The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

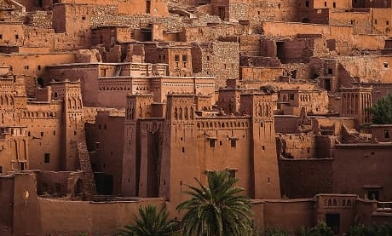

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

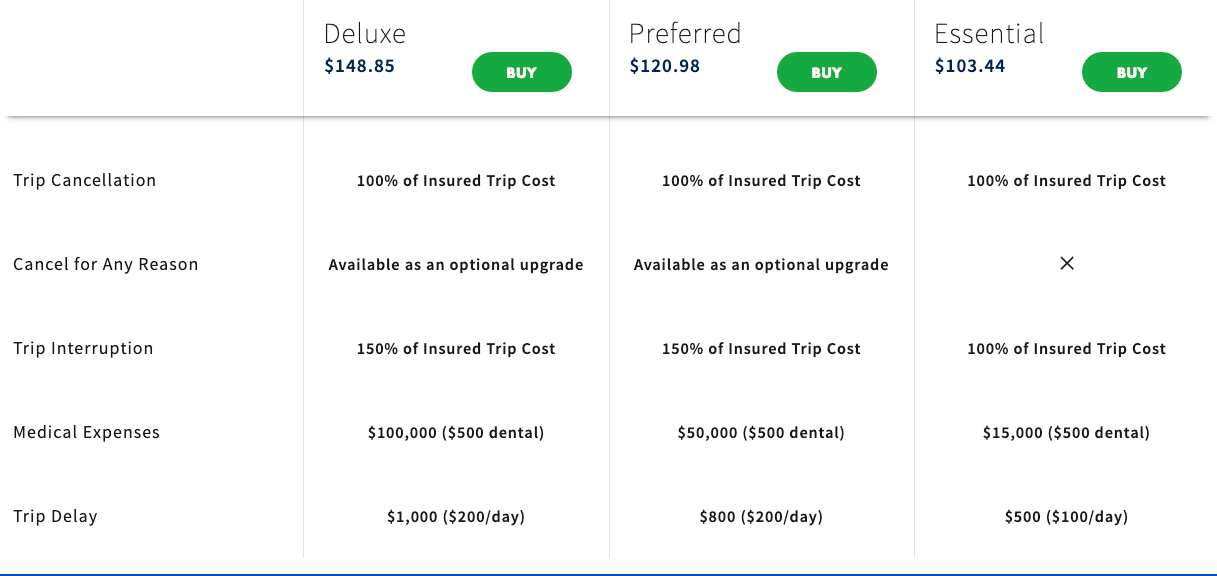

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

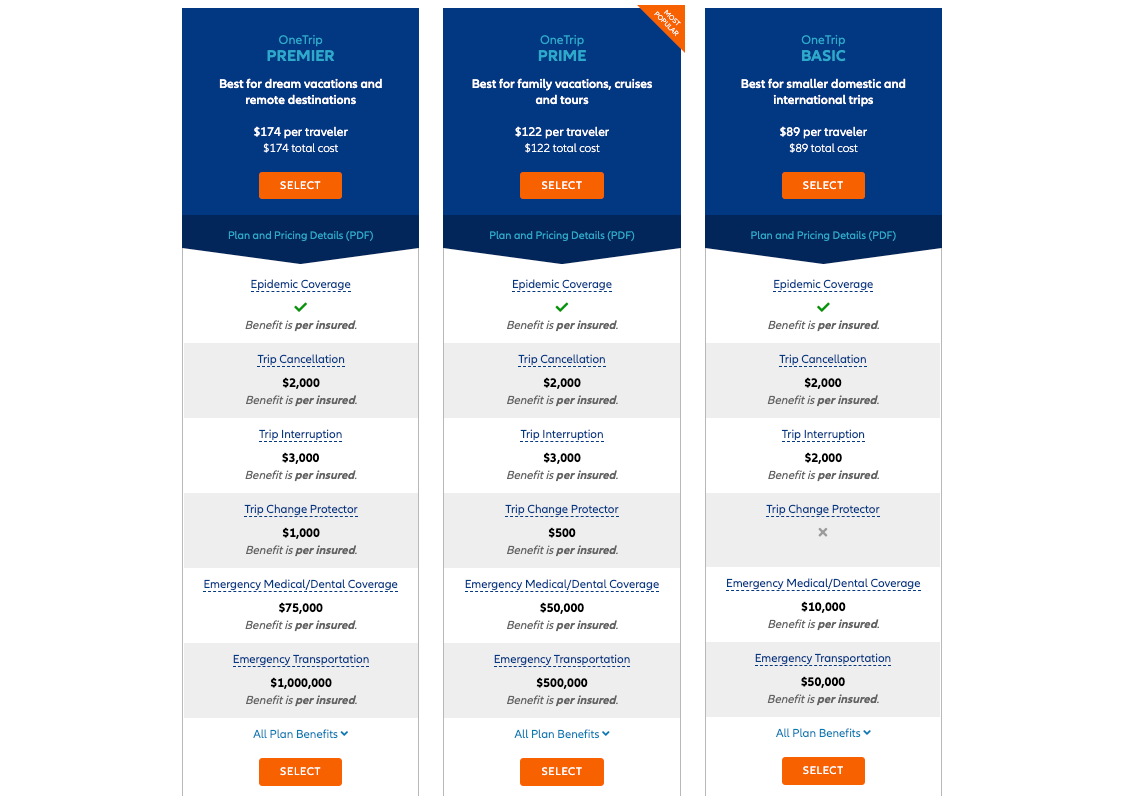

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

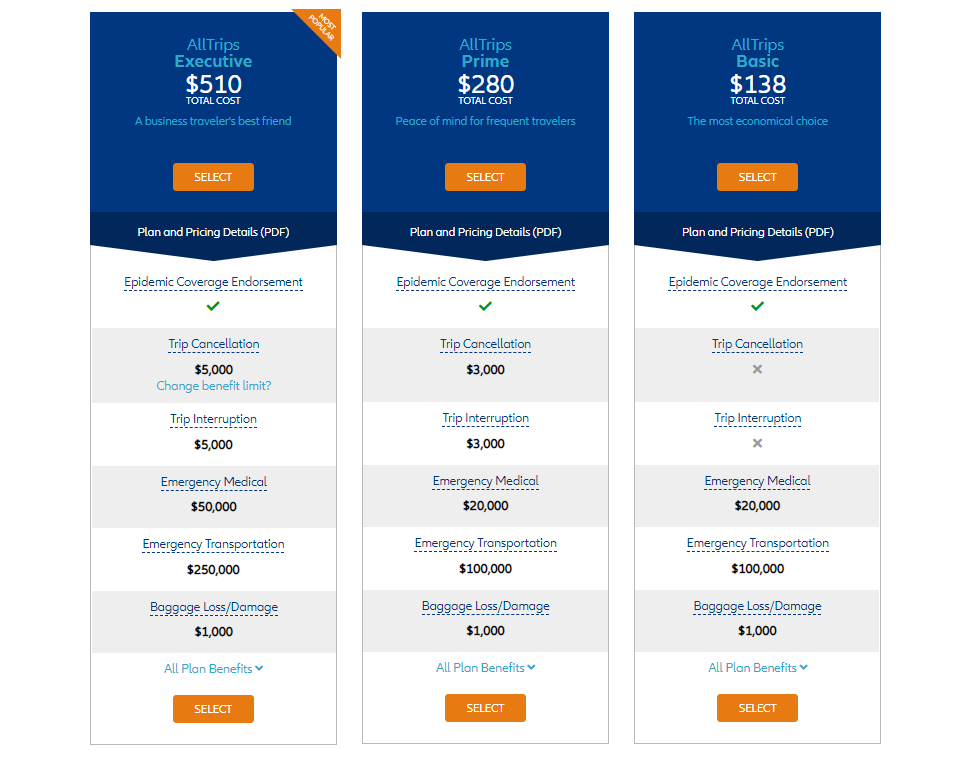

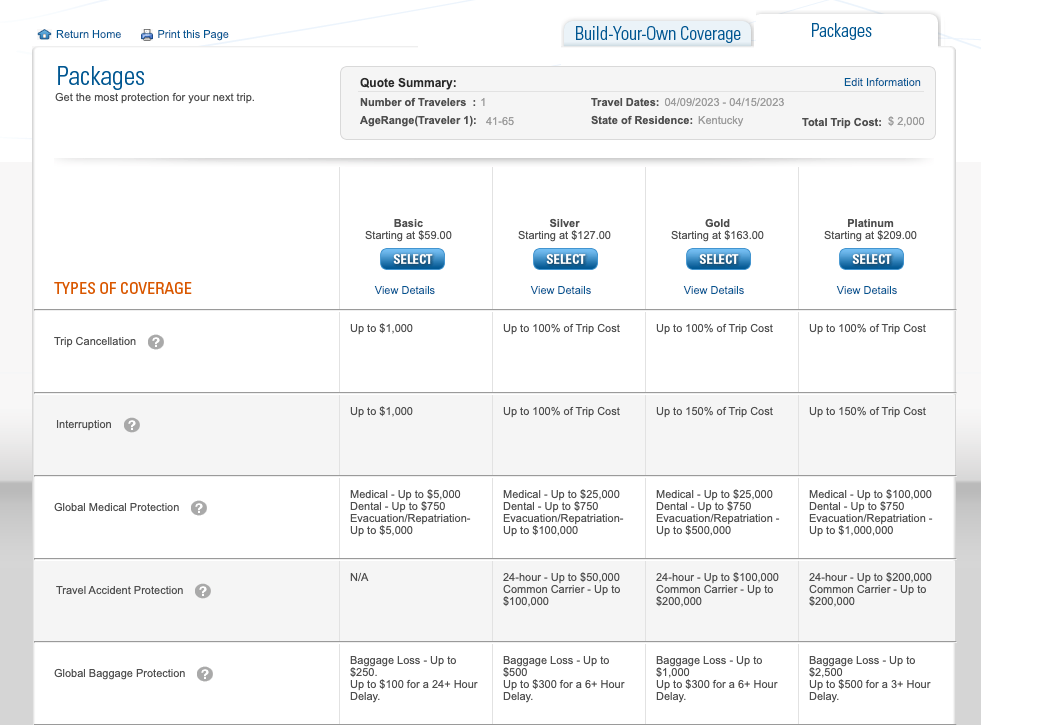

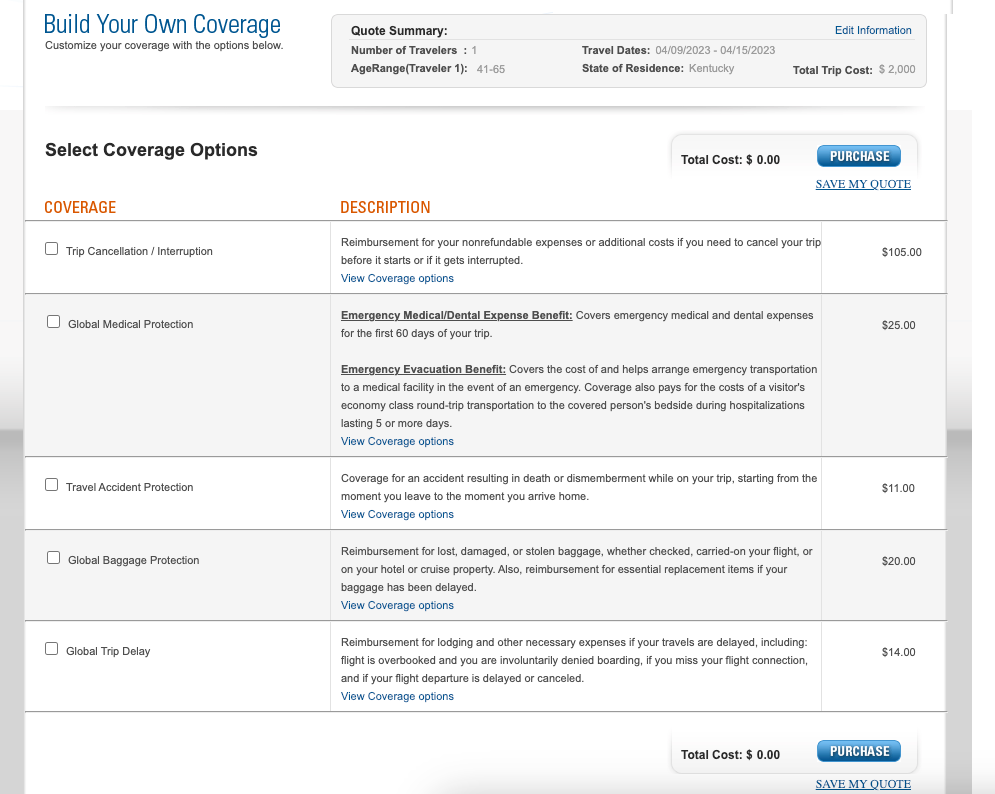

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

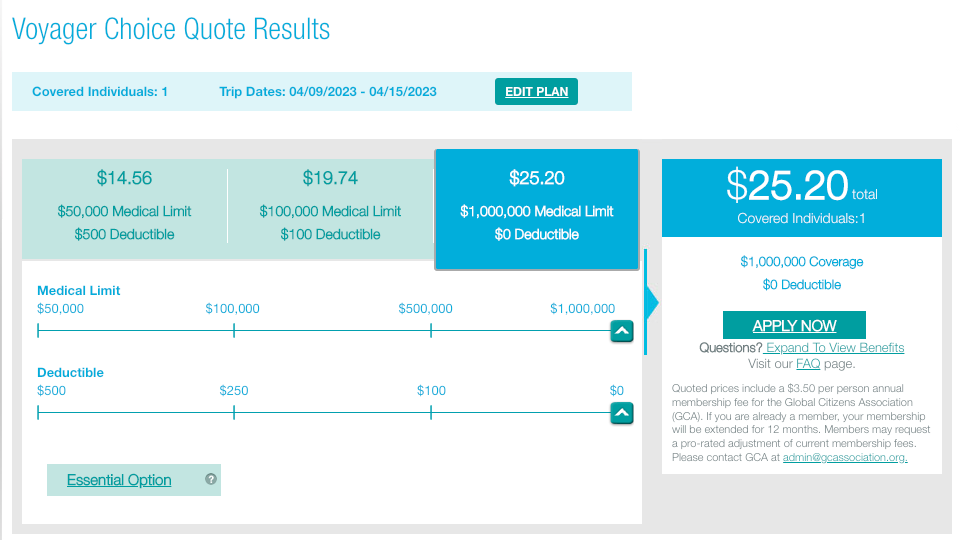

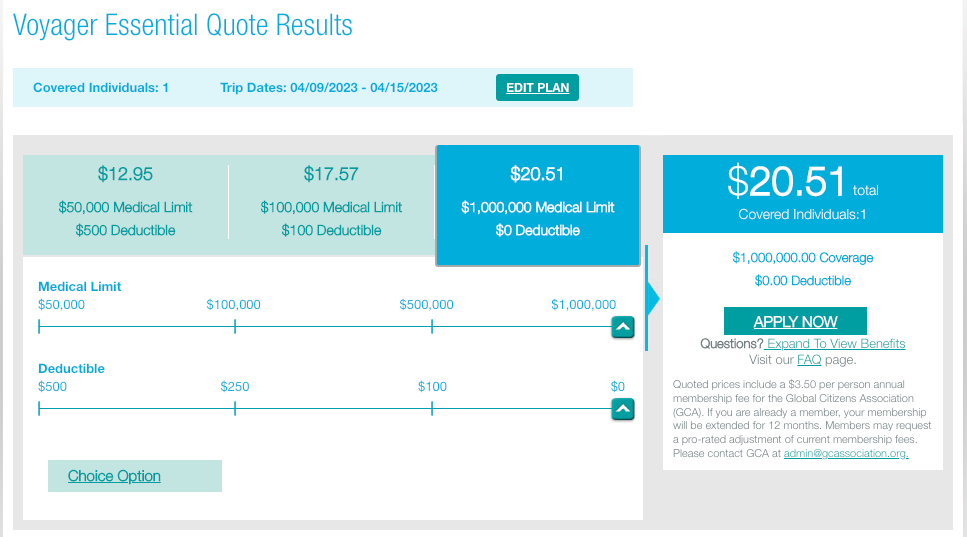

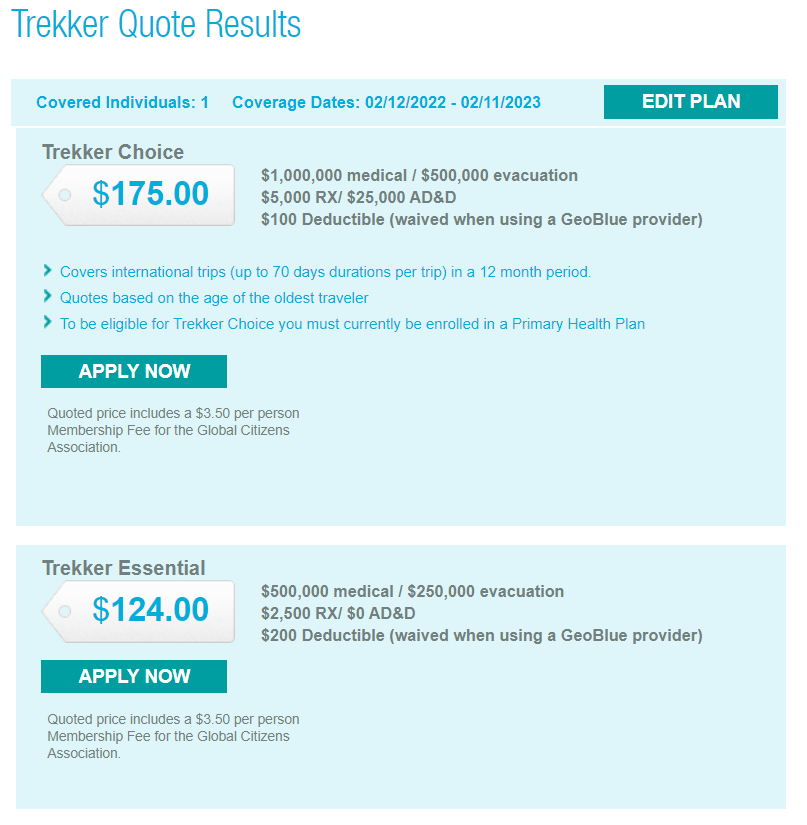

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

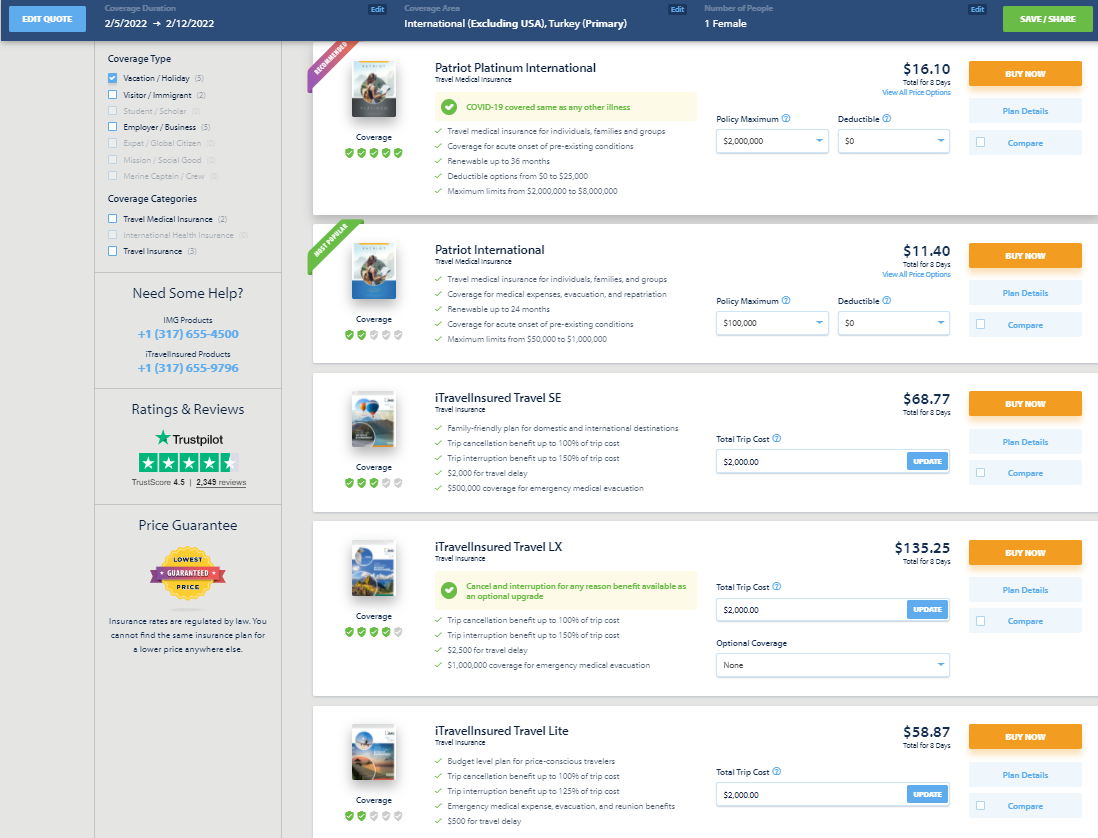

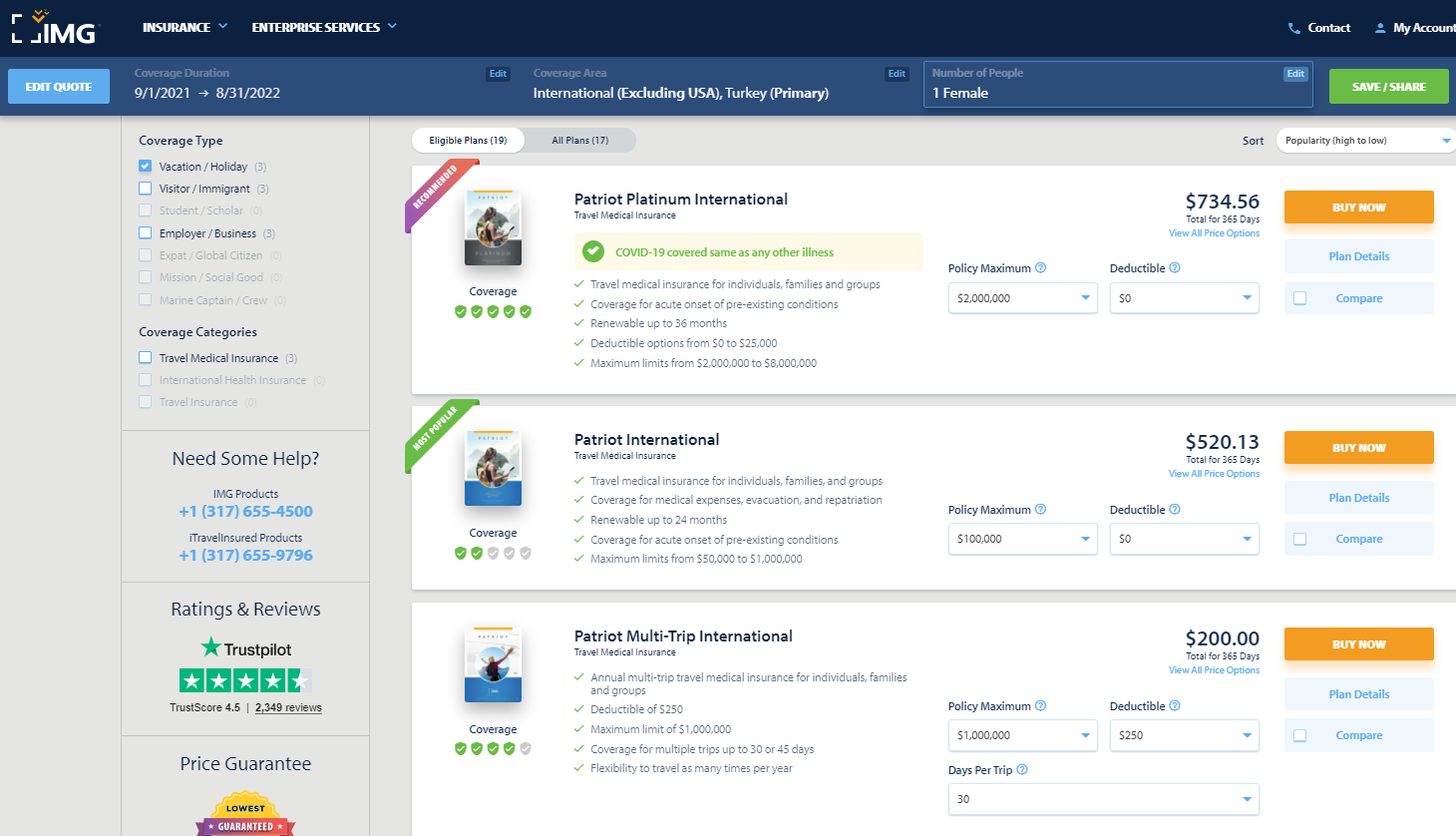

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

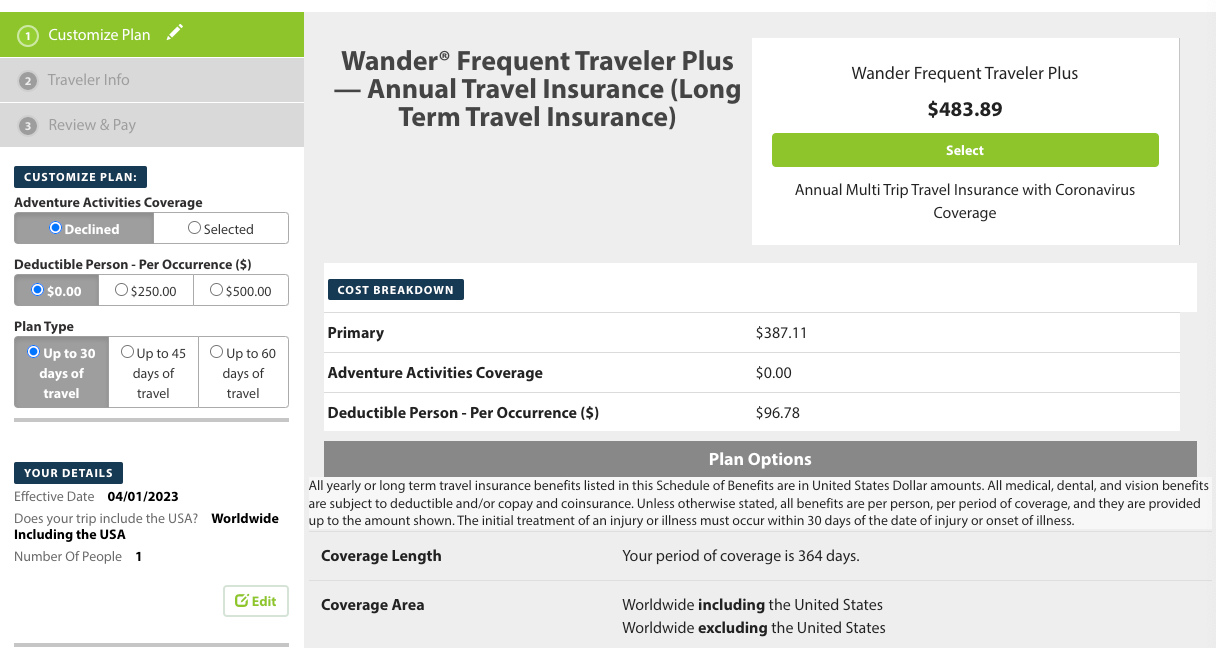

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

Travelex Insurance

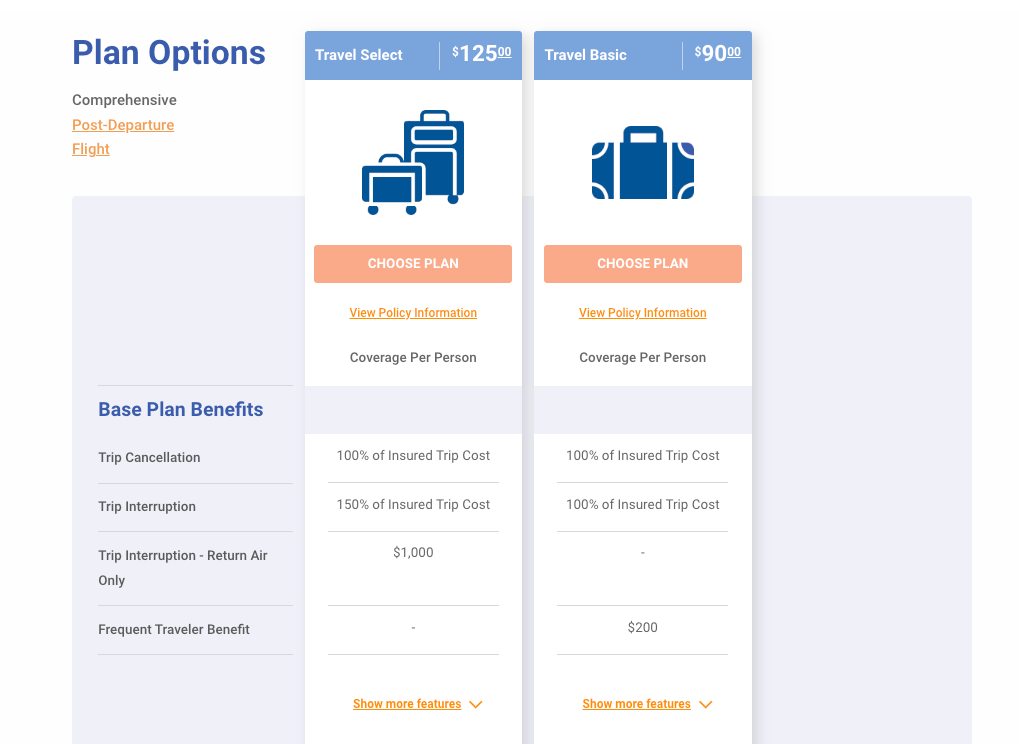

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

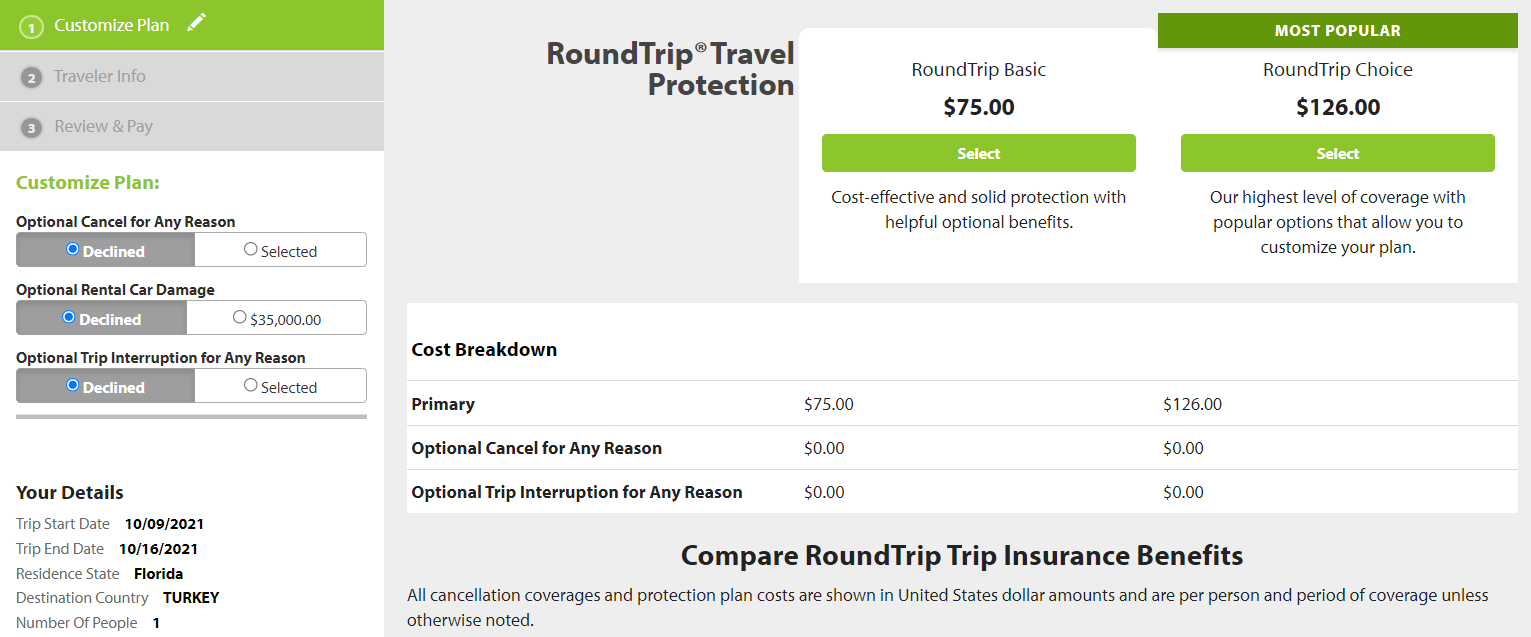

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

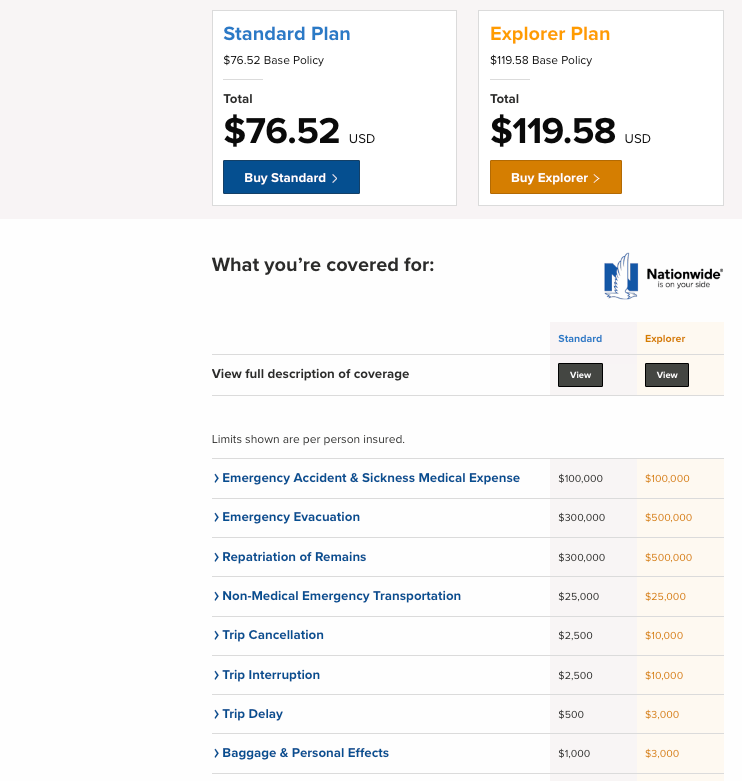

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

- Gadget Insurance

- Gadget Insurance Reviews

- Compare Gadget Insurance

- Gadget Insurance Guides

- Pet Insurance

- Pet Insurance Reviews

- Compare Pet Insurance

- Pet Insurance Guides

- Travel Insurance

- Travel Insurance Reviews

- Compare Travel Insurance

- Travel Insurance Guides

- Equine Insurance Reviews

- Compare Equine Insurance

The Definitive Guide to Single Trip Travel Insurance

The single trip travel insurance guide.

There are currently well over 500 different single trip travel insurance policies to choose from. Selecting the right policy can seem a little overwhelming, so you will be glad to know that we have reviewed every one for you, ranking them by cover, sums insured and premium.

This review guide will help you understand what to look out for when picking single trip travel insurance and how to choose the right policy for you and your family.

The Single Trip Travel Insurance Market

What is a single trip travel insurance, what does single trip travel insurance cover.

- When should I buy single trip travel insurance

Can you take out single trip travel insurance after leaving?

Why get single trip insurance, who is a single trip travel insurance policy for, how much does single trip travel insurance cost, what affects the price of single trip travel insurance, what are the benefits of single trip travel insurance, what are the drawbacks of single trip travel cover, what are the exclusions under single trip holiday insurance, what extras can i include under a single trip travel.

- Tips when comparing single trip travel insurance.

Despite the current economic climate and the looming results of Brexit, there has been a steady increase in the number of visits abroad, which have risen by 31% since 2010, a trend which has been forecast to continue.

78% of all trips abroad were to Europe, with Spain being the most popular European destination (26% of all trips). North America (including Canada) was the second most visited destination with 6.5% of all UK overseas visits being made to the region. The number of flights leaving UK airspace has also increased from 46 million in 2013 to 61.7 million in 2017.

Short breaks and city trips, particularly to European destinations is a rising trend aided by budget airlines and an avalanche of online providers offering cheaper last minute deals. Trips typically last no more than four nights. This has led to a change in holiday habits, indicating that consumers are taking a greater number of shorter overseas breaks rather than one long annual holiday.

The benefit of a single trip policy is that you are only paying for the specific time you are away.

As mentioned above single trip travel insurance covers a wide range of unknown situations, such as:-

- Cancellation/Curtailment/Abandonment - The need to cancel, curtail or abandon your trip, as a result of death, bodily injury, illness, redundancy, foreign office directive, natural disaster or catastrophe.

- Emergency Medical Expenses – The cost of medical treatment and associated expenses (such as repatriation) required as a result of an illness or injury caused whilst you are abroad.

- Baggage Cover – The loss, theft, or accidental damage to your luggage, personal possessions or money.

- Missed Departure – additional expenses to assist you in reaching your destination if you have missed your original departure.

- Delayed Departure – Compensation if your flight is delayed for 12 hours or more.

- Delayed Baggage – The cost of essential items if your baggage has been lost or delayed.

- Personal Accident – Financial compensation disability or death as a result of an accident.

- Personal Liability – Protection if you injure a third part or damage their property.

- Legal Expenses – Should you need to sue for compensation.

- Hijack/Mugging – Compensation should you be hijacked or mugged whilst abroad.

When should I buy single trip travel insurance?

Your single trip policy should be purchased the moment you book your holiday or trip. Even if you are not planning to travel for several months, the moment that you take out a policy, you will be covered for cancellation of your trip.

For example: -

You or a relative become sick or have an accident and are unable to go on the trip.

You might have been made redundant and can't afford to go on the trip and you didn't know about the redundancy when you booked.

You could be forced to cancel your holiday due to bereavement.

Despite the need to book insurance immediately after you have reserved your trip, it is estimated that 35% of consumers actually take out travel insurance 0-1 days before they leave. Whilst no-one wants to cancel their trip abroad, at least insuring early will mean the Insurer will refund some or all of the travel costs.

Yes . If you have already left and forgotten travel insurance, there are several companies who will still provide cover. This is on the understanding that nothing has occurred at the time of taking out the cover which has led to a claim or may lead to a potential claim.

Obviously, the Insurer would not pay for your belongings if you’ve already lost them, medical bills if you’ve already incurred them, or any other events known to exist at the time of arranging cover which might give rise to a subsequent claim.

We have listed a few examples of companies who offer this service.

- True Traveller

- Globelink Travel Insurance

- Alpha Travel Insurance

To prevent fraud, there is normally no cover in the first 48 hours after you’ve taken out a policy, except where you suffer an injury as a result of an accident.

Whilst the last twelve months has seen an increase in the sale of single trip travel insurance, it is estimated that anywhere between 1 million to 3 million travellers didn't bother to take out a policy before they left for their trip abroad. Those customers who didn't take out cover cited the cost, poor past experience, or ignorance as the main reasons for not insuring themselves.

Travel Insurance has never been more competitive. A single trip policy covering a few days away can be purchased for just a few pounds. There is no good reason for you to travel abroad without Insurance. It doesn't make any financial sense NOT to take out travel insurance.

If you are planning a trip, even if it is only to Europe for a few days, you shouldn't just rely on the European Health Insurance Card . A serious injury may still leave you with a large medical and repatriation bill, having your luggage stolen or having to cancel the trip altogether, can leave you thousands of pounds out of pocket. For the cost of a round of drinks, you can travel knowing you are fully protected, should the unthinkable happen.

Most single trip policies can be taken out by an individual. Many policies offer a discount for couples (who live together) and families consisting of a single or two parents and up to eight children. In many cases children can travel free of charge

Asda Travel Insurance will include children at no extra cost under their family policy

Insurewithease.com will cover children for free under all their single trip policies

Some single trip policies will allow groups of individuals (who are not necessarily related) to cover themselves under the same policy (as long as they are travelling together and to the same destination). The majority of these will cover up to ten individuals and offer a discount.

A few companies will cover more than ten individuals such as TopdogTravelInsurance.com

Most policies require you to insure for a minimum of three days with a maximum period of 12 months (some companies will cover you up to 24 months), useful if you are planning to travel around the world for a year, or need to spend a few months with relatives. (There are specialist backpacker policies for longer term travel, but the cover isn't usually as comprehensive).

What you’ll pay for travel insurance is affected by a number of individual factors, such as:

Your age - In general the younger you are the cheaper your insurance is going to be. However some Insurers charge more for the under 25's, so it's important to compare costs. Price increase steadily until you hit your 60's when there is a huge step up in cost, in some cases by as much as 100%.

For travellers over the age of 75 the choice becomes less and the premium even higher. There are several companies who have no age limit on single trip travel insurance such as Holidaysafe.com , and Allclear Travel Insurance , who also specialise in travel insurance with Medical Conditions.

The level of cover - Like other companies, we rate travel insurance policies on a scale of 1 - 5, (with 5 being the highest rating) but unlike other companies, we take a much stricter approach to our award structure. We believe a 5 star policy should be just that, a policy that has the most comprehensive and highest levels of cover, combined with the lowest excess.

Of course these policies come with a higher price tag, but you can still find five star rated policies that are extremely competitive. For Example Holidaysafe's five star rated Premier Plus policy costs only £39.23 for a two week vacation anywhere in the world.

Four star policies are still worth considering but may not have the absolute highest levels of cover. The cheapest four star rated policy based on the same duration and destination as the example above is through Explorer Travel Insurance and their four star rated Platinum policy costing £28.37 .

If you don't need the highest levels of cover, three star policies are an option. Cover tends to meet the industry averages, but may be missing features like gadget cover, or end supplier failure and the excess may be higher.

You need to pay more attention and compare policies carefully if you are choosing a three star policy, to make sure your requirements are still met, but there are some great bargains to be had. Using the same criteria as above, Alpha Travel Insurance provides the cheapest option in respect of their three star rated Alpha 50 ST policy costing £22.61 .

One and two star policies are for those who only require the bare minimum cover for example just medical expenses and aren't worried about cancellation, baggage cover, missed or delayed departure. The advantage is that premiums are extremely cheap. If you are one of those people that hasn't in the past bothered with travel insurance, you should at the very least opt for a one or two star rated policy that covers emergency medical expenses, like CheaperTravelInsurance's bronze policy .

The type of holiday - two weeks sunbathing by the pool is going to cost less than two weeks skiing. Any holiday which includes adventurous activities such as skiing, scuba diving, mountain climbing, or trekking will cost you more and in most cases will be a paid option in addition to the standard premium.

Your Destination - Trips are normally split into three or four (sometimes five) regions. Trips to Europe France Germany etc. will be the cheapest. Taking advantage of the European Health Insurance card means that medical bills are lower for the Insurer.

Some Insurers charge a higher premium to include Balearic countries (Mallorca for example), as they tend to operate a higher level of private healthcare which costs more.

Some Insurers use a different rating structure if you are visiting either Australia or New Zealand. Whilst medical costs tend to be higher than European countries, there are reciprocal healthcare arrangements in place between the UK and these countries, known as MEDICARE and the medical cost to the Insurer is reduced.

The last two regions are the rest of the world excluding the USA and Canada and worldwide including the USA and Canada. In general terms, the further you travel the more expensive the policy will be. The cost of medical treatment in the USA and Canada, whilst excellent, is notoriously expensive and naturally premiums charged reflect this.

The duration of your holiday - Simply put, the longer you are abroad, the higher the cost of travel insurance.

Medical Conditions – if you have a pre-existing medical condition, chances are your premium will be higher. However there are some good travel insurers, who specialise in travel insurance with Medical conditions such as All Clear Travel Insurance . Don’t be tempted not to disclose any conditions, as failure to declare a pre-existing medical condition could invalidate your insurance. Read our guide on the rules of taking medicine abroad .

- You only pay for the exact time you will be away.

- The cover you choose will be tailored to that specific trip. For example if you have recently purchased an expensive laptop, you can make sure it’s specified. You can also make sure specific activities are covered which may not be the case with annual travel insurance .

- Most annual policies have a single trip limit of 31 days. If you are travelling abroad for a longer period, a single trip policy would be the only option.

- If you are only planning to go abroad once per year, a single trip policy should be cheaper than an annual one.

- It may be more expensive to purchase single trip policies if you are planning more than one trip per year.

- Every time you take a trip abroad, you would have to spend additional time re-comparing quotes and cover.

- You must remember to take out a single trip policy every time you book a trip abroad.

- Prices for travel insurance could increase over the course of a year, whereas with an annual policy you have already paid the premium for twelve months cover.

- Loss or theft of, or damage to baggage, including valuables, gadgets and money if they are left unattended at any time (including a vehicle, or whilst in the care of a carrier), unless they were locked in a safe or left in your locked accommodation.

- Loss or damage caused by your baggage being delayed confiscated or detained by customers or any other authority.

- Losing or not having the correct documents (passport, visa, inoculation certificate, travel tickets) that you need to travel.

- Travelling to a country or specific area, which has been advised against by the Foreign and Commonwealth office, or World Health Organization.

- Travelling, to take part in a professional sport, or professional entertaining.

- Changing your plans, returning home or cancelling a trip, because you no longer want to travel, didn’t enjoy the holiday or simply changed your mind.

- Placing yourself in unnecessary danger, for example jumping or diving from a pier, wall, bridge or rock, including tomb stoning, or shore diving.

- Climbing on top of or jumping from a vehicle. Climbing or jumping from a building or balcony.

- Drinking too much alcohol, or taking drugs.

- Claiming for costs that were paid for using any airline mileage reward scheme.

- Claiming for illness caused as a result of a pre-existing medical condition, which you didn’t declare when taking out the insurance.

- Planning an adventure holiday which includes an activity such as skiing , scuba diving, white water rafting or mountaineering and you haven’t told the Insurer.

In addition to the standard cover, you are in many cases, able to extend a policy to include further activities such as Golf or Cruise holidays , and the additional costs associated with a wedding abroad.

Travel Insurance may also be extended to cover business trips , including business equipment and car hire excess. For those who plan to trek or mountaineer, cover can be extended to include the cost of search and rescue.

Tips when comparing single trip travel insurance

You should think about the type of trip you are taking (business, relaxing holiday, weekend break, adventure holiday), the overall cost, how much luggage you are taking with you.

Emergency Medical Treatment - The vast majority of policies cover £10 Million and upwards, but you should go for at least £5 Million.

Cancellation – Make sure that the maximum exceeds the total cost of your holiday, including hotel or villa, flights, or cost of travel and pre-paid excursions.

Baggage – Add up the total cost of personal possessions that you will take with you on your trip and make sure this is under the policy limit. Also pay attention to the single article limit, the valuables limit, and the limit for gadgets like laptops, mobile phones etc. Make sure you are not carrying more than you are insured for.

Money and Cash – Check the policies inner cash limit. Don’t carry more cash than the limit allows, because if it is stolen or you are mugged, you won’t be insured.

Legal Expenses – It is always good to know that you have any legal costs covered, so go for a policy that includes it as standard.

Personal Liability – Accidents happen and sometimes caused by you, so choose a policy that includes at least £1 Million, preferably £2 Million of Personal Liability cover.

Activities – Think about the activities you plan to do whilst on your trip and check the policy to ensure they are either automatically included (even common activities like swimming or snorkelling) or that you have paid the correct additional premium to include them.

Excess – Some policies don’t charge any excess, but if you can stand to take a small hit in the event of a claim, then premiums can be reduced if you elect a large voluntary excess.

Finally if you are using a comparison website, don’t just settle for the cheapest, because the protection offered may not be enough to cover your holiday. Carry out your research carefully. If you want an unbiased opinion use our free travel insurance comparison and rating tool to help you narrow down your search.

Travel News

15 Mar 2020

Coronavirus Travel Insurance Update

05 Mar 2020

Flybe goes out of business What are my rights?

11 Feb 2020

Travel Insurance Coronavirus and Your rights explained

23 Sep 2019

Thomas Cook collapses – British Tourists are flown back home

16 Apr 2019

The European Health Insurance card how it works in 2019

23 Jan 2019

Why Bother with Insurance for your holiday?

16 Nov 2018

Our Top Ten Tips for Travelling with Medical Conditions

02 Oct 2018

Primera Air Collapses Passengers left stranded and out of pocket

04 Aug 2018

ABTA warning to Holidaymakers – Our ten tips for safer travel

17 Jun 2018

Taking medication abroad in 2018

- Press Releases

- Terms & Conditions

- Privacy Policy

- Mission Statement

Copyright © 2024 - That's Insurance

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

OneTrip Premier

If you're planning an incredible family vacation, you need travel insurance benefits to match. OneTrip Premier doubles most of the OneTrip Prime plan's post-departure benefits. With up to $75,000 in emergency medical benefits and up to $1 million in emergency transportation benefits, you know your family's protected. Trip cancellation benefits can reimburse your prepaid, non-refundable expenses — such as vacation rental costs, resort fees, and transportation costs — if you must cancel your trip due to a covered reason. Kids 17 and under are covered free when traveling with a parent or grandparent (not available on policies issued to Pennsylvania residents).

OneTrip Premier also offers a fixed inconvenience payment of $100 for covered travel delays and baggage delays — no receipts required (just proof of delay). If you’re renting a car for your trip, you can upgrade your plan to include the affordable OneTrip Rental Car Protector.

Please note that OneTrip Premier is designed for trips up to 366 days. All benefits are per insured traveler unless otherwise noted.

Benefits/Coverage

Benefits/Coverage may vary by state, and sublimits may apply. Please see your plan for full details.

Epidemic Coverage

Adds certain epidemic-related covered reasons for Trip Cancellation/Interruption; Travel Delay; Emergency Medical Care; and Emergency Transportation benefits. For example, you may be reimbursed for prepaid, nonrefundable, unused trip costs if you must cancel your trip because you, a travel companion, or a family member are diagnosed with an epidemic disease such as COVID-19.

Trip Cancellation

Up to $200,000

Reimburses your prepaid, non-refundable expenses if you must cancel your trip due to a covered reason. The OneTrip Premier Plan is the only plan from Allianz Global Assistance that includes a NOAA hurricane warning as a covered reason for trip cancellation. Please read your plan documents for details.

Benefit is per insured traveler.

Trip Interruption

Up to $300,000

Reimburses you for the unused, non-refundable portion of your trip and for the increased transportation costs it takes for you to return home due to a covered reason.

Emergency Medical

Provides benefits for losses due to covered medical and dental emergencies that occur during your trip. There is a $750 maximum for all covered dental expenses.

Emergency Medical Transportation

Provides benefits for medically necessary transportation to the nearest hospital or appropriate facility following a covered illness or injury.

Baggage Loss/Damage

Covers loss, damage or theft of baggage and personal effects.

Baggage Delay

Reimburses the reasonable additional purchase of essential items during your trip if your baggage is delayed or misdirected by a common carrier for 12 hours or more. (Receipts for emergency purchases are required.) You can also opt to receive a fixed inconvenience payment of $100 after a covered baggage delay, with no receipts required (just proof of delay).

Travel Delay

$1,600 (Daily Limit $200)

Reimburses up to $200 per day per person for additional travel and lost prepaid expenses if your trip is delayed for three or more hours for a covered reason. Can also reimburse eligible additional transportation expenses if you miss your cruise or tour because of a covered delay. You may opt to receive a fixed inconvenience payment of $100 per day after a covered travel delay, with no receipts required (just proof of delay).

Trip Change Protector

Reimburses fees or extra expenses from a carrier or supplier if you must cancel or change your airline, rail, cruise, or tour itinerary for a covered reason.

Benefit is per insured traveler.

SmartBenefits®

$100 per insured person, per day (Up to the maximum no-receipts limit)

With SmartBenefits ® , you can opt to receive a fixed inconvenience payment of $100 per insured person, per day, for a covered travel delay or baggage delay (up to the maximum no-receipts limit). No receipts required — just proof of a covered delay. You may receive this payment automatically if your covered travel delay occurs on a flight monitored by Allianz Global Assistance. You can submit your flight itinerary online .

24-Hr Hotline Assistance

With Allianz Global Assistance, you'll never travel alone. Our multilingual assistance team is available 24 hours a day to help you handle covered travel emergencies. We can help you find local medical and legal professionals, arrange to send a message home, help re-book your flight and/or hotel arrangements, help with missed connections, lost/stolen travel documents, and much more.

Provides personalized information about your destination and assists you with obtaining restaurant reservations, tee times and tickets to events.

Cancel Anytime

Optional Upgrade

Reimburses 80% of your lost non-refundable trip costs if you cancel your trip for almost any unforeseeable reasons your plan does not already cover.

OneTrip Rental Car Protector

Don't pay more at the rental car counter. Protect yourself for just $11 per calendar day with primary collision/loss damage coverage for physical damage to a rental car.

Pre-Existing Medical Condition

Your plan may provide pre-existing medical conditions coverage if you, a traveling companion, or family member has a pre-existing medical condition. We define a pre-existing medical condition as an injury, illness, or medical condition that, within the 120 days prior to and including the purchase date of this policy: 1. Caused a person to seek medical examination, diagnosis, care, or treatment by a doctor; 2. Presented symptoms; or 3. Required a person to take medication prescribed by a doctor (unless the conditions or symptoms are controlled by that prescription, and the prescription has not changed). The illness, injury, or medical condition does not need to be formally diagnosed in order to be considered a pre-existing medical condition.

Coverage for a pre-existing medical condition is excluded unless:

- You purchased your plan within 14 days of making your first trip payment or first trip deposit;

- On the policy purchase date, you insured the full non-refundable cost of your trip with us. This includes trip arrangements that will become non-refundable or subject to cancellation penalties between the policy purchase date and the departure date. (If you incur additional non-refundable trip expenses after you purchase this policy, you must insure them with us within 14 days of their purchase. If you do not, those expenses will still be subject to the pre-existing medical condition exclusion.);

- You are a U.S. resident;

- You were medically able to travel on the day you purchased the plan.

All other contract terms and conditions apply.

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

Type the country where you will be spending the most amount of time.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

RELATED PRODUCTS

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

How Much Travel Insurance Costs (and When You Should Get It)

E very time you buy a plane ticket, cruise trip or other travel tickets, you end up getting asked the same thing: Do you want to add travel insurance for just a few extra dollars? In that moment, you’re probably excited about buying your tickets and making plans, not thinking ways you can pay more for insurance for—what exactly?

Travel insurance sounds like one of those types of insurance you don’t need , just like extended warranties are generally not worth it. But in some cases, shelling out for travel insurance is a smart move. Let’s take a look at your options and when travel insurance makes sense or doesn’t.

What does travel insurance cover and how much does it cost?

You can get travel insurance from a number of sources: the airline or cruise carrier directly, an independent travel insurance agency, and, sometimes, your credit card. Travel insurance typically costs between five and 10% of your trip cost , according to travel insurance comparison site SquareMouth .

The insurance coverage varies by your carrier as well as the individual policy you purchase. Overall, though, travel insurance is meant to protect you against unforeseen travel misfortunes, like an illness that forces you to cancel your trip.

There are four main types of coverage included in most travel insurance.

Trip cancelation and trip interruption insurance

This reimburses you for non-refundable travel costs if your trip is canceled or seriously delayed due to a natural disaster, illness, or if your carrier goes out of business . Independent and carrier-provided insurance policies offer protection up to the amount you purchased.

One aspect that can raise the cost of your travel insurance policy is “cancel for any reason” coverage. If you want this coverage, you must buy your policy within two or three weeks of making your trip deposit or buying your tickets. It gives you the right to cancel up to a few days before your departure date and get a refund of about 50% to 75% of your costs.

It may seem silly to get insurance for simply changing your mind. But some reasons you might need to cancel your trip wouldn’t be covered by regular cancelation insurance, like a job loss that dramatically reduces your income or the illness of a family member.

Our favorite sturdy suitcases to protect your belongings on your next trip:

- Most durable carry-on: Pelican Air Luggage

- Best value: Samsonite Winfield 2

- Budget option: Samsonite Omni

Insurance for baggage and personal items

If someone steals something from your bag or your luggage is lost or delayed , travel insurance will pay you for the trouble of replacing your personal gear.

You usually get coverage of up to $500 per delayed bag and up to a few thousand dollars for a lost bag.

Travel accident insurance

Just as you wouldn’t want to go without medical insurance in everyday life, when you’re traveling abroad, it’s important to stay covered in case of accidents.

Coverage typically includes doctor visits, ambulance rides, hospital stays, and prescription medication. It may also cover the cost of evacuation to get you back home during a medical emergency. This category typically covers costs up to $100,000-$200,000.

Accidental death or dismemberment insurance

If someone in your party dies or suffers a life-altering accident, this insurance feature pays out up to about $500,000, depending on the situation.

Is travel insurance worth it?

As with other insurance policies, buying travel insurance (or not buying it) is a gamble. You don’t want to ever regret not buying the insurance, but you also don’t want to pay for something you don’t need. Looking at the list above, you might already be covered for some of these items elsewhere—perhaps you already have life insurance that covers death or dismemberment or health insurance that covers emergencies abroad.

Two rules of thumb: Travel insurance is worth it when you’re traveling abroad and your health insurance doesn’t cover emergencies outside of your country, or when a large portion of your trip is non-refundable.

For everything in between, consider how much a financial disaster it would be if something bad happened on your trip or you had to miss it. Here’s a three-step process to decide, in case you’re still not sure:

How to know if you should get travel insurance?

You probably don’t need travel insurance if you got one of those cheap last-minute flights. Travel insurance would cover lost bags and delays, but the policy price wouldn’t be worth it for most people. If you’re on an expensive trip, though, or there are more chances something will go wrong (you’re traveling to Chicago during the winter, for example, or to the Caribbean during hurricane season), you’ll probably want to insure it.

Your credit card likely offers travel insurance

If your credit card offers travel insurance—most rewards cards offer some coverage —read the fine print to see if it would take care of your insurance needs. Any travel plans you want coverage for must be booked on the credit card that offers travel insurance.

If you opt for your credit card’s travel benefits, carry the coverage details with you so you don’t have to scramble in the event of an emergency. And if you need to file a claim, do it ASAP —cards tend to have a claim window of about 30 days after an incident—and keep all receipts from any expenses incurred during the emergency.

Keep in mind that travel accident and emergency medical coverage is less likely to be covered by your credit card. If this is a concern, you’ll probably still want to explore a separate travel insurance policy.

How much will travel insurance costs for my trip?

Use comparison sites like InsureMyTrip and SquareMouth to compare independent agency policies available for your trip. While the insurance offered by airlines and cruise lines are often comparable (and often provided by the same third-party insurers), it’s hard to read the fine print of what your coverage will be when you’ve got tickets in your checkout cart. The independent insurers are usually a bit cheaper, too.

Finally, remember that you have to get insurance before your trip starts; it won’t protect you if you get the insurance after an accident happens or your trip is canceled. That would be like trying to get home insurance after your house has already burned down.

Sign up for Lifehacker's Newsletter. For the latest news, Facebook , Twitter and Instagram .

Click here to read the full article.

I'm a financial planner, and I'd recommend annual travel insurance to anyone who loves to travel abroad

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

- Frequent and spontaneous travelers will likely benefit from annual travel insurance policies.

- Your credit card may come with some travel protections, but it may not be enough.

- When choosing a policy, look at what it covers, not just what's cheapest.

Summer is just a few months away — and if you're planning a vacation this year, the last thing you want is an unexpected event to derail your plans (and cost you hundreds).

Flights get delayed or canceled constantly. Luggage disappears into the ether. Medical emergencies occur in remote destinations. Yet many jetsetters simply cross their fingers and hope for the best rather than prepare for the worst.

That's why, as a financial planner, I believe it's crucial to consider protecting your trips with the right insurance coverage. One option often overlooked, particularly by frequent travelers, is annual travel insurance .

Annual travel insurance covers all your trips within 365 days. Unlike stand-alone travel insurance, which only covers you for a specific trip, an annual policy covers any trips you take within the year.

That's why I tell clients who travel frequently that an annual policy is a good choice for their needs. By opting for an annual plan, you don't have to go through the hassle of booking multiple policies and potentially save money compared to purchasing individual trip coverage. Here's how it works.

What to look for in a policy

While specifics may vary depending on the insurer and plan tier, most include the following key benefits:

- Trip cancellations or interruptions: You may be able to get reimbursed for expenses (even nonrefundable ones!) related to an illness, injury, or natural disaster that forced you to cancel or cut your trip short.

- Emergency medical and dental care: If you fall ill or get injured while traveling, your insurance can help cover the cost of medical treatment.

- Emergency evacuation: In a serious medical emergency or security situation, your policy will arrange and pay for transportation to a hospital or back to your home country.

- Lost, delayed, or damaged baggage: If your luggage is lost, delayed, or damaged during your trip, you can get financial coverage for essential items while you wait for your stuff to be recovered or replaced.

- Trip delays and missed connections: When your travel plans are disrupted due to issues like mechanical problems or severe weather, you may get reimbursement for additional expenses incurred, like meals, lodging, and transportation.

It's important to note that annual travel insurance plans have limitations. Certain high-risk activities, pre-existing medical conditions, and travel to specific regions may be restricted or require additional coverage.

Some travelers may assume that their credit card's built-in travel protections are enough. While many travel rewards credit cards offer perks like rental car insurance, trip cancellation, and baggage reimbursement, the coverage limits are often much lower than a dedicated annual travel insurance plan.

Credit card coverage for emergency medical care is also particularly limited — capped at a few thousand dollars — which may not be enough in the face of a major international medical emergency.

How much travel justifies an annual plan?

For the occasional traveler who takes one or two trips a year, single-trip policies will probably work for you. But if you fall into any of these buckets, you may want to consider an annual policy:

- Regular international travelers (three or more trips abroad yearly)

- Road warriors frequently away for work

- Adventurers engaging in high-risk activities like heli-skiing, scuba diving, or mountain climbing

- Cruisers and tour group travelers

- Students or retirees taking extended trips throughout the year

- Those visiting developing countries with limited medical care

Annual plans cover all of your trips within a 365-day period after purchasing. They're basically a bundle of multiple policies into one package deal. This means you only have to buy one policy to manage, locking in your coverage for the year.

How to decide if an annual policy makes sense for you

Start by reviewing your travel plans this year — and your risk tolerance. Calculate how much buying individual travel insurance policies would cost you over the next year and compare it to the price of an annual plan.

Don't just focus on the premium — carefully evaluate coverage limits, exclusions, and deductibles to ensure you have enough protection for your needs.

An annual policy gives you the flexibility to take spontaneous trips without the hassle of obtaining last-minute insurance. More importantly, it provides peace of mind, knowing that you're covered for a wide range of travel disruptions and emergencies.

As the busy summer travel season ramps up, definitely explore protecting your trips with insurance, especially if you're jetting off internationally. Spending hours on the phone trying to rebook canceled flights or worrying about affording an overseas medical emergency is no way to vacation.

- Main content

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Single Trip Travel Insurance

Single-trip travel insurance

No age limit and all medical conditions considered

Kids go free on family policies(1)

Flight Delay Assistance Plus – available on our premier policies

Off on your travels? Pack our single-trip travel insurance

Wherever you’re travelling to and however long you're going for, don't forget about your travel insurance. It might not be the most exciting thing to think about but it's just as important as your passport and travel tickets.

Single-trip travel insurance is suitable cover for you if you're about to go away on just one trip. Any more than that and you may be better off with annual multi-trip travel insurance .

Medical Assistance Plus: 24/7 holiday health support

Have peace of mind when you travel knowing health professionals are just one click away.

Medical Assistance Plus (2), powered by Air Doctor, comes free with all our travel insurance policies. It gives you access to outpatient medical support while you’re away.

Through the service you can book an in-person or video consultation with a doctor. You can also get prescriptions delivered to your nearest pharmacy.

We’ll send you an SMS reminder about the service the day before you travel (for single-trip and backpacker cover) or the day before your policy begins (for annual multi-trip cover).

What’s covered?

Here’s a summary of the cover our single-trip policies provide. For full details check our policy documents. Terms and conditions apply.

Cancellation and cutting short your trip

We'll repay you for any non-refundable, unused travel and accommodation costs if you have to cancel or cut short a trip due to reasons set out in the policy

Emergency medical expenses

We may be able to help if you need emergency medical treatment, return to the UK and more while you’re abroad

Missed departure (3)

We’ll also cover any extra travel and accommodation costs you're charged if you arrive too late to travel on your booked transport. As long as they match the reasons set out in the policy

Items that are usually carried or worn during a trip are covered if they get lost, stolen or damaged

Personal liability and legal costs

You’ll also get protection for any unexpected legal costs you might be charged while you’re away

Sporting activities included

We cover over 100 sports and activities free of charge, but there are some we don’t cover at all. Check your policy wording for the full list and our terms and conditions, as some aren’t covered for personal injury or personal liability

Choose a travel insurance cover level

We can offer you a choice of economy, standard and premier cover levels.

Policy wording

Upgrade your cover with ease

Need cover for your policy that's not included as standard? Just pay a little more to add these upgrades – optional or mandatory depending on the trip type.

This optional extra helps protect you from the impact of airspace disruption, natural catastrophes, terrorist acts or Covid-19 (5)

If you’re happy with the cover offered, but worried about excess fees, you can opt for an excess waiver. For an additional premium, you can add it to any Post Office level of cover for zero excess fees (5)

Insure all your devices with our easy-to-add gadget cover. It’s perfect to protect all your smartphones, tablets, laptops and consoles (5)

Specialist cover is mandatory for winter sports like skiing and snowboarding. There’s greater risk of emergency costs. Make sure you’re protected on the pistes (5)

If you're going on a cruise, specialist cover is both important and mandatory. It covers missed departure due to breakdown, falling ill on board, being confined to your cabin, lost baggage and more (5)

Trip extensions are available up to 45 or 60 days, increasing from the standard 31 days (5)

All medical conditions considered

Living with a medical condition shouldn’t stop you seeing the world. And, with the right travel insurance in place, you can enjoy peace of mind on your adventures – just in case something unfortunate happens.

At Post Office, we cover most pre-existing conditions. Contact us for a quote to see if we can cover you. It’s important to declare upfront all your medical conditions and any medication you're taking.

If we can't help and yours is a serious pre-existing medical condition, check the Money and Pensions Scheme (MaPS) directory. It lists companies that may be able to help you. Or call 0800 138 7777 .

Ready to get a quote?

Let’s find the protection that’s right for your travels. Get a quote for Post Office Travel Insurance

An award-winning provider

Best travel insurance provider.

Post Office won a ‘Best Travel Insurance Provider’ award at the Your Money Awards in 2021, 2022 and 2023

Post Office won a “Best Travel Insurance Provider” award at the British Travel Awards in 2023

Defaqto 5-star rated cover

Our travel insurance policies with premier level cover are Defaqto 5-star rated

Common questions

Does single-trip travel insurance cover covid-19.

Policies purchased from the 28 March 2024 onwards provide cover if:

- You test positive for Covid-19 within 14 days of your trip and are required to self-isolate by a medical practitioner, the NHS or any UK government body

- A medical practitioner certifies you as too ill to travel due to Covid-19

- You, someone you’re travelling with, or someone you’re staying with is required to self-isolate by a medical practitioner, UK government body or health authority

- You, an immediate relative (6) or someone you plan to travel or stay with dies or is hospitalised due to Covid-19

If an insured trip has to be cut short, the unused portion of it can be claimed for if:

- You, an immediate relative (6) or someone you’re travelling or staying with dies or is hospitalised due to Covid-19

There’s also cover for medical and repatriation costs if you fall ill with Covid-19 while away. Call our emergency assistance line and we’ll help you seek treatment if needed, we can also arrange to bring you back to the UK.

There’s no other coronavirus cover on our policies but, for extra reassurance, you can add our trip disruption cover upgrade option. This gives you added protection against missed departures and expenses charged due to change of testing or quarantine requirements. Add it to your preferred policy for an extra premium.

If you bought your policy with us between 31 March 2022 and 27 March 2024 , some cover for Covid-19 is included as standard. Please visit our coronavirus FAQs page for the full details.

Should the FCDO advise against all travel to your destination, there is no cover under any section of the policy if you decide to travel.

It’s important to follow FCDO advice on essential travel. If you choose to travel and the trip’s not essential, we’ll only cover a claim if the cause isn’t linked to the reason for the FCDO advice. This limitation applies even if you’ve purchased an optional trip disruption cover upgrade . You may be able to travel with full cover if we authorise, in writing, that your trip’s essential before you travel. To request this, please email [email protected] .

Please make sure you’re clear what’s covered and what’s not. Check the answers to common questions about coronavirus cover and the full policy wording for more details.

What’s covered with single-trip travel insurance?

With single-trip travel insurance, you’re covered for a range of issues that might happen while you're away. These include medical expenses, cancellation or cutting short your trip, plus the loss of your belongings. But check the policy details before you decide on which cover to get. The amounts and things you're covered for a will depend on the level of cover you take out. Take a look at our policy document to find out which one best suits your needs.

Does single-trip travel insurance cover cancellation?

Yes, your single-trip travel insurance policy will cover you if your trip's cancelled or cut it short, for some situations. These can even include cancelling or shortening a trip due to coronavirus, in some cases. You’ll find full details of what’s covered and what isn’t in the policy wording .

Will I need extra cover with single-trip travel insurance?

It depends on what level of cover you need for your trip. The level of cover you have with a single-trip policy is the level you chose when you applied for the travel insurance.

It’s a good idea to list out the cover you think you might need while you’re away. That makes it easier to compare policies to find the one that’s right for you.

For instance, some policies include cover against the impact of Covid-19. But you might want to add extra protection in case the virus causes you to miss a departure or other delays. Check our new trip disruption cover upgrade for further information on how we can help.

Some activities require mandatory additional cover. If you’re going skiing or on a cruise, you’ll need to take out extra specialist cover. That’s because these types of trips involve a different level of risk for insurers. Please be aware that these covers will add an extra cost to your insurance package.

There are some adventure sports and activities that are covered as standard on our single-trip travel insurance and others that aren’t. It’s important to fully understand your policy document so you don’t become involved in something that you’re not covered for.

What are the advantages of single-trip travel insurance?