- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

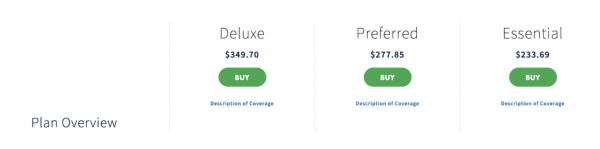

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Qatar / Qatar

Qatar airways, aig in travel guard deal.

Mathaf presents ‘Khalid Albaih: Shahid’ exhibition

Qatar spearheads action to manage climate change-related risks: Al-Attiyah Foundation

DohaGuides YouTube Channel

How To Get Health Insurance For Visitors To Qatar (2024)

Doha Guides Team regularly reviews this article to ensure the content is up-to-date and accurate. The last editorial review and update were on 16 January 2024.

According to a recent announcement by Qatar’s Ministry of Public Health (MoPH), visitors to Qatar are required to have a health insurance policy starting from 1 February 2023.

Qatar’s Law No. (22) of 2021 regulating healthcare services in Qatar stipulates that visitors must be covered by a mandatory health insurance scheme. The mandatory health insurance scheme will be implemented in phases, and the first phase has started on 1 February 2023 .

This article will discuss everything you need to know about health insurance for visitors to Qatar , including the cost, coverage, authorised providers and how visitors can buy health insurance.

Is Health Insurance For Visitors To Qatar Mandatory?

Why is qatar introducing a health insurance policy, how to get visitors’ health insurance, moph approved health insurance.

- Cost of Visitor's Health Insurance Policy:

Validity Period of Health Insurance For Visitors To Qatar

- Coverage Under Visitor's Health Insurance Policy

Criteria for Accepting International Health Policy

Moph helpline, frequently asked questions.

Starting 1 February 2023, all visitors to Qatar applying for a visitor’s visa are required to have health insurance policies. This is mandatory for all types of visit visas including Family Visit Visa , GCC Residents Visit Visa , and Visa On Arrival .

AUGUST 2023 UPDATE: According to Qatar Government’s Hukoomi helpline, visitors traveling on an instant visa and staying in Qatar for less than 30 days do not need to obtain Health insurance . However it is highly recommended to have insurance as it can be helpful in case of an emergency.

GCC citizens are exempted from the mandatory health insurance while entering Qatar.

According to MOPH, the health and well-being of visitors are of paramount importance. Therefore the Government has established the necessary regulations to ensure that visitors are protected against accidents and medical emergency-related conditions during their stay.

By implementing a sustainable and effective healthcare system, and by regulating healthcare expenditures, the scheme aims to regulate health insurance and ensure continuous improvements.

Visitors Applying For Visit Visa Online

- Visitors applying for a visit visa online via the Metrash App will be directed to the MOPH website.

- There, they can select one of the insurance companies registered with the Ministry to purchase the visitors’ policy after completion of all other relevant visa requirements.

- Once the insurance policy is issued by the selected insurance company, the Ministry of Interior will issue the appropriate visit visa.

The Visitor will receive the Health Insurance Policy from the website of the Insurance companies. The policy can be printed, kept and shown when needed.

Visitors Eligible For Visa On Arrival

To ensure speedy completion of your procedures upon arrival at the various border crossings (airport, land and seaports), visitors are advised to purchase a visitor insurance policy before arriving at these ports from the MOPH link provided below and follow the same procedures mentioned.

The registered insurance companies are listed on the Ministry of Public Health’s website. Visitors can choose any one of the listed insurance companies through the links available on MOPH website:

Here is the link to the page on the MOPH website.

The registered insurance companies (in alphabetical order) are:

- Al Khaleej Takaful Insurance

- Beema Damaan Islamic Insurance Company

- Doha Insurance Group

- Doha Takaful

- General Takaful

- Islamic Insurance

- Qatar General Insurance & Reinsurance Co. Q.P.S.C.

- Qatar Insurance Company

- QLM Life & Medical Insurance Company

MoPH has indicated that for visitors who hold international health insurance, the insurance policy must include Qatar, be valid during their stay in the country and be issued by one of the insurance companies approved in Qatar.

Cost of Visitor’s Health Insurance Policy:

The standard premium for a single insurance policy will be QAR 50 for 30 days (USD 13.73). For the extension of a visit visa beyond 30 days, the visitor will have to buy an additional policy.

In addition, visitors can obtain additional health insurance policies, and the premiums for these policies will vary depending on the insurance company’s prices.

Health insurance premiums cannot be refunded after the purchase of the policy if the stay duration is less than the period of the visa.

The effective date of coverage is the date of entry of the visitor at any border.

If the visitor wishes to extend his/her stay in the State of Qatar, then he/she must purchase a new health insurance policy. The minimum duration of the visitor’s insurance policy is 30 days, it is not possible to purchase a policy with less than this duration.

The basic visitor insurance policy in case of a single-entry visa expires upon leaving the State of Qatar through any air, sea or land ports.

There is an insurance policy for multiple-entry visas and it remains valid from the date of entry until the policy expires.

Coverage Under Visitor’s Health Insurance Policy

The mandatory health insurance for visitors will only cover emergency medical treatments and accidents .

Emergency Medical Treatment:

- Up to QAR 150,000 for the policy period and within the State of Qatar.

- Emergency medical assistance with a sub-limit of QAR 35,000, includes:

- Emergency ambulance transportation within the State of Qatar, and where necessary.

COVID-19 and Quarantine:

- Sub-limit up to QAR 50,000.

- Covid-19 treatment for positive cases.

- Quarantine expenses (for confirmed cases) are up to QAR 300 per day.

Repatriation:

In the event of the visitor’s death within the State of Qatar, the cost of repatriation is covered up to an amount of QAR 10,000.

Is there a waiting period for this policy to be active?

No, there will be no waiting period for the visitor’s health insurance policy.

Does the policy require any copayment or deductible?

No copayment or deductible will be required for any covered services as per the terms and conditions stipulated in the visitor’s health insurance policy.

In addition to the listed insurance companies, Qatar MOI may accept some international health insurance companies, subject to the fulfilment of the following conditions and requirements set by the Ministry of Public Health to be accepted for entry visa issuance:

- To be issued by one of the insurance companies included in the approved list by the Ministry of Public Health.

- Its geographical coverage includes the State of Qatar.

- To be valid and cover the period of stay in the country.

- To cover emergency services and accidents with an annual limit of 150,000 Riyals or more, without deductibles or excesses.

- To include a QR code.

The policy can be uploaded to the website of the Ministry of Interior or a paper copy to be submitted to the competent officer at the border crossing.

In case of any queries about the mandatory health insurance policy, you can call the MOPH Helpline on 16000 (inside Qatar) . Extension number 1 is dedicated to health insurance. International visitors can call 00974-44069963. For complaints, you can email: [email protected]

Is travel insurance mandatory for Qatar visit visa?

Yes, travel insurance is mandatory for all visitors to Qatar with effect from 1 February 2023.

How much is the travel insurance fee for Qatar visit visa?

The premium for the Mandatory Visitors’ Health Insurance policy is QAR 50 per month.

Does the Visitor Health Insurance Policy cover me in GCC or other countries?

No. The Visitor Health Insurance coverage is limited to the State of Qatar only.

What documents are needed in case of emergency treatment?

Passport & Insurance Policy Documents will be required for emergency treatment.

Does the basic insurance policy for visitors cover emergencies during travel?

The basic visitor insurance policy coverage begins upon the visitor entering the State of Qatar.

Related Articles:

- How Hayya Card Holders Can Visit Qatar in 2023

- Qatar Visa On Arrival For Indians: Complete Guide

- GCC Residents Visit Visa (With List of Professions)

- Qatar Family Visit Visa: Requirements and Procedure

- Qatar Family Residence Visa Procedure

Copyright © DohaGuides.com – Full or partial reproduction of this article is prohibited.

97 thoughts on “How To Get Health Insurance For Visitors To Qatar (2024)”

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

In addition to the below, please note that I am unable to pay the visa fee to issue the visa without buying the insurance (Again). Unfortunately I was unaware that the insurance policy needs to be purchased after the visa approval and not before.

please help me in this.

Dear DG, I purchased the QIC Insurance policy while submitting the request for family visit visa. I got the message that my visa request is approved and there is a link to purchase the insurance policy. My concern how do I upload the insurance copy which I already purchased before visa request was approved? The insurance policy starts from 24th April 24 and it is for 3 months. Do I have to buy the insurance policy again or is there a way to upload the policy online in Metrash?

Your prompt response is much appreciated.

Thanks and regards Habeeb

Start typing and press enter to search

- KQIC Kuwait

- QIC Europe Limited

- QIC Real Estate

- Antares Group

- Travel Insurance

Travel Insurance is more than a piece of paper

We’ve got you protected, covers that protects you and your family.

- Travel without Trouble – pay for where you travel

Buying your travel insurance

In case of a claim, get quote today.

Get a Quote

Buying your travel insurance should be more than just having the papers required for visiting Schengen countries – it is about providing the feeling of security for you and your family if things go wrong

Travel insurance with QIC gives you the security of knowing you and your family are in good hands, should something happen

Get Travel insurance with covid-19 cover and enjoy a safe trip

If you contract COVID-19 while on a covered trip, we will pay the cost of the medical treatment , and you may be covered for trip cancellation in the event of confirmed infection with Covid-19, 14 days prior to your departure

Refer for covid 19- extension wordings for a detailed description of covers

Click here for policy wordings

If you lost your baggage

If your bags don’t show up when you do – or they are damaged – we will compensate you for the things you need in order to enjoy your travels uninterrupted

If your trip is cancelled or shortened

Do you have to cancel because you’re sick or for another reason beyond your control? No worries! We will reimburse a fixed amount to cover your incurred travel expenses

If you have Medical expenses

Need to go to the hospital while traveling? We’ll cover your expenses caused by accidents, illness

From lost or damaged luggage to accidents caused by terrorism and more – QIC has got you covered!

Medical Expenses

Treatments and hospitalization in case of illness while travelling

Personal Accidents

Accidents during your trip, including injuries, disability, and death

Third-Party Damage

Damages you might cause to others or to their properties

Loss of Passport

Reimbursement for getting a replacement travel document

Covid-19 Cover

Medical, hospitalization, quarantine and trip cancelation fees in case of a COVID-19 infection

Loss of Baggage

Compensation for lost luggage in airports or transit areas

Trip Cancelation

Covers non-refundable expenses in case your trip got canceled

Terrorism Attacks

Damages and injuries due to terrorism acts in abroad

Optional Extra: Winter Sports Extension

Covers you in case of accidents occurring while skiing and guarantees you a memorable, hassle-free winter vacation Click here for policy wordings

Get a quote today and get 20% discount on your travel insurance .

Travel without trouble – pay for where you travel.

Travelcare Plus covers you for travel destinations across the world including USA, Canada as well as Schengen countries. All you have to do is select the travel destination (as categorized below) and pay the premium accordingly.

- Regional – includes GCC, Arab countries, India, Pakistan, Sri Lanka, Bangladesh, Korea, Philippines, Indonesia, Nepal and Bhutan.

- Worldwide excluding USA and Canada- With this extensive cover, travellers could be covered for loss of baggage or any other travel related inconveniences like loss of Passport.

- Worldwide- This cover has been designed for travellers who will be visiting the USA/Canada.

- Fly Europe – This cover has been specially designed for travellers who are required to buy insurance to avail a visa for Schengen countries. This policy only covers for Medical Expenses up to USD 50,000.

TravelCare Plus policy wordings

*Annual Policy is for mutiple trips for maximum of 90 days

At QIC, our customers’ convenience and the quality of services we provide at an equitable cost are of utmost importance

We understand the hassle one goes through when visiting a branch to manage insurances or make calls for subscriptions etc.

We are, therefore, proud to offer you qic.online , where you can purchase your travel insurance at the click of a button

To make it even simpler, you can download our QIC App manage your insurances easily from your smartphone

Android App

QIC Call Center: 8000 742 – open Sunday through Thursday from 7 AM – 8 PM, Saturday from 9 AM – 5 PM

Product Manager: Rayane Malak QIC Retail Department Email: rayane.malak@qic.com.qa

Having a claim to register – is always a hassle; we know this. We have therefore done our utmost to make registering and managing claims with us as easy and fast as possible

You can read much more about our Travel Insurance claims process here and you can always call us on 8000 742 for assistance or email us at personal.claims@qic.com.qa

Brilliance. Excellence. Success.

Qatar Insurance Company Q.S.P.C. Tamin Street, West Bay, PO Box: 666, Doha, Qatar

A.M. Best Europe assigned financial strength rating of A- (Excellent) and issuer credit rating of “a-” (Excellent) to QIC and its subsidiary Anteres-Re Read More

Standard & Poor's (S&P) confirmed its ‘A-’ issuer credit and financial strength ratings on QIC, with a stable outlook. Read More

Get Connected

Personal Insurance /Retail Life & Medical Media Careers Customer Service

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Pet Week 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

AIG Travel Guard insurance review: What you need to know

Whether you need an annual plan or a policy for a last-minute trip, travel guard can deliver..

Travel Guard is one of CNBC Select 's picks for best travel insurance , thanks to its wide range of customizable policies. But are any of them right for you? Below, we review the provider and its offers and how they compare to the competition to help you choose the right travel insurance for your next trip.

Travel Guard review

Other insurance offered, how it compares, bottom line, travel guard® travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

24/7 assistance available

- A variety of plans are available to help cover different types of trips

- Not all products are available for purchase online

Travel Guard® is a global travel insurance provider specializing in plans for leisure and business travelers. Its online travel insurance packages include five options, from basic and last-minute trip coverage to more comprehensive plans. This allows travelers to pick a plan that best matches their situation.

For example, budget-minded travelers might go for the Essential Plan which offers basic protections, such as trip cancellation, interruption and delay insurance, coverage for lost, damaged and delayed baggage, and medical, evacuation and death coverage.

On the other hand, the Deluxe Plan — the most comprehensive option — adds such extras as missed connection coverage, security evacuation, travel inconvenience benefits and more. It also boosts high limits for essential coverages.

Last-minute travelers can opt for the Pack N' Go Plan which only includes certain post-departure coverages. Or, if you travel often, the Annual Plan can cover your trips throughout the year.

Finally, Travel Guard offers "offline" travel insurance packages, meaning you'll have to call if you're looking for a specialty plan.

Coverage types

Depending on the plan, here are the types of protection Travel Guard can include in your package:

- Trip cancellations

- Trip interruption

- Baggage coverage

- Baggage delay

- Travel medical expenses

- Travel inconvenience benefits (reimbursement for such situations as runway delays, cruise diversion and other unforeseen situations)

- Medical evacuation

- Trip Saver (reimbursement for meals, hotels and transportation if you need to begin your trip sooner due to weather or airline changes)

- Trip exchange (reimbursement in case you have to cancel your trip and book a new one due to covered unforeseen circumstances)

- Security evacuation (due to a riot or civil disorder)

- Flight guard (coverage for accidental death or dismemberment that occurs when traveling by plane)

- Pre-existing medical conditions exclusion waiver

You can also customize your plan with add-ons, such as car rental insurance and "cancel for any reason" coverage .

Travel Guard landed on our list of the best travel insurance companies thanks to its variety of coverage. With plenty of options to choose from, both online and offline, it's easy to build a policy that meets your needs.

Travel Guard also features 24-hour concierge services that you can use to book a new flight in case of an emergency or delay.

The provider's website also offers informational resources — here, you can check travel news, read safety tips and find general travel advice. Additionally, the website lets you modify your plan, file a claim and check its status, or apply for a voucher or refund.

As of writing, Travel Guard doesn't offer any discounts. That's common for travel insurance — you're more likely to find deals when shopping for other types of insurance, such as home and auto insurance .

Travel Guard is a portfolio of travel insurance and travel-related services offered by AIG Travel, a member of American International Group (AIG). AIG also offers life insurance and a variety of business insurance products.

Travel Guard makes it easy to get a travel insurance policy customized to your needs. But before you purchase coverage, it's always a good idea to shop around.

For example, if you're going on a cruise, you might want to look at Nationwide Travel Insurance . The provider advertises cruise-specific insurance with three plan options available. This type of coverage is designed with issues unique to cruises in mind — from ship-based breakdowns to missed pre-pard excursions.

If you're planning a more active trip filled with rock climbing or sky diving, Berkshire Hathaway offers the AdrenalineCare® plan which features coverage for unforeseen costs that result from participating in extreme sports on your trip, as well as reimbursement for sporting equipment delay. Pre-existing conditions are covered under this plan (if you meet qualifying conditions).

Berkshire Hathaway Travel Protection

Berkshire Hathaway Travel Protection has multiple plans to cover vacations from luxury travel to adventure travel. The brand's LuxuryCare offers the highest limits of travel insurance coverage offered by the company. Quotes and policies are available online.

As you can see, offerings vary by provider. It can be helpful to compare multiple companies and the plans they offer to find what works best for you. It's even better if you gather several quotes to ensure you're getting a good price for your policy.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Travel Guard offers plenty of ways to customize your policy, making it a solid choice for travel insurance. You can also access additional options by giving Travel Guard a call. However, make sure to check out other travel insurance companies too — comparison shopping is essential when picking any type of financial product.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of insurance products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- Kasasa bank accounts: Get up to 6% APY with this high-yield checking account Elizabeth Gravier

- Pets Best pet insurance review and price Liz Knueven

- These are the best cash management accounts of May 2024 Elizabeth Gravier

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Office No. 402, 4 th floor, QFC Tower 1, West bay, Doha, Qatar, P.O. Box 23043

Tel: +974 4496 74 28

Administration

Handling of the administration for Qatar policies for all lines of business:

E-mail: [email protected]

To report a new claim, for questions concerning the handling of your file:

Toll Free: 00 800 971126 E-mail: [email protected]

For information and questions regarding our products, your cover, our service our for a quote with calculation of the premium, the general and specific conditions, and/or other relevant documents with contractual or pre-contractual information, please contact your broker.

AIG Travel Guard Insurance | Money

W e’ve reviewed Travel Guard from AIG as part of our exploration of the best travel insurance companies of 2023. This review will cover the pros, cons and features of AIG Travel Guard to help you decide if it’s the best travel insurance provider for you.

Best for Add-Ons

AIG travel insurance stands out for its wide variety of add-on options. Travel Guard offers a security bundle, pet bundle, sports bundle and many other add-ons to customize your travel insurance.

AIG Travel Guard Travel Insurance Pros and Cons

AIG Travel Guard is one of many insurance providers that support international travelers while they’re abroad. It isn’t your only option, so let’s take a look at how the company’s policies compare to competitive offerings. Here’s an overview of what you can expect from a Travel Guard travel insurance policy.

- Up to $1 million in evacuation coverage

- Plenty of add-on options

- Optional waiver for pre-existing conditions

- CFAR upgrade doesn't cover the entire trip

- Premiums can get expensive

Pros explained

AIG Travel Guard insurance is highly rated across review platforms. This might be the right insurance company for you if you’re looking for a policy with high coverage for medical evacuations, a range of add-ons and waivers for pre-existing conditions.

$1 million medical evacuation coverage

One of the main reasons people buy travel insurance is to pay for an emergency medical evacuation. If you get sick or injured while abroad, you may need to be evacuated for your safety.

With Travel Guard Deluxe from AIG, you get up to $1 million in coverage for medical evacuations. Travel Guard Preferred offers $500,000 for evacuations, and Travel Guard Essential offers $150,000. That coverage goes toward flights and other costs to get you to a safe location where you can receive high-quality medical care.

Offers a variety of special add-on coverages

AIG Travel Guard Insurance offers a wide variety of add-on coverage options. These riders can be added to your plan to customize your trip. These include:

- Medical bundle: This supplies extra coverage for medical costs and the option to choose your hospital.

- Wedding bundle: This allows you to cancel your trip if a destination wedding is canceled.

- Pet bundle: This provides a daily benefit for the costs of traveling with a dog or cat, plus coverage for veterinary bills.

- Inconvenience bundle: This covers certain problems that don’t end your trip, such as credit card cancellations, closed attractions and trip delays.

- Adventure sports bundle: This removes coverage exclusions for injuries caused by extreme sports such as scuba diving, skydiving and rock climbing.

- Baggage bundle: This gives increased coverage for baggage loss and delays.

Pre-existing medical conditions waiver available for purchase

If you have a pre-existing condition that could lead to medical costs during your trip, Travel Guard offers waivers to extend coverage for those expenses. The waiver must be bought before your trip. It might be worthwhile for travelers with chronic conditions, immune system deficiencies, and other conditions that can make traveling especially dangerous.

Cons explained

AIG travel insurance isn’t right for everyone. Before you buy a Travel Guard plan, you should be aware that you can’t get a full reimbursement when you cancel for any reason and that your premium might be more expensive than other options.

Cancel for Any Reason upgrade only covers 50% of trip costs

Cancel for any reason (CFAR) policies are common with travel insurance companies. This add-on allows you to be reimbursed no matter why you cancel your trip.

A standard travel insurance plan only offers reimbursements for a prescribed list of eligible reasons for canceling. These include medical or weather-related emergencies and the death of a close family member or traveling companion. But with CFAR, you can cancel under any circumstances and still receive coverage — as long as you do so 48 hours before departure.

Unfortunately, AIG Travel Guard with CFAR only offers a 50% reimbursement of your prepaid travel expenses. Other companies offer a higher reimbursement percentage, so consider whether you want more comprehensive protection before signing up for this insurance.

Expensive premiums

AIG Travel Guard is not the cheapest travel insurance company out there. Your exact premium depends on several factors, including your destination, plan type, add-ons and age. But based on our sample quotes, AIG travel insurance plans are slightly more expensive, on average, than other insurers’ plans.

AIG Travel Guard Travel Insurance Plans

Like shopping for the best travel credit cards , choosing the best travel insurance plan takes time and research. The best plan will save you money and give you peace of mind, while the wrong plan could be an unnecessary expense. That’s why looking for insurance companies offering multiple policy options is best.

AIG Travel Guard offers three main plans plus two bonus plans for international travel insurance. Let’s break those options down in detail.

Travel Guard Essential is a very basic travel plan offered by AIG. This budget-friendly plan comes with standard coverage for trip cancellations, interruptions and delays. Medical coverage goes up to $15,000 plus $500 for dental costs and $200 for lost or damaged baggage.

The Essential plan is best for a tourist or short-term traveler who is willing to sacrifice comprehensive coverage for a lower insurance premium. The plan can be beefed up with any of AIG’s add-on bundles.

Travel Guard Preferred is a mid-priced option for someone who wants more coverage. This policy comes with medical coverage of up to $50,000 and evacuation coverage of up to $500,000. Damaged, lost or stolen baggage is covered up to $1,000.

Travel Guard Deluxe, the most expensive plan offered by AIG, comes with a wide range of benefits and includes security evacuation, missed-connection coverage, trip-saver coverage and more. This plan offers up to $1 million for a medical evacuation.

Travel Guard Deluxe is a good choice for someone traveling to rural or dangerous areas. It covers almost any emergency and even includes robust coverage for your beneficiaries in case of a fatal accident.

AIG’s Pack N’ Go plan is designed for travelers who buy their insurance at the last minute. There is no cancellation coverage, but this plan offers up to $25,000 in medical coverage plus $500 for lost or damaged baggage. Buying travel insurance at the last minute is not recommended, but this is a helpful option if you plan a trip quickly.

You can purchase an annual travel insurance plan through AIG. An annual plan is ideal for someone who travels frequently, especially to dangerous areas. With Travel Guard’s annual plan, you’ll get:

- Trip delay coverage: $150 per day, up to $1,500

- Trip interruption coverage: up to $2,500

- Lost baggage coverage: up to $2,500

- Baggage delay coverage: up to $1,000

- Medical expenses coverage: up to $500,000 (dental coverage up to $500)

- Accidental death coverage: up to $50,000

- Emergency evacuations and repatriation of remains: up to $500,000

These benefits apply to multiple trips within the same year. You can renew your coverage annually or cancel at the end of a payment period. Purchasing an annual plan is usually less costly than insuring two trips individually.

AIG Travel Guard Travel Insurance Pricing

AIG travel insurance is comprehensive but on the higher end of the price spectrum. Premiums for Travel Guard Essential and Premium are on par with industry standards. Travel Guard Deluxe is slightly more expensive because of the added coverage that comes with it.

For example, our quote for a month-long vacation in Europe for two people costing around $5,000 came to around $300 with Travel Guard Premium and $560 with Travel Guard Deluxe. Add-on bundles will add a flat rate to that price. Our quotes for the same trip came out to around $150–$300 with other travel insurance companies.

Of course, that’s just an estimation. Your exact premium will vary depending on your travel dates, destination, age, number of people in your party and other factors. AIG family travel insurance goes up in price for each family member added.

Talk to an AIG Travel Guard representative to get a personalized quote for your travel insurance. You can also request a quick quote online for a basic estimate.

AIG Travel Guard Travel Insurance Financial Stability

AIG Travel Guard is an established insurance provider and a publicly traded company. It has an A rating from AM Best, which reflects a high degree of financial strength and stability. AIG also has a rating of A2 from Moody’s and an A+ from Standard and Poor’s. Because Travel Guard is a product of AIG, you should expect this insurer to remain stable in the future.

AIG Travel Guard Travel Insurance Accessibility

Here’s how AIG Travel Guard compares with other top insurers in terms of accessibility.

Availability

AIG travel insurance offers coverage on six continents. You can search for your destination country on AIG’s website to ensure coverage is available, but remember that not all coverage is available in all destinations.

When it comes to buying travel insurance, AIG is only available to residents of the U.S.

Contact information

You can call AIG’s travel insurance phone number any time to get more information about your policy or request help. Both of these numbers have 24/7 availability:

- U.S. toll-free, 1-855-203-5962

- U.S. and international collect, 1-715-345-0505

If you need to file an AIG travel insurance claim, you can connect with a customer service agent online or over the phone. You can also reach AIG by mail at:

Travel Guard

3300 Business Park Drive

Stevens Point, WI 54482

User experience

While it does offer a travel-assistance app, this insurer isn’t as up-to-date with modern technology as other options. Its Travel Assistance app has 2-star ratings on both Google Play and the App Store and is difficult to navigate. The website is also slightly confusing and has several pages stating the same information. On top of that, AIG travel insurance claims must be filed directly with an agent.

However, getting a quote on the AIG website is easy. It takes less than a minute, and you don’t need to provide your name or any contact information.

AIG Travel Guard Travel Insurance Customer Satisfaction

AIG Travel Guard receives a high rate of customer complaints. It’s rated 1.01/5 stars with the Better Business Bureau. Some reviewers report a lack of helpful customer service and problems getting their AIG travel insurance refund for a canceled trip.

Keep in mind that these complaints are fairly standard in the travel insurance industry. Your individual experience will vary depending on your plan and other details.

AIG Travel Guard Travel Insurance FAQ

What does aig travel guard travel insurance not cover.

- Pre-existing conditions (without an optional waiver)

- Traveling against your doctor's advice

- Traveling against warnings about war or other dangerous conditions

- Trip cancellation due to concerns over a COVID-19 outbreak at home or in your destination country. You may be eligible for cancellation coverage if you have a confirmed diagnosis of COVID-19 before your departure.

What is the AIG Travel Guard claims process like?

Is aig travel guard travel insurance worth it, how we evaluated aig travel guard travel insurance.

We evaluated AIG Travel Guard for this review based on several factors, including:

- Range of plan options

- Accessibility

- Customer reviews and complaints

- Claims filing process

- The extent of coverage for the cost

Summary of Money’s AIG Travel Guard Travel Insurance Review

AIG Travel Guard stands out for its variety of add-ons. Its optional bundles allow you to customize your plan to meet your travel needs. While the Deluxe plan is a little more expensive than other options, Travel Guard could be the right choice for you if you value flexibility and extensive coverage.

Whichever insurance policy you choose, be sure to plan ahead and buy your insurance far in advance. Keep an eye out for other ways to save on your trip, including the best travel rewards credit cards and travel booking sites .

© Copyright 2023 Money Group, LLC . All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer .

Qatar Visa for Indians

Qatar, one of the smallest countries in the Arabian Gulf, is embracing tourists from all over the world. It has a raft of offerings for its visitors - delectable local as well as international cuisine, mind-boggling architecture and entertainment. The country seamlessly integrates modern comforts or amenities with millennia of Middle Eastern culture, making for an unforgettable journey.

Tourists will find adventure, beach fun, luxury, and adventure sports in Qatar. And, because the destination is still new to the tourism limelight, you have the opportunity to experience all of these before it gets overly crowded.

If this simple introduction to the State of Qatar piqued your interest and you're on the move to pay a visit to this gorgeous nation, keep reading this post. It seeks to give out information on the most important thing you will need to visit Qatar. Yes, we mean Qatar Visa for Indians. There is another important thing travellers from India need — Qatar travel insurance plan. It can secure your journey from all types of crises. At Tata AIG, we provide the best travel insurance plans online. Our international travel health insurance packages are designed to provide the best financial protection possible with a hassle-free insurance buying and claiming process. You may compare travel insurance Qatar plans by visiting our official website before picking the one that best meets your needs.

Having a Tata AIG travel insurance policy for your Qatar trip will eliminate the need to worry about breaking the bank in times of emergency. In addition, our Qatar travel insurance policy starts as little as ₹40.82/day*. You can also opt for a Tata AIG Qatar family travel insurance policy if you're travelling with your family. Contact us to take this alliance forward.

Anyway, let us get to the main subject of the post regarding Qatar visa requirements for Indian citizens. Continue reading to learn the ins and outs of it.

Qatar Visa: Everything You Need to Know

The State of Qatar's visa policy is quite lax, particularly when compared to other Middle Eastern nations. Citizens of GCC (Gulf Cooperation Council) like Saudi Arabia, Kuwait, Bahrain, and the UAE have the liberty of movement to Qatar, eliminating the need for a visa. There are 80 other countries whose citizens can also enter the State of Qatar without a visa, and India falls under this category.

Qatar on-arrival visa for Indian nationals can be obtained by providing a valid Indian passport with at least a validity of 6 months as well as a confirmed two-way flight ticket. As a result, the citizens of India are not required to get a Qatar visa prior to travelling to the State of Qatar. However, a Qatar visa for Indians comes with a validity period of 30 days, with the possibility of extending it for a further 30 days if necessary.

Note: The Government of Qatar has established new travel restrictions for some nationals who wish to visit the State of Qatar. Qatar's government has classified nations into two groups: GREEN list nations and RED list nations. So, what does this imply for Indians? Because India is now on the red list of nations, you'll need to spend a day in a hotel quarantine if you visit.

This alters a few aspects of your Qatar visa requirements. Before travelling, you'll need to submit a few extra papers and application forms. You'll get to know all of these in the "Documents Required for Qatar Visa" section. Read on to learn more about the same.

Qatar Visa Types for Indians

There are numerous Qatar visa types for Indian nationals depending on various factors. They are primarily classified according to the reason for the visit, the duration of stay, and other criteria. The following are the most prevalent forms of permits:

Qatar Tourist Visa : A Qatar tourist visa for Indian nationals is granted when a person intends to visit the nation for tourism purposes. This particular visa is not required for a 30-day visit; however, it should be obtained if you want to remain for more than 30 days in the State of Qatar.

Qatar Friends and Family Visa : This particular visa is necessary if you are planning to visit friends and family in the nation. You will need an invitation from the individual you're visiting in the State of Qatar to procure this permit. Because the validity terms are very similar to the Qatar tourist permit, a permit isn't necessary for a 30-day visit. It's only required if you want to remain for more than 30 days.

Qatar Business Visa : A business visa is required when a businessperson travels to Qatar to conduct business-related operations or make business deals. The duration of your business permit is determined by the purpose of your stay. It can also be regarded as a form of multiple entrance permit.

Qatar Transit Visa : A Qatar transit visa is acquired from the Qatar Embassy when the tourist or traveller is scheduled to transit in the State of Qatar before flying to another port. It's often provided for hours, based on the duration of the trip.

Documents Required for Qatar Visa for Indians

Citizens of India are lucky to receive a Qatar visa on arrival for 30 days from the Government of Qatar. Nevertheless, they must still complete all of the conditions and have all of the necessary documentation. It is critical that you complete all of the required steps in the procedure before embarking on your vacation. You must also have the necessary papers. Otherwise, your Qatar visa on arrival may be refused, extending your visa processing time.

- Your passport should be valid for a minimum of six months and has at least two blank pages.

- You should have a confirmed return flight ticket to India.

- For Indian citizens, at least $1,400 in cash or a valid debit/credit card with three months' bank statements is required, which also applies to families.

- Evidence of lodging with a hotel reservation made through the "Discover Qatar" website.

- You should be completely immunised and have all of your vaccines up to date. The Ministry of Public Health must authorise your vaccination.

- Before flying to Qatar, you should provide a negative PCR test that is no more than 48 hours old.

- Before flying to the State of Qatar, you should complete an online registration on the Ehteraz website and obtain authorisation from the Ministry of Public Health.

- Complete the Qatar acknowledgement form.

- As a precaution, you must spend a day in hotel quarantine since Indian nationals are on the Government of Qatar's RED list.

The following papers, in addition to a passport and pictures, are necessary for stated visas:

Qatar Business Visa :

- Application Form V1

- Letter from the firm outlining the aim of the business

- Permit or Residence identity

Qatar Employment Visa :

- Letter from the recruiter outlining the type and nature of your work

- The original contract of employment, as well as a photocopy

- Proof of qualifications

Qatar Student Visa :

- Admission letter from a recognised university

- Certificate of salary from the local sponsor

- Your academic or educational papers

Qatar Transit Visa :

Qatar Friends and Family Visa :

- Proof of friend or family's residence

- Letter of invitation from the friend or family member

Qatar Visa Application for Indians: How to Do It?

The majority of the Qatar visa application procedure takes place online. Before you begin the procedure, there are a few things you should consider. The applicant must meet the qualifying criteria and provide all required documentation and other prerequisites. There are two options for getting to Qatar. You may either apply online before your travel or receive a Qatar visa on arrival. The qualifying conditions vary depending on the approach you choose. The procedures are as follows:

Before Arrival :

- Navigate to the Embassy of Qatar's official website.

- Complete the visa application form for Qatar.

- Affix scanned copies of the necessary papers based on the kind of visa type.

- Upload the papers and the visa application form online.

- Pay the required Qatar visa processing fees.

- After the process is completed, you will receive the Qatar visa via email.

On Arrival :

- Reserve a ticket for an onward as well as a return trip from the State of Qatar.

- Make a hotel reservation or provide other types of lodging.

- Bring evidence of lodging with you.

- Consult the officials after arrival to obtain a Qatar visa on arrival.

- Please provide all needed documents.

- You'll be given a Qatar visa waiver if you complete the necessary procedures.

The officer at the Immigration counter will ask you some questions regarding your stay in the State of Qatar. After your Qatar visa application's been processed, the officer will place a sticker on your passport as proof that your visa application was successful.

Now that you're done with the immigration procedure, you're now free to enjoy the gorgeous State of Qatar.

Qatar Visa Price for Indian Nationals

The Qatar visa price for Indian nationals is completely free of charge for every visa-eligible traveller. Extending or renewing a Qatar visa on arrival is likewise free of charge.

Qatar Visa Check Status

Since the Qatar visa is an electronic permit, it's simple to perform a Qatar visa check to know the progress of your application. To check the status, go to the website of Qatar Visa, fill out the necessary information, and monitor where the procedure has progressed. You may even find out how you have to go to the interview and how much time it will take for your visa to be completely processed.

Qatar Visa Processing Time

Generally, the processing time is 8 to 10 working days, except for any Qatar holiday, and Friday and Saturday. Nonetheless, if it's pending with the Security Department, it might take a little longer.

Embassy/Consulate of Qatar in India

Embassy/consulate of india in qatar, travel and precautionary measures to be undertaken in qatar.

Paying a visit to Qatar is both exhilarating and eye-opening. However, when travelling overseas, it is critical to avoid getting too caught up in the excitement of adventure and to keep travel security and safety precautions in mind.

- Before visiting Qatar, learn about the country's laws and regulations.

- Keep your passport in a secure place at all times. Make duplicates of any other vital papers.

- Follow all of Qatar's norms and regulations.

- Avoid attracting undue attention. Try to fit in and vibe with the culture.

- Respect Qatar's culture, rules, and people.

- Do not stay in Qatar after your visa has expired.

- Keep an eye on your belongings, especially in public and crowded places.

- Avoid travelling alone in distant or unknown locations.

- Do not participate in illegal activity or break any rules.

- Use no disrespectful remarks or vulgar words, especially in public.

- Keep your friends and family informed of your location.

- Be alert, monitor your surroundings, be aware of the people around you, and trust your instincts.

- Choose the finest travel insurance in India to sufficiently cover your trip to Qatar.

COVID-19 Safety Guidelines

Listed below are some “to-be-followed” COVID-19 safety guidelines while you are on your trip to Qatar:

- Always wear a non-surgical mask that covers your mouth and nose, especially if you're going somewhere public.

- Maintain social distancing.

- When travelling, wash your hands frequently and bring hand sanitiser.

- Maintain a healthy lifestyle and keep an eye out for COVID-19 signs. If you see any of these symptoms, separate yourself and get tested as soon as possible.

- Cooperate with local governments and authorities to assist them in keeping Qatar safe and secure in accordance with COVID-19 recommendations.

Note : If you experience any COVID-19 symptoms or need any kind of medical assistance, you may always utilise your travel coverage to obtain financial and other assistance.

Why Do You Require Travel Medical Insurance for Your Travel to Qatar from India?

When planning a vacation to Qatar, you should thoroughly investigate everything to ensure that your trip is beneficial. Mishaps, on the other hand, might happen at any time when on vacation in another country. And to get out of such circumstances, you'll need a lot of money. As a result, while Qatar travel insurance is not required, it is highly advised for anybody considering a trip to the nation in the near future.

Furthermore, given the sensitivity of health issues as a result of the current coronavirus pandemic, it's always preferable to be prepared ahead of time. This way, you can guarantee that you will return with nothing but wonderful memories!

However, while purchasing a travel insurance plan online, it is equally critical to review the various possibilities, compare them, and then select the best one. With the aid of our online travel insurance premium calculator, you can browse through the insurance policy pricing at Tata AIG's official website and then select one that is not only inexpensive but also comes with a broad range of coverage options. You should be aware that your selected travel insurance should include enough medical coverage, luggage loss coverage, trip extension/cancellation coverage, evacuation and repatriation coverage, etc.

All of the benefits stated above, as well as many more, are available with Tata AIG's travel insurance Qatar plan online. Our travel insurance products will provide you with a high level of financial security throughout your overseas journey to Qatar.

Perks of Having a Tata AIG Qatar Travel Insurance Plan

With Tata AIG's online Qatar travel insurance plan, you may take advantage of a variety of travel health insurance coverage options.

Luggage Cover : If you lose your baggage in transit or are delayed at any of the connecting airports, our luggage cover will compensate you for the loss. The coverage option is available in our Qatar travel health insurance policy, and it allows you to choose full compensation for the entire cost of all items in your checked-in baggage.

Medical Cover : Our travel health insurance Qatar policy is exclusively designed to offer you the necessary monetary coverage in the event of an unexpected accident or illness during your vacation that necessitates hospitalisation. The Tata AIG travel medical insurance plan for Qatar also covers COVID-19-related treatment. If you contract COVID during your trip to Qatar and require hospitalisation, Tata AIG Qatar travel insurance will cover the expenses.

Journey Cover : You will have comprehensive coverage for your whole vacation with our Qatar travel insurance plan from India. It will include cash insurance against the loss of your passport, hotel cancellations, travel delays or cancellations, and so on.

Other Perks : The following are some more perks of having a policy under Tata AIG:

Qatar travel insurance will begin at the most economical rate of ₹40.82/day*.

Purchase travel health insurance for Qatar from India instantly via our official website, with no need to go through a full-blown medical examination. The ability to pay your travel insurance Qatar premium in INR (₹) while obtaining coverage in Qatari Rial.

Must-See Places in Qatar

With so many Qatar tourist attractions, your holiday in the State of Qatar is guaranteed to be unforgettable. To make it even more intriguing, put these renowned Qatar places in your itinerary without fail:

- Immerse yourself in the stunning beauty of the Doha Desert

The Doha Desert remains virtually undisturbed yet is infused with the delights of limitless excitement and enjoyment. Nothing beats a large stretch of the sandy desert for aesthetic beauty. The sheer splendour of the vastness of this magnificent scene will undoubtedly leave you speechless. Enjoy an exciting desert adventure and get to know the area firsthand. Remember to fasten your seatbelt before embarking on this heart-pumping adventure!

- Visit Al-Zubarah to learn about Qatar's influential history

As you walk over miles and miles of sand, a gorgeous fortress appears out of nowhere. The majesty of this UNESCO-nominated fort is unparalleled. Many visitors arrive at the fort by camelback, while others arrive via jeep. The fort appears to be telling the tourists its story. Simply stand in front of this huge fort and gaze at it. You'll understand the significance of this building and its role in Qatar's history. You will be drawn to the building, and a journey inside the fort will be an eye-opening experience. It is, without a doubt, one of Qatar's most sought-after tourist attractions.

- Qatar National Museum brings Qatar's natural history to life

The State of Qatar is recognised for its tremendous past, and this museum appears to have given its rich cultural legacy a voice. The museums provide a magnificent tale of how the nation evolved, developed, as well as turned out to be modern. The museum appears to be an origami treasure due to its intricate design. Distinct design and sharp edges give us a peek at the architects' incredible architectural skill level. The museum's design is inspired by Desert Rose.

- Smells worthy of drooling from Souq Waqif

Souq Waqif, Doha's main bazaar, is famous for its drool-worthy aromas emanating from shisha and delectable regional cuisines, which come in a variety of delicious tastes. When combined with freshly prepared juicy kebabs and cardamom tea, it provides a distinct fruity aroma. A mishmash of incense, spices, and fragrance fills the air with a lovely aroma.

- Enjoy a one-of-a-kind visit to the popular Falcon Market

The locals of Qatar are obsessed with falconry. Paying a visit to the exceptional Falcon Market is one of the most surprising yet unforgettable experiences for guests. The Falcon Hospital in the neighbourhood can compete with any five-star medical facility. Many tourists come to see the famed Falcon Festival. One of the exciting things to do in the State of Qatar is to hold a falcon in your hand and take photographs of it!

- Discover Qatar's cultural side at Katara Cultural Village

Katara Cultural Village, situated in Doha, Qatar's sparkling capital, is an excellent illustration of how a nation dependent on real estate and oil is forging a place as a global cultural and leisure destination. Katara Cultural Village is a must-see for its entertaining musical events, art exhibitions, flashy restaurants providing a variety of tasty cuisines, and other attractions. It's like going back in time when you visit this attraction!

- The Corniche is a visual treat for tired eyes

Can you believe that the gorgeous seaside promenade known as Corniche was once a landfill? It's a beautiful seven-kilometre stretch along Doha Bay. The crescent-shaped promenade is surrounded by modern structures and lush greenery. Its spectacular beauty and bright aura draw a large number of visitors and residents who come to appreciate the stunning images that are a delight for the eyes. The promenade offers views of beautiful architectural features such as Al Dafna Park and the Museum of National Art. It is the ideal site to watch man's and nature's harmony!

- Gaze at the treasure trove of collections at the Museum of Islamic Art

The Museum of Islamic Art, designed by IM Pei (Chinese architect), opened its doors to the public in 2008. The museum seems to be a stack of boxes stacked on top of each other at first view. Its white limestone veneer is relaxing, and its clean geometric edges give it an austere appearance. The building's top features eye-like apertures inspired by a 13th-century ablution fountain. This museum is organised into multiple levels, each with its own collection of relics.

- Villaggio Mall - A Shopping Lover's Paradise

Villaggio Mall, designed in the style of Venice, is a shopper's dream. With its striking design and indoor waterways, this Doha mall is one of the country's finest, attracting 50,000 people every day. Sprawled across 360,000 square metres. Shoppers may visit some of the greatest brand stores, such as Gucci, Dolce & Gabbana, Christian Dior, and others. A sky-blue roof and an interior canal that runs through the mall create a Venice-like atmosphere. Enjoy interesting activities such as Gondola Rides, Go-Karting, Cinema ai IMAX, Ice Rink, and delicious dining options.

- Purple Island - A place where mangroves meet history

This stunning island, also known as Al Khor Island, will undoubtedly take your breath away. The island is a secret gem for nature enthusiasts, encompassing all hues of beauty. Immerse yourself in its beauty and tranquil surroundings, learn more about its age-long history and observe vivid flora and blossoms, unique marine life, fossils, fauna, and a leisurely walk through the salt marshes. You must add this unusual destination to your bucket list and have fun discovering a new side of Qatar.

Qatar: Fast Facts

Information last updated Feb 23. While this information is sourced reliably, visa requirements can change. For the most current visa details, visit the official Consulate/Embassy website.

Disclaimer / TnC

Your policy is subjected to terms and conditions & inclusions and exclusions mentioned in your policy wording. Please go through the documents carefully.

Related Articles

Why senior citizens travel insurance is must?

5 Myths of Travel Insurance

Going for a vacation. Here are five reasons you need travel insurance

What are the reasons for qatar visa rejection.

Listed below are some of the common reasons for Qatar visa refusal:

- Because of a lack of information.

- The visa applicant isn't qualified for the applied category and falls within the scope of legal ineligibility grounds.

How can an individual extend their Qatar on-arrival visa?

Luckily, this isn't a difficult task. All one needs to do is complete the application form on the website of the Ministry of Interior. When completing the application form online, one must provide information such as nationality, visa number, and passport number. They'll be notified of their visa extension once they have completed their online application form.

How many days post arrival may I extend my Qatar visa on arrival for Indians?

You'll only be able to extend your Qatar visa on arrival if you do so within 30 days of receiving your first visa on arrival.

What is the minimum bank balance necessary to obtain a Qatar visa?

Well, you need to have at least $1,400 in credit/debit card or cash to obtain a Qatar visa. However, there may be criteria depending on the kind of visa you have and whether it is a short-term or a long-term visa. As soon as you know the sort of visa you require, you might need to validate this information. The requirements can change depending on several factors.

Other Destinations

Insurance is the subject matter of the solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read sales brochure / policy wording carefully before concluding a sale. Trade logo displayed above belongs to TATA Sons Private Limited and AIG and used by TATA AIG General Insurance Company Limited under License. 2008, TATA AIG General Insurance Company Limited, all rights reserved. Registered Office : Peninsula Business Park, Tower A, 15th Floor, G.K.Marg, Lower Parel, Mumbai - 400 013, Maharashtra, India. CIN: U85110MH2000PLC128425. IRDA of India Regn. No. 108. Toll Free Number : 1800 266 7780 / 1800 22 9966 (only for senior citizen policy holders). Email Id – [email protected] . Category of Certificate of Registration: General Insurance.

2008, Tata AIG General Insurance Company Limited, all rights reserved. Registered Office : Peninsula Business Park, Tower A, 15th Floor, G.K.Marg, Lower Parel, Mumbai - 400 013, Maharashtra, India. CINNumber : U85110MH2000PLC128425. Registered with IRDA of India Regn. No. 108. Insurance is the subject matter of the solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read sales brochure / policy wording carefully before concluding a sale. Trade logo displayed above belongs to Tata Sons Private Limited and AIG and used by TATA AIG General Insurance Company Limited under License. Toll Free Number : 1800 266 7780 / 1800 22 9966 (only for senior citizen policy holders). Email Id – [email protected] .

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

- Forms Centre

- Self-Service

Beware of phishing scams. For more information, please visit our Safety Tips page.

The GST rate will increase to 9% on 1 January 2024. Visit this page for more information.

Travel Guard ® Direct

√ Up to $80 in eCapitaVouchers (Single Trip Plan)

√ Luggage & travel data (Annual Multi-Trip Plan)

√ Promo code AIGTGD

√ Promo till 19 May 2024

Make a claim

- Renew Annual Travel

- Make Changes to Your Travel Policy

- Request for Proof of Cover Letter

Current Promotion

May Travel Promotion

Use promo code: aigtgd for annual multi-trip and single trip plans. .

Promotion is valid till 19 May 2024 . T&Cs apply.

AIG Travel Assistance Services