My TRS Claim

Browser not supported

The browser that you are using cannot run the TRS Claim application: it does not properly support html "canvas" elements and so cannot be used to generate a QR code.

Please install a more up-to-date browser, such as the latest version of Chrome , Firefox , or Edge .

- 1. Disclaimer

- 2. My Travel Details

- 3. My Invoices

- 4. My Payment Details

- 5. My Claim Code

Step 2 of 5 -

Important note to all claimants.

This web page will assist you to enter information required to lodge a Tourist Refund Scheme (TRS) claim.

When you have finished entering your information it will be stored in a QR code. This QR code is your TRS Claim Code, and it must be presented at the TRS location at the airport on the day you depart from Australia.

Creating a TRS Claim 'QR' Code may allow your claim to be processed faster at TRS as your claim information is pre-filled.

Your Privacy

The Department of Home Affairs collects and deals with personal information in accordance with its Privacy Policy.

Your use of this TRS Application is regulated by its Terms and Conditions, including the application's Privacy Statement.

By checking this box, I understand and accept the TRS Application's Terms and Conditions, including the Privacy Statement.

Tax Invoice Requirements

A valid tax invoice includes:

- the retailer's name, address and Australian Business Number (ABN)

- a description of the goods that allows us to match the goods to the invoice

- the purchase price of the goods, including the GST or WET paid (or total price including GST)

- the date of purchase

- the invoice must be in English.

Tax invoices for $1,000 or more must also show your name (and only your name) as it appears in your passport.

Tax Invoice s :

Invoice Date: Invoices must be dated within 60 days of your Departure Date Invoices cannot be dated in the future Invoice/Receipt Number:

Total for : $

Estimated Refund for ABN: $

The invoices for ABN are not eligible for a refund because they total less than $300.

Total Of All Invoices: $ Estimated Total GST/WET Refund Being Claimed: $

Each abn on the claim must have invoices totalling a minimum of $300. the highlighted abns do not qualify., up to 10 invoices may be added..

* How do you want your refund to be paid, if approved?

Credit Card

The following credit cards are accepted:

Please note Union Pay debit cards are not accepted.

This application does not collect credit card details. Present your credit card when submitting your claim on departure.

Australian Bank Account

Cheque (not recommended)

Cheques may take 2 months to arrive, from date of departure.

Travel Details:

Passport Issuing Country:

Passport Number:

Australian Resident:

Departure Date:

Invoice Date: Invoice/Receipt Number:

Total All Invoices: $

Estimated gst/wet refund in australian dollars being claimed against all invoices (if approved): $, payment details:.

Payment Method:

Present your credit card when submitting your claim on departure.

Account Name:

BSB Number:

Account Number:

Cheque Currency:

Declaration:

I claim the Goods and Services Tax (and Wine Equalisation Tax if applicable) under the Tourist Refund Scheme (TRS) for the goods described in this TRS claim application.

I confirm that:

- These goods were acquired by me within 60 days of my departure date, and paid in full for the amounts indicated in this TRS claim on the associated invoices;

- The goods in this TRS claim will be in my possession and exported by me on the specified date of departure from Australia.

I understand that if I return to Australia with the goods, I may be required to pay applicable duties including GST and WET.

You have finished supplying the information needed to process your TRS claim and it is now saved in the following claim code. Please print or save this claim code.

You may save the claim code by right-clicking it and selecting your browsers Save Image/Picture... option.

To submit your TRS claim, you must present this claim code and any additional claim codes you have created at the TRS location at your port of departure from Australia.

Ensure you have the following items ready to be inspected:

- The goods you are claiming a refund against;

- Your Tax Invoice(s);

- Your passport; and

- Your boarding pass.

If you cannot present your claim code, your claim will be processed manually.

If when requested by an ABF officer you cannot present some or any of the goods listed above, some or all of your claim may be rejected.

Please note: this claim contains invoices that do not meet eligibility requirements.

To submit your Tourist Refund Scheme (TRS) claim, you must present this claim code at the TRS facility at your port of departure.

If, when requested, you cannot present some or any of the items listed above prior to departing the country, some or all of your claim may be rejected.

Tax Invoice Summary

Tax Invoice s . Total:

Estimated Refund (subject to approval)

Terms and Conditions

Privacy statement.

The Department of Home Affairs (Home Affairs) is collecting and using your personal information for the purpose of assessing and refunding the Goods and Services (GST) and Wine Equalisation Tax (WET) in accordance with section 168 of the A New Tax System (Goods and Services Tax) Act 1999 (Cth). Home Affairs may disclose this information to the Australian Taxation Office and any retailers from whom you have attached invoices for the purposes of assessing and determining your eligibility for a GST/WET refund. If a tax refund is due to be paid to you, your personal information will be disclosed to a contracted commercial agency to facilitate the processing of that refund.

Failure to complete this application or provide this information may result in Home Affairs being unable to process your tax refund using this application.

Personal information will be collected, used, stored and disclosed by Home Affairs in accordance with the Australian Privacy Principles in Schedule 1 of the Privacy Act 1988 (Cth).

Further information regarding how Home Affairs handles personal information can be found in Home Affairs' privacy policy .

Warning: The TRS claim code generated by this app is not encrypted and can be read by any device capable of reading a QR code. You bear sole responsibility for the security of the code and its data.

Conditions on the use of this application, the eligibility rules for making a TRS claim, and the process for making a claim are detailed on the TRS information page .

Legal Statement

Making a false or misleading statement to an officer, including by presenting false documents, may result in the application of penalties.

Any goods subject to this TRS claim must be declared if they are brought back into Australia. You may be required to repay the GST/WET refunded under the TRS plus any additional customs duties and taxes payable on the ENTIRE VALUE of ALL the general goods you are importing.

Failure to declare imported goods may also result in the application of penalties (see the TRS Information page).

Invoice Details

What can i claim.

You can claim on most goods provided you can present a valid tax invoice.

You cannot claim against:

- GST-free goods

- Services, such as car hire and accommodation

- Beer, spirits, tobacco and tobacco products

- Goods consumed in Australia

- Dangerous goods (goods you can't take out with you on the aircraft)

- Goods which are not accompanying you on departure including goods you have freighted or posted out of Australia.

For more information refer to the TRS Information page .

Invoice Items:

* Please describe OTHER goods below. Your claim will be rejected if these goods do not meet the TRS requirements.

Amount Paid for Claimable Goods, including GST/WET

Government agencies communicate via .gov.sg websites (e.g. go.gov.sg/open) . Trusted website s

Look for a lock ( ) or https:// as an added precaution. Share sensitive information only on official, secure websites.

Tourist Refund Scheme

Duty Free Concession and GST Relief

Declaration and Payment of Taxes

Prohibited and Controlled Goods

Guide For Travellers

Three Quarter Tank Rule

The Tourist Refund Scheme (TRS) is administered by Singapore Customs on behalf of the Inland Revenue Authority of Singapore (IRAS). The scheme allows tourists to claim a refund of the Goods and Services Tax (GST) paid on goods purchased from participating retailers if the goods are brought out of Singapore via Changi International Airport or Seletar Airport.

For more information on the scheme’s qualifying conditions and tourist eligibility criteria, please refer to IRAS’ webpage on Tourist Refund Scheme .

Where can I claim GST refund?

GST refund, subject to conditions of the scheme, can be claimed at these locations:

- Changi Airport

- Seletar Airport

How do I process my GST refund?

Before departing from the airport, please proceed to the electronic TRS (eTRS) self-help kiosk to apply for your GST refund. You will need to scan your physical passport to retrieve all eTRS transactions tagged to your passport.

- For check-in items: Before checking-in your purchases, proceed to the eTRS self-help kiosks located at the Departure Check-in Hall (before Departure Immigration) to apply for your GST refund.

- For hand-carry items: Proceed to the eTRS self-help kiosks located at the Departure Transit Lounge (after Departure Immigration) to apply for GST refund.

Customs Inspection: If you are notified at the kiosk to present your goods for physical inspection at the Customs Inspection Counter, you will have to present the following items in person :

1) Goods which you have purchased;

2) Original invoice/receipt issued by the retailer clearly stating the price, description of the goods, serial number (if any); and

3) Physical passport and boarding pass/confirmed air ticket.

Additional Information:

- You should be submitting your GST refund claim at the terminal where you will be checking in your purchases or where your flight will be departing from.

- Singapore Customs does not issue eTRS transactions nor process any refund (cash or non-cash). To check if you have been successfully issued with eTRS transactions by participating retailers or for updates on the refund status of your eTRS transactions, please visit touristrefund.sg to register and login to your e-Service account.

All refunds (cash or non-cash) are processed by Global Tax Free Pte Ltd (the approved Central Refund Counter Operator), not Singapore Customs.

For enquiries relating to the status of your approved refund, please contact:

Global Tax Free Pte Ltd

Tel: (+65) 6513 3756 ( Weekdays from 9am to 6pm ) Tel: (+65) 6546 5074 ( Weekdays after 6pm, Weekends and Public Holiday ) Email: [email protected] Website: touristrefund.sg

Refunds are not allowed on :

Services (like car rental, entertainment, dry cleaning, etc.);

Goods which are wholly or partly consumed in Singapore;

Goods purchased for business or commercial purpose;

Goods exported by freight;

Accommodation in hotel, hostel, boarding house or similar establishments; and

Goods not presented for inspection.

Do note that the following acts constitute serious offences which result in penalties and possible imprisonment:

Making a false declaration in the refund application to Singapore Customs; and

Taking goods out of the Departure Check-in Hall/ Transit Area or passing the goods to someone else, after the refund application has been approved.

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

Tourist refund scheme

The tourist refund scheme applies to goods purchased at prices that include GST or WET.

Last updated 21 April 2022

Travellers departing Australia can get a GST or WET refund under the tourist refund scheme (TRS), administered by the Department of Home Affairs and its operational arm the Australian Border Force (ABF).

The scheme applies to goods purchased at prices that include GST or WET, from a retailer with an ABN and registered for GST.

It does not apply to services such as accommodation. GST-free goods cannot get a refund under the scheme, as no GST has been paid.

Crew members of an aircraft or ship are not eligible to claim refunds under the scheme.

A traveller may claim a refund under the TRS if the purchases meet the following requirements.

- The purchases are from a single business with the same Australian business number (ABN) and total AUD$300 (GST inclusive) or more. For example, if you bought items from one business, even on separate invoices, that together total AUD$300 the goods were purchased within 60 days of departure from Australia.

- The traveller has original tax invoice/s for the goods.

- The travelling passenger paid for the goods.

- Carry or wear the goods on board the aircraft or ship as cabin baggage unless they are oversized or subject to aviation security measures and the airline requires them to be checked in as hold luggage.

- Present their tax invoices (in English), goods, passport and boarding pass to the TRS facility when departing Australia.

- Make the claim at the TRS facility at an airport at least 30 minutes prior to the scheduled departure time or 60 minutes if travelling on a cruise.

Residents of Australia's external territories, such as Norfolk Island, Christmas Island and the Cocos (Keeling) Islands, can also get a GST refund if they export the goods to their home territory as accompanied or unaccompanied baggage or as cargo.

Travellers bringing goods back into Australia for which they have already claimed a TRS refund

You must declare any goods you bring back to Australia, for which a TRS claim was made by you or another person when the goods left Australia. You can do this by declaring the goods at question 3 on your incoming passenger card when you return to Australia.

Unless another concession applies, for example concessions on personal clothing (excluding furs), you may need to pay GST on goods you bring back into Australia. This happens when the value of those goods, combined with any other goods you import for which another concession doesn’t apply, exceeds the passenger concession allowance External Link .

Penalties may apply if you fail to declare these items.

What retailers are required to do

When a customer requests a full refund you should check their invoice to determine if they have already claimed under the Tourist refund scheme External Link . If a claim has been approved the invoice will contain a stamp from the ABF.

Customers applying for a refund when they have already obtained a TRS refund are not entitled to receive a refund for the GST/WET portion of the invoice.

To obtain a full refund, a customer must provide proof that the GST/WET has been repaid when they declared the goods on their return to Australia.

Published: April 11, 2023

International travel from Australia is experiencing a surge as COVID-19 restrictions have been lifted, allowing travelers to finally visit those incredible destinations they’ve been dreaming of for so long. Whether you’re traveling for business or leisure purposes, now is the perfect time to pack your bags and embark on your next adventure. With the global vaccination efforts well underway and many countries reopening their borders to tourists, there are countless opportunities to explore new cultures, indulge in exotic cuisine, and create unforgettable memories with your loved ones. So why wait? Start planning your next international trip today and get ready to experience all the world has to offer.

Head Straight To The Tips

After completing their shopping, both international travelers and Australian residents may be eligible to receive a refund for the Goods and Services Tax (GST) and/or Wine Equalization Tax (WET) on certain items they take out of the country by ship or aircraft. This program, called the Tourist Refund Scheme (TRS), is an initiative of the Australian Government. The TRS is applicable for goods that are purchased from a retailer who has an ABN and is registered for GST, and the prices of which include GST or WET.

So, let’s delve into the process of successfully claiming the TRS and at the end I would also share some tips which I think could be useful in this purpose.

Claiming TRS

Travelers can claim the TRS at the international airport if their purchases meet the following requirements:

- Goods are purchased from a single business with the same Australian business number (ABN), but not different stores within that business if they have different ABNs

- Goods must total AUD$300 (including GST) or more

- Goods are purchased within 60 days of departing Australia

- You must have the original paper tax invoice/s for the goods

- You must get a valid paper tax invoice in English with:

- your name (and only your name) as it appears in your passport if the invoice is $1,000 or more

- a description of the goods that allows TRS officials to match the goods to the invoice

- the retailer’s name, address and ABN (ACNs and ARNs not accepted)

- the amount of GST or WET paid (or total price including GST)

- the date of purchase

- You, as the travelling passenger, must have paid for the goods yourself

- You carry or wear the goods on-board the aircraft or ship as cabin baggage unless they are oversized or subject to aviation security measures (and the airline requires them to be checked in as “hold” luggage)

- Residents of Australia’s external territories (e.g., Christmas Island, Norfolk Island, and the Keeling Islands) can also get a GST refund if they export the goods to their home territory as baggage or as cargo

- You must have oversized, and restricted goods sighted by ABF Client services before checking in and take the stamped invoices to the TRS Facility on the day of departure

- You must claim in person by showing your passport, boarding pass and original tax invoices to the TRS Facility on the day of your departure:

- more than 30 minutes before your scheduled departure at an airport

- 1-4 hours before your scheduled departure at a seaport

- Declare any goods you bring back to Australia, for which a TRS claim was made by you or another person when the goods left Australia.

- On returning to Australia, you must declare the goods at Question 3 on your Incoming Passenger Card (IPC)

- Penalties may apply if you fail to declare these items

- If you bring goods back into Australia for which a GST refund via the TRS has been claimed, the goods must be declared, and if the value of those goods (combined with any other overseas/duty free purchases) exceeds the passenger concession allowance, any applicable GST and/or duty may need to be paid unless another concession (example, all personal clothing – except furs) is available.

Allowances for TRS (Dos)

- You can make several purchases over several days

- You can calculate the GST refund amount yourself by dividing the total price in dollars by 11

- You can ask your domestic airline to make your goods available to you before your international connection

- Take your passport to ensure the name on the passport is the same on the tax invoice

- Only claim at your last port of departure from Australia (this may be different to where you originally boarded your aircraft or cruise ship)

- Only get refunds paid to you or another person by:

- credit card (Amex, Diners, JCB, MasterCard, Union Pay, Visa)

- Australian bank account

- mailed cheque (not recommended)

TRS restrictions (don’ts)

TRS has a large number of restrictions that must be understood before applying. Here they are in full:

- get a cash refund

- use photocopied, reprinted or duplicate invoices

- ship goods separately

- when it is less than 30 minutes before your scheduled departure time

- at a domestic airport

- before the day of departure

- after you leave Australia

- if you are operating air or sea crew

- if you are buying for a business

- if the invoice has a name other than your own as the buyer

- alcohol except wine with alcohol content less than 22%

- tobacco and tobacco products

- dangerous goods which are prohibited on an aircraft or ship for safety reasons; liquids, gas cylinders and fireworks

- goods wholly or partially consumed in Australia; food, drinks, perfume

- cosmetic enhancements that are attached permanently; hair implants, dental work / implants, hair extensions and breast implants

- gift cards and vouchers; goods purchased with gift cards or vouchers are eligible for a refund subject to all other TRS requirements being met

- unaccompanied goods; freighted and posted goods unless the goods are being exported to an External Australian Territory by a resident of that territory

- goods purchased overseas and imported into Australia

- GST-free goods; abalone, baby food, medications, medical aids and appliances, lenses for prescription spectacles, nebulisers, CPAP breathing machines

- services; accommodation, taxis and tours, house plans and drawings, car rental, shipping/postage charges, warranties and labour charges, training and educational courses or the course documents/materials (physical or digital).

Starting the Process by Lodging online

You can complete your claim online before you fly. This process won’t actually lodge it, but it can reduce your time at an airport TRS facility, as the officer won’t have to type in all your details. The Australian Government Department of Home Affairs has developed online and mobile Tourist Refund Scheme apps that allow you to enter the information required.

These apps allow you to store details in a Quick Response (QR) code that can be scanned at some TRS facilities. To lodge your TRS claim in Australia with apps you must:

- Enter your travel details

- Enter details of the goods for which you are claiming a refund of GST and/or WET

- Enter how you prefer to receive your tax refund

- If you have more than ten invoices, enter them in batches of ten and print a QR code for each batch

- On your departure day, present the TRS facility your goods, original paper tax invoices and QR codes

On The Day of Departure (Most Important) :

I will now detail the process of lodging the claim at the airport, specifically at Sydney International Airport, as this was where I began my travel. Please note that the following description and all the photos provided pertain to those who wish to lodge the claim at the TRS facility at Sydney International Airport, as this will be their final port before departing Australia.

As you arrive at the airport you would see the information desk along with some retailers and a few signage where it says Rideshare & Pick-up . This is a very spacious area and with lots of displays. It is also located at level 1. Now, to get to TRS office you keep going down the hallway towards Arrivals B .

As you come near the end, you would notice the signage for Australian Border Force – TRS ABF Client Services – which would be on the next level.

After taking the lift, as you come up to the level 2, there you would find the TRS office. Depending on the time of the day and number of people present at the time of your visit, you might have to wait a bit until your turn comes. The officers would sight the invoices as well as the goods however, they would only sign off those invoices for which the concerning items you intend to carry only inside your checked baggage or as oversized item.

In short, the TRS facility at level 2 would sign off those items that you don’t carry with you . And hence, since you still have few items to take with you in your carry-on luggage, all those invoices would be left out at this stage.

Once your items have been verified and the invoices signed, you will return to level 1 to check in your baggage at the counter of your airline. After checking in your baggage, you will proceed to the immigration procedure. Upon entering the departure terminal, you will join the immigration queue which typically takes only a few minutes, depending on your travel document.

After completing the immigration process, you will arrive on the other side of the terminal where you will find all the duty-free shops. The final step in claiming your refund is to locate the TRS office within the departure terminal and present any items that you still have in your carry-on luggage. The TRS office is located on the left-hand side near gate 8. Once you show them the items, they will verify the claim and provide you with a receipt indicating the amount you will receive. That’s it! In the next few days, the refund will be deposited into your nominated account (if you selected bank transfer as your preferred method of receiving the refund).

Helpful Tips To Maximize Your Gain

- Lodge TRS online and get a QR Code

- Have your invoices printed in case of digital copies (Make sure the invoices have “TAX INVOICE” written on them)

- Got some big-ticket items to purchase that you want to claim the GST? Well, you only got some sixty (60) days from the day you purchase till the day you claim. So, buying too early during a sale might come with a loss later ! (Keep Reading)

- You can buy as much clothing you would like; you can bring all of it back. But for the rest, its only up to 900 AUD worth that you get exemption. So, buying big ticket electronics can get you out of concession quickly!

- Purchasing from Amazon (AU) is NOT recommended unless the item itself is worth more than 300 AUD as Amazon doesn’t give you invoices with their ABN in most cases . You have to collect the invoice form individual seller for each item. So, if you want to make several purchases with smaller amounts Amazon is not the best option.

- For smaller amounts purchasing from MYER, JB HI-FI, Officeworks etc. are recommended as for all the items I purchased from MYER for instance, such as bags, pans, clothing etc. always had MYER ABN on them. It is worth noting that MYER marketplace items have MYER ABN instead of the ABN of that individual seller. And since the ABN is same, all those purchases count towards 300 AUD threshold.

For more information, visit the website , email [email protected] or

Telephone: If you are calling the TRS from within Australia: 1300 555 043 If you are calling the TRS from outside Australia: +61 2 6245 5499.

- Tourist Refund Scheme (TRS), Australian Border Force

- Tourist Refund Scheme, Australian Government, Australian Taxation Office

- Tourist Refund Scheme, Sydney Airport

Get Updates And Stay Connected -Subscribe To Our Newsletter

Navigation menu, social links.

Our Location

Contact Information

- [email protected]

- +61 2 8007 3726

Read Our Blog

Project – 100 Strangers (64/100) – Kaisa

Project – 100 Strangers (63/100) – Hanneke

© blissful-penguin.com.au 2024

Tourist Refund - On-line

Just wondering if anyone knows if there is clarity around on-line purchases and claiming the refund?

The instructions here [https://www.abf.gov.au/entering-and-leaving-australia/tourist-refund-scheme/for-travellers] says "goods purchased over the Internet and imported into Australia" cannot be refunded, yet:

1. most manufactured goods are imported; and

2. some large on-line sites now pay GST (eBay, Amazon etc).

So, for example, if I purchased noise-cancelling headphones to take and use on the plane from Amazon Australia (who have an ABN) and supplied from an Australian supplier, could I claim the refund?

Thanks in advance, oh knowledgeable ones.

- Report as inappropriate

Most helpful reply ato certified response

You can generally claim the GST component back under the Tourist Refund Scheme (TRS) when departing Australia if;

- The headphones were purchased from a business with a Australian business number, and total $300 (GST inclusive) or more.

- you're leaving Australia and you purchased the headphones in the 60 days before leaving Australia

- you've got the original tax invoice for the headphones, and when you rock up to TRS facility you can prove that you're the travelling passenger that paid for them, and

- you're listening to tunes on your new cans as you make the claim (you usually need to carry or wear the goods on board the aircraft or ship as cabin baggage).

The ATO has provided some info on TRS here. It sounds like you'll be able to make a claim as you're not importing the goods as a consumer (importation probably happened earlier in the supply chain). This is just an assumption, and I'd suggest you get a firm answer from the TRS team directly, as it's administered by Home Affairs (Border Force). You can call them on one-three hundred 555 043 or email trs @abf.gov.au

Thank you @Miccles

Informative and midly humourous! What more could one ask for?!

I'll e-mail the TRS team and get an answer ...which I might post here for others.

Related articles

- Working for a food delivery service

- Managing your business with myGovID and RAM

- Tax tips for managing your side hustle

- Strengthen your small business with our new online learning platform

Related keywords

- Archived Archived

- Find a Store

- Watch List Expand Watch list Loading... Sign in to see your user information

- My eBay Summary

- Recently Viewed

- Bids/Offers

- Purchase History

- Selling/Sold

- Saved Searches

- Saved Sellers

- My Messages

- Get Exclusive Savings

- Notification

- Expand cart Loading... Something went wrong. View cart for details.

Paying tax on eBay purchases

- Items delivered to Australia – Goods and Services Tax (GST)

Items delivered overseas

Refunded purchases.

Many countries and jurisdictions around the world apply some type of tax on consumer purchases, including items bought on eBay. Whether the tax is included in the listing price, added to your order total or charged at the border depends on the order price, the item's location and your delivery address.

If additional tax is applicable on your eBay purchase, you'll usually see this indicated on the listing page. The confirmed tax amount will be shown on the checkout page, before you pay.

Are you a seller looking for information about tax on your eBay sales? Read our article on taxes and import charges for sellers .

Items delivered to Australia – Goods and Services Tax (GST)

Australian Goods and Services Tax (GST) generally applies to purchases delivered to Australian buyers. (Visit the Australian Taxation Office website for a list of GST-exempt products - opens in new window or tab .)

Items sold from Australia

If the item's located in Australia, the listing price is GST-inclusive, where applicable. Sellers may not add GST to the final sale price after an item has sold. If you need a tax invoice showing the GST component for an item you bought, please contact the seller.

Items imported into Australia

eBay is required to collect GST on orders up to AU $1,000 imported into Australia. If you're buying an item located outside Australia and you select an Australian delivery address, eBay will add GST to the total at checkout. The seller receives payment for the order (item price + postage costs), and eBay remits the GST to the Australian Taxation Office (ATO).

If GST was collected, you can view and download a tax invoice from the Order details page in your Purchase history - opens in new window or tab .

For orders valued at over AU $1,000, the GST is generally collected at the Australian border. You may need to pay it as part of clearing your parcel through customs.

For more information about buying from overseas sellers, see our article about international purchases and postage .

If you're having an order delivered to an address outside Australia, local consumer tax and/or customs duty may apply. Online marketplaces such as eBay may be responsible for collecting the tax, or the parcel's recipient may need to pay these as part of clearing the parcel through customs.

While we've included basic information for some countries here, it is only intended as a guide and is by no means exhaustive. For more information, please check the local tax and customs regulations.

Items delivered to New Zealand – Goods and Services Tax (GST)

eBay is required to collect GST on orders up to NZ $1,000. You'll see the GST included in your order total at checkout. If GST was collected, you can view and download a tax invoice from the Order details page in your Purchase history - opens in new window or tab .

For orders valued at over NZ $1,000, the GST is generally collected at the NZ border. The recipient may need to pay it as part of clearing the parcel through customs.

Items delivered to the US – sales tax

Tax laws vary between states, and sales tax may be required to be collected by the seller, collected by eBay, or paid directly by the buyer. If your delivery address is in one of the US states where either the seller or eBay is required to charge sales tax, the tax will be included in the order total at checkout.

If the item's being sent from outside the US, the recipient may have to pay duty and customs processing fees. However, items under $100 which are a gift will generally be cleared without any additional charges.

Items delivered to the UK – Value Added Tax (VAT)

As of 1 January 2021, eBay is required to collect VAT on certain orders placed on eBay sites and delivered to UK addresses:

- Orders up to £135 sent from outside the UK

- Orders where the item is located in the UK, but the seller is not based in the UK

You'll see the VAT included in your order total at checkout, and you can view and download a tax invoice from the Order details page in your Purchase history - opens in new window or tab .

On orders over £135 imported to the UK, eBay will not collect VAT but the recipient may need to pay VAT as part of clearing the parcel through customs.

Items delivered to EU countries – Value Added Tax (VAT)

If the item's being sent from outside the EU, the buyer or recipient may need to pay VAT and customs duty.

As of 1 July 2021, eBay is required to collect VAT on certain orders placed on eBay sites and delivered to EU addresses. For consignments where eBay does not collect taxes, or for orders above a certain value, buyers may need to pay additional import fees (e.g. VAT and duties) as part of clearing their parcel through customs, or when their order is delivered.

If you paid tax on your purchase through eBay and you get a refund for your order, you'll also get a refund for the proportionate amount of tax. For example, if you receive a full refund, you'll get the entire tax back. If you receive a 50% partial refund, you'll get 50% of the tax back. Any refunds processed outside eBay's systems are not eligible for a tax refund.

If you paid import taxes or duty as part of clearing your parcel through customs but you then returned the item, please contact the customs authority regarding a refund of the charges.

If additional tax is applicable on your eBay purchase, you'll see this indicated on the listing page and the tax amount will be shown on the checkout page, before you pay.

Related help topics.

See other articles in:

You might also be interested in:

You'll find items from all over the world on eBay. International sellers can send items to you through regular postage services, or they may use one of eBay's shipping programs.

Listing items for sale internationally is a great way to help increase your sales, but it's important to make sure your items aren't prohibited on our global sites.

- Skip to navigation

- Skip to main content

Popular searches

Your previous searches.

- Integrated Cargo System (ICS)

Participation in the Tourist Refund Scheme (TRS)

If you have an Australian Business Number (ABN), are registered for the GST and can produce a valid tax invoice, you are eligible to participate in the scheme. No registration to the TRS is required.

A TRS sale is the same as a normal sale. However, your customers will need an original tax invoice.

To be eligible to claim under the TRS, invoices must total $300 (GST inclusive) or more from a single ABN, and may be made up of multiple purchases on multiple days provided each purchase is made within 60 days of the customer's departure from Australia.

If passengers buy lower-priced goods from your store on different days within the 60-day period, they might ask you to consolidate their invoices. To help facilitate the passenger’s TRS claim and reduce their time queuing, consolidation of tax invoices by retailers is appreciated.

The tax invoice is necessary for travellers as evidence of the date and price of the purchase. It should also contain your ABN, a description of the goods supplied and the GST amount. Tax invoices for purchases of AUD 1000 or more must contain the identity of the purchaser.

More information on tax invoices is available by contacting the Australian Taxation Office .

Need a hand?

TRS Question Regarding eBay Purchase

Hi all … If I purchase an overseas item over $300 from ebay.com.au, can I print off the invoice from ebay and present it (along with the item) - at the airport TRS office for a GST refund ??

I understand that an Australian ABN number is required. In this case, I'm assuming it will be ebay Australia's ABN.

Related Stores

no; ebay is a facilitating platform. TRS will offer you a refund on items sold by Australian retailers, so if an item was from an Australian Retailer with aus stock, simply request a proper TAX invoice from them.

Thanks for that !! … I guess that means that TRS will not refund GST from an ebay overseas seller.

Overseas sellers cannot provide you with a tax invoice as they do not have an ABN that they can quote for refunding GST. The ABN will not be eBay’s ABN but will be the ABN of the seller so long as they have registered for an ABN and for GST.

Local sellers you will need to check whether they are GST registered and have an ABN. The ABN on a tax invoice you receive if the seller is registered will not be eBay’s ABN but the ABN of the seller.

In many cases many businesses on eBay that sell a lot will exceed the $75,000 a year in sales threshold and will have to register for GST. In this case you can also request in the comments when making a purchase that they send you a tax invoice. Some sellers with less tham $75,000 will also be registered.

If you’re not sure you can always message them first and ask if they can provide you with a tax invoice. Make sure the tax invoice is fully compliant. The minimum details includes their ABN, their address, cost of goods, description, and amount of GST. If the amount is more than $1,000 your address must also be on the invoice.

Thanks for that information - very useful.

ebay australia & new zealand pty ltd is the entity that collects gst from australian buyers when they purchase items located overseas. they're registered for gst.

http://www.abr.business.gov.au/ABN/View/22086288888

check your email for an tax invoice from them.

I'm a bit confused - are you saying that ebay Australia can provide a tax invoice that can be used to get a TRS refund on GST ??

EBay cannot provide a tax invoice. They are not the seller. Only the seller can provide the tax invoice.

I don't think this is right.

eBay provide services by being a market place in the transaction (just like Westfield). eBay make profit by charging seller fee and eBay pass the GST to the seller

Buyer will need invoice from the seller to claim TRS.

https://www.homeaffairs.gov.au/trav/ente/tour/are-you-a-trav…

Under "What can’t be claimed?"

"goods purchased over the Internet and imported into Australia"

You nailed it !! …. Thankyou.

Speaking of which, is there and damn way in ebay of filtering searches to exclude foreign sellers? The located in australia filter does nothing. You get results, and look and the seller shows based in china.

New Forum Topics

Mission Moscow : A Conversation with Evgeny Kozlov

Mr. Evgeny Kozlov, Deputy Head Mayor of Moscow Government and Chairman of the Moscow City Tourism Committee, who has come to the city to attain BLTM, the annual prestigious travel event at the Leela Ambience Convention Centre, Delhi spoke with TW Editor Anirban Dasgupta on his vision and goal with the all-new tourism initiatives in Moscow.

The bond between India and Russia has a long history of culture, literature, love, and of course politics. But recently, there has also been a lot of talk about Gastronomical tourism. Any personal experience with this?

My personal take on the bond between India and Russia stems from my recent experience of trying authentic Indian cuisine in Moscow. I thoroughly enjoyed the spicy flavours of the Curry dish I tried and it left a lasting impression on me. This made me appreciate the cultural exchange between our two countries even more. I believe that Moscow, being a culinary hub, is a great place for people from all over the world, including Indian visitors, to immerse themselves in our rich history and culture. It’s a unique experience that brings people together and showcases the diversity of the gastronomic universe. Moscow has a thriving food scene with various international cuisines to explore, from Chinese to South African and Latin American. This culinary diversity reflects the open-mindedness and curiosity of the Russian people when it comes to trying new types of food. Moscow truly has something for everyone, and I encourage Indian tourists to come and indulge in this gastronomic journey.

How optimistic are the post-pandemic recovery figures?

After the Covid-19 pandemic, we have witnessed a remarkable recovery in tourism in Moscow. In fact, we have been able to restore 90% of the pre-pandemic tourist flow. In the first half of 2023, almost a million foreign tourists visited Moscow, with over 600,000 of them arriving during the summer season. Among the non-CIS countries, China has led the way in terms of tourist traffic, followed by Iran, the United Arab Emirates, Turkey, and India. Prior to the pandemic, India’s tourist flow was steadily growing at a rate of 12-15% annually. Although we faced challenges during the pandemic, we have now put in place all the necessary conditions for a successful recovery. Moscow is known for hosting numerous international exhibitions, forums, congresses, and conferences, attracting approximately 3.6 million business visitors in the past year alone. Among these visitors, India ranks third in terms of foreign business tourists in Moscow. To further promote tourism, we have initiated the MICE Ambassadors training program in India, which aims to assist Indian businesses in exploring opportunities and selecting relevant events in Moscow.

Can you please share your vision for future tourism development in Moscow?

Thank you for asking this question. I have a multi-faceted vision for the future tourism development in Moscow.

Firstly, I believe that tourism should provide a personal and authentic experience for each individual. Therefore, customization of experiences is crucial. For business tourists, we aim to offer special infrastructure facilities that cater to their specific needs and requirements. We are closely collaborating with infrastructure providers to ensure seamless experiences for those visiting Moscow for business purposes. On the other hand, when it comes to leisure or family tourists, we recognize the importance of providing a support system and guidelines for those traveling with their families, especially children. We are working with museums, theatres, and restaurants to customize their services and products to cater to tourists of all ages, including children. Furthermore, I envision rearranging tourism in Moscow to encourage visitors to delve into the history and heritage of our country. A significant part of my tourism goal is to motivate and inspire the youth and younger generations to travel to Russia. This involves providing affordable pricing for accommodations, entertainment, museums, and other attractions.

We are already constructing tailor-made infrastructure that specifically targets the young generation in Russia, and by next year, we plan to extend and promote these offerings to international young visitors as well. By rebranding the image of Moscow as a destination for longer stays, relaxation, and enjoying various facilities, we aim to change the perception that it is merely a transit or stop-over city. Lastly, the beautiful weather in Moscow during the summer months provides an opportunity to create delightful memories for tourists. I want every visitor to experience the sunshine, green landscapes, parks, cafes, restaurants, swimming pools, and sports facilities that Moscow has to offer during this time.

In summary, my vision for the future of tourism in Moscow revolves around creating customized travel experiences for every type of traveller.

How do you prioritize sustainability and responsible tourism practices in the development of business tourism?

How easy or difficult is it to get a Visa for an Indian Tourist at present?

Acquiring a Visa for Indian tourists has become easier with the introduction of the e-visa system. Since its launch in August 2023, more than 30,000 tourists have already utilized this system. The e-visa offers several advantages over traditional visas, such as avoiding the need to visit consulates or embassies. The application process only requires a digital photograph and a scan of the passport data page. The e-visa has a validity period of 60 days from the date of issuance, with a maximum stay of 16 days in Russia. This convenient and streamlined process is available to citizens of 55 countries, including India. Indian tourists are currently ranked third in terms of business travellers from outside the CIS countries visiting Moscow.

Author: Anirban

Share article, related news.

BLTM 2023 showcases top destinations for Bleisure and MICE Travel

École Ducasse Abu Dhabi Studio, in partnership with Erth Hospitality, to open this December

No comment be the first one., leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Bahasa Indonesia

- Slovenščina

- Science & Tech

- Russian Kitchen

How to use the Moscow Metro (PHOTOS+INFOGRAPHICS)

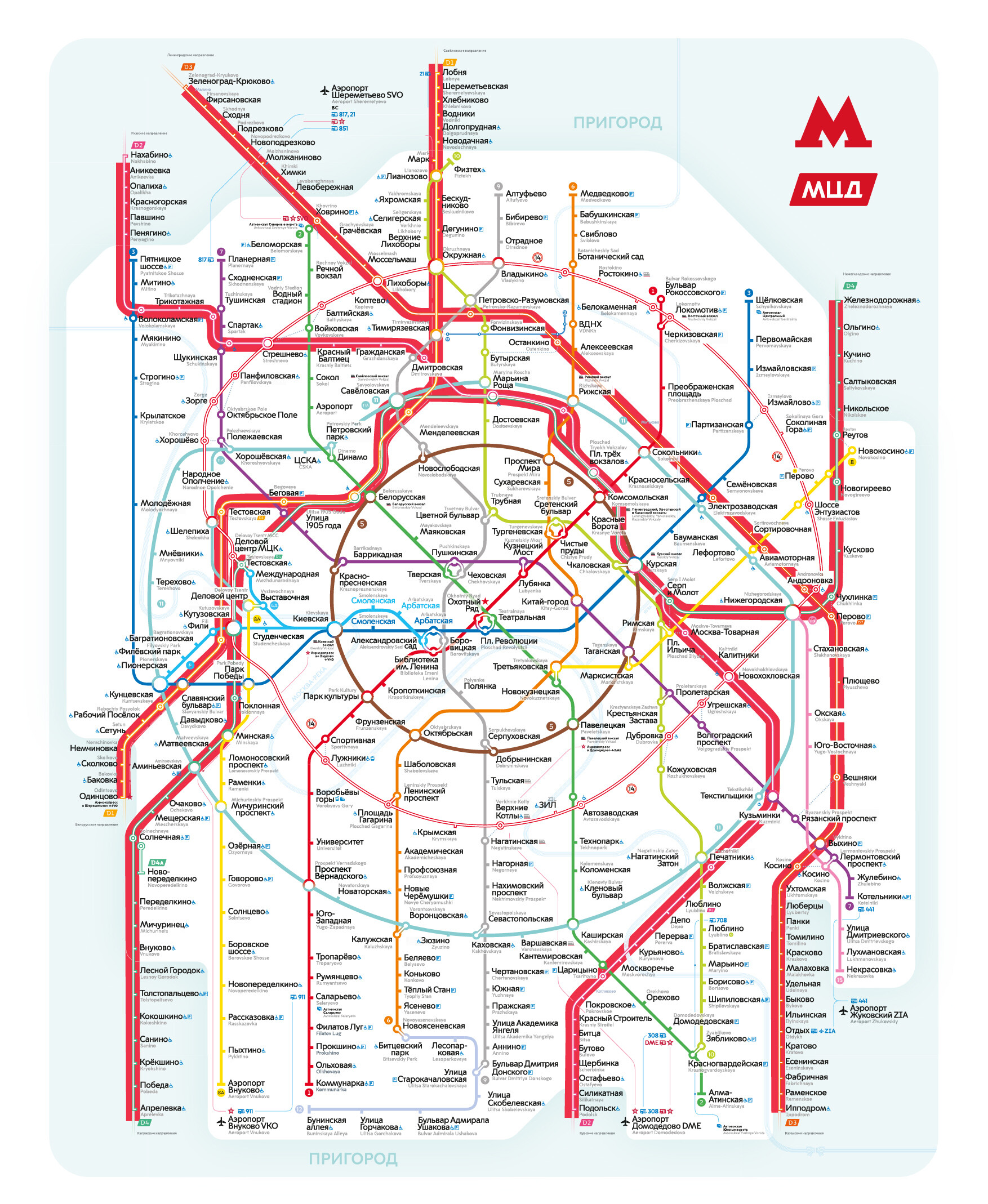

It’s really convenient to use the Moscow Metro and city trains. They operate from 5:30 in the morning to 1:00 at night and you can pay for them with the same ‘Troika’ ticket card. Indeed, the map of the subway looks complex. But that’s only at first glance.

For starters, let’s separate the underground metro from surface city trains. The underground map is marked by bright solid lines, while the lines of surface routes are marked by two parallel lines with a white gap in between.

Underground metro system

It has two ring lines – the brown Koltsevaya, or Circle line (5) and the new Bolshaya Koltsevaya line (Big Circle Line) colored turquoise (number 11). These rings cross all other underground metro lines, so if you need to reach another line from the outskirts – it’s convenient to use one of the ring lines.

Circle Line

We can consider that the center of the city is inside of the ring line (5). Also there’s a multitude of transfers from one line to another within the brown ring. The record holder is Biblioteka Imeni Lenina – Arbatskaya – Alexandrovsky Sad – Borovitskaya. These whole four lines crossed in one place (right next to the Moscow Kremlin). Also, you can reach the Kremlin quickly and conveniently from stations Okhotny Ryad – Teatralnaya – Ploshchad Revolyutsii, which also have transfers between each other.

Big Circle Line

You can also reach the Vnukovo Airport right by metro! The corresponding station of the Solntsevskaya Line (8A) was opened in September 2023.

How does the underground metro operate?

Pykhtino metro station, opened in 2023

The intervals between trains are really small – on average about 2 minutes; during rush hour, they run even more often. So you don’t need to run and squeeze yourself into closing doors (that’s also dangerous). Just wait for the next train, it’ll arrive quickly. Unlike the subway systems of other cities – the trains run along single lines, without branching away. So you can just board the train in the required direction without worrying that you will go somewhere you didn’t intend to.

There are only two exceptions:

- From Alexandrovsky Sad Station of the light-blue line trains run either to Mezhdunarodnaya Station (where Moscow City is located, where a lot of businessmen go) or to Pionerskaya.

- Bolshaya Koltsevaya line also has the so-called fork branching: from Savelovskaya Station to the Business Center (also to Moscow City).

Sometimes you can hear an announcement ‘This train runs to the station…’ If you need to go further, you simply need to get off at the station the train is bound for, and wait for the next train. Perhaps, this train just needs to go to the depot.

Surface routes:

Apart from the underground metro itself, the new map marks suburban trains. You can tell them apart immediately – these lines are indicated with two parallel lines with a white gap in between.

1) MCC: Moscow Central Circle (14)

Moscow Central Circle (MCC)

Let’s take a look at the map again and find a red circle, situated between the underground Koltsevaya (5) and Bolshaya Koltsevaya (11) lines. This is the Moscow Central Circle (14) or simply MCC.

This is a surface urban train that circles around the city. There are stations from where you can transfer to the underground metro. However, these transfers usually are not as short as between subway stations. Sometimes you’ll need about 10 minutes of walking to transfer.

So we don’t recommend you to use MCC purely as a transfer route. In addition, the interval between trains on MCC is longer than in the metro, and can reach 4-8 minutes, depending on the time of day.

However, a big advantage of the MCC is that it has a lot of stations that are far removed from the metro, and which are most conveniently reached specifically by the MCC.

2) Moscow Central Diameters (MCD)

Moscow Central Diameters (MCD)

Moscow diameters on the metro map are the longest lines that cross the entire city (hence, they are called diameters). They are reminiscent of urban trains, like S-Bahn in Berlin or Vienna or RER in Paris.

Those are suburban train lines that run from suburbs (from the Moscow Region, marked as a green shadow on the map) and, crossing the entire city, are bound for suburbs on the other side of the city. At some of the stations of a diameter you can get off and transfer to the metro or the MCC. During rush hour, MCD trains run with an interval of 5-7 minutes.

D1 – Belorussko-Savyolovsky Yellow Diameter runs from Odintsovo Station south-west from Moscow through Moscow City and Belorussky railway station to Sheremetyevo Airport and to Lobnya Station in the north.

D2 – Kursko-Rizhsky Pink Diameter runs from the Moscow Region city of Podolsk in the south through Kursky railway station, Three Station Square (Leningradsky, Kazansky, Yaroslavsky), and Rizhsky railway station to the village of Nakhabino in the north-west.

D3 – Leningradsko-Kazansky Orange Diameter runs from Ippodrom Station in the south-east (the city of Ramenskoye) to Zelenograd in the north.

D4 – Kaluzhsko-Nizhegorodsky Green Diameter runs from the city of Aprelevka in the south-west through Moscow City, Belorussky, Savelovsky, and Kursky railway stations, as well as through Three Station Square (Leningradsky, Kazansky, Yaroslavsky) to Zheleznodorozhnaya Station in the city of Balashikha in the east.

A fifth MCD line is also projected, which is promised to be finished by 2028. It will connect the south (Domodedovo) and the north (Pushkino).

3) Moscow Monorail

Moscow Monorail (highlighted above) and Light metro (bottom)

Look for the only monorail line in Russia to the north from the center of Moscow. It’s not just a surface line, it’s an elevated line that stands on piles. It’s a short line (13) that operates in an excursion mode – from it, you can get a beautiful view of the Ostankino TV Tower, for example.

Once per half an hour, the train runs from Timiryazevskaya Station (which is near the station of the same name on the Serpukhovsko-Timiryazevskaya (9) line, which is the gray metro line) to Ulitsa Sergeya Eisensteina Station, which is located next to the entrance to the VDNKh park and to the VDNKh metro station of the Kaluzhsko-Rizhskaya (6) metro line.

4) Light metro

Butovskaya (12) line in the south of Moscow runs from Buninskaya Alleya Station to Bitsevsky Park Station; from it, you can make a transfer to the gray Serpukhovsko-Timiryazevskaya (9) line and the orange Kaluzhsko-Rizhskaya (6) line. This line runs mostly on the surface, entering a tunnel, but is considered a part of the subway (hence, this line is marked with a solid line as other metro lines).

A useful piece of advice

The Moscow Metro website has an interactive map with all metro lines, MCC, and diameters. With it, you can build a route from the departure station to the destination station, take a look at all travel options and where you can make necessary transfers.

How to pay the fare

The convenience of the Moscow transportation system is that you only need the Troika card for travel with any type of public transport, be it the metro, suburban trains, or buses/trams. You can purchase it in ticket offices or from machines at stations. Also in souvenir shops and in the metro internet store you can purchase keychains, bracelets, and rings that work like a Troika card, as well as Troika cards with a unique and custom design.

Troika design dedicated to the 875th anniversary of Moscow

You can top up your card by simply adding a particular amount of money – or purchase the Unified ticket for 60 travels or unified unlimited ticket for 1/3/30/90/365 days.

The deposit price of the Troika card is 80 rubles, and you can get it back when returning the card to the ticket office. The validity period of the card is 5 years, so you can save it for future travels.

One MCC, MCD (in the city center), and metro trip costs 54 rubles. Transfers in the metro, MCC, or between diameters are free within 90 minutes. The fare on MCD in the suburbs costs 71 rubles.

Important: you need to pay the fare in the metro and MCC only upon entrance. On diameters, you need to activate trips upon entrance and then tap your card again at the turnstile upon exiting.

Also almost every station has a terminal where you can pay your fare, tapping your bank card.

Dear readers,

Our website and social media accounts are under threat of being restricted or banned, due to the current circumstances. So, to keep up with our latest content, simply do the following:

- Subscribe to our Telegram channel

- Subscribe to our weekly email newsletter

- Enable push notifications on our website

- Install a VPN service on your computer and/or phone to have access to our website, even if it is blocked in your country

If using any of Russia Beyond's content, partly or in full, always provide an active hyperlink to the original material.

to our newsletter!

Get the week's best stories straight to your inbox

- 10 architectural styles you can find in Moscow (PHOTOS)

- 5 MUST-DO experiences in Moscow

- 20 interesting places in Moscow & Moscow Region you can reach with the capital's newest train system

This website uses cookies. Click here to find out more.

2018 Primetime Emmy & James Beard Award Winner

R&K Insider

Join our newsletter to get exclusives on where our correspondents travel, what they eat, where they stay. Free to sign up.

A History of Moscow in 13 Dishes

Featured city guides.

Advertisement

Supported by

Student Protest Movement Could Cause a Tumultuous End to School Year

Protesters were arrested at the University of Minnesota and Yale, and the House speaker, Mike Johnson, said he would come to Columbia to speak to Jewish students about antisemitism on campuses.

- Share full article

By Troy Closson

As a wave of pro-Palestinian activism on college campuses showed few signs of abating on Tuesday, the demonstrations have raised new questions about what shape the end of the semester may take for thousands of students across the United States.

At Columbia University, where the arrests of more than 100 protesters unleashed a flurry of national protests, students will have the option to attend their last week of lectures remotely for safety reasons. At the University of Texas at Austin, protesters announced plans to occupy a campus plaza and said that, at least for them, “class is canceled.”

And at the University of Michigan, administrators were already looking ahead and bracing for graduation. They set up designated areas for demonstrations, and agreed to “generally be patient with lawful disruptions.”

“Commencement ceremonies have been the site of free expression and peaceful protest for decades,” the university said in an online message, adding, “And they will likely continue to be.”

The steps are an acknowledgment that the last weeks of the spring could be among the most difficult for administrators at some of the nation’s most prestigious universities. On Tuesday, the campus police at the University of Minnesota took nine people into custody after they erected a protest encampment, following dozens of arrests at Yale and New York University.

Other demonstrations continue to emerge from coast to coast, including at the University of New Mexico and Emerson College. At California State Polytechnic University, Humboldt, students took over a campus building, and barricaded the exits with chairs and trash bins.

The pro-Palestinian student movement has disrupted campus life, especially for Jewish students. Many have said they no longer feel safe in their classrooms or on university quads as the tone of protests at times has become threatening. Speaker Mike Johnson said he would meet with Jewish students at Columbia University on Wednesday and give remarks about the “troubling rise of virulent antisemitism on America’s college campuses,” according to a news release.

At the same time, many school leaders may face the possibility of graduation ceremonies transforming into high-profile stages of protest over the war in Gaza.

No matter how administrators approach these final weeks, the stakes are uniquely high for students who are graduating. Many graduated from high school in the first months of the coronavirus pandemic, and never walked across the stage or celebrated alongside their classmates.

The tumult on campuses escalated after Columbia’s administration called in the police last week to arrest student protesters who had organized a large encampment on a school lawn and refused to leave.

At the New School in Manhattan, where protesters have set up tents inside a school lobby, a couple dozen students formed a picket line on Tuesday as they chanted to the beat of a drum. When one student was asked how long protesters intended to continue the demonstrations, she said there was no immediate end in sight.

“We’re demanding something,” said the student, Skylar Schiltz-Rouse, a freshman who joined the protest on Monday. “So if it doesn’t happen, we’re going to have to keep going.”

It was not yet apparent whether the turmoil at schools would prompt additional arrests, or whether college leaders would adopt a less aggressive playbook as the semester winds down.

Many administrators, watching the uproar at Columbia, seem to be choosing other strategies to handle the protests. Several universities, including Harvard and schools in the California State University system, have shut down parts of their campuses in an effort to avoid major clashes and conclude the school year quietly.

“What you’re seeing is an inability to find spaces for dialogue and conversation and understanding,” said Benjie Kaplan, the executive director of Minnesota Hillel, a Jewish student group.

After school leaders often inflamed unrest with their initial responses, some have begun to hit the brakes.

At Barnard College, Columbia’s affiliate school, many student protesters had received interim suspensions for last week’s tent demonstration. But in a Monday night email, the school’s president, Laura Ann Rosenbury, extended an olive branch.

The school would lift most of the suspensions and restore students’ access to campus, she said, as long as they promised to follow the rules. Those who still face discipline would have access to hot meals, mental health counseling and academic support. And with a professor’s permission, they could also finish out the semester virtually.

“I strongly believe that exposure to uncomfortable ideas is a vital component of education, and I applaud the boldness of all of our students who speak out,” Ms. Rosenbury said in the email, her first message since the arrests of protesters on Columbia’s campus last week, several of whom were Barnard students.

“But,” she said, “no student should fear for their safety while at Barnard.”

She added: “In these last few weeks together before our seniors graduate, let’s be good to one another.”

Some pro-Palestinian students, though, may regard commencement as an opportunity.

Protesters at many schools have vowed to press on until their universities divest from companies with ties to Israel, often chanting “We will not stop. We will not rest.” Administrators are on high alert for demonstrations or threats, as tens of thousands of families travel to campuses in May and June to attend graduations.

Dagmar Michelson, a senior at the New School, was unsure if protests were planned for the university’s May 17 ceremonies. But if they are, she added, she would not be upset.

“It’ll be nice for those who haven’t recognized their privilege,” she said.

Earlier this month, the University of Southern California cited security concerns when it canceled a speech by its valedictorian , a first-generation Muslim student who questioned the university’s explanation. The school later said it would also not host outside honorees.

Already, students have organized demonstrations meant to disrupt cherished college traditions.

At Michigan, several dozen protesters took over a celebration for honors students last month, waving signs that read “Divest Now” and interrupting a speech by the university’s president, Santa J. Ono, according to The Michigan Daily .

“Protest is valued and protected,” Dr. Ono said in a statement after the event. “Disruptions are not.”

Shira Goodman, the senior director of advocacy at the Anti-Defamation League, said the disturbance at Michigan “may unfortunately be a harbinger for what’s to come.”

The group is concerned about the potential of harassment or “identity-based hostility” toward Jewish families at graduation ceremonies. “We remain deeply concerned,” Ms. Goodman said in a statement.

Some colleges are now stepping in to promise Jewish students a safe haven. Brandeis, a historically Jewish university in Massachusetts, said this week that it would extend its deadline for transfer applications in response to campus protests.

The president, Ronald D. Liebowitz, said the school would provide an environment “free of harassment and Jew-hatred.”

Other schools have had little time to look ahead to the future as they reel from the last few days.

At N.Y.U., where at least 120 people were arrested on Monday night after refusing to vacate a plaza, several students said on Tuesday that they would continue to voice support for Palestinians, and were unconcerned that their protest activities might upend final essays and assignments.

The university had said it turned to the police because “disorderly, disruptive and antagonizing behavior” of protesters created safety concerns. But on Tuesday, a professional faculty organization shot back.

The school’s chapter of the American Association of University Professors called “much of their account” false, referring to the administration, and criticized the decision to call the police as an “egregious overstep.”

And at Columbia, the university’s president, Nemat Shafik, is facing the threat of a formal censure resolution from the school’s faculty for her handling of demonstrations. Many Republican lawmakers are also still calling for her resignation, arguing that the school has failed to safeguard its Jewish students.

The decision to offer hybrid classes at Columbia seemed to be a tacit acknowledgment that many students were, at the very least, uncomfortable there. Many are expected to log on from their dorms and apartments. Others might attend from a large protest encampment that remained in the center of campus.

Along with the demonstration, occasional outbursts at rallies have occurred outside the campus’s gates over the past several days. But otherwise, Columbia has been quiet during what is typically a bustling final week of the semester.

Angela V. Olinto, the university provost, said in an email on Monday night that if even one student wanted to finish out the year online, professors should offer hybrid classes — or move to fully remote if that was not an option.

“Safety is our highest priority,” Dr. Olinto said.

Maia Coleman , Eliza Fawcett , Colbi Edmonds , Jose Quezada , Ernesto Londoño , Kaja Andric , Coral Murphy Marcos , Dana Goldstein , Karla Marie Sanford and Stephanie Saul contributed reporting.

Troy Closson reports on K-12 schools in New York City for The Times. More about Troy Closson

Touropia Travel Experts

Discover the World

17 Top Tourist Attractions in Moscow

The capital of Russia is an incredible place to explore. Visitors to Moscow come away spellbound at all the amazing sights, impressed at the sheer size and grandeur of the city. Lying at the heart of Moscow, the Red Square and the Kremlin are just two of the must-see tourist attractions; they are the historical, political and spiritual heart of the city – and indeed Russia itself.

A fascinating city to wander around, stunning cathedrals, churches, and palaces lie side-by-side with bleak grey monuments and remains from the Soviet state. In addition to its plethora of historical and cultural tourist attractions, Moscow is home to world-class museums, theaters and art galleries.

Renowned for its performing arts, fantastic ballets and amazing circus acts, catching a show while in Moscow is a must. The wealth of brilliant restaurants, trendy bars, and lively nightlife means there is something for everyone to enjoy.

See also: Where to Stay in Moscow

17. Tsaritsyno Palace

Once the summer residence of Catherine the Great, the stunning Tsaritsyno Palace is now a museum-reserve. The architecture is magnificent and there is a lovely park surrounding it for visitors to explore.

Located in the south of Moscow, the palace was commissioned in 1775 and recent renovations mean its lavish interior looks better than ever before with its elegant halls and beautiful staircases.

The exhibits on display look at the life of the empress as well as the history of Tsaritsyno itself. The huge palace grounds are also home to some other delightful buildings with the elegant opera house and wonderful brickwork of the Small Palace being particularly impressive to gaze upon.

Starting out in 1935 as the ‘All-Union Agricultural Exhibition’, VDNKh has slowly morphed over the years into the fascinating open-air museum of today. Remarkably, over 400 buildings can now be found within its confines.

The huge park complex has numerous pavilions representing former Soviet republics on show, such as those of Armenia and Turkmenistan and the distinctive architecture of each of the buildings is always interesting to gaze upon. In addition to this there is the fascinating Memorial Museum of Cosmonautics which is dedicated to space exploration and the fun Moskvarium aquarium even offers you the chance to swim with dolphins.

With lots of eateries scattered about and numerous entertainment options such as horse-riding and zip-lining, there is something for everyone to enjoy; the Friendship of Nations fountain truly is wonderful.

15. Kremlin Armoury

One of the oldest museums in the city, the Kremlin Armoury has a wealth of treasures; highlights include the ornate Grand Siberian Railway egg, the historic Cap of Monomakh and the stunning Imperial Crown of Russia which often has a crowd of tourists around it, jostling to take a photo.

Once the royal armory, there are loads of fascinating objects on display. Perusing the many sabers, jewelry, armor and more is as interesting as it is educational and entertaining and the swords are so finely crafted that you’ll almost wish you could pick up one and wield if yourself.

Established in 1851, the museum is situated in the Moscow Kremlin.

14. GUM Department Store

Standing for ‘Main Universal Store’ in Russian, GUM is stunning. Its wonderful skylights and beautiful facades mean it doesn’t look out of place alongside its illustrious neighbors on Red Square.

With over 200 shops, boutiques and upmarket eateries inside, it is a shopaholic’s heaven and concerned partners will be glad to find more affordable options alongside luxury brands such as Dior and Prada.

The main department store in the city, GUM was opened in 1893. The stunning architecture makes it well worth a visit even if shopping isn’t your thing.

13. Moscow Metro

It’s not often that public transport looks like a work of art. So many stops on the Moscow Metro will astound visitors with their beauty and elegance.

Decked in marble and with frescoes covering the walls, the stations are amazing to gaze upon and are part of one of the longest metro systems in the world, with the first stations opened in 1935.

Using the metro is the quickest and easiest way to get around Moscow and braving the crowds of commuters is well worth it for the beauty all around you.

12. Arbat Street

An elegant yet lively street, Arbat is full of impressive architecture and was once a popular place to live for aristocrats, artists, and academics.

A historic place, it is down Arbat Street that Napoleon’s troops are said to have headed on their way to capture the Kremlin.

Nowadays, there are many cafes, restaurants, and shops, as well as various monuments and statues to former residents such as Alexander Pushkin who was reputed to be a lover of the Russian Empress due to his massive influence in court.

11. Novodevichy Convent

Drenched in history, the Novodevichy Convent is located in a striking building that was once a fortress. This captivating place is well worth visiting when in Moscow.

Founded in 1524, the convent houses four cathedrals; Smolensk Cathedral is the undoubted highlight due to its delightful 16th-century frescoes.

Wandering around the grounds is like stepping back in time. The Novodevichy Cemetery is where many famous leaders of the Soviet Union are buried, such as Yeltsin and Khrushchev.

10. Pushkin Museum

Despite its name, the Pushkin Museum of Fine Arts actually has no connection at all to the famous poet other than that it was named in his honor after his death. A delight to visit, its extensive collection focuses on European art with masterpieces by Botticelli, Rembrandt, and van Gogh all featuring.

Sculptures, graphic art, paintings and more can be found in its beautiful galleries; various sections look at themes and epochs such as the Renaissance, the Dutch Golden Age, and Byzantine art.

Among the many highlights are the clownish characters which can be found in Cezanne’s Fastnacht (Mardi Gras) and the twirling ballerinas who look so elegant in Degas’ Blue Dancers. Picasso’s Young acrobat on a Ball is also well worth checking out for its interesting use of shapes and colors.

9. Christ The Savior Cathedral

This gorgeous Russian Orthodox cathedral is located on the banks of the Moskva River, just a stone’s throw away from the Kremlin.

The church as it stands today was consecrated in 2000, as the original church that stood here was destroyed on the command of Josef Stalin in 1931 due to the anti-religious campaign.

With its delightful golden dome, spires and dazzling white facades, the Christ the Savior Cathedral is stunning. The interior is just as captivating to wander around, with its beautifully tiled floors and impressive altar.

8. Lenin Mausoleum

Opened to the public in 1924, Lenin’s Mausoleum is one of the most popular tourist attractions in Moscow. The red granite structure is located at the heart of the city in Red Square.

Lenin’s embalmed body lies in a glass sarcophagus; it is a somewhat eerie experience walking past the former leader of the Soviet Union but is well worth doing as you understandably can’t do it anywhere else in the world.

After visiting the mausoleum, head to the Kremlin wall right next to it for more graves of important communist figures such as Stalin and Brezhnev.

7. Tretyakov Gallery

Home to the most extensive and impressive collection of Russian fine art in the world, the State Tretyakov Gallery is definitely worth visiting when in Moscow for the wealth of amazing art pieces that it has on display.

Having started out as the private art collection of the Tretyakov brothers, there are now over 130,000 exhibits. Highlights include the iconic Theotokos of Vladimir which you will almost certainly recognise despite probably not knowing the name and Rublev’s Trinity which is considered to be one of highest achievements in Russian art.

An absolute must for art lovers, the State Tretyakov Gallery will delight visitors with all that is has to offer.

6. Kolomenskoye

Once a royal estate, Kolomenskoye is now a museum-reserve and lies a few kilometers outside of the city center. A captivating place to visit, there is a plethora of history on show and the site overlooks the Moskva River.

Consisting of four historical sites, there are extensive gardens for visitors to explore, as well as loads of interesting old buildings, the former village of Kolomenskoye itself and the impressive Palace of the Tsar Alexey Mikhailovich – once considered the Eighth Wonder of the World by contemporaries.

Among the many stunning sights, it is the brilliantly white Ascension Church that is the undoubted highlight – dating back to 1532.

5. Gorky Park

Lying alongside the Moskva River, the huge Gorky Park is a lovely place to visit. Its extensive gardens are home to numerous cultural institutions and visitors should definitely check out the Garage Museum of Contemporary Art and while the eclectic exhibits may not always feature such incredible sights as a balloon-covered rider on a zebra; they certainly always succeed in pushing back the boundaries of art.

Pop-up exhibitions and festivals can be found from time to time in the park itself and there is an open-air theatre and numerous eateries alongside a plethora of leisure activities.

Whether it’s cycling, table tennis or yoga that you are after or beach volleyball and rowing, Gorky Park certainly has it. In winter, there is a huge ice rink for visitors to enjoy.

4. Bolshoi Theatre

The Bolshoi Theatre is the main theater in the country. The amazing opera and ballet performances it has put on over the centuries go a long way in explaining Russia’s rich history of performing arts.

While the Bolshoi Ballet Company was established in 1776, the theater itself was opened in 1825. The glittering, six-tier auditorium is lavishly and decadently decorated; it is a fitting setting for the world-class performances that take place on its stage.

Spending a night watching a performance of such classics as The Nutcracker or Swan Lake at the Bolshoi Theatre is sure to be a memorable experience and the beauty all around you only adds to the sense of occasion.

3. Moscow Kremlin

This famously fortified complex is remarkably home to five palaces and four cathedrals and is the historic, political and spiritual center of the city. The Kremlin serves as the residence for the country’s president. It has been used as a fort, and this fact is made clear by its sheer size. The Kremlin’s outer walls were built in the late 1400s.

Under Ivan III, better known as Ivan the Great, the Kremlin became the center of a unified Russian state, and was extensively remodeled. Three of the Kremlin’s cathedrals date to his reign that lasted from 1462-1505. The Deposition Church and the Palace of Facets were also constructed during this time. The Ivan the Great Bell Tower was built in 1508. It is the tallest tower at the Kremlin with a height of 266 feet (81 meters).

Joseph Stalin removed many of the relics from the tsarist regimes. However, the Tsar Bell, the world’s largest bell, and the Tsar Cannon, the largest bombard by caliber in the world, are among the remaining items from that era. The Kremlin Armory is one of Moscow’s oldest museums as it was established more than 200 years ago. Its diamond collection is impressive.