Look into the Future (song)

- View history

Look into the Future

- 1 Frontiers Tour

- 2 Journey (band)

- 3 The Party's Over (Hopelessly In Love)

Look into the Future (album)

- Edit source

- View history

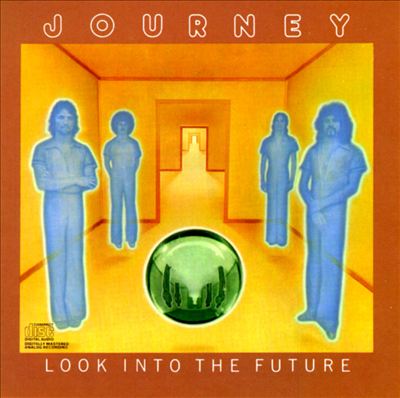

Look into the Future is the second album by Journey .

It was proceeded by Journey and followed by Next .

Tracklist [ ]

- On a Saturday Night

- Look into the Future

Personnel [ ]

- Gregg Rolie - lead vocals, keyboards

- Neal Schon - guitar

- Ross Valory - bass

- Aynsley Dunbar - drums

- 1 Steve Perry

- 2 Aynsley Dunbar

- 3 Raised on Radio (album)

- Kiss Rights Sale Not About Money

- Albums That Tore Apart Bands

- Revisiting Van Halen's First Show

- End of the Road for Pearl Jam?

- Top 200 '70s Songs

How Journey Tried to Shake Things Up on ‘Look Into the Future’

Journey were already at a crossroads after just one jammy studio project.

The live shows weren't the problem. Journey were drawing nicely around the Bay Area concert circuit.

"They were like a jazz/fusion/rock kind of thing," manager Herbie Herbert told Melodic Rock in 2008. "We played with Weather Report, Mahavishnu Orchestra, Santana and Robin Trower and bands like that. And it just went over perfect, and I loved that original band and many people did."

But then Journey's self-titled debut stalled at a disappointing No. 138. Expectations were far higher for a group that boasted former members of Santana ( Gregg Rolie and Neal Schon ) and Frumious Bandersnatch (Ross Valory and George Tickner), and there were already rumblings from Columbia Records.

"We had built this cult audience in quite a few places, because we had toured extensively for three years – and very hard," Schon told Goldmine in 2013. "I would say nine months out of every year we toured, and we had built quite a following being one of the original jam bands in San Francisco. You know, people really enjoyed seeing us live. We weren't selling any records, but we were selling lots of tickets."

Listen to Journey's 'On a Saturday Nite'

Look Into the Future , issued in January 1976, was perfectly titled. They committed to becoming more song focused, while trying to retain the progressive touches that showcased Journey's musical chops on the first album. "We decided we'd taken that kind of music as far as we could," Rolie told Rolling Stone in 1980.

To some degree they succeeded, but only by separating these two impulses. Side One stacked more commercial-sounding moments like "On a Saturday Nite" and "Anyway" with a cover of "It's All Too Much " from the Beatles ' Yellow Submarine , then Journey stretched out more on the next side: "I'm Gonna Leave You" went just past seven minutes, while the episodic title song became their second-longest released song at 8:13.

They lost George Tickner, the band's rhythm guitarist, along the way – though he still ended up with two songwriting co-credits, "You're on Your Own" and "I'm Gonna Leave You." Undaunted, Journey released Look Into the Future and immediately headed out on a tour that lasted from February through December 1976, concluding at the Winterland in San Francisco.

"Lately, I think the band has gotten more loose and relaxed onstage, and it comes off," Rolie told Tom Vickers in 1976. "With George, there was a tenseness. He wasn't really into it. He likes writing, but onstage he didn't enjoy himself."

Schon also described the lineup shift as a form of addition by subtraction. "There are parts where you miss the sound of another guitar," he told Vickers, "but it gives us more space."

Listen to Journey's 'I'm Gonna Leave You'

Unfortunately, maintaining that rugged schedule didn't make a substantial impact on sales. Look Into the Future fared better than the band's eponymous first record but got to only No. 100. Still hopeful, Rolie said Journey took it all in stride.

"We were never discouraged, because every time we've gone out on the road, there's been growth," Rolie said back then . "We've learned more about each other, the music and the industry. Journey is a democratic situation that will last, because everyone is a little older now and more aware – and that's the only way a band can work. Everyone has their own musical taste and their own ideas, but we've learned how to use them to improve the group."

Yet it appeared there was an inherent commercial ceiling with this particular mixture of creative voices – especially when former tour mates in Kansas took a germ of an idea from Journey and turned it into a breakthrough hit. "I think if you'll listen to "I'm Gonna Leave [You]" on the Look Into the Future record," Herbert told Melodic Rock, "it's ' Carry On Wayward Son ' by Kansas. They just lifted it."

Journey tried shaking things up again on 1977's Next , toughening up their sound and even handing the microphone to Schon for two songs. But when that project halted at No. 85, larger changes were demanded by the band's label bosses.

"You look up and it's 1977, and they've toured all year – all through Europe with Santana and another big tour with ELO both in '76 and '77, and it just wasn't happening," Herbert noted. "So I was just in a complete scramble, and they were gonna drop the act. So there was a scramble to do something to modify what we were doing. So I said we'll change it: We'll go commercial."

Steve Perry 's phone would soon be ringing .

Top 100 Live Albums

See Neal Schon Among Rock’s Forgotten Supergroups

More From Ultimate Classic Rock

Look into the Future

STREAM OR BUY:

Release Date

Discography timeline, allmusic review, user reviews, track listing, similar albums, moods and themes.

- Cast & crew

- User reviews

A journey across a dystopian future America, following a team of military-embedded journalists as they race against time to reach DC before rebel factions descend upon the White House. A journey across a dystopian future America, following a team of military-embedded journalists as they race against time to reach DC before rebel factions descend upon the White House. A journey across a dystopian future America, following a team of military-embedded journalists as they race against time to reach DC before rebel factions descend upon the White House.

- Alex Garland

- Nick Offerman

- Kirsten Dunst

- Wagner Moura

- 3 User reviews

- 30 Critic reviews

- 79 Metascore

- 1 nomination

- American Soldier (Middle East)

- Checkpoint Soldier

- Hanging Captive

- Commercial Soldier Mike

- Commercial Corporal

- Commercial Soldier #1

- Aid Worker Refugee Camp

- All cast & crew

- Production, box office & more at IMDbPro

See A24's Film Slate for 2024

More like this

Did you know

- Trivia Actors Nick Offerman and Jesse Plemons weren't known to be a part of the project until the first trailer dropped in December 2023. Plemons even denied the rumor that he was in the film earlier that year.

Unnamed Soldier : What kind of *American* are you?

- Connections Featured in Nerdrotic: Woke Hollywood's Civil WAR? Disney DESTROYS Hasbro - Nerdrotic Nooner 388 with Chris Gore (2023)

User reviews 3

- Apr 6, 2024

- How long will Civil War be? Powered by Alexa

- April 12, 2024 (United States)

- United States

- United Kingdom

- Ngày Tàn Của Đế Quốc

- Atlanta, Georgia, USA

- See more company credits at IMDbPro

- $50,000,000 (estimated)

Technical specs

- Runtime 1 hour 49 minutes

- Dolby Digital

- IMAX 6-Track

Related news

Contribute to this page.

- See more gaps

- Learn more about contributing

More to explore

Recently viewed

Diving into the Node.js Website Redesign

Brian Muenzenmeyer

By now you've noticed nodejs.org's fresh new look!

We've taken great care in approaching this design with a nod to the past and look to the future. The site has many converging use cases, thousands of pages, and is a daily resource to many. The whole story had some dead ends and detours. But in the end it was a collective effort; coming to life with the contributions of over three dozen contributors and fantastic teamwork with select partners. The site improves the information architecture, brings content to users' fingertips like never before, and puts in place a stable development platform for years to come. We've also iterated on a revamped developer experience, clearer CI/CD feedback, and an approachable tech stack.

Read on for a deeper dive into the journey and insights into what's to come.

- Scale and Constraints

The nodejs.org site has been around for over 14 years. A design resembling the utilitarian download and docs homepage first appeared in late 2011. This was Node.js 0.6 days, for context.

Ever since, the site has slowly grown in scale, as the project has needed it to. It contains 1600+ pages. At its peak it had almost 20 localized languages. The domain serves 3 billion requests a month, with 2 petabytes of data transferred. It would be an understatement to say that the site is a critical resource for the Node.js community. It was absolutely paramount to ensure changes didn't cause unnecessary disruption, both to users and contributors.

- A False Start: nodejs.dev

The project's first attempt at a redesign began in 2019. The work started on a new domain and a new repo, nodejs.dev . In retrospect, this might have unintentionally doomed the project from the start. The team faced challenges of siloed development. Put simply, this codebase was not where the community or contributors were. Established contributor workflows were not present. Already busy people volunteering their time don't want to learn a second set of tools. It was too heavy a burden. The project was not able to sustain the kind of leadership it needed to maintain momentum. Additionally, a singular cutover for the new tech stack would have been complicated and pose a risk to the established presence of the site.

Out of nodejs.dev, however, came a lot of lessons and renewed content. A series of comprehensive learning resources was created that we carried forward into our current design. A vision from all this was forming: incremental evolution, in-place development, and as little disruption as possible.

- Reassembling the Airplane in Flight

In 2022, Claudio Wunder joined the project. He bridged the gap between both development efforts. He steered the web team toward a new direction: pivot back to the existing repository. Consider how the site could be rebuilt while still functioning as a production-grade resource.

The codebase was starting to show its age across a number of dimensions. The design was stale. The Metalsmith and Handlebars templates had fallen out of favor for most web developers approaching the project. The internals of the site were hard to extend and poorly documented. Trying to blend code and content was a challenge.

The team carefully considered the tech stack. The first stage of the in-flight redesign dwelt on nextra , an excellent Next.js static site generator. This was a great way to get started, but as the site grew, we needed a custom setup. We found ourselves "breaking out" of nextra's conventions more and more, relying on the underlying Next.js patterns and power tools that nextra abstracts away.

Next.js was a natural progression, notable for its flexibility and power. For instance, the site is still statically built for end-user speed and foundational hosting independence but leverages Next.js's incremental static regeneration to pick up dynamic content like releases. React offered an authoring experience not only more aligned with the current skillsets of contributors, but also with a larger ecosystem of tools at our disposal.

We had a close partnership with Vercel along this journey. They provided direct support when the scale of the site strained webpack's memory management during static export. This was a symbiotic relationship of sorts. Our needs pushed their platform to improve, and their platform enabled us to build a better site. We beta-tested new releases before public availability, a real-world stress test for the framework.

In April 2023, we performed a miniature cutover. This is a bit of an ironic statement. The pull request was 1600 files and pushed the GitHub UI to the limits of its rendering capabilities. The site's infrastructure would change, but the look and feel, content, and authoring experience would remain unchanged. This was a critical milestone—proof we could rebuild the airplane in flight.

The OpenJS Foundation was kind enough to help fund our redesign with designer Hayden Bleasel . Hayden brought a modern design to the site and helped us think through the multi-faceted use cases we encountered. The result was a Figma document that we could use to guide our development. Included were UX flows, dark/light modes, page layouts, mobile viewport considerations, and a component breakdown.

Realizing the design as code was next, and an effort distributed across the world. A lot of emphasis was placed on sequential build-up of foundational design elements and structured component hierarchies. We built variants of components from day one and considered internationalization at the outset. This reduced rework and made any task accessible to a newcomer. We started building components in isolation via Storybook and Chromatic 's hosted instance. Storybook was a great place to prototype, iterate on, and test components. We choose to use Tailwind CSS , but with an emphasis on design tokens and applied CSS. This common language helped newcomers orient to our approach and translate the Figma.

Orama search puts all the site's content at a user's fingertips. They index our static content and provide lightning-fast results of API content, learning material, blog posts, and more. The team there directly contributed this integration and continues to help us deliver a superb experience. It's already hard to imagine not having this feature.

The reach that Node.js enjoys in our communities is important to us. As such, the old site was internationalized to almost 20 languages. An unfortunate combination of events led us to reset all translations, however. This was a hard decision, but the right one given the circumstances. We're working with Crowdin to re-establish our efforts. This will include a careful parsing of the new MDX-based content. We're looking forward to the continual internalization in the coming months.

As we built and started previewing the site both on the new infrastructure and redesigned, having deeper insight into end-user behavior was invaluable. We've leveraged Sentry to provide error reporting, monitoring, and diagnostic tools. This has been a great help in identifying issues and providing a better experience for our users. Sentry was also useful prior to the redesign work to identify issues in the old site via replayed user sessions.

Throughout all of these integrations and development steps, we've focused on end-user accessibility and performance. Vercel and Cloudflare support ensures the site is fast and reliable. We've also invested in our CI/CD pipeline with GitHub Actions, providing contributors with real-time feedback. This includes visual regression testing with Chromatic, Lighthouse results, and a suite of linters and tests to ensure the site quality remains high.

- Grace Hopper and Hacktoberfest

Throughout the site redesign, we've worked actively to make for an inclusive and welcoming experience. The redesign effort aligned well with both Grace Hopper Celebration's Open Source Day in September of 2023, and then Hacktoberfest the following month. Both events expose new contributors to projects across the ecosystem. We prepared for these events by staging "good first issues" as discrete development tasks. In the case of Grace Hopper, we also provided in-the-field mentorship so attendees could end the day with a landed PR. We're proud to say that we had a number of first-time contributors to the project as a result.

During Grace Hopper alone, 40 PRs opened from 28 authors. Hacktoberfest saw 26 more PRs.

- Documentation, documentation, documentation

An open source project is only as good as its documentation. Allowing new contributors to asynchronously establish context is essential. To that end, we don't limit DX (developer experience) to tooling. The redesign served as an excellent opportunity to identify and improve gaps in our docs. Along the way, we iterated on or introduced:

- COLLABORATOR_GUIDE

- CONTENT_VS_CODE

- CONTRIBUTING

- DEPENDENCY_PINNING

- TRANSLATION

New code has a strong focus on inline code and configuration comments, separation of concerns, and clearly defined constants. The use of TypeScript throughout helps contributors understand the shape of data and the expected behavior of functions.

- Future Plans

The redesign sets the stage for a new era of the Node.js website. We have a solid foundation in place that will last for years to come. If the past is any indicator, we'll be iterating within this space for a long time.

But the work isn't done yet. We'll:

- extend the site redesign to the API docs. They are in a separate codebase but plan to port the styles developed here to the API. This is careful work again that cannot disrupt daily use or contribution.

- explore a monorepo for the website and API docs. This should improve coupling where it matters and reduce the overhead of managing two separate codebases.

- reset internationalization efforts. The prior translations could not be carried over. Our heavy markdown / MDX approach poses a unique challenge we are partnering with Crowdin to solve.

- continue to improve the CI/CD processes. We've made great strides in providing self-service feedback to contributors, but there's more to do.

Many people and organizations have contributed in both big and small ways to realize the redesign. We'd like to thank:

- first and foremost, all contributors and collaborators that make this project possible.

- Chromatic for providing the visual testing platform that helps us review UI changes and catch visual regressions.

- Cloudflare for providing the infrastructure that serves Node.js's Website, Node.js's CDN, and more.

- Crowdin for providing a platform that allows us to localize the Node.js Website and collaborate with translators.

- Hayden Bleasel for his design work on the Node.js redesign.

- Orama for providing a search platform that indexes our content and provides lightning-fast results.

- Sentry for providing an open source license for their error reporting, monitoring, and diagnostic tools.

- Vercel for providing the infrastructure that serves and powers the Node.js Website

- and lastly, the OpenJS Foundation for their support and guidance.

The community is strong, and we're excited about what we can accomplish together.

Here is your weekly reminder that the Node.js project is driven by volunteers. Therefore every feature that lands is because someone spent time (or money) to make it happen. This is called Open Governance. Matteo Collina, via social media

Want to get involved? Check out the project on GitHub .

Thanks to Amal Hussein and Claudio Wunder for helping gather info for this post.

- Share full article

For more audio journalism and storytelling, download New York Times Audio , a new iOS app available for news subscribers.

The Accidental Tax Cutter in Chief

President biden says he wants to rake in more money from corporations and high earners. but so far, he has cut more taxes than he’s raised..

This transcript was created using speech recognition software. While it has been reviewed by human transcribers, it may contain errors. Please review the episode audio before quoting from this transcript and email [email protected] with any questions.

From “The New York Times,” I’m Michael Barbaro. This is “The Daily.”

[THEME MUSIC]

Today, in his campaign for re-election, President Biden says that raising taxes is at the heart of his agenda. But as it turns out so far, he’s done the opposite as president. My colleague Jim Tankersley explains.

It’s Wednesday, April 3.

Jim, welcome back. We haven’t seen you since the State of the Union. Always a pleasure.

So, so great to be here. And yeah, I finally recovered from staying up all night with you guys.

Yeah, you don’t even know all night. You stopped and we kept going.

That’s true. I did. I got a robust three hours that night. You’re right.

[LAUGHS]:: So Jim, in your capacity as really the chief economic thinker covering this president, you recently came across something very surprising.

Yeah, it started with a pretty basic question for me. I like to do this crazy thing, Michael, where I like to take candidates’ promises and see if they’ve come true.

It’s a little bit wild, but it’s what I do for fun. And in this case, I wanted to look at a very central promise of President Biden’s campaign in 2020, which he has repeated while in office.

I promise you, I guarantee you we can build back, and build back better with an economy that rewards work, not wealth.

The promise was he was going to raise taxes.

But I tell you what I’m going to do, and I make no apologies for it. I’m going to ask the wealthiest Americans and the biggest corporations of the Fortune 500 companies, 91 making a collective billions of dollars, didn’t pay a single solitary penny in federal tax!

Not taxes on the middle class, not taxes on low income workers, but he was going to raise taxes on corporations and the rich.

But I’m going to make sure they pay their fair share!

He was going to make them pay their fair share. And he leaned into it.

Guess what? You’re going to start paying your fair share. I’m going to ask them to finally begin to pay the fair share. It’s not a punishment. Pay your fair share.

He said it over and over.

Fair share? Translation — it’s back to the failed policies of the 1970s.

Republicans loved this. They repeated it too. They told voters that the president was going to raise taxes.

Joe Biden bragging about raising taxes on corporations. That means less money for those very employers to hire people back.

They talked about all the ways in which corporate tax increases could rebound on workers.

Joe Biden will shut down your economy, raise taxes, wants a $4 trillion tax increase. He’s the only politician I’ve ever seen who said, we will raise your taxes. You’re supposed —

It was a very big part of the economic debate for the campaign.

And I wanted to know, is that true? Has that actually played out in the policy agenda the president has had?

So I asked some economists at the Tax Policy Center in Washington to run an analysis and just say, let’s look at all of the ways Biden has changed the tax code in all of those laws he’s signed, and ask, has he raised taxes as president? And it turns out the answer is he has not raised taxes.

On net, he has cut more taxes than he’s raised.

How much more has he cut taxes than raised them?

So by the math that economists use when they look at budgets, the traditional way of scoring tax changes, he has cut taxes by $600 billion on net.

Hmm. A lot of money, a lot of tax cuts.

It’s a lot of tax cuts. The president has been a net tax cutter.

So Jim, why and how did Biden end up cutting taxes, especially if his stated intent was to raise taxes?

Well, there’s two sides of this equation and two complementary explanations for what’s happened here. The first side is the tax increases that Biden ran on, he’s only done a couple of them. He has trillions of dollars of ideas for how to raise taxes on rich people and corporations. The Treasury Department publishes an entire book full of them every year called “The Green Book.”

But in the actual legislation he signed, there’s only been a couple, really. There was a tax on stock buybacks that companies do and then a new minimum tax for certain multinational corporations that have very low tax rates. Those add up to real money, but they are not, in the grand scheme of Biden’s tax increases, a really large amount of the agenda he’s proposed.

So explanation number one, he just hasn’t been that successful in passing tax increases, and there’s a lot of reasons for that. The biggest one is just the simplest one is that he’s just had a really hard time persuading members of Congress, including Democrats, to back some of his favorite tax increases. He wants to raise the corporate income tax rate, which President Trump cut in his 2017 tax bill. Biden wants to raise it to 28 percent from 21 percent. Congress has not had any appetite to go along with that.

He wanted to get rid of what’s called the carried interest loophole, a long-time white whale of Democratic policy making. But he could not get even 50 Democrats to go along with that. Senator Kyrsten Sinema of Arizona was opposed to it, and so it didn’t get included.

And he did some pieces of legislation on a bipartisan basis. And in those cases, Republicans were just not going to pay for anything by raising taxes, and so he had to take those off the table there. So it’s all added up to just not very much activity in Congress to raise taxes on what Biden wants to do.

Got it. So that’s the side of a ledger where Biden simply fails to increase taxes because he can’t get Congress to increase taxes.

Right. But there’s another side, which is also that Biden has signed into law a decent number of tax cuts.

And that starts from the very beginning. Just a couple of months into his presidency, if you’ll recall, we’re still in the depths of the COVID-19 pandemic, the economy is wobbling after it had started to rebound. Biden proposes what is essentially a stimulus bill.

And he includes some tax cuts in there, a tax cut for families, a child tax credit. And it also includes — you remember those direct checks that people got as part of that bill?

Yes, $1,400. I remember them.

Yes, those were technically tax cuts.

So the stimulus bill starts with that. The next year, he passes this bill that is trying to accelerate manufacturing of things like semiconductors in the United States. That’s the CHIPS Act. And that includes some corporate tax cuts for companies that invest in the kind of manufacturing that Biden wants. This is industrial policy via carrots for corporations. And Biden is handing them out as part of this bill.

So tax cuts there. And then finally the Inflation Reduction Act, which includes the largest climate effort in American history is a bunch of corporate tax cuts at its core, tax cuts for manufacturing of solar panels, tax cuts for people to buy electric vehicles, tax cuts for all sorts of things tied to the transition from fossil fuels to lower emission sources of energy. And those tax cuts add up. They add up for corporations. They add up for individuals. And in the end, that full suite of tax cuts that he’s passed across all of this legislation outweighs the modest tax increases that were also included in the Inflation Reduction Act to reduce its cost.

Got it. So a very big reason why Biden ends up cutting taxes, beyond the fact that he’s not able to raise them through Congress, is that that’s what it took, according to those in his administration, to get American industry and American consumers to change their behavior in line with policy goals such as getting more domestic computer chip manufacturing and getting more people to buy electric vehicles they decided the way to do that was to give people tax breaks, which means he cut their taxes.

Right, people and companies. The president certainly has talked throughout the campaign about wanting to give middle class families a break. But he has also, in the process of crafting policy, really come to rely on tax cuts for people and for corporations as a way of achieving these policy goals. And in many cases, again, this is what he had to do to pass these bills through even Democrats in Congress.

Senator Joe Manchin of West Virginia didn’t want to just send money to companies that were making solar panels. He wanted there to be tax incentives for it. And so that is part of the reason why these were created as tax incentives. And so all of this adds up to more of a tax cutting record than you might have imagined when Biden was on the campaign trail.

I’m curious who really ended up benefiting from these tax cuts. You said they went to people and to corporations, but on the whole, did they end up reaching lower income Americans, middle income Americans, or the rich?

Well, we don’t have a full distributional analysis, which is what you’re asking for, of the entirety of Biden’s tax changes. But what we can say this — particularly the ones that were in that early stimulus bill, the recovery plan, those were very much targeted toward lower income and middle income Americans.

There were income limits on who could get things like the Child Tax Credit. Obviously, the direct payments went to people who were middle class or less. So the analysis of that would suggest that these were tax cuts for lower income people, for middle class people. And on the flip side, what I think we are likely to see with the electric vehicle credit through the Inflation Reduction Act is that while there are some income limits on who can qualify for that credit, that the people who end up claiming that credit tend to be the higher earners among the people who qualify.

Right. Who buys a Tesla, after all? Somebody with a fair amount of money.

Right, exactly. And of course, the corporate tax cuts go to companies, flow through to their shareholders. There’s a huge debate in the academic literature among politicians about how much of that benefit actually ends up going to their workers versus stays with shareholders. But we can broadly say that Joe Biden has done a lot for certain corporations who are trying to advance his manufacturing goals in particular to reduce their tax bills. And that is certainly not in line with the rhetoric you hear him talking about most of the time about making corporations pay their fair share. And the White House acknowledges this. I asked them about it. And they basically said, we think there’s a difference between just cutting the corporate tax rate in a way that helps anybody no matter what they’re doing and what we’re trying to do, which is basically reward corporations for accelerating the energy transition.

Understood. But where does this ultimately leave Biden’s campaign promise to make the tax code fairer and to make sure that the well-off in particular and corporations are paying their, what he calls, fair share?

Well, I think by Biden’s own measurements, by his own ambitions, he would have to agree that he is nowhere close to what he believes would be a fair share for corporations. Because Biden is still running on this. As he enters his re-election campaign, as it really heats up, a rematch with Donald Trump, the president is really leaning into this message of we need to do more. We need to raise more taxes on corporate America. It is time for these companies and for high earners to pay their fair share.

Right. I didn’t get it done in the first term. But if you elect me, I’ll get it done in the second.

Give me another shot, and this time, I promise, will be different.

[MUSIC PLAYING]

We’ll be right back.

So Jim, let’s talk about Biden’s tax raising plans for a theoretical second term and why anyone should have any faith that he could get it done, if there’s a second term, given the experience so far of his first term.

Yeah, well, man, there’s a lot of plans to talk about. I don’t think we can get through all of them, but we can certainly hit the highlights here. So we can start with the couple of things that Biden has been able to do to raise taxes on corporations. He wants to take those and then plus them up.

He’s put this new minimum tax on corporations. It’s a 15 percent minimum tax on certain multinationals. He now wants to raise that to 21 percent.

He wants to take that corporate stock buyback tax which is 1 percent right now, and he’d like to quadruple it to 4 percent. And then he goes after some things large and small. He wants to do new taxes that hit the use of corporate and private jets. He wants to do new taxes on companies that pay large amounts of compensation to their executives.

And then we get to some really big taxes on high earning individuals. So the president has said over and over again, he won’t raise taxes on anyone making less than $400,000 a year. But he’s got a bunch of taxes for the people above that. So he wants to raise the top marginal income tax rate. He wants to take it from 37 percent, which is the level set by President Trump’s 2017 tax law, and bring it back to 39.6 percent, which is what it was before. He also wants to impose what he calls a billionaires tax.

OK. It’s a 25 percent tax on the total value of all of the assets of anyone worth more than $100 million.

OK, wait. I have several questions about this.

First being a fact check, if it’s a billionaires tax, it’s interesting that it’s going after people who have just 100 million.

Yeah, I think most billionaires would be offended at the inclusion of 100 millionaires in that. Yes, totally agree. That is factually inaccurate, the name.

Right. But beyond that, this sounds very much like a wealth tax, which we don’t really have in our system.

Yeah, it’s a sort of wealth tax. The Biden people don’t call it a wealth tax, but it is a tax on something other than income that you report every year to the IRS as having been earned. It goes beyond just, oh, I got interest from my stock holdings or I made money from my job. It’s, oh, the value of my art collection increased last year, and now Biden’s going to tax me on that increase, even if I didn’t sell the art.

That’s a real change, and that reflects the president’s view that people with enough money to buy enormous art collections that appreciate enormously in value should be paying more in taxes.

Right. And of course, a tax like this is extremely perhaps maddeningly hard to actually pull off. It’s hard to get someone to describe their art collection’s value so that you can apply a 25 tax to it. So this might end up being more of a political statement than a practical tax.

Yeah, there’s also questions about whether it’s constitutional. So there’s all sorts of drama around this proposal, but it is certainly, if nothing else, a statement of the president’s intent to make people worth a lot of money pay a lot more in taxes.

OK, so that’s a lot of proposed tax increases, almost all of them focused on those who are rich and corporations. Overall, Jim, what stands out to you about this Biden term two tax increase plan?

I think we could very fairly say that it’s the largest tax increasing plan by a sitting president or a presidential nominee for a party in American history.

He wants to get a lot of money from corporations and people who earn or are worth a lot of money.

But the rub, of course, is it’s hard to see the Congressional math that lets Biden accomplish these tax increases, some of which, like you said, he couldn’t get done the first time. Why would we think he would get them done the second time even if he wins this fall?

Yeah, it would be really difficult. Biden would have to win in November. Democrats would have to take the House of Representatives back from Republicans, which is certainly possible. It’s very closely divided right now. And they’d need to hold at least 50 seats in the Senate. And then those 50 Democrats in the Senate would have to be willing to go along with far more in tax increases than Democrats were last time around.

So if there is a second term, it feels like we should assume it will be very difficult perhaps even quite unlikely he’s going to get to push through a lot of these taxes. Which makes me wonder, Jim, why is Biden running on a tax program that he knows has so little chance of becoming reality and when it’s pretty clear that he’s gotten a lot of stuff done without raising taxes? It turns out that’s not been all that essential to getting infrastructure or climate bills done. So why is he making this so central?

Several reasons. One of them is it’s very important to him rhetorically to talk about fiscal responsibility. Big parts of the Biden agenda, the CHIPS bill, the infrastructure bill, some other legislation, were not actually paid for. The spending and tax cuts were not offset by tax increases.

So they’re going to add to the debt.

Right. So they’re going to add to the debt. Same is true of the stimulus bill. But moving forward, the president has said that he’s going to pay for his agenda and he’s actually going to have some extra tax dollars coming in left over to help pay down future budget deficits. And on paper, it’s the way to pay for Biden’s other big, expansive plans that he hasn’t been able to do but wants to — universal child care, federal paid leave, investing in elder care, just a whole bunch of things that he still wants to do more — housing initiatives.

The president needs money to make a case that he’s being fiscally responsible, and this is the money that would do that.

So that’s one reason. Another reason is the calendar. Biden and his team are looking ahead to the end of 2025, and they know that if he wins another term, he will be in office at a rare moment in Washington, when basically tax policy has to be on the Congressional agenda.

Well, Republicans, when they passed their tax cuts in 2017, set a bunch of them to expire at the end of 2025 in order to lower the cost of the bill.

These are the Trump tax cuts.

The Trump tax cuts. And that includes all the tax cuts for individuals. So now that those are coming due, there’s going to be a fight in Washington over whether to extend them or make them permanent or change them in some way or just let them expire, and Democrats know there’s going to be a huge fight that will reach almost certainly the floor of the House and the Senate. And so Biden wants to be ready.

He wants to be ready with a suite of policy proposals that Democrats can basically pull off the shelf and try to use to put Republicans in a box. Basically say, we would like to keep taxes low or cut them further for low income workers, middle class workers. But we want to pay for that by raising taxes on the rich. You Republicans also want to do nice things for low and middle class workers, but you want to cut taxes for corporations and the rich, and we think that’s a political loser for you.

So Biden is ready with what they think will be a political winner for Democrats in this almost certain floor tax fight at the end of 2025.

And that brings us to the last reason why Biden is doing this, and maybe the most important, which is it’s really good politics.

Just explain that. Why is talking about tax increases, net tax increases, such good politics?

If you talk to Democratic pollsters, if you talk to people inside the White House, outside the White House, political strategists anywhere in Biden’s orbit, they all agree that the public loves the idea of forcing rich people and corporations to pay their, quote, “fair share.” It’s just become a winning and central political argument in Democratic campaigns, the idea that corporations avoid taxes, that rich people avoid taxes, and that Joe Biden is trying to position himself as a champion of the idea that they need to pay more. Those corporations and those rich people need to pay more, and he’s going to make it happen.

You’re describing this as something that is kind of a new political reality. Is that right?

Yeah, it’s evolved over the last decade or so I think. For a long time in Washington, the conventional wisdom was just couldn’t talk about tax increases of any kind. They were poison. There was a whole anti-tax movement that did a really good job of messaging that, and Democratic candidates got very scared of talking about raising taxes even on the very, very rich.

That started to turn over time. But it’s really changed. I think we saw in the 2020 election that the Democratic primary had just enormous amounts of taxes on corporations and the rich funding all sorts of policy proposals — Medicare for all and universal child care and trillions and trillions of dollars — and Democratic candidates like Liz Warren and Bernie Sanders competing to see who could tax corporations and the rich the most.

Biden is a product of that primary. He was one of the most moderate people in that group, but his proposals are really outside of the historical norm for Democratic candidates up until then. And that reflects the fact that pollsters have been doing all this research, finding that the American people, including independents and increasingly numbers of Republicans, just don’t think corporations pay their fair share and are open to the idea they should pay more.

This is really interesting, and it makes me think that what you’re really saying is that there might have been a time when a Democratic nominee like Joe Biden might have reveled in his image as an overall tax cutter. But that is not this moment, and that is not this candidate. He wants to be a tax increaser. He thinks that is where the politics are.

I think that’s exactly right when you think about tax increaser as tax increaser on the rich and on corporations. There’s two ways to be a successful populist politician. One of them is to be like Trump and run around saying you’re going to do enormous tax cuts for everybody, which is a Republican version of populism. Trump, my biggest tax cut in history, I’m going to do another huge, enormous tax cut. It’s going to be so big you won’t believe it.

There might have been a time when Democrats tried to follow that playbook. But Biden’s not doing that. He’s leaning into the other side of populism. He’s telling workers, hey, I’m on your side with these big companies. They’re trying to screw you, and I’m not going to stand for it. And so I’m going to raise their taxes. I’m going to make them pay more so that there’s more money for you, whether that’s more tax cuts or more programs or whatever.

And that is the Democratic version of populism right now, and that’s the one that Joe Biden is running on. And that’s why he’s so happy to talk about raising corporate taxes because it’s a way to tell workers, hey, I’m on your side.

Right. Even if that’s not what he’s done or ever may be able to do.

Yeah. Part of the problem with populism is that you make a lot of promises you can’t keep, and this certainly, in his first term, has been an area where the president has talked a much bigger game than he’s been able to execute. The second term might be different, but that doesn’t really matter for the campaign. What matters is the rhetoric.

Well, Jim, thank you very much. We appreciate it.

Thank you. Always a pleasure.

Here’s what else you need to know today. On Tuesday, Israel confirmed that it had carried out the airstrike that killed seven aid workers delivering food to civilians in Gaza. The attack, which occurred on Monday, struck a convoy run by the World Central Kitchen, a nonprofit group. At the time of the attack, the aid workers were traveling in clearly marked cars that designated them as non-combatants.

Israel’s Prime Minister Benjamin Netanyahu described the attack as unintentional and said that his government deeply regretted the deaths. In its own statement, World Central Kitchen called the strike unforgivable and said that as a result, it would suspend its aid work in Gaza, where millions of people are in dire need of both food and medicine.

Today’s episode was produced by Stella Tan and Mary Wilson with help from Michael Simon Johnson. It was edited by Lisa Chow, contains original music by Dan Powell and Marion Lozano, and was engineered by Chris Wood. Our theme music is by Jim Brunberg and Ben Landsverk of Wonderly.

That’s it for “The Daily.” I’m Michael Barbaro. See you tomorrow.

- April 7, 2024 The Sunday Read: ‘What Deathbed Visions Teach Us About Living’

- April 5, 2024 • 29:11 An Engineering Experiment to Cool the Earth

- April 4, 2024 • 32:37 Israel’s Deadly Airstrike on the World Central Kitchen

- April 3, 2024 • 27:42 The Accidental Tax Cutter in Chief

- April 2, 2024 • 29:32 Kids Are Missing School at an Alarming Rate

- April 1, 2024 • 36:14 Ronna McDaniel, TV News and the Trump Problem

- March 29, 2024 • 48:42 Hamas Took Her, and Still Has Her Husband

- March 28, 2024 • 33:40 The Newest Tech Start-Up Billionaire? Donald Trump.

- March 27, 2024 • 28:06 Democrats’ Plan to Save the Republican House Speaker

- March 26, 2024 • 29:13 The United States vs. the iPhone

- March 25, 2024 • 25:59 A Terrorist Attack in Russia

- March 24, 2024 • 21:39 The Sunday Read: ‘My Goldendoodle Spent a Week at Some Luxury Dog ‘Hotels.’ I Tagged Along.’

Hosted by Michael Barbaro

Featuring Jim Tankersley

Produced by Stella Tan and Mary Wilson

With Michael Simon Johnson

Edited by Lisa Chow

Original music by Dan Powell and Marion Lozano

Engineered by Chris Wood

Listen and follow The Daily Apple Podcasts | Spotify | Amazon Music

In his campaign for re-election, President Biden has said that raising taxes on the wealthy and on big corporations is at the heart of his agenda. But under his watch, overall net taxes have decreased.

Jim Tankersley, who covers economic policy for The Times, explains.

On today’s episode

Jim Tankersley , who covers economic policy at the White House for The New York Times.

Background reading

An analysis prepared for The New York Times estimates that the tax changes President Biden has ushered into law will amount to a net cut of about $600 billion over four years.

“Does anybody here think the tax code’s fair?” For Mr. Biden, tax policy has been at the center of his efforts to make the economy more equitable.

There are a lot of ways to listen to The Daily. Here’s how.

We aim to make transcripts available the next workday after an episode’s publication. You can find them at the top of the page.

The Daily is made by Rachel Quester, Lynsea Garrison, Clare Toeniskoetter, Paige Cowett, Michael Simon Johnson, Brad Fisher, Chris Wood, Jessica Cheung, Stella Tan, Alexandra Leigh Young, Lisa Chow, Eric Krupke, Marc Georges, Luke Vander Ploeg, M.J. Davis Lin, Dan Powell, Sydney Harper, Mike Benoist, Liz O. Baylen, Asthaa Chaturvedi, Rachelle Bonja, Diana Nguyen, Marion Lozano, Corey Schreppel, Rob Szypko, Elisheba Ittoop, Mooj Zadie, Patricia Willens, Rowan Niemisto, Jody Becker, Rikki Novetsky, John Ketchum, Nina Feldman, Will Reid, Carlos Prieto, Ben Calhoun, Susan Lee, Lexie Diao, Mary Wilson, Alex Stern, Dan Farrell, Sophia Lanman, Shannon Lin, Diane Wong, Devon Taylor, Alyssa Moxley, Summer Thomad, Olivia Natt, Daniel Ramirez and Brendan Klinkenberg.

Our theme music is by Jim Brunberg and Ben Landsverk of Wonderly. Special thanks to Sam Dolnick, Paula Szuchman, Lisa Tobin, Larissa Anderson, Julia Simon, Sofia Milan, Mahima Chablani, Elizabeth Davis-Moorer, Jeffrey Miranda, Renan Borelli, Maddy Masiello, Isabella Anderson and Nina Lassam.

Jim Tankersley writes about economic policy at the White House and how it affects the country and the world. He has covered the topic for more than a dozen years in Washington, with a focus on the middle class. More about Jim Tankersley

Advertisement

IMAGES

VIDEO

COMMENTS

Look into the Future is the second studio album by Journey.It was released in January 1976 by Columbia Records.. For their second album, the members of Journey toned down the overt progressiveness of their first, self-titled release, in favor of a more focused approach. Despite that, Look into the Future still retains some of the experimental approach and sound of the debut, especially in the ...

Community content is available under CC-BY-SA unless otherwise noted. Look Into The Future is the second album by Journey. released in 1976. On A Saturday Nite It's All Too Much Anyway She Makes Me (Feel Alright) You're On Your Own Look into the Future Midnight Dreamer I'm Gonna Leave You Look Into The Future includes a cover of It's All Too ...

Look into the Future TBA. Look into the Future TBA. Journey Band Wiki. Explore. Main Page; All Pages; Community; Interactive Maps; Recent Blog Posts; Wiki Content. Recently Changed Pages. In the Morning Day; Of a Lifetime/Tour Dates; Faithfully/Tour Dates; ... Journey Band Wiki is a FANDOM Music Community.

History 1973-1977: Formation, Journey, Look into the Future and Next Neal Schon, the remaining original member of Journey in 2008. The original members of Journey came together in San Francisco in 1973 under the auspices of former Santana manager Herbie Herbert.Originally called the Golden Gate Rhythm Section and intended to serve as a backup group for established Bay Area artists, the band ...

Look into the Future is the second album by Journey. It was proceeded by Journey and followed by Next. On a Saturday Night [[ [[ [[ [[ Look into the Future [[ [[ Gregg Rolie - lead vocals, keyboards Neal Schon - guitar Ross Valory - bass Aynsley Dunbar - drums

The lyrics for Look into the Future were written by Journey's keyboardist, Gregg Rolie. He has a knack for capturing complex emotions and weaving them into unforgettable lyrics. 3. How did Look into the Future impact Journey's career? Look into the Future marked a significant milestone for the band, solidifying their place in the rock music ...

Look into the Future is the second studio album by Journey. It was released in January 1976 on Columbia Records. For their second album, the members of Journey toned down the overt progressiveness ...

Look Into the Future fared better than the band's eponymous first record but got to only No. 100. Still hopeful, Rolie said Journey took it all in stride. Still hopeful, Rolie said Journey took it ...

Look into the Future Review by Stephen Thomas Erlewine. Journey's second album, Look Into the Future, is essentially a reprise of their debut, and while the music has a sharper focus and better instrumental sections than its predecessor, it still lacks strong material and is a little too directionless to function as good jazz-rock.

J̲o̲urney - Lo̲o̲k Into The F̲uture (Full Album) 1976. 0:00. Journey - Look Into The Future. 8:13. On a Saturday Nite. 3:59. Anyway. 4:11. Explore the tracklist, credits, statistics, and more for Look Into The Future by Journey.

Still I'm coming home. Yes, you know I'm coming home someday. The future's brighter now it's not so far away. Yes, I'm coming home. I'm coming home some way. [Chorus] But still I'm coming home ...

Provided to YouTube by ColumbiaLook into the Future · JourneyLook Into The Future℗ 1976 CBS Records Inc.Released on: 1976-01-01Composer, Lyricist: Neal Schon...

Rare high quality live version of "Look Into The Future" by Journey where Steve Perry joins Gregg Rolie on vocals for the chorus. Recorded live in Chicago, I...

Look Into the Future, an Album by Journey. Released in January 1976 on Columbia (catalog no. CBS 69203; Vinyl LP). Genres: Progressive Rock. Rated #455 in the best albums of 1976. Featured peformers: Gregg Rolie (lead vocals, keyboards), Neal Schon (guitar, background vocals), Ross Valory (bass guitar, background vocals), Aynsley Dunbar (drums, percussion), Journey (producer), Glen Kolotkin ...

Artist: Journey Title: Look into the futureYear: 1976

Listen free to Journey - Look Into The Future (On a Saturday Nite, It's All Too Much and more). 8 tracks (). Look into the Future is Journey's second studio album. It was released in January 1976 on Columbia Records. For their second album, the members of Journey toned down the overt progressiveness of their first, self-titled release, in favor of a more focused approach.

Look into the Future is the second studio album by Journey. It was released in January 1976 by Columbia Records. For their second album, the members of Journey toned down the overt progressiveness of their first, self-titled release, in favor of a more focused approach. Despite that, Look into the Future still retains some of the experimental approach and sound of the debut, especially in the ...

recording of: Look Into the Future (from 1975-08 until 1975-09) writer: Gregg Rolie, Neal Schon and Diane Valory. publisher: Weedhigh‐Nightmare Music, ヤマハミュージックエンタテインメントホールディングス ( holding company - do not use as release label) and 日音 Synch事業部. 5.

Provided to YouTube by Columbia Look into the Future · Journey Look Into The Future ℗ 1976 CBS Records Inc. Released on: 1976-01-01 Composer, Lyricist: ...

"Look Into The Future" is the second studio album by Journey. It was released on January 1, 1976.Gregg Rolie - keyboards, lead vocalsNeal Schon - guitarRoss ...

Civil War: Directed by Alex Garland. With Nick Offerman, Kirsten Dunst, Wagner Moura, Jefferson White. A journey across a dystopian future America, following a team of military-embedded journalists as they race against time to reach DC before rebel factions descend upon the White House.

We've taken great care in approaching this design with a nod to the past and look to the future. The site has many converging use cases, thousands of pages, and is a daily resource to many. The whole story had some dead ends and detours. ... Read on for a deeper dive into the journey and insights into what's to come. Scale and Constraints.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features NFL Sunday Ticket Press Copyright ...

Kerr followed his father into medicine, and in the last 10 years he has hired a permanent research team that expanded studies on deathbed visions to include interviews with patients receiving ...

transcript. The Accidental Tax Cutter in Chief President Biden says he wants to rake in more money from corporations and high earners. But so far, he has cut more taxes than he's raised.

Share your videos with friends, family, and the world

2nd album by Journey from 1976.