GET A QUOTE

Schengen Travel Insurance for Europe

(based on 3539 ratings)

Travel Insurance for Schengen visa and Europe

Need travel and medical insurance to obtain a Schengen Visa for Europe? Buy AXA Schengen Travel Insurance online and get your insurance certificate immediately. The certificate is accepted by all consulates and embassies representing the 27 countries in the Schengen Area

Find the Schengen insurance you need: COMPARE NOW

- Medical expenses up to €30,000

- Repatriation

- 24-hour assistance

- COVID coverage under conditions

- Meets requirements from the E.U

- Medical expenses covered up to €100,000

- Extended protection in all Schengen countries, Ireland and Great Britain

- Medical repatriation

€328 per year

How to buy your Insurance?

Our travel avatar Priyan will explain how to safely buy your Schengen Visa travel insurance online.

Do you cover emergency medical costs related to Coronavirus?

We will cover your medical costs related to Coronavirus provided you haven't travelled against World Health Organisation or any other government body’s advice in your home country or the country you are travelling to) or medical advice.

The embassy states that I must get an insurance certificate with Covid protection. Is this possible?

All issued electronic certificates purchased on the axa-schengen site include this disclaimer: “Medical fees related to COVID-19 are covered in the terms, conditions & exclusions established in the insurance policy”.

What are the covered countries?

AXA’s Europe Travel insurance and AXA's annual Multi Trip travel insurance offer extensive protection, covering medical expenses up to €100,000 in the following European countries: Austria, Belgium, Croatia, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland, as well as the United Kingdom , Bulgaria, Cyprus, Ireland, Romania.

AXA's Low Cost insurance covers medical expenses up to €30,000 in the following European countries: Austria, Belgium, Croatia, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland .

What is Schengen travel insurance ?

Schengen travel insurance provides you with travel and medical insurance for all the 27 countries that make up the Schengen Area - covering you for trips across the continent or holidays in any nation within the Schengen Zone. AXA is the leading provider of this type of insurance.

Here is the complete list of countries that you can visit with Schengen insurance (provided you have a Schengen visa ) : Austria, Belgium, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, The Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland.

Why do I need travel insurance to visit Europe ?

A requirement for obtaining a Schengen Visa is to have insurance covering you in all states in the Schengen Area up to medical costs of €30,000. The easiest way to do this is to obtain Schengen travel and medical insurance from an accredited provider, such as AXA, which is the leading brand for this type of insurance.

Not all travelers require a Schengen Visa to travel to the Schengen Area, as countries including the U.S.A., Mexico, Brazil, and Canada have visa-free arrangements with the Schengen Zone. However, it is still strongly recommended you obtain insurance as all your medical costs, or those you may incur should something go wrong on your trip, may not be covered without obtaining travel insurance. If you are planning to travel to more than one Schengen country or want to be flexible with your itinerary, it is also a great way to ensure you are covered in the majority of countries in Europe.

If you are a U.K national, we recommend you to read our detailed guide on the effects of Brexit on travel and residency in Europe .

Will getting travel insurance ensure I get a Schengen visa ?

Although it is an essential document to supply when applying for a Schengen Visa, you will also need to supply other supporting documents that outline the reasons for your visit, your itinerary and accommodation plans, as well as how you intend to support yourself and any plans to work or study. Your application may also be rejected by embassy officials - but this is relatively rare as long as all your documents are in order.

How can AXA help with your travel insurance ?

AXA can help by providing you with Low Cost Schengen Area travel insurance that meets your visa requirements when traveling to the Schengen Area from as little as €22 per week - a fee that will cover you for medical expenses up to €30,000 in all Schengen countries - a price that isn’t too hard on your wallet ahead of your trip! A certificate proving you are insured will also be available immediately, meaning you can get on with your application.

AXA is the number one provider of travel insurance for trips to Europe and offers assistance 24/7, as well as other options and tailor-made products. Other coverage available includes our Europe Travel insurance, costing €33 per week, or Schengen Multi Trip insurance, which is perfect for regular travelers and available for €328 for a year’s coverage.

What should I do if I have a medical issue while in the Schengen Area?

Please contact us as soon as possible on the phone number given with the special conditions you receive after taking out your policy. Our helpful staff will then do all we can to resolve your issue and get you treatment or travel home, in line with the conditions of your policy.

Frequently asked questions about countries covered by Schengen travel insurance

1 - does schengen insurance cover countries other than those in the schengen area .

Other than those microstates mentioned, no. If you plan to travel to countries outside the Schengen Area, you will need to get insured there, though this will not affect your Schengen travel insurance covering you while inside the area.

2 - I want to buy travel insurance for my partner and children as a group. Can I do so ?

Yes. You can buy for up to 10 people with only one payment.

3 - Can I get a refund if my Schengen Visa application is refused?

Subject to certain conditions, yes. However, you will need to provide documentation from the embassy, consulate, or visa application center where you applied stating the reason for the refusal.

Get Schengen insurance

Copyright AXA Assistance 2023 © AXA Assistance is represented by INTER PARTNER ASSISTANCE SA/NV, a public limited liability company governed by Belgian law with registered office at Regentlaan 7, 1000 Brussel, Belgium – Insurance company authorized by the National Bank of Belgium under number 0487 and registered with the Crossroads Bank for Enterprises under number 0415 591 055 – RPR Brussels- VAT BE0415 591 055

AXA Travel Insurance Global | AXA Assicurazione Viaggio | AXA Assurance Voyage | AXA Seguros y asistencia en viajes | AXA Seguro de viagem

COVID Information | Click here to learn more about our COVID Travel Insurance

Why should I purchase Travel Insurance?

Whether you're embarking on a weekend getaway or a month-long adventure, unexpected events can happen. An AXA protection plan can help ease your mind and help safeguard your trip, offer reimbursement for covered medical costs, and provide travelers with 24/7 access to assistance services, among other benefits.

Need to cancel your trip due to an unforeseen event?

Get coverage for your trip against illnesses, injuries, and natural disasters. Travel insurance can reimburse you for your prepaid, non-refundable trip costs.

Was your luggage lost or stolen?

Our travel plans can offer reimbursement for the value of your belongings, up to the policy limit. This includes coverage for lost or stolen passports, visas, or other important travel documents, as well as any necessary expenses related to replacing these items.

Stranded due to unexpected travel delays?

Whether it’s rebooking your flight, finding alternative transportation, or providing a place to stay, our 24/7 travel assistance team is here to help!

Is domestic and international medical coverage provided?

Our travel plans can provide up to $250,000 in medical coverage domestically and internationally for emergencies and accidents while traveling.

SILVER PLAN

Best for Domestic Travel

- 100% of Insured Trip Cost for Trip Cancellation

- $25,000 Emergency Accident & Sickness Medical

- $750 Baggage & Personal Effects

Best for Cruise

- $100,000 Emergency Accident & Sickness Medical

- $1,500 Baggage & Personal Effects

PLATINUM PLAN

Optional Cancel For Any Reason Coverage

- $250,000 Emergency Accident & Sickness Medical

- $3,000 Baggage & Personal Effects

Compare Our Silver, Gold, Platinum Plans

Axa travel insurance benefits.

Medical Travel Benefit

AXA offers coverage for certain emergency medical expenses that result from an accidental injury or illness while traveling as well as emergency medical evacuation and repatriation. Learn more

Trip Cancellation

We can reimburse you up to the maximum benefit of your selected travel plan, that is due to an unforeseen event including illness and inclement weather and other covered reasons. Learn more

Emergency Evacuation

AXA Offers coverage for medically necessary evacuations and repatriation as directed by a physician to the nearest adequate medical facility or your home. Learn more

Baggage Loss

AXA offers reimbursement coverage in the event your baggage or personal effects are lost damaged or stolen during your trip. Learn more

Cancel For Any Reason

AXA offers coverage up to 75% of your prepaid nonrefundable trip costs if your trip is cancelled for any reason. Learn more

Trip Interruption

AXA offers coverage for your non-refundable trip costs in the event you cannot continue on your trip due to a covered reason. Learn more

Frequently Asked Questions About Travel Insurance

What is travel insurance, what does travel insurance cover on a cruise, why choose axa, how much does travel insurance cost, what is a pre-existing medical condition, does travel insurance have covid benefits.

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

Make the most out of your travels. Get AXA Travel Insurance and travel worry free!

Over 20 Years of Experience | Located in 30+ Countries | 24/7 Travel Assistance

Common concerns about travel insurance.

- It is a clever idea to purchase travel insurance If you are willing to protect your trip from variety of common travel-related incidents, including trip cancellations, flight delays or cancellations, lost or stolen baggage, and medical emergencies.

- Travel insurance provides coverage against medical expenses, reimbursement for lost or stolen luggage, compensation for expenses incurred due to travel delays and more while you are travelling.

- Travel insurance is to provide financial protection to travelers in case of unexpected events. Without adequate insurance coverage, travelers may face significant financial losses and hardships if they encounter any unforeseen circumstances while traveling in the Schengen Territory.

- A good option for travelers who are concerned about unforeseeable events or who want the freedom to cancel their trip for any reason. When you purchase CFAR coverage, you can cancel the trip without losing your entire prepaid, nonrefundable vacation expenses. Exclusive to Platinum Package holders.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AXA Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is AXA?

Axa travel insurance plans, which axa travel insurance plan is best for me, can you buy axa travel insurance online, is axa legit, what isn't covered by axa travel insurance, is axa travel insurance worth it.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss , trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

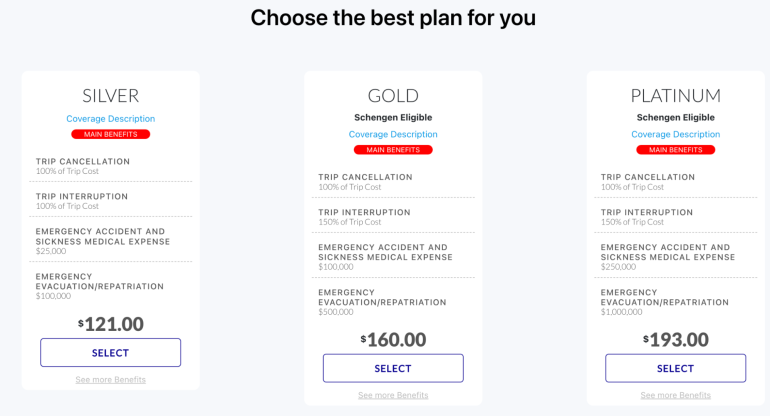

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions , a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

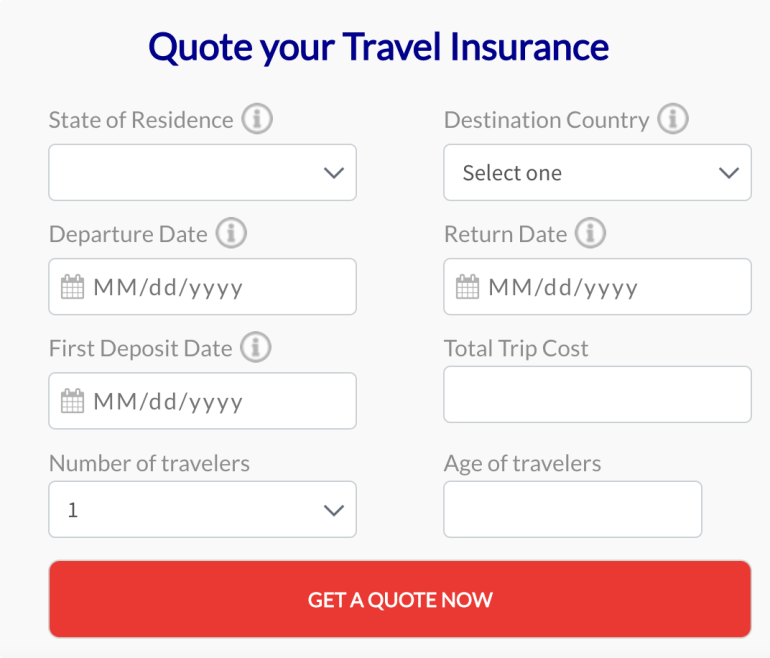

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

AXA handles more than 14 million cases each year, and every plan includes access to their 24/7 assistance hotline. The company is well established and has three plans for travelers to choose from.

AXA travel insurance covers several benefits including but not limited to 100% trip cancellation and trip interruption, medical emergencies, emergency evacuations, baggage delay or lost baggage, and accidental death and dismemberment. The Platinum plan also lets you add Cancel For Any Reason coverage.

AXA's least expensive plan, Silver, and its mid-range Gold policy do not have the option to add-on Cancel For Any Reason coverage. For travelers who opt to purchase the Platinum insurance plan, you can add Cancel For Any Reason coverage a la carte within 14 days of paying the initial trip deposit.

In the event that you need to make a claim, you can upload supporting documents online. If the claim is accepted, you will receive reimbursement within 30 days.

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Compare Travel Insurance Ireland

Compare travel insurance to find the best travel insurance in Ireland. We do all the searching for you to find the best & cheap travel insurance. With just a few clicks using our 'travel insurance compare' feature, you can purchase the best travel insurance policy. It's Quick and Easy!

Single trip covers you one trip from the time you leave Ireland until you return including travelling to multiple countries.

Annual multi-trip covers you for an unlimited number of trips for a specified duration within one year.

Backpacker will cover you for between 3 and 24 months and include travel to multiple destinations. This cover is also known as ‘long stay’ or ‘extended stay’.

Policies will normally exclude cover if you are travelling to an area or country where the Department of Foreign Affairs has advised against travel. For advice on countries not to travel to and for more information prior to travel, visit https://www.dfa.ie/travel/travel-advice/

Annual multi-trip: cover will commence on the specified start date. If you choose to include cancellation cover, it will begin on the policy start date you have selected and not the date you buy your insurance.

Single trip and backpacker: cover will commence on the day you incept the insurance if you choose to include cancellation cover.

What to consider

Annual multi-trip: if you choose to include cancellation cover, it will begin on the policy start date and not the date you buy your insurance. Therefore, if you set the start date for when your first trip begins, you will not be covered if you are unable to travel.

Single trip and backpacker: if you choose to include cancellation cover, it will begin on the date you buy your insurance. All other policy features will begin on the date you select.

Who is covered?

Individual: this is to cover Individual travellers travelling alone or together.

Couple: this will usually cover 2 adults residing at the same address.

Family: usually two adults and a specified number children under the age of 18 who live at the same address. This also includes single parent families.

Definitions may vary from insurer.

Individual: as the name suggests, this will cover one traveller.

Couple: this will typically cover two adults who live at the same address.

Family: this will typically cover two adults and up to four children under the age of 18 who live at the same address.

Winter sports: an additional cover required if you are going on a trip that will involve you skiing or snowboarding etc. This may also include cover for off-piste skiing and for your equipment.

Cruise cover: these policies include cover for cruises and may include extras such as missed port departure and cabin confinement.

Business Trip: these policies are tailored for the business traveler and may include additional cover for mobile phones, laptops or other items used in support of your business.

Always read the policy wording carefully as it may include specific conditions and exclusions. Please ensure that your insurance provider will cover you for all destinations on your cruise.

Private Heath Insurance

Insurers will usually offer a discount and cover some pre-existing conditions automatically if all the insured persons hold an eligible Private Health Insurance policy that covers in-patient medical treatment abroad of at least €55,000 per person per claim. The policies will usually re-quire you to claim from your PHI provider in the first instance if you receive medical treatment abroad with the Travel Insurance benefits offering a top up if you exceed the limit of your PHI.

Please refer to the insurer’s policy documents for full terms and conditions.

What is a medical condition?

An illness or injury for which you have taken medication or been given treatment.

This also includes conditions from which you have suffered symptoms, but not yet had a diagnosis and ongoing medical conditions. Policies may exclude any claims relating to being on a waiting list to receive a diagnosis or treatment or a terminal illness. This may also extend to non-travelling family members.

This policy is only available to you if you have been permanently resident in Ireland for the past six months.

What our customers say

Find Best Travel Insurance in Ireland with Ucompare

Ucompare's tool does all the hard work for you and helps you to compare & buy cheap travel insurance in Ireland.

Whether it's the annual travel insurance, single trip, backpacker travel, or global travel insurance; fill in our simple form & get multiple quotes to compare & choose the best insurance.

Annual trip Policy

Our annual trip holiday insurance policies cover avid travelers for a full 12-month period. You can select from various geographical locations, including Europe, the US, Australia, or even worldwide.

An annual trip travel insurance policy covers you for all trips made within the year, so you never need to worry about any last-minute panic to arrange travel insurance.

If you are a frequent flyer, it will often be much better value than individual policies for each trip.

Single trip Policy

We also offer a huge range of comprehensive single trip travel insurance options. If you don't travel as frequently, the single trip option can save you a lot of money and stress if anything doesn't go to plan.

This travel insurance type offers advantages, including the policy being tailor-made and designed especially for your trip abroad.

We offer a large range of add-on options for whatever you may need.

Backpacker Policy

If you are travelling for an extended period of time, our backpacker travel insurance options have you covered.

It is the most popular option for those jetting off to travel the world and is essential if you will be away from home for more than 3 months.

Our Backpacker travel insurance policy options can cover you for up to 2 years, so no matter how long you will be away for, make sure to get a quote today.

Benefits of Travel Insurance with Ucompare

Travelling brings you the most wonderful memories to cherish forever. But sometimes things may not always go according to the plan.

Lost luggage at the airport, flight cancellations, flight delays, natural disaster or a medical emergency can seriously hamper your travel plans.

Unfortunately, you don't have control over these mis happenings. But what's in your control is to buy the right holiday insurance policy which provides you the cover you need in these unfortunate circumstances.

Our travel insurance options come with a range of benefits to give you the best cover possible. These include delayed or lost baggage cover, trip cancellation cover, winter sports cover, and car hire excess cover.

Many benefits come as a standard with your policy. For any extras, you might require you can select various add-ons, so be sure to know what you are looking for with the help of our easy to understand comparison tool.

With the range of benefits on offer, you can select the perfect travel insurance policy tailored to your precise needs.

With some help from Ucompare, finding the best deal on your holiday insurance is quick and easy with our easy and stress-free comparison tool, there hasn’t been a better time to choose your next policy.

Hope this will help you find the best travel Insurance in Ireland

Buy Cheap Travel Insurance with Ucompare

Travel Insurance is absolutely essential for anyone who is considering travelling abroad. The Travel Insurance market in Ireland can be daunting so UCompare.ie has brought all of the main competitors together to make your life easier.

UCompare.ie offers a range of Cheap Travel Insurance products in Ireland and they also offer more comprehensive and specialised cover too.

There are a number of different ways in which you can save money on your travel insurance. For instance, many companies automatically select the postage and text message option when you are running a quotation, if you pay attention & remove these options you could save yourself up to €5.00.

Another way to save money is to watch out for the automatic renewal option. While this can be seen as convenient for some travellers, it also pays to shop around and ensure that you are getting the best deal around every year.

Get a travel insurance quote from The AA

All the help you need to buy the right travel cover for your holiday, get a European Health Insurance Card, and what to do if things go wrong.

Why get travel insurance?

Travel insurance can protect you financially if something goes wrong when you’re travelling abroad or on holiday.

This could include paying for medical care if you fall ill, refunding your booking if you have to cancel or compensating you for lost or stolen personal belongings.

Find out how to secure the right travel insurance in our guide. Here’s what’s included:

What travel insurance covers

Types of travel insurance.

- Buying travel insurance in Ireland

- What the European Health Insurance Card covers

- Making a claim on your travel insurance

Holiday consumer rights

What’s covered by travel insurance.

It depends on the insurance provider and level of cover you choose, but most decent policies cover:

- Emergency medical assistance: which pays for the cost of medical treatment if you fall ill overseas. This also covers repatriation costs to get you home to Ireland if you’re not well enough to travel on a standard flight.

- Personal accidents & injury: which pays you a lump sum if you have a serious accident on your holiday resulting in life-changing injuries, for example, losing a limb or your sight.

- Cancellation & curtailment: which refunds the cost of your trip if you need to cancel or cut short your trip due to unforeseen circumstances, for example, if you or a family member are seriously ill or you’re made redundant after you book.

- Luggage & personal possessions: which pays out the cost of replacing lost or stolen luggage and for essential items to tide you over if your baggage is delayed at the airport.

- Lost or stolen money & documents: covers your foreign currency, including cash like U.S. dollars or British pounds. This also covers your travel documents and passport if they’re lost or stolen on your trip.

- Personal liability cover: which protects you financially if you cause an accident or injure someone else while abroad.

You can also add extra cover to include things like:

- Winter sports, e.g. skiing and snowboarding

- Extreme sports, e.g. scuba diving or paragliding

- Golf equipment & bookings, including your clubs and green fees if you’re injured or too ill to play

Make sure you take your European Health Insurance Card (EHIC) if you’re travelling in Europe, even if you have travel insurance.

To get the right value from your insurance, it pays to get the right type of insurance tailored to your circumstances and the type of travel.

Here’s the types of insurance you can get in Ireland:

- Single trip insurance: This covers one trip only, usually for between 30 and 60 days and is the cheapest.

- Multi-trip insurance: Also called annual cover, it covers multiple trips in one year. It may cover worldwide or just Europe & UK trips.

- Backpackers insurance: Cover designed for travellers going on a long trip or holiday abroad. Many standard travel policies only offer cover for up to 30 days per trip, but with a backpacker policy, you can get cover for up to two years plus cover for visiting multiple counties.

- Winter travel insurance: Cover that includes extra protection for activities like skiing, snowboarding and tobogganing. Some standard travel insurance policies exclude these activities because they’re high risk and the cost of medical care on the slopes can be very expensive.

- Elderly travel insurance: Cover for older people can be harder to find or more expensive because over 65’s pose a greater risk for medical care. It may also have more restrictions, so take more time to read the T&Cs and compare quotes.

- Family travel insurance: Cover for your children will work out cheaper if you buy a family policy and if you choose annual family cover you’ll have the flexibility to travel as an individual or a couple too. Perfect for a snatched weekend away!

You can read our guides How to find the right travel insurance guide or How to get travel insurance as you get older to find out more about other types of insurance.

Single trip or annual multi-trip travel insurance?

If you have more than two trips planned per year, it’s usually cheaper to get an annual policy, but your age and medical history may affect what’s available.

With annual cover, you’ll be covered for any short trips in Ireland, but if you plan to travel outside of Europe and the UK or are unsure of your travel plans, choose an annual policy that covers worldwide destinations.

For a look at the pros and cons of single versus multi-trip insurance, visit How to choose the right travel insurance .

How to choose the right type of cover

You’ll save money by choosing the right type of travel insurance for your circumstances, so ask yourself these questions before buying:

- How many trips are you taking? Consider taking out annual cover if you plan to travel more than three times per year.

- What will you be doing? Consider specialist cover if you plan to go skiing or do another high-risk activity.

- Who is the cover for? Check for discounted cover if travelling as a couple, family or group. If you’re over 70 your choice may be more limited.

For more advice on finding the right insurance for your needs, visit our how to find the best travel insurance guide.

Does travel insurance cover COVID-19?

Losses due to epidemics, border closures, warnings, travel advisories or quarantine rules are generally not covered; however, some insurers offer COVID-19 related benefits.

They may provide cancellation, curtailment, medical expenses and accommodation cover if you get COVID-19 while abroad and are unable to return home as planned.

If this is an important concern, shop around, read the terms and conditions carefully and get several quotes before choosing a travel policy.

Buying travel insurance

How much does travel insurance cost.

Standard single trip insurance could cost you less than €25 if you are young with no underlying medical conditions, but may not provide the cover you need if it’s very cheap.

Annual or multi-trip travel insurance could cost around €50 or more for European cover and €65 or more for Worldwide cover. The older you are, the higher the premium regardless of your health.

If you have private medical insurance which covers you while you’re abroad, your travel insurance will be cheaper still.

What affects the price of cover?

- your destination

- your medical history

- whether you have private health insurance

To find the cheapest travel insurance quote, shop around so you can compare prices and benefits.

What if I have private medical insurance?

Even if your existing medical insurance covers you abroad, a comprehensive travel insurance policy can offer financial protection in other areas, for example, if you need to cancel your trip or your travel money is stolen.

The good news is that many travel insurers in Ireland offer a discount on your quote if your medical insurance covers you abroad, which could make your travel insurance even cheaper.

If you hold private medical insurance, you could get up to 25% off the travel cover price.

What’s the age limit on annual multi-trip cover?

For many annual policies, the maximum age limit is 75 years, but often people over 70 years must hold private health insurance.

Should you buy the cheapest travel insurance?

Although it’s tempting to pick the cheapest policy, it’s not always a good idea with travel insurance. The cheapest policies will offer less cover and have more exclusions.

It’s best not to scrimp on cover for medical expenses and personal liability because you could end up liable for eye-watering expenses if you get ill or are involved in an accident on holiday.

Also, pick a policy that fully covers the cost of the holiday and your belongings and find a policy that includes enough financial protection for you and your family.

Who offers travel insurance in Ireland?

Most of the large insurers in Ireland offer travel insurance, as do private health companies. An online search will also provide a selection of smaller, travel insurance specialists.

Although there are many insurance providers to choose from, many policies are underwritten by the same companies.

What you need to buy travel insurance

Before you buy your travel insurance, you’ll need to know:

- Your destination: usually shown as UK and the Channel Islands, Europe or Worldwide (including or excluding USA and Canada).

- The dates of your trip: this is the date you leave Ireland and the date you arrive back in Ireland.

- Who needs to be covered: usually shown as individual, couple or family but check the help information for exclusions.

- The age of each traveller if you’re buying a group policy, have that information to hand.

You may also be asked to confirm:

- If you hold private medical insurance that covers trips abroad

- If you need cover for winter sports

When should you buy travel insurance?

It’s best to buy your single-trip travel insurance as soon as you book your trip so you’re covered if the flights, accommodation or package holiday is cancelled.

This will also cover you if something happens before your trip starts, which means you have to cancel your holiday, e.g. you or a relative becomes seriously ill.

For an annual or multi-trip policy, you need to know roughly when you’ll be travelling as you have to choose a start date for your policy and it runs a year from that date. If you book a holiday that starts before your policy does, you won’t be covered.

The European Health Insurance Card

What is european health insurance (ehic).

It’s free healthcare available to Irish residents and EU citizens living in Ireland. The European Health Insurance Card, known as the EHIC or formerly E111, shows that you’re eligible for free healthcare when you travel in Europe.

If you’re travelling to the EU or European Economic Area (EEA) you should take it with you in case you become unwell or have an accident and need medical attention.

Each member of your family needs an EHIC when they travel within the EU. You can apply for them in person, by post, or online if you have a medical or drug payment scheme card.

What does it cover?

Here’s a summary of what the EHIC does and doesn’t cover you for:

- Free or reduced cost state healthcare in any of the EU and EEA countries

- Pre-existing medical conditions

- Routine maternity care - as long as you’re not going there to give birth

- A temporary stay up to three months*

Not covered

- Private healthcare or costs for something like mountain rescue

- Ongoing or permanent healthcare

- Medical expenses, if your reason for going abroad is to have treatment

- The cost to fly you back to Ireland

*If you’re a student studying abroad, you’ll be covered for up to an academic year.

How to use the card

If you need medical care while you’re away, you must show your EHIC to the public medical centre or hospital as evidence of eligibility.

You can expect to get the same treatment and care as local residents and on the same terms.

If public healthcare is free in the country you’re visiting, you won’t pay anything, but if there’s a charge for medical services, you’ll be charged too.

Here’s more information about how to use your EHIC in each country and any costs involved.

Do you still need travel insurance?

Yes, it’s essential you get travel insurance and an EHIC, or you won’t be covered for things like cancellation and lost or stolen luggage.

Your EHIC just covers medical costs in the EU, but travel insurance can include many extras to suit your trip, such as winter sports cover. You can find out more about how to choose the best travel insurance in our helpful guide.

How to renew or apply for the EHIC

You can either apply or renew:

- In person: at any local health office except Dublin North West. Check what ID to take.

- By post: Print out an application form and post it to your local health office along with any documents required.

- Online: using the official HSE website

The EHIC is completely free. Never use a website that tries to charge you a fee.

Claiming on your travel insurance

You’ll need to contact your insurance company as soon as possible in the event of a problem.

Remember to take your travel insurance documents and their emergency contact details with you when you travel. Take a paper and electronic copy of the policy so you have more than one way of accessing the information.

If you’re taking expensive items abroad, jot down serial numbers or take photos of your electronics or jewellery before you travel.

Here’s the emergency claim numbers of popular travel insurers in Ireland:

Claiming for illness, accidents and medical emergencies

If you need medical treatment while you’re away, you’ll need to contact your insurer as soon as possible. Your insurer has to agree to any medical procedures, so do this before treatment takes place.

This may not be possible in an emergency, so get evidence of any treatments or medication you’ve paid for.

Depending on the country you’re in, you may have to pay up-front for treatment and claim it back when you get home, so always secure medication receipts or an invoice for medical treatment.

It’s vital you tell your insurer about any existing health problems or conditions when you take out insurance, or you may not be covered.

Claiming for lost, stolen or damaged belongings

If your belongings are lost or stolen, inform the local police within 24 hours of your items going missing and get a statement. If this isn’t possible, tell someone else such as your hotel manager, tour operator or airline and get a written report.

If you have to replace essential items, such as toiletries or clothing, keep receipts for everything you need to purchase and provide them as evidence to support your claim.

Your insurer will want to see that you’ve taken reasonable steps to look after your luggage or belongings whilst travelling, so be prepared for questions and support your claim with evidence wherever possible.

Claiming if you have to cancel your trip

Your claim for cancellation or trip curtailment will only be accepted under certain conditions. It’s wise to check the small print for acceptable reasons, but typically they will be:

- unexpected death, illness or injury involving you, your partner or fellow travellers

- unexpected damage to your home, such as fire, flood or burglary

- you’ve been advised not to travel due to pregnancy (after you bought insurance)

- you’ve been called for jury service or as a court witness

Check your policy schedule for the rules of reimbursement should you have to cut short your trip.

You now have the same rights whether you book your holiday at a high street retailer or online. Here are your consumer rights if you book a package holiday or linked travel arrangement.

When can you cancel?

You can cancel at any time up to the start of your holiday for a reasonable cancellation fee. The less notice you give, the more money you’ll lose.

You may be entitled to a full refund without paying any fee in the following situations:

- In extraordinary circumstances: e.g. war, terrorism, floods and earthquakes that will significantly affect the holiday or stop you from reaching your destination safely.

- If the price increases by more than 8%: you have the right to cancel without paying a charge. Contractually no price changes are allowed within 20 days of the departure date.

- If significant changes to the holiday are made: e.g. departure and arrival times that will affect your accommodation and transport arrangements.

When can the travel company cancel?

They may have to cancel due to extraordinary circumstances beyond their control or where they can’t get the minimum number of participants needed for a trip to run. In these situations, you have the option of:

- A replacement holiday of equal or superior quality

- A lower quality holiday, plus a refund for the difference between the two trips

- A full refund

Can your holiday price go up after you’ve booked?

Yes, the cost can go up but not within 20 days of your departure date. The cost of your trip may be affected by increases to:

- Transport costs e.g. fuel prices

- Taxes, fees and duties charged at airports or ports

- Currency exchange rates

What are my package holiday rights?

If you book a package holiday, you should be:

- Given all the essential information from the retailer or trader before the booking is completed.

- Able to contact the organiser directly and through the retailer you bought the package from (if different).

- Entitled to a full refund and repatriation if the trader becomes insolvent.

- Able to transfer the holiday to another traveller, giving reasonable notice and you may have to pay costs.

- Offered suitable alternative arrangements at no extra cost if a significant proportion of the travel services can’t be provided.

- Given assistance if you’re in difficulty e.g. access to healthcare or alternative travel arrangements.

How to complain about your holiday

You must raise any issues with the travel organiser without delay, where you feel a service isn’t satisfactory. If you delay, it could affect the compensation you get.

They should be allowed to put things right, but if this doesn’t happen, you should gather evidence to support your complaint e.g. take photos or video footage.

If the matter is still unresolved when you’re back home, you should put your complaint in writing within 28 days of the holiday end date. Details of where to send your complaint should be shown in the contract’s terms and conditions.

If you’re unhappy with their response or they fail to respond within a reasonable timeframe, you can contact:

- The Competition and Consumer Protection Commission (CPPC): who can investigate Irish traders and ensure they comply with the Consumer Protection Act.

- ECC Ireland: who can settle complaints between consumers and traders in another EU country, not Ireland.

Travel companies may use arbitration to resolve complaints. This is where an independent party investigates and reviews the evidence to decide how much compensation to award.

You also have the option of pursuing a claim up to €2,000 through the Small Claims Court.

Specific travel insurance questions

What is the maximum length trip i can get cover for.

It depends on the insurer. Most insurance providers cover trips lasting up to 30 days, but you could find cover up to 60 days if you shop around.

If you buy an annual travel insurance policy, you’re covered for multiple trips but only up to the maximum duration per trip and total duration for the year.

If you need continuous cover for longer, backpacker insurance usually lasts up to a year but can last up to two years.

Do you need special travel cover if you're pregnant?

Most travel insurance policies will cover you to travel in the early stages of pregnancy, but you should always check how far into the pregnancy the cover will last. For example, you may be covered to travel up to 32 weeks into your pregnancy but not beyond this date. If you fall pregnant after taking out a travel insurance policy and will be at a late stage in your pregnancy when you’re due to travel, you may be able to claim for cancellation.

What is a linked travel arrangement?

This is where you buy two or more travel services from different companies that are linked. For example, you book a flight on one website and click on a targeted link to another website where you book accommodation for your trip.

The second booking must be made no later than 24 hours after the first, to count as a linked travel arrangement.

You have fewer rights with a linked travel arrangement than with a package contract and you’re only covered against insolvency with the first booking.

What does repatriation mean?

It’s the return of someone to their own country. For example, if you fall seriously ill during your holiday you’d have to travel back to Ireland early and may need treatment on the flight home.

Emergency repatriation can be very expensive because you may need to travel back to Ireland in a specialist air ambulance, or you might have to be brought home from a remote location.

Repatriation is usually included in the medical cover benefit of a travel insurance policy, but check the policy document to make sure.

- (01) 254 1300

- open mobile menu close mobile menu

Travel Insurance

Finally getting down to planning that trip away? At Quote Devil we are committed to offering great value Travel Insurance and by arranging cover exclusively online we can pass these savings on to you.

You’re minutes away from ensuring your next holiday is protected so you and your family can focus on enjoying your next break.

Click here for the quote!

Travel Insurance Discount

Enjoy 10% OFF travel insurance today with promo code DEVIL10. Click here to see how much you can save.

Multi Trip Insurance

Multi trip travel insurance is the best type of policy for most people. It’s an annual policy so you only have to worry about it once a year and then you can forget about it until you receive your renewal in twelve months’ time.

Whether travelling for business or pleasure our multi-trip policy has you covered. The main reason for travel insurance is to cover for emergency medical expenses including 24 hour emergency assistance, lost or stolen money or personal property, and the cancellation or curtailment of your holiday.

Single Trip Insurance

Looking for one off holiday cover? At Quote Devil we have you covered by providing you with some of the best value single trip cover on the market. You’re only a few clicks away from securing a great price and the peace of mind you need.

Treatment abroad and medical repatriation can be expensive, and it’s easy to end up with a big bill if you fall sick or are injured overseas. Although it’s a great idea to get a European Health Insurance Card (EHIC), is it highly recommended you also take out a suitable travel insurance policy to cover your holiday.

Our single trip policies also cover you for emergency repatriation, holiday cancellation, delays, lost luggage, and theft of personal belongings.

Regular Traveler? Maybe consider one of our Multi-Trip policies and allow yourself a stress free 12 months!

Covid-19 Cover

Quote Devil travel insurance policies include extra protection against Covid-19. All of our travel policies include Covid-19 Medical and Cancellation Cover as standard.

Winter Sports Travel Insurance

Going skiing this winter? Quote Devil has you covered! Our online quote form includes the option to add winter sports cover , either for a one-off trip or as part of your annual multi trip policy

We cover all of the following;

- Cross-country skiing

- Glacier walking or trekking

- Ice skating

- Mono skiing

- Off-piste skiing

- Off-piste snowboarding

- Recreational ski or snowboard racing

- Snowboarding

- Snowmobiling

- Tobogganing

Backpacker Travel Insurance

If you’ve finished your studies and aren’t yet ready for the working world, now is a great time to see the world. Although it might seem a good idea to save on this part of your trip, paying for insurance can be the best thing you can do.

Travelling with Medical Conditions

Are you sick of being charged through the roof for travel insurance because you have a pre-existing medical condition? Quote Devil can help.

Our online medical screening system is easy to use and means you can still get a quote online. If cover is refused for your pre-existing medical condition, we will only exclude any claims relating to that medical condition. The rest of your travel insurance cover will not be affected by this exclusion.

Age Related Travel Policies

You are retired and your feet are starting to get itchy. Now is the time for your S.K.I. Holiday (Spend the Kids Inheritance!).

Taking into consideration health conditions, we aim to provide cover for all ages including those in their golden years. Unlike most other providers of travel insurance Quote Devil can offer you a single trip or annual policy up to the age of 86, with a maximum travel duration of 31 days.

Have any questions?

If you’ve still got a question about our travel insurance policies please call us on 01 245 1300.

Please see policy wording for full terms and conditions including maximum trip durations and cover limits.

IMAGES

VIDEO

COMMENTS

In general, travel insurance costs about 3 - 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans: With AXA Travel Protection, travelers to Ireland will be offered three tiers of insurance: Silver, Gold and Platinum.

Sunway Holidays. Save 5% with Sunway. View offer. We find this an excellent incentive to keep our insurance with AXA. Others are cheaper but with all we save using the AXA breaks, AXA are the best. Thank you. We like the whole idea very much and would like to see it continue .It certainly keeps me from moving to another insurer.

With AXA travel insurance you benefit from assistance throughout your trip: before, during and after and everywhere in the world. Take advantage of our comprehensive guarantees: coverage of your medical expenses abroad, 24-hour medical assistance, teleconsultation, travel cancellation insurance, repatriation insurance and loss of luggage.

We pride ourselves on our exceptional customer service, and always strive to provide a great experience for our valued customers. Our customer reviews are independent and unbiased. AXA Insurance Ireland provides insurance for homes, cars, vans and more. Get an insurance quote online, by telephone or by visiting one of our local branches.

The maximum stay on a visitor's visa is 90 days. AXA's Europe Travel insurance offers extensive protection for those traveling to Ireland - as it can cover medical expenses up to €100,000 in Ireland and other Schengen Area countries. It also allows you to obtain the travel insurance certificate required with your visa application.

If you become sick in Europe, travelers with AXA Travel Protection can contact the AXA Assistance hotline 855-327-1442. Contact information is typically provided within the insurance documentation. Please ensure to read through your policy details and information.

With our travel insurance we can take great care of you too. GET A QUOTE. Whether traveling domestically or internationally, you want to plan for the unexpected. Our travel protection plans include many benefits such as Trip Cancellation, Trip Interruption, Emergency Medical Expense, Emergency Evacuation and Baggage Delay to help give you peace ...

AXA is the number one provider of travel insurance for trips to Europe and offers assistance 24/7, as well as other options and tailor-made products. Other coverage available includes our Europe Travel insurance, costing €33 per week, or Schengen Multi Trip insurance, which is perfect for regular travelers and available for €328 for a year ...

An insurance plan that fully protects your particular trip is a vital part of any travel planning process. Unforeseen circumstances such as flight delays or cancellations, lost baggage, and medical emergencies can be very stressful, time-consuming and expensive. While we can't prevent or predict an unfortunate turn of events, we can prepare ...

Travel Assistance Wherever, Whenever. Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage. 855- 327- 1441.

Platinum. Platinum is AXA's highest tier level. This plan includes: Trip delay: $300 per day, with a $1,250 maximum. Trip cancellation: 100% of the trip cost. Trip interruption: 150% of the trip ...

With AXA Car Insurance, you are covered to drive in the following countries: Republic of Ireland, Northern Ireland, Great Britain, Isle of Man and the Channel Islands. Your policy is also automatically extended to cover you to travel to EU member states for up to 90 days in any period of insurance.

Ucompare's tool does all the hard work for you and helps you to compare & buy cheap travel insurance in Ireland. Whether it's the annual travel insurance, single trip, backpacker travel, or global travel insurance; fill in our simple form & get multiple quotes to compare & choose the best insurance.

Compare Insurance Ireland is an Irish comparison site offering helpful information about travel insurance limits and benefits. Compare holiday insurance quotes today for great deals. If you are renting a car, don't forget to compare car hire excess insurance for cheap quotes. Insurance schemes include Blue Insurance Ltd T/A Multi-Trip Travel ...

Standard single trip insurance could cost you less than €25 if you are young with no underlying medical conditions, but may not provide the cover you need if it's very cheap. Annual or multi-trip travel insurance could cost around €50 or more for European cover and €65 or more for Worldwide cover. The older you are, the higher the ...

Simply sign up for our Online Travel Insurance today to receive medical coverage adapted to your individual needs, with a global network ready to assist you 24 hours a day, 7 days a week, wherever you happen to be in the world. Find out what makes AXA the world's leading insurance provider. Discover all our travel insurance shops around the ...

If you choose international insurance with AXA - Global Healthcare, you can be sure of: Medical cover that's designed for life, from mental health support ¹ to emergency surgery. International specialist and expert care when and where you need it with our Virtual Doctor service 2. Quick payouts - Over 80% of eligible claims 3 are paid ...

If you've still got a question about our travel insurance policies please call us on 01 245 1300. Please see policy wording for full terms and conditions including maximum trip durations and cover limits. Compare Cheap Travel Insurance in Ireland. Get Holiday Insurance on Backpacking, regular travelling & Multi-Trip Insurance.

To make a travel insurance claim, please call the AXA Assistance Claims Centre as soon as possible on: From Ireland Phone - 01 4311204. From Abroad Phone - 00 353 143 11204. When contacting the claims department, please quote Ref: AA Travel Insurance and have the following information to hand; Policy number. Date Insurance purchased.

Great Value Travel Insurance. At Chill, we can offer you the right level of cover for your annual family holiday, city break or that trip of a lifetime you've been promising yourself to go on for ages. Customise your trip type, destination, and cover level to get an online travel quote in minutes. Then get back to booking your flights, looking ...

Today at 18:30. Hundreds of drivers are getting refunds after being overcharged for their motor insurance by Axa. The overcharging blunder goes back a number of years and relates to the failure of ...

Car insurance. Get AXA Car Insurance from as little as £306 (10% of AXA Comprehensive Car Insurance customers paid this or less between 1 December 2023 and 29 February 2024).We pay out 99.8% of car insurance claims (Data relates to personal car insurance claims for policies underwritten by AXA Insurance UK plc from January to December 2023).