- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

United Award Travel: What You Need to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Does United have an award chart?

How many miles do i need to book united award travel, how can i find the lowest-priced united award flights, combining money and miles to book united flights, using the united excursionist perk to save more miles, final thoughts on united mileageplus awards.

United Airlines’ loyalty program, MileagePlus, allows members to redeem United miles on award flights with both United and its partner airlines. Although there is no longer a United award chart, MileagePlus still offers some great ways to redeem miles for United award travel. Below, we dive into what you need to know for booking United award travel.

United ditched its award chart in November 2019, making it harder to predict how many miles you’ll need to book an award flight with the airline. According to United, award pricing can “fluctuate based on a variety of factors, including demand.”

» Learn more: The best airline credit cards right now

Because United eliminated its award chart, you’ll need to search for a specific flight on United.com or through the United MileagePlus X app to determine how many miles are required for a given flight.

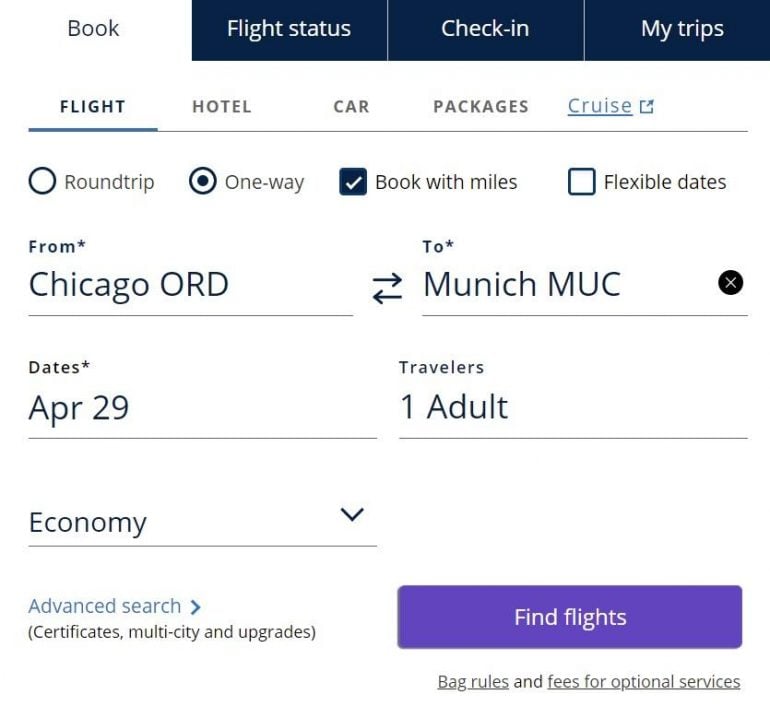

On United.com, make sure the “Book with award miles” option is selected before running your search.

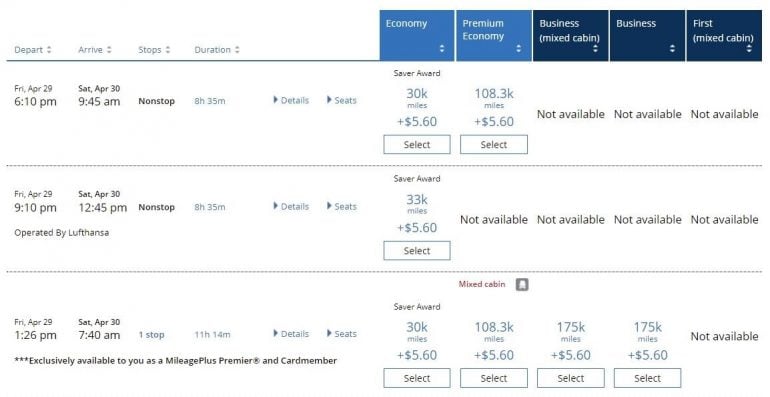

Using a flight from Chicago-O’Hare to Munich as an example, you’ll get results that will show you a range of prices. These are often affected by the class of service and whether the flight is with United or a partner airline.

On the date selected, from Chicago to Munich, an economy seat ranges from 30,000 to 33,000 miles, while premium economy is 108,300 miles and business class is 175,000 miles.

» Learn more: Best benefits of United Airlines credit cards

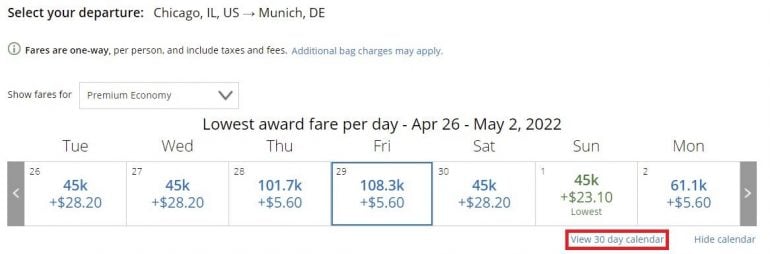

If you want to find the lowest-priced award flights on United and are flexible with travel dates, it would be wise to take advantage of the “View 30 day calendar” feature.

Searching for premium economy award tickets using the 30-day United award calendar shows that we can save thousands of points by adjusting travel dates by a few days.

Flexibility is your friend if you want to book the lowest-priced award ticket. For example, if you were set on flying on April 29th, you’d need to use 108,300 miles to fly. However, if you move your travel ahead or back by just a day or two, you would instead only need 45,000 miles.

» Learn more: All the ways to earn United MileagePlus miles

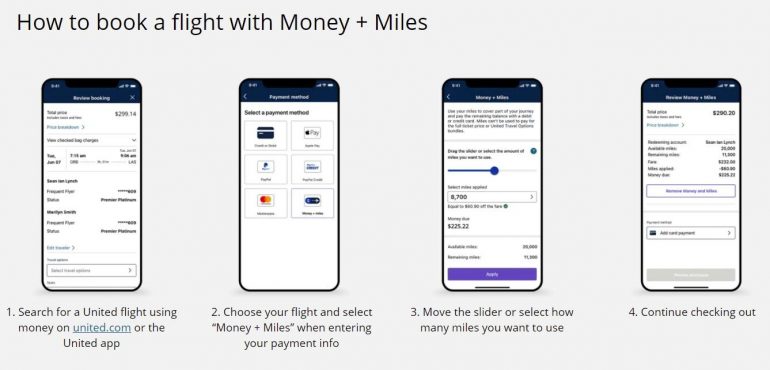

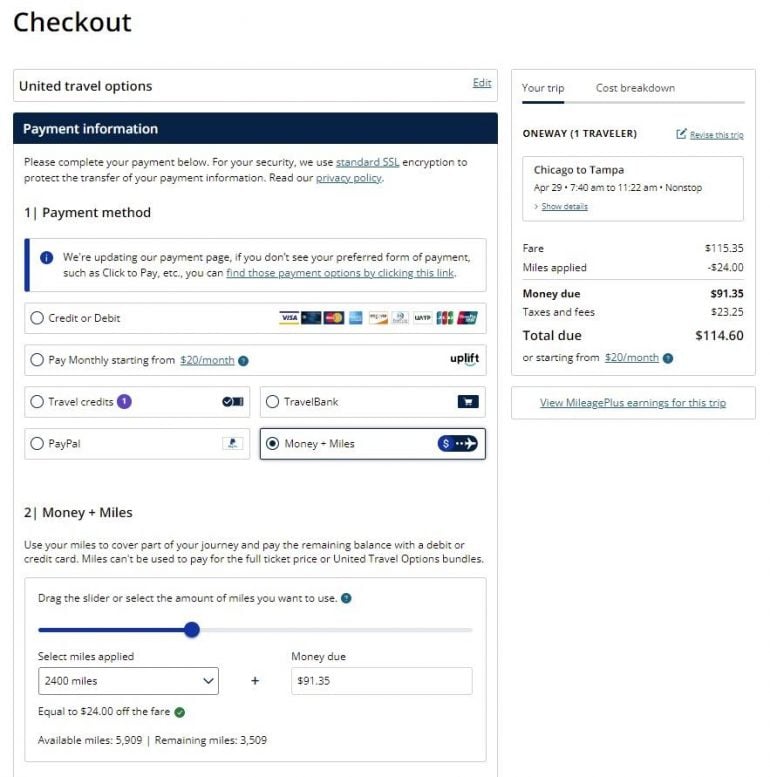

If you’re running low on miles, United offers MileagePlus members a way to combine miles and money to book flights. This can easily be done on United’s website by following these steps:

First, search for your desired flight using money on United.com or the United app.

Choose your flight and select the “Money + Miles” option.

Select the flight portions you want to pay in money and miles.

The Money + Miles option on United can be helpful when you have a pile of United miles but not enough to fully cover the cost of your award ticket. When you pay for flights using Money + Miles, your United miles are valued at 1 cent per mile — just below our baseline value for United miles at 1.2 cents each (here's how we came to that number ).

For example, you’d be able to save $24 off your flight by using 2,400 United miles. If you're trying to get out-sized value for your United miles, paying for your flight this way is not the strategy. You'd likely be better off saving those miles for a future business cabin booking.

» Learn more: The NerdWallet guide to the United MileagePlus Program

United offers an Excursionist Perk feature that can save you miles on your United award travel booking. The Excursionist Perk can get you a one-way award ticket for award bookings on certain multi-city itineraries.

Here's an example of how it works: Let's say you want to fly economy class on a United award ticket from Chicago to London, then later fly from London to Paris before flying back home to Chicago from Paris. Your flight between London and Paris could be free with the Excursionist Perk.

According to United’s website, there are a few caveats to qualify for the Excursionist Perk:

The Excursionist Perk cannot be in the MileagePlus defined region where your travel originates (for example, if your journey begins in North America, you will only receive the Excursionist Perk if travel is within a region outside of North America).

Travel must end in the same MileagePlus defined region where travel originates.

The origin and destination of the Excursionist Perk must be within a single MileagePlus defined region.

The cabin of service and award inventory of the free one-way award is the same or lower than the one-way award preceding it.

Only the first occurrence will be free if two or more one-way awards qualify for this benefit.

The Excursionist Perk can be a great way to save miles on your United award travel booking if you can make it work.

» Learn more: Which United credit card should you get?

Although United no longer offers an award chart and it’s harder to predict United award travel pricing, United’s MileagePlus program still provides a lot of value to its members (especially those who can be flexible with their travel dates).

United also allows MileagePlus members to pay for certain flights using a mixture of miles and money, which is a nice perk for casual and serious miles collectors alike. If you’re looking to save on a multi-city itinerary, you should try to see if your travel qualifies for the United Excursionist Perk to save even more miles.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-2x Earn 2 miles per $1 spent on dining, hotel stays and United® purchases. 1 mile per $1 spent on all other purchases

50,000 Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

1x-2x Earn 2 miles per $1 spent on United® purchases, dining, at gas stations, office supply stores and on local transit and commuting. Earn 1 mile per $1 spent on all other purchases.

75000 Earn 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.

1x-3x Earn 3x miles on United® purchases, 2x miles on dining, select streaming services & all other travel, 1x on all other purchases

60,000 Earn 60,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first 3 months your account is open.

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Sweepstakes

United's 'Miles Play' Promotion Is Back — and You Could Rack Up Some Serious Points

Scoring a few extra points is easy with this one.

:max_bytes(150000):strip_icc():format(webp)/StellaShonHeadshot-b33d9d4047484623bb4425c4ef317a74.jpeg)

Courtesy of United Airlines

Planning to fly with United soon? You could earn bonus miles with the airline's latest "Mile Play" promotion. So long as you're traveling by a certain date and so long as you're one of the few targeted for the offers.

It's free to sign up for United's MileagePlus program, which allows travelers to stack points that they can use on future trips, and to gain status for perks like complimentary upgrades and free checked bags. It also allows travelers access to promotions like its United Mile Play program, which is sort of like a lottery system that gives certain users specific promotions based on their MileagePlus number. The promotion isn't offered to every member every time it's offered, but when it is, it's always enticing.

Each offer is targeted to the individual user, but everyone who takes advantage of the offer must register and make their transactions by June 7, 2024, at 11:59 p.m. CT to get the benefits.

Travel + Leisure spotted a few examples of promotions that different fliers were targeted for:

- Book and take a flight (must be $100+) and earn 3,000 miles

- Book and take 2 flights (must be $200+) and earn 8,300 miles

- Book and take 3 flights (must be $225+) and earn 12,000 miles

United says these miles will be posted to accounts "six to eight weeks after the promotion ends," so don't expect to use them immediately after travel. When redeeming those miles, travelers can check the rates using the "Book with miles" button on the airline's homepage .

It's worth noting that these bonus miles are awarded to any standard earnings travelers would earn on their ticket. Fliers without United status will earn five miles per dollar spent on the base fare of a ticket, while a top-tier Premier 1k member can earn upwards of 11 miles.

Furthermore, United offers several unique ways for travelers to rack up miles , even if they're not flying. Just a few weeks ago, the airline launched a new, customer-friendly feature to pool miles between groups of up to five members. Travelers can also earn miles from everyday spending on a co-branded United credit card or by exchanging their unwanted gift cards .

To participate in this promo, travelers just need to have their United MileagePlus number readily available and enter it on the promotional page . And maybe have a little good luck on their side too.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

United Airlines credit cards have a secret perk that makes it easier to book awards

Jason Steele

Julie Sherrier

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 5:12 a.m. UTC April 22, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

joshblake, Getty Images

Sometimes the best reason to have an airline credit card isn’t necessarily for the miles you can earn and redeem, it’s for the perks.

You can earn far more points using Chase credit cards like the Chase Sapphire Preferred® Card and the Chase Freedom Flex℠ * The information for the Chase Freedom Flex℠ has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. than you will from the cobranded United credit cards issued by Chase. And since you can transfer Chase Ultimate Rewards® points into United MileagePlus miles, there’s little reason to use a United card just to earn miles.

Instead, you should have a United MileagePlus card for its benefits, including free checked bags and discounts on in-flight purchases.

But there’s one other important benefit that you rarely see mentioned by Chase or United. MileagePlus cardmembers are eligible for “special member pricing” that’s otherwise reserved just for those with elite status. Just by having a United MileagePlus credit card, you’ll get the same, lower pricing that United elite status holders have access to, which can mean significant mileage savings on award flights.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

Chase Sapphire Preferred® Card

Welcome bonus.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s Take

- Flexible points that can be transferred to 14 travel partners or redeemed through Chase Travel℠ at 1.25 cents each.

- $50 annual statement credit toward Chase Travel hotel bookings.

- Valuable travel protections.

- $95 annual fee.

- Category bonuses are limited and not competitive against other travel cards.

- Transfer partner list is limited compared to programs like Amex Membership ® Rewards and Citi ThankYou ® .

Card Details

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

What is “special member pricing”?

Let’s say you wanted to fly from Denver to Paris this summer. When I searched for flights on July 11, 2024, and filtered out options with more than one stop, I found flights starting at 70,000 miles.

But once I added my card to my MileagePlus account and logged in as a cardholder, the same options were available starting at just 40,000 miles.

You’ll notice that the lower priced options have a small notation indicating that it’s granted “special member pricing.” And true travel nerds might notice that the higher priced option shows a fare code of YN, while the lower priced option shows the code of XN, which is reserved for cardmembers and those with elite status.

Which credit cards offer United’s special member pricing?

All United MileagePlus credit cards issued by Chase include this benefit, which includes:

- United Gateway℠ Card * The information for the United Gateway℠ Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- United℠ Explorer Card * The information for the United℠ Explorer Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- United Quest℠ Card * The information for the United Quest℠ Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- United Club℠ Infinite Card * The information for the United Club℠ Infinite Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- United℠ Business Card * The information for the United℠ Business Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- United Club℠ Business Card * The information for the United Club℠ Business Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Except for the no-annual-fee Gateway card, all of these cards have an annual fee — starting at a $0 intro annual fee for the first year, then $95 for the Explorer card and topping off at $525 for the United Club Infinite card.

If you’re just looking for access to lower-priced flight awards, you might be tempted to get the Gateway card, which comes with a welcome offer of 20,000 miles after spending $1,000 on purchases in the first three months of account opening. Instead, I’d recommend getting either the Explorer card, which currently has a welcome bonus of 50,000 miles after spending $3,000 on purchases in the first three months of account opening, the Quest card, which offers 60,000 miles and 500 Premier qualifying points after spending $4,000 on purchases in the first three months of account opening, or the Club Infinite card, which comes with 80,000 miles after spending $5,000 on purchases in the first three months of account opening.

After having the card for a year, you might decide that you want to keep the card for its other perks. But you can always request a downgrade to the no-annual-fee Gateway card. This move allows you to keep your miles and account open, eliminate the annual fee and continue to enjoy lower-priced flight awards.

Looking to get the most out of your United rewards? Read our guide on how to earn and redeem United miles

Final verdict

The hardest part of award travel isn’t always earning the points and miles, it’s finding efficient ways to spend them. United makes this easy for those with elite status and anyone who holds one of their credit cards. By signing up for the best card offer available and longer-term keeping a no-annual-fee United card open at all times, you can be assured of the lowest prices when you book your United award tickets.

*The information for the Chase Freedom Flex℠, United Club℠ Business Card, United Club℠ Infinite Card, United Gateway℠ Card, United Quest℠ Card, United℠ Business Card and United℠ Explorer Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Jason Steele is a freelance writer specializing in credit cards and award travel. Since 2008, Jason's work has appeared in over 100 outlets and he's been widely quoted in the mainstream media. Jason also produces CardCon, which is The Conference for Credit Card Media.

Julie Stephen Sherrier is a personal finance writer and editor based in Austin, TX. She is the former senior managing editor for LendingTree, responsible for all credit card and credit health content. Before joining LendingTree, Julie spent more than a decade as the managing editor and then editorial director at Bankrate and CreditCards.com. She also served as an adjunct journalism instructor at the University of Texas at Austin.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Capital One Quicksilver benefits guide 2024

Credit Cards Lee Huffman

Can you pay off one credit card with another?

Credit Cards Louis DeNicola

Amex Gold vs. Platinum

Credit Cards Harrison Pierce

Why I chose the Chase Sapphire Preferred as my first ever rewards card

Credit Cards Sarah Li Cain

How to use Alaska Airlines Companion Fare

Credit Cards Ariana Arghandewal

How I maximize my Chase Ink Business Unlimited Card

How to do a balance transfer with Discover

9 ways to maximize the Citi Custom Cash card’s 5% cash-back categories

American Express Business Platinum benefits guide 2024

Credit Cards Chris Dong

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Credit Cards Jason Steele

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

You might be a small business owner and not even know it

Chase Freedom Flex benefits guide 2024

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Chase United Mileageplus Explorer Card

14 Valuable Benefits of the United Explorer Card [$2,200+ Value]

Spencer Howard

Former Content Contributor

51 Published Articles

Countries Visited: 21 U.S. States Visited:

Jessica Merritt

Editor & Content Contributor

83 Published Articles 476 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Senior Editor & Content Contributor

88 Published Articles 653 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

![united mileage travel 14 Valuable Benefits of the United Explorer Card [$2,200+ Value]](https://upgradedpoints.com/wp-content/uploads/2022/11/United-Club-ORD-Gate-C10.jpeg?auto=webp&disable=upscale&width=1200)

1. Welcome Bonus ($720)

2. 2x miles with united airlines ($150), 3. 2x miles at hotels and restaurants ($400), 4. access extra mileageplus award space ($200), 5. free checked bag with united airlines ($100), 6. 2 united club passes per year ($118), 7. get priority boarding ($50), 8. 25% back on inflight purchases ($25), 9. elite status spend waiver ($100), 10. global entry, tsa precheck, or nexus application fee credit ($100), 11. trip delay insurance ($100), 12. baggage delay insurance ($100), 13. lost luggage coverage ($50), 14. trip cancellation and interruption insurance ($50), final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

For those who fly with United Airlines regularly or even just several times per year, the United℠ Explorer Card has some benefits that can save you money and improve your travel experience.

These benefits extend beyond earning points and into different protections that can ensure you are reimbursed for some problems you might face during your travels.

This co-branded credit card is provided by Chase and falls under the Chase 5/24 rule, so keep that in mind when you are making your credit card decisions.

Let’s dive in and take a look at the many benefits of the United Explorer card.

United MileagePlus Benefits

United Airlines is one of the largest airlines in the world, so there’s a good chance you’ll find yourself flying with them at some point. You might as well make the experience enjoyable!

United℠ Explorer Card

With priority boarding privileges, no foreign transaction fees and more, MileagePlus members will definitely enjoy their partnered card.

You travel United all the time, but you have heard that there could be ways to make your travel experiences even better, including priority boarding, free bags, and more miles.

You should consider the United℠ Explorer Card , because this card does all that and more!

- 2x miles per $1 on United purchases, dining purchases (including delivery services), and hotel stays

- 1x mile per $1 on all other purchases

- First checked bag free for you and up to 1 traveling companion

- 25% statement credit on United inflight purchases

- Priority boarding

- Global Entry, TSA PreCheck, or NEXUS statement credit

- 2 United Club 1-time passes each year

- Premier upgrades on award tickets

- Travel and purchase protections

- $0 intro annual fee for the first year, then $95 annual fee

- Does not earn transferable rewards

- Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

- $0 introductory annual fee for the first year, then $95.

- Earn 2 miles per $1 spent on dining, hotel stays, and United ® purchases

- Up to $100 Global Entry, TSA PreCheck ® or NEXUS fee credit

- 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Explorer Card

- Free first checked bag - a savings of up to $140 per roundtrip. Terms Apply.

- Enjoy priority boarding privileges and visit the United Club℠ with 2 one-time passes each year for your anniversary

- Member FDIC

Financial Snapshot

- APR: 21.99% - 28.99% Variable

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Airline Credit Cards

- Travel Rewards Credit Cards

Rewards Center

United MileagePlus Frequent Flyer Program

- Benefits of the United Explorer Card

- Best Credit Cards for Airport Lounge Access

- Best Chase United Credit Cards

- Best Credit Cards for Global Entry and TSA PreCheck

We value United miles at 1.2 cents per mile, so a 50,000-mile welcome bonus for the United Explorer card would be worth $720.

Unfortunately, United Airlines now awards MileagePlus miles for flights based on how much you spend on the flight in conjunction with your elite status. Here’s a breakdown of how miles are earned for flying with United:

However, with the United Explorer card, you can earn an extra 2x miles per dollar whenever you book a flight with United Airlines. We’ll value this benefit at $150, assuming you purchase $5,000 worth of airfare per year.

This means that as just a general member of MileagePlus, you’ll earn 7x miles per dollar on all flights purchased with United Airlines. If you’re a Premier 1K member, you’ll earn 13x miles per dollar when you book your flights with United.

Hot Tip: Check out the best ways to earn tons of United miles , and you’ll be booking amazing trips before you know it!

With all the miles you earn, you can redeem your United miles for some amazing flights, such as Lufthansa first class , one of the most luxurious in-flight experiences (complete with Champagne and caviar!).

Earns 2x miles per dollar at hotels and restaurants. We value this benefit at approximately $400, assuming you spend around $1,000 per month in combined purchases at hotels and restaurants.

Once you earn enough United miles, you’ll be ready to hunt for some award space to book flights for your next vacation.

If you are looking for an economy class award, holding the United Explorer card gives you a big advantage as you will have access to extra economy class award space.

Cardholders also have access to standard-level awards whenever there is a seat available on a flight. Typically, this perk is only available to those who have earned elite status . While this is a very poor use of points (you should always look for saver-level awards), the ability to book an award seat at any time can be very useful in a pinch.

We value this at $200, assuming you can conservatively save around 13,000 miles every year by accessing extra saver-level award space.

As a cardholder, you can save tons of money on your flights with United Airlines with the free checked bag benefit. If you purchase your flight on United with the United Explorer card, you and 1 companion on your itinerary will each receive a free checked bag.

Unlike other airline co-branded credit cards, you are required to use the United Explorer card to pay for the flight if you want to be eligible to receive your free checked bag.

We value this at $100, assuming you take 1 checked bag on 1 round-trip flight every year.

Airports can be hectic places, especially during busy travel seasons, but a reprieve in an airport lounge can turn a normally stressful experience into a relaxing one.

Once approved for the United Explorer card, you will receive 2 single-use United Club passes . You’ll continue to receive 2 passes every year you keep the card.

We peg these to around $118 since each United Club pass costs $59.

Flights are often very full these days, and the situation on United Airlines is no different. With the United Explorer card, you will receive priority boarding access to help ensure there is overhead space for your carry-on bag.

This benefit can be particularly useful if you have a tight connection or obligations shortly after arrival such as a meeting.

We estimate the value of priority boarding to be around $50, though your time (and sanity) might be more valuable than that.

Get 25% back on United inflight Wi-Fi, food, and drinks.

Everybody’s travel habits are different, but if we assume you’ll spend $100 on inflight purchases every year, getting 25% off means getting back $25 per year.

United credit cardholders can earn Premier Qualifying Points (PQP) through their annual credit card spending and can apply this earned PQP toward Premier 1K status.

The United Explorer card earns 25 PQP for every $500 spent, up to 1,000 PQP in a calendar year.

Hot Tip: Other Chase United credit cards have varying PQP earning capabilities — visit United’s MileagePlus cardmember update page for more details and terms and conditions .

With Premier 1K elite status, you’ll have access to Star Alliance business class lounges as a Star Alliance Gold member when you travel abroad, even when flying in economy class. This can be particularly nice before a long flight or when connecting abroad.

In fact, if you are departing from the U.S. on a trip to Europe, Southeast Asia, Australia, etc., you’ll even have access to United Clubs and you won’t have to use one of your 2 complimentary United Club passes.

The value of this benefit is super subjective — it could be a game-changer if you’re on the cusp of getting top-tier elite status. It could also be totally insignificant if you’ve already qualified for your elite status goal. We estimate this benefit at $100 per year.

Every 4 years receive a credit of up to $100 for Global Entry , TSA PreCheck , or NEXUS enrollment or renewal.

Travel Protections

The United Explorer card doesn’t just help you earn and redeem United miles. In fact, it can even help when your flights don’t go as planned. Let’s discuss a few of this card’s benefits that can protect you when things go wrong.

As frustrating as it can be, flights get delayed sometimes. With the United Explorer card, you are entitled to trip delay insurance if your flight is delayed by 12 hours or overnight.

When you book your flights with this card, you are entitled to reimbursement of up to $500 in reasonable expenses that can include hotel accommodations, ground transportation to and from the airport, and meals.

Make sure you request and receive documentation from the airline so you can submit your claim and get reimbursed.

If your travel is prone to delays from weather (such as in the Midwest or Northeast), you’ll get much more value from this benefit. We estimate the value of this to be around $100.

Another frustration travelers occasionally face is a delay in the arrival of their checked bags. If you booked your flight with the United Explorer card and your bags are delayed by at least 6 hours, you are entitled to reimbursement.

This benefit covers essential items such as toiletries, clothing, and even a charging cable for your cell phone. Chase will reimburse you up to $100 for each day that the bag doesn’t arrive (up to $500).

Although the maximum reimbursement amount is $500 per trip, we assume a conservative value of $100.

Taking things a step further, in the unfortunate event that your bags are not just delayed but lost, you are also covered by Chase. Whether it is a checked bag or a carry-on bag, each passenger is eligible for up to $3,000 in reimbursement.

Even though losing your luggage is a horrible experience and could result in a reimbursement of up to $3,000, we estimate that this benefit has a value of $50.

If your trip is cut short or canceled because of severe weather or illness (plus some other situations), you could be eligible for up to $6,000 in trip interruption or cancellation insurance.

This coverage includes reimbursement for prepaid, non-refundable common carrier travel expenses.

While we sincerely hope you don’t need to ever use this benefit, we assume the value of this benefit is around $50.

It’s clear from the start that the United Explorer card can help you earn more United miles to book award travel. But with perks such as increased economy class award space and the elite status spending waiver, it brings a lot more to the table than just the ability to earn miles.

To top it off, holding the United Explorer card ensures that you are protected during your travels, so you don’t have to stress about flight delays and problems with your checked and carry-on bags.

If you plan on flying with United Airlines even just a few times per year, the United Explorer card can save you a ton of money on checked bag fees, make booking award flights easier, and protect you from some unforeseen events during your travels.

Frequently Asked Questions

Do miles earned with the co-branded united credit cards count toward elite status.

No, the points earned with the Chase United cards are redeemable for award flights but do not help you earn status.

Can you transfer United MileagePlus miles to other airlines or hotels?

No, MileagePlus miles must be used to book award flights with United Airlines.

Can you have more than one co-branded United credit card?

What points can be transferred to united miles.

Chase Ultimate Rewards transfer to United almost instantly at a 1:1 ratio. Marriott transfers to United at a 3:1.1 ratio. When you transfer 60,000 Marriott points to United in a single transaction, you’ll also get another bonus of 5,000 United miles.

Was this page helpful?

About Spencer Howard

Always a fan of flying, it was only natural that Spencer was drawn to finding a way to improve the travel experience.

Like many, he started this journey searching for cheap flights to take him around the world. This was fun for a while, but Spencer was intrigued by the idea of flying in business and first class!

Throwing himself into what became an extensive research project, Spencer spent 3-4 hours per night learning everything he could about frequent flyer miles over the course of several months (he thinks this is normal). He runs Straight to the Points, an award-seat alert platform.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Quick Points: How to pool United MileagePlus miles with family and friends

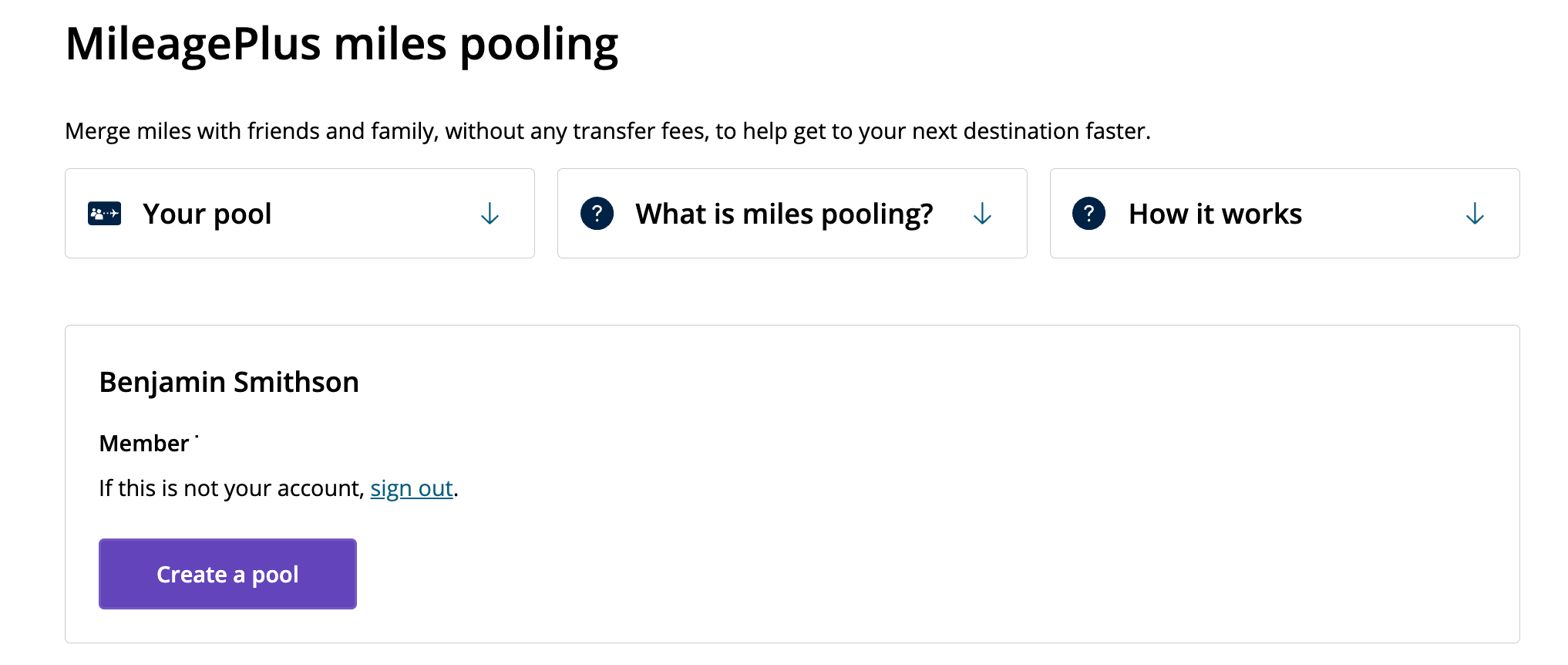

In March, United Airlines announced that United MileagePlus members could begin pooling their hard-earned miles with friends and family to reach their travel goals sooner. This is an ideal situation for those with kids — there is no age limit on who can earn MileagePlus miles — and those who are short on miles for an award flight and want to cut the cost of their trip.

If you don't have enough miles in your account to book your next redemption but a friend or family member has a small amount they are unlikely to use, you could consider pooling the miles together so that at least one of you can use them to book an award flight.

It's also a handy option if you wish to book a group trip and use miles from different accounts on the same reservation. So, if you want to know how to pool your United miles, keep reading to learn more.

Related: Best United Airlines credit cards

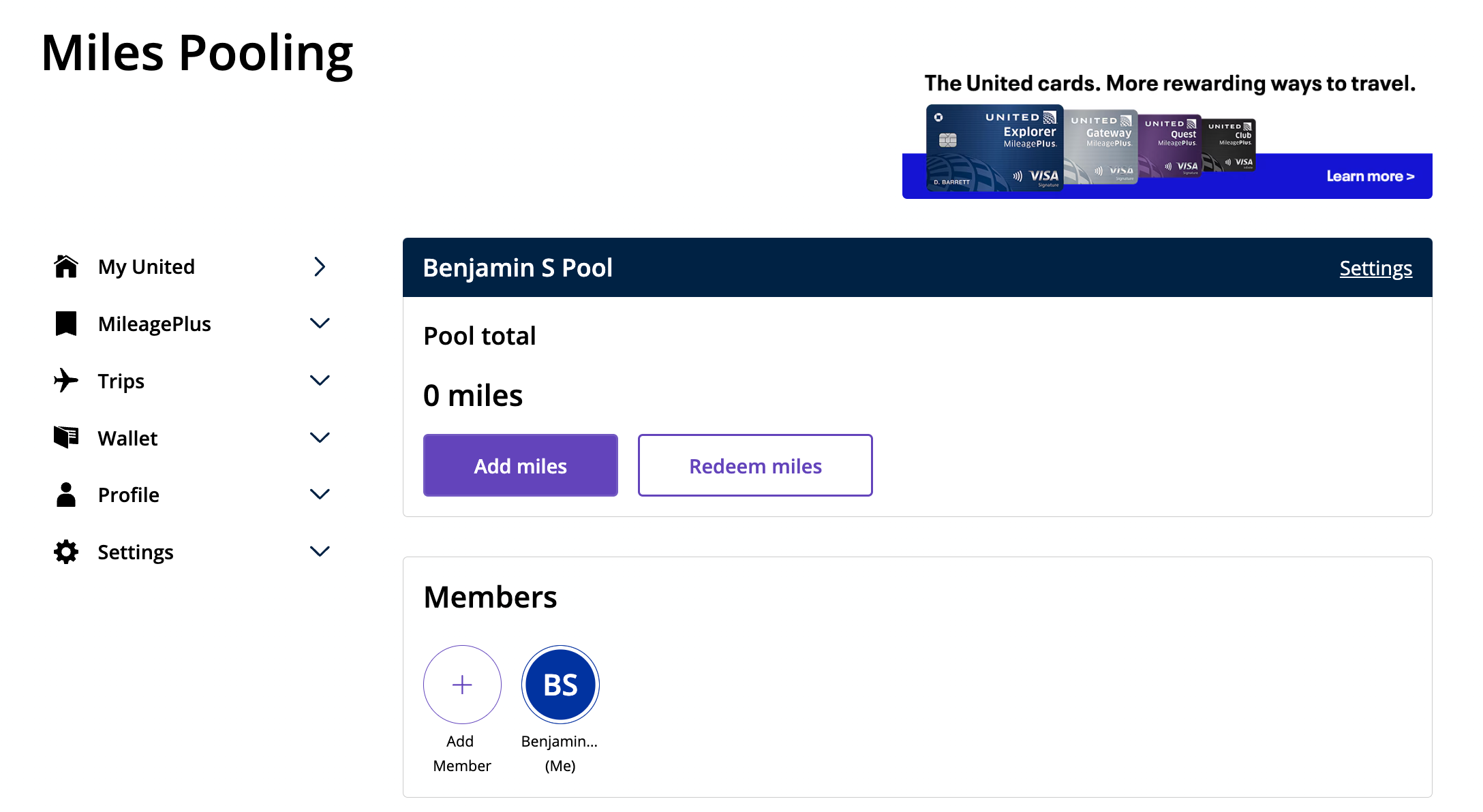

The first step in pooling your miles is deciding who will be the "pool leader." This can be any United MileagePlus member who is at least 18 years or older. Whoever is designated the pool leader will control the pooled miles within the group. (Note: You can only be part of one pool group at a time.)

If you don't wish to be the pool leader, it is a good idea to select someone you trust with your miles to facilitate the booking. They will manage the miles in the pool and authorize pool members to redeem them. Though you can allocate the number of miles you want to contribute to the pool group, once miles are transferred to a pool, you cannot undo the transfer.

To create a pool, click on "MileagePlus" on the United.com homepage, then "My account." On the left side of your account page, you'll see a drop-down arrow for MileagePlus. Click on it, and you'll see "Miles pooling." There, you'll be directed to the miles pooling page, where you can click on "Create a pool." Once you agree to the terms and conditions, you can create your pool.

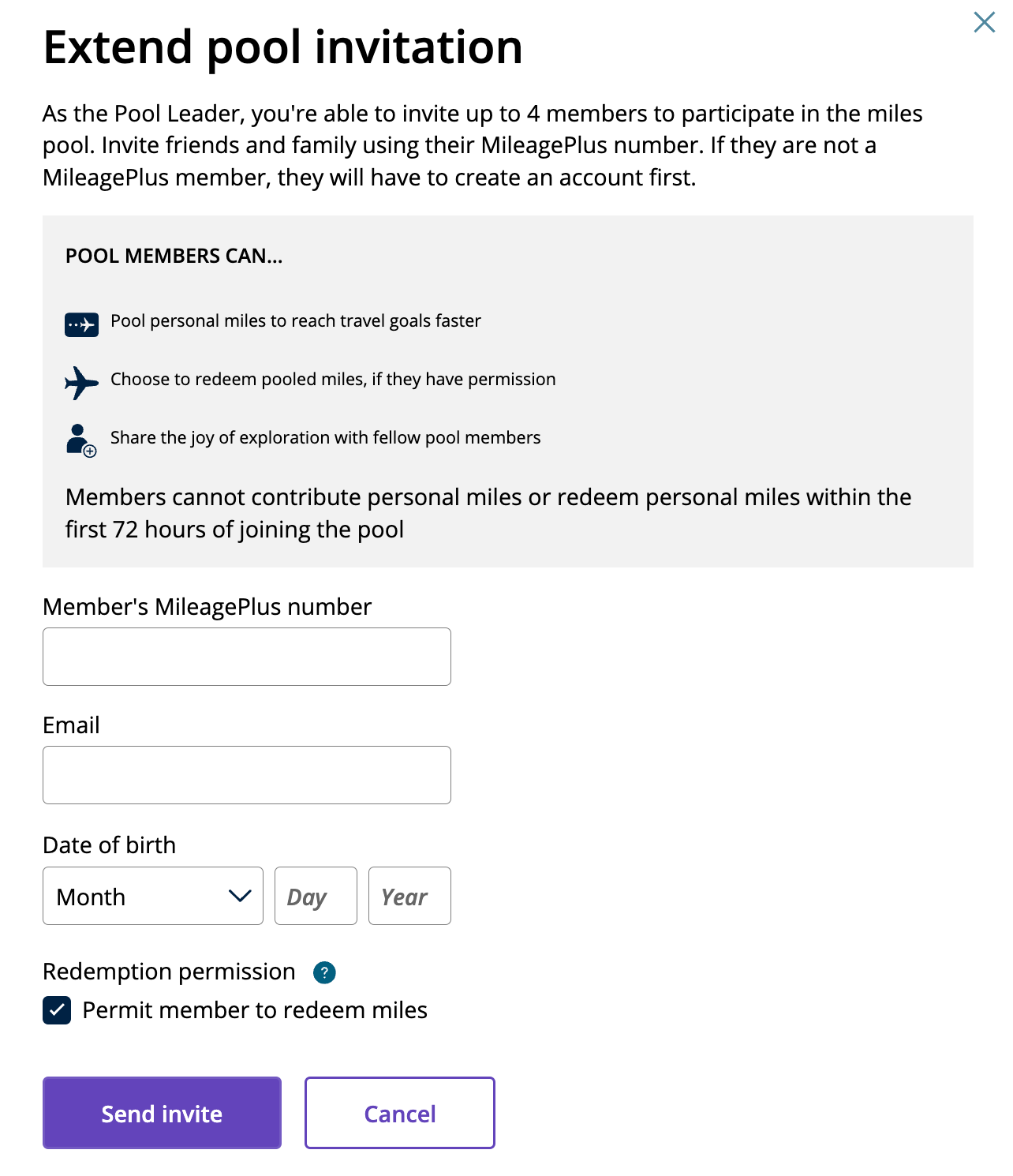

The pool leader can invite up to four MileagePlus members to join their pool. These members don't need to be related to the pool leader (and even if they are, it is no problem if the surnames or postal addresses are different).

You can also invite friends and even children, provided they are MileagePlus members and the total pool, pool leader included, does not exceed five members.

Remember, pool members can only belong to one MileagePlus pool at a time and cannot contribute or redeem miles within the first 72 hours of joining the pool. Pooled miles cannot be used for seat upgrades or redemptions on partner airlines like Lufthansa and Air Canada.

Related: Is Air Canada premium economy worth it on the Boeing 777-300ER from Amsterdam to Toronto?

The pool leader will need the MileagePlus number and email of each member they wish to invite to the pool so they can receive the invitation.

Pool members should monitor their emails to receive the pooling invite. Once they accept the invite, they can choose how many MileagePlus miles they wish to contribute to the pool. Members can choose to transfer their entire miles balance or only a small amount while keeping the rest of their miles in their personal account.

Pooled miles have no impact on a MileagePlus member's elite status .

If the pool leader decides to leave the pool, the miles are distributed equally among the members. Pool members must wait 90 days after exiting any pool before joining another.

IMAGES

COMMENTS

Build your mileage balance with the MileagePlus X app. Earn miles on shopping, dining, and eGift Card purchases with our free and easy to use app. Earn up to 1,000 bonus miles when you join MileagePlus Shopping SM and spend $25 within two weeks. Book hotels on Rocketmiles and get up to 10,000 miles per night, every time.

Find the latest travel deals on flights, hotels and rental cars. Book airline tickets and MileagePlus award tickets to worldwide destinations.

Redeem for other travel. You can also redeem United MileagePlus miles for United Club memberships, hotel stays and Wi-Fi. But we seldom recommend doing this. ... You can use United miles to pay for inflight Wi-Fi on domestic United flights, but the cost varies by flight length. The airline also offers a $49 monthly Wi-Fi pass for $49 or 7,500 ...

United economy plus seats. (Photo courtesy of United Airlines) Based on our most recent analysis, NerdWallet values United MileagePlus miles at 1.2 cents apiece. To determine the value of reward ...

Use United miles for hotels. You could also redeem your MileagePlus miles for hotel stays. For example, a one-night stay in Scottsdale in December 2024 will cost 42,100 United miles (with a cash ...

TPG values Chase Ultimate Rewards points at 2.05 cents apiece, while United miles are worth 1.4 cents apiece. You can also redeem your Chase points for United flights in the Chase Ultimate Rewards travel portal. When you do this, you'll generally earn United miles since your ticket will be coded as a paid fare. More ways to earn United miles

Searching for premium economy award tickets using the 30-day United award calendar shows that we can save thousands of points by adjusting travel dates by a few days. Flexibility is your friend if ...

Flights. When you fly with United Airlines, you can earn miles on the base fare of your ticket, excluding taxes and fees. The number of miles earned varies depending on your MileagePlus elite ...

Earning miles: The card earns 3 miles per dollar on United purchases, 2 miles per dollar on dining, travel and select streaming services and 1 mile per dollar elsewhere. Card perks: The United Quest Card — the most recent addition to Chase's United portfolio — offers many perks to United frequent flyers.

United Airlines (UA) is one of the world's biggest airlines. Based out of Chicago, United operates 4,500 flights and over 300 destinations all over the world. MileagePlus is United's frequent ...

9x fare (minus taxes and fees) Premier 1K. 11x fare (minus taxes and fees) United MileagePlus earning rates for United tickets. Instead of earning 2,500 miles for a cross country flight from Washington, DC to Los Angeles, you'll earn just 1,000 miles if you paid $205.60 for that ticket and don't have elite status.

For eligible flights that earn miles based on the fare 1, all members will receive 5 base miles per dollar, and Premier members will earn Premier bonus miles based on their Premier status on the date of travel as shown below: Earning Premier bonus miles. MileagePlus status. Base miles earned (based on fare 1)

50,000 bonus miles after you spend $3,000 in the first three months of account opening. Category bonus earning. 2x on United purchases; 2x miles on dining and hotel stays booked directly with the ...

March 21, 2024. United becomes first major U.S. airline to allow members of its loyalty program, MileagePlus®, to pool their miles with family and friends into a joint account. This new feature makes it easier for family members of all ages -- and groups to share and use miles for award travel. MileagePlus miles pooling is now available on ...

Make a direct request for miles from their existing account to your MileagePlus account here. Miles transfers cost $7.50 USD* per 500 miles. *Plus, a processing fee of $30.00 per transaction. Buy miles to build your balance, send a gift of miles to friends and family, or make a one-time miles transfer. Get the miles you need to make the most of ...

At a glance. United MileagePlus is a popular and valuable program, particularly for booking Star Alliance partner awards on airlines like Lufthansa and Air Canada. While prices vary on its own award flights, United doesn't add fuel surcharges to any award bookings.

Fliers without United status will earn five miles per dollar spent on the base fare of a ticket, while a top-tier Premier 1k member can earn upwards of 11 miles. Furthermore, United offers several ...

Travel awards are not eligible for mileage accrual with MileagePlus or any other loyalty program. Starting on January 1, 2023, travel awards booked using MileagePlus miles for award flights operated by United or United Express are eligible to earn Premier ® qualifying credits. Eligible award flights will earn 1 PQP per 100 miles redeemed, as ...

Just by having a United MileagePlus credit card, you'll get the same, lower pricing that United elite status holders have access to, which can mean significant mileage savings on award flights ...

9x miles per dollar. Premier 1K. 11x miles per dollar. However, with the United Explorer card, you can earn an extra 2x miles per dollar whenever you book a flight with United Airlines. We'll value this benefit at $150, assuming you purchase $5,000 worth of airfare per year.

How to earn United miles. There are many ways to earn United Airlines miles, but the easiest (and quickest) method is through credit card rewards. United Airlines has a handful of co-branded credit cards issued by Chase, including: United Gateway℠ Card: Earn 30,000 bonus miles after you spend $1,000 on purchases in the first three months your ...

Reach him at 843-937-5552 or [email protected]. United Airlines charges one of the highest fees to transfer frequent flier miles, but also now allows members to combine and share miles at ...

Share to Linkedin. Alaska Airlines' Mileage Plan is the best frequent-flyer program, a new report says. It ranks above last year's top program, United Airlines' MileagePlus, which now ranks ...

United Club Infinite Card: Earn 80,000 bonus miles after you spend $5,000 on purchases in the first three months from account opening. United Quest Card: Earn 60,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first three months your account is open. United Explorer Card: Earn 50,000 bonus miles ...

The following elite status benefits can be used when flying Oneworld partner airlines such as Alaska Airlines, Japan Airlines, Qatar, British Airways and others. AAdvantage Gold status = Oneworld ...

In March, United Airlines announced that United MileagePlus members could begin pooling their hard-earned miles with friends and family to reach their travel goals sooner. This is an ideal situation for those with kids — there is no age limit on who can earn MileagePlus miles — and those who are short on miles for an award flight and want to cut the cost of their trip.

Welcome to CoBrowse united.com! During a phone conversation with an agent, we may be able to better assist you with CoBrowse, a customer support solution. CoBrowse will allow the agent to see what you see and answer your questions. They will only be able to see united.com - nothing else.

Fly - United Airlines. About United. Products and services. Popular destinations. Careers Important notices.