Pay for your flight with Uplift

Feel good about where you fly and how you pay for it. With Uplift, you can book your trip now and pay for it over time with budget-friendly monthly payments.

Low monthly payments

Budget-friendly loan options.

Easy application

Receive a quick decision.

No surprises

That means no late fees, no prepayment penalties.

Automatic payments

So you don't have to remember due dates either.

How Uplift works

Step 1: Select Uplift at checkout

Shop for your trip on our website or app like you normally do and select Uplift as your payment method at checkout.

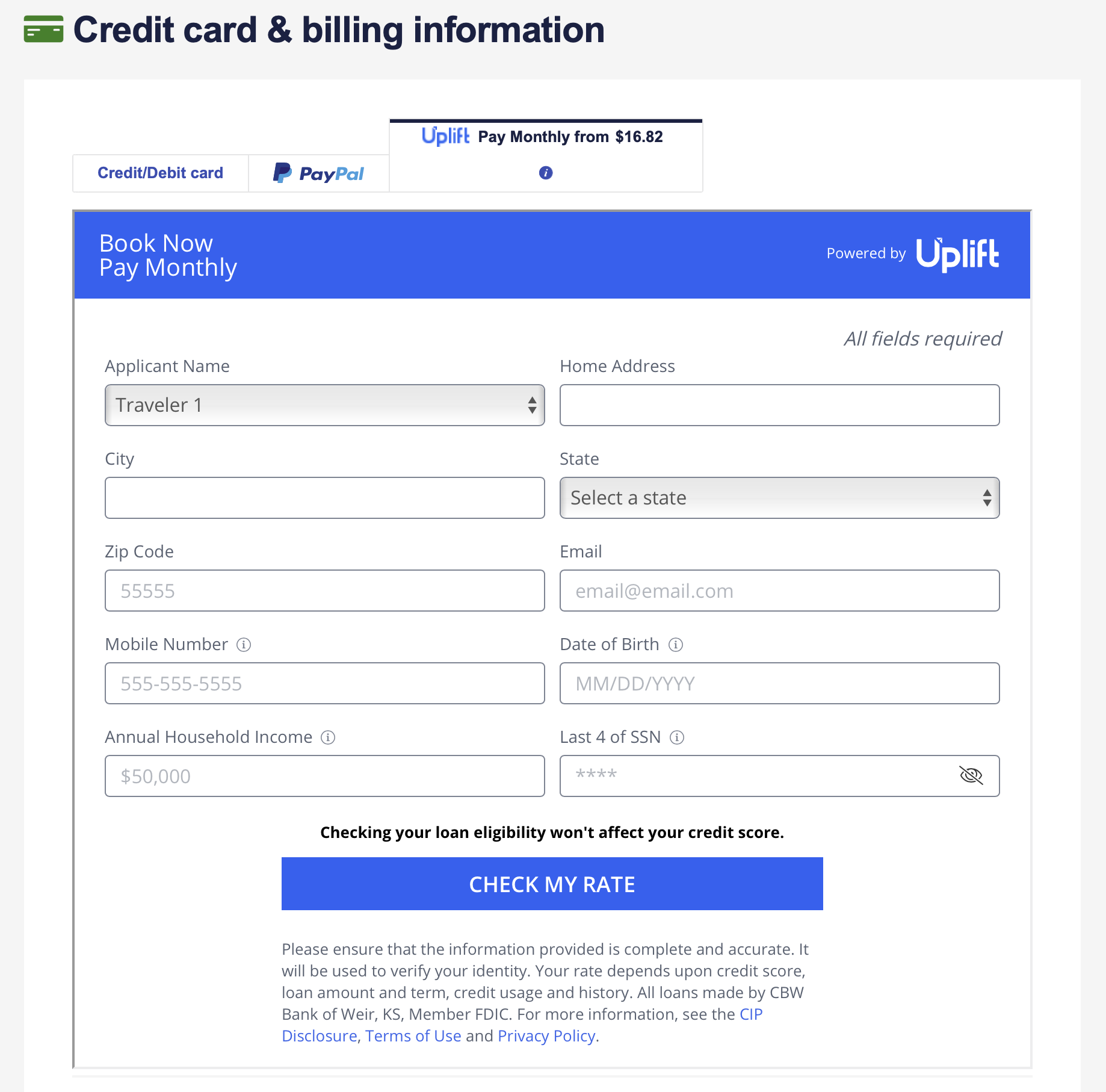

Step 2: Complete a quick application

Provide a few pieces of information and receive a quick decision without ever leaving the payment page.

Step 3: Enjoy your trip

Relax knowing you can travel now and pay for it over time with low monthly payments.

Frequently asked questions

What is uplift.

Uplift gives you the freedom to purchase travel now and pay over time with simple monthly payments. Some plans include interest while some are interest-free.

How do I apply?

Shop for your flights like you normally would. Then, select Uplift as your payment method at checkout. You’ll complete a short application and receive a quick decision letting you know if you’ve been approved. You can choose the terms of your plan before you complete checkout and enjoy your trip.

How is my loan term offer determined?

Uplift looks at a number of factors, including your credit information, purchase details and more.

How do I make installment payments?

You can make a payment anytime by visiting pay.uplift.com and selecting the “Loans” tab. From there, select the "Make a Payment" button.

Uplift recommends you enable AutoPay at the time of purchase so your payments are automatically deducted from your bank account each month. You can enable AutoPay on the "Accounts" page on pay.uplift.com. You can also update your payment method here at any time.

Can I travel before paying off my trip with Uplift?

Yes! You do need to allow a few days between booking your trip and departure for things to process. Other than that, you are free to travel whenever—even before you’re all paid off.

Where can I find Uplift’s Privacy Policy and Terms of Use?

Here is the Privacy Policy and Terms of Use for Uplift.

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Not everyone is eligible. Loans made through Uplift are offered by their lending partners . Privacy Policy and Terms of Use . Uplift’s address: 440 N Wolfe Road, Sunnyvale, CA 94085

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How Uplift Buy Now, Pay Later Works for Travel

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is Uplift buy now, pay later?

Which airlines offer financing through uplift, how uplift works for travel, should you use buy now, pay later for travel, alternatives to uplift, if you’re interested in using uplift to pay for travel.

Many travelers want to book vacations, but with inflation and surging demand affecting the price of airline tickets, rental cars and other household expenses, sometimes they simply don't have the money. Instead of carrying a balance on high-interest rate credit cards, some are turning to buy now, pay later options like Uplift to finance their travel.

Here's a look at how Uplift buy now, pay later works, when you should or shouldn’t use it and what other alternatives exist for financing a trip.

Uplift is one of the buy now, pay later options available to finance purchases of clothes, household goods, travel and more. BNPL allows you to spread the cost of purchases across multiple payments.

These financial technology — or fintech — companies generally offer easier credit than traditional credit cards or personal loans. Some don't pull a hard inquiry from your credit report, which means that signing up won't affect your credit score.

Uplift doesn't charge any fees to customers, including late fees or prepayment penalties. However, depending on your purchase and credit history, you may pay interest between 0% and 36%. Uplift charges simple interest on its loans, which means it doesn't charge interest on top of interest.

» Learn more: Factors that affect your credit score and how to improve them

When booking your flight, you’ll notice that many airlines offer BNPL financing through Uplift or one of its competitors. Uplift is currently available for use on many U.S. and international airlines.

Here are a few of the major airlines that offer financing through Uplift:

Air Canada.

Alaska Airlines.

Allegiant Airlines.

Frontier Airlines.

Hawaiian Airlines.

Southwest Airlines.

Spirit Airlines.

United Airlines.

Delta Air Lines and American Airlines use a different BNPL service called Affirm.

Here's how to book your flight using Uplift:

Find a participating airline .

Choose your travel dates, departure city and destination as usual.

Select the flight that meets your needs.

Enter traveler(s) details.

At the payment screen, select Uplift as your payment method.

Enter your personal details and click "check my rate."

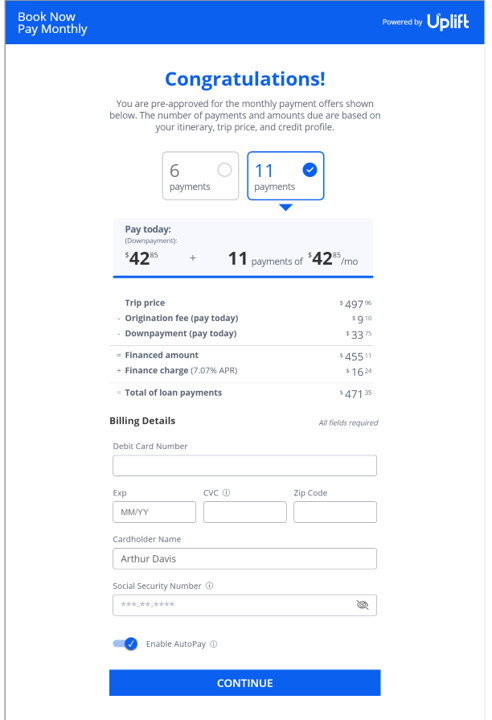

You’ll be presented with several payment options, including higher and lower monthly payments. Choose the payment plan that works best for you.

Complete your purchase.

How to apply for Uplift financing

The application process is quick and easy. After selecting Uplift as your payment method during checkout, you’ll provide basic personal information like your name, mobile number and date of birth. If you are a U.S. citizen, you must also provide your Social Security number. Then, you'll receive an instant credit decision.

Depending on your credit history, purchase details, repayment term and other factors, you may or may not pay interest on your purchase. Uplift interest rates vary between 0% and 36%.

Uplift will send email and text reminders when a payment is due. You'll make payments at Uplift.com according to the plan that you selected — loan proceeds go to the airline from Uplift.

Automatic payments are available to ensure that all of your payments are made on time. If you don't authorize this, you'll need to make each monthly payment manually. You can also pay off your balance early without incurring prepayment penalties.

Even if you don't have a flight to purchase, some of Uplift's partners allow customers to pre-qualify ahead of time. This will give you a good idea of how much you can afford through its buy now, pay later financing.

» Learn more: Tips for traveling without a credit card

While many people view BNPL loans as a good way to finance purchases, they may not be a wise choice. The loans can make it easy to get into debt, and the recurring payments can quickly overwhelm your budget.

Here are some reasons you may want to skip financing with a BNPL loan:

Cannot travel immediately. Because the payment process between Uplift and the airline isn't immediate, you must wait a few days between booking your flight and when you travel. For travelers who are in a hurry, BNPL financing may not work.

Fees add up. Though Uplift advertises itself as a fee-free service, other BNPL apps may charge fees. Depending on the size of your purchase, BNPL fees may be more than the interest charges from other options, like a credit card or personal loan.

No flexibility with payments. When you make a BNPL purchase, there’s a predefined repayment schedule that you must adhere to. You cannot extend your repayment schedule or refinance your payments through Uplift. Payments are usually more than the minimum payment due on a credit card. If you can’t make the BNPL payment, some lenders charge a late fee. In most cases, you can’t make any additional purchases until your account is brought current.

Credit limits can be much lower. Many BNPL apps offer financing without the traditional hard credit check and underwriting that credit cards require. Because of that, credit limits tend to be lower than many credit cards.

Doesn't earn rewards. Most BNPL loans don't earn rewards like a credit card when paying for your flights. This makes it harder to earn miles, points or cash back toward your next vacation.

No travel benefits. Travel credit cards also include other benefits that BNPL apps don't include, such as trip interruption or cancellation insurance, delayed/lost baggage protection and trip delay reimbursement.

Not all airlines accept BNPL apps. The roster of airlines that accept BNPL financing is growing, but not all airlines currently participate. Among the major U.S. airlines, only American Airlines doesn't offer BNPL financing. Alaska, Delta, Frontier, JetBlue, Southwest and United all offer some form of buy now, pay later payment options.

» Learn more: How travel credit cards work

While buy now, pay later loans are growing in popularity, they aren't always the best option when booking a flight. These payment alternatives to Uplift may be a better option for your situation:

Pay with your existing credit card. While you may pay a higher interest rate, credit card minimum payments are fairly low. Because of this, you'll have more flexibility with your monthly minimum payments over a loan through Uplift.

New credit card 0% APR offer. If you need extra time to pay off your purchase without incurring interest, a 0% APR credit card is an excellent option.

Get a personal loan. A personal loan offers a fixed payment schedule. Lenders who do traditional underwriting may offer a lower interest rate than a company like Uplift that does a quick credit check.

Apply for peer-to-peer lending. Peer-to-peer lending platforms are a good option for consumers with fair credit.

» Learn more: Best 0% APR and low interest credit cards

BNPL lenders like Uplift enable customers to pay for their flights over time without using their credit cards. Depending on your credit and purchase details, you may qualify for 0% financing on your purchase.

While BNPL financing can be attractive, remember that you won't earn additional rewards like you would when using a credit card. Additionally, these purchases don't have the same benefits and protections as a credit card, and won’t offer insurance for trip cancellation, lost bags or a trip delay. Consider all of the factors before deciding if using Uplift or BNPL loans are right for you when booking your next flight.

Yes, you can pay for someone else's flight using Uplift. You don't have to be on the trip to use this payment method.

No, you may travel even if your balance isn't paid off. This flexibility is actually one of the main benefits of using Uplift buy now, pay later financing. The main caveat, however, is that you should allow a few days between your purchase and travel dates so that the application and payment process can be completed.

If your plans change and you need to cancel the flight, the first step is to contact the airline. The airline will process the cancellation and, if you are eligible for a refund, the airline will notify Uplift. Your account will be updated when the cancellation is fully processed. Travelers who aren't eligible for a refund are still responsible for paying the outstanding balance on their Uplift account.

Yes, you can use Uplift to finance multiple purchases at a time. Uplift looks at several factors, including your credit information and existing BNPL loans, before approving each request. Note that approval by Uplift in the past doesn't guarantee your next application will be approved.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

- Book a Flight

- Manage Reservations

- Explore Destinations

- Flight Schedules

- Track Checked Bags

- International Travel

- Flight Offers

- Low Fare Calendar

- Upgrade My Flight

- Add EarlyBird Check-In

- Check Travel Funds

- Buy Carbon Offsets

- Flying with Southwest

- Book a Hotel

- Redeem Points for Hotels

- More Than Hotels

- Hotel Offers

- Best Rate Guarantee

- Rapid Rewards Partners

- Book a Vacation Package

- Manage My Vacation

- Vacation Package Offers

- Vacation Destinations

- Why Book With Us?

- FLIGHT STATUS

- CHANGE FLIGHT

How do I apply?

Shop for your items and add them to your cart like you normally would. When you are ready to check out, simply select Uplift as your payment method. To apply, you'll need to provide some basic information like your mobile number, date of birth, and if you are a US resident, your Social Security number. If you're approved, finish checking out and you're done.

How are my loan offers determined?

We look at a number of factors, including your credit information, purchase details, and more.

How do I make installment payments?

You can make a payment anytime by visiting pay.uplift.com and clicking on the Loans tab. From there, click the Make a Payment button. We recommend that you enable AutoPay at time of purchase so that your payments are automatically deducted each month. If you don't have AutoPay enabled, visit pay.uplift.com , click on the Accounts page, and set the AutoPay toggle to ON. You can also change the form of payment on file with Uplift anytime by visiting pay.uplift.com .

I purchased a trip using Uplift, can I travel before it’s paid off?

Yes! You do need to allow a few days between booking and your departure date for things to process. Other than that, you are free to travel whenever - even before you're all paid off.

What is your Privacy Policy and Terms of Use?

Here is a link to our Privacy Policy and Terms of Use .

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Minimum $49 purchase required. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders. Privacy Policy and Terms of Use .

*0% APR offer available on 3 month terms between 4/1/2024-4/14/2024 for approved applicants purchasing Wanna Get Away Plus®, Anytime, and Business Select® tickets. Based on a purchase price of $200, you could pay a down payment of just $50 today, followed by 3 monthly payments of $50 at 0% APR. APRs range from 0%-36%, not everyone is eligible to receive a 0% APR offer. Minimum $49 purchase required. Actual terms are based on your credit score and other factors and may vary. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders . Privacy Policy . Terms of Use .

Help Center

- Terms & Conditions

- Privacy Policy

- Do Not Sell/Share My Info

© 2024 Southwest Airlines Co. All Rights Reserved.

Travel now and pay in installments with this convenient travel lender.

Uplift offers a buy-now, pay-later (BNPL) service that lets you travel now and pay later. To use the service, you must book through one of its partner sites, which includes many airlines and cruise companies. Rates range from 0% to 36% APR – this is as high as some credit cards, but without the benefits of rewards or cash back. But Uplift only does a soft credit check and can be a good option if you don't want to use cards or cash to pay for travel.

Best for: Travelers with good credit who need to finance their next trip.

- Travel while making payments

- No late fees or prepayment penalties

- Borrowers with credit scores of 550 or higher are eligible

- High maximum APR of 36%

- Limited selection of travel partners

- May require a down payment

Bottom line: Uplift can be a good choice if you're looking to beat the high rates offered by travel credit cards. But its limited selection of partners — and potentially high APR for borrowers with fair credit — mean you'll be limited in how you use your funds. Read our full review or get our 30-second take .

Our take on Uplift travel loans

Uplift, owned by Upgrade, offers a buy-now, pay-later service through top airlines, cruise lines, resorts and travel booking agencies. It’s best for people who want to pay for travel in installments or don’t want to tie up their credit cards or use cash.

Unlike many lenders, Uplift only does a soft credit check when you apply for financing, skipping the long application process. Just fill out a short form at checkout and receive an instant decision and payment plan on your purchase. Uplift also reports your repayments to Equifax so you can build your credit.

But your booking options are limited to Uplift partners, and you don’t get the benefit of earning points or miles as you do when you book with a travel or rewards card. On the plus side, there are no late fees and no prepayment penalty if you pay your Uplift balance off early.

While some borrowers may pay no interest at all when getting a loan with Uplift, rates can run high if your credit is on the lower end – so you’ll need to decide if paying in installments makes financial sense for you.

Eligibility requirements for Uplift

To finance your next vacation with Uplift, you’ll need to meet three basic criteria:

- Credit score of over 550

- Trip must originate in the US if financing air travel

- Must be going on the trip to be eligible for financing

Uplift is acquired by Upgrade

Uplift was recently bought by Upgrade , a personal loan lender that works with lower-credit borrowers. The idea behind this merger is to make credit available to people who don’t necessarily want to open a new credit card or apply for a personal loan to pay for large travel expenses like airline tickets and cruises.

Uplift loans cover big and small travel expenses

Uplift finances exclusively through the merchants in its network, so you’ll be able to break down the cost your trip into monthly increments.

- Fixed interest rates could be as low as 0% — but borrowers with bad credit may face an annual percentage rate (APR) up to 36%

- No late fees, origination fees or prepayment penalties.

- The typical loan term is 11 months, but some merchants may offer terms of up to 24 months.

Pricing is based on your credit score and the cost of your travel package, among other factors. While Uplift accepts borrowers with bad credit, you’re unlikely to qualify for a competitive rate. If you have good to excellent credit, you may be able to score an APR close to its minimum of 0%, making it much less expensive than most credit cards.

You can use our calculator to gauge how much your travel might cost when financed through Uplift. Enter the amount you need to borrow, how long you expect to be paying off the loan in the term field and your potential interest rate to see your monthly payment.

Uplift monthly payment calculator

Fill out the form and click on “calculate” to see your estimated monthly payment., based on your loan terms, how uplift compares to other lenders.

Compare Uplift’s rates, terms and features to other popular loan providers.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Uplift reviews and complaints

As of January 2023, Uplift has an A+ rating with the BBB and is not accredited. Reviews on its BBB page are mixed, holding a 2.71-star rating. Many of the negative reviews reference poor customer service, communication issues, and problems around payment and refund issues. The few positive reviews are pleased with the service, with most being happy with the buy-now-pay-later terms and quick application process.

On its Trustpilot page, reviews are just as mixed, holding a 2.5-star rating. Some people are pleased with Uplift’s customer service, also citing an easy application and praising the simple payment system. Negative reviews — similar to its BBB profile — often report issues around cancellations, refunds and repayments.

We also reviewed a number of reviews for Uplift, with the majority of them being negative. Complaints are in the same vein as we’ve seen on Trustpilot and BBB — past customers cite issues with refunds and payments, and reports of poor customer service.

How the application works

When you use Uplift, you’ll need to find a travel partner through its website — or you can book directly from a provider’s website. If your trip is available to finance, you’ll see the option to pay with Uplift on the checkout page when you’re ready to book your vacation.

If you’re approved and want to accept the loan offer, you’ll need to enter your full Social Security number and payment information. Uplift does a soft pull of your credit to determine final approval. Though not always the case, you may also need to provide a down payment when you book your trip.

Uplift partners with airlines, cruise lines and resorts

Uplift works with a wide selection of flights, cruises, resorts and vacation packages, including:

- American Airlines Vacations

- Carnival Cruises

- Expedia Cruises

- Funjet Vacations

- Norwegian Cruises

- Royal Caribbean Cruises

- Southwest Vacations

- Spirit Airlines

- Spirit Vacations

- United Airlines

- United Airlines Vacations

- Universal Orlando Resort

- Vacation Express

You can view Uplift’s full list of partners on its website.

Payments are made automatically through Uplift

Interest starts to accrue as soon as you receive your financing. Monthly payments are automatically withdrawn from the debit or credit card you have on file — and Uplift sends you both email and text reminders before each withdrawal.

Uplift also allows you to make manual payments on its website by signing in to your account. And since there are no prepayment penalties, you could save on interest if you pay your loan off before its due date.

If you know you won’t be able to make a payment, notify Uplift at least three days before the due date to request a 15-day grace period to prevent a late payment. Payments more than 30 days late may be reported to Equifax, which could damage your credit.

You still need to pay for canceled trips and changed plans

Much like a credit card, you must pay back Uplift even if you aren’t able to travel. If the travel provider gives you a cash refund, then you can use that to make payments on your loan. But even if your refund is a travel credit or gift certificate, you need to continue to make payments.

Is Uplift legit?

Uplift is a legitimate service that allows you to borrow for your vacation — and it works with top travel partners across the US. It has a secure website and a privacy policy that covers how your information is collected and used. You can contact Uplift by phone or email, and it frequently responds to customer complaints on its Trustpilot page.

3 alternatives to Uplift

A travel loan isn’t always the right choice. In fact, it could be the wrong choice if you don’t have firm plans or don’t qualify for a low APR on your loan. Although using Uplift makes travel much more affordable, it can still be more expensive than saving up or using a credit card.

- Savings should always be your first choice to avoid paying interest. This may not always be possible — especially if you need to make an emergency trip — but it is the least expensive option.

- A credit card may be a good alternative to Uplift if your APR is higher than 20%. Since there are credit cards designed with travel rewards in mind, there may be a less expensive deal that earns you points toward future vacations.

- Of course, other personal loans may be a solid alternative as well . You should compare lenders to find the best APR and terms. Uplift may be convenient, but for borrowers with good to excellent credit, you may be able to score a lower rate with a different lender.

Not sure Uplift is right for you? Check out our guide to financing your vacation or compare more personal loan options to pay for your next trip.

Personal loan ratings

Ask a question using your email below.

Hi there, looking for more information? Ask us a question.

Error label

You are about to post a question on finder.com :

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our finder.com Terms of Use and Privacy and Cookies Policy .

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

February 11, 2020

I live in WV and when I go to apply at the end of my vacation package its states not eligible in WV. Is this true?

Charisse Finder

Thanks for reaching out to Finder.

Yes, it’s true. Unfortunately, Uplift is not authorized to do business in West Virginia due to regulatory practices.

If you want to learn more information about regulatory lending practices in West Virginia, you may contact your state securities regulator.

I hope this helps.

Cheers, Charisse

October 03, 2019

Does Uplift report payments to the major credit bureaus?

Yes, Uplift will report accurate payment status on a monthly basis to the credit bureau, although they did not give specific information which credit bureau(s) they report to.

They also reserve the right to report partial or late payments of 30 days or longer to consumer reporting agencies in accordance with applicable law.

September 23, 2019

Can you have more than one UpLift loan at a time?

September 25, 2019

Yes. UpLift allows you to have more than one active loan however, credit restrictions may apply and all loan approvals are credit dependent at the time of your application.

Kat Aoki is a personal finance writer at Finder, specializing in consumer and business lending. She’s written thousands of articles to help consumers make better decisions on their home loans, bank accounts, credit cards, cryptocurrency and more. Kat is well versed in working with leading brands in the real estate, mortgage and personal finance industries, and her expertise has been featured on Forbes Advisor, Lifewire and financial comparison sites like iSelect and realestate.com.au. She holds a BS in business administration from California State University, Sacramento and enjoys hiking and yoga in her spare time. See full profile

- Best personal loans

- Best no origination fee personal loans

- Best personal loans for fair credit

- Best personal loans for bad credit

- Fast approval loans

- Best debt consolidation loans

- Emergency loans

- Short term loans

- Long term loans

- Loans for legal fees

- New employees

- Loans for 18-year-olds

- Cosigner and joint loans

- Loans for rent

- Loans for flight training

- Wedding loans

- Best moving and relocation loans

- Tax refund advance loans

- Personal loans

- Personal lines of credit

- Best short-term loans of 2024

- Student loans

- Business loans

- Debt relief programs

- LendingClub

- LightStream

- OneMain Financial

- All Reviews

- $1,000 loans

- $1,500 loans

- $2,000 loans

- $3,000 loans

- $5,000 loans

- $10,000 loans

- $15,000 loans

- $20,000 loans

- $25,000 loans

- $35,000 loans

- $50,000 loans

- $75,000 loans

- $100,000 loans

- Best Egg vs. Upstart

- LendingClub vs. LendingTree

- LightStream vs. SoFi

- Prosper vs. Best Egg

- Prosper vs. LendingClub vs. Upstart

- SoFi vs. LendingClub

- Upstart vs. Prosper

- Upstart vs. SoFi

- Upgrade vs. Upstart

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

Update your browser

Be sure you have the most current version of your browser for the best experience on AAVacations.com. Browser requirements Opens in a new window

- Skip to global navigation

- Skip to content

- Skip to footer

Vacation package deals

Plan your getaway

- Save up to $125 on your European vacation Book by April 15

- Sign up for email offers Opens in a new window

- aa.com Opens in a new window

- Destinations

- AAdvantage®

AAdvantage® login

Logout Exclusive AAdvantage® experiences Verify AAdvantage® Number(s)

Enjoy now. Pay over time.

Spread the cost of your trip over low monthly payments.

Experience Buyer's Joy Feel good about what you book and how you pay for it. With Uplift, you can make thoughtful purchases and pay for them in bite-sized installments while keeping yourself on a budget.

Low monthly payments Budget-friendly loan options

Easy application Quick decision

Surprise-free No late fees or prepayment penalties

Easy AutoPay No payment dates to remember

- Select Uplift at checkout Add purchases to your cart just like you normally would. When you are ready to check out, choose Uplift as your form of payment.

- Quick & easy Provide a few pieces of information and receive a quick decision.

- Enjoy now Enjoy your trip now and pay for it over time with low monthly installments.

Find vacations

Frequently Asked Questions

- What is Uplift?

Uplift gives you the freedom to book travel now and pay over time with simple fixed installments. Some plans include interest while some are interest-free. When you're ready to check out, just select "Uplift" as your payment method, complete a short application and receive quick decision. Choose the terms of your payment plan, finish checking out and enjoy your purchase. Then, pay over time with simple, no-surprise monthly payments.

- How do I apply for installment payments through Uplift?

Shop for your items and add them to your cart just like you normally would. When you are ready to check out, simply select Uplift as your payment method. To apply, you'll need to provide some basic information like your mobile number, date of birth, and if you are a U.S. resident, your Social Security Number. If you're approved, finish checking out and you're done.

- How are my loan term offers determined?

We look at a number of factors, including your credit information, purchase details and more.

- How do I make installment payments?

You can make a payment anytime at pay.uplift.com and clicking on the Loans tab. From there, click the Make a Payment button.

We recommend that you enable AutoPay at time of purchase so that your payments are automatically deducted each month. If you don't have AutoPay enabled, visit pay.uplift.com, click on the Accounts page and set the AutoPay toggle to ON. You can also change the form of payment on file with Uplift anytime at pay.uplift.com.

Make installment payments Opens in a new window

- I purchased a trip using Uplift, can I travel before it’s paid off?

Yes! You do need to allow a few days between booking and your departure date for things to process. Other than that, you are free to travel whenever - even before you're all paid off.

- What is your Privacy Policy and Terms of Use?

Privacy Policy Opens in a new window

Terms of Use Opens in a new window

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Minimum $300 purchase required. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders.

Uplift lenders Opens in a new window

Uplift’s Address: 440 N. Wolfe Road Sunnyvale, CA 94085

Airport lookup

Our system is having trouble.

Please try again or come back later.

Please tell us where the airport is located.

Your session expired

Any confirmed reservations have been saved, but you'll need to restart any searches in progress

- Search Search Please fill out this field.

What You Need to Know About Uplift

A buy-now-pay-later service for travel

How Does Uplift Work?

Is there a credit limit.

- Does Uplift Affect Credit Score?

Does Uplift Charge Interest?

Is uplift safe, who accepts uplift.

- How Do Returns Work With Uplift?

How Do I Pay Uplift?

DaniloAndjus / Getty Images

You might not have heard of Uplift yet. But if you like to travel and you're a fan of increasingly popular buy-now-pay-later (BNPL) lenders , you probably will soon.

Uplift has been combining both of these things—travel and BNPL loans—since 2014, but it's rapidly poised to grow as travel picks back up again after pandemic restrictions. According to a January 2021 company press release, it plans to handle more than $1 billion in transactions over the next 18 months.

Learn how Uplift’s installment plans work, which fees it charges, its interest rates, and what the purchase process is like.

Uplift offers one product: installment loans with term lengths from three months to two years for purchases made with its travel partners. Uplift teams up with some of its partners to provide special travel offers, such as 0% APR loans.

To use Uplift, you'll add your travel purchases to your cart and then apply for a loan through Uplift at checkout.

You can use Uplift to purchase only travel you participate in, either alone or with other people. You can't use Uplift to pay for a trip someone else is taking without you.

Is There a Minimum Purchase Size When Using Uplift?

Yes. The minimum you can borrow is $100.

Is There a Maximum Purchase Size When Using Uplift?

Yes. The maximum you can borrow is $25,000.

Do Products Bought With Uplift Ship After First Payment?

You're only able to make travel-related purchases with Uplift, so you won't really receive any products in the mail, per se.

You can complete your travel before you finish paying off the loan, but you'll need to apply for the loan at least a few days before you plan to travel in order for the charge to be processed. Don't rely on Uplift if you need to travel today.

Can I Use Uplift to Pay Bills?

No. Uplift works for travel purchases only.

Uplift loans don't have a set credit limit since each loan is a separate product. You can have more than one loan, but each one is considered on a case-by-case basis.

Uplift does not offer prequalifications or rate checks. Instead, the only way to know whether you're approved for a loan is to apply for it during the checkout process. You don't have to accept the loan terms if you don't want to, and Uplift only does a hard credit check if you accept the loan.

Does Uplift Affect Your Credit Score?

Not all BNPL lenders will check your credit, but some do. Here's where Uplift stands on the issue.

Does Uplift Check Credit?

Yes. When you apply for a travel loan during checkout, Uplift will do a soft credit check to see if you're eligible for financing and check your identity.

If you're approved and you click "proceed" with the loan, then Uplift will do a hard credit check . This one can ding your score by a few points but remains on your credit report for 12 months, in some cases.

Does Uplift Report Your Activity to Credit Bureaus?

Yes. Unlike some other BNPL lenders, Uplift reports your payments to the credit bureaus . This means you can use Uplift loans to help build credit as long as you make on-time payments.

What Credit Score Do You Need to Use Uplift?

Uplift declined to say what credit score is required for approval. But in general, the better your credit score, the better your chances of approval.

In addition to your credit score, Uplift considers other factors when you apply for a loan, such as the timeline of your travel.

If Uplift denies your application, it will send you a letter explaining why.

Yes, Uplift charges 0% to 36% APR and uses simple interest rather than compound interest . The average rate for loans is 15% APR, though travel partners such as Allegiant and Carnival offer 0% promotions, according to a company representative.

Generally, the more creditworthy you are, the better the rates you may qualify for. If you have good credit, Uplift may be a cost-effective way to get a loan. But if your credit score isn't the greatest, an Uplift loan with a 36% APR can be quite expensive.

For example, the average credit card interest rate for people with bad or fair credit was around 24% in 2021, according to The Balance’s research. If you opt for a personal loan instead, it'll be cheaper still—the average interest rate on a 24-month personal loan was between 9% and 10% during the same period, according to the Federal Reserve.

Does Uplift Charge Fees?

Yes, a small number of loans may have a 2% origination fee that’s rolled into the loan. However, Uplift doesn't charge prepayment penalties or late fees.

Yes. Uplift is trusted by some of the largest companies in the travel industry, so you should feel confident that your purchase is as safe as anywhere else.

However, using services like Uplift may cause you to overspend, especially if you have good credit and can qualify with ease. Also, Uplift’s BNPL program may tempt you to make purchases that throw you off track for your long-term goals, like saving up for a house or an emergency fund.

That said, Uplift can be a good choice if you absolutely need to travel and you're confident you can pay back what you borrow. If you need to travel for your last chance to see a family member, for example, Uplift absolutely can be a good option because of how it splits up payments over time. It can also be a good choice if you can qualify for 0% APR financing and you're looking to build credit, too.

As of 2020, Uplift partnered with more than 100 travel brands, including:

- Royal Caribbean

- Southwest Airlines

- Universal Orlando

- United Airlines

- CheapCaribbean.com

- Secrets Resorts & Spas

Because its travel partners are pretty diverse, Uplift can offer financing for hotel stays, cruises, airline tickets, rental cars, and attractions.

How to Use Uplift Online

There's only one way to use Uplift:

- Visit a travel partner, which you can find listed on Uplift's directory .

- Choose which purchases you want to make and add them to your cart.

- When checking out, select "Uplift" from the payment options.

- Enter in your information, such as your name and the last four digits of your Social Security number.

- If you're approved, Uplift will show you a range of payment plans to choose from.

- Pick which plan you like, and then complete your purchase.

Unlike some BNPL lenders, Uplift does not offer an app or a way to make purchases at non-partner stores with a digital card number.

How to Use Uplift in Stores

Since Uplift is focused on one area—travel purchases—you can generally only use it online. You may be able to use it in certain offline cases, too, such as through Uplift's travel advisor partners or call centers.

How Do Returns Work When Using Uplift?

If you request a refund from the merchant or if your trip is canceled, a few things can happen.

Your ability to get your money back is always subject to the merchant's own refund policies. A merchant can choose to deny your refund if it's outside of the scope of the merchant’s cancellation policies, so you should read these carefully before you make a purchase. If the merchant allows refunds, you'll either get a credit or voucher you can use for future travel, or the merchant sends a cash refund to Uplift.

If the merchant opts for a cash refund, Uplift will credit your loan with the amount of the refund. It can take up to 90 days for this to happen, so you may still be paying on your loan for quite some time after it's canceled. If that refund wipes out your balance and there's still money left, Uplift will refund you the remaining money.

But—and this is important—if the merchant gives you a voucher for future travel, you still must pay back your Uplift loan. You can use this voucher to book travel later and it'll likely be paid off by then, but it can be a bummer to be paying for travel that you can't use yet.

Uplift recommends sending to support@uplift.com a copy of the email that confirms your refund.

If you're in the United States, you have two options for how to pay:

- ACH transfer from your bank

If you're in Canada, you can pay using these two methods:

- Direct debit from a bank account

- Visa or Mastercard virtual debit card

When you sign up for your loan, Uplift will ask you to link your payment method and sign up for autopay. You don't have to agree to autopay, but it's always a good idea to do this for any debt so that you don't miss any payments. Otherwise, you'll need to remember to log in each month and make your payment.

Uplift is also unique in that it requires monthly payments. In comparison, many other BNPL lenders require biweekly payments.

What Happens If I Don’t Pay Uplift?

Uplift doesn't charge late fees, but there are plenty of other reasons why you'll want to make your payments on time.

If more than 30 days pass since your last payment, your Uplift loan will continue to accrue interest, making it more expensive to pay off. Uplift may blacklist you from getting another loan through them again and may also report your late payments to the credit bureaus, which can damage your credit score .

Uplift. " Buy Now, Pay Later Travel Leader Uplift Raises $68M in Credit Financing to Support Rapid Growth in Anticipation of 2021 Travel Industry Rebound ."

myFICO. " Credit Checks: What Are Credit Inquiries and How Do They Affect Your FICO Score ?"

Board of Governors of the Federal Reserve System. " Consumer Credit - G.19 ."

Uplift. " Buy Now, Pay Later Travel Leader Uplift Raises $68M in Credit Financing to Support Rapid Growth ."

Uplift. " Payments and Refunds ."

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Best of Wellness Awards 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

'buy now, pay later' can help fund your next trip but here's what you need to know about these loans, select walks you through what you need to know if you're considering a point-of-sale loan to finance your next trip.

With summer in full swing, and many countries easing travel restrictions, you might be eager to plan a post-pandemic trip. Even if you managed to save some money ahead of time, travel expenses can quickly add up, and you might be tempted to choose the 'buy now, pay later' option that's offered at checkout on many travel websites, including Carnival or Expedia.

These point-of-sale loans are seductive to consumers who don't want to pay for their post-pandemic vacations with one lump-sum payment, allowing people to make payments over a fixed period of time, sometimes without high interest rates.

But is using the 'buy now, pay later' option to pay for your flights or hotel stays too good to be true?

Select explores some of the benefits and drawbacks of using 'buy now, pay later' for travel.

What are point-of-sale loans?

How do point-of-sale loans work, should you use point-of-sale loans for travel, bottom line.

'Buy now, pay later' providers (also known as point-of-sale loans) offer consumers the option to sign up for a payment plan either when they're buying something on a retailer's website or directly through the loan provider's website ahead of purchase

Point-of-sale loans give consumers the ability to make installment payments over a fixed period of time until they completely pay off their purchase. This means that you'll make payments toward your purchases bi-monthly or monthly depending on the plan and/ or provider.

These payments can typically be automated by providing your debit card or bank account information. While many providers boast 0% interest rates, some point-of-sale loans can have interest rates upwards of 30%, higher than the APRs on many credit cards.

Some of the most popular providers are Afterpay , Affirm , Klarna and Uplift . Klarna offers point-of-sale loans, some with 0% APR, that allow you to make four payments every two weeks and require a deposit at checkout, while Afterpay allows you to pay over six weeks. Afterpay, Uplift, Klarna and Affirm also offer consumers longer payment periods of up to one, two or even three years.

When you purchase a flight or an item, you're given different financing options at checkout, such as the opportunity to pay with a credit card, gift card or point-of-sale loan . You'll be redirected to the POS provider website where you can enter your personal information.

Some companies won't perform a credit check while others will perform either a soft or hard credit inquiry . Soft credit checks don't negatively impact your credit score , but hard inquiries will temporarily decrease your score. Based on the information you enter, you'll either be approved or denied for the loan.

Afterpay doesn't do any credit checks while Klarna does soft and hard credit checks, depending on the loan.

The impact a point-of-sale one has on your credit score depends on whether the provider reports your payment history to the credit bureaus . For example, Affirm only reports your credit history to Experian for some loans and not others. For the loans that Affirm does report to Experian, your payment history, the length of your credit history with Affirm, the amount of your loan and your late payments can all show up on your credit report.

Make sure to read the terms and conditions of your POS loan to see if your negative payment history is reported to the credit bureaus.

Travel expenses might seem like the perfect opportunity to use a point-of-sale loan because it's oftentimes a big purchase that you might not have the immediate cash on hand to cover.

Klarna, Afterpay, Affirm and Uplift all offer 'buy now, pay later' option for certain travel partners. Affirm has partnerships with Delta Vacations, Priceline, StubHub and Alternative Airlines, a flight booking website. Uplift is exclusively focused on providing point-of-sale loans for travel, with around 200 travel partners , including United Airlines, Kayak , Southwest Airlines and Royal Caribbean.

Uplift will help you cover transactions costing anywhere from $100 to $25,000. Interest rates range from 7% to 30%, but there are a few travel partners such as Carnival Cruise Line and Atlantis that have a 0% APR, according to Tom Botts, chief commercial officer at Uplift. The average APR for an Uplift point-of-sale loan is 15%, which is similar to the average APR for credit cards .

"We use a variety of factors to determine eligibility," Botts says. "Interest rates are based on a number of factors including credit history, transaction amount and time to travel."

Uplift also only performs a soft credit check which won't negatively impact your credit score.

If you're able to secure a loan with 0% APR and make your payments on time, a point-of-sale loan could be a good choice for funding a trip. But if those monthly payments won't easily fit within your budget, be wary of a POS loan and read the fine print beforehand to determine how much you'll end up paying in interest.

For example, if you use Affirm to finance your purchases on Alternative Airlines , you can only get a 0% APR on your point-of-sale loan if you buy a flight that costs less than $500. If your ticket costs more than $500 , you could incur an interest rate of up to 30%, depending on your creditworthiness.

If you spend $1,000 on a flight and choose a 12-month payment plan with Affirm, you'll have to cough up nearly $100 in interest if you have a 20% APR on your loan. One perk of using Affirm over a credit card is that you'll have a longer payment period (of 3, 6, 12 or 18 months) which helps to spread the expenses over time into more manageable payments. And with an installment loan from Affirm or Uplift, the interest doesn't compound month over month, so your payment stays the same over the loan's term.

But a big drawback of using point-of-sale loans for travel is having to deal with unexpected problems, like trip cancellations or delays, says Priya Malani, the CEO and founder of Stash Wealth.

"If a trip is canceled or delayed with unexpected fees, your loan is still due. You're on the hook for the agreed upon total. Even though you may have checked out in one fluid process, you're still working with two separate entities — the travel provider and the POS loan provider," Malani says.

When it comes to funding your resort stay in Cancun or your flight to the Maldives, there are other options for financing your trip.

Travel rewards credit cards offer higher rewards rates for money spent on travel and the points you earn can go toward booking flights or hotels. While travel credit cards typically come with an annual fee, some offer a 0% introductory period, so you won't have to worry about high interest rates kicking in for 12 months or longer. If you go the 0% APR route, make sure you set up a repayment plan and pay the minimum each month so you don't end up paying late fees or big interest charges.

The Chase Sapphire Preferred® Card is currently offering a welcome bonus offer where new cardholders can earn 60,000 points after they spend $4,000 on purchases in the first three months from account opening. Points can be redeemed for $750 worth of travel when booked through Chase Travel℠.

Chase Sapphire Preferred® Card

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Welcome bonus

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Regular APR

21.49% - 28.49% variable on purchases and balance transfers

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater

Foreign transaction fee

Credit needed.

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

The Capital One Venture Rewards Credit Card (see rates and fees ) is also a solid choice but comes with a smaller welcome bonus and higher rewards rate than the Preferred, giving 2X miles per dollar on every purchase and a welcome offer of 75,000 bonus miles if you spend $4,000 within three months of account opening.

Capital One Venture Rewards Credit Card

5 Miles per dollar on hotel and rental cars booked through Capital One Travel, 2X miles per dollar on every other purchase

Earn 75,000 bonus miles once you spend $4,000 on purchases within 3 months from account opening

N/A for purchases and balance transfers

19.99% - 29.99% (Variable)

$0 at the Transfer APR, 4% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you

See rates and fees . Terms apply.

Travel cards also often come with additional perks such as car rental insurance, trip cancellation insurance and purchase protection. You won't get any of these perks when you use a POS loan for travel.

If you worry about putting a big expense on your credit card or you're only eligible for a POS loan with high APR, you should also consider creating a travel fund instead.

By saving your money in a high-yield savings account , you'll be earning more (thanks to compound interest ) than you would be if you put your money in either a checking account or a traditional savings account. Creating a separate fund for travel can also give you a money goal to strive for and setting up automatic monthly transfers can help you avoid spending money on other short-term, more frivolous purchases.

Point-of-sale loans are attractive because of how easy they are to use — you simply provide some basic information about yourself to the loan provider before checking out and you can instantaneously get a loan that will allow you to spread the cost of your trip over a few months. If you're not diligent about reading the fine print, however, there can be a lot of caveats to using the 'buy now, pay later' option, including high interest rates and late fees.

- What to do if your homeowners insurance claim is denied Liz Knueven

- Best car insurance companies in Illinois based on price, customer service and coverage Liz Knueven

- Does car insurance cover hail damage? Liz Knueven

You can now book Southwest flights now and pay later, but should you?

Last week, Southwest Airlines became the latest carrier to offer travelers the option to book flights now and pay later with the travel finance services company, Uplift. (Previously, this service was only available on Southwest Vacations packages.)

The service's main focus is making travel more attainable for some by offering monthly payment options when purchasing flights. The service is currently available for a number of airlines, including Alaska Airlines, Allegiant, Air Canada, Frontier, Spirit, United and others. It also has partnerships with a handful of online travel agencies, cruise lines and resorts.

It's always great to have more payment options, but there's a question on all our minds: is taking out a loan for travel a good idea? Here, I'll show you how Uplift works when booking airline tickets and the costs associated with using the service.

Let's dive in!

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter .

How Uplift works

Using Uplift is simple. Head to Southwest's website, enter your desired itinerary and continue through the booking process as usual. You'll see a "pay monthly" option at the check-out screen where you can quickly apply for an Uplift loan. Uplift can be used on purchases of $100 or more.

The loan application asks for basic information like your address, income and last-four of your Social Security Number. The website states that loan applications are processed immediately and that checking loan eligibility doesn't affect credit, so it's likely a soft credit pull .

If approved, you'll be presented with your loan options. This includes a 6-month and 11-month loan term alongside their respective interest rates and monthly payments. There's may be a downpayment due at the time of booking on some bookings. Uplift states that your loan terms are based on your itinerary, trip price and credit profile.

You'll also be prompted to set up payments before completing your booking. You can pay with a debit card and have the monthly payment automatically charged to your debit card.

Related: 6 simple rules to stay out of credit card debt

costs associated with Uplift

There are a few costs associated with using Uplift to pay for your travel. As you'd expect, the most obvious expense is your interest. Uplift charges simple interest on all bookings, and — as discussed — your rate depends on your credit profile. Unlike carrying a balance on a credit card, Uplift only charges interest on the purchase, not the interest incurred over the life of the loan.

According to Uplift's website, APR can range between 0% and 36%. At the high-end, this is an incredibly high interest rate that's more than most credit cards. It's unclear when the company offers a 0% interest rate, but I suspect this is reserved for special limited-time offers. For example, Carnival Cruises is currently offering 0% promotional loans on cruises with $0 down.

You may be subject to a loan origination fee on some Uplift loans too. This fee varies based on your loan and doesn't look to be charged on all loans. Thankfully, Uplift has confirmed that origination fees are not charged on Southwest bookings. You'll also be asked to pay a downpayment when you first open your loan.

Related: 5 personal finance strategies that will help you to travel more this year

Does it make sense to finance travel with Uplift?

As a general rule of thumb, it's not the best idea to buy something you can't afford. However, there are certain situations where it's out of our control and having an option like this can save the day. For instance, if you have to book a last-minute emergency flight and can't swing the cost then this could be an option worth exploring.

If you do take advantage of Uplift's payment option, then you'll want to pay it off as soon as you can to avoid accumulating interest. However, you may be better off putting it on a credit card that has 0% or a low APR rate to avoid unnecessary interest charges. It depends on what interest rate you're quoted for and how soon you expect to pay the loan back.

At the same time, it's easy to see why airlines are adding Uplift as a payment method now. Leisure travel is recovering after being put on pause during the coronavirus pandemic . Splitting a travel expense up into monthly payments may be attractive to some travelers, even if it means paying interest and other fees.

Oh, and if you're curious: flights booked with Uplift will still earn miles like any other flight.

Related: 13 expenses that you should not put on your credit card

Bottom line

Using Uplift could be a great option if you have to take a last-minute emergency trip. Otherwise, it's generally best to not get yourself into debt just to take a spontaneous vacation. There are plenty of ways to earn points and miles every day that could ultimately lead to booking your dream vacation.

As the old saying goes: "Good things come to those who wait." In this case, don't rush a trip that you're not financially prepared for — focus on upping your points and miles game instead.

Additional reporting by Liz Hund

Feature photo by VDB Photos / Shutterstock.com

Travel now. Pay over time.*

Through Uplift, you can book your trip today and make easy monthly payments that fit nicely within your budget. It's a fast and easy way to turn your ideal vacation into reality. Plus, you can travel before your loan is paid off.

With Uplift Pay Monthly you get:

Great rates

Affordable plans

Pay off your vacation with convenient monthly payments. To keep things simple, Uplift can automatically process your payments and notify you with a convenient email and text.

Quick and easy application

Simply select Pay Monthly at checkout, complete a short application, and you’ll receive a quick decision.

No surprises

Make the same fixed payment each month with no late fees and no prepayment penalties.

Questions? Visit the Uplift FAQ page .

*Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders . Privacy Policy . Terms of Use . Uplift’s Address: 440 N. Wolfe Road Sunnyvale, CA 94085

$500 instant savings at select resorts. Book now.

Travel now. Pay later.*

Through Uplift, you can book your trip today and make easy monthly payments that fit nicely within your budget. It's a fast and easy way to turn your ideal vacation into reality. Plus, you can travel before your loan is paid off.

With Uplift Pay Monthly Option you get:

- Low Monthly Payments

- Budget-friendly loan options

- Easy Application

- Quick decision

- Surprise-Free

- No late fees or prepayment penalties

- No payment dates to remember

Visit Uplift's Frequently Asked Questions Page to learn more

Uplift - Buy Now, Pay Later 17+

Shop interest free. zero fees., uplift inc..

- #180 in Shopping

- 4.7 • 2.6K Ratings

iPhone Screenshots

Description.

Buy Now, Pay Later with the world's most popular travel brands and shop hundreds of your favorite stores and pay over time with low, monthly installments. Uplift gives you a better way to pay for the things that matter most and even features interest-free terms*! Here’s how it works: Already an Uplift customer? Great! Download and easily start managing all your thoughtful purchases and account information directly within the app today. Not an Uplift customer? No problem! Simply download and explore plenty of travel inspiration for your next adventure with tons of the worlds favorite travel brands. When you’re ready to book with one of our travel partners, simply select “Pay with Uplift” at checkout. We’ll help you split the total amount into bite-sized monthly payments. You can choose the plan that works best for your budget. Unlock Purchase Power so you can shop at hundreds of great stores, too! Qualifying customers in good standing will be able to unlock their Purchase Power over time and start shopping at their favorite stores. Uplift’s Purchase Power tells you just how much we can offer you through the Uplift app to spend and pay back over time with an installment plan. Shoppers can select “Pay with Uplift” at purchase and split the total amount into bite-sized monthly payments. Once you pick your plan, we’ll issue you a virtual card. Copy the card information and use it at checkout—just like you would use a regular credit card - and complete your purchase! You’re probably thinking that there must be a catch. Well, there isn’t! There are no fees or mystery charges. Simply follow your surprise-free monthly payment plan to pay off your purchases and unlock Purchase Power over time. What makes Uplift great? Let us count the ways: EASY UPLIFT ACCOUNT MANAGEMENT You can easily manage your Uplift purchases, monthly payments, and account information directly in the My Uplift tab within the Uplift App. Update your payment information, AutoPay status, and more right from your mobile device. SIMPLE, SURPRISE-FREE PAYMENTS No fees. Ever. No prepayment penalties. No confusing math. Best of all, you don’t have to mastermind a pay-off strategy. Upfront, you’ll know exactly how much to pay and when, so you can pay off your tab easily. INTEREST-FREE OPTIONS AVAILABLE* The Uplift app gives you interest-free payment options. That gives you more time to make your money work for you and more freedom to enjoy your purchase—without undue strain to your finances. Know that not all plans are interest-free and some plans include interest. Take the stress out of traveling and shopping, all in one place! Make doing the things you love a reality while using a smarter way to shop and pay. Problems with downloading or installing the app? See www.uplift.com/app-faq Still need help? Reach out! [email protected] Terms of Service: https://www.uplift.com/terms/ *3 month Interest-free terms are only available when checking out for certain merchants and well qualified applicants. 0% APR offers available for qualified applicants. Based on a purchase price of $200 you could pay a down payment of $50 today, followed by 3 monthly payments of $50 at $0% APR. Minimum purchase may be required. Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders. Terms of Use: www.uplift.com/terms Privacy Policy: www.uplift.com/privacy

Version 2.2.0

Minor bug fixes and improvements.

Ratings and Reviews

2.6K Ratings

Ease of use

I’ve used 3 different buy now-pay later apps, Klarna, Affirm & Afterpay. This one is a keeper! They all have different repayment plans but I really like paying in 3 months, zero down & no interest. Other than Affirm the shortest time are 4 payments every 2 weeks with an amount due now. Affirm is worse actually unless you finance a big purchase. I’ve used them for 2 yrs. I have good credit score (700’s), never missed a payment or been late but they advertise if you do exactly those requirements you can pay at a lower interest rate. That is a lie period. I still get charged 29%-36%. So I’m going to be using Uplift.

Developer Response ,

Thank you so much for your kind review! We wish you happy shopping in the future!

Unprofessional

I have used Uplift in the past and I was extremely impressed with the app in the beginning. Then my purchase power went up and I was able to make purchases on my budget. One day I logged in and everything disappeared! I still have a small balance to pay off (less than $30) but no one at the company has given me a real answer. Customer service says they are not sure what is going on with the app. The email support advised me to go use other apps platforms because they are unable to define a specific time frame for operations. I was also told by their customer service representative that they were “surprised that I had a loan because everyone else is using the travel app”! I’m so disappointed in this app because I thought they were going to be honest but I’m going to pay them that little bit and delete the app. It’s been going on for over a year now and nothing has changed. I was paying the balance slowly hoping it would be up and running by now but I was wrong. Please Uplift don’t respond to my review with that bot reply because emailing support team is a waste of time.

I got approved with uplift for a purchase . I even already made the virtual card . But the app kept freezing so i close the app and opened it back up when i went back to the purchase area and click for the virtual card the card disappeared and thinking it like other apps i went to virtual card area to see if i can see the card info but it wouldn’t show up . I then cancel the card because it said that once it cancel that i will see my power purchase go back instantly. I waited an 1 hour and nothing . Not only isthe purchase power did not Reverse but the app also keeps freezing and getting error . I logged in logged out . I even deleted the app and still the app is not Longing . This is simply the worst app i y see. I never had such issue’s with any app before and it frustrating anf confusing since i was literally so close to checking out before it failed.

Hi mAkieya18 - we're sorry to hear this. We'd like to understand more about the issues you're experiencing and work together on any possible fixes. If you wouldn't mind sending an email to [email protected] with the email address you are using in the app, we will assist. Thank you!

App Privacy

The developer, Uplift Inc. , indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy .

Data Linked to You

The following data may be collected and linked to your identity:

- Financial Info

- Contact Info

- Identifiers

Data Not Linked to You

The following data may be collected but it is not linked to your identity:

- Diagnostics

Privacy practices may vary, for example, based on the features you use or your age. Learn More

Information

- App Support

- Privacy Policy

You Might Also Like

Four | Buy Now, Pay Later

Postpay | Shop Now. Pay Later.

Sezzle - Buy Now, Pay Later

Zip - Buy Now, Pay Later

Progressive Leasing

$500 instant savings at select resorts. Book now.

Travel Now. Pay Later.

Travel now. pay later..

Your dream trip doesn’t have to wait. We partner with Uplift to give you the option to break your payments into convenient monthly installments, even AFTER you’ve already traveled.

Uplift allows you to stretch your budget and lock in prices while they're at their lowest, allowing you to do more with your money, like upgrading your room and booking excursions. Travel now, pay later.

Ready to book? Just select “Pay Monthly” at checkout and complete an easy, commitment-free application. Submit an application and you’ll receive a quick decision. From here, you can pay off our vacation in fixed monthly payments!

Still have questions? Give us a call at 1-855-592-3224 and we will gladly explain how it works.

- Go to navigation

- Go to main content

- Go to search

- Go to footer

Main content

Uplift - book now. pay over time..

Feel good about what you book and how you pay for it. With Uplift, you can make thoughtful purchases and pay for them in bite-sized pieces while keeping yourself on budget.

Flight search

Why uplift.

Now you can spread your adventure into easy payments with Uplift's Pay Monthly option. Uplift, a third party provider, offers access to affordable payment options that fits nicely within your monthly budget. It's a fast and easy way to turn your ideal vacation into a reality.

Low Monthly Payments

Budget-friendly loan options

Easy Application

Quick decision

Surprise-Free

No late fees or prepayment penalties

Easy AutoPay

No payment dates to remember

How Uplift Works

Select Uplift at Checkout

Add your trip to the cart just like you normally would. When you are ready to book, choose Uplift as your form of payment.

Quick & Easy

Provide a few pieces of information and receive a quick decision.

Enjoy your trip now and pay for it over time with low monthly installments.

Frequently Asked Questions

What is uplift.

Uplift gives you the freedom to book travel now and pay over time with simple fixed installments. Some plans include interest while some are interest-free. When you’re ready to checkout, just select “Uplift” as your payment method, complete a short application, and receive a quick decision. Choose the terms of your payment plan, finish checking out, and enjoy your purchase. Then, pay over time with simple, no-surprise monthly payments.

How do I apply?