U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The Best Travel Insurance for Mexico in 2024

Allianz Travel Insurance »

Seven Corners »

Generali Global Assistance »

Trawick International »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance for Mexico.

Table of Contents

- Allianz Travel Insurance

- Seven Corners

While Mexico is a lot closer to the United States than most other international destinations, that doesn't mean you don't need travel insurance. Travel to Mexico puts you at risk of many of the same perils you'll face in other parts of the world, including the prospect of becoming injured or ill during your trip, facing travel delays or flight cancellations , or dealing with baggage delays once you arrive.

Before you plan a relaxing getaway or adventure trip in a destination like Mexico City , Puerto Vallarta or Cancún , you'll want to have a travel insurance plan lined up and ready to go. Our advice? Start your search by comparing the following Mexico travel insurance plans and all they have to offer.

Frequently Asked Questions

Just like with other international trips, you should know that your own personal health insurance coverage will not apply in Mexico. The same is true if you have a government health plan like Medicare. (See our article on this topic for more information.)

At the bare minimum, you'll want to have travel health insurance that applies if you become sick or injured during your vacation. Other types of insurance coverage can also make sense for travel to Mexico, including coverage for trip cancellations, delays, lost baggage, missed connections and more.

Mexico travel insurance policies vary widely in terms of what they offer and how much coverage you get. Ultimately, you should compare plans side by side and make sure you're getting enough coverage for the type of trip you're taking and the specific risks you're taking on.

That said, common protections found in Mexico travel insurance plans cover:

- Baggage delays

- Emergency medical evacuation

- Trip cancellation

- Trip interruption

- Travel delays

- Lost luggage reimbursement

- Medical expenses

- Rental car damage

Some plans available for Mexico trips also include optional cancel for any reason (CFAR) coverage that reimburses you for part of your prepaid trip cost when you cancel your trip for any reason at all. Certain coverage options also provide protection for preexisting medical conditions if certain conditions are met, which is a factor you'll want to take note of if you or someone in your traveling party has a medical condition that could pose a problem on your trip.

- Allianz Travel Insurance: Best Overall

- Seven Corners: Best for Families

- Generali Global Assistance: Best for Medical Emergencies

- Trawick International: Best for Adventure Travel

- WorldTrips: Best for Nomads and Remote Workers

Option to purchase CFAR and preexisting medical conditions coverage

Kids age 17 and younger covered for free

Lower coverage limits for medical expenses than some providers

- $100,000 in coverage for trip cancellation (per traveler)

- $150,000 in coverage for trip interruption (per traveler)

- $500 in Trip Change Protector coverage

- $50,000 in emergency medical coverage (per traveler)

- $500,000 for emergency medical transportation (per traveler)

- $1,000 toward baggage loss or damage (per traveler)

- $300 in coverage for baggage delays of 12 hours or more (per traveler)

- $800 in protection for travel delays per traveler (daily limit of $200 applies)

- $100 per insured person, per day in SmartBenefits coverage for eligible delays

- 24-hour hotline assistance

- Concierge services

Optional CFAR and preexisting conditions waiver available

Coverage for up to 10 travelers in a single plan

Low coverage limits on Trip Protection Basic plan

- Up to $500,000 in coverage for emergency medical expenses ($750 emergency dental limit)

- $1 million in coverage for emergency medical evacuation and repatriation of remains

- Trip cancellation coverage worth up to 100% of the trip cost (maximum $100,000 per person)

- Trip interruption coverage worth up to 150% of the trip cost

- Trip delay coverage worth up to $2,000 ($250 per person, per day)

- $1,500 in coverage for missed cruise connections or tours (up to $250 per day)

- $2,500 in coverage for baggage and personal effects (limit per item of $250)

- Baggage delay coverage worth up to $500 (maximum $100 per day) after delays of six hours

CFAR and preexisting medical conditions coverages available

High coverage limits for medical expenses and evacuation

CFAR coverage only reimburses at 60%

Low emergency dental limit

- Up to $1 million in coverage for emergency medical evacuation and transportation

- $250,000 coverage limit for medical expenses ($500 limit for dental emergencies)

- 100% of trip cost for trip cancellation

- 175% of trip cost for trip interruption

- $1,000 per person for travel delays ($300 per person daily limit)

- $2,000 per person in coverage for baggage

- $2,000 per person in coverage for sporting equipment

- $500 per person for baggage delays

- $500 per person for sporting equipment delays

- $1,000 per person in coverage for missed connections

- Air flight accident accidental death and dismemberment (AD&D) coverage worth $100,000 per person (maximum $200,000 per plan)

- Travel accident AD&D coverage worth $50,000 per person (maximum $100,000 per plan)

- $25,000 per person for rental car damage

- 24-hour travel support

- Identity theft resolution services

Coverage for 450-plus sports and activities

Generous benefits for emergency evacuation

No CFAR option available with this plan

No preexisting conditions waiver

- Trip cancellation coverage for 100% of prepaid trip cost (up to $50,000)

- Trip interruption coverage for 125% of prepaid trip cost (up to $62,500)

- Trip delay coverage up to $1,000 for delays of 12 hours or more ($200 per day)

- Inconvenience benefits worth up to $500 per trip

- Medical coverage up to $100,000

- $10,000 in coverage for search and rescue (not available in New York)

- Up to $1 million in coverage for emergency medical evacuation

- Up to $3,000 in coverage for baggage and personal effects

- Baggage delay coverage worth up to $750 after a delay of 12 hours or more

- Sports equipment rental coverage worth up to $5,000 (not available in New York or Washington)

Useful medical coverage for frequent travelers to Mexico

Potential for high coverage limits for medical expenses

No coverage for trip cancellation

Available coverage limits vary by age

- Up to $250,000 in maximum coverage for illnesses and injuries

- Up to $100,000 in coverage for emergency medical evacuation

- $10,000 in coverage for political evacuation

- $1,000 in coverage for emergency dental expenses

- Up to a $20,000 lifetime maximum for repatriation of remains

- $5,000 in trip interruption insurance

- Up to $3,000 for lost checked luggage ($6,000 lifetime maximum)

- Travel delay coverage worth up to $100 per day after delays of 12 hours (two-day maximum)

- Personal liability coverage worth up to $25,000

Why Trust U.S. News Travel

Holly Johnson is a seasoned travel expert who has been creating content about travel insurance, cruises, all-inclusive resorts and more for more than a decade. She has visited more than 50 countries around the world and has an annual travel insurance plan of her own. Johnson also has experience navigating the claims process for travel insurance plans and has successfully filed several travel insurance claims for trip delays and trip cancellations more than once. Johnson works with her husband, Greg, who is licensed to sell travel insurance, and owns the travel agency Travel Blue Book .

You might also be interested in:

9 Best Travel Insurance Companies of April 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The Best Travel Medical Insurance of 2024

Explore protection options for unexpected health issues abroad.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Allianz Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Allianz Travel Insurance cover?

Allianz single trip plans, allianz annual/multi-trip plans, which allianz travel insurance plan is best for me, can you buy allianz travel insurance online, what isn't covered by allianz travel insurance, is allianz travel insurance worth it.

- Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Travel Insurance is provided by Allianz Global Assistance, an insurer that operates in 35 countries and serves 40 million customers in the U.S. The company offers several types of travel insurance plans depending on your needs.

Travel insurance will help protect you if unexpected events affect your vacation. Whether you’re looking for a comprehensive plan or emergency medical coverage only to supplement the travel insurance you have from your credit cards , Allianz Global Assistance offers plenty of options.

Allianz trip insurance plans fall into two categories: single trip and annual/multi-trip plans. We evaluated several single trip and annual/multi-trip plans to help you figure out which policy makes sense for you.

Depending on what type of coverage you’re looking for, Allianz offers several different travel insurance options. Allianz’s plan choices fall under single trip or annual/multi-trip plans.

Single trip plans are designed for individuals who are leaving their home, visiting another destination (or destinations) and returning home. These travel insurance plans are the most comprehensive and provide benefits like trip cancellation, trip interruption and medical coverage.

Annual/multi-trip plans are designed for those who like to take a lot of little trips throughout the year as well as for business travelers. Because the coverage period is longer, these plans are more expensive.

Some of these plans include medical coverage only while others also provide more comprehensive travel insurance perks. There’s coverage for business equipment as these plans are geared toward work travelers.

Allianz offers five travel insurance plans for single trips, including a plan that's mainly focused on emergency medical coverage.

The OneTrip Cancellation Plus plan is geared toward domestic travelers who are looking for trip cancellation, interruption and delay coverage but don't need post-departure benefits like emergency medical or baggage loss. This plan is Allianz’s most affordable option.

OneTrip Basic, Prime and Premier are three comprehensive travel insurance plans.

OneTrip Basic is the most economical plan and offers trip cancellation, interruption and delay benefits along with emergency medical and baggage loss.

OneTrip Prime provides all the benefits of the Basic plan but with higher limits, a few extra coverage areas and complimentary coverage for children 17 and under when traveling with a parent or grandparent.

OneTrip Premier offers the most coverage, doubling almost every post-departure limit of the Prime plan with more covered cancellation reasons.

If you don't need pre-departure trip cancellation and interruption protections or you already have coverage through a premium travel credit card , the standalone OneTrip Emergency Medical plan may be a good choice. The plan mainly provides emergency medical protections along with some baggage loss/delay benefits.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

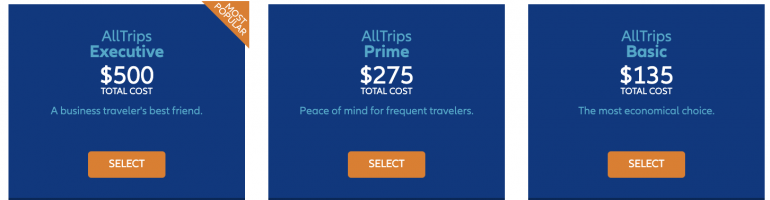

Allianz single-trip plan cost

Here's a look at the cost of an Allianz travel insurance policy for a one-week, $1,500 vacation to Croatia in August 2020 taken by a 30-year-old from Texas.

The OneTrip Premier is the most expensive plan and provides the highest level of protection, especially for emergency medical events.

However, if you’re OK with lower limits on emergency medical, a OneTrip Prime or Basic plan could be a more appropriate choice. These costs represent a range of 3.4%-7.5% of the total cost of the trip, which is in line with typical costs of 4%-8%, according to the U.S. Travel Insurance Association.

» Learn more: How to find the best travel insurance

Allianz offers four different annual/multi-trip plans.

AllTrips Basic is suitable for those who would like emergency medical coverage while abroad but don't need trip cancellation and interruption benefits. The AllTrips Prime, Executive and Premier plans provide an entire year of comprehensive travel insurance benefits.

The Executive and Premier plans offer various levels of trip cancellation and interruption benefits. The Executive plan is specifically designed for business travelers since it offers protection for business equipment.

Allianz annual/multi-trip plans cost

Let's look at an example of an annual Allianz travel insurance plan that starts in July 2020 for a 50-year-old from Illinois.

Coverage under these plans is offered for trips up to 45 days in length.

The AllTrips Executive plan costs significantly more than the other plans; this is mainly due to higher trip cancellation coverage, emergency medical and business equipment protections. The Executive coverage amount for trip cancellation can be increased beyond what is quoted here, driving that plan's price up to as much as $785.

If you’re not concerned with pre-trip cancellation benefits and don’t need the increased level of medical coverage, the Basic plan is the most affordable option.

For trips longer than 45 days, the AllTrips Premier plan might be a better choice as it offers coverage for up to 90 days. Using the same search parameters but with 90 days of coverage per trip, the cost of the annual plan is $475.

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re abroad.

If you have a premium travel card (e.g., the Chase Sapphire Reserve® ): These cards often offer some trip cancellation and trip interruption coverage, so you may not need a plan that offers all the same coverage. In this case, getting the OneTrip Medical plan might be enough.

If you’re going on a trip and returning home: OneTrip Prime, Basic or Premier are good options to choose from while offering different levels of coverage.

If you’ll be going on multiple and longer trips: the AllTrips Premier plan might be best as it provides insurance benefits for trips up to 90 days in length. The remaining three annual AllTrips plans cover multiple trips, up to 45 days.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card: In these instances, it's best to choose a comprehensive plan depending on how much coverage you need and for how long. Consider one of the single trip or multi-trip plans.

» Learn more: Your guide to Chase Sapphire Reserve travel insurance

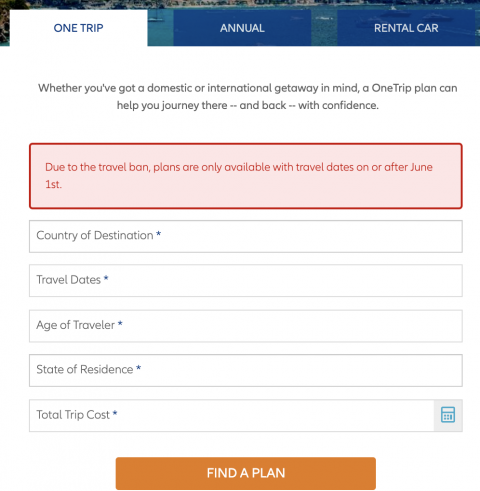

Yes, head over to AllianzTravelInsurance.com and choose "Find a Plan" from the menu on the top.

You will be able to view all plans or see plans categorized by single trip, annual/multi-trip and a rental car add-on option. Once you’ve decided on the plan you want, choose the "Get a Quote" option.

You will be required to input the relevant trip details before you can see which plans are available to you in your state.

» Learn more: Is travel insurance worth it?

Travel insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing, and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

Allianz has been offering insurance for more than 25 years. The company is well established and offers numerous single and annual travel insurance policies to fit many different needs.

Allianz travel insurance plans offer a wide array of benefits including (but not limited to): coronavirus-related coverage, trip cancellation, interruption, emergency medical coverage and transportation, baggage loss/damage, baggage delay, travel delay, change fee coverage, loyalty program redeposit fees, 24-hour assistance and many more benefits. Each plan is different, so you’ll want to look at the specific plans you’re considering to know exactly which benefits you’ll receive.

No, Allianz doesn't offer the Cancel For Any Reason optional upgrade. Review the policy details of the Allianz plan you’re considering to ensure you’re comfortable with the list of covered reasons. For example, the loss of a job can be considered a covered reason, but wanting to cancel a trip because you’re afraid to travel isn't.

Most often, you will need to file a claim with the insurer after you’ve incurred costs. If the claim is approved, you will receive a reimbursement. In other instances (e.g., covered baggage delay), the insurer will pay you a fixed amount per day and you won’t need to submit receipts.

Allianz Global Assistance offers several good travel insurance plans to choose from. If you’re looking for a travel insurance plan for a vacation, a single-trip plan is your best bet.

If you’re a frequent traveler or take lots of business trips, a multi-trip plan could be the way to go. If you have a travel credit card, look at what travel insurance benefits you may already have so you don’t duplicate your coverage .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Enable JavaScript

Please enable JavaScript to fully experience this site. How to enable JavaScript

Trip insurance for Mexico residents

Allianz Travel trip insurance

When the unexpected occurs, be prepared with trip insurance

Top reasons to buy trip insurance.

- Peace of mind while traveling

- Protect your travel investment

- Assistance throughout your trip

Trip insurance coverage overview

Trip insurance from Allianz Travel is designed for your specific travel needs. For your convenience, you can choose trip insurance when you buy your flight.

Satisfaction guarantee

Receive a refund on your premium within 10 days of purchase if you decide to cancel your coverage and you have not filed a claim or departed on your trip.

Additional assistance

Coverage by country of residence.

- United States

- Frequently asked questions

AWP Mexico, S. A. de C. V. is the administrator of this plan under Allianz Travel brand. Insurance coverage are provided by Allianz Mexico, S. A. Compania de Seguros.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Allianz Travel Insurance Coverage Review — Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

33 Published Articles 3134 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Why Purchase Travel Insurance

Allianz epidemic coverage endorsement, onetrip plans — for affordability and select coverages, alltrips annual plans — cover all of your trips for a 12-month period, how to obtain a quote with allianz, onetrip emergency medical plan, onetrip cancellation plus plan, rental car damage protector, allianz vs. credit card travel insurance, allianz vs. other travel insurance companies, allianz vs. point-of-sale travel insurance and protection, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

There are a lot of choices when it comes to travel insurance companies , so narrowing your selection to those that have a solid financial rating, offer products that provide good value, and receive high customer ratings should be baseline criteria.

Allianz Global Assistance company ( Allianz Travel) checks all of those boxes. Its parent company, Allianz SE, receives an A+ rating from A.M. Best (a leading insurance financial rating firm), and the company offers competitive individual trip and annual travel insurance products. It also serves over 45 million customers in the U.S. each year with 84% of those customers giving the company a 5-star rating.

Allianz has also been around a long time. In fact, the company was there to insure the Wright Brothers’ first flight and the construction of the Golden Gate Bridge — so you know you’re working with an established organization. You’ll also find that Allianz does business in more than 35 countries.

Let’s take a look specifically at Allianz Travel’s insurance products, show you how to obtain a quote, and give you some tips on purchasing and comparing travel insurance policies.

And while our focus is on Allianz Travel coverage, much of our information can apply to purchasing travel insurance in general.

Travel insurance can protect your trip investment with coverage for disruption due to unforeseen events such as severe weather, should you become ill, for illness in your family, missed connections, medical emergencies, and more.

Deciding whether to purchase travel insurance for your trip is an option each time you make a travel booking. The coverage is commonly offered by airlines, cruise companies, tour operators and other travel providers at the point of sale. If you travel infrequently and the cost is relatively low, you may just opt for the coverage during the booking process.

However, if you’re going to be taking several trips, you may be able to save money and receive better coverage if you compare with other travel insurance policies in the marketplace. Additionally, you’ll want to determine if it makes sense to purchase single insurance coverage for each trip or an annual all-trips-included policy.

Situations where it makes sense to purchase travel insurance include the following:

- You’re booking an expensive trip that includes a lot of non-refundable upfront expenses

- Your trip includes several travel providers (i.e. airlines, hotels, and tour operators)

While travel insurance is meant to cover unforeseen events, purchasing Cancel for Any Reason coverage may allow you to cancel your trip for any reason.

Bottom Line: If you’re uncomfortable with the amount of money you have at risk when you travel, securing travel insurance can provide immediate peace of mind . You’ll have solace in knowing that if you needed to cancel your travel plans due to a covered event or if your travel is disrupted, you’ll be able to recoup most, or all, of your investment.

Travel Insurance and the COVID-19 Virus

Most travel insurance policies do not provide coverage for trip cancellation due to fear of the coronavirus pandemic . However, COVID-19 is an included illness on many travel insurance policies as it relates to certain coverages such as emergency medical care while traveling and canceling a trip if you become ill with the virus. You may also have coverage if a family member or travel companion contracts the virus and you must cancel your trip as a result.

The only way to cover trip cancellations due to fear of contracting COVID-19 is to purchase Cancel for Any Reason insurance. This coverage can be added to a comprehensive travel insurance policy (with limitations) and subsequently allows you to cancel your trip for any reason.

While Allianz does not offer Cancel for Any Reason insurance , it may cover COVID-19 related illness in the following circumstances:

- Emergency medical care while traveling

- Trip cancellation due to becoming ill with the virus

Allianz recently announced that it is adding a new endorsement to select policies that will offer limited coverage for COVID-19 . Circumstances such as becoming ill with COVID-19 and having to cancel your trip, hospitalization, and trip delays due to such illness while traveling will have coverage.

Emergency transportation coverage has also been expanded to include COVID-19-related illness. Terms and conditions apply and the endorsement is not available on all policies Allianz offers.

You can find policies that offer Cancel for Any Reason insurance at TravelInsurance.com and Aardy.com .

Bottom Line: Travel insurance policies normally do not cover canceling your trip because of fear you might get ill. However, Cancel for Any Reason insurance allows you to cancel a trip for any reason you determine is necessary.

Types of Travel Insurance Policies Available With Allianz

Allianz Travel offers 2 core types of travel insurance plans: single trip plans and multi-trip plans . Each plan allows you to select the level of coverage you want and subsequently, the level of premium you prefer to pay.

We’ve used criteria to obtain a quote for a traveler age 35, traveling for 1 week to Mexico on a trip costing $3,000 . All benefits are per person, per trip, unless otherwise noted.

The single trip option allows you to select from a Basic, Prime, or Premier plan. Premiums vary by plan and coverage levels. For the example we selected, the premiums ranged from $116 for the Basic to $192 for the Premier pla n .

OneTrip Basic Plan — the Most Affordable Plan

The OneTrip Basic plan offers basic trip protection at an affordable price.

OneTrip Prime Plan — the Most Popular Plan

Need more coverage but still want your travel insurance protection to be affordable? The OneTrip Prime plan offers higher coverage limits at a reasonable cost.

The following are the maximum coverage limits for OneTrip plans. These coverages can be found under the OneTrip Premier Plan:

- Trip Cancellation — up to $100,000 reimbursement for prepaid non-refundable expenses; pre-existing medical conditions included

- Trip Interruption — up to $150,000 reimburses for remaining non-recoverable expenses and increased cost of return transport due to trip interruption as the result of a covered event; pre-existing medical conditions included

- Emergency Medical — up to $25,000

- Emergency Medical Transportation — up to $500,000 for transportation to the nearest medical facility

- Baggage Loss/Damage — up to $1,000 for theft, loss, or damage

- Baggage Delay — up to $300 for delays 12 hours or more

- Trip Delay — up to $800 ($200/day for 4 days) for delays of 6 hours or more, for eligible expenses; an option to receive $100/day with no receipts required is also available

- Change Fee Coverage — $500

- Loyalty Program Re-deposit Fee Coverage — $500, covers re-deposit of points/miles due to covered trip cancellation

- 24 Hour Hotline Assistance

- Optional coverages include pre-existing medical coverage, rental car coverage, and required to work coverage — restrictions apply

Also worth noting is that kids age 17 and under are covered at no additional charge when traveling with a parent or grandparent.

Bottom Line: Allianz offers several levels of single-trip travel insurance plans that can fit every budget and level of coverage needed.

If you’re a frequent traveler and want to ensure all of your trips are covered without having to purchase individual travel insurance policies, one of the AllTrips plans might be an appropriate choice. All of the trips you book within the 12-month policy period are covered automatically.

Coverage limits are per person, per trip, but more than 1 person can be included in the policy. Children 17 and under are covered at no additional charge when traveling with a parent or grandparent.

The AllTrips Executive plan is the most comprehensive policy and includes the maximum coverage limits listed below . AllTrips Prime and AllTrips Basic have less coverage than the Executive plan but may still be appropriate for your situation.

For example, the AllTips Basic plan does not include trip cancellation/interruption insurance but has emergency medical, evacuation, trip delay, baggage insurance, and car rental insurance.

- Trip Cancellation — up to $10,000 reimbursement for prepaid non-refundable expenses

- Trip Interruption — up to $10,000 reimburses for remaining non-recoverable expenses and increased cost of return transport due to trip interruption as the result of a covered event

- Emergency Medical — up to$50,000

- Emergency Medical Transportation — up to $250,000 for transportation to the nearest medical facility

- Baggage Loss/Damage — up to $1,000 for theft, loss, or damage

- Baggage Delay — up to $1,000 for delays 12 hours or more

- Trip Delay — up to $200 per day for eligible expenses, up to $1,600 in coverage , for delays of 6 hours or more

- Rental Car Damage and Theft — up to $45,000

- Business Equipment Coverage — up to $1,000

- Change Fee Coverage — up to $500

- Loyalty Program Redeposit Fee — up to $500

- Travel Accident Insurance — up to $50,000

- Concierge Services

- Optional Pre-Existing Medical Coverage — restrictions apply

Bottom Line: Allianz’s AllTrips 12-month plans offer affordable options to cover every trip you have booked or have yet to book within a 12-month period.

Travel insurance is one of the easiest policies for which to obtain a quote and subsequently purchase a policy. Unlike auto or home insurance, you simply input some basic information about your trip, your age, where you reside, and your quote is instant.

You can then read through the coverages, select a policy that fits, and hit the purchase button. There is also no risk as you’ll have a free-look period where you can review the policy and decide whether to keep it or not.

If not, you can get a full refund. This period can be 10-14 days after purchase , depending on your plan and state regulations.

Additional Travel Insurance Offered by Allianz

In addition to the travel insurance packages offered by Allianz, you can purchase these additional plans and coverages available for single trips:

If trip interruption/cancellation is not important to you, you’ll find this plan with emergency medical, baggage insurance , emergency transport, travel accident coverage , and trip delay an affordable alternative.

If you need to cancel your trip for a covered reason or your trip is interrupted for a covered event, you’ll have coverage. Trip delay and 24-hour assistance are included.

For $9 per day, receive rental car damage/theft coverage, rental car trip interruption protection, and baggage loss coverage.

Hot Tip: If trip cancellation/interruption or trip delay coverage comes with your credit card is adequate for your trip but you want additional medical coverage, the Allianz’s OneTrip Emergency Medical plan may be a viable and affordable supplement.

How Allianz Compares

When it comes to comparing travel insurance policies, it’s difficult to match apples to apples. Coverages vary widely, as well as terms and conditions. The lowest-priced policy is not always the best value for your needs. The flip side is possible, too. You may find a policy with plenty of coverage at a price that is more than you want to spend.

The best solution is when you find a balance between coverage and cost.

Here’s how Allianz’s travel insurance offerings compare with other travel insurance options.

The coverage that comes with your credit card does not compare with a comprehensive travel insurance policy . In addition to the limited travel insurance coverage credit cards offer, if you do have a claim, you’ll have the potential hassle of dealing with a third-party claims administrator.

With that being said, the trip cancellation, trip interruption, trip delay insurance, and primary rental car insurance coverages found on several credit cards may be more than adequate for your trip.

Here are some of the best credit cards for travel insurance:

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- Annual and monthly statement credits upon enrollment ( airline credit, Uber Cash credit, Saks Fifth Avenue credit, streaming credit, prepaid hotel credit on eligible stays, Walmart+ credit, CLEAR credit, and Equinox credit )

- TSA PreCheck or Global Entry credit

- Access to American Express Fine Hotels and Resorts

- Access to Amex International Airline Program

- No foreign transaction fees ( rates and fees )

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card ® , Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card ® . Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card ® . Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR ® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card ® . Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card ® . An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Financial Snapshot

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

American Express Membership Rewards

- Amex Platinum 150k Welcome Bonus Offer

- Benefits of The Amex Platinum

- How to Use 100,000 Amex Platinum Points

- Amex Platinum Card Requirements

- American Express Platinum Military Benefits

- Amex Platinum and Business Platinum Lounge Access

- Amex Platinum Benefits for Authorized Users

- Amex Platinum vs Delta Platinum

- Amex Platinum vs Chase Sapphire Reserve

- Capital One Venture X vs Amex Platinum

- Amex Platinum vs Delta Reserve

The Amex Platinum card comes with trip cancellation and trip interruption insurance with a benefit of $10,000 per trip, up to a maximum of $20,000 per account per 12-month period.

Pay for your trip with your eligible card and you, your immediate family, and eligible traveling companions are covered for non-refundable expenses paid to the travel provider. Trip interruption coverage will also reimburse for additional travel expenses incurred due to a covered loss during your trip.

Trip delay coverage is also included on the Amex Platinum card for delays more than 6 hours. Reimbursement for incidentals and eligible incurred expenses is limited to $500 per trip with 2 claims allowed per 12-month period.

The Amex Platinum card also comes with emergency medical evacuation coverage .

For more information, check out our detailed guide to the travel insurance benefits offered by the Amex Platinum card.

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

- APR: 21.49%-28.49% Variable

Chase Ultimate Rewards

- The Chase Sapphire Preferred 80k or 100k Bonus Offer

- Benefits of the Chase Sapphire Preferred

- Chase Sapphire Preferred Credit Score Requirements

- Military Benefits of the Chase Sapphire Preferred

- Chase Freedom Unlimited vs Sapphire Preferred

- Chase Sapphire Preferred vs Reserve

- Amex Gold vs Chase Sapphire Preferred

Pay for your trip with your eligible card for up to $10,000 in coverage per person, $20,000 per trip, and up to $40,000 in a 12-month period. You and your qualifying immediate family are covered.

You’ll also find primary car rental insurance on the Chase Sapphire Preferred card and the Chase Sapphire Reserve ® .

To learn more about the travel insurance benefits on the Chase Sapphire Preferred card , you’ll want to review this detailed article.

Chase Sapphire Reserve Card

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- 5x points on airfare booked through Chase Travel SM

- 3x points on all other travel and dining purchases; 1x point on all other purchases

- $300 annual travel credit

- Priority Pass airport lounge access

- TSA PreCheck, Global Entry, or NEXUS credit

- Access to Chase Luxury Hotel and Resort Collection

- Rental car elite status with National and Avis

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- APR: 22.49%-29.49% Variable

- Chase Sapphire Reserve 100k Bonus Offer

- Chase Sapphire Reserve Benefits

- Chase Sapphire Reserve Airport Lounge Access

- Chase Sapphire Reserve Travel Insurance Benefits

- Chase Sapphire Reserve Military Benefits

- Amex Gold vs Chase Sapphire Reserve

In addition to the same trip cancellation/interruption/delay coverage as the Chase Sapphire Preferred card, the Chase Sapphire Reserve card offers up to $2,500 in emergency dental and medical coverage , emergency medical evacuation .

For more information check out this guide to all of the travel insurance benefits offered by the Sapphire Reserve.

Before purchasing any travel insurance policy, it’s wise to compare — fortunately that’s an easy task to execute. With comparison sites such as the ones listed here, you can compare as many as 100 travel insurance policies very quickly and find a policy that fits your situation and budget.

Keep in mind that insurance rates and coverages are highly regulated by the states . Insurance companies file a certain policy for a certain price with the state insurance commission, then the company is allowed to offer that policy, at that price, in that state.

For this reason, you won’t find the same policy offered at different prices. However, you could find a policy that is a better fit and possibly for less money by comparing several companies’ offerings.

Not all comparison sites include Allianz but when comparing similar policies, you’ll find that the company is competitively priced (a few companies lower and many companies higher). Individual results will vary based on your criteria.

Here are 4 websites that allow you to easily compare travel insurance policies.

- Insure My Trip — With over 60,000 customer reviews, 21 highly-rated travel insurance providers, and a best price guarantee, Insure My Trip makes it easy to find the right travel insurance policy.

- Travelinsurance.com — Compare major top-rated travel insurance company policies easily with this licensed online insurance search engine.

- SquareMouth — This popular travel insurance search engine offers easy comparisons of hundreds of policies offered by dozens of highly-rated insurance companies.

- Aardy — AardvarkCompare is a licensed travel insurance company with agents on staff to help you find the right travel insurance policy. Its website allows you to compare the policies of over 30 travel insurance providers.

There are also specialty companies such as World Nomads that do a great job providing travel insurance for active individuals. If you’re into outdoor sports, adventure activities, or even more risky activities such as skydiving, you can find coverage through World Nomads.

Bottom Line: If you’re looking to purchase a travel insurance policy, you’ll want to compare companies and policies . First, look at companies with a strong financial rating, select a policy with coverages that are a priority to you, then select a premium you’re comfortable paying.

Allianz is actually one of the companies that provides the travel insurance you’re offered when you book a flight. An example is displayed in the above image of their offerings when you purchase a Delta Air Lines ticket.

Point-of-sale travel insurance, however, can run from inexpensive options that offer little coverage to expensive options that provide greater coverage but still have limitations, similar to stand-along travel insurance policies.

If you fly once or twice a year, the coverage is adequate for your needs, and the cost is reasonable, you may easily choose to go this route and purchase coverage at the point of sale. However, you may fare better by securing a separate travel insurance quote to compare coverage/cost.

Always read the fine print before purchasing any coverage to ensure you’re getting the coverage you expect. For example, one might assume by looking at this example that canceling the trip would be covered, when in reality the covered reasons are limited.

Bottom Line: Even for point-of-sale travel insurance to cover a single travel purchase, it’s good to get a comparison quote. Securing a quote may save you money while offering broader coverage that could cover your entire trip versus just a portion of it.

Allianz is a solid, established, company offering a nice selection of packaged travel insurance products. Its website is easy to use with a quick quoting function and a simple purchase process. The site is also easy to understand as it is clearly written in plain language rather than legal verbiage.

One downside of Allianz is that the company does not sell Cancel for Any Reason Insurance . This is not an issue if you understand this up front and know that your policy does not allow you to cancel a trip for just any reason. After all, this is the case with most travel insurance — there are specific covered reasons for being able to cancel a trip and have coverage.

Cancel for Any Reason insurance can also result in a premium as much as 70% more than a standard policy, so many travelers may not consider it due to its cost.

If money is not a concern, you can purchase as much insurance as you’d like to have. However, in reality, purchasing travel insurance that works for you involves finding a balance between the coverage you want and the maximum premium you’re willing to pay.

Allianz is a respected company that offers a variety of policy choices with appropriate coverage for the majority of travelers at price points that fit most budgets.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Is travel insurance worth it.

Yes, it can be worth it. If you are uncomfortable with the amount of money you would lose or be forced to pay in the event you had to cancel your trip or if you incurred disruption while traveling, you should purchase travel insurance.

An inexpensive trip or single flight may not warrant purchasing travel insurance, but insuring an expensive or complicated trip where you have a lot of non-refundable prepaid expenses at risk makes economic sense.

Travel insurance also provides the intangible benefit of peace of mind, knowing you are protected if you have to cancel due to a covered event or your trip is disrupted once in motion.

What is covered for trip cancellation?

There are limited covered reasons for receiving a benefit from trip cancellation insurance. The number 1 reason most travelers cancel their trips, according to InsureMyTrip.com , is the unforeseen illness of the traveler or of family members.

Fortunately, this is a covered reason for trip cancellation, although the level of coverage varies by company and policy.

Additional covered reasons can include death, hospitalization, or accident to you or covered family, legal obligations, your home becomes uninhabitable, the default of the travel provider, or natural disaster.

Deciding not to take a trip is not a covered reason for trip cancellation. Cancel for Any Reason insurance must be purchased in order to cover canceling a trip for a reason you personally deem necessary.

Does travel insurance cover flight cancellations?

Yes, travel insurance can cover flight cancellations in certain circumstances and depending on the policy purchased.

However, if an airline cancels your flight, whether prior to travel or during your travels, you would first contact the airline or the agency where you purchased your ticket for rebooking, a refund, or travel credit.

If you are not made whole, you could then look for coverage in your travel insurance policy.

If a flight is canceled due to weather during your travels, for example, and you are forced to incur unexpected expenses as a result, you could have coverage under a travel insurance policy if these expenses are not covered, or insufficiently covered, by the airline.

There could also be coverage under trip interruption/delay insurance if an airline cancels a flight and it causes you to miss ongoing travel which has been prepaid and is non-refundable.

Which is the best travel insurance company?

The best travel insurance company will have a high financial rating from a respected insurance industry rating company such as A.M. Best, offer a selection of coverages that matches your protection priorities, and does this at a price you’re willing to pay.

You should check reviews as well, keeping in mind that most consumers want to pay the least amount of money they can at the time of purchase and by doing so, coverage can be sacrificed. When there’s a claim, it’s natural to want the highest degree of coverage, although that may not have been the level purchased.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![allianz travel mexico The Ultimate Guide to Buying the Best Travel Insurance [For You]](https://upgradedpoints.com/wp-content/uploads/2018/09/Travel-insurance-tag-on-luggage.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Disfruta de tus viajes por México y viaja protegido

Asistencias en viaje méxico, ¿por qué elegir allianz travel para mis viajes por méxico.

Viajar es dejar atrás lo ordinario y tirar la rutina por la ventana, sin saber exactamente lo que está por venir. Sin embargo con nuestros 60 años de experiencia, sabemos que también en los viajes pueden suceder imprevistos. Es por eso que el apoyo de profesionales de confianza es crucial. Allianz Travel te ayuda a que viajes tranquilo con la protección de sus servicios de asistencia al viajero.

Disfruta de tus viajes por México con total confianza, ya sea solo, con tu familia, con amigos o de negocios, nuestra Asistencia al Viajero Nacional te proporciona la tranquilidad y cobertura necesaria.

Nuestra protección cuenta con asistencia médica, incluyendo epidemias o pandemias como el COVID-19; también tienes una compensación en caso de cancelación o interrupción de viaje, pérdida o demora de equipaje, entre otros beneficios más.

Estos servicios de ayuda al viajero funcionan muy bien para quienes quieren tener una red de proveedores médicos más ámplia a la que le ofrece su seguro público o privado y protege la inversión de tu viaje tanto para gastos de viaje no utilizados, como para gastos de hospedaje por causas médicas, traslados médicos, orientación telefónica, que otros servicios de salud no incluyen.

No dudas más y adquiere tu plan de Asistencia de Viaje México, comprarlo es fácil y económico.

Desliza para ver más

Plan México Básico 10% off

Desde: $295 MXN

Condiciones Generales

Plan México Premium 30%+20% off

Desde: $570 MXN

Plan Anual 30%+20% off + 1 niño incluido

Más información.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

OneTrip Rental Car Protector

We've created a solution to save you time and money at the car rental counter. Our car rental insurance product is called OneTrip Rental Car Protector and provides primary coverage for covered collision, loss and damage up to $50,000, along with 24-hour emergency assistance. For only $11 per calendar day you can be covered, and won't ever have to worry about using your personal car insurance company.

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

Type the country where you will be spending the most amount of time.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Rental Car Insurance Tips & Resources

Rental car insurance can be confusing, complicated and costly. So do you really need car rental insurance ? That’s a question we hear often from travelers. The answer is yes — and no.

In most cases, you don’t need all the different kinds of rental car insurance that the rental company pushes you to buy. However, there’s one type of insurance you should get: a collision damage waiver, which covers costs associated with rental car damage or theft. It’s smart to buy a collision damage waiver before renting a car, because you can save money and avoid aggressive upsells. The OneTrip Rental Car Protector from Allianz Global Assistance provides up to $50,000 in coverage for just $11 per calendar day — and, with few exceptions, covers you anywhere in the world.

In this resource guide, we help you understand if you need rental car insurance and share our best tips for saving money and driving safely overseas. Travel happy!

Featured Articles

The Four Types of Rental Car Insurance, Explained

Here it comes across the counter: the contract you have to sign to get your... More »

What Does Rental Car Insurance Cover?

What exactly does OneTrip Rental Car Protector from Allianz Global Assistance cover?... More »

What to Do in a Rental Car Accident

In the aftermath of a car accident, drivers tend to have more questions than answers... More »

{{articlePreview.snippet}} Read More

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

- Travel insurance plans

Tin Leg Travel Insurance Cost

Compare tin leg travel insurance.

- Why You Should Trust Us

Tin Leg Travel Insurance: An In-Depth Review

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Before finalizing your travel plans, look into various insurance policies to safeguard yourself against potential risks. Travel insurance is an invaluable resource that can protect you from many unforeseen issues, but not all companies provide the same level of coverage. And some companies' policies may cost more than others.

That's where Tin Leg Travel Insurance comes in. Created by travel agency Squaremouth, Tin Leg Travel Insurance offers eight different plans with varying coverage levels and benefits, with the option to add Cancel for Any Reason (CFAR) coverage to select plans. Keep reading to see if Tin Leg Travel Insurance is the right travel insurance for you.

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Policy coverage includes most pre-existing health conditions

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical and evacuation amounts for peace of mind

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. COVID coverage included by default on all insurance plans

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers a wide range of plans for various budgets and travel needs

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some plans offer CFAR, “cancel for work reasons,” financial default, and unemployment coverage

- con icon Two crossed lines that form an 'X'. Limited add-on coverage options

- con icon Two crossed lines that form an 'X'. Baggage loss and delay coverage is low compared to competitors

Tin Leg travel insurance offers eight travel insurance plans to meet the unique needs of travelers.

- Tin Leg was founded in 2014 by the travel insurance industry experts at Squaremouth. Designed to meet the most common needs of travelers, these policies offer comprehensive Trip Cancellation and Trip Interruption benefits, and a range of Emergency Medical and Medical Evacuation limits.

Overview of Tin Leg Travel Insurance

Tin Leg Travel Insurance is a travel insurance provider founded in 2014 by travel insurance aggregator SquareMouth. With eight different plans, Tin Leg Travel Insurance is one of the providers listed in our guide on the best travel insurance companies , specifically for travelers with pre-existing conditions. We chose Tin Leg Travel Insurance because seven of its eight plans offer pre-existing condition waivers, with a 15-day purchase window and no extra cost.

That said, Tin Leg Travel Insurance has other coverages that are noteworthy. Its coverage limits for emergency evacuation go up to $1 million, which is great particularly if you have nautical travel plans as water-to-land rescues can be costly.

Additionally, sports equipment loss is included with seven of Tin Leg Travel Insurance's eight plans. However, you will need to call for more information on adventure sports, as Tin Leg Travel Insurance doesn't guarantee coverage.

Tin Leg's Travel Insurance Plans

Tin Leg Travel Insurance travel insurance offers eight travel insurance plans: Economy, Basic, Standard, Luxury, Adventure, Silver, Platinum, and Gold. Each plan offers varying levels of protection that correspond to the premium costs.

Here's a look at what you'll get with each plan. We've split the eight plans into two tables to make things easier to follow.

Here's how the Adventure, Silver, Platinu, and Gold plans compare:

Additional Coverage Options

Tin Leg Travel Insurance travel insurance offers additional coverage options, but they're only available on specific plans.

You can add rental car damage coverage to the Luxury plan for an additional fee. And both the Gold and Silver plans allow you to add on CFAR (cancel for any reason) coverage . With CFAR coverage travel insurance, you can cancel for any reason not listed in the base policy and be reimbursed — in the case of Tin Leg Travel Insurance, for 75% of your trip costs.

How to Purchase and Manage Your Tin Leg Policy

Travel insurance coverage varies greatly, and the amount you pay reflects the range of protection . However, since travel insurance protects your financial investment, it's typically worth spending a few extra dollars for higher coverage maximums, especially for medical insurance and evacuation expenses.

Getting a quote from Tin Leg Travel Insurance travel insurance is an easy process. You can do so from their website or an insurance aggregator like SquareMouth. You should be prepared to provide the following information:

- Number of travelers

- Age of traveler(s)

- Duration of trip

- Whether you want trip cancellation coverage

- Date of booking

- If you have any trip payments left to make

- One country you're traveling to

- Country of residence/citizenship

After inputting some personal information, such as your age and state of residence, along with your trip details, like travel dates, destination, and trip costs, you'll get an instant quote for the plans available for your trip. And from there, it's easy to compare each option based on your coverage needs and budget.

Now let's look at a few examples to estimate Tin Leg Travel Insurance's coverage costs.

As of April 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following Tin Leg Travel Insurance travel insurance quotes:

Premiums for Tin Leg Travel Insurance plans are between 1.8% and 3.9% of the trip's cost, well below the average cost of travel insurance . It's also relatively cheap compared to many of its competitors

Tin Leg Travel Insurance provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

Once again, premiums for Tin Leg Travel Insurance plans are between 3.4% and 5.2%, below the average cost for travel insurance.

A 65-year-old couple looking to escape New Jersey for Mexico for two weeks with a trip cost of $6,000 would have the following Tin Leg Travel Insurance quotes:

Premiums for Tin Leg Travel Insurance plans are between 6.9% and 9.4%, which is roughly in line with the average cost for travel insurance. This is to be expected, as travel insurance is often more expensive for older travelers.

How to File a Claim with Tin Leg Travel Insurance

One exceptionally nice aspect of Tin Leg Travel Insurance is that you can report a claim online or over the phone. You can contact Tin Leg Travel Insurance's claims department at 844-240-1233 or by email at [email protected] . It's available on weekdays between 8 a.m. and 4 p.m. ET.

You'll be asked to fill out a claims form that asks about your trip details and the issue you faced. Tin Leg Travel Insurance will then ask you to file supporting documents related to your claim. If you're filing a claim because you canceled a flight due to an illness, they'll likely require medical documentation that supports this claim.

Tin Leg Customer Service and Support Experience

Tin Leg Travel Insurance is well reviewed, receiving an average of 4.6 stars out of five on SquareMouth across nearly 3,800 reviews. Reviews on its Better Business Bureau are consistent with its SquareMouth score, also averaging 4.6 stars across over 110 reviews, admittedly a limited sample size. Additionally, Tin Leg Travel Insurance is not certified with the BBB.

While most customers reported a smooth and speedy claims service, some noted that communication from Tin Leg Travel Insurance during the process can be spotty. Additionally, customers complained about their claims being denied due to requirements they were unaware of when purchasing coverage. One customer wrote about how they had to cancel a trip because of work, but hadn't been working at their company long enough to qualify for trip cancellation coverage.

See how Tin Leg Travel Insurance travel insurance stacks up against the competition.

Tin Leg Travel Insurance vs. AIG Travel Guard

To compare Tin Leg Travel Insurance travel insurance to Travel Guard , we'll consider the coverage limits from their highest-rated, Gold and Travel Guard Deluxe plans, respectively.

With AIG Travel Guard's Deluxe plan, you'll get:

- Trip cancellation coverage up to $150,000

- Trip interruption coverage up to $225,000

- Emergency medical coverage of $100,000

- Coverage for baggage loss, theft, or damage up to $2,500

- Travel delay coverage of up to $1,000

Comparing those coverages with Tin Leg Travel Insurance's Gold plan, you'll see that AIG's coverages are better than Tin Leg Travel Insurance's in all areas except one – emergency medical. While AIG offers emergency medical coverage of $100,000, Tin Leg Travel Insurance's coverage limit is $500,000 (in primary coverage).

If the medical coverage piece is what's most important to you, Tin Leg Travel Insurance would be the right choice in this scenario. That said, having $100,000 in emergency medical coverage is nothing to scoff at, so it may come down to comparing premium costs.

Remember that the premium costs will depend on the traveler's age, trip destination, and trip cost. So you'll need to compare these two insurers using your trip-specific information to get a solid idea of the costs associated with each plan.

Read our AIG Travel Guard insurance review here.

Tin Leg Travel Insurance vs. Allianz Travel Insurance

Both Allianz Travel Insurance and Tin Leg Travel Insurance travel insurance offer a variety of travel insurance plans designed for different types of travelers with varying types and degrees of coverage.

In this comparison, we'll look at Allianz Travel Insurance's most popular single-trip plan, the OneTrip Prime plan, compared to Tin Leg Travel Insurance's Basic plan.

With Allianz Travel Insurance's most popular single-trip OneTrip Prime plan, you'll get:

- Up to $100,000 in trip cancellation coverage

- Up to $150,000 in trip interruption coverage

- $50,000 in emergency medical coverage

- Up to $1,000 in coverage for baggage loss, theft, or damage

- Up to $800 in travel delay coverage

In looking at Tin Leg Travel Insurance's basic plan, you'll find that these two policies offer the same $50,000 coverage limit for emergency medical. Still, Allianz Travel Insurance's plan exceeds Tin Leg Travel Insurance's in the other coverage limits. That said, you'll have to quote both of these policies using your personal trip information to make an informed decision, especially if cost is the most important factor to you.

Read our Allianz travel insurance review here.

Tin Leg Travel Insurance vs. Credit Card Travel Insurance

Do you have a travel credit card? If so, consider the type of insurance coverage it may (or may not) offer. Some basic coverages, like primary rental car insurance, are provided through your credit card's travel protection . And if you don't need medical coverage or don't have a lot of non-refundable trip expenses, the coverage offered by your credit card could suffice.

That said, don't forget that credit card coverage is sometimes considered secondary coverage. That means you'll have to file a claim with any other applicable insurer before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

Tin Leg Travel Insurance FAQs

All policies except Economy cover pre-existing medical conditions as long as you purchase your policy within 15 days of trip deposit.

You have 14 days after you purchase your policy to refund your Tin Leg Travel Insurance policy, as long as you haven't left for your trip.