- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to AmEx Platinum Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

When does the AmEx Platinum travel insurance kick in?

Amex platinum travel insurance benefits and limits, how to make an amex travel insurance claim, what if the card’s insurance benefits are insufficient, the platinum card® from american express travel insurance, recapped.

Travel insurance can provide peace of mind when you’re away from home, especially when you’ve spent significant money on your vacation. Although you can choose to buy a separate travel insurance policy, not everyone wants or needs to do so.

Many travel credit cards offer complimentary insurance for a variety of occurrences. The Platinum Card® from American Express offers travel insurance with a suite of benefits for eligible travelers, including coverage for trip interruption, rental car damage and lost luggage.

Let’s take a look at travel insurance on The Platinum Card® from American Express , its limits and the benefits it provides.

» Learn more: What is travel insurance?

So, does The Platinum Card® from American Express have travel insurance? The short answer to this is yes, but you’ll need to meet specific requirements for it to apply.

To get coverage from your card, you’ll need to use it to pay for your trip in its entirety. This is true whether you’re looking to utilize the trip insurance or the rental car insurance — you must pay for the full cost with The Platinum Card® from American Express .

Be aware of coverage limitations if you’re traveling using points or miles. While it’s possible to receive benefits when using your card to pay the taxes and fees on a reward redemption, coverage may not always apply.

You may still be covered for trip interruption, delay, and cancellation insurance when using points or frequent flyer miles.

However, rental car and baggage insurance only apply when you’ve used your card to pay for the full cost of whatever you’re buying — no points allowed. The exception is if you redeem American Express Membership Rewards to pay for some or all of the booking.

» Learn more: How does credit card travel insurance work?

We’ve included a breakdown of all the insurance benefits and other travel protections provided by The Platinum Card® from American Express .

Trip cancellation protection

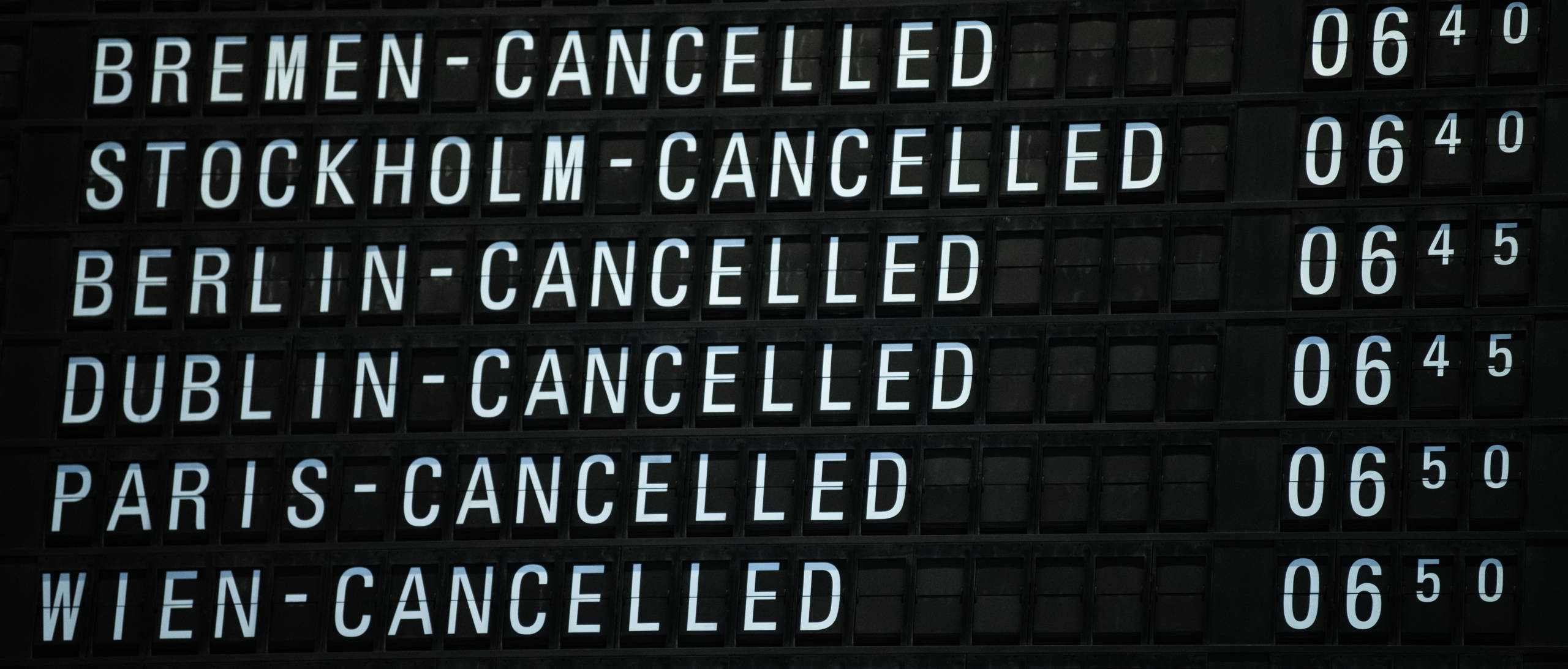

The trip cancellation insurance you’ll receive will pay for any nonrefundable losses you incur due to a covered event.

Given the current climate, you may also be wondering: does The Platinum Card® from American Express travel insurance cover COVID? It can, depending on the reason you need to cancel. Covered events include quarantine imposed by a physician or illness for you, your family members or a traveling companion.

Other eligible events include a change in military orders, inclement weather or jury duty.

If you need to cancel your trip, AmEx will provide up to $10,000 per trip and a maximum of $20,000 every 12 months. Terms apply.

» Learn more: The guide to American Express travel insurance

Trip interruption coverage

As with trip cancellation protection, trip interruption insurance will reimburse you for nonrefundable losses by a covered event.

If your trip is interrupted, American Express will cover you for prepaid land, air and sea travel bookings you’ve missed. They’ll also pay for the cost of an economy-class ticket on the most direct route to rejoin your covered trip (or take you home).

The maximum benefit you’ll receive is $10,000 per trip and up to $20,000 every 12 months. Terms apply.

Trip delay insurance

As it sounds, trip delay insurance will reimburse you for expenses incurred when your trip doesn’t go as scheduled. In the case of The Platinum Card® from American Express , coverage kicks in after you’ve been delayed by at least six hours for a covered reason.

Covered purchases may include food, toiletries, lodging, medication and other personal use items. You’ll be reimbursed for up to $500 on a covered trip and can make two claims within a 12-month period. Terms apply.

Rental car insurance

The Platinum Card® from American Express provides secondary rental car insurance . This means it’ll kick in after other claims — like those made to your personal insurance — have been paid. To activate coverage, you’ll need to decline the insurance offered by the rental car company.

AmEx will provide up to $75,000 due to damage or theft of the rental vehicle, but be aware that the policy doesn’t provide liability insurance.

It’ll also give you up to $1,000 per person (max of $2,000) for personal property lost in the incident and up to $5,000 for accidental injury. Finally, you’ll receive up to $300,000 for accidental death or dismemberment, though the rates will vary depending on the severity of your injuries.

This rental car insurance is valid worldwide with a few notable exceptions, including Australia, Italy and New Zealand. Terms apply.

» Learn more: Credit cards that provide travel insurance

Baggage coverage

Cardholders and their families are eligible for baggage insurance provided they’ve paid for the fare using The Platinum Card® from American Express . This benefit is only for lost baggage; delayed luggage is not protected.

Coverage limits vary depending on whether you’ve checked your bag or carried it on:

Checked bags: Up to $2,000 per person.

Carry-on: Up to $3,000 per person.

Note also that checked baggage is only covered when you’re actually traveling with a common carrier. Meanwhile, carry-on luggage is also covered when traveling to and from or waiting at the terminal.

There are also specific limits for high-risk items such as jewelry and electronic equipment. For these items, you’ll receive a maximum of $1,000 per person per trip. Terms apply.

» Learn more: Baggage insurance explained

Premium Global Assist

What else does The Platinum Card® from American Express travel insurance cover? Although this last benefit isn’t technically a type of travel insurance, it’s worth including as it can offer help while you travel.

AmEx’s Premium Global Assist hotline is a 24/7 service that can assist you in various ways, such as helping you get a new passport, finding translation services and even arranging for emergency medical evacuation.

Although using Premium Global Assist is free, the services that you may end up using are not necessarily covered by AmEx.

There are exceptions to this — if you need repatriation of mortal remains, emergency medical evacuation or if a child under 16 is left without care, AmEx will provide aid at no additional cost. Terms apply.

To file a claim, you’ll need to contact your benefit administrator. The phone number and timeframe will vary according to the type of insurance you’re using:

Trip cancellation, interruption or delay insurance: Within 60 days, call 844-933-0648.

Baggage insurance: Within 30 days, call 800-228-6855 or online .

Rental car insurance: Within 30 days, call 800-338-1670 or online .

» Learn more: The guide to AmEx Platinum rental car benefits

If The Platinum Card® from American Express travel insurance doesn’t seem like it’ll be enough for your trip, or if its coverage doesn’t include features that you’d like to have, consider purchasing a separate travel insurance policy before you travel.

Several companies allow you to compare various policies for any vacation and modify inclusions as you shop.

» Learn more: How much is travel insurance?

The travel insurance offered by The Platinum Card® from American Express includes some pretty generous benefits for travelers, especially since it’s complimentary (the $695 annual fee notwithstanding). Terms apply.

If you want to take advantage of this insurance, pay for your trip using your AmEx card and double-check any other stated requirements before heading out to ensure coverage.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Your guide to Amex's travel insurance coverage

Update : Some offers mentioned below are no longer available. View the current offers here .

American Express premium credit cards offer some of the best perks in the credit card space. While lounge access and travel credits are typically the highlights of these cards, some of the lesser-known benefits, such as trip delay reimbursement and trip cancellation and interruption insurance, are becoming hot topics as the coronavirus pandemic continues to impact the travel industry.

Want more credit card news and advice from TPG? Sign up for our daily newsletter!

As a result, many TPG readers have sent in questions about Amex's travel insurance protections. As travel restrictions change, policies and best practices will likely change as well. But this guide will walk you through which Amex credit cards have these benefits, what's currently covered and how you can file a successful claim.

Related: Best credit cards for trip cancellation and interruption insurance

Amex cards offering trip delay, cancellation or interruption insurance

Here is an overview of the Amex cards that offer trip delay reimbursement, trip cancellation/interruption insurance or both:

The information for the Hilton Aspire Amex card and American Express Corporate Platinum Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: The best credit cards with travel insurance

What is covered by trip cancellation and interruption insurance?

You can find the full terms and conditions of what is generally covered on your respective card in your Guide to Benefits, which can be found through your online account. I'll use the Delta SkyMiles® Reserve as an example.

Here is a rundown of the "covered losses" provided by Amex's trip cancellation and interruption insurance:

- Accidental bodily injury or loss of life or sickness of either the eligible traveler, traveling companion or a family member of the eligible traveler or traveling companion

- Inclement weather, which prevents a reasonable and prudent person from traveling or continuing on a covered trip

- The eligible traveler or his or her spouse's change in military orders

- Terrorist action or hijacking

- Call to jury duty or subpoena by the courts, either of which cannot be postponed or waived

- The eligible traveler or traveling companion's dwelling made uninhabitable

- Quarantine imposed by a physician for health reasons

Related: Book carefully if you have multiple Amex cards that offer travel protections

Amex also provides an extensive list of things that are not covered by trip cancellation/interruption insurance:

- Pre-existing conditions

- The eligible traveler's suicide, attempted suicide or intentionally self-inflicted injury

- A declared or undeclared war

- Mental or emotional disorders, unless hospitalized

- The eligible traveler's participation in a sporting activity for which he or she receives a salary or prize money

- The eligible traveler's being intoxicated at the time of an accident. Intoxication is defined by the laws of the jurisdiction where such accident occurs

- The eligible traveler being under the influence of any narcotic or other controlled substance at the time of an accident, unless the narcotic or other controlled substance is taken and used as prescribed by a Physician

- The eligible traveler's commission or attempted commission of any illegal or criminal act, including but not limited to any felony

- The eligible traveler parachuting from an aircraft

- The eligible traveler engaging or participating in a motorized vehicular race or speed contest

- Dental treatment except as a result of accidental bodily injury to sound, natural teeth

- Any non-emergency treatment or surgery, routine physical examinations

- Hearing aids, eyeglasses or contact lenses

- One-way travel that does not have a return destination

- A counterfeit scheduled airline or train ticket; or a scheduled airline or train ticket which is charged to a fraudulently issued or fraudulently used eligible card.

- Any occurrence while the eligible traveler is incarcerated

- Loss due to intentional acts by the eligible traveler

- Financial insolvency of a travel agency, tour operator or travel supplier

- Any expenses that are not authorized and reimbursable by the eligible traveler's employer if the eligible traveler makes the purchases with a commercial card

If you do find yourself canceling or cutting a covered trip short, here are the basic guidelines provided by Amex on what types of expenses are covered for trip cancellation/interruption:

"If a Covered Loss causes an Eligible Traveler's Trip Interruption, we will reimburse you for the nonrefundable amount paid to a Travel Supplier with your Eligible Card for the following: 1. The forfeited, non-refundable, pre-paid land, air and sea transportation arrangements that were missed; and 2. Additional transportation expenses that the Eligible Traveler incurs less any available refunds, not to exceed the cost of an economy-class air ticket by the most direct route for the Eligible Traveler to rejoin his or her places of origin.

If a Covered Loss causes an Eligible Traveler to temporarily postpone transportation by Common Carrier for a Covered Trip and a new departure date is set, we will reimburse you for the following: 1. The additional expenses incurred to purchase tickets for the new departure (not to exceed the difference between the original fare and the economy fare for the rescheduled Covered Trip by the most direct route); and 2. The unused, non-refundable land, air, and sea arrangements paid to a Travel Supplier with your Eligible Card."

What is covered by trip delay insurance?

Trip delay coverage provides reimbursement for reasonable additional expenses incurred when your trip is delayed due to a covered hazard for more than six hours.

Coverage is limited to $500 per trip and cardmembers are only eligible for two claims each 12 consecutive month period.

Amex outlines what is not covered, which includes the following:

- Covered losses that are made public or known to the eligible traveler prior to the departure for the covered trip

- An eligible traveler's expenses paid prior to the covered trip

Filing a claim

When you have a delay or trip cancellation/interruption that you think qualifies for coverage, you can file a claim by calling Amex at 1-844-933-0648 within 60 days of the covered loss.

Trip delay reimbursement requires the following documentation:

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss

- Receipts - Acceptable documentation includes the following:

- A statement from the common carrier that the covered trip was delayed

- Charge receipt

- Copies of common carrier ticket(s)

- Receipts for travel expenses

Trip cancellation/interruption insurance requires slightly different documentation.

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss. Acceptable documentation includes:

- Court subpoenas, orders to report for active duty, physician orders, etc.

- Copies of your common carrier tickets and travel supplier receipt

- Your eligible card billing statement showing the charges for the covered trip

- Copy of travel supplier's cancelation policy

After Amex receives notice of your claim, instructions will be sent on how to send the proof. Typically, you have up to 180 days to file a claim after a delay or cancellation.

Proof of flight delay or cancellation

One of the documents required to file for trip delay reimbursement is a verification form that outlines the reason for the delay or cancellation by the carrier. You can typically get this at the airport when the delay or cancellation is announced, but keep in mind that it may require a supervisor. Each U.S. major airline also has a process for requesting this information after the fact.

Here is an overview of the process that major U.S. airlines require for you to receive a delay or cancellation verification form:

Amex cards that offer car rental insurance

Unfortunately, no American Express credit cards offer primary car rental coverage, although most offer secondary coverage. You can see the entire list of cards that offer secondary car rental protection on the American Express website . However, all American Express credit cards offer an optional "Premium Car Rental Protection policy" that can be added to rentals made using the card for a small fee.

Read our guide on when to use American Express' Premium Car Rental Protection for more details on this coverage option.

You can add Premium Car Rental Protection to any American Express card . TPG has a guide of the best American Express cards , but here are some of the best cards in terms of the return you could receive when renting a car. Note, the estimated return rate for these cards is based on TPG's latest valuations:

- Hilton Honors American Express Aspire Card: $450 annual fee (see rates and fees); 4.2% return on car rentals booked directly from car rental companies; no foreign transaction fees (see rates and fees)

- The Blue Business® Plus Credit Card from American Express: $0 annual fee (see rates and fees); 4% return on general spending on the first $50,000 in purchases per calendar year and 1x thereafter; 2.7% foreign transaction fee (see rates and fees)

- The Amex EveryDay® Preferred Credit Card from American Express: $95 annual fee; 3% return on general spending in billing cycles where you make 30+ purchases; 2.7% foreign transaction fee

The information for the Amex EveryDay Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer baggage insurance

If you're a frequent traveler, you've likely run into this situation at some point (it's the worst). Over the years, airlines have been working on improving the baggage system by introducing live bag tracking. Regardless, it's still a smart idea to have some protections in place, like baggage insurance.

Related: Everything you need to know about Amex's baggage insurance plan

This is why you need to pay attention to the benefits each of your travel rewards cards offers. Nearly all of Amex's premium rewards cards offer baggage insurance. You can check out the full list of cards and details on American Express's website.

The types of losses it covers: You're covered for losses resulting from damaged, stolen or lost baggage, including both carry-on and checked bags.

When you're covered: To be eligible for coverage, you have to travel on a common carrier, which Amex defines as any air, land or water vehicle (other than a personal or rental vehicle) that is licensed to carry passengers for hire and available to the public. Your rental car, as well as taxis and ride-share services such as Uber and Lyft, would be excluded from this protection.

To receive coverage, you also need to pay for the entire fare with an eligible American Express card or by using Membership Rewards points to book tickets through Amex Travel . Trips booked with miles from other sources — even the cobranded Delta SkyMiles cards from Amex — are excluded. Your trip also isn't covered if you used a combination of miles and dollars unless the miles came from a Membership Rewards transfer. This is a welcome change. A few years ago, a TPG staffer found out the hard way that Amex's policy didn't cover frequent flyer mile awards.

Who's covered: This policy covers both primary and additional cardholders, as well as cardmembers' spouses or domestic partners and any dependent children under 23 years old. In addition, travelers must be permanent residents of one of the 50 states, Washington, D.C., Puerto Rico and the U.S. Virgin Islands.

How much it covers: Most American Express credit cards will cover replacement costs for checked bags and their contents up to $500 per person, although so-called "high-risk items" are only covered for a maximum of $250. These items include jewelry, sporting equipment, photographic or electronic equipment, computers and audio/visual equipment. Carry-on bags are covered for up to $1,250, which is good to know since your belongings could be stolen from the overhead bins.

You'll enjoy additional coverage if you use The Platinum Card from American Express, The Business Platinum Card from American Express, the Platinum Card from American Express Exclusively for Mercedes-Benz and Morgan Stanley-branded Platinum Card (but not the Delta SkyMiles® Platinum American Express Card).

The information for the Amex Platinum Mercedes-Benz and Morgan Stanley Platinum card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer medical assistance

One of the lesser known benefits of some of Amex's most premium cards is its Premium Global Assistance. This benefit can quite literally be a lifesaver if you or an immediate family member run into any unexpected issues or accident on your trip. For example, this service can help you arrange emergency medical referrals.

All Amex cards have access to Amex's Global Assist Hotline, but the Premium Global Assist Hotline and higher level of coverage are reserved exclusively for the Amex's premium cards:

- The Platinum Card from American Express

- The Business Platinum Card from American Express

- American Express Corporate Platinum Card

- Hilton Honors Aspire Card from American Express

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Marriott Bonvoy Brilliant® American Express® Card

- American Express Centurion Card

- American Express Business Centurion Card

The information for the Amex Centurion and Amex Business Centurion cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Having a card with trip insurance can save you hundreds of dollars when unexpected hiccups happen in your travel plans. Still, it can be confusing to know what is covered and the right documentation you need to file a claim.

Nothing is worse than getting through an entire claims process only to be denied or have to start over because you don't have the required documentation for the insurance provider. Before you start filing a claim, make sure you have the documents listed above. Keep in mind that a provider may ask for additional documentation related to the incident, so you may have to collect receipts and other forms to help your case.

If you're starting to travel again, it's also a good idea to consider booking refundable travel . Some airlines and hotels even waive cancelation fees and/or change fees for certain fares, which can make last-minute adjustments in the case of emergencies.

Additional reporting by Stella Shon and Madison Blancaflor.

For rates and fees of the Amex Platinum card, please click here. For rates and fees of the Amex Gold card, please click here. For rates and fees of the Amex Business Gold card, please click here. For rates and fees of the Amex Green card, please click here. For rates and fees of the Hilton Aspire card, please click here. For rates and fees of the Amex Blue Business Plus card, click here. For rates and fees of the Marriott Bonvoy Brilliant card, click here. For rates and fees of the Delta SkyMiles Reserve card, please click here. For rates and fees of the Delta SkyMiles Reserve Business card, please click here. For rates and fees of the Delta SkyMiles Platinum card, please click here. For rates and fees of the Amex Business Platinum card, click here.

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

any idea if “covered reason” includes covid related events?

No, COVID would not be a covered reason. Covered reasons are outlined in the insurance policy handbook

I called Amex and baggage delay is not covered unless you purchase additional travel insurance with Amex. Luckily I did. They didn’t say what exactly I can or can’t get reimbursed. They just said up to $500 is covered for me and $500 is covered for my son.

The American Express Platinum Canada Card does cover baggage delay

https://www.americanexpress.com/ca/en/charge-cards/the-platinum-card/

“Baggage Delay Insurance17† You can receive up to $1,000 in coverage (aggregate maximum with Flight Delay Insurance), for reasonable and necessary emergency purchases for essential clothing and sundry items purchased within four days of arrival at your destination when your checked-in baggage on your outbound trip is delayed for 6 hours or more when you fully charge your airline ticket to your Platinum Card.”

Do you know if the insurance will cover trip interruption if I paid for my flights with avios points but paid the taxes and hotel bills with the amex card?

Also, will my card insurance cover my family if I am not on return flight with them?

Hi Viviene,

No, the insurance won’t apply. If you used Avion points, you’d have to use an Avion credit card to pay the balance for your insurance to apply.

Any supplementary card holders would be covered, but if your family is not supplementary users, and you’re not travelling with them, the insurance wouldn’t apply.

Leave a Comment Cancel Reply

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

- Credit cards

The unique benefits of the Platinum Card ® from American Express

Welcome offer

The Platinum Card® is the Best Premium Travel Card in Canada.

With this welcome offer, you can earn up to 100,000 Membership Rewards points :

- 70,000 Welcome Bonus points after you charge $10,000 in net purchases to your Card in your first 3 months of Cardmembership

- 30,000 points when you make a purchase between 14 and 17 months of Cardmembership

With this card, you get:

- 2 points per dollar for dining purchases

- 2 points per dollar on travel purchases

- 1 point per dollar on all other purchases

You can use your Membership Rewards points in many ways:

- Transfer points to airline partners: Aeroplan, Avios (British Airways / Qatar Airways ), Flying Blue, Delta Skymiles, etc.

- Transfer points to hotel programs ( Hilton Honors, Marriott Bonvoy)

- Redeem points for statement credits to offset any travel purchase charged to your Card ( 1,000 points = $10 )

- Redeem points for statement credits towards other purchases ( 1,000 points = $10 )

With this card, you also have advantages for your travels:

$200 Annual Travel Credit

- $200 Annual Dining Credit

- $100 NEXUS Card Statement Credit

- Complimentary and unlimited access for you and one additional traveller to over 1,200 airport lounges worldwide

- Hilton Honors Gold Elite status (complimentary breakfast at all Hilton hotels)

- Marriott Bonvoy Gold Elite status

- Access to the Fine Hotels & Resorts program

Last but not least, the Platinum Card® is distinguished by the numerous insurance coverages offered: theft and damage for rental cars, travel accident of $500,000 Emergency medical expenses (out-of-province or out-of-country), lost or stolen baggage, flight delays and misdirected baggage, hotel or motel burglary, Purchase Protection, Purchase Security.

Like all American Express Canada Cards, there is no minimum income requirement .

The Platinum Card ® clearly stands out from the competition because of the various benefits it provides for frequent travelers. I will try to assign a value to each of them.

Access to airport lounges

It’s something I personally love (and I know many of the Facebook group members do too!).

The benefit

The Platinum Card ® provides free unlimited access to the cardholder and a travel companion at most of the lounges listed below.

When we look at just the Priority Pass membership included for the Platinum Card ® holder, we are talking about a benefit that has a value of US$429 / year .

And American Express has a special agreement with Priority Pass to add a travel companion to this pass (which would have cost US$ 32 / visit otherwise)!

That’s not taking into account access to all the other types of lounge around the world:

Here are the conditions of access for each type of lounge:

The value of airport lounge access

Being reasonable in my estimates, thanks to this advantage of access to airport lounges offered by the Platinum Card ® , I estimate saving $40 per person each time we pass through an airport (for drinks/meals).

That’s not counting the rest you get versus waiting in some terminals (especially with young children)!

For a couple who pass through the airport five times a year, that saves $400 a year .

Hotel status Benefit

American Express has partnered with various hotel programs to gain access to higher statuses by being a Platinum Card ® holder.

Of all the hotel programs, I consider only the status offered by the Platinum Card ® on the Hilton Honors side to be of value.

It is the only one to offer breakfast in most of the group’s hotels .

Unfortunately, Marriott Bonvoy’s Elite Gold status has lost its lustre, with the program now reserving the benefit of complimentary breakfasts for Elite Platinum members.

I would have liked to see American Express offer Platinum Elite status, or at least status nights to reach that level of status faster.

The value of hotel statuses

The value of this Platinum Card ® benefit is relative. It will be based on the number of stays made in these different hotels each year. If your preference is Hilton Group hotels, getting free breakfast for each of your nights can be a great benefit!

At an average rate of $20 per breakfast per person for ten nights stay per year, this could mean savings of $400 a year.

But if you stay at Marriott hotels instead, the value of this benefit is lessened.

It’s up to you to decide how much value you place on this benefit, depending on your travels! I estimate it at around $200 a year .

If there’s one easy-to-quantify benefit of the Platinum Card ® it’s the $200 annual travel credit.

When you apply for the Platinum Card ® , you’ll receive a $200 annual travel credit to be used via American Express Travel services. This may be:

- A car rental

- A travel package

Then, each year, when you renew your Platinum Card ® membership fee, you get this credit again. In this article, I explain how the Annual Travel Credit works .

The value of the travel credit

Having the opportunity to travel several times a year, it’s easy for me to use the $200 annual Platinum Card ® credit. So it’s worth $200, for trips I would have bought anyway!

$200 annual dining credit

Another easy-to-quantify benefit of the Platinum Card ® is the $200 annual dining credit.

When you sign up for the Platinum Card ® , you get a $200 annual dining credit.

This credit is applied to your restaurant bill based on a list of American Express restaurants .

Then, every year on January 1, you get this credit again.

The value of the annual dining credit

Having the opportunity to dine at good restaurants in Montreal, I can easily use the Platinum Card ® $200 annual dining credit. So it has a value of $200 for a meal in a good restaurant, which I would have done anyway!

Instead of using my ® Card" href="https://milesopedia.com/en/go/amex-cobalt-card/" rel="noindex">American Express Cobalt ® Card (which earns me 5 points per dollar at all restaurants ), I’ll use my ® " href="https://milesopedia.com/en/go/amex-platinum-card/" rel="noindex">American Express Platinum Card ® .

$100 NEXUS credit

The Platinum Card ® comes with another benefit for travellers: the $100 NEXUS Card Statement Credit . Simply charge your NEXUS membership (every 4 years) onto your Platinum Card ® to get this credit.

The Membership Rewards program

In addition to the travel benefits, it is important to note the excellent earning rate of Membership Rewards points through the Platinum Card ® :

- 2 Membership Rewards points per dollar spent in restaurants and bars

- 2 points for every $1 in Card purchases on eligible travel

- 1 Membership Rewards point per dollar per dollar of other purchases

Here is an example of earning rate:

The Platinum Card ® – like the American Express Cobalt ® Card – allows you to use your Membership Rewards points in a multitude of ways, “without being caught” with Aeroplan points:

- via transfers to other airline or hotel loyalty programs

- via the fixed-point travel programme for flights

- via account credit for travel purchases

- via account credit for everyday purchases

Bottom Line

For sure, the Platinum Card ® is not for everyone and remains a card for travelers.

However, suppose you have travel plans and can take advantage of its various benefits ($200 annual travel credit, $200 Annual Dining credit, airport lounge access, status, etc.) and Membership Rewards points accumulation categories. In that case, this is THE card to get in anticipation of those trips!

Benefits easily exceed the annual fee (especially in the first year with a welcome bonus).

For me, it remains an essential card alongside my American Express Cobalt ® Card !

This post was not sponsored. The views and opinions expressed in this review are purely my own. American Express is not responsible for maintaining or controlling the accuracy of the information published on this website. For complete and up-to-date product information, click on the Apply Now link. Terms and conditions apply.

All posts by Jean-Maximilien

Suggested Reading

- Book Travel

- Credit Cards

American Express Platinum Card

Best offer is available via a referral link

Signup bonus:, annual fee:, earning rate:, referral bonus:, perks & benefits:.

The American Express Platinum Card is one of the leading travel rewards credit cards in Canada. With best-in-class travel perks, the ability to earn powerful Membership Rewards points, and the premium allure of a flashy metal finish, the Platinum Card should have a place in every frequent traveller’s wallet.

Despite the $799 annual fee (which is the highest among major Canadian credit cards), the card’s welcome bonus and ongoing benefits might even tempt you to keep it for years to come.

Bonuses & Fees

The Platinum Card is currently offering a welcome bonus of up to 100 ,000 Membership Rewards points when applying through a referral link.

The points are earned as follows:

- 70,000 MR points upon spending $10,000 in the first three months

- 30,000 MR points upon making a purchase in months 14–17 as a cardholder

The annual fee of $799 is one of the highest around, although the Platinum Card offers a $200 travel credit once per year, making the “effective” annual fee $599 per year.

There are also referral bonuses as a Platinum cardholder if you refer your friends or family to the card. You’ll earn 10,000 MR points for every referral you make, up to a maximum of 225,000 MR per calendar year.

Earning Rewards

On daily spending, the Platinum Card allows you to earn:

- 2 MR points per dollar spent on travel and dining purchases in Canada

- 1 MR point per dollar spent on all other purchases

The 2x return on dining in Canada is competitive with other travel cards, although keep in mind that the American Express Cobalt Card offers 5 MR points per dollar spent on the same purchases.

Likewise, the 2x return on travel is good, although the same benefit is offered by the Gold Rewards Card as well.

Lastly, the 1x return on all other purchases isn’t outstanding, but since the card earns the powerful Membership Rewards points , you have plenty of options to redeem them.

Overall, the Platinum Card’s tiered earning rate is quite standard when you look at it as a whole, especially since it matches or can evcen be bettered with other, less costly cards in the Amex portfolio.

Redeeming Rewards

The Membership Rewards program offers outstanding redemption opportunities. This is primarily because it’s a flexible, transferable rewards currency.

You can transfer your MR points at a 1:1 ratio to Aeroplan and British Airways Executive Club , as well as a host of other global frequent flyer programs (including Cathay Pacific Asia Miles ) at a 1:0.75 ratio. Moreover, you also have the option of converting points to Marriott Bonvoy at a 1:1.2 ratio for booking hotel stays.

Furthermore, you can redeem MR points directly for flights through the Amex Fixed Points Travel reward chart, although these are limited to round-trip flights departing from Canada.

Lastly, you have the option of redeeming MR points directly against travel purchases at a rate of 1 cent per point (cpp), although this is typically not recommended, as the value pales in comparison to what you could get by booking flights through Aeroplan, Avios, or even the Fixed Points Travel chart.

Perks & Benefits

What really sets the Platinum Card apart, though, and what is meant to justify its hefty $799 annual fee, is the outstanding travel benefits.

Chief among these is the c omplimentary membership in Priority Pass , which grants you (and one guest) access to more than 600 Priority Pass airport lounges all over the world for free. Most major airports have a Priority Pass lounge, meaning that you’ll rarely be without a relaxing space before your flight to grab a drink or a quick meal, away from the crowds at the gate.

As a Platinum cardholder, you’ll automatically be bestowed with Marriott Gold Elite status and Hilton Gold status . These fast-tracked membership levels come with their own series of valuable benefits when staying at each chain.

Another outstanding benefit is access to American Express’s Fine Hotels & Resorts program , which allows you to book special rates at select luxury hotels around the world. These rates include perks such as suite upgrades, daily breakfast for two, and benefits unique to each property (examples include a private airport transfer or a spa & dining credit). The FHR program often pops up with third-night-free or fourth-night-free offers as well, meaning that there’s plenty of good deals to be had.

Among many other bells and whistles, the Platinum Card also offers priority security lane access at Toronto Pearson Airport , upgrades and discounts on car rentals with Hertz and Avis, and of course the aforementioned $200 annual travel credit that can be used towards any flight, hotel, car rental, or vacation booking made with Amex’s Platinum Travel Service.

A new benefit introduced to the card in 2023 is the annual $200 dining credit, which can be used at some of Canada’s top restaurants. You’ll need to make a purchase of $200 or more at an eligible restaurant with your Platinum Card.

Lastly, the Platinum Concierge is worth a brief mention. They’re a “global concierge” team that’s able to help you out with any and all requests you may have, wherever you are. In the past, they’ve helped me out with everything from restaurant bookings to last-minute flower orders.

They aren’t miracle workers, so don’t expect them to be able to snag a spot for you at the hottest restaurant in town for tomorrow evening, but they will proactively put you on the waitlist or look to confirm a spot for you on some future date. Personally, I do find it incredibly useful to have a capable, service-oriented Platinum Concierge just a call away.

Insurance Coverage

As a premium travel credit card, you can be sure that the Platinum Card’s insurance coverage is top-drawer as well. Some examples of its strong coverage include:

- Emergency medical insurance: Up to $5 million of coverage for the first 15 days of your out-of-province trip, for travellers aged 65 and under.

- Lost baggage insurance for lost or stolen baggage, up to $1,000 of coverage total

- Trip cancellation / trip interruption insurance: For Trip Cancellation, up to $2,500 of coverage per insured person, with a maximum of $5,000 for all insured persons, and for Trip Interruption, up to $2,500 of coverage per insured person, with a maximum of $6,000 for all insured persons on the same covered trip.

- Baggage delay insurance, up to $1,000 (aggregate total with Flight Delay insurance), for items purchased within four days when your baggage is delayed – this is different from lost and stolen baggage insurance, which doesn’t cover delays.

- Auto rental collision/loss damage insurance: Comprehensive coverage for up to 48 consecutive days for cars with an MSRP of up to $85,000, which can help you save on the insurance fees that the car rental company would otherwise charge.

I was recently in a situation where the airline had mishandled my bags and left them in a connecting city, and the card I had booked the ticket with came with coverage for lost and stolen baggage but not delayed baggage, leaving me to cover my costs for a few days out-of-pocket. With the Platinum Card, you’ll be able to rest easy knowing that you are covered in the event that your bags go sightseeing on their own for a little while.

Additionally, the card also offers Purchase Security and Extended Warranty Protection, covering most eligible items you’ve purchased with your card should they be stolen or damaged within 90 days of purchase, as well as an extended one-year warranty period compared to the manufacturer’s warranty.

Historical Offers

The American Express Platinum Card does not have a minimum income requirement to be eligible. You'll earn the best available signup bonus if you apply using a referral link. Consider supporting Prince of Travel by applying for the card via the link below.

33 Comments

About the “2 MR points per dollar spent on travel purchases”… I made two purchases (Sleep and Country Inns)… I got only 1x the points. I did not see any “Canada” limitation as for the dining earn rate. I booked through their web sites. Does the 2x points comes later? Any limitation I am not aware of? I will call the customer service later.

Well, it seems Amex corrected the discrepancies themselves.

But now, I find that they charged 1.42 USD CAD Exchange Rate on pruchases I made in the USA. Look at the mean rate of Oct 19-21, even the min max, and it never went over 1.395…

Are they supposed to charge market rate+ 2.5%

Was a platinum cardholder in 2018 and just reapplied this fall. I was hoping to slip through and get the bonus offer, but no deal. they denied it as I previously was a primary card holder. I’m also not eligible for the disney+ offer that was recently given to other platinum members because it’s targeted to people who have had the card for one year (according to the agent I spoke with). Bummer, but thought it might be helpful for anyone considering re-applying with their eyes on the bonus.

I am just curious if there’s flight delay/ cancellation on Flair airline (assuming there’s only one flight per day leaving to my destination), would that mean the travel delay insurance will pretty much automatically kick in and cover me up to $1,000?

The historical offers chart is great and tends to show that is the worse possible time to get this card (6k in 3 mths not 6 mths, less MR rewards). Take it or leave it for now and wait for a better offer (MR pts versus spending effort).

Also the 20k MR adder is after a 12 mths period means we pay twice the card fees to get them ? the cobalt seems a better deal today

I have both the Amex Platinum and the Amex Platinum Business and am trying to decide which to keep. What do you recommend, and why?

I just received my card and I am confused about the point bonus. I sweat that when I applied 10 days ago it was 110k point but now I am seeing that the current offer is 80k Can someone confirm?

Bonus will be the same as when you applied. So if offer was 110k, you’ll get 110k.

I’d like to know if PoT has ever used the International Airline Program benefit of Platinum card?

https://www.americanexpress.com/ca/en/benefits/the-platinum-card/international-airline-program.html

Discounts available on the base fare for qualifying International First, Business, and Premium Economy Class tickets at participating airlines when you book with Platinum Travel or online at American Express Travel and pay in full with your American Express Card. Discounts available to Cardmember and up to seven additional passengers when travelling together on the same itinerary. Please note, when booking online at americanexpress.ca/travel, the discounts are limited to five additional passengers.

It would be nice to read about this particular bit from PoT.

Does the refundable hotel trick no longer work for Amex platinum? I think I got my $200 credit clawed back

Is there a limit on the 3 MR points per dollar spent on dining in Canada? I beleive on the Cobalt the 5X rate is capped at $30,000? I spend upwards of $300,000 a year on business dining expenses and therefore like the higher dining rate on this card. If so I will apply through your referal link soon.

Hello Ricky,

I’m in the process of getting the ITIN and have just got the Hilton Honours card. I’m wondering if applying for Amex Canadian cards such as Platinum, Gold, and Cobalt would be considered taking up space for the Chase 5/24 rule.

Only US personal cards count for 5/24.

For the hotel loyalty programs, say MB, with Gold Status, does that mean you only need 25 additional nights to reach Platinum? Can you combine with the MB Amex’s 15 qualifying nights?

Nope, you just get the status, not the qualifying nights. To reach Platinum, you’d still need 50 nights.

How long will the Marriott Gold Elite status, Hilton Gold status, and Radisson Gold status be for, As long as the platinum card is active?

Correct. If the Platinum Card is cancelled, the status should last until February of the following year (though there are some anecdotes of the Hilton Gold status in particular being “sticky” for quite a few years after cancellation).

Long time Gold holder and thinking of applying for Platinum but not keeping it beyond year 2. Does this impact the MR assuming the new card gets linked to the existing account? Any risk of losing the MR? No plans of churning.

Does AMEX enforce the no rewards bonus if you had the card previously thing? Is there a way to find out before paying the fee? It’s so sketchy how they bury that and say they will approve it anyway.

It’s unclear if it’s enforced. They’ll approve it anyway because you’re always allowed to hold the card again, but you aren’t “supposed” to get the bonus again. For what it’s worth, a few recent repeat applicants for the Platinum Card did get the bonus.

I have an Amex gold, if I apply to the Amex plat with your link will it upgrade my current card and will I still be eligible for the rewards?

It would be in addition to your current card rather than replacing your current card. Yes, you’d be eligible.

The Prince of Travel article states the cardholder and a guest have lounge access with the Platinum card. The Amex website (under footnotes) does not mention a guest. Does anyone know which is accurate?

Apparently, only Priority Pass Lounge: Footnote 7 says, “At any visit to a Priority Pass lounge that admits guests, you may bring in one (1) guest for no charge. ” https://www.americanexpress.com/ca/en/benefits/the-platinum-card/lounges.html

Does is cover auto collision/ damages insurance?

I had a Platinum personal card from 1999 to 2016. If I apply now will I be eligible for the MR bonuses? If not, would my wife, who had a supplimental Gold card in the past associated with my Platinum card, get the MR bonuses if she applied now?

Your wife would definitely be eligible for all bonuses if she’s never been a primary cardholder before.

As for yourself, with a 5-year gap plus a strong history as a loyal cardholder, I’d say your chances are good. Worst case you won’t get the bonus, but in your situation I wouldn’t be worried about a repeat application hurting your relationship with Amex.

Does anyone know what benefits are available to additional added card holders? Would an additional card holder also benefit from getting Marriott Elite Gold status for example?

My amex PP up for renewal this month May 2021. I hope they will work with me here on the renewal considering my circumstances.

I don’t see any mention of the Shangri-La Jade status on Amex Platinum website. They state the other three brands.

They’ve just phased it out as of March 31! Good catch – edited.

only seeing 25,000 in incognito mode both chrome and microsoft

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

American Express Platinum Card ®

Flytrippers award won.

Summary of Flytrippers' review

Why get this card.

- Good welcome bonus of ≈ $801

- Unlimited access to airport lounges (for 2 people)

- Gold Elite Status at Marriott and Hilton hotels

- Plenty of luxury travel benefits

- The flexibility of hybrid rewards

- Excellent earn rate on travel

- Exceptional travel insurance coverage

It’s really the best card for frequent travelers or luxury travelers!

WHO SHOULD GET THIS CARD

- Those who travel a lot and want unlimited lounge access

- Those who enjoy luxury travel

- Those who can reach a minimum spend of $10,000 in 3 months

- Go to our editorial card review page

- Free 30-page guide on the card

- Keep scrolling here for all the details

- Apply now via Amex secure link

- See all the best credit cards in Canada

Card details

Welcome bonus structure (2 separate bonuses) (INCREASED OFFER)

70,000 points Bonus after spending $10,000 (in a maximum of 3 months) *30,000 points Bonus after making a purchase between 14 and 17 months of Cardmembership (not included in our Flytrippers Valuation)

70,000 points Total with the main part of the bonus *100,000 points Total with the entire bonus

Earn on the minimum spending requirement

10,000 points Minimum earn on the minimum spending requirement of $10,000 (at base earn rate of 1 pt/$)

Total rewards by unlocking the welcome bonus

80,000 points Main part of the welcome bonus + earn on the minimum spending requirement to unlock it *110,000 points Entire welcome bonus + earn on the minimum spending requirement to unlock it

‣ Apply for The Platinum Card from American Express

Value of the welcome bonus offer (at our Flytrippers Valuation of ≈ 1.5¢/pt )

≈ $1050 Welcome bonus (70,000 pts) ≈ $150 Earn on the required spending (10,000 pts) $200 Travel credit that can be cashed out (fixed value) ≈ $100 Dining credit of $200 for 2024 (conservative value) ≈ $100 Dining credit of $200 for 2025 (conservative value) –$799 Card fee (deducted from Flytrippers Valuation)

≈ $801 Total net value by unlocking the welcome bonus alone

‣ Learn more our Flytrippers Valuation of welcome bonuses

Effective return rate

≈ 8.0% Return on the minimum spending requirement (≈ $801 on $ 10,000 in 3 months)

‣Learn more about effective return rates (coming soon)

Rewards acquisition summary

$1600 Rewards you get for $799

Rewards from welcome bonus

You will have 80,000 Amex MR points after unlocking the Welcome Bonus AND a separate $200 annual travel credit .

The points give you either:

- ≈ $1200 in rewards at the Flytrippers Valuation + $200

- $800 in rewards at the simpler minimum fixed value + $200

Concrete examples of redemptions

Here are some of the actual redemptions you can get with these points:

14 one-way short-distance reward flights such as Toronto-New York or Toronto-Washington

8.5 one-way medium-distance reward flights such as Toronto-Miami or Toronto-Nashville

7 one-way longer distance reward flights such as Toronto-Costa Rica or Toronto-Mexico

1.5 one-way business class reward flight such as Vancouver-Japan or Toronto-Switzerland

11 one-way short-distance reward flights in several regions of the world

17 completely free nights in beautiful hotels in specific destinations like Bali

$1400 discount on specific flights that are very expensive in cash

$800 as a simple travel credit that can be applied to any travel expense

‣ Learn more about the best uses of Amex points

Earn rate (at Flytrippers Valuation)

2 points per $ ( ≈ 3% ) on travel, dining, and food delivery apps 1 point per $ ( ≈ 1.5% ) everywhere else

‣Learn more about credit card earn rates (coming soon)

Earning with additional cards

Fee for additional cards: $250 with the travel benefits like lounge access / $0 without the travel benefits (first 2 cards, then $50) Quantity allowed: 9 Minimum age: 13 years old

‣Learn more about additional cards (coming soon)

American Express Lounge Collection You get unlimited access to over 1,400 airport lounges around the world, for you and 1 guest. All Priority Pass lounges, Plaza Premium lounges, Centurion Lounges, and a few others.

‣ Learn more about the American Express Lounge Collection

$200 annual travel credit The credit can be applied to any booking made with Amex Travel (flights, hotels, cars) or can even be cashed out with a pro tip .

‣Learn more about the Amex Platinum annual travel credit (coming soon)

$200 annual dining credit The dining credit gives you $200 to use at a list of the best restaurants in Canada. Credit covers tips and taxes too, but must be used in 1 transaction. You get 1 credit of $200 per calendar year, including in 2023.

‣Learn more about the Amex Platinum annual dining credit (coming soon)

$100 NEXUS credit A credit will appear if you charge a NEXUS fee to your card — and you should really have NEXUS if you don’t already.

‣Learn more about the Amex NEXUS credit (coming soon)

Hotel elite status benefits You get Gold Elite status with Marriott Bonvoy (8000+ hotels) and Hilton Honors (6000+ hotels).

‣ Learn more about the Marriott Elite status benefits (Hilton coming soon)

Car rental elite status benefits You get elite status with Hertz and Avis.

‣Learn more about the Amex Platinum car rental status benefits (coming soon)

The Fine Hotels + Resorts program Amazing benefits at very luxurious and expensive hotels, exclusively for Platinum Cardmembers. The average value of the benefits is $750 per stay.

‣Learn more about the Fine Hotels + Resorts program (coming soon)

The Hotel Collection program Benefits at top luxury hotels, such as a US$100 credit to use at the hotel and a free room upgrade.

‣Learn more about The Hotel Collection program (coming soon)

24/7 concierge service You have access to a concierge service that can make restaurant reservations, organize deliveries for flowers or other things, and complete various research tasks for you.

‣Learn more about the Amex Platinum concierge service (coming soon)

Amex Offers program Access to discounts, credits, and special offers throughout the year. This card comes with better offers than all others, valued at over $200 depending on your buying habits.

‣ Learn more about the Amex Offers program

American Express Experiences program Access to exclusive virtual and in-person experiences and pre-sale tickets to lots of events.

‣Learn more about the American Express Experiences program (coming soon)

Exclusive Platinum events Similar, but with many additional events that are exclusive to Platinum Cardmembers. I love going to the free Amex Platinum lounge on the beach during Art Basel in Miami every year.

Metal card weighing 18 grams The luxurious and heavy card is internationally recognized as a status symbol, if you care about those kinds of things.

‣Learn more about the Amex Platinum design (coming soon)

Insurance included

Medical travel insurance 15 days (64 years and under) Flight delay insurance ($1,000, 4h minimum) Rental car insurance Baggage & personal effects insurance Trip cancellation insurance Trip interruption insurance Travel accident insurance Hotel burglary insurance Purchase insurance Extended warranty

‣Learn more about the American Express Platinum Card ® ‘s insurance coverage (coming soon)

Insurance not included

Mobile device insurance

‣Learn more about the different types of insurance coverage (coming soon)

Redemptions American Express points can be used for specific flights to maximize their value (via transfers to partner programs or via the Amex flight chart) or for hotel nights (via transfers to partner programs). But they can also be used as a simple travel credit (which can be applied to any travel expense).

‣ Learn more about the American Express rewards program (coming soon)

Pricing Amex points are hybrid rewards: They can be used as fixed-value rewards (fixed value of 1¢) or variable-value rewards (value depending on how you use them; our Flytrippers Valuation is ≈ 1.5¢).

‣ Learn more about American Express points (coming soon)

Expiry Amex points never expire as long as you have the card. And even if you no longer have the card, you can easily extend the expiration indefinitely.

‣ Learn more about American Express points expiry (coming soon)

Pooling If you have travel companions, it’s possible to pool Amex points via transfer partners.

‣ Learn more about pooling American Express points (coming soon)

Transfers American Express points can be transferred to multiple partner programs and this often provides the best value.

‣ Learn more about American Express point transfers (coming soon)

Other redemption options American Express points can be used for rewards other than travel but this should be avoided.

‣ Learn more about why you should always use your rewards for travel (coming soon)

Rewards program logistics You can use your points directly on the American Express website or app.

‣ Learn more about how to get started with American Express rewards (coming soon)

Rewards program summary Rewards: American Express points Type: Hybrid rewards Subtype (fixed value): “Eraser” rewards Subtype (variable value): “Standard” or “Dynamic” Rewards (depending on the transfer partner) Variety: Bank rewards Flytrippers Valuation: ≈ 1.5¢ per point Minimum value: 1¢ per point Maximum value: Unlimited Transferable: Yes (8 partners)

‣ Learn more about rewards programs basics (coming soon)

Card eligibility Minimum personal/household income: $0 Age: Majority in your province Estimated credit score: Good or Excellent Credit bureau: TransUnion

‣ Learn more about credit card eligibility requirements (coming soon)

Welcome bonus eligibility You must not have had the American Express Platinum Card ® before.

‣ Learn more about credit card welcome bonus eligibility rules (coming soon)

Offer end date Offers subject to change at any time

‣ Subscribe to Flytrippers’ free travel rewards newsletter to get all card updates

Card details Issuer: American Express Network: American Express Card Type: Card with no pre-set spending limit Product Type: Personal card

‣Learn more about credit card types (coming soon)

Fees and rates Card fee: $799/year Fee for additional card (with benefits): $250 Fee for additional card (without benefits): $0 (first 2 cards, then $50) FX fee: 2.5% Purchases annual interest rate: N/A Funds advances annual interest rate: N/A Balance transfer fee: N/A

‣ Learn more about why Flytrippers recommends ignoring fees and rates (coming soon)

- Unlock special experiences with the Platinum Card ®

- Earn up to 100,000 Membership Rewards ® points – that’s up to $1,000 towards a weekend away

- New Platinum® Cardmembers, earn 70,000 Welcome Bonus points after you charge $10,000 in net purchases to your Card in your first 3 months of Cardmembership

- Plus, earn 30,000 points when you make a purchase between 14 and 17 months of Cardmembership

- Earn 2 points for every $1 in Card purchases on eligible dining and food delivery in Canada, 2 points for every $1 in Card purchases on eligible travel, and 1 point for every $1 in all other Card purchases

- Access a $200 Annual Travel Credit through American Express Travel Online or Platinum ® Card Travel Service

- Enjoy a $200 Annual Dining Credit at some of Canada’s best restaurants

- Unlock $200 or more in additional value with Member extras. You can earn statement credits for qualifying purchases with participating brands

- Take full advantage of The American Express Global Lounge Collection TM which unlocks access to over 1300 airport lounges worldwide. This includes The Centurion ® Lounge network, Plaza Premium Lounges, and hundreds of other domestic and international lounges designed to enhance your travel experience

- Enjoy flexible ways to use your points such as statement credits for any eligible purchase charged to your Card, new travel purchases booked on American Express Travel Online through the Flexible Points Travel Program, and eligible flights through the Fixed Points Travel Program

- Transfer points 1:1 to several frequent flyer and other loyalty programs

- Enjoy complimentary benefits that offer an average value of $750 CAD at over 1,300 extraordinary properties worldwide when you book Fine Hotels + Resorts

- Platinum Cardmembers can enjoy access to special events and unique opportunities

- Enjoy premium benefits at the Toronto Pearson Airport

- You will also have access to many leading hotel and car rental companies’ loyalty programs. Our partners include Marriott International, Hilton Hotels and Resorts, Hertz and Avis

- Interest applies in accordance with your Cardmember Agreement, Information Box, and Disclosure statement if the total New Balance is not paid by the Payment Due Date each month. All payments must be received by the Payment Due Date shown on the monthly statement

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, (I/we) may receive compensation from American Express, which can be in the form of monetary payment.

Start earning rewards today

And make sure to download our free checklist for when you get a new card—it includes very important mistakes to avoid (it will open in a separate tab, or you can click here ).

via Amex secure application

*Beta version of card page. Sign up to get updated guide soon.*

This content is not sponsored. However, this page may contain some affiliate links that allow Flytrippers to earn a commission at absolutely no cost to you. Thank you for using our links and helping us keep all our content free for everyone. This helps us fulfill our mission of helping Canadians travel more for less.

The views and opinions expressed on this page are purely our own. They have not been provided, approved, endorsed, or ratified by any third party mentioned on the site.

Financial institutions are not responsible for updating or ensuring the accuracy of the information on Flytrippers’ website. All the information was independently collected by Flytrippers and not provided by financial institutions.

All offers described on the Flytrippers website are subject to the financial institutions’ latest terms and conditions, which can be found on their official website. No efforts are spared to ensure this page is up to date but offers from financial institutions change quickly. It is your responsibility to ensure the accuracy of these offers on their website. Flytrippers will not accept any responsibility for the accuracy of the offers or the result of your actions.

Flytrippers’ website does not contain all available credit card offers or all available credit card products on the market. In addition, Flytrippers never shares an offer if it is not considered advantageous for some travelers, at its sole discretion.

No author on Flytrippers’ website is a financial advisor, a financial planner, a legal professional, or a tax professional. No author on Flytrippers’ website can in any way be considered as such.

All articles, pages, and content on Flytrippers’ website are merely personal opinions of a general nature and are for informational purposes only and should not be considered advice for specific situations. It is your responsibility to perform your own personal research to ensure that travel rewards are appropriate for your own situation.

You can learn more about our terms of use here .

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

American Express Travel Insurance Coverage Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3068 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1167 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Why Purchase Travel Insurance

Travel insurance and the covid-19 virus, package policy options, custom select coverage options, pricing by age, cancellations and changes, to other travel insurance companies, to credit card travel insurance, travelinsurance.com, insuremytrip, squaremouth, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

We frequently discuss the travel insurance coverages that are offered complimentary on most credit cards . We do so because these benefits, especially the long list of travel insurance coverages on premium cards, can save you money, offer peace of mind during your travels, and provide help if something goes wrong.

These complimentary coverages are useful and can offer more than adequate coverage for most trips. However, if you’re investing in an expensive trip or 1 that involves multiple travel providers, purchasing a comprehensive travel insurance policy is a prudent move. You’d also want a travel insurance policy if your trip has a complicated itinerary or if you’re anxious about the possibility of having to cancel any portion of the journey.

Additionally, it’s imperative that if you’re worried about having medical coverage while traveling, you’d want to purchase a travel insurance policy that provides medical coverage.

Fortunately, travel insurance is widely available, reasonably affordable, and simple to secure. There are several reputable travel insurance companies , highly-rated by financial rating organizations such as AM Best , that offer nearly endless options from which to choose.

American Express Travel Insurance , underwritten by AMEX Assurance Company, is one of those highly-respected, highly-rated, established companies offering comprehensive travel insurance solutions.

Join us while we check out the types of policies the company offers, any limitations of which to be aware, and additional options for protecting your next trip appropriately.

Travel insurance can help you avoid losing the investment you made when booking your trip, reimburse you for covered expenses should your trip be disrupted due to a covered event, or pay for emergency medical services.

Policies are designed to cover disruption due to the reasons listed in the policy you purchased. These reasons consist of events that are unforeseen and unexpected.

Here are a few situations where travel insurance could cover your loss:

- You or a covered family member become ill and you must cancel your trip. Trip insurance can cover prepaid non-reimbursable expenses.

- You are injured in an accident during your trip and need to be evacuated to a hospital by air ambulance.

- You become ill during your trip and must return home versus continuing on your journey.

- Your flight is delayed or canceled and you must stay at a hotel and incur expenses for lodging and incidentals.

Whether you should purchase travel insurance or not is a personal decision. If losing your trip investment or having to pay for extra expenses if the trip is disrupted makes you uncomfortable or would present a financial burden, then you should purchase a comprehensive travel insurance policy.

If worrying about having to cancel your trip or having it disrupted during your journey is an issue, purchasing a travel insurance policy will definitely deliver some peace of mind, both prior to and during your trip.

For more tips on buying travel insurance in general, you’ll find valuable information in our guide to buying the best travel insurance .

Bottom Line: The longer, more expensive, and more complicated your trip, the greater the need for a comprehensive travel insurance policy.

When you purchase travel insurance and your trip is canceled, you expect to have coverage. However, not all cancellations are covered — only those specifically listed in your policy.

Once COVID-19 was declared a pandemic, it became a known event and therefore is not covered on travel insurance policies. While it’s reasonable to want to cancel your trip due to fear of COVID-19, canceling a trip due to the fear of any illness is not a covered reason on any travel insurance policy.

There is also no coverage for canceling a trip due to a U.S. State Department announcement warning of COVID-19 in a particular area.

In order to have coverage for voluntary trip cancellations, you would need to purchase “Cancel for Any Reason Insurance” (CFAR) . CFAR is not a stand-alone insurance policy — it is an add-on coverage you select when you purchase a travel insurance policy or coverage you may be able to add to a travel insurance policy after purchase, within an initially specified timeframe.

CFAR insurance is expensive, does not cover the entire cost of your trip, and not all companies sell the coverage, including American Express Travel Insurance.

Additionally, there is a small window of time when you are able to purchase the coverage, including during your initial purchase or up to 10 to 21 days after the purchase, depending on the company.

While American Express Travel Insurance does not cover trip cancellation due to fear of contracting COVID-19, there may be coverage in certain circumstances. For example, if you become sick with the virus and have to cancel your trip as a result, you may have coverage under trip cancellation insurance.

Additionally, if you become ill with the virus during your travels, you may have coverage under Travel Medical Protection. Terms and conditions apply.

Bottom Line: Travel insurance does not cover canceled trips due to fear of getting COVID-19 or a government declaration that a specific destination is unsafe. Cancel for Any Reason Insurance must be purchased to cover these voluntary cancellations.

American Express Travel Insurance Options

American Express offers you 2 options when it comes to purchasing travel insurance. You can select a package policy that includes several types of coverages in 1 plan or you can build your own travel insurance plan and select just the coverages that are important to you.

Coverage is worldwide except for where it would violate U.S. trade or economic sanctions. All permanent U.S. residents are eligible to purchase travel insurance with American Express.

American Express Travel Insurance offers 4 levels of travel insurance package policy plans — a Basic Plan, Silver Plan, Gold Plan, and Platinum Plan. Each has its own levels of coverage and associated premium cost.

Let’s take a look at the package policy offerings and pricing. We chose a week-long trip for a 40-year old that cost $3,000. Prices ranged from $59 to $208 to cover the entire trip.

With package policies, you can expect to find the following coverages. The limits of coverage differ based on the policy plan you select.

- Trip Cancellation/Interruption — Receive reimbursement for prepaid non-refundable expenses due to cancellation for covered reasons and additional costs if your trip is disrupted, also for covered reasons.

- Global Medical Protection — Receive worldwide emergency medical and dental coverage for the first 60 days of your trip and access to emergency evacuation/repatriation services.

- Travel Accident Protection — Receive coverage for accidental death/dismemberment from the time you leave on your trip until the time you arrive home.

- Global Baggage Protection — Coverage varies from $250 to $2,500 for lost luggage depending on the level selected. Baggage delay coverage starts from 3- to over 24-hour delays, depending on the policy plan selected.

- Global Trip Delay — Receive up to $300 per day, $1,000 per trip, depending on the level of coverage selected. Coverage is valid for delayed/canceled flights or involuntary-denied boarding.

- 24-Hour Travel Assistance — Have global access to planning and emergency assistance before and during your trip.

Bottom Line: American Express Travel Insurance offers 4 different levels of package policies, each comprising a collection of coverages most travelers look for. The plan you select and the level of coverage limits chosen determine the amount of the premium cost.

If some of the coverages in the package plan are not important to you, you can select only the coverage(s) you want and pay accordingly. Perhaps, for example, you have a need for just medical coverage while traveling abroad. You have the option to select just that coverage.

This example shows the levels of coverage available and the associated premium costs. The Gold Plan selected offers up to $100,000 in emergency medical, up to $750 in emergency dental, and up to $100,000 in emergency evacuation/repatriation. The price of this plan would be $32 for the entire trip.

Bottom Line: Having the option to select only the coverages you want allows you to save money by not paying for coverages you don’t need. This is a key benefit of purchasing travel insurance through American Express Travel Insurance. Few travel insurance companies offer the option to purchase stand-alone travel medical coverage.

Additional Information — American Express Travel Insurance

Like most travel insurance companies, American Express Travel Insurance prices its products within age brackets. The price for coverage is the same for everyone in that specific age bracket.

Based on dozens of quotes obtained, pricing brackets were determined to be as follows:

- Age 17 to 40

- Age 41 to 65