- Entertainment

5 best travel insurance plans in Singapore with Covid-19 coverage (2022)

As travel becomes possible again (woohoo!), travel insurance is now once again something that is relevant in our lives.

Remember the good old days when lost luggage was your biggest worry? These days, the most likely mishaps to happen are related to Covid-19, whether they be an infection or a trip cancellation.

Not all insurers cover Covid-19, but a handful do - to varying extents. Here's a comparison of the five best plans in Singapore.

Does travel insurance cover Covid-19?

When the Covid-19 pandemic started, most insurers did not extend their coverage to Covid-19-related mishaps.

The pandemic was quickly considered a "known event", which insurers usually do not offer compensation for. So, if your flight got cancelled because of Covid-19, you'd be out of luck.

Now. as travel restrictions get lifted, insurance companies are rushing for a slice of the pie. Since the virus looks like it's here to stay, insurers are starting to offer coverage specifically for Covid-19.

But Covid-19 coverage is such a new thing that it can vary quite a bit from insurer to insurer. Given a bit of time, insurers will start to understand what their competitors are offering and coverage across the board is likely to become more similar.

Do note that the plans still exclude travelling against a travel advisory put in place by the Singapore government or by the local authority at your trip destination. So be sure to check announcements on both ends before you depart.

Another common exclusion is failing to take precautions against Covid-19. This is broadly worded in the insurance policy but could include not following any Covid-19 regulations at your destination or on the plane. So make sure you wear your mask whenever it's required and don't go attending any illegal raves.

Best travel insurance with Covid-19 coverage

* For a one-week trip to Germany

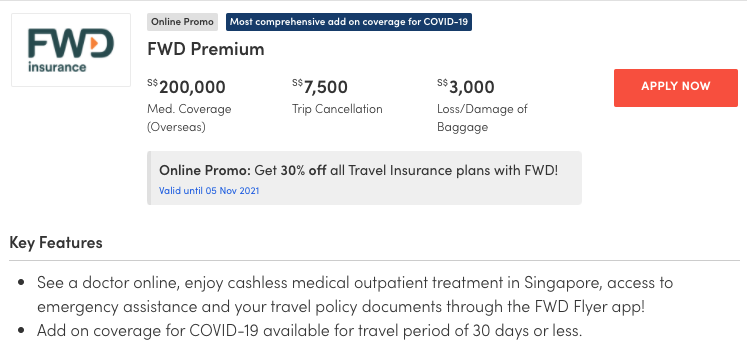

1. FWD travel insurance + Covid-19 coverage

FWD offers some of the cheapest travel insurance plans in Singapore, so this is a budget-friendly option if you're already baulking at the cost of all the antigen tests you'll have to take before and after your trip.

Here's a quick run-through of the Covid-19 coverage offered by this plan:

- Trip cancellation and loss of deposit

- Trip disruption

- Overseas hospital cash

- Hospital cash while in Singapore

- Medical expenses

- Emergency medical evacuation and repatriation

The plan reimburses some of your travel-related expenses if you are diagnosed with Covid-19 no more than 30 days before your scheduled departure date, or if you have to change your itinerary because of a Covid-19 diagnosis while overseas.

You also get to claim medical expenses and a hospital cash benefit if you get hospitalised overseas or for up to 14 days in Singapore upon your return.

The coverage is very bare bones but the plan is frickin cheap. Get this if you can't afford anything else.

2. AIG Travel Guard insurance

Here's a quick run-down of the plan's main offerings:

- Trip cancellation

- Early return home

- Overseas medical expenses

- Emergency medical evacuation

- Overseas quarantine allowance

This plan offers compensation if you catch Covid-19 in Singapore and have to postpone your trip, or if you or a family member catch the virus before your departure date and you have to cancel your trip because of that. You also get medical coverage and a quarantine allowance.

This is quite a decent list of benefits compared to what the other plans are offering, but there are a few perks missing from the list, including a daily hospital cash benefit, early return home and trip interruption due to quarantine or other government advisories.

Overall, the plan is on the cheap side but honestly quite bare bones. If you can afford this plan, you could also just spend a few more bucks to get a better one.

READ ALSO: Travel insurance claims guide - what to do, what receipts to keep and more

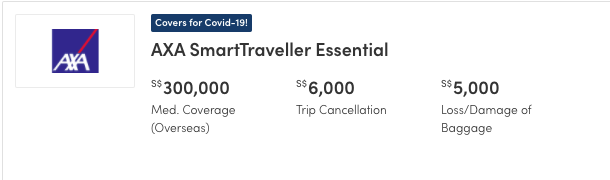

3. AXA SmartTraveller travel insurance

Here's what this plan gets you:

- Pre-departure trip cancellations and postponement

- Trip curtailment or rearrangement losses

- Overseas hospitalisation allowance

The medical expenses category is quite generous here. You can claim for costs incurred within 90 days of your trip.

One perk that not all insurers offer is overseas quarantine allowance if you're forced to hole up in a hotel or quarantine centre overseas due to a Covid-19 infection.

You can't claim for this if you're already claiming for hospitalisation, though you'd have to be really unlucky to get both quarantined AND hospitalised in one trip.

AXA also tends to be quite flexible when it comes to trip curtailment or rearrangement.

You can claim under this section not only if you yourself catch Covid-19 but if there is a death in your family due to Covid-19, public transport gets cancelled due to Covid-19 or there is a Covid-19 outbreak at your destination which prevents you from continuing on your trip.

In short, this plan has one of the most comprehensive benefits lists available, and it isn't even that expensive. This one gets a thumbs-up.

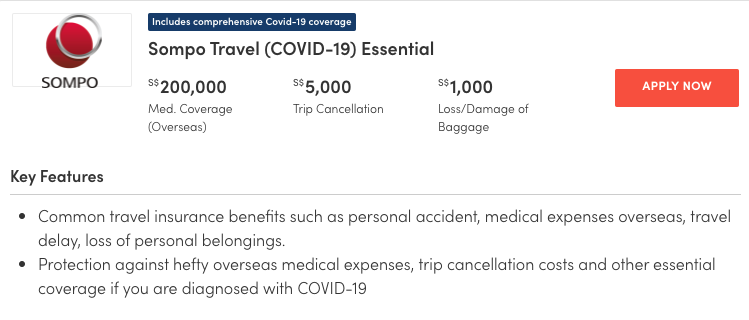

4. Sompo Travel (Covid-19) Essential travel Insurance

The key benefits are as follows:

- Trip postponement

- Trip curtailment

- Medical expenses overseas

- Overseas hospital income

Compensation for trip cancellation or postponement is offered if you, an immediate family member or a travelling companion also insured by Sompo, got diagnosed with Covid-19 not more than 30 days before your departure date.

If your travel partner gets infected you can choose to claim for your travel expenses rather than go alone.

The same goes for trip curtailment while overseas. While on your trip, you can make a claim for having to change your itinerary if your travelling companion or an immediate family member back in Singapore gets diagnosed with Covid-19 and you need to cut short your trip to return to Singapore.

Medical expenses can be claimed for a period of up to 45 days (the first day being the day you first seek treatment while overseas) or when the limit in your benefits table is first reached, whichever happens first.

Note that you might be left high and dry if you are ill for more than 45 days.

Overall, this plan is generous when it comes to changes to your travel plans, but not so much when it comes to medical treatment. It's probably best if you are young, have no existing health issues and have already been vaccinated.

5. NTUC Income travel insurance

Here's a run-down of the key benefits:

- Cancelling your trip due to Covid-19

- Postponing your trip due to Covid-19

- Shortening your trip due to Covid-19

- Trip disruption due to Covid-19

- Emergency medical evacuation due to Covid-19

- Sending you home due to Covid-19

NTUC Income offers up to $150,000 worth of overseas medical expenses and up to $150,000 worth of evacuation or repatriation expenses if you contract Covid-19 overseas. This coverage is valid for the first 90 days of your trip.

They have recently enhanced their Covid-19 cover to allow claims for trip cancellations and postponements due to you (or your travel companion) being diagnosed with Covid-19 or getting issued an isolation order by the government.

Covid-19 vaccine complications are now covered under medical expenses as well. For more details on what is covered, refer to the NTUC Income website and policy conditions.

There are no excluded countries due to Covid-19 except for Afghanistan, Iraq, Liberia, Sudan and Syria, which are normally excluded from the regular travel insurance plan as well.

In addition, NTUC Income has collaborated with Raffles Medical to offer Covid-19 (PCR) swab test at $124.2 along with a series of other types of pre-departure tests.

What to do if you get Covid-19 during/after travel?

First of all, when booking your trip, you should retain all receipts, tickets and itineraries in case your trip has to be cancelled or altered.

At the first sign of a Covid-19 infection or related travel disruption, you should call your insurer and ask for guidance. Many insurers maintain a 24-hour hotline for travel claims.

[[nid:549261]]

To make a claim you will usually have to submit your insurer's form with supporting documents within the deadline mentioned in your contract (usually 30 days). Don't wait until you're back in Singapore to check which documents you need.

If you catch Covid-19 while you're in Singapore, you will likely have to submit the results of a PCR Swab Test or Antigen Rapid Test conducted at a clinic or hospital.

It gets a bit more complicated if you're overseas. The insurer will likely require documentation from the hospital as well as a doctor's letter stating that you are unfit to travel and/or recommending treatment.

If you need to be quarantined overseas, you should make sure you have a quarantine order from the government, otherwise you may not be able to claim for quarantine allowance. Remember to ask for this as not all countries automatically issue such documentation.

This article was first published in MoneySmart .

7 Best Singapore Travel Insurance Plans for US Citizens in 2024

Updated on January 10, 2024 by Matthew H. Nash – Licensed Insurance Agent

- SwiftScore Our SwiftScore is a unique and proprietary insurance ranking system objectively comparing key metrics which are most important to Singapore travelers. Learn more at the end of this page.

STARTING PRICE FOR 2-WEEK TRIP TO THE SINGAPORE

CAN YOU CANCEL YOUR TRIP FOR ANY REASON?

BEST WEBSITE FOR

Comparing Policies

- Compare dozens of the best Singapore travel insurance policies from all the major providers in one place

- Easily filter for the features you want and get support from their award-winning customer service team

- Founded in 2013, TravelInsurance.com has helped hundreds of thousands of travelers find affordable insurance coverage

BEST POLICY FOR

Fast Claims

- Super fast claims via their 100% digital platform with a helpful mobile app

- Faye makes it easy to add-on coverage for vacation rentals, adventure/extreme sports, pet emergencies, and “cancel for any reason” at competitive prices

- Underwritten by Crum & Forster, Faye is known for its exceptional customer support, with 4.8/5 stars on Trustpilot

- SwiftScore Our SwiftScore is a unique and proprietary insurance ranking system objectively comparing key metrics which are most important to travelers. Learn more at the end of this page.

BEST POLICY FOR

Travelers Aged 55+

- Pre-existing medical conditions are covered for a reasonable fee and they offer “cancel for any reason” as an add-on

- $2,000 COVID quarantine coverage available w/ Safe Travels Voyager plan

- Founded in 1998 and underwritten by Nationwide and GBG Insurance

BEST WEBSITE FOR

Filtering Plans

- This comparison website has the most comprehensive filters especially for Covid-19 which helps you search for the specific benefits you need

- They have “Zero Complaint Guarantee” which promises a fair claims process

- Established in 2003, Squaremouth has consistently been recognized for it’s exceptional customer service

BEST POLICY FROM

An Established Brand

- Well rounded, inexpensive travel insurance plans from an established and top rated global insurance company

- AXA has plans that cover pre-existing conditions and their “Platinum” plan covers “cancel for any reason” with an optional add-on. They also offer helpful 24/7 Worldwide Travel Assistance Services

- Founded in 1959 and underwritten by Nationwide

Family Travel

- Their “Trip Interruption for any Reason” feature allows you to get a 75% reimbursement for any additional expenses if you decide to go home early from your trip

- They have a variety of insurance products to suit any travel needs

- Founded in 1993 and underwritten by Nationwide Insurance

Long-term Travel

- Ideal for digital nomads and long-term travel, available to anyone anywhere

- Scored lower because short-term travel coverage isn’t as robust as competitors

- Founded in 2018 and is underwritten by Lloyds of London

CAN YOU CANCEL YOUR TRIP FOR ANY REASON?

Singapore travel insurance FAQs

What are the most important things to consider when buying a singapore travel insurance policy.

Before buying a trip insurance policy, you will need to find out whether it provides coverage for travelers to Singapore. Most policies do, but it is always worth checking. Make sure that it covers the full length of your trip, from your departure date through your return date. Also, do you plan to participate in any extreme sports or adventure activities during your time in Singapore? (Yes, they have them!) You will need to verify these details with each insurance company whose policies you’re interested in to determine if they will cover your preferred sports. I have found comparison sites, like SquareMouth.com , to help filter for policies that cover specific activities. Another aspect to take into account when buying Singapore travel insurance is whether you or any of your travel companions who will be insured on the same policy have pre-existing medical conditions. If so, purchasing a pre-existing condition upgrade package will be critical to your protection while traveling in Singapore. And since travel requirements are in flux these days, I encourage travelers to consider purchasing a “Cancel for Any Reason” (CFAR) optional plan. CFARs give you the freedom and flexibility to change your plans at any time and for any reason and receive a 75% reimbursement of your total trip cost.

How do you get the cheapest travel insurance plan?

The cheapest travel insurance plan may not always be the best option. Before buying any policy, please read the full policy details to ensure it meets all your needs. The best plan will be competitively priced and provide all the necessary coverage. I recommend using a comparison site such as WithFaye.com since it will allow you to sort through policies by price.

How many people does one trip insurance policy cover?

Single Trip plans can cover as many as 10 people who are residents of the same state and have the same travel dates and itineraries. However, should your travel companions live in another state or have different travel itineraries, they will need their own insurance policy. If traveling with 8 or more people, you may want to purchase a Group policy as you will get a better deal. Unlike Single Trip policies, Group policies cover all your travel companions, regardless of their state, and still provide comparable coverage.

Can you purchase Singapore travel insurance when you’re already on vacation?

The short answer is yes. That said, there is one major caveat: your travel insurance policy will only be active from the date of purchase and is not retroactive. Therefore, you cannot file a reimbursement claim if anything happens on your trip before buying travel insurance, such as becoming hospitalized or losing your luggage.

Does travel insurance coverage include emergency dental work?

Travel insurance plans cover limited emergency dental work. Whichever policy you choose will likely provide $100-$750 of coverage for natural teeth only. Policies tend to exclude crowns, bridges and false teeth. Providers do not accept claims for annual exams or routine cleanings and generally restrict the time window in which you can have covered dental work. Always read the full details of any policy you’re considering to get a clearer picture of the dental coverage it provides.

How do travel insurance companies define trip interruption?

Trip Interruption coverage protects against any extraordinary, unforeseen or unexpected event requiring you to leave your vacation early and fly home. Examples of such occurrences include terrorist attacks, inclement weather and any insured traveler’s injury, illness or death. Trip Interruption coverage kicks in the day you leave on your trip, which is why it’s referred to as a post-departure benefit.

What are approved trip delay expenses?

Should your trip be delayed by the minimum number of hours stated in your policy, you will receive reimbursement for approved expenses such as ground transportation, hotels, meals, and internet access. Every policy allows a different amount, but generally, the reimbursable daily total ranges from $150 to $200 per insured traveler until you reach the policy’s cap.

Will travel insurance cover a relative’s death?

This differs from one policy to the next. If a relative’s death results from suicide or a pre-existing condition, bereavement benefits may not be available if you bought the cheapest possible policy. However, policies with higher premiums may provide bereavement benefits, regardless of the cause of death. Another discrepancy between providers is who qualifies as a “covered relative.” Grandparents? Siblings? In-laws? Pets? Remember to read any travel insurance policy’s full details for specifics so you have a clear picture of what benefits you will be afforded under different circumstances.

Common problems tourists experience in Singapore and how to steer clear:

One of the most frequent illnesses plaguing Singapore travelers is sunstroke (heatstroke). To prevent sunstroke, stay out of the mid-afternoon sun when it’s strongest, drink plenty of water, eat juicy fruits and vegetables and get plenty of rest. Symptoms may include high fever, nausea, vomiting, delirium, sweating and increased heart rate. Consult a medical professional promptly if you experience one or more of these symptoms. Mosquitoes are a problem throughout SE Asia and transmit several illnesses, including the zika virus and dengue fever. To minimize the risk of contracting either, use strong bug spray all over, including your feet, if you plan to wear sandals or open-toed shoes. Dengue fever can be debilitating, if not deadly. Dengue expresses itself via high fevers and vomiting, though other common symptoms are fatigue, severe body aches, muscle pain and rashes. Get to a hospital immediately if you experience any of these. Receiving fluids intravenously and remaining under medical supervision until you are well enough to care for yourself is extremely important to your recovery. With dengue fever, the body’s blood platelet count drops so low that internal hemorrhaging may occur. This can be fatal, so do not take this lightly. It may take up to 8 weeks to fully recover from dengue fever, although many get better sooner. Therefore, ensure you purchase a travel insurance plan that has comprehensive medical coverage. The good news is that Singapore has excellent medical services.

Since Singapore is a city-state with a predominantly urban landscape, the potential accidents you could have are far fewer than if you were in another country. The most common injuries, such as twisting an ankle, breaking a bone and scraping a knee or elbow, typically result from tripping or falling while sightseeing.

Singapore consistently ranks as one of the safest countries in the world. Its laws are far-reaching and strictly enforced and even petty theft is rare.

Emergency resources for Singapore

Phone numbers.

If you are dialing from your US phone, 911 will connect you with the police. However, if you are calling from a Singaporean phone, dial 999 for the police, 995 for fire and ambulance services and 1777 for non-emergency ambulance services.

US embassy or consulate details

The US has an embassy in Singapore. Please visit their website for hours of operation, location, and information regarding citizen services.

Additional information to help travelers have a better experience in Singapore:

The currency is the Singapore Dollar (SGD). If you need cash during your vacation, you will get the best exchange rates, even with fees, by withdrawing cash using your US debit card. Remember to notify your bank of your travel dates and destination before leaving the US so they do not block your card. Cash machines/ATMs are found throughout. While it’s helpful to always have cash on hand in Singapore, many businesses accept major credit cards.

Getting Around

Between the MRT system (subway), buses, ferries, taxis, bicycles and cable car, getting around Singapore is quite easy, especially since most major attractions are within walking distance of an MRT station. The MRT runs between 5:30 am and midnight and buses from 6 am until midnight, covering similar territory to the MRT but extending further beyond downtown. Ferries shuttle passengers between the city center and the surrounding islands. You will need an EZ-Link card to use any of Singapore’s trains and buses. They are available for purchase at 7-Eleven stores, Passenger Service Centres located within many MRT stations, and any TransitLink office. Once you have an EZ-Link card, you will need to add credit, or as they say in Singapore, top it up. Cards usually come loaded with some money (S$5-7), but you will need to add more. Use the card to “tap in” (on the sensors) before getting on a bus or train and “tap out” when you get off. Taxis are relatively cheap in Singapore, but there are numerous surcharges to be aware of. Some are based on the location from which you hail a cab or schedule a pickup and whether you’re traveling during rush hour or late night hours (midnight to 6 am). An alternative to metered taxis is Grab, a top-rated ride-booking service similar to Uber that operates through their mobile app. (Uber no longer has services in Singapore.) Buses also run to nearby Malaysia if you wish to explore another captivating country in the region. International buses are clean, affordable, and comfortable.

Singapore has four official languages: English, Mandarin, Malay, and Tamil. Most locals understand and speak English, especially those working in service positions. Also, “Singlish,” a commonly spoken mix of English and other languages––mainly Malay––can be heard all about. It involves using unusual cadence, changing word order, dropping pronouns and prepositions, shortening phrases, and more. Don’t be surprised if you hear people add lah to the end of a sentence or a question. While it doesn’t have a direct translation, it is used for emphasis. Here are a few words and expressions that may help you out:

- ang moh – westerner

- auntie – any woman you’re speaking or referring to (even strangers)

- can! – yes, it’s OK.

- hawker centres – open-air food court (usually very cheap)

- Inggrish – English

- kopi – coffee

- kopitiam – coffee shop

- looksee – take a look

- makan – a meal, food or to eat (Malay)

- shiok – very good, delicious

- talk cock – to not say anything of meaning or that makes sense

- uncle – any man you’re speaking or referring to (even strangers)

- wah! – an expression of unease, surprise or angst

Many establishments, particularly restaurants with table service, will add a 10% service charge to your bill. Service charges are paid directly to the restaurant, not your server. The same is true for most hotels. There is much debate around this subject as to whether or not the staff actually receive their portion of the service charge, so if you feel better leaving your server a separate tip, 10-15% is appropriate. I recommend tipping porters S$2 per bag for assisting you, S$5-10 for concierges/receptionists for any extra assistance they may provide, S$5-10 for valets and housekeepers S$5-10 per day for a job well done or exceeding expectations. You can round up to the next substantial amount for bartenders, salon staff, tour guides, and taxi drivers. For example, if the charge is S$47, you can round up to S$50. If you receive poor service, do not feel obliged to tip anyone. Whatever you do, please do not attempt to tip anyone at Changi International Airport, as the law prohibits staff from receiving them. And remember, tipping is not a cultural norm in Singapore, so it is always optional.

Unusual Laws

Singapore has many unusual laws, most of which will not apply to you or your vacation. However, a few could land you in trouble, or at least with a steep fine. The first and most famous is that chewing gum has been illegal in Singapore since 1992. Also, eating and drinking on all public transport is outlawed. This is important to remember as you’re out exploring since Singapore is known for its sweltering heat and often suffocating humidity. Drink plenty of water and enjoy your snacks before getting on trains, buses or ferries. Other illegal things in Singapore include leaving public toilets unflushed and purchasing, using or possessing e-cigarettes or imitation tobacco products. Also, be aware that having illicit drugs, including marijuana, can result in the death penalty.

Packing advice for Singapore

Apart from Travel Insurance, we recommend you bring the following items for maximum health, safety and enjoyment of your trip to Singapore.

A final note about travel insurance for Singapore

I have spent dozens of hours researching travel insurance, including getting quotes and comparing coverage from all the most popular brands. Regardless of where you’re going, I am confident that you will also find that WithFaye.com offers the best way to compare policies with the ideal combo of coverage and price.

I wish you and yours an incredible journey.

SwiftScore Ranking Methodology

- Average price for a 2-week vacation based on a 35-year-old California resident traveling to the Singapore with a $3,500 trip cost

- Coronavirus coverage

- Cancel for any reason (CFAR)

- AM Best rating of the underwriter

- Key policy details including cancellation, interruption, emergency medical evacuation, and baggage & personal effects

- Ease of sign up

- Policy language clarity

- User reviews

- Travel Insurance

Travel Insurance — Must-Have or Good-to-Have?

If travel is on the horizon for you this year, then getting sufficient travel insurance is a worthy investment for peace of mind for your next adventure.

by Sihan Chia on Apr 20, 2024

Whether it’s a weekend getaway or taking the road less travelled on a month-long adventure , planning ahead is crucial to ensure a smooth and hassle-free trip.

An essential aspect of travel planning is purchasing travel insurance. With a plethora of options available, it’s tempting to opt for the cheapest travel insurance plan available. But is the cheapest always the best choice? Read on to learn how to make an informed decision when it comes to purchasing travel insurance and some scenarios where investing in a more expensive plan might be beneficial.

The Temptation of Cheap Travel Insurance

In today’s digital age, finding cheap travel insurance is just a few clicks away. Many budget-friendly options promise adequate coverage at a fraction of the cost of premium plans. While saving money is always a plus, it’s essential to understand what you’re getting for your money.

Related: How Travel Insurance Can Protect Your Refund Rights for Flight Cancellations and Delays

What does cheap travel insurance typically cover.

Cheap travel insurance plans often offer basic coverage, which may include:

- Trip cancellation or interruption

- Baggage loss or delay

- Emergency medical expenses

- Emergency evacuation

While these coverages are essential, they may have limitations in terms of coverage amounts, exclusions, and deductibles. For instance, a cheap plan may have a low coverage limit for emergency medical expenses or exclude coverage for adventure sports or pre-existing medical conditions .

Related: What’s Inflating Your Travel Expenses This Year?

When is it worth investing in a more expensive plan, extended coverage and higher limits.

If you’re embarking on a high-value trip or travelling to a destination with high medical costs, investing in a more expensive travel insurance plan with higher coverage limits can literally be lifesaving if emergencies arise. Premium plans may provide:

- Higher coverage limits for emergency medical expenses including evacuation

- Coverage for adventure sports and activities

- Additional benefits such as trip delay, missed connections, and rental car damage

Related: Average Costs and Benefits of Travel Insurance

Pre-existing medical conditions.

If you have pre-existing medical conditions , opting for a cheap travel insurance plan may not provide sufficient coverage. Many budget-friendly plans exclude coverage for pre-existing conditions or offer limited coverage, which can leave you vulnerable to significant out-of-pocket expenses in case of a medical emergency abroad.

Related: Afraid of Getting Your Travel Insurance Claim Rejected? Take These Precautions

Comprehensive coverage.

For travellers seeking comprehensive coverage, including cancel for any reason (CFAR) or upgrade options for lost or stolen items, a more expensive travel insurance plan may be worth the investment. Premium plans often offer:

- Cancel for any reason coverage

- Upgrade options for lost or stolen items

- Enhanced 24/7 travel assistance services

Related: Travel Insurance From Airlines vs Insurance Companies – Which is Better?

Risks of insufficient travel insurance coverage.

Opting for the cheapest travel insurance plan without carefully reviewing the coverage details can expose you to potential risks such as:

Financial Risks

Inadequate coverage for emergency medical expenses, trip cancellation, or lost baggage can result in significant financial impact on you. Medical emergencies abroad can lead to exorbitant medical bills, and without sufficient coverage, imagine the horror of you paying out-of-pocket!

Limited Protection

Cheap travel insurance plans often come with limitations and exclusions that may not provide adequate protection for your specific travel needs. For instance, exclusions for adventure sports or pre-existing medical conditions can leave you unprotected in case of an accident or illness related to these activities.

Additional Stress

Dealing with unexpected situations such as lost baggage, flight cancellations, or medical emergencies without adequate travel insurance coverage can be stressful and ruin your travel experience.

Related: How To Survive and Thrive as a Solo Traveller

How to make an informed decision.

Assess Your Travel Needs

Before purchasing travel insurance, assess your travel needs and the potential risks associated with your trip based on the following factors:

- Destination and travel activities

- Value of your trip and prepaid expenses

- Health condition and medical history

Compare Plans

Shop around and compare different travel insurance plans to find one that offers the best value for your money. Pay attention to the coverage limits, exclusions, deductibles, and additional benefits offered by each plan.

Read the Fine Print

Carefully read the policy terms and conditions, including the coverage exclusions and limitations. Make sure you understand what is covered and what is not to avoid any surprises in case of a claim.

Consult An Insurance Expert

If you’re unsure about which travel insurance plan to choose, call and ask an insurance expert or travel advisor who can help you find a plan that meets your specific needs and provides adequate coverage for your trip. It’s always better to get the conversation on record, preferably on email so you can clarify any questions before purchasing.

While cheap travel insurance can save you money upfront, it may not always provide sufficient coverage for your travel needs.

Investing in a more expensive travel insurance plan with comprehensive coverage can offer better protection and peace of mind, especially for high-value trips or travellers with pre-existing medical conditions. By assessing your travel needs, comparing different plans, and reading the fine print, you can make an informed decision and choose a travel insurance plan that offers the best value for your money.

Ultimately, we travel to relax and create happy memories for ourselves and our loved ones, so all you need is that one purchase to ensure a safe and worry-free experience.

Compare the best travel insurance plans available on our platform before you fly!

Compare Best Travel Insurance in Singapore Find Out More

A Guide To Travel Insurance

Best Travel Destinations Off the Beaten Path to Beat the Crowd

Travel Diaries: 5 Safest Travel Destinations in the World

How to Pick the Best Travel Insurance

How to Go on a Round the World Trip Without Going Broke

Cover Image: Unsplash

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation or endorsement by AMTD PolicyPal Group in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Under AMTD Digital, AMTD PolicyPal Group consists of PolicyPal Pte. Ltd., Baoxianbaobao Pte. Ltd., PolicyPal Tech Pte. Ltd., and ValueChampion.

UOB Travel Insurance Review 2022: Promo, Covid-19, Complimentary Insurance

UOB travel insurance is something of a hidden gem. When you buy travel insurance, the usual names that come to mind are NTUC , MSIG , FWD and so on.

But in my opinion, UOB travel insurance offers pretty decent coverage – and I’m saying this as someone who is not a fan of UOB at all. This is a pleasant surprise because local banks usually don’t try very hard with their insurance products.

Let’s take a closer look so you can decide if it’s worth your money.

- UOB Travel Insurance: Summary

- UOB Travel Insurance: Coverage

- UOB Travel Insurance Covid-19 Coverage

- UOB Travel Insurance Promo

- UOB Complimentary Travel Insurance

- UOB Travel Insurance: Extreme Sports

- UOB Travel Insurance Claims Review

- Should I buy UOB Travel Insurance?

1. UOB Travel Insurance: Summary

UOB travel insurance is sold under the brand UOB Insure & Travel. It’s actually provided by UOI (United Overseas Insurance) which is UOB’s insurance arm.

This is not to be mixed up with the complimentary travel insurance UOB offers its commercial cardholders. UOB’s InsureTravel is like any other travel insurance provider offering their travel insurance plans for purchase. You don’t have to be an existing UOB customer to buy UOB’s InsureTravel plans.

2. UOB Travel Insurance: Coverage

Two years ago, the UOB travel insurance had only 2 tiers – Essential and Preferred.

Now, UOB InsureTravel comes in 3 tiers:

- Basic Plan (cheapest, lowest coverage)

- Essential Plan

- Preferred Plan (most expensive, highest coverage)

UOB InsureTravel has categorised their insurance premiums into 3 areas for its single-trip plans:

- Area 1 : Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Thailand and Vietnam

- Area 2 : Asia countries excluding Middle East countries, Central Asia countries and Russian Federation. Australia and New Zealand included.

- Area 3 : Anywhere in the world

On the other hand, UOB InsureTravel’s annual plans has categorised their insurance premiums in 2 areas for its annual trip plans:

- Area 4 : ASEAN, Asia countries excluding Middle East countries, Central Asia countries and Russian Federation. Australia and New Zealand are included under Area 4

- Area 5 : Anywhere in the world

UOB InsureTravel’s coverage, claim limits, and key benefits are as follows:

UOB InsureTravel’s plans range from $46 to $123. Even when it’s not discounted, UOB InsureTravel is definitely on the more affordable end of travel insurance plans.

We love a good deal any day of the week but does UOB InsureTravel’s coverage really give you a bang for your buck?

In terms of coverage, UOB travel insurance seems pretty legit. Medical coverage is excellent for its price, travel inconvenience benefits are not the best but still decent, and if you’re using a UOB credit card you also get bonus fraud protection. Even with a Basic plan, the claim limits are pretty high.

Comparison of UOB travel insurance prices vs other travel insurance providers:

Looking at the table above, UOB InsureTravel might not seem like the best in class travel insurance product . However, the thing to note is of the four insurance providers listed, only UOB InsureTravel’s policies include Covid-19 coverage.

Covid-19 coverage has to be purchased as an add-on for FWD and Tiq by Etiqa travel insurance policies. Given that what you pay for UOB InsureTravel’s travel insurance plans also includes Covid-19 coverage, you get your money’s worth in coverage.

Total Premium

FWD Premium

[ Win a Rolex, Samsonite Luggage & More! | MoneySmart Exclusive] • Enjoy 25% off your policy premium • Get S$88 Revolut Cash Award* and an Eskimo Global 1GB eSIM with every policy purchased. T&Cs apply. BONUS: For a limited time only, there are over S$11,000 worth of prizes to be given away in our Grand Draw . Stand a chance to score: • 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • 1x Samsonite Robez 68/25 EXP (worth S$550) weekly Increase your chances of winning when you refer friends today. T&Cs apply PLUS, get S$100 Revolut Cash Award when you are the 8th and 88th Successful Applicant each week to sign up for a new Revolut account in our Giveaway. T&Cs apply.

Key Features

Enjoy cashless medical outpatient treatment in Singapore, access to emergency assistance and your travel policy documents through the FWD SG app!

Add on coverage for COVID-19 available for both Single & Annual Trips for travel period of 90 days or less.

Optional add on coverage available when your trip is cancelled for any reason for Single Trips. (To be purchased within 7 days of your initial trip deposit for your trip).

Optional add on coverage available for pre-existing Medical Conditions for Single Trips plans (up to 30 days) with S$50,000 coverage for medical expenses incurred overseas and 50% co-payment for trip cancellation, postponement and more!

.png)

[MoneySmart Exclusive] • Enjoy 40% off your Single Trip policy premium and 60% off Covid-19 add-on for Annual Plans. T&Cs apply • Get S$88 Revolut Cash Award* with every policy purchased. T&Cs apply. PLUS, get S$100 Revolut Cash Award when you are the 8th and 88th Successful Applicant each week to sign up for a new Revolut account in our Giveaway. T&Cs apply. [Etiqa's 10th Year 2024 Grand Draw] Stand a chance to win S$10,000 cash or a Singapore Mint Lunar Dragon 1 gram 999.9 fine gold medallion (worth S$173) with eligible Etiqa/Tiq by Etiqa plans purchased. T&Cs apply.

Comprehensive Covid-19 add-on, protecting you before, during and after your trip

Covers Cruise to Nowhere

Instant claims encashment via PayNow

24-hour worldwide emergency travel support

Get paid upon a 3-hour flight delay, even without submitting a claim

3. UOB Travel Insurance Covid-19 Coverage

Given how affordable UOB’s InsureTravel policies are, it might come as a surprise to you that its plans already include Covid-19 coverage:

UOB InsureTravel’s Covid-19 coverage is also worthy of singing praises. Even the basic plan’s overseas medical expenses coverage limit is $100,000. In comparison, FWD’s Covid-19 coverage will set you back by an additional $20.60-$34.04 for $200,000 in overseas medical expenses.

Given just how pocket-friendly UOB InsureTravel plans are, upgrading to the Preferred plan is still cost competitive with other insurance providers who offer Covid-19 coverage as an add-on.

4. UOB Travel Insurance Promo

We’ve mentioned a fair bit about how affordable and price competitive UOB InsureTravel’s plans are. I don’t know about you, but I really hate buying stuff at full price, especially when I just know there’s going to be a sale just around the corner.

UOB travel insurance is kind of like that. When there’s a promotion, UOB travel insurance can be downright cheap, making it one of the best prices you can get in Singapore. Currently, there’s an ongoing promotion of 30% off on single-trip plans and 10% off on annual plans .

Here are the UOB InsureTravel prices after the 30% discount:

After discount, UOB’s InsureTravel policies certainly give you the best value for money especially considering that it also includes Covid-19 coverage.

You can keep tabs on the latest promotions on the UOB travel insurance page.

5. UOB Complimentary Travel Insurance

If you’re a UOB cardholder, you can qualify for UOB’s complimentary travel insurance if you charge the entire fare of your air ticket to any of the following cards:

- UOB One Credit Card

- UOB EVOL Card

- UOB Absolute Cashback American Express Card

- UOB Visa Signature

- UOB PRVI Miles American Express

- UOB PRVI Miles World Mastercard

- UOB PRVI Miles Visa

- KrisFlyer UOB Credit Card

Who does love free things? But as the old adage goes, there are no free lunches in the world. The UOB complimentary travel insurance coverage is extremely limited compared to the normal (paid) UOB travel insurance. It’s coverage is limited to the following:

- Personal Accident coverage of $500,000

- Emergency Medical Assistance, Evacuation & Repatriation coverage up to S$50,000 due to an accident or illness (including due to COVID-19 with effect from 1 April 2022)

UOB’s complimentary travel insurance coverage is incredibly bare bones. You’d definitely need to purchase your own travel insurance even if you are a UOB cardholder and qualify for the complimentary coverage.

Plus, there’s the added trouble of having to sign-up online to qualify for the complimentary travel insurance.

6. UOB Travel Insurance: Extreme Sports Outdoor Adventure

As we’ve seen in the sections above, the UOB travel insurance is actually legit.

However, UOB isn’t the most lenient of insurers when it comes to adventure activities, so UOB travel insurance is not for thrill-seekers who really want to test fate.

Here’s a list of outdoor activities that are covered, taken from the UOI policy wording document which is rather hidden from view. The notable exceptions are activities in which you’re airborne – bungee jumping, skydiving and so on.

If you’re an adventure junkie planning to chase an adrenaline rush while you’re on holiday, the UOB InsureTravel plans are definitely limited in its extreme sports and outdoor adventure coverage. D efinitely consider DirectAsia’s Extreme Sports travel insurance rider as an add-on to your UOB InsureTravel plan. It helps that UOB InsureTravel policies are wallet-friendly to begin with.

7. UOB Travel Insurance Claims Review

UOB travel insurance’s cumbersome claims process that seems to be stuck in time might just be my least favourite thing about UOB InsureTravel. To submit your claim, you have to:

UOB travel insurance claims: Download the claim form from the UOB travel insurance page and email the completed form with supporting documents and receipts. Successful claims will then be credited to your account or the cheque will be sent to you via mail.

The inconvenience aside, UOB does have a 24-hour emergency hotline to tend to your queries anytime of any day. The details are as follows:

Emergency assistance hotline: +65 6222 7737

While there isn’t much fodder online about UOB travel insurance’s claims process, we did find one customer review being less than enthused about a full voicemail box. However, we’d take it with a pinch of salt given that it dates all the way back to 2013.

8. Should I buy UOB travel insurance?

UOB InsureTravel’s travel insurance is one of the most bang-for-buck ones out there – even the mid-tier Essential plan has excellent coverage.

It doesn’t make sense to overpay for your travel insurance unless you’re embarking on a high-stakes trip, like a thrill-seeking adventure. If you have an itinerary that’s heavy on extreme sports and outdoor adventure, you will definitely want to get an add-on that is more niche since UOB InsureTravel’s coverage in that category is greatly limited.

Overall, UOB travel insurance offers very good travel insurance benefits all around, from medical coverage to travel inconveniences that may arise from Covid-19. It’s an added plus that unlike other insurance providers, UOB’s InsureTravel travel insurance plans are inclusive of Covid-19 coverage.

The UOB InsureTravel policy also differentiates itself from other providers with additional benefits that are not common practice. For instance, UOB’s InsureTravel plans extend coverage to compassionate visits by a friend or family member.

On top of that, if you’re a UOB cardholder, you also enjoy the following exclusive benefit:

Looking to buy UOB travel insurance? Compare all Singapore travel insurance policies by price and coverage first .

Related Articles

Travel Insurance Singapore Guide (2023): Must-Knows for Choosing the Best Travel Insurance

Airline Travel Insurance – What does SIA, Scoot, Jetstar travel insurance cover?

Best Travel Insurance Plans in Singapore [content outdated due to Covid]

Related articles

Travel Insurance Promotions & Other Money-Saving Hacks (2018)

The Best Travel Insurance in Singapore 2018 Review

5 Best Annual Travel Insurance Policies in Singapore 2018

The post AXA Travel Insurance Singapore Review 2022 appeared first on the MoneySmart blog .

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans , Insurance and Credit Cards on our site now!

The post AXA Travel Insurance Singapore Review 2022 appeared first on MoneySmart.sg .

Original article: AXA Travel Insurance Singapore Review 2022 .

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Latest stories

Yan fried bee hoon: is pm lee’s favourite chicken wing worth the wait.

The post Yan Fried Bee Hoon: Is PM Lee’s favourite chicken wing worth the wait? appeared first on SETHLUI.com.

Rita Ora just showed up at the 2024 Met Gala basically naked in an open-sided dress

Rita Ora showed up almost fully naked to the 2024 Met Gala in a multicoloured Marni dress that was completely open-sided revealing she was braless & commando

EmRata is almost naked in a sparkly see-through Versace dress at the 2024 Met Gala

Emily Ratajkowski just hit the 2024 Met Gala almost totally naked wearing a sparkly see-through Versace backless dress. We are *so* in love with this look!

Texas mother made son, 3, ‘say goodbye to daddy’ on camera before shooting boy dead

Savannah Kriger laid her wedding dresses on her bed and shot her wedding portraits, police say

Dua Lipa Wore the Flossiest G-String Ever to Pull Off This Butt-Baring Look at the 2024 Met Gala

The event marked the pop star's third Met Gala, after making her debut at the event in 2019

An Indian woman accused her husband of forcing her to have ‘unnatural sex.’ A judge said that’s not a crime in marriage

An Indian judge has dismissed a woman’s complaint that her husband committed “unnatural sex,” because under Indian law it’s not illegal for a husband to force his wife to engage in sexual acts.

Chinese climbers stuck on cliff for more than an hour due to overcrowding

Images of tourists stuck partway up a mountain in eastern China went viral, showing it’s not just Everest that’s prone to overcrowding.

Kendall Jenner flashes her bum in never-worn vintage dress at the 2024 Met Gala

Kendall Jenner attended the 2024 Met Gala looking incredible in a dress with bum crack cut-outs. Her vintage archival Givenchy gown has never been worn before.

Jennifer Lopez Takes Naked Dressing to New Heights in Sheer Gown at 2024 Met Gala That Took 800+ Hours to Make

Lopez serves as co-chair for this year's glam event

Mother arrested for throwing disabled son into crocodile-infested canal in India

Woman says her husband considered child a burden and they frequently quarrelled about it

Crystal Palace 4-0 Manchester United: Goal controversy fails to hide fact Man Utd are masters of own downfall

Rasmus Hojlund harshly denied what would have been a leveller in an otherwise woeful display from Man Utd

Blackpink’s Jennie Goes Electric Blue in Alaïa Minidress on Met Gala 2024 Red Carpet

This is Jennie's second year on the Met Gala.

Israel rejects Hamas ceasefire offer

Israel rejected a ceasefire offer from Hamas on Monday night, vowing to continue with its invasion of the southern Gazan city of Rafah and saying a last-minute proposal had failed to meet its key demands.

4 Singapore Blue-Chip Stocks You Can Buy and Hold Forever

We highlight four solid blue-chip names that you can buy and safely own for the rest of your life. The post 4 Singapore Blue-Chip Stocks You Can Buy and Hold Forever appeared first on The Smart Investor.

Michael Owen calls for Man Utd to sack Erik ten Hag before FA Cup final

Former Manchester United players lined up to call for the club to sack manager Erik ten Hag after their disastrous season plumbed new depths on Monday night with the 4-0 humilitation at Crystal Palace.

Non-Americans Are Revealing The Ways They Can “Spot An American Tourist From A Mile Away” — And I’m Both Laughing And Crying

I also feel personally attacked at the accuracy of these.

Inside the 'Awkward Scene' When Kate Middleton and Prince William Arrived Late to King Charles' Coronation

Royal biographer Robert Hardman unravels what happened on the all-important morning

Opening 90 stores in 10 years, owner of Hup Lee Fried Bee Hoon passes on at 51

The post Opening 90 stores in 10 years, owner of Hup Lee Fried Bee Hoon passes on at 51 appeared first on SETHLUI.com.

Russia threatens to strike British military sites over Cameron’s Ukraine weapons pledge

British ambassador called to the foreign ministry in Moscow

Tottenham: Heung-min Son sends message to squad as Ange Postecoglou tactics face scrutiny

Spurs are on their worst run of form in two decades

- Best Beauty Buys 2024

- Sex & Marriage

- Cooking Tips

- Festive Food

- Asian Recipes

- Celebrity Recipes

- Dessert Recipes

- Healthy Recipes

- Quick & Easy Recipes

- Western Recipes

- Beauty & Health

- Diet & Nutrition

- Entertainment

- SPA AWARDS 2023

- Great Women of Our Time

- Also available at:

Privacy Menu

Copyright © 2024 SPH Media Limited. Co. Regn. No. 202120748H. All rights reserved.

5 Best Travel Insurance Plans In Singapore With Covid-19 Coverage (2022)

As travel becomes possible again, travel insurance is once again something that is relevant in our lives, and so is our health and safety.

Remember the good old days when lost luggage was your biggest worry? These days, the most likely mishaps to happen are related to Covid-19 , whether they be an infection or a trip cancellation. As travel becomes possible again (woohoo!), travel insurance is now once again something that is relevant in our lives.

Not all insurers cover Covid-19, but a handful do — to varying extents. Here’s a comparison of the 5 best plans in Singapore.

4 Singaporean Women Offer Pandemic-Safe Travel Tips

4 Hotel Bathrooms So Gorgeous You’ll Never Want To Leave

Should You Travel With Your Unvaccinated Child?

When the Covid-19 pandemic started, most insurers did not extend their coverage to Covid-19-related mishaps. (Read more here.) The pandemic was quickly considered a “known event”, which insurers usually do not offer compensation for. So, if your flight got cancelled because of Covid-19, you’d be out of luck.

Now. as travel restrictions get lifted, insurance companies are rushing for a slice of the pie. Since the virus looks like it’s here to stay, insurers are starting to offer coverage specifically for Covid-19.

But Covid-19 coverage is such a new thing that it can vary quite a bit from insurer to insurer. Given a bit of time, insurers will start to understand what their competitors are offering and coverage across the board is likely to become more similar.

Do note that the plans still exclude travelling against a travel advisory put in place by the Singapore government or by the local authority at your trip destination. So be sure to check announcements on both ends before you depart.

Another common exclusion is failing to take precautions against Covid-19. This is broadly worded in the insurance policy but could include not following any Covid-19 regulations at your destination or on the plane. So make sure you wear your mask whenever it’s required and don’t go and attend any illegal raves.

FWD offers some of the cheapest travel insurance plans in Singapore, so this is a budget-friendly option if you’re already balking at the cost of all the antigen tests you’ll have to take before and after your trip.

Here’s a quick run-through of the Covid-19 coverage offered by this plan:

- Trip cancellation and loss of deposit

- Trip disruption

- Overseas hospital cash

- Hospital cash while in Singapore

- Medical expenses

- Emergency medical evacuation and repatriation

The plan reimburses some of your travel-related expenses if you are diagnosed with Covid-19 no more than 30 days before your scheduled departure date, or if you have to change your itinerary because of a Covid-19 diagnosis while overseas.

You also get to claim medical expenses and a hospital cash benefit if you get hospitalised overseas or for up to 14 days in Singapore upon your return.

The coverage is very bare bones but the plan is frickin cheap. Get this if you can’t afford anything else.

View this post on Instagram A post shared by FWD Singapore (@fwd_sg)

Here’s a quick run-down of the plan’s main offerings:

- Trip cancellation

- Early return home

- Overseas medical expenses

- Emergency medical evacuation

- Overseas quarantine allowance

This plan offers compensation if you catch Covid-19 in Singapore and have to postpone your trip, or if you or a family member catch the virus before your departure date and you have to cancel your trip because of that. You also get medical coverage and a quarantine allowance.

This is quite a decent list of benefits compared to what the other plans are offering, but there are a few perks missing from the list, including a daily hospital cash benefit, early return home and trip interruption due to quarantine or other government advisories.

Overall, the plan is on the cheap side but honestly quite bare bones. If you can afford this plan, you could also just spend a few more bucks to get a better one.

Here’s what this plan gets you:

- Pre-departure trip cancellations and postponement

- Trip curtailment or rearrangement losses

- Overseas hospitalisation allowance

The medical expenses category is quite generous here. You can claim for costs incurred within 90 days of your trip.

One perk that not all insurers offer is overseas quarantine allowance if you’re forced to hole up in a hotel or quarantine centre overseas due to a Covid-19 infection. You can’t claim for this if you’re already claiming for hospitalisation, though you’d have to be really unlucky to get both quarantined AND hospitalised in one trip.

AXA also tends to be quite flexible when it comes to trip curtailment or rearrangement. You can claim under this section not only if you yourself catch Covid-19 but if there is a death in your family due to Covid-19, public transport gets cancelled due to Covid-19 or there is a Covid-19 outbreak at your destination which prevents you from continuing on your trip.

In short, this plan has one of the most comprehensive benefits lists available, and it isn’t even that expensive. This one gets a thumbs-up.

View this post on Instagram A post shared by AXA (@axa)

The key benefits are as follows:

- Trip postponement

- Trip curtailment

- Medical expenses overseas

- Overseas hospital income

Compensation for trip cancellation or postponement is offered if you, an immediate family member or a travelling companion also insured by Sompo, got diagnosed with Covid-19 not more than 30 days before your departure date. If your travel partner gets infected you can choose to claim for your travel expenses rather than go alone.

The same goes for trip curtailment while overseas. While on your trip, you can make a claim for having to change your itinerary if your travelling companion or an immediate family member back in Singapore gets diagnosed with Covid-19 and you need to cut short your trip to return to Singapore.

Medical expenses can be claimed for a period of up to 45 days (the first day being the day you first seek treatment while overseas) or when the limit in your benefits table is first reached, whichever happens first. Note that you might be left high and dry if you are ill for more than 45 days.

Overall, this plan is generous when it comes to changes to your travel plans, but not so much when it comes to medical treatment. It’s probably best if you are young, have no existing health issues and have already been vaccinated.

View this post on Instagram A post shared by Sompo Singapore (@sompo_sg)

Here’s a run-down of the key benefits:

- Cancelling your trip due to Covid-19

- Postponing your trip due to Covid-19

- Shortening your trip due to Covid-19

- Trip disruption due to Covid-19

- Emergency medical evacuation due to Covid-19

- Sending you home due to Covid-19

NTUC Income offers up to $150,000 worth of overseas medical expenses and up to $150,000 worth of evacuation or repatriation expenses if you contract Covid-19 overseas. This coverage is valid for the first 90 days of your trip.

They have recently enhanced their Covid-19 cover to allow claims for trip cancellations and postponements due to you (or your travel companion) being diagnosed with Covid-19 or getting issued an isolation order by the government.

Covid-19 vaccine complications are now covered under medical expenses as well. For more details on what is covered, refer to the NTUC Income website and policy conditions.

There are no excluded countries due to Covid-19 except for Afghanistan, Iraq, Liberia, Sudan and Syria, which are normally excluded from the regular travel insurance plan as well.

In addition, NTUC Income has collaborated with Raffles Medical to offer COVID-19 (PCR) swab test at $124.2 along with a series of other types of pre-departure tests.

View this post on Instagram A post shared by NTUC Singapore (@ntucsingapore)

First of all, when booking your trip, you should retain all receipts, tickets and itineraries in case your trip has to be cancelled or altered.

At the first sign of a Covid-19 infection or related travel disruption, you should call your insurer and ask for guidance. Many insurers maintain a 24-hour hotline for travel claims.

To make a claim you will usually have to submit your insurer’s form with supporting documents within the deadline mentioned in your contract (usually 30 days). Don’t wait until you’re back in Singapore to check which documents you need.

If you catch Covid-19 while you’re in Singapore, you will likely have to submit the results of a PCR Swab Test or Antigen Rapid Test conducted at a clinic or hospital.

It gets a bit more complicated if you’re overseas. The insurer will likely require documentation from the hospital as well as a doctor’s letter stating that you are unfit to travel and/or recommending treatment.

If you need to be quarantined overseas, you should make sure you have a quarantine order from the government, otherwise you may not be able to claim for quarantine allowance. Remember to ask for this as not all countries automatically issue such documentation.

Text: Joanne Poh/ Money Smart

21 Unique Singapore Date Ideas That'll Make You Feel Like You're Travelling

This Local Female-Led Company Is Pioneering Daycations During The Pandemic

Singapore And South Korea To Allow Quarantine-Free Travel From Nov 15

- travel insurance

SHARE THIS ON

What’s hot.

Tried And Tested: A Singaporean's Guide ...

What To Buy In JB: 10 Personal Care & Ot...

Hong Kong Disneyland Review: Everything ...

The Best Sushi Restaurants In Tokyo, Acc...

The Best Bintan Hotels & Resorts For Fam...

7 Family-Friendly Things You Didn't Know...

10 Best Family-Friendly Hotels In Hong K...

The Best Kid-Friendly Activities In Hong...

Cult Beauty Stores In Tokyo For Japanese...

10 New Cafes in Hong Kong To Check Out O...

Don't Miss Out Ever Again!

Yes, I would also like to receive SPH Media Group's ⓘ marketing and promotions.

moolahgeeks is no longer being updated. Our recommendations may be outdated and should not be relied upon. Learn more

The Best Travel Insurance in Singapore

The Bottom Line

The best travel insurance policies offer high levels of protection for a reasonable price and make it easy for you to get paid on a claim. We looked at nearly 20 insurers’ travel policies in Singapore and ranked them on their pricing, protection levels and customer experience to find the best travel insurance policy for you in Singapore.

We recommend MSIG for a worldwide single-trip cover and Income (NTUC) for single-trip cover within Asia as of October 2022.

If you travel a lot and are looking for an annual plan, MSIG offers one for the price of less than 5 single-trip plans. MSIG also has the best policies that cover pre-existing conditions.

Both these insurers offer reasonably priced plans and have received strong ratings from customers.

If you simply want the cheapest travel insurance plan, consider HL Assurance , bubblegum or Ergo .If you’re comfortable with a much cheaper policy that does not cover COVID-19 related issues, go with FWD .

Everything we recommend

Great combination of positive customer reviews, high cover levels and reasonable pricing.

Income Insurance offers the best value for money on Single-Trip plans for Travel in Asia.

FWD offers the cheapest policies with good protection levels but with a COVID-19 exclusion

MSIG offers the best value on their Pre-existing conditions cover add-on

If you found this useful, consider signing up for your preferred cards via the links above. This gives you access to the best deals and helps us maintain the site.

Who this is for

Travel is often one of the largest annual expense items for individuals and families in Singapore. Travel takes you out of your comfort zone at home and puts you in an unfamiliar setting. While it is a great way to expand you horizons, a lot can also go wrong when you travel.

You may be a parent of young children, worried they might fall sick the day you are planning to fly or you may be a couple heading out for an adventure in a third world country, worried that your luggage may be stolen. Perhaps you are heading to a relaxing beach that might get hit with an unseasonal hurricane or maybe your local insurance plan does not cover overseas medical expenses.

In all these cases, a travel insurance policy would help you. Even the best policy won’t salvage the trip for you but at least they can make the hit to your wallet go away.

In this post we look at the best travel insurance policies available for you in Singapore.

How we selected

We spent more than 40 hours researching travel insurance options in Singapore. We explored the travel insurance policies offered by 18 insurers here.

We collected more than 60 data points for each insurer . This included collecting prices for different types of policies, going through terms and conditions in the policy documents, combing through customers reviews on various websites and interacting with their customer service.

We started by collecting the prices for each policy offered by the insurer along 4 dimensions – Single trip vs. Annual plan, destination in Asia vs. Worldwide, for a Couple and for a Family of 4, for different cover levels.

Most insurers offer policies with 3 levels of protection , although some offer only 1 or 2. We collected prices for all the tiers and classified them as the small, medium and large plans , corresponding to the level of coverage offered.

We then collected the level of protection offered by each insurer for the 5 main risks they cover – Medical, Accident, Trip Cancellation / Curtailment, Baggage Loss and Personal Liability.

Table 1: Level of Medical Cover Provided by Insurer

Table 2: Level of Travel Cancellation Cover Provided by Insurer

Since the level of protection provided by each insurer for different risks is not standardized, it can be hard to compare two policies. Cheapest isn’t always the best and neither is the most expensive .

The data in the table below shows the problem of choosing based on price – while AXA is the cheapest of the 3, the medical cover it provides is a fraction of the other two. Allianz is the most expensive but it doesn’t even provide a death or a personal liability benefit. NTUC is barely a dollar more than AXA but has the best cover across all risks.

Table 3: Using per dollar protection for comparing policies

To understand which policies offered the best value, we calculated how much cover you get for each dollar of premium paid . We calculated this for each of the 5 major risks covered.

For instance, in the table above, AXA charges S$88.94 to provide a S$30,000 Medical cover and a S$50,000 Death cover. That means each dollar of premium buys you about S$337 of Medical cover and S$562 of Death cover.

The NTUC policy above, gives you S$2,778 of Medical and S$1,667 of Death cover per dollar of premium you pay. That’s a lot more protection per dollar.

We ranked all policies based on the cover per dollar they provided for each of the 5 risks.

For example, we ranked Single-Trip policies from all insurers for a couple traveling within Asia for the cover provided for Medical, Death, Trip Cancellation and Baggage Loss and Personal Liability.

We also ranked all 18 insurers’ Annual Plans for a Family of 4 traveling to a Worldwide destination for the cover provided for all 5 risks.

In total, we ranked 24 policies of each insurer across these 5 risks based on the cover per dollar.

We then converted these rankings in to a composite score for each policy . To calculate this score, we gave much more weight to their rankings for Medical and Trip Cancellation covers and less weight to the Personal Liability cover.

Why? This was based on our subjective assessment of the severity and frequency of the likely claims in each category.

In other words we think you are much more likely to need a Medical claim than a Personal Liability claim. A baggage loss claim is likely to be smaller than a Trip Cancellation claim and so get a lower weight in our ranking.

We preferred Insurers and policies with higher composite scores. But we applied two more filters before making our selections.

First, we wanted to be sure that the policy with the highest composite score offered adequate cover. Remember the score is based on the cover provided per dollar. So policies providing very low cover could still score well but may not provide adequate protection.

For example, bubblegum’s single trip policies offer S$150,000 of Medical cover and S$5,000 of Trip Cancellation cover. Because of their very low premium, they also score well across the board.

Now a S$150,000 Medical cover may be more than enough for a trip to low cost countries in Asia, but it could be inadequate if you’re headed to USA or even Australia.

So we did not consider policies that offered inadequate cover , in our opinion.

Second, we wanted to be sure the insurer provides a good claims experience . After all, a policy offering the best value is still useless if the insurer won’t service the claim.

For this we looked at the customer reviews and ratings of each insurer on Seedly and Google Maps. We preferred insurers that had plenty of reviews since ratings based on a few reviews can swing easily.

Table 4: Customer Reviews and Ratings

We also preferred the rating on Seedly over the rating on Google Maps. This was because reading through the reviews on both sites, we found Seedly reviews were much more focused on claims experience while Google review were more focused on the purchase experience.

This was a very significant factor in our recommendations. For example, HL Assurance and Ergo, both, consistently ranked near the top for value offered by their policies. But we do not recommend either. If we ignore the reviews, they would take the #1 & #2 spot easily.

We do not recommend HL Assurance because it scores a meagre 2.50 stars in 19 reviews on Seedly with many complaints about claims experience. It does score a solid 4.40 stars on Google with 900+ reviews but most of those reviews focus on the buying experience.

We do not recommend Ergo because it has too few reviews on both Seedly and Google, and again the verdict is split with 4.40 on Seedly and 1.80 (ouch!) on Google. While their customer service was able to address our questions, we did not come away very confident after the interaction.

Policies without COVID-19 Cover By default most travel policies come with a COVID-19 cover. However, FWD, Tiq and DirectAsia offer policies without a COVID-19 cover by default and you can optionally buy a COVID-19 cover add-on.

For these 3 insurers we compared their premiums after including the COVID-19 add-on premium. We discuss policies without COVID-19 cover below.

Pre-Existing Conditions All insurance policies, by default, do not cover costs for treatment of your pre-existing conditions. However Income (NTUC), MSIG, Tiq and Chubb do offer single-trip policies that cover pre-existing condition under the Medical cover.

These policies are much more expensive and have a much lower cover for pre-existing conditions. But they may still be useful if you have a serious pre-existing condition.

Discounts & Pricing Changes All Insurers usually offer large discounts on their list prices for Travel policies. On the day we collected pricing data, we found every insurer offered a discount of 20-60% on their list price.

Some offer this discount by default i.e. you do not need to even enter a promotion code. It is automatically included in the quotation online e.g. Income had a 50% discount automatically applied. Others like FWD need you to enter the discount code while getting a quote.

This has two implications. First, if you’re not getting a discount, look around the website to make sure you’re not missing the offer . On some website (e.g. FWD) the offer sometimes shows up after you have spent some time on the website or just as you’re about to leave the website.

Second, while the coverage terms may remain relatively stable over time, the discounts (and even list prices) may change from time to time. What happens to our analysis then?

Right now we don’t have access to the data that will allow us to update our recommendations in real time. We aim to update this analysis with fresh prices at least twice a year , if not more.

In the meantime, we think the current analysis should remain largely accurate through the holiday season this year (2022).

The Best Single-Trip Travel Insurance for Asia – Income (NTUC)

We recommend Income (NTUC) travel insurance if you are traveling in Asia. Income Insurance is not the cheapest but offers the best blend of affordable price, strong customer ratings and good cover levels in each protection category.

Income’s standard travel plans for Asia ranked in the middle of the pack for pricing. However many of the cheaper plans from competitors had lower coverage levels e.g. DirectAsia and bubblegum both offer only S$150,000 medical cover under the “Small” plan while Income offers S$250,000.

Most other competitors with lower pricing either didn’t have enough ratings for us to feel confident about their claims process or had poor ratings. See our discussion of the Cheapest Travel Insurance below.

If you would like to price-shop, we suggest comparing against FWD , MSIG and Tiq .

Table 5: Single-Trip Policy for Couples, Travel in Asia – Small Plan

The Best Single-Trip Travel Insurance for Worldwide cover- MSIG

If you are traveling to destinations outside Asia, we recommend TravelEasy plans by MSIG . Again, MSIG does not offer the cheapest plan but instead offers a great blend of affordable price, good cover levels in all categories and strong customer ratings.

MSIG’s plans also rank in the middle of the pack for pricing but they have really strong customer ratings on both Seedly and Google and the protection levels in each category are competitive.

For bargain hunting, compare against FWD , NTUC and Tiq .

Table 6: Single-Trip Policy for Family, Travel Worldwide – Small Plan

The Best Annual Travel Insurance Plan – MSIG

If you travel frequently and are considering an Annual plan for travel insurance, we recommend MSIGs TravelEasy plans.

Unlike our other recommendations, MSIG has among the cheapest annual plans in Singapore. While the average annual plan in Singapore costs nearly 6x as much as a similar single-trip plan, the annual plans from MSIG only cost about 4.5x the equivalent single-trip plan.

Compare against DBS-Chubb , Tokio-Marine and HL Assurance for a deal.

Table 7: Annual Policy for Family, Travel Worldwide – Medium Plan

The Best Travel Insurance with Pre-Existing Cover – MSIG

Most travel insurance policies do not provide cover for medical expenses due to pre-existing conditions. We found 4 insurers in Singapore that offer a single-trip policy with cover for pre-existing conditions.

These policies are a lot more expensive than regular policies and the cover for pre-existing conditions is much lower than for other medical expenses. But if you do have a serious pre-existing conditions, it may be worthwhile to pay up.

We recommend MSIG’s TravelEasy Pre-Ex plans as they offer the highest coverage per dollar of premium for both Asia and Worldwide destinations.

MSIG offers the lowest level of protection for pre-existing conditions, ranging from S$75,000 to S$150,000. If you need a higher cover, Income’s Enhanced PreX Prestige plan offers cover of up to S$300,000 and also offers good value per dollar of premium.

Table 8: Medical Cover for Pre-Existing Conditions

Best Policy without COVID-19 Cover – FWD

FWD , Tiq and DirectAsia also offer travel insurance policies that do not include medical and travel disruption cover for COVID-19.

These policies are much cheaper than the policies that cover COVID-19. For example, a non-COVID policy by FWD is 40%+ cheaper than an identical policy with COVID cover. For their cheapest policy (called Premium), the COVID-19 add-on can often be more expensive than the actual policy.

With yet another COVID-19 wave underway the lower premiums come with a fair bit of risk.

If you are comfortable with a non-COVID-19 policy, we recommend FWD for single-trip covers and DirectAsia for annual covers. DirectAsia’s plans have lower coverage levels than FWD and Tiq, so it is better to compare FWDs “Small” plan with DirectAsia’s “Medium” plan for a more appropriate comparison.

Even with that change, DirectAsia is 10-60% cheaper than the other two for the annual, non-COVID plans.

Table 9: Single-Trip Policy for Family, Travel in Asia – Small Plan, No COVID Cover

The Cheapest Travel Insurance in Singapore

None of our recommended plan are the cheapest in their categories. Is it really worth paying up for something like travel insurance?

We think yes. After all what you’re really buying when you buy travel insurance is the experience you have when you file a claim. Most people never actually get to experience this but that is what you are buying.

What good is saving S$15 on the premium if that results in getting your claim rejected or having to spend a few hours pushing through the bureaucracy of the claims department at your chosen insurer.

That said, we love a good deal and totally understand if you want to take your chances with a less known insurer. We would still avoid insurers that already have plenty of bad reviews.

HL Assurance had plans that were consistently among the cheapest in all categories but missed out on being our pick due to a 2.50 rating on Seedly with many complaints about claims handling process.

To be fair, this 2.50 rating was based only on 19 reviews while they have a solid 4.40 rating on Google with 937 reviews. But most Google reviews focused on a positive experience of buying the policy while the Seedly reviews focused on bad claims experience.

This was a disappointment and a very tough decision for us because not only are their plans among the cheapest, they also offer better than average protection across most categories.

For example, their “small” plan offers S$5,000 protection for baggage loss which is the highest of all small plans. The S$7,000 protection for trip cancellation and S$250,000 protection for Medical expenses are all better than average as well.

If you are open to take a chance with a less well-reviewed insurer and save some money, HL Assurance would be the one to try. They are VERY competitive in every category – single-trip for Asia and Worldwide, for couples and families and for all Annual plans.