- International edition

- Australia edition

- Europe edition

Feelgood story turns bad as Sky humiliates Indigenous teenager who caught $1m barramundi

Peter Stefanovic interview with teenager who won Northern Territory tourism competition turns sour. Plus: Daily Telegraph embraces Chat GPT

It was the feelgood story of the year from the Northern Territory when 19-year-old Keegan Payne caught a barramundi worth $1m in a competition designed to promote tourism.

“The whole family was shocked – they’re all proud of me,” he told the ABC. “We’re from Katherine, Mum’s from Kakadu.

“It’s pretty hard going for us at the moment with money but now, with a million dollars, don’t have to complain about it.”

Keegan Payne, a 19-year-old from the rural town of Katherine, today becomes the NT's newest millionaire, after snagging the million dollar fish on the Katherine River. https://t.co/IoxNE5Q1lb — ABC News (@abcnews) April 30, 2024

But one live interview, on Sky News Australia , turned into a humiliating experience for the Indigenous teenager when the host, Peter Stefanovic, asked him a question about an incident he was involved in when he was 16.

“There is a claim online that you stole a Polaris Ranger and Polaris quad that you and your friends stole and damaged from a business a few years back. First of all, is that true?” Stefanovic asked.

A shocked Payne, who was sitting in the Darwin Sky News studio, quietly said “yes”.

Pushed to explain himself, Payne said he and his mates “weren’t thinking at the time”, were “still young” and that he regretted it “big time”.

It was excruciating to watch.

Contacted by the Daily Mail , Payne’s former boss Bob Cavanagh said the young man had “always felt so terrible for what he did” and he was an otherwise “good kid”. He had also offered to pay him back.

After the Stefanovic interview, Cavanagh told Sky News reporter Matt Cunningham he did not proceed with police charges at the time, opting instead to talk to the boys and their parents and they agreed to work for free on weekends.

Indigenous leader and Sydney city councillor Yvonne Weldon said she was appalled by the interview.

“They invited him on to talk about his prize catch and then proceeded to put him on the stand for an adolescent misdemeanour,” Weldon said in a LinkedIn post. “In doing so, they’ve shown no regard for his wellbeing and right to privacy.

“Moreover, they have perpetuated a harmful and negative stereotype about Aboriginal young people.”

Naomi Moran, the general manager of the Koori Mail, said “this is what institutionalised discrimination looks and sounds like in mainstream media”.

“A narrative that is so familiar,” Moran said, also on LinkedIn. “That a black person will only be who he once was, rather than who he has become in this country.

“We must continue to call out this representation of our people in mainstream Australian media .”

Sky News did not respond to a request for comment and Stefanovic deleted his social media accounts overnight.

On Friday afternoon Sky News issued a statement that recounted the exchanges in the interview and included an apology to Payne.

“Sky News Australia and Peter Stefanovic apologise to Mr Payne and his family for raising these claims during the live interview about his million dollar win in the fishing competition,” the statement said. ”Mr Stefanovic has reached out to Mr Payne and his family directly to convey his apology.”

The original video had been taken down by Friday afternoon.

Fitz tackled

Sydney Morning Herald sports writers are slugging it out in the paper over the emotive issue of banning the kick-off in NRL matches as a measure to reduce high-impact tackles that may cause concussion.

The SMH’s chief sports writer, Andrew Webster, took aim at Peter FitzSimons on Friday over a column by FitzSimons about moves to prevent head impacts in NRL.

Conceding there is “nothing quite as boring as columnists trading barbs in their allocated space”, Webster wrote he was so hurt by what Fitz had written that he had to respond .

“How dare someone accuse us of not caring about these people, our mates, just so they can fill column inches to prove they’re right and we’re wrong,” Webster said.

“So, in summary, we get it Fitz.

“You hang your journalistic hat on your coverage of concussion and that’s fair enough. You were the first and that will never be forgotten. You deserve credit for fighting the good fight.

“But wouldn’t it be more effective to bring people with you on this concussion journey, instead of continually belittling them?”

What did Fitz say to provoke this angry response? In a column on Thursday headlined “The expert opinion is in: NRL must take on the kick-off concussion issue”, without naming Webster, he ridiculed “people saying that a source of concussions in the NRL, the long kick-off, is no problem, and that all of us who advocate changing it for the sake of sanity are somewhere between engaging in a silly debate and out to destroy the game”.

Webster’s column two days earlier had referred to the kick-off ban proposal as a “silly debate”.

Will Fitz now respond to Webster’s response to his criticism?

Picture imperfect

The executive chairman of News Corp Australia, Michael Miller, has shown an optimistic attitude to artificial intelligence, telling staff last year it would “change our industry” and setting up an AI working group to explore “10 new high-value opportunity areas for AI”.

He also boasted last August that News Corp was producing 3,000 articles a week using generative artificial intelligence.

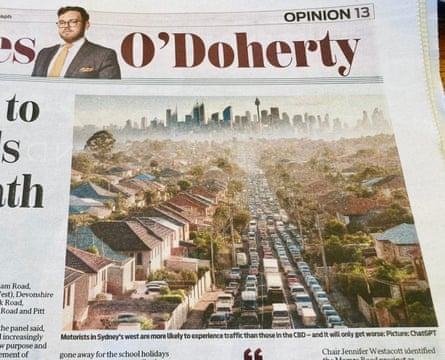

Now it would appear AI is increasingly being used for illustrations at the Daily Telegraph, replacing newspaper photography or commissioned art. An opinion piece by James O’Doherty about federal funding for roads, published last Friday, was accompanied by an image of a traffic jam snaking though a fictional western Sydney suburb, credited to ChatGPT.

A quick review showed us many of the opinion pieces by O’Doherty, Joe Hildebrand, Tim Blair and Andrew Bolt are now illustrated by ChatGPT. We have asked the editor, Ben English, what the paper’s policy is.

Ten stops celebrating

The Ten Network may have won the defamation case brought by Bruce Lehrmann but the network has had little to celebrate since the judgment was handed down on 15 April.

Not only is Ten likely to have to cover millions in legal costs due to Lehrmann being of extremely limited means but its behaviour outside the federal court raised the ire of Justice Michael Lee, who demanded Ten’s lawyers explain themselves before the costs hearing on Wednesday.

Lawyer Justin Quill, who was authorised to comment on the judgment by Ten, said outside the court Ten had been vindicated by the judgment.

Lee, who described the comments as misleading and discourteous, said it was it is “open to argue” that Ten’s conduct “was intended to, or had the tendency to, interfere with the administration of justice in a particular proceeding”.

Three very “contrite” lawyers submitted affidavits to Lee apologising for saying his judgment was a “vindication” and performing a backflip on some evidence given at the trial.

Lisa Wilkinson was heavily criticised in the media for an acceptance speech she gave at the Logies in 2022 for the Project interview with Brittany Higgins. The speech led to the criminal trial in the ACT supreme court for the alleged sexual assault of Higgins being delayed by three months.

Ten’s chief litigation counsel, Tasha Smithies, told the court in February she did not think there were any issues with the Logies acceptance speech, which she had approved.

Lee did not agree, asking Ten why it “repeatedly expressed the view that the Logies speech not only did not have the tendency to interfere with the administration of justice but presented no difficulty whatsoever”.

Smithies told Lee the judgment had been “profound and sobering” and she had a different view now she had reflected on it.

“Since the delivery of the trial judgment I have taken counsel from senior members of the legal profession including Dr Matt Collins AM KC about the advice I gave in relation to the Logies speech, the evidence I gave, and the observations and conclusions about me in the trial judgment,” Smithies said in her affidavit.

“As a result of all of those matters, I believe I’ve developed greater insight into my conduct.”

In a separate claim for costs, Taylor Auerbach’s solicitor Rebekah Giles told the court her client had run up a bill of close to $40,000 for giving evidence. Her fees alone were $900 an hour.

Devil in the detail

The ABC has deleted a social media post which was not marked “analysis” and which gave the impression the public broadcaster’s newsroom was accusing the prime minister of getting it “horribly wrong”.

The article was commentary by Annabel Crabb about Anthony Albanese’s appearance at the domestic violence rally in Canberra.

ANALYSIS: The footage of Prime Minister Anthony Albanese attempting to cope with the febrile environment outside Parliament House at Sunday's domestic violence rally is nearly unwatchable, writes Annabel Crabb https://t.co/SgA3LWtxxV — ABC News (@abcnews) May 3, 2024

The new post on X is clearly labelled.

The ABC told Weekly Beast the automated process dropped the word “Analysis” from the post on X.

- Australian media

- The weekly beast

- Sky News Australia

- Indigenous Australians

- Defamation law (Australia)

- News Corporation

Most viewed

More From Forbes

The world’s best beaches—according to a 2024 report.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Overlook of Trunk Bay, St. John, US Virgin Islands in the Caribbean, which was named the top beach ... [+] in world in 2024 by The World's Best Beaches.

U.S. residents don’t need a passport to travel to this year’s winner of the “World’s Best Beach.” The No. 1 best beach in the world for 2024 is: Trunk Bay, located on St. John, a U.S. Virgin Island, according to The World’s 50 Best Beaches presented by Banana Boat.

Sheltered from the Caribbean tradewinds, the waters are calm and ideal for swimming and, you can duck underwater with your snorkel gear on to be greeted by colorful fish darting around the reef.

Each year, the World’s 50 Best Beaches asks thousands of travel professionals to nominate their favorite beaches, and then the organization narrows the list down with factors that include the uniqueness of the surrounding landscape, the soundtrack of nature, and takes into consideration things like whether the waters are calm enough to swim in and the idyllic beaches aren’t too crowded.

Trunk Bay on St. John in the U.S. Virgin Islands was named the top beach on the 2024 edition of the ... [+] World's 50 Best Beaches list.

The World’s 50 Best Beaches joins a number of other rankings that are out to determine the very best beaches in the world, including the TripAdvisor ranking that named Praia da Falésia in Olhos de Água, Portugal the best beach in the world earlier this year. Recently, Malta’s Ghajn Tuffieha Bay Beach was named the most beautiful beach in Europe by European Best Destinations. Unofficially, “Barbie” put the spotlight on pink-sand beaches around the world in the past year, too.

Sony Is Making A Truly Terrible Mistake With Helldivers 2 Update Sony Reverses Course

‘baby reindeer’: stephen king writes essay praising netflix stalker series, apple iphone 16 new design and performance upgrades revealed in leak.

While there’s many gorgeous beaches around the world where turquoise water laps the sand, Trunk Bay is a quintessential Caribbean paradise that rises above the rest for a few reasons, according to the World’s 50 Best Beaches findings.

“Visitors praise the incredibly soft sand and the crystal-clear, pool-like waters, but what truly distinguishes Trunk Bay from other Caribbean destinations is its setting within the stunning Virgin Islands National Park,” the report says.

This means that the beach is a protected area, and truly a place to getaway, with lush greenery and local wildlife.

An aerial shot of Trunk Bay, located on St. John in the U.S. Virgin Islands.

Trunk Bay is named after the Leatherback turtle, which are native to the area and called “trunks.”

"Trunk Bay and the many beaches across the U.S. Virgin Islands hold a special place in the hearts of those who call our beautiful islands home as well as our returning visitors," says Joseph Boschulte, Commissioner of the USVI Department of Tourism in a news release. "We have long regarded our beaches as some of the best in the world, and this recognition helps us share that with the world."

The Caribbean's high season runs from December through April, and that’s when Trunk Bay is busiest.

Last year, Lucky Bay, a kangaroo hangout in western Australia, took the top spot on the best beaches list.

The Top Beaches in The U.S.

The only beach in the contingent U.S. to make the top 50 list was Henderson Beach along the Emerald Coast in Florida, which took the No. 44 spot.

Henderson Beach in Florida was the only beach in the contingent U.S. to land on the World's 50 Best ... [+] Beaches list in 2024.

Lanikai Beach on Oahu snagged the No. 14 spot and the palm-lined Kapalua Bay Beach on Maui ranked No. 40 on this year’s list.

The Top 10 Beaches in the World

Catamaran boat anchored off of sandy beach with view from under a shady tree on Meads Bay on the ... [+] Caribbean island of Anguilla.

Here are the other beaches that cracked the top 10 in the World’s 50 Best Beaches 2024 list:

No. 1: Trunk Bay, U.S. Virgin Islands

No: 2: cala mariolu, italy.

Cala Mariolu

No. 3: Meads Bay, Anguilla

No. 4: entalula beach, philippines.

Entalula Island Beach

No. 5: Voutoumi Beach, Greece

Voutoumi Beach

No. 6: Turquoise Bay, Australia

Aerial view of Turquoise Bay in Australia.

No. 7: Pink Beach, Indonesia

Aerial view Pink beach, Komodo national park, Flores, Indonesia

No. 8: Anse Georgette, Seychelles

Anse Georgette, Seychelles

No. 9: Green Lagoon, French Polynesia

Fakarava Atoll, Tuamotu Archipel, French Polynesia

No. 10: Horse Shoe Island, Myanmar

Horse Shoe Island, Myanmar

- Editorial Standards

- Reprints & Permissions

Intelligent Investment

Global Hotel Investor Intentions Survey 2024

Global hotel investors plan to buy more this year.

May 1, 2024 15 Minute Read

Executive Summary

- Over half of the 300 hotel investors surveyed worldwide by CBRE Hotels Research intend to buy more in 2024 than in 2023, while only 14% expect to buy less.

- Plans for increased hotel investment across regions are based on expectations of higher returns, price adjustments, distressed opportunities and a lower cost of capital.

- Nearly 75% of respondents say they are most attracted to opportunistic and value-add hotel assets in 2024.

- In the U.S., upper-upscale and upscale/upper-midscale are the most popular chain-scale targets in 2024. Canadian investors favor lower- and middle-price tier chain scales, while higher-price tier properties are preferred in Europe, Mexico, Central America and the Caribbean. Upper-upscale properties are the most popular investment chain scale among Asia-Pacific investors.

- Resorts are the most attractive hotel property type for investors in the U.S., Mexico, Central America and the Caribbean. Central business districts (CBDs) are the most attractive submarkets for European and Canadian investors, while Asia-Pacific and European investors particularly favor those in gateway cities.

- In the U.S., gateway markets like New York and Washington, D.C. topped the list of cities expected to outperform in 2024, along with leisure-focused markets like Miami, Charleston and Austin. In Europe, investors favor gateway markets like London and Madrid. Among Mexican markets, Los Cabos, Cancun and Mexico City are expected to have the strongest performance in 2024.

Click to enlarge

Global Outlook

CBRE Hotels Research is cautiously optimistic about hotel market fundamentals this year, as outlined in our 2024 Global Hotels Outlook report. Following a 33% drop last year, we expect investment activity to pick up in the second half of 2024 due to highly anticipated Federal Reserve interest rate cuts.

Figure 1: Global Hotel Investment Volume & Share of Cross-border Capital

CBRE’s inaugural Global Hotel Investor Intentions Survey of more than 300 investors from the Americas, Europe, Asia-Pacific and the Caribbean casts a positive outlook on global hotel investment in 2024. More than 50% of surveyed hotel investors plan to buy more this year than last, while only 14% expect to buy less. Investors from the U.S., Mexico, Central America and Europe are the most optimistic about increased investment activity.

Figure 2: Investor Intentions for Hotel Acquisition Allocations

Cross-border investment is an important source of hotel capital. Approximately 20% of survey respondents invest cross-regionally. We believe the percentage of intra-regional investors, (i.e., U.K. investments in Spanish or French hotels) is considerably higher. Given the positive sentiment among investors, CBRE Hotels Research expects that the cross-border capital share of total global hotel investment will increase in 2024.

Figure 3: Percentage of Investors Engaging in Cross-regional Hotel Investment

Other key findings of our survey include:

- More than half of Americas region investors said they are mostly targeting hotels affiliated with globally recognized brand families (Marriott, IHG, Hilton, Rosewood, etc.), while the highest percentages of European and Asia-Pacific investors said they are mostly targeting vacant-possession 1 hotels. U.S. and European survey respondents showed a preference for hotels affiliated with globally recognized brand families. However, more than half of Asia-Pacific investors said they are more likely to target independent hotels for short-term investment.

1 Either the property is vacant and not operating as a hotel or there is a lease/management in place that terminates upon sale.

Figure 4: Branded Hotel Share of Total Supply in 2023 & Share of Surveyed Investors Targeting Branded Hotels in 2024

- Full-service remains the most preferred hotel concept globally, favored by 38% of survey respondents. However, U.S. investors expressed more interest in limited-service (40%) than full-service (32%), followed by extended-stay (21%). Interestingly, approximately one-third of Asia-Pacific, Mexican and Central American investors favor hotel-branded residential properties.

Figure 5: Percentage of Hotel Concepts as Investment Target by Region

- Upper-upscale and luxury hotels are the most preferred hotel classes globally by 45% and 39% of surveyed investors, respectively. There are some preference variances between the regions; for example, more Canadian investors said they favor mid- and low-priced hotel classes than the global survey average, while U.S. investors prefer upscale and upper-midscale properties. However, all hotel classes scored high, with over 50% of investors finding them either somewhat or most attractive.

Figure 6: Attractiveness of Hotel Types for Investment Globally

- Almost half of all surveyed investors find resort markets the most attractive locations for hotel investment. Resort locations are most favored by U.S., Mexican, Central American and Caribbean investors, while urban locations are most favored by European, Canadian and Asia-Pacific investors.

Figure 7: Attractiveness of Hotel Locations for Investment Globally

High costs remain the biggest challenge for investors this year: borrowing costs (52% of those surveyed), labor costs (44%), and construction costs (26%). Geopolitical risks were among the top three concerns for investors from Europe, Asia Pacific, Mexico and Central America.

Figure 8: Top Challenges for Global Investors

United states.

U.S. investors have generally positive sentiment about the hotel market this year, with half of those surveyed planning to increase their hotel investment. This is being driven by expectations of higher total returns and favorable price adjustments. For those who plan to buy less this year, dispositions to strengthen the balance sheet, along with securing and servicing debt, are the top concerns.

Figure 9: U.S. Investors’ Buying Intentions

The most favored location types are central business districts (CBDs) and resorts, while upper-upscale and upscale/upper-midscale are the most popular chain-scale targets in 2024. We expect RevPAR growth of 4.1% for urban locations, with increased group, business and international travel. We also expect consistent leisure demand and modest ADR gains to support 2.0% RevPAR growth for resort locations.

Figure 10: Most Attractive by Chain Scale – U.S.

Figure 11: most preferred location type – u.s., figure 12: hotel acquisition/development intentions by service offering – u.s..

Increased borrowing costs and labor expenses are the most challenging issues this year, followed by higher insurance costs. These costs are likely to pressure margins further in 2024. While we expect traditional hotel demand and pricing may be tempered by competition from alternative sources like cruise lines, short-term rentals and outdoor lodging, U.S. investors do not appear as concerned with this competitive encroachment, with 29.5% identifying competition from alternative sources as a challenge.

Figure 13: Major Challenges for Real Estate Investors in 2024 – U.S.

Major urban markets like New York and Washington, D.C. are expected to have the strongest hotel market fundamentals in 2024, along with leisure-focused locations like Miami, Charleston and Austin. Given limited new hotel supply and restrictions on Airbnb units, New York City is 2024’s most attractive investment market, followed by Miami, Charleston and Boston. Perhaps because more distressed assets could enter the market and make pricing more favorable, investors indicated interest in San Francisco—a market that has lagged in recovery since the pandemic.

Figure 14: Markets With Highest Investor Interest – U.S.

Canadian hotel investors fall into two broad categories: those with hotels as their core business, accounting for more than 75% of their investment portfolio, and those with hotels as a value-added business, accounting for less than 25% of their portfolio. Almost all investors expect their hotel allocation to remain about the same as in 2023, with only small increases or decreases based on opportunities. Those who expect an increase cite favorable total return prospects as the main driver, while those who expect a decrease cite declines in gross operating profit and difficulty in securing and servicing debt.

Figure 15: Portfolio Allocation to Hotels – Canada

While most Canadian investors indicate that they plan to invest domestically, those who are considering cross-border investment generally favor the U.S., Caribbean, Mexico and Central America.

Figure 16: Hotel Investment by Region – Canada

Central business districts (CBDs) and the suburbs are the most attractive locations for Canadian hotel investors this year. Upscale, upper-midscale and midscale/economy are the most attractive hotel chain scales, while extended-stay is the most attractive hotel type.

Figure 17: Most Preferred Location Type – Canada

Figure 18: most attractive by chain scale – canada.

Increased borrowing costs/cost of capital and labor costs are seen as the biggest challenges for Canadian investors this year. Renovation and remodeling costs are also seen as a significant challenge.

Figure 19: Major Challenges for Real Estate Investors in 2024 – Canada

Mexico, central america & the caribbean.

More than 50% of surveyed investors from Mexico, Central America and the Caribbean expect to buy more hotel assets this year, while only 12% expect to buy less.

Figure 20: Mexican, Central American & Caribbean Investor Buying Intentions by AUM

Total return prospects were cited as the biggest reason to increase hotel investment this year. Hotel assets are expected to outperform other commercial property types in 2024 due to increased tourism and interest-rate stabilization.

Figure 21: Reasons to Increase Hotel Investment in 2024 – Mexico, Central America & Caribbean

Rising labor costs are the main challenge for investors. In Mexico, the rise in nearshoring 2 has caused more demand for workers, increasing labor costs as companies compete for talent. Increased borrowing costs/cost of capital were the second biggest challenge for investors. However, for the first time since its rate-tightening cycle began in 2021, the Bank of Mexico cut its benchmark interest rate by 25 basis points to 11.0% in March.

2 Companies relocating to Mexico to serve the North American market and the addition of new production lines by companies already located in the country.

Figure 22: Major Challenges Facing Real Estate Investors in 2024 - Mexico, Central America & Caribbean

Resorts are by far the most attractive location types, followed by airport and CBD locations. We expect business travel to continue its recovery, fueled by more new companies to the region.

Figure 23: Preferred Location Types - Mexico, Central America & Caribbean

Figure 24: main targets for hotel acquisitions - mexico, central america & caribbean.

Demand for full-service and all-inclusive hotels has been increasing exponentially, mainly at the most popular beach destinations such as Cancun, Punta Cana and Los Cabos. These two segments are most favored by approximately 60% of surveyed investors this year.

Figure 25: Hotel Acquisition/development Targets by Service Offering – Mexico, Central America & Caribbean

Luxury hotels are the most attractive chain scale for 64% of surveyed investors this year as post-pandemic travel demand continues to recover.

The region has attracted many all-inclusive boutique hotels. Los Cabos, for example, is attracting more visitors with greater purchasing power.

Figure 26: Most Attractive for Investment by Chain Scale – Mexico, Central America & Caribbean

Los Cabos, Cancun and Mexico City are expected to have the strongest performance in 2024. The Mexican Caribbean market continues to break records for tourist arrivals, driven by the start of the Mayan Train and the new Tulum International Airport.

Los Cabos likely will be a high-demand luxury destination in 2024, while Punta Cana is emerging as another attractive destination for hotel investors due to a growing tourism industry and strong economic growth.

Figure 27: Most Attractive Markets for Investment – Mexico, Central America & the Caribbean

Ninety-five percent of surveyed European investors expect to either maintain or increase their hotel investments in 2024. This intention is supported by the perception that a pricing floor for hotels has largely been established, as well as by optimistic total return prospects.

Figure 28: European Investor Buying Intentions

Twenty-eight percent of respondents cited price adjustments as the primary reason to increase their hotel asset allocations this year. This suggests a belief that prices have bottomed out, with 21% of respondents citing more optimism about total return prospects.

Sixteen percent of respondents view distressed opportunities as a compelling reason to increase hotel asset allocations, as some hotel owners are facing higher refinancing costs and a need to divest for immediate cash flow.

Figure 29: Reasons to Increase Hotel Asset Allocations in 2024 – Europe

Increased borrowing and labor costs were the two biggest challenges cited by European investors this year. Geopolitical conflicts rounded out the top three concerns, since they can significantly affect the fundamental demand drivers behind hotel operating performance.

Figure 30: Major Challenges for Real Estate Investors in 2024 – Europe

A majority of respondents (63%) indicated a preference for full-service hotels, with limited-service significantly trailing at 17% and extended-stay selected by only 6%. The stabilization of hotel room rate growth and the reduction in the average length of stay in extended-stay hotels appear to be affecting sentiment for this segment.

Figure 31: Hotel Acquisition/development Intentions by Service Offering – Europe

The survey indicates a clear preference among respondents for upper-upscale and luxury hotel segments by 51% and 45% of investors, respectively. The attractiveness of luxury hotels is supported by their robust operating performance in key European markets post-pandemic. Not only have luxury hotels rebounded swiftly, but they have also outperformed the overall market, buoyed by strong pent-up demand.

Figure 32: Hotel Acquisition Intentions by Chain Scale – Europe

CBD assets are the most popular, while gateways dominate preferred cities. London remains the most preferred market, followed by Madrid. Despite the notable new luxury supply in Rome, it remains among the top 10 most preferred European markets. Confirming Greece’s strong positioning over the past five years, Athens now features among the top 10.

Figure 33: Preferred Location Types – Europe

Figure 34: markets with highest investor interest – europe.

Asia-Pacific

Despite net buying intentions across most commercial real estate sectors remaining subdued in Asia-Pacific (see CBRE’s 2024 Asia Pacific Investor Intentions Survey ), nearly 60% of survey investors say they will buy more this year.

Figure 35: Asia-Pacific Investor Buying Intentions

With the rebound in tourism, particularly in Japan, Singapore and Australia, investors have been increasing their allocation to hotel assets within the region. Investors cited pricing adjustments as the biggest reason for increased hotel investment this year. CBRE Research believes most hotels have already undergone substantial price corrections during the pandemic and therefore are at an attractive price point for investors.

Figure 36: Reasons to Increase Hotel Asset Allocations in 2024 – Asia-Pacific

Hotel investors remain focused on gateway cities and resort markets in Asia-Pacific. In gateway cities, investors will target assets with operational flexibility to quickly adjust rates and capitalize on the upswing in tourism, especially in Korea, Japan, Thailand and Australia. Opportunistic investors are also interested in potential co-living conversions of hotels, particularly in Hong Kong SAR, Korea and Japan.

Investors targeting resorts will continue to focus on markets with prolonged periods of strong performance post-recovery and strong mainland Chinese tourist penetration, such as Thailand, Bali and Maldives.

Figure 37: Preferred Location Types – Asia-Pacific

Amid ongoing capital markets volatility, upper-upscale has emerged as the most appealing segment for Asia-Pacific hotel investors. This has been driven by growth in global wealth and a willingness by travelers to spend more on accommodation following the prolonged closure of borders.

As consumer demand has risen, so too has profitability, which has been highly attractive to investors. This trend should continue over the next 12 months as investors target upper-upscale/luxury assets with good cash flow.

Figure 38: Hotel Acquisition Intentions by Chain Scale – Asia-Pacific

While more international hotel brands are entering the Asia-Pacific market, investors indicate a preference for vacant-possession hotels. Although yields for such assets are typically lower, investors indicated they are most attractive due to flexibility of operator selection and potential refurbishment.

Investors cited stable income performance and low exit risks as the primary reasons for acquiring hotels with global brand management agreements. As institutional investors consider increasing their footprint within the hotel sector, the typically long term of global hotel brand agreements is very attractive.

Figure 39: Preferred Hotel Operational Agreement at Acquisition – Asia-Pacific

Among service categories, full-service remains the top choice for Asia-Pacific investors this year, followed by hotel-branded residential development. Investors in markets with strong residential demand like Japan, Australia and Korea will attract hotel-branded residences alongside the growing co-living industry.

Figure 40: Hotel Acquisition/development Intentions by Service Offering – Asia-Pacific

Surveyed investors expect that hotels will have the least repricing pressure of any commercial real estate sector in Asia-Pacific this year.

A rise in international arrivals from key markets hiked Asia-Pacific hotel room rates in 2023, ensuring continued optimism by hotel operators this year, particularly in Japan, Singapore and Korea.

Demand-based pricing has allowed operators to use average daily rates to offset inflationary pressure across the region. Changing rates allows hotel owners to swiftly counteract rising operating costs and mitigate the impact of inflation compared with other sectors, resulting in limited repricing pressure.

Asia-Pacific hotel assets are expected to reprice more modestly than in other regions as more international arrivals and hotel revenue growth offset some of the anticipated headwinds over the next six to 12 months.

Figure 41: Pricing Expectations by Sector – Asia-Pacific

Who took part in our survey.

The 2024 CBRE Global Hotel Investor Intentions Survey was derived from our regional investor intentions surveys. Hotels account for more than three-quarters of assets under management (AUM) for approximately 47% of the 300 survey respondents, while 26% have between $5 billion and $10 billion of their AUM in hotels. The surveys were conducted in early 2024.

Figure 42: Percentage of Survey Respondents by Type

Figure 43: percentage of survey respondents by aum, figure 44: percentage of survey respondents by portfolio exposure to hotels, related insights, 2024 european hotel investor intentions survey.

April 16, 2024

CBRE's 2024 European Investor Intentions Survey delves into the responses of Europe-based investors, exploring their investment appetite in hotel assets and their preferred strategies and markets for 2024.

2024 Global Hotels Outlook

March 20, 2024

After RevPAR rose to a record high in 2023, CBRE expects the U.S. to see another year of improvement in 2024.

Related Services

CBRE Hotels delivers bottom-line impact to hotel clients globally by providing advisory, capital markets, investment sales, research & valuation s...

Rachael Rothman

Head of Hotels Research & Data Analytics

- Phone +1 804 201 2004

Christine Bang

Research Manager

Ronald Chan

Assoc Dir Research Hotels EMEA

- Phone +1 852 2820 1567

Gus McConnell

Associate Director, Research, Asia Pacific

Nicole Nguyen

VAS - Senior Vice President, Hotels

Lic. Candidate Member AIC

- Phone +1 647 943 3745

- Mobile +1 647 625 1890

Yadira Torres

Managing Director CBRE Mexico, Colombia & Costa Rica

Sergio Macias

Jr. Manager

- Phone +52 55 8526 8881

Michael Nhu

Sr Economist, Glob Hotels Fcst

- Phone +65 63478863

- Mobile +65 97290597

Lindsay Dyer

Sr Research Data Analyst

.png)

- Phone +1 202 585 5599

Insights in Your Inbox

Stay up to date on relevant trends and the latest research.

IMAGES

COMMENTS

Tourism Australia | 146,978 followers on LinkedIn. Our vision: to make Australia the most desirable and memorable destination on earth | Tourism Australia is the Australian Government agency responsible for attracting international visitors to Australia, both for leisure and business events. The organisation is active in around 15 key markets and activities include advertising, PR and media ...

4 people have recommended Erin. With 10+ years experience in the digital industry, I am currently working at Tourism Australia in the Marketing Technology Team as their Digital Content Delivery Manager, responsible for supporting business stakeholders with the management of Tourism Australia's multilingual websites and Adobe Experience Manager ...

The Perth Airport WA Tourism Awards are calling! Nominate now and celebrate your hard work, innovation, and commitment to making WA a premier travel destination ⭐️ With 27 award categories ...

Join an award-winning tourism and transport companyAccess to a range of Employee BenefitsTraining…See this and similar jobs on LinkedIn. ... Tourism Western Australia Perth, Western Australia, Australia. Master less than 35 NC - Master IV.

Peter Stefanovic interview with teenager who won Northern Territory tourism competition turns sour. Plus: Daily Telegraph embraces Chat GPT It was the feelgood story of the year from the Northern ...

The latest edition of The World's 50 Best Beaches is out. If you're a U.S. resident, you don't need a passport to visit the No. 1 best beach in the world for 2024.

The 2024 CBRE Global Hotel Investor Intentions Survey was derived from our regional investor intentions surveys. Hotels account for more than three-quarters of assets under management (AUM) for approximately 47% of the 300 survey respondents, while 26% have between $5 billion and $10 billion of their AUM in hotels.