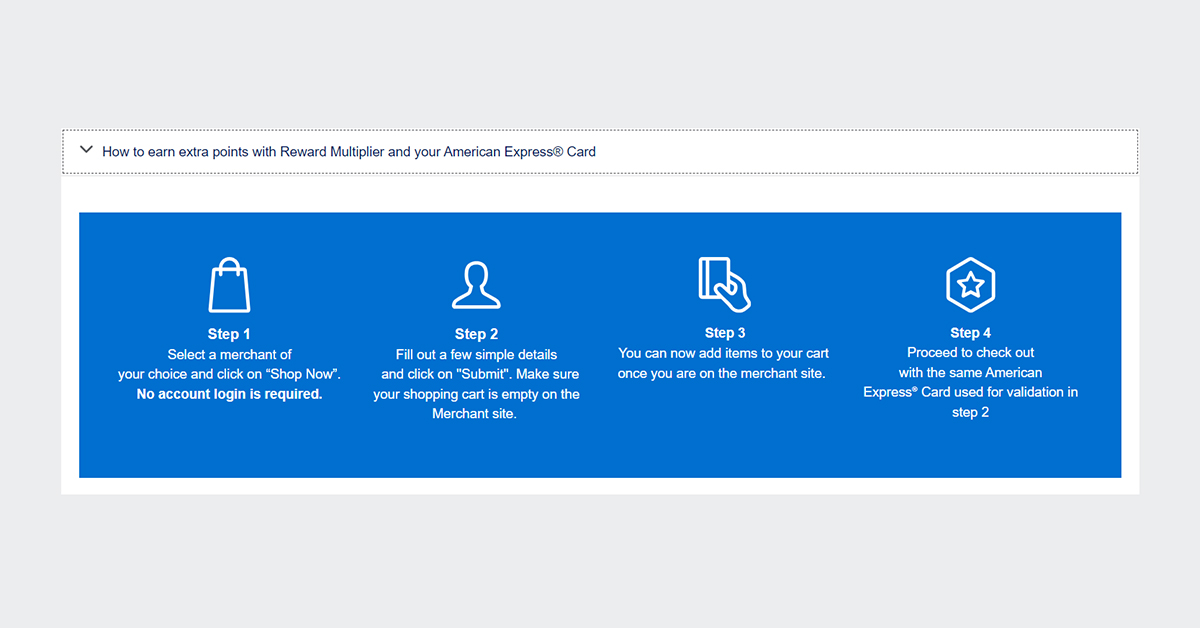

How to Earn Bonus Reward Points with Reward Multiplier

Carry out the following steps if you want to earn bonus Membership Reward Points on your Amex credit card at the Reward Multiplier portal –

- Head over to the Amex Reward Multiplier portal. Choose any merchant you wish to purchase from, and then click Shop Now. You do not need to log in to your account.

- Enter a few details about your credit card and then click Submit. When you reach the merchant website through the portal, make sure that the Cart is empty before you begin choosing what to purchase.

- Add the products and vouchers that you want to buy to your cart.

- Move to the checkout page and make sure to pay with the Amex credit card that you used earlier for validation.

Terms and Conditions

These are the terms and conditions related to the Amex Reward multiplier offer –

- Only eligible Amex credit cards, as discussed above, can get the Reward Multiplier benefits, and the accelerated reward rate is different for different cards.

- You will receive the bonus reward points only if you reach the merchant website through the Reward Multiplier portal and not directly.

- American Express can modify the offer or change their partner merchants without prior notice at any time.

- The maximum bonus reward points are capped at 25,000 per month, regardless of the Amex credit card you are using.

- The bonus reward points on your Amex credit card earned through shopping through the Reward Multiplier portal are credited within 120 days after the transaction.

- You must make the entire payment with your Amex credit card on the merchant website to be eligible for the bonus reward points. You will not get the bonus reward points if you partly make the transaction with another payment option.

- You will not earn the bonus reward points in case you cancel the transaction or return your purchased items.

- If you have credited the bonus reward points and your transaction is deemed ingenuine or canceled, the bonus points will be reversed from your account.

What to do for Successfully Earning Bonus Reward Points?

You only get bonus reward points for complete and genuine transactions that the merchant can track and verify. To ensure a successful transaction, keep the following points in mind.

- Clear your browser cache and cookies before you log in.

- Go to your browser settings and enable cookies there.

- Ensure that you have an empty cart before you begin shopping and adding items at the merchant website.

- Make sure that you are not browsing in a private or incognito mode.

- Once you redirect from the Reward Multiplier portal to the merchant website, do not open any price comparison or discount coupon websites.

- Make sure to complete the transaction wholly with your Amex credit card and not use any other payment method for partial payments.

- Do not cancel the transaction or return all or part of your purchased products; otherwise, you won’t get the bonus reward points.

- Do not open the merchant’s mobile application while you are being redirected from the Reward Multiplier portal.

Exclusions from the Reward Multiplier

You will not earn bonus reward points on certain products through the Reward Multiplier portal –

Bonus reward points are not credited on delivery charges, taxes, and other charges incurred while purchasing products or services from merchants.

Gift Vouchers via Reward Multiplier

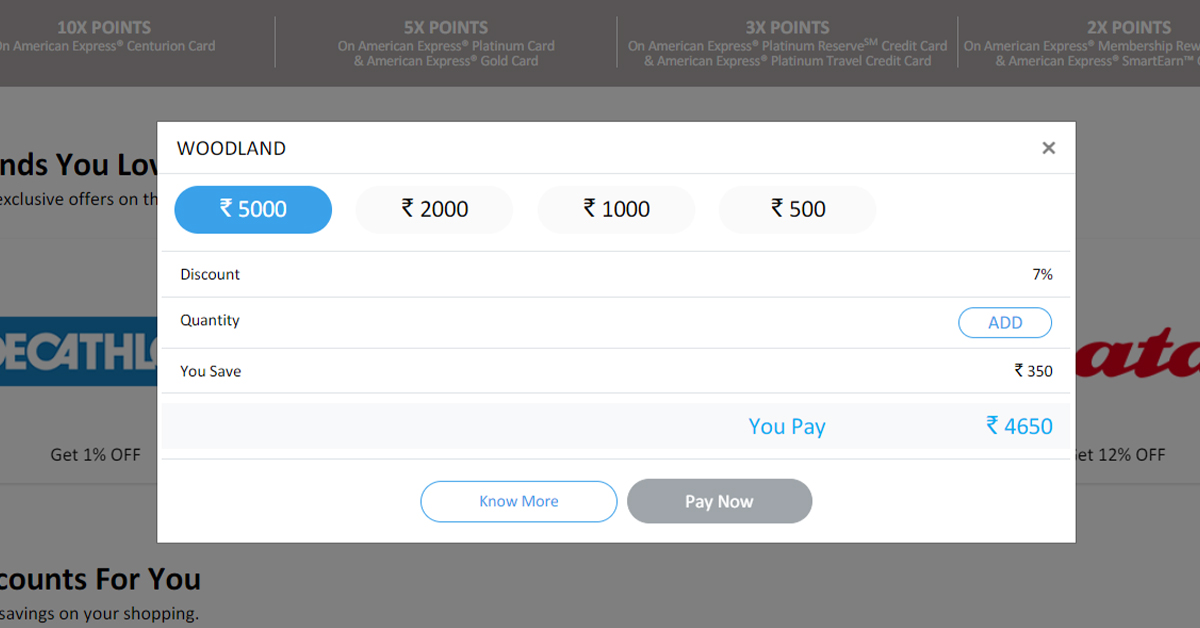

In a few clicks, you can get gift vouchers from your favorite brands via the Reward Multiplier portal.

- Open the Reward Multiplier portal and click Shop Now; you will be redirected to the Amex Gyftr website, which has gift vouchers from top brands.

- Add all the gift vouchers you want to purchase, and then click on Check Out.

- Proceed with the payment using your American Express credit card, and the voucher will be sent to your registered mail address.

- The bonus Membership Rewards points will reach your account within five days.

On the Gyftr portal , you can get exclusive discounts on top brands’ gift vouchers in addition to the bonus reward points on your credit card.

You can click on any brand and then choose the denomination of the gift card you want to purchase.

Also, you can either get the promo codes and use them directly at the brands you want to shop at, or you can send gift vouchers to your friends and family members as a surprise.

You can use your gift vouchers or cards in the following way –

- Visit the brand’s online store for which you have the gift card.

- Choose the products or services you want to purchase and add them to your cart.

- Click on the gift voucher or gift card segment on the payment page.

- Enter your gift voucher code and then click Apply. After the final step, the amount will be redeemed automatically. Different brand pages may have different steps to redeem your gift voucher.

Bottom Line

Just like the Axis Grabdeals and HDFC Smartbuy, the American Express Reward Multiplier portal makes your credit card more rewarding and beneficial by offering bonus reward points. Amex has partnered with multiple top brands and regularly comes up with other offers in addition to the accelerated Membership reward points.

American Express has a great lineup of credit cards in the Indian market, and the Reward Multiplier offer makes it even better for their cardholders. Make sure you follow all terms and conditions and make the payment in the correct manner so that you earn bonus Membership Reward points.

1. What is the American Express Reward Multiplier?

American Express Rewards Multiplier is an aggregator portal by American Express that is exclusively for AmEx credit cardholders. You can shop for e-vouchers and book flight/hotel tickets on Reward Multiplier. All transactions on the Reward Multiplier portal earn Membership Rewards Points at an accelerated rate (up to 10X).

2. What is the maximum number of Bonus Membership Rewards Points that can be earned on shopping via American Express Rewards Multiplier?

You can earn a maximum of 25,000 Bonus Membership Rewards Points in a given calendar month on shopping via the American Express Rewards Multiplier.

3. Do I earn the Bonus Membership Rewards Points if I shop directly from one of American Express’s partner merchants (not via the Reward Multiplier link)?

No, in order to earn the Bonus Membership Rewards Points, you must land on the partner merchant’s website through a link on the Reward Multiplier portal.

4. Do I earn the Bonus Membership Rewards Points if part of the payment is made via some other payment method?

No, you’ll earn the Bonus Membership Rewards Points only if you make the payment in full using your eligible American Express credit card.

Amazon GV not available on Amex Platform, has it been removed?

Yes, it has been removed

Write A Comment Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

Find the perfect credit card in India by comparing the most rewarding options in one place!

- Privacy Policy

- Terms & Conditions

Contact Info

© Copyright 2024 Card Insider

Made With ❤ in India.

Type above and press Enter to search. Press Esc to cancel.

Do Amex airline credits cover mileage boosters?

Update : Some offers mentioned below are no longer available. View the current offers here .

Reader Questions are answered twice a week by TPG Senior Points & Miles Contributor Ethan Steinberg .

Premium credit cards like The Platinum Card® from American Express entice users to pay substantial annual fees by offering a long list of luxury travel and lifestyle perks to offset the cost. Some, like a Priority Pass Select airport lounge membership or hefty bonus multipliers for certain spending categories are relatively straightforward to use, while others require a bit more effort to maximize. Enrollment required for select benefits. TPG reader Taylor wants to know if he can use his Amex airline credits for mileage boosters ...

[pullquote source="TPG READER TAYLOR"]I have a few Delta flights coming up and am curious whether the $200 annual airline fee credit on my Amex Platinum will cover a mileage multiplier purchased at check-in? I know this isn't the best bang for my buck but I'm not sure how else to use the credit.[/pullquote]

Let me start by saying that Taylor is not alone, and I've heard from many friends and readers who struggle to fully use their Amex airfare credit each year. Amex offers one of the most restrictive airline credits on its Platinum cards (up to $200 per calendar year) and its American Express® Gold Card (up to $100 per calendar year). Unlike Chase and Citi which offer broad travel credits on their premium credit cards that apply to just about any type of travel purchase you can imagine, Amex's airfare credit only applies to airline incidental fees. It explicitly excludes the one thing people most want to use it on, actually buying plane tickets. It used to be possible to get around this by buying airline gift cards and being reimbursed, but that loophole closed this year leaving many Platinum cardholders struggling to utilize a key benefit of the card.

Related: Choosing an airline for your Amex Platinum $200 airline-fee statement credit

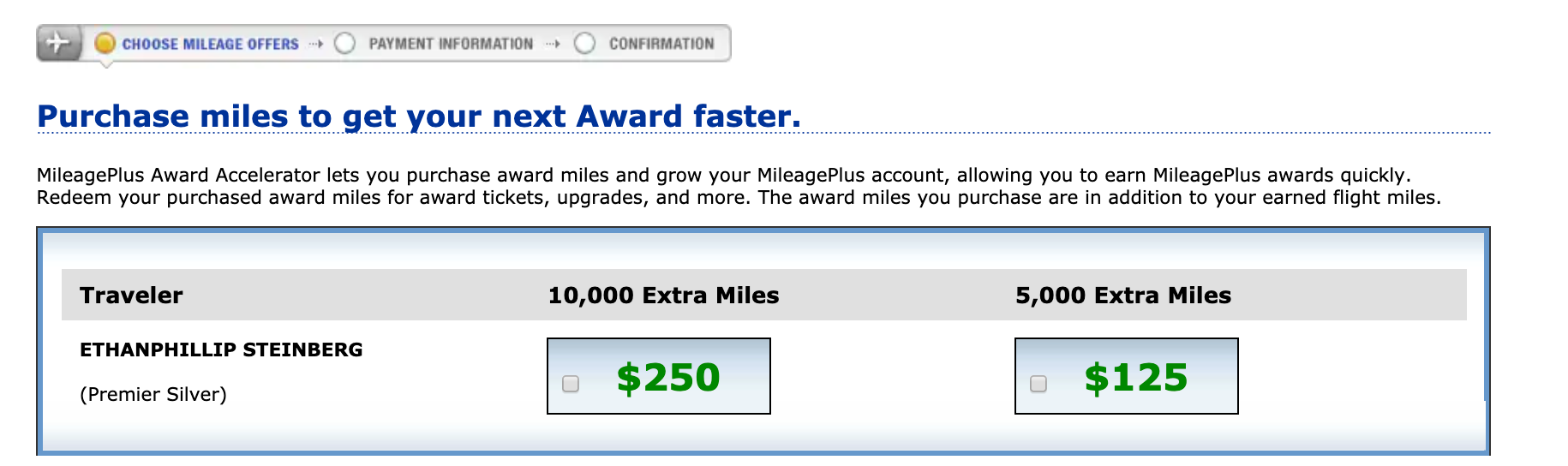

Many airlines (including all three U.S. legacy carriers) will offer you the ability to buy extra miles during the check-in process or even before your flight. These deals are usually a hard pass, as the price just doesn't make sense. For example, I have an upcoming United flight from Washington, D.C. (IAD) to Detroit (DTW) . I have the option to buy 5,000 extra miles for $125 or 10,000 extra miles for $250, a cost of 2.5 cents per mile. TPG values United MileagePlus miles at 1.3 cents each , and even though I can usually redeem them for a higher value than that, I'm not going to buy them at such a high price. This is why we strongly recommend passing on these offers and looking for other ways to boost your mileage balance, like signing up for a new travel rewards credit card or waiting for a sale if you need to buy miles.

When it comes to the Amex Platinum card, the $200 annual airline fee credit is poorly defined . While there isn't a clear list of which charges are eligible, the terms and conditions specifically exclude the following types of purchases:

"Airline tickets, upgrades, mileage points purchases , mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees. The airline must submit the charge under the appropriate merchant code, industry code, or required service or product identifier for the charge to be recognized as an incidental air travel fee"

Based on this it would appear that mileage multipliers are not an eligible purchase, yet a number of readers in the TPG Lounge were quick to jump in and confirm that they had received reimbursement when purchasing a mileage multiplier on their select airline, as recently as about two weeks ago. The airlines people mentioned having success with were Delta and American, though it's possible that others would work as well depending on how they code the purchase. Since these are technically excluded, there's no guarantee this will work.

The biggest issue is that if the credit doesn't automatically apply, I wouldn't expect Taylor to have much luck getting an Amex representative to manually issue it given the specific exclusion of mileage points purchases. This is just like the gift card loophole — it worked for a long time, but when it suddenly stopped working people who didn't receive the credit had no recourse with Amex since gift cards had always been explicitly excluded.

Related: Maximizing benefits with the Amex Platinum card

Bottom line

Taylor should be able to get about 10,000 miles give or take by buying a mileage booster with his preferred airline, in this case Delta . However, this is not the best redemption value, so he'll want to weigh this heavily when the annual fee comes due next year and he needs to decide whether to keep or cancel the card.

If you have an Amex Platinum (including The Business Platinum Card® from American Express) or Amex Gold and are struggling to use your annual airline fee credit, one popular use that is entirely within the published terms and conditions of the benefit is to spend your credit on seat selection, specifically on upgrading to premium economy. While "upgrades" are excluded from the list of eligible charges, many airlines still allow you to "upgrade" to premium economy simply by paying to select a seat in that cabin. At the end of the day, it's all about how your charge is coded when it's submitted to Amex.

Thanks for the question, Taylor, and if you're a TPG reader who'd like us to answer a question of your own, tweet us at @thepointsguy , message us on Facebook or email us at [email protected] .

You are using an outdated browser. Please upgrade your browser to improve your experience.

Manage My Account

Help With My Account

Manage My Card

Help With My Card

Travel Services

Travel Benefits

Help With Travel

Insure Myself

Insure My Possessions

Help With Insurance

Benefits And Offers

Manage Membership

Corporate Payment Solutions

Accept Our Cards

Help With Business

Frequently Asked Questions

Top Actions

Top Questions

Discover how your spends can add up to big rewards.

Make your spending on dining, shopping, utilities, insurance and overseas travel count more than ever, with benefits worth ₹6,00,000* per annum., your platinum card gets you a welcome gift of taj vouchers worth ₹45,000 in the first year of cardmembership., american express® platinum card, simply use the calculator below and see how your benefits and rewards add up.

Benefit from points which Basic and Supplementary Cardmembers get from annual spend + Bonus Membership Rewards on Fuel+ Taj Vouchers during Birthday Month T&C 1

Value of 4 bonus points earned basis annual spend on this platform. T&C 2

Taj Epicure membership worth ₹5,000 + EazyDiner Prime membership worth ₹3,500 + 25% discount with average spend of ₹6,000 per transaction.T&C 3

Airline: 15% off on Vistara + Lodging: upto 25% off on Premium Getaways + 30% off on Taj Suites + Access: Amex proprietary and domestic partner lounge + Amex Travel benefit worth ₹30,000 +Domestic Meet and Greet, Delhi. T&C 4

3X points on overseas spend + Lodging: FHR benefit worth ₹37,000 + Airline: 25% off on Virgin Atlantic + Access: Centurion and proprietary/domestic lounge. T&C 5

1 golf tee off session = ₹3,000 (green fee waiver) + 1 golf lesson = ₹1,250 Assuming Cardmember will play/take golf lesson 6 times in a year. T&C 6 .

Exclusive 20% off on a joining fee of ₹250,000 of Quorum Club.T&C 7

Total Annual Benefit

Annual Benefit from Limited time period offers and Wellness benefits available on your Card. Click here to know more about Limited time period offers.

Intangible benefits.

Benefits to match your world

- Platinum Concierge - Whether you’re looking for theatre tickets, an anniversary gift, a restaurant recommendation or help booking your next trip, just call. We’ll tap into our global network of contacts to help you out.

- Platinum Travel Services - You decide the destination and leave everything to us. From tickets aboard the best airlines to hotel reservations, sightseeing guides and more, we will put together the perfect trip for you.

- Limited Card Liability - If your Card is lost or stolen your liability is nil after you report the loss to us within three days of the loss. If the loss is reported beyond three working days then the maximum liability will be limited to INR 1,000.

- Elite tier memberships - Complimentary access to Hilton Honors Gold, Marriott Bonvoy Gold Elite, Radisson Rewards Gold, Taj Reimagined Epicure ,Hertz Gold Plus Rewards.

- Events - Special invitation to a host of events both in India & abroad.

- No pre-set spending limit - Enjoy flexible spending power with "no pre-set limit" that keeps adjusting automatically based on your financials, spend pattern, credit record and account history.

Terms & Conditions apply

- 3X Membership Rewards points on overseas spend: Assuming Basic Cardmember will spend 6 Lacs, and each Supplementary Cardmember will spend 3 Lacs on the Card. Assuming redemption rate to be up to 0.4 per point. Formula for basic: (spend/40) *0.4*2 and formula for Sup:(spend/40)*0.4*2* number of supps.

- Fine hotel and resorts: Daily Breakfast for 2 for 2 days: ₹10,000; Room Upgrade for 2 nights: ₹2,000; Unique Amenity: ₹6,500; Late Checkout - ₹8,500.

- Virgin Atlantic Offer: 25% Offer on the business class ticket; Ticket: Delhi to New York; Average base fare: 1 Lac per person per round trip (base fare).

- Proprietary lounges: Each visit to Delhi/Mumbai proprietary lounges will cost ₹3,000.

- Centurion Lounges: Each visit costs $50.

Illustration for Card Member Reference:

₹24,000 (Cardmember both basic and Supplementary Cardmembers will get 3X on all international spend) + ₹37,000 (Fine Hotel and Resort Benefit) + ₹75,000 (Benefit from Virgin Atlantic Offer) + ₹19,950 (Benefit that Cardmembers can drive from Centurion Lounges and Prop/domestic lounges)= ₹1,55,950.

6. Cardmember is entitled to Green Fees waiver at our 30+ partner golf courses. Green fees is assumed to be ₹3,000 per round subject to slots’ availability at the golf course. Assuming Cardmember will play 6 times in a year. Cardmember is entitled to complimentary golf lessons at our partnering golf courses. The price per lesson is assumed to be around ₹1,250 per round and 6 lessons of golf in a year. Assuming Cardmember or Supplementary Cardmember will take 6 lessons in a year.

Illustration for Card Member Reference :

- The value mentioned above is generic; indicative based on the average usage by the existing American Express® Platinum Cardmembers.

- This is the benefit that can be derived from the product basis the generic Spend we have taken, and actual benefit may vary from Cardmember to Cardmember basis their respective spend.

- This calculator contains certain benefits which are available for limited time only.

- The benefit is initially calculated in USD and then converted into ₹ for representation purpose. Hence, value is subject to exchange fluctuation. For this version we have taken value of $1 as ₹73.

Kindly refer to detailed Terms and Conditions on offers at https://www.americanexpress.com/in/benefits/the-platinum-card/ and click on this link for Most important terms.

IMAGES

VIDEO

COMMENTS

From short flights to long hotel stays, you can use Pay with Points for all or part of the purchase through AmexTravel.com. Or, earn 5X Membership Rewards points when you book with your Platinum Card. This includes up to $500,000 per calendar year on flights booked directly with airlines or through American Express Travel and eligible prepaid ...

Earn 80,000 Amex Membership Rewards points after you spend $8,000 on purchases on the card in your first six months of card membership. Earn 5 points per dollar for flights booked directly with airlines or with American Express Travel (on up to $500,000 on these purchases per calendar year, then 1 point per dollar) Earn 5 points per dollar on ...

The Amex Platinum offers 5x Membership Rewards points: On flights booked directly with airlines. On flights booked through Amex Travel. A few things to note about the 5x points on airfare purchases: You're capped at earning 5x points on up to $500,000 in flight purchases per calendar year (which shouldn't be an issue for a vast majority of ...

Booking this same $300 Delta flight with the Amex Platinum Card would net you 1,500 Membership Rewards points with the 5x multiplier.And you could turn around and transfer those points right back to your Delta SkyMiles account because Membership Rewards points transfer to Delta SkyMiles at a 1:1 ratio - 1 point gets you 1 Delta SkyMile.

Here are some of our favorite ways to redeem 150,000 Amex points for Hilton stays: 3 nights at Waldorf Astoria Monarch Beach for 143,000 Amex points. 3 nights at Conrad Koh Samui for 143,000 Amex points. 3 nights at Reykjavik Konsulat Hotel, Curio Collection by Hilton, for 120,000 Amex points. 3 nights at Hilton Seychelles Labriz Resort & Spa ...

Current Amex Platinum offer. Currently, there's a 80,000-point welcome offer after you spend $8,000 in the first six months of card membership. TPG values Membership Rewards points at 2 cents each, making this welcome offer worth $1,600. That is nearly three times the card's $695 annual fee, so at the very least, you can justify carrying the ...

1. Welcome Bonus. The Platinum Card lets you earn 80,000 Membership Rewards Points after spending $8,000 on purchases on the card in the first 6 months of card membership. Depending on how you ...

The current welcome bonus for the Amex Platinum is 80,000 Membership Rewards points after you spend $8,000 on purchases within the first six months of card membership. This is slightly above the standard welcome offer we have seen. THE POINTS GUY. According to TPG's latest monthly valuations, Amex Membership Rewards points are worth 2 cents ...

and Plug In. Experience the latest shows, audiobooks, music, news and recipes. Get up to $20 in statement credits each month when you use your Platinum Card ® for eligible purchases on Audible, Disney+, The Disney Bundle, ESPN+, Hulu, Peacock, SiriusXM, and The New York Times when you purchase directly from one or more of the providers.

To get up to $100,000 in theft and damage coverage, Florida residents have to pay $15.25 per rental, California residents are charged $17.95 and residents of all other states pay $24.95 per rental ...

For the trip cancellation and interruption insurance coverage benefit of The Platinum Card® from American Express, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card.

Eligible Platinum Card Members may bring either up to two guests, or their immediate family (spouse/domestic partner and children under 21) to the Club at a per-visit rate of $50 per person, per location or to Grab and Go at a per-visit rate of $25 per person, per location.

How to make an AmEx travel insurance claim. To file a claim, you'll need to contact your benefit administrator. The phone number and timeframe will vary according to the type of insurance you ...

Step 2: Select Transfer Points under Redeem. Image Credit: American Express. Step 3: Choose your desired airline or hotel transfer partner and select Transfer Points. If you haven't already, you will need to link your frequent flyer account to your Membership Rewards account.

The Amex Business Platinum rocks out when it comes to travel perks. ... The 1.5x rewards multiplier is capped at two million dollars ... Is the Amex Business Platinum Card® from American Express ...

And if you're new to the Amex Platinum, you can earn a generous welcome offer: a sizable 100,000 Membership Rewards points after spending $6,000 in purchases within your first six months of card membership. But the truly unique element of the offer is a bonus multiplier on non-travel items.

The Amex Platinum offers an up-to-$240 digital entertainment statement credit, broken down to up to $20 in monthly statement credits when you pay for participating subscription services. They ...

Click on "Shop Now" to land on a brand-new destination to shop for e-vouchers. Add all the e-vouchers you wish to buy to your cart and proceed to check out. Make payment using your American Express ® Card to get your e-voucher on your registered email. Enjoy your Membership Rewards® points that will be credited to your account within 5 days.

Forex Markup charges are standard 3.50% + GST. For the AMEX Platinum Travel card an income proof of a minimum gross ₹6LPA is required whether you are salaried or self-employed. AMEX doesn't process applications on a Card-to-Card basis. Your CIBIL score should be a minimum of 750. You must have an address proof of any serviceable area.

Earn 10X* on Centurion® & 5X* on Platinum with Reward Multiplier. Earn 10X* on Centurion® & 5X* on Platinum with Reward Multiplier. Earn additional e-vouchers worth up to ₹20,000 when you shop from 50+ brands like Apple, Dyson, Nykaa, Flipkart, MakeMyTrip, Tanishq and many more. T&C Apply.

The Amex Platinum sign up bonus changes often. Right now, it's one of the highest offers we've seen, so here's how you can grab 175k points. News. ... At Upgraded Points, our team has rigorously evaluated nearly every travel and rewards credit card available for both consumers and businesses. Our recommendations are based on direct experience ...

The Platinum Card® from American Express. Amex Platinum: Earn 80,000 Membership Rewards points after you spend $8,000 on purchases within the first six months of card membership. Earning points: 5 points per dollar spent on airfare purchased directly through airlines or Amex Travel (on up to $500,000 on these purchases per calendar year, then ...

American Express Reward Multiplier May 2024 Update - Check out all latest monthly reward multiplier offers here. Card Categories. All Categories; Best Credit Cards ; ... American Express Platinum Travel Credit Card: 3x: 2 points per Rs. 50 spent: 1 point per ₹50 spent: 3 points per ₹50 spent: American Express Gold Card: 5x:

But the Business Platinum Card takes things a step further with added credits like up to $400 in annual credits at Dell.com and one of our favorite perks of all: A 35% rebate when using points through Amex Travel to book with the domestic airline of your choice - or any first or business class flight.. Keep reading for more details on this new, increased welcome bonus offer.

When it comes to the Amex Platinum card, the $200 annual airline fee credit is poorly defined. While there isn't a clear list of which charges are eligible, the terms and conditions specifically exclude the following types of purchases: "Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free ...

Make your spending on dining, shopping, utilities, insurance and overseas. travel count more than ever, with benefits worth ₹6,00,000* per annum. Your Platinum Card gets you a welcome gift of Taj Vouchers worth ₹45,000 in the first year of Cardmembership. American Express® Platinum Card. Simply use the calculator below and see how your ...