How to Sell Commercial Insurance

Written by: Nik Ventouris

Last updated: September 26, 2023

Navigating the world of selling commercial insurance policies can feel like a complex task, especially with the constant industry changes and competitive landscape. However, with the right tools and strategies, you can learn how to sell commercial insurance policies successfully and build a rewarding career in this field.

This guide will provide comprehensive insights into effective techniques for selling commercial insurance policies, the role of digital marketing in generating sales, and valuable tips for those embarking on this career path.

How to Sell Commercial Insurance Successfully

As we embark on the digital era, insurance agents must adapt and leverage online marketing strategies to increase their commercial sales.

This section will delve into digital marketing techniques like social media, content marketing, pay-per-click (PPC) advertising, and website creation. These strategies, when appropriately harnessed, can significantly broaden your client base and enhance your sales performance.

Social Media

In today’s interconnected world, social media platforms such as Facebook, Twitter, LinkedIn, and Instagram have emerged as potent tools for promoting and selling commercial insurance policies.

Here are some in-depth steps to maximize your social media presence:

- Create business profiles: Establish a professional business page on each platform. This page will act as your digital storefront, where potential clients can learn more about your services

- Regular posting: Consistency is key in social media marketing. Regularly posting updates, articles, tips, and industry news related to commercial insurance is a great way of showing your audience that you are active and knowledgeable

- Engage with your audience: Social media is a two-way street. By responding to comments, messages, and reviews promptly you can foster a sense of community and show your audience that you value their input

- Use relevant hashtags: Hashtags can significantly increase the visibility of your posts. Use popular and relevant hashtags to reach a broader audience interested in commercial insurance

Recommended Service

As a commercial insurance agent, we recommend working with Arrow; Arrow uses AI in order to offer up to five personalized posts a week, online traffic boosts, and weekly reporting.

Content Marketing

Content marketing is a strategy that involves creating and disseminating valuable and relevant content to attract, engage, and retain an audience.

Below, we’ve explored some of the best ways to utilize content marketing for selling commercial insurance policies:

- Start a blog: Blogs are a great way to share in-depth information about commercial insurance topics. Make sure to regularly post insightful articles that answer common questions, explain complex concepts, or provide useful tips

- Create visual content: Visual content like videos, infographics, and charts can make complex information far more engaging. Try sharing these on your social media platforms to increase your reach

- Offer free resources: You can offer downloadable resources like ebooks, guides, or templates related to commercial insurance for free in exchange for contact information, which builds your email list

- Email marketing: Regularly send out newsletters or updates sharing your blog posts, new policies, or industry news. Keep the content helpful and engaging to maintain your audience’s interest

Recommended : If you are interested in boost-starting your content marketing campaign, have a look at Sitetrail’s premium press release services .

Pay-Per-Click (PPC) Advertising

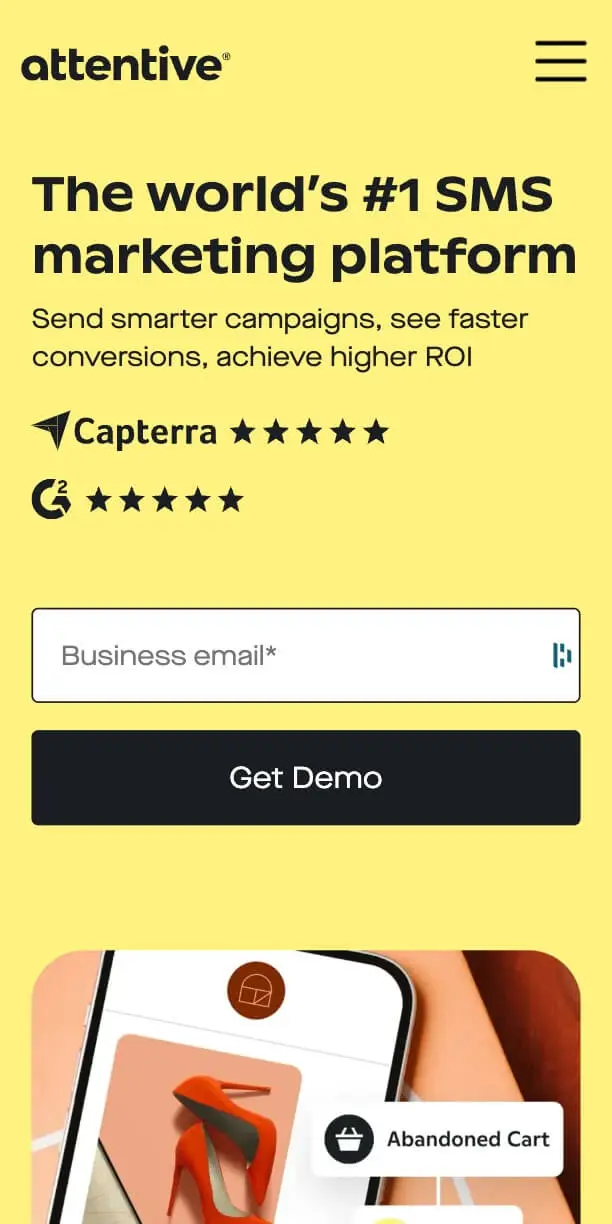

PPC advertising can be a potent tool to reach potential clients who are actively searching for commercial insurance services online.

The tips below can help you maximize your PPC advertising efforts:

- Keyword selection: Choose keywords relevant to commercial insurance. These are the words or phrases your potential clients would type into the search engine

- Compelling ad copy: Write engaging ad copies that highlight the benefits and unique selling points of your commercial insurance policies

- Set a budget: PPC advertising works on a bidding system. Set a daily budget and monitor your ad performance to ensure you’re getting a good return on investment

- Optimize for conversion: Your ads should lead to a landing page designed to convert the visitor into a client. The landing page should be clear, concise, and persuasive, with a strong call to action

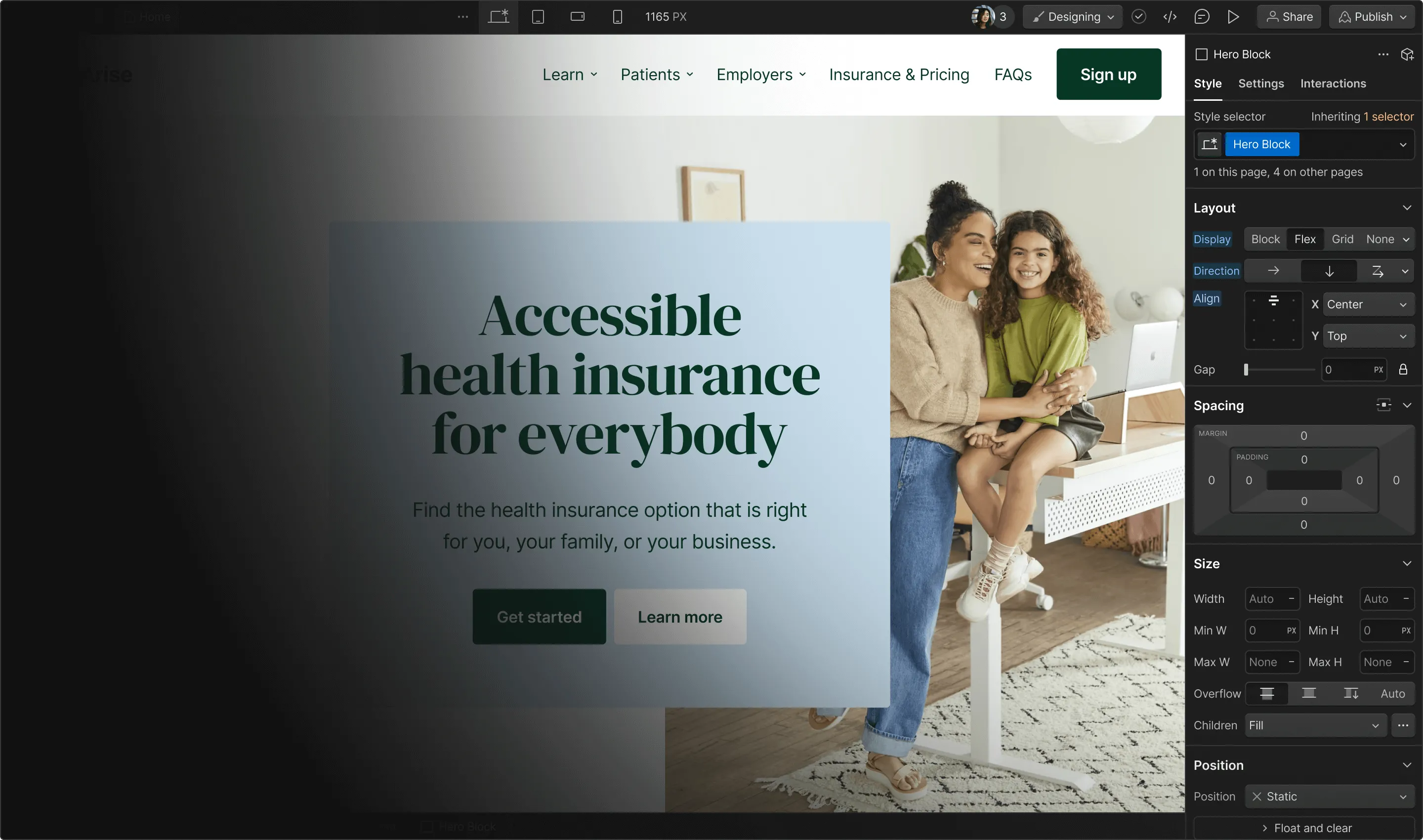

Building a Website

In the digital age, a professional and user-friendly website is a necessity for every insurance agent. It serves as the digital face of your insurance business, where potential clients can learn more about your services, get in touch, or even sign up for a policy.

Below are key steps to building a successful website:

- Choose a domain name and hosting provider: Your domain name should be easy to remember and related to your new business; a good hosting provider will also ensure that your website is always accessible and loads up quickly

- Design your website: The website layout should be clean, easy to navigate, and mobile-friendly. Ensuring your website is compatible with various screen sizes is important as many clients will visit your site on their smartphones

- Provide detailed information: Include detailed information about your insurance policies and services. Also, as a business owner, it is important to tell your visitors about your team and why they should choose you

- Contact form: Make it easy for prospective clients to contact you by including a contact form on your website. This form can also help you gather the email addresses of potential clients for future marketing efforts

- Search engine optimization (SEO): Use SEO techniques to improve your website’s visibility on search engines, such as using relevant keywords in your content, optimizing your images, and securing quality backlinks

Recommended Software

We recommend the GoDaddy Website Builder as a small insurance agent company. GoDaddy meets most small business needs while providing an extremely straightforward user experience.

Tips for Selling Commercial Insurance

Commercial insurance sales can be a challenging but rewarding career path.

The following tips provide practical advice to increase your sales performance and build a successful career as a commercial insurance agent.

- Understand your target audience: Knowing your target clients’ needs and preferences can help you tailor your sales pitch and marketing efforts. Make sure you understand their pain points and how your policies can address them

- Build strong relationships: Long-term relationships are key to success in insurance sales. One of the best ways to form these connections is by providing excellent customer service, maintaining regular communication, and going the extra mile to meet your clients’ needs

- Offer competitive pricing: While price isn’t everything, it’s certainly a consideration for most businesses. Ensure your policies offer good value, as customers will be happier to spend money if they believe they are getting a good deal

- Highlight unique selling points: Differentiate your policies from your competitors by highlighting what you offer that others don’t. This could be anything from unique coverage options to superior customer service

- Keep up with industry trends: The insurance industry is always evolving. Stay informed about the latest trends, regulations, and technologies to serve your clients better and stay ahead of the competition

- Invest in continuous learning: The most successful insurance agents are always learning. Attend workshops, webinars, and industry events to broaden your knowledge and improve your sales skills. For example, a real estate agent must always keep up-to-date with market trends in house prices and changes to property laws

More specific tips and strategies to enhance your selling have been explored in our How to Sell Insurance article.

How to Become a Commercial Insurance Agent

Becoming a successful commercial insurance agent requires a blend of education, licensing, and experience. This section will guide you through the steps necessary to start your career in commercial insurance.

Step 1: Complete Pre-Licensing Education

Before obtaining a license, most states require commercial insurance agents to complete a pre-licensing education course . These courses cover essential topics like insurance laws, regulations, and the specifics of different insurance products.

Requirements can vary by state, so make sure to check with your state’s insurance department for precise information.

Step 2: Pass a Licensing Exam

After completing the pre-licensing education, you’ll need to pass a licensing exam. This will test your understanding of insurance principles, regulations, and products. Most states have resources to help you prepare for the exam, including study guides and practice tests.

Step 3: Apply for a License

Once you’ve passed your state’s property and casualty license exam, you can apply for an insurance agent license. The application process usually involves submitting an application form, paying a fee, and undergoing a background check.

Step 4: Gain Experience

As a newly licensed agent, gaining experience is crucial. It is common for agents to start their careers working for established insurance agencies, where they can learn from experienced agents and build their client base.

Step 5: Continuous Learning and Development

Even after becoming a licensed agent, continuous learning is crucial. Attend workshops, conferences, and webinars to stay updated on industry trends and regulations. This will not only help you serve your clients better but also make you more competitive in the field.

Recommended: For more information, we recommend having a look at our state-specific How to Become an Insurance Agent article.

How to Sell Commercial Insurance FAQ

How to be successful at selling commercial insurance.

Success in selling commercial insurance comes from understanding your target audience, building strong relationships, offering competitive pricing, and highlighting your unique selling points. Staying up-to-date with industry trends and investing in continuous learning also contribute significantly. For more general guidance on how to improve your insurance sales performance, see our article on How to Sell Insurance .

Can you make a lot of money in commercial insurance?

Yes, commercial insurance can be quite lucrative. Earnings are often commission-based, so your income potential can be high, especially with a solid client base and effective sales strategies. Having said that, this will ultimately depend on a variety of factors, such as your experience and location.

What is the best insurance to sell to make money?

While it varies, life insurance and commercial insurance are often cited as profitable due to higher premiums and the potential for earning recurring commissions. To read more, have a look at our state-specific How to Get Your Insurance License overview.

How do you sell an insurance policy to a customer?

Selling insurance requires you to understand the customer’s needs, present suitable policy options, highlight the benefits, and provide excellent customer service to build trust and loyalty. It is important to tailor the pitch of your policies to the needs a customer has expressed — above all, this is what will attract and retain clients.

What license do I need to sell commercial insurance?

You need a property and casualty (P&C) license to sell commercial insurance. This involves completing pre-licensing education, passing a licensing exam, and meeting any other state-specific requirements. More information regarding the P&C license can be found in our Property and Casualty License (P&C License) article.

Featured Articles

- Insurance Agent Marketing

- Best Insurance Courses

- Property and Casualty License

- How to Become an Insurance Agent

- How to Get Your Insurance License

- How Do Insurance Companies Make Money

For all related articles, have a look at our How to Sell Insurance page.

- Weekend Getaways

- Connecticut

- Massachussets

- Pennsylvania

- Washington, D.C.

- Food & Drink

- California Edition

- Central America

- South America

Crucial Steps to Start a Travel Business in New York City

Want to start a travel business in NYC? Well, you’ve reached the right place. New York has always been an excellent choice for entrepreneurs to start a business. The Big Apple is the business capital of America and has the 3rd best access to venture capital. However, the competition is also fierce because many startups are gaining traction since the beginning of 2021.

Starting a travel business in New York is a great business idea. Your timing will also be perfect because the CDC has decided that vaccinated Americans can start traveling within and outside the country. You can begin with low startup costs and there are plenty of opportunities if you have the passion to sell.

However, starting a travel business can be as complex as any other entrepreneurship. You will need all the help you can get to make sure that you are on the right path. That is why we are going to list the crucial steps that can get you started on your entrepreneurial journey.

Steps to Start a Travel Business in NYC:

1. form a travel business idea.

Before you think of starting a travel business, you should explore some ideas and do your research. You should also consider your personal interests, skill sets, and available resources. But most importantly, you should dwell on the reasons why you wish to start a travel business.

You should select a niche after a thorough evaluation. Selecting a niche helps you to establish your brand name. But more importantly, it will help you to formulate a business plan that includes startup costs, competition analysis, and revenue strategies.

It will give you a better idea of your chances of making a profit through your travel business. You will need to present a business plan if you want to get funds from lenders or investors.

2. Decide the Legal Structure

The next step would be to form a legal structure for your travel company. Some of the most common ones are:

- Sole proprietorship

- Partnership

- Limited Liability Company

- Corporation

There are some special legal structures as well, like a limited partnership. You must choose the legal structure that offers the best financial benefits for your travel business. You should also know that you can change your business structure as your travel agency evolves and your business goals.

3. Choose a Brand Name

If you are forming a Limited Liability Company (LLC) or a corporation, you need to check the uniqueness of your travel business name. You will find that all existing businesses have filed with the New York Department Of State (DOS).

Once you have chosen a unique name, you can file an Application for Reservation of Name with the DOS and reserve it for 60 days. There are specific requirements that you need to follow to name an LLC or a corporation.

If your sole proprietorship or general partnership business has a different name from the owner/partners, you will need to file a certificate with the county. If your travel agency operates entirely online, you will have to choose and register your business domain name. You should also check federal and state trademarks to avoid infringements.

4. Build a Business Website

No travel agency can operate in the current times without a proper business website. You should start the process of creating a website as soon as you have chosen a brand name. You may wonder why we are suggesting you create a website even before you have registered your business.

It will take time to market your agency on the Internet, and creating a website is the first step. If you do not have any web-building experience or might be preoccupied with other aspects of your business, you should hire local website designers. An NYC web design will ensure that your website is created according to the latest tourism trends of the city.

Once you have a running travel agency website, you can start marketing it on various social media platforms. You will also be able to take steps to optimize the SEO of your website content so you can attract local and national travelers. A running website will come in handy to promote introductory offers and your opening event. You can even create a countdown of your opening date on your website and social media platforms.

If you’re going to accept payments online, register for PayPal, Payoneer, and other online payment options, but also be open to accepting cryptocurrencies – as these are becoming extremely popular. You can easily learn more about this by taking a few blockchain technology courses .

5. Register Your Business Entity

Once you have decided on a name, you need to register your travel business in New York. There are certain differences depending on the legal structure of your business. You can check the Small Business Administration (SBA) website to learn how to register your startup. The common steps are:

- To choose a registered agent to accept tax and legal documents for your business (You don’t want to get into any tax issues )

- Get an Employer Identification Number from the IRS

- File the documents of formation

You do not need to file any organizational documents for a sole proprietorship in the state of New York.

The same goes for general partnerships. But you should ideally have a written partnership agreement to solve any future disputes. If you wish to form a limited liability partnership, you will have to file a Certificate of Registration with the DOS.

You need to file the required articles of organization with the DOS to form an LLC in New York. Even though it is not a legal requirement, you should prepare an operating agreement describing the rules of your LLC operations.

You will have to file a Certificate of Incorporation with the DOS to establish a corporation in the state of New York. You should also establish the internal operational rules of your travel company by preparing bylaws. But again, it is not legally required.

6. Apply For the Licenses and Permits

The good news is that you do not have to obtain a license at a federal level to open your travel agency. But you will have to register yourself as a Seller of travel (SOT) in the state of New York. Any New York-based travel agent needs to go through the NY’s Article 10-A Truth in Travel Act .

You should specifically look at Section 157-A for outlines of disclosures that you are required to provide to your customers. You have to register with the Department of Taxation and Finance (DTF) in New York. You must also register your business with the Department Of Labor (DOL) if you plan to have employees.

You may also need additional licenses and permits for your travel agency depending on your business. Some of the areas covered by them are:

- Health and safety

- Protection of the environment

- Constructions and buildings

7. Obtain the Necessary Insurances

Business insurances are crucial to protect your travel organization and personal assets in case of an emergency. You can contact professional insurance agents to explore various coverage options. They will also be able to advise you on the legal requirements for business insurance. For example, worker’s compensation is necessary for legal compliance in most of the United States if you have employees.

There are a few additional requirements for starting a travel business apart from the ones we mentioned. Some of them include choosing a business location, checking the zoning regulations, and opening a business bank account. You can also consult the local authorities and government business services to learn more about the process.

Want to read more of our latest posts? Check out the reasons you should visit Queens this year, or our short guide on what to do in Chelsea , Manhattan.

Alex is a computer geek, programmer, who loves traveling. Not the usual mix, but Alex is always with his laptop – no matter how high the mountain he’s hiking on. On every peak he reaches, he writes a story that captures it all.

RELATED ARTICLES MORE FROM AUTHOR

Next generation travel apps you should use, coworking at brooklyn boulders: finding the balance between work and play, new on offmetro, dive into fun and make a splash: join the annual riverkeeper..., wanderlust wonders: four most beautiful pennsylvania road trips (with videos), nourish your soul: explore healing workshops in long island city, get off here: the best things to do in larchmont, ny, hitting the trails with your newest adventurer: 3 easy hikes with....

Contact us if you’d like to contribute!

Sarah Knapp

Allison Tibaldi | Former Editor, New York

Josh Laskin

Annie McBride

Carly Pifer | Senior Writer

Kate E. O’Hara | Writer

Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

Is travel insurance worth it?

April 30, 2024 | 2 min read

Planning a trip and wondering if you need a travel insurance policy? Keep reading to learn more about travel insurance to decide whether it’s right for you.

Key takeaways

- Travel insurance can provide financial protection if things go wrong before or during a trip.

- You might get travel insurance to cover potential losses from trip cancellations or delays, lost baggage or medical issues.

- Factoring in details specific to your trip and balancing with existing coverage might help you decide whether travel insurance is right for you.

Earn 75,000 bonus miles

Redeem your miles for flights, vacation rentals and more. Terms apply.

What does travel insurance do?

Travel insurance is a type of specialized protection that might help protect against financial losses from airline delays, medical issues or other unexpected occurrences. Some travel insurance plans focus on specific things, like lost baggage or health care. Others offer a wide range of benefits under a single plan. It’s a good idea to make sure you understand the terms and conditions, because coverage varies.

When might travel insurance be beneficial?

Some of the situations where it can help to have travel insurance include:

Interruptions and cancellations

Trip delay insurance covers food and lodging expenses if you experience an airline delay. Trip cancellation insurance can reimburse your prepaid costs if an illness forces you to cancel entirely.

Baggage issues

Baggage loss coverage can reimburse you if your luggage is lost, stolen, damaged or delayed.

Medical emergencies

Travel health or medical insurance can cover everything from medication to emergency medical evacuation if you become sick or injured when traveling abroad .

When might travel insurance be unnecessary?

There’s no right or wrong time for travel insurance. It depends on your circumstances. But when deciding whether travel insurance is worth it, you can consider things like:

- Type and length of trip: If the trip’s refundable, you might not need extra protection. And a short or cheap trip might not be worth the cost of coverage.

- Your existing coverage: Check existing policies and agreements. If you have coverage through your health insurance provider, credit card issuer or card network, you may not need more.

Considering travel insurance in a nutshell

Travel insurance can offer peace of mind if anything goes wrong before or during a trip. But it may not always be worth it. If you’re considering travel insurance coverage, looking at your situation, your trip and the terms and conditions of your existing insurance policies could help you determine whether the benefits outweigh the costs.

If you’re interested in getting insurance coverage from a credit card, you can check out the benefits that come with Capital One rewards credit cards .

Related Content

How does travel insurance through capital one cards work.

article | December 14, 2023 | 6 min read

All about booking with Capital One Travel

article | 7 min read

Are travel credit cards worth it?

article | January 9, 2024 | 7 min read

How Much Does Travel Insurance Cost in 2024?

The average cost of travel insurance .

Travel insurance has the potential to cover unexpected expenses and offer you clarity in the face of uncertainty. But before you reap the benefits, you've got to pay for your policy. If you're wondering, "How much does travel insurance cost?" You're not alone. We'll reveal that number, explain factors contributing to the cost of travel insurance, and more. Hint: it's affordable on virtually every travel budget and is well worth every cent.

Let's get right into it!

How Much Does Travel Insurance Cost?

A good rule of thumb is that, on average, travel insurance costs around 5% to 6% of the total cost of your trip. So, if your trip costs around $2,000, you should expect to pay about $100 to $120 for your policy. But this won't be the case across the board. For instance, some will pay up to 12% of their trip cost for their travel insurance policy. With this higher percentage, a travel policy for a $2,000 trip could cost around $240.

How Much Does AXA Travel Insurance Cost?

AXA Travel Protection plans start at $16. Domestic travelers looking to stretch their budget should consider our Silver plan , which includes basic coverage for trip cancellation, baggage, emergency medical, and more.

The Gold and Platinum plans provide greater coverage options and are best suited for international travel and cruises.

Factors Affecting the Cost of Travel Insurance

There is no exact percentage or dollar amount you can expect to pay for your trip insurance without getting a personalized quote. Many shoppers start by getting quotes from several companies so they can estimate the cost or bargain-shop. Price variation is common among companies. Several factors affect the cost of travel insurance, and we'll explore them all below:

The Cost of the Trip

The more expensive your trip is, the more your travel insurance may cost. This is because higher ticket trips often have more nonrefundable costs (lengthier hotel stays, further flights, longer retreats), which equates to potentially higher payouts to you should you file a claim.

Recall that travel insurance for a $2,000 trip may cost around $100 - $120. For a $15,000 trip, that cost estimate rises to $750 to $900. So, expect to pay more if you're taking a high-ticket vacation.

Note: Not every trip expense can be included under your policy — only nonrefundable ones. Travel insurance only reimburses nonrefundable costs. You won't be able to file a claim for refundable expenses.

The Type of Plan

The plan you choose depends on your risk-tolerance. For instance, basic plans cover common trip mishaps such as trip-cancellations, missed connections, flight delays, etc.

Other more expensive plans will cover everything included in a basic plan but with higher coverage limits and more optional add-ons such as Cancel for Any Reason, rental car insurance and more.

Check out AXA’s Travel Protection plans to determine which plan fits you

Where You're Going

When it comes to international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. Are you going to a calm, low-risk area like Norway or Denmark? Or are you going to a riskier area? Travel insurance for higher-risk areas usually commands a higher price tag. You're more likely to be involved in an incident or unexpected situation in risky countries. On the other hand, trip policies for lower-risk countries may be more affordable. As a reminder, it’s important to check policy terms, as some policies may or may not provide coverage to specific countries.

How Long You'll Be Gone

The longer your trip is, the longer the window of opportunity is for things to go awry. A policy for a one- or two-day trip won't cost much in most cases. But insurance for a month-long trip is a different story. Your likelihood of experiencing a trip-related delay, illness, or accident increases the longer you'll be away.

How Old You Are

Your age plays a significant role in your travel insurance price. The older you are, the greater your risk of experiencing a medical issue and needing to file an insurance claim. As a result, those of advanced age should be prepared to pay significantly more for their policy than someone who's much younger.

Number of Travelers

As you might expect, bigger travel groups will need more insurance coverage than a smaller travel group would. So, a solo traveler may pay significantly less for a policy than a family of 6 would.

Add-Ons You Choose

Depending on where you shop for your travel insurance, you may be able to pay for additional benefits to better tailor your policy to your preferences. A couple of these add-ons include:

Cancel for Any Reason Coverage - This is an add-on benefit that allows you to cancel your policy for any reason at all.

Collision Damage Waiver - This waiver covers rental car damage in the event of a collision.

IMPORTANT: The cheapest travel insurance policy isn't going to always be the best fit for you. These policies don't give you as much coverage as some of the more comprehensive policies do. Your level of coverage should coincide with the amount of coverage you need. We'll touch more on this later.

GET YOUR FREE QUOTE

Getting a Quote for Travel Insurance

You have a good general idea of what travel insurance costs. But what if you want to know how much your insurance policy will be for your specific trip? You need a quote. At AXA, you can get a free, no-obligation quote based on your trip details. It outlines the three plans we offer, basic benefit details, and a cut-and-dry price per plan.

To get a quote, go to the AXA homepage and fill out this form:

After clicking "Get a quote now," you'll instantly see your trip coverage options and how much each of them will cost. Getting an exact quote for your travel insurance is much better than taking a guess.

How to Buy Travel Insurance

Some may think buying travel insurance is a labor-intensive endeavor, but that's not the case if you know what to expect. At AXA, there are two main routes to choose from: the online DIY route and the agent route. The DIY route is traveler-led, where you'll get a quick, no-obligation quote online, read over AXA's policy options , and select and pay for your ideal policy.

On the other hand, if this is your first time buying travel insurance, enlisting the help of an agent may be in order. AXA's agents are standing by to answer any questions you may have about travel insurance in general, walk you through the quote generation process, explain your travel policy options, and assist with the payment step. It's much more hands-on than the online DIY option. Call an AXA travel insurance agent at 855-327-1441 and pick option 2.

Choose the Right Travel Insurance for You

We'd be remiss if we didn't communicate the importance of choosing the right travel insurance for you. You may be able to keep costs low with a basic plan if you're taking a solo domestic trip to Denver for a couple of days. But if you're taking a long, international trip or visiting a high-risk area, it may be worth it to purchase a more expensive plan that gets you more coverage for unexpected scenarios.

Moreover, if you're prone to medical issues or simply want more peace of mind during your trip, select a plan with more substantial benefits.

Regardless, before you choose a plan, read the terms and benefits of a given plan and be sure you understand it fully.

Happy Travels!

Now, you don't have to wonder, "How much is travel insurance?" You have a general idea of how much you'll need to insure your trip, you know how to get a quote, and you understand the factors associated with travel insurance prices. Before you go, we encourage you to explore AXA Travel Insurance. Whether you plan on exploring domestically, country-hopping internationally, or taking a relaxing cruise, there's a plan designed to cover what matters most. AXA's high-value plans can help shield you from unforeseen circumstances so you can focus on enjoying your trip. Learn more from our FAQ page here . We hope you found all the information you were looking for, and we wish you an outstanding trip!

Sources

Gusner, P. (2022, April 11). Average Cost Of Travel Insurance 2022. Forbes Advisor. https://www.forbes.com/advisor/travel-insurance/average-travel-insurance-cost/

Horvath, S. (2024, January 26). Average Cost of Travel Insurance in December 2023. MarketWatch. https://www.marketwatch.com/guides/insurance-services/travel-insurance-cost/

Rawson, C. (2024, March 1). Average Cost of Travel Insurance in Jan. 2024. NerdWallet. https://www.nerdwallet.com/article/travel/how-much-is-travel-insurance

Travel Insurance |Travel Medical Insurance| AXA Partners US. (n.d.). AXA Travel Insurance. Retrieved March 4, 2024, from https://www.axatravelinsurance.com/ https://www.axatravelinsurance.com/

Travel Insurance Plans | AXA Travel Insurance. (n.d.). AXA Travel Insurance. https://www.axatravelinsurance.com/our-plans

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

Welcome to our new website! Do you have feedback for us?

Travel Insurance

Choose a plan now; rest easy later., why use travel protection.

We recommend Travel Protection because of common travel problems such as flight delays, injuries and illness, unpredictable weather, and lost or stolen luggage. Our Travel Insurance Plan provides protection designed just for travelers and can provide coverage for many of the things that can go wrong before and during your trip.

Some Travelers Aren't Covered by Credit Card Travel Protection - generally, these travel benefits only apply to the cardholder, so other passengers traveling with you are left without options!

Concern Over Preexisting Conditions - Most credit card coverage excludes cancelation due to preexisting conditions, our travel insurance will have your back no matter what!

Extra Assurance & Coverage - Credit card protection includes a variety of limitations to potential or unexpected events that could arise when you travel, our insurance provides you extra assurance that you have coverage on a wide variety of issues.

Top Ten Reasons to Use Travel Insurance

- You have to cancel your trip due to an unexpected event such as bad weather, an illness in the family, or the financial default of your airline, cruise line or tour operator.

- You have to return home early due to an unexpected emergency such as an illness or death in the family.

- Your luggage is lost or delayed, forcing you to purchase essentials, or prescription medications.

- Your luggage or personal effects are damaged or stolen.

- You become ill or injured and learn that your health care plan doesn't cover you outside the U.S.

- You need an emergency medical evacuation due to an accident or sudden illness.

- You run into flight delays and miss a portion of your trip or cruise.

- Your trip is interrupted due to an unexpected hurricane or storm.

- You lose your passport, leaving you stranded abroad.

- You need assistance with replacing a prescription or an emergency cash transfer.

Why LeisureCare?

The LeisureCare Travel Protection Plan is provided through Aon Affinity, a worldwide leader in travel protection and assistance services plans..

LeisureCare plans provide:

- Coverage you can count on.

- A broad array of coverages provide protection specifically designed for travelers.

- A world of service.

- Aon Affinity provides a suite of travel assistance services you can begin using from the moment you purchase your plan.

- Lose your passport? Need a translator? Have to send a message to family or friends? Call anytime. We're here to help.

- Always there, everywhere. Whether you need a medical evacuation from a remote corner of the world or help to track a lost bag, Aon Affinity's 24-hour toll-free travel helpline is just a phone call away.

Include the LeisureCare Travel Protection Plan! Call your Vacation Specialist today!

This is only a brief overview of coverages. For additional information including terms, conditions and exclusions, refer to the plan description.

To view descriptions of coverage with summaries of the terms, conditions, and exclusions, click on the appropriate link. Your travel agent will provide you with your best options at the time of booking.

- Standard Cruises, land vacations, etc., when buying insurance at the time of deposit or up to 15 days thereafter. LeisureCare Standard

- Standard cruises, land vacations, etc., when buying insurance within 1 and 15 days of the deposit. LeisureCare Classic

- Luxury Cruises, available with deposit and up to within 7 days of final payment. LeisureCare Luxury

- Cancel for Any Reason Insurance. Can only be purchased on non-luxury cruises at the time of deposit. LeisureCare with Cancel For Any Reason

This is only a brief overview of the benefits and services of the plan. Travel insurance benefits are underwritten by Arch Insurance Company, with administrative offices in Jersey City, NJ (NAIC #11150), under Policy Form series LTP 2013 and applicable amendatory endorsements. This is a general overview of insurance benefits available. Coverages may vary in certain states and not all benefits are available in all jurisdictions. Please refer to your certificate of benefits or policy of insurance for detailed terms, conditions and exclusions that apply. Aon Affinity is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc. (TX 13695); (AR 100106022); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Services, Inc.; in CA, Aon Affinity Insurance Services, Inc. (CA 0G94493), Aon Direct Insurance Administrators and Berkely Insurance Agency and in NY, AIS Affinity Insurance Agency. On & On Inc. DBA TravelPerks Dream Vacations is licensed under OR License #100228074

- Member Benefits

- Become a Travel Advisor

- Member Resources

The BC Travel Insurance Course and Exam

A Notice, issued by the Insurance Council of BC on January 5, 2005, announced that "Travel Agents engaged in the sale of Travel Insurance receive a limited conditional exemption from the Licensing Requirements under the Financial Institutions Act". The full text of the notice and other information is available at www.insurancecouncilofbc.com or you may download the PDF of the Notice.

The Notice went on to say that as of January 1, 2005, only the travel agent or wholesaler that is registered under the Business Practices and Consumer Protection Act (BPCPA) is required to hold a restricted travel insurance license with the Insurance Council of British Columbia .

To qualify for the license exemption, the following conditions must be met:

- The individual must be an employee or commissioned salesperson of a licensed travel agency

- The individual must successfully complete the travel insurance course (i.e read and understand the Study Manual) and exam

- Individuals who have already passed the exam do not have to retake the exam

- Individuals who have not been actively involved in the travel insurance industry for two or more years must take the course (i.e. read and understand the Study Manual) and exam again before they are eligible for the exemption

- It is the responsibility of the travel agency to determine whether an individual meets the education requirement.

- The individual must complete a minimum of two hours of continuing education each calendar year. Continuing Education

- The Insurance Council of BC plans to conduct spot audits of travel agencies to ensure compliance with these requirements.

- It is the travel agency's responsibility to ensure all of its employees and commissioned salespersons comply with the exemption provisions. Please note that if travel agents have questions regarding whether they need to take the course and exam, or questions about how the new changes affect them should contact the Insurance Council of BC directly at:

- Personal Finance

- Today's Paper

- Partner Content

- Entertainment

- Social Viral

- Pro Kabaddi League

Travellers book long-term insurance as Schengen visa rules come into play

Travellers have shown a remarkable interest in selecting appropriate add-ons for their travel insurance. riders covering baggage or belongings loss, trip cancellation, adventure sports coverage.

)

Schengen visa | Photo: Schengen visa information website

EU eases Schengen visa rules for Indians: Costs, processing time explained

Explained: how indians can now get five-year, multi-entry schengen visa, are indians eligible for 5-year schengen visa all you need to know, schengen visa to go online, no need for in-person appearance at consulate, thailand plans schengen-style visa for asia: how does it impact you, venice imposes world's first tourist entry fee: all you need to know, cred introduces offline qr code 'scan & pay' service, kiosks for merchants, rbi directs talkcharge to return funds in ppi- wallets to consumers, risky borrowing: india's household debt has likely surged to all-time high, h-1b visa holders can now sue over fraud-linked visa revocations.

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Apr 26 2024 | 2:52 PM IST

Explore News

- Suzlon Energy Share Price Adani Enterprises Share Price Adani Power Share Price IRFC Share Price Tata Motors Share Price Tata Steel Share Price Yes Bank Share Price Infosys Share Price SBI Share Price Tata Power Share Price HDFC Bank Share Price

- Latest News Company News Market News India News Politics News Cricket News Personal Finance Technology News World News Industry News Education News Opinion Shows Economy News Lifestyle News Health News

- Today's Paper About Us T&C Privacy Policy Cookie Policy Disclaimer Investor Communication GST registration number List Compliance Contact Us Advertise with Us Sitemap Subscribe Careers BS Apps

- Budget 2024 Lok Sabha Election 2024 IPL 2024 Pro Kabaddi League IPL Points Table 2024

When to Buy Travel Insurance: Timing Your Purchase Perfectly

Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. Datalign's free tool matches you with financial advisors in your area in as little as 3 minutes. All firms have been vetted by Datalign and all advisors are registered with the SEC. Get started with achieving your financial goals!

The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

- Purchase travel insurance when traveling internationally or on long and expensive trips.

- Buying travel insurance right after booking your trip is best, as some coverage options are time-sensitive.

- Cancel For Any Reason policies and coverage for pre-existing coverage require early purchase.

Travel insurance protects you against financial losses and medical emergencies while on a trip. You'll want to book travel insurance when going on long, expensive, or international trips. However, the exact timing of your purchase is also important.

Generally, you'll want to buy travel insurance soon after you book your trip to get the maximum coverage out of your policy. Here's what you need to know about travel insurance and when you should buy it.

Ideal timing for travel insurance purchase

Though you can insure your trip anytime after booking, the best time to purchase travel insurance is immediately after booking your trip.

For one, unexpected circumstances may arise between when you book your trip and when you leave. If an injury or inclement weather cancels your trip before you have a chance to purchase travel insurance, you may not get a refund. Purchasing travel insurance early reduces the chances of that happening.

Michelle Osborn, owner of boutique travel agency Outta Here Travels , says, "Most travel insurance policies have a time limit of when you can purchase to get the maximum benefits."

It's important to note that you do not have to have every detail of your trip planned before purchasing travel insurance. Most policies are flexible, so you can add details and update your costs in the days leading up to the trip. Don't let some unplanned details in your trip prevent you from purchasing travel insurance.

Advantages of purchasing travel insurance early

When you purchase travel quickly after booking, you'll have additional coverage options.

- Purchase cancel for any reason coverage , which reimburses you for 60% to 75% of your costs if you back out on your travel plans for a reason not usually covered. CFAR policies must be purchased within 15 to 21 days of putting down the first deposit on your trip. You can find our picks for the best CFAR travel insurance here.

- Guarantee coverage for pre-existing conditions. Many travel insurers won't cover pre-existing conditions unless you purchase coverage within two weeks of booking your trip.

- Cancel your travel insurance if you're not happy with it. Most plans allow you to cancel your insurance and get a refund — as long as you do so within 15 days and your trip hasn't started.

If you cannot purchase your travel insurance right after booking, you should still qualify for a policy if your trip hasn't been canceled. Most companies allow you to buy insurance until the day of your trip. You just won't have access to CFAR or pre-existing condition coverage.

When to buy annual travel insurance

Annual travel insurance , sometimes referred to as multi-trip insurance, covers you for all your trips over a 12-month period. This type of travel insurance may be a good option if you regularly travel for work or have a handful of trips, particularly international trips, planned for the next 12 months.

"Travel insurance should definitely be purchased anytime you travel out of the United States," Osbon says. "The main reason is most US health insurance policies don't cover treatment internationally."

You may want to buy annual travel insurance just before your first trip begins. Since these plans last 365 days, you can stretch your policy to cover the most travel. However, this may limit your coverage, so tread carefully. For example, you may not be able to get medical coverage for pre-existing conditions.

"In the case of a pre-existing medical condition, you'll need to meet a few requirements to be covered," says Jeff Rolander, director of claims at Faye Travel Insurance . "Faye's travel protection covers pre-existing conditions as long as you purchase your plan within 14 days of your initial trip deposit and are medically able to travel when you purchase your plan."

Important: Cancel for any reason coverage is not available on annual travel insurance plans. This add-on can only be purchased for single-trip policies.

When is it too late to buy travel insurance?

You should be able to purchase travel insurance any time before the date of your trip. Once the day of your departure rolls around, the window will close. You also can't purchase travel insurance during your trip or after an injury or loss has already happened.

The moral of the story: It's always better to buy sooner rather than later.

"Right when you book your flights or hotel stay is when you should get your trip covered," Rolander says. "The sooner you buy coverage for your trip, the sooner your coverage starts."

Get Travel Insurance Quotes Online

Protect your trip with the best travel insurance . Compare travel insurance quotes from multiple providers with Squaremouth.

When to buy travel insurance frequently asked questions

How soon after booking a trip should i buy travel insurance.

You should purchase travel insurance within two weeks of booking your trip to receive maximum benefits, especially pre-trip cancellation coverage.

Can I buy travel insurance on the day I leave for my trip?

While you can purchase travel insurance up until the day of departure, doing so may limit certain benefits. Additionally, last-minute travel insurance won't cover pre-existing health conditions.

Does the length of my trip affect when I should buy travel insurance?

Lengthier and more expensive trips generally call for travel insurance because you have more to lose. Purchasing travel insurance earlier mitigates the potential damage of a cancellation.

What if I need to add coverage or make changes after purchasing travel insurance?

Most travel insurance policies allow for modifications or additions within a specific period after purchase, but it's important to check the policy terms.

Are there any disadvantages to buying travel insurance too early?

Purchasing travel insurance early is generally beneficial for comprehensive coverage, but you may see your premiums rise if you make significant changes to your travel plans.

If you enjoyed this story, be sure to follow Business Insider on Microsoft Start.

- Finance & Insurance ›

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

Leading reasons why consumers bought travel insurance in the U.S. 2023

Almost 80 percent of consumers in the United States who bought travel insurance in 2023 did so for their peace of mind. A further 21 percent made the purchase after it was recommended to them. Meanwhile, the leading reason U.S. consumers did not buy travel insurance was thinking they did not need it.

Leading reasons why consumers bought travel insurance in the United States in 2023

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

January 2024

United States

September 12 to 19, 2023

1,000 respondents

18 years and older

nationally representative by age, gender, race, and region

Online survey

Other statistics on the topic

Personality & Behavior

- Participation in Halloween activities in the United States 2015-2023

Food & Nutrition

- U.S. pumpkin prices during Halloween 2017-2023

Retail & Trade

- Annual Halloween expenditure in the United States 2005-2023

- U.S. pumpkin production 2001-2023

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

You only have access to basic statistics. This statistic is not included in your account.

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

Business Solutions including all features.

Statistics on " Halloween in the U.S. "

- Leading consumer spending events by expected average spend in the U.S. 2023

- Annual Halloween expenditure in the U.S. 2023, by item

- Americans' planned spending on Halloween-related items 2005-2023

- Americans' planned spending on Halloween-related items by category 2023

- Expected spend among Gen Z for Halloween in the United States 2023

- Expected spend among millennials for Halloween in the United States 2023

- Expected spend among women for Halloween in the United States 2023

- Plans for Halloween celebrations in the U.S. in 2023

- Opinions on when it is still too early to show Halloween items in the U.S. 2023

- Halloween shopping start in the United States in 2023

- Expected change in Halloween spending among U.S. consumers 2023

- Areas of inspiration for Halloween in the U.S. 2023

- Stores in which U.S. consumers planned to make their Halloween purchases 2023

- Stores in which young U.S. consumers planned to make their Halloween purchases 2022

- Timing of Halloween costume purchases among consumers in the United States 2023

- Stores in which U.S. consumers planned to shop for Halloween costumes 2023

- Planned spending on Halloween costumes among consumers in the U.S. 2022

- Leading sources of inspiration for Halloween costumes among U.S. adults 2022

- Leading sources of inspiration for Halloween costumes among Gen Z in the U.S. 2022

- Main social networks used for DIY Halloween costume ideas in the U.S. 2022

- Timing of Halloween candy purchases among consumers in the United States 2023

- Consumer spending on Halloween candy in the United States 2017-2023

- Number of people who planned to carve a jack-o-lantern for Halloween U.S. 2017-2023

- Jack-o-lantern expenditure in the U.S. 2017-2023

- U.S. pumpkin production value 2001-2023

- U.S. per capita consumption of fresh pumpkins 2000-2022

Other statistics that may interest you Halloween in the U.S.

Consumer expenditure

- Premium Statistic Leading consumer spending events by expected average spend in the U.S. 2023

- Basic Statistic Annual Halloween expenditure in the United States 2005-2023

- Basic Statistic Annual Halloween expenditure in the U.S. 2023, by item

- Premium Statistic Americans' planned spending on Halloween-related items 2005-2023

- Premium Statistic Americans' planned spending on Halloween-related items by category 2023

- Premium Statistic Expected spend among Gen Z for Halloween in the United States 2023

- Premium Statistic Expected spend among millennials for Halloween in the United States 2023

- Premium Statistic Expected spend among women for Halloween in the United States 2023

Consumer behavior

- Basic Statistic Participation in Halloween activities in the United States 2015-2023

- Basic Statistic Plans for Halloween celebrations in the U.S. in 2023

- Basic Statistic Opinions on when it is still too early to show Halloween items in the U.S. 2023

- Premium Statistic Halloween shopping start in the United States in 2023

- Premium Statistic Expected change in Halloween spending among U.S. consumers 2023

- Basic Statistic Areas of inspiration for Halloween in the U.S. 2023

- Premium Statistic Stores in which U.S. consumers planned to make their Halloween purchases 2023

- Basic Statistic Stores in which young U.S. consumers planned to make their Halloween purchases 2022

Halloween product shopping

- Basic Statistic Timing of Halloween costume purchases among consumers in the United States 2023

- Premium Statistic Stores in which U.S. consumers planned to shop for Halloween costumes 2023

- Premium Statistic Planned spending on Halloween costumes among consumers in the U.S. 2022

- Premium Statistic Leading sources of inspiration for Halloween costumes among U.S. adults 2022

- Premium Statistic Leading sources of inspiration for Halloween costumes among Gen Z in the U.S. 2022

- Premium Statistic Main social networks used for DIY Halloween costume ideas in the U.S. 2022

- Premium Statistic Timing of Halloween candy purchases among consumers in the United States 2023

- Premium Statistic Consumer spending on Halloween candy in the United States 2017-2023

Pumpkin production & consumption

- Basic Statistic Number of people who planned to carve a jack-o-lantern for Halloween U.S. 2017-2023

- Premium Statistic Jack-o-lantern expenditure in the U.S. 2017-2023

- Basic Statistic U.S. pumpkin prices during Halloween 2017-2023

- Basic Statistic U.S. pumpkin production 2001-2023

- Basic Statistic U.S. pumpkin production value 2001-2023

- Basic Statistic U.S. per capita consumption of fresh pumpkins 2000-2022

Further Content: You might find this interesting as well

Introduction to TravelSafe Travel Insurance

- Coverage Options

- Purchasing and Managing a Policy

- Customer Service and Support

Compare TravelSafe Travel Insurance

- Why You Should Trust Us

TravelSafe Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

TravelSafe Insurance is a travel insurance company owned by the Chester Perfetto Agency, which provides a wide array of travel insurance options such as health, life, and auto insurance. TravelSafe can cover longer trips than many of its competitors, but charges high rates. It's also known for its golf-specific coverage.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to 120 days' coverage available for travelers ages 79 and under (30 days for 80+)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $2,500 per person for missed connections over three hours or more

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip delay coverage of up to $150 per person per day kicks in after six hours or more

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Policy can be purchased by U.S. citizens living abroad

- con icon Two crossed lines that form an 'X'. Medical coverage ceiling of $100,000 may be low for some travelers' needs.

- con icon Two crossed lines that form an 'X'. Claims reviews from customers say performance is not always the best

- A well-rounded insurance plan for travelers who are concerned about missing connections for cruise-related travel

- Classic and Basic travel insurance plans

- GolfSafe travel insurance plans provide coverage for you and your equipment

- Travel medical insurance through partner Trawick International

Among the companies included in our guide on the best CFAR travel insurance , TravelSafe Insurance offers thick insulation against the unpredictability of travel. The trips that TravelSafe Insurance can insure are on the higher end of the industry, covering trips lasting up to 150 days and costing up to $100,000. TravelSafe Insurance's Classic plan also offers coverage for people who are up to 100 years old.

One standout feature of TravelSafe Insurance is that all of its plans offer primary coverage, so you can file immediately with TravelSafe Insurance instead of going through your health insurance provider first, even with TravelSafe Insurance's Basic plan. Many travel insurance companies only provide primary coverage with their higher-tiered plans.

That said, TravelSafe Insurance's Basic plan costs more than many travel insurance companies' most expensive plans. This brings up the issue of cost. While its plans are technically within the bounds of the average cost of travel insurance, TravelSafe Insurance certainly stretches those limits, and it's certainly more expensive than many of the best travel insurance companies.

Ultimately, TravelSafe Insurance is best for travelers taking an expensive trip who can afford expensive insurance.

Coverage Options from TravelSafe

TravelSafe Insurance has two main policies for those seeking travel insurance: travel insurance for stateside and international travelers and travel insurance for those who are planning golf trips. For each policy type, travelers can choose between classic and basic coverage. And golfers can choose between GolfSafe Secure and GolfSafe Secure Plus.

Here's how the three TravelSafe Insurance travel insurance plans stack up in terms of what's included and coverage limits:

TravelSafe Insurance also offers specific golf insurance plans, which is something incredibly unique among travel insurance companies. If you're an avid golfer, purchasing golfing insurance will cover things like lost holes, something regular travel insurance won't. TravelSafe Insurance's golf insurance plan benefits are as follows:

Additional coverage options from TravelSafe

TravelSafe Insurance offers several optional coverages for its travelers:

Rental car damage and theft coverage: Available for both Basic and Classic plans, this add-on covers up to $35,000 per covered vehicle.

Business and sports equipment rental: Also available for both TravelSafe Insurance plans, your rental equipment is covered for up to $1,000.

CFAR coverage: Only available for Classic+, you'll receive 75% of your nonrefundable trip costs. You must purchase your policy within 21 days of your initial trip deposit.

TravelSafe Travel Insurance Cost

The premium you pay will depend on various factors, including the age of the travelers, destination, and total trip costs. The average cost of travel insurance is 4% to 8% of your travel costs.

After inputting some personal information, such as your age and state of residence, along with your trip details, like travel dates, destination, and trip costs, you'll get an instant quote for TravelSafe Insurance plans available for your trip. And from there, it's easy to compare each option based on your coverage needs and budget.

Now let's look at a few examples to estimate TravelSafe Insurance coverage costs.

As of 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following travel insurance quotes:

- Basic: $112

- Classic: $147

- Classic (Plus): $274

Premiums for TravelSafe Insurance plans are between 3.7% and 9.1% of the trip's cost, within and above the average cost of travel insurance.

TravelSafe Insurance provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

- Basic: $153

- Classic: $202

- Classic (Plus): $377

Once again, premiums for TravelSafe Insurance plans are between 3.8% and 6.3% of the trip's cost, within the expected range of travel insurance costs.

A Texas family consisting of two 40-year-old parents with a 10-year-old and 4-year-old on a two-week trip to Australia for $20,000:

- Basic: $512

- Classic: $676

- Classic (Plus): $1,616

TravelSafe Insurance plans cost between 2.6% and 8.1% of the trip's cost, below and within the average cost of travel insurance.

A 65-year-old couple looking to escape New Jersey for Mexico for two weeks with a trip cost of $6,000 would have the following quotes:

- Basic: $472

- Classic: $582

- Classic (Plus): $952

Premiums for TravelSafe Insurance plans are between 7.8% and 15.9%, which is well the average cost for travel insurance. While older travelers should expect higher premiums, these prices are on the higher end of what you should be paying.

Purchasing and Managing a TravelSafe Policy

Purchasing a TravelSafe Insurance policy is fairly simple. You'll first need to obtain a quote through TravelSafe Insurance's website. Be prepared to provide the following details:

- State of residence

- Destination(s)

- Departure/return dates

- Date of initial deposit

- Total trip cost

- Number of travelers

- Birthday of traveler(s)

Once you obtain a quote and pick your plan, you'll enter some additional information about yourself, such as your address and contact information.

How to File a Claim with TravelSafe

If you experience a loss while insured by TravelSafe, you need to act quickly. You have 20 days after the loss to notify TravelSafe Insurance, at which point an agent will send you forms for filing proof of loss. If TravelSafe Insurance don't send a form withi 15 days, you can send your own written statement about what happened along with proof. This must be completed within 90 days of the loss.

You have several options if you need to file a claim for TravelSafe Insurance.

If you need emergency help, you can call their toll-free numbers below.

- Toll-free (US-only): 1-877-539-6729

- Direct: 1-727-475-2808

If you're international, call the following toll-free number: 1-866-509-7713.

TravelSafe Customer Service and Support

Almost all reviews for TravelSafe Insurance are concentrated on its SquareMouth page, where it has an average rating of 4.3 stars out five across over 1,500 reviews. Though an overall positive score, it's worth mentioning that most of the positive reviews come from people who didn't have to file a claim. Some of these reviews mentioned having to alter their insurance plan, which was an overall positive experience.

However, many of the reviews that mention the claims process are negative. Customers mentioned long wait times, uncommunicative claims representatives, and little guidance during the claims process. Additionally, while many travel insurance companies regularly engage with reviews, both positive and negative, TravelSafe Insurance rarely replies to customer reviews.

Learn more about how TravelSafe Insurance travel insurance compares against top insurers.

TravelSafe Travel Insurance vs Faye Travel Insurance

Faye Travel Insurance is a completely digital travel insurance company. Unlike TravelSafe Insurance, Faye Travel Insurance completely covers all cruise travel. Faye doesn't cover golf trips as TravelSafe Insurance does. They have similar amounts of coverage, but Faye Travel Insurance is about $20 cheaper for its comparable international plans.

Faye Travel Insurance covers your trip, your health, and your belongings just like TravelSafe Insurance does. But with Faye Travel Insurance, you can add different things that meet your needs, like car rental, extreme sports, and pet care.

Read our Faye travel insurance review here.

TravelSafe Travel Insurance vs World Nomads Travel Insurance

TravelSafe Insurance is an excellent option if you're traveling and participating in regular activities, like trying different foods and basic activities, like taking a train to places. But if you want to do extreme sports, it might not be the right coverage for you. Instead, consider getting a travel insurance plan like World Nomads Travel Insurance . World Nomads covers over 100 different extreme sports, and you can specifically add on different sports that you want to try. It's a better coverage insurance plan for someone who's a little bit more adventurous.

That said, if you're only planning on doing a specific activity, like golfing, TravelSafe Insurance has a plan for you. They cover golfing trips specifically with more coverage than World Nomads.

Read our World Nomads travel insurance review here.

TravelSafe vs Credit Card Travel Insurance

Some credit cards, especially travel rewards cards, come with travel benefits such as primary rental car insurance for your vehicle if you decide to rent one. However, travel insurance is generally more comprehensive than credit card coverage. For example, TravelSafe Insurance offers benefits like death and dismemberment coverage; credit cards don't typically cover this benefit.

However, you can use both your credit card benefits and your travel insurance to get the fullest coverage possible.

Read our guide on the best credit cards with travel insurance here.

TravelSafe Travel Insurance FAQ

Yes, TravelSafe Insurance is known for providing reliable coverage for international travel, including medical emergencies and trip interruptions.

TravelSafe Insurance typically allows the purchase of travel insurance up until the day before departure, making it suitable for last-minute travel plans.

TravelSafe Insurance offers policies that include coverage for trip cancellations due to COVID-19, but it's important to review the specific terms and conditions of each plan.

Claims with TravelSafe Insurance are generally handled efficiently, with a straightforward process for filing and tracking claims, and timely reimbursements according to customer feedback.

Yes, TravelSafe Insurance offers the option to add adventure sports coverage to their policies, catering to travelers who engage in higher-risk activities.

Why You Should Trust Us: How We Reviewed TravelSafe

For this review, we made sure to include the most updated information and pulled real-time quotes from TravelSafe Insurance's website. We compared two different companies that had similar coverage to TravelSafe Insurance to ensure the best review possible. We only included reputable plans. And we looked at factors like what's covered, policy limits, and coverage options.

Read more about how Business Insider rates insurance products here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

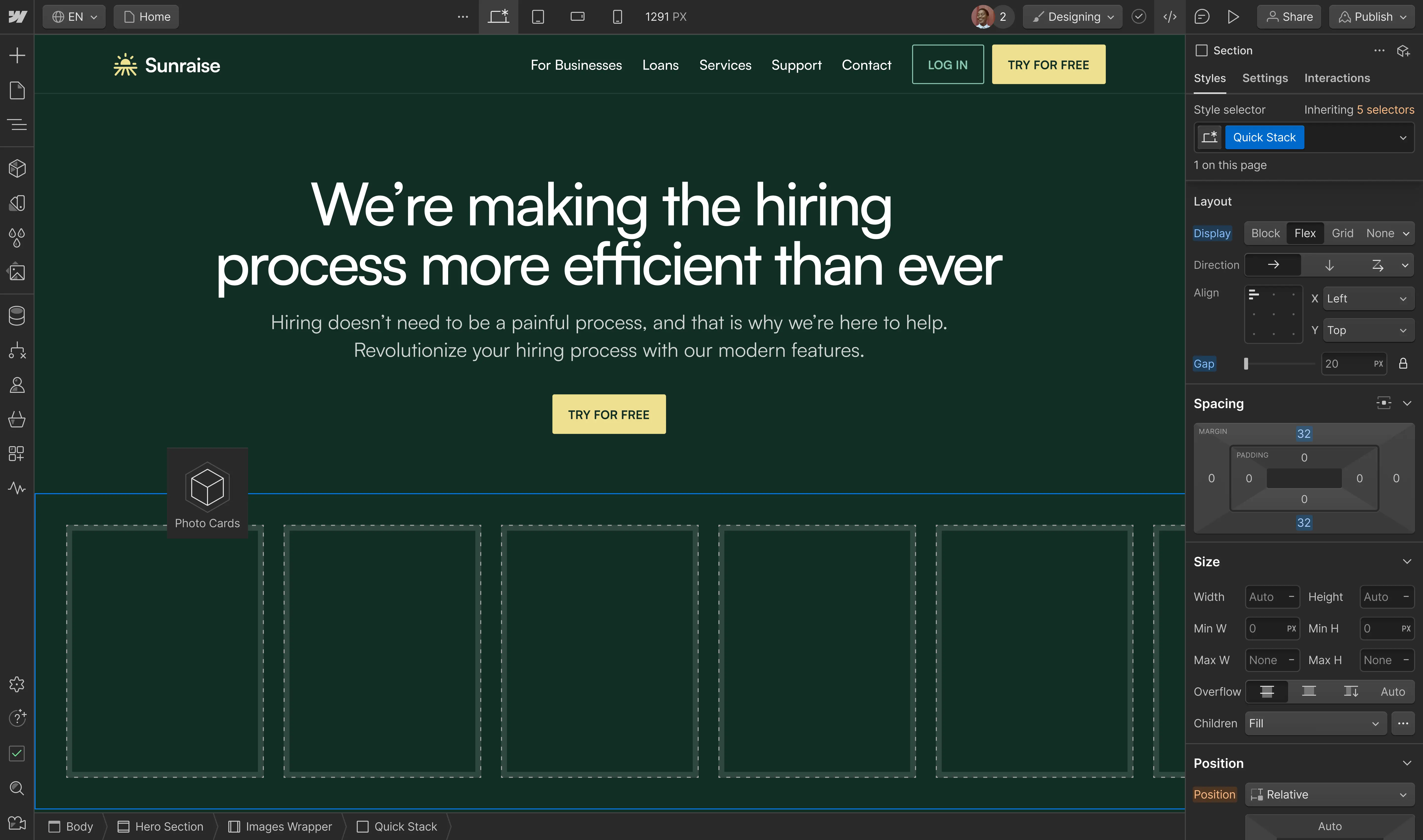

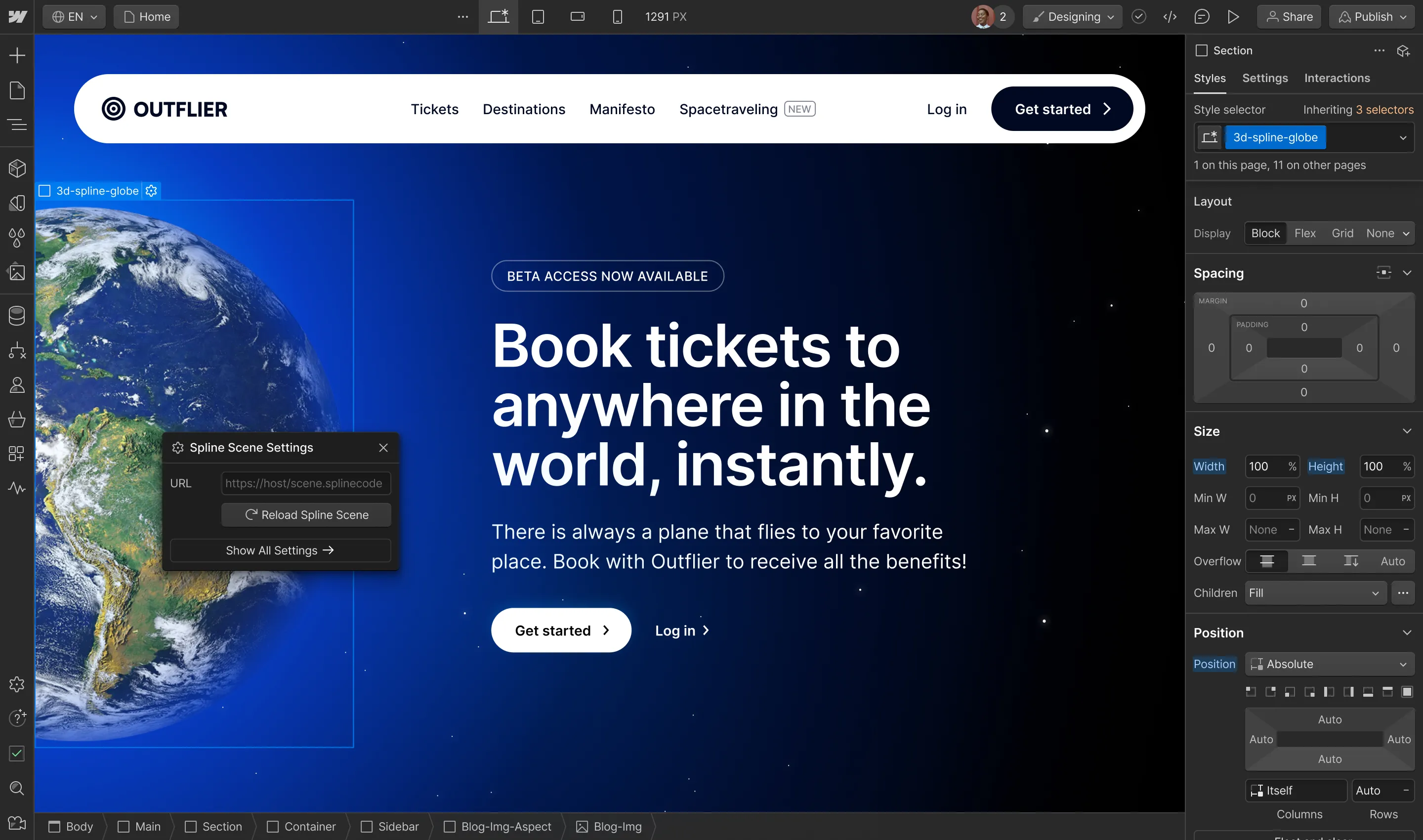

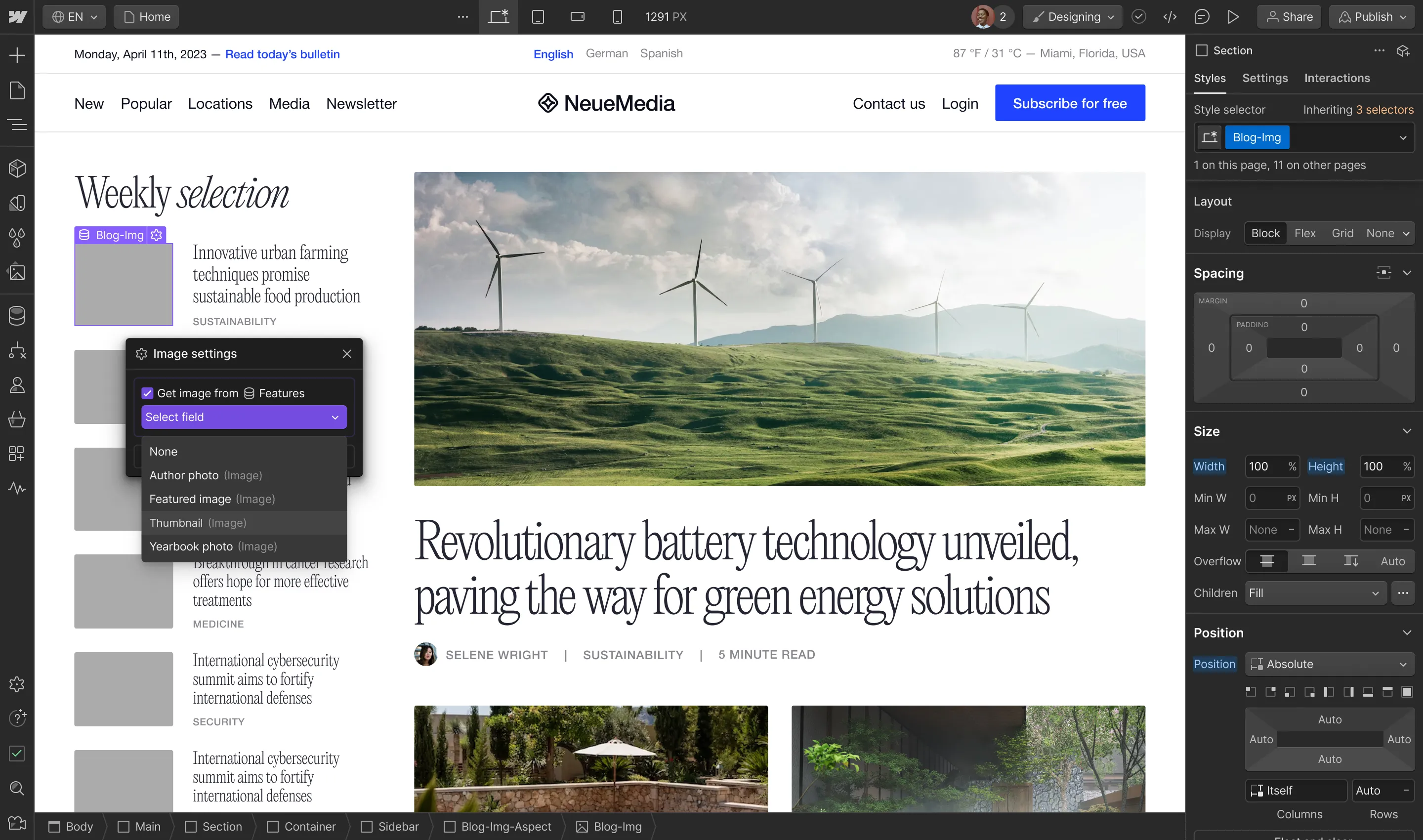

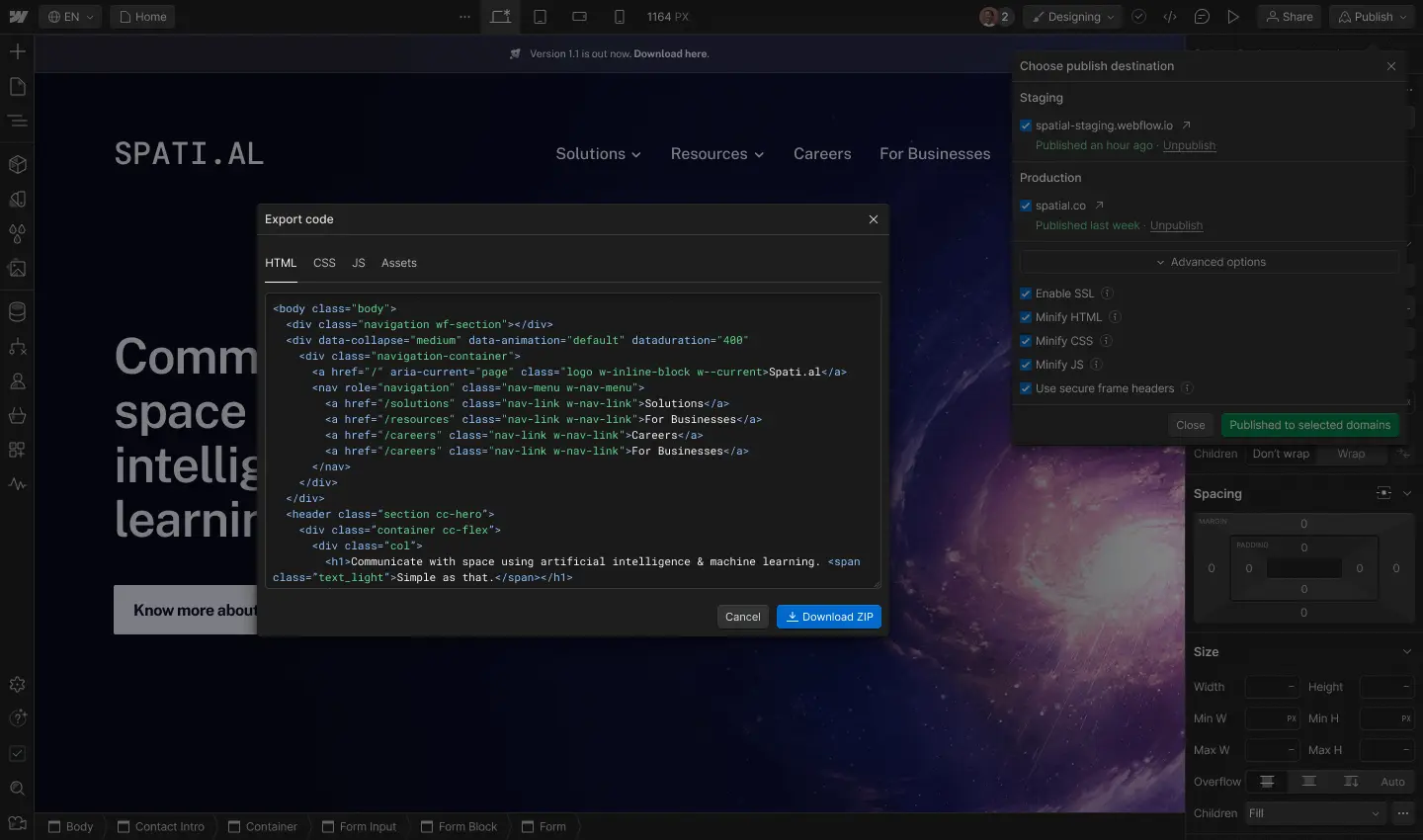

Build with the power of code — without writing any

Take control of HTML, CSS, and JavaScript in a visual canvas. Webflow generates clean, semantic code that’s ready to publish or hand to developers.

Creative power that goes beyond templates

You design, we generate the code — for everything from fully custom layouts to complex animations.

Fully customize page structure

Drag in unstyled HTML elements to build exactly what you want — then turn footers, nav bars, and more into components you can reuse.

Style your site exactly how you want

Take full control of CSS properties and a class system that cascades changes across your site — plus use variables to sync with external design systems.

Create complex, rich animations

Design scroll-based and multi-step interactions and easily work with Spline, 3D, Lottie, and dotLottie files — all without even thinking about code.

Create content-rich pages

Automatically pull live content from Webflow's powerful CMS into any page — then easily add or edit content over time.

Go live quickly

Publish straight to the web or export clean, semantic code for production.

Trusted by 200,000+ leading organizations

Dropbox sign, a platform designed for growth.

Tools to help you scale your site with your business.

Webflow Apps

Connect your site to the tools your team uses every day — plus find and launch apps in the Webflow Designer.

Collaboration

Work better together, ship faster, and avoid unauthorized changes with advanced roles and permissions, page branching, and more.

Optimize your SEO and improve discoverability with fine-tuned controls, high-performance hosting, and flexible content management tools.

Localization

Create fully localized experiences for site visitors around the world — from design and content to translation and more.

Webflow Enterprise

Webflow Enterprise gives your teams the power to build, ship, and manage sites collaboratively at scale.

A scalable, reliable platform

Scale your traffic, content, and site performance to match your business — without worrying about reliability.

Advanced collaboration

Build and launch sites quickly — and safely — with powerful features designed to help large teams collaborate.

Dedicated, tailored support

From implementation support to in-the-moment troubleshooting, we’re here to offer personalized help.

Security and compliance

Launch with peace of mind thanks to Webflow’s robust security and compliance features and reliable hosting infrastructure.

We’ll help you get started

Browse the Marketplace, educational videos, and customer stories to find what you need to succeed with Webflow.

The 2024 State of the Website

Discover key challenges today’s marketing teams are facing, as well as opportunities for businesses in 2024.

Webflow 101

Learn the fundamentals of web design and development through this comprehensive course.

Marketplace

From templates to Experts, discover everything you need to create an amazing site with Webflow.

Webflow University

Search from our library of lessons covering everything from layout and typography to interactions and 3D transforms.

Reimagining web development teams

Discover how moving web responsibilities closer to marketing and design can accelerate speed to market.

Figma to Webflow

Learn the entire design process from idea to final output as we take you through Figma, Cinema 4D and Octane, and Webflow.

Get started for free

Try Webflow for as long as you like with our free Starter plan. Purchase a paid Site plan to publish, host, and unlock additional features.

IMAGES

VIDEO

COMMENTS

We call these roles "designations.". In addition to the initial reporting, the company needs to keep the information about their designations up to date as changes are made. Report changes via email to [email protected], by fax to 503-378-4351 or by mail to DFR Licensing, PO Box 14480, Salem, OR 97301.

Step 1: Complete Pre-Licensing Education. Before obtaining a license, most states require commercial insurance agents to complete a pre-licensing education course. These courses cover essential topics like insurance laws, regulations, and the specifics of different insurance products.

Learn the key steps to successfully sell your life insurance policy, understand buyer types and navigate legal and financial aspects effectively.

6. Apply For the Licenses and Permits. The good news is that you do not have to obtain a license at a federal level to open your travel agency. But you will have to register yourself as a Seller of travel (SOT) in the state of New York. Any New York-based travel agent needs to go through the NY's Article 10-A Truth in Travel Act.

List every fictitious business name used by the Seller of Travel. If the applicant intends to sell travel through a subsidiary business, a division, or a department, list all fictitious business names associated with those subsidiaries -- for example: ABE, Inc., dba: Lincoln Country Tours, Kentucky Travel Division, and Log Cabin Travel ...

Travel insurance is a type of specialized protection that might help protect against financial losses from airline delays, medical issues or other unexpected occurrences. Some travel insurance plans focus on specific things, like lost baggage or health care. Others offer a wide range of benefits under a single plan.

International and domestic travel insurance coverage is necessary for travelers everywhere. Visit AXA to learn what it is and why you may need it for your next travel excursion. ... License Number 0H74893). Non-insurance assistance services are provided by AXA Assistance USA, Inc. and are not underwritten by Nationwide Mutual Insurance Company. ...

Travel insurance benefits are underwritten by Arch Insurance Company, with administrative offices in Jersey City, NJ (NAIC #11150), under Policy Form series LTP 2013 and applicable amendatory endorsements. This is a general overview of insurance benefits available. ... Licensed under OR License #100228074 1510 Jacobs Drive • Eugene, OR 97402.

Please note that if travel agents have questions regarding whether they need to take the course and exam, or questions about how the new changes affect them should contact the Insurance Council of BC directly at: Phone: 604-688-0321 or 1-877-688-0321. www.insurancecouncilofbc.com.

Travel Insurance Made Easy™ We make it easy to compare and buy travel insurance from top rated insurers in just a few minutes. Millions of travelers use TravelInsurance.com to protect their trips across the globe. Find the best plan and buy online at the guaranteed lowest price.

Already, there's a 3-4 per cent increase in users booking travel insurance policies exceeding 45 days in April 2024, a trend expected to rise further due to the relaxed visa norms, shows data analysed by Policybazaar. Schengen destinations have also seen a 100% jump in senior citizen travellers. Schengen destinations are the 26 European ...