- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

The Best Group Travel Insurance Companies of 2024

Buying group travel insurance for a trip can financially protect you and your travel companions if the itinerary doesn’t go as planned.

Taylor Medine started blogging about her experiences stretching a dollar in 2013 as a recent college grad. Eventually, that passion grew into a career studying personal finance topics and demystifying them for people like her — the everyday consumer. When she’s not writing, you’ll find her hunting for travel deals or trying (and often failing) at a DIY project.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

Based on our research, Travelex is our top recommended travel insurer for groups thanks to its streamlined enrollment process, which covers up to 10 travelers under one application. Its affordable policies are also beneficial for parents traveling with children — adult policies include one child under age 17 without an extra premium.

If you’re traveling with others, you may benefit from buying group travel insurance. Group travel insurance bundles coverage between family or friends taking the same trip, offering more affordable policies and convenience for the whole group.

Can You Get Travel Insurance for a Group?

Yes, you can get travel insurance for a group, but group members must have similar travel itineraries. Many travel insurance websites let you pull quotes and purchase group travel insurance plans online. Group coverage can be for family members or between friends.

Group travel insurance typically covers emergency medical expenses and evacuations, luggage loss or delay and cancellations due to sickness or death. Groups can also choose to tack on add-ons such as Cancel-for-any-reason (CFAR) coverage.

Top 7 Best Travel Insurance Group Travel Insurance Companies

Here are our top picks for companies that offer group travel insurance:

- Travelex : Our pick for families

- Faye: Our pick for an all-online experience

- Seven Corners : Our pick for international travelers

- Nationwide: Our pick for cruise travel

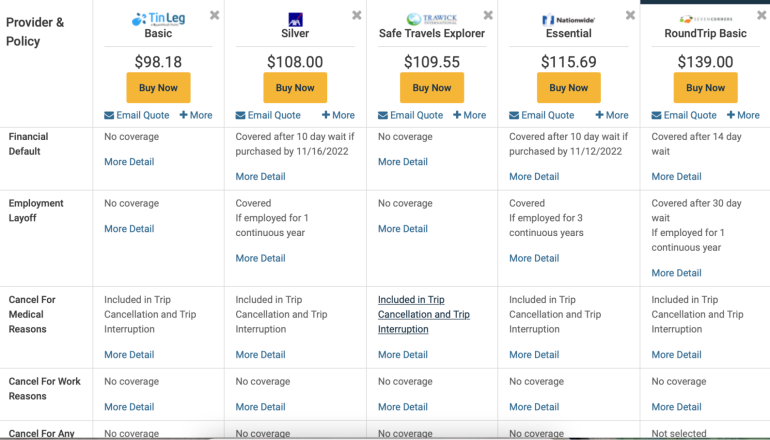

- Tin Leg: Our pick for customizable coverage

- AXA: Our pick for leisure travelers

- Allianz Global Assistance: Our pick for concierge services

We created a hypothetical group trip to gain an estimate of costs for each insurer. We based our cost analysis on a group of 10 traveling from Massachusetts to the Dominican Republic for two weeks in June. Five travelers are 34 years old, and five travelers are 40. The trip costs $2,500 per person or $25,000 total.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Compare Travel Insurance Companies For A Group

Pros & Cons

Travelex is Our pick for families for group travel insurance. With a Travelex plan, you can cover up to ten people in your group under a single plan. This simplifies the enrollment and claims process and can help you save money compared to purchasing plans individually. Additionally, adults with a travel plan receive coverage for children under 17 for no additional cost.

Travelex also offers a flexible cancellation policy, cancel for any reason coverage worth up to 75% of trip costs, and several plan add-ons.

Add-on options

- Adventure sports coverage

- CFAR coverage (up to 75% of trip costs)

- AD&D and medical benefit upgrades

- Car rental collision

Faye Travel Insurance made our list of the best group travel insurance providers thanks to its convenient application process. With Faye’s automated underwriting, most applicants can buy travel insurance for a group in less than 10 minutes. You just have to enter each person’s email and date of birth to see group pricing.

You can adjust pricing data and add optional coverages from the purchase page, making Faye a good choice for quick, convenient quotes. If your trip is interrupted, Faye offers unique add-ons that suit a range of traveler needs, including rental car and pet coverage.

Add-on options

Faye travel insurance offers the following add-on options for group policies:

- Cancel for any reason (CFAR) coverage

- Rental car coverage

- Adventure and extreme sports protection

- Vacation rental damage protection

A group of 10 travelers taking a 14-day trip to the Dominican Republic valued at $10,000 can expect to pay $977 for coverage, which averages out to $98 per traveler.

We like Seven Corners coverage for international travel because even the most basic policies let you add Cancel for Any Reason (CFAR) coverage. This gives you the flexibility to call off a trip and get reimbursed for reasons not typically covered by insurance, like work or school obligations. For big groups putting down a large deposit on a getaway, this coverage can give you peace of mind.

Seven Corners also offers COVID-19 protections. For example, insurance coverage can reimburse you for medical costs if someone in the group catches COVID-19 during the trip. Seven Corners RoundTrip policies are underwritten by the United States Fire Insurance Company, which gets an A rating from AM Best.

Add-On Options

- Cancel for any reason coverage (CFAR)

- Trip interruption for any reason coverage

- Rental car damage coverage

- Sports and golf equipment coverage

Nationwide specializes in cruise travel insurance, a boon for groups taking to the high seas for a getaway. With cruise coverage, you can get reimbursed for costs incurred if a cruise line’s itinerary changes because of fire, mechanical problems or other issues.

Aside from those cruise-specific coverages, Nationwide provides other basic travel protections for emergency medical expenses and lost, stolen or delayed baggage problems. Nationwide policies don’t come with special pandemic coverage that some other insurers on our list, but they have medical expenses and cancellation coverages, which could pay medical costs and prepaid travel costs if you get sick while on your cruise.

You may be able to include the following add-ons to your policy:

- Cancel for any reason coverage (higher level plans)

- Rental car collision and loss coverage

- Accident death and dismemberment coverage

Tin Leg offers a variety of policies, giving passengers the ability to highly customize their trip insurance.

For example, the Tin Leg Adventure policy protects from sport-related problems, like lost equipment, equipment delivery delays and canceled sporting events fees. A policy like this can make sense if you’re planning a group golf or fishing trip, for example.

Different companies underwrite Tin Leg policies, and the AM Best rating for those companies varies. Berkshire Hathaway Speciality Insurance is one underwriter, and it has an A++ (Superior) AM Best financial strength rating. Spinnaker Insurance Company is another underwriter with an A- rating.

You may be able to include the following add-ons to premium policies:

- CFAR coverage

AXA offers one of the most affordable plans on our list, ideal for leisure and budget travelers. Basic insurance comes with trip cancellation and interruption coverage, plus protections for medical emergencies.

Cancel for any reason insurance isn’t available in AXA’s Silver policy plan, the cheapest travel insurance option. CFAR becomes an add-on option if you upgrade to a Platinum policy, but that costs more. In our trip scenario, the policy rate increased by more than 50% when pivoting from the Silver to the Platinum package.

Customizable add-ons are available if you upgrade from basic AXA coverage to more premium policies. With a premium plan, these add-ons may be an option:

- Collision damage waiver

Allianz Global Assistance is a popular travel insurance provider that serves more than 55 million customers. We like that Allianz Global Assistance provides a 24-hour concierge service you can use to plan trip events, make reservations and more.

Basic plans also come with pandemic coverage, so you won’t lose all your trip costs if you come down with COVID-19 before or during the trip. CFAR insurance is an add-on option if you upgrade to the company’s OneTime Prime or OneTime Premier plans.

- Rental car protection

- Cancel for any reason coverage (higher-level plans)

What Do Group Travel Insurance Policies Cover?

Travel insurance is financial protection you can buy to mitigate the risks associated with travel. It typically covers a range of potential mishaps, such as trip cancellations and lost baggage . Policies compensate you for non-refundable trip expenses, medical emergencies and evacuations. What is coverage and what is not depends on your specific policy details.

Some groups considering travel insurance may like the reassurance that their financial investment is protected in the face of unforeseen events. Group travel involves coordinating the plans and schedules of multiple people, making it more susceptible to disruptions caused by illness, flight delays and other unexpected incidents. Travel insurance can offer peace of mind by providing financial protection and streamlining the process of addressing unforeseen challenges.

Travel insurance coverage includes multiple types of protections, depending on the insurer. Common coverages include:

- Trip cancellation: Group travel insurance often includes trip cancellation as base coverage, reimbursing the costs of your prepaid, non-refundable trip expenses in case of an unforeseen event. To qualify for this coverage, a group member must suffer a qualifying event as named in the policy, like a storm causing a flight cancellation.

- Emergency medical: Depending on your health insurance provider, you could be liable for a percentage of any hospital bills you incur if injured outside the U.S. Emergency medical protection ensures that group members receive medical assistance and coverage for unexpected medical expenses while traveling. It covers illnesses, injuries, hospitalization and emergency medical evacuations.

- Travel delay : Insurance can compensate for additional expenses (accommodations, meals and transportation) incurred because of a covered delay, such as flight cancellations or severe weather waits for a cruise.

- Evacuation: Emergency evacuation coverage is important in remote and international destinations. It covers the costs of medically necessary evacuations, such as airlifting travelers to the nearest suitable medical facility if appropriate care is not available locally.

- Trip interruption: If your group’s trip is cut short because of unforeseen circumstances, such as a family emergency or severe illness, trip interruption coverage can help reimburse the unused portions of your trip. It can also cover the cost of booking new flights home, which is why it usually has a higher coverage percentage than cancellation coverage.

- CFAR coverage: CFAR coverage is an add-on that provides flexibility to cancel your trip for reasons outside those listed in your policy. While it often comes at an additional cost, CFAR allows you to recoup a significant portion of your prepaid expenses if you decide not to travel for personal reasons, providing an exceptionally high benefit for expensive group trips.

Common Add-ons

Add-ons for travel insurance can vary, but some may include:

- Accidental death and dismemberment coverage

- Sporting and golf equipment coverage

Considering COVID-19

We still live in a world where COVID-19 is an active virus that could throw a wrench into travel plans. Travel insurance may cover your group members if their trip is canceled or interrupted due to a medical illness, such as catching COVID-19. However, canceling due to fear of travel alone may not be covered. Reading the terms of your policy can help you understand how you’re protected.

How Much Does Group Travel Insurance Cost?

According to our research, the average cost of a travel insurance policy for groups is $335. However, the actual cost of your group plan may vary based on the number of travelers, traveler ages, destination, total trip cost and provider chosen.

Use the calculator below to help estimate the cost of your group’s travel insurance policy.

Factors Impact The Cost of Group Travel Insurance Cost

Many factors affect the cost of a group travel insurance policy, including:

- The number of people: The number of people traveling is the primary influence of price. For every person included in the policy, the insurer takes on a new level of risk by providing all travelers with individual protections. You can expect to receive a general discount for every traveler you add, but the overall cost goes up as your group size increases.

- The magnitude of the trip: The duration of your trip also adds more risk to the insurance provider, increasing costs. The longer your trip, the more opportunities for something to go wrong. If you’re traveling to a remote location where medical or political evacuation may be more likely, you can expect to pay more for travel insurance.

- The cost of the trip: Like individual travel insurance, your trip cost directly affects the coverage price. Trip cancellation and interruption levels depend on each individual’s non-refundable expenses. As individual trip costs increase, the total price of your trip coverage also increases.

Buying travel insurance as a group presents opportunities to save on individual coverage, but you can follow a few strategies to lower costs even more. Start by collecting quotes from each of the top group insurers on our list to see which offers the most affordable policy . Because of differences in underwriting processes, finding the same coverage at different prices between insurers is possible.

Tailoring the insurance plan to meet your group’s specific requirements is another good tactic that allows you to avoid unnecessary expenses and find adequate coverage. Weigh if you need any add-on coverages, and consider medical-only coverage if your group is less concerned about cancellations and interruptions. For frequent travelers, looking at annual policies covering multiple trips is a cost-effective alternative to buying separate policies for each journey.

Is Group Travel Insurance Worth It?

Getting group travel insurance with people sharing the same itinerary and travel reservations can make sense. Managing one policy can be convenient, and you’re aware that each person you’re responsible for on the trip has adequate protection.

For friends, students , and extended family coming from different places and meeting up at a location at different times, you’re better off going with separate coverage. That’s because you need to provide similar travel dates and the same trip destination to get a quote. And from a planning standpoint, it would likely be easier to manage policies for separate itineraries individually.

Frequently Asked Questions About Group Travel Insurance

Is it better to buy travel insurance as a group or individual.

It depends on your travel plans. If you’re traveling in a group with shared plans, buying group travel insurance can be an affordable and easy way to obtain coverage.

For people traveling from separate locations with different itineraries, getting individual policies is a better way to get the best coverage for everyone going on the trip.

What is group travel insurance?

Group travel insurance policies are travel insurance policies that cover several members, such as 10 or more, taking a trip together.

What is the difference between group travel insurance and individual travel insurance?

Group travel insurance policies are for larger groups. An individual travel insurance policy can cover you and other travelers, like your children or your partner — but it doesn’t cover members of a larger party like group travel insurance does.

Is it cheaper to get travel insurance as a group?

It depends. Factors like the trip cost and how many people are going can all contribute to the price. Comparing rates with different providers can help you find the most affordable policy with coverage that’s sufficient for your getaway.

Other Insurance Resources From MarketWatch Guides

Gain insight into our ratings for the best home, renters, pet, travel or life insurance providers and find affordable recommendations for necessary insurance products.

- Prominent Pet Insurance Companies

- Premier Travel Insurance Companies

- Outstanding Homeowners Insurance Providers

- Top Renters Insurance Firms

- Budget-friendly Renters Insurance Providers

- National Term Life Insurance Providers

- Cost-effective Homeowners Insurance Companies

Methodology: Our System for Ranking the Best Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

More Travel Insurance Guides

- Best covid travel insurance companies

- Best cruise insurance plans

- Best travel insurance companies

- Cheapest travel insurance

- Health insurance for visitors to usa

- Best senior travel insurance

- Best travel insurance for families

- Best student travel insurance plans

- Travel insurance for parents visiting USA

- Best travel medical insurance plans

- How much does travel insurance cost?

If you have questions about this page, please reach out to our editors at [email protected] .

More Travel Insurance Resources

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best Family Travel Insurance Plans

Travelex Insurance Services »

Allianz Travel Insurance »

Seven Corners »

World Nomads Travel Insurance »

AIG Travel Guard »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Family Travel Insurance Plans.

Table of Contents

- Rating Details

- Travelex Insurance Services

- Allianz Travel Insurance

The best travel insurance plans can provide you with considerable peace of mind, but the real value comes into play when you wind up using your coverage. Hassles like flight delays, lost luggage and unexpected injuries can be stressful and traumatic, yet travel insurance can reimburse you for the financial costs associated with these mishaps.

If you are planning to travel with your entire family in tow, you already know that the stakes are higher and the potential for losses even greater. For example, you'll want to make sure children traveling with you have travel medical insurance as well as coverage for trip cancellations and interruptions.

You'll need to compare the best family travel insurance plans of 2023 if you want to find the right one for you and ensure each of your dependents is covered by your policy. U.S. News has compiled this guide to the best of the best when it comes to companies offering family travel insurance, since these top picks make it easy and affordable to add children to your plan.

- Seven Corners

- World Nomads Travel Insurance

- AIG Travel Guard

Best Family Travel Insurance Plans in Detail

Travel Select plan offers complimentary coverage for children 17 and younger

Primary coverage with no deductibles

Travel Select only includes up to $50,000 in protection for emergency medical expenses (optional upgrade available)

Meager policy limits ($200) for delayed baggage and sporting equipment

- Trip cancellation protection worth up to 100% of prepaid travel expenses (up to $50,000)

- Trip interruption coverage worth up to 150% (up to $75,000)

- Up to $2,000 ($250 per day) in coverage for trip delays

- $750 for missed connections

- $50,000 for emergency medical and dental expenses

- $500,000 in coverage for emergency medical evacuation and repatriation of remains

- $1,000 in insurance for baggage and personal effects

Single-trip travel insurance plans include free coverage for children ages 17 and younger

Allianz offers annual travel insurance plans for families

Not all plans cover kids for free

Get coverage for up to 10 people in a single policy

Generous policy limits for emergency medical expenses and evacuation

Kids aren't covered for free

Emergency dental coverage is capped at $750

- Trip cancellation coverage worth up to 100% of prepaid trip costs

- Trip interruption coverage up to 150%

- Trip delay coverage up to $2,000 ($250 per day)

- Up to $1,500 in protection for missed tours or cruise connections ($250 per day)

- Up to $500,000 in coverage for emergency medical expenses

- Up to $1 million in protection for emergency evacuation

Includes coverage for up to seven children on a single policy

Provides coverage for more than 200 adventure activities and sports

No free travel coverage for kids with paid adults

No option to customize coverage with CFAR protection

- Up to $100,000 in emergency medical insurance

- $500,000 in coverage for emergency medical evacuation

- $3,000 in insurance for lost baggage and belongings

- $10,000 in insurance for trip cancellation

Free coverage for one child 17 or younger with each paying adult relative on the plan

Choose from three tiers of travel protection based on your needs

Travel medical expense coverage is low ($15,000) with Essential plan

Essential plan also has low limits for baggage delays ($200) and lost or stolen luggage ($750)

- Up to 100% in coverage for trip cancellation

- 150% in coverage for trip interruption

- $1,000 in baggage insurance

- $300 in protection for baggage delays

- $50,000 in insurance for emergency medical expenses

- $500,000 in protection for medical evacuation

Family Travel Insurance: Coverages You'll Need

As you compare the best travel insurance plans for families, you might be wondering which types of coverage are most important. Ultimately, that depends on the cost of your trip, where you're traveling and the travel issues you worry about the most.

Frequent traveler Linda L. Adkins of Spokane, Washington, says she purchases travel insurance for every trip since her U.S.-based health insurance policy doesn't apply when her family travels overseas. She worries not only about emergency medical expenses that could come into play, but also about the high costs of medical evacuation if a family member needs to be transported a long distance or even back to the U.S.

Adkins has also endured scenarios where her luggage was temporarily lost by an airline while traveling internationally, and she says her delayed baggage benefit was useful when it came to purchasing clothing and toiletries. "I spent almost $100 per day for three days in a row while we waited for our bags," she says.

Adkins saved her receipts and received reimbursement through her travel insurance provider's baggage delay benefit.

U.S. News recommends having the following types of coverage (at a minimum) in place for every trip with kids:

- $50,000-plus in primary insurance per traveler for emergency medical expenses

- Coverage for COVID-19

- $100,000-plus in coverage for emergency medical evacuation

- Adequate protection for trip delays and lost or delayed baggage

Frequently Asked Questions

Credit card travel insurance can provide coverage for families, although the types and amounts of protection you receive can be limited. As an example, the Chase Sapphire Reserve credit card comes with trip cancellation coverage for up to $10,000 per person and up to $20,000 per covered trip, as well as lost luggage reimbursement worth up to $3,000 per passenger if the cardholder or an immediate family member has their luggage lost by a common carrier.

Fine print with the card also states that trip delay coverage can apply if common carrier travel gets delayed by more than six hours or requires an overnight stay, and that both the cardholder and their family members can be reimbursed up to $500 per ticket for incidental travel expenses including meals and lodging.

For credit card travel insurance to apply, the cardholder needs to pay for common carrier travel for all of their family members with the credit card in question. In other words, simply carrying a travel credit card with travel insurance benefits won't be enough.

Travel insurance plans are built to cover every person listed on the application for coverage. This means you can apply for travel insurance as an individual or as a family who wants all members covered under a single plan.

That said, some travel insurance plans are superior for families since they offer free coverage for dependents. Others offer comprehensive travel insurance policies that provide broad coverage for groups up to 10 people.

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, and she has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – in their family media business.

You might also be interested in:

The Best Travel Medical Insurance of 2024

Holly Johnson

Explore protection options for unexpected health issues abroad.

Flight Insurance: The 4 Best Options for 2023

Protect your flight (and peace of mind) with the top coverage plans.

Cruise Insurance: Why You Need It + 4 Best Options for 2024

Protect your cruise journey from start to finish (and ports along the way).

The 5 Best International Travel Insurance Companies for 2024

Find the best international travel insurance coverage for all your trips abroad.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

These are the 4 best family travel insurance plans

Find coverage that fits your family's travel plans with these four companies..

Family vacations are a special time, and ensuring they go smoothly is essential to making memories that will last forever. Travel insurance is one way to ensure that any bumps in the road can be smoothed over, from a lost bag to an injury abroad.

CNBC Select reviews the best travel insurance plans for families based on coverage, cost and plan variety. (See our methodology for more information on how we choose the best family travel insurance companies.)

Best family travel insurance

- Best for families with young children : Allianz

- Best for affordability : Faye

- Best for CFAR coverage : Travel Insured International

- Best for cruises : Berkshire Hathaway Travel Protection

Best for families with young children

Allianz travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

10 travel insurance plans make it possible to customize your coverage. For families, Allianz's OneTrip Prime package covers children age 17 and younger when traveling with a parent or grandparent.

24/7 assistance available

- Trip cancellation benefits can reimburse your prepaid, nonrefundable trip payments if you have to cancel your trip for one of the covered reasons stated in your plan documents.

- Limited coverage for risky sports

Who's this for? Allianz is great for families with young children as its OneTrip Prime travel insurance policy offers free coverage for children ages 17 or under when traveling with a parent or grandparent. Though this benefit isn't available to Pennsylvania residents, it could help families with younger children lower the cost of their travel insurance coverage.

Standout benefits: Allianz's cancel for any reason (CFAR) coverage has an enhanced version available that can cover up to 80% of trip expenses if you have to cancel for a reason that's not covered.

[ Jump to more details ]

Best for affordability

Faye travel insurance.

Faye offers travel insurance with a convenient online buying experience and an app with real-time travel alerts. It's one simple plan includes coverage for common issues, like trip cancellation, emergency medical expenses and trip delay coverage. It also offers coverage for pre-existing medical conditions when plans are purchased within 14 days of an initial trip deposit.

- Covers Covid like any other medical condition

- CFAR is available for up to 75% of trip costs for an additional cost.

- Additional coverage options like vacation rental damage coverage and pet care coverage.

- Not all benefits are available in all states.

Who's this for? Faye travel insurance stands out for families on a budget. Its policies start at just $4.64 per day (for 14 days) for domestic trips and $5.16 per day (for 14 days) for international trips. It's also great for those who want a completely digital experience and would rather manage a policy through an app than an agent or by phone.

Standout benefits: Faye's intuitive interface makes it easy to get travel insurance coverage on your own time, and quotes are available entirely online. On top of the standard trip delay, cancellation and interruption coverage, you can purchase CFAR coverage, coverage for adventure and sports activities and a pet care add-on, which can cover illness or injury for your pet when traveling with you, or extra kenneling costs if your trip is delayed if you leave your pet at home.

Best for CFAR coverage

Travel insured international travel insurance.

Travel Insured International has two simple travel insurance plans — the Worldwide Trip Protector and Worldwide Trip Protector Gold. Its plans are affordable and offer the option of cancel for any reason (CFAR) coverage.

- Optional CFAR coverage and interruption for any reason coverage

- Medical coverage can be lower than other options

Who's this for? Travel Insured International could be a great fit for families looking for the flexibility of a CFAR addition to ensure they'll be covered for any reason they need to cancel. The company's wide variety of reasons for cancellation includes coverage for school year extensions with all plans.

Standout benefits: Travel Insured International's Worldwide Trip Protector can cover all children 17 and under for free when traveling with related adults.

Best for cruises

Berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection has multiple plans to cover vacations from luxury travel to adventure travel. The brand's LuxuryCare offers the highest limits of travel insurance coverage offered by the company. Quotes and policies are available online.

- Wide variety of policies available

- Strong financial strength rating by AM Best

- Cancel for any reason only provides reimbursement for up to 50% of non-refundable trip payments

Who's this for? Berkshire Hathaway Travel Protection offers cruise-specific packages for families setting sail on a cruise.

Standout benefits: Cruise plans include coverage for missed connections and unique challenges you could face on a cruise vacation, like cruise disablement and diversion.

More on our top family travel insurance companies

Allianz offers 10 different travel insurance policies for travelers and trips of all types, including single-trip and multi-trip coverage. It also offers quotes and claims online, making the experience simple.

CFAR coverage available?

Yes, up to 80% of prepaid, non-refundable trip costs

24/7 assistance?

[ Return to summary ]

While relatively new to the space, Faye's travel insurance plans combine affordability and easy access. Policies are backed by the United States Fire Insurance Company.

Yes, up to 75% of prepaid, non-refundable trip costs

Travel Insured International

Travel Insured International has been offering travel insurance for over 25 years. It has two tiers of coverage (available in most states) that can help you meet all your travel protection needs.

Berkshire Hathaway Travel Protection

Berkshire Hathaway Travel Protection offers several tiers of travel protection and insurance, including packages specifically designed for road trips and cruises. Its strong A++ financial strength rating also helps it stand out against the competition.

Up to 50%, only available on LuxuryCare packages

Does travel insurance cover family members?

Generally, you can insure your whole family on one travel insurance plan, so you won't have to buy separate plans for every traveler. Your travel insurance plan will cover every person listed on the policy.

Does travel insurance cover cancellation due to a death in the family?

In many cases, travel insurance can help you recoup the cost of your vacation if you have to cancel due to a death in your family. However, you'll want to carefully read your policy's definition of a family member, as not everyone in your life could be included.

Bottom line

A family vacation can be a big investment, so it's important to protect yourself in case anything goes awry. Having a travel insurance plan that's easy to access, provides 24/7 support and fits your specific travel concerns and budget can help ensure your trip will go smoothly.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every travel insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of travel insurance products. To research the best travel insurance companies, we compiled over 100 data points on more than a dozen travel insurance companies. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. See our methodology for more information on how we choose the best travel insurance companies.

Our methodology

To determine the best travel insurance companies, CNBC Select analyzed dozens of travel insurance companies and compared them based on various factors.

While narrowing down the best travel insurance companies, we focused on the number of plans available, the availability of 24/7 assistance to access while traveling, coverage for Covid-19, the availability of cancel for any reason coverage, and financial strength (which measures a company's ability to pay on contracts) using A.M. Best ratings. We also considered family-friendly features, such as the inclusion of children on policies for free with parent's coverage, and reasons for cancellation, including school year extension as a reason for cancellation.

Note that the premiums and policy structures advertised for travel insurance companies are subject to fluctuate in accordance with the company's policies.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- These are the best homeowners insurance companies in Florida Liz Knueven

- First-time homebuyer grants: What you need to know Kelsey Neubauer

- Earn elevated perks during Amex's Platinum Card anniversary celebration Andreina Rodriguez

What is group travel insurance?

- Do I need it?

What does group travel insurance cover?

- How to get the best deal

What is group travel insurance, and should you get it instead of a regular travel insurance policy?

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

- Group travel insurance is a single policy that covers groups of 10 or more.

- Everyone in the group must have the same itinerary and travel to the same destination.

- Shop early and compare quotes to get the best deal.

Whether you're preparing for a large family reunion in another state, booking a business trip with colleagues, or traveling with your college crew to a new country, you might want to consider group travel insurance for the entire traveling party.

Here's what you need to know about group travel insurance — how to determine if you need it, different options, and tips to secure the best deal.

Group travel insurance is a single travel insurance policy that protects everyone on a trip. Group travel insurance policies are available for groups of 10 or more. Unlike other insurance policies that only cover one person or one family, group travel insurance can cover any group traveling together. You do not have to be related.

Group travel insurance policies usually offer comprehensive coverage, including standard protections against lost luggage, legal fees, medical emergencies, trip cancellations, and more.

The coverage you select applies to everyone in the group. Each group member can make individual claims, which is helpful if only one or two people need to make a claim. But if everyone is involved, the entire group can file claims.

Do I need group travel insurance?

Group travel insurance might make sense if everyone in your group has the same itinerary and travels to the same destination. The main perk of group travel insurance versus separate policies for each person is that it streamlines the purchasing process. You can buy one policy instead of multiple. Plus, it might be cheaper.

But to make it work, your group needs to be organized. This is especially true if group members intend to split the cost of the policy. It's crucial to communicate well with the people in your group and ensure everyone is on the same page.

Also note that there are many credit cards with travel insurance , though it won't cover everyone in a large traveling group. But if you're on the fence about travel insurance to begin with, paying for your travel with a card that offers some coverage is a good solution.

Most group travel insurance policies offer comprehensive coverage. Comprehensive policies usually cover common travel issues like cancellations and medical emergencies.

Here's the coverage you can typically expect from a comprehensive group travel insurance policy.

- Trip cancellation insurance: If you need to cancel your trip, this coverage reimburses you for the cost of travel. Each policy includes a list of cancellation reasons that are covered.

- Travel insurance for baggage: This covers the cost of stolen or missing luggage.

- Emergency medical evacuation insurance: Covers the cost of transportation from one location to another due to an emergency medical situation.

- Travel medical insurance: If you need medical care due to illness or injury while you're traveling, this part of the policy covers the cost.

- Trip interruption travel insurance: If you have to cut your trip short due to an unforeseen emergency, this helps pay for travel plan changes.

- Trip delay travel insurance: If there are delays to your flight or another aspect of your trip, this covers extra costs associated with the delay. It might include reimbursement for meals or hotel expenses.

How to get the best deal on group travel insurance

Depending on the details of your trip, group travel insurance might be cheaper than purchasing individual policies for each traveler. But that is not always the case.

As you shop for group travel insurance, there are steps you can take to ensure you get the best deal.

Get multiple quotes

It's smart to get quotes from several providers so you can compare coverage options and pricing. You can use a travel insurance comparison site like SquareMouth or TravelInsurance.com, or you contact providers directly. Once you know the price range for protection, you can select the provider that seems like the best fit.

Last-minute travel coverage is usually more expensive than shopping in advance. As soon as you know the itinerary and have your travel booked, start looking for coverage to find the best deal. Plus, your policy kicks in right away, which is helpful if an event occurs in the lead-up to a trip.

Understand the coverage

Dig through the policy details, including coverage details and deductibles. If you don't need specific coverage, ask if you can remove it. Similarly, you might be able to raise your deductible and lower your premium. But it's essential to ensure you can afford the deductible amount if you need to file a claim.

Group travel insurance frequently asked questions

Group travel insurance is a single policy that covers 10 or more people traveling together. Group members can file individual claims, but everyone on the policy has the same protection, and there's one price for the coverage. Individual travel insurance covers one person or one family. The coverage options are similar for both.

Individual travel insurance policies cover one person. You can usually add immediate family members like your spouse or children to the policy. Group travel insurance covers groups of 10 or more.

Multi-trip insurance, also called annual travel insurance , is a travel insurance policy covering every trip you take in one year. It's an annual policy that only protects the policyholder.

Most of the top travel insurance companies offer group policies, including Allianz Travel Insurance , AXA Travel Insurance , Seven Corners Travel Insurance , and Tin Leg Travel Insurance . If you don't have a particular provider in mind, consider using a site like SquareMouth that compares quotes from multiple insurers.

- Main content

Our products and plans are tailored to fit your needs based on your country of residence. If you are not a US resident, please select your country of residence below to receive travel insurance plans tailored to your needs.

Not a US Resident?

Welcome to Advisor Connect (formerly Agentlink). Log into our new user-friendly travel insurance plan booking platform. This enhanced platform has a full suite of tools designed to help our travel advisors and other Travel Guard partners quote and offer travel insurance plans to clients.

If you are having problems logging in or can’t remember your username or password, please contact our Travel Guard Tech Support at 866-729-5215; Monday - Friday 7 a.m. to 6 p.m. CDT.

The California Consumer Privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A “sale” is the exchange of personal information for payment or other valuable consideration and includes certain advertising and analytics practices. “Sharing” means the disclosure of personal information for behavioral advertising purposes, where the information used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to access our website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we use to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Policy .

We have received your request to opt out of the sale/sharing of personal information..

More information about our privacy practices.

‹ Traveler Types

Family Travel Insurance Plans

Understand the importance of family travel insurance plans for your next vacation and make sure you’re covered with the right Travel Guard® plan.

Traveling with your family is an amazing way to create lasting memories. While a travel insurance plan is important for any trip, it can be especially helpful when you’re traveling with kids or extended family members like grandma and grandpa. Coordinating schedules to plan your family vacation is hard enough, let a Travel Guard travel insurance plan help protect your travel investment so you can focus on the fun.

Ready to book your family travel?

Travel Guard’s award-winning travel insurance plans provide excellent coverage options and access to 24-hour emergency travel assistance. Compare our travel insurance plans to find the best option for your family travel. Get travel insurance the way you want it!

What is a family travel insurance plan?

Family travel insurance plans offer the coverage and benefit limits you need for all of your family members. Every family is unique, and there’s no one-size-fits-all travel insurance plan for every family. That’s why Travel Guard travel insurance plans offer customizable options so you can build the plan that works best for your family.

What does a family travel insurance plan cover?

Look for a plan that has the coverage and benefit limits your family needs. Popular plan features include:

- Medical expense coverage

- Pre-existing medical condition exclusion waiver – great if you’re traveling with grandparents or family members who may have health conditions (if purchased within 15 days of initial trip deposit)

- Trip cancellation/interruption coverage

- Missed flight connection assistance

- Baggage coverage

- Car rental coverage (optional add-on coverage)

- Cancel For Any Reason (optional add-on coverage available with certain plans)

- Pet bundle – traveling with your furry family members, make sure they have coverage too (optional add-on coverage available with certain plans)

- Emergency travel assistance – specialized representatives are available 24/7 to help

Do I need a family travel insurance plan?

For any trip, it’s smart to protect your travel investment, but when you’re traveling with your family it can be even more important. Traveling with multiple family members can mean increased flight and hotel costs as well as more opportunities for the unexpected to arise. All of Travel Guard’s travel insurance plans come with access to our specially trained representatives for 24/7 emergency travel assistance . Our staff can help with anything from rebooking missed flights to finding quality medical care while you’re traveling – so you can focus on family. We know you have enough to worry about when traveling with family, let Travel Guard help with the unexpected.

Which Travel Guard travel insurance plan is best for my family trip?

Travel Guard’s Preferred Plan is a great option for families traveling together. With the most optional add-on coverages available, our Preferred Plan is customizable to fit your exact needs. If you’re traveling with grandparents or family members with health conditions, you might want to look at our Deluxe Plan , which offers the highest medical expense benefit limits.

Are kids included on Travel Guard travel insurance plans?

Travel Guard’s Deluxe , Preferred and Essential plans all include family coverage. One child who is age 17 or under, and is booked to travel with (and is related to) the primary adult named on the policy, is included in the rates for each paying adult. Note that this does not apply to optional coverages, and the child’s trip cost must be equal to or less than the adult traveler(s) trip cost.

Do family travel insurance plans cover individuals?

Your family travel insurance plan will cover any of the individuals on your policy. Benefit limits are listed at the maximum limit per insured. For example, if the plan lists $50,000 in medical expense coverage on your schedule of benefits, you will have up to $50,000 in coverage for each individual covered under the policy.

Why book your family travel insurance plan through Travel Guard?

Travel Guard is one of the world’s leading travel insurance providers with a network of service centers located in Asia, Europe and the Americas, ensuring the highest quality emergency travel services and medical assistance while you’re traveling. With early purchase benefits and optional add-on coverages, you can customize the plan and coverages you need for your family.

Get travel insurance the way you want it!

Reviews and testimonials.

“I travel often, for business and pleasure. I will never travel again without travel insurance.”

Last year I traveled with my daughter, who is an athlete who competes in tournaments worldwide. I had not purchased travel insurance, and she was injured, requiring a hospital visit. It was a nightmare when we returned, and I tried to get reimbursed through her health care provider for an out-of-network, out-of-country, hospital visit. This year, I purchased travel insurance for us both through Travel Guard – but for me it was just an after-thought – it never occurred to me that I would need it. Just three days into a 10-day trip to London, I received news that my father was placed in hospice and had little time to live. I immediately made arrangements to return to the U.S. with the assistance of my agent, who was great at finding me a flight and making all the arrangements for my return. The claim process was very easy for that emergency travel. I travel often, for business and pleasure. I will never travel again without travel insurance. It really gives you peace of mind that you can return, if necessary, without any hassle or delay

- Elizabeth, GA.

Discover more about family travel

Destination guides.

Travel Safety

Travel News

Call us at: 800-826-5248

Travel Guard on Facebook Travel Guard on LinkedIn Travel Guard's You Tube Channel

Travel Insurance Education Center Our Plans Compare Plans Coverage Information Frequently Asked Questions Get a Quote Non-US Residents COVID Information

Traveler Resources Travel Safety Travel News Travel Tips

Travel Guard About Us Contact Us Press Releases Careers Sell Travel Guard Affiliate Program Media Contact

Self Service Help Center Get a Quote View My Policy Modify My Policy Cancellations & Refunds Claims Strike List Alert List Certificate of Insurance Library

Copyright © 2024, Travel Guard. Non insurance services are provided by Travel Guard. Terms of Use | Privacy Policy | Accessibility Statement | Our Underwriter | Do Not Sell or Share My Personal Information | About AIG Ads

Coverage available to U.S. residents of the U.S. states and District of Columbia only. This plan provides insurance coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of this policy with your existing life, health, home, and automobile insurance policies. If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc. (Travel Guard). California lic. no.0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, travelguard.com . CA DOI toll free number: 800-927-HELP . This is only a brief description of the coverage(s) available. The Policy will contain reductions, limitations, exclusions and termination provisions. Insurance underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., a Pennsylvania insurance company, with its principal place of business at 1271 Avenue of the Americas, 37th FL, New York, NY 10020-1304. It is currently authorized to transact business in all states and the District of Columbia. NAIC No. 19445. Coverage may not be available in all states. Your travel retailer may not be licensed to sell insurance, and cannot answer technical questions about the benefits, exclusions, and conditions of this insurance and cannot evaluate the adequacy of your existing insurance. The purchase of travel insurance is not required in order to purchase any other product or service from the Travel Retailer.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

5 Tips for Booking Group Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

1. Purchase early

2. get multiple quotes, 3. negotiate discounts, 4. opt for flexible insurance, 5. consider travel card travel insurance, types of travel insurance, if you want to book group travel insurance.

Are you planning a group travel event? Maybe you have a large family, or you’re heading to an event hosted by your employer. Whatever the case, you may be looking to purchase travel insurance for your time out of town; but since there are so many of you, it may make sense to purchase group travel insurance instead.

So, is it better to buy travel insurance as a group or individual? The short answer is that it depends.

If this is something you’re considering, read on to discover the different types of travel insurance, where to find group travel insurance plans and other tips for booking this type of insurance.

After you’ve figured out what you’re looking for, there are still a few things for you to consider before buying your insurance. Here are our top tips.

Navigating travel insurance can be overwhelming on its own and can be compounded when you’re traveling with a group. Since every traveler will have different needs, you’ll likely want to get the most comprehensive insurance available. That means buying early .

There are certain time limitations to specific types of insurance. Specifically, both pre-existing condition insurance and Cancel For Any Reason insurance are time sensitive.

Pre-existing medical condition insurance can generally be purchased from 10 to 21 days after first putting down a deposit on your trip.

Cancel For Any Reason insurance also typically needs to be purchased from 10 to 21 days after putting down your deposit.

After these time frames, these insurances become unavailable and anyone in your group needing them will have to look elsewhere.

You’ll also need to purchase travel insurance before an incident occurs. If you break your leg just before your trip but haven’t purchased insurance yet, it won’t cover the costs for cancellation.

Not only do travel insurance companies sell different types of insurance, but they price it differently as well. This is true for travel insurance for groups and individual insurance. This means you’ll want to get more than one quote for your travel insurance.

We tested the waters with our own search. In it, we put down a group of nine travelers heading overseas for a two-week vacation. The average cost for each traveler was $4,500 and their ages ranged from 35 to 55.

An insurance search comparison tool like Squaremouth can show you a variety of options for a given trip. In this example, it came back with a quote of $2,431 all-in. The other option we looked into, Seven Corners , returned a cost of $2,286.

» Learn more: How to find the best travel insurance

This tip is more applicable to those with larger groups or those who may be traveling more often. If, for example, you’re a corporate customer whose employer is planning on quite a few conferences, you’ll likely need to purchase group travel insurance more than once.

With the power of a crowd or the promise of additional business, you may want to consider contacting your travel insurance company directly to negotiate a better rate for your group.

» Learn more: What does travel insurance cover?

The needs of the many necessitate flexibility, and nowhere is this more evident than when trying to purchase a group travel insurance policy. We noted earlier that you’ll want to opt in early if you’re looking for the best coverage availability.

Because you’re traveling with a group, you’ll also want to choose insurance that gives you flexibility. This can come in many forms. Some insurances will provide you with reimbursement if you’re laid off, for example. Others will allow you to purchase an add-on that allows you to cancel for any reason.

It may be more expensive, but you’ll likely want to choose those additional coverages for your group insurance so that everyone is covered for a variety of incidents.

Finally, you’ll also want to consider flexibility when it comes to a return period. Insurance providers will generally offer money-back guarantees on their policies. The amount of time you’ll have to consider your decision will depend on your plan. This can range from 10 to 14 days, but it can span a longer period.

» Learn more: Is travel insurance worth it?

Did you know that many travel cards come with their own form of complimentary travel insurance? Coverage limits and types will depend on the card that you hold, but generally, you can expect to see things like rental car insurance, lost luggage insurance, trip cancellation insurance and trip delay insurance.

Your group may even be covered when an individual uses their card to pay for the trip. With the Chase Sapphire Reserve® , for example, the cardholder and their family members are all covered in the event something goes awry. Covered travelers include:

Stepparents.

Aunts and uncles.

Grandparents.

Legal guardians.

Nieces and nephews.

Parents and siblings.

That’s quite a range!

The Platinum Card® from American Express also features travel insurance, though its definitions for who is covered are even broader. You’ll still need to pay for the trip with your eligible card, but you, your family members and your traveling companions all qualify for this insurance.

Note that a traveling companion is someone who has made advanced arrangements with you or your family members to travel together on a covered trip. Terms apply.

However, before you go all-in on travel card insurance , you’ll want to review the coverage limits. With a large enough group, you may find that the complimentary insurance offered by your card isn’t sufficient for your needs.

» Learn more: The best travel credit cards right now

Before you begin searching for travel insurance, you’ll first want to figure out what you’re looking for. Different companies will sell different types of travel insurance with varying levels of coverage, and the price changes to match.

Most often, you can expect to find these varieties of travel insurance available for purchase:

Accidental death insurance .

Baggage delay and lost luggage insurance .

Cancel for Any Reason insurance .

Emergency evacuation insurance .

Medical insurance .

Rental car insurance .

Trip cancellation insurance .

Trip delay insurance .

Trip interruption insurance .

Most individuals purchase base level travel insurance coverage and then customize their plan to better fit their specific trip needs. Cancel For Any Reason insurance is a popular add-on; while it's an upcharge, it can help you get back up to 75% of your nonrefundable travel expenses.

Travel insurance can provide peace of mind when you’re away from home, and there’s no reason why groups shouldn’t want it, too. Before purchasing a group policy, make sure you’re getting multiple quotes and searching for flexible plans so that everyone has what they need.

Finally, check out your travel card to see if its complimentary insurance that fits with your travel plans.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Agent Information

Group travelers.

Travel is better together, and the best thing you can do for your group is to keep everyone safe and protected on your trip. Contact a Seven Corners licensed agent to get the best travel insurance for groups.

Lead Your Team with Confidence

From school trips to friends’ getaways to vacations with the entire extended family, travel insurance for groups is a must-have. Seven Corners can help everyone protect the money they’ve spent for their trip and be prepared in case of a medical emergency while traveling. When they’re relying on you, you can rely on us.

Protection Wherever Your Group Goes

Traveling outside the U.S. with your crew? You want travel medical insurance. Worried about cancellations and lost baggage, regardless of whether it’s a domestic or international trip? You want trip protection. We’ll help you get the right plan for your group on the go.

Protection for Your Trip Expenses

Protection for your health, protection for your belongings, political or security evacuation, natural disaster evacuation, 24/7 emergency travel assistance services, travel insurance tips.

← Return to Blog

Category: group-travelers

Is Travel Medical Insurance Affordable and Worth the Cost?

Felipe’s Emergency Medical Evacuation from Myanmar

303 Congressional Blvd.

Carmel, Indiana 46032

Our Markets

- Consumer Insurance

- Government Solutions

- Trip Protection

- Trip Protection Annual Multi-Trip

- Trip Protection USA

- Travel Medical

- Partnerships

- 24 Hour Urgent Travel Assistance

- Frequently Asked Questions

- Developer Portal

- System Status

Copyright © 2024 Seven Corners Inc. All rights reserved.

Privacy | Cookies | Terms of Use | Security

Do You Need Group Travel Insurance?

Group travel insurance can help protect you from financial losses while traveling with multiple people..

)

AFCPE Accredited Financial Counselor

6 years experience in the personal financial industry

Theresa is a writer and former financial advisor with experience helping clients solve money challenges. She uses her expertise to clarify complex personal finance concepts.

Read Editorial Guidelines

Featured in

)

15+ years in content creation

7+ years in business and financial services content

Chris is a seasoned writer/editor with past experience across myriad industries, including insurance, SAS, finance, Medicare, logistics, marketing/advertising, and many more.

Updated October 10, 2023

)

Table of contents

- Group travel insurance

- How it works

- Who should consider it

- Filing a claim

- Choose the best insurance

Group travel is an exciting way to explore the world while making deeper connections with your fellow travelers. But like any form of travel, it comes with certain risks.

Enter group travel insurance — a type of insurance policy that helps protect you and your travel companions from unexpected events, including medical emergencies and flight delays or cancellations.

Here’s what you need to know about group travel insurance, how it works, and when it might make sense for you to add it to your trip plans.

What is group travel insurance, and why is it important?

Group travel insurance is a type of insurance policy that covers a group of people taking a trip together. This could include families, friends, school groups, or sports teams. While what’s considered a group varies by insurer, it generally refers to 10 or more people traveling together.

Group travel policies and individual travel policies are similar in that they both provide coverage for common travel-related risks, including trip cancellation, lost luggage, and medical costs. Group travel insurance extends this coverage to a larger number of people.

When deciding whether to insure a group of travelers, travel insurance companies typically look at the number and ages of the people traveling, the total trip cost, and the destination. Some insurers may also impose age restrictions for group travel insurance. That’s why it’s important to carefully review the terms and conditions of your group travel policy to understand its specific coverage, limits, and exclusions.

How group travel insurance works

If you’re thinking about purchasing group travel insurance, it’s helpful to understand how it works and what you can expect to pay for coverage. Here’s what you need to know to make an informed decision.

Coverage options

The type and amount of group travel coverage you need depends on the needs of your specific group. Coverage options may include but aren’t limited to trip cancellation, travel delay, emergency medical care, trip interruption, and medical evacuation. Generally, travelers must be going to the same destination and have similar travel dates to qualify for group coverage.

Cost of group travel insurance

In general, you can find plans for as low as $600 and up to $1,600 or more depending on the coverage offerings. [1]

The cost of group travel insurance depends on your trip details, including your destination, group size, ages of travelers, and trip duration. International travel may cost more than travel within the U.S.