Hawaii Is the Latest Place to Consider a Tourist Tax—Here's Where Else Travelers Need to Pay to Enter

By Olivia Morelli

Hawaii is the latest destination to consider taxing visitors to help address the effects of climate change and overtourism, two issues that are particularly front of mind in the Aloha State following the devastating Lahaina fire .

The so-called climate tax is part of a bill first introduced in January that could pass as early as this spring. If approved, visitors to Hawaii would be charged a $25 flat fee during check-in at hotels and short-term rentals. The money would go onto support sustainability initiatives in the state including wildfire and flood prevention, coral reef restoration, emergency water supplies, green infrastructure, and coastal restoration.

The concept of tourist tax isn’t a new one. They have long been the norm for many countries in Europe such as Greece, Spain, and Germany, and hotel tax is standard across many destinations, including US states. The impact of the pandemic on the travel industry was severe—hotels, restaurants and hospitality venues closed, people that relied on tourism for their livelihoods suddenly faced huge losses, and money that the government relied on for development and maintenance was depleted. As a result, many countries have decided to implement a tourist tax to help support local needs. Below, we take a look at what exactly tourist tax is, and which places are introducing the measure for 2024.

Bhutan's tourist tax (one of the most expensive fees on the list) recently decreased from $200 to $100 per night.

What is tourist tax?

Originally, tourist tax was introduced by certain governments with the aim of tempering overtourism and generating income from large numbers of travelers entering the destination. Bhutan , for example, has asked tourists to pay a significant sum of money to enter since it opened to international visitors in 1974. The country uses the tax (called the Daily Sustainable Development Fee) in an attempt to preserve the country’s natural, undisturbed beauty and to protect traditional Buddhist culture . Barcelona , meanwhile, uses the city’s tourist tax to fund local construction and development projects. Most tourist taxes are added onto the cost of your accommodation in the form of a percent or flat fee.

Which destinations will begin imposing tourist taxes in 2024?

- This January, Iceland reintroduced its tourist tax following a pandemic hiatus.

- The Indonesian government began taxing travelers visiting Bali from February 14, 2024.

- In 2024, the UK is imposing a new system called an Electronic Travel Authorization (ETA), whereby visitors from the US, Europe, Australia, and Canada will be required to apply for permission and pay to enter the country.

- Pro tip: Next year, the EU will begin implementing a new tourist visa , whereby non-EU citizens traveling from outside the Schengen zone will need to fill out a €7 (around $7.57) application to enter the country.

Bali started charging tourists a $10 entrance fee on February 14, 2024.

Which destinations currently impose tourist tax?

The below destinations currently impose tourist taxes on travelers entering the country, but the amount of tax charged changes frequently. While we have included some guidance on projected costs, make sure you check with your accommodation or the tourism board for each destination before traveling.

- Austria : The cost of tourist tax is typically added onto your accommodation bill, and is around 3.2% in Vienna.

- Belgium : In Brussels, the tourist tax is typically below $5 and is added onto your accommodation bill, but it varies from city to city.

- Bhutan : Visitors to Bhutan are required to pay a daily Sustainable Development Fee of $100 per person.

- Bulgaria : Tourist tax in Bulgaria varies on destination and hotel standard, but it is usually below $2.

- Caribbean islands: Most of the Caribbean islands charge tourist tax, and the price ranges depending on the island–in St Lucia, for example, it is around 8%, whereas in the Dominican Republic it is 18%.

- Croatia : The cost of tourist tax in Croatia depends on the season you are traveling in and where you are staying.

- Czech Republic: In Prague , tourist tax typically costs around CZK 50 per night (around $2).

- France : Tourist tax here is based on a municipal rate, but the standard cost is typically under $6 a night. As of this January, the nightly visitor fee in Paris has increased to between $3 and $17, dependent on hotel type.

- Germany : It varies from city to city–in Berlin , the standard tourist tax is 5% of the accommodation price.

- Greece : The price you pay in Greece depends on the standard and size of your accommodation. It shouldn’t be more than $5 per night.

- Hungary : Travelers should expect to pay around 4% of the cost of accommodation per night.

- Iceland: The newly reintroduced fee applies to travelers staying at campsites (about $2), hotels (about $4), and cruises (about $7).

- Italy: Venice will begin charging tourists a €5 nightly fee (about $5.50) in 2024.

- Indonesia: Starting on February 14, travelers will have to pay 150,000 rupiah (around $10) upon entering Bali .

- Italy : Depending on the city, tourist tax can be somewhere between $1 and $8 per night.

- Japan : If you’re traveling to Japan, expect to pay 1,000 yen (about $6.65) in tourist tax.

- Malaysia : In 2023, the cost of tourist tax across Malaysia was approximately $2 per night.

- New Zealand: Travelers visiting New Zealand have to pay an International Visitor Conservation and Tourism Levy (IVL) which costs $35 NZD (about $22).

- Portugal : The country charges tourist tax in 13 cities, including Lisbon and Porto . The cost is about $2 per night.

- Thailand : The tourist tax for travelers visiting Thailand is 300 baht (about $8) for visitors arriving by air and 150 baht (about $4) for those arriving by land or water.

- The Netherlands : Amsterdam is one of Europe’s most expensive places for tourist tax–currently the rate states at 7% of accommodation price plus a flat rate of €3 (about $3.24) per person per night.

- Switzerland : The price varies depending on the destination, and it ranges from about CHF 2 (about $2.30) to CHF 7 (about $8) per person per night.

- Slovenia : Again, the rate changes from destination to destination (it is higher in cities than in more rural areas), but generally the cost is around €3 (about $3.24).

- Spain : Several cities in Spain have recently decided to raise the price of tourist tax, and other cities are in discussions about following suit. In Barcelona, the fee is €4 (about $4.30), whereas in the Balearic Islands the fee is between €1 (about $1.10).

- USA: When traveling to the US, visitors need to apply for an ESTA (Electronic System for Travel Authorization), which is a type of visa allowing travellers to stay in the country for up to 90 stays. It is valid for two years. The cost of an ESTA is $21. A version of this article was originally published on Condé Nast Traveller UK .

By signing up you agree to our User Agreement (including the class action waiver and arbitration provisions ), our Privacy Policy & Cookie Statement and to receive marketing and account-related emails from Traveller. You can unsubscribe at any time. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Awesome, you're subscribed!

Thanks for subscribing! Look out for your first newsletter in your inbox soon!

The best things in life are free.

Sign up for our email to enjoy your city without spending a thing (as well as some options when you’re feeling flush).

Déjà vu! We already have this email. Try another?

By entering your email address you agree to our Terms of Use and Privacy Policy and consent to receive emails from Time Out about news, events, offers and partner promotions.

- Things to Do

- Food & Drink

- Arts & Culture

- Time Out Market

- Coca-Cola Foodmarks

- Los Angeles

Get us in your inbox

🙌 Awesome, you're subscribed!

These are all the destinations you’ll need to pay extra to visit this year

More and more popular travel destinations are introducing tourist taxes to tackle problems caused by overtourism – here’s what you’ll have to pay

This year, international travel is forecast to bounce back to the highest levels since 2019 – and while that’s great news for the tourism industry in general, many cities, attractions and entire regions are suffering under the weight of overtourism .

The potential for damage to historic sites, unhinged tourist behaviour and the simple issue of overcrowding are all common consequences of overtourism. That’s why a growing list of popular travel destinations have introduced a tourist tax, with the hopes of controlling visitor numbers and improving local infrastructure to better cater to higher visitor capacity.

Many countries and cities introduced a tourist tax in 2023, and many more are due to launch theirs in 2024. Tourist taxes aren’t a new thing – you’ve probably paid one before, tied in with the cost of a plane ticket or the taxes you pay at a hotel.

However, more destinations than ever before are creating this fee for tourists, and many places have increased the cost of existing ones. Here’s a full list of all the destinations charging a tourist tax in 2024, including all the recently introduced and upcoming tourist taxes you need to know about.

Austria charges visitors a nightly accommodation tax which differs depending on province. In Vienna or Salzburg , you could pay 3.02 percent per person on top of the hotel bill.

Belgium , like Austria, has a nightly fee. Some hotels include it in the rate of the room and add it separately to your bill, so read it carefully.

The rate in Brussels is charged per room, and varies depending on the size and rating of your hotel, but is usually around €7.50. Antwerp also charges per room.

Bhutan has always been known for its steep tourist taxes and charges. In 2022, the Himalayan kingdom tripled the amount it charged visitors in tax to a minimum of $200 per day , but that amount has since been lowered. In 2024, the daily fee for the majority of visitors is $ 100, and that is due to continue until August 31, 2027.

Bulgaria applies a fee to overnight stays, but it reaches a maximum of only €1.50.

Caribbean Islands

The following Caribbean Islands charge a tourist tax, ranging from between €13 to €45: Antigua and Barbuda, Aruba, the Bahamas, Barbados, Bermuda, Bonaire, the British Virgin Islands, the Cayman Islands, Dominica, the Dominican Republic , Grenada, Haiti, Jamaica, Montserrat, St. Kitts and Nevis, St. Lucia, St. Maarten, St. Vincent and the Grenadines, Trinidad and Tobago, and the US Virgin Islands.

The tax tends to be tied into the cost of a hotel or a departure fee.

Croatia only charges its visitors a fee of 10 kuna (€1.33) per night during peak season.

Czechia (also known as Czech Republic)

Czechia only applies a fee to those travelling to Prague . It doesn’t apply to those under the age of 18, and is less than €1 per person, per night.

France ’s ‘taxe de séjour’ varies depending on city, and tends to be added to your hotel bill. It varies from €0.20 to €4 per person, per night.

Earlier this month, Paris announced it would be increasing its fee by up to 200 percent for those staying in hotels, Airbnbs, and campsites, but that it plans to put the funds towards improving the city’s services and infrastructure.

READ MORE: The cost of visiting Paris will soar this summer – here’s why

Germany charges visitors a ‘culture tax’ (kulturförderabgabe) and a ‘bed tax’ (bettensteuer) in certain cities, including Frankfurt , Hamburg and Berlin , which tends to be around five percent of your hotel bill.

Greece ’s tourist tax is based on numbers. Specifically, how many stars a hotel has, and the number of rooms you’re renting. The fee was introduced by the Greek Ministry of tourism to help pay off the country’s debt, and can be anything from €4 per room.

Hungary charges visitors four percent of the price of their room, but only in Budapest .

Iceland is introducing a tourist tax to protect its ‘unspoilt nature’ this year, which will cost between €4 to €7 per night. It comes after annual tourist numbers reached an estimated 2.3 million per year.

In Indonesia , the only destination which charges a tourist tax is Bali , and the fee is set to increase this February to $10 (£7.70, €8.90, IDR 150,000) – but is a one-time entry fee, not a nightly tax. It apparently goes towards protecting the island’s ‘environment and culture.’

Much like in France, Italy ’s tourist tax varies depending on your location. Rome ’s fee is usually between €3 to €7 per night, but some smaller Italian towns charge more.

Venice finally announced in September that its tourist tax, a €5 (£4.30, $5.40) fee which will be applicable on various days during high season, will launch in 2024. It only applies to day-trippers rather than those staying overnight, though.

Japan has a departure tax of around 1,000 yen (€8).

Malaysia has a flat-rate tax which it applies to each night you stay, of around €4 a night.

New Zealand

New Zealand ’s tax comes in the from of an International Visitor Conservation and Tourism Levy of around €21 which much be paid upon arrival, but that does not apply to people from Australia.

Netherlands

The Netherlands has both a land and water tax. Amsterdam is set to increase its fee by 12.5 percent in 2024, making it the highest tourist tax in the European Union.

Portugal has a low tourist tax of €2, which applies to all those over the age of 13. It’s only applicable on the first seven nights of your visit and applies in 13 Portuguese municipalities, including Faro, Lisbon and Porto.

Olhão became the latest area to start charging the fee between April and October. Outside of this period, it gets reduced to €1 and is capped at five nights all year round. The money goes towards minimising the impact of tourism in the Algarve town.

Slovenia also bases its tax on location and hotel rating. In larger cities and resorts, such as Ljubljana and Bled, the fee is higher, but still only around €3 per night.

Spain

Spain applies its Sustainable Tourism Tax to holiday accommodation in the Balearic Islands to each visitor over the age of sixteen. Tourists can be charged up to €4 per night during high season.

Barcelona ’s city authorities announced they plan to increase the city’s tourist tax over the next two years – the fee is set to rise to €3.25 on April 1, 2024. The council said the money would go towards improving infrastructure and services. This is in addition to regional Catalan tax.

Switzerland

Switzerland ’s tax varies depending on location, but the per person, per night cost is around €2.20. It tends to be specified as a separate amount on your accommodation bill.

Thailand

Thailand introduced a tourist tax to the price of flights in April 2022, in a similar effort to the Balinese aim of moving away from its rep as a ‘cheap’ holiday destination. The fee for all international visitors is 300 baht (£6.60, $9).

The US has an ‘occupancy tax’ which applies across most of the country to travellers renting accommodation such as hotels, motels and inns. Houston is estimated to be the highest, where they charge you an extra 17 percent of your hotel bill.

Hawaii could be imposing a ‘green fee’ – initially set at $50 but since lowered to $25 – which would apply to every tourist over the age of 15. It still needs to be passed by lawmakers, but if approved, it wouldn’t be instated until 2025.

The European Union

Finally, the European Union is planning on introducing a tourist visa , due to start in 2024. The €7 application will have to be filled out by all non-Schengen visitors between the ages of 18 and 70, including Brits and Americans.

READ MORE: Why sustainable tourism isn’t enough anymore

Stay in the loop: sign up to our free Time Out Travel newsletter for all the latest travel news.

- Liv Kelly Contributing Writer

Share the story

An email you’ll actually love

Discover Time Out original video

- Press office

- Investor relations

- Work for Time Out

- Editorial guidelines

- Privacy notice

- Do not sell my information

- Cookie policy

- Accessibility statement

- Terms of use

- Modern slavery statement

- Manage cookies

- Advertising

Time Out Worldwide

- All Time Out Locations

- North America

- South America

- South Pacific

Destinations behind a paywall? What to know about the increasing tourist fees worldwide.

Travelers to Venice will have to pay up to see its historic canals and islands, which are UNESCO World Heritage Sites.

To regulate heavy tourist traffic and “protect residents,” the City of Water announced tourist groups will be capped at 25 people – about half the capacity of a tourist bus – and ban loudspeakers, which create “disturbances,” according to the Italian city. Over the summer, crowds in St. Mark’s Square, the city’s main plaza, caused bridges to back up , and tourists saw overflowing trash cans.

The city said the biggest culprits are day-trippers, who don’t add much economic value to the city – like eating at local hotels or restaurants – while still putting pressure on the city’s infrastructure. In 2022, 30 million people visited the City of Canals, but only 3.2 million stayed overnight in the historic city center.

“I refuse to visit the city during tourist season even when friends and family are staying with me because the crowds are so crazy,” Nathan Heinrich, an American writer and designer who holds dual citizenship in Italy and lives just outside Venice, told USA TODAY.

This year, the city will trial a new day-tripper entrance fee of €5 per person ($5.44) during 29 peak days between April and mid-July. To enforce the fee, daytime visitors must register online and download a QR code, which officials will randomly ask to verify. If a traveler doesn't have the code, they can pay the tax on the spot along with an extra fine of up to €100 ($108.82).

Learn more: Best travel insurance

What to do in Hawaii? Locals weigh in on if these popular spots are worth the hype

The news makes Venice the latest popular destination to increase fees aimed at tourists. Last year, Amsterdam announced it would increase its tourist tax by 12.5%, making it the highest in Europe. Closer to home, Hawaii failed to pass a widely supported bill in May that would make tourists pay for a $50 pass to enjoy the islands’ natural beauty.

As the demand to see and experience new places only strengthens, many popular destinations are working to add or increase fees aimed at the sheer number of travelers they get.

“There are concerns about overtourism and the strain it puts on the local infrastructure, the environmental impacts, and frankly it’s just a revenue stream,” Jason Block, CEO of travel advising company and a collection of travel brands known as WorldVia Travel Group, told USA TODAY. “You look at these places that are really dependent on tourism as an industry – and especially coming out of the pandemic where they lost a lot of that revenue – they’re playing a little bit of catch-up. They’re also seeing other destinations implementing without much impact to demand.”

Experts consider these fees the future of travel, so here’s how they are going to affect travelers.

What are tourist taxes?

Tourist taxes are “something virtually every destination has in some shape or form” as a way to generate income from travelers, Block said.

Nearly all destinations have a lodging tax, which is automatically added to your final hotel bill. Honolulu raised its lodging tax two years ago, adding up to 18% onto the hotel room rate. Destinations also have similar fees added onto final airline ticket prices or port charges if traveling by cruise ship.

More destinations are raising these fees to coincide with the increased demand. In January 2023, Aruba raised its lodging tax from 9% to 12.5%, and Amsterdam’s will rise from 7% to 12.5% this year.

As for entrance fees like Venice’s or the upcoming electronic visa for the United Kingdom , these are newer concepts, but Block fully expects them to stay.

“The lodging taxes have been there forever now, but you’re seeing places that have a separate environmental fee or levy or another line item, like an entry fee,” Block said. “You’ll see three, four, five line items. So it starts with your simple hotel transaction or a short weekend flight, a night in a hotel, and activities could have a lot of different tax lines.”

Where does the tourist tax revenue go?

It’s not all bad news for travelers, Block said.

The money from tourist taxes are more likely than not reinvested into the destination. Though the revenue is typically aimed at improving life for the residents, it will also “make the travel experience better,” Block said. “One of the worst things you can do is pay for your dream trip to Venice and have a bad experience because the sewers are overrun or the roads are bad.”

Not so hidden. Blame social media and pent-up demand for exposing your favorite hidden vacation spot

Iceland , known for its striking natural beauty, said it would broaden its accommodation tax to help protect its environment for future generations. The fee increase also aligns with the country’s goal to be carbon-neutral by 2040.

“Tourists are enjoying (these resources), so they should foot part of the bill,” Block said.

How are tourist taxes going to affect travelers?

It depends. As more places introduce more fees, there can be concerns of a lack of transparency, Block said. It’s crucial for travelers to look closely at the breakdown of their airfare or hotel room and not just base their budget off the advertised price, he added.

Though these fees seem inconsequential at first, they can add up. “When you add it all up for a week for a family of four, even if you’re sharing a single hotel room, that’s not insignificant,” Block said. Paris charges a flat €4 ($4.35) per person per night lodging fee, so for a family of four for seven nights, there’s an additional €112 ($121.88) on the hotel bill.

Despite this, many travelers support the fees if it means contributing to the destination’s sustainability.

"It's such a stunning place, with its canals and narrow alleys, but the sheer number of people visiting is putting a strain on it,” said Kayden Roberts, a digital nomad who visited in 2023. “Introducing a tourist tax here makes a lot of sense. It's not just about making money; it's about keeping Venice beautiful and preserving its cultural and historical treasures.”

Heinrich, the American designer, doesn’t think tourists will even bat an eye at the fees and will continue with their travel plans. “Anyone who can afford to take a trip to Italy can most likely afford a few extra euros to take a day trip into the city,” he said.

Others are worried the increase in tourist taxes could limit accessibility for travelers with lower budgets, but finding a solution is tricky. “This could be the start of a slippery slope of exclusivity that puts popular and important tourist destinations behind a paywall," said Heather Rameau, a content creator for travel brands based in Washington, D.C. “Ultimately, we all share this world and deserve access to see its beautiful places.

“Is there a need to better regulate and control the number of people visiting popular tourist spots, especially those that have a delicate ecosystem or are at risk due to climate change or other factors? Yes,” she said. “But is charging more money the way to do it? I'm not sure.”

Where has the highest tourist taxes?

- Amsterdam: 12.5% of the nightly lodging rate

- Barcelona: - Up to €6.25 ($6.80) per person, per night

- Paris: - About €4 ($4.35) per person, per night

- Dominican Republic: 23% of the hotel rate goes to taxes

- Antigua and Barbuda: $100 for entry/exit fee

- Honolulu: Up to 18% of the nightly lodging rate

Latest News

BestPrice travel to promote the image of Vietnam at New York’s times square

How private MCAT tutors address specific weaknesses or areas of improvement for medical school applicants

Marriott International celebrates the 2024 J. Willard Marriott Awards of Excellence honorees

Landal GreenParks UK sees big growth in inbound holiday market

Next generation leaders earn their seat at the table at IMEX Frankfurt

RDB Hospitality expands luxury services with addition of Lenox VIP Global

Ronald Leitch appointed Chief Operating Officer of AGS Airports

NH Collection’s debut in Finland continues a proud legacy of legendary hospitality

Deepak Chopra aboard SH Diana in New York as Swan Hellenic announces two new “Explore & Restore” cruises in Brazil

VisitEngland joins forces with AccessAble to promote new tourism accessibility guides

What is the tourist city tax and who is charging it?

By reading this article, you will find out exactly what a tourist city tax is, who is charging it, and, more importantly, why is it being charged?

If you’ve recently visited Europe, you might have been asked to pay a tourist city tax. Most travelers out there wonder if this practice is legal, as they don’t know exactly what it means. However, there is a large number of European countries and cities that have implemented this so-called tourist city tax.

Therefore, we are here to answer all of your questions related to it. By reading this article, you will find out exactly what a tourist city tax is, who is charging it, and, more importantly, why is it being charged?

Without any further ado, let’s get right into it!

The history of the tourist city tax Up until recently, people didn’t actually realize they were charged a tourist city tax. Yes, that’s true, you were probably being charged with one of these fees if you have visited Europe in the past 20 years.

Reportedly, the city of Paris introduced a fee similar to what we know today as tourist city tax way back in 1994. At that time, plenty of other countries, such as Austria, Switzerland, Germany, Greece, and the Netherlands, were charging this fee.

The reason for which nobody was noticing is that it was actually incorporated in the accommodation price. So, if you ever thought that the prices seem a little bit inflated, it was because of this fee.

However, things have evolved, and apartment stays and B&B services appeared on the market out of a sudden. Let’s see how this fact influenced the tourist city tax and made it be excluded out of the accommodation price and actually charged in cash when a customer is leaving a certain hotel.

The reason behind the tourist city tax First of all, it is entirely legal – therefore, don’t worry; you haven’t been scammed if you were asked to pay such a fee. According to various sources, the tourist city tax was implemented because of the poor economy of some countries and cities.

As the state of the economy was decreasing, the municipalities of some cities were having a hard time maintaining the infrastructure of the respective cities. Therefore, they came up with a fee that applies to non-residents, in order to alleviate some of the problems they were facing.

For example, in Milano, the tax has been in force since the 1st of September 2012. One of the regional laws that describe this fee states that hotels and non-hotels are both seen as accommodation facilities and, therefore, they should demand such fee from their customers.

So, you are likely to be charged such a fee if you stay in hotels, motels, and touristic residences. Moreover, you can also be charged if you rent a vacation home, a mountain hut, a hiking shelter, apartments, or stay in youth hostels, or any type of outdoor accommodations.

How is the tourist city tax applied? Usually, the fees apply to one person and for one day of stay. You will most likely be asked to pay this tax in cash, at the moment you check-out out of your accommodation. In Rome, for example, the tax changes according to the type of accommodation you are staying in. If you have a room in a 3-star hotel, you will have to pay two Euros per person, per night. However, if you stay in a 4- or 5-star hotel, you will have to pay three Euros per person, per night.

On the other hand, in Amsterdam, Berlin, and Cologne, the tourist city tax is 5% of your hotel room bill. Moreover, you might be required to pay such a fee for your children as well – but Italy does not usually charge individuals that are under 14 or 16 years old.

It’s important to remember that the tourist city tax has to be paid for a maximum of ten nights spent in a certain hotel or type of accommodation that charges this fee. That said, if you book a multiday tour with accommodation stays etc. on tour and holiday booking portal such as Bookmundi, the price they list is included includes Tourist City Tax.

Furthermore, not only European countries seem to be affected by this tax. We say affected because a lot of people don’t realize that they were going to pay it anyway, even if it was hidden in the accommodation price or not. Reportedly, Dubai and America have also introduced tourist city taxes.

Where does the tourist city tax go? As we mentioned before, the municipality of the city is responsible for the city tax – they charge it and they take it. We also said that the money resulted from the tourist city tax is used to fix certain economic problems. It is usually used to support and develop the local tourist industry, while in some countries, the money is used to raise revenue for government departments that have been hard-pressed.

Therefore, you don’t have to think wrong of the tourist city tax, as in most countries, it is used to improve your stay there. For example, in Catalonia, Spain, this tax has helped raise around 126 million Euros – which has been equally split between town halls, local tourism boards, and the Catalan Tourism Agency.

The bottom line So, now you know exactly what a tourist city tax is – it’s basically a fee that you’ve always been paying if you’ve visited some popular European cities and is used to support the development of tourism in those areas.

Most tourists are quite scared about this tax, but for no reason at all. It’s true, we don’t like the fact that we’re being charged a fee just because we are tourists, but this is how things work and this is how local accommodation communities get the support they need, especially if they are located in countries with a poor economy.

For example, take a look at Greece, a country that’s been in economic crisis and recovering from it for a long time. It is one of the most beautiful countries in the world and the accommodation there is quite cheap as well – we wouldn’t mind having to pay some extra euros to support it, right?

We hope that our article made you understand better the purpose of this tourist city tax so that the next time you are asked for one you don’t get all confused and you can just enjoy your stay!

Stavros Andriopoulos

- Stavros Andriopoulos https://www.traveldailynews.com/author/stavros-andriopoulos/ Secret havens: Unlocking hidden gems of the luxury world with VIP access

- Stavros Andriopoulos https://www.traveldailynews.com/author/stavros-andriopoulos/ Meet Porto Angeli Beach Resort and Olympic Palace Resort in Rhodes island, Greece

- Stavros Andriopoulos https://www.traveldailynews.com/author/stavros-andriopoulos/ The pros of visiting land-based casinos during your travels

- Stavros Andriopoulos https://www.traveldailynews.com/author/stavros-andriopoulos/ Planning a trip to China with kids

Related posts

Previous post, str: emea, central/south america hotel performance for august 2018, new bedford harbor hotel joins the ascend hotel collection.

eSIM Go launches global travel eSIM service in partnership with SWISS

Impress your Airbnb guest on their next vacation

McDreams becomes Europe’s first hotel group to roll out 100% AI-powered phone system integrated with Like Magic

Europeans defy costs and conflicts to embrace travel in Summer 2024

SAS expands connectivity to Scandibavian Winter destinations

airBaltic and Bulgaria Air start codeshare cooperation

Sofitel Al Hamra Beach Resort opens its doors on the shores of Ras Al Khaimah

Prague Airport and Korean Air celebrate two decades of Seoul connection

Understanding Nevada’s modified comparative negligence law

Exhibitions & Conferences Alliance welcomes ICCA as its newest Alliance partner

BEONx and JUYO Analytics partner to streamline data access for hoteliers

Good Travel Management announces strategic partnership with Trinity Event Solutions

Finnair resumes flights to Tartu

Afreximbank funds $30m. for Silversands Hotel expansion in Grenada

AMG survey reveals consensus on importance of training but not on how to develop new advisor talent

“Tauck On Tour” events coming to UK travel advisors this Fall

Global Travel Marketplace expands and rebrands as Connecting Travel Marketplace

Sporting events elevated Madrid hotel performance in April

easyJet to open 10th UK base at London Southend Airport next spring signalling continued UK growth

Middle East hotel construction pipeline rises to 612 projects/144,222 rooms at Q1 2024

The Vinoy Resort and Golf Club hires Chris Major as Golf and Club Operations GM

IEG: The Board of Directors approves the consolidated interim report as of March 31, 2024 – Revenues at 88.9m. euros

U.S. Travel applauds passage of Long-term FAA Renewal Bill

Travel and tourism sector deal activity down by 13.5% YoY in January-April 2024, finds GlobalData

THE WELL appoints Zeev Sharon as Chief Development Officer to lead integrated wellness brand’s global expansion

Icelandair transported more than one million passengers this year

Qatar hotel market sees significant performance boost during Eid al-Fitr

New research highlights toll of business travel on mental health and a need for more support from employers

Avianca will only transport passengers aged 14 or younger who travel with their parents or a responsible adult

CEIR releases Q1 2024 index results, growth of U.S. B2B exhibition industry continues

Luxury digital concierge company The Prelude to hit $20m in first year sales

Celebrity Cruises’ revolutionary ship Celebrity Apex homeports in Southampton for first-ever season from the UK

Oklahoma Tourism and Recreation Department launches new “Find Yourself in Oklahoma” campaign

Transportation methods from Alicante airport to Benidorm

Oceania Cruises launches innovative and free marketing solution for trade partners

TAAG assumes exclusive operation od the Luanda – Lisbon route with its international fleet

Hotel rewards programs are going greener, extending across brands, new report finds

Pegasus launches direct route from Istanbul to Bratislava

MIA starts 2024 with record growth and an A+ bond rating

Time Out Market to open in Budapest

JW Marriott and Flamingo Estate debut a global brand partnership to guide travelers on a sensorial journey rooted in well-being

Yuppi Group leverages Turkish destination specialism to launch B2B hotel platform Pax2Night

Reputable merchant advance companies for business owners

Best April in Katowice Airport’s history

Erna Solberg named Havila Pollux

Soaring passenger traffic, longer stays: Mastercard Economics Institute on travel in 2024

Consistency in differentiation: How GCC is building the future of their travel destinations

Carnival Corporation rolls out SpaceX’s innovative Starlink across entire global fleet

Dream Yacht Sales welcomes Jeremy Tutt as Global Yacht Sales Director

Tribute Portfolio debuts in the United Arab Emirates with The First Collection at Jumeirah Village Circle, a Tribute Portfolio Hotel

Wellness real estate market reached $438bn. in 2023 and is forecast to more than double to $913bn. by 2028

Sojern expands its guest experience solutions to Europe

Waymore’s Guest House & Casual Club announces new General Manager

Forty-five percent of the hotel projects in Europe’s total pipeline are under construction at the end of Q1 2024

New Grill Room General Manager and Sommelier at The Windsor Court Team

Corazón Cabo Resort & Spa appoints new Director of Sales and Catering

Travel demand remains resilient in Q2 2024: TUI achieves record revenue of 3.6bn euros

First Club Med in the Middle East announced, $100 million development

Higher Lake Mead water levels bolster business for marina, boating operator

Elevate your travel experience with essential tech on a budget

Google rolls out enhanced AI-driven travel planning features

Game changers: Trends shaping college sports today

VisitScotland Connect 2024 hailed a success

Fraport Group continues growth in First Quarter of 2024

Travelport and WestJet confirm new long-term Content agreement

Sights of Belek you must visit

How to make the most of your trip to Napa Valley

South Western Railway hosted the rail industry’s first national safeguarding conference

Sabre Corporation reinforces partnership with ACI blueteam Spa with new contract

Trip.com Group and Rezdy join forces to offer new travel experiences around the world

The Ritz-Carlton, San Francisco appoints new General Manager

Berlin celebrates five years of Sustainable Meetings Berlin at IMEX

Over 200,000 additional seats from Shannon Airport this summer to destinations across Europe and the USA

Destination DC highlights impactful role in hosting global meetings at IMEX Frankfurt

WTTC and IC Bellagio partner for new consumer campaign

PCMA and The Strategic Alliance of the National Convention Bureaux of Europe announced Convene 4 Climate

Hotel Equities selected to manage first Hampton by Hilton-branded hotel in St. Thomas, U.S. Virgin Islands

Abra Group reaches agreement for strategic investment in Wamos Air

Chisinau International Airport will be the host of the International Aviation Conference

Mews acquires HS3 Hotelsoftware to bolster German expansion

Paradies Lagardère announces Q1 restaurant openings at Atlanta, Boston and Oklahoma City Airports

Generation Voyage monetizes content through affiliate sales powered by Stay22

Celestyal finalises agreement with Abu Dhabi and AD Ports Group

New dates for Essence of Africa, the continent’s premier buyer forum

LanzaJet announces Doreen Pryor as Chief Financial Officer

Neptune Luxury Resort announces culinary collaboration with acclaimed Italian chef Salvatore Andolina

Fontainebleau Miami Beach to unveil all-new coastal convention center in Q4 2024

Cvent announces Top Meeting Destinations and Top Meeting Hotels in Europe for 2024

Prague remains among world’s most sought-after meeting destinations

Over 260 applications from 60+ countries: Best Tourism Villages 2024 adventure kicks off

Seychelles and Mauritius Tourism met at the Arabian Travel Market (ATM) in Dubai

IRF and SITE, along with research partner Oxford Economics, launch 2024 edition of incentive travel survey

Explore Worldwide furthers expansion in North America with new team and Toronto office

Colletts Travel evolves with reservation module new technology from Dolphin Dynamics

Skyscanner launches Savvy Search – its new generative AI travel planning tool

BCD Meetings & Events launches three-year strategic plan following momentus growth

RiminiWellness 2024: Shaping the future of wellness and fitness industry

Traveloka becomes first Platinum Sponsor of GSTC to promote sustainable tourism

The Brunelleschi Hotel gets the prestigious Michelin Key

Minor Hotels appoints Lokesh Kumar as Vice President of Development for the Middle East

onefinestay unveils villas in Provence

Outdoorsy launches weather guarantees for RV rentals with “Roamly Weather by Sensible”

UK awards Alain St.Ange the “Nelson Mandela Leadership Award”

Resorts World Cruises to homeport in the Arabian Gulf

Dondra Ritzenthaler Takes the Helm as Chief Executive Officer of Azamara Cruises

Storrington Collective is appointed to handle the UK Public Relations for the entire Cotton Lifestyle Group

ATL Airport District appoints Rylee Govoreau as Sales Manager

Aeronology accepted into global luxury travel group Virtuoso

The world of travel and tourism: A journey through cultures and destinations

Grace La Margna St Moritz joins American Express Fine Hotels + Resorts

Digital Markets Act: European Commission designates Booking.com as gatekeeper

Al Ansari Exchange signs a strategic partnership with Etihad Airways

ASM Global Europe to open four new UK venues by 2027

Oman’s Travel & Tourism sector predicted to reach new heights in 2024, says WTTC report

Air Serbia launches contest for company mascot

Royal Caribbean’s Utopia of the Seas begins tests at sea

Traveazy Group unveils the future of B2B travel solutions at ATM 2024

Aena’s airports in Spain registered more than 25.6 million passengers in April

Qatar’s Travel & Tourism sector achieves record growth in 2024

Casablanca: A must-visit destination in 2024 according to TripAdvisor

Caribbean Week 2024 set to sparkle in New York City

BLS International secures visa outsourcing contract with Portuguese Embassy in Morocco

Caribbean tourism flourishes: Insights from CHTA at CHRIS 2024 Summit

OsaBus invested 1m. euros in new buses to expand services in Barcelona

Illinois Office of Tourism announces international visitor growth in 2023

Hyatt doubles down on Latin America growth with 30+ planned openings through 2027

The Emirates Group achieved record profits and revenue in 2023-24, driven by robust demand and strategic global expansion

Mondee Holdings announces record Q1 2024 financial results, highlighting AI-driven growth in the travel sector

The Vines Resort & Spa announce villa expansion

HyperPay showcased innovative hospitality service at Arabian Travel Market 2024

Ethiopian Airlines Group assumes management role for Ethiopia’s new Legacy Lodges through Ethiopian Skylight Hotel

ACI World welcomes new Vice Presidents to lead Events & Commercial Services, and Safety, Security, and Operations

Traveling with white snus: A guide to regulations and recommendations

Understanding wrongful deaths from a legal perspective: A guide

Portugal’s Travel & Tourism poised for historic year, says WTTC

TravelgateX returns to CON-X 2024 with a new concept, “Enough, redefined”: Pushing the boundaries in the travel industry and technology

Why the USA is the perfect host for the World Cup

Six tips for becoming a travel influencer on Instagram

Iberostar announces re-opening of 5* Iberostar Selection Creta Marine following 3 year renovation

Three smart tech must-haves for a bleisure trip

Bud & Marilyn’s takes home title of “2024 Merchant of the Year”

Introducing DEOS: A new vision of luxury by the Myconian Collection

Delta Air Lines operates its Prague – New York route again

Emirates return to Edinburgh Airport, Pegasus starts twice weekly flights to Istanbul

British Airways announces the launch of its new Customer Access Advisory Panel

Air India strengthens presence in Europe with additional flights to Amsterdam, Milan and Copenhagen

Ryanair extends Trinity College Dublin partnership to 2030

Redefining luxury in the Middle East: Insights from Arabian Travel Market 2024

Sheen Falls Lodge partners with Seabody for enhanced wellness experience

UN Tourism puts spotlight on investments and empowerment at AIM Congress

IAG reports strong First Quarter, forecasts positive outlook for 2024

Amsa Hospitality and Radisson Hotel Group extend partnership with the signing of Radisson Hotel Madinah set to open this year

Alaska Airlines launches new way for guests to join the journey to help make air travel more sustainable

Copthorne Hotel Aberdeen unveils major renovations

Top-performing airlines set themselves apart with friendly staff, J.D. Power finds

Hilton announces Dale MacPhee as General Manager of Conrad Washington, DC

Bardessono Hotel & Spa in Napa Valley unveils $1.8m. guestroom renovations

Mews and YouLend partner to launch “Flexible Financing” for hospitality expansion

British Airways Holidays unveils 2024 travel trends influencing UK consumers

Daniel Alexander of Tanjung Kelayang Reserve in Indonesia and President of MTPA met Seychelles Consultant Alain St.Ange at ATM in Dubai

InterLnkd crowned winner of the ATM 2024 Start-up Pitch Battle, held in association with Intelak

airBaltic lunches direct flights from Riga to Skopje, Chisinau, and Pristina

El Cortez Hotel & Casino announces plans to enhance casino

JW Marriott Chicago unveils reimagined event space

Cloud5 appoints Frank Ziller as Chief Technology Officer

Vingcard enhances hotel security with MIFARE Ultralight AES compatibility

Authenticity and Innovation at the forefront of CityDNA’s “Reality Check!” Conference

Travel entrepreneur and startup funding is growing in the Middle East but more investment is needed, say industry experts at ATM 2024

Brief Travel Is Taxing in More Ways Than One

For 10 years leading up to 2020, the U.S. tourism industry was thriving. Tourism taxes accounted for nearly 6% of state and local tax collections. Then came the pandemic and everyone stayed home. A strong sector of the economy suddenly collapsed. One-third of travel jobs were lost , travel spending declined by nearly $500 billion and states lost billions of dollars in tax revenue.

In 2019, tourism generated $180 billion in tax revenues for federal, state and local governments. During the pandemic’s early days, tourism-reliant states were hit hard by declining revenues. Hawaii initially projected $300 million in lost tax collections and 6,000 jobs. New York City lost $1.2 billion in tax revenue. Nevada faced a bleak economic outlook when visitor spending declined by 52.2% from the previous year. While traditional tourist destinations faced massive losses, rural areas across America saw an uptick in travelers.

Rural areas near state and national parks saw visitor numbers grow as more people sought outdoor recreation as a lower COVID-19 risk alternative. Airbnb reported a rise in homes booked in rural areas in 2021. In Jackson Hole, Wyo. , lodging tax revenue hit record highs. Tourism tax revenue in Arkansas totaled $20.54 million in 2021, 16.7% higher than 2019 collections. While increased tourism is beneficial for state revenue, it also comes with costs. Areas that experienced a boom in visitors faced a new problem- additional stress on state and local resources.

The sudden shift to domestic rural travel during the pandemic highlights the need for policymakers to think about the burdens tourists place on state and local resources. Gini Pingenot , director of external affairs at Colorado Counties Inc., reported a lack of sufficient infrastructure to host the number of visitors that came to Colorado. In addition, individuals who live in popular tourist areas are being priced out of the communities in which they work. Both these issues reverberate in other rural areas where tourism boomed because of COVID-19. In fact, a study conducted by the University of Montana found 38% of residents disagreed that increased tourism improved the quality of life for Montana residents (the most recorded since 1992). Negative sentiment among locals in highly traveled areas has some state lawmakers modifying tourism tax legislation.

Tourism tax revenues are typically earmarked. For example, some states earmark lodging tax revenue to promote tourism. To tackle issues brought on by shifting travel preferences to small rural communities, legislators have changed the ways tourism tax revenue can be allocated. In Washington County Utah—home to Zion National Park—legislators passed a bill to increase spending flexibility for lodging tax revenue. It is no longer required to be spent on tourism promotion. Colorado legislators passed a bill to allow county lodging taxes to support affordable housing in an effort to combat rising costs in areas with heavy tourism.

The national average gas price reached a record high of $4.60 per gallon in May 2022. This year, more than 50% of Americans plan to take a domestic vacation, according to AAA. Only 42% of those travelers said gas prices would not affect their plans.

Business Tourism

Whereas domestic leisure travel is on the rise, domestic business travel continues to struggle and currently accounts for only 14% of travel spending, down from 26% in 2019. Between 2020 and 2021, $391 billion in travel spending was lost as employers halted business travel. The revenue that came from business accommodations, airfare, car rentals and event spaces plummeted at the start of the pandemic. Business travel has since resumed, but it has changed. Businesses may be forced to reduce the size or change the location of events to comply with COVID restrictions. Companies also continue to rely on video conferences and meetings.

There are conflicting opinions on the recovery of business travel. Deloitte reported likely improvement of corporate travel demand in the first half of 2022 but warned that travel was unlikely to reach near 2019 levels. The U.S Travel Association found that eight in 10 travel managers reported changes to business travel policies, including fewer business trips. The association forecasts business travel will not reach pre-pandemic levels until 2024. Yet, American Airlines and Delta Air Lines report promising business travel numbers. Hotel companies also show more optimism in business travel recovery. Hilton expects business travel to reach pre-pandemic levels by the end of 2022.

Considerations for Legislators

Policymakers seeking to capitalize economically on tourism can consider several approaches:

- Examine travel trends. Being prepared puts states in a better position to mitigate the negative impacts of increased tourism. Every state has a tourism office that collects travel data. Collaboration with that office will help policymakers develop effective tourism policies.

- Ensure coordination among the agencies with a role in tourism. State tourism offices, history preservation agencies, state park offices and transportation departments are some of the agencies where collaboration benefits state tourism.

- Assess the taxes imposed on tourist activities. The World Travel and Tourism Council warns that high tourism taxes can have a negative impact on revenue collected by deterring travelers from visiting a destination or leading to shorter stays to cut costs. Likewise, organizations and businesses hosting large events and conventions may be discouraged from visiting destinations with high tax rates. Local businesses dependent on tourist spending are also affected by high tax rates. Consumers may choose to spend less locally to offset the costs of accommodations, car rentals and airfare. On the other hand, tourism taxes can allow local governments to pay for services in the community.

Below are tables of state tax rates on lodging and car rentals.

DO NOT DELETE - NCSL Page Search Data

Related resources, fy 2025 state budget status, state taxation of short-term rentals, state tax toolkit, contact ncsl.

For more information on this topic, use this form to reach NCSL staff.

- What is your role? Legislator Legislative Staff Other

- Is this a press or media inquiry? No Yes

- Admin Email

Which major destinations charge a tourist tax (or are planning to soon)?

When traveling abroad, it's a good idea to account for any tourism taxes you must pay during your stay.

Some are a small extra cost added to what you pay for your accommodation per night. Others may be a one-and-done (or even daily) fee, such as Thailand's tourist tax . In some places like Bhutan, these fees can be quite costly.

You might find your vacation spot has implemented this kind of tax for several reasons. It could be a response to overtourism and concerns about sustainability and the environment (case in point: Venice, Italy), or it could simply be a way to help the local economy put funds back into tourism infrastructure.

Here, we'll look at top tourist destinations that charge a tourism tax and how much each will cost you.

After increasing its tourist tax in 2024, Amsterdam now has the highest tourist levy in Europe, with hotels, vacation rentals (including Airbnbs) and camping sites all charging guests an additional 12.5% of their overnight rate (excluding value-added tax).

Meanwhile, cruise travelers are charged 14 euros (around $15) as part of the "day tripper tax" for every day spent in Amsterdam. The charge, however, excludes passengers who start or end their cruise in Amsterdam and those living in Amsterdam.

Find out more about the various kinds of taxes on Amsterdam's official website .

Balearic Islands, Spain

Fees on the islands vary from 1 to 4 euros per night, depending on the accommodation type, as follows:

- 4 euros (around $4.30) for those staying in luxury hotels

- 3 euros (around $3.20) for those staying in midrange hotels

- 2 euros (around $2.15) for cruise passengers and those staying in cheaper hotels and apartments

- 1 euro (around $1) for campers and hostel guests

This sustainable tourism tax applies to Minorca, Mallorca, Formentera and Ibiza. Travelers under the age of 16 are exempt.

Germany charges tourists both a culture tax, known as "kulturforderabgabe," and a bed tax, known as "bettensteuer," in several of its more popular cities, including Berlin, Hamburg and Frankfurt.

In Berlin, the tourist tax is 5% of the room price. It varies in other cities such as Frankfurt (2 euros per night) and Hamburg (up to 3 euros per night).

Depending on the accommodation type (either the number of stars the hotel holds or the number of rooms), Greece charges 0.50 euros to 4 euros per night.

Manchester, England

The newly introduced City Visitor Charge costs 1 British pound ($1.25) per room, per night.

France's tourist tax varies depending on which city you are visiting but generally costs 0.80 euros to 4 euros per night, depending on the kind of accommodation you choose. Find out more .

This year, however, Paris' tourist tax has been raised in advance of the Summer Olympics. You can now expect to pay between 0.75 and 15 euros per night, depending on your accommodation.

The tax is 2 euros per night for the first seven nights in Lisbon, Porto, Faro and nine other municipalities. Other parts of the country that charge a tourist tax usually have lower fees, around 1 euro to 1.50 euros per night.

In the capital of the Czech Republic, there is a charge of 50 korunas ($2.11) per person, per night for hotel stays.

In Rome, the tax varies from 3 to 7 euros per night, depending on the star rating of your accommodation.

In addition to the tourist taxes for Spain's Balearic Islands mentioned above, you'll find a couple of taxes apply when visiting Barcelona.

The city charges two different taxes to tourists. The first is the city tax, which increased in April 2024 to 3.25 euros per night. Visitors must also pay a regional tax depending upon the type of accommodation they're staying in.

- 2.25 euros per night for rental accommodations

- 1.70 euros per night for four-star hotels

- 3.50 euros per night for five-star and luxury hotels

Cruise passengers also pay different amounts depending on the length of their stay. Expect to pay 3 euros for visits less than 12 hours and 2 euros for visits longer than 12 hours.

Venice, Italy

Taxes in this popular tourist destination vary from 1 euro to 5 euros per night and are paid to your accommodation. A separate tax for people visiting on a daytrip during peak times between April and mid-July costs 5 euros.

Other destinations

Additional places in Europe that charge tourist taxes include Austria, Belgium, Bulgaria, Croatia, the Hungarian capital of Budapest, Malta, Montenegro, Slovenia and Switzerland. Some locales may only have regional tourist taxes.

Tourist taxes can always be introduced later, so be sure to do your own research before you travel. This is especially true for Edinburgh, Scotland, as the city is on the brink of introducing a tax of 2 euros per night . Potential tourism tax discussions are also underway in Wales .

North America

A Transient Occupancy Tax of around 12% to 14% of the room price will appear on California hotel stays, according to Turbotax . There may be other tourism-related taxes as well.

Rates vary across the country, but Alberta, British Columbia, Manitoba, Nova Scotia and Quebec are among the areas that add a visitor tax to a hotel's price.

While Hawaii doesn't currently have a tourist tax, Hawaii Gov. Josh Green proposed a $25 fee on visitors when they arrive and check in to a hotel or short-term rental; it may pick up speed and become a reality at some point. This isn't the first time a fee on visitors has been suggested in Hawaii, with previous calls for a $50 so-called Green Fee visitor payment also recently put forward.

New York City

New York City charges a hotel room occupancy tax to visitors that costs about 14% of the room price plus up to $2 per room, per night, according to the New York City government website .

In addition to the ones mentioned above, you should expect taxes and fees on hotel stays in most other U.S. states.

Latin America, South America and the Caribbean

Buenos Aires

Tourists will pay $1.50 per room, per night when staying in Argentina's capital city.

The Caribbean

Taxes vary by country in the Caribbean. For example, Bonaire has a one-off $75 fee that tourists need to pay via its official website , while Aruba adds 12.5% to your room rate plus $3 per room, per night. In Barbados, you'll pay $2.50 to $10 per room, per night, and there will typically be a $70 departure tax already included in your flight cost.

Antigua and Barbuda, the Bahamas, Bermuda, the British Virgin Islands, the Cayman Islands, Dominica, the Dominican Republic, Grenada, Haiti, Jamaica, Montserrat, St. Kitts and Nevis, St. Lucia, St. Maarten, St. Vincent and the Grenadines, Trinidad and Tobago, and the U.S. Virgin Islands are also known to apply tourist taxes. Check details before booking or traveling, as there may be a departure tax already included in your airfare.

Galapagos Islands, Ecuador

In 2024, entry fees for visitors to Galapagos National Park are set to double in cost, with visitors now paying $200 to enter the park from Aug. 1. A reduced fee is set to be available for children under the age of 12, and children younger than 2 will be able to enter for free.

Quintana Roo, Mexico

This region charges a one-off tourist payment of 224 Mexican pesos (around $13) to visit any destination in Quintana Roo. This includes Cancun, Cozumel, Holbox, Playa del Carmen and Tulum. A tourist tax may also be added to hotel stays in these areas and other parts of Mexico.

Asia and the Pacific

Bali, Indonesia

Bali introduced a tourist tax in February 2024. It charges 150,000 rupiahs (around $9.25) in addition to other visa fees. The tax aims to combat overtourism on the popular island.

Until recently, Bhutan charged a whopping $200 fee per day. Known as the Sustainable Development Fee, this tourist tax is designed to assist with paying for infrastructure improvements, environmental efforts and fair wages for locals, among other things.

However, this was recently reduced to around $100 per day to encourage more people to visit. This is the most expensive tourist tax in the world and is paid regardless of your accommodation type.

There is a charge of 1,000 yen ($6.47) included in all airfare for flights departing Japan. Find out more .

Malaysia's tourist tax costs 10 Malaysian ringgits ($2.08) per room, per night.

The tourism tax in the Maldives ranges from $3 to $6 per day. The Green Tax total varies depending on if you're staying in a guesthouse, hotel or resort. Find out more .

New Zealand

When you book your New Zealand visa, you'll usually pay 35 New Zealand dollars ($20.60) for the International Visitor Levy.

A one-time fee of 300 baht ($8.14) was introduced in June 2023. All tourists arriving by air will need to pay this tax. For visitors who enter the country via a port or land border, the fee will be 150 baht.

Bottom line

More and more, tourist taxes are becoming a regular part of travel around the world. While these fees are nominal and shouldn't cause too much of a dent in your budget in most cases, they can rack up quite quickly in some destinations if you're not careful. Always research the fees at the destination you plan to visit before you get there, and make sure you budget for it if you don't want a surprise bill.

Related reading:

- Key travel tips you need to know — whether you're a first-time or frequent traveler

- Best travel credit cards

- Where to go in 2024: The 16 best places to travel

- 6 real-life strategies you can use when your flight is canceled or delayed

- 8 of the best credit cards for general travel purchases

- 13 must-have items the TPG team can't travel without

The pros and cons of a tourist tax

Visitor levies can boost tourism but a lack of transparency troubles critics

- Newsletter sign up Newsletter

1. Pro: pays for costs of tourism

2. con: consumer spending squeeze, 3. pro: avoids overtourism, 4. con: discourages visitors, 5. pro: supports investment, 6. con: lack of transparency.

Visitors to Wales could soon be paying more for an overnight stay amid plans to introduce a tourism tax in the country.

If the plans are confirmed Wales would follow in the footsteps of Manchester , which has introduced a tourist tax for people making overnight stays in the city and comes into operation tomorrow, said the BBC .

Many destinations around the world have tourism taxes, noted VisaGuide , including Barcelona, Venice, Thailand and Slovenia. It has proven a controversial topic though, with disagreement over whether it boosts the tourism industry or threatens its very survival.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Supporters say a tourism tax can lead to the increasingly elusive goal of a well-managed, sustainable, and lucrative tourism industry, with the costs of tourism being picked up in a well-run way.

Recommending that the Welsh government should introduce a tourist tax, the Bevan Foundation argued that such a move would “help to reflect the true costs of tourism” such as “clearing up litter, providing car parking, keeping beaches clean” and “building public footpaths”.

Some feel that adding yet more pounds to the cost of a holiday is dangerous during a cost-of-living crisis. The tourism sector in Edinburgh is, for the most part, “vocally opposed to the introduction of a tourist tax, particularly in the current economic climate”, claimed Holyrood magazine.

Marc Crothall of the Scottish Tourism Alliance told the outlet that 60% of visitors are domestic, who “may at present be reaching a tipping point due to a consumer spending squeeze”.

By increasing the cost to visit certain areas, a tourist tax can help reduce overcrowding and make the experience more enjoyable. This can help avoid “overtourism” – where locals or visitors feel that there are too many tourists, leading to deterioration in quality of life.

For instance, Bhutan has “only ever been reluctantly open to tourists”, said The Times , but now the mountain kingdom is “cranking its tourism tax to an eye-watering level” by charging up to $200 (£161) a day in tax.

The flipside is that by increasing the cost of visiting a particular location, tourism taxes could discourage some tourists from choosing destinations that actively want more visitors.

Some “deem this sort of levy unnecessary or even detrimental to the sector – driving away visitors or limiting their spending during their visit”, said accountants Knights Lowe . However, in a poll, hoteliers in Manchester voted 80% in favour of the tourist tax, said EuroNews , suggesting that fears it could damage tourism are not widespread.

A tourist tax can generate additional cash for the local government and tourism industry, which can be used to fund infrastructure and services that benefit tourists and residents alike.

“From signage to facilities to the myriad of public realm improvements that make places attractive”, tourism infrastructure comes “at public cost”, said the Bevan Foundation, and “while the public do benefit, so too does the tourism industry”, so both parties should chip in.

Some suspect that tourism taxes will simply disappear into wider local authority budgets. Perhaps the “largest challenges” of a tourism tax is “ensuring transparency around how it’s used”, said Rosie Spinks on Skift .

If the money “just goes into a general pot because local finances are strained”, said Tim Fairhurst, secretary general of the non-profit European Tourism Association, and if it’s just seen as “a classic ‘tourists don’t vote, you can get easy money off them’”, then that is “not a smart way to go”.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Cartoons Sunday's cartoons - 2024 votes, AI woes, and more

By The Week US Published 19 May 24

Cartoons Artists take on checklists, ice creams, and more

The Week Recommends This Spanish spot has fantastic restaurants "rooted in the region's distinctive produce"

By The Week UK Published 19 May 24

Why Everyone's Talking About Visitors to the Louvre have dubbed the crowded experience 'torture' as famous landmarks suffer from overtourism

By Chas Newkey-Burden, The Week UK Published 29 April 24

The Week recommends Rich in Celtic culture, coastline and castles, England's neighbouring nation has much to offer visitors

By Adrienne Wyper, The Week UK Published 19 March 24

Under The Radar Tensions over tourists taking photographs of iconic Japanese women have reached 'boiling point'

By Chas Newkey-Burden, The Week UK Published 1 March 24

Talking Point Tourists flock to familiar sights from Saltburn, One Day and Emily in Paris, but locals are less than impressed

By Chas Newkey-Burden, The Week UK Published 26 February 24

Feature It wasn't all bad!

By Catherine Garcia, The Week US Published 11 January 24

The Explainer Travelers' fascination with the macabre is not new

By Devika Rao, The Week US Published 29 November 23

The Week Recommends Everything you need to know for a coastal break in Pembrokeshire

By The Week Staff Published 6 September 23

Pros and Cons Lower levels of air pollution will come at a cost to some motorists in this bitterly divisive issue

By Julia O'Driscoll Published 31 August 23

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise With Us

The Week is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future US, Inc. Full 7th Floor, 130 West 42nd Street, New York, NY 10036.

City tax (tourist tax)

A city tax (also called a tourist tax ) is a fee that is paid by inbound travelers when they stay in hotels, resorts, B&Bs , hostels , vacation rentals , or other types of accommodation in many European cities. It’s implemented as a means to support local infrastructure and improve the tourism sector.

A city tax is not included in the room rate and is usually paid at check out. The amount depends on the type of accommodation, its location, and the season.

Depending on city regulations, a tourist tax amount can be a percentage of the room rate or a fixed fee (applied per person per night). A fixed fee also sometimes depends on the room type . For example, in Paris, the city tax varies from €0.25 (1 and 2-star campsites) to €5 (palaces). In Manchester, overnight guests are charged £1 per night per room. In Amsterdam, it’s 7 percent of the room rate plus €3 per person per night.

Common exemptions include children (age varies), people with disabilities, bus drivers, tour guides, and some other categories.

Recommended content for you

Video: business vs leisure travel, video: seasonal travel and why we may want to reduce it.

Tourist Taxes: How These Hidden Figures Impact Travel

Sustainable Travel: Opportunities Digital Technology Provides for a Greener Business

Travel Startups and Tourism Trends to Invest In

Our website uses cookies to ensure you get the best experience. By browsing the website you agree to our use of cookies. Please note, we don’t collect sensitive data and child data.

To learn more and adjust your preferences click Cookie Policy and Privacy Policy . Withdraw your consent or delete cookies whenever you want here .

Get in Touch

Yes, I understand and agree to the Privacy Policy

The Efficiency of State Administration of Local Taxes

Key findings.

- Central administration of local taxes is a common feature of sales taxes but is less common for income, tourism, and other local taxes.

- Absent centralized administration, localities increase their administrative costs, impose substantial additional compliance costs on businesses, and reduce overall levels of compliance.

- A patchwork approach to local tax A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. administration is particularly onerous for multijurisdictional businesses which often facilitate local transactions.

- Uniformity is increasingly important under Wayfair standards, especially as localities expand the use and definition of marketplace facilitators. Locally administered taxes create significant tax complexity, and in some cases, the expansion of these obligations on third-party platforms can raise constitutional concerns.

- Central administration benefits both taxpayers and governments, as it increases compliance, reduces compliance costs, and expands markets.

Table of Contents

Introduction, only centralization of local sales tax administration is common, central administration reduces administrative and compliance costs, central administration does not expose local governments to revenue risks.

- Undue Local Tax Complexity Imperils Municipal Tax Schemes Post

A mosaic of overlapping tax districts, differing tax rates, and multiple points of administration can make compliance with local taxes a daunting prospect—particularly for nonresident businesses.

The owner of a motel in Cartersville, Georgia , for instance, would have to collect a $5 per room lodging fee for each of her guests, remitting those collections to the state. Additionally, she would need to collect a local hotel and motel tax of 8 percent and remit it to the Cartersville city government. [1] She would also owe state and local sales tax A sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions . Many governments exempt goods like groceries; base broadening , such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding . on the transaction, remitted to the state. And, truth be told, she could probably handle this without too much difficulty, because she only operates in one jurisdiction.

But if she accepts a reservation through a booking website, the online agency that facilitated the transaction would be responsible for collecting and remitting these taxes. The agency would require a specific relationship with Cartersville, Georgia—and thousands of other jurisdictions across the country, each of which could potentially have different base, rate, compliance, and audit A tax audit is when the Internal Revenue Service ( IRS ) conducts a formal investigation of financial information to verify an individual or corporation has accurately reported and paid their taxes. Selection can be at random, or due to unusual deductions or income reported on a tax return. requirements.

By contrast, if this same motel were located in a place like Phoenix, Arizona , [2] all tourism taxes would be collected by the state government. Any booking website connecting people with hotel rooms, homestays, or any other activity subject to local tourism taxes could fully comply through state-level filings.

It is easy to see how local taxation can quickly become complex without one, central knowledge base, filing system, and set of rules, and many states have taken steps to simplify local administration on some level. An examination of the general landscape reveals that centralized collection administration of local sales taxes is common, reduces compliance and administration costs for localities and businesses, and does not adversely affect local revenue—in fact, it can even increase local revenue by giving cities and towns access to more of the market. Centralizing tourism and other local taxes is less common—which puts significant burdens on online platforms—but provides similar benefits to states.

Thirty-one states are “home rule” states, and another nine have some home rule provisions. In these states, local governments have plenary grants of authority. They are free to enact whatever laws are not inconsistent with state or federal law, or where their authority has not been expressly proscribed. Generally, however, states remain free to adopt statutory restrictions on, or parameters for, local tax authority in these states.

It is only where there are constitutional enshrinements of home rule that give localities broad authority over their own organic law, as in Colorado , [3] where “home rule” and mandatory centralization of local tax administration can conflict. In a state like Colorado, it is hard for residents and even policymakers to appreciate just how unusual the state’s approach is, and how common it is for local taxes to be centrally administered. In fact, the benefits of central administration have made such a system prevalent among states for almost every kind of tax localities can levy—most commonly sales taxes, but many states centralize income and even lodging and tourism taxes.

It is important to recognize that home rule, in and of itself, is not a bar to centralized collection and administration of local taxes. And it is equally important to recognize that home rule is not a blank check for local tax administrators—even where constitutionally granted. Municipal tax authority in these jurisdictions is still constrained by federal and state constitutional protections of interstate commerce. Local jurisdictions may not adopt provisions that unduly burden remote transactions—like those facilitated by a booking website—even if they generally possess the authority to create their own tax systems.

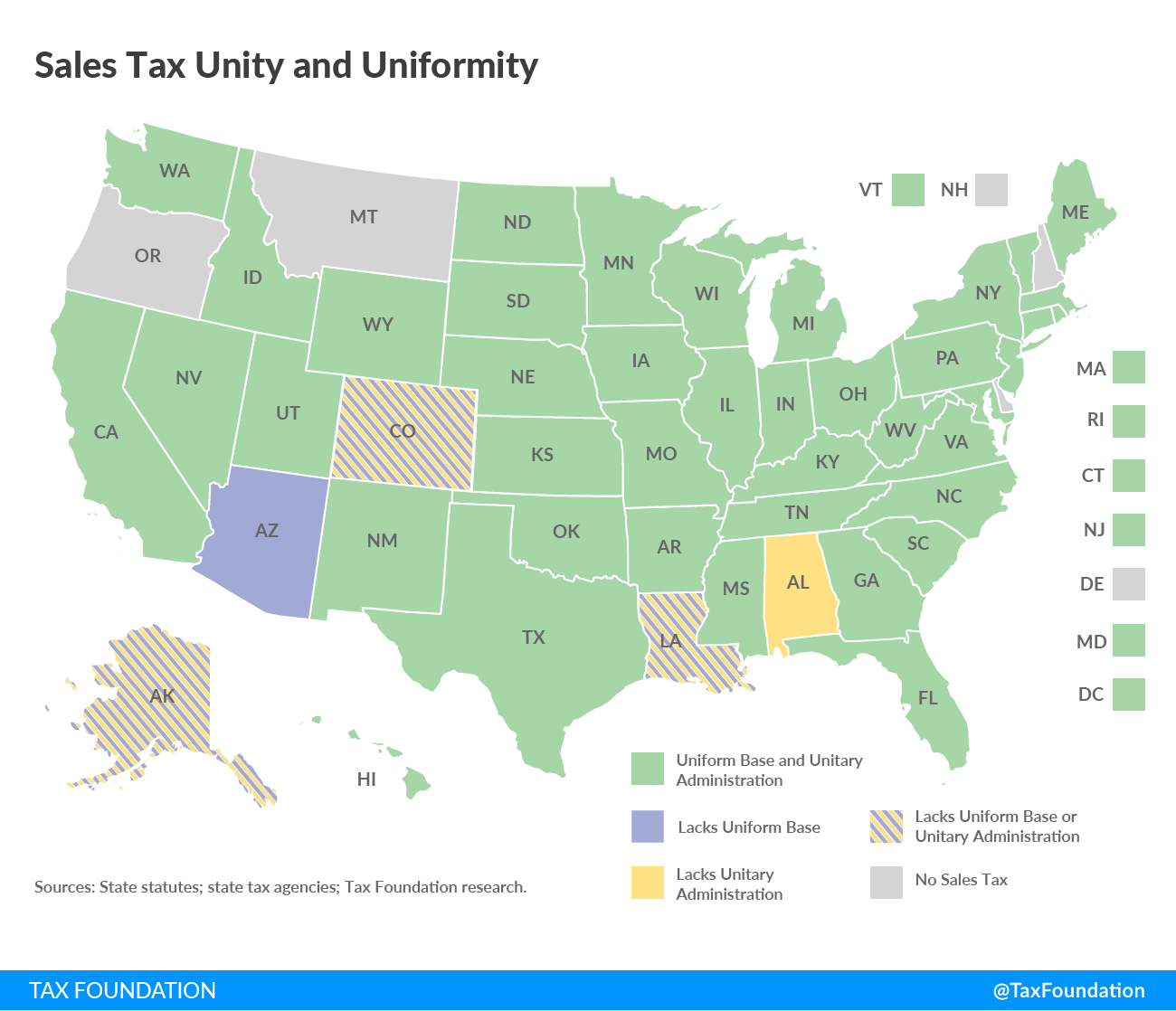

Of the 38 states that allow local option sales taxes (including Alaska , which allows sales taxes on the local, but not state, level), all but four states ( Alabama , Alaska, Colorado, and Louisiana ) collect sales taxes on behalf of localities. In Alaska, this is an outgrowth of the state’s decision to forgo its own sales tax but to grant the authority to localities. In the other three states, it stems from strong home rule traditions and constitutional grants of local taxing power. Central sales tax collection has historically been the norm for those states with centralized collection, but Arizona followed suit more recently when it consolidated its collection authority in 2017. [4]

In some states, only select jurisdictions may impose a sales tax, while in others, a broad range of jurisdictions—counties, municipalities, and various local authorities—may opt, either by ordinance or local referendum, to impose one. Generally, these local sales taxes are levied on the same base used at the state level, and collections and administration are centralized within the state’s revenue agency, with the local share remitted to the municipality by the state collection authority. In many cases, moreover, states make it relatively easy to link a delivery address or geographic coordinates with a local rate through free software solutions that can be used on a standalone basis or through their integration with a variety of third-party vendors.

Although it is less prevalent for other tax types, centralized administration does not stop at sales taxes. Seventeen states allow local income taxes in addition to state-level personal income taxes. Most localities collect these taxes themselves, but six states collect income taxes on behalf of localities (see Table 1). These states allow residents to file their local and state taxes on the same form, simplifying the process for both taxpayers and the government.