Free Travel Budget Calculator: Easily Make Your Vacation Budget

Packed for Life contains affiliate links. If you make a purchase using one of these links, we may receive compensation at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases. See my Disclosure policy for more info.

Ready to take the hassle out of planning and managing your vacation budget? Our online Free Travel Budget Calculator is simple, and easy to use, and can help you plan and track your vacation expenses in just a few clicks.

I’ve used these same methods and categories of expenses for every trip I’ve taken over the last 25 years. From multiple 3 month solo adventures through Europe and South America, to weeks long trips to Cuba and Vancouver Island, Canada with my family.

Now online with automatic calculations, so you don’t have to mess around with spreadsheets or hand write in printables that clutter up your home.

In this post you’ll get access to this free tool, plus, you’ll get my top tips for planning your budget effectively for your trips and how to save money on travel. All the advice you need for smarter travel planning is right here.

Table of Contents

How to Use the Travel Budget Calculator & Try It Out!

Make sure to bookmark this page so you can come back to it anytime you need to track your vacation expenses and make travel plans.

This free vacation budget calculator will give you an estimate of total travel costs for your trip and whether your budget is enough to cover what you want to do.

It can help you identify areas you can potentially save money on trip expenses. Whether it’s choosing more budget-friendly hotels, walking or taking the bus instead of taxis, or prioritizing your top not-to-miss activities.

You can also start with your budget.

Then play around with the length of your trip, how much hotels, flights etc will cost to help you determine your price range for each travel expense as well.

- Enter 0 (zero) if there are certain categories you don’t need . The calculator will output an error ($NaN) if you don’t.

- Instructions for the calculator are below the Travel Budget Calculator, to give you an idea of what you should include under each budget item.

Vacation Budget Calculator

Calculator instructions.

Enter all your estimated expenses you’ve gathered during your vacation research.

Make sure it’s actually a realistic travel budget. For a family trip with young kids, you’ll also need to factor other things like diapers, baby wipes etc.

- Travel Budget : Enter your overall vacation budget you have for this trip.

- Number of Travellers: Enter the number of people you are paying for on this trip

- Number of Nights: Enter the number of nights you will need accommodations for. This will be used to calculate hotel costs.

- Number of Vacation Days: Enter the number of days you will be on vacation. Include travel days to be safe . This will be used to calculate your overall food & drink, daily transportation and activity costs.

- Total Flight Costs: Enter the estimated total of flight costs for everyone travelling. Be sure to include any baggage fees.

- Transportation Costs: Enter the total transportation costs for the trip. This is for any major transport costs that aren’t flights like trains, city transfers, car or RV rentals.

- Daily Transportation Costs: Enter your anticipated daily transport costs. This is for things like taxis, buses, Ubers, parking costs etc, you might need to get around every day.

- Hotel Costs (Per Night): Enter the amount your accommodations will cost each night. Don’t forget to include any tips for housekeeping staff etc. you may need to pay.

- Total Tour Costs: Enter your overall total budget or cost for tours, including guide tips.

- Activity Costs (Per Day) : Enter the amount you expect to spend on activities daily (do not include tours). These are for things like seeing movies, souvenirs, shopping, trips to a rec centre / pool, bowling, seeing a hockey game or a concert etc.

- Food & Drink Costs (per Day): Enter your overall daily food & drink budget or expected costs for everyone. Don’t forget to include tips.

- Miscellaneous Expenses: Enter an amount of money you will have overall for unexpected expenses or miscellaneous costs that pop up. Be sure to also include extra travel expenses not covered elsewhere.

- Travel Insurance: Enter the overall amount of money you will pay for travel insurance for everyone. This is for things like travel health insurance, trip cancellation insurance etc.

Budget Outputs

Currency Note: While the output is in dollars (uses the $ symbol), you can really use any numerical currency you’d like. Just ignore the $ symbol.

Once you hit the calculate button, you will get 4 pieces of info based on the numbers you provided:

- Total Vacation Costs : This is the estimated cost for your vacation based on the info you provided.

- Over Budget / Under Budget: This is the amount you are either over or under budget. If your expenses are over your vacation budget, it will say Over Budget and the number will be negative. If it says Under Budget, that is the amount you are under your estimated budget.

- Travel Costs Per Day: This is the amount of money your trip will cost you each day.

- Cost Per Person Per Day: This is the amount of money your trip will cost you per person, each day.

Make sure to review your results. If your over budget are there things you can do to bring the costs down? Or is there a way you can save or make more money before your trip?

Why You Need A Travel Budget

Listen, I am all for spending a little extra to do things our family doesn’t get to do at home.

But there is nothing more anxiety-inducing than running out of money on a trip, or having to pay off huge credit card bills at 28% interest because you didn’t plan ahead.

This is where a vacation budget can really help.

It doesn’t mean you can’t have fun or spend money.

Creating a budget will actually help you be able to afford your dreams. Plus be able to relax & have fun on your vacation knowing you won’t be in debt when you get back home.

The trip budget calculator will make financial planning fun, and easy.

How To Set Your Travel Budget & Determine Expenses

1. determine your overall travel budget.

First things first. Decide on your overall vacation budget or the money you are willing to spend on this trip.

When determining your overall vacation budget, you’ll want to consider a few things:

- How much money are you willing to spend on this trip?

- How much have you already saved?

- How long do you plan to go for? (more or less time can impact your budget)

- How many people will be travelling? (some places like Europe limit 4 people to a hotel room, this can significantly impact cost)

- When do you want to travel and how much time do you have to add to your vacation fund?

- How much extra can you afford to put away every week / month on top of your regular bills & household expenses?

- Is there any way you can decrease household expenses, or increase your income to add to your vacation fund faster?

Just make sure it’s a realistic budget. It doesn’t do anybody any good to use too low or too high numbers as a starting point.

2. Do Your Research

The type of trip you want to take, the length and the type of activities you want to do, will really impact your budget.

For example a week long trip to Thailand will be much different than a week in Japan, or a trip to Disneyworld.

Do some intial research to give you an idea of what your basic travel expenses will costs, so you can have ballpark figures to enter in the travel cost calculator.

You can always google average costs of living / travelling at your destination.

Careful planning is an important part of any travel budget.

3. Find Ways to Cut Costs

Unless you have a rich benefactor, or suddenly won the lottery, it’s a good idea to consider ways you can cut costs, save money and use your travel budget wisely.

Besides using our holiday budget calculator, our favourite ways to save money on travel expenses.

Transportation & Accommodation

- Find flight deals & error fares : The best way is with Going (Formerly Scott’s Cheap Flights) Flight tickets can be a big expense and make up a good portion of the total cost usually.

- Consider housesitting: Trusted Housesitters is our go-to site for housesitting around the world.

- Rent a place with a kitchen : Save money on food with a vacation rental . They can also be cheaper than renting multiple hotel rooms if you have a large family or group.

- Compare car rentals: Using Discover Cars can help you save up to 70% by quickly comparing rental cars options.

- Book early: Hotels, flights and trains are generally cheaper booked in advance. You won’t want to risk paying significantly more waiting until last minute.

- Take public transportation: If it’s safe to do so, take the local bus, or walk instead of relying on expensive taxis all the time.

⭐️ Also check out our list of the best ways to save money on flights .

General Money Saving Tips

- Travel off season or peak season: Not only is it usually much cheaper, there’s usually fewer tourists.

- Use a credit card with no foreign transaction fees : Those transaction fees can really add up. Also consider if travel credit cards with points are for you.

- Eat where the locals eat : Avoiding the touristy restuarants, and eating where the locals eat will not only save you lots of money, it will give you a more authentic look into their local cuisine and culture.

- Avoid popular destinations: The most popular touristy destinations often cost a lot of money, compared to smaller, lesser known destinations.

- Consider using travel agents: Sometimes a travel agent can find you a great deal, with much less work on your part.

- Adjust your travel style: Luxury resorts may be out of your price range. Road trips, camping trips can be just as memorable for for a family vacation.

- Plan free activities : Pick some free activities to do in between your more expensive tours, theme parks, & day trips to ancient ruins.

- Check out these ways to save on flights

Final Thoughts Using The Vacation Budget Calendar

Creating a vacation budget might seem challenging, but don’t worry! Equipped with the right tools and a bit of strategic planning, your next epic adventure is closer than you think.

Using a vacation budget calculator can help guide you to make smart, affordable choices, allowing you to experience the journey you’ve always dreamed of, without stressing about expenses.

Travel can be exciting and enjoyable at all budget levels. So here’s to making memories with your family, and friends.

Related travel planning resources:

- Ultimate Pre-Travel Checklist

- Family beach vacation tips

- Tips for saving money on road trips

- Easy ways to build a travel fund

- Save money on attractions: Where to buy online tour tickets

Donna Garrison is the founder of Packed for Life, an ever curious traveler with a passion for making memories with her family. With a unique perspective on travelling on a budget gathered over 30 years, 20 countries and 5 continents she gives families the tools & resources they need to experience the joys of travelling more for less through practical solutions. She helps over 20,000 families a month plan & take the family travel, camping and road trip adventures of their dreams in Canada, the USA and around the world. Contact her at: Donna [at] packedforlife.com

Similar Posts

70 Best Canned Foods for Camping: No Refrigeration (+ Recipes)

Wondering what canned food for camping you should pack? We’ve…

50+ Camping Gifts For Kids They’ll Love & Use

Looking for the best camping gifts for kids? As a…

105+ Easy Road Trip Meals & Snacks: Best Road Trip Food

Road trips are exciting adventures to take with your friends,…

17 Family Beach Vacation Tips (For Successful Beach Trips With Kids)

Heading out on a beach trip with kids? We’ve put…

What To Do If Your Lugagge Is Lost Or Delayed

Delayed and lost luggage seems to be the norm not…

Printable Camping Planner: For Easy & Fun Camping Trips

Looking for an easy way to plan your next Camping…

Privacy Overview

Sharing is caring.

Help spread the word. You're awesome for doing it!

Travel Budget Calculator

Your ultimate guide to smart travel planning.

Planning a trip can be exhilarating, but it often comes with the stress of managing finances. Fear not! With the Travel Budget Calculator, you can embark on your dream journey with confidence. In this guide, we’ll delve deep into the intricacies of budgeting for travel, empowering you to make informed decisions and maximize your experiences.

Understanding the Travel Budget Calculator

Embarking on a journey starts with meticulous planning, and the Travel Budget Calculator serves as your trusty companion. This tool revolutionizes the way you approach travel expenses, offering a comprehensive overview of your financial landscape. By inputting essential details such as number of nights, duration, accommodation preferences, and activity interests, the calculator generates a personalized budget tailored to your preferences and constraints.

Benefits of Using the Travel Budget Calculator

Planning your itinerary can be overwhelming, but the Travel Budget Calculator simplifies the process. Here’s why incorporating this tool into your travel planning arsenal is a game-changer:

- Efficiency in Planning: Say goodbye to tedious spreadsheets and guesswork. The Travel Budget Calculator streamlines the planning process, providing instant insights into your projected expenses. With a few clicks, you can fine-tune your budget and allocate resources efficiently, ensuring a hassle-free travel experience.

- Financial Transparency: Transparency is key to effective budgeting, and the Travel Budget Calculator offers just that. By breaking down expenses across various categories such as transportation, accommodation, dining, and activities, you gain a clear understanding of where your money is allocated. This transparency empowers you to make informed decisions and prioritize experiences that matter most to you.

- Flexibility and Customization : No two travelers are alike, and the Travel Budget Calculator recognizes that. Whether you’re a budget-conscious backpacker or a luxury seeker, this tool adapts to your preferences and constraints. Adjust parameters such as accommodation standards, dining preferences, and activity intensity to tailor your budget to your unique travel style.

Travel Budget Calculator: Your Key to Financial Freedom

In conclusion, the Travel Budget Calculator empowers you to embark on unforgettable journeys without compromising your financial stability. By leveraging its capabilities and implementing savvy budgeting strategies, you’ll unlock a world of possibilities and create cherished memories that last a lifetime. So, what are you waiting for? Start planning your next adventure today and let the Travel Budget Calculator be your guiding light.

FAQs About Travel Budget Calculator

Below are some basic questions that arise while using a travel budget calculator.

Q. How does the Travel Budget Calculator work?

A. Calculating a travel budget isn’t rocket science; it’s just simple math. As we know, if we have exact numbers in front of us, decision-making becomes much easier. A Travel Budget Calculator simply provides us with all the expense numbers.

Q. Is the Travel Budget Calculator suitable for all types of travelers?

A. Absolutely! Whether you’re a budget-conscious backpacker, a luxury seeker, or somewhere in between, the Travel Budget Calculator adapts to your preferences and constraints. Simply adjust the parameters to align with your unique travel style and embark on your adventure with confidence.

Q. Can I trust the accuracy of the Travel Budget Calculator?

A. Yes, the Travel Budget Calculator is designed to provide accurate and reliable estimates based on the information provided. However, it’s essential to factor in unforeseen expenses and fluctuations in prices to ensure comprehensive budget planning.

Q. Can I save my budgeting preferences for future use?

A. Unfortunately, the Travel Budget Calculator does not currently offer a save feature but you can download it. However, you can easily recreate your budgeting preferences each time you plan a trip by inputting the relevant details into the calculator.

Q. How frequently should I update my travel budget?

A. It’s advisable to review and update your travel budget regularly, especially as your trip approaches and circumstances change. Factors such as fluctuating exchange rates, last-minute bookings, and unexpected expenses can impact your budget, so staying proactive is key to financial planning success.

Travel Cost Estimator (Easy Free Tool)

Calculate and download the travel costs for your next trip or vacation.

Travel Details

Transportation, accommodation, food & beverage, other expenses.

Total Estimated Cost: $0.00

Cost Per Day: $0.00

Estimate vs. Budget: $0.00

Per Person Per Day: $0.00

How Do You Calculate Travel Costs?

The first step to figure out your estimated travel costs is to calculate your travel expenses.

To calculate these travel expenses, you can utilize the travel costs calculator above, which allows you to enter some travel details and get an estimate of how much you will spend in total.

- Select your country to get an estimate of a daily budget. We used websites like budgetyourtrip.com , TripAdvisor and Forbes to collect the estimated daily budget for each country.

- Add your estimated budget in the first input field.

- The number of vacation days and the number of people in the next two input fields.

- The total costs of your transportation options, flights, car rental, gas, train, bus, or taxi etc.

- The charges per night of the accommodation, hotel, hostel, or Airbnb etc.

- Enter the cost per day of your daily activities and tours / museums, attractions, or participate in any activities.

- The total food and beverage expenses per day, don’t forget to count any snacks and drinks.

- Miscellaneous costs like SIM Cards / Internet / souvenirs and other items.

- Tips at restaurants, hotels, and other services.

- The total cost of your travel insurance, you can also add an emergency fund for unexpected expenses or changes in plans.

- Click Calculate to see the results.

- You can download the budget if you want to keep a copy in your phone.

How Much Budget Do You Need To Travel?

The answer to this question depends on your destination, duration, travel style and preferences.

As a general rule, you can use the following formula to estimate how much budget you need to travel:

Travel budget = (Daily budget x Number of days) + Flight cost (Round-trip)

The daily budget is the amount of money you spend on average per day during your trip, excluding the flight cost.

This includes ground transportation, accommodation, food and beverages, activities and attractions, shopping and souvenirs, travel insurance, and tips and other expenses.

The number of days is the duration of your trip, from the day you depart to the day you return.

This includes the travel days, which are usually more expensive than the rest of the days.

The flight cost is the price of your round-trip ticket to and from your destination.

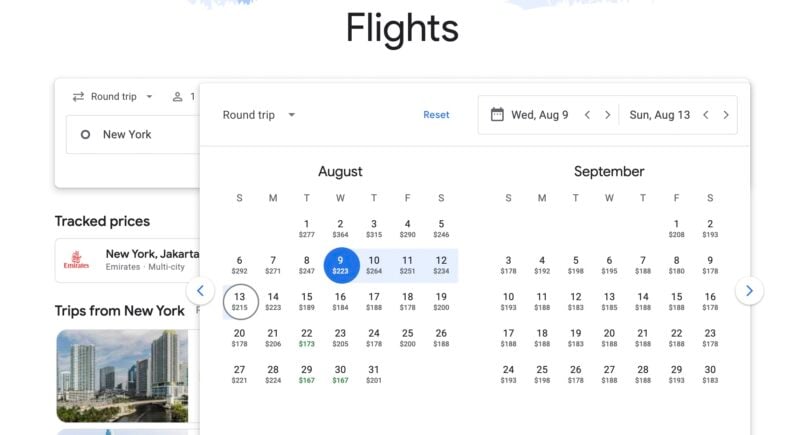

Flights can vary depending on the season, the airline, the route, and the booking class. You can always use google flight to get the best deals.

For example, if you want to travel to Paris for 10 days, and your daily budget is $100 (Including an Eiffel tower summit ticket ), and your flight cost is $500, then your travel budget is:

Travel budget = ($100 x 10) + $500 = $1,500

This is the total budget you need to enjoy Paris for 10 days, based on the estimated expenses.

Of course, this is just an example, and your actual travel budget may vary depending on your specific trip and choices.

But this formula can give you a rough idea of how much money you need to travel, and help you plan your budget accordingly.

How Much Daily Budget Do You Need To Travel?

There is no definitive answer to this question, as it depends on many factors, such as the destination, the travel style, duration, and your preferences.

This is a general rule that you can use to estimate how much daily budget you need to travel, based on the average cost of travel in different regions of the world.

These numbers are based on a backpacker budget, which means staying in hostels, eating local, using public transport, and doing mostly free or cheap activities.

If you prefer a more high end or luxurious travel experience, you can expect to pay more.

If you’re traveling to more expensive countries like Spain, Greece or Norway for example, you can have some extra expenses.

But on a cheaper or more accessible destination, such as Mexico, Morocco, or Thailand, you can expect to spend less.

Frequently Asked Questions About Calculating Travel Costs

A. There are several ways to save when you travel, like booking your flights and hotels early, avoid traveling during peak times and make the most of reward points and any travel discounts.

A. Use public transportation, walk, or cycle whenever possible instead of relying on taxis or renting a car.

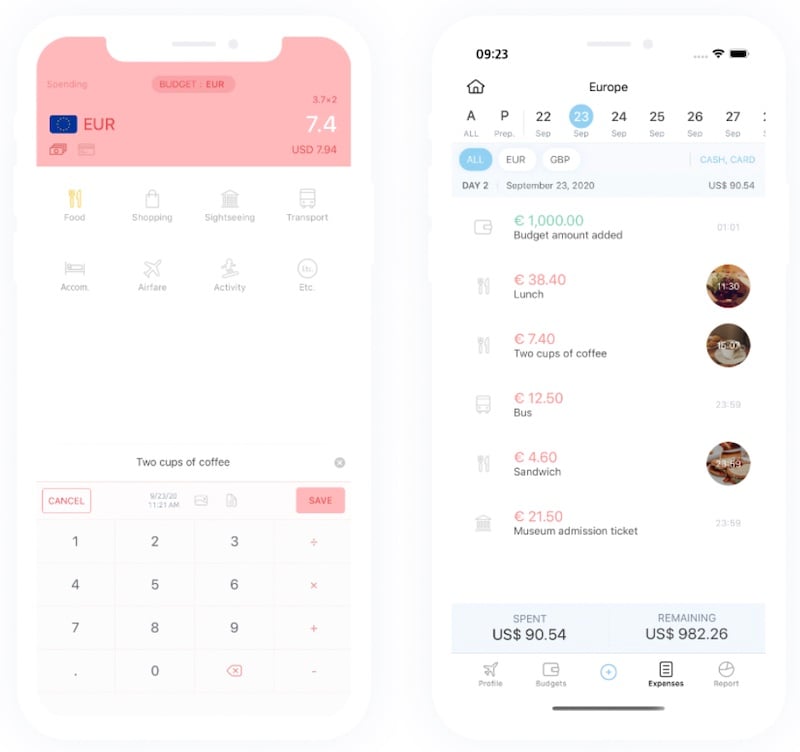

A. To keep track of the expenses that the travel cost calculator gives you, use a mobile app that suits you, a journal and a pen (my favorite), a spreadsheet, or travel expense tracker to jot down any money that comes out of your pocket.

A. Again it doesn’t’ matter if you are traveling for or a weekend or 30 days, the answer will depend on several factors like travel style, destination etc, use the travel cost estimator above and enter 30 days as the number of lavation days, and you will get an estimated budget.

A. Yes. You can use the calculator for any type of trip, whether you are traveling on by RV or by a plane or car.

Other useful calculators

- Airlines Luggage Size And Weight Calculator : Get your airline baggage size and weight for a hassle free flight.

- Travel Packing & Clothing Weight Calculator : Generate a complete packing list for your next vacation while staying within your airline luggage size and weight limits.

- Linear Inches Calculator for luggage

Travel Budget Calculator with Trip Mileage Calculator

This calculator will help you to budget for a family vacation by allowing you to create your own self-calculating worksheet.

You can create the worksheet either from scratch or from a sample travel budget, and you can include up to 8 categories, each with up to 10 expense items.

This budgeting tool even includes a built-in trip mileage calculator, a built-in trip fuel calculator, and 5 built-in multipliers (per adult, child, travel day, fun day, mile, etc.) for calculating the total cost of an expense from a unit cost.

This means that if you make a change to a multiplier, like shorten your trip by one day for example, you will be able to see the cost difference instantly. Cool!

And finally, the calculator will give you the option of printing out a customized blank budget worksheet and/or a completed budget spread sheet. You can even choose whether or not you want blank lines to appear on the printed worksheet, and if so, how many.

Also on this page:

- Don't borrow from your future vacations.

- How to stay on budget while traveling.

- Give equal focus to the post vacation.

Travel Budget Calculator

Create and calculate a travel budget, either from scratch or from a preloaded list of expenses.

Selected Data Record:

A Data Record is a set of calculator entries that are stored in your web browser's Local Storage. If a Data Record is currently selected in the "Data" tab, this line will list the name you gave to that data record. If no data record is selected, or you have no entries stored for this calculator, the line will display "None".

Number of adults:

Optional: If you want to use the built-in multiplier for adults, enter the number of adult travelers here.

Number of children:

Optional: If you want to use the built-in multiplier for children, enter the number of child travelers here.

Number of nights of lodging needed:

Optional: If you want to use the built-in multiplier for lodging nights, enter the number of lodging nights here.

Number of travel days:

Optional: If you want to use the built-in multiplier for travel days, enter the number of travel days here. The travel budget calculator will add travel and fun days to arrive at the total number of days.

Number of fun days:

Optional: If you want to use the built-in multiplier for fun days (non-travel days), enter the number of fun days here. The travel budget calculator will add travel and fun days to arrive at the total number of trip days.

Trip Mileage Calculator & Trip Fuel Calculator:

If you will be using a vehicle for travel, this section contains a calculator that will help to estimate the cost of gasoline for trip, as well as a field for entering the estimated total number of miles (miles can then be used as an expense multiplier).

Vehicle's miles per gallon rating:

Optional: If you want to use the built-in fuel cost calculator, enter the vehicle mile per gallon (MPG) rating here.

Cost per gallon of gasoline:

Optional: If you want to use the built-in fuel cost calculator, enter the cost of one gallon of gasoline here.

Miles calculator:

You can use the following mini calc to add up the miles per travel day, per fun day, and any extra. Entries to these fields will be multiplied by their corresponding number of days entered at the top of the calculator and added together to arrive at the total trip miles.

Total number of miles:

Optional: If you want to use the built-in fuel cost calculator, enter the estimated number of drive-miles for the trip. Expand the description in this row to use a mini calc to add up the miles per travel day and/or the number of drive-miles per fun day, plus any extra miles -- all based on the multipliers you entered in the top section of the calculator.

Estimated number of gallons of gasoline:

If you have completed the prerequisite MPG and total miles entries, this line will show the calculated number of gallons of gas needed for the trip.

Cost of gasoline (amount to enter in worksheet):

If you have completed the prerequisite MPG, cost per gallon, and total miles entries, this line will show the calculated cost of gasoline for the trip. You can then enter this amount in the travel budget worksheet below -- usually found under the Transportation category.

Travel Categories and Expenses:

If you would like the Travel Budget Calculator to populate all categories and item fields with suggested titles, tap the Load Sample button in this row. If you would like to clear the category and item titles, tap the Clr button on this row (may also appear as Clear or Clear Worksheet ).

Categories: Tap the plus signs (+) to expand each category. Tap the category names to edit them.

Expenses: After expanding a category, tap any expense name (or "Blank") to open a popup wherein you can make changes to the name and budget amount.

Edit Category Name:

Tapping the "Save" button will close the popup and save the changes to the main worksheet, whereas tapping the "Cancel" button will close the popup without saving the changes.

Note that the "Times" field only applies if the "Per -->Times" option is selected. Tapping the "Save" button will close the popup and save the changes to the main worksheet, whereas tapping the "Cancel" button will close the popup without saving the changes.

Budget Summary:

This section of the calculator will keep an updated summary of your entries.

Amount you are budgeting for travel:

This is the budget amount you entered in the top section of the Travel Budget Calculator.

Total of all entered expenses:

This is the total of all expenses you have entered into the Travel Budget Calculator.

Under/-Over budget:

This is the amount you are over or under budget. If the result is preceded by a minus sign, your entered expenses exceed the amount you are budgeting for your trip.

Printable Worksheet Settings:

To create a printable travel budget worksheet, indicate how many blank category and expense rows you want included in the worksheet, and then tap the "Create Printable Worksheet" button. This will open a printer friendly window displaying your current travel budget worksheet.

Note that you can create a blank budget worksheet by leaving all of category and expense amounts set to zero.

Number of blank categories:

Select the number of blank categories you would like included in the printable travel budget worksheet. The maximum number of categories that will display in the worksheet is 8. For example if you have 6 categories with entries, but would like two more blanks for later use, select 2 from the drop-down menu. This will include 6 completed categories in the worksheet and two blank categories. If you are printing out a blank worksheet, simply select the total number of categories you would like included.

Number of blank expense lines:

Select the number of blank rows you would like included for each category in the printable travel budget worksheet. The maximum number of rows that will display for each category in the worksheet is 10. For example if you have a category with only 4 entries, but would like two more blank rows for later use, select 2 from the drop-down menu. This will include the 4 completed rows, plus two blank rows, for the category in the worksheet . If you are printing out a blank worksheet, simply select the total number of blank rows you would like included for each category.

If you would like to save the current entries to the secure online database, tap or click on the Data tab, select "New Data Record", give the data record a name, then tap or click the Save button. To save changes to previously saved entries, simply tap the Save button. Please select and "Clear" any data records you no longer need.

Related Calculators

Help and tools, on how to budget for and take vacations in a way that won't ruin future vacations., budget travel tip #1: don't borrow from your future vacations.

The most important budget travel tip is to never borrow money to pay for a family vacation.

Because if you continue to borrow money to pay for your family vacations you will have less and less money available for future vacations.

And the more financial stress you experience as a result of the ever-increasing monthly debt payments, the more you will feel you need an escape (vacation) from the added stress, and the more you will have to borrow to escape.

It's a vicious cycle that can lead to financial and emotional bankruptcy.

Budget Travel Tip #2: Travel On a Budget

If you want to avoid jeopardizing future vacations, it's imperative that you create a realistic budget for your trip and then stick to your budget.

This is rarely easy since traveling with credit cards is safer than traveling with cash. But unlike an empty wallet, a credit card does not provide a clear indication you've exceeded the amount you budgeted for a given expense category.

Therefore, in order to make sure you stay within your travel budget limits, it's important that you keep a running tab of all of your travel spending as it occurs.

One of the best ways I have found to keep a running tab of your travel spending is to use a blank checkbook register.

- Allocate a few pages of the register for each trip expense category.

- Record the budgeted amount as the starting balance for each series of pages.

- Record each expenditure as they occur into the appropriate section of the checkbook register and deduct the amount from the balance -- just as you would when writing a check.

- When the balance of a category reaches zero you know you have exhausted the funds budgeted for that category.

- Spending any more for a zero-balance category means you will have to either transfer funds from other sections, or increase your debt.

Budget Travel Tip #3: Give Equal Focus to the Post Vacation

In order to successfully plan a budget family vacation, it's important to use your imagination for more than just imagining how much fun you will have.

You also need to give equal focus to imagining how you will feel about the vacation after it has occurred. You can do that by honestly answering the following types of questions.

- Will the memories, souvenirs, and photos be as exciting to you as looking forward to the vacation?

- Will you spend the next year partially depressed because you dearly miss laying on the beach, hearing the ocean waves crash onto shore, and being waited on hand and foot?

- Will you spend several weeks working harder than normal just to catch up on everything you fell behind on while away?

- How many hours did you have to work at your job in order to earn the after-tax, after-work-related-expense income to pay for the vacation?

- After calculating the lost interest income from not being able to invest the cost of the vacation, will you still see the vacation as being a good investment?

- Is there anything else you could have bought with the cost of the vacation that the family could have enjoyed for a longer period of time than the length of your vacation?

- After returning home from your vacation do you think you will feel like you could have gotten by with less of a vacation?

The bottom line is, don't be like most people who only use their imaginations to envision how much they will enjoy the "party" aspect of their actions, while failing to use their imaginations to envision the "hangover" aspect of their actions.

Adjust Calculator Width:

Move the slider to left and right to adjust the calculator width. Note that the Help and Tools panel will be hidden when the calculator is too wide to fit both on the screen. Moving the slider to the left will bring the instructions and tools panel back into view.

Also note that some calculators will reformat to accommodate the screen size as you make the calculator wider or narrower. If the calculator is narrow, columns of entry rows will be converted to a vertical entry form, whereas a wider calculator will display columns of entry rows, and the entry fields will be smaller in size ... since they will not need to be "thumb friendly".

Show/Hide Popup Keypads:

Select Show or Hide to show or hide the popup keypad icons located next to numeric entry fields. These are generally only needed for mobile devices that don't have decimal points in their numeric keypads. So if you are on a desktop, you may find the calculator to be more user-friendly and less cluttered without them.

Stick/Unstick Tools:

Select Stick or Unstick to stick or unstick the help and tools panel. Selecting "Stick" will keep the panel in view while scrolling the calculator vertically. If you find that annoying, select "Unstick" to keep the panel in a stationary position.

If the tools panel becomes "Unstuck" on its own, try clicking "Unstick" and then "Stick" to re-stick the panel.

Vacation Budget Calculator

This Vacation Budget Calculator by MoneyFit.org will help you financially prepare for your planned upcoming vacation, whether you are heading across an ocean or just across town.

How This Calculator Can Help

Money Fit’s Vacation Budget Calculator steps you through 11 trip-related expense categories to remove the guesswork from trying to determine how much money you will need to spend on your upcoming travel.

From airfare or cruise tickets to gasoline to travel snacks, or from attraction fees to dining out and shopping for souvenirs, this tool covers the most significant expenditures of your upcoming vacation. Before overspending on your next trip, spend 5 or 10 minutes now with this calculator.

Expected Expenses

Contact information.

*Meeting with a counselor and participating in a DMP are not factors in a FICO credit score: www.myfico.com/credit-education/credit-scores/whats-not-in-your-credit-score

Additional Vacation Budget Related Money Motivation Articles:

Find important answers, advice, and analysis to a wide range of personal finance topics in our Money Motivations blog.

Lottery Winnings And Taxes

Leveling Up Your Finances, Video Game Style

SIMPLE Personal Finances

What Financial Freedom Means & How to Get It

Money Fit by DRS Joins NFCC

Money Fit Launches “Start Now, Start Right” Program

Related calculators.

Debt Solutions

- Credit Card Debt Relief

- Debt Consolidation

- Credit Counseling

- Debt Management

- Payday Loan Consolidation

- Housing Counseling

Financial Education

- Money Fit Academy

- My Life My Choices - Student Edition

- Scholarship Program

- Money Fit Blog

- Financial Wellness for Organizations

About Money Fit

- Client Login

Connect With Us

- Privacy Policy

- Terms of Use

- State Licenses

© 2024 Money Fit by DRS 6213 N. Cloverdale Rd, Suite 130, Boise, ID 83713 Money Fit is a nationwide nonprofit 501(c)(3) organization. We do not lend money.

This Website Is Using Cookies. We use cookies to improve your experience. By continuing, you agree to our cookie use.

Client Credit Report Authorization

- Obtain and review your credit report, and

- Request verifications of your income and rental history, and any other information deemed necessary for improving your housing situation (for example, verifying your annual property tax obligations and homeowner’s insurance fees)

- Counseling Agencies

- Debt Collectors

- Mortgage Servicers

- Property Management Companies

- Public Housing Authorities

- Social Service Agencies

Client Privacy, Data Security, and Client Rights Policy

NOTE: This sheet is to inform new or returning clients about our services, records, fees, and limitations that may affect you as a consumer of our services. This form also discloses how we might release your information to other agencies and/or regulators. If you do not understand a statement, please ask a Debt Reduction Services (DRS) counselor for assistance.

Debt Reduction Services, Inc. (DRS) has put into place policies and procedures to protect the security and confidentiality of your nonpublic personal information. This notice explains our online information practices and how we use and maintain your information to conduct our financial education and credit counseling sessions and to fulfill information and question requests. This privacy policy complies with federal laws and regulations.

To provide our financial education and credit counseling services, we collect nonpublic personal information about you as follows: 1) Information we receive from you, 2) Information about your transactions with us or others, and 3) Information we receive from your creditors or a consumer reporting agency. We do not share this information with outside parties.

We use non-identifying and aggregate information to better design our website and services, but we do not disclose anything that could be used to identify you as an individual.

You hereby authorize DRS, when necessary, to share your nonpublic personal, financial, credit, and any information that you provided (including any computations and assessments produced) with the following entities in order to help DRS provide you with appropriate counseling or guide you to appropriate services: third parties such as government agencies, your lender(s), your creditor(s), and nonprofit housing-related and other financial agencies as permitted by law, including the U.S. Department of Housing and Urban Development.

To prevent unauthorized access, maintain data accuracy, and ensure the correct use of information, we have put in place appropriate physical, electronic, and managerial procedures to safeguard and secure the information we collect online. We limit access to your nonpublic personal information to our employees, contractors and agents who need such access to provide products or services to you or for other legitimate business purposes.

Debt Reduction Services, Inc. complies with the privacy requirements set forth in the HUD housing counseling agency handbook 7610.1 (05/2010), including the sections 2-2 Mc, 3-1 H(2), 3-3, 5-3 F, and Attachment A.5. At all times, we will comply with all additional laws and regulations to which we are subject regarding the collection, use, and disclosure of individually identifiable information.

- Services : DRS provides the following housing-related services: counseling that includes Homeless Assistance, Rental Topics, Pre-purchase/Homebuying, and Home Maintenance and Financial Management for Homeowners (Non-Delinquency Post-Purchase); Education courses that include Financial literacy (including home affordability, budgeting, and understanding use of credit), Predatory lending, loan scam or other fraud prevention, Fair housing, Rental topics, Pre-purchase homebuyer education, Non-delinquency post-purchase workshop (including home maintenance and/or financial management for homeowners), and other workshops not listed above.

Please refer to DebtReductionServices.org for details of our services.

- Limits : Our services are limited to our normal weekday business hours. We do not provide individual counseling or education services after hours or on weekends, although our education courses are available 24/7.

- Fees : We do not charge fees for our financial management counseling and education. However, if you use them, you may have to pay for our Debt Management Program, Student Loan Counseling, Bankruptcy Certificate Services or certain financial education courses (homebuyer education, rental topics, fair housing, predatory lending, and post-purchase-non-delinquency including home maintenance and/or financial management for homeowners).

- Records : We maintain records of the services you receive, including notes about your progress or other relevant information to your work with us. You have the right to access and view your records by making a request to your counselor.

- Confidentiality : We respect your privacy and offer our services in confidence with the understanding that we may share such information with auditors and government regulators. Certain laws or situations may also lead to disclosing confidential issues, such as those involving potential child abuse or neglect, threats to harm self or others, or court subpoenas.

- Refusal of Services : You have the right to refuse services without any penalty or loss.

- Disclosure of Policies and Practices : You will be provided our agency disclosure statement.

- Sharing of Information : Sometimes we will need to contact other agencies or we may need to share your information, including your records, with other agencies or with regulators. We will do this only if you sign this form that gives us permission except for limited reasons; please see # 5 above for examples of such situations.

- Other : You have the right to be treated with respect by our staff, and we expect the same from you in return. We encourage you to always ask questions if something is not clear. We also encouraged you to express your thoughts and advocate throughout our services.

You acknowledge that this authorization will remain in effect for the duration of time that DRS serves as your housing counselor or financial education provider. You also acknowledge that should you wish to terminate this authorization, you will notify DRS in writing.

Disclosure Statement

Program disclosure form, disclosure to client for hud housing counseling services.

- Housing Education Courses : DRS offers many online self-guided education programs classified as Financial, Budgeting, and Credit Workshops (FBC), Fair Housing Pre-Purchase Education Workshops (FHW), Homelessness Prevention Workshops (HMW), Non-Delinquency Post Purchase Workshops (NDW), Predatory Lending Education Workshops (PLW), Pre-purchase Homebuyer Education Workshops (PPW), and Rental Housing Workshops (RHW). These courses help participants increase their knowledge of and skills in personal finance, including home affordability, budgeting, and understanding the use of credit, as well as predatory lending, loan scams, and other fraud prevention topics, fair housing, rental topics, pre-purchase homebuyer education, non-delinquency post-purchase topics including home maintenance and/or financial management for homeowners, homeless prevention workshop, and other workshops not listed above relating to personal finance and housing. Course details are found below under “Housing Workshops.”

- Home Equity Conversation Mortgage (HECM) Counseling (RMC) : Via telephone and virtual platforms, we offer the required HECM counseling nationwide in addition to in-person counseling in Boise, Idaho. We also offer in-home counseling options in thirty counties across southern Idaho for an additional fee to cover our travel and additional staff time costs.

- Home Maintenance and Financial Management for Homeowners (Non-Delinquency Post-Purchase) (FBC) : Clients receive counseling and materials on the proper maintenance of their home and mortgage refinancing. Clients can find help and resources by phone, in our Boise office, or virtually on all topics related to stabilizing their long-term homeownership.

- Services for Homeless Counseling (HMC) : Clients receive phone, virtual, or in-person (Boise) counseling to evaluate their current housing needs, identify barriers to and goals for housing stability, establish a path to self-sufficiency, and connect with emergency shelters, income-appropriate housing, and/or other community resources (e.g. mental healthcare, job training, transportation, etc.).

- Pre-Purchase Counseling (PPC) : Clients receive counseling through the entire homebuying process. Assistance may involve creating a sustainable household budget, understanding mortgage options, building their credit rating, and putting together a realistic action plan to set and achieve homeownership goals. Additionally, clients will receive materials and resources about home inspections and other homeownership topics relevant to successfully maintaining a home.

- Rental Housing Counseling (RHC) : Via phone, in-person appointments (Boise, ID), or virtual platforms, clients receive housing counseling relevant to renting, including rent subsidies from HUD or other government and assistance programs. Topics can also address issues and concerns having to do with fair housing, landlord and tenant laws, lease terms, rent delinquency, household budgeting, and finding alternate housing.

- A Debt Management Program (DMP) for consumers struggling to pay their credit cards, collections, medical debts, personal loans, old utility bills, and past-due cell phone accounts;

- The Budget Briefing and Debtor Education Certificates that are required during the Bankruptcy filing process;

- A Student Loan Repayment Plan Counseling and application service.

Relationships with Industry Partners

No client obligation, housing counseling and education fee schedule, online education program fees*.

Homebuyer Education Course : $59 per participant

- Self-paced course available here , our online housing counseling and education center. Certificates will be automatically generated upon completion of the course (approximately 6-8 hours)

Rental , Fair Housing , Predatory Lending / HOEPA , Post-Purchase (Non-delinquency post-purchase workshop, including home maintenance and/or financial management for homeowners) Online Workshops : $49 per participant

- Approximately 1 hour each

Other Self-Guided Financial Literacy Webinars (e.g. credit , budgeting , homeless prevention , debt prevention ): $0

One-on-one Counseling Fees*

Pre-purchase Homebuying Counseling, Rental Counseling, Post-purchase Ownership Maintenance and Financial Management : $75

- Session by the hour

Reverse Mortgage/HECM Counseling with Required Certificate :

Credit Report Fee : Paid Directly by Client

*Fees for all but our online education courses and workshops can be paid online by debit card, credit card, or PayPal or in person by cash, check or money order to: “Debt Reduction Services, Inc.” Registration fees are non-refundable 24 hours or less before the start of an in-person course or workshop. Certificates are non-transferable

*Fees may be waived for households with income of 150% or less of that identified on the US Department of Health and Human Services Poverty Guidelines Page

†Home visit counseling is available in 30 southern Idaho counties for potential HECM borrowers at additional costs to cover our travel (IRS reimbursement rates apply) and staff time ($50 per hour or fraction there).

- Travel Planning Guide

A Travel Planning Guide

Travel cost calculators for countries around the world.

Budget Your Trip is designed to help you plan a better vacation by gathering travel costs for various destinations around the world. Whether you're traveling on a shoestring budget, or looking to splurge on a luxury resort, our website will help you understand how to get the most for your money.

We offer travel planning resources that you can use to estimate, plan, and track your travel budget. Our information and resources are free of charge for travelers. If you're in the beginning stages of planning your trip, you can search for your destinations here , find your favorite place, and see what others have spent on low-end, mid-range, and luxury trips and vacations. Alternatively, you can select a country from the list of countries to find out what the typical mid-range travel costs are for that area. The costs are broken down by category and include everything from accommodation, to food, entertainment and transportation budgets. These destination budget pages also give you an overview of what to expect in your chosen country, things to see and do, how to best get around, and what you can expect from the local cuisine. From a country page, you can dive deeper into specific cities, too. This information is designed to be used as a starting point for you as you begin deciding where to go and how much you need to save.

All of our information comes from travelers just like you. All of the average daily travel costs are calculated from travel budgets that have been provided by real people who have already visited these locations. This way, you can get a realistic perspective on what you might spend. Our numbers are constantly updated to ensure that you get the most up-to-date information. If you register on our website (free) you can use our travel planning tools to help you plan your own budget before your trip even begins. You can break down your estimated expenses by category and see graphs and charts of where your money will likely go. Learn which cities and countries will have the greatest impact on your trip expenses, and rework your route to ensure that you get the most bang for your buck.

Then, once your trip begins, you can track your budget to make sure you don't overspend. Whether you're going on a one week holiday, or a one year odyssey, it helps to know that you're not spending more than you have saved. By tracking your budget on this website, you'll also be helping other travelers. If you notice your destination of choice is missing from our list, track your trip costs on our website and help future travelers. Your expenses will be added to our estimates, and as our data grows, so does our comprehensiveness and accuracy.

This is a tool that is created by travelers, for travelers. We understand how important budgeting is to a trip. Guidebooks may offer some budgeting advice, but information is often out-of-date, difficult to locate, and limited in its value. This website is supported by a community of travelers who want easy accessibility.

Are You Just Beginning?

Many travelers become overwhelmed when they begin planning their trip. If you're going on vacation for a few weeks, it's hard to narrow down your choices to one or two countries. If you're taking time off of work for a gap year, planning your route can get overwhelming to say the least. Whatever type of trip you're planning, you should first narrow your options down by region. Some parts of the world are more expensive than others, but within regions there is a lot of variability as well. You can also check out our travel planning guide for tips and advice on traveling cheaper.

Narrowing Your Options

The region or countries you decide to visit will dictate how much money your trip will require. It's best to understand costs before you begin your trip, so you know exactly what to expect from your destinations of choice.

Asia in particular has countries that range from super expensive, like Japan, to very low cost, like India or Nepal. Southeast Asia is well known as an affordable destination for those on a limited budget, but if you want a high end vacation, there are plenty of resorts in Thailand as well.

Africa can be surprisingly expensive for first time visits. Depending on your country of choice, the selection of hotels can be limited, restaurants may be overpriced, and safaris can quickly eat away at your budget. Still, you'll find plenty of affordable places to go in this vast continent. Ethiopia is an unexpected surprise for visitors who want to see a different side of Africa. Morocco is Africa with an Arab twist, and Kenya is probably your most affordable option if you're hoping to do a safari.

South America is another region that is reasonable in cost. Some countries, like Brazil, may quickly eat away at your budget, but others, like Bolivia, are perfect for those with limited financial options.

In Europe, you'll quickly find that your money goes a lot farther in the Eastern European countries than it does in the Western European countries. Still, prices can be quite high all over, so it's good to learn a few tricks, like couchsurfing, to ensure that your finances stay in check.

If you're headed to North America, national parks and small towns are usually the least expensive options. Consider traveling with a tent and you'll save yourself a lot of money. While hostels are few and far between, campgrounds are abundant, particularly near the most popular parks like the Grand Canyon and Yosemite. In Mexico, head inland and you'll find many more affordable choices than you would on the coast where luxury resorts are abundant.

The Caribbean Islands are not a popular option for independent travelers. You'll rarely find a backpacker spending time in the region, but if you're looking for a comfortable vacation with all the amenities, then you've found the right place to go. Despite the high costs, or perhaps because of them, it is important to understand which islands offer the best deals for cost conscious travelers.

Central America is a small region, but it has a lot to offer. It is a great introduction to a new culture, and your budget can be kept to a minimum. Still, if you're looking for a resort, you don't have to look far as there are many diverse places to stay in this fascinating area.

Many people shy away from the Middle East, but those that make the trip are greeted by a welcoming culture, friendly people, and a one of a kind experience. Countries are diverse in style, culture, and costs, so it's best to do your research ahead of time and choose places that will fit your travel style to ensure your trip is all that you hoped.

Australia and New Zealand are no longer budget destinations, but backpackers still flock to the area. By planning ahead and looking for the best deals you can ensure you get the most out of your trip.

- Privacy / Terms of Use

- Activities, Day Trips, Things To Do, and Excursions

- Travel Calculators

- Trip Budget Calculator

Calculate an estimated budget for your upcoming trip using this calculator.

Estimated Trip Budget:

Please fill in all required fields.

The Trip Budget Calculator is an essential tool to help you accurately estimate and plan your travel expenses for a seamless and enjoyable journey. By entering crucial trip details such as transportation, accommodation, food, activities, and miscellaneous costs, the calculator provides you with a well-informed budget projection.

How to Use the Trip Budget Calculator:

- Number of Travelers: Begin by entering the total number of travelers who will be joining the trip. This helps the calculator accurately estimate expenses based on the size of your group.

- Number of Days: Input the duration of your trip in terms of the number of days you plan to spend at your chosen destination. This allows the calculator to factor in costs over the entire duration of your stay.

- Tour Destination: Specify the name of your tour destination, such as a city or place you'll be visiting. This information aids in understanding the location and potential cost variations associated with your trip.

- Average Daily Expense per Traveler ($): Provide an estimate of the average daily expenses per traveler. This should encompass basic necessities like meals, local transportation, and other small expenses.

- Transportation Cost ($): Enter the anticipated cost of transportation for your trip. This includes expenses related to flights, train tickets, or fuel costs if you're driving to your destination.

- Daily Food Expense per Traveler ($): Estimate the daily food expenses per traveler, covering meals, snacks, and dining out. This allows the calculator to account for your sustenance throughout the trip.

- Budget for Activities ($): Allocate a budget for the various activities and attractions you plan to enjoy during your journey. This includes entrance fees, excursions, and entertainment expenses.

- Miscellaneous Costs ($): Consider any additional costs that might arise during your trip, such as souvenir shopping, tips, and unforeseen expenses.

Real-Time Example:

Suppose you're planning a trip with the following details:

- Number of Travelers: 2

- Number of Days: 7

- Tour Destination: Paris, France

- Average Daily Expense per Traveler: $100

- Transportation Cost: $500

- Daily Food Expense per Traveler: $30

- Budget for Activities: $300

- Miscellaneous Costs: $200

By inputting the above values and clicking "Calculate," the Trip Budget Calculator will provide you with an estimated total budget of $2820 for your trip to Paris, France. This real-time example demonstrates how the calculator helps you plan and budget for various aspects of your travel, ensuring a worry-free and enjoyable experience.

Benefits of the Trip Budget Calculator:

- Precise Budgeting: The calculator ensures that you have a realistic and comprehensive budget plan tailored to your travel preferences.

- Effective Planning: By breaking down expenses, you can prioritize and allocate funds wisely, optimizing your travel experience.

- Financial Confidence: With a well-calculated budget, you can enjoy your trip without worrying about overspending or financial constraints.

Conclusion:

The Trip Budget Calculator simplifies the process of planning your travel expenses by offering an insightful budget estimate. Utilize this tool to make the most of your journey, confident in your financial preparations and able to focus on creating unforgettable memories. Travel with peace of mind, knowing you've taken the necessary steps to manage your expenses efficiently.

Note: If the tool does not work properly or the results are different than you expected, please help us improve it by providing details about the issue. Click here to contact us and report the problem.

- Travel Time Calculator

- Privacy Policy

- Terms of Use

Copyright 2023 CalculatorCentral.com

CalculatorCentral sidebar Menu

- Age Difference Calculator

- Birth Age Calculator

- Life Expectancy Calculator

- Time Since Calculator

- Break-Even Point Calculator

- Employee Salary Calculator

- ROI Calculator

- Startup Costs Calculator

- Garden Bed Area Calculator

- Material Cost Estimator

- Sewing Fabric Yardage Calculator

- Woodworking Project Planner

- Carbon Footprint Calculator

- Energy Consumption Calculator

- Plastic Waste Reduction Calculator

- Water Usage Calculator

- Catering Quantity Calculator

- Event Space Capacity Calculator

- Guest List Calculator

- Party Budget Calculator

- Investment Returns Calculator

- Mortgage Payment Calculator

- Retirement Savings Calculator

- Savings Goal Calculator

- BMI Calculator

- Calorie Intake Calculator

- Daily Protein Intake Calculator

- Target Heart Rate Calculator

- Class Average Calculator

- College GPA Calculator

- College Savings Calculator

- Cumulative GPA Calculator

- Easy Grader for Teachers

- Exam Average Calculator

- Finals Calculator

- Final Grade Calculator

- Grade Percentage Calculator

- Grading Calculator

- High School GPA Calculator

- Middle School GPA Calculator

- Middle School GPA Calculator Without Credits

- Quiz Grade Calculator

- Semester GPA Calculator

- Student Loan Repayment Calculator

- Test Average Calculator

- Test Grade Calculator

- Tuition Cost Calculator

- Weighted Grade Calculator

- Water Intake Calculator

- Sleep Debt Calculator

- Daily Steps to Miles Converter

- Stress Level Calculator

- Flooring Calculator

- Wallpaper Estimator

- Roofing Material Calculator

- Paint Quantity Calculator

- Bill Total Calculator

- Discount Calculator

- Markup Calculator

- Percentage Calculator

- Percentage Contribution Calculator

- Percentage Difference Calculator

- Percentage Error Calculator

- Percentage Growth Calculator

- Tax Calculator

- Debt Payoff Calculator

- Budget Calculator

- Credit Card Interest Calculator

- Loan Amortization Calculator

- Women’s Adventure Tours

- ONLINE CLASS: How to travel the world on a shoestring budget

Travel Budget Calculator

- Travel gear

- Posts about learning to travel on a budget

- Digital Nomad Class: A Life of Travel

- How to become a Digital Nomad: Everything you need to know

- How to Find Digital Nomad Jobs in 2024 (and beyond)

- Posts about becoming a digital nomad

Need to create a travel budget? This nifty calculator will help you estimate your costs based on the country you choose, including Europe, Asia, and more. You can even check airfares without leaving this page.

Huge shoutout to Budgetyourtrip.com . Their database of global travel costs makes this calculator possible. Be sure to visit their site and sign up for their great newsletter!

Ready to plan your adventure? It’s as easy as 1•2•3

- Find flights & hotels on Expedia

- Get cheap bus tickets on BusBud

- Get a free travel insurance quote from World Nomads

What’s next?

Join a women’s adventure.

I’m taking small groups of women on budget-conscious tours that dive deep into some of my favorite places. We eat, dance, cook, and walk the streets with local people.

Learn about budget travel …

- How I Afford International Travel (without a trust fund)

- How To Plan Last Minute Travel

- How to Travel for Free as a Volunteer

FAQs about creating a travel budget

Start by researching airfare, which can be as much as half your trip cost. Then look at lodging costs. Add in any expensive tours or other entertainment. If you’re frugal, and willing to cook some of your meals, your food and transportation don’t need to cost any more than they would if you stayed home. But keep in mind that expensive restaurants and shopping are big temptations, and many travelers like to indulge themselves with spa treatments, cocktails, coffee drinks, appetizers, and desserts.

It depends on where you’re going. In parts of Southeast Asia, South America, and Africa you can eat, sleep, and enjoy yourself for as little as $50 a day. Europe, Canada, Australia, and the US are quite a bit more expensive, and if you choose to travel in a luxurious style, you could spend $200 a night just on lodging. The best way to know how much to budget is to research actual costs for the type of lodging, transportation, and activities you would want at your destination.

If you want to save on transportation costs, stay close to home. If you want to travel internationally, consider the northern parts of South America. Ecuador and Colombia are affordable countries to visit, and airfares are very reasonable from the US. If you don’t mind spending on airfare but want to live cheaply after you arrive, consider Southeast Asian countries like Malaysia, Indonesia, Thailand, or Cambodia. All have very low costs of living.

- More Networks

Travel Budget Calculator Tool

Planning your next vacation? Use this free budget travel calculator tool to plan and estimate your next trip.

Please enter your expenses on a per-person basis. (U.S. dollars )

How many days will you be staying?

What is the hotel's nightly rate, what's your daily budget for food and drinks, is there a fee for travel visas, what is your budget for fun activities, what's the daily car rental rate at your destination, expected airfare costs (per-person):, do you plan to purchase travel insurance.

(The average cost for travel insurance is about $125USD)

Fees for additional baggage (per-person):

Estimate total trip cost, enjoy this calculator share it or tweet it.

Attention all vacation planners! Are you tired of the stress and confusion that often comes with budgeting for your next trip? Look no further than our free budget travel calculator tool! Designed to streamline the vacation planning process, this tool can help you estimate your expenses and stay on budget, making your next adventure stress-free and affordable. Give it a try and see how easy vacation planning can be!

How to calculate your travel budget using this trip calculator tool

- Enter the cost of obtaining a travel visa for the destination country. (In US dollars)

- Choose whether or not to get travel insurance for your trip. (Highly recommended.)

- Enter the number of days you’ll be in town. You can move the pointer forward or backward by dragging it, or you can input the number of days in the box next to it.

- Input your estimated budget that you have set aside for some fun activities during your trip. (Think local private tours?)

- Enter the cost of your hotel, Airbnb, or hostel stay per night.

- If you’re renting a car, enter the daily rate.

- Enter the amount of money you plan to spend on food and beverages during your trip.

- Enter the per-person cost of plane tickets to and from your location.

- The entire cost of your trip will be displayed on the right side.

Having the right budget will make sure that your next adventure is one to remember. This free vacation calculator can help you plan the perfect vacation. Wishing you a wonderful trip!

Get the official "Follow Your Wild" Travel Enamel Pin!

You can personalize your purse, blouse, or backpack with this vibrant enamel pin. An eye-catching enamel pin that gives you a desire to travel.

Become a part of the adventure travel community!

We are a global community of adventurers, explorers, and entrepreneurs. Our community is made up of adventurers, explorers, and entrepreneurs from all over the world. Be sure to use the hashtag #FollowYourWild when sharing your adventure travel stories.

Follow Adventrgram on Instagram !

Adventure roam

Your Passport to Adventure

- Travel budget

Travel Budget Calculator: Plan Your Dream Trip Without Breaking The Bank

- 1.1 How Does the Travel Budget Calculator Work?

- 2 Benefits of Using a Travel Budget Calculator

- 3 Maximizing Your Travel Budget

- 4 Conclusion

The Importance of a Travel Budget Calculator

Are you dreaming of a well-deserved vacation but worried about overspending? Look no further! Our travel budget calculator is the perfect tool to help you plan your trip while keeping your finances in check. Whether you’re a seasoned traveler or a first-timer, this calculator will ensure that you make the most of your budget and have an unforgettable experience.

How Does the Travel Budget Calculator Work?

Our travel budget calculator takes into account various factors such as transportation, accommodation, food, activities, and miscellaneous expenses. It provides you with an estimated budget for your trip based on your destination, duration of stay, and personal preferences. By inputting these details, the calculator will create a customized budget plan tailored to your needs.

Benefits of Using a Travel Budget Calculator

1. Financial Peace of Mind: Planning ahead and sticking to a budget will help you avoid overspending and financial stress during your trip. With our travel budget calculator, you’ll have a clear idea of how much money you need to allocate for each aspect of your journey.

2. Flexibility: Want to splurge on a fancy dinner or an adventurous activity? No problem! Our calculator allows you to adjust your budget accordingly, so you can indulge in those exciting experiences without feeling guilty.

3. Efficient Planning: With the help of the travel budget calculator, you can easily compare prices and make informed decisions. It will suggest cost-effective alternatives for accommodations, transportation, and activities, helping you save money without compromising on quality.

Maximizing Your Travel Budget

1. Research Your Destination: Before using the travel budget calculator, gather information about your destination. Look for affordable accommodations, local transportation options, and budget-friendly activities. This way, you can input accurate data into the calculator and get the most precise budget estimate.

2. Prioritize Your Experiences: Make a list of the must-see attractions and activities at your destination. Allocate a higher portion of your budget to these experiences, and consider cutting back on less important ones. This will ensure that you make the most of your trip and create lasting memories.

3. Be Realistic: While it’s essential to save money, it’s also crucial to be realistic about your expectations. Don’t compromise on your comfort or safety to save a few bucks. Use the travel budget calculator as a guide, but always trust your instincts when it comes to important decisions.

Planning a trip doesn’t have to be stressful or financially draining. With our travel budget calculator, you can take control of your expenses and make the most of your well-deserved vacation. So, what are you waiting for? Start using our travel budget calculator today and embark on your dream trip without breaking the bank!

Related Stories

10 essential tips for travel planning with excel.

How Much Does It Cost To Go On Vacation?

Friends On A Budget: How To Have Fun Without Breaking The Bank

You may have missed.

- Travel tips

Tips On Making Your Travel Experience Fun

- Travel Destination

What Is The Best City To Visit? Find Your Perfect Destination

You are here

Holiday budget planner, how much do i need to travel overseas.

If Travel Agents had a dollar for every time a client asked this question they’d move past investment bankers on the earnings scale pretty quickly. So where do you start?

Our shiny new budget planner will help you decide how much you need based on your destination, your holiday, and your own spending habits.

Punch in your holiday deets and some amazing robots will combine crowd-sourced Numbeo data* with our exchange rates - just like magic. Bippity boppity boo, budget!

Try our travel budget calculator now!

What goes into a travel budget.

A good budget is like a warm apple pie. It makes you feel all safe and warm, but it takes a few ingredients to get to the finished product. Having a holiday budget also means you’ll be able to have more apple pie and not feel guilty apart from the excess holiday calories but they don’t really count anyway, right?

Everybody’s budget is different, but this will give you an idea of the things to think about when planning your holiday expenses:

Flights and transport costs

Flights are the big expense for most travellers, especially if you’re heading to Europe or the USA. If you’re planning on moving around during your holiday (disregard if you’re planning on spending 2 weeks parked in an overwater bungalow in Tahiti) chances are you’re going to need to splash the cash on public transport, airport transfers and the odd Uber or taxi.

Ah food, one of the best parts of travelling overseas and a worthy and important part of any travel budget. Food is probably the hardest part to budget precisely for on the account of everyone’s tastes being different, the vast difference between prices between places on the ground and the variation of cost of living between different countries.

Are you planning on bungee jumping in NZ, spree shopping in Paris, hiking the Inca trail, hot air ballooning in Cappadocia, scuba diving in Fiji, checking out Stonehenge or any other activity that isn’t free? Make a list of your must do’s, have a Google and add all these costs up too.

Pre-departure expenses

Probably the easiest piece of the budget puzzle to forget because it’s the least fun aspect of your holiday. Who gives a hoot about immunisations, visas and travel insurance? You, that’s who. If you can’t afford travel insurance, you can’t afford to travel. Check out Smart Traveller for handy tips on what’s required for entry into the country of your dreams.

Inspiration

I_demiquinn_sintra portugal_budget-planner-min.jpg.

How Much Money Do I Need To Travel Europe?

I_georgiaslattery_cab at times square_budget_planner-min.jpg.

How Much Money Do I Need To Travel the USA?

Why travel money.

How to Budget for a Trip: The Easiest Travel Budgeting Method (+ Tips!)

Here’s a silly secret: I love budgeting travel… and I also think that most guides to creating a travel budget make it entirely too complicated.

I initially wrote this guide on how to budget for a trip almost 7 years ago, when we were prepping for what we were then calling a 6 month round the world trip (spoiler: depending on your definition of “trip”, it never actually ended).

50+ countries and the better part of a decade later, I’m still using the exact same, simple formula for calculating our budget while traveling–even if our definition of “on a budget” has changed over the years.

Planning to hit the road soon and wondering how much money you need for your trip?

Whether you’re headed off on a 2-week Europe trip or you’re planning to live out of a backpack for years like we did, our simple method for budgeting travel expenses has you covered.

Here’s the travel budget strategy that we swear by to this day!

Table of Contents

Our Formula for Creating a Travel Budget

Why we like this travel budgeting system, example of how to budget for a trip, tips for travel budgeting, planning a trip.

Some links in this post may be affiliate links. If you make a purchase through one of these links, we may earn a small commission at no extra cost to you. Please see our disclosure policy for more detail.

Here’s our incredible simple calculation for travel expenses:

(Money Saved – Major Expenses) / Number of Days Traveling = D aily Budget

That’s it–simple, easy to remember, and allows you to easily translate your savings from a pile of money into an actual travel budget.

Some long term travelers prefer to divide by the number of weeks instead of the number of days, on the premise that some days you may blow a large amount, and then have cheaper days to make up for it.

While that is 100% true and Jeremy and I definitely balance expensive days with inexpensive ones, I still prefer to think in terms of days.

In my experience, smaller numbers tend to be more easily tracked, and are less overwhelming as a result.

How to Define Major Travel Expenses

“Major expenses” can be somewhat of an ambiguous term, but I tend to use this for pricey plane tickets, travel insurance, and large monthly bills that you’re still responsible for during your trip (say, a car payment or health insurance).

If you’re headed to any destinations that require a visa, be sure to include those costs as well!

For shorter trips, I also like to include lodging and certain cheaper transportation costs (night trains, budget airline flights, rental cars) here, but for long-term travel, that’s obviously not practical.

The point of the major expenses category is simply to remove the money that is allocated for specific expenses from play before determining how much you have to spend.

This is to avoid either a) running around feeling like you have more money than you do and overspending or b) anxiously fretting about the upcoming expense (like a plane ticket home) and saying no to things that you want to do because you’re needlessly stressed about not having enough money.

Personally, we’re much more likely to do the second.