Search NYU Steinhardt

Travel reimbursements related to coronavirus (covid-19).

Per President Hamilton’s communication on March 9, 2020 and Provost Fleming’s communication on March 3, 2020, the University is prohibiting all upcoming non-essential international and domestic University-sponsored travel until further notice.

Upcoming NYU-sponsored international and domestic travel is eligible for reimbursement if it meets the following criteria:

International travel must have been booked prior to March 3, 2020.

Domestic travel must have been booked prior to March 9, 2020.

Steps for Reimbursement

Employees or students must contact the airline and/or travel provider to request a refund. If a full refund is not available, and cancellation fees are incurred, proof of charges should be submitted just as if the employee or student traveled (in most cases, the cancellation fee, or in cases where no cancellation is permitted, the cost of the ticket) for a reimbursement.

In certain circumstances, a travel voucher may be provided for future travel, in lieu of a refund. If a voucher is provided, the employee or student will be fully reimbursed with the expectation that the voucher will be used for University-related travel in the future.

Reimbursement requests should be submitted with appropriate documentation for the reason the trip was cancelled and either the (1) cancellation fee or (2) evidence that the ticket was non-cancellable/changeable. Employees should ensure this additional information is submitted with their reimbursement requests in AP Workflow.

If travel is non-refundable (per #1) and would have been charged to a sponsored program, it should now be charged to the department/center/PIs Fund 20 chartfield until we receive further guidance if the expense may still be charged to the grant.

All non-refundable expenses must be recorded under the program code "VIRUS" + appropriate school / unit fund / org / account / project.

The University requested that all upcoming or already incurred expenses that cannot be recovered (e.g., expenses related to spring break programs that have been cancelled) must be recorded under the program code "VIRUS" + appropriate school / unit fund / org / account / project. This allows us to measure the full financial impact of COVID-19 on our results and support a potential insurance claim.

Journal entries recorded through JEMS to move expenses incurred to program code VIRUS must include the original transaction details (PO, voucher, journal ID, Pcard/CTA transaction, etc.) in the support. All expenses must be for valid business purposes and comply with NYU policies. The above also applies to travel originally charged to a sponsored program for which a refund is not available, until we receive further guidance if the expense may still be charged to the grant.

Please send all JEMS requests to [email protected] .

Non-refundable expense : A faculty member contacts the hotel and airline to cancel an international trip and obtain a refund. Both the hotel and airline refuses to refund the faculty as the original bookings were non-refundable. NYU will reimburse the faculty for the hotel and airline with written proof of hotel and airlines refusal to refund the faculty.

Partially refundable expense : A faculty member calls the airline to cancel a $1,000 flight and obtain a refund. The airline assessed a $250 cancellation fee and the faculty member was refunded $750. NYU will only reimburse the faculty for $250 with proof of cancellation fee charge.

Fully refundable expense : A faculty member calls the airline to cancel a $1,000 flight and obtain a refund. The airline provides the faculty member a full refund of $1,000. NYU will not reimburse the faculty member because the full value of the flight was reimbursed.

- Skip to Main

- About Arts & Science

- Community Commitment

- Leadership of Arts & Science

- Arts & Science Board

- Administrative Resources

- The Silver Professors

- Global Distinguished Professors

- Departments and Programs

- Centers, Institutes and International Houses

- Events Calendar

- Big Questions Series

- Teaching Innovation Series

- Volunteer Opportunities

- CAS Alumni Achievement Award

- LS Alumni Ambassador Award

- Meet the Arts & Science Human Resources Team

- Administrative and Manager Resources, Policies, and Forms

- Performance Management

- Learning and Development

- Employee Benefits

- Employee Recognition Programs

- HR Services

- FAS Fiscal, Payroll, and Academic Appointment Contacts

- New Employee Resources

- AY 23-24 Hybrid/Remote Work Policy Guidelines

- CMS Resources & Support

- Visual Identity

- Design Resources

Fiscal Affairs

Welcome to a&s fiscal.

A&S Fiscal provides service and expertise to support the activities of the Departments and Programs within Arts & Science. We review departmental budgets, post-award accounting, and provide expert knowledge on governing cost-principles. We also review transactions to ensure compliance with applicable federal, sponsor and university requirements.

Online Resources

- Fiscal Guide Includes all policy and processing guidelines

- Fiscal Announcements Includes all fiscal related email communications sent to Departments

- Frequently Asked Questions (FAQs)

- Personnel Directory Email us at [email protected] or contact individual team members directly

Fund Definitions

Undesignated Funds

Fund 10 Department's operating budget for current fiscal year

Designated Funds

Fund 20 Management Designated Fund 21 Expendable endowment income Fund 22 Gift Funds

Sponsored Research

Fund 24 Non-governmental agency or organizational grants and/or contracts Fund 25 Government grants and/or contracts

Fiscal Transaction Approvals

It is the responsibility of everyone involved in the use of university resources, from the individual initiating a transaction to the individual approving or processing requests for reimbursement, to know and understand all applicable policies. The NYU Travel and Expense Policy of the university, in particular, should be consulted for guidance on which expenses are legitimate or valid and thus may be incurred using university funds. The NYU Travel and Expense Policy provides guidelines to ensure that valid business expenses are reimbursed in a fair and equitable manner; that business expenses are reported, recorded, and reimbursed in a consistent manner; and that individuals comply with all applicable federal, state, and local rules and regulations. Individuals who initiate, approve or process requests for payments or reimbursement are required to know and understand these policies, to ensure that university funds are used appropriately and to assist compliance to applicable university and government requirements.

In order to improve school-wide financial review and controls, Arts & Science requires procedures for approval of financial transactions and reinforcing procedures established by the University as part of the NYU Travel and Expense Policy . Those relevant responsibilities, policies and procedures are provided below:

1. Authorized approvers and approval levels.

The approver to any payment/ reimbursement request should be the individual with a supervisory relationship to the employee being paid or reimbursed. When the approver is not available, an alternate approver (who has signature authority over the funds) may authorize the request. This means:

- All requests from deans must be approved by the Dean of Administration or the Associate Dean for Fiscal Affairs.

- All requests from department or program administrators must be approved by their chair or director (up to $2,500) or A&S Fiscal Affairs.

- All requests from department faculty or subordinate administrators must be approved by their chair or program director or senior administrator (up to $2,500); or alternatively, A&S Fiscal Affairs.

- In no case should the approver/alternate approver and the payee be the same individual.

2. Responsibilities of initiators.

All individuals reporting expenses for reimbursement or making payment requests are responsible for verifying that:

- Expenses are valid (i.e., expenses comply with the university's policy on Business Expenses);

- Chartfields are correct (i.e., that the expenses are charged to the correct funds, and that correct account codes are used for the type of expenses incurred);

- Federal “unallowable costs” are segregated and charged to an appropriate NYU account; and,

- Appropriate documentation is attached to support the validity of expenses (i.e., original receipts, final hotel folio, Missing or Inadequate Documentation Report wherever required, etc.).

- Expenses incurred in the conduct of University business generally should be accounted for within 60 days after the date of expenditure, completion of event, or upon return from a trip.

- All cash advances should be cleared within 60 days from the “end date” indicated on the Request for Advance Form.

3. Responsibilities of approvers.

The approver is responsible for verifying the following:

- That the expense is permitted under the NYU Travel and Expense Policy of the university, and that no non-reimbursable expenses are included;

- That funds to which the expense is charged are sufficient;

- That documentation is adequate and correct (In case of inadequate or missing documentation, the approver's signature signifies that he/she is aware of the fact, has verified the explanation, and deems the expense valid for reimbursement);

- In no case should the approver and the payee be the same individual.

4. Signatures

- All requests must bear the original signature of the initiator and the approver, who by doing so acknowledge their fiduciary responsibility and compliance with the policies and procedures of the university.

- Rubber stamp signatures and proxy signatures are not acceptable. Proxy signatures are usually executed by “unofficial” designees, who write an Approver's name then affix their own initials to indicate that the signature is executed on behalf or in the absence of the Approver.

These procedures apply to all expenditures of university funds, including the following forms of payment:

- Petty Cash Voucher

- iBuy Orders & Payments

- Purchase Orders

- Small Dollar Orders

- Copy Central (used for duplicating and other copying needs)

- Book Store/Computer Store Purchase Orders Note that all computer orders, no matter the dollar amount, must be approved the Office of A&S Computer and Information Technology

School-Wide Authorizers

The Fiscal Affairs Analyst assigned to your unit is the primary contact for approvals of transactions initiated by chairs or directors, as well as expenses that exceed the $2,500 departmental limit. They are also authorized to approve transactions initiated by department administrators should a chair or director not be available.

The Director of Fiscal Affairs is authorized to approve larger (over $25,000) transactions.

The Associate Dean for Fiscal and Administrative Affairs is authorized to approve larger dollar transactions as well as requests by the deans.

Please refer to our directory for contact information.

Departments

- Applied Physics

- Biomedical Engineering

- Center for Urban Science and Progress

- Chemical and Biomolecular Engineering

- Civil and Urban Engineering

- Computer Science and Engineering

- Electrical and Computer Engineering

- Finance and Risk Engineering

- Mathematics

- Mechanical and Aerospace Engineering

- Technology, Culture and Society

- Technology Management and Innovation

Degrees & Programs

- Bachelor of Science

- Master of Science

- Doctor of Philosophy

- Digital Learning

- Certificate Programs

- NYU Tandon Bridge

- Undergraduate

- Records & Registration

- Digital Learning Services

- Teaching Innovation

- Explore NYU Tandon

- Year in Review

- Strategic Plan

- Diversity & Inclusion

News & Events

- Social Media

Looking for News or Events ?

Booking Business Travel

NYU’s preferred online travel booking tool is SAP Concur. Travel & Expense online booking tool (“Concur Travel”) replaces the Egencia online booking tool. Access the travel booking website, or the SAP Concur mobile app to book travel online. When necessary, travelers will engage with CTP travel counselors to book via phone or email, and for customer support or account management

Related Links

On this page, important: effective october 30, 2023: nyu’s travel & expense solution is powered by sap concur, important changes.

Egencia was disabled on October 30, 2023. Collegiate Travel Planners (CTP) is NYU's new travel management company

No pre-approval for international travel

No advance reimbursements. NYU T&E Card or a Department Travel Card is strongly recommended to avoid paying for travel bookings in advance with your personal funds

The SAP Concur Mobile App provides helpful on-the-go capabilities to book travel, change seats, take pictures of receipts, create expense reports, etc.

Employees should pay for business travel with a Travel & Entertainment (T&E) or Department Corporate Travel (CTA) Card , which is paid directly by the University, so you do not have to use a personal credit card to book travel . P-Card can be used to book conference expenses. If you use your personal credit card to pay for travel expenses, you must wait until after completing the trip to submit reimbursement. The university is no longer reimbursing for travel costs charged to a personal credit card befor e a trip. The Concur system will block all advance reimbursement submissions, which means NO exception will be accepted by the system.

If you do not have a Travel & Entertainment (T&E) Card, travel at least twice a year, or incur more than $2,500 annually in travel and local entertainment expenses; please submit a T&E Card request in Concur . Allow two weeks to receive your T&E Card.

Before You Get Started

Please ensure you have updated your travel profile (Video) (PDF) the first time you use Concur. You must ensure that your legal first and last name in PeopleSync matches the government-issued ID you present for travel .

Your legal first and last name in PeopleSync will be used to update your traveler profile in Concur.

For these data elements, contact PeopleLink to request updates as necessary. Ensure the proper set up of expense Delegate / Travel Arranger as needed and review the updated policies , transition checklist , and training resources .

Access to Concur

NYU’s preferred online travel booking tool is SAP Concur .The platform is accessible via webpage, mobile app, and phone.

- Bookmark the tile for quick future access by right-clicking on a card

- Download the mobile app

- Log in with your N Number as the username, followed by @nyu.edu (e.g., [email protected])

- Find your N Number on the back of your NYU ID

The mobile app allows users to book travel, capture receipts, create expense reports, etc.

Setting-Up Delegates

Set up a delegate if you have an administrator who supports you.

- Travel Arranger : Can book a flight, hotel, car rental, etc. on your behalf

- Expense Delegate : Can prepare your expense reports, and submit cash advance requests for you

Contact your Department iTravel Super-User or drop by a Support Session if you need assistance setting-up delegates.

NOTE: Delegates can only prepare, and CANNOT submit your expense reports. The end-user must submit expense reports in Concur. You must select the "Can View Receipts" checkbox to allow a delegate to email receipts to a user’s "Available Receipts" library

Step-by-Step Booking Process

Collegiate Travel Planners (CTP) , powered by Concur, is NYU's travel management supplier. Travelers can conveniently make all bookings using the online tool. Although using Concur for booking travel is not mandatory, it is highly recommended.

1. Review Preferred Service Providers

Before initiating the booking process, familiarize yourself with NYU's preferred airlines, hotels, and car/rail services.

- Preferred Airlines

- Preferred Hotels

- Preferred Cars & Rails

2. Access Booking Links

Utilize the provided booking links for each service:

- Book a Flight ( Video ) ( Google Doc )

- Book a Hotel ( Video ) ( PDF )

- Book a Car ( Video ) ( Google Doc )

- Change a Trip After Purchase ( Video ) ( PDF )

3. Reporting Price Match / Fare Review

If you find cheaper airfare outside Concur Travel, you might want to:

- Email screenshots to [email protected]

- Include details such as dates, carrier, flight number, and class

- Provide information on where the lower fare was found

- The CTP Lead Team will review your submission and respond with their findings

Refer to the Price Match Process Document for comprehensive details and restrictions

4. Registering Trips Booked Outside of CTP

If you've booked your itinerary outside of CTP:

- Faculty, staff, and students are strongly encouraged to register travel plans via NYU Travel

- This registration ensures communication in emergencies and alerts about local incidents

For any issues with the registration tool, contact [email protected]

NOTE: There is a Flat Fee charged by CTP

Travel Tips

- Air, Hotel, and Car: NYU preferred providers will be notated in Concur

- Out of Policy: Warnings will show when booking out of policy – but will not stop travel bookings

- Guest Booking Process: Anyone at the University may book guest travel

- Travel Arranger / Delegation: The traveler must delegate travel booking arrangements to a travel arranger. A traveler may have more than one travel arranger

- Grants and Federal Funds: Related travel must be booked in accordance with the Fly America Act . A pop-up message with link to FAA is provided

- TripIt Pro Subscription: App that incorporates all travel details as well as provides travel alerts, including flight changes, gate changes etc.

Helpful Resources & Tips

- Training & Resources Page

- Book Travel Useful Links

- T&E Expenses Q&A

- Travel & Expense Tip Sheet

- Pre-Trip Travel Request with Cash Advance

- Creating an Expense Report Based on a Completed Trip Booked through Concur Travel / CTP ( Video )

- Troubleshooting Missing Transactions ( Video ) ( PDF )

- Adding or Removing Cash Advances ( Video ) ( PDF )

- Creating a Cash Advance Return ( Google Doc )

- Working with Missing Receipts and Receipts Affidavits ( Video ) ( PDF )

- Entering Personal Car Mileage ( Video ) ( PDF )

- Converting Foreign Currency Transactions ( Video ) ( PDF )

- Correcting and Resubmitting an Expense Report ( Video ) ( PDF )

- Deleting an Expense Report ( Video ) ( PDF )

- CTP Agent Fee (Google Doc)

NYU Travel & Expense Tips

NYU Expense FAQs

NYU Travel FAQs

NYU Payment Card FAQs

Tandon Travel & Expense FAQs

Support Team

AskFinanceLink Support

- Email: [email protected]

- Phone: 212-998-1111

- Business Hours: Mon-Fri, 9:00 AM - 5:00 PM ET

Global Payment Card Team Support

- Email: [email protected]

- Phone (Domestic): 888-551-6203

- Phone (International): 402-252-5505

- Business Hours: Mon-Fri, 8:00 AM - 6:00 PM ET

Urgent Travel Assistance

- Email: [email protected]

- Phone (Toll-Free): 1-866-698-5601

- Mailbox: 43222

- Phone: 1-212-998-2999

For travel-related inquiries, contact the Global Travel Team. Your Tandon Department iTravel Super-User is the key contact for iTravel assistance.

Support NYU Law

- Office of Financial Management

NYU School of Law faculty members incur various types of travel expenses as they perform tasks and duties that support the operations of the institution and further its missions. This policy is to ensure that faculty members who incur valid travel business expenses are reimbursed in a fair and equitable manner, that business expenses are reported, recorded and reimbursed in a consistent manner throughout the School of Law, and that the School of Law complies with all applicable federal, state, and local rules and regulations.

NYU Travel and Expense Policy : This policy is intended to ensure proper stewardship of University funds by providing guidelines for their appropriate use, and outlining procedures that will help members of the University community comply with all applicable rules and regulations.

Expense Reimbursement Policy : This policy is intended to ensure that employees who incur valid business expenses are reimbursed in a fair and equitable manner; that business expenses are reported, recorded, and reimbursed in a consistent manner throughout the University; and that the University complies with all applicable federal, state, and local rules and regulations.

© 2024 New York University School of Law. 40 Washington Sq. South, New York, NY 10012. Tel. (212) 998-6100

ITP/IMA Help

Conference travel reimbursement, students applying for conference travel reimbursement awards:.

We try, when possible, to help support the costs of students who have been invited to show student work or present at out-of-town conferences. Funding for such trips each semester is scarce, but here is the process:

- Applications will be considered for travel expenses outside of a 50 mile radius of NYC for such things as: airfare, car rental, hotel stays, and meals. Awards range from $100.00 to $500.00.

- You must apply IN ADVANCE to be considered. We cannot accept “after-the-fact” requests for reimbursement. The applications have to wait for the nearest faculty meeting for a decision.

- Please send your request via email to Shirley Lin ([email protected]).

- If you have been granted an award, Shirley will provide you with detailed instructions as to how to request reimbursement (providing us with original receipts, etc.). Please see below for the official University guidelines and policies. Those who do not follow these guidelines for accounting for their expenses in a timely manner may forfeit their opportunity for reimbursement.

____________________________________________________

University Guidelines & Policies on the Reimbursement of Travel Expenses:

You must submit your request for reimbursement, along with all supporting documentation, no later than 60 days after the completion of your trip.

Airfare Policies : Travelers are expected to purchase economy-class travel. Business class travel may be allowed for overseas flights and continuous flights exceeding 6 hours, but must be pre-approved by the Department Chair.

Receipt Policies:

- Airline / Rail : Receipts should confirm the trip details, as well as the method of payment and the amount paid. Boarding passes for all flights are required.

- Conference / Seminar : Registration receipts should show name, date, venue, and cost. Please also provide proof of attendance, such as a conference badge or any other supporting materials.

- Hotel / Lodging : An itemized bill for lodging and expenses, or a printout of an online transaction is required. Hotel / lodging expenses should not exceed a maximum of $300.00 per night.

- Business Meals : Detailed, itemized receipts and written business purpose of the meals are required.

- Credit Card Statement : It is strongly encouraged to provide a credit card statement highlighting all charges made for which reimbursement is sought. Any unrelated charges may be blacked out.

Foreign Currency Policies : Expenses should be reported in U.S. dollars with a conversion calculation attached. Conversions should reflect the conversion rate on the date of the expense or charge. For a free online currency converter, please use the following: https://www.oanda.com/currency/converter/

Missing Documentation : If you are missing any of the above documentation, you may be able to replace it with a Missing/Inadequate Documentation Report form . When in doubt, please save all travel materials and documentation related to your trip. The more information you can provide, the faster we can process your requests for reimbursement.

Please ask Shirley Lin ([email protected]) if you have any questions about this process.

Expense Reimbursement

Create an expense report.

When you return from your trip or incur non-travel-related expenses, create an expense report to get reimbursed for your expenses paid for out of pocket or with your NYU individual T&E card.

- Non-Travel Related Expense Reports ( Google Doc )

- Creating a New Expense Report ( Video ) ( PDF ) - includes T&E card and out of pocket transactions

- Adding out-of-pocket expenses to an expense report ( Video ) ( PDF )

- Adding T&E card transactions to an expense report ( Video ) ( PDF )

- Adding travel allowances (per diem) to an expense report ( Google Doc )

- Itemizing Expenses ( Video ) ( PDF )

- Allocating Expenses ( Video ) ( PDF )

- Itemizing Nightly Lodging Expenses ( Video ) ( PDF )

- Adding Attendees to a Business Expense ( Video ) ( PDF )

- Working with Available Receipts ( Video ) ( PDF )

Other Actions in Travel and Expense

- Creating an Expense Report Based on a Completed Trip Booked through Concur Travel/CTP ( Video ) ( PDF )

- Troubleshooting Missing Transactions ( Video ) ( PDF )

- Adding or Removing Cash Advances ( Video ) ( PDF )

- Creating a Cash Advance Return ( Google Doc )

- Working with Missing Receipts and Receipt Affidavits ( Video ) ( PDF )

- Entering Personal Car Mileage ( Video ) ( PDF )

- Converting Foreign Currency Transactions ( Video ) ( PDF )

- Correcting and Resubmitting an Expense Report ( Video ) ( PDF )

- Deleting an Expense Report ( Video ) ( PDF )

- Expense FAQs (Google Doc)

Additional Resources

- Expense Type to GL Mapping Resource

- This is not the same as payroll direct deposit and must be setup separately in PeopleSync.

- NYU Input Expense Report Process Map (PDF)

- Concur Expense Tutorial (Note: This is a recording of a Super User training session )

- Concur Expense Tips & Tricks (Note: This is a recording of a Super User training session )

- FINANCIAL SERVICES HOME

Search form

- News & Events

Employee Travel and Reimbursement Fiscal Year End Updates FY 2024

Employee Travel and Reimbursement (ET&R) has included updates for the 2024 fiscal year-end process. Please use the information below as a reference for the fiscal year-end schedule related to out-of-pocket reimbursements, corporate card charges, and experimental subject payment forms.

Out of Pocket Expenses*

Both electronic and paper reimbursement forms must be submitted, approved, and received in ET&R by the end of the day on Monday, June 17, 2024, to be posted in the current fiscal year.

Experimental Subject Payment Forms*

Experimental Subject Payment forms must be received in ET&R by 5:00 pm on Monday, June 17, 2024, to be posted in the current fiscal year.

*NOTE : all reimbursement forms/expense reports are due to ET&R by 5:00 pm on Monday, June 17, 2024. This is a change from prior fiscal years.

Corporate Card Transactions – Concur

- All expense reports received in ET&R by the end of the day on Monday, June 17, 2024, will be processed in fiscal year 2024.

- 695685 - Unapproved Corporate Card Transactions; Assigned corporate card expenses without complete approval.

- 695695 - Unassigned Corporate Card Transactions; Unassigned corporate card expenses with no action taken.

- ET&R will send Untimely Posting Notification emails for transactions through May 15 beginning Wednesday, May 22 through Wednesday, June 12, 2024.

- Employee Travel & Reimbursement will stop posting transactions for fiscal year 2024 on Monday, July 8, 2024. We will send a complete list of Assigned and Unassigned transactions to Business Managers and Management Centers on Tuesday morning, July 9, 2024. This will allow time for departments to review the outstanding corporate card charges and process accruals per their management center guidelines. ET&R will not process an accrual of corporate card charges for fiscal year 2024.

► Deadlines for departments that are using the WORKS system for FLEET and other applicable programs will be communicated by the Card Services team.

We appreciate your continued support. If you have questions, please contact a member of our team at 668-3877 or via email at [email protected] .

- Articles >

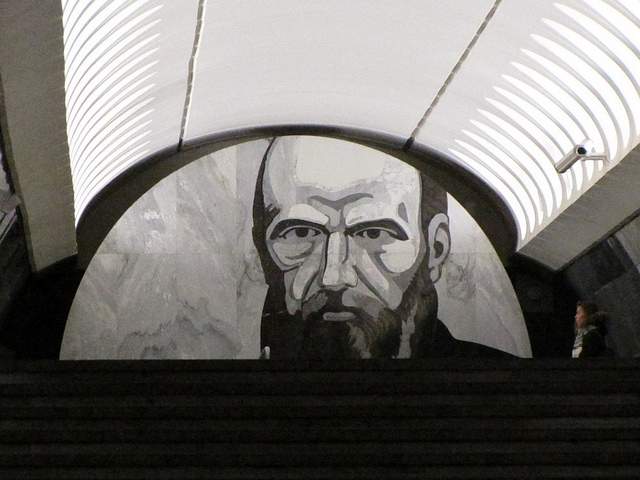

The Moscow Metro Museum of Art: 10 Must-See Stations

There are few times one can claim having been on the subway all afternoon and loving it, but the Moscow Metro provides just that opportunity. While many cities boast famous public transport systems—New York’s subway, London’s underground, San Salvador’s chicken buses—few warrant hours of exploration. Moscow is different: Take one ride on the Metro, and you’ll find out that this network of railways can be so much more than point A to B drudgery.

The Metro began operating in 1935 with just thirteen stations, covering less than seven miles, but it has since grown into the world’s third busiest transit system ( Tokyo is first ), spanning about 200 miles and offering over 180 stops along the way. The construction of the Metro began under Joseph Stalin’s command, and being one of the USSR’s most ambitious building projects, the iron-fisted leader instructed designers to create a place full of svet (radiance) and svetloe budushchee (a radiant future), a palace for the people and a tribute to the Mother nation.

Consequently, the Metro is among the most memorable attractions in Moscow. The stations provide a unique collection of public art, comparable to anything the city’s galleries have to offer and providing a sense of the Soviet era, which is absent from the State National History Museum. Even better, touring the Metro delivers palpable, experiential moments, which many of us don’t get standing in front of painting or a case of coins.

Though tours are available , discovering the Moscow Metro on your own provides a much more comprehensive, truer experience, something much less sterile than following a guide. What better place is there to see the “real” Moscow than on mass transit: A few hours will expose you to characters and caricatures you’ll be hard-pressed to find dining near the Bolshoi Theater. You become part of the attraction, hear it in the screech of the train, feel it as hurried commuters brush by: The Metro sucks you beneath the city and churns you into the mix.

With the recommendations of our born-and-bred Muscovite students, my wife Emma and I have just taken a self-guided tour of what some locals consider the top ten stations of the Moscow Metro. What most satisfied me about our Metro tour was the sense of adventure . I loved following our route on the maps of the wagon walls as we circled the city, plotting out the course to the subsequent stops; having the weird sensation of being underground for nearly four hours; and discovering the next cavern of treasures, playing Indiana Jones for the afternoon, piecing together fragments of Russia’s mysterious history. It’s the ultimate interactive museum.

Top Ten Stations (In order of appearance)

Kievskaya station.

Kievskaya Station went public in March of 1937, the rails between it and Park Kultury Station being the first to cross the Moscow River. Kievskaya is full of mosaics depicting aristocratic scenes of Russian life, with great cameo appearances by Lenin, Trotsky, and Stalin. Each work has a Cyrillic title/explanation etched in the marble beneath it; however, if your Russian is rusty, you can just appreciate seeing familiar revolutionary dates like 1905 ( the Russian Revolution ) and 1917 ( the October Revolution ).

Mayakovskaya Station

Mayakovskaya Station ranks in my top three most notable Metro stations. Mayakovskaya just feels right, done Art Deco but no sense of gaudiness or pretention. The arches are adorned with rounded chrome piping and create feeling of being in a jukebox, but the roof’s expansive mosaics of the sky are the real showstopper. Subjects cleverly range from looking up at a high jumper, workers atop a building, spires of Orthodox cathedrals, to nimble aircraft humming by, a fleet of prop planes spelling out CCCP in the bluest of skies.

Novoslobodskaya Station

Novoslobodskaya is the Metro’s unique stained glass station. Each column has its own distinctive panels of colorful glass, most of them with a floral theme, some of them capturing the odd sailor, musician, artist, gardener, or stenographer in action. The glass is framed in Art Deco metalwork, and there is the lovely aspect of discovering panels in the less frequented haunches of the hall (on the trackside, between the incoming staircases). Novosblod is, I’ve been told, the favorite amongst out-of-town visitors.

Komsomolskaya Station

Komsomolskaya Station is one of palatial grandeur. It seems both magnificent and obligatory, like the presidential palace of a colonial city. The yellow ceiling has leafy, white concrete garland and a series of golden military mosaics accenting the tile mosaics of glorified Russian life. Switching lines here, the hallway has an Alice-in-Wonderland feel, impossibly long with decorative tile walls, culminating in a very old station left in a remarkable state of disrepair, offering a really tangible glimpse behind the palace walls.

Dostoevskaya Station

Dostoevskaya is a tribute to the late, great hero of Russian literature . The station at first glance seems bare and unimpressive, a stark marble platform without a whiff of reassembled chips of tile. However, two columns have eerie stone inlay collages of scenes from Dostoevsky’s work, including The Idiot , The Brothers Karamazov , and Crime and Punishment. Then, standing at the center of the platform, the marble creates a kaleidoscope of reflections. At the entrance, there is a large, inlay portrait of the author.

Chkalovskaya Station

Chkalovskaya does space Art Deco style (yet again). Chrome borders all. Passageways with curvy overhangs create the illusion of walking through the belly of a chic, new-age spacecraft. There are two (kos)mosaics, one at each end, with planetary subjects. Transferring here brings you above ground, where some rather elaborate metalwork is on display. By name similarity only, I’d expected Komsolskaya Station to deliver some kosmonaut décor; instead, it was Chkalovskaya that took us up to the space station.

Elektrozavodskaya Station

Elektrozavodskaya is full of marble reliefs of workers, men and women, laboring through the different stages of industry. The superhuman figures are round with muscles, Hollywood fit, and seemingly undeterred by each Herculean task they respectively perform. The station is chocked with brass, from hammer and sickle light fixtures to beautiful, angular framework up the innards of the columns. The station’s art pieces are less clever or extravagant than others, but identifying the different stages of industry is entertaining.

Baumanskaya Statio

Baumanskaya Station is the only stop that wasn’t suggested by the students. Pulling in, the network of statues was just too enticing: Out of half-circle depressions in the platform’s columns, the USSR’s proud and powerful labor force again flaunts its success. Pilots, blacksmiths, politicians, and artists have all congregated, posing amongst more Art Deco framing. At the far end, a massive Soviet flag dons the face of Lenin and banners for ’05, ’17, and ‘45. Standing in front of the flag, you can play with the echoing roof.

Ploshchad Revolutsii Station

Novokuznetskaya Station

Novokuznetskaya Station finishes off this tour, more or less, where it started: beautiful mosaics. This station recalls the skyward-facing pieces from Mayakovskaya (Station #2), only with a little larger pictures in a more cramped, very trafficked area. Due to a line of street lamps in the center of the platform, it has the atmosphere of a bustling market. The more inventive sky scenes include a man on a ladder, women picking fruit, and a tank-dozer being craned in. The station’s also has a handsome black-and-white stone mural.

Here is a map and a brief description of our route:

Start at (1)Kievskaya on the “ring line” (look for the squares at the bottom of the platform signs to help you navigate—the ring line is #5, brown line) and go north to Belorusskaya, make a quick switch to the Dark Green/#2 line, and go south one stop to (2)Mayakovskaya. Backtrack to the ring line—Brown/#5—and continue north, getting off at (3)Novosblodskaya and (4)Komsolskaya. At Komsolskaya Station, transfer to the Red/#1 line, go south for two stops to Chistye Prudy, and get on the Light Green/#10 line going north. Take a look at (5)Dostoevskaya Station on the northern segment of Light Green/#10 line then change directions and head south to (6)Chkalovskaya, which offers a transfer to the Dark Blue/#3 line, going west, away from the city center. Have a look (7)Elektroskaya Station before backtracking into the center of Moscow, stopping off at (8)Baumskaya, getting off the Dark Blue/#3 line at (9)Ploschad Revolyutsii. Change to the Dark Green/#2 line and go south one stop to see (10)Novokuznetskaya Station.

Check out our new Moscow Indie Travel Guide , book a flight to Moscow and read 10 Bars with Views Worth Blowing the Budget For

Jonathon Engels, formerly a patron saint of misadventure, has been stumbling his way across cultural borders since 2005 and is currently volunteering in the mountains outside of Antigua, Guatemala. For more of his work, visit his website and blog .

Photo credits: SergeyRod , all others courtesy of the author and may not be used without permission

Skip to Content

- Travel Reimbursement

Thank you for joining us for PhD visit Day. We are excited to welcome you to our campus and hope you enjoy your visit. To make things as easy for you as possible please use this guide to ensure an easy trip.

All purchases submitted to be reimbursed must be purchased by the invited PhD Candidate. Any purchases made by someone else will not be reimbursed.

Receipts Are Required!

- Vendor Name

- Date of purchase

- Description and quantity of each item purchased

- Cost per item (if available)

- Total cost of order (This must match the amount charged)

- Shows no tax was charged

- Cardholder name and/or card number

- Flight receipts need to also have the traveler's name

- Venmo, PayPal and other third-party payment sites

- Frequent flyer miles

- Gift cards

- Account credits

- Travel Certificates

- We only reimburse domestic flights. Any requests for international flights will be rejected.

- We will not reimburse flights that are not economy class seating.

- Please avoid third-party sites like Expedia or Travelocity as they do not provide valid receipts for our finance team to reimburse you. It is best to book directly with the airline you wish to fly. If you do choose to book through a third-party vendor, you will need to provide a copy of your bank statement showing the purchase along with whatever documentation they send you. Without this you will not be reimbursed .

Driving / Car Service

- If you plan on driving to CU, you must provide proof that it was cheaper to drive vs fly.

- If tipping a Lyft or Uber driver it must be based off the base amount and not the additional fees that are often added on. Tips are not to exceed 20%. Any amount over 20% will not be reimbursed.

Reimbursement Forms

When submitting your reimbursement request you will use one of the two links listed below. The first link is strictly for US Citizens and the second is for international reimbursements.

- U.S. Citizen or a green card-holding permanent resident and live in the U.S.

- International Students

Please wait till after the trip to submit your reimbursement requests

US citizen reimbursements take 4 weeks to process through CU’s system, while international reimbursements can take 8 weeks (about 2 months). This process will take longer if you do not provide all the necessary documentation or provide invalid documentation.

If you need help or have general financial questions, please email [email protected]

2024 Aerospace PhD Applicant Visit Day

- Schedule of Events

- Research Lab Open Houses

- Saturday Activities

Apply Visit Give

Departments

- Ann and H.J. Smead Aerospace Engineering Sciences

- Chemical & Biological Engineering

- Civil, Environmental & Architectural Engineering

- Computer Science

- Electrical, Computer & Energy Engineering

- Paul M. Rady Mechanical Engineering

- Applied Mathematics

- Biomedical Engineering

- Creative Technology & Design

- Engineering Education

- Engineering Management

- Engineering Physics

- Environmental Engineering

- Integrated Design Engineering

- Materials Science & Engineering

Affiliates & Partners

- ATLAS Institute

- BOLD Center

- Colorado Mesa University

- Colorado Space Grant Consortium

- Discovery Learning

- Engineering Honors

- Engineering Leadership

- Entrepreneurship

- Herbst Program for Engineering, Ethics & Society

- Integrated Teaching and Learning

- Global Engineering

- Mortenson Center for Global Engineering

- National Center for Women & Information Technology

- Western Colorado University

Watch CBS News

Biden is canceling $7.4 billion in student debt for 277,000 borrowers. Here's who is eligible.

By Aimee Picchi

Edited By Alain Sherter

Updated on: April 12, 2024 / 3:29 PM EDT / CBS News

The Biden administration on Friday said it's canceling $7.4 billion in student debt for 277,000 borrowers, with the recipients scheduled to receive emails today to alert them to their loan discharges.

The latest effort extends the debt relief provider under President Joe Biden after the Supreme Court last year blocked his administration's plan for broad-based student loan forgiveness. With the latest batch of loan cancellations, the White House said it has forgiven about $153 billion in debt for 4.3 million student borrowers.

Biden, who had made student loan relief a major campaign pledge, is tackling an issue that affects about 43 million Americans with a combined $1.7 trillion in student debt. It's a burden that some borrowers and their advocates say has harmed their ability to save for a home or achieve financial milestones, an issue that was echoed by Education Secretary Miguel Cardona in a conference call with reporters.

"I talked to a teacher in New York this week who took out a loan for $30,000," Cardona said Friday, "and after over a decade of paying and being a teacher the debt was $60,000, and she was saying that the interest was so high that the payments that she was making wasn't even touching her principal."

He added, "We are fixing a broken system. We're relentless and taking steps to transform a broken system into one that works people across the country."

Here's what to know about who is eligible for the latest round of forgiveness.

Who qualifies for the student loan forgiveness?

Three groups of people qualify under the latest round of debt relief, the White House said.

- $3.6 billion for 206,800 borrowers enrolled in the SAVE plan.

About $3.6 billion will be forgiven for nearly 207,000 borrowers enrolled in the Saving on a Valuable Education (SAVE) plan, an income-driven repayment program, or IDR, that the Biden administration created last year.

The White House said borrowers who are getting their debt discharged under SAVE had taken out smaller loans for their college studies. The plan allows people to receive forgiveness after they made at least 10 years of payments if they originally took out $12,000 or less in loans to pay for college; borrowers with larger loans are eligible after 20 or 25 years of repayment, depending on what types of loans they have.

"You sacrifice and you've saved for a decade or more to make your student loan payments, and you originally borrowed $12,000 or less, you're going to see relief," Cardona told reporters. "An overwhelming number of those who qualify for SAVE were eligible for Pell grants and come from low- and middle-income communities."

- $3.5 billion for 65,700 borrowers in income-repayment plans.

These borrowers will receive forgiveness through "administrative adjustments" to repayment plans where loan servicers had made it tougher for some borrowers to qualify for relief.

"These are people who paid for a long time but were being deprived of relief because of administrative and servicing failures," Cardona said. "These people met the contract of their loan" and will receive forgiveness.

- $300 million for 4,600 borrowers through Public Service Loan Forgiveness (PSLF).

The PSLF program is designed to help public servants like teachers and government employees achieve debt forgiveness after 10 years of repayment. It's a program that started in 2007 but had been plagued with complex rules that effectively hampered people from getting their debt discharged, with only 7,000 receiving loan forgiveness prior to the Biden administration.

With the latest round of discharges, the Biden administration has forgiven $62.8 billion in loans for 876,000 borrowers through PSLF.

Are there legal challenges to Biden's debt forgiveness plans?

In two separate lawsuits, Republican attorneys general in 18 states are pushing to have the SAVE plan tossed and to halt any further student debt cancellation. They say the SAVE plan oversteps Biden's authority and makes it harder for states to recruit employees. They also contend the plan undermines a separate cancellation program that encourages careers in public service.

It's unclear what the suits could mean for loans that have already been canceled. A court document filed by Kansas' attorney general says it's "unrealistic to think that any loan forgiveness that occurs during this litigation will ever be clawed back."

—With reporting by the Associated Press.

- Biden Administration

- Student Loan

Aimee Picchi is the associate managing editor for CBS MoneyWatch, where she covers business and personal finance. She previously worked at Bloomberg News and has written for national news outlets including USA Today and Consumer Reports.

More from CBS News

When does a home equity loan make sense? What experts say

How much would a $15,000 home equity loan cost per month?

Should you get a home equity loan before the Fed's April meeting?

When does a home equity loan make sense?

2024 Guide to HMRC Mileage Rates for Businesses

Dealing with HMRC mileage rates can be tricky, but it doesn't have to be a headache.

If you're looking for a simpler way to manage business travel expenses and stay on top of compliance , we've got some insights that can help.

We'll be covering:

- What are the HMRC Mileage Rates?

- What is the HMRC Mileage Allowance?

- When Can Employees Claim Business Mileage from Home?

- What is Travel Allowance in the UK?

- What are HMRC Fuel Advisory Rates?

- HMRC Mileage Rates for Electric Cars

- Taxation of HMRC Mileage Rates

- How to Apply the HMRC Business Mileage Rates: A Guide for Employers

- Keeping a Mileage Log for HMRC Compliance

Let's make managing travel expenses easier together.

What are the HMRC Mileage Rates?

The HMRC sets specific mileage rates for individuals using their personal vehicles for business purposes. These rates are designed to simplify calculating travel expenses for employers and employees, ensuring fair compensation for business use of a personal car.

Breakdown of HMRC Mileage Rates

Cars & vans : For the first 10,000 miles in a tax year, the rate is 45 pence per mile. Once you exceed this threshold, the rate drops to 25 pence for each additional mile.

Motorcycles : A consistent rate of 24 pence per mile applies, irrespective of the distance travelled within the tax year.

Bicycles : Cyclists can claim 20 pence per mile for business miles travelled.

The HMRC 10,000 Mile Threshold

The initial 10,000 miles are considered to bear a higher cost, accounting for the vehicle's depreciation, maintenance, and running costs.

The rate reduction beyond 10,000 miles acknowledges the supposed decrease in these costs as the vehicle ages and accumulates mileage.

What do HMRC Mileage Rates Cover?

The HMRC mileage rates are meticulously calculated to cover all expenses associated with using a personal vehicle for business purposes.

This includes, but is not limited to:

Maintenance

Insurance costs

The intention is to offer a straightforward, fair mechanism for employees to be reimbursed without having to detail every individual cost incurred.

What is the HMRC Mileage Allowance?

The HMRC mileage allowance is a rate set by HMRC that allows businesses in the UK to reimburse employees for the use of their personal vehicles for business purposes.

The primary goal of the mileage allowance is to provide a tax-free threshold for mileage reimbursement, ensuring that employees are compensated for the business use of their vehicles without incurring additional tax liabilities.

Tax Implications of Mileage Allowances for Employers & Employees

The HMRC mileage allowance is designed with tax efficiency in mind.

Reimbursements made at or below the HMRC-approved rates are not subject to tax or National Insurance contributions. This applies to both employers and employees, making it a tax-efficient way to handle business travel expenses .

For Employers:

Reimbursements within the HMRC rates do not incur additional tax liabilities.

Payments above the HMRC rates must be reported, and the excess is subject to tax and National Insurance contributions.

For Employees:

Receiving mileage allowance at or below the HMRC rates does not affect taxable income.

If reimbursements are below the HMRC rates, employees can claim Mileage Allowance Relief on their tax return for the difference.

When Can Employees Claim Business Mileage from Home?

The HMRC guidelines allow employees to claim mileage for travel from their home to a temporary workplace or for specific business journeys that aren't part of their regular commute.

The key criteria for these claims under the HMRC mileage rates include:

Temporary workplace visits : If you’re travelling to a location for a limited duration or for a temporary purpose, this can qualify as a claimable business journey.

Distinct business journeys : Travelling from home directly to meet clients, attend business meetings at different locations, or carry out site visits are examples of claimable business mileage.

Regular Commute vs Business Travel: The Difference

Regular commute : This is travel between your home and your permanent place of work. These journeys are not claimable under HMRC mileage rates because they’re considered as non-business travel.

Business travel : This encompasses any travel that is solely for business purposes, excluding your normal commute. It's these journeys that the HMRC mileage rates aim to cover, ensuring employees are reimbursed for the additional costs incurred.

Claiming Your Business Mileage

For employees looking to claim their business mileage , here's a simplified process:

Document your journeys. Keep a detailed log of your business journeys, including dates, destinations, and miles travelled. Documentation is key to substantiating your claims.

Calculate your mileage. Use the current HMRC mileage rates to calculate your total claim amount. Remember, the rates differ depending on the vehicle used and the number of business miles covered.

Submit your claim. Provide your documented journey log and calculated mileage to your employer. Employers typically have a process in place for these reimbursements.

For employers:

Ensure clarity around what constitutes claimable business mileage and communicate this effectively to your team to streamline the reimbursement process.

Offer support and guidance on how to log and claim business mileage. This will not only ensure compliance with HMRC guidelines but also foster a transparent and supportive work environment.

What is Travel Allowance in the UK?

Travel allowance encompasses a broader spectrum of work-related travel expenses than mileage allowance. While mileage allowance specifically covers the costs of using a personal vehicle for business purposes, travel allowance can include various other travel-related expenses.

Travel Allowance vs Mileage Allowance: The Difference

Mileage allowance : Directly related to the use of a personal vehicle for business journeys, calculated using the HMRC mileage rates. It's designed to cover vehicle-related costs such as fuel, maintenance, and depreciation.

Travel allowance : Encompasses a wider range of employee travel expenses incurred due to business activities. This can include public transport fares, accommodation costs, and meals during business travel, in addition to mileage costs when using public or alternative modes of transport.

Criteria for Claiming Travel Allowances

To claim travel allowances effectively, understanding the criteria set by HMRC is essential. Claims must be for expenses wholly, exclusively, and necessarily incurred in the performance of the duties of employment.

Key criteria include:

Temporary work locations : Travel expenses to and from temporary work locations can qualify for travel allowance claims.

Necessary overnight stays : Costs incurred during necessary overnight business trips, including accommodation and meals, are claimable.

Public transport usage : Expenses related to business travel via public transport, including trains, buses, and taxis, fall under travel allowance.

What is Included in the Travel Allowance UK?

Transport costs : Train tickets, bus fares, taxi receipts, and airline tickets for business-related travel.

Accommodation : Hotel or other lodging expenses when overnight stays are required for business purposes.

Meals and subsistence : Reasonable costs for meals during business travel, subject to HMRC guidelines.

Incidental expenses : Minor costs associated with business travel, such as internet charges at a hotel.

Both employers and employees need to keep detailed records and receipts for all travel expenses claimed under the travel allowance.

This not only ensures compliance with HMRC regulations but also facilitates a smooth reimbursement process.

What are HMRC Fuel Advisory Rates?

HMRC Fuel Advisory Rates are guidelines set for the reimbursement of fuel expenses incurred during business travel in company cars and vans. These rates are designed to:

Reimburse employees for business travel in their company vehicles.

Allow employees to repay the cost of fuel used for private travel in company vehicles.

It’s important to note that these rates should not be used in circumstances other than those specified above.

How are Fuel Advisory Rates Calculated?

The process of calculating these rates is both systematic and reflective of current market conditions.

Here’s how HMRC determines the advisory fuel rates:

Quarterly reviews : HMRC reviews the rates quarterly, considering the latest fuel prices and vehicle efficiency data.

Fuel prices : The latest prices for petrol, diesel, and LPG are obtained from reliable sources, including the Department for Energy Security and Net Zero and the Automobile Association.

Vehicle efficiency : Average miles per gallon (MPG) figures are derived from manufacturer data and adjusted for annual sales to businesses. For LPG vehicles, the MPG used is 20% lower than for petrol due to lower energy density.

Electric vehicles : The advisory rate for electric cars is calculated using electricity price data and car electrical consumption rates, ensuring a fair assessment of electric vehicle running costs.

Note : You can calculate employee car and fuel benefits using HMRC’s calculator .

Applying the HMRC Fuel Advisory Rates

Employers can apply these rates in two key scenarios:

Reimbursing employees : If the mileage rate paid to employees does not exceed the advisory fuel rates based on the engine size and fuel type of the company car, there’s no taxable profit or National Insurance contribution due.

Employees repaying for private travel : Correct recording and repayment of private travel mileage at these rates or higher ensure there’s no fuel benefit charge.

Key Points for Employers & Employees:

Employers have the flexibility to use their own rates if their vehicles are more fuel-efficient or if the cost of business travel is higher than the guideline rates, provided they can justify the higher cost per mile.

Employees must accurately record all private travel mileage and use the correct rate to calculate repayments for fuel used for private travel.

HMRC Mileage Rates for Electric Cars

Electric vehicles (EVs) offer a unique set of advantages and challenges when it comes to business travel. Recognising this, HMRC provides specific mileage rates for electric cars, distinct from those for petrol, diesel, or hybrid vehicles.

These rates are designed to account for the cost of electricity used for business travel, rather than fuel consumption, offering a fair and equitable means of reimbursement for EV users.

Impact of Electric Cars on Business Travel Expenses & Reimbursements

The adoption of electric vehicles can significantly alter the landscape of corporate travel expenses :

Cost-effectiveness : Generally, electric cars are cheaper to "fuel" compared to traditional petrol or diesel vehicles, potentially reducing overall travel expenses.

Environmental benefits : Encouraging the use of EVs aligns with corporate sustainability goals , reducing the carbon footprint associated with business travel.

Tax incentives : Utilising HMRC’s mileage rates for electric cars can also offer tax benefits, aligning financial incentives with eco-friendly practices.

What is the HMRC Mileage Rate for Electric Cars?

As of 1 March 2024, the HMRC mileage rate for fully electric cars is set at 9 pence per mile .

This rate provides a simple way for businesses and employees to calculate reimbursements for business travel using electric vehicles, ensuring that drivers are compensated for the electricity cost of their journeys.

Note : This rate is subject to periodic reviews by HMRC, reflecting changes in electricity costs and the evolving efficiency of electric vehicles. Make sure to stay updated with the latest rates to ensure compliance and maximise the benefits of integrating electric vehicles into your fleets.

Taxation of HMRC Mileage Rates

The HMRC mileage rates are designed to simplify the reimbursement process for business travel, providing a tax-efficient framework for compensating employees. But, are HMRC mileage rates taxable?

The answer hinges on adherence to the prescribed rates and the purpose of the journeys:

Non-taxable allowances : Mileage allowances paid at or below the HMRC-approved rates for business travel are not considered taxable income. These rates are calculated to cover the vehicle's operating costs, and reimbursements within these limits do not require tax payments from the employee.

Excess payments : Should an employer choose to reimburse at a rate higher than the HMRC-specified mileage rates without justifying the increased expense, the excess amount could be subject to tax and National Insurance contributions as it is considered earnings.

Employer Reporting Obligations

Employers play a crucial role in ensuring the tax efficiency of mileage reimbursements:

P11D forms : When providing mileage allowances, employers must report any amounts that exceed the approved HMRC mileage rates on the employee's P11D form . This form details benefits and expenses that have not been subject to PAYE tax.

PAYE Settlement Agreements : In some cases, employers may opt to cover the tax on excess mileage payments through a PAYE Settlement Agreement (PSA) . This agreement allows the employer to make one annual payment to HMRC covering all taxes due on minor, irregular, or impracticable employee expenses or benefits, including mileage rate excesses.

Are HMRC Mileage Rates Taxable?

As long as mileage allowances do not exceed the prescribed rates for the actual business miles travelled, they remain tax-free.

This approach incentivises the accurate recording and reporting of business travel, aligning employee reimbursements with actual travel costs without additional tax burdens.

How to Apply the HMRC Business Mileage Rates: A Guide for Employers

Understanding how to apply HMRC mileage rates correctly not only aligns with legal requirements but also supports fair and transparent compensation for employees using their personal vehicles for work .

Step 1: Understand the Rates

Familiarise yourself with the current HMRC mileage rates for cars, vans, motorcycles, and bicycles.

These rates are designed to cover the cost of using personal vehicles for business purposes, including fuel, maintenance, and wear and tear.

Step 2: Establish a Policy

Develop a clear corporate expense policy on business mileage that includes how and when mileage can be claimed, the documentation required for claims, and how the HMRC mileage rates will be applied within your organisation.

Need help building your expense policy? Use our free expenses policy template .

Step 3: Educate Your Team

Ensure that all employees understand the policy, the importance of accurate mileage tracking, and how to submit mileage claims.

Clear communication prevents misunderstandings and promotes compliance.

Step 4: Implement Mileage Tracking

Encourage employees to keep detailed logs of their business mileage.

Whether through manual logs or digital tools, accurate records are crucial for compliance and reimbursement.

Step 5: Verify & Calculate Reimbursements

Review submitted mileage logs for accuracy and calculate reimbursements using the HMRC mileage rates.

Ensure that claims are justified and fall within the guidelines provided by HMRC.

Step 6: Process Reimbursements

Timely process mileage expense claims, providing reimbursements through payroll or as a separate payment, according to your business practices.

Keeping a Mileage Log for HMRC Compliance

Let's break down why keeping a detailed mileage log is crucial and how digital tools can make this task simpler and more reliable:

The Benefits of Keeping Detailed Mileage Logs

Ensuring tax compliance : Precise mileage logs are your safeguard against tax issues. They serve as solid evidence that supports your travel expense claims according to HMRC mileage rates, ensuring you stay on the right side of tax laws.

Guaranteeing correct reimbursements : For both individuals and businesses, accurate logs mean accurate reimbursements. No guesswork involved - every mile travelled for business is accounted for and compensated correctly.

Preparedness for audits : Should HMRC inquire further into your travel claims, a comprehensive mileage log provides a clear, detailed account of your business journeys, proving that your claims are justified and compliant.

How Technology Simplifies Mileage Tracking

Gone are the days of pen and paper logs - technology offers a streamlined, error-minimising approach to mileage tracking .

One standout solution is ExpenseIn , an expense management solution that embodies efficiency and compliance in mileage tracking.

Why Choose ExpenseIn for Your Mileage Tracking Needs?

Automated journey tracking : Utilise GPS technology to automatically record your trips' start and end points, ensuring every business mile is accurately captured without manual input.

HMRC-compliant mileage logs : Generate logs that meet HMRC's strict requirements, detailing every aspect of your business travel, from dates and distances to the purpose of each journey.

Ease of use and integration : With user-friendly interfaces and compatibility with various financial systems, tools like ExpenseIn make mileage logging accessible and straightforward, no matter where you are.

Moving to a digital mileage log system is not just about compliance; it's about embracing a solution that offers clarity, convenience, and confidence in every mile you log for business.

Ready to transform how you track mileage? Take the first step with ExpenseIn. Book a demo today and discover how our tool can simplify your mileage logging, ensure HMRC compliance, and save you time and money.

Explore our faster, simpler and smarter approach to expense management.

Related stories, are your mileage expense records hmrc compliant.

HMRC PAYE Explained: Tax Deductions, Deadlines & Requirements

HMRC Subsistence Rates: Everything You Need to Know

Claiming Back Travel Expenses from HMRC: A Step-by-Step Guide for Businesses

Sign up to stay in the know

Subscribe to our newsletter and get the latest ExpenseIn news and expense management insights straight to your inbox.

COMMENTS

The Travel and Expense Policy replaced the current Business Expenses policy on September 1, 2021 and is designed to align with the Payment Card Policy and Expense Reimbursement policies. These resources are available for you to learn more about the changes prior to the compliance deadline. Overview of Travel and Expense Policy (presentation)

Open FIN 002: All About Business Travel in iLearn (NYUHome login required) This tutorial is an overview of New York University's standardized Travel and Expenses Policy as it pertains to business travel. It will summarize which types of expenses during business travel are permissible and non-permissible under University policy.

NYU Faculty and Staff reimbursements are processed via Travel & Expense (Concur) system by submitting an Expense Report. Travel & Expense (Concur), a web & mobile app-based service, is a seamless and paperless process that allows NYU faculty and staff to process and track requests for reimbursements and cash advances. The mobile capability provides on-the-go access and puts expense receipt ...

The airline provides the faculty member a full refund of $1,000. NYU will not reimburse the faculty member because the full value of the flight was reimbursed. Steinhardt School of Culture, Education, and Human Development. Guidelines on how to process reimbursements related to cancelled business travel due to Coronavirus (COVID-19)

ALL guests requesting travel reimbursement must register in i-Buy, NYU's payments system. We highly recommend registering in i-Buy before beginning your travel. Reimbursement must be requested no later than 30 days after completing your travel. NYU only issues international reimbursements by wire transfer.

The NYU Travel and Expense Policy of the university, in particular, ... The approver to any payment/ reimbursement request should be the individual with a supervisory relationship to the employee being paid or reimbursed. When the approver is not available, an alternate approver (who has signature authority over the funds) may authorize the ...

NYU's preferred online travel booking tool is SAP Concur.The platform is accessible via webpage, mobile app, and phone.. Access Travel & Expense via NYU Home Card. on the website. Bookmark the tile for quick future access by right-clicking on a card; For on-the-go capabilities, use the SAP Concur Mobile App. Download the mobile app; Log in with your N Number as the username, followed by @nyu ...

Policies. NYU School of Law faculty members incur various types of travel expenses as they perform tasks and duties that support the operations of the institution and further its missions. This policy is to ensure that faculty members who incur valid travel business expenses are reimbursed in a fair and equitable manner, that business expenses ...

Applications will be considered for travel expenses outside of a 50 mile radius of NYC for such things as: airfare, car rental, hotel stays, and meals. Awards range from $100.00 to $500.00. You must apply IN ADVANCE to be considered. We cannot accept "after-the-fact" requests for reimbursement. The applications have to wait for the nearest ...

When you return from your trip or incur non-travel-related expenses, create an expense report to get reimbursed for your expenses paid for out of pocket or with your NYU individual T&E card. Non-Travel Related Expense Reports ( Google Doc) Creating a New Expense Report ( Video) ( PDF) - includes T&E card and out of pocket transactions.

Workflow or the Albert Student reimbursement system. The University Policy does not allow other persons or departments to pay for an individual's Membership Fees. 4. What is a Travel Advance at NYU? a. The University allows Accounts Payable to process Travel Advances for employees and students traveling on University business.

Part 102, Rules of the Chief Administrative Judge. Please refer to these rules for all judicial travel reimbursement policies. Travel should be limited to that which is absolutely necessary and via the least costly method possible. The use of Skype meetings and conference calls, when possible, is strongly encouraged.

Fiscal 2024 Travel Reimbursement Rates Employees. In-State or Out-of-State Meals and Lodging: Refer to the U.S. General Services Administration's (GSA's) federal Domestic Maximum Per Diem Rates, effective Oct. 1, 2023. If the city is not listed, but the county is listed, use the daily rate of the county.

Employee Travel and Reimbursement (ET&R) has included updates for the 2024 fiscal year-end process. Please use the information below as a reference for the fiscal year-end schedule related to out-of-pocket reimbursements, corporate card charges, and experimental subject payment forms. Out of Pocket Expenses* Both electronic and paper reimbursement forms must be submitted,

Veteran travel 101: Applying for travel reimbursement - VA News. You may be eligible for travel reimbursement if you pay expenses to and from your appointment. Learn if you're eligible and how to file a claim.

Have a look (7)Elektroskaya Station before backtracking into the center of Moscow, stopping off at (8)Baumskaya, getting off the Dark Blue/#3 line at (9)Ploschad Revolyutsii. Change to the Dark Green/#2 line and go south one stop to see (10)Novokuznetskaya Station. Check out our new Moscow Indie Travel Guide, book a flight to Moscow and read 10 ...

Reimbursement Forms. When submitting your reimbursement request you will use one of the two links listed below. The first link is strictly for US Citizens and the second is for international reimbursements. U.S. Citizen or a green card-holding permanent resident and live in the U.S. International Students

White House announces new round of student loan cancelations 03:17. The Biden administration on Friday said it's canceling $7.4 billion in student debt for 277,000 borrowers, with the recipients ...

Elektrostal Elektrostal is a city in Moscow Oblast, Russia, located 58 kilometers east of Moscow.Population: 155,196 ; 146,294 ; 152,463 ; 135,000; 123,000; 97,000 ...

Rome2Rio is a door-to-door travel information and booking engine, helping you get to and from any location in the world. Find all the transport options for your trip from Elektrostal to Moscow right here. Rome2Rio displays up to date schedules, route maps, journey times and estimated fares from relevant transport operators, ensuring you can ...

Rome2Rio is a door-to-door travel information and booking engine, helping you get to and from any location in the world. Find all the transport options for your trip from Kazanskiy Vokzal to Elektrostal right here. Rome2Rio displays up to date schedules, route maps, journey times and estimated fares from relevant transport operators, ensuring ...

From 2011 onwards, HMRC established clear mileage reimbursement rates for different types of vehicles, which are as follows: Cars & vans: For the first 10,000 miles in a tax year, the rate is 45 pence per mile. Once you exceed this threshold, the rate drops to 25 pence for each additional mile. Motorcycles: A consistent rate of 24 pence per ...