Get a 3 month Revolut Premium trial. Click here

I’ve been traveling for almost 20 years, and until this year I hadn’t found a good spending solution.

I’m sure the stress (before I heard of Revolut) sounds familiar. For 20 years I went back and forth with:

Should I exchange money at the airport, or take money out from an ATM?

Why tf is my bank charging me so much more in exchange rate fees?

Wait, the bank charges a conversion fee AND an international transaction fee?!

I’d come to the conclusion that this was what it meant to be privledged to travel overseas – that you had to suck it up and eat the bank fees.

This past year though, I’ve traveled with Revolut in my wallet (both my phsical wallet, and my Apple wallet). And it’s saved me serious money.

Revolut is financial website and digital app used by 35+ million people, with the tools you need to easily spend, transfer, and protect your money overseas. You can set up accounts in multiple currencies, get a debit card for travel, and you can do it for no monthly fee on the Standard plan.

It’s quick to sign up for a standard account, and there is no monthly fee. If you click here you get a 3 month trial of Revolut premium (higher limits on ATM withdrawrals & currency exchange).

There are already a million Revolut reviews (spoiler – it’s trusted), so why bother writing another? Because the look of that sexy black metal card in my wallet ACTUALLY excites me.

So read on to get excited with me – Revolut is now the only way I spend my money.

Revolut Travel Card Review: Why I Only Spend Money With Revolut

I’m so happy excited using revolut.

All photos in this post are of the metal card, only available on the Metal plan

I didn’t want to write about ‘just another travel card’ until I had very thoroughly tested it and finally found a permanent solution. So since May I have used my Revolut card in the UK, Greece, Spain, Australia, and Morocco.

It’s the best travel card I’ve had, has changed the way I spend money, and I do get a mini adrenalin kick whenever I see the exchange rate they charge me, and realize that I’ve just beaten the banks.

Though I do wonder if it really counts as saving if I buy another mojito with the extra cash?!

Here are 10 quick reasons to love Revolut before jumping into the full details:

- No monthly fee on Standard plan, paid plans available

- Can top-up and hold accounts in several currencies

- Make payments in 150+ countries

- Phsyical debit card

- Withdrawals at over 55,000 ATMs worldwide (Up to plan’s limits)

- Track your spending in the Revolut app

- Quick currency conversions for 30+ currencies

- Great value with the Revolut exchange rate

- Compatible with Google Pay and Apple Pay

- Fantastic security features for travelers

Who are Revolut?

Revolut is a British financial technology company who have built an amazing reputation since starting in 2015.

They offer banking and travel cards , with accounts for multiple currencies, and while these work the same as opening an account with a linked debit card with any other traditional bank, Revolut was specifically created to help you make the most of your money.

They have great features like instant accounts, and virtual cards, unlimited foreign exchange (fees may apply outside of plan allowance), and cashback on specific purchases. You can convert currencies in an instant and load up to 30+ currencies on your travel money card, without having to exchange money at the airport again.

I’ve made cash withdrawrals in both Morocco, the UK, and Greece, on amazing exchange rates, basically as if my account was local.

After having put it to the test over the course of 6 months, Revolut has saved me a lot of money.

Withdrawing Money from ATMs

Spoiler: no fee withdrawals / great rates / find atms in the app.

When you open an account with Revolut , you instantly get access to virtual cards, which I linked to my Apple Wallet and was using to pay for things the next day (good reason to go through McDonalds for coffee – I needed to test Revolut!).

And I’ve paid for most things using my virtual Revolut card, including the London Tube, which I was incredibly impressed when I found I could just tap my phone on either end without having to fight with a ticket machine.

But despite most of the world being cash free, I still always stop by an ATM.

I’ve always found I need cash at some point when I’m traveling. There’s always amazing street food, or someone to tip, or your phone battery dies because you’re using it 10 times more than at home, from taking 1,000 selfies, to constantly running Google maps.

And in many countries still, cash is king.

Withdrawing money from overseas ATMs can be expensive using a home bank card, and cost you a lot of money in fees.

But Revolut allows you to withdraw money from ATMs overseas without fees , within limits per month depending on the plan you’re on. I’ve taken money out in both Greece and Morocco, and it was stupidly easy.

Make sure you activate your card, set up your pin number, and turn ATM withdrawrals ON within the mobile app. If you don’t want to make ATM withdrawrals, you can turn this off, which is extra security in case your card is lost.

Pro tip: Within the mobile app is an ATM locator , which allows you to share your locaiton and it will find ATMs nearby.

Fees may apply outside of your plan allowance and ATM operator may charge their own fees.

Best Currency Exchange Rate

Spoiler: it beat the google exchange rate for me.

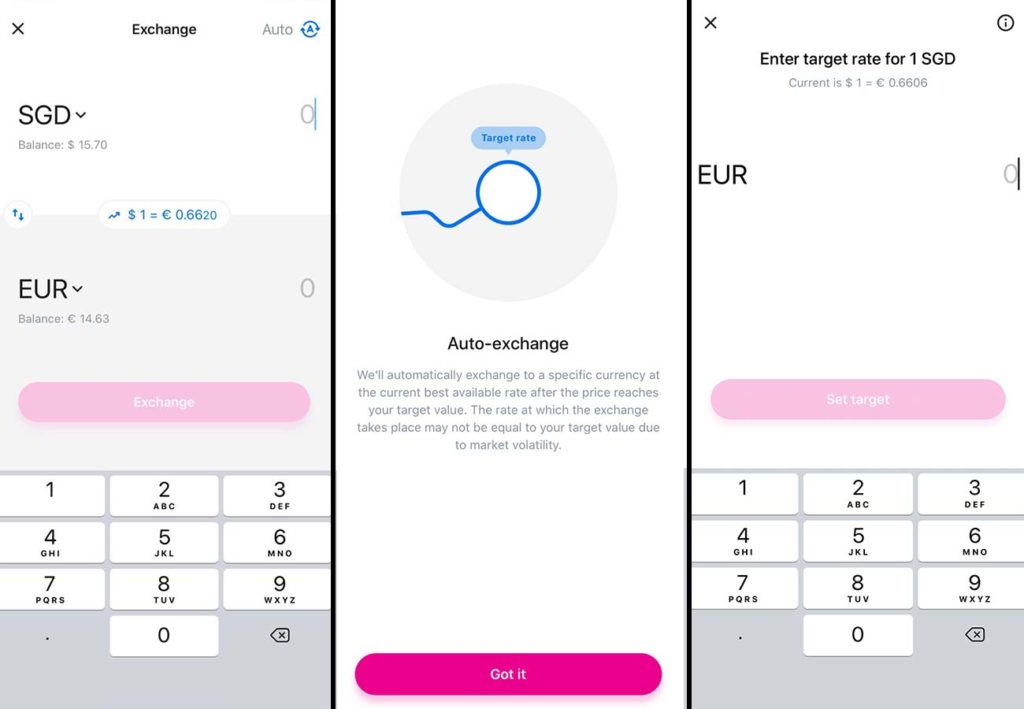

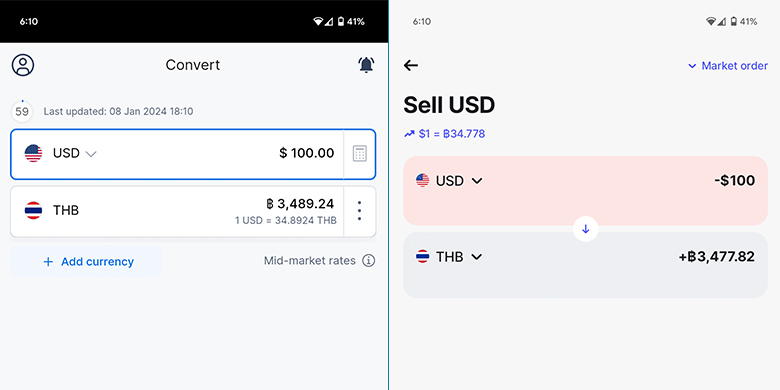

Revolut offers one of the best exchange rates around which is why they’re one of the most popular options for travel cards.

There’s even a currency converter on their website (and in the app) where you can check the real exchange rate at that moment in time.

If you really want to get the most out of your money, you can set up multiple currency accounts, and convert your money to the local currency you plan to use when the exhange rate is at it’s best. This is called locking in your exchange rate.

Or, if you know it doesn’t really fluctuate too much, you can keep your money in your home currency account (AUD for me), and when you spend on Revolut, it converts your money based on the exchange rate of the day.

I personally leave my money in AUD because I find it simpler. Market exchange rates are changing all the time, almost every day, and I personally don’t find value in spending my time keeping an eye on the rates to decide when I’ll get the most of an exchange.

You can definitely do this, but I found I saved money all the same.

If you’re a digital nomad and you’re recieving payments in multiple currencies, Revolut accounts are also a great way to recieve money in foreign currencies without the crazy foreign currency fees, or PayPal exchange rates.

There is a weekend markup on exchange rates, so keep this in mind.

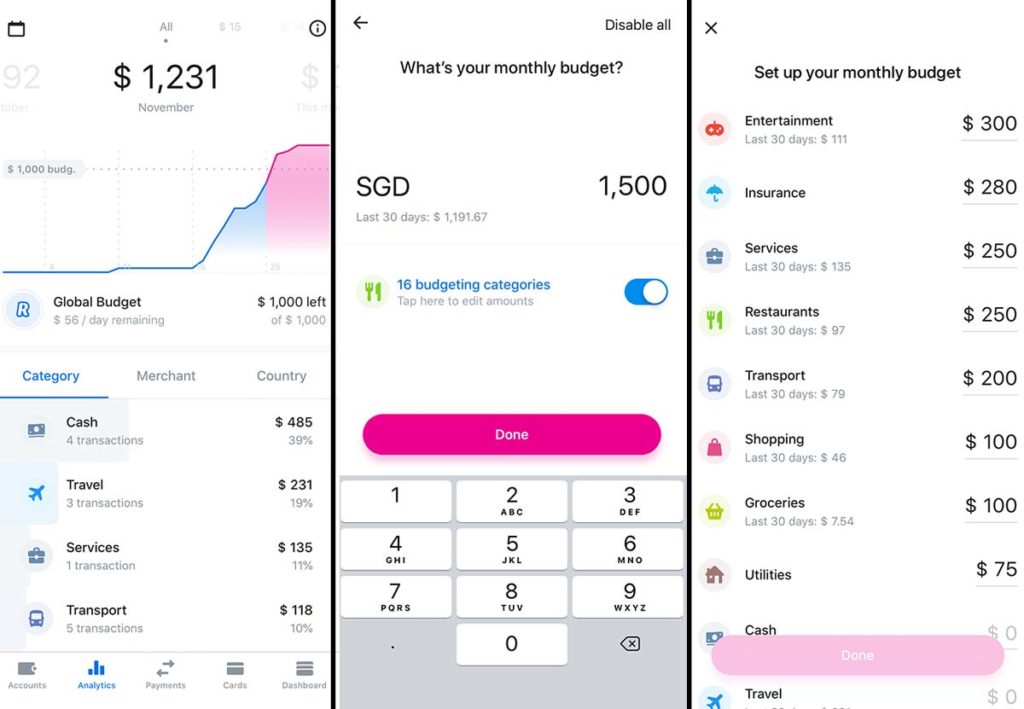

Track Your Spending in the Revolut App

The Revolut app is seriously good , and it’s very easy to track your spending, and do everything you need to do from your phone.

Keeping in mind that there is no traditional phone or in-branch banking with Revolut, everything is based off the app. Which is fortunately one of the easiest, most well thought-out and use intuitive apps I’ve used.

Through the app, you can see all of your individual transactions, and there are also instant spending notifications – alerts for transactions in and out of your account.

You can add money to your accounts, add new and exchange money between your currency accounts, access your currency converter, pull up your statements, set a monthly budget, set a spending limit on your cards.

If you’re spending one currency, and pulling it from your base currency account (ie me spending Euro in Europe, without having converted my AUD), each transaction shows you both the amount you spent in your currency, and the amount you spent in the foreign.

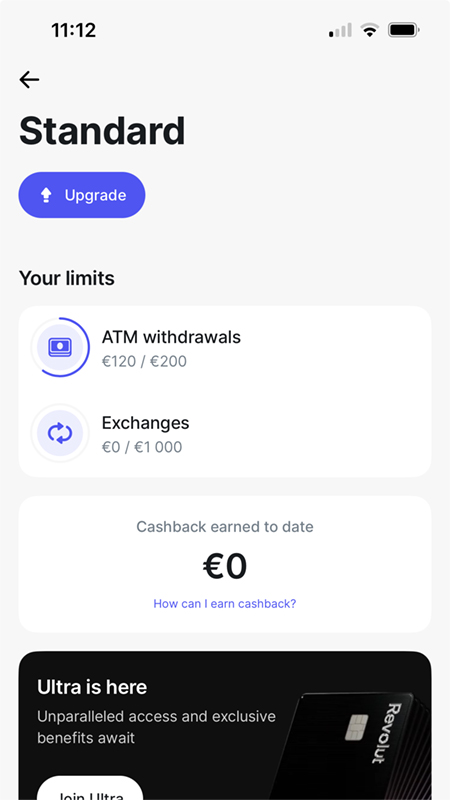

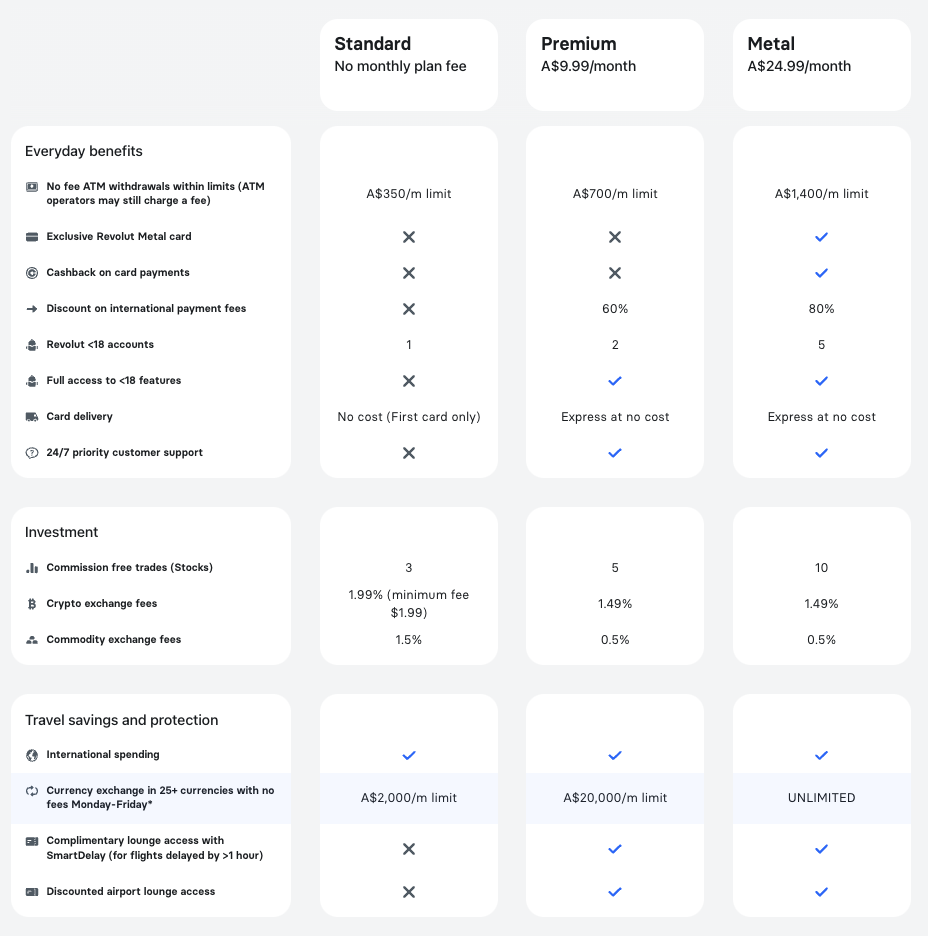

Choosing the Right Plan for You

Revolut standard – no fee.

The Revolut standard plan is fantastic, and doesn’t have monthly account fees. There are no fees for ATM withdrawals ($350/m limit), it comes with one debit card, and there are no currency exchange fees from Monday to Friday, to a $2,000 per month limit.

- Account fee – $0

- Australian ATM fee – $0 (up to $350/month) and 2% of withdrawal amount after that

- Foreign transaction fee – 0%- 1.5% (depending on amount and when the transfer is made)

- Overseas ATM fee – $0 (up to $350/month) and 2% of withdrawal amount after that

This is an account and card you can use at both home and abroad, with no catches or hidden fees if you use it within the above limits.

It comes with a Revolut Visa card that connects to their app and your digital wallets, and you can spend money in over 150+ countries.

Honestly, this has everything you need if you want a basic no fills spending solution. But there are also paid plans you can consider, with some great extra features if they better suit your lifestyle.

Revolut Premium – Click here for a 3 month trial

- Account fee: $9.99/month

- Australian ATM fee: $0 (up to $700/month) and 2% of withdrawal amount after that

- Foreign transaction fee: 0%- 1.5% (depending on amount and when the transfer is made)

- Overseas ATM fee: $0 (up to $700/month) and 2% of withdrawal amount after that

With the Premium Revolut account, you pay a $9.99 AUD monthly account fee, and have benefits you don’t get with the standard account.

Premium users have transfers in 30+ major currencies up to a $20,000 monthly limit (Monday to Friday, otherwise an additional 1% fee is charged). The no-fee ATM withdrawal limit is also raised to $700 AUD.

You can choose the color of your Visa card, get priority customer support with the app, and can access disposable virtual cards for greater online security (these cards regenerate after every transaction keeping your card details safe).

You also get discounts to LoungeKey Passes which offer access to over 1,000 airport lounges around the world and can buy these within the app.

Click this link to get a 3 month trial of their premium account.

Revolut Metal – The Plan I’m On Personally

- Account fee: $24.99/month

- Australian ATM fee: $0 (up to $1,400/month) and 2% of withdrawal amount after that

- Foreign transaction fee: 0%-1% (depending on when the transfer is made)

- Overseas ATM fee: $0 (up to $1,400/month) and 2% of withdrawal amount after that

The Revolut Metal account has everything the Premium tier has to offer, but it does also come with a fancy Revolut Metal card. This is the plan I am personally on , and the Metal card is the card you see in my photos.

Metal users are also the only customers able to take advantage of the Revolut’s cashback feature. That includes 1% cashback for card payments made outside of Australia and 0.1% cashback for those made within Australia.

There is a cashback limit for metal plan, up to the cost of the plan.

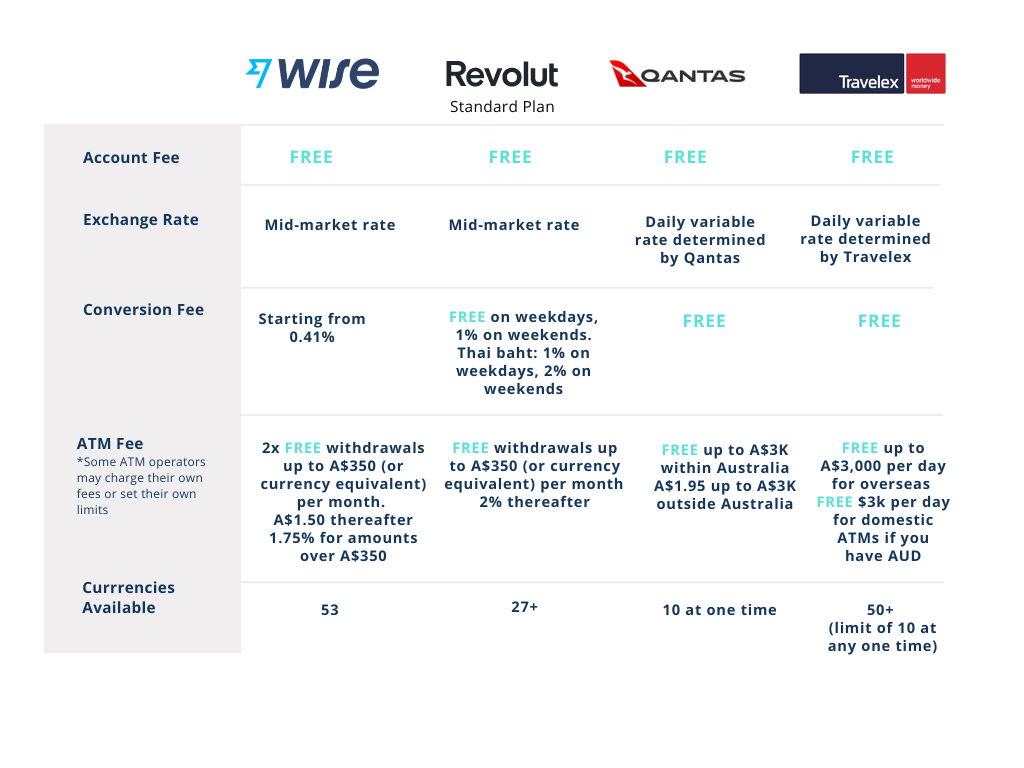

Comparison of Revolut Account Plans

My travel spending and lifestyle might not be the same as yours, so do make your own decision about the plan which is right for you.

My recommendation: Check out the standard account for yourself (or take advantage of the premium trial while it lasts ) and then check out the paid options if you think an upgrade aligns with what you need.

This table is correct as of December 2023, but before deciding which account is right for you, I recommend you go to the Revolut website to check if anything has changed.

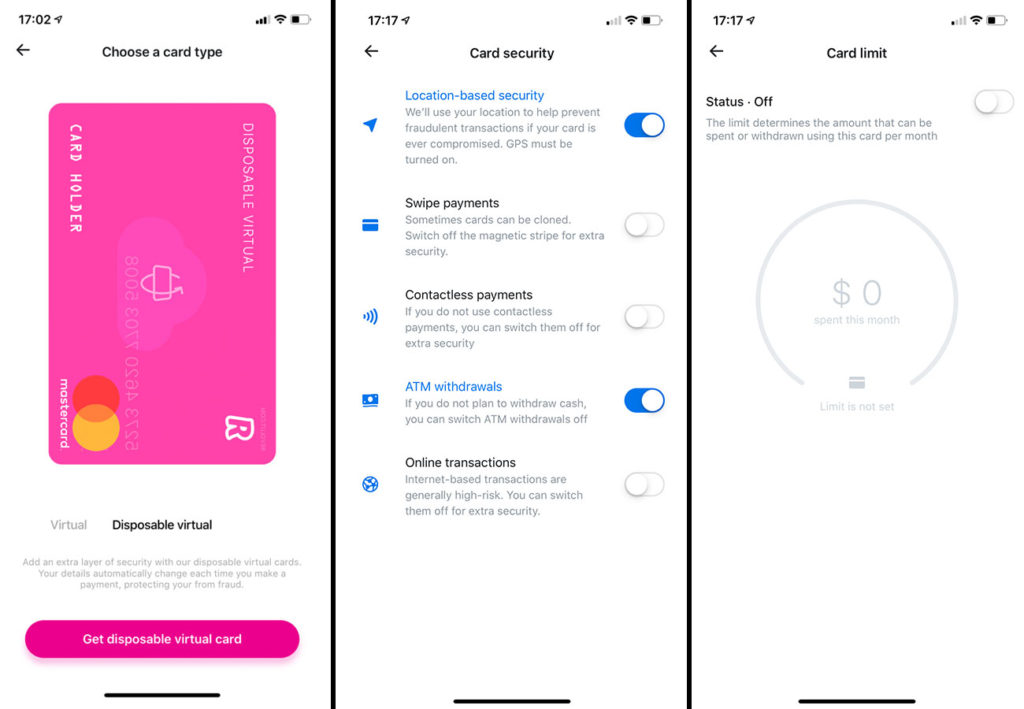

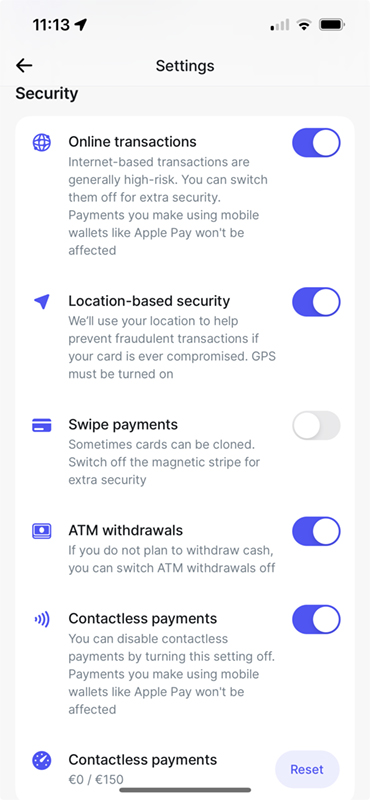

I’ve been seriously impressed with Revolut’s security features , and this is not something I found mentioned in other online reviews, so I think it’s well worth writing about.

The Revolut mobile app is full of security you can tailor to your needs. While I open my online account on my browser with my passcode, I open the phone app using FaceID for extra security.

Their offer of disposable virtual cards for premium account users is fantastic. This is a single use virtual card for online shopping, which is good for one use, and then expires.

If you’re worried about entering your card details into a foreign computer while you’re traveling, or perhaps you’re forced to use public WiFi to buy something, you can use this disposable virtual card and not have to worry about exposing the main.

You can lock or freeze any cards whenever you need. And within each card settings, you have the option to tailor your card security to your needs, turning features on and off like online shopping, swipe payments, ATM withdrawrals, and contactless payments.

These security features do work , as the first time I tried to use my Revolut card, it declined my attempt at a contactless payment. I went into the settings, toggled contactless payments ON, and the payment then worked (check your card settings before you use).

I’ve also never had my account frozen or locked because I was spending in a foreign country, as most banks tend to do. That said, spending money overseas is the whole point of Revolut!

How to Sign Up

Offering an efficient foreign currency exchange service, no-fee ATM withdrawals, and no hidden fees when it comes to transfers, Revolut is baggage free!

Signing up to Revolut is all done via their app.

Click here and then you’ll provide your mobile number, name, address, and payment details (if you’re signing up for a Premium or Metal account).

Opening an account is instant, and you can then add money with your account details as you would by making any other domestic transfer.

Revolut will send the corresponding debit card to your given address, which you can then activate (remember to set up your security features) in the app before you start using it.

It’s that simple and easy!

My Australian credit cards have a terrible exchange rate, and have always charged me 3% per transaction overseas.

So now I exclusively travel with Revolut in my wallet.

Check out Revolut’s website to find out more and see if it’s right for you.

I’m home from my last trip and still have $62.07 sitting in my Revolut account. If I had come home with that in cash, I would have lost it to my jars of leftover foreign currency.

While I could transfer it back to my main bank, I’ll leave it sitting there knowing I’m using Revolut again , the next time I travel.

If You Liked This Post You May Also Like:

Things to Know about International Credit Card Payments

Should You Use a Debit Card or Credit Card When You’re Traveling?

How to be Smart When Spending Money Overseas

Megan is an Australian Journalist and award-winning travel writer who has been blogging since 2007. Her husband Mike is the American naturalist and wildlife photographer behind Waking Up Wild ; an online magazine dedicated to opening your eyes to the wonders of the wild & natural world.

Having visited 100+ countries across all seven continents, Megan’s travels focus on cultural immersion, authentic discovery and incredible journeys. She has a strong passion for ecotourism, and aims to promote responsible travel experiences.

Charlie Schwab for us Amerikanski’s. Been using their debit across the world for 12 years. No fee ATM’s with unlimited rebates when machines charge, great currency conversion rates pretty much equal to the XE App

Post a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search This Site

I am Megan Jerrard, professional travel blogger/journalist with a focus on adventure, discovery, immersion and inspiring you to explore!

Recent Posts

- The Best Sustainable Ways to Get Around on Vacation

- Navigating Food Choices Abroad for Health-Conscious Adventurers

- 6 Thoughtful Gestures to Make Mom Feel Special from Anywhere in the World

- Unforgettable Indonesian Cruise Tours & Packages: Exploring Islands from Bali to New Guinea

- Navigating Massachusetts’ Hidden Gems: A Solo Traveler’s Guide

Popular posts

- International Love: Maintaining a Long Distance Relationship

- Illegal Ink – 11 Countries Where Showing Your Tattoos Could Get You Kicked Out!

- 7 Things To Know Before Travelling by Overnight Train in Vietnam

- A Travelers Guide to Tap Water: Countries Where The Drinking Water is Unsafe

- Countries That Don’t Celebrate Christmas

Revolut Travel Card Review: Is Revolut Good For Traveling?

by Melissa Giroux | Last updated Dec 5, 2023 | Travel Finances , Travel Tips

If you haven’t been living under a rock, you’ve probably already heard about the Revolut card. Revolut is a digital bank that was launched in 2015.

One of the main reasons it has gained so much popularity in such a small window of time is primarily due to the fact it has everything you would need from an online bank in a simple, modern, and easy-to-use app.

Before we do a complete Revolut review and how travelers can use the Revolut travel card abroad, let’s first look at the basics.

KEY TAKEAWAYS

- Revolut is good for traveling, especially if you choose a paid plan.

- You can use Revolut safely abroad, and you can block and unblock your card as much as you want. This can be helpful if you think an ATM or a shop seems a bit dodgy.

- The Revolut Premium and Metal plans offer travel medical insurance options and discounts on airport lounges, which are ideal for travelers.

Revolut Card: The Basics

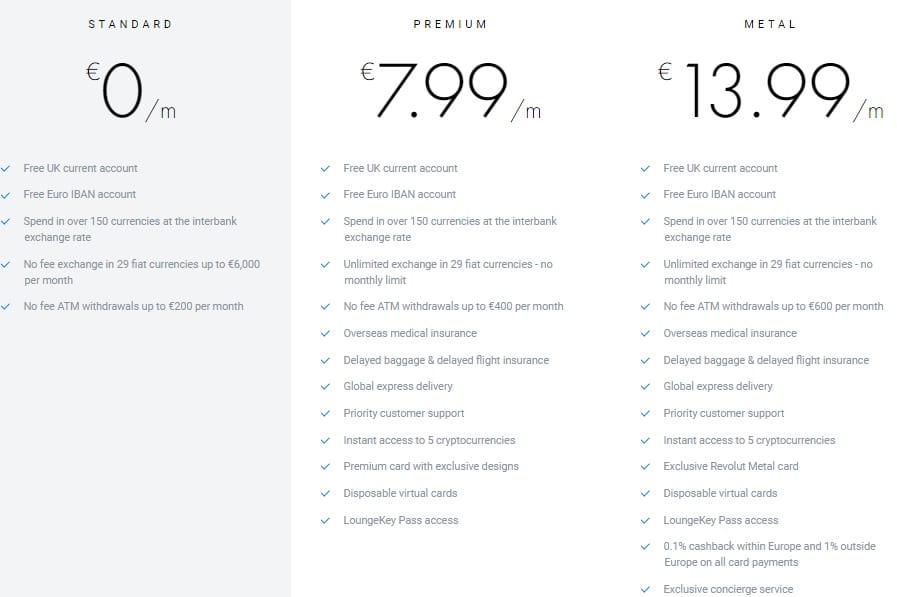

Revolut has three different card types and four main plans, including Standard, Standard Plus, Premium, and Metal.

The Standard card has no fee and offers some basic benefits.

However, the Premium and Metal cards provide some exciting features, especially if you are a frequent traveler.

Here is a quick breakdown of the main benefits/prices of each of the cards:

**Revolut also has Revolut Business for companies, big and small, that do business beyond borders.

Get Revolut Now

Another major advantage of the Revolut card is that it takes minutes to open an account.

All you need is a working phone number, and with that, you’ll be able to open an account and get a virtual bank card.

To get a physical card, you’ll need to order one, and it takes around 14 days to deliver. You will also need to veri f y your identity .

One of the disadvantages of Revolut is that, at the moment, it isn’t available to residents of all countries.

Currently, only legal residents of the European Economic Area (EEA), Australia, Singapore, Switzerland, Japan, and the United States can download the online bank.

Once you have your card and your identity is verified, you are ready to take full advantage of your Revolut card. This is where the fun begins.

If you are a meticulous traveler who loves planning and budget travel , then the Revolut travel card is the perfect solution for you.

Revolut Travel Card: Spending, Budgeting & Saving

The best part of the Revolut card is that the account section grants you the ability to look at all of your transactions by day, week, and even month.

You can also group transactions into specific categories. So, for example, if you budgeted 200 dollars for restaurants at X location for June, you can track all those costs in the app.

You can also download statements, upload receipts and add notes to each transaction to keep track of your spending.

You can even split the bill if you are traveling with someone or send them money by scanning their QR code.

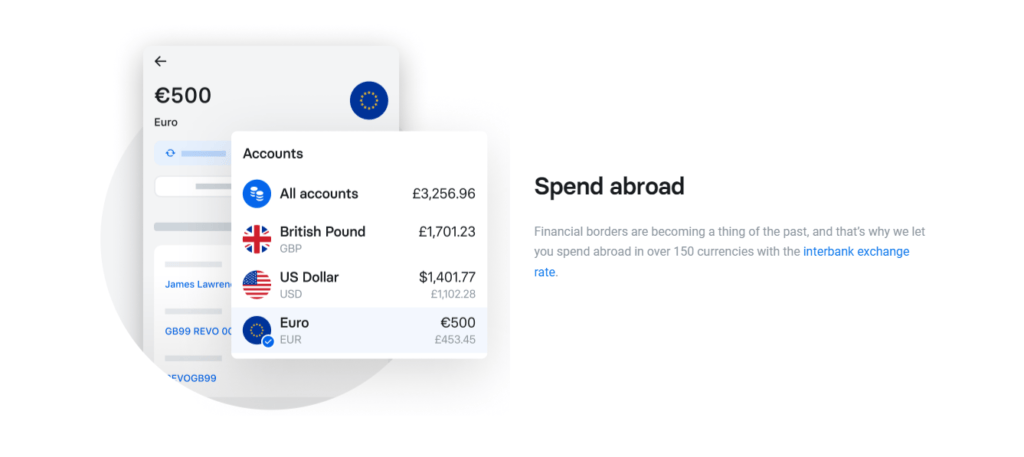

If you are traveling abroad, the app allows you to create multiple accounts in various currencies.

This means that you can exchange your US dollar for Euro and have two separate accounts in two different currencies.

This also means that whether you are traveling in France or the US, you can pay in the local currency. Be aware that not all currencies are currently available.

Nevertheless, if you are paying for something in a different currency, Revolut converts your account balance into the local currency using the real interbank exchange rate.

This allows you to avoid being charged a fee and a mediocre exchange rate set by the ATM provider or merchant acquirer.

Another great feature is that the app sends you a notification the second you pay with your card, even before the receipt has finished printing (as long as you are connected to the Internet).

The app also has vaults, where you can save money for travel . You can create multiple vaults, like a “travel to Egypt” vault or a “weekend spa getaway” vault.

You can fund the vaults with a one-time transfer, recurring transfer, or something the Revolut card calls spare change.

Spare change means the app will round up the spare change from your Revolut card spending and place it in this vault.

Using Revolut Abroad

Can Revolut be used abroad? Yes!

Now, you may be wondering “Is Revolut good for traveling?” It is!

I’ve been using Revolut abroad for a few years now, and it’s my go-to card.

So, how does Revolut work abroad?

With the Revolut travel card , you can transfer money abroad in 30+ currencies with the interbank exchange rate , with a small 0.5% fee for anything above €1,000 each month during the weekdays.

However, one disadvantage is that when markets are closed on the weekend, fees are charged at 0.5% and 1% on currency exchange rates no matter the transfer amount.

Revolut also charges an international fee, which will be listed in the payment breakdown when you are sending your money.

The major advantage of Revolut is that it offers the ability to send money around without hidden fees and provides fast and secure money transfers.

The foreign exchange rate can be viewed on the Revolut app before exchanging currency or making a bank transfer involving foreign exchange.

The Revolut travel card also allows you to withdraw cash from an ATM using your Revolut card without fees.

The disadvantage of this is that if you have the standard plan, that means that you’ll only be able to take out 200 dollars per month.

That being said, using a Revolut card abroad is fairly easy and safe.

Security: Preventing Fraud

One of the worst feelings in the world is realizing that your main travel card has been lost or cloned.

What usually ends up happening is a mad dash to call your main bank abroad to freeze the card and ask for a replacement.

Don’t worry, we’ve all been there. The problem is that some banks can take up to 3-4 weeks before they can send you a replacement card, which can ruin your time abroad.

Revolut claims that it is 7x better than a regular bank in stopping card fraud. This is due to their anti-fraud system that helps keep fraudulent transactions under 0.01%.

But that’s not all. Revolut allows users to freeze and unfreeze their cards easily in the app, it takes seconds.

You can also enable location-based security to reduce fraudulent transactions, disable contactless, online, swipe payments or even choose a monthly card spending limit for extra peace of mind.

And, if you do lose your card, you can order a replacement card in the app and ask for express delivery, which usually takes around 2-3 days, depending on your location.

Also, if you lose your phone, Revolut has an automated phone line to block your card instantly.

Extra Perks When Using Revolut Abroad

Although there aren’t many perks with the Standard and Standard Plus plans, if you are a frequent traveler, then you might consider opting for the Premium or Metal Plans.

These plans have perks like pay-per-day travel medical insurance, which means that you can get location-trigger coverage and only pay for the days you use.

You can also upgrade for the delay and lost baggage insurance, emergency dental, and medical coverage, and even insure up to three adults and all your children.

These plans also have lounge access to +1000 airport lounges globally and SmartDelay, which allows you to get an airport lounge pass if your flight is delayed more than an hour.

Get Revolut

Revolut Sign-Up Bonus Promotion

Upgrade to a global lifestyle with Revolut. Transform your finances when you level up to Premium with Revolut’s Premium trial .

You’ll get features to help you save, spend and invest smarter than ever.

Get a 3-month Revolut Premium subscription trial, effective today.

Note that this promotion work everywhere except for Australia and Singapore, where the offer is a cash bonus of $15 AUD in Australia and $15 SGD in Singapore.

All new Revolut customers are eligible.

Final Thoughts On Revolut Travel Card

It seems as if the Revolut card is the travel card of the future.

Not only can it be one of the best cards to use while you are abroad, but it also can be a great day-to-day bank card.

Although the card has a lot of advantages, it is also important to note that there are still some countries where the card might not work.

For example, Revolut users have noted in previous years that the Revolut card didn’t work in many establishments in Rio de Janeiro, Brazil.

Also, be wary that their online support service is not always the best, unlike your local bank.

If you do run into problems, there isn’t a physical location where you can go and talk with a manager. You’ll need to use the chat feature on the app, which can be better than having to call from abroad.

All in all, the Revolut card is a great card to travel with, but it shouldn’t replace your main bank card and instead might be a great backup card that you can use when abroad or if you’re a European expat.

If you’re American, read our Revolut USA review .

Read more about the best banking options for expats .

If you’re not sure if Revolut is the right card for you, you may want to open a multi-currency account with Wise . Learn more about Wise here or compare both Wise and Revolut .

If you want to keep cash flowing even while abroad, you must check out these ways to make money while traveling !

MY TOP RECOMMENDATIONS

BOOK HOTEL ON BOOKING.COM

BOOK HOSTEL ON HOSTELWORLD

GET YOUR TRAVEL INSURANCE

LEARN HOW TO START A TRAVEL BLOG

LEARN HOW TO VOLUNTEER ABROAD

- Destinations

- Travel Tips

- Community Trips

- TTIFridays (Community Events)

- SG Travel Insider (Telegram Grp)

Revolut Review: The pros, the cons, what it does, and what it’s not

This Revolut Review has been updated here .

I’m a pretty old school traveller, the kind that usually brings loads of cash on a trip. I still remember carrying S$3,000 worth of cash for my three-month solo backpacking trip around South America because I wanted to avoid getting crappy debit/credit card exchange rates! Yet it’s a pain exchanging money before a trip. Other than physically heading to a store somewhere, there’s the struggle of figuring out which money changer has the best rates.

Read also : Which Multi-Currency Travel Card is best for me?

When Revolut reached out to us to review their product, I thought it was a good idea to travel around Germany without any cash (ok I had maybe €2.8 of coins).

We’re not finance people, but we tried our best to experience it as a normal traveller and see what worked and what didn’t. Hopefully you’ll find this Revolut review useful!

Disclosure : While the writer was provided with spending allowance to test the card, it’s in The Travel Intern’s interest to protect the editorial integrity of our website. We have taken every reasonable effort to ensure a realistic and honest review for our readers.

But first, what’s a Multi-Currency Travel Card?

The basic premise is that credit cards charge too much for currency exchange, and multi-currency travel cards try to level the playing field with better exchange rates (very close to the physical money changer). You can also typically hold multiple currencies in your account, allowing you to plan ahead and exchange money when the rates are more favourable.

Revolut Review: How it works

Compared to many other multi-currency debit cards, Revolut has plenty of interesting features. Here’s an overview of the important stuff.

Main Revolut Features & Pricing Plans

Revolut Multi-currency Debit Card & Wallet Your Revolut card works like a debit card, and you can use it in any place that accepts Visa . Simply top-up using your debit/credit card, and you’re free to exchange and store up to 28 currencies in your multi-currency wallet. When you make a purchase, the card will automatically deduct from the relevant currency. If there are insufficient funds in that currency, it will automatically convert any leftovers from your other currencies, starting from your base currency (SGD in our case). This ensures that payment is always seamless as long as you have money in your account.

Revolut Budgeting Tools

Other than acting as a multi-currency wallet and overseas debit card, there are also budgeting and analytics tools on the App to make spending more organised. Revolut automatically categorises all your purchases instantly, making it easier to track and manage your expenses. You can even set monthly budgets by categories and easily tell when you overspend.

To make it more effortless in saving towards your goals, there is also a feature called Vault that can add your spare change into a savings vault. It does this by automatically rounding up your purchases to the nearest dollar and saving it in your account.

Revolut is free to use, but if you want even more features, there are three Revolut Visa cards with monthly subscription plans .

The paid Revolut Pricing Plans gives you a higher limit for ATM withdrawals, a lower currency exchange fee, priority customer support, nicer physical cards, and LoungeKey Pass access. The Metal Card also offers 1% cashback on overseas spending.

Interestingly, the paid Revolut cards also provide travel insurance coverage from Tokio Marine . They mainly cover: – Emergency Medical Treatment & Related Expenses with a maximum aggregate limit of S$10m per Policy – Emergency Dental Treatment up to S$2,000 – Delayed baggage cover up to S$200

Currency Exchange Rates & ATM Withdrawal

Currency Exchange Fees : 0-2.5% depending on membership and market hours Overseas ATM Withdrawal : Free up to S$350 (Standard), S$700 (Premium), S$1050 (Metal) every month, 2% Fair Usage Fee after

Currency Exchange Rates Revolut uses the real-time interbank mid-market rates to calculate currency exchange rates, which is really close to the rate you see on Google. The rate refreshes every few seconds, keeping it as close to the real-time rates.

The good thing about using a multi-currency wallet is that you can lock in favourable exchange rates ahead of time before you need it. Revolut allows you to pre-set auto-exchange targets , so you don’t have to monitor them constantly. Simply set your target and let the App do the rest. Alternatively, you can set up Price Alerts if you want to do it manually.

Currency Exchange Fees A currency exchange fee is charged based on a few factors — your membership level (standard, premium or metal card), amount you exchange each month, and London’s market hours. With Revolut, you are split into either a “Regular” or “High Frequency Standard” customer.

*High Frequency Standard rates are charged to standard users (free membership) who have exchanged more than S$9,000 or equivalent in any rolling month.

Revolut also locks in the closing rate for the weekend (UTC) and charges more currency exchange fees to protect against market fluctuations when it’s closed. Here’s the breakdown:

Exchange Fees during market hours (UTC, Mon-Fri)

Exchange Fees after market hours (UTC, Sat-Sun, trading holidays)

Overseas ATM Withdrawals ATM withdrawal is free up to certain amounts depending on your membership level. Standard: S$350/month Premium: S$700/month Metal Card: S$1050

A 2% usage fee is charged for amounts exceeding your limit but that shouldn’t be an issue when travelling in places where card payment is widely accepted.

Revolut Security Features Review

Easy control over security features What I especially loved about Revolut is the control you have over all the security features. If you happen to lose your card, you can deactivate your card temporarily Through the Revolut App . This temporary feature is great because I’m sure many of us have been in situations where we think we’ve lost our credit card, only to find them a few days later after going through the trouble of calling the bank and having it deactivated permanently. You can also easily toggle security features like location-based security, use of contactless payments, ATM withdrawals, online payments, or magnetic stripe usage. This means even if you lose it without realising, the card cannot be misused since the features only work when you activate them.

Disposable Virtual Cards For Premium & Metal Card users, you create Disposable Virtual Cards — perfect for times when you need to make an online payment through a dodgy looking website.

According to Revolut, the Disposable Virtual Card will automatically be destroyed and a new one is generated each time an online payment is made. This reduces the risk of online credit card fraud since it can only be used once.

Card Limits You can also set your own spending limits in the App easily without going through the hassle of calling your bank and waiting forever for a customer service staff to answer your call.

User Experience

In general the App’s User Interface is clear and easy to use. Everything you need to do can be accessed within a few clicks from the Home Screen. Tutorials can also be easily accessed via the (i) icon at the top right of the App.

Revolut Review — Putting the Revolut Card to the Test

Having not exchanged any cash before the trip, reliability was a very important factor for me. Here are some common situations with the corresponding internet exchange rate to see how well Revolut fared. I used the Premium Card, which gave me some extra perks like being able to withdraw more money from the ATM at lower currency exchange fee.

(1) Using the Revolut Card for food, activities, and transport

I used Revolut everywhere. At restaurants, paying for museum tickets, and even on the subway. While I generally always made sure I had Euros in my account, there were occasions where I put the exchange rates to the test by letting the account automatically convert from my remaining SGD.

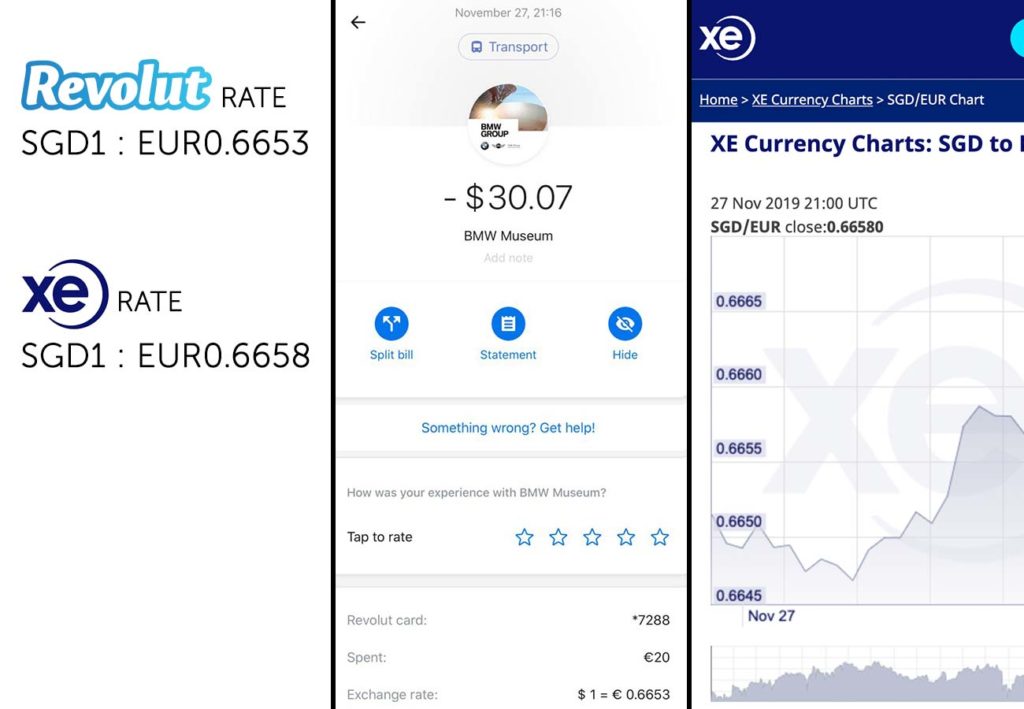

ATTRACTIONS: BMW Museum Entrance x2 (27 Nov 2019) Revolut Exchange Rate SGD1 : EUR0.6653 Internet Exchange Rate (xe.com) SGD1 : EUR0.6658 Difference = – EUR 0.0005

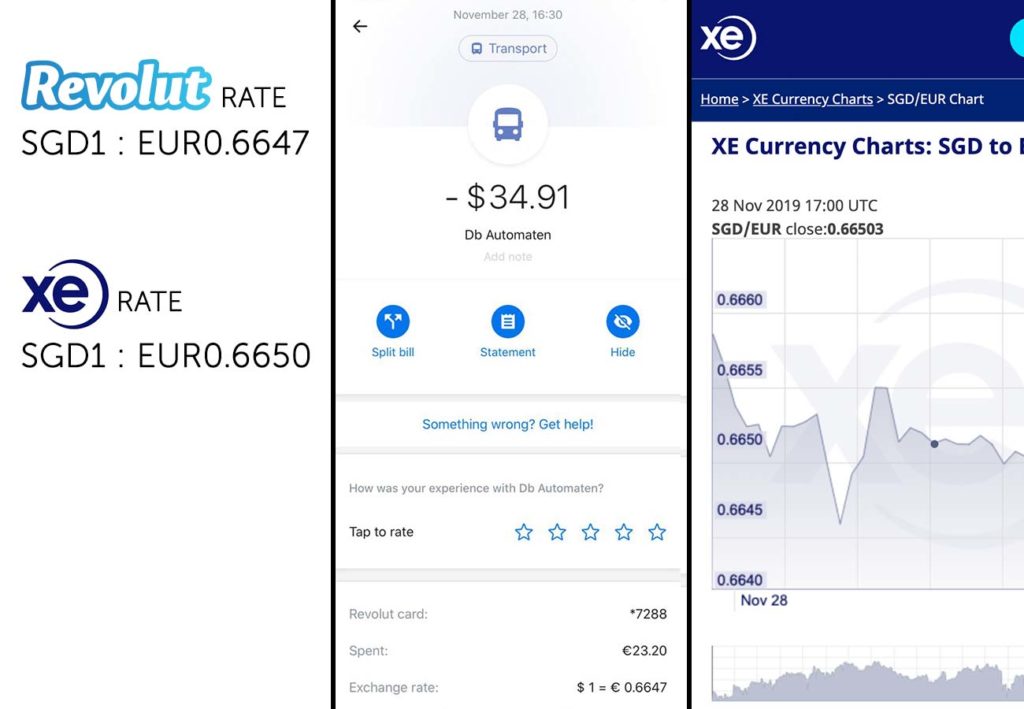

ATTRACTIONS: Airport Transport x2 (28 Nov 2019) Revolut Exchange Rate SGD1 : EUR0.6647 Internet Exchange Rate (xe.com) SGD1 : EUR0.6650 Difference = – EUR 0.0003

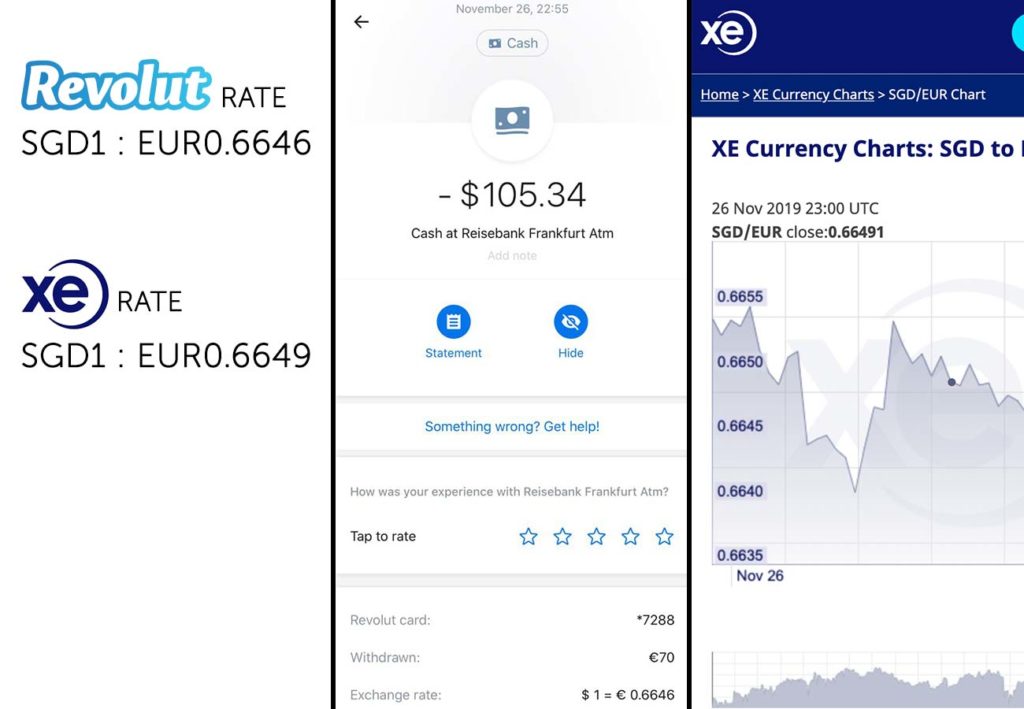

ATTRACTIONS: Overseas ATM Withdrawal (26 Nov 2019) Revolut Exchange Rate SGD1 : EUR0.6646 Internet Exchange Rate (xe.com) SGD1 : EUR0.6649 Difference = – EUR 0.0003

The rates were pretty good and there was hardly any difference between Revolut’s Rate and the Internet’s Rate.

(2) Withdrawing Money from the ATM

Unfortunately there were still places that required cash. For those situations, I was able to draw cash at ATMs that accepted VISA.

Since I had already pre-exchanged Euros and have not exceeded my limit of S$700 for the Premium Card, there were no additional charges or surprises on the exchange rate. Pro-tip : Avoid tourist ATMs that charge a processing fee. I only encountered one during our trip to Germany, so I’m pretty sure you can just look for another ATM that does not charge extra.

(3) Testing the security features

Just to make sure everything worked as described, I decided to test a couple of the security features. For the main test, I basically deactivated the card and tried using it at a restaurant. The card didn’t work and I had to quickly activate it so I didn’t hold up the queue! I also tried withdrawing money after toggling ATM Withdrawal off. As expected, the card wouldn’t work!

Revolut Review — Pros, Cons, and Final Thoughts

All in all, the Revolut card worked as described. Despite not changing any cash beforehand, travelling around Germany with the Revolut card turned out pretty seamless. It might not be a replacement for credit cards but for its preferential currency exchange rates, it’s a pretty convenient option for overseas spending.

Pros – Works as described with good currency exchange rates – Robust security controls – Intuitive UI

Cons – Weekday/weekend Exchange Rates can be more obvious – Requires an Internet Connection for card management or top-ups – No credit card benefits

Quick Tips for Maximising your Revolut Card

(1) Use Auto-Exchange or Price Alerts to lock in exchange rates Plan ahead and utilise the in-app Auto Exchange or Price Alert features. If you know that you’re heading to Europe, set a target for auto-exchange rate so to lock in favourable rates! (2) Exchange currency on weekdays There’s an additional 0.5-1% surcharge on weekends. Unless you absolutely need to, I’ll try to do the bulk of my currency exchange on weekdays. (3) Monitor currency exchange rates. It refreshes really often If you hover around the currency exchange screen on the Revolut App, you will notice that the currency exchange rates fluctuate every few seconds. Monitoring it for a bit can score you a slightly more favourable exchange rate. Those extra dollars saved can go towards your travel fund! (4) Always make sure you have spare SGD in your account Despite using a local sim card with data, there were instances where there wasn’t any internet connection. To avoid being in a situation where you don’t have enough money in your account, plan ahead and top up more.

During my trip, I only exchanged enough Euros for our needs, while maintaining some spare SGD in my account. I wanted to avoid situations where I ran out of Euros and didn’t have internet connection to top up my card on the Revolut App, especially in smaller towns and rural areas!

As Germany and the rest of the world become more cashless, I can see how multi-currency debit cards like Revolut becoming an essential for overseas spending. It was honestly a joy bringing only a small card holder around instead of a bulky wallet!

If you’re planning on getting the Revolut Card, sign-up here for an additional S$5 bonus credit when you sign up. We get a small commission too so it’s win-win! Do note that you’ll need to complete the identity check, top-up the minimum sum, and order the FREE physical card for the S$5 bonus credit!

Hope you found this Revolut Review useful. Do let us know if you have any questions or suggestions to improve this review.

This post was brought to you by Revolut .

For more travel inspiration, follow us on Facebook , Instagram , and YouTube .

View this post on Instagram A post shared by The Travel Intern (@thetravelintern) on Jul 11, 2019 at 6:27am PDT

RELATED ARTICLES MORE FROM AUTHOR

The Ultimate USJ Guide and Tips (2024) — Universal Studios Japan

Mobile Payment in China: Step-by-step Guide to Using Alipay and WeChat Pay without a Chinese Bank Account

Singaporean Guide to Travelling in Retirement with S$2.7k a month

Gem at the fringe of town — One Farrer Hotel Staycation Review

2D1N Southern Islands Staycation — St John Island, Lazarus Island, Kusu Island on a Yacht

The Best Card for Overseas Spending — Multi-currency Cards vs. Miles Credit Cards

I normally use Wise formally Transferwise. Does Revolute offer a better service in terms of security and value for money. Transferwise has always given fantastic exchange rates and VERY LOW fees. IS Revolute a better service?

Me too, I’m also interested to know the answer so i’m watching for a reply 🙂

LEAVE A REPLY Cancel reply

Save my name, email, and website in this browser for the next time I comment.

2D1N JB Itinerary — The Broke Friends Getaway

New Direct Flight to Broome — Idyllic Australian Beach Getaway Now...

Climbing Mount Kinabalu — A Beginner-Friendly Guide to Scaling One of...

25 Unique Things to Do in Taiwan Besides Visiting Night Markets

25 Exciting Things to Do in Shanghai — First Timer’s Guide...

- Terms Of Use

- Privacy Policy

Dave's Travel Pages

Greek Island Hopping | Greece Travel Ideas | Bicycle Touring

Revolut Travel Card Review – The Best Travel Money Card?

My Revolut card review is based on a year of using it in 10 different countries. Here's what I like about the Revolut travel card, what can be improved, and why I think you should consider it as a travel money card.

Revolut Travel Card Review

Have you ever noticed, that when it comes to getting hold of travel money you get ripped off no matter what you seem to do?

Whether it's your bank charging a fee you hadn't heard of before, or a crazy exchange rate that bears no relation to reality, they seem to get you in the end. And don't get me started on airport currency exchange rates!

Surely, there must be some way to get an honest currency exchange rate?

Well, there is now, thanks to the Revolut cash card .

We've been using the Revolut cards for a little over a year, and they were our main cards to get hold of travel money during our 5-month-trip in SE Asia. Here's an explanation of how the Revolut card works, and our honest review.

What is the Revolut account?

There's two ways to look at what the Revolut account is.

One, is to think of the Revolut account as a current account that can be easily managed through your mobile phone. The big bonus here being that you can store money in different currencies. They also provide banking details for different currencies which is great for me, as I can use it as a way to receive payments into my online business.

The second, and perhaps simplest way to think of the Revolut card for most people, is that it is a pre-paid travel card. You can make transfers into the Revolut card from your bank account, and then convert it into any currency you like (well, within reason).

The truth is, it's both things, and offers a great deal of flexibility for anyone wanting to store different currencies, or who has travel plans.

The Revolut Card itself

The Revolut account comes with a card, either Visa or Mastercard, which you can use as a debit card for purchases, or for ATM withdrawals.

As we opened our accounts a year ago, I can't honestly remember if we had a choice between the two, or were given what came. However it was, I have a Visa Revolut Card, and Vanessa has a Revolut Mastercard.

The Revolut card acts as a debit card, and you can only withdraw or spend money that is available in the account. You can easily monitor the account in the Revolut app you'll need to download to a smartphone.

You can apply for a Revolut card here : Get Revolut Card

Opening a Revolut account is really straightforward and quick. You will need to provide your address and passport, and you will be sent your card in the post in a few days.

The Revolut App

The app is where you can monitor the holdings in your Revolut account. After transferring money in, you can leave it in its original currency, or exchange it straight away.

The app is very simple to use, and if you have an internet connection, will even give you real time updates when you withdraw money or spend money on the card.

Why should I open a Revolut account?

People who travel a lot can really benefit from a Revolut account, as it offers a very easy way to spend money abroad. You can send money from your primary bank account to your Revolut account, and then use your Revolut card the same way you would use any other card.

The main difference when using a Revolut card vs a bank card, is that the rate offered is interbank exchange rate, i.e. a fair rate. Depending on your bank and the type of card you have with them, you will probably discover that a Revolut card gives you a much better exchange rate, and smaller handling fees.

Why a Revolut Card was best for Vanessa

In Vanessa’s case, every Greek bank has its own policy when withdrawing or spending money abroad. Revolut rates and handling fees were much better than any of the four Greek banks she asked, for debit as well as credit cards.

Additionally, most of the Greek banks clearly stated that, even when a customer informed them in advance that they would travel abroad for an extended period of time, they could still deactivate the card if they noticed “suspicious activity” and couldn’t get in touch with the customer via the registered phone number.

Therefore, Revolut was really the easiest way to spend money abroad.

Why a Revolut Account was almost the best for Dave

In my case, I have a Halifax Clarity card from the UK. This card gives a perfect exchange rate with no fees, in a similar fashion to Revolut. What makes the Clarity card a winner over Revolut for me, is I can withdraw an unlimited amount of cash without additional fees.

The downside to my Halifax card, is that I have to pay the amount off the same day using my online banking app in order to avoid interest charges. This is a pain, especially when travelling countries with poor connection!

So, I found the Revolut card to be a useful addition to my ‘travel toolkit', and of course it's always good to have multiple cards just in case when you travel!

How much does it cost to open a Revolut account?

We found it quite hard to believe, but opening a basic Revolut account is totally free of charge. This includes the card itself, which is perhaps what separates Revolut from other pre-paid travel cards.

OK, so what's the catch?

Well, nothing is ever entirely perfect, right?!

If you go for the basic (free) version of Revolut, you can withdraw up to 200 pounds or euro per month for free at ATMs, while for any excess there will be a fee of 2%.

However, you can still use the Revolut card as a debit card, and there are no Revolut card fees for amounts of up to 6,000 euro a month.

Revolut Card Fees

Apart from the free basic version, there are two types of upgrades that you can look into.

These are definitely worth it, especially for people travelling often for up to 40 continuous days.

If you choose any of the “premium” or “metal” upgrades, you will get a higher withdrawal limit (400 euro and 600 euro, respectively).

Many other perks, such as travel and medical insurance and a few others, are also included. In our case, travelling for five months, this wasn’t applicable, so we just went with the basic free version of Revolut which suited us just fine.

Why do you need a mobile phone to use the Revolut card?

Technically speaking, as soon as you apply to get your Revolut plastic card, you don’t really need to use a phone in order to spend your money. However, the phone is essential in order to monitor your transactions, and it’s also the only way to manually exchange money from one currency to another.

As an example, if you have GBP stored in your Revolut account and expect the GBP to drop vs the Euro, you can convert all your GBPs into Euros.

All transactions with your card are recorded instantly on the app, and you will always get an instant notification as soon as you make a payment, or whenever you are online next. We often received the notification before getting the paper receipt!

The phone is also necessary if you want to send money to a friend, transfer money to the Revolut account from another account, or vice versa.

Finally, if you need to freeze your card, it is easy to do it through the app. So if your card is stolen, lost or misplaced, you can quickly freeze it and request a new one.

Revolut and cryptocurrencies

People who are using cryptocurrencies will be pleased to know that Revolut can currently be used with Bitcoin, Bitcoin Cash, Litecoin, Ethereum and XRP.

However, I personally don't think this is worth it right now, as you can't transfer in crypto from outside wallets. The day that happens, Revolut will be truly revolutionary!

Our experience with the Revolut card

Quite honestly, we can’t recommend the Revolut card highly enough. We had both a Mastercard and a Visa during our trip, and we used both of them interchangeably.

In our five months of travelling to countries such as Myanmar , Vietnam , Thailand and Singapore , there were only 2 instances where our card was rejected when trying to pay by debit card.

As for ATMs, some of them didn’t accept a Mastercard, so we used the Visa instead – but that has nothing to do with Revolut itself.

At one point, we had to get in touch with customer service – this was all through the app, and it was quick and easy. It turned out that there was a glitch in the system at that time, and they promised to fix it soon, which they did. So, 5 stars for customer experience!

While it was a little frustrating to have to pay the 2% fee for ATM withdrawals of over 200 euro a month, it was still very little compared to any Greek ATM card. And the amount of times we did that was still cheaper than paying the monthly fee. And a LOT cheaper than using airport currency changers!

Overall, we totally suggest that you get a Revolut card, even if you don’t travel too often – it’s free, it’s generally accepted everywhere, and it’s hassle free.

Related posts on saving money when traveling:

- Money in Greece

- How much does it cost to cycle around the world

- How to book a Santorini hotel without breaking the bank

- Travel budget for a bike tour in Europe

3 thoughts on “Revolut Travel Card Review – The Best Travel Money Card?”

It’s a prepaid card Writing on the back Some car rental will not accept prepaid card

Beside that Great

Hello dave,

Obviously you are one of the lucky ones who did not have any problems during your travel.

Think of all the other customers of revolut bank who have their accounts locked during their travel. And have no access to their accounts.

And also think about the customers who have problems with transferring money that are missing or take too long to access their monies.

Think of the customers who are having problems accessing their live agents with poor customer services.

I can only write about my experiences, and so far they have all been positive. Like every bank, product or service there’s going to be people who have negative experiences, and it sounds like you are one of those. I hope whatever went wrong was resolved for you!

Leave a Comment Cancel reply

Best Travel Cards: Revolut vs Curve Comparision

In an era where global travel is commonplace, the efficiency of managing finances abroad is a key concern. Choosing the right travel card, like Revolut or Curve, can make a significant difference in terms of costs and convenience. These cards offer unique features, but understanding their fee structures, especially during weekends versus weekdays, is crucial for travelers.

Table of Contents

Revolut’s Travel Card Features

Revolut stands out for its competitive edge in international spending. Here’s a closer look at its fee structure:

- Currency Exchange Rates : Revolut offers interbank exchange rates. However, during weekends (Friday 23:59 – Sunday 23:59), a markup ranging from 0.5% to 1.5% is added to major currencies to account for market fluctuations.

- Withdrawal Limits : Free ATM withdrawals are limited to a certain amount per month (e.g., £200). Beyond this, a 2% fee is applied.

- Weekday vs. Weekend Fees : For transactions during weekdays, Revolut applies the real exchange rate without additional fees for most currencies. On weekends, as mentioned, a markup is added.

Curve’s Travel Card Features

Curve offers a straightforward approach with a focus on flexibility. Here’s how their fees are structured:

- Dynamic Currency Conversion : Curve offers currency conversion at the Mastercard wholesale rate. A 2% fee applies if the transaction involves a currency not held in the account.

- Real-Time Notifications : Curve provides instant notifications, including details on currency conversion rates.

- Weekday vs. Weekend Fees : Curve applies the Mastercard wholesale rate without additional fees on weekdays. However, for weekends, there’s a surcharge of 0.5% to 1.5% on foreign transactions, similar to Revolut.

Additional Benefits and Considerations

When choosing a travel card, it’s important to consider more than just the fees and exchange rates. Here’s how Revolut and Curve stack up in terms of extra benefits and security features.

Revolut’s Extra Benefits

- Rewards and Perks : Revolut offers cashback rewards and discounts with various global partners, enhancing the value for frequent travelers.

- Travel Insurance : Comprehensive travel insurance coverage is included with premium accounts.

- Security Features : Features like card freeze/unfreeze, location-based security, and customizable spending limits add an extra layer of security.

Curve’s Extra Benefits

- All Your Cards in One : Curve allows you to link multiple bank cards, simplifying your wallet and making it easier to manage different accounts while traveling.

- Curve Cash : Offers cashback at selected retailers.

- Enhanced Security : Real-time alerts and the ability to instantly lock your card from the app provide peace of mind.

Conclusion: Choosing Your Ideal Travel Card

In conclusion, both Revolut and Curve offer compelling features for international travelers. Revolut stands out for its competitive exchange rates and comprehensive travel insurance, while Curve excels in simplifying card management and providing flexible security options.

Your choice ultimately depends on your specific travel habits and financial needs. Consider the following when making your decision:

- Fee Structure : Are you a frequent traveler who needs the best exchange rates without worrying about weekend markups? Revolut might be your go-to. However, if you prefer a more straightforward approach with fewer surcharges, Curve could be more suitable.

- Travel Frequency and Spending Habits : If you travel often and spend significantly, Revolut’s cashback rewards and insurance benefits can add value. For those who prefer a more minimalistic approach, Curve’s ease of use and card consolidation feature may be more appealing.

- Security and Management : Both cards offer robust security features, but Curve’s unique ability to consolidate multiple cards offers a different kind of convenience.

Whatever your choice, ensure it aligns with your travel lifestyle and financial goals. Both Revolut and Curve are strong contenders in the travel card market, each with their own set of advantages.

Best Meditation Chair: Top Picks for Comfort and Support

Best Protein Powder: Top Picks for Maximum Muscle Gain 2023

Welcome to SavvySaver Central – where your wallet breathes a sigh of relief! 🎉

Your go-to destination for unbeatable deals and savvy shopping tips. At SnapUpSavings, we’re dedicated to helping you snag the best discounts and value buys. Join our community of smart savers and never overpay again!

- Privacy Policy

Revolut review – Is it still worth it?

Our rating:

As editor of Money Saving Answers, I discuss Revolut in a number of our travel articles. It stands out as one of the best cards for foreign travel .

Despite me personally using Revolut since 2016, neither myself nor the team at Money Saving Answers have ever written a complete review. Today I’m going to change that which my personal Revolut review.

Revolut review – Pros and Cons

What is revolut.

At its core Revolut is a digital banking service offering borderless multicurrency accounts, and frictionless currency exchanges. It can be used as a main bank account to receive your salary or pay bills, direct debits and standing orders, but where it really shines is currency exchange and foreign travel.

Founded in London in 2015, Revolut started as a prepaid travel card similar to that of the former TravelEx Supercard . I remember using the card in Ireland in 2016, and was impressed by the speed at which the spending notifications popped on my phone even before the cashier had handed me a receipt.

Since then, Revolut has expanded its services and is no longer a pure prepaid travel card, but a digital account that covers ‘ all things money .’ It has over 25 million customers worldwide, and operates in over 20 countries.

Is Revolut a bank?

Yes, and no. It is a fully licenced bank in the EU, and has applied for a banking licence in the UK, and a bank charter in the USA.

Interestingly, it doesn’t look likely to be granted a UK banking licence anytime soon. It originally applied in January 2021, but since then has had a number setbacks, the latest being it’s company accounts which as of January 2023 were seven months overdue.

Who is Revolut for?

Revolut can be used in many of the same ways you’d use a normal bank account from the likes of Barclays, Santander etc… but I’d argue that’s mainly for people who want to save money when either travelling abroad, spending in foreign currencies, or exchange money without the exorbitant fees or poor rates offered on the highstreet.

That might be digital nomads (or which there are around 2.4m Brits), Frequent travellers, foreign home owners, students taking a semester abroad, those with friends and family abroad etc. the list is endless.

Revolut fees and plans

Revolut offers four different price plans:

- Standard – free

- Plus – £2.99

- Premium – £6.99

- Metal – £9.99

The difference between standard and plus is mostly the fees and limits involved when using various Revolut services. Metal and Premium step this up and include travel insurance, airport lounge discounts, and other benefits. In this article though I’m mainly going to focus on the free standard plan, as that the one most will opt for.

Fees and limits

Revolut is generally open and upfront about its fees, but there are still a few gotchas around, especially for those on the free standard plan.

Firstly, you can exchange foreign currency fee-free up to your £1,000 fair use allowance. After that you’ll be charged 1%.

Local payments i.e., those in the UK in GBP are always free, as are transfers to other Revolut users, and bank accounts within the Single Euro Payment Area (SEPA).

On weekends, Revolut adds a 1-2% (depending on currency) mark-up on currency exchanges to cover any movement in the exchange rate when FX-markets are closed. Try to avoid exchanging any currency during these times if you can.

Revolut ATM limits and fees

ATM withdrawals are free up to £200 per 30 day period, and up to 5 withdrawals. After this there is a 2% fee with a minimum of £1. Those who need more can withdraw up to £3,000 equivalent per day, which is the highest limit we’ve seen amongst any card. It will cost though. At 2% you’ll be charged £20 for every £1,000.

Casual users should be able to avoid most of the fees, especially given the prevalence of contactless payments in popular holiday destinations.

Those relying on cash, or travelling for extended period (or with a family), are likely to run into the fair use fee, and the ATM withdrawal fee.

Exceeding the free ATM withdrawal limit catapults Revolut from one of the cheapest cards around to one that should be avoided. If you’re a heavy cash user then Starling or Chase would be better, as although the maximum daily limit is lower, you won’t be charged for withdrawals.

Revolut prepaid card(s)

On joining Revolut you are given a free virtual card. This can be used for online, and point of sale transactions (via ApplePay or GooglePay) in either GBP or a foreign currency.

You can also have a free physical card, but you might need to pay a delivery free of £5. Often this is waived though.

There’s also a disposable card. This is designed for online shopping where you may not fully trust the website to store your details. On each use the card is destroyed, and replaced with a new one. Refunds still make their way to your Revolut account, but retailers cannot charge the card again.

This is a great security feature, that I’ve found especially useful in taking advantage of free trials that require card details to be entered.

Another useful feature for travellers is the mix of Visa and Mastercard products. The physical and disposable cards are Visa debit, while the virtual card is a Mastercard debit. It’s rare that stores won’t accept both, but it has happened to me on my travels that my Mastercards were rejected whereas Visa cards went through fine.

The Revolut app

The Revolut app has grown over the years to encompass the company’s ‘ all things money ’ strategy. And while it offers a number of great features, I have found it has become quite bloated.

It’s still quick and easy enough to use, and shouldn’t cause anyone any problems, but the interface is a little busy for my tastes.

It makes heavy use of icons, which is fine, but the sheer number of products and services means some things can get lost in the clutter.

When I open a banking app, I expect my money to be the main focus of the app. Revolut does show your balance when opening the app, but only in one currency. If you have balances in other currencies you have to click on a little drop down arrow to switch.

If you want to total up how much you have in your account across all currencies, you need to scroll down towards the bottom of the page past Revolut’s suggestions and cashback offers, and analytics to see your ‘net worth’ as it’s called in the app.

Adding money and transferring money options are right there up top which is great, but the option to exchange money is hidden away under a sub-menu. I find this strange as the main benefit of Revolut over other neo banks is the currency exchange feature.

I’d really like to see that exchange button next to the ‘add money’ and ‘transfer money’ options.

By default, the home screen shows just a single recent transaction, with the option of clicking ‘See all’ to access more. I’d like to see more transactions listed here. Instead, the bottom third of the screen is taken up by suggestions of things Revolut thinks you might be interested in. It’s basically just advertising for Revolut’s other services.

Overall, the app is fast and functional, with most options available in one or two clicks, but with so much going on, some ability to customise at least the Home Screen would be a welcome addition.

How to open a Revolut account and get 3 months free premium

Signing up to Revolut takes less than 5 minutes, and because Revolut isn’t a bank, you don’t need to jump through as many hoops as you do with some accounts. There are no credit checks, and you don’t even need proof of address.

For those reasons, it’s also a great first account for those new to the UK. And in some cases your Revolut account statement, can be used as proof of address when opening accounts elsewhere such as Virgin’s M account. See out guide on basic bank accounts for more information on this.

Steps to open a Revolut account

If you sign up to Revolut via the link here , you’ll get three months of Premium for free. That includes free travel insurance so it is definitely worth it if you are travelling within the next few months.

Download the app by clicking our link and using the QR code.

Sign up for an account: Open the app and select “Sign up”. You’ll be asked to provide some personal information, such as your name, email address, and phone number.

Verify your identity: Revolut uses a secure process to verify your identity, which typically involves taking a photo of your passport or driving licence, and a selfie.

Add a funding source: To start using your Revolut account, you’ll need to add a funding source or top up your account. You can do this by linking your bank account or debit/credit card, or via ApplePay and GooglePay.

Activate your card: Once you’ve completed the sign-up process and chosen your plan, you can order your Revolut card. You can choose between a physical or virtual card, and it will be delivered to you within a few days.

Revolut Crypto fees

Revolut launched its cryptocurrency platform in 2018. It allows all Revolut customers to buy, sell, and hold cryptocurrencies in-app. The fees for which depend on the subscription held.

- Standard and Plus users – 1.99% of the value of the transaction or £0.99 whichever is greater

- Premium and Metal users – 1.49%

Standard and Plus users should also bear in mind that crypto exchanges count towards their £1,000 monthly fair usage limit.

I tested the platform back in 2018 amidst the Bitcoin hype. It was easier to use and understand than a dedicated crypto exchange, and used the same familiar interface you get when exchanging foreign currency.

The fact that I had money sitting in my Revolut account at the time, made it quick and easy buy a few fractions of BTC or XRP or whatever I dabbled in at the time.

The only drawback I found came later, when I wanted to move my crypto to an external wallet. It just wasn’t possible. Fortunately, that has now changed and you can move your crypto assets to other wallets or cold storage.

Obviously, it’s not as detailed or full featured as dedicated crypto exchange, but it’s this simplicity that makes it great for those who are curious to learn more about crypto in general.

Revolut vs Wise

Revolut is by far the most popular multicurrency card, but it’s not the only game town. Wise (formerly Transferwise) also has a large following.

Both offer free multicurrency accounts with debit cards. Both can be used a bank accounts if you wish to have your salary paid into them, or set up direct debits and standing orders. There are some key differences though.

Wise focuses on low fees, while Revolut focuses on versatility. That doesn’t mean Wise is cheaper though. In fact, in the exchanges I have conducted Revolut always won out.

There are caveats to that though. Both use the midmarket rate for currency exchanges but and for 15 of the most common currencies Revolut is cheaper as it doesn’t charge a fee, provided you stay within the fair use policy of your plan (which for the free plan is £1,000 a month).

Wise does charge a free, but it’s up front and transparent about this. Where is beats Revolut is on exchanges in more exotic currencies where Revolut adds a 1% mark up, and on exchanges outside of market hours, which can incur as much as a 2% mark up.

In terms of the debit cards, Revolut edges out Wise. Both allow spending in over 150 currencies, but Revolut customers on the free standard plan withdraw up to £200 a month fee free (in one go), whereas Wise offers two free ATM withdrawals of just £100 each, then charges up to 2% thereafter.

Bearing in mind that my experience with Wise is limited to a few small transfers in testing and a few card transactions. It is a popular card in its own right especially amongst ex-pats and is said to be better with dealing with transfers to the USA.

Chase vs Revolut

It may seem odd to compare Chase and Revolut, but in terms of spending abroad, they both perform a similar function. The main difference is that Revolut offers in-app currency exchange and foreign bank transfers in over 15 different currencies, and spending in over 150. Chase doesn’t yet offer international transfers, nor does it offer a currency exchange function.

In terms of holiday spending, Chase is the clear winner. Both offer fee free point of sale spending aboard, but when it comes to ATM withdrawals it’s a different story.

The free Revolut account limits monthly ATM withdrawals to just £200 equivalent. Withdrawals over this amount are charged a 2% fee. Foreign ATM withdrawals via Chase, are limited to £1,500 a month, with a maximum daily amount of £500. In addition, Chase users visiting the USA can use Chase ATMs to avoid and ATM fees charged by the foreign bank.

That’s not all though, Chase previously offered 1% cashback on spending via its debit card even when abroad. It has now amended this offer. Customers can still earn 1% cashback on spending, but must deposit at least £500 a month into their account. The cashback is also now limited to £15 a month.

Is Revolut safe?

In the UK Revolut is not a bank, it’s an e-money institution. Although it is still regulated by the Financial Conduct Authority, it isn’t part of the Financial Services Compensation Scheme.

Instead, customer deposits are ring-fenced at Barclays and Lloyds, and cannot be used by Revolut for its own business activities. This provides a good degree of protection should anything happen to the company, but isn’t as iron-clad as full FSCS protection.

Additionally, Revolut isn’t signatory to the voluntary Contingent Reimbursement Model Scheme (CRM) , and has receive criticism in the past for refusing to reimburse victims of fraud where seemingly authorised payments were made.

This is something that has been highlighted recently on the BBC, as a few victims of this type of authorised fraud have had trouble claiming anything back from Revolut.

Is Revolut still worth it?

With the growth in digital banking and increased competition across the ‘travel money’ sector, I must admit I don’t find myself using Revolut anywhere near as much as I did in the past.

That being said, there still many reasons to love Revolut. For one, it’s just so quick and easy. Exchanges are simple, and transfers to euro accounts are always via SEPA instant, which isn’t something that can be said for Starling. It also has a ton of services and features that just available from any other UK bank or fintech. Cryptocurrency and commodities investing for example right there in the same app. Shared vaults, group bills etc..

It’s also constantly innovating and adding new features. Many of these features aren’t just limited to Premium members either, but available to all account holders. An example of this is the virtual disposable card, which is great for online shopping security. A Premium feature on Monzo, but included in free standard plan for Revolut customers.

For mainstream currencies it’s cheaper than Wise for the most part, and wins out as a travel card against Currensea (see our Revolut vs Currensea article) provided you can live within the tight limits of the free standard account. A top foreign travel credit or debit card, such as the Barclaycard Rewards, or Starling debit card still better for day-to-day spending abroad though.

It’s not all positive though. Critical support is abysmal, you can’t actually talk to human. There’s also the question of fees. The standard plan is free, but only to a point. The fees for going over what are quite small allowances can add up if you aren’t careful, and on top of these, you can be hit by out-of-hours fees on currency exchanges.

The company and its management are also questionable. It has been involved in a number of scandals over the years, from a culture of bullying, to disabling money laundering checks .

The latest negative headlines centre around the lack of support for victim of fraud where seemingly ‘authorised’ transactions were made. It was also more than 7 months late filing its annual accounts . Not something you expect from a would-be bank.

Fortunately, the vast majority of customers remain unaffected by these incidents, but it certainly doesn’t help public perception, especially in an age where banks are increasingly adopting a more ethical stance. See Kroo for example.

As a long-time account holder, my opinion is that Revolut certainly has its benefits, and although I’m not thrilled about its corporate governance, or public image, I do still see a use case for it in certain circumstances. In particular for currency exchange and transfers to foreign accounts. Always making sure never to leave large sums of money in the account for any length of time due to the lack of FSCS protection.

Got a Revolut story? Good or bad, we’re keen to hear your experiences.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

The original multi-currency account, and still one the best

Money in your inbox

Join thousands of like-minded money savers and receive money saving hints, tips, and offers, direct to your inbox.

By entering your email address you agree to our Terms of Use and Privacy Policy and consent to receive emails from from Money Saving Answers.

7 Honest Reasons Why Revolut is the Best Travel Card in 2024 (A Review of the Prepaid Travel Card)

- Post last modified: Updated on March 19, 2024

- by Post author: Michael Smulian

If you’re looking for the best prepaid card to travel with in 2024, Revolut has it all, and more! Get FREE ATM withdrawals around the world and buy foreign exchange at the cheapest rates.

It feels like an eternity ago since our first Revolut card was delivered in the post. To be honest, we tried several other mobile bank cards including Bunq, Monese, Starling, Monzo, and N26. We simply couldn’t be sure which one was the best. We had to try them all.

Since then, we’ve travelled the world and used this time to try every nook and cranny of the Revolut app . And after a year, we came to the conclusion that Revolut is simply the best travel card we’ve ever used.

This review covers why the Revolut travel card is better than it’s competitors. It also lists 7 honest reasons why you should never travel again without ordering your free travel card today.

We’ll also throw in 3 months of Revolut Premium for free. So you can try out the best travel card for yourself.

In this guide

What is revolut and how does the travel card work, 1. free prepaid card with no hidden fees, 2. get the best exchange rate and pay zero commission, 3. free and easy to top up your revolut prepaid card, 4. free worldwide atm withdrawals, 5. exchange and hold up to 36 currencies with no commission, 6. spend in 136 currencies, 7. your money is safe with the revolut app, unlock more benefits with revolut paid plans, 1. live chat customer support response time, 2. no credit card top up, 3. limited ways on how to contact revolut, revolut alternatives, wrapping things up.

If you’ve heard of Revolut, you can move right along. Your time should be spent in the next sections finding out why you should get the best travel card.

But if you’ve never heard of it or you’re wondering how does Revolut work, we’ll be happy to enlighten you.

Revolut claim to be a Fintech company that offers banking services in several countries across the world.

We figured they don’t call themselves a bank because they don’t actually have any branches where you can walk into. The magic happens in the Revolut mobile app which is how you manage your money.

We’d personally like to think of Revolut as a mobile bank that truly is, as they claim, radically better.

They offer a prepaid travel card jam packed with amazing features, which we can’t wait to fill you in on. You’ll receive a Visa or Mastercard and get to manage everything from spending to withdrawals all from the app.

Let’s jump straight into what you get with the Revolut travel card.

Note: You can access the full list of countries where you can get a Revolut card here.

Revolut Travel Card Review: Why You Need to Get the Best Travel Card

The moment of truth has finally arrived! Here’s why you should get the Revolut travel card today. You can thank us later.

Join the newsletter for article updates, tips and deals to travel better, cheaper and smarter!

Don’t fill this out if you're human:

Or sign-up via WhatsApp

Why pay bank fees when you don’t have to?

You get a free card with Revolut’s transparent standard pricing plan . It’s not the first mobile bank to offer free stuff and certainly won’t be the last. This is simply how they attract customers.

But what really sets Revolut apart vs mobile banks such as N26, is that you’re getting a lot more value. And it’s absolutely free!

Here’s what you’ll get for FREE with a Revolut travel card on the standard plan:

- Free local bank account (Euro IBAN for EEA residents)

- Spend in 136 currencies at the interbank exchange rate

- Exchange in 36 currencies up to £1,000 / €1,000 / $1,000 / A$2,000 per month with no commission

- Free International ATM withdrawals up to £200 / €200 / $400 (Out-of-Network ATMs) / A$350 per month

Just stick to these limits when you travel and you’ll never have to pay any bank fees again.

The best way to stick to these limits is to budget. We always estimate our travel costs to make sure we don’t over spend and pay any fees.

Tip: If you’re travelling in a group or as a couple, you should each consider getting a Revolut travel card. You’ll increase your limits if you spend collectively.

Note: The interbank exchange rate is what banks use to swap or exchange currencies. It’s a real-time or live rate, which is why it is constantly changing in the Revolut app.

If you’re travelling abroad, you’ll likely need foreign currency to fund those excursions and new experiences.

With Revolut you can now exchange currencies in the Revolut app at the real interbank exchange rate. That’s like getting the same rate you see on Google or on apps such as XE .

Yeah, you read that right! Don’t believe us? See for yourself!

If you need foreign currency (Forex) for your travels, simply exchange currency in the app to lock in the best rate. Just bear in mind that Revolut charges fixed rates when exchanging currency on weekends. So that’s between 5pm New York time on Friday and 6pm New York time on Sunday. Keep reading to learn how to buy Forex on the app.