Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Platinum Card

Full List of Travel Insurance Benefits for the Amex Platinum Card [2024]

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Compliance Editor & Content Contributor

78 Published Articles 639 Edited Articles

Countries Visited: 40 U.S. States Visited: 27

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3059 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

![amex platinum travel multiplier Full List of Travel Insurance Benefits for the Amex Platinum Card [2024]](https://upgradedpoints.com/wp-content/uploads/2022/09/Amex-Platinum-Upgraded-Points-LLC-09-Large.jpg?auto=webp&disable=upscale&width=1200)

Amex Platinum Card Overview

Standard car rental coverage, premium car rental protection coverage, trip cancellation and trip interruption insurance, trip delay reimbursement, baggage insurance, emergency medical transport and evacuation — complimentary coverages, additional medical assistance, other hotline services, filing a claim, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Frequent travelers who are interested in premium travel benefits and solid reward-earning opportunities gravitate to The Platinum Card ® from American Express . The card, as well as The Business Platinum Card ® from American Express , has been the go-to card for meeting travelers’ earning, redemption, and benefits needs.

We frequently cover Membership Rewards points-earning opportunities , as well as a multitude of ways to maximize the redemption options . We’ve even done a deep dive into getting the most from statement credits offered by Amex cards.

Next up in our collection of articles focusing on the valuable perks that come with the Amex Platinum card is the card’s travel insurance benefits. Insurance can be inherently confusing in general and the insurance coverages that come with credit cards can be equally so.

Fortunately, even a quick overview will give you some insight as to the insurance coverages you can expect on the Amex Platinum card. So, right here and now, we’re stepping up to deliver just that.

Let’s take a look at exactly which insurances come with the card, how these benefits can provide a level of peace of mind, and find out what situations might trigger the coverage to provide economic value.

It’s important to have a little background on the card to put its coverage into context. Here are important card details, including the current welcome bonus and annual fee.

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- Annual and monthly statement credits upon enrollment ( airline credit, Uber Cash credit, Saks Fifth Avenue credit, streaming credit, prepaid hotel credit on eligible stays, Walmart+ credit, CLEAR credit, and Equinox credit )

- TSA PreCheck or Global Entry credit

- Access to American Express Fine Hotels and Resorts

- Access to Amex International Airline Program

- No foreign transaction fees ( rates and fees )

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card ® , Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card ® . Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card ® . Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR ® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card ® . Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card ® . An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Financial Snapshot

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

American Express Membership Rewards

- Amex Platinum 150k Welcome Bonus Offer

- Benefits of The Amex Platinum

- How to Use 100,000 Amex Platinum Points

- Amex Platinum Card Requirements

- American Express Platinum Military Benefits

- Amex Platinum and Business Platinum Lounge Access

- Amex Platinum Benefits for Authorized Users

- Amex Platinum vs Delta Platinum

- Amex Platinum vs Chase Sapphire Reserve

- Capital One Venture X vs Amex Platinum

- Amex Platinum vs Delta Reserve

Hot Tip: Check to see if you’re eligible for a welcome bonus offer of up to 125k (or 150k) points with the Amex Platinum. The current public offer is 80,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

Car Rental Loss and Damage Insurance

The Amex Platinum card comes with complimentary standard car rental insurance that provides secondary coverage when using your card to reserve and pay for your entire rental car contract. You also have the option to purchase premium primary car rental coverage .

For either coverage to be valid, you must decline the rental car agency’s LDW (loss damage waiver) or CDW (collision damage waiver) coverage when renting the vehicle.

Here’s an overview of how both of these coverages work:

Secondary (standard) coverage means that you must first file a claim with any other applicable insurance you might have before the card coverage applies.

You can expect to receive excess secondary coverage for these losses:

- Damage to and theft of the vehicle

- Personal property up to $1,000 per person/$2,000 per accident

- Accidental injury up to $5,000 per claimant

- Accidental death/dismemberment up to $300,000

This is just a snapshot of the standard secondary car rental coverage; several terms and conditions apply. You should access the official guide to benefits or call your benefits administrator for specific information.

One of the real car rental insurance perks of holding the Amex Platinum card is having access to Premium Car Rental Protection coverage for just 1 low fee that covers the entire rental period, not a per-day charge like the rental agency charges.

Although there are some credit cards with primary rental car insurance , the American Express Premium Car Rental Protection coverage, in some circumstances, can provide equal or better coverage and elevated peace of mind. Terms and conditions apply.

Bottom Line: Consider Amex Premium Car Rental Protection if you don’t have a credit card that provides primary car rental insurance. Additionally, if you are renting an expensive vehicle that exceeds your card’s limit of coverage or the maximum length of the rental period on your other card is limited to less than 42 days, the Amex Premium Car Rental Protection could also be a prudent choice.

Trip cancellation and trip interruption insurance are designed to cover unexpected, unforeseen events that may cause you to have to cancel your trip or that cause a disruption in a trip you’re already started.

To be eligible for coverage, purchase your entire round-trip common carrier ticket with your Amex Platinum card.

American Express has a broad definition of who is covered under this benefit. Eligible travelers can include the cardholder, traveling companion, family member of the eligible traveler, or family member of the traveling companion.

Examples of events that could be covered include the following:

- Bodily Injury or Illness — If you, a traveling companion, or a family member of either, experience an accidental injury or become ill, causing you to cancel your trip, you may have coverage

- Bad Weather — If extreme weather causes your trip to be canceled or disrupted, there could be coverage

- Change in Military Orders —Applies to cardmember and/or spouse (spouse definition includes domestic partner)

- Terrorist action or hijacking

- Jury duty or other qualifying legal obligation

- Uninhabitable dwelling of either the cardmember or traveling companion

- Quarantine imposed by a physician for health reasons

You can expect coverage of up to $10,000 per trip , and a maximum limit of $20,000 per card per 12-month period.

Terms and conditions apply.

Bottom Line: While the trip cancellation/trip interruption benefit covers specifically stated reasons for trip cancellation/interruption, there is no coverage for voluntary cancellations, disruptions due to known events, or for preexisting conditions. Additional terms and conditions can be found in your guide to benefits or call the benefits administrator prior to your trip.

Experiencing a trip delay is inevitable so having coverage for added expenses as a result of that delay could be a welcome economic benefit. To qualify for trip delay coverage, just pay for the full amount of your common carrier round-trip transportation ticket with your Amex Platinum card.

The delay must be for more than 6 hours for you to be eligible for reimbursement for necessary incidentals, meals, and lodging.

Coverage limits are $500 per covered trip and a maximum of up to 2 covered trips in each consecutive 12-month period. Coverage is secondary to other coverage that applies and does not include expenses that are reimbursed by the airline or other entities. Additional terms and conditions also apply.

Losing a checked bag used to be a very common occurrence. With new technology and tracking mechanisms, however, incidents have declined, but they still happen. If you do happen to experience lost bags, however, you can count on the baggage insurance found on the Amex Platinum card.

To activate the coverage , simply pay for your common-carrier fare with your card and/or Membership Rewards points.

Here’s the coverage you can expect for lost luggage:

- Checked Bags — Up to $2,000 per covered person, per trip

- Carry-on Bags — Up to $3,000 per covered person, per trip

- Specialty High-value Items — Up to $1,000 per person, per covered trip ($2,000 for New York residents, maximum $10,000 per trip)

- Combined Limit — The limit for all baggage, including high-risk items, is $3,000 per covered person, per single trip

Checked baggage is covered only while traveling on a common carrier . Carry-on baggage is additionally covered while traveling to , from , and when waiting at the carrier terminal.

Note that the coverage on the card is secondary to any other insurance or reimbursement you might receive from the airline. There is no coverage for delayed baggage , but several other credit cards do offer this coverage .

Premium Global Assist Hotline

While technically not insurance coverage, having access to help when you’re traveling, 24/7, is sure to provide additional peace of mind. The Amex Platinum card offers a premium version of a dedicated helpline that serves as a welcome resource should things go wrong during your travels.

Here are the types of assistance you can expect from the service:

One of the premium services offered on the card is complimentary emergency medical transport or evacuation . If you or a covered family member becomes injured or ill during your travels, you could receive emergency medical transportation or evacuation , if necessary.

You can expect to receive the following services without charge when arranged via the hotline:

- Emergency Transport or Evacuation — Transport to the nearest medical facility or transport from an inadequate medical facility

- Transport of Family Member — Transport may be covered for an adult member to be by the bedside of the cardmember or for the cardmember’s minor child (who had been traveling alone with the cardmember) to be transported back to the U.S.

- Transport of Remains — Amex will pay for the transport of remains back to the U.S.

- Post-Evacuation Assistance — If you’re evacuated and your return ticket back to the U.S. has become invalid, Amex will arrange and pay for transportation back to the U.S.

Please note that the Premium Global Assist Hotline does not cover any medical expenses or emergency transportation services arranged outside of the hotline. Several terms and conditions apply to these coverages.

In addition to the complimentary coverages offered by the hotline, you’ll find these additional medical services:

- Medical Referrals — Receive help finding an English-speaking doctor, a hospital, or other needed medical services

- Prescription Replacement Assistance — Get help with replacing lost or forgotten medications

There is no charge for the referral service but cardmembers are responsible for actual services received from the provider.

- Passport/Visa Assistance — Whether you need help replacing a passport or have a need to contact the U.S. consulate, the hotline can assist

- Emergency Translation Services — Receive over-the-phone services or written language translation assistance

- Legal Referrals — Should you need legal services during your trip, the hotline can help you find local bail bond services that accept Amex or refer you to other legal personnel

- Financial Assistance — The hotline can help you arrange cash wire services, help you check out of your hotel remotely, or assist with lost card situations

- Emergency Message Relay — In the event of an emergency, the hotline can send a message to a family member, friend, or another recipient on your behalf

- Lost Items — Should you lose an item, your baggage gets lost, or other missing possession, the hotline can help track it down

- Trip Planning Services — Access information such as weather, currency exchange rates, passport/visa requirements, customs information, travel warnings, and more

Bottom Line: The Amex Platinum card comes with complimentary emergency transportation and evacuation services with no stated limit. Additional medical, legal, and travel service referrals are also complimentary, but other than the emergency medical transportation and evacuation, services rendered must be paid for by the cardholder.

As with any insurance claim, you’ll need to report any event as soon as possible, provide supporting documentation, and follow up after the claim has been filed.

You could be expected to submit any, or all, of the following:

- Copies of your common carrier ticket

- Copies of your credit card statement showing the expenses

- Proof of the loss (i.e. a copy of physician’s quarantine order, military orders, etc.)

- Copy of the travel supplier’s cancellation policy

- Any other supporting documentation requested by the claims administrator

Claims must be reported within 60 days but it is best to do it as soon as possible. Once you report the claim, you’ll receive instructions for completing the next steps in the process.

Hot Tip: Be sure to take photos and videos, keep receipts, secure any applicable police report, and hold on to other documentation that might be needed to support your claim. Keep in mind that supporting information can be difficult to obtain after the fact but may be readily secured at the time of the claim.

While the insurance that comes with the Amex Platinum card won’t take the place of a comprehensive travel insurance policy , you’ll find value in several of the benefits.

Utilizing Premium Car Rental Protection, trip cancellation/interruption, trip delay, and complimentary emergency medical transport or evacuation could save you more than you could imagine in certain circumstances.

Additionally, knowing the coverages you have in advance has tremendous value. You’ll be armed with information to make educated decisions that can protect each aspect of your trip and be better prepared for how you might handle a covered incident during your travels. If you’re looking for other card options, see our article on the best credit cards for travel insurance .

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

For the car rental collision damage coverage benefit of The Platinum Card ® from American Express, car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car rental loss or damage coverage is offered through American Express Travel Related Services Company, Inc. For the trip cancellation and interruption insurance coverage benefit of The Platinum Card ® from American Express, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company. For the trip delay insurance benefits of The Platinum Card ® from American Express, up to $500 per covered trip that is delayed for more than 6 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company. For the baggage insurance plan benefit of The Platinum Card ® from American Express, baggage insurance plan coverage can be in effect for covered persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier vehicle (e.g. plane, train, ship, or bus) when the entire fare for a ticket for the trip (one-way or round-trip) is charged to an eligible card. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage, in excess of coverage provided by the common carrier. The coverage is also subject to a $3,000 aggregate limit per covered trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each covered person with a $10,000 aggregate maximum for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. For the Premium Global Assist Hotline benefit of The Platinum Card ® from American Express, you can rely on the Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, we may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card members may be responsible for the costs charged by third-party service providers.

For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of The Business Platinum Card ® from American Express, click here .

Frequently Asked Questions

Is the amex platinum card travel insurance any good.

While the insurance that comes on your Amex Platinum card does not replace a comprehensive travel insurance policy, there is value in the coverages that come complimentary on the card.

Benefits such as trip interruption/cancellation/delay insurance and Amex Premium Car Rental Protection can provide economic value by saving you money should something go wrong during your travels.

Having access to the Premium Global Assist Hotline and complimentary emergency medical transport or evacuation could render peace of mind knowing you have the coverage should you need it.

Does the Amex Platinum card cover flight cancellations?

The Amex Platinum card comes with trip cancellation, trip interruption, and trip delay insurance that can cover flight cancellations for only the specific (limited) reasons listed in the terms and conditions.

As with most insurance, the coverage that comes on your card is not meant to cover voluntary flight cancellations.

For these types of cancellations, you would need to purchase Cancel for Any Reason Insurance , which can be added to some comprehensive travel insurance policies.

Does the Amex Platinum card come with primary car rental insurance?

No. The Amex Platinum card comes with complimentary standard secondary car rental insurance, which means you must first file a claim with any other insurance that may apply before the card coverage is valid.

However, the card does offer a unique benefit that allows you to purchase premium primary car rental insurance for 1 low fee that covers the entire rental period.

This coverage is valid for rental periods up to 42 days in length and costs $12.25 to $24.95 per period, depending on the state in which you reside and the coverage limit you select.

Does the Amex Platinum have delayed baggage insurance?

While the Amex Platinum card comes with lost, stolen, or damaged luggage coverage, it does not offer a delayed baggage benefit.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![amex platinum travel multiplier The Amex Platinum Card – Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2019/01/American-Express-Platinum-2.4.2021.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Is the Delta Platinum Amex worth it? For many, yes. Here’s how to be sure it’s right for you

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Delta recently revamped their credit card offering and made their Delta SkyMiles® Platinum American Express Card a lot more attractive to both casual and power users alike. Whether you’re a Delta frequent flyer or casual user, the card has a good value proposition for many different kinds of people. The card doesn’t have a terribly strong earning rate for rewards, but the ancillary benefits more than make up for that. This card could make sense to have and to hold, but not for necessarily everyday use.

Delta SkyMiles® Platinum American Express Card

See Rates and Fees

Intro Bonus

Reward rates.

- 3x Earn 3 miles per dollar at hotels

- 2x Earn 2 miles per dollar at restaurants worldwide and U.S. supermarkets.

- 1x Earn 1 mile per dollar of eligible purchases.

- Benefits for Delta flyers, like first checked bag free, MQD Boost and MQD earned through spending

- Companion certificate good for a round trip domestic, Caribbean or Central American Main Cabin flight each year upon renewal of your card

- 15% Discount on Award Tickets on Delta Flights

- High annual fee

- Limited travel insurance options

- Companion pass comes with limitations

- Statement credits toward Delta Stays, Resy and rideshare purchases

- Consumer protections including cell phone insurance, extended warranty, and purchase protection

For whom is the Delta SkyMiles® Platinum American Express Card worth it?

One of the main reasons people consider an airline credit card is the perks that you can get by flying with the airline or rewards for using your card in everyday spending. This card shines with Delta Air Lines related benefits including checked bag waivers, priority boarding, achieving elite status, a companion pass for free travel, access to the upgrade list and more.

The rewards earned aren’t great, but they’re also not subpar. Overall, it’s a good card for someone who wants to increase their relationship with one of the world’s largest airlines.

Someone pursuing elite status with Delta

Chances are that if you’re flying enough to take advantage of all the benefits of the Delta Platinum American Express card, you’re going to be knocking on the door of elite status soon. Simply holding the card will get you a $2,500 MQD (Medallion Qualifying Dollars) boost each year, enough to get you halfway to Silver Medallion status.

If you’re racking up spend through purchases, you can also add $1 MQD for every $20 spent on the card. While it may not be a ton of MQDs, for every $10,000 spent on the card you’ll net $500 MQD.

People who can make use of the monthly rebates

Every month you’ll earn $10 in credit for rideshare services and $10 for Resy purchases in the U.S. There’s also a $150 credit that comes after booking a prepaid hotel or vacation package via the Delta Stays website.

While the $150 comes in one fell swoop, the $120 for rideshare and Resy restaurants come in $10 monthly chunks, and if you don’t use them each month, you’ll lose them. If there are restaurants that participate in the Resy network nearby where you live, then this could be an easy redemption. Otherwise, make sure to not forget to use them every month.

People who are on Delta planes fairly often

If you’re a casual Delta flyer then you’re probably not considering applying for this card anyway, but it goes without saying that the person getting the most benefits from this card is someone who flies with Delta on the regular.

The companion pass that comes with the card is good for a round trip flight in the Main Cabin to the U.S., Mexico, the Caribbean, and Central America, so you can take a trip with a friend or loved one each year. You’ll earn miles and MQD for the trip as the primary cardholder but the guest will not be eligible to earn any miles.

The other fringe benefits of the card such as the TakeOff15 discount, free checked bags, priority boarding, complimentary Medallion upgrades and elite status boost will all benefit you only when you’re flying on Delta.

For whom is the Delta SkyMiles® Platinum American Express Card not worth it?

If you don’t think that you’ll be able to achieve elite status and you’re just looking for some basic flight benefits, the card might be a little too expensive and too powerful for the general user. Also, if you value using airport lounges when you travel, know that the card offers zero ability to enter the Sky Clubs in airports worldwide. In the past you had the ability to purchase day passes at a reduced rate, but that benefit has been discontinued.

Big Spenders

For those looking to spend multiples of tens of thousands of dollars a year, there are other personal cards that could provide more value. Apart from the 3 miles per dollar at hotels and the 2 miles per dollar at restaurants worldwide and U.S. supermarkets, 1 mile per dollar of eligible purchases.

There are many cards on the market that offer multipliers for all purchases no matter the source. The Capital One Venture X Rewards Credit Card earns 2x miles on everyday purchases and 10x miles on hotels and rental cars booked through Capital One Travel. The American Express® Gold Card earns 4X Membership Rewards® Points at restaurants (including takeout and delivery in the U.S.) and 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1x), along with 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com, giving you the chance to earn potentially thousands more rewards each and every year.

To view rates and fees of the American Express® Gold Card , see this page .

Travelers who value flexibility in your reward choices

All Delta credit cards from American Express earn only one type of reward, Delta SkyMiles. Those miles can be used on Delta flights and flights with the Delta partners, but offer poor redemption values elsewhere.

If you enjoy the flexibility of using your rewards on multiple airlines, hotels , or even just for cash back , you’ll want to consider a card that earns a flexible reward currency. Look for cards that earn Chase Ultimate Rewards, American Express Membership Rewards, Citi ThankYou points, or Capital One Venture X Miles. All of these will allow you the flexibility to redeem however you like.

How to Maximize Rewards with the Delta SkyMiles® Platinum American Express Card

Since this card earns bonuses of 3 miles per dollar at hotels and 2X miles on dining, make sure that you’re pulling out this card to pay at all your hotels and restaurants. This will make sure that you’re earning as many SkyMiles as possible. Don’t forget that this card also works to earn 2X miles on supermarkets in the U.S., offering you the ability to earn even more.

Another pro tip is to set up alerts to remind you about using your monthly credits. You could set a reminder every 15th of the month telling you to “use my Delta Amex credits,” that way not a single one goes to waste.

Finally, don’t miss out on the welcome bonus. Currently there is a limited time offer of 50,000 Bonus Miles after you spend $3,000 in purchases on your new Card in your first 6 months of Card Membership. If you don’t hit this number, you will have missed out on a huge number of miles for your future travel. If you’re worried you are getting close but you don’t know how much more you have to spend, call the number on the back of the card or contact Amex via chat. They’ll be able to give you the amount you need to achieve your bonus.

The takeaway

While the annual fee might be a turn-off for many applicants, the benefits have the ability to strongly outweigh the price. Between the rideshare, restaurant, hotel, and Global Entry credits you’re earning well over the annual fee, a total of $490 back every year. Those credits don’t even take into account the money you’ll save by taking a friend or loved one with you on a vacation somewhere nice with the annual companion pass. Overall this card makes a solid choice for those looking to increase their flight benefits with Delta Air Lines.

Frequently Asked Questions

Is the companion pass difficult to use.

While there are certain restrictions on where and when you can use the pass, using it is quite simple. When you log into your Delta account the certificate will be automatically loaded for you in the “certificates and eCredits” section of the website.

Simply make your booking like you would as normal, and the computer will automatically apply the certificate discount for you. Make sure to give yourself plenty of advance notice to get the best pricing and availability for flights.

How do I apply the Take Off15 discount?

There are no special promotion codes or special code to enter to use the 15% discount on Delta flights. When you are logged into your SkyMiles account, the system will automatically detect that you have a Delta SkyMiles Platinum credit card and the 15% will come off the top. If you’re not seeing the discount, make sure that you’re redeeming for Delta flights and not for one of their partners.

Do the miles I earn with the credit card expire?

There’s no rush to use the miles you earn since Delta got rid of their expiration of their SkyMiles quite some time back. This gives you the chance to build up a balance to save for the flight of your dreams without feeling the FOMO of having to use your miles before a certain date.

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefits guide for more details. Underwritten by Amex Assurance Company.

EDITORIAL DISCLOSURE : The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends ™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

Airline credit card reviews

American airlines aadvantage® mileup® mastercard review: doesn’t go the distance unless you are spending for status, is the delta gold amex worth it yes, if you check the occasional bag, delta skymiles® blue card review: earn delta skymiles without an annual fee, delta skymiles® platinum american express card review: a mid-tier card with a valuable companion certificate, delta skymiles® platinum business american express card review: the business card for loyal delta flyers who don’t require lounge access, citi® / aadvantage® executive world elite mastercard® review: luxury travel perks at a steep price, citi aadvantage platinum card review: if goldilocks could choose a card for aa rewards, this one would be just right, aeroplan credit card review: get it for the elite status, keep it for the partner airlines, delta skymiles reserve review: the card for flyers who want lounge access, is the delta platinum amex worth it for many, yes. here's how to be sure it's right for you, united quest card review: a suite of united airlines benefits for the more-than-casual flyer, is the delta reserve amex worth it here's how to decide, is the delta skymiles® platinum business card worth it here’s how to decide.

- TechnoFino Community

- Credit Card Reviews

- Best Credit Cards

- Credit Card Perks

- The Clash Of The Cards

- Bank Account

- Debit Card Reviews

- Airline Loyalty Guides

- Hotel Loyalty Guides

- Personal Finance Guides

- Banking Kissa

AMEX Platinum Travel Credit Card Review

AMEX Platinum Travel as the name suggests is a travel-based card for all AMEX enthusiasts. I would call this another no-brainer card from the AMEX stable. I have reviewed the other AMEX cards like AMEX Gold Charge and AMEX MRCC here.

Let’s check out what is so tempting about this card!

- 1 Charges and Welcome Benefits

- 2 Regular Reward Accrual

- 3 Milestone Benefits

- 4 AMEX Reward Multiplier

- 5.1 Statement Credit/ Pay with Points

- 5.2 Travel With Points

- 5.3 Insta Vouchers

- 5.4.1 Airlines Transfer Partners

- 5.4.2 Hotel Transfer Partners

- 6 TechnoFino Maximum

- 7.1 Airport Lounge Access

- 7.2 Fuel Surcharge Waiver

- 7.3 Forex Markup Charges

- 8 Eligibility Criteria

- 9 TechnoFino Recommends

Charges and Welcome Benefits

AMEX doesn’t give you a spends-based fee waiver but you may get a waiver or a retention offer to keep you in the loop. Especially if you hold other AMEX cards then AMEX really values the overall relationship. Even then the rewards of this make up for the fee very easily.

Application through referral is a clear-cut winner due to the extra NIL Joining fees. Check out the link for detailed referral benefits information. You can apply for any of the six AMEX Cards available in India via this link.

If you face any problems in the application process you can contact me on Technofino Community .

You can choose to apply for any AMEX card from the link in the banner. To choose and apply a card of your choice simply click on the View All Cards option and select one. All the information for that particular card is readily available on the website.

Regular Reward Accrual

- *Spends exclude Insurance payments, Utilities and Fuel but are counted for milestone spends.

- Reward points never expire.

- You get to earn MR points even on wallet loads .

Milestone Benefits

- You can get up to 48000 MR points on completing both milestones.

Technofino Tip : Credit of AMEX points on completing the milestones is not automatic. After completion of the first milestone, you will get 7500 MR points automatically and the rest of the points will need to be requested from AMEX and same goes for the 4L milestone.

AMEX Reward Multiplier

AMEX has a Reward Multiplier portal just like HDFC Smartbuy from where you can purchase gift vouchers or do affiliate shopping and get 3X the usual reward points.

Reward Redemption

Statement credit/ pay with points.

AMEX allows you to take a statement credit on eligible transactions or pay with points on select merchants while entering OTP for your transaction at a value of 25p/point. Most of the new AMEX cardholders use this redemption method but trust me there can’t be a method worse than this to use your MR Points. They are much more valuable than this so kindly ignore these two options.

Travel With Points

Another method to redeem your MR points. With this, you can purchase flights, prepaid hotels, car rentals, and more on AmexTravel. Again this gives you a value of 25p/MR point and is highly not recommended .

Insta Vouchers

AMEX further offers you a huge variety of instant vouchers against your MR points which have different values for different brands.

Clearly, this card is meant for travel only since MR points are better redeemed for Taj Stays Voucher or Marriott Transfer since that is where the value lies.

TechnoFino Tip: Since the MR points are credited into a common pool so if you hold either an AMEX MRCC or an AMEX Gold Charge then you can redeem them for AMEX Gold Collection Vouchers which will you a much better value.

Like redeeming a 24K Taj Voucher will give 58p/MR Point and Amazon Pay/ Flipkart Voucher will give you just 37p/ MR Point.

Transfer Points

Now, this is the hottest redemption option for MR points and if you can play well with this you can yield values of even greater than a rupee per point.

Airlines Transfer Partners

AMEX allows you to transfer points to 8 different airline partners and some of them are so unique that none of the Indian credit cards allows you to transfer points to them like Asia Miles. We have a curated list of all AMEX airline transfer partners here . For booking award tickets using points, you can refer to this post on the TechnoFino Community.

Hotel Transfer Partners

Now, this is the most sought redemption option since anyone with a Platinum or Gold status with Marriott Bonvoy can just extract a value of more than 1Re/MR point by transferring a 1:1 ratio with suite upgrades, Breakfast and lounge access with complimentary drinks are an added plus. Since AMEX is the sole transfer partner to Marriott Bonvoy , many points miners use MR points only for transfer to Marriott.

Other than this you can transfer to Hilton Honors also but the value is not that great as compared to Marriott. We have curated a complete list of AMEX hotel transfer partners h ere .

It takes about 0-5 days to transfer Amex MR Points to various loyalty programs so transfer them well in advance to use them.

TechnoFino Maximum

This card is good for just ₹4L spent in a year and after that, the spending can be put on other cards.

On completing both the milestones you will have 48000 MR points in your kitty along with a Taj Voucher worth ₹10,000.

Now with a value of 50p/MR point when redeemed for travel one would get a ₹34,000 worth (including TAJ voucher) reward value on completing both milestones which converts to an 8.5% reward rate . I mean what more can one ask for? If you are not into travelling and will redeem the points for Flipkart vouchers then the value drops to ₹24,400 and the reward rate comes out to be nearly 6.1% which is also not bad in my opinion.

And if you hold any of the gold collection cards along with this card then with 58p/ MR Point value on a 24K Taj Voucher redemption you can easily earn up to a 9.5% reward rate. Even for cash-back lovers 18,000 worth of cash equivalent Amazon Pay vouchers along with a ₹10K Taj Voucher the reward rate translates into 7%!!!

Other Benefits

Airport lounge access.

You are eligible to access only third-party airport lounges using AMEX Platinum Travel since to access AMEX Proprietary lounges you need to have an AMEX Platinum Charge card.

For International lounges only the Priority Pass membership is complimentary and all access will be chargeable. Also, access is restricted only to primary cardholders.

Fuel Surcharge Waiver

- 0% for HPCL transactions less than ₹5,000,1% fee per transaction is applicable for all HPCL transactions on and above ₹5,000.

- 1% of the transaction value subject to a minimum of ₹10 + applicable taxes, will be charged as a convenience fee at fuel stations operated by the Public Sector Oil Marketing Companies BPCL and IOCL.

- 2.5% of the transaction value subject to a minimum of ₹10 + applicable taxes, will be charged as a convenience fee at fuel stations of all other Oil Marketing Companies (except HPCL, BPCL and IOCL).

Forex Markup Charges

- Forex Markup charges are standard 3.50% + GST.

Eligibility Criteria

- For the AMEX Platinum Travel card an income proof of a minimum gross ₹6LPA is required whether you are salaried or self-employed. AMEX doesn’t process applications on a Card-to-Card basis .

- Your CIBIL score should be a minimum of 750.

- You must have an address proof of any serviceable area.

- Serviceable City List- Guntur, Hyderabad, Krishna, Medak, Rangareddy, Visakhapatnam, Vizianagaram, Chandigarh, Jaipur, Ahmedabad, Gandhinagar, Bardoli, Surat, Vadodara, Ambala, Jhajjar, Panchkula, Bengaluru, Kochi, Bhopal, Indore, Mumbai, Pune, Raigad, Thane, Bhubaneswar, Khurdha, Mohali, Chennai, Coimbatore, Erode, Kanchipuram, Krishnagiri, Salem, Tiruvallur, Gautam Buddha Nagar, Hooghly, Howrah, Kolkata, North 24 Parganas, South 24 Parganas, Delhi, Noida, Ghaziabad, Gurgaon, Faridabad, Vijayawada, Ernakulam, Secunderabad, Aluva, Ropar, Hosur, Sriperumbudur, Tiruppur, Baramati, Navi Mumbai, Lucknow, Trivandrum, Mysuru, Nasik, Nagpur, and Ludhiana.

AMEX has recently started serving the following Tier 2/3 cities as well

Agra, Ajmer, Allahabad, Ambala, Amritsar, Aurangabad, Chittoor, Dehradun, Goa, Guntur, Guwahati, Jodhpur, Kanpur, Kolhapur, Kozhikode, Kurnool, Madurai, Meerut, Patiala, Raipur, Rajkot, Ranchi, Thrissur, Trichy and Udaipur.

Application through referral is a clear-cut winner due to the extra NIL Joining fees. Check out the link for detailed referral benefits information. You can apply for any of the six AMEX Cards available in India via this link. Even better, you can also get another 2000 Bonus MR Points by spending ₹5000 within 90 days of membership.

TechnoFino Recommends

AMEX Platinum Travel is one of their best credit cards which provides an exceptional reward rate of 8.5% and is one of my go-to cards till I complete its milestone for the year. The only issue with AMEX cards is low acceptance but if you swipe your cards in premium places then there is nothing to stop you from clinching all of those milestones.

Isn’t AMEX Platinum Travel a no-brainer for all? Feel free to share your tricks in the comments below.

Chief Editor, TechnoFino. Personal finance nerd! Physics enthusiast and trainer. When not into Physics, he is minting points and hunting for the next best credit card for himself.

Related Articles

Ihcl: the ultimate guide for indians, best credit cards in india for dining spends, united mileageplus: the ultimate guide for indians, 19 comments.

How do you calculate ₹34k value for 48k points and you say 0.5/MR point? Isnt it ₹24k for 48k points. Same with flipkart how do you get ₹26k? 48k points x 0.3/MR point = ₹14.4k

34K Value includes Taj Voucher also. I have slightly tweaked the Flipkart value. Thanks for pointing it out.

How do we request for that extra MR points after reaching the respective milestones? What do we exactly say to the Amex Customer Support for that 100% bonus points on top of the milestone benefit? Will they honour our request or purely at their discretion? Is there any nice way of asking so that our request won’t be turned down.. Thanks for the tip.. A very nicely written article…

“Technofino Tip: Credit of AMEX points on completing the milestones is not automatic. After completion of the first milestone, you will get 7500 MR points automatically and the rest of the points will need to be requested from AMEX and same goes for the 4L milestone.”

I think I got the answer I was looking for, It is there in the T&C/s Plat travel card as a last point..

* Membership Rewards points received on spend milestones is a combination of threshold Membership Rewards points and Bonus Membership Rewards points. You will get your threshold Membership Rewards points once you achieve the spend milestones however, to claim your Bonus Membership Rewards points, please dial the number mentioned at the back of your Card

Great find!

Thanks for confirming…

A question on renewal fee: Do we get any MR points on paying the reweal fee of 5k+GST? Assuming we spent more than 4 lakhs in card memebership year, can we ask for annual fee waiver ( or atelast partial) or any any MR points? Do they generallly consider these kind of requests . Thanks in advance.

No official criteria but unofficially Spend 2L in 60 days and get an annual fee waiver Get an annual fee waiver in lieu of 10K MR points Pay an annual fee and get 15K MR points

Thanks heaps for the insights.

I have now spent 2L within 50 days.. How shall I request for annual fee waiver?

Does this card or any other AMEX card benificial if spends are not that much (6-10k pm) as other card is used as primary because of acceptance?

No this card is useful only if you can spend 4L exact else the reward rate drops drastically.

Does a Amex Platinum Metal card whose yearly fees is close to 70k better than this card or you would rate this card as the best in the segment considering the MR points it is giving.

Hi Bhavye. I follow your blog and I am a big fan of yours. I got my amex platinum travel card yesterday and was thinking of applying for amex mrcc as well based on your recommendation of pooling the points and redeeming for 24 karat gold collection. When enquired at the call centre, to my surprise, the executive said that redemption catalogues of MRCC & Platinum travel are different and one can’t redeem platinum points for 24 karat gold collection. Please suggest.

Hi, it was different for mcc and plat travel, but recently amex started allowing pooling points

Do we earn MR points on rent payment? Is it counted towards milestone? What are the extra charges?

I applied using above link , the application was successful and final screen showed we will call you , however after 1 week there is no call. Pls suggest way forward

Kindly Call AMEX on 1-800-419-2122 or mail them.

Thanks for the detailed review Bhavye! Just a couple of queries:

1. Can the milestone points be redeemed for Air Miles as well? Since in your review and the official website, its only mentioned that the welcome/milestone reward points can be redeemed against Taj voucher (0.5/- per point) or Flipkart voucher (0.3/- per point)

2. Do you have redeemed points for AirMiles? If yes, can you share some details on the same that what exactly is an AirMile in terms of actual value in Rs. This option seems more flexible and lucrative but I cant find its proper details anywhere on the net.

3. I;’m a MRCC holder, and I talked to the customer service today only and he clearly mentioned that I wont be having access to gold collection with my new travel platinum card! :-/

LEAVE A REPLY Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Stay Connected

Latest articles, indusind bank eazydiner platinum credit card review, amex smartearn credit card review.

Update : Some offers mentioned below are no longer available. View the current offers here .

Reader Questions are answered twice a week by TPG Senior Points & Miles Contributor Ethan Steinberg .

Premium credit cards like The Platinum Card® from American Express entice users to pay substantial annual fees by offering a long list of luxury travel and lifestyle perks to offset the cost. Some, like a Priority Pass Select airport lounge membership or hefty bonus multipliers for certain spending categories are relatively straightforward to use, while others require a bit more effort to maximize. Enrollment required for select benefits. TPG reader Taylor wants to know if he can use his Amex airline credits for mileage boosters ...

[pullquote source="TPG READER TAYLOR"]I have a few Delta flights coming up and am curious whether the $200 annual airline fee credit on my Amex Platinum will cover a mileage multiplier purchased at check-in? I know this isn't the best bang for my buck but I'm not sure how else to use the credit.[/pullquote]

Let me start by saying that Taylor is not alone, and I've heard from many friends and readers who struggle to fully use their Amex airfare credit each year. Amex offers one of the most restrictive airline credits on its Platinum cards (up to $200 per calendar year) and its American Express® Gold Card (up to $100 per calendar year). Unlike Chase and Citi which offer broad travel credits on their premium credit cards that apply to just about any type of travel purchase you can imagine, Amex's airfare credit only applies to airline incidental fees. It explicitly excludes the one thing people most want to use it on, actually buying plane tickets. It used to be possible to get around this by buying airline gift cards and being reimbursed, but that loophole closed this year leaving many Platinum cardholders struggling to utilize a key benefit of the card.

Related: Choosing an airline for your Amex Platinum $200 airline-fee statement credit

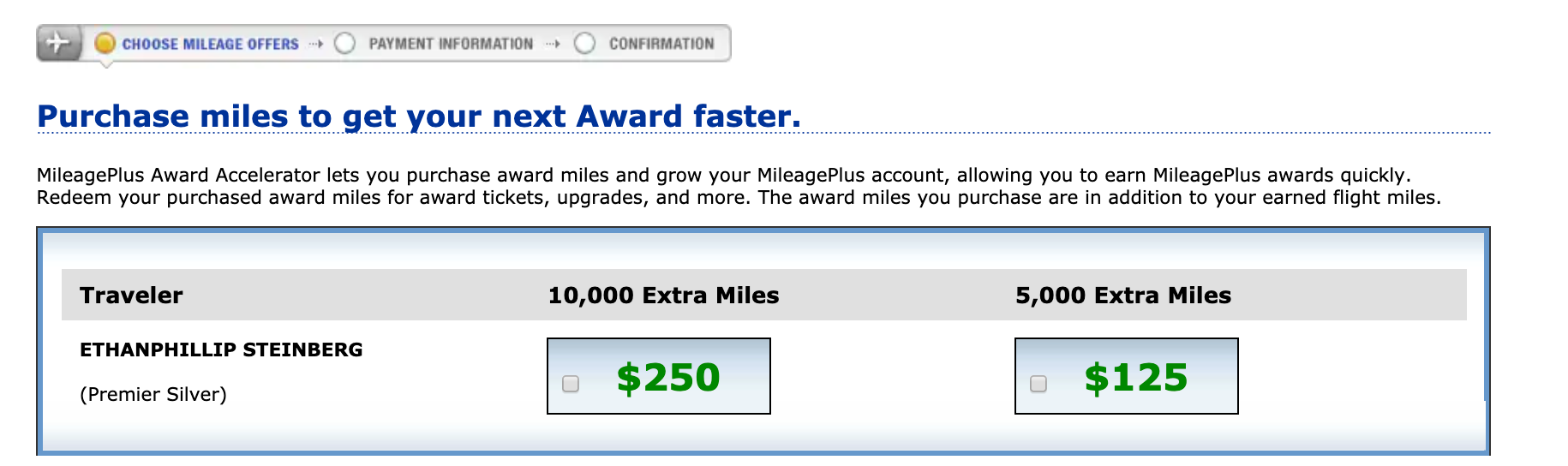

Many airlines (including all three U.S. legacy carriers) will offer you the ability to buy extra miles during the check-in process or even before your flight. These deals are usually a hard pass, as the price just doesn't make sense. For example, I have an upcoming United flight from Washington, D.C. (IAD) to Detroit (DTW) . I have the option to buy 5,000 extra miles for $125 or 10,000 extra miles for $250, a cost of 2.5 cents per mile. TPG values United MileagePlus miles at 1.3 cents each , and even though I can usually redeem them for a higher value than that, I'm not going to buy them at such a high price. This is why we strongly recommend passing on these offers and looking for other ways to boost your mileage balance, like signing up for a new travel rewards credit card or waiting for a sale if you need to buy miles.

When it comes to the Amex Platinum card, the $200 annual airline fee credit is poorly defined . While there isn't a clear list of which charges are eligible, the terms and conditions specifically exclude the following types of purchases:

"Airline tickets, upgrades, mileage points purchases , mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees. The airline must submit the charge under the appropriate merchant code, industry code, or required service or product identifier for the charge to be recognized as an incidental air travel fee"

Based on this it would appear that mileage multipliers are not an eligible purchase, yet a number of readers in the TPG Lounge were quick to jump in and confirm that they had received reimbursement when purchasing a mileage multiplier on their select airline, as recently as about two weeks ago. The airlines people mentioned having success with were Delta and American, though it's possible that others would work as well depending on how they code the purchase. Since these are technically excluded, there's no guarantee this will work.

The biggest issue is that if the credit doesn't automatically apply, I wouldn't expect Taylor to have much luck getting an Amex representative to manually issue it given the specific exclusion of mileage points purchases. This is just like the gift card loophole — it worked for a long time, but when it suddenly stopped working people who didn't receive the credit had no recourse with Amex since gift cards had always been explicitly excluded.

Related: Maximizing benefits with the Amex Platinum card

Bottom line

Taylor should be able to get about 10,000 miles give or take by buying a mileage booster with his preferred airline, in this case Delta . However, this is not the best redemption value, so he'll want to weigh this heavily when the annual fee comes due next year and he needs to decide whether to keep or cancel the card.

If you have an Amex Platinum (including The Business Platinum Card® from American Express) or Amex Gold and are struggling to use your annual airline fee credit, one popular use that is entirely within the published terms and conditions of the benefit is to spend your credit on seat selection, specifically on upgrading to premium economy. While "upgrades" are excluded from the list of eligible charges, many airlines still allow you to "upgrade" to premium economy simply by paying to select a seat in that cabin. At the end of the day, it's all about how your charge is coded when it's submitted to Amex.

Thanks for the question, Taylor, and if you're a TPG reader who'd like us to answer a question of your own, tweet us at @thepointsguy , message us on Facebook or email us at [email protected] .

- Travel Planning Center

- Ticket Changes & Refunds

- Airline Partners

- Check-in & Security

- Delta Sky Club®

- Airport Maps & Locations

- Flight Deals

- Flight Schedules

- Destinations

- Onboard Experience

- Delta Cruises

- Delta Vacations

- Delta Car Rentals

- Delta Stays

- In-Flight Wi-Fi

- Delta Trip Protection

- How to Earn Miles

- How to Use Miles

- Buy or Transfer Miles

- Travel with Miles

- SkyMiles Partners & Offers

- SkyMiles Award Deals

- SkyMiles Credit Cards

- SkyMiles Airline Partners

- SkyMiles Program Overview

- How to Get Medallion Status

- Benefits at Each Tier

- News & Updates

- Help Center

- Travel Planning FAQs

- Certificates & eCredits

- Accessible Travel Services

- Child & Infant Travel

- Special Circumstances

- SkyMiles Help

TakeOff 15: Delta SkyMiles® American Express Card Member Benefit

TakeOff 15 is an exciting Card benefit exclusively for Delta SkyMiles Gold, Gold Business, Platinum, Platinum Business, Reserve and Reserve Business American Express Card Members. Card Members save 15% when booking Award Travel with miles on Delta flights when using delta.com or the Fly Delta app.* Anytime. Terms apply , Go to footer note .

*Discount not applicable to partner-operated flights or to taxes and fees.

In-page Links

- Current Delta SkyMiles® American Express Card Members , Go to footer note

- Not a Delta SkyMiles® American Express Cardholder? , Go to footer note

- Need to Make a Change to Your Award Travel Ticket? , Go to footer note

Current Card Members

Eligible Delta SkyMiles® Amex Card Members can enjoy 15% off Award Travel.* Anytime. Here’s how to take advantage of this Card benefit and travel more to the places you love. Terms apply , Go to footer note .

How To Get This Benefit:

- Search for Award Travel by selecting “Shop with Miles” in the search criteria on delta.com or in the Fly Delta app. Be sure to log into your SkyMiles account before searching for best results.

- Select an eligible flight. When you get to check out, you will see the miles savings applied for your itinerary.

- Use your Delta SkyMiles® American Express Card to earn miles with your Card on any taxes and fees for your itinerary.

*Discount not applicable to partner-operated flights or to taxes and fees.

Beach Getaway: 33,000 28,000 Miles + taxes & fees = 5,000 Miles saved with TakeOff 15.

**For example purposes only. Actual flight prices vary.

Not A Delta SkyMiles® American Express Card Member?

Become a Delta SkyMiles® American Express Card Member and start enjoying the TakeOff 15 Card Member benefit in addition to other benefits designed to elevate the way you travel.

Take 15% off when booking Award Travel with miles on Delta flights with your Delta SkyMiles® Gold, Gold Business, Platinum, Platinum Business, Reserve or Reserve Business American Express Card.*

View Terms , Go to footer note

While shopping for Award Travel on delta.com or in the Fly Delta app*:

- Before completing your purchase, you will see a personalized offer for the Delta SkyMiles® American Express Card.

- Apply for a Delta SkyMiles® American Express Card. Upon approval, use your new Card to pay applicable taxes and fees for your booking and start enjoying all your Card benefits. TakeOff 15 benefit will automatically be applied at check out for qualifying Award Travel.

Or, explore our New Card Member offers and choose the Card that’s right for you. Learn More , opens in a new window

*Terms apply. Discount not applicable to partner-operated flights or to taxes and fees.

Need to Make a Change to Your Award Travel Ticket?

Take advantage of this 15% savings when changing your Award Travel ticket with miles on Delta flights using delta.com or the Fly Delta app*.

- Log into your SkyMiles account and select your itinerary within My Trips. Select Modify Flights and proceed to search for alternative flights on delta.com or in the Fly Delta app.

- If your new flight qualifies for the TakeOff 15 benefit mileage savings*, you will see the savings automatically applied.

- Use your eligible Delta SkyMiles® American Express Card to pay for applicable taxes and fees for your booking.

*Discount not applicable to partner-operated flights or to taxes and fees

Terms and Conditions

Eligibility: Basic Delta SkyMiles Gold, Platinum and Reserve American Express Card Members, as well as Basic Delta SkyMiles Gold, Platinum and Reserve Business American Express Card Members (each, an “Eligible Card”), can get at least a fifteen percent (15%) discount off the mileage portion of an Award Ticket (the “TakeOff 15” benefit). Additional Card Members are not eligible.

Available only if entire itinerary is on Delta and Delta Connection® carrier-operated and ticketed flights booked at delta.com or the FlyDelta app. Not available on flights operated by other carriers. Not available for Pay with Miles, Miles + Cash, seat upgrades purchased after the initial flight booking, or other Delta products or services. Discount only applies to the mileage portion of the Award Ticket fare and does not apply to applicable taxes and fees which must be paid using the Eligible Card. Card Member must be logged-in to a SkyMiles account linked to an Eligible Card to receive the TakeOff 15 benefit discount. Mileage discount will be greater than or equal to 15% of the overall miles portion for the Award Ticket. An Award Ticket is a ticket issued by Delta pursuant to the SkyMiles Program Rules, by which SkyMiles members may redeem miles and pay applicable government-imposed taxes and fees in exchange for air transportation. All Award Ticket rules apply, as set forth on delta.com and in the specific terms incorporated into your Award Ticket. Award Travel is defined as travel using an Award Ticket. Award Travel seats are limited and may not be available on all flights or in all markets.

SkyMiles account balance must have sufficient miles for the entire Award Ticket(s) being purchased. TakeOff 15 benefit is not combinable with certificates, Delta eCredits, Delta Gift Cards, vouchers, or with any other discounts or promotional offers.

Award Ticket Taxes/Fees: Award Ticket taxes and fees include only U.S. excise and departure/arrival taxes, airport charges, segment fees, the September 11th Security Fee, and international taxes and fees normally included in the Award Ticket.

Award Ticket Cancellations and Changes: In the event of a voluntary cancellation of the Award Ticket to which the TakeOff 15 benefit was applied, redeemed miles will be redeposited into the Card Member’s SkyMiles account, except for Basic Economy tickets. Current Award Ticket redeposit fees apply. Basic Economy cancellations will result in cancellation charge assessed in miles, as outlined in fare rules. Remaining miles after deduction of the cancellation charge will be redeposited to Card Member’s SkyMiles account. There is no discount applicable to the cancellation charge.

If changing an Award Ticket after ticketing, discount is applied to the new Award Ticket (if eligible), and the difference in miles will be deducted from the Card Member’s SkyMiles account (if the new Award Ticket mileage amount is higher) or redeposited into the Card Member’s SkyMiles account (if the new Award Ticket mileage amount is lower). Basic Economy tickets are not eligible for voluntary changes. SkyMiles Member must be an active Basic Delta SkyMiles, Gold, Platinum or Reserve American Express Card Member or Basic Delta SkyMiles Gold, Platinum or Reserve Business American Express Card Member at time that the Award Ticket is changed to be eligible for the TakeOff 15 benefit on the changed Award Ticket.

Miscellaneous: All SkyMiles Program rules apply to SkyMiles Program membership, miles, offers, mile accrual, mile redemption, and travel benefits. To review the rules, please visit Program Rules. SkyMiles Program and offers are void where prohibited by law, and terms are subject to change without notice. Other restrictions apply.

- Investor Relations

- Business Travel

- Travel Agents

- Comment/Complaint

- Browser Compatibility

- Accessibility

- Booking Information

- Customer Commitment

- Tarmac Delay Plan

- Sustainability

- Contract of Carriage

- Cookies, Privacy & Security

- Human Trafficking Statement (PDF)

You are using an outdated browser. Please upgrade your browser to improve your experience.

Manage My Account

Help With My Account

Manage My Card

Help With My Card

Travel Services

Travel Benefits

Help With Travel

Insure Myself

Insure My Possessions

Help With Insurance

Benefits And Offers

Manage Membership

Corporate Payment Solutions

Accept Our Cards

Help With Business

Frequently Asked Questions

Top Actions

Top Questions

Discover how monthly routine expenses can take you further

With the american express ® platinum travel credit card., make the journey rewarding with exciting benefits as you use it for monthly expenses like utilities, insurance, groceries and more..

American Express ® Platinum Travel Credit Card

Simply enter your expenses in the fields below and see how your rewards add up.

Value of 4 bonus points earned basis annual spend on this platform. T&C 2

Airline: 15% off on Vistara + Lodging: 35,000 points on Premium Getaways + 30% off on Taj Suites + Access: Amex proprietary and domestic partner lounge + Amex Travel benefit worth ₹30,000. T&C 4

Exclusive 20% off on a joining fee of ₹250,000 of Quorum Club.T&C 7

15% off and 3X points on Herman Miller + 25% off on Tata CLiQ Luxury + Benefit from bonus points on Nature Morte + 40% off on Eco Rent A Car. T&C 8

Total Annual Benefit

Terms & Conditions apply 1. The above calculations have been made basis the Membership Rewards® points earned on your spends, Membership Rewards points earned on reaching spend criteria and Taj Experiences E-Gift Card: Get 1 Membership Rewards point on every ₹50 spends Get 15,000 Membership Rewards points on meeting ₹1.9 Lac spends in a card membership year Get additional 25,000 Membership Rewards points on meeting ₹4 Lac spends in a card membership year (Assuming 90% of spends on business as usual reward eligible categories and 10% of spends on non Membership Rewards point categories like Utility, Insurance etc.) 2. A Cardmember earns 3X points at merchants under the Reward Multiplier programme. 3. Lounge access limited to 8 complimentary visits per year(capped at 2 visits per quarter). Each visit costs Rs.750. 4. Welcome Gift of Membership Rewards points are redeemable for Flipkart vouchers or the ‘Pay with Points’ option on American Express Travel Online worth ₹3,000.

IMAGES

VIDEO

COMMENTS

From short flights to long hotel stays, you can use Pay with Points for all or part of the purchase through AmexTravel.com. Or, earn 5X Membership Rewards points when you book with your Platinum Card. This includes up to $500,000 per calendar year on flights booked directly with airlines or through American Express Travel and eligible prepaid ...

Earn 80,000 Amex Membership Rewards points after you spend $8,000 on purchases on the card in your first six months of card membership. Earn 5 points per dollar for flights booked directly with airlines or with American Express Travel (on up to $500,000 on these purchases per calendar year, then 1 point per dollar) Earn 5 points per dollar on ...

The Amex Platinum offers 5x Membership Rewards points: On flights booked directly with airlines. On flights booked through Amex Travel. A few things to note about the 5x points on airfare purchases: You're capped at earning 5x points on up to $500,000 in flight purchases per calendar year (which shouldn't be an issue for a vast majority of ...

American Express Gold Card. American Express Platinum Reserve Credit Card. American Express Platinum Travel Credit Card. American Express Membership Rewards Credit Card. American Express SmartEarn Credit Card. Earn 2X points with. Shop, dine, travel with your favorite brands & earn extra reward points every time you pay using your AmEx card.

1. 5x Membership Rewards Points. You will get one point for each dollar charged for an eligible purchase on your Platinum Card from American Express. You will get 4 additional points (for a total of 5 points) for each dollar spent on eligible air and hotel purchases. Eligible air purchases are purchases of scheduled flights made directly with a ...

Use the airline fee credit to pay for checked bags, prepay for a seat or buy lounge passes. If you're able to use up all $200 each year you're a card member, it helps offset the card's high ...

Booking this same $300 Delta flight with the Amex Platinum Card would net you 1,500 Membership Rewards points with the 5x multiplier.And you could turn around and transfer those points right back to your Delta SkyMiles account because Membership Rewards points transfer to Delta SkyMiles at a 1:1 ratio - 1 point gets you 1 Delta SkyMile.

And if you're new to the Amex Platinum, you can earn a generous welcome offer: a sizable 100,000 Membership Rewards points after spending $6,000 in purchases within your first six months of card membership. But the truly unique element of the offer is a bonus multiplier on non-travel items.

Current Amex Platinum offer. Currently, there's a 80,000-point welcome offer after you spend $8,000 in the first six months of card membership. TPG values Membership Rewards points at 2 cents each, making this welcome offer worth $1,600. That is nearly three times the card's $695 annual fee, so at the very least, you can justify carrying the ...

For the trip cancellation and interruption insurance coverage benefit of The Platinum Card® from American Express, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card.

The Platinum Card® from American Express provides a slew of travel benefits — including access to over 1,400 airport lounges and up to $200 in Uber cash each year. Among these marquee benefits ...

If you're a frequent traveler, The Platinum Card® from American Express might be worth considering. This luxury travel credit card offers a range of benefits, including high rewards on airfare and select travel purchases, over $1,400 in annual credits, access to exclusive airport lounges worldwide, complimentary elite status with hotels and car rental agencies, and many other luxury perks.

Because it offers so much, it also has some underrated perks that can get lost in the shuffle. 1. Bonus points on airfare. The Platinum Card® from American Express isn't known as a great card for ...

You book a Fine Hotels + Resorts® property through AmexTravel.com — and you earn 5X Membership Rewards® points. You also save by receiving your $200 Hotel Credit (up to $200/year back) because you booked a prepaid Fine Hotels + Resorts® stay through AmexTravel.com using your Platinum Card®. The Hotel Collection requires a minimum two ...

American Express Reward Multiplier March 2024 Update - Check out all latest monthly reward multiplier offers here. Card Categories. All Categories; Best Credit Cards ; ... American Express Platinum Travel Credit Card: 3x: 2 points per Rs. 50 spent: 1 point per ₹50 spent: 3 points per ₹50 spent: American Express Gold Card: 5x:

The Capital One Venture X Rewards Credit Card earns 2x miles on everyday purchases and 10x miles on hotels and rental cars booked through Capital One Travel. The American Express® Gold Card earns ...

I have reviewed the other AMEX cards like AMEX Gold Charge and AMEX MRCC here. Let's check out what is so tempting about this card! 1 Charges and Welcome Benefits. 2 Regular Reward Accrual. 3 Milestone Benefits. 4 AMEX Reward Multiplier. 5 Reward Redemption. 5.1 Statement Credit/ Pay with Points. 5.2 Travel With Points.

Usually, you earn 5X Points on the Platinum and Gold cards, 3X Points on Platinum Reserve and Platinum Travel Credit cards, and 2X points on other American Express Proprietary cards. American Express, however, frequently runs offers on the Reward Multiplier program, allowing you to earn even more Membership Reward Points.

Platinum isn't a great rewards card, and it wasn't meant to be. It's an easy way to buy basic hotel and rental car status, access to lounges, etc. so that if you travel a lot, your travels are a bit more comfortable. The card is meant for the non-business traveler who will never travel enough to get elite status otherwise.

Concierge). I talked to a Amex executive (just a friend) and jokingly told him to tell the ceo to allow Airbnb with their 5x multiplier.. he surprisingly commented, "why don't you just book the Airbnb thru the concierge/travel team so you get the multiplier?". Now he doesn't work on the points/travel side of Amex but he is high up and I ...

When it comes to the Amex Platinum card, the $200 annual airline fee credit is poorly defined. While there isn't a clear list of which charges are eligible, the terms and conditions specifically exclude the following types of purchases: "Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free ...

Experience the latest shows, audiobooks, music, news and recipes. Get up to $20 in statement credits each month when you use your Platinum Card ® for eligible purchases on Audible, Disney+, The Disney Bundle, ESPN+, Hulu, Peacock, SiriusXM, and The New York Times when you purchase directly from one or more of the providers. This can be an annual savings of up to $240.

Delta SkyMiles® Platinum American Express Card: Earn 50,000 bonus miles after you spend $3,000 on your new card in your first six months of card membership. $350 annual fee (see rates and fees).

Terms and Conditions. Eligibility: Basic Delta SkyMiles Gold, Platinum and Reserve American Express Card Members, as well as Basic Delta SkyMiles Gold, Platinum and Reserve Business American Express Card Members (each, an "Eligible Card"), can get at least a fifteen percent (15%) discount off the mileage portion of an Award Ticket (the "TakeOff 15" benefit).

10X* on Centurion® & 5X* on Platinum with Reward Multiplier. 10X* on Centurion® & 5X* on Platinum with Reward Multiplier. Enjoy 10X* Centurion and 5X* on Platinum on 50+ brands like Apple, Croma, Flipkart, MakeMyTrip, M&S, Tanishq and many more. T&C Apply.