Meal Allowances for Employees: Everything You Need to Know

A meal allowance, also known as a food allowance, meal stipend, or employee meal benefit, is a predetermined amount of money provided to employees for the purpose of purchasing food.

Updated April 2, 2024 by Sarah Bedrick

Meal allowances, also known as food allowances, are a relatively old concept. Depending on a person's functional role within an organization, companies would give their people meal stipends to use when on travel and/or taking out customers or prospective clients.

Fast forward to today, the idea of a meal stipend has transformed quite a bit. Meal stipends are gaining traction because organizations that once catered in-office lunches or snacks for their people are now realizing their limitations. They are now implementing more inclusive ways to support their employees' food needs and give them the power of choice.

We developed this guide to give you everything you need to know about meal stipends.

Here's what is covered in this guide:

What is a meal stipend?

- Examples of meal stipends

- What people spend their food stipends on

Benefits of food stipends

- Finding the budget

- How to create one for your organization

First, a definition:

A meal stipend is a predetermined amount of money provided to employees for the purpose of purchasing food.

The stipend funds can be used for buying lunch for remote employees , or items like snacks, groceries, and beverages that will make their working experience more convenient, healthy, productive, and supported. Some even call them a grocery allowance because they're so flexible for your employee's food needs. It's easy to see why meal stipends are one of the best employee benefits .

Ready to offer a meal allowance stipend?

Compt customers see 90%+ employee engagement rates!

Who Offers Meal Allowances Today

The tech industry, typically a first mover when it comes to unique employee benefits, has many companies that offer meal benefits. The BuiltIn community of tech startups, for example, lists over 1,000 different companies with "some meals provided" and a smaller number offering "free daily meals".

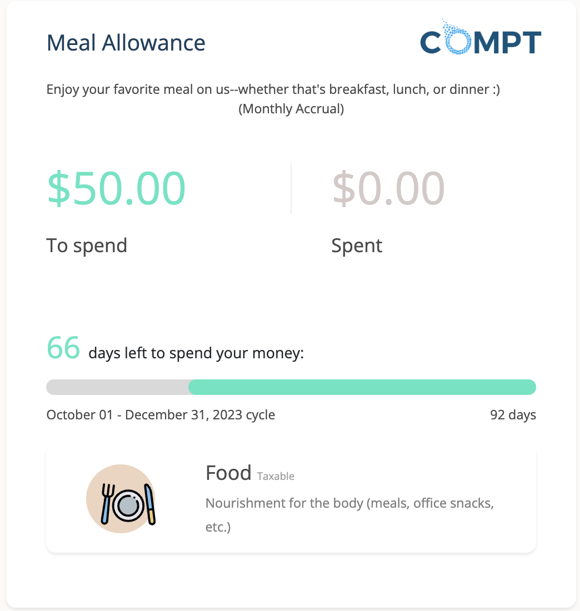

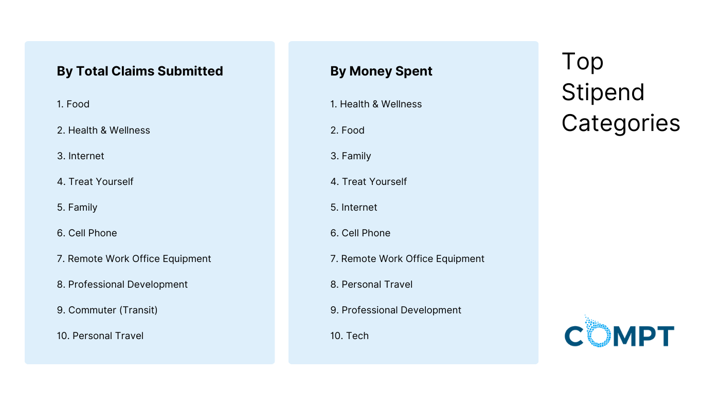

As we detail in our 2024 Lifestyle Benefits Benchmarking Study where we analyzed Compt customer stipend usage data, Food was the #1 category in which employees submitted claims.

Examples of Meal Allowances

Below are a few examples of top companies supporting their people with food allowances:

1. MasterClass

MasterClass's employee perks include $120/month as an interim snack stipend (due to COVID).

2. Snapchat

Snapchat gives its people $16/day for food .

Depending on the office, SAP would provide in-house catered meals or a food stipend .

Webflow has not set a meal-only stipend, but they do have a " Remote Work Stipend " which includes the option to buy food, tech, and productivity-related items.

5. Lose It!

Lose It! gives their employees $100 to spend on lunch delivery.

What do people spend their meal allowance stipend on?

- Breakfast, lunch, or dinner

- Snacks for their home office

- Coffee, tea, and other beverages

- Protein bars and meal replacement shakes

- Takeout or delivery

- Healthy food kits such as Blue Apron, Hello Fresh, and Purple Carrot

- Healthy prepared food options such as Freshly

Meal allowances for travel

Whether your employee is away for a few hours or staying for several days to attend a conference, it's likely they will incur meal expenses during their trip.

In such situations, providing a meal stipend to cover business-related meals such as breakfast, lunch, or dinner is a viable option. However, it's important to establish a clear meal allowance policy for employees to refer to before embarking on their journeys.

The federal Meals & Incidental Expenses (M&IE) rate serves as the standard benchmark for reimbursing employees for their business-related meal expenses while traveling. For the year 2023, the rate stands at $59 per day for most small localities in the United States. If you are considering a meal allowance for employee work-related travel, check out our Expense Management product suite, as these are considered business expenses.

Note that per diems are not considered wages and therefore are non-taxable.

Whether your team is in-office, remote, or hybrid, there are plenty of benefits to offering your people a meal allowance. Below we highlight the most common five.

1. Happier people and increased productivity

Your people will purchase the food they genuinely need to make their remote work life easier and more comfortable. When people can easily refuel in ways that satisfy their convenience, tastebuds, and dietary needs, they're happier and more productive.

2. Attract & retain talent

Catered meals were a staple in many offices across the nation pre-COVID. However, how many companies have been able to continue this since COVID began? Not too many.

As this Protocol piece points out , people are mourning the loss of their free lunches and snacks. You can stand out against the crowd by adapting and offering a food stipend today so that your employees get support for their most basic life needs.

3. Equitable & inclusive

Today more than ever, people's diets are varied due to preferences, intolerances, and allergies. With a food stipend or grocery allowance you're able to create an employee lifestyle benefit that supports everyone, regardless of whether they're paleo, vegetarian, vegan, gluten-free, dairy-free, and more.

4. Cost-effective

If offering free lunches or meals to your people is a priority, this is one of the most cost-effective ways to do so.

Catered meals on-site are a thing of the past and it is also a time-consuming process to make sure the right amount of food is delivered, at the right time, while also ensuring people have the food they need (e.g. paleos, vegetarians, vegans), and the office space is cleaned up afterward.

Food allowances allow people to get their favorite foods while sticking to a budget, and without worrying about the time or costs of cleaning up.

If you want to see why they're so cost-effective, see how much you could be saving by using Compt to manage your meal stipend .

5. Scalable

A food stipend is an easy and scalable way to set your people up with the food they want. Additionally, the right perk management software can also help ensure that taxes are accounted for, always.

Learn more about the benefits of an employee stipend program.

Download the free guide to find out why employee stipends and lifestyle spending accounts are now the most common company perk.

How to find the budget for a meal stipend

At first glance, it might feel like you have to create a new budget for this, and while that might be the case, there are other options to find the budget. Below we break down the various options to creating a meal allowance program, by either getting new budget approved or consolidating an existing budget.

Option 1: Create a new budget

If you've already decided this is an important endeavor for your company and its people, then you're set!

If using a perk solution, be sure to count this cost into the budget. Or if you're managing them manually, you need to find a way to quantify this cost as well since the cost of time and labor to manage these is often a more hidden cost that will fall on HR.

Option 2: Transition existing food or snack budgets

If offering on-site catering for your people is a thing of the past, and that budget is still available, transition this money into a meal allowance. Learn how Compt can help you manage a meal stipend .

Option 3: Transition existing perks

According to a recent SHRM report , about one-third of companies plan to extend the option for remote and hybrid work into the future.

To remain competitive for talent, companies need to evolve their fringe benefits and stipends to meet the needs of current and prospective employees. If you're looking for a way to serve your people in unbelievably meaningful ways, transition the "old perk budget" into a meal allowance, or even a remote work stipend or general perk stipend .

Use our helpful calculator to determine the cost of your perk vendors , and how much you can save by switching to food stipends with Compt .

Office pizza parties and branded thermo mugs just aren't cutting it anymore

How to set up a meal stipend:.

Setting up a meal allowance isn't a heavy lift for HR teams. Below we break them down into two steps.

1. First determine how much you want to offer your people and within what timeframe.

Look to the examples above if you need inspiration, or use our Perk Vendor Cost Calculator which can help you identify the budget.

Keep in mind, you don't need to offer a lot of money to make a big difference.

2. Decide how you’ll manage the program.

There are three ways to manage a stipend program, and they include:

1) Managing the process manually.

If you choose this option, you'll need to set up a process to track employee food purchases, collect receipts, manage balances, process approval and paid-out food perks, as well as rejections or ones which need further review.

Keep in mind that food allowances are a taxable benefit !

Because of this, you might want to use Google forms to track submissions, excel or Google sheets to track progress, and create a process to track the nontaxable vs taxable (for IRS compliance).

2) Select an expense software to manage it.

Expense software solutions like Expensify and Concur are largely meant for business expenses which these are not.

If using this option, make sure every employee has an account with your company's expense software option and that you've also set up a way to track the individual employee food budgets (this prevents overspending), and work with your finance team to identify and execute on the best plan for accounting for taxes.

3) Select a lifestyle benefits software to manage it.

Options for employee stipend solutions have grown tremendously over the past few years as more people turn to inclusive and flexible options for their people.

This kind of software can be especially helpful if it explains your food program details to your team members (and supports communication in remote teams ), tracks their spending balances, and spending. Perk solutions should streamline your admin by having important information at your employees' fingertips.

Other types of stipends

There are more stipends than just a meal allowance. Have you done an employee benefits survey to see what kind of perks your team may want?

Do a Google search for “top perks” and inside almost every list is a surprising number of perk stipends.

- 7 Startups With the Coolest Perks — 1 of 7 are perk stipends

- 25 Best Companies for Perks and Benefits — 4 of the 25 companies offer stipends

- 15 Cool Job Perks That Keep Employees Happy — 3 of 15 are perk allowances

So what are the other types of stipends or allowances? Below is a list of a few more you can consider implementing.

- Health & wellness stipend

- Learning & development stipend

- Cell phone stipend

- Remote work stipend

- Internet stipend

- Travel stipends

- Charitable giving stipend

- Pet care stipends

- Student loan stipends

- Anniversary bonus

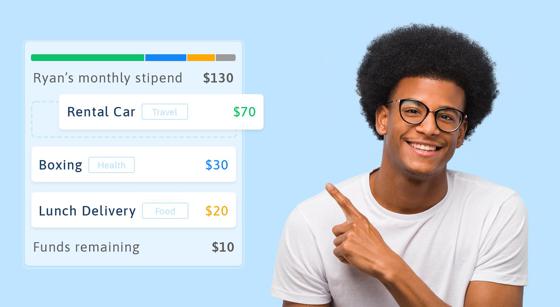

- General perk stipend : Companies combine one or more of the stipends above together to create a general perk stipend that allows employees to pick from many spending categories. The example below shows Sam's stipend which includes the learning, health, and food categories.

Stipends or allowances make it possible for companies to offer more perks as lifestyle benefits with less money and while ensuring that they're personalized to meet the needs of their people.

Sarah Bedrick

Chief Marketing Officer

Prior to Compt, Sarah worked at HubSpot for 6+ years, where she helped to build, scale, and grow the HubSpot Academy division. She is obsessed with understanding what makes a company culture great, being a career and life coach to people in tech, and creating cherished memories with her husband and two young kids. Her favorite Compt stipend category is Health & Wellness.

See how a meal stipend program can satisfy your team

Let's connect to see how a meal allowance - or any other flexible lifestyle benefit - can cater to all of your people's unique needs.

Login Register

Pay calculator tool

Find wages and penalty rates for employees.

Leave calculator tool

Work out annual and personal leave

Shift calculator

Rates for your shifts

Notice and redundancy calculator

- Accessibility

- Subscribe to email updates

- Visit Fair Work on YouTube

- Visit Fair Work on Twitter

- Visit Fair Work on Facebook

- Visit Fair Work on Instagram

- Visit Fair Work on LinkedIn

Automatic translation

Our automatic translation service can be used on most of our pages and is powered by Microsoft Translator.

Language help

For professionally translated information, select your language below.

Popular searches

- minimum wages

- annual leave

- long service leave

Allowances, penalty rates and other payments

Employees may be entitled to a higher pay rate for working at particular times of the day or on certain days of the week.

On this page:

Penalty rates, allowances or other entitlements, stand downs and pay during severe weather or natural disasters, tools and resources, related information.

Some employees may be entitled to a higher pay rate for working at particular times of the day or on certain days of the week. This may include:

- working on a weekend or public holiday

- working late at night or early in the morning

- working extra hours.

Find out more on our Penalty rates and Overtime pay pages.

Employees may also be entitled to an allowance or other entitlements where they:

- need to wear special clothing at work

- work in a workplace that damages or dirties their clothes or footwear

- use their own vehicle for work

- spend time travelling for work.

Find out more on our Allowances and Uniforms, vehicle and travel entitlements pages.

Use our Pay and Conditions Tool to calculate penalty rates and allowances in your industry.

The specific penalty rates or allowances that an employee needs to be paid depends on the award, agreement or other industrial instrument that applies. There can be other workplace arrangements in place that affect this including salary arrangements, employment contracts or individual flexibility arrangements (IFAs).

Employees need to be paid at least the amounts that they’re entitled to under the applicable award, regardless of the workplace instrument or arrangement in place.

There are limited circumstances where an employer can stop paying an employee or an employee’s pay and entitlements can be reduced. This includes:

- where an employee has been stood down because there is no useful work for an employee due to events beyond the control of the employer

- events such as severe and inclement weather where it is unreasonable or unsafe to continue work, or

- when a natural disaster affects a business.

Find out more at:

- Stand downs

- Pay during severe or inclement weather and natural disasters

- Pay and Conditions Tool

- Minimum wages

- Paying wages

Help for small business

- Find tools, resources and information you might need in our Small Business Showcase .

The Fair Work Ombudsman acknowledges the Traditional Custodians of Country throughout Australia and their continuing connection to land, waters, skies and communities. We pay our respects to them, their Cultures, and Elders past, present and future.

Thank you for your feedback. If you would like to tell us more about the information you’ve found today you can complete our feedback form .

Please note that comments aren't monitored for personal information or workplace complaints. If you have a question or concern about your job, entitlements or obligations, please Contact us .

Bookmark to My account

- Get priority support!

- Save results from our Pay, Shift, Leave and Notice and Redundancy Calculators

- Bookmark your favourite pages

- Ask us questions and save our replies

- View tailored information relevant to you.

Log in now to save this page to your account.

- Fair Work Online: www.fairwork.gov.au

- Fair Work Infoline: 13 13 94

Need language help?

Contacting the Translating and Interpreting Service (TIS) on 13 14 50

Hearing & speech assistance

Call through the National Relay Service (NRS):

- For TTY: 13 36 77 . Ask for the Fair Work Infoline 13 13 94

- Speak & Listen: 1300 555 727 . Ask for the Fair Work Infoline 13 13 94

The Fair Work Ombudsman is committed to providing you with advice that you can rely on. The information contained in this fact sheet is general in nature. If you are unsure about how it applies to your situation you can call our Infoline on 13 13 94 or speak with a union, industry association or a workplace relations professional.

Printed from fairwork.gov.au Content last updated: 2023-10-30 © Copyright Fair Work Ombudsman

All You Need To Know About Business Travel Meal Expenses

Home » Corporate Travel » All You Need To Know About Business Travel Meal Expenses

When planning to send an employee on a business-oriented trip or to an event for company exposure, one overlooked aspect of travel planning is business travel meal expenses. Yes, it is quite easy to forget to plan for a traveling employee’s meal allowances amongst all the other tasks like hotel bookings and flight check-ins. However it is an essential component of the overall travel. Therefore, let’s see how to plan for this important and inevitable expense of business travel.

How do we define business meal expenses?

Meal expenses can occur in many different circumstances. Travel managers should be vigilant while mentioning the expenses that will paid by the company and that which are not. They should communicate the same with the employee as well.

1. Meal allowance for business travel

When an employee has to travel for a meeting with prospective clients or with representatives of a stakeholding company, business meals will make up for an important expense. These expenses should be paid by the company or should be reimbursed if the employee is paying for it out of their pockets.

2. Dining with a client or prospect

Often a business will find themselves hosting their clients for a meeting or inviting over prospective clients to discuss details or sign the dotted line for future collaboration. In these instances, some employees involved with the project will have to take the client or the prospect teams on a dinner following a successful meeting or perhaps even if the meeting did not go as expected. These dinners can be quite expensive, and the hosting business should bear the costs, as trying to be economical in these instances might send the wrong message to the guests.

3. Meal expenses when attending conferences

Business events and conferences often provide a complimentary meal, whether it be a lunch or dinner to all attendees post the completion of the event. But it is not always provided by the house. Further going to a conference usually is not a one-day activity, flights are booked with a day in hand before and the return is booked for the day after. An employee would have to pay out of pocket for plenty of other meals, if not covered by their employers.

Importance of covering meal expenses of a traveling employee

In common, employees attend a business meeting or corporate event in a foreign place on account of doing a job. Meal expenses that come with the travel assignment are expenses made towards the successful completion of a corporate task. Therefore the employer must reimburse the employee for any meal expenses made. Businesses can also provide the employees with a company credit card or similar means to cover meal expenses during the travel.

Different ways of covering meal expenses

1. prepaid corporate cards.

Prepaid corporate expense cards are cards already paid for by the business. They are provided to traveling employees to cover travel-related expenses while on the trip within the allotted amount. Such a card will also cover meal expenses when necessary.

2. Virtual corporate wallets

Prepaid virtual wallets function the same way as their prepaid card counterpart, apart from existing virtually. With virtual transactions becoming predominantly the main form of money transfer with vendors and service providers today, virtual wallets are very convenient.

3. Corporate credit cards

Credit cards come with the added benefit of having an expense limit and corporate can review and evaluate all expenses after the trip and pay the card balance accordingly.

4. Post-trip reimbursement

Though considered unconventional today, reimbursing an employee after they have paid out of pocket for all expenses and provided an expense report to the corporate is also a possibility.

What is included in business travel meal allowance?

Should be included

- Breakfast, lunch, and dinner expenses while on business trips or attending conferences

- Meal expenses incurred when hosting clients and prospects

- Expenses incurred when inviting a client or prospects to a meal

- Expenses for special meals for specific health conditions or religious beliefs of an employee. E.g.: Gluten free or Halal foodp

Should not be included

- Snacking expenses are usually not covered by the corporate

- Expenses incurred when attending an informal or unnecessary party or event during a business trip

- Alcohol expenses are also not covered by the corporate but some exceptions to this can be found

- Amidst all this, there are always certain gray areas where considerations as per the requirement of the situation, can be made

Meal expenses are given when considering business travel or when hosting clients. Pre-planning for meal expenses can be a useful exercise in proper budget allocation. While most travel managers deem it secondary in importance to many other decisions like flight and hotel booking, it is a crucial decision to make for the well-being of the employees. It further ensures a smooth completion of the task at hand for the employees.

Suggested Read: Top 5 Health Tips For Frequent Business Travelers

Business Travel Meal Expenses FAQs

What is a business meal expense.

Business meal expenses can be broadly defined as expenses made towards meals when traveling or eating out locally for the economic or social growth of the company.

What are the different ways of covering an employee’s business meal expenses?

Prepaid corporate cards, prepaid virtual wallets, corporate credit cards, and post-expense reimbursement.

What should fall under business meal expenses?

Three meals of the day, breakfast, lunch, and dinner when traveling for corporate goals. Along with expenses incurred when hosting clients, also additional expenses are incurred if the employee in question needs a special meal like a gluten-free, dairy-free, or Halal meal.

What should not fall under business meal expenses?

Unnecessary snacks, alcohol, and expenses incurred to attend irrelevant parties/social events when on a business trip should not be considered business meal expenses.

Pratyush is a traveling enthusiast who always looks for innovations in business travel management. He has 5 years of experience writing content on corporate travel management and working closely with expert business travel facilitators.

Related Posts

Travel And Expense Policy: Objectives Of Corporate T&E Policy

Among an organization’s most prominent controllable costs, business travel expense is the second largest after salaries. It impacts the organization’s bottom-line irrespective of the company’s size. While ‘travel and expense’ are unavoidable because of their Read more…

What Is The Meaning Of Open Booking?

Open booking refers to a travel booking approach where employees have the freedom to book their travel arrangements outside of the traditional corporate travel management system. Instead of using a designated platform, employees can book Read more…

Corporate Expense Cards: Types And Benefits

Corporate expense cards for travel ensure easy payment and streamlined management of expenses. These cards can be of any type such as corporate credit cards, prepaid corporate cards, VCC, Airline specific cards, and many more. Read more…

Let's get started!

Thanks for submitting your details.

We'll get back to you shortly.

General Retail Industry Award 2020

This Fair Work Commission consolidated modern award incorporates all amendments up to and including 2 April 202 4 ( PR772934 ).

Clause(s) affected by the most recent variation(s):

15—Ordinary hours of work and rostering arrangements

Table of Contents

[Varied by PR746868 , PR747326 , PR750473 ]

Part 1— Application and Operation of this Award . 4

1. Title and commencement 4

2. Definitions . 4

3. The National Employment Standards and this award . 7

4. Coverage . 7

5. Individual flexibility arrangements . 10

6. Requests for flexible working arrangements . 11

7. Facilitative provisions . 12

Part 2— Types of Employment and Classifications . 13

8. Types of employment 13

9. Full-time employees . 13

10. Part-time employees . 14

11. Casual employees . 16

12. Apprentices . 17

13. Junior employees . 19

14. Classifications . 19

Part 3— Hours of Work . 20

15. Ordinary hours of work and rostering arrangements . 20

16. Breaks . 25

Part 4— Wages and Allowances . 26

17. Minimum rates . 26

18. Payment of wages . 32

19. Allowances . 33

20. Superannuation . 37

Part 5— Overtime and Penalty Rates . 39

21. Overtime . 39

22. Penalty rates . 43

Part 6— Shiftwork . 44

23. Application of Part 44

24. What is shiftwork . 44

25. Rate of pay for shiftwork . 44

26. Rest breaks and meal breaks . 46

27. Rostering restrictions . 46

Part 7— Leave and Public Holidays . 46

28. Annual leave . 46

29. Personal/carer’s leave and compassionate leave . 52

30. Parental leave and related entitlements . 52

31. Community service leave . 52

32. Family and domestic violence leave . 52

33. Public holidays . 53

Part 8— Consultation and Dispute Resolution . 54

34. Consultation about major workplace change . 54

35. Consultation about changes to rosters or hours of work . 55

36. Dispute resolution . 55

Part 9— Termination of Employment and Redundancy . 56

37. Termination of employment 56

38. Redundancy . 58

Schedule A —Classification Definitions . 60

Schedule B —Summary of Hourly Rates of Pay . 71

Schedule C —Summary of Monetary Allowances . 99

Schedule D —School-based Apprentices . 102

Schedule E —Supported Wage System .. 104

Schedule F — Agreement to Take Annual Leave in Advance . 108

Schedule G —Agreement to Cash Out Annual Leave . 109

Part 1—Application and Operation of this Award

1. Title and commencement

1.1 This is the General Retail Industry Award 2020 .

1.2 This modern award commenced operation on 1 January 2010. The terms of the award have been varied since that date.

1.3 A variation to this award made by the Fair Work Commission does not affect any right, privilege, obligation or liability acquired, accrued or incurred under this award as in force before that variation.

2. Definitions

[Varied by PR733977 , PR750473 ]

In this award:

Act means the Fair Work Act 2009 (Cth).

adult apprentice means an apprentice who is 21 years of age or over at the start of their apprenticeship.

adult employee means an employee who is 21 years of age or over.

[Definition of casual employee inserted by PR733977 from 27Sep21]

casual employee has the meaning given by section 15A of the Act .

community pharmacy means a business to which all of the following apply:

(a) the business is established wholly or partly for compounding or dispensing prescriptions for, or selling medicines or drugs to, the general public from the premises on which the business is conducted, whether or not other goods are so sold from those premises; and

(b) if required to be registered under legislation for the regulation of pharmacies in force in the place in which the premises on which the business is conducted are located, the business is so registered; and

(c) the business is not owned by a hospital or other public institution or operated by government.

defined benefit member has the meaning given by the Superannuation Guarantee (Administration) Act 1992 (Cth).

employee means a national system employee as defined by section 13 of the Act .

employer means a national system employer as defined by section 14 of the Act .

enterprise instrument has the meaning given by subitem 2(1) of Schedule 6 to the Fair Work (Transitional Provisions and Consequential Amendments) Act 2009 (Cth).

exempt public sector superannuation scheme has the meaning given by the Superannuation Industry (Supervision) Act 1993 (Cth).

Fair Work Regulations means the Fair Work Regulations 2009 (Cth).

fast food operations means an operation taking orders for, preparing, selling or delivering any of the following (or doing any combination of 2 or more of those things):

(a) food or beverages sold primarily for consumption away from the point of sale; or

(b) food or beverages packaged, sold or served in such a way as to allow them to be consumed away from the point of sale should the customer so decide; or

(c) food or beverages sold or served in food courts, shopping centres or retail complexes, excluding coffee shops, cafes, bars and restaurants that primarily provide a sit down service.

general retail industry is defined in clause 4.2.

immediate family has the meaning given by section 12 of the Act .

junior employee means an employee who is less than 21 years of age.

[Definition of long term casual employee deleted by PR733977 from 27Sep21]

MySuper product has the meaning given by the Superannuation Industry (Supervision) Act 1993 (Cth).

National Employment Standards , see Part 2-2 of the Act . Divisions 3 to 12 of Part 2-2 of the Act constitute the National Employment Standards . An extract of section 61 of the Act is reproduced below.

The National Employment Standards are minimum standards applying to employment of employees. The minimum standards relate to the following matters:

(a) maximum weekly hours (Division 3);

(b) requests for flexible working arrangements (Division 4);

[Paragraph (ba) inserted by PR733977 ppc 27Sep21]

(ba) offers and requests for casual conversion (Division 4A);

(c) parental leave and related entitlements (Division 5);

(d) annual leave (Division 6);

[Paragraph (e) varied by PR750473 ppc 15Mar23]

(e) personal/carer’s leave, compassionate leave and paid family and domestic violence leave (Division 7);

(f) community service leave (Division 8);

(g) long service leave (Division 9);

(h) public holidays (Division 10);

(i) notice of termination and redundancy pay (Division 11);

(j) Fair Work Information Statement (Division 12).

on-hire means the on-hire of an employee by their employer to a client, where the employee works under the general guidance and instruction of the client or a representative of the client.

[Definition of regular casual employee inserted by PR733977 from 27Sep21]

regular casual employee has the meaning given by section 12 of the Act .

shiftworker means an employee to whom Part 6—Shiftwork applies.

shop with departments or sections means a shop that has a clearly distinguishable department or section staffed by a manager and at least 3 subordinate employees who work solely or predominantly in that department or section.

standard hourly rate means the minimum hourly rate for a Retail Employee Level 4 in Table 4—Minimum rates .

standard weekly rate means the minimum weekly rate for a Retail Employee Level 4 in Table 4—Minimum rates .

State reference public sector modern award has the meaning given by subitem 3(2) of Schedule 6A to the Fair Work (Transitional Provisions and Consequential Amendments) Act 2009 (Cth) .

State reference public sector transitional award has the meaning given by subitem 2(1) of Schedule 6A to the Fair Work (Transitional Provisions and Consequential Amendments) Act 2009 (Cth) .

Table 1—Facilitative provisions means the Table in clause 7.2.

Table 2—Span of hours means the Table in clause 15.1.

Table 3—Entitlements to meal and rest break(s) means the Table in clause 16.2.

Table 4—Minimum rates means the Table in clause 17.1.

Table 5—Junior rates (retail employee levels 1, 2 and 3 only) means the Table in clause 17.2.

Table 6—4 year apprentice minimum rates (pre-January 2014 start) means the Table in clause 17.3(a).

Table 7—4 year apprentice minimum rates (start January 2014 or later) means the Table in clause 17.3(b).

Table 8—3 year apprentice minimum rates (pre-January 2014 start) means the Table in clause 17.3(c).

Table 9—3 year apprentice minimum rates (start January 2014 or later) means the Table in clause 17.3(d).

Table 10—Overtime rates means the Table in clause 21.2(e).

Table 11—Penalty rates means the Table in clause 22.1.

Table 12—Period of notice means the Table in clause 37.1.

video shop means a business the primary function of which is the hire to the public of videos, DVDs or electronic games.

3. The National Employment Standards and this award

3.1 The National Employment Standards (NES) and this award contain the minimum conditions of employment for employees covered by this award.

3.2 Where this award refers to a condition of employment provided for in the NES , the NES definition applies.

3.3 The employer must ensure that copies of this award and of the NES are available to all employees to whom they apply, either on a notice board conveniently located at or near the workplace or through accessible electronic means.

4. Coverage

[Varied by PR764967 ]

4.1 This industry award covers, to the exclusion of any other modern award:

(a) employers in the general retail industry throughout Australia; and

[4.1(b) varied by PR764967 ppc 08Aug23]

(b) employees (within a classification defined in Schedule A—Classification Definitions) of employers mentioned in clause 4.1(a).

4.2 general retail industry means the retail sale or hire of goods or services for personal, household or business consumption including:

(a) clothing; and

(b) food; and

(c) furniture and household goods; and

(d) personal and recreational goods; and

(e) bakery shops at which the predominant activity is baking products for sale on the premises; and

(f) the provision of repair services for household equipment; and

(g) the provision of customer information or assistance at retail complexes; and

(h) the delivery of newspapers by employees of a newsagent,

but excluding the following that are covered by other awards:

(i) the retail sale or hire of goods or services by any of the following:

(i) community pharmacies; or

(ii) pharmacies in hospitals or other institutions providing an in-patient service; or

(iii) hair and beauty establishments; or

(iv) stand-alone butcher shops; or

(v) stand-alone nurseries; or

(vi) manufacturing or processing establishments other than seafood processing establishments; and

(j) hair and beauty work undertaken in the theatrical, amusement or entertainment industries; and

(k) clerical functions performed away from a retail establishment; and

(l) warehousing and distribution; and

(m) motor vehicle retailing and motor vehicle fuel and parts retailing; and

(n) restaurants, cafes, hotels, motels or fast food operations; and

(o) building, construction, installation, repair or maintenance contractors engaged to perform work at a retail establishment.

4.3 This industry award also covers:

(a) on-hire employees working in the general retail industry (with a classification defined in Schedule A—Classification Definitions) and the on-hire employers of those employees; and

(b) apprentices or trainees employed by a group training employer and hosted by an employer covered by this award to work in the general retail industry (with a classification defined in Schedule A—Classification Definitions) at a location where the employees mentioned in clause 4.1(b) also perform work and the group training employers of those apprentices or trainees.

4.4 However, this industry award does not cover any of the following:

(a) employees excluded from award coverage by the Act ; or

NOTE: See section 143(7) of the Act .

(b) employees covered by a modern enterprise award or an enterprise instrument or their employers; or

(c) employees covered by a State reference public sector modern award or a State reference public sector transitional award or their employers; or

(d) employers covered by any of the following awards:

(i) the Fast Food Industry Award 2010 ; or

(ii) the Meat Industry Award 2020 ; or

(iii) the Hair and Beauty Industry Award 2010 ; or

(iv) the Pharmacy Industry Award 2020 .

4.5 If an employer is covered by more than one award, an employee of that employer is covered by the award containing the classification that is most appropriate to the work performed by the employee and the industry in which they work.

NOTE: An employee working in the general retail industry who is not covered by this industry award may be covered by an award with occupational coverage.

5. Individual flexibility arrangements

5.1 Despite anything else in this award, an employer and an individual employee may agree to vary the application of the terms of this award relating to any of the following in order to meet the genuine needs of both the employee and the employer :

(a) arrangements for when work is performed; or

(b) overtime rates; or

(c) penalty rates; or

(d) allowances; or

(e) annual leave loading.

5.2 An agreement must be one that is genuinely made by the employer and the individual employee without coercion or duress.

5.3 An agreement may only be made after the individual employee has commenced employment with the employer.

5.4 An employer who wishes to initiate the making of an agreement must:

(a) give the employee a written proposal; and

(b) if the employer is aware that the employee has, or should reasonably be aware that the employee may have, limited understanding of written English, take reasonable steps (including providing a translation in an appropriate language) to ensure that the employee understands the proposal.

5.5 An agreement must result in the employee being better off overall at the time the agreement is made than if the agreement had not been made.

5.6 An agreement must do all of the following:

(a) state the names of the employer and the employee; and

(b) identify the award term, or award terms, the application of which is to be varied; and

(c) set out how the application of the award term, or each award term, is varied; and

(d) set out how the agreement results in the employee being better off overall at the time the agreement is made than if the agreement had not been made; and

(e) state the date the agreement is to start.

5.7 An agreement must be:

(a) in writing; and

(b) signed by the employer and the employee and, if the employee is under 18 years of age, by the employee’s parent or guardian.

5.8 Except as provided in clause 5.7(b) , an agreement must not require the approval or consent of a person other than the employer and the employee.

5.9 The employer must keep the agreement as a time and wages record and give a copy to the employee.

5.10 The employer and the employee must genuinely agree, without duress or coercion to any variation of an award provided for by an agreement.

5.11 An agreement may be terminated:

(a) at any time, by written agreement between the employer and the employee; or

(b) by the employer or employee giving 13 weeks’ written notice to the other party (reduced to 4 weeks if the agreement was entered into before the first full pay period starting on or after 4 December 2013).

NOTE: If an employer and employee agree to an arrangement that purports to be an individual flexibility arrangement under this award term and the arrangement does not meet a requirement set out in section 144 of the Act then the employee or the employer may terminate the arrangement by giving written notice of not more than 28 days (see section 145 of the Act ).

5.12 An agreement terminated as mentioned in clause 5.11(b) ceases to have effect at the end of the period of notice required under that clause.

5.13 The right to make an agreement under clause 5 is additional to, and does not affect, any other term of this award that provides for an agreement between an employer and an individual employee.

6. Requests for flexible working arrangements

[6 substituted by PR763197 ppc 01Aug23]

Requests for flexible working arrangements are provided for in the NES .

NOTE: Disputes about requests for flexible working arrangements may be dealt with under clause 36—Dispute resolution and/or under section 65B of the Act .

7. Facilitative provisions

7.1 This award contains facilitative provisions which allow agreement between an employer and an individual employee, or the majority of employees, on how specific award provisions are to apply at the workplace.

7.2 The following clauses have facilitative provisions:

Table 1—Facilitative provisions

7.3 The agreement must be kept by the employer as a time and wages record.

Part 2—T ypes of Employment and Classifications

8. Types of employment

8.1 An employee covered by this award must be one of the following:

(a) a full-time employee; or

(b) a part-time employee; or

(c) a casual employee.

8.2 At the time of engaging an employee, the employer must inform the employee of the terms on which they are engaged, including whether they are engaged as a full-time, part-time or casual employee.

8.3 Moving between types of employment

(a) A full-time or casual employee can only become a part-time employee with the employee’s written consent.

(b) Moving to part-time employment does not affect the continuity of any leave entitlements.

(c) A full-time employee:

(i) may request to become a part-time employee; and

(ii) if that request is granted by the employer, may return to full-time employment at a future date agreed in writing with the employer.

9. Full-time employees

An employee who is engaged to work an average of 38 ordinary hours per week in accordance with an agreed hours of work arrangement is a full-time employee.

NOTE: The hours of work arrangement is agreed between the employer and the employee. See clause 15.6 (Ordinary hours of work).

10. Part-time employees

[Substituted by PR731097 ppc 01Jul21]

10.1 An employee who is engaged to work for fewer than 38 ordinary hours per week and whose hours of work are reasonably predictable, is a part-time employee.

10.2 An employer may employ part-time employees in any classification defined in Schedule A —Classification Definitions .

10.3 This award applies to a part-time employee in the same way that it applies to a full-time employee except as otherwise expressly provided by this award.

10.4 A part-time employee is entitled to payments in respect of annual leave and personal/carer’s leave on a proportionate basis.

10.5 At the time of engaging a part-time employee, the employer must agree in writing with the employee on a regular pattern of work that must include all of the following:

(a) the number of hours to be worked on each particular day of the week (the guaranteed hours ); and

(b) the times at which the employee will start and finish work each particular day; and

(c) when meal breaks may be taken and their duration.

NOTE: An agreement under clause 10.5 could be recorded in writing including through an exchange of emails, text messages or by other electronic means.

10.6 Changes to regular pattern of work by agreement

The employer and the employee may agree to vary the regular pattern of work agreed under clause 10.5 on a temporary or ongoing basis, with effect from a future date or time. Any such agreement must be recorded in writing:

(a) if the agreement is to vary the employee’s regular pattern of work for a particular rostered shift – before the end of the affected shift; and

(b) otherwise – before the variation takes effect.

NOTE 1: An agreement under clause 10.6 could be recorded in writing including through an exchange of emails, text messages or by other electronic means.

NOTE 2: An agreement under clause 10.6 cannot result in the employee working 38 or more ordinary hours per week.

EXAMPLE: Sonya’s guaranteed hours include 5 hours work on Mondays. During a busy Monday shift, Sonya’s employer sends Sonya a text message asking her to vary her guaranteed hours that day to work 2 extra hours at ordinary rates (including any penalty rates). Sonya is happy to agree and replies by text message confirming that she agrees. The variation is agreed before Sonya works the extra 2 hours. Sonya’s regular pattern of work has been temporarily varied under clause 10.6. She is not entitled to overtime rates for the additional 2 hours.

10.7 The employer must keep a copy of any agreement under clause 10.5 , and any variation of it under clause 10.6 or 10.11 , and, if requested by the employee, give another copy to the employee.

10.8 For any time worked in excess of their guaranteed hours agreed under clause 10.5 or as varied under clause 10.6 or clause 10.11 , the part-time employee must be paid at the overtime rate specified in Table 10—Overtime rates .

10.9 The minimum daily engagement for a part-time employee is 3 consecutive hours.

10.10 Changes to regular pattern of work by employer

(a) An employee’s regular pattern of work agreed under clause 10.5 or 10.6, other than the employee’s guaranteed hours, may be changed by the employer giving the employee 7 days, or in an emergency 48 hours, written notice of the change.

(b) However, the regular pattern of work of a part-time employee must not be changed from week to week or fortnight to fortnight or to avoid any award entitlements. If the employer does so, the employee must be paid any award entitlements as if the regular pattern of work had not been changed.

NOTE 1: Clause 15.7 contains additional rostering provisions. Clause 35 contains requirements to consult with employees about roster changes.

NOTE 2: See clause 27—Rostering restrictions for the rosters of shiftworkers.

NOTE 3: An employee’s guaranteed hours including the days on which those guaranteed hours are agreed to be worked can only be changed by agreement. See clause 10.6.

10.11 Review of guaranteed hours

(a) If an employees’ guaranteed hours are less than the ordinary hours that the employee has regularly worked in the previous 12 months, the employee may request in writing that the employer increase their guaranteed hours on an ongoing basis to reflect the ordinary hours regularly being worked.

(b) An employee may only make a request under clause 10.11(a) once every 12 months.

(c) The employer must respond in writing to the employee’s request within 21 days.

(d) The employer may refuse the request only on reasonable grounds.

EXAMPLE: Reasonable grounds to refuse the request may include the reason that the employee has regularly worked more ordinary hours than their guaranteed hours is temporary—for example where this is the direct result of another employee being absent on annual leave, long service leave or worker’s compensation.

(e) Before refusing a request under clause 10.11(c), the employer must discuss the request with the employee and genuinely try to reach agreement on an increase to the employee’s guaranteed hours that will give the employee more predictable hours of work and reasonably accommodate the employee’s circumstances.

(f) If the employer and employee agree on an increase to the employee’s guaranteed hours, the employer’s written response must record the agreed increase.

(g) If the employer and employee do not reach agreement, the employer’s written response must include details of the reasons for the refusal, including the ground or grounds for refusal and how the ground or grounds apply.

NOTE: If the employer and employee agree in writing to increase the employee’s guaranteed hours, this will vary the agreement under clause 10.5.

(h) The employer and employee may seek to resolve a dispute about a request under clause 10.11(a) in accordance with clause 36—Dispute resolution.

NOTE: This could include a dispute about whether the employer’s refusal of a request was reasonable, whether the employer discussed the request with the employee as required under clause 10.11(e), or whether the employer responded in writing to the request as required under clauses 10.11(c), (f) or (g).

11. Casual employees

[Varied by PR733977 , PR735945 ]

[11.1 deleted by PR733977 from 27Sep21]

[11.2 deleted by PR733977 from 27Sep21]

[11.3 renumbered as 11.1 by PR733977 from 27Sep21]

11.1 An employer must pay a casual employee for each hour worked a loading of 25% on top of the minimum hourly rate otherwise applicable under clause 17 — Minimum rates .

NOTE 1: The casual loading is payable instead of entitlements from which casuals are excluded by the terms of this award and the NES . See Part 2-2 of the Act .

NOTE 2: Overtime rates applicable to casuals are set out in Table 10—Overtime rates .

NOTE 3: Penalty rates applicable to casuals are set out in Table 11—Penalty rates .

[11.4 renumbered as 11.2 by PR733977 from 27Sep21; substituted by PR735945 ppc 06Dec21]

11.2 The minimum daily engagement of a casual employee is 3 hours, or 1.5 hours’ in the circumstances set out in clause 11.3 .

[11.5 renumbered as 11.3 by PR733977 from 27Sep21]

11.3 The circumstances are:

(a) the employee is a full-time secondary school student; and

(b) the employee is engaged to work between 3:00 pm and 6:30 pm on a day on which the employee is required to attend school; and

(c) the employee, with the approval of the employee’s parent or guardian, agrees to work for fewer than 3 hours; and

(d) employment for a longer period than the agreed period is not possible either because of the operational requirements of the employer or the unavailability of the employee.

[11.6 renumbered as 11.4 by PR733977 from 27Sep21]

11.4 An employer must pay a casual employee at the end of each engagement or weekly or fortnightly in accordance with pay arrangements for full-time and part-time employees.

11.5 Offers and requests for casual conversion

[11.5 inserted by PR733977 from 27Sep21]

Offers and requests for conversion from casual employment to full-time or part-time employment are provided for in the NES .

NOTE: Disputes about offers and requests for casual conversion under the NES are to be dealt with under clause 36—Dispute resolution.

[11.7 deleted by PR733977 from 27Sep21]

12. Apprentices

12.1 An employer may engage apprentices.

12.2 Any engagement must be in accordance with the law regulating apprenticeships in force in the place in which the apprentice is engaged.

12.3 This award applies to an apprentice in the same way that it applies to a full-time employee except as otherwise expressly provided by this award.

12.4 An employer must pay an apprentice in accordance with clause 17.3 — Apprentice rates or, for an adult apprentice, 17.4 — Adult apprentices .

12.5 Except in an emergency, an employer must not require an apprentice to work overtime or shiftwork at any time that would prevent their attendance at training in accordance with their training contract.

12.6 Training

(a) An employer must release an apprentice from work to attend training or any assessment in accordance with their training contract without loss of pay or continuity of employment.

(b) Subject to Schedule D—School-based Apprentices, time spent by an apprentice in attending training or any assessment in accordance with their training contract is to be regarded as time worked for the employer for the purpose of calculating the apprentice’s wages and determining the apprentice’s employment conditions.

(c) An employer must reimburse an apprentice for all fees paid by the apprentice themselves to a registered training organisation (RTO) for courses that the apprentice is required to attend, and all costs incurred by the apprentice in purchasing textbooks (not provided or otherwise made available by the employer) that the apprentice is required to study, for the purposes of the apprenticeship.

(d) The employer must make any reimbursement required under clause 12.6(c) by whichever of the following is the later:

(i) 6 months after the start of the apprenticeship; or

(ii) 6 months after the relevant stage of the apprenticeship; or

(iii) 3 months after the start of the training provided by the RTO.

(e) Reimbursement under clause 12.6(c) is subject to the employer being satisfied that the apprentice is making satisfactory progress in the apprenticeship.

12.7 Block release training

(a) Clause 12.7 applies to an apprentice who is required to attend block release training in accordance with their training contract.

(b) If the training requires an overnight stay, the employer must pay for the reasonable travel costs incurred by the apprentice in travelling to and from the training.

(c) The employer is not obliged to pay costs under clause 12.7(b) if the apprentice could have attended training at a closer venue and attending the more distant training had not been agreed between the employer and the apprentice .

(d) Reasonable travel costs in clause 12.7(b) include:

(i) the total cost of reasonable transportation (including transportation of tools, where required) to and from the training; and

(ii) accommodation costs; and

(iii) reasonable expenses, including for meals, incurred which exceed those incurred in the normal course of travelling to and from the workplace.

(e) R easonable costs in clause 12.7(b) do not include payment for travelling time or expenses incurred while not travelling to and from the block release training.

(f) The amount an employer must pay under clause 12.7(b) may be reduced by any amount that the apprentice has received, or was eligible to receive, for travel costs to attend block release training under a Government apprentice assistance scheme.

(g) The employer may only make a reduction under clause 12.7(f) for an amount that an apprentice was eligible to receive, but did not receive, if the employer advised the apprentice in writing of the availability of the assistance and the apprentice chose not to seek it.

13. Junior employees

NOTE: Junior employee is defined in clause 2—Definitions.

13.1 An employer may engage junior employees.

13.2 An employer must pay a junior employee in accordance with Table 5—Junior rates (retail employee levels 1, 2 and 3 only) .

14. C lassifications

14.1 An employer must classify an employee covered by this award in accordance with Schedule A —Classification Definitions .

14.2 The classification by the employer must be based on the skill level as determined by the employer that the employee is required to exercise in order to carry out the principal functions of the employment.

14.3 Employers must notify employees in writing of their classification and of any change to it.

Part 3—Hours of Work

15. Ordinary hours of work and rostering arrangements

[Varied by PR731097 , PR772934 ]

15.1 Ordinary hours may be worked by an employee on the day specified in column 1 during the span of ordinary hours specified in column 2 of Table 2—Span of hours .

Table 2—Span of hours

15.2 However, ordinary hours may be worked:

(a) from 5:00 am in a newsagency; or

(b) until midnight in a video shop; or

[15.2(c) varied by PR772934 retrospectively from ppc 01Oct20]

(c) until 11:00 pm on all days of the week if the trading hours of the retailer extend beyond 9:00 pm on a Monday to Friday or 6:00 pm on a Saturday or Sunday.

15.3 Ordinary hours of work on any day are continuous, except for rest breaks and meal breaks as specified in clause 16 — Breaks .

15.4 Subject to clause 15.5 , the maximum number of ordinary hours that can be worked on any day is 9.

15.5 An employer may roster an employee to work up to 11 ordinary hours on one day per week.

15.6 Full-time employees

(a) In each establishment an assessment must be made as to the kind of arrangement for working the average of 38 ordinary hours per week required for full-time employment that best suits the business of the establishment.

(b) Either the employer or the employee may initiate the making of an assessment.

(c) An assessment cannot be made more frequently than once per year.

(d) Any proposed arrangement arising out of the making of an assessment must be discussed with the affected employees with the objective of reaching agreement on it.

(e) Different groups of employees may be subject to different arrangements.

(f) An arrangement may provide for a full-time employee to be rostered to work the required number of hours in any of the ways mentioned in clause 15.6(g) and may adopt any of the options mentioned in clause 15.6(h) for working the average of 38 hours per week.

(g) The ways are:

(i) working 38 hours per week; or

(ii) working 76 hours over 2 consecutive weeks; or

(iii) working 114 hours over 3 consecutive weeks; or

(iv) working 152 hours over 4 consecutive weeks; or

(v) working an average of 38 hours per week over a longer period agreed between the employer and the employee.

(h) The options are:

(i) working 5 days of 7 hours and 36 minutes each per week; or

(ii) working days of varying length per week; or

(iii) taking 4 hours off per fortnight in addition to the rostered day off; or

(iv) taking a fixed day off per 4 week cycle; or

(v) taking a rotating day off per 4 week cycle; or

(vi) having an accumulating day off per 4 week cycle with a maximum of 5 days being accumulated over 5 such cycles.

(i) In an establishment at which at least 15 employees are employed per week on a regular basis, the employer must not roster an employee to work ordinary hours on more than 19 days per 4 week cycle.

(j) Clause 15.6(i) is subject to any agreement to the contrary between the employer and an individual employee.

(k) By agreement between the employer and an individual employee, the employee may be rostered to work:

(i) not more than 4 hours on one day per 2 week cycle; or

(ii) not more than 6 hours on one day per week; or

(iii) not more than 7 hours and 36 minutes on any day.

(l) Substitution of rostered days off

(i) With the agreement of the majority of affected employees, an employer may substitute another day or half day for a rostered day or half day off of an employee in any of the following circumstances:

· a machinery breakdown; or

· an electrical power shortage or breakdown; or

· an unexpected spike in the work required to be performed by the business; or

· another emergency situation.

(ii) A rostered day off may be changed by the employer and an employee by mutual agreement.

(m) Banking of rostered days off

(i) By agreement between the employer and an employee, up to 5 rostered days off may be banked in any one year.

(ii) A banked rostered day off may be taken at a time that is mutually convenient to the employer and the employee.

15.7 Rostering arrangements

(a) A roster period cannot exceed 4 weeks except by agreement in clause 15.6(g)(v).

(b) The employer must not roster an employee to work ordinary hours on more than 5 days per week, except as provided by clause 15.7(c).

(c) The employer may roster an employee to work ordinary hours on 6 days in one week if the employee is rostered to work ordinary hours on no more than 4 days in the following week.

(d) Consecutive days off

(i) The employer must roster an employee to work ordinary hours in such a way that they have 2 consecutive days off per week or 3 consecutive days off per 2 week cycle.

(ii) Clause 15.7(d)(i) is subject to any agreement for different arrangements entered into between the employer and an individual employee at the written request of the employee.

(iii) Different arrangements agreed under clause 15.7(d)(ii) must be recorded in the time and wages record.

(iv) The employee may end an agreement under clause 15.7(d)(ii) at any time by giving the employer 4 weeks’ notice.

(v) An employee cannot be required as a condition of employment to make a request under clause 15.7(d)(ii).

(e) Consecutive days of work

The maximum number of consecutive days on which an employee may work (whether ordinary hours or reasonable additional hours) is 6.

15.8 Employees regularly working Sundays

(a) The employer must roster an employee who regularly works Sundays in such a way that they have 3 consecutive days off (including Saturday and Sunday) per 4 week cycle.

(b) Clause 15.8(a) is subject to any agreement for different arrangements entered into by the employer and an individual employee at the written request of the employee.

(c) Different arrangements agreed under clause 15.8(b) must be recorded in the time and wages record.

(d) The employee may end an agreement under clause 15.8(b) by giving the employer 4 weeks’ notice.

(e) An employee cannot be required as a condition of employment to agree to an arrangement under clause 15.8(b).

15.9 Notification of rosters

[15.9 substituted by PR731097 ppc 01Jul21]

(a) The employer must ensure that the work roster is available to all employees, either exhibited on a notice board which is conveniently located at or near the workplace or through accessible electronic means.

(b) The roster must show for each employee:

(i) the number of ordinary hours to be worked by them each week; and

(ii) the days of the week on which they will work; and

(iii) the times at which they start and finish work.

(c) The employer must retain a copy of each completed work roster for at least 12 months and produce it, on request, for inspection to an authorised person.

(d) Due to unexpected operational requirements, the roster of an employee other than a part-time employee may be changed by mutual agreement by the employer and the employee at any time before the employee arrives for work.

NOTE 1: Clause 10.6 deals with when the roster of a part-time employee may be changed by mutual agreement.

NOTE 2: Clause 35 contains requirements to consult with employees about roster changes.

(e) For employees other than part-time employees, the employer may make permanent roster changes at any time by giving the employee at least 7 days’ written notice of the change. If the employee disagrees with the change, the period of written notice of the change required to be given is extended to at least 14 days in total.

NOTE: Clause 10.10 deals with when the roster of a part-time employee may be changed by their employer.

(f) The employer and employee may seek to resolve a dispute about a roster change in accordance with clause 36—Dispute resolution.

(g) Clause 15.9(h) applies to an employee other than a part-time employee whose roster is changed in a particular week for a one-off event that does not constitute an emergency and then reverts to the previous roster in the following week.

(h) The employer must pay the employee at the overtime rate specified in Table 10—Overtime rates for any extra time worked by the employee because of the roster change in clause 15.9(g).

(i) An employer must not change the roster of an employee with the intention of avoiding payment of shiftwork or penalty rates, loadings or other applicable benefits. If the employer does so, the employee must be paid any shiftwork or penalty rates, loadings or benefits as if the roster had not been changed.

NOTE: See clause 27—Rostering restrictions for the rosters of shiftworkers.

16. Breaks

16.1 Clause 16 gives an employee an entitlement to meal breaks and rest breaks.

16.2 An employee who works the number of hours in any one shift specified in column 1 of Table 3—Entitlements to meal and rest break(s) is entitled to a rest break or rest breaks as specified in column 2 or a meal break or meal breaks as specified in column 3.

Table 3—Entitlements to meal and rest break(s)

NOTE 1: An employee who works less than 4 hours in a shift has no entitlement to a paid rest break.

NOTE 2: The rest breaks and meal breaks of shiftworkers are paid. See clause 26—Rest breaks and meal breaks.

16.3 The timing of rest and meal breaks and their duration are to be included in the roster and are subject to the roster provisions of this award.

16.4 In rostering rest and meal breaks, the employer must seek to ensure that the employee has meaningful breaks during work hours.

16.5 An employer cannot require an employee:

(a) to take a rest break or meal break within the first or the last hour of work; or

(b) to take a rest break combined with a meal break; or

(c) to work more than 5 hours without taking a meal break.

16.6 Breaks between work periods

(a) An employee must have a minimum break of 12 hours between when the employee finishes work on one day and starts work on the next.

(b) If an employee starts work again without having had 12 hours off work, the employer must pay the employee at the rate of 200% of the rate they would be entitled to until the employee has a break of 12 consecutive hours.

(c) The employee must not suffer any loss of pay for ordinary hours not worked during the period of a break required by clause 16.6.

(d) The employer and an individual employee or a group of employees may agree that clause 16.6 is to have effect as if it provided for a minimum break of 10 hours.

Part 4—Wages and Allowances

17. Minimum rates

[Varied by PR718821 , PR726419 ; corrected by PR725977 ; varied by PR728848 , PR730833 , PR729257 , PR731018 , PR733977 , PR740678 , PR762112 , PR767876 ]

17.1 Adult rates

[17.1 varied by PR718821 ; corrected by PR725977 ; varied by PR729257 , PR740678 , PR762112 ppc 01Jul23]

An employer must pay an adult employee (other than an apprentice) the minimum hourly rate specified in column 3 or for a full-time employee the minimum weekly rate specified in column 2, in accordance with the employee classification specified in column 1 of Table 4—Minimum rates .

NOTE 1: Adult employee is defined in clause 2—Definitions.

NOTE 2: Provision for calculating rates for a junior employee is at clause 17.2.

NOTE 3: Clause 25—Rate of pay for shiftwork sets out rates of pay for shiftwork.

NOTE 4: Schedule B—Summary of Hourly Rates of Pay contains a summary of hourly rates including overtime, shiftwork and penalty rates.

Table 4—Minimum rates

17.2 Junior rates (retail employee levels 1, 2 and 3 only)

[17.2 renamed and substituted by PR728848 ; varied by PR767876 ppc 31Dec23]

An employer must pay a junior employee, who is classified as a retail employee level 1, 2 or 3 and aged as specified in column 1 of Table 5—Junior rates (retail employee levels 1, 2 and 3 only) , the minimum percentage specified in column 2 of the minimum rate that would otherwise be applicable under Table 4—Minimum rates .

Table 5—Junior rates (retail employee levels 1, 2 and 3 only)

17.3 Apprentice rates

(a) An employer must pay an apprentice completing a 4 year apprenticeship who began the apprenticeship before 1 January 2014 the minimum percentage specified in column 2 of the standard weekly rate in accordance with the year of the apprenticeship specified in column 1 of Table 6—4 year apprentice minimum rates (pre-January 2014 start) .

Table 6—4 year apprentice minimum rates (pre-January 2014 start)

(b) An employer must pay an apprentice completing a 4 year apprenticeship who began the apprenticeship on 1 January 2014 or later the minimum percentage specified in column 2 or, for an apprentice who has completed year 12, the minimum percentage specified in column 3 of the standard weekly rate in accordance with the year of the apprenticeship specified in column 1 of Table 7—4 year apprentice minimum rates (start January 2014 or later) .

Table 7—4 year apprentice minimum rates (start January 2014 or later)

(c) An employer must pay an apprentice completing a 3 year apprenticeship who began the apprenticeship before 1 January 2014 the minimum percentage specified in column 2 of the standard weekly rate in accordance with the year of the apprenticeship specified in column 1 of Table 8—3 year apprentice minimum rates (pre-January 2014 start) .

Table 8—3 year apprentice minimum rates (pre-January 2014 start)

(d) An employer must pay an apprentice completing a 3 year apprenticeship who began the apprenticeship on 1 January 2014 or later the minimum percentage specified in column 2 (or, for an apprentice who has completed year 12, the minimum percentage specified in column 3) of the standard weekly rate in accordance with the year of the apprenticeship specified in column 1 of Table 9—3 year apprentice minimum rates (start January 2014 or later) .

Table 9—3 year apprentice minimum rates (start January 2014 or later)

17.4 Adult apprentices

NOTE: Adult apprentice is defined in clause 2—Definitions.

(a) An employer must pay a first year adult apprentice who began the apprenticeship on 1 January 2014 or later and is in the first year of their apprenticeship at not less than whichever of the following is the greater:

(i) 80% of the standard weekly rate ; or

(ii) the rate in either Table 7—4 year apprentice minimum rates (start January 2014 or later) or Table 9—3 year apprentice minimum rates (start January 2014 or later) , as applicable, for the first year of the apprenticeship.

(b) An employer must pay an adult apprentice who commenced on 1 January 2014 or later and is in the second or a subsequent year of the apprenticeship at not less than whichever of the following is the greater:

(i) the lowest rate in Table 4—Minimum rates ; or

(ii) the rate in either Table 7—4 year apprentice minimum rates (start January 2014 or later) or Table 9—3 year apprentice minimum rates (start January 2014 or later) , as applicable, for the relevant year of the apprenticeship.

[17.4(c) varied by PR733977 from 27Sep21]

(c) Clause 17.4(d) applies to an employee who, immediately before entering into a training agreement as an adult apprentice with an employer, had been employed by the employer as a full-time employee for not less than 6 months, or as a part-time or regular casual employee for not less than 12 months.

(d) The minimum rate that was applicable to the employee immediately before the person entered into the training agreement continues to be applicable to the employee throughout the apprenticeship.

17.5 Higher duties

(a) An employer must pay an employee who performs for more than 2 hours on any particular day or shift duties of a classification higher than the employee’s ordinary classification, the minimum hourly rate specified in column 3 of Table 4—Minimum rates for that higher classification for the whole of that day or shift.

(b) An employer must pay an employee who performs for 2 hours or less on any particular day or shift duties of a classification higher than the employee’s ordinary classification, the minimum hourly rate specified in column 3 of Table 4—Minimum rates for that higher classification for the time during which those duties were performed.

17.6 Supported wage system

For employees who, because of the effects of a disability, are eligible for a supported wage , see Schedule E—Supported Wage System.

17.7 National training wage

(a) Schedule E to the Miscellaneous Award 2020 sets out minimum wage rates and conditions for employees undertaking traineeships.

[17.7(b) varied by PR718821 ; corrected by PR725977 ; varied by PR729257 , PR740678 , PR762112 ppc 01Jul23]

(b) This award incorporates the terms of Schedule E to the Miscellaneous Award 2020 as at 1 July 2023. Provided that any reference to “this award” in Schedule E to the Miscellaneous Award 2020 is to be read as referring to the General Retail Industry Award 2020 and not the Miscellaneous Award 2020 .

[Note inserted by PR723829 ; deleted by PR726419 ; inserted by PR730833 ; deleted by PR731018 ppc 01Sep21]

18. Payment of wages

NOTE: Regulations 3.33(3) and 3.46(1)(g) of Fair Work Regulations 2009 set out the requirements for pay records and the content of payslips including the requirement to separately identify any allowance paid.

18.1 The employer may determine the pay period of an employee as being either weekly or fortnightly. However, if before 1 January 2010 the employer paid employees classified at Retail Employee Level 4 or above on a monthly pay cycle, the employer may continue that arrangement.

18.2 Wages must be paid for a pay period according to the number of hours worked by the employee in the period or they may be averaged over a fortnight.

18.3 Pay day

(a) Wages must be paid on a regular pay day.

(b) Employers must notify employees in writing about which day is the regular pay day.

(c) The regular pay day of an employee may only be changed by the employer giving the employee 4 weeks’ written notice.

18.4 Payment on termination of employment

(a) The employer must pay an employee no later than 7 days after the day on which the employee’s employment terminates:

(i) the employee’s wages under this award for any complete or incomplete pay period up to the end of the day of termination; and

(ii) all other amounts that are due to the employee under this award and the NES .

(b) The requirement to pay wages and other amounts under clause 18.4(a) is subject to further order of the Commission and the employer making deductions authorised by this award or the Act .

NOTE 1: Section 117(2) of the Act provides that an employer must not terminate an employee’s employment unless the employer has given the employee the required minimum period of notice or “has paid” to the employee payment instead of giving notice.

NOTE 2: Clause 18.4(b) allows the Commission to make an order delaying the requirement to make a payment under this clause. For example, the Commission could make an order delaying the requirement to pay redundancy pay if an employer makes an application under section 120 of the Act for the Commission to reduce the amount of redundancy pay an employee is entitled to under the NES .

NOTE 3: State and Territory long service leave laws or long service leave entitlements under section 113 of the Act , may require an employer to pay an employee for accrued long service leave on the day on which the employee’s employment terminates or shortly after.

19. A llowances

[Varied by PR718821 , PR718977 ; corrected by PR725977 ; varied by PR729257 , PR729444 , PR740678 , PR740850 , PR762112 , PR762270 ]

NOTE: Regulations 3.33(3) and 3.46(1)(g) of Fair Work Regulations 2009 set out the requirements for pay records and the content of payslips including the requirement to separately identify any allowance paid.

19.1 Clause 19 gives employees an entitlement to monetary allowances of specified kinds in specified circumstances.

NOTE: Schedule C—Summary of Monetary Allowances contains a summary of monetary allowances and methods of adjustment.

19.2 Meal allowance

(a) Clause 19.2 applies to an employee to whom all of the following apply:

(i) the employee is required to work overtime of more than one hour on any day after the time at which the employee ordinarily finishes work for the day; and

(ii) the employee was not given at least 24 hours’ notice of that requirement; and

(iii) the employee cannot reasonably return home for a meal within the period of the meal break.

(b) The employer must:

[19.2(b)(i) varied by PR718977 , PR740850 , PR762270 ppc 01Jul23]

(i) pay the employee a meal allowance of $21.57 ; or

(ii) supply the employee with a meal.

[19.2(c) varied by PR718977 , PR740850 , PR762270 ppc 01Jul23]

(c) If the number of hours worked under a requirement mentioned in clause 19.2(a)(i) exceeds 4, the employer must pay the employee a further meal allowance of $19.56 .

19.3 Special clothing allowance

(a) In clause 19.3 special clothing means any article of clothing (including uniform, waterproof or other protective clothing) that the employer requires the employee to wear or that it is necessary for the employee to wear.