TravelAsker

Can I use my PNC card internationally?

Travel Destinations

November 5, 2023

By Kristy Tolley

Using PNC Card Internationally

If you’re planning to travel abroad, you may be wondering if you can use your PNC card. The good news is that PNC offers several cards that are accepted worldwide, making it easy to access your funds while traveling. However, there are some important things to consider before using your PNC card overseas, including fees, currency conversion rates, and cardholder protections.

PNC Card Acceptance Abroad

PNC cards are accepted at millions of locations around the world, including merchants, ATMs, and banks. However, it’s important to note that not all merchants may accept your PNC card, especially in countries where chip-enabled cards are not yet widely used. It’s always a good idea to carry cash as a backup, just in case you encounter a merchant that does not accept your PNC card. Additionally, some ATMs overseas may charge a fee for withdrawals, so it’s important to check with PNC to see if there are any affiliated ATMs that offer fee-free withdrawals.

Types of PNC Cards with Global Acceptance

PNC offers several cards that are accepted worldwide, including the PNC Bank Visa Debit Card, PNC Bank Visa Credit Card, PNC Premier Traveler Visa Signature Credit Card, and PNC Points Visa Credit Card. All of these cards come with chip technology and are accepted at merchants that accept Visa cards worldwide. However, it’s important to note that not all PNC cards come with the same benefits, such as travel rewards or no foreign transaction fees. Be sure to check with PNC to see which card is best for your international travel needs.

PNC Card Fees for International Transactions

When using your PNC card internationally, there may be fees associated with foreign transactions, such as ATM withdrawals, purchases, and currency conversions. These fees can vary depending on the type of PNC card you have and the country you are visiting. It’s important to check with PNC to understand what fees may apply to your specific situation. Additionally, it’s a good idea to notify PNC of your travel plans ahead of time, so they can monitor your account for any suspicious activity.

PNC Card Currency Conversion Rates

When using your PNC card overseas, you may encounter currency conversion rates that are different from the ones you’re used to. These rates are determined by the foreign exchange market and can fluctuate frequently. PNC offers a currency conversion tool on their website to help you estimate the cost of your purchases in your home currency. It’s important to note that some merchants may offer to convert your purchase into your home currency, but this may come with additional fees and unfavorable exchange rates.

PNC Cardholder Protections Overseas

PNC offers several cardholder protections when using your PNC card overseas. These include fraud monitoring, zero liability for unauthorized transactions, and emergency card replacement. However, it’s always a good idea to take extra precautions when traveling, such as keeping your card in a secure location and not sharing your PIN with anyone.

Activating Your PNC Card for International Use

Before you travel abroad, it’s important to activate your PNC card for international use. This can be done through PNC’s online banking portal or by calling their customer service line. It’s also a good idea to set up travel notifications, so PNC is aware of your travel plans and can monitor your account for any suspicious activity.

Using PNC Online Banking Abroad

PNC’s online banking portal is available worldwide, making it easy to manage your account while traveling. However, it’s important to be cautious when using public Wi-Fi or shared computers, as these may be vulnerable to hacking and identity theft. It’s always a good idea to use a secure connection and avoid accessing sensitive information on public networks.

PNC Card Travel Notifications and Alerts

PNC offers travel notifications and alerts, which can be set up through their online banking portal or mobile app. These notifications can help you stay on top of your account activity while traveling, such as ATM withdrawals or purchases. Additionally, PNC offers fraud alerts, which can notify you of suspicious activity on your account and help prevent fraud.

Alternatives to Using Your PNC Card Abroad

If you’re concerned about fees or acceptance issues when using your PNC card overseas, there are several alternatives to consider. These include carrying cash, using a prepaid travel card, or opening a bank account in the country you’ll be visiting. It’s important to research these options ahead of time and understand the fees and benefits associated with each.

Tips for Safe and Secure PNC Card Use Overseas

When using your PNC card overseas, there are several tips to keep in mind to ensure safe and secure transactions. These include keeping your card in a secure location, not sharing your PIN with anyone, and monitoring your account activity regularly. It’s also important to be aware of your surroundings and avoid using your card in areas that may be vulnerable to fraud or theft.

Conclusion: Using Your PNC Card Internationally

Using your PNC card overseas can be a convenient way to access your funds while traveling. However, it’s important to be aware of fees, currency conversion rates, and cardholder protections when using your card abroad. By taking the necessary precautions and staying informed, you can use your PNC card with confidence while traveling the world.

Kristy Tolley

Leave a comment cancel reply.

- Digital Nomad Visas

- Remote Jobs

PNC Travel Notice: A Complete Guide

We know this for sure: traveling is one of the most rewarding experiences of a lifetime, and not many would disagree. It’s about exploring new destinations and immersing yourself in different cultures, the allure of travel is undeniable. However, amidst the excitement, it’s essential to take care of logistical aspects to ensure a smooth journey so that you don’t encounter any troubles during your adventures abroad.

One of the significant concerns for travelers is ensuring uninterrupted access to their bank accounts. This brings us to the importance of a ‘PNC travel notice.’

Suppose you are a PNC Bank customer planning an upcoming trip. This guide will give you a comprehensive understanding of the PNC travel notice, its variations, and how to set one up efficiently.

Table of Contents

What is a pnc travel notice, keyword variations to understand, 1. via the pnc app:, 2. online banking:, 3. in-person or over the phone:, check your card type and fees, carry multiple cards, use chip and pin technology, notify pnc of any changes, monitor your account activity, wrapping up, frequently asked questions (faqs).

A PNC travel notice is a notification you provide to PNC Bank, informing them of your travel plans .

By setting up this notice, you’re alerting the bank about potential foreign transactions on your account. This helps in two main ways:

- Preventing Unwanted Blockages: Banks use sophisticated algorithms to detect suspicious activity on your account. A sudden transaction from a foreign country could flag your account, leading to an unwanted block. By setting up a travel notice, you’re pre-emptively letting the bank know such a transaction is expected.

- Ensuring Smooth Transactions: With the bank informed about your travel plans, you can confidently use your PNC card abroad, knowing that your transactions will go smoothly.

While the term ‘PNC travel notice’ is widely used, one might come across several variations of the phrase. Here’s a brief on each:

- PNC Bank Travel Notice: This straightforward variation explicitly mentions the bank’s name.

- Travel Notice PNC: A simple inversion of the main keyword, this term serves the same purpose.

- PNC Travel Notice on App: This refers to setting up the travel notice via PNC’s mobile application.

- PNC Card Travel Notice: This emphasizes using the PNC card during travels.

- PNC Credit Card Travel Notice: A more specific version focusing on PNC’s credit card services.

- PNC Online Banking Travel Notice: This refers to setting up the notice via PNC’s online banking platform.

Setting Up Your PNC Travel Notice

The PNC mobile app provides an intuitive interface to set up your travel notice. Here’s a step-by-step guide:

- Open the PNC app on your smartphone.

- Navigate to the ‘More’ or ‘Settings’ tab.

- Look for the ‘Travel Notice’ option and select it.

- Fill in your travel details, such as destinations and travel dates.

- Confirm the information and submit.

If you prefer using a desktop, PNC’s online banking platform is equally efficient:

- Log in to your PNC online banking account.

- Navigate to the ‘Services’ or ‘Account Settings’ section.

- Find and select the ‘Travel Notice’ option.

- Provide the necessary travel details and confirm.

For those who prefer a more traditional approach:

- Visit your nearest PNC bank branch and speak with a representative.

- Alternatively, call PNC’s customer service and provide them with your travel details.

Tips and Tricks for Using Your PNC Card Abroad

Now that you’ve set up your travel notice, you can use your PNC card abroad.

However, there are some additional tips and tricks that can help you make the most of your card and avoid any hassles:

Depending on whether you have a debit or credit card from PNC, there may be different fees associated with foreign transactions.

For example, debit cards may charge a 3% foreign transaction fee and $5 per ATM withdrawal, while credit cards may vary depending on their features.

It’s advisable to check your card type and fees before you travel and plan your budget accordingly.

It’s always a good idea to have more than one card with you when you travel in case one gets lost, stolen, or damaged. You can also use different cards for different purposes, such as one for ATM withdrawals and another for purchases. This way, you can minimize the fees and maximize the rewards.

Most PNC cards come with chip and PIN technology, adding an extra security layer to your transactions.

Instead of swiping your card and signing a receipt, insert your card into a terminal and enter your PIN. This reduces the risk of fraud and identity theft. However, not all merchants may accept chip and PIN cards, so carrying some cash is best.

If your travel plans change unexpectedly, such as extending your stay or visiting a different country, you should notify PNC immediately. This way, you can update your travel notice and avoid any potential issues with your card. You can do this via the app, online banking, or phone.

While traveling, monitoring your account activity and reporting any suspicious or unauthorized transactions to PNC immediately is essential.

You can use the app or online banking to check your balance, view your transactions, and set up alerts. You can also contact PNC’s customer service if you need any assistance.

Traveling is an exciting and enriching experience that can broaden your horizons and create lasting memories. However, it also requires careful planning and preparation to ensure a hassle-free trip . One of the key aspects of travel planning is ensuring access to your bank account and using your card abroad.

By setting up a PNC travel notice, you can inform the bank of your travel plans and avoid any unwanted blockages or fees on your account. You can also use tips and tricks to make the most of your card and enjoy smooth transactions.

Whether traveling for business or pleasure, a PNC travel notice can help you have a stress-free and enjoyable journey.

You can set up a travel notice via the PNC mobile app, online banking, by visiting a branch, or over the phone.

The process is similar to the general PNC travel notice. Use any of the abovementioned methods and specify that you’ll use your PNC card abroad.

Open the app, go to ‘More’ or ‘Settings,’ find the ‘Travel Notice’ option, enter your details, and submit.

Choose from the options: PNC app, online banking, in-person, or over the phone.

SHARE THIS POST

LEAVE A REPLY Cancel reply

Save my name, email, and website in this browser for the next time I comment.

What To Do if Your Flight Gets Canceled? Travel Expert Weighs In

Asia dominates the list of rising remote work hubs, chinese youth: charting new paths abroad away from the domestic grind, the nomad weekly newsletter.

Your weekly roundup of digital nomad news, visa information, destination tips and resources.

Recent Posts

Curaçao digital nomad visa: requirements, application process, fee, more, peru introduces a new opportunity for digital nomads: the digital nomad visa, south korea unveils new visas to boost tourism and embrace digital workforce.

- About This Site

Being Digital Nomad reports on digital nomad visas, remote jobs, destinations, as well as news and features on travel trends and tips.

Popular Tags

Popular posts, norway’s digital nomad visa guide: here’s what travelers need to know, google flight hack: how to uncover the best travel deals, digital nomad visa 101: everything you need to know.

© Being Digital Nomad

Sign On to Online Banking or select another service

- Mortgage Application Status Tracker

- PNC Benefit Plus HSA

- PNCI International

DO NOT check this box if you are using a public computer. User IDs potentially containing sensitive information will not be saved.

Get our mobile banking app:

Virtual Wallet®

- Credit Cards

- Prepaid, Reloadable Card

- Online & Mobile Banking

- ATM Banking

- Student Banking

- Military Banking

- PNC WorkPlace Banking®

- PNC Choice Banking

- PNC HomeHQ®

- Mortgage Purchase & Refinance

- Home Equity Lines of Credit

- Construction and Lot Loans

- Personal Loans & Lines of Credit

Student Loans

- Student Loan Refinancing

- Explore Options in the Lending Portal

INVESTING & MANAGING WEALTH

- PNC Investments

- PNC Private Bank

Explore Topics

- Managing Wealth

- Small Business

- The Great Timing Debate: When to Claim Your Social Security Benefit

- Kids Flown the Coop? 10 Not-So-Obvious Money Tips for Empty Nesters

- Do You Know the Most Common Types of Cybercrime?

- 5 Questions to Consider as You Plan Your Retirement Income Strategy

How Mobile Banking Can Help You Save Time and Money

When it comes to getting your banking questions answered, using your mobile banking app can help you save time and even allow you to avoid fees.

Stay Informed on News and Issues Impacting PNC Customers

Visit Update Center

Security & Privacy

- Report Fraud

- Report Phishing Attempt

- Privacy Policy

- Visit Security & Privacy Center

- Home Equity

Frequently Asked Questions

- Lending Hardship Service & Support

- Visit Customer Service Center

How Can We Help You

- Call 1-888-PNC-Bank

- Tweet @PNCBank_Help

- Locate a Branch or ATM

- Schedule an Appointment

get a clear picture of where you are today and plan for the future you want

Experience Financial Wellness

Checking & Savings. Together.

Spend, save and grow your money with Virtual Wallet®.

Earn Unlimited 2% Cash Back on Purchases

With the new Cash Unlimited SM Visa Signature ® Credit Card.

Introducing Low Cash Mode®

Everyone can have a low cash moment. We're here to help when you do.

When you open and use a new, qualifying business checking account.

- Corporate & Institutional

- Español false xf false

- Customer Service

Welcome to PNC! How can we help you today?

Customer service & support , how can we help you today , browse by products , service & support information for your existing account or loan , find answers to commonly asked account questions, where can i find my full account and routing number.

Routing numbers are nine digit numbers that can also be referred to as banking routing numbers, routing transit numbers, RTNs, and ABA numbers. This code identifies your financial institution and it can differ depending on where you opened your account and the type of transaction you make.

There's a number of ways you can find your Account/Bank Routing numbers:

PNC Mobile App

For all Deposit Accounts (Checking and Savings)

- Sign on to the Mobile app.

- Select your account, then go to Account Actions and select Account and Routing Numbers .

- Verify your identity by entering a one-time passcode to view your full account number and routing number.

Online Banking

For Deposit Accounts (Checking and Savings)

- For Virtual Wallet accounts , go to Account Activity , change the selected Virtual Wallet account from the dropdown if needed, and select Go to the Account and Routing Number link.

- For all other checking and savings accounts, select the Show Account & Routing Number link.

- Verify your identity by entering a one-time passcode and follow the instructions for viewing your full account number and routing number.

On Your Online Statement:

If you have activated Online Statements within Online Banking, you can find your full account number on the PDF version of your Online Statements. To find your full account number:

- Sign on to Online Banking.

- Select your account.

- Click on the Online Statements link from the Account Activity page.

- Click on the Print Statement link. The full account number can be viewed on the top right hand corner of the statement.

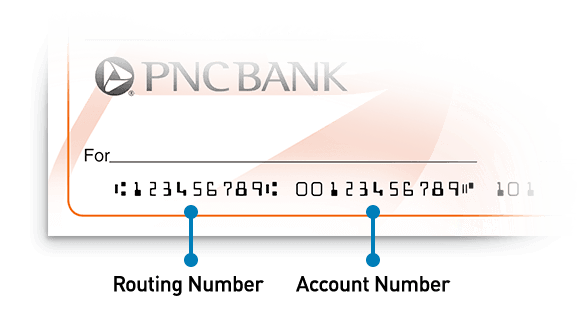

On Your Paper Checks:

Your Account number and Bank (ABA) Routing number can be found at the bottom of your checks:

If you don’t have your checkbook handy, don’t worry. If you have recently written a check that has posted to your account you can:

- Within the Posted Transactions section of the Account Activity page, locate a recently posted check and click on the blue hyperlink under the Description column.

- View an image of the check to obtain the routing and account number.

Note on Incoming Wire Transfers: If you want to set up incoming wire transfers, your routing number is different than the one displayed on your account(s). To set up an incoming wire transfer you will need your account number and this PNC Bank Routing Number: 043000096

What should I do if I can't access my account, or forgot my Online Banking Password or User ID?

If you forget your password, you can reset it online with your debit card information or a phone number that you have enrolled through online banking..

To reset your Password and regain access immediately, click on "Forgot Your User ID or Password?" located in the Online Banking Sign On block on pnc.com. This link will walk you through the steps necessary to reset your Password

If you forget your User ID, you will need to contact us directly by either calling us, contacting us via chat, or stopping into any of our PNC Branches to obtain this information.

How do I change the address, phone number, or email address on my account?

It's easy to change the address you have on file with pnc for your accounts:.

In Online Banking, Click on the Customer Service tab and then select the "Customer Profile" option at the top. You'll see your personal information.

To update your mailing address:

- Click "edit" next to the Customer Address section.

- Place a check next to the account(s) that you would like to change.

- Type in your new address and click the "next" button.

- Confirm that the new address is correct and click the "submit modifications" button.

To update your phone number:

- Click “edit” next to the Telephone Numbers section.

- Delete the digits in either the Primary and Secondary fields.

- Click the “Next” button.

To update your email address:

- Click “edit” next to the Email Addresses section.

- Type in your new email address.

- Confirm your new email address by reentering it.

- Click the “Submit Modifications” button.

For international address change requests , connect with us using Message PNC in the PNC Mobile app or Online Banking. Include your phone number and a physical, international address or a Military Box address.

For Business Accounts: In order to change the address on record, please contact the PNC Business Banking Care Center at 1-877-287-2654 . Some business accounts will require a visit to your local PNC branch to change the address.

How do I order checks?

It’s easy to order checks with online banking:.

- Sign in to Online Banking

- Click on the Customer Service Tab

- In the Manage Accounts section, click on Order Checks & Supplies.

- Click on the “Checks/Supplies” link under the Order column next to the account for which you want to order checks.

Sign up for Automatic Check Reorder so you don’t have to remember about reordering checks.

Automatic Check Reorder is a free service offered by PNC that notifies you when 70% of your checks are gone. At that time, you can make changes to your check style or address. Your new checks will be mailed to you automatically

Not sure if you’re already enrolled in Automatic Check Reorder?

- In the Manage Accounts section, click on "Order Checks & Supplies".

You will see a list of your open accounts. Look in the Automatic Check Reorder column and it will state “Enabled” for the accounts that are enrolled.

What is a Pending Transaction?

How do i set up alerts for my account, setting up alerts is easy once you're logged into online banking..

- From your Alerts tab, access the Alert Profile Page.

- The Alert Profile Page provides a snapshot view of all the alerts eligible for each account.

- From there, you can add/view or edit account and security alert settings.

The following types of Alerts are available:

- Deposit Account Alerts

- Credit Card Alerts (provide balance & payment information)

- Debit/Credit Card Transaction Alerts

- Security Alerts

- Service Alerts

You can set up your account(s) to receive alerts via email or text messages [2] .

How do I dispute a transaction on my account that I do not recognize?

You can dispute some debit or credit card transactions electronically via your Online Banking by going to the Customer Service tab.

There are two separate processes for debit card and credit card transactions after you go to the Customer Service tab.

To dispute a debit card transaction:

- Sign On to PNC Online Banking.

- Click the "Customer Service" tab.

- Select "Dispute a Transaction” from the Account Services section.

- Select the account associated with the dispute, and confirm your address.

- Click "Next."

- Select the transaction you wish to dispute from the transaction list. If you don't see see the transaction you wish to dispute or have other questions, please contact us at 1-888-PNC-BANK (762-2265) .

- The steps that follow will walk you through how to place the dispute. If you have any other questions or concerns, please contact us.

To dispute a credit card transaction:

- Select "Dispute a Transaction” link under “Credit Card”.

- Select the account associated with the dispute, and enter information regarding the disputed transaction.

- Click "Send".

- If you have any other questions or concerns please contact us.

Important Account Information for Existing Checking Customers

Why did i receive an overdraft item or returned item (nsf) fee, how do i place a stop payment on a check or pre-authorized payment.

A "Stop Payment" allows you to stop payment on a check, range of checks or pre-authorized payment (excluding cashier's checks, money orders or other cash equivalent items).

To place a Stop Payment:

- Select "Stop Payment" from the Account Services section.

- Select the type of stop that you would like to place.

- The screens that follow will walk you through the remaining steps to place the stop payment.

All Stop Payment requests on a pre-authorized payment must be received by PNC at least three (3) business days before the payment is scheduled to be made. Once placed, Stop Payment orders remain effective for six (6) months from the date authorized. You can place another stop payment order for an additional six months when the expiration date arrives.

Stop Payment requests on checks are not effective if, either before or within 24 hours from the time when the stop payment was requested, PNC Bank cashes the check or has become otherwise legally obligated for its payment. PNC Bank will assume no responsibility if any information provided is incorrect or incomplete and would cause the check or pre-authorized payment or transfer order to be paid (i.e., incorrect check number, date, account number, or invalid amount).

Please note that additional fees may apply. For more information, refer to the applicable schedule of service charges and fees:

My card was lost, stolen, damaged, or destroyed, how can I get a new one?

If your card has been lost or stolen, resolve this through the PNC Mobile App [3] or Online Banking. Or, contact us immediately at one of the following phone numbers.

Step by Step Instructions to issue a new Debit Card

Step by Step Instructions to report your Credit Card lost or stolen.

Step by Step Instructions to issue a Credit Card replacement.

Personal Debit Cards 1-888-PNC-BANK (1-888-762-2265)

Business Debit Cards 1-877-BUS-BNKG (1-877-287-2654)

PNC Premier Traveler Visa® Signature Credit Card 1-877-588-3602

PNC Premier Traveler Reserve Visa® Signature credit card 1-877-631-8996

All other personal credit cards 1-800-558-8472 (domestically) or 1-412-803-7787 (internationally) [1]

Business Credit Cards 1-800-474-2101 (domestically) or 1-412-803-7787 (internationally) [1]

Replacement card fees may apply.

For debit cards, please refer to the Consumer Schedule of Service Charges and Fees or the Business Checking Account and Related Charges for additional information on replacement debit card fees.

For credit cards, please call us at the appropriate number above.

How do I access the Automated Telephone Banking Service?

Our toll-free Customer Service number will get you fast, easy and secure account information from our automated banking system. There's no waiting and it's available anytime, whenever you need it. Use it to check balances, hear account activity, transfer funds and much more.

To access the Automated Telephone Banking Service, you will need the following:

- Your User ID you associated with your account, as well as

- Your Telephone PIN Number you registered with your account (in many cases, this is the same as your PNC Debit Card PIN).

Once you enter the information required to access your account, just follow the instructions given to you through the automated system

How do I complete a wire transfer or International Money Transfer?

At this time, self-service wires and International Money Transfers are available in all regions.

In Online Banking:

- Sign on to PNC Online Banking.

- Select the Transfer Funds tab

- Select Send a Wire or International Transfer.

In the PNC Mobile App:

- Log into the PNC Mobile App.

- Go to the Transfer tab.

- Choose Send a Domestic Wire or Send an International Transfer.

For additional questions, select “Message PNC” on the right hand side of your PNC Online Banking “My Account” tab.

To process a wire or International Money Transfer we will need the following information about your recipient:

- Name of person or business

- Bank routing number

- Account number

If you are requesting a wire within a branch, you will also be asked to provide valid photo ID.

Additionally, depending on the type of transfer, we will need information about the recipient’s account:

- Domestic wires require a U.S. routing and full account number. Keep in mind that many banks have a specific routing number for wires. Your recipient should contact their bank with questions.

- International wires require either an international bank account number (IBAN) or a full account number and SWIFT code, also known as a Business Identifier Code (BIC). Your recipient should contact their bank with questions.

- International Money Transfers require a full account number. Certain banks may accept the recipient’s debit card number or mobile phone number in lieu of an account number.

Fees for sending a wire or International Money Transfers vary by account type, see your fee schedule or call us at 1-800-272-6868 for details.

Perform a Domestic Wire Transfer:

You can request to send a domestic wire from any personal PNC checking or savings account within the Transfer Funds tab of your online banking, or within the Transfers section of the PNC Mobile App.

- You can also contact a local branch for an appointment to complete your domestic wire. More information on current branch services can be found in our branch locator

- If you prefer, you can also call our Wire Transfer Customer Care center 1-800-272-6868 Monday through Friday, 8:30 A.M. – 4 P.M. EST to request a domestic wire transfer. For PNC General Customer Service, contact 1-888-762-2265 .

Only send money to people and businesses you know and trust.

Perform an International Wire or International Money Transfer:

You can request to send an international wire or International Money Transfer from any personal PNC checking or savings account within the Transfer Funds tab of your online banking, or within the Transfers section of the PNC Mobile App.

- You can also contact a local branch for an appointment to complete your international wire or International Money Transfer. More information on current branch services can be found in our branch locator

We are not able to process requests for international transfers over the phone.

Note: to process a domestic wire transfer over the phone, you may need to complete a Wire Transfer Agreement. The form can be found by signing into Online Banking and visiting the Customer Service tab / Online Documents Center. Domestic wire transfer may not be available same day. In some instances, requests may not be processed until the following business day. We may attempt to call you to verify your wire instructions. Incorrect information or delays in reaching you may delay the processing of your wire transfer.

To receive an incoming international Wire Transfer you will need PNC Bank's SWIFT Code (BIC): PNCCUS33 .

If you have questions about your account or want to bank by phone, we have a number for you to call.

- @PNCBank_Help

The official PNC Bank customer support account - answering your service questions, providing tips and information.

Visit us at one of our many ATMs and Branches near you, or make an appointment.

Personal Product & Service Specific Support

Monday - Friday: 8:00 a.m. - 9:00 p.m. ET Saturday - Sunday: 8:00 a.m. - 5:00 p.m. ET

1-888-PNC-BANK (762-2265)

Personal Credit Cards

Automated account information is available 24/7

1-800-558-8472

Personal Banking Accounts

Monday - Thursday: 8:00 a.m. - 9:00 p.m. ET Friday: 8:00 a.m. - 5:00 p.m. ET

1-800-822-5626

Monday - Friday: 8:00 a.m. - 5:00 p.m. ET

1-800-762-1001

Investments

Monday - Friday: 8:00 a.m. - 6:00 p.m. ET

1-800-622-7086

Small Business Product & Service Specific Support

Business banking accounts.

Monday - Friday: 8:00 a.m. - 9:00 p.m. ET Saturday - Sunday: 8:00 a.m. - 5:00 p.m. ET

1-877-BUS-BNKG (287-2654)

Business Credit Cards

1-800-474-2101

Calling from Outside the United States

Personal accounts.

Call International Collect: 412-803-7711 [1]

Business Accounts

Call International Collect: 412-803-0141 [1]

Call International Collect: 412-803-7787 [1]

Special Support

Servicio de Ventas y Servicio al Cliente en Español

1-866-HOLA-PNC (465-2762)

PNC accepts Telecommunications Relay Services (TRS) calls.

1-888-PNC-BANK

Veterans & Active Military

Monday - Friday: 8:30 a.m. - 4:30 p.m. ET

1-844-PNC-SCRA (762-7272)

We Also Recommend

Update Center

Keep up to date on the status of known issues for PNC services.

We are committed to protecting the security and confidentiality of your information.

Security & Privacy Center

- Accessible Banking

We strive to continually enhance the accessibility and usability of our website and mobile applications so that you can successfully manage your finances.

Important Legal Disclosures & Information

Check with your phone service provider for specific international calling instructions, rates and charges that may apply. Collect calling availability varies by country and may require a local operator.

PNC Alerts are free to customers. However, third party message and data rates may apply. These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply.

PNC does not charge a fee for the Mobile Banking service. However, a supported mobile device is needed to use Mobile Banking. Also, your wireless carrier may charge you for data usage. Check with your wireless carrier for details regarding your specific wireless plan and any data usage charges that may apply. PNC products, services and prices are subject to change.

Visa and Visa Signature are registered trademarks of Visa International Service Association and used under license.

Bank deposit products and services provided by PNC Bank, National Association. Member FDIC .

Read a summary of privacy rights for California residents which outlines the types of information we collect, and how and why we use that information.

- SMALL BUSINESS

- CORPORATE & INSTITUTIONAL

- Locate ATM/Branch

- Mobile Apps Directory

- Diversity & Inclusion

- Corporate Responsibility

- Terms & Conditions

- Cookie Preferences

- Do Not Sell or Share My Personal Information

The PNC Financial Services Group, Inc. All rights reserved.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What Banks Charge for Debit Foreign Transaction Fees

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Foreign transaction fees can add up fast when using your debit card abroad . The fees are often 1% to 3% of the amount of a purchase, and many banks also apply the fee to ATM withdrawals.

Below, we compare the amount financial institutions charge to make an international ATM withdrawal or debit card purchase.

» Looking for information about credit cards? See how to avoid credit card foreign transaction fees.

Banks with no debit card foreign transaction or ATM fees

Capital one 360.

Capital One’s online bank stands apart from many banks because it doesn’t charge a currency conversion fee or a fee for using a foreign ATM network. If an out-of-network ATM operator charges you a fee, however, it won’t be reimbursed by Capital One 360.

Charles Schwab Bank

This brokerage firm’s banking unit doesn't charge a fee when you use its debit card at an ATM overseas, and it offers unlimited reimbursements for ATM fees from cash withdrawals worldwide, regardless of the network used. And it doesn't charge currency conversion fees for debit card transactions.

Discover® Bank

Discover doesn’t charge foreign ATM network or foreign transaction fees. But Discover card acceptance can be limited outside of the U.S., Canada, Mexico and some Caribbean nations.

With an HSBC Premier Checking account, customers pay no foreign transaction fees. HSBC also has a worldwide network of ATMs.

The mobile-only banking app Varo joins the ranks of other travel-friendly banks. It charges no foreign transaction fees or ATM fees at over 40,000 Allpoint® ATMs. (There is a $3.50 charge on out-of-network and international ATMs.)

Foreign transaction fees by bank or credit union

How do I avoid foreign transaction fees on my debit card?

You may want to consider switching to a bank with no foreign transaction fees. Travelers can also benefit from a credit card that skips these fees, especially if you go abroad frequently.

» See NerdWallet's picks for the best no foreign transaction fee credit cards.

And no matter where you bank, let your financial institution know where you'll be traveling before you depart to avoid any unwarranted fraud alerts on your account.

» Want to earn more on your savings? Browse NerdWallet's list of best high-yield online savings accounts.

⏰ Limited-time offer

SoFi Checking and Savings

NerdWallet rating

Limited-time offer

at SoFi Bank, N.A., Member FDIC

Don’t miss out on a bigger bonus

Get a NerdWallet-exclusive bonus of up to $400 when you open an account and hit $5,000 in direct deposits within 25 days after your first one. That’s $100 more than SoFi’s normal $300 bonus! Select "Learn More" to get started. Expires 4/22/24. Terms apply.

On a similar note...

Find a better checking account

View NerdWallet's picks for the best checking accounts.

How to Set a Travel Notice for Your Credit Cards

Susan Shain

Susan is a freelance writer who specializes in turning complex financial topics into engaging and accessible articles. She's been writing about personal finance for six years, and was previously the senior writer at The Penny Hoarder and a staff writer at Student Loan Hero. Her personal finance writing has also appeared in publications like MarketWatch and Lifehacker.

When I worked at a ski rental shop in Breckenridge, Colorado, I witnessed many international (and some out-of-state) customers’ credit cards get declined.

Not because their credit limits were too low or because they were purchasing too much — but because they failed to set up travel notifications with their card issuers.

So now, any time I travel to a foreign country, I always set up a travel notice on my credit card beforehand.

Since I travel with the Chase Sapphire Reserve® (Review), I create a Chase travel notice, but you can take this step with most major credit or debit cards. Here’s how.

What Is a Credit Card Travel Notice?

As a way to prevent fraud , your credit card issuer monitors your spending activity. If it notices a suspicious purchase — in an unusually large amount, or from a new location — it may decline the transaction. This could be more likely in countries where fraud is a bigger problem.

Which is why the answer to the question “Should I notify my credit card company when traveling?” is usually yes.

Although you can often get away with shopping in another state without triggering a red flag, international travel is another story.

By notifying your credit card of your travel plans, you’ll reduce the chances of getting your transaction declined in the checkout line — which, trust me, is never fun — and having to call your card issuer to verify your purchases. It’s still possible to have your purchases declined after setting a travel notice, but it’s much less likely.

How to Set Up Travel Notices for 8 Major Credit Card Issuers

Ready to create your first travel alert? While you could call your card issuer, it’s easier to do it online.

Here’s how to set up travel notices with eight different credit card issuers.

When you visit MoneyTips, we want you to know that you can trust what’s in front of you. We are an authoritative source of accurate and relevant financial guidance. When MoneyTips content contains a link to partner or sponsor affiliated content, we’ll clearly indicate where that happens. Any opinions, analyses, reviews or recommendations expressed in our content are of the author alone, and have not been reviewed, approved or otherwise endorsed by the advertiser.

We make every effort to provide up-to-date information; however, we do not guarantee the accuracy of the information presented. Consumers should verify terms and conditions with the institution providing the products. Some articles may contain sponsored content, content about affiliated entities or content about clients in the network. While reasonable efforts are made to maintain accurate information, the information is presented without warranty.

Chase travel notice

Because of the company’s abundant travel perks and partnership with the Visa network — which is widely accepted worldwide — Chase cards are a favorite among globetrotters.

You can create Chase travel notifications up to a year in advance for credit cards, and up to 14 days for debit cards. Your travel dates can span an entire year — if you’re away for longer, you’ll simply have to adjust your dates once you’re on the road. Chase will have your request on file within 24 hours from the time you submit.

To set up Chase travel notifications, you’ll need to log in to your account and click on the credit card you plan to use. Under the “Things you can do” dropdown menu on the right, you’ll see the “Travel notification” option. That will take you to your “Profile & Settings” page, where you’ll be able to create a travel alert.

Insider tip

Depending on the type of Chase account you have, the process may be slightly different for you. In any case, just look for your “Profile & Settings” page, and then look for a button to set a travel notice.

Alternatively, if you’re already outside the country, you can call Chase collect at 1-302-594-8200 to alert the issuer of your travel plans.

Setting up a travel notice with the Chase bank app

After logging in to the Chase mobile app, tap the profile icon (this should appear as the outline of a person) and select “My settings.” Choose “Travel” within the settings menu and tap “Update” near any credit or debit card products you’ll be taking.

This will allow you to enter the details for your upcoming trip, which can be edited at a later time. Saving this information will successfully set up a travel notice.

Our favorite Chase travel card: While many Chase credit cards are adventure-ready, we’d recommend the Chase Sapphire Preferred® Card for new travelers. Not only does it earn 2X Chase Ultimate Rewards points per dollar on travel, but you’ll also get a great introductory bonus: 60,000 bonus points after spending $4,000 on purchases in the first 3 months. You’ll also earn 5X Ultimate Rewards points per dollar on Lyft rides and travel purchased through Chase Ultimate Rewards. You can transfer the points you earn to a variety of airline and hotel loyalty programs. The Sapphire Preferred has a $95 annual fee.

American Express travel notice

Surprise! You actually can’t create an Amex travel notice.

On its site, the issuer says it uses “industry-leading fraud detection capabilities” that help it recognize when you’re on the road, thereby eliminating the need to create an American Express travel notification.

The issuer does recommend you update your contact information, so it can reach you in case of any complications, and download the Amex app, so you can manage your account on the go.

Note that Amex credit cards aren’t as widely accepted across the globe. If you’re a frequent international traveler, we’d recommend looking for a card with a Visa or Mastercard logo instead because they’re accepted by most merchants.

Our favorite American Express travel card: For its $695 Rates & Fees annual fee, The Platinum Card® from American Express offers a slew of travel perks. They include extensive airport lounge access; 5X Membership Rewards points per dollar on eligible flights and hotels (starting 1/1/21, on up to $500,000 spent per calendar year); and up to $200 in Uber credits per year. Its introductory bonus is Earn 100,000 Membership Rewards® points after you spend $6,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu..

Capital One travel notice

As with Amex, there’s no need to set a travel notice for Capital One credit cards.

If you log in and click “Set Travel Notification,” you’ll be greeted by this window:

The issuer, long popular with international travelers for its lack of foreign transaction fees, says: “With the added security of your Capital One chip card, travel notifications are no longer needed on your credit card.”

It notes Capital One will cover you with its $0 fraud liability policy, and will also be on the lookout for any suspicious activity.

Our favorite Capital One travel card: The Capital One Venture Rewards Credit Card is a fantastic, easy-to-use travel rewards card, offering 2X Venture miles per dollar on everything. The introductory bonus is 60,000 bonus miles for spending $3,000 in the first 3 months. It comes with a $95 annual fee.

Bank of America travel notice

Ready to travel with your Bank of America card? Log in to your account, and in the menu at the top right, you’ll see “Help & Support.”

Hover over those words, and a drop-down menu will appear. Click on “Set Travel Notice” — and voila! You’ll be able to add your travel dates and destinations, as well as extra details about your trip, like any planned layovers.

Setting a travel notice with Bank of America.

Bank of America cards allow you to set travel notices up to 60 days in advance, and they can last for up to 90 days. If you’ll be traveling longer than that you’ll need to adjust your travel notice later on.

Our favorite Bank of America travel credit card: If you don’t want to pay an annual fee, the Bank of America® Travel Rewards Credit Card might work for you. You’ll earn 3X points per dollar at the Bank of America travel center and 1.5X points on everything else. After you make $1,000 in purchases in the first 90 days, you’ll earn 25,000 points — enough for a $250 statement credit toward travel purchases.

Citi travel notice

If you have a Citi credit card, the first step is to log in to your account.

Then you should hover over the “Services” button in the menu, and then select “Travel Services.” Next you can select “Manage Travel Notices,” before selecting the card for which you want to set a notice. Unlike some other issuers, you’ll need to set a separate notice for each card you plan to travel with.

Citi advises making sure your contact information is up to date before traveling, and also to download the Citi Mobile App to more easily monitor your account.

Here’s what setting a Citi travel notice looks like:

Setting a travel notice with Citi.

Then, once you fill out your destination and dates and verify your info, you’ll be good to go!

Our favorite Citi travel credit card: The offers a generous 3X ThankYou points per dollar on air travel and at gas stations, restaurants, supermarkets, and hotels. You can earn None. There’s a None annual fee to pay for this card.

Discover travel notice

Although Discover credit cards aren’t the best for traveling internationally, as they aren’t accepted as widely as Visa or Mastercard, you should still set up a travel notice if you bring your Discover card overseas.

You can do this from your online account by selecting “Manage” at the top of your screen, then clicking “Manage Cards” and then “Register Travel.”

Setting a travel notice with Discover.

Our favorite Discover travel card: For a card with no annual fee, the Discover it® Miles isn’t a bad choice. You’ll get 1.5X miles per dollar spent on everything, with double your miles at the end of your first cardholder year.

PNC travel notice

If you have a PNC credit or debit card, the bank recommends you set up a travel notice, explaining: “You typically use your card at local merchants and online, but suddenly you’re buying tapas in Madrid or sushi in Tokyo. This unexpected activity is what triggers the alert. Although less likely, this kind of predicament also can happen when traveling domestically.”

To notify PNC, you can either call the financial institution at 1-888-PNC-BANK or set up an alert online. After logging in to your account, you’ll select: “Customer Service” –> “Account Services” –> “Debit/ATM Card Services” –> “Edit/View Preferences.”

Then, in the bottom right corner of your screen, you’ll see an option to “Notify PNC of Foreign Travel.” After filling it out with your dates, destinations, and phone number, you’ll be ready to go.

Recommended PNC travel credit card: Like the BofA card, the PNC Premier Traveler® Visa Signature® isn’t the best option out there — but it’s fine for PNC loyalists. It offers a 30,000-mile introductory bonus when you spend $3,000 in the first three billing cycles, and 2X miles per dollar spent on everything. Its $85 annual fee is waived the first year.

Wells Fargo travel notice

If you’d like to tell Wells Fargo of your travel plans, you can either call the number on the back of your card, use the bank’s mobile app, or log in to your online account.

If you choose the latter method, you’ll hover over the “Accounts” dropdown menu, then click on “Manage Cards” –> “Manage Travel Plans.” As with the other issuers, you’ll enter your dates and destinations before submitting.

Recommended Wells Fargo travel credit card: There aren’t any Wells Fargo travel cards at the moment.

If you’d prefer a Visa card from Wells Fargo for traveling, consider the Wells Fargo Active Cash℠ Card . It offers 2% cash back on everything you buy, with a solid introductory bonus, but it also has a foreign transaction fee.

4 Things to Consider When Choosing a Travel Credit Card

If you’re looking for another piece of plastic to add to your wallet, here are four things to consider when choosing the best travel rewards credit card:

- Foreign transaction fees: Some credit cards charge a 3% fee for making purchases in a foreign currency. If you plan to travel abroad, make sure your chosen card has no foreign transaction fees.

- Annual fees: Many of the top-tier travel rewards credit cards have hefty annual fees. But before getting scared off, see if the card offers any credits or benifits that offset it. For example, while the Chase Sapphire Reserve® has a $550 annual fee, it also offers a $300 annual travel credit that applies toward flights, car rentals, and even Lyft rides.

- Rewards and perks: One of the most compelling reasons to get a travel credit card is the opportunity to earn points and miles that you can exchange for free travel. So take a look at your potential card’s introductory bonus and earning ability. You should also read the fine print to learn all about its travel perks, which might include airport lounge access or travel insurance.

- Loyalty programs: The majority of hotel chains and airlines have co-branded cards that earn additional rewards when you spend money with them. So if you are loyal to a particular brand, it’s wise to consider the co-branded options. For hotel cards, examples include the IHG® Rewards Club Premier Credit Card, Marriott Bonvoy Boundless™ Credit Card, and The World of Hyatt Credit Card. For airline cards, you can choose from options like the United℠ Explorer Card or Southwest Rapid Rewards® Plus Credit Card.

Whichever card you choose, be sure to set a travel notice before you board your next train or cruise or flight — and then enjoy your vacation free of worries!

You don’t have to stick to “travel credit cards” just because you want to, you know, travel with your credit card. As long as you set up a travel notification when you go, you can use any card you’d like. So, in case they’re a better fit, here are links to the best cash back, balance transfer, and 0% intro APR credit cards.

Share Article

On This Page Jump to Close

You should also check out….

10 tips to save on overseas ATM withdrawals this summer

No matter how much you plan ahead, you'll often need to withdraw money in the local currency when you're overseas. Of course, the U.S. dollar is accepted in some countries and you'll want to have a credit card on you. However, there might be situations where that will just not work — and the local currency (in cash) is the only accepted form of payment.

Think of taxi rides, the corner store, tips and excursions — and much more. You never know when the need for cash (in the local currency) will come up, so it pays to be prepared by having a debit card that won't charge exorbitant fees when taking cash out of the ATM.

So before you get on your next international flight, here are a number of ways to prepare in advance tof ensure you have cash on hand while overseas.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter .

What is an ATM foreign transaction fee?

An ATM foreign transaction fee is a fee you pay for using an ATM abroad. Banks have varying policies on fees you will pay for using an ATM that isn't their own, which is typically a flat fee when you are in the U.S. If you're using an another bank's ATM abroad, you may pay this flat fee (often around $5) plus a 1%-3% foreign conversion fee for using an ATM dispensing a currency other than U.S. Dollars.

Know if your credit card charges an ATM foreign transaction fee

There are plenty of reasons to hold and use travel rewards cards , but they shouldn't be your go-to when it comes to withdrawing cash at the ATM. Even if you use a card with no foreign transaction fees , the ATM withdrawal will likely entail a large cash advance fee , as they consider the money withdrawn as a loan.

And it gets worse: There's no grace period on cash advances, so you'll be incurring interest charges from the day of the withdrawal, usually at a rate that's even higher than the purchase rate.

Even if you are using a travel rewards credit card that refunds ATM fees worldwide, such as the Chase Sapphire Preferred Card , the money withdrawn is typically considered a cash advance. Although you won't have to pay the ATM fee, the interest fees can quickly add up.

Choose the right debit card to save on ATM fees when traveling

There are three ways you could be hit with fees when using your debit card overseas. First, your bank could charge you a fee for using an out-of-network ATM — both at home and at ATMs abroad. Second, the bank that owns the ATM could tack on additional fees. Finally, you can be charged foreign transaction fees at the ATM, just as you can when making credit card purchases.

Avoid debit cards that charge out-of-network fees

Before you leave home, you'll want to make sure you have a debit card that will not charge you any fees.

There's nothing worse than being charged twice to use your ATM card at an out-of-network machine (once by your bank and once by the ATM owner). To avoid this, open an account that doesn't impose out-of-network fees and ensure this applies not just at ATMs in the U.S. but also in other countries. One great option is to get a Capital One 360 Checking account. This card will not charge you any fees on withdrawals, even if it is out of network.

Related: The top 9 checking accounts for avoiding foreign ATM fees

Use a debit card that's part of a large network, including ATMs abroad

One way to avoid the fees from out-of-network transactions is to use a debit card that's part of a large, international network.

One popular option for those traveling abroad is to have a SoFi Money Checking account . The debit card that comes with the account reimburses account holders at any of Allpoint's 55,000+ network ATMs — available both domestically and abroad.

Related: 3 banks travelers should use to save money on fees

Find a card that reimburses ATM fees

Several banks and credit unions offer reimbursements for ATM fees charged by other banks. So even though your bank might not charge you a fee, you could be hit by the bank operating the ATM. Fortunately, many banks will reimburse those fees — some up to a certain amount per month; others are unlimited.

A great option is the Schwab Bank High Yield Investor Checking account . With this debit card option, you'll receive unlimited ATM fee reimbursements — both domestically and abroad. It's also a great card to use abroad if you only have a credit card that charges foreign transaction fees, since this card waives those fees on ATM withdrawals and debit card purchases. We still recommend traveling overseas with a credit card that offers no foreign transaction fees , so you can earn points and miles on purchases that you can pay for on your card.

Related: The best checking accounts

Watch out for ATM foreign transaction fees

When you're taking out smaller amounts of money, a 3% foreign transaction fee is far preferable to a $3 ATM fee. But if you need to withdraw hundreds of dollars outside of the U.S., you should look for a debit card with no foreign transaction fees on ATM withdrawals and on purchases. This includes debit cards from Capital One, Charles Schwab and Discover.

Avoid changing money at the airport

If there's one place where you're guaranteed to get the worst deal, it's at the arrivals area of an international airport. Here, you'll usually find the highest ATM fees, the least-favorable exchange rates and the highest likelihood of being short-changed. Try to avoid exchanging money at international train stations and ferry ports as well.

However, using the ATM at the airport may sometimes be your safest bet and may be a necessity. First, there should be security personnel nearby, which should increase your safety while using the ATM. Additionally, you may need cash before heading outside. If you're taking a taxi or public transit to your hotel, you may need local currency to pay. In these situations, you may need to use an airport ATM out of obligation.

If you have a card that will reimburse the withdrawal fee at ATMs abroad, then the fee doesn't matter as much. If you're in need of cash right away, make sure to check the conversion rate before withdrawing and choose the best-value option if the airport has more than one ATM network available.

What to know before using ATMs in different regions

Regardless of where you're traveling, a general rule of thumb is to always use ATMs in public spaces where you feel safe and secure. Be sure to check the card reader for anything suspicious such as card skimmers , so you don't become a victim of identity theft. Finally, always be aware of your surroundings when withdrawing money and entering secure personal information. Make sure no one is watching you, and be sure to cover your PIN when entering it.

Here are some pointers for those traveling through different regions:

Similar to the U.S., ATMs are nearly everywhere and not too hard to find. Europe hasn't completely adopted paperless payments in the way the U.S. has, so it's always good to have some cash in your wallet when traveling through the region. This is especially important if you plan to travel to smaller towns or shop at local markets.

Middle East

Credit cards are generally accepted throughout the Middle East, but if you plan to go to smaller towns or certain countries — like Iran — you'll want U.S. dollars or the local currency and a no-fee debit or credit card for backup. If you need to get cash out, you shouldn't have any issues finding an ATM, except in Iran, where foreign cards simply do not work.

Cash is definitely still the main payment method in most Asian countries, especially in Southeast Asia. ATMs aren't too hard to find, but that's highly dependent on what country you're in. U.S. dollars are sometimes more valuable than the local currency in countries such as Cambodia, Vietnam or Myanmar, so carry around some dollars for backup.

Regardless, remember to pack a card that doesn't charge foreign transaction fees and reimburses those pesky ATM fees. If your debit card charges foreign transaction fees, make larger withdrawals in the local currency to minimize those add-on charges. Make sure to have a secure wallet to carry all of your cash in. Cash is also important as you'll occasionally have to pay for certain visas with cash upon arrival.

You likely won't run into any issues finding an ATM in the big cities, but you may not be so lucky when on the outskirts. The U.S. dollar is highly valuable across the continent. In fact, many national parks only accept the U.S. dollar or the euro, so you should come prepared with a decent amount of U.S. cash in an assortment of bills. The local currency is preferred in smaller towns, which you can withdraw from a local ATM.

South America

Cash is king in South America and credit cards are not always accepted. Brazil is the exception here, with incredibly high rates of credit and debit card use. Elsewhere, you'll definitely be making lots of ATM trips while traveling through the continent, so be sure to alert your bank about where exactly you'll be traveling. The U.S. dollar is also commonly accepted, so it's always good to have some dollars in case. Note that all 12 countries on the continent have different currencies, so you won't want to take out too much of one currency if you plan to hop around.

U.S. dollars are the most widely accepted currency in the Caribbean, with the euro and other local currencies behind it. Similar to traveling through other regions, it's always good to carry around some cash in case, but credit cards are pretty widely accepted throughout the region. When you need to replenish your wallet, head to the ATM, as that's where you're likely to get the best exchange rate.

Note that if you're traveling to Cuba, the cash situation is much different than the other islands. U.S. dollars are not widely accepted. In fact, if you try to convert U.S. dollars to Cuban Convertible Pesos (used by foreign visitors), you'll often be charged a 10% commission by the government. Your best bet is to carry cash for daily spending, since U.S. credit and debit cards are not accepted in the country.

Other tips for saving money on currency conversion

Never underestimate the power of the U.S. dollar

While it's important to have local currency, you may receive a better effective exchange rate when using U.S. dollars. I'm often surprised by how much demand there is for U.S. currency in foreign countries, and I've had great success when offering to pay in dollars — especially at smaller stores and with merchants in a large bazaar.

On the other hand, hotel operators and other large companies often impose their own exchange rates, which can be very unfavorable. If you're paying in dollars or exchanging money, note that you'll often get the best rates on $100 and $50 notes, with smaller notes fetching a lower rate and old or worn bills not accepted for exchange in many places.

Be extremely careful in paying in the local currency

Dynamic Currency Conversion , or DCC, is a popular scam with merchants and credit card processors. Supposedly, this "service" offers you the opportunity to pay in your local currency, but it really just adds a huge commission. In theory, you're supposed to be asked to agree to this "service." Between language barriers and the merchant's incentive to earn a commission, many travelers get duped into these inflated charges. This happened to me when Hertz in Italy fraudulently added a 4.5% commission to my bill, but I successfully received a refund when I contacted its executive customer service.

Always contact your bank before you go

The only thing worse than paying extra fees for an ATM transaction is having your withdrawal declined. Yet this can happen if you travel overseas without notifying your bank in advance and it suspects fraud. Before you leave, call your bank and provide a list of the countries you plan on visiting, even if you just have a layover.

Bottom line

There's a time and a place to earn valuable points or miles by using a travel rewards credit card . Unfortunately, withdrawing money abroad is not one of them. By understanding the different surcharges you could face when using an ATM aboard and choosing the best debit cards to help you avoid withdrawal or foreign transaction fees at these ATMs, you can access cash in other countries at little to no cost.

Additional reporting by Jason Steele

Personal Finance

Best prepaid debit cards for 2024.

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created independently from TIME’s editorial staff. Learn more about it.

Prepaid debit cards—also known as “reloadable” debit cards—allow you to add money to your debit card in advance, so it’s there when you need it. Once you add money to the card, you can use it as you would use a traditional debit card. Uses might include withdrawing cash, paying bills, or purchasing online or in a store.

The main benefit of reloadable debit cards is the ability to add only as much money as you need. This prevents you from overdrawing your account or going into debt. Result—a flexibility that makes them a useful tool when it’s important to limit spending, such as with a child who gets their first debit card. The cards on this list are among the best prepaid debit cards available today.

Best prepaid debit cards compared 2024

Our recommendations for the best reloadable debit card, best for cash app customers: cash app card.

Why we picked it : The Cash Card is the logical choice if you frequently use Cash App, but it’s a good choice in general thanks to its $0 reload fees. The account has no minimum deposit or monthly fees, so you won’t have to worry about junk fees eating away at your balance.

If you regularly use Cash App, the Cash Card is a convenient way to access the money in your Cash App account. The card is a Visa , so it’s accepted at most online and retail stores. Stored balances on your Cash Card are FDIC-insured up to $250,000, so your money is safe. Another benefit of this card is that you can add offers via the Cash App, allowing you to save money on purchases.

However, this card doesn’t earn rewards in the form of cash back, so you won’t get extra earnings on every purchase. In addition, no free ATM network is available. You will pay $2.50 any time you make a withdrawal, even at in-network ATMs. Out-of-network ATMs may charge an additional fee.

- No monthly or annual fees.

- Get direct deposits up to two days early.

- Save money with Cash App Offers.

- Fees apply for instant deposits.

- There are daily and weekly ATM withdrawal limits.

Learn more on our full review .

Best for Paypal Customers: PayPal Prepaid Mastercard

PayPal Prepaid Mastercard®

Why we picked it : If you frequently send and receive money with PayPal, it could make sense to get the PayPal Prepaid Mastercard. It lets you access your PayPal balance with a physical card anywhere Mastercard is accepted. Plus, it doesn’t cost anything to add money to your account via direct deposit.

The PayPal Prepaid Mastercard is a prepaid debit card you link to your PayPal account. The card lets you transfer money from your PayPal account and add money at MoneyPass ATMs without incurring a fee. You can use the card anywhere Mastercard is accepted and it includes other features like direct deposit and cash reload. It also includes special offers called Payback Rewards that let you save money at select retailers.

- Link directly to PayPal account for easy transfers.

- Savings account with 5% APY on balances of up to $1,000.

- Early direct deposit available.

- $4.95 monthly fee.

- Must have a PayPal account to access all features.

- Cash reload fee of up to $3.95.

Best for Financial Education: GoHenry

GoHenry Debit Card

Why we picked it : Financial literacy is important, but GoHenry understands kids may not always be excited to learn about it. Its Money Missions feature provides fun videos and quizzes to teach kids and teens money skills even at a young age. Its allowance feature also allows parents to give kids an allowance automatically.

The GoHenry card is designed for kids and teens ages 6 to 18 to help them learn valuable financial skills. These include setting savings goals, making spending decisions, and tracking their balance. Kids can get paid for tasks like chores and receive an automatic allowance. In the app, parents can set spending limits, receive real-time notifications, and block or unblock the card. The app also has the option to set up donations to charities like the Boys & Girls Club of America.

- Teaches kids financial literacy

- Offers parental control

- No risk of overdrafts or debt for kids

- Requires a monthly subscription fee of $4.99 per child

- No investing options for children or parents

- No free ATM withdrawals

Best for Walmart customers: Walmart MoneyCard

Walmart Money Card

Why we picked it : Walmart is still the largest retailer in the U.S., maintaining a sizeable lead over Amazon in total sales. That means there are a lot of opportunities to earn cash back on Walmart purchases, and this card capitalizes on that, paying 3% on Walmart purchases. That, combined with other benefits like earning interest on savings, make this a great choice for Walmart customers.

Purchases at Walmart.com earn 3% cash back with this card, while purchases at Walmart fuel stations earn 2% cash back. At Walmart stores you will earn 1% cash back. You can also earn 2% annual percentage yield (APY) on savings, up to a maximum average daily balance of $1,000. There is also up to $200 of overdraft protection and no monthly fee. Despite this card’s benefits, there is a big caveat to keep in mind: Cash back is limited to just $75 annually.

- High cash-back rates.

- Early direct deposit.

- Mobile check deposit.

- Monthly fee if you don’t receive at least $500 in direct deposits.

- Foreign transaction fees, ATM withdrawal fees and other fees.

- $15 fee for overdrafts.

Best for pairing with a savings account: Netspend® Visa® Prepaid Card

Netspend® Visa® Prepaid Card

Why we picked it : NetSpend offers a high APY on its savings accounts, letting you earn a little extra on your savings. However, one caveat is that you only earn 5% APY on balances of up to $1,000. You also have to have the NetSpend Card, which has monthly fees of up to $9.95. Still, it’s nice to see that you can earn some interest with this account.

The Netspend® Visa® Prepaid Card has many benefits, including no credit check, no minimum balance requirements, and no activation fees. In addition, you can get paid via direct deposit up to two days early. There is also a “purchase cushion” that will cover you for up to $10 if you don’t have enough money to pay for a purchase.

- No minimum balance or activation fees.

- No credit check required.

- Earn a high yield with a linked savings account.

- $9.95 per month for the monthly plan.

- Pay-as-you-go plan charges $1.95 per transaction.

- No fee-free ATM network.

Best for building credit: Extra Debit Card

Extra Debit Card

Why we picked it : This card can help you build credit, reporting your credit usage to credit bureaus Experian and Equifax at the beginning of the month. The caveat is that it doesn’t report to TransUnion. It’s also impressive that it helps you build credit without requiring a credit check. This means you can get credit-building benefits without a negative impact on your credit score.

The Extra Debit Card is issued by Evolve Bank & Trust or Patriot Bank, N.A. With the Extra Debit Card , you use Plaid to connect the card to your existing bank account. It then uses your bank account balance to assign you a spending limit, which it calls Spend Power. When you buy something with the card, Extra covers the transaction and then pays itself back the next business day.

Although Extra reports your on-time and late payment activity to credit bureaus, a credit check isn’t necessary since you use your checking account balance to pay for your purchases. Two plans are available with this card: The Credit Building plan costs $20 per month or $150 per year. You can also opt for the Credit Building + Rewards plan, which costs $25 per month or $199 per year. With the rewards plan, you can earn 1% in points for everyday purchases.

- Reports credit usage to Experian and Equifax monthly.

- Earns 1% cash back.

- Cheapest plan costs $149 per year

- Doesn’t report to TransUnion.

- Plan that earns rewards is more expensive.

Best for No Credit Check: Current Build

Current Build Card

Why we picked it : Access to credit-building features can be rare with prepaid cards, especially if you want to avoid fees. That’s not the case with the Current Build Card, as it reports to credit bureaus and charges no monthly or annual fees. Credit cards in this sector can sometimes hold people back, but the Current Build Card is a clear exception.

The Current Build Card is a secured credit card designed to help you build credit while you bank. No credit check is required, making it ideal for people with poor or limited credit. With this card, you add cash to your Current account, which becomes your spending limit. When you spend money with the card, Current sets money aside to cover the amount of the transaction.

Since the money in your account is equal to your card’s limit, it won’t let you overdraw with the card. Current also reports your activity to credit bureaus, allowing you to build credit while using the card. There is no APR, either, so using the card won’t result in burdensome interest costs.

- No annual fee or APR.

- Helps build credit

- $3.50 fee to add cash to your account.

- Can’t upgrade to an unsecured card.

- Requires a current account.

Best for avoiding fees: Bluebird by American Express

Bluebird Prepaid Debit Card

Why we picked it : The last thing prepaid debit card users need is to be hit with a slew of unnecessary fees, and that’s where the Bluebird card stands out. There are no monthly fees, foreign transaction fees or fees to add cash at Family Dollar. It even gives you access to early direct deposit for free.

The Bluebird by American Express has the lowest fees overall. It won’t nickel-and-dime you with card fees or monthly fees. In addition, there are no cash reload fees at Family Dollar and a lower $3.74 fee at Walmart locations. You can make free cash withdrawals at 37,000 locations in the MoneyPass ATM network. Plus, you can use the card to get paid up to two days sooner with Early Direct Deposit.Pros:

- No monthly fees.

- Free withdrawals at MoneyPass ATMs.

- Supports mobile check deposit.

- $5 fee to get a card.

- Reload fees of up to $3.95.

- There are daily and monthly spending limits.

Best for earning rewards: Serve American Express Prepaid Debit Account

Serve Prepaid Debit Card

Why we picked it : For the right customer, this card can be free to use and earn some extra cash back. Specifically, it’s ideal for those who receive a direct deposit of at least $500, as that lets you avoid the monthly fee. Notably, customers in New York, Texas, and Vermont can also avoid the monthly fee even without a direct deposit.

The Serve prepaid debit account from Amex earns unlimited 1% cash back on in-store and online purchases. Funds are added to your account as soon as the transaction settles with Serve. Debit cards, as opposed to credit cards , aren’t known for earning cash back, making the Serve prepaid debit account a notable exception. You can redeem your cash back on purchases made in-store or online.

- Earns cash back.

- No monthly fees with a $500 direct deposit.

- Free ATM network.

- A monthly fee applies if you don’t receive the minimum direct deposit.

- Charges fees for out-of-network withdrawals.

- Charges foreign transaction fees.

Best for supporting underserved communities: ONE VIP Visa Prepaid Card

ONE VIP Visa Prepaid Card

Why we picked it : If voting with your wallet is important to you, it’s worth taking a look at the ONE VIP Visa. It earns 1.5% cash back on Netflix, Uber and Sephora purchases. It also earns 1.5% cash back at select Black-owned businesses. All other purchases earn 0.5% cash back.