Your guide to Amex's travel insurance coverage

Update : Some offers mentioned below are no longer available. View the current offers here .

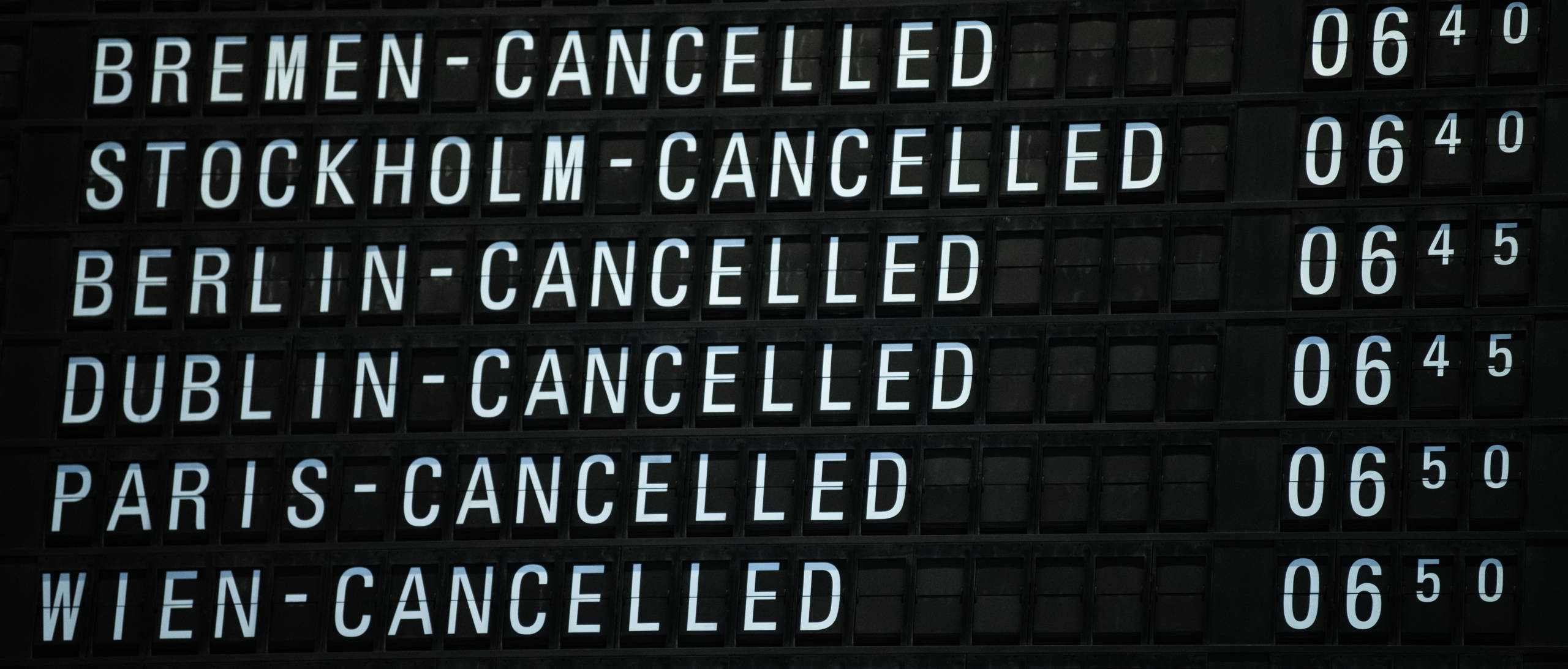

American Express premium credit cards offer some of the best perks in the credit card space. While lounge access and travel credits are typically the highlights of these cards, some of the lesser-known benefits, such as trip delay reimbursement and trip cancellation and interruption insurance, are becoming hot topics as the coronavirus pandemic continues to impact the travel industry.

Want more credit card news and advice from TPG? Sign up for our daily newsletter!

As a result, many TPG readers have sent in questions about Amex's travel insurance protections. As travel restrictions change, policies and best practices will likely change as well. But this guide will walk you through which Amex credit cards have these benefits, what's currently covered and how you can file a successful claim.

Related: Best credit cards for trip cancellation and interruption insurance

Amex cards offering trip delay, cancellation or interruption insurance

Here is an overview of the Amex cards that offer trip delay reimbursement, trip cancellation/interruption insurance or both:

The information for the Hilton Aspire Amex card and American Express Corporate Platinum Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: The best credit cards with travel insurance

What is covered by trip cancellation and interruption insurance?

You can find the full terms and conditions of what is generally covered on your respective card in your Guide to Benefits, which can be found through your online account. I'll use the Delta SkyMiles® Reserve as an example.

Here is a rundown of the "covered losses" provided by Amex's trip cancellation and interruption insurance:

- Accidental bodily injury or loss of life or sickness of either the eligible traveler, traveling companion or a family member of the eligible traveler or traveling companion

- Inclement weather, which prevents a reasonable and prudent person from traveling or continuing on a covered trip

- The eligible traveler or his or her spouse's change in military orders

- Terrorist action or hijacking

- Call to jury duty or subpoena by the courts, either of which cannot be postponed or waived

- The eligible traveler or traveling companion's dwelling made uninhabitable

- Quarantine imposed by a physician for health reasons

Related: Book carefully if you have multiple Amex cards that offer travel protections

Amex also provides an extensive list of things that are not covered by trip cancellation/interruption insurance:

- Pre-existing conditions

- The eligible traveler's suicide, attempted suicide or intentionally self-inflicted injury

- A declared or undeclared war

- Mental or emotional disorders, unless hospitalized

- The eligible traveler's participation in a sporting activity for which he or she receives a salary or prize money

- The eligible traveler's being intoxicated at the time of an accident. Intoxication is defined by the laws of the jurisdiction where such accident occurs

- The eligible traveler being under the influence of any narcotic or other controlled substance at the time of an accident, unless the narcotic or other controlled substance is taken and used as prescribed by a Physician

- The eligible traveler's commission or attempted commission of any illegal or criminal act, including but not limited to any felony

- The eligible traveler parachuting from an aircraft

- The eligible traveler engaging or participating in a motorized vehicular race or speed contest

- Dental treatment except as a result of accidental bodily injury to sound, natural teeth

- Any non-emergency treatment or surgery, routine physical examinations

- Hearing aids, eyeglasses or contact lenses

- One-way travel that does not have a return destination

- A counterfeit scheduled airline or train ticket; or a scheduled airline or train ticket which is charged to a fraudulently issued or fraudulently used eligible card.

- Any occurrence while the eligible traveler is incarcerated

- Loss due to intentional acts by the eligible traveler

- Financial insolvency of a travel agency, tour operator or travel supplier

- Any expenses that are not authorized and reimbursable by the eligible traveler's employer if the eligible traveler makes the purchases with a commercial card

If you do find yourself canceling or cutting a covered trip short, here are the basic guidelines provided by Amex on what types of expenses are covered for trip cancellation/interruption:

"If a Covered Loss causes an Eligible Traveler's Trip Interruption, we will reimburse you for the nonrefundable amount paid to a Travel Supplier with your Eligible Card for the following: 1. The forfeited, non-refundable, pre-paid land, air and sea transportation arrangements that were missed; and 2. Additional transportation expenses that the Eligible Traveler incurs less any available refunds, not to exceed the cost of an economy-class air ticket by the most direct route for the Eligible Traveler to rejoin his or her places of origin.

If a Covered Loss causes an Eligible Traveler to temporarily postpone transportation by Common Carrier for a Covered Trip and a new departure date is set, we will reimburse you for the following: 1. The additional expenses incurred to purchase tickets for the new departure (not to exceed the difference between the original fare and the economy fare for the rescheduled Covered Trip by the most direct route); and 2. The unused, non-refundable land, air, and sea arrangements paid to a Travel Supplier with your Eligible Card."

What is covered by trip delay insurance?

Trip delay coverage provides reimbursement for reasonable additional expenses incurred when your trip is delayed due to a covered hazard for more than six hours.

Coverage is limited to $500 per trip and cardmembers are only eligible for two claims each 12 consecutive month period.

Amex outlines what is not covered, which includes the following:

- Covered losses that are made public or known to the eligible traveler prior to the departure for the covered trip

- An eligible traveler's expenses paid prior to the covered trip

Filing a claim

When you have a delay or trip cancellation/interruption that you think qualifies for coverage, you can file a claim by calling Amex at 1-844-933-0648 within 60 days of the covered loss.

Trip delay reimbursement requires the following documentation:

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss

- Receipts - Acceptable documentation includes the following:

- A statement from the common carrier that the covered trip was delayed

- Charge receipt

- Copies of common carrier ticket(s)

- Receipts for travel expenses

Trip cancellation/interruption insurance requires slightly different documentation.

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss. Acceptable documentation includes:

- Court subpoenas, orders to report for active duty, physician orders, etc.

- Copies of your common carrier tickets and travel supplier receipt

- Your eligible card billing statement showing the charges for the covered trip

- Copy of travel supplier's cancelation policy

After Amex receives notice of your claim, instructions will be sent on how to send the proof. Typically, you have up to 180 days to file a claim after a delay or cancellation.

Proof of flight delay or cancellation

One of the documents required to file for trip delay reimbursement is a verification form that outlines the reason for the delay or cancellation by the carrier. You can typically get this at the airport when the delay or cancellation is announced, but keep in mind that it may require a supervisor. Each U.S. major airline also has a process for requesting this information after the fact.

Here is an overview of the process that major U.S. airlines require for you to receive a delay or cancellation verification form:

Amex cards that offer car rental insurance

Unfortunately, no American Express credit cards offer primary car rental coverage, although most offer secondary coverage. You can see the entire list of cards that offer secondary car rental protection on the American Express website . However, all American Express credit cards offer an optional "Premium Car Rental Protection policy" that can be added to rentals made using the card for a small fee.

Read our guide on when to use American Express' Premium Car Rental Protection for more details on this coverage option.

You can add Premium Car Rental Protection to any American Express card . TPG has a guide of the best American Express cards , but here are some of the best cards in terms of the return you could receive when renting a car. Note, the estimated return rate for these cards is based on TPG's latest valuations:

- Hilton Honors American Express Aspire Card: $450 annual fee (see rates and fees); 4.2% return on car rentals booked directly from car rental companies; no foreign transaction fees (see rates and fees)

- The Blue Business® Plus Credit Card from American Express: $0 annual fee (see rates and fees); 4% return on general spending on the first $50,000 in purchases per calendar year and 1x thereafter; 2.7% foreign transaction fee (see rates and fees)

- The Amex EveryDay® Preferred Credit Card from American Express: $95 annual fee; 3% return on general spending in billing cycles where you make 30+ purchases; 2.7% foreign transaction fee

The information for the Amex EveryDay Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer baggage insurance

If you're a frequent traveler, you've likely run into this situation at some point (it's the worst). Over the years, airlines have been working on improving the baggage system by introducing live bag tracking. Regardless, it's still a smart idea to have some protections in place, like baggage insurance.

Related: Everything you need to know about Amex's baggage insurance plan

This is why you need to pay attention to the benefits each of your travel rewards cards offers. Nearly all of Amex's premium rewards cards offer baggage insurance. You can check out the full list of cards and details on American Express's website.

The types of losses it covers: You're covered for losses resulting from damaged, stolen or lost baggage, including both carry-on and checked bags.

When you're covered: To be eligible for coverage, you have to travel on a common carrier, which Amex defines as any air, land or water vehicle (other than a personal or rental vehicle) that is licensed to carry passengers for hire and available to the public. Your rental car, as well as taxis and ride-share services such as Uber and Lyft, would be excluded from this protection.

To receive coverage, you also need to pay for the entire fare with an eligible American Express card or by using Membership Rewards points to book tickets through Amex Travel . Trips booked with miles from other sources — even the cobranded Delta SkyMiles cards from Amex — are excluded. Your trip also isn't covered if you used a combination of miles and dollars unless the miles came from a Membership Rewards transfer. This is a welcome change. A few years ago, a TPG staffer found out the hard way that Amex's policy didn't cover frequent flyer mile awards.

Who's covered: This policy covers both primary and additional cardholders, as well as cardmembers' spouses or domestic partners and any dependent children under 23 years old. In addition, travelers must be permanent residents of one of the 50 states, Washington, D.C., Puerto Rico and the U.S. Virgin Islands.

How much it covers: Most American Express credit cards will cover replacement costs for checked bags and their contents up to $500 per person, although so-called "high-risk items" are only covered for a maximum of $250. These items include jewelry, sporting equipment, photographic or electronic equipment, computers and audio/visual equipment. Carry-on bags are covered for up to $1,250, which is good to know since your belongings could be stolen from the overhead bins.

You'll enjoy additional coverage if you use The Platinum Card from American Express, The Business Platinum Card from American Express, the Platinum Card from American Express Exclusively for Mercedes-Benz and Morgan Stanley-branded Platinum Card (but not the Delta SkyMiles® Platinum American Express Card).

The information for the Amex Platinum Mercedes-Benz and Morgan Stanley Platinum card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer medical assistance

One of the lesser known benefits of some of Amex's most premium cards is its Premium Global Assistance. This benefit can quite literally be a lifesaver if you or an immediate family member run into any unexpected issues or accident on your trip. For example, this service can help you arrange emergency medical referrals.

All Amex cards have access to Amex's Global Assist Hotline, but the Premium Global Assist Hotline and higher level of coverage are reserved exclusively for the Amex's premium cards:

- The Platinum Card from American Express

- The Business Platinum Card from American Express

- American Express Corporate Platinum Card

- Hilton Honors Aspire Card from American Express

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Marriott Bonvoy Brilliant® American Express® Card

- American Express Centurion Card

- American Express Business Centurion Card

The information for the Amex Centurion and Amex Business Centurion cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Having a card with trip insurance can save you hundreds of dollars when unexpected hiccups happen in your travel plans. Still, it can be confusing to know what is covered and the right documentation you need to file a claim.

Nothing is worse than getting through an entire claims process only to be denied or have to start over because you don't have the required documentation for the insurance provider. Before you start filing a claim, make sure you have the documents listed above. Keep in mind that a provider may ask for additional documentation related to the incident, so you may have to collect receipts and other forms to help your case.

If you're starting to travel again, it's also a good idea to consider booking refundable travel . Some airlines and hotels even waive cancelation fees and/or change fees for certain fares, which can make last-minute adjustments in the case of emergencies.

Additional reporting by Stella Shon and Madison Blancaflor.

For rates and fees of the Amex Platinum card, please click here. For rates and fees of the Amex Gold card, please click here. For rates and fees of the Amex Business Gold card, please click here. For rates and fees of the Amex Green card, please click here. For rates and fees of the Hilton Aspire card, please click here. For rates and fees of the Amex Blue Business Plus card, click here. For rates and fees of the Marriott Bonvoy Brilliant card, click here. For rates and fees of the Delta SkyMiles Reserve card, please click here. For rates and fees of the Delta SkyMiles Reserve Business card, please click here. For rates and fees of the Delta SkyMiles Platinum card, please click here. For rates and fees of the Amex Business Platinum card, click here.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Gold Card

Full List of Travel Insurance Benefits for the Amex Gold Card [2023]

Christine Krzyszton

Senior Finance Contributor

308 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Jessica Merritt

Editor & Content Contributor

88 Published Articles 493 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Senior Editor & Content Contributor

96 Published Articles 684 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

![amex travel insurance for hotel Full List of Travel Insurance Benefits for the Amex Gold Card [2023]](https://upgradedpoints.com/wp-content/uploads/2022/09/Amex-Gold-Upgraded-Points-LLC-19-Large.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Amex gold card — snapshot, amex gold card — travel insurance benefits, travel benefits, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The American Express ® Gold Card is known for being a go-to card for everyday purchases at restaurants and at U.S. supermarkets. The card also doubles as a travel rewards card offering elevated earnings on select flight purchases and a nice selection of flexible travel redemption options.

The card is far less known for its travel insurance benefits. Today, we’re turning the spotlight on some of the useful travel insurance benefits that come with the card and talking about how these benefits can add value to the cardholder.

First, let’s look at the overall earning and redemption features of the Amex Gold card, then jump right into the list of travel insurance benefits you can expect to find on the card.

This is the best card for food lovers who dine out at restaurants (worldwide), order take-out and want big rewards at U.S. supermarkets!

The American Express ® Gold Card is a game-changer.

With this card, you can earn 4x Membership Rewards points at restaurants and you’ll also earn 4x Membership Rewards points at U.S. supermarkets on up to $25,000 per calendar year in purchases, then 1x.

There isn’t another card on the market that offers a 1-2 punch like this. Of course, there are several other benefits of the Gold Card as well, including extra monthly dining rewards and more.

- 4x points per dollar at restaurants, plus takeout and delivery in the U.S.

- 4x points per dollar at U.S. supermarkets, up to $25,000 per calendar year in purchases; and 1x thereafter

- 3x points per dollar on flights purchased directly from airlines or at Amex Travel

- $250 annual fee (see rates and fees )

- No lounge access

- Earn 60,000 Membership Rewards ® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards ® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards ® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards ® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express ® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

Hot Tip: Check to see if you’re eligible for a welcome bonus offer of up to 90,000 points with the Amex Gold card. The current public offer is 60,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

Why We Like the Card Overall

We like that you can jumpstart your earnings with a generous welcome bonus after meeting minimum spending requirements in the first 6 months after card approval.

The Amex Gold card also strikes a nice balance between functioning as an everyday spending card and offering accelerated earnings on flights. It also offers flexible travel redemption options.

You’ll earn 4x Membership Rewards points at restaurants worldwide and at U.S. supermarkets (on up to $25,000 in purchases each year). Plus, you’ll receive 3x earnings on flights purchased directly with the airline and via AmexTravel.com .

With monthly statement credits for select purchases, it’s easy to find enough value to offset the annual fee.

When it’s time to use your rewards, you’ll have options such as redeeming points for flights via AmexTravel.com or transferring your points to the American Express transfer partners for even more potential value.

While the Amex Gold card doesn’t come with a long list of comprehensive travel benefits, you’ll find these core travel insurance benefits useful for saving money and for access to assistance should something go wrong during your journey.

Car Rental Loss and Damage Insurance

Having car rental insurance can save you money and provide a level of peace of mind when renting a vehicle . The Amex Gold card comes with secondary car rental insurance that would require you to first file a claim with any other applicable insurance before card coverage kicks in.

Secondary coverage can still be valuable coverage, but there is another car rental coverage option included on the card that is a much better choice.

Premium Protection

The option to purchase Premium Protection car rental insurance on the Amex Gold card is a game changer.

You’ll pay one low price of $12.25 to $24.95 for the entire period, up to 42 total days, for primary theft and damage coverage. The actual rate will depend on your state of residence and the level of coverage chosen. Note that this is not a per-day rate like the car rental agencies charge.

Just enroll in the coverage via your online card account, then whenever you charge your rental car to your card, you’ll have the coverage automatically. You are not charged prior to renting a car.

There is no deductible. Accidental death/dismemberment coverage is included. Liability coverage, uninsured/under-insured motorist coverage, or disability coverage is not included.

Cardholders and authorized listed drivers are covered.

Applicable coverages for both secondary and Premium Protection include rental car damage, theft, and loss of use.

Coverage is not available when renting vehicles in Australia, Ireland, Israel, Italy, Jamaica, and New Zealand.

There are several additional exclusions, including the theft of an unlocked vehicle, illegal activity, intoxication of the driver, and war. Access the Guide to Benefits for a complete list of exclusions, terms, and conditions.

Filing a Claim

You can file a claim online or call 800-338-1670. You must file the claim within 30 days of the event and submit the required claim form within an additional 15 days. You’ll then have 60 days to submit the required documentation.

Bottom Line: The Amex Gold card comes with secondary car rental insurance with the option to purchase primary Premium Protection for one low rate that covers the entire rental period.

Trip Delay Insurance

To be eligible for trip delay insurance, you must pay for your entire trip with your Amex Gold card, associated rewards, or a combination of the 2. Using airline vouchers, certificates, or discounts, such as those associated with your frequent flyer account, in combination with your card, are also acceptable. Eligible travelers include family members, travel companions, and a spouse or domestic partner.

Trip delay insurance reimburses an eligible traveler for incidental expenses incurred after a 12-hour or greater trip delay. Eligible expenses can include lodging, meals, toiletries, medication, and necessary personal items.

Eligible Losses and Coverage Limits

The following types of losses are eligible covered losses :

- Inclement weather preventing a traveler from beginning a trip or continuing on a trip

- Terrorism or hijacking

- A common carrier’s equipment failure (documented)

- Lost/stolen travel documents, such as passports

You could receive up to $300 per trip with a limit of 2 claims per card, per 12-month period. Coverage is secondary to any other applicable coverage including reimbursement by the airline.

Loss exclusions include prepaid expenses, losses that were known to the public or the traveler prior to the trip, and intentional acts by the covered traveler. Access the card’s Guide to Benefits for more details on loss exclusions under trip delay coverage.

You’ll have 60 days from the date of the loss to file a claim. You can do so by calling 844-933-0648 or the number on the back of your card to be directed to the claims department.

You’ll then have 180 days to submit the required documentation, which can include a statement from the common carrier validating the delay, receipts, your card statement showing the trip charge, and other requested supporting information.

Bottom Line: The Amex Gold card comes with trip delay insurance that provides up to $300 per trip for eligible expenses incurred after a 12-hour or greater delay due to a covered loss.

Baggage Insurance Plan

To be eligible for baggage insurance, pay for your common carrier ticket entirely with your Amex Gold card and/or associated rewards. Trips paid for, in full or in part, with non-American Express rewards such as airline loyalty programs are not eligible.

You, your spouse or domestic partner, children under 23, and certain dependent handicapped children are covered for baggage insurance as long as the trip is paid for in full with your card and/or associated rewards.

Lost, damaged, or stolen baggage is covered, except in the event of war, government confiscation, or acts arising out of customer actions, for the following coverage limits.

High-risk items such as jewelry, gold, silver, platinum, electronics, furs, and sporting equipment, are limited to $250 per item maximum, per trip.

Certain items are not covered under baggage insurance — here is a condensed list of those items:

- Credit cards, cash, securities, or money equivalents (such as money orders or gift cards)

- Travel documents, tickets, passports, or visas

- Plants, animals, or food

- Glasses, contact lenses, hearing aids, prosthetic devices, and prescription or non-prescription drugs

- Property shipped prior to departure

You’ll have 30 days from the date of the loss to file a claim. To file a claim, you can go online or call 800-228-6855 within the U.S. To call from outside of the U.S., call 303-273-6498 collect.

You’ll then have 60 days to submit supporting documentation including a list of items lost, receipts, a statement showing the trip was purchased with the card or associated rewards, and common carrier reports.

Please note that we have abbreviated coverage descriptions and all terms and conditions are not spelled out in their entirety. You’ll want to access the benefits guide for full information.

Bottom Line: You and certain family members are covered for baggage insurance of up to $1,250 per person when traveling with a common carrier. You’ll need to pay for your entire trip with your card or rewards associated with your card for coverage to be valid.

Travel Accident Insurance

Travel accident insurance that comes with the Amex Gold card pays a benefit in the unlikely event of accidental death or dismemberment of the primary card member, additional card member, spouse or domestic partner, or children under the age of 23.

The trip must be paid for with the Amex Gold card and/or associated Membership Rewards points (Pay With Points).

The coverage pays a benefit for death or severe injury suffered as a result of riding in, boarding, exiting from, or being struck by a common carrier.

The benefit paid is based on a table provided and can be up to $100,000.

While not travel insurance specifically, these additional benefits can provide assistance when planning a trip or if an unexpected event should disrupt your trip.

Emergency Travel Assistance

The Amex Global Assist Hotline provides important 24/7 assistance when traveling more than 100 miles from home. Receive help finding medical, legal, and translation referrals as well as assistance securing emergency transportation.

In addition, you could receive help securing a replacement passport or finding missing luggage.

You can reach the Global Assist Hotline at 800-333-2639. Outside the U.S., call 715-343-7977.

Actual services provided by third parties that incur costs are the responsibility of the cardholder.

Services are also not available in areas such as Cuba, Iran, Syria, North Korea, or the Crimea region.

No Foreign Transaction Fees

You’ll want to include the Amex Gold card during your next trip, as the card does not charge foreign transaction fees ( rates & fees ).

Additional Travel Benefits

Receive help planning your trip with Insider Fares via AmexTravel.com, upgrade your flights with points , American Express Travel Insurance , onsite benefits at The Hotel Collection , Amex Offers , and more.

While the Amex Gold card comes with several valuable travel insurance benefits, you would not select the card for this specific reason. The card shines when it comes to earning on select everyday purchases, for purchasing airline tickets, and its flexible travel redemption options. Those should be key reasons for selecting the card.

The fact that there are travel insurance benefits that come complimentary with the card is just one more reason to consider the card.

If having premium travel insurance benefits is a priority for you, you might consider the Chase Sapphire Preferred ® Card , The Platinum Card ® from American Express , the Chase Sapphire Reserve ® , or the Capital One Venture X Rewards Credit Card , all of which offer some of the best travel insurance benefits.

You can read about more credit cards with travel insurance in our article on this specific topic.

For the car rental collision damage coverage benefit of the American Express Gold Card, car rental loss and damage insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car rental loss or damage coverage is offered through American Express Travel Related Services Company, Inc. For the trip delay insurance benefit of the American Express Gold Card, up to $300 per covered trip that is delayed for more than 12 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company. For the baggage insurance plan benefit of the American Express Gold Card, baggage insurance plan coverage can be in effect for eligible persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier (e.g. plane, train, ship, or bus) when the entire fare for a common carrier vehicle ticket for the trip (one-way or round-trip) is charged to an eligible account. Coverage can be provided for up to $1,250 for carry-on baggage and up to $500 for checked baggage, in excess of coverage provided by the common carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. For the global assist hotline benefit of the American Express Gold Card, you can rely on the Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Third-party service costs may be your responsibility. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Card members may be responsible for the costs charged by third-party service providers.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of the American Express ® Gold Card, click here . For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Does the amex gold card have travel insurance benefits.

While the list of travel insurance benefits on the Amex Gold card is not extensive, you will find coverage such as secondary car rental insurance, the option to purchase Premium Protection car rental insurance, trip delay, baggage insurance, a Global Assist Hotline, and travel accident insurance.

Does the Amex Gold card have trip interruption or trip cancellation insurance?

No. The Amex Gold card does not offer trip interruption or trip cancellation insurance. The card does come with trip delay insurance.

Does the Amex Gold card charge foreign transaction fees?

No. You will not be charged foreign transaction fees when using the Amex Gold card for foreign purchases ( rates & fees) .

Does the Amex Gold card cover lost luggage?

Yes, the Amex Gold card can cover lost, stolen, or damaged luggage. The coverage is secondary to any coverage or reimbursement received by the airline or other applicable insurance.

Does the Amex Gold card have good car rental insurance?

The Amex Gold card comes with secondary car rental insurance, which means that you must first file a claim with any other applicable insurance before card coverage kicks in. You will have the option, however, to purchase Premium Protection for one low rate that covers the entire rental period, up to 42 days.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![amex travel insurance for hotel Amex Gold Card vs. Amex Rose Gold Card [Are They Different?]](https://upgradedpoints.com/wp-content/uploads/2022/08/Amex-Gold-vs-Amex-Rose-Gold-Upgraded-Points-LLC.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

I swear by my AmEx card with a hefty annual fee. I get tons of travel perks and over $1,000 in credits for Uber, hotels, stores, and more.

- As someone who travels for work, I'm always looking for ways to make travel more cost-efficient.

- Although my Platinum Card® from American Express charges a $695 annual fee, I find it saves me money.

- In addition to the travel perks, my card gets me over $1,000 in credits for Uber, hotels, and more.

As a full-time, on-the-go content creator, I practically live at airports and am always looking for ways to make my travel experience easier.

From trying out the latest packing cubes to looking for flight deals, I'm all about efficiency and saving money.

That's why it may be surprising to learn that one of my biggest travel game-changers involves spending money with a travel credit card. Like the 41% of Americans with a travel card , I use mine to save money on hotels, flights, and more.

Although the $695 annual fee for my American Express Platinum Card seems steep at first glance, it's actually saved me money in the long run. And, more importantly, it's made my travels much smoother.

Here are just some of The Platinum Card® from American Express benefits I use most often.

My American Express Platinum Card gives me access to the Centurion Lounge

Because I travel frequently, lounge access is important to me. Call me bougie, but I love having a quieter space to sit down and enjoy a meal and a drink before my flight.

As a Platinum cardholder, I can access Centurion and Priority Pass lounges worldwide. Of course, this benefit is only worthwhile if you, like me, enjoy eating and drinking at airports and your home airport has a Centurion Lounge.

With airport restaurants and bars charging sky-high prices for basic food and drink, enjoying complimentary gourmet food in the Centurion Lounge is a treat.

I also get a $200 airline-fee credit

As a Platinum cardholder, I can choose a qualifying airline and enroll to receive up to $200 of statement credit for incidental airline fees each year.

This includes checked bag fees , in-flight purchases, seat assignments, and airport-lounge day passes when I pay for them using my American Express Platinum Card. While these fees might seem small, they add up quickly when traveling frequently.

The $240 digital entertainment credit can be used on things like streaming services and news sites

As a frequent traveler, I rely on digital entertainment, and luckily, my card provides $20 in statement credits each month for some of the most popular digital entertainment services after enrollment.

Peacock, Disney+, The Disney Bundle, ESPN+, Hulu, The New York Times, and The Wall Street Journal are all services that can be reimbursed if I pay for them using my Platinum card.

I always take advantage of the $200 annual hotel credit

With my American Express Platinum Card, I get a one-time $200 statement credit on a pre-paid booking with Fine Hotels + Resorts (FHR) or The Hotel Collection (THC) through American Express Travel.

I also get perks like a complimentary daily breakfast for two, room upgrades (when available), and a $100 property credit on top of the statement credit. This can generally be used at hotel restaurants or even spas, but can vary based on each property.

I use the FHR benefit each year on a special stay — this year, I stayed at the historic Royal Hawaiian on Waikiki . I received a $200 credit after paying for my room, early check-in and late checkout, free breakfasts, a room upgrade, and a property credit that I used for a nice dinner and drinks at the pool.

With my card, I can get reimbursed for Clear Plus, TSA Precheck, and/or Global Entry

In my opinion, the worst part of the airport experience is going through security. That's why I take every step possible to make things easier for myself.

With my card, I can enroll to get reimbursed for the $100 Global Entry fee, which expedites customs screenings for international arrivals in the U.S. Global Entry also includes TSA PreCheck , which makes the domestic airport-security process quicker.

I also get a $189 statement credit for CLEAR Plus, a paid membership program that uses facial recognition or fingerprints for identity verification at some airports, after enrollment.

I even get credit for Uber Eats and Saks purchases

Another perk of my credit card I can enroll in is a monthly Uber Cash benefit. Each month, $15 is deposited into my Uber account to use on rides — or my favorite, Uber Eats. I also get an extra $20 credit in December.

When I'm traveling and want to stay in, or return from a trip and don't want to hit the grocery store, I'll use the Uber benefit to get delivery using Uber Eats. Just be sure to use the benefit each month, as it doesn't roll over.

I also receive $50 in statement credit from Saks Fifth Avenue every six months after enrollment. I use this for buying gifts or small items, offsetting the cost of a larger purchase, or getting something special for an upcoming trip.

My card covers insurance for rental cars and trip delays

When I use my Platinum card, I don't spend extra money on insurance for rental cars or trip delays.

If I rent a car using my card and enroll in the program, I get secondary rental-car insurance that can cover some damages beyond what my primary insurance would.

I also have peace of mind when it comes to travel delays or interruptions.

If I book a trip with my card and the flight is delayed for more than six hours for a qualifying reason, I can get reimbursed for purchases that resulted from the delay — up to $500 per trip. This could include meals, lodging, and personal items. I hope I'll never need to use it, but it feels good to know I have it.

I find the card pays for itself in benefits

Overall, the benefits I gain from being an American Express Platinum cardholder are worth the $695 annual fee.

Because I travel so often for work, it's nice to know I have access to conveniences like lounges and expedited security programs.

For rates and fees of The Platinum Card® from American Express, please click here.

Watch: While Delta's business is 'extremely robust,' the airline's marketing chief stays focused on the data

- Main content

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Pet Week 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

How to use the chase sapphire preferred hotel credit, the chase sapphire preferred's hotel credit goes a long way toward paying off the card's annual fee..

The Chase Sapphire Preferred® Card currently has an elevated intro offer of 75,000 bonus points after you spend $4,000 on the card in the first three months from account opening. This card has a $95 annual fee , but, you can earn back over half of that cost every year by taking advantage of a single easy-to-overlook perk — the annual hotel credit.

Sapphire Preferred card members can receive a $50 annual Chase Travel Hotel credit every account anniversary year for hotels booked through the Chase Travel SM portal . Here's what you need to know about how to use this credit and when it makes sense.

Chase Sapphire Preferred bonus and perks

What is the chase sapphire preferred $50 hotel credit, how to use the chase sapphire preferred's $50 hotel credit, when does it make sense to use the chase sapphire preferred's $50 hotel credit, alternative cards with hotel credits, bottom line, chase sapphire preferred® card.

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Welcome bonus

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

Regular APR

21.49% - 28.49% variable on purchases and balance transfers

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater

Foreign transaction fee

Credit needed.

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

The Sapphire Preferred's intro bonus offer is currently 15,000 points higher than the standard offer. This makes it a great time to apply because you're getting the same ongoing card benefits along with the additional upfront value.

This card earns Chase Ultimate Rewards® points, which are some of the best travel rewards thanks to their versatility. You can redeem Chase points for cash back or similar redemptions for one cent each. And if you use your Chase points to book travel through Chase Ultimate Rewards, you'll get a 25% boost in value as a Sapphire Preferred cardholder (1.25 cents per point).

You can really ratchet up your points' value by taking advantage of Chase's transfer partners . Chase points transfer to 14 airline and hotel loyalty programs at a 1:1 ratio. Through these programs, you can book business-class award flights or luxury hotels and dramatically increase the value of your rewards. This includes plenty of one-way Star Alliance business-class flights from North America to Europe for only 60,000 to 70,000 Aeroplan miles, flights that normally costs thousands of dollars.

The Sapphire Preferred also comes with a long list of travel and purchase insurance benefits. You'll get trip delay reimbursement, primary rental car collision coverage , purchase protection, extended warranty coverage and more.

The Chase Sapphire Preferred annual hotel credit can earn you an automatic statement credit of up to $50 every card anniversary year. To qualify for the credit, you need to book a hotel through Chase Travel SM and pay for the booking with your Sapphire Preferred card.

The $50 in hotel purchases that earn you the credit will not earn Chase points. Once a qualifying transaction is posted to your account, the statement credit should get credited within one or two billing cycles.

To use the Sapphire Preferred annual hotel credit, you book a hotel stay through Chase Travel SM . This platform works like booking through another online travel agency like Expedia , Priceline or Kayak . Simply search for the dates and the location where you need a hotel and book from the available options.

To use the hotel credit, first log in to your Chase credit card account and navigate to the Ultimate Rewards page. Next, select the "Travel" drop-down menu and click "Book travel."

Choose "Hotels" and enter the information for your trip. Once you start a search, you can filter the results by star rating, brand, cost and more.

After you've selected the hotel and specific room type, you'll be able to see the final cost in dollars and points.

To earn the full $50, you need to charge at least $50 on your card. If you want to pay with points, just be sure to redeem points for all but $50 of the cost. You can easily adjust how many points you're using for the booking in the "Points redeemed" box, just be sure to click the update button when you change the number of points you want to use.

From here follow the steps to enter the traveler information and payment card info before you finalize the reservation. Be sure to pay with your Chase Sapphire Preferred card. If you don't book with your Sapphire Preferred, you won't earn the credit.

The Sapphire Preferred hotel credit is straightforward — just book a hotel through Chase Travel SM to qualify for the offer. However, you should compare prices for the same dates, hotel and room type to ensure you're getting the best price when booking with Chase. As long as you aren't paying more for the booking, taking advantage of this credit makes sense.

If elite status perks are worth more to you for a particular stay, you may want to consider trying to maximize this credit on a different booking. That's because when you book hotels through a third-party site such as Chase Travel SM you typically won't earn elite status credit. You also won't normally receive elite status benefits, such as free breakfast or room upgrades.

If you're looking for hotel credits and benefits, a co-branded hotel credit card will typically offer the most value, but the perks will be tied to a specific brand. For statement credit perks that are more universal, you'll likely need to consider a general travel credit card.

The Capital One Venture X Rewards Credit Card (see r ates and fees ) offers an annual travel credit of up to $300 for bookings made through Capital One Travel. This credit applies to hotels, but also flights, rental cars and more. When you combine this travel credit with the card's annual 10,000-mile bonus, it's not hard to justify keeping this premium credit card .

Capital One Venture X Rewards Credit Card

10 Miles per dollar on hotels and rental cars, 5 Miles per dollar on flights when booked via Capital One Travel; unlimited 2X miles on all other eligible purchases

Earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

19.99% - 29.99% variable APR

$0 at the Transfer APR, 4% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you

Foreign transaction fees

See rates and fees . Terms apply.

Read our Capital One Venture X Rewards Credit Card review.

The U.S. Bank Altitude® Reserve Visa Infinite® Card has an incredibly easy-to-use travel and dining credit worth up to $325 every year. To qualify for the credit you don't need to book through a specific site. Instead, you just pay for travel or dining with the card and you'll earn the credit on the first $325 in eligible spending.

U.S. Bank Altitude® Reserve Visa Infinite® Card

5X points on prepaid hotels and car rentals booked through the Altitude Rewards Center; 3X points on every $1 on eligible travel and mobile wallet spending

Earn 50,000 bonus points (worth about $750 in travel) after spending $4,500 within the first 90 days of account opening

22.24% to 29.24% (Variable)

3% of the amount of each transfer, with a $5 minimum

See rates and fees , terms apply.

For a limited time, the Chase Sapphire Preferred has an excellent increase welcome offer. However, it also has an extensive array of ongoing benefits for cardholders. These benefits include an annual $50 hotel credit that applies to hotel bookings you make through Chase Travel SM .

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every credit card article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit cards . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- First-time homebuyer grants: What you need to know Kelsey Neubauer

- Earn elevated perks during Amex's Platinum Card anniversary celebration Andreina Rodriguez

- Here are the best corporate credit cards of 2024 Jason Stauffer

7 Best Hotel Credit Cards of 2024

Money.com has partnered with CardRatings.com for our coverage of credit card products. Money and CardRatings may receive a commission from card issuers. Our site does not include all card companies or all available card offers.

Whether on vacation or business, hotels can make or break your travel experience — and your budget as well.

Hotel credit cards can help alleviate some of that cost, or simply make your stay a lot more comfortable and enjoyable thanks to the many benefits they offer.

Here, we picked some of the best hotel credit cards from a variety of hotel chains that can reward frequent travelers and occasional vacationers alike.

Our Top Picks for Best Hotel Credit Cards of 2024

- Hilton Honors American Express Aspire Card — Best for Luxury Travel

- Hilton Honors American Express Card — Best No Annual Fee

- IHG One Rewards Premier Credit Card —Best Overall Value

- Marriott Bonvoy Brilliant® American Express® Card — Best for International Travel

- Marriott Bonvoy Business® American Express® Card — Best for Business

- Wyndham Rewards Earner® Business Card — Best for Small Businesses

- Wyndham Rewards Earner® Plus Card — Best for Budget Travel

Other Hotel Credit Cards We Considered

Best hotel credit cards reviews.

The companies in our top picks are listed in alphabetical order.

- High 14x points reward rate at Hilton properties

- $200 in flight credits (up to $50 each quarter) on qualifying airfare purchases

- Annual free night

- No TSA PreCheck or Global Entry statement credit

Terms apply. Please click here for applicable rates and fees.

Why we chose it: Hilton Honors American Express Aspire Card delivers on all fronts, from high point earnings to valuable statement credits, all for a very competitive annual fee in the luxury category.

The Hilton portfolio is one of the largest and most recognized in the world. The Hilton Honors American Express Aspire Card offers very high rewards for many different categories. This includes 14x points on Hilton purchases, the highest among the cards we researched. It also offers a high 7x points on select travel and U.S. restaurants.

Points aren’t the only way to save, though, as the card offers a variety of statement credits. Cardholders can get up to $400 in statement credits for their expenses at participating Hilton resorts, a $200 flight credit for qualifying flight purchases (divided into $50 each quarter) and a $100 property statement credit when booking a minimum two-night stay at Waldorf Astoria Hotel & Resorts or Conrad Hotel & Resorts. (Terms apply.)

There’s also a large amount of insurance coverage, including trip cancellation and delay insurance, baggage insurance plan and car rental loss and damage insurance*.

All information about the Hilton Honors American Express Aspire Card has been collected independently by Money.com

- 7x Hilton Honors Bonus points at the Hilton

- 5x points at U.S. supermarkets, U.S. restaurants and U.S. gas stations

- Car rental loss and damage insurance*

- No annual free night

- No trip cancellation/delay insurance

Why we chose it: The Hilton Honors™ Card by American Express’ high rewards on hotel spending as well as everyday categories make it one of the best options for consumers looking for a no-annual-fee hotel card. (Terms apply.)

The no-annual-fee card_name offers 7X Hilton Honors Bonus Points on eligible purchases made with your card at Hilton portfolio hotels and resorts. It also offers 5x on everyday categories like U.S. supermarkets, U.S. restaurants and U.S. gas stations, which makes earning free nights and other perks a lot easier than many of its competitors.

Cardmembers get automatic Hilton Honors™ Silver Status with the card, which earns you 12x additional points per dollar. After spending $20,000 in a calendar year, the card also offers a bump up to Hilton Honors™ Gold Status, which earns 18x points per dollar, totaling 25x Hilton Honors bonus points per dollar when using the card at Hilton hotels.

The card also offers purchase protection, extended warranty and car rental loss and damage insurance*. Unfortunately, it doesn’t provide flight or baggage insurance.

- Anniversary free night

- Low $99 annual fee

- TSA PreCheck(R), Global Entry or NEXUS statement credit every four years

- 5x points on travel, dining and gas

- No rental insurance

Why we chose it: The card_name offers some of the best rewards in its class, including an annual free night, a TSA PreCheck® statement credit every four years and 10x on IHG® purchases.

The IHG One Rewards Premier Credit Card has some of the best rewards and perks available among cards with annual fees in the $100 range.

This includes 10x points for purchases made at IHG® properties, which include well-known hotels such as the Regent, Intercontinental® Hotels and the Holiday Inn®, as well as lower cost options like Hotel Indigo® and Candlewood Suites®. In addition, cardholders get 10x points for being a hotel member and 6x bonus points for being a Platinum member, a status that’s granted automatically upon card approval.

Beyond the 10x points on hotel purchases, the IHG One Rewards Premier Credit Card offers 5x points on travel, dining and gas, providing big opportunities to accumulate points toward stays, room upgrades and more.

Like other cards on this list, it also offers a free night every year and a statement credit for TSA PreCheck®, Global Entry or NEXUS of up to $100 every four years, a unique benefit in this class.

The card also has a pretty broad suite of insurance coverage, including purchase protection, baggage delay insurance, lost baggage reimbursement and trip cancellation/delay insurance. It lacks any sort of rental insurance, however, which could be a bummer if vacations include a roadtrip.

- $300 Brilliant Dining Credit: up to $25 per month for eligible purchases at restaurants worldwide

- Global Entry or TSA PreCheck statement credit every four or four and half years

- Marriott International has properties in the most countries out of any hotel chain

- Airport lounge access with Priority Pass Select (enrollment is required)

- Very expensive $650 annual fee

Why we chose it: Marriott Bonvoy Brilliant® American Express® Card has a wide array of insurance coverage*, along with high-value statement credits and perks that could make up for its high annual fee.

If you have a long list of countries you want to visit, then this Marriott hotel card might be of interest. Marriott International the most countries out of any other hotel chain, with nearly 8,000 properties in 131 countries.

This card also provides a $100 fee credit every four years for Global Entry when you pay for the application with the card_name , which makes returning to the U.S. much smoother. Cardholders also have the option of receiving a fee credit every four and a half years for TSA PreCheck® (up to $85 through a TSA PreCheck® official enrollment provider). Keep in mind that, if approved for Global Entry, you’ll also be approved for TSA PreCheck® at no additional charge.

The card_name offers 6x points at Marriott properties and a $100 luxury property credit for qualifying charges at luxury hotels The Ritz Carlton or St. Regis. You can also earn 3x Marriott Bonvoy points at restaurants worldwide and on flights booked directly with airlines, along with up to $300 in monthly $25 statement credits for eligible purchases at restaurants worldwide.

There’s also a long list of insurance coverage for your travels, such as trip cancellation and delay insurance, car rental loss and damage insurance and baggage insurance plans*, among others.

After spending $60,000 in a calendar year on the card, cardholders get an Earned Choice Award (only one per year). This can be in the form of five suite nights awards, each of which can be redeemed for a room upgrade, a free night valued up to 85,000 points or $1000 when purchasing a Marriott Boutique Bed for your home.

As other cards on this list, the card_name offers an annual free night at participating Marriott Bonvoy® hotels.

- 4x points at restaurants worldwide and U.S. gas stations

- 4x points on wireless phone services from U.S. providers and on U.S. shipping services

- Free night award after each renewal month, plus additional free night after spending $60,000 in a calendar year

- $125 annual fee is higher than most competitors

- No flight cancellation/delay insurance

Why we chose it: The Marriott Bonvoy Business® American Express® Card offers the chance of two free nights each year and rewards business owners with 4x points on U.S. wireless phone and U.S. shipping services. (Terms apply).

The card_name offers 6x points at Marriott properties, as well as automatic Gold Elite Status.

In addition to points, Gold Status offers 25% more points than the regular member rate. Cardholders also get 15 Elite Night Credits each anniversary year, which helps reach the next step in the Marriott Bonvoy membership program (Note that you need 50 Elite Night Credits to reach Platinum Elite Status).

The card also offers 4x points for everyday spending and business-related transactions, such as worldwide restaurants, U.S. gas stations, and U.S. phone and shipping services.

When it comes to additional hotel perks, the Marriott Bonvoy Business® American Express® Card offers the usual annual free night reward, and a second free night after spending $60,000 in a calendar year. There’s also the Amex Business Card Rate, which is a 7% discount on eligible reservations as a benefit of being a Marriott Bonvoy® Member and a Marriott Bonvoy Business® American Express® Card Member when booked directly with Marriott. (Terms apply).

Insurance wise, purchase protection, extended warranty, baggage insurance plan and car rental loss and damage insurance* are included. Note, however, that it does not offer trip cancellation insurance.

- Receive 7,500 point bonus each account anniversary

- 6x points on gas

- 4x points on dining and groceries

- Automatic platinum level

- No insurance coverage

Why we chose it: Wyndham Hotels & Resorts has one of the broadest range of budget options among hotel chains in the USA, and their Wyndham Rewards Earner® Plus Card has enough rewards to take full advantage of it.

While most hotel chains have a very broad range of options, not all have budget hotels widely available nationwide. Wyndham Hotels & Resorts does. With multiple low-cost options such as Days Inn, Microtel Inn & Suites, Travelodge, Super 8 and more all over the country, cardholders will, more often than not, find a budget option for their travels.

The Wyndham Rewards Earner® Plus Card will increase savings even further as it offers 6x points on Wyndham purchases, as well as on gas. In fact, gas expenses alone could earn over 7,500 points in a year, enough to redeem for a night at various Wyndham properties, which might make this card even more appealing for road trip enthusiasts. On top of that, it also offers 4x points on dining and grocery stores (excluding Walmart® and Target®), as well as 1x point on all other qualifying purchases.

There’s also a 7,500 point bonus each anniversary year, which might be enough for a free night since, as mentioned above, Wyndham has multiple properties with rooms that can go for as low as 7,500 points. If redeemed for a go free® nights cardholders get a 10% discount, leaving 750 points in your account to start saving for the next one. (Do note that rooms for 7,500 points are not available at all participating hotels, so make sure there are rooms at this price where you’re going or save up for a costlier stay.)

There’s also a Wyndham Rewards PLATINUM upgrade, which includes perks such as free Wi-Fi, early check-in (upon request), Avis® and Budget® complimentary rental upgrades, and more.

Unfortunately, the card does not offer insurance or protection beyond standard fraud liability protection, so make sure to have insurance when you get those free rental car upgrades.

All information about the Wyndham Rewards Earner® Plus Card has been collected independently by Money.com.

- Annual 15,000 point bonus

- 8x on qualifying gas purchases

- 5x on marketing and select utilities

- No statement credits

- No travel-related insurance

Why we chose it: The Wyndham Rewards Earner® Business Card provides high rewards on both hotel purchases and business-related expenses for a modest annual fee, on top of a generous annual bonus that could be redeemed for up to two free nights.

This Wyndham card gives you 8x points at Wyndham, in addition to 12x points as a Diamond level member (automatic upon card approval) — this translates to 20x points per dollar when making eligible purchases at qualifying Wyndham properties.

The card is also roadtrip-friendly as it earns 8x points on gas, which is double what cards in its class offer, and still more than even the most premium cards. Making it even more convenient for cross country trips, Wyndham has the most properties in the U.S. of any hotel chain, and includes budget hotels such as Days Inn and Howard Johnson.

As far as business rewards go, you can earn 5x points on marketing and advertising, including most digital platforms like Google Ads and Facebooks, and on utilities, such as phones and electrical service.

Although it doesn’t offer an annual free night, the card does offer 15,000 bonus points each anniversary year. That can be redeemed for up to two nights, depending on the room cost (Wyndham rooms start at 7,500 points). Cardholders also get a 10% discount when redeeming points for go free® nights, a program that offers nights at a fixed points value, which could be 7,500, 15,000 or 30,000 depending on the hotel.

Unfortunately, there are no insurance policies other than cell phone protection and the standard fraud liability protection, which is this card’s biggest drawback. If you plan on traveling by plane a lot, consider other of our picks for a more comprehensive insurance package.

All information about the Wyndham Rewards Earner® Business Card has been collected independently by Money.com.

Best Western Rewards® Premium Mastercard®

- 40,000x points when you spend $5,000 every 12 billing cycles

- High 10x points in Best Western purchases

- Early check-in and late check-out (based on availability)

This card offers up to 20x points when booking at a Best Western, 10x through the card itself and 10x for being a Best Western Rewards® member (the card also gives automatic Platinum status). In addition to these high rewards, cardholders get 40,000 points after spending $5,000 with the card every 12 billing cycles, a very low spending requirement compared to others. However, the rewards aren’t high enough to make up for its $89 annual fee.

All information about the Best Western Rewards® Premium Mastercard® has been collected independently by Money.com.

Marriott Bonvoy Boundless® Credit Card

- One free night annually

- $95 annual fee is low compared to competitors

- 3x points on groceries, dining and gas up to $6,000 combined

- Spending cap on rewards

This Marriott card by Chase is a great option if you value the Marriott brand, which has the largest hotel network in the world. It offers 6x points at the Marriott, which can become 17x points thanks to member rewards and the automatic Silver Elite Status.

All information about the Marriott Bonvoy Boundless® Credit Card has been collected independently by Money.com.

World of Hyatt Credit Card

- Large suite of insurance coverage

- Discoverist status automatic upgrade

- Low reward rate

- $95 annual fee is too much for what it offers

The World of Hyatt Credit Card by Chase shines due to its coverage, which includes baggage delay insurance, lost baggage reimbursement, trip cancellation/delay insurance, purchase protection and rental collision waiver. While this is a large plus, its rewards are lackluster, especially given the card’s $95 annual fee.

All information about the World of Hyatt Credit Card by Chase has been collected independently by Money.com.

Best Hotel Credit Cards Guide

How do hotel credit cards work, how to choose the best hotel credit card, how to maximize the value of your hotel credit card, how to redeem your hotel credit card rewards, latest news on hotel credit cards.

A hotel credit card is a co-branded card issued by a hotel line and a financial institution such as Chase Bank or American Express®. These cards usually provide high reward rates for booking stays, buying tickets for shows or merchandise at all the hotels under the brand’s umbrella. These rewards are in addition to the ones you’ll get as a loyalty member, as these cards will automatically grant you member status with the brand.

Overall, hotel credit cards work just like regular credit cards, meaning you’ll have a credit line for an established amount that you can use, and you have to make at least a minimum payment each billing cycle.

Reward structures are similar to regular credit cards too, you earn a certain amount of points, statement credits or other miscellaneous benefits depending on how much you spend and where.

Here are some of the difference on how rewards work:

- Hotel credit cards offer more points than average credit cards do when you make eligible purchases at participating hotels, including at restaurants within hotel premises, gift shops and more.

- Points are added to the ones you get as an elite status member of the hotel brand, a status that also comes automatically with card enrollment. This increases the points earned significantly.

- Unfortunately, points tend to be limited to the particular brand instead of the issuer’s. For example, points earned through the IHG One Rewards Premier Credit Card, which is issued by Chase, can’t be used in the Chase Ultimate Rewards® portal.

- Points have drastically more value when redeemed for hotel purchases such as hotel stays or room upgrades when compared to statement credits or gift cards, for example.

Hotel benefits

Some offer other such as a free night every year, free breakfast, special discounts, priority booking, early check-in and much more depending on the hotel and the type of card. These, of course, will depend largely on the type of annual fee the card charges.

There are roughly four tiers of annual fees when it comes to cards. These are, typically, no annual fee cards, budget or low cost ($50-$99), mid-range ($150-$300) and luxury or premium ($350+).

Pros and cons of hotel credit cards

Hotel credit cards are packed with perks, but whether a card is worth it for you will depend on many factors. Here are some pros and cons to consider:

- Rewards at the hotel are very high and are added to rewards earned as a member

- Many cards offer at least one free night annually

- Hotel-related perks such as early check-in, free breakfast and room discounts

- Usually offer travel benefits like rewards for buying tickets, travel-related insurance and more

- Many of the major hotel brands have large networks of hotels for different budgets and locations

- High reward rates are typically limited to purchases within the hotel brand, not everyday spending

- Flight-related perks aren't as abundant as with more general travel cards

- Points tend to be much less valuable when redeemed outside of the hotel

Hotel credit cards vs. travel credit cards

While travel credit cards could encompass hotel, airline and general travel-focused cards, travel cards — such as the Chase Sapphire Reserve® or the Capital One VentureOne Rewards Credit Card — usually reward you for a variety of travel-related expenses, for example, airline tickets and rentals, such as the. Hotel credit cards, on the other hand, are specifically designed to give you higher rewards and specific perks when you make purchases within their hotel line.

Travel cards

- Usually offer much higher rewards for travel purchases, including airfare and rental cars

- Can offer high rewards in hotels regardless of brand

- More versatility and options when transferring reward points

- Offer a wider variety of insurance policies, such as rental insurance and baggage protection

- Tend to have more bonus categories than branded hotel cards

Hotel cards

- Points earned at hotels surpass those of travel cards, which, at the most, grant 10x points, while hotel cards offer up to 14x, on top of points acquired through membership, totaling well past 20x points per dollar

- Have hotel-specific perks such as free stays, free Wi-Fi and free breakfast

- Bumps up your member status at the hotel chain, which in turn increases the amount of perks

- Points can be worth a lot more during specific times of the year or in specific hotels within the brand, depending on time, location and any deals available

Not all hotels are made equal, and neither are their credit cards or membership rewards programs. When choosing a hotel credit card, it’s important to take into account not just the card itself, but the hotels it works with.

1. Compare credit card basics

As with any other credit card, you should compare features like the annual fee, APR, the issuer and a baseline of the rewards offered.

As mentioned above, there are different tiers, according to the annual fee. Once you’ve decided how much you’re willing to pay, you can start to compare rewards, benefits, insurance and the hotel network. Once you’re comparing within each category, you’ll more easily find standouts that deliver far more benefits than their direct competitors.

2. Think about how often you travel