Ohio State nav bar

The Ohio State University

- BuckeyeLink

- Find People

- Search Ohio State

You are here

Complying with travel policies.

The University has several policies and procedures related to reimbursement and prepayment of travel expenses. The following guide is designed to assist travelers with policy compliance, to avoid exceptions to University policy.

Please review the FAQ guide titled Avoid Exceptions , for a summary of the exceptions most common to EHE.

What are some best practices to avoid violating University travel policy?

- Obtain Travel Pre-Approval – The University requires travelers to obtain approval from their department chair or supervisor before their trip occurs. This approval needs to come through https://etravel.osu.edu/travel/ (preferred) OR a business leave request.

- Avoid Late Reimbursements (over 90 days) – The University requires travelers to turn in receipts if requesting reimbursement within 90 days of their return. Receipts can be emailed, mailed or dropped off to the EHE Service Center in 350 Campbell Hall.

- Hotel Nightly rate is within limits – The University requires travelers to obtain nightly hotel rates below 2x the federal lodging rate for that city or obtain the conference rate for the hotel. Hotel nightly rates above 1.5x the federal lodging rate require additional business purpose.

- Rental Cars: The University requires travelers to obtain the DW/CDW/LDW and liability insurance, regardless if your personal insurance covers car rentals. Book on the CTP site and OSU discounts and insurance is automatic.

- Airfare : Must use CTP to book flights. The University requires travelers to purchase economy flight seats for all domestic and under 5 hour international flights. International travel over 5 consecutive hours can upgrade to business class seating. Preferred seating (even if required by airline), airfare insurance, TSA pre-check, Global Entry and CLEAR membership expenses are not reimbursable.

- Reasonable transportation expenses – The University allows for transportation expenses for travelers, including taxi, Uber, and Lyft. As these expenses can fluctuate depending on demand, city, and other factors outside of the traveler’s control, higher expenses are expected but are requested to be reasonable. An example of an unreasonable transportation expense is upgrading the service provided (Lyft Lux, Uber Black, Black Car taxi service, etc.) instead of the standard service.

- https://portal.ehe.osu.edu/finance/service-center for information and forms from the College

- Federal Lodging & Per Diem rates https://www.gsa.gov/travel/plan-book/per-diem-rates (Meal rates =“M&IE”)

Need hands-on help with general purchasing requests? Contact Melissa Savage ( [email protected] ) in 149 Arps Hall to set up a meeting to discuss best practices or to receive a tutorial regarding the eRequest system.

Recent Announcements

- Digital Accessibility Policy Training for all Faculty and Staff Ohio State is in the process of implementing its Digital Accessibility Policy. Per the policy, all College of Education and... Read more

- Campbell Hall Renovation Visit the Campbell Hall Renovation website Campbell Hall FAQs Townhall Recordings Watch alumni recording Watch faculty... Read more

- Annual Merit Compensation Process Your HR Team has begun the planning process for the Annual Merit Compensation Process (AMCP) for all eligible regular... Read more

- Year-end reviews With the Performance Management Year-End Review period currently upon us, your HR team would like to remind you of the... Read more

- Career Roapmap Implementation As part of the Career Roadmap initiative, some employees within the college have been identified as having raise to minimum... Read more

- Upcoming Federal Work Study (FWS) deadlines Upcoming Federal Work Study (FWS) deadlines to note: The last day for FWS students working spring semester to earn FWS... Read more

Ohio State nav bar

Ohio state navigation bar.

- BuckeyeLink

- Search Ohio State

Travel Instructions: Preapproval, booking, and reimbursement

Preapproval, booking, and reimbursement

This page includes instructions for:

Travel preapproval

Combining business and personal travel

Booking travel

- Requesting travel reimbursement

Screenshots of typical requests are also provided at the end of the document

To request permission to travel, faculty, staff, and grad students must submit a Spend Authorization (SA) through Workday. The SA must be approved prior to departure and before making any travel-related purchases. Travel is reviewed centrally, so approval times can vary widely. To be safe, we recommend that you allow at least 3 weeks to get approval for any travel.

For additional details, please see OSU Travel Policy and the Workday Spend Authorization Job Aid .

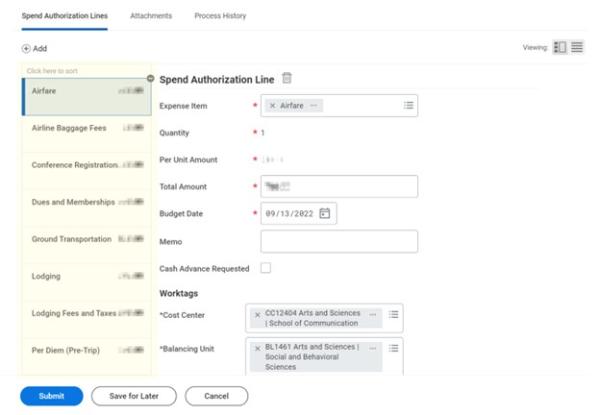

What follows is a brief overview of how to submit an SA. Items marked with an asterisk* require that additional documentation be attached to the SA. Required documentation is described in the Attachments section.

- Log into WorkDay ( https://workday.osu.edu/ )

- Type Create Spend Authorization in the search bar, hit enter, and click on the link that appears

- Under Spend Authorization Information complete all fields (even fields that are not identified as required)

- Under Spend Authorization Details* in the box labeled “Justification” describe and justify the travel (what, when, where, and why).

- Airfare: An estimated cost is fine. Please use the field labeled “Arrival date” to indicate the date on which you will return from your trip.

- Baggage Fees: These must be entered separately from airfare.

- Rental Vehicle*: An estimated cost is fine.

- Mileage (Federal Rate)*

- Lodging*: An estimated cost is fine. The university will only reimburse a standard/single room rate for one guest. You may arrive one day prior and depart one day after the business activity.

- Conference Registration: You must identify a “supplier” (e.g., International Communication Association).

- Dues and Memberships: You may also request approval to renew your membership to the professional association at the same time that you register for a conference.

- Ground Transportation: In the Memo field enter the mode of transportation (e.g.: Uber, Lyft, taxi, bus, subway, train) and in the Item Details - Business Reason field describe the trip’s purpose (e.g., home to airport, hotel to airport). You may combine all trips into one item.

- Parking: In the Item Details field describe the type of parking (e.g., airport parking, hotel parking).

- Per Diem (Pre-Trip): Enter the Destination and Number of Days at the bottom of this section and the dollar amount will be filled in automatically. Treat travel days as half a day.

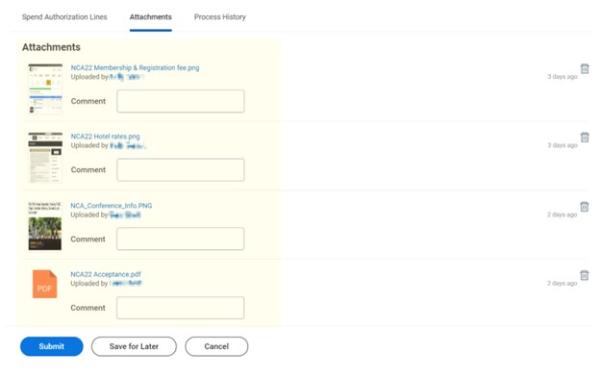

- Travel justification: If attending a conference, you must provide (i) documentation of paper acceptance or presentation details, and (ii) documentation showing dates/location of conference (e.g., a screenshot of the conference website). Please also describe any additional travel plans (e.g., adding personal travel, flying in/out different cities, etc.)

- Rental vehicle: If you rent a vehicle instead of flying, you must attach a comparison flight and ASC cost comparison form. You will only be reimbursed for the less expensive option.

- Mileage: If you plan to drive your own car, please attach a Google Map documenting the distance (starting at Derby Hall) and attach both comparison flight and car rental quotes along with an ASC cost comparison form . You will only be reimbursed for the least expensive option.

- Lodging: If you are attending a conference and are unable to book using the conference hotel rate, you must include a justification (i.e., the hotel is sold out).

- If you need to stop before you are done, click “Save for Later” and record the 10-digit SA number.

- If you are done, click “Submit” and make a record of the 10-digit SA number.

Once your SA is approved, you may proceed with booking your travel (see “Booking travel”). If you have not received travel preapproval by at least 3 days before your expected travel date, please contact Brandon and Gwyn.

If you need to revise your SA (after step (7) above):

- Type My Spend Authorization in the search bar, hit enter, and click on the link that appears

- Find your SA number in the list displayed and move the mouse to the magnifying glass icon (🔍). An orange box containing three dots will appear. Click on this, and a pop-up menu will appear. Use the menu to select Spend Authorization > Change.

If you plan to combine business and personal travel or if you intend to fly in/out of different cities (other than home city/conference city), you must note this in the original SA, including which dates are business travel and which are personal travel.

Once the SA is approved and you prepare to book your travel, you must also generate a cost comparison itinerary. The comparison is between the cost of the trip if it did not include personal travel to the cost of the trip including personal travel. To be eligible for reimbursement, the flight cost comparison must be generated using CTP at the same time that the flight is booked through CTP.

Expenses should only be incurred once Spend Authorization approval is received.

All faculty and staff business travel airfare must be procured through the university's contracted travel agency Corporate Travel Planners (CTP). Graduate students are not required to book through CTP.

Go to CTP’s website ( https://busfin.osu.edu/buy-schedule-travel/travel ) and click Book Travel Online . Use the Trip Search tool to find your preferred flight itinerary, view rates, etc. You can also use this function to gather flight cost comparisons when applicable (see below).

You should also confirm that Brandon can access your account. Under Profile/Profile Settings, click on Setup Travel Assistants to add [email protected] as a travel assistant and check “Can book travel for me.” Faculty or staff should check that Brandon Moore “Is my primary assistant for travel.” Graduate students should also check that Brandon Moore “Is my primary assistant for travel.”

Please contact Brandon with any questions or concerns.

Go to OSU Discount Car Rentals ( https://busfin.osu.edu/buy-sell-travel/travel/rental-car-discounts ), log in with your OSU credentials, and scroll down to Make a Business Reservation. Select the links for Enterprise, National or Hertz to view rates or place a reservation.

Requesting travel reimbursement

All reimbursement documentation must be submitted within 60 days . The traveler is no longer eligible for reimbursement beyond the 60-day limit.

- Use this template to prepare an expense report summarizing all expenses for which you are seeking reimbursement. File soc_travel_reimb_form_rev_092822.xlsx 26.01 KB

- If you combined personal and business travel, you will need to provide a receipt for the purchased flight, a quote for the comparable flights (created at the time of purchase), and ASC cost comparison form

- Email the report and the receipts to the appropriate administrative staff: Brandon Moore (.4566)

The school’s administrative staff will submit the reimbursement requests through Workday on faculty/staffs’ behalf.

Screenshots of a sample request

Top section

Spend Authorization Lines

Attachments

Search form

Plan business travel.

Ohio State is committed to becoming a preeminent global university – with faculty, staff and students engaged in teaching, learning and discovery throughout the U.S. and around the world. The university's policies and procedures for business travel enable Ohio State to effectively comply with federal and state regulations.

The university will initiate payment for reasonable and necessary business expenses. A necessary expense is one for which there exists a clear business purpose and is within university policy limitations. The business purpose must support or advance the goals, objectives and mission of the university, and adequately describe the expense as a necessary, reasonable and appropriate business expense for the university.

Know before you go

Before you travel on behalf of the university, review the rules and resources:

Policy & FAQ – Know and understand the rules (policies and procedures) before travel arrangements are made

International Travel Restrictions & Warnings – Review State Department and Ohio State restrictions and warnings

Traveler Quick Tips – quick guide to Ohio State business travel

Wireless Security – Securely connect to Wifi while traveling, using the Eduroam Network.

Travel Planning Guide

Before You Depart : Planning, policy, pre-departure checklist and what to take with you

Travel Expenses : Transportation, lodging, meals and miscellaneous expenses

Health : Immunizations, health concerns, m edical Insurance, m edical emergencies

Safety : Advisories, export control, legal issues, safety guidelines

Money : ATM, debit and credit cards; university PCard; cash and traveler's checks; how to exchange money

Communication : Phone, email, emergency contacts

When You Return : Post-trip checklist, receipts and reimbursements

NOTE: The Travel Planning Guide is a general resource and may not be inclusive of all considerations necessary for planning your business travel. Consult your Service Center, Fiscal Office or other university-related travel resources to ensure all policies and basic requirements are considered.

Planning Guide Topics

The Ohio State University

- BuckeyeLink

- Find People

- Search Ohio State

CFAES COVID-19 Resources: Safe and Healthy Buckeyes | COVID-19 Hub | CFAES Calendar

Ohio State University Extension

Search form

Travel info, breadcrumb menu, travel tips:.

- 2024 mileage rate: $.675

- Use updated Ground Transportation LOG , Workday will calculate new mileage amount when date in Expense Lines is first day of travel from the LOG

- Get travel in within 60 days

- Use first travel date on log for expense line date

- Only one month per LOG

- IF BLANKET Spend Authorization is split to 2 LINES or more, can attach SAME LOG in EACH LINE, each line will use the different Worktags

- SA= Spend Authorization- can only edit if no expenses have been put in, if inadvertently closed or over the budgeted amount, no new SA can be created- put in COMMENT of SA# and explanation of why closed

- ADD attached approval if using Worktags not in your approval hierarchy

OVERNIGHT TIPS:

- Pay for meals personally- get reimbursed via Per Diem (Pre-Trip for Spend Authorization/Post-Trip for Expense Report)

- No need to use both 'Lodging' and 'Lodging with Fees and Taxes' for Expense Items–as one invoice is to be paid, this could be when you could use the Itemization section of the Expense Report to separate out if any expenses like “Parking” are on the invoice, input to its own Spend Category in Itemization

- If not getting conference rate, check the GSA rates, allowable up to 1.5 times the standard

- Determine estimated cost of overnight trip before Creating Spend Authorization: (mileage= personal miles; ground transportation= taxi, bus, shuttle, tolls; baggage (coming and going); lodging, registration, per diem, parking (airport? hotel?); remember to attach map and agenda that shows meals

- Determine if needing cost comparison worksheet as an attachment: Driving vs Flying, Vacation in Conjunction with Business, international form for international travel

- Expense PCard charges within 7 days of payment

- University only pays for lowest reasonable expenses

- CTP (Corportate Travel Planners) - must use CTP for “continuity of care” so the University can be involved in getting employees home should some disaster occur. Keep documentation from CTP in case of cancellations, if credit is issued put ER# of original charge in entry for the credit. DO NOT USE PCard for CTP expenses- CTP uses their own credit card to pay and charge your SA. Must have an approved SA in order to get airfare purchase with CTP.

When is a Spend Authorization needed?

If you are registering for a virtual meeting or single-day in-person meeting, the expense can be put on a pcard and submitted on an expense report without being tied to a spend authorization. Your mileage to the in-person meeting, if applicable, can be submitted along with your regular monthly mileage on your blanket spend authorization. We are not able to submit registration expenses against blanket spend authorizations.

Any overnight travel requires a separate spend authorization specific to the overnight trip, and all associated expenses (registration, mileage, per diem, etc) should be submitted on expense reports tied to that specific spend authorization.

- If a virtual conference/session- no travel, only registration- then the registration is considered non-travel and no SA needed- *** it’s important to clearly mark virtual in the business purpose and/or memo

- If NO travel involved or claimed for a conference/session (held in your office or within same miles as commute) and registration is the only expense- then the registration is considered non-travel and no SA needed.

NOTE: Carpooling will need a separate SA, in case of expenses that could arise- as in last minute change of plans and have to drive after all, or if splitting cost of mileage, etc.

NOTE: when traveling on OSP grants submit a separate SA

What if the registration is internal and nothing to tie back to the SA in Workday?

- The internal registration won’t get tied to the SA, but should still be reflected as an expected cost, so put a LINE in the SA request for REGISTRATION.

How does the Spend Authorization get tied to the Expense Report put in for travel expenses?

- When in Header page (first screen) of Create Expense Report- choose the 3 rd radio button, Create New Expense Report from Spend Authorization , then click the drop down arrow to choose the correct SA

- See Blanket In-State Mileage and Overnight Travel job aids

- This brings in your payroll default Worktags. Make sure these are changed to match the approved SA where you are expensing the travel

Do I have to fill out ITEMIZATION in the expense report?

- Only needed when splitting out Spend Categories, such as hotel bills if they include parking, or other charges on the bill to be separated out to another SC (NOT to separate out fees/taxes)

If I use the PCard for registration, hotel or other travel expenses, how will that get tied back to my travel Spend Authorization?

- See this NEWS article: Reassigning Expense Credit Card Transactions

- Expect a wait time for the system to ‘catch up’ as the PCard Manager works through this process and for it to show up in the assignees Workday

How can I cancel a Spend Authorization?

- In the case when F2F conferences have been cancelled or changed to ‘virtual’ conferences, the SA’s should be canceled, here’s the NEWS article: To Close Spend Authorizations

- When the job aid mentions 'related actions' click on the 3 dots in the red header bar to get the ACTIONS gray column to show up- then you HOVER over the Spend Authorization… and should see next step, which must be to END

Complete the Travel Comparison Worksheet prior to travel and attach to the Spend Authorization in the following situations: o Drive vs. Fly o Mileage vs. Rental Vehicle o Personal Travel in Conjunction with Business Travel

City of Columbus Certificate of Exemption, Hotel /Motel Excise Tax

The ohio state university tax status (when traveling out-of-state).

Know the tax exemption status of the state in which you are traveling. The state-by-state information about sales tax shows the university’s tax status in each state and provides the applicable tax exemption certificates. If a supplier asks for a tax-exempt number, Ohio State’s employer identification number 31-6025986 can be provided.

Ohio Admin. Code 3364-40-03 - Travel and business expense reimbursement

- State Regulations

When on official business, university travelers will exercise the same care in incurring expenses that a prudent person would exercise on personal business. Reimbursement for in-state and out-of-state travel will be made for travel and living expenses (meals and lodging) incurred on official university business. Travelers must itemize travel and living expenses for the purposes of reimbursement within "Concur." Reimbursement will be dependent upon providing supporting documentation including original receipts for all expenses incurred. Expenses that are submitted one hundred-eighty days after the date the expense was incurred are not reimbursable .

To encourage the most efficient and economical means of travel for accomplishing the stated business purpose of the trip and to standardize the reporting and documentation of expenses in accordance with federal and state laws and regulations.

Prior to each trip, travelers must obtain approval from the appropriate executive officer (president, vice president, dean, director, provost, or designee). Executive officers may establish other travel regulations applicable to their areas of responsibility which fall within this general policy. The proper approval of an expense report constitutes approval of the itinerary as well as the accuracy and reasonableness of the request for reimbursement. Such approval must be documented prior to the trip and available for audit review. Estimated costs and the business purpose must be included in the travel request. Travelers should verify that planned travel is eligible for reimbursement before making travel arrangements.

Advances of university funds for travel purposes are not permitted except for intercollegiate athletic team travel. Any request for exceptions to this must have the authorization of the associate vice president for finance or designee. Receipts and a copy of the deposit of any unused cash must be submitted to the university's accounts payable department within five business days after the date of conclusion of the trip .

In accordance with the Ohio ethics commission advisory opinion number 91-010, division (A) (4) of section 2921.42 and division (A) of section 2921.43 of the Revised Code prohibit a state officer or employee from accepting or using, for personal travel, a discounted or free "frequent flyer' airline ticket or other benefit from an airline if he/she has obtained the ticket or other benefit from the purchase of airline tickets, for use in official travel, by the department, division, agency, institution, or other entity with which he/she is connected. Therefore, any miles earned from university paid or reimbursed travel, although accumulated in the traveler's name, must be used for official university business travel. In order to assist with compliance with this ruling, airline tickets for university employees must be purchased using a university purchasing card ("P-card") or through the purchasing department.

Travel by coach air, rail, bus or other common carrier must be at the most reasonable available rate for the chosen method and time of travel. No reimbursement will be made at first-class rates where other accommodations are available.

In accordance with the Fly America Act ( 49 U.S.C. 40118 ), generally individuals charging travel to federal funds must use U.S. flag air carriers to the maximum extent possible when commercial air transportation is the means of travel between the United States and a foreign country or between foreign countries. Travelers not utilizing U.S. flag carriers must demonstrate compliance with the exception to this requirement that is provided under a bilateral or multilateral air transportation agreement to which the United States government and the government of a foreign country are parties, and which the department of transportation has determined meets the requirements of the Fly America Act. This requirement will not be influenced by factors of cost, convenience or personal travel preference.

All university of Toledo ("UT") faculty and staff are required to register with the university when they travel internationally for university business at: http://www.utoledo.edu/policies/academic/international-studies-and-programs/pdfs/3364-85-01-international-travel-registration.pdf .

For any university travel, whether or not a reimbursement is requested, the travel itinerary issued with the ticket should be submitted with the expense report.

The use of a privately-owned vehicle will be reimbursed up to the internal revenue service ("IRS") standard mileage rate at the time of travel, excluding some grants which may authorizes less than the IRS standard mileage rate. The mileage rate includes all expenses incurred for using the privately-owned vehicle except parking fees and tolls.

All employees are expected to follow the prudent person rule and use reasonable judgment in selecting the appropriate mode of transportation factoring cost, availability, safety, and efficiency. When possible, employees are encouraged to use the most economical mode of transportation. Employees need to factor the total inclusive costs of travel when determining the mode of travel. For instance, it may be less expensive for airfare and ground transportation (taxi, shuttle) when compared to personal vehicle mileage reimbursement, parking, and tolls. The university holds the right to reimburse at the less expensive mode of transportation .

Mileage will not be reimbursed for the following: travel between work and home; travel from home to a point between a traveler's home and primary work site; travel between the university campuses (main campus, health science campus, Scott park campus, center for the visual arts, Stranahan arboretum, lake Erie research center); and travel between buildings on the individual university campuses named above. Travelers interested in deducting mileage for tax purposes are encouraged to explore the matter with a tax advisor.

An individual who uses a privately-owned vehicle for university business must meet liability insurance requirements of the motor vehicle financial responsibility laws of the state of Ohio. Any accidents that occur while a traveler is on university business should be reported immediately to the department of risk management at the university.

The university requires all purchases of rental vehicles to be made via a university P-card or through the purchasing department.

All travelers are encouraged to use the least expensive mode of transportation. When other less expensive transportation is not available or appropriate, rental car expenses will be reimbursed. All employees are expected to follow the prudent person rule and use reasonable judgment in selecting the appropriate mode of transportation factoring cost, availability, safety, and efficiency .

In order for an individual or group to obtain a rental car, the traveler(s) must provide adequate written justification and receive advance written approval from the appropriate vice president. Reimbursement will be approved for rental of an appropriately sized vehicle for the number of participants. This approval must be attached to the expense report .

If a traveler decides to rent a vehicle in lieu of using a lower cost mode of transportation and does not follow the prudent person rule, the university holds the right to reimburse at a less expensive rate for transportation .

If it is necessary for a traveler to rent a car from a car rental agency, the traveler should select the insurance coverage from the car rental agency. If using a preferred supplier, the insurance coverage may be included free of charge. Consult the purchasing department car rental website at: https://www.utoledo.edu/depts/supplychain/purchasing/pref erred_suppliers/vehicle_rental.html for preferred vendors and their terms. If it is necessary for a traveler to rent a car outside of the United States, the driver must purchase all local coverage as well as optional coverage. If the filing of an insurance claim becomes necessary, the signed rental agreement must be filed with the department of risk management .

Transportation costs, such as parking fees, tolls, taxi, gratuities, and airport limousine fares are reimbursable on an actual costs basis. Receipts must be obtained and submitted for any such expenses that exceed twenty-five dollars.

An individual who travels for an authorized, overnight business event may claim a meal allowance based on federal meal and incidental expense per diem rates for the continental United States ("CONUS" rates) for each full day of travel. Personal meals will be reimbursed up to the per diem rate. A P-card should not be used for individual meals at any time.

First and last day of travel when an overnight stay is required will be reimbursed at seventy-five per cent of the federal per diem rate, while on authorized travel status.

Reimbursement will not be provided when meals are provided by the hotel, conference or meeting. Adjustments to per diem reimbursement will be made as follows:

Breakfast: twenty-five per cent of the federal per diem rate, while on authorized travel status.

Lunch: twenty-five per cent of the federal per diem rate, while on authorized travel status.

Dinner: fifty per cent of the federal per diem rate, while on an authorized travel status .

No reimbursement will be made to an individual traveler for the actual cost of meals in excess of the appropriate daily allowance.

The daily per diem rates for all destinations can be found at: https://www.gsa.gov/travel/plan-book/per-diem-rates .

Business meals with individuals not affiliated with the university will be reimbursed at actual cost upon submission of appropriate receipts. Business meeting meals must have a business purpose and must include two or more persons (at least one non-university employee). If there is a question regarding the business purpose of the trip, a dean or vice president must approve the expense.

Costs should be reasonable and customary for the location. The expense report must contain the date, place, business reason, persons in attendance and business relationship of persons entertained. Business meeting and group travel meals reimbursements cannot use the per diem rate. All receipts are required.

The university requires all purchases for lodging to be made via a university P-card or through the purchasing department.

Other expenses directly related with the purpose of a particular business trip are reimbursable provided that they are necessary, reasonable, and supported by original receipts.

Expenses that relate to business activities (such as fax or printing charges) will be reimbursed if the appropriate receipt is provided. Purpose and reason for the expense must be documented.

A tip of twenty per cent or less of the cost of the associated goods or services is allowable, or the tip is customary and of a reasonable amount in cases where the tip cannot be associated to a specific cost. Examples include baggage handling (one dollar per bag), express check in, concierge service, and shuttle service. Tips for room cleaning are not reimbursable .

Dry cleaning and laundry for extended stays in excess of one week are reimbursable. Receipts must be obtained and submitted with the expense report .

Travelers are required to use their P-card for airline tickets, lodging, and rental car purchases or they must be purchased through the purchasing department unless reimbursement is authorized and approved by the appropriate president, vice president, dean, or provost.

Travelers are required to comply with the university of Toledo purchasing card policy and procedures.

If any portion of the traveler's travel expenses are to be reimbursed in full or in part by a third party, those components of the expense report must be noted. The university will reimburse the traveler for those travel expenses that are to be paid by a third party only after funds have been properly receipted from the third party. The controller's office must be notified when the reimbursement is received from the third party so the correct deposit of those funds may be made and prompt reimbursement made to the traveler.

Personal expenses are not reimbursed and must be paid out-of-pocket. Such expenses are not directly related to the business travel, and may include personal entertainment such as hotel pay per view movies; refreshments made available in the hotel room; airline upgrades; purchase of additional personal travel insurance; and personal grooming.

The university encourages employees coordinating travel for non-university personnel to comply with the travel and business expense reimbursement policy when those expenses will be paid or reimbursed by the university. These individuals include guests, lecturers, consultants, prospective faculty and staff, and students.

If a circumstance arises that is not specifically covered in the travel and business expense reimbursement policy, the controller's office should be consulted for guidance.

State regulations are updated quarterly; we currently have two versions available. Below is a comparison between our most recent version and the prior quarterly release. More comparison features will be added as we have more versions to compare.

Ohio State navigation bar

- BuckeyeLink

- Search Ohio State

- Life Events

- HR Services

- Awards and Events

Comprehensive Benefits

Ohio State offers a comprehensive benefits package with a variety of options to meet your unique needs.

Select a category below for more information or select All Benefits to browse the comprehensive suite of benefits offered to Ohio State employees. Use the Benefits Eligibility button to learn what’s available to you, and use the Benefit Plan Rates button to discover costs of coverage.

Health and Wellness

Leave & time off.

Enroll in Workday

Additional Resources

- Benefits Webinars and Videos

- Dependent Eligibility

- Student Employee Benefits

- Total Rewards at Ohio State

- Affordable Care Act (ACA)

- Non-Discrimination Statement

- Benefit Composite Rates

Popular Resources

- Benefits Overview Book

- Medical Benefit Comparison Chart

- Medical Benefit Specific Plan Details

- Dental Benefit Summary Chart

- Vision Benefit Summary Chart

- Faculty and Staff Tuition Assistance Program Guidelines

- Dependent Tuition Assistance Program Guidelines

Related Policies

- Flexible Work

- Paid Time Off

- Relocation Expenses

- Student Employment

- Transitional Work

HR Connection hrconnection.osu.edu (614) 247-myHR (6947) (614) 292-7813 (Fax) [email protected]

Ohio State navigation bar

- Buckeye Link

- Search Ohio State

Testimony to the Ohio Senate Workforce and Higher Education Committee

The following testimony was submitted to the Ohio Senate Workforce and Higher Education Committee on Wednesday, May 8, 2024.

Introduction

Chair Cirino, Vice Chair Rulli, Ranking Member Ingram and the members of the Ohio Senate Workforce and Higher Education Committee: My name is Ted Carter, and I have the honor of serving as the 17th President of The Ohio State University.

It is a privilege to appear before you to discuss the important investments the state of Ohio makes in higher education and our university – and, in return, how Ohio State takes seriously the responsibility of making good on those investments for the benefit of students and the communities in which we all live, work and serve.

As you know, I am relatively new to Ohio State and the state of Ohio, but I am not new to the idea and critical importance of service leadership. Throughout my career, I have been driven by a sense of service at the highest level, and I was drawn to Ohio State precisely because it operates at the highest levels of academics, research, clinical care, athletics and more.

We are the state’s flagship, land-grant, public research university with a student body of more than 65,000 – and one of the largest institutions of higher education in the world.

Along with our Columbus campus, the university has campuses in Lima, Mansfield, Marion and Newark, as well as the College of Food, Agricultural, and Environmental Sciences Wooster campus – an important component of our statewide research enterprise and home to the Ohio Agricultural Research and Development Center and our Agricultural Technical Institute. We are home to 15 colleges; over 200 majors; almost 300 master’s, doctoral and professional degree programs; 15,000 acres; and 40,000 full-time employees, including student employees. Ohio State has extension offices that serve Ohioans in every part of the state. Ohio State students, alumni, patients, employees and facilities can be found in each of Ohio’s 88 counties.

We consistently rank among the top public institutions for academic programs at the undergraduate and post-graduate levels, including online education. Complementing and enhancing these programs are a nearly $1.45 billion global research enterprise, the nationally recognized Wexner Medical Center with inpatient and outpatient care throughout central Ohio, and a leading athletics program with 36 sports and more than 1,000 student-athletes.

Ohio State is a large, complex organization that is a joy to lead.

My wife, Lynda, and I came to Ohio State in January of this year for the start of the spring semester. We came from the University of Nebraska System, where I served as president. Prior to that role, I served as superintendent of the United States Naval Academy, and as president of the U.S. Naval War College.

Overall, my career in the Navy spanned 38 years; 6,300 flying hours; 125 combat missions; and, perhaps most germane to my testimony today, a continuous commitment to teaching and learning. I believe both are lifelong pursuits and the common ground between my service in the military and my career in higher education.

It should come as no surprise, then, that a significant part of what attracted me to Ohio State is embodied in the university motto of “Education for Citizenship.” That is, our university’s fundamental identity as a public, land-grant institution dedicated to service for the greater good. The education provided by Ohio State, the discoveries made by our faculty, and our partnerships with businesses and organizations are always in service to something bigger than us. Specifically, it is our foundational mission to extend higher education broadly to all Ohioans – and to bring greater investment in intellectual capital and economic development to Ohio. These ideas are the basis not only for what Ohio State has become, but also for what it must continue to be: a university with the primary purpose to serve.

When I said it was a joy to lead this institution, it is because of the tremendous opportunities we have to be of meaningful service. I am humbled to lead this great university, and I am proud to be counted as part of Buckeye Nation. What is truly joyful to me is that so many share in this pride no matter where I go in the state.

Some weeks ago, I made my first visits to our Lima, Newark, Mansfield and Marion campuses. The university’s regional locations are an essential part of our educational mission as well as our accessibility efforts for all Ohioans, and I could not have been more impressed by the quality of the faculty and students and the promise they provide to the state and the region. Spotlighting and further advancing these resources for Ohio families will continue to be a focus of my administration. I have dedicated my life and career to public service, and every day at Ohio State is validation that I am where I am supposed to be.

I would be remiss if I did not mention that this is my first opportunity to appear before the legislature and offer testimony before a standing committee. When I began my tenure at Ohio State five months ago, I said that my immediate focus would be to listen, learn and earn trust. I consider our time together to be part of that process, and I truly appreciate the opportunity to speak with you today.

Investment in Ohio State and Higher Education

The university and state are inextricably linked; investing in one is an investment in the other. Ohio State as we know it today exists because of such an investment.

Our institution, originally named the Ohio Agricultural and Mechanical College, came about because of the Morrill Act, signed by President Abraham Lincoln on July 2, 1862. We were then founded by the Ohio General Assembly with the passage of the Canon Act in 1870. And we were located first in Columbus because the residents of Franklin County rallied together to raise funds to purchase Neil Farm and build our first facilities. Immediately, two of the cornerstones of this university’s character were laid down even before we opened our doors. First, we are committed to educational access. This was the motivating force behind the Morrill Act. Second, we are dedicated to working in the interest of the communities, state, and country that created us.

From these relatively modest beginnings, including a first class of 24 students in 1873, Ohio State has grown into one of the nation’s leading learning, teaching and research engines, currently ranked No. 17 among public universities nationally. Ohio State’s scale puts us in a unique position to have positive and lasting impact on the people of Ohio. We are a large and complex organization – and I know from experience that can present challenges to maximum efficiency and efficacy – but the very scale on which Ohio State operates also presents opportunities to make an impact in a way few other institutions can.

In fact, the university’s scope and scale exceed all national peers in terms of offering comprehensive services related to academics, health care, athletics and more. To provide a picture of all that Ohio State offers in terms of services and resources compared to R1 research universities and other Big Ten Conference schools, Ohio State is the only university that offers the full range of health sciences colleges, including a medical college and colleges of nursing, optometry, veterinary medicine, dentistry, public health and pharmacy. This range is noteworthy as these specialized professional schools require smaller class sizes with higher cost of instruction and equipment, but they are vital to fulfilling the university’s land-grant mission and providing the highly trained and educated health professionals needed to serve Ohio.

Ohio State is the largest employer in central Ohio. More broadly, the university’s most recent economic impact report, analyzing 2019 data and released in September 2022, notes that almost 117,000 jobs are supported by Ohio State both directly and indirectly throughout the state. Additional statewide numbers include $663.1 million generated in tax revenue to state and local governments. Overall, the university’s annual economic impact for the state of Ohio was an estimated $19.6 billion. Those numbers are likely higher today, despite the economic impacts of a global pandemic. Still, based on our most recent data, the state of Ohio invested $629.3 million in the university in 2019 and realized a $19.6 billion return. Many years of state funding contributed to Ohio State’s growing impact, and that one-year snapshot demonstrates the link between the state and the state’s flagship university.

Just as vitally, Ohio State, along with its sister colleges and universities in Ohio, adds great gravitational pull to the region’s economy. People go to school here, and they overwhelmingly tend to stay in Ohio to start their careers and families. Almost 80% of Ohio’s public college and university graduates are working in Ohio one year after graduation; 73.8% are still here five years after graduation; and almost 70% are here 10 years after graduation. Specifically at Ohio State, as of our most recent data, more than 70% of our undergraduates who planned to enter the workforce stayed in the state. And 66% of Ohio State graduate and PhD students stayed in Ohio. When you consider that roughly 30% of our students are from out of state, those percentages are exceptional. About 14,000-plus students equipped with an Ohio State education enter and put their skills to good use in the workforce and economy of our state each year.

Keeping our graduates in Ohio is more important than ever. Nationally, fewer students are graduating from high school, and competition for these students is fierce. Attracting and retaining talent – while continuing to partner with state and industry leaders to anticipate the most in-demand fields – will remain areas of focus.

Industry partnerships

A significant part of the university’s approach to advancing workforce development is through partnerships with industry leaders. I will mention just a few among hundreds of examples taking place throughout our colleges and units.

To begin, Ohio State has had a formalized partnership with Honda for more than 20 years, resulting in hundreds of research projects as well as internships, co-op experiences and full-time, post-graduation positions for Ohio State students. Last year, Ohio State and Honda announced a partnership with the state of Ohio, JobsOhio and Schaeffler Americas to establish a 25,000-square-foot battery cell research center. Opening next year, the lab will accelerate the domestic development of battery cell materials and manufacturing technologies while providing an experiential learning setting for advanced battery technology workforce development. The project also has the support of the federal government.

Another example is Amgen, one of the largest pharmaceutical companies in the country. Amgen is bringing its production work here to the state, and the company’s talent strategy for Ohio focuses on working with Ohio State to provide learning opportunities for students and further build its workforce pipeline. Right now, 99 Ohio State alumni work for Amgen and, through this partnership, we expect that number to grow dramatically.

Additionally, Ohio State is working closely with Intel, two- and four-year institutions, and state economic development officials to develop curriculum, launch new degree and certificate job training programs, and advance research programs that will support the industry’s workforce and research needs. To date, Ohio State’s College of Engineering has launched two new minors and eight new certificates, at both the graduate and undergraduate level, in semiconductor devices and semiconductor fabrication technology. The university also offers a Bachelor of Science in Engineering Technology exclusively at our regional campuses. Students develop the business-oriented engineering skills that are in demand at places like Intel. In 2022, Ohio State launched the Midwest Semiconductor Network to support the development of semiconductor nanofabrication facilities in the Midwest and the broader, national efforts to promote U.S. leadership in semiconductors and microelectronics. The network comprises 31 colleges and universities in five states across the Midwest working to leverage existing research, curriculum and faculty expertise.

As part of this network, the Industry Advisory Board was launched in June of 2023. Jim Evers, Intel’s VP and Ohio site manufacturing and operations manager, chairs this board, which provides guidance and direction to the network’s academic and research endeavors, including such areas as curricular content, co-curricular activities, career employment planning, training and cooperative education, and industry-focused research.

Again, our collaborations with Honda, Amgen and Intel only scratch the surface of how Ohio State interfaces with businesses and organizations to address quickly emerging workforce development and research needs. For example, we meet regularly with JobsOhio and many of the JobsOhio Network partners (One Columbus, Dayton Development Coalition, etc.) to provide input and resources for economic development projects. We are also focused on bringing together our research scientists with industry partners and students to tackle society’s biggest challenges through the Carmenton innovation district. When fully built, Carmenton will cover more than 350 acres that bring together entrepreneurial, corporate, academic and health care communities in collaborative spaces and programs. Our deepest appreciation goes to the city of Columbus and JobsOhio for their investment in this exciting endeavor.

Spaces already in use include: Ohio State’s Pelotonia Research Center, which houses the Pelotonia Institute for Immuno-Oncology and the Chlapaty Laboratory focused on cardiovascular innovation; and the Energy Advancement and Innovation Center, where faculty, students, local entrepreneurs and industry experts are collaborating to advance the next generation of renewable energy, artificial intelligence and smart systems. Koloma, an Ohio State clean energy startup that launched in the basement of one of our buildings, has committed to leasing space in this center. Koloma has recently raised over $300 million in venture capital.

Notably, Ohio State ranks No. 6 in the country in industry-sponsored research, totaling $155.2 million in FY23, up 9% from FY22. As mentioned, Ohio State’s research engine continues to attract record-breaking investment – with immediate and long-term benefits for our country and state. Our annual research and development expenditures of $1.45 billion in FY23 represent a 6% increase over FY22. In the most recent National Science Foundation Higher Education Research and Development survey, Ohio State ranked No. 11 among all universities, ahead of public research peers such as the University of North Carolina, Chapel Hill, and private research institutions such as Harvard University.

Federal expenditures brought $694.7 million to Ohio State in FY23, an increase of 9% from FY22. University research saw growth across the portfolio of agencies, including:

- National Institutes of Health (14% increase)

- National Science Foundation (11% increase)

- Department of Defense (25% increase)

- Department of Energy (10% increase

Growth in research expenditures is spread across the university, with eight of 15 colleges seeing 10% increases or more year-over-year: business, dentistry, engineering, law, medicine, optometry, public health and veterinary medicine. And it isn’t just about the numbers. It’s about what our research is doing. It’s about what Ohio State’s research means to changing the lives of Ohioans, to saving lives of Ohioans, and for people across our country and around the world.

Health care and training

Ohio State’s dedication to working in the interest of our communities is again evident in the clinical care provided throughout Ohio by the Wexner Medical Center. The medical center has been named to U.S. News & World Report’s list of “Best Hospitals” for 31 consecutive years. The James is also one of only 57 comprehensive cancer centers designated by the National Cancer Institute, recognizing their scientific leadership in laboratory and clinical research, in addition to serving our communities and the broader public by integrating training and education for biomedical researchers and health care professionals. As mentioned, no other major university has seven health sciences colleges on one campus like Ohio State does in Columbus – meaning we can provide greater outreach of services to individuals and families across the state. Ours is the only veterinary teaching hospital in a three-state area – and we are No. 3 among veterinary colleges ranked by the American Veterinary Medical Association Council on Education. Our state-supported dental school serves Ohioans at more than 40 extramural sites, as well as through a pediatric mobile dental clinic that travels to central Ohio schools, including Columbus City Schools, to provide care.

Collectively, Ohio State’s graduate and professional programs continue to rank among the best in the nation and the state, according to the U.S. News & World Report 2024-25 edition of “America’s Best Graduate Schools.” The rankings place the College of Nursing’s traditional Master of Science (MS) program as No. 4 in the nation, and first among public institutions. This year is the sixth straight in which the MS degree program has ranked among the nation’s top 10. The college’s Doctor of Nursing Practice program again ranked among the country’s top 20.

Everywhere I go throughout the state, I hear inspiring stories and expressions of gratitude from people for the care and compassion they and their families received through the university’s medical enterprise. To demonstrate this reach more empirically, the Wexner Medical Center in 2023 cared for more than 427,000 distinct patients with nearly 4.3 million encounters from across each of the 88 counties in Ohio combined — including 291 distinct patients with 2,345 encounters in Adams County, 736 distinct patients with 9,328 encounters in Wyandot County and more than 216,000 distinct patients and 2.3 million encounters in Franklin County. The university proudly supports more than 100 medical facility locations that serve as major referral centers for patients throughout Ohio and the Midwest. Through our telestroke and teleneurology networks, our specialists are able to provide care to patients, as well as support physicians in more than 30 hospitals in rural and underserved areas in Ohio.

This footprint is growing. In the past several years, we have opened outpatient care facilities in Dublin and New Albany, as well as the James Outpatient Care in the Carmenton innovation district, which is home to central Ohio’s first and only Proton Therapy Center in partnership with Nationwide Children’s Hospital. The center opened in December and is already treating adult and pediatric patients from 16 Ohio counties and growing. In April, we broke ground on an outpatient care facility in Powell. We are nearing completion of the new Wexner Medical Center Inpatient Hospital Tower. Once opened and admitting patients, it will be Ohio’s standard-bearer for clinical training and care, bringing 824 state-of-the-art, private, adult patient rooms – nearly doubling the bed capacity between the existing Rhodes and Doan Halls. The university has made substantial investments in the physical infrastructures of our College of Dentistry and the College of Optometry to improve training and outreach.

I want to also note the Interdisciplinary Health Sciences Center on the Columbus campus. The project includes a 120,000-square-foot renovation of Hamilton Hall and construction of a new 100,000-square-foot building to serve multiple disciplines. Phase one was completed in 2022, phase two opened last year, and the final phase opens this month. Already, students from across the health sciences – dentistry, medicine, nursing, optometry, pharmacy, public health and veterinary medicine – are working collaboratively to build team approaches to care with the most up-to-date technologies, including virtual reality and enhanced anatomy and surgical practice labs. The center also provides opportunities for tomorrow’s health care professionals to explore emerging telehealth innovations, which can further expand the scope of care we are able to provide by staying in regular communication with patients between in-person visits.

Teaching and learning at the forefront of modern technologies are critical to the future of health care. Last year, Ohio State awarded 1,784 doctorates and professional degrees, making us one of the top producers of these graduates in the nation. To a significant degree, Ohio State is feeding the nation’s pipeline of health care providers, and we must continue to train these professionals with the technologies and techniques that address, complement and anticipate emerging patient needs.

Our impact is being immediately felt in Ohio, not only through patient-care facilities and services, but also by boots on the ground. For example, 76% of all Ohio State medical students are residents of Ohio. At this year’s Match Day, 35% of our medical students matched to health care institutions in the state of Ohio. Additionally, 80% of our undergraduate and graduate enrollment in nursing is made up of in-state students. As the health care needs of Ohioans and Americans continue to evolve, our land-grant mission necessitates that the university’s services evolve with them.

All of these examples serve to highlight how the capital budget represents a shared investment in the people of Ohio.

Capital Budget Request

In terms of the FY25-26 capital appropriations request, Ohio State’s focus remains on addressing deferred maintenance.

As one of the largest universities in the country, Ohio State has more than 39 million gross square feet of building space, with a current replacement value of approximately $18 billion, and total operating expenses of $7.9 billion. In addition to our size, approximately 48% of Ohio State’s buildings are at least 50 years old or older – not uncommon across most campuses in the nation.

Each year, Ohio State completes a robust capital planning process resulting in a comprehensive Capital Investment Plan. Projects included in the plan are evaluated for their alignment with strategic, financial and physical plans, including our recently updated campus master plan, Framework 3.0. This integrated approach ensures that capital investments support the strategic mission of the university, combining investments in new facilities with reinvesting in older facilities to make sure that our physical spaces continue to be relevant for the future of higher education and supporting the workforce needs of the state of Ohio.

For the FY25-26 biennium, Ohio State submitted requests totaling roughly $76.5 million in deferred maintenance projects.

This funding includes $64.95 million for 10 bundled renewal and renovation projects on the Columbus campus affecting roughly 50 buildings. These funds will be used for roof, HVAC, elevator, fire system, electrical and other infrastructure renovations. A partial demolition of Evans Laboratory is also included in the request. The Lima, Mansfield, Marion and Newark regional campuses are each slated to receive $1.7 million for prioritized renovation projects on each campus. The College of Food, Agricultural, and Environmental Sciences Wooster campus would receive $6 million for renovations to its Fisher Auditorium.

The university has identified, through updated building assessments, critical building systems that need renewal or replacement. The most urgent projects are prioritized and included in the submission to the state as our Ohio State specific spending request for the capital bill.

The resources we are seeking from the state are an important piece of our overall plan to keep pace with our deferred maintenance needs. The investment of state capital dollars for these projects will be leveraged by other funding sources, maximizing the impact to the university’s deferred maintenance liability. Investments in critical building system projects as proposed will ensure that students have access to safe and appropriate spaces.

Challenges and Opportunities

While Ohio State is a great university in a strong fiscal position, we face several of the same headwinds experienced by institutions of higher education across the country. I understand that my tenure has begun at a time of uncertainty, and my approach to leading through challenging times has always begun with a careful balance of priorities and values. I take seriously this responsibility, and I would like to take this opportunity to address a number of these areas in turn:

Declining faith in the value of higher education

There has been much talk nationally about the value of our country’s colleges and universities. Is it worth it for students and families? Is it worth it for the taxpayers who help to fund our public institutions of higher learning?

The facts show that a college education remains tremendously important. The wage gap between college and high school graduates has been widening for many years now, and it continues to widen. I also understand, however, that student debt is a massive problem in this country. If the success of our students is our North Star – and it is – then we must be able to provide the preparation and training vital to workforce development at a cost that will not impede their opportunities or their career development.

I am proud to say we are making progress in terms of affordability and student access at Ohio State. Because of several university initiatives, donor support and the state’s commitment to the Ohio College Opportunity Grants and State Share of Instruction, we have seen debt for Ohio State students continue to fall. In the 2022-2023 academic year, 58% of Ohio State’s bachelor’s degree recipients graduated with zero student loan debt. For the rest, the 42% who do leave with debt, their debt has fallen from $27,000 on average five years ago to less than $25,000 now. To put that on the national scale, our percentage of students who leave with no debt is 20% better than the U.S. average. And the average debt is well over $4,000 less than the national average — again, close to 20%.

Unfortunately, when people say that the costs of college are increasing, they are probably understating it. Between 2007-2022, U.S. public university tuition and fees increased 85.3%, far surpassing CPI/Inflation of 38.8% during the same period. What people may not know is that, over the same 16-year period in Ohio, public university tuition and fees increased only 33.7%. Ohio State’s in-state tuition and fees increased only 27.9%, more than 10% lower than the rate of inflation, and only a third as much as the national average. Further, since 2007, Ohio State’s undergraduate tuition and fees have increased at a slower rate than all but two other public universities in Ohio.

Last year at Ohio State, more than 9,500 students received merit-based scholarships; 48% of our undergraduate students receive federal grants, including pell grants, and 70% of undergraduates receive institutional grants, with the average amount of grants, aid and scholarships students receive being almost $12,000.

In short, Ohio State offers an exemplary education at a lower cost than the majority of our peers. In Ohio, we are the second most affordable of any school that has a selective admission process. If you look at peer institutions in the expanded Big Ten Conference, there are 18 schools now. Eleven of those schools are more expensive than Ohio State, putting our university in the top half for affordability.

Our efforts thus far constitute great progress, but we can and will do more. One thing we can do is continue to utilize the Ohio State Tuition Guarantee, which freezes tuition and fees for four years for all in-state first-year Buckeyes and their families. Even with tuition increases, it guarantees there are no surprises for undergraduates and their families over the course of four years. Another key is graduating on time. Our most recent data shows that 71% of undergraduate students on the Columbus campus graduate in four years, while 88% graduate in six years. We also know that student success requires ever-increasing coordination across our large and complex university. In partnership with the offices of Academic Affairs and Student Life, Ohio State has launched an enrollment policies, connection and completion group. This group is considering all the levers that impact a student’s ability to access, progress and complete their degree in a timely manner. Should this work succeed, and we think it will, we should see our four-year graduation and completion rates rise.

Ohio State has eliminated 70% of all course fees over the last several years. At the same time, our four regional campuses across the state and the Agricultural Technical Institute in Wooster offer a lower cost of attendance. We offer discounts on summer semester credit hours to help students finish their education at a quicker pace. In FY24, we expect to distribute approximately $415 million in financial aid at Ohio State, and I am especially proud that we offer in-state tuition to military families regardless of their place of residence.

Finally, at Ohio State, administrative and operational efficiencies have funded millions in student financial aid and have reduced student textbook costs by 75%. These efficiencies paid for $53.9 million in additional student aid.

As long as I serve as president of this great public institution, the affordability of and accessibility to an Ohio State education will remain paramount. Ohio State, first and foremost, is an institution created for Ohioans. Most people are surprised when I tell them that, across all our campuses, roughly 73% of our undergraduates are natives of the Buckeye State. The fact is that if you are an Ohio student with a high school diploma or a GED, you will be accepted to Ohio State. For some, that means they will have the chance to attend one of our superb regional campuses, where they can start and, if they so choose, finish their degrees at a lower cost. For those who want to be in Columbus, our campus-change program allows any student in good academic standing on one of our regional campuses to switch to the Columbus campus after completing 30 credit hours.

We also prioritize our pathway agreements with Ohio community colleges that provide students with an option to transfer credits efficiently and seamlessly to complete a bachelor’s degree in almost 80 fields. We have pathway agreements with Columbus State Community College, Central Ohio Technical College in Newark, North Central State College in Mansfield and Rhodes State College in Lima. The goal is to empower any student in Ohio to engage in higher education.

Diversity, equity and inclusion (DEI)

Much has been debated nationally about diversity, equity and inclusion at colleges and universities. My philosophy is simple. I want Ohio State to value diversity of thought, protect freedom of expression and foster a welcoming environment for Ohioans from every community in this state. We have a diverse student, faculty and staff community that hail from across the state of Ohio, all 49 other states and many countries. We want all to feel welcome here.

No doubt, you have seen numerous figures about the number of faculty and staff who conduct diversity, equity and inclusion work at Ohio State. These figures have all been produced without our input or guidance. The reality is this: We are a large, complex organization and there are various ways to tally the number of employees in any job description across all our campuses, colleges and units. I believe strongly in transparency, and we have provided the DEI expenses and headcount to the committee as requested.

More than half of the expenses at Ohio State include:

- Required spending for the Office of Institutional Equity, which includes spending for the Americans With Disabilities Act, Title IX and other compliance-related programs. Just to give a sense of scope, Ohio State has more than 7,000 students who are registered with our Student Life Disability Services unit and who receive academic accommodations for a wide variety of disabilities.

- Costs related to and funded by research grants, third party gifts and student scholarships.

- Expenses related to programming that supports retention, persistence and graduation for a number of student populations, including: first-generation students, parenting students, historically underrepresented students and students from rural Ohio and Appalachia.

- Programs for Ohioans such as no-cost services to help individuals with disabilities continue to farm and providing culturally competent pediatric dental care in underserved areas of Ohio.

I want to focus on the question that most directly affects our students’ success: What services and support do we need to provide to do everything we can to embody our motto – Education for Citizenship – and have our students graduate and prepared to enter the workforce?

Here is my commitment to you: We will continue to serve students from all backgrounds and in all circumstances, whether urban or rural, first generation, parenting students, veterans and more. Right now, the university is hard at work on examining how to streamline and make more efficient its services for all students – and ensuring that these services have a clear and shared focus on enhancing success.

Artificial intelligence (AI)

The implications of recent and rapid advances in the development and availability of generative AI systems are resounding across the landscape of teaching and learning. Various offices across Ohio State – including the Drake Institute for Teaching and Learning, the Office of Technology and Digital Innovation, University Libraries and the Center for the Study of Teaching and Writing – have developed comprehensive resources for university instructors regarding AI platforms, as well as their benefits, limitations and broad implications for academic integrity.

For many classes and instructors, there are opportunities for integrating AI into teaching and learning. For example, students in our College of Engineering have used generative AI for exploring solutions to coding problems. Other instructors are using AI in assignments in which they ask students to evaluate and critique an AI output against human-based statements – on literature reviews and even clinical practice scenarios. In doing so, students learn how to evaluate both the benefits and shortcomings of generative AI. Not only can incorporating AI improve learning quality, but it also prepares students to become familiar with technologies they may be using after graduation, including in the workforce.

Though generative AI tools will shape the future of work, research and technology, they can stand in conflict with academic integrity when used in the wrong way. All Ohio State students have obligations under the Code of Student Conduct to complete all academic and scholarly activities with fairness and honesty. Our professional students also have the responsibility to uphold the professional and ethical standards found in their respective academic honor codes as well as the Code of Student Conduct.

Specifically, students are not to use unauthorized assistance in the laboratory, on field work, in scholarship, or on a course assignment unless such assistance has been authorized by the course instructor. In addition, students are not to submit their work without acknowledging any word-for-word use and/or paraphrasing of writing, ideas or other work that is not their own. Among the several revisions to the university’s Code of Student Conduct in November 2023 was a clarification that unauthorized use of generative AI systems or similar technology to complete academic activities would be an example of academic misconduct. The university’s Committee on Academic Misconduct investigates all reported cases of alleged academic misconduct by students.

In terms of administration of the university, AI technologies can advance operational excellence at Ohio State by continuously improving business processes. These technologies are rapidly evolving, and the university is exploring tools that could be utilized in our educational, research and innovation, and health care endeavors.

The university’s Office of Technology and Digital Innovation, for example, is working to better understand how these systems protect the security and privacy of information they collect, especially as it pertains to institutional data. University community members have been advised not to enter any non-public institutional data into generative AI tools. Additionally, Ohio State recently made Microsoft Copilot available to all faculty, staff and students. Copilot is an AI-powered chat for the web, and user data is protected when logging in with university credentials. With Copilot, university users can receive assistance with narrowing down vendor choices, planning a business trip and more.

To develop a more comprehensive and coordinated approach toward generative AI, the university stood up a multidisciplinary working group in late 2023 that includes faculty, students and representatives from the Office of Academic Affairs; Enterprise for Research, Innovation and Knowledge; Wexner Medical Center; Athletics; Office of Business and Finance; Office of Human Resources; Office of Legal Affairs; and others. This group is considering opportunities and risks while making recommendations about how to set the foundation for the university’s path forward with AI. Recommendations from the workgroup will be delivered later this year.

From an operational standpoint, a few examples of more classical AI and automation activities already implemented at the university include: bank account reconciliation and automated mapping; accounts payable invoice analytics and complex matching; and the use of a variety of accounting bots to automate previously manual accounting tasks. In addition, the university’s implementation of Workday has put in place a platform that ensures opportunities for future automation and classical/generative AI implementation as the technology continues to evolve. For example, Workday recently notified us that they have acquired HiredScore, an AI-powered talent management solution that can reduce the cost and increase the speed of hiring and improve the recruitment experience for hiring managers, candidates and employees. We expect to have access to additional generative AI via Workday developing it on their own and acquiring it in the marketplace.

Once again, the challenges discussed here are not unique to Ohio State, our Ohio colleges and universities, or institutions of higher education across the country. Regardless, we understand the importance of proactively addressing the concerns of our community and our constituencies – and Ohio State will continue to do so.

In closing, I want to thank you, Mr. Chairman and the members of this committee, for the opportunity to appear before you and testify today.

Conversations such as these are important. Our nation is in a divisive period. Even more so, the public has lost trust in large institutions of all kinds. They have lost trust in the government. They have lost trust in the medical community. They have lost trust in the pharmacy community. They have lost trust in religious communities. They have lost trust in even the military, which has historically been one of the most trusted organizations that we’ve had since the Vietnam War.

As I have said, higher education is included in this. One of the reasons I wanted to come to Ohio State is to be in a position to lead the conversation that helps to change these perceptions. I will submit to you, in the present, that only a few public land-grant universities of our stature can turn this conversation around. At Ohio State, we have the people. We have the ambassadors. We have the backing of the Buckeye community that understands how important our mission is to our state, country and world.

This university has changed tremendously over the course of its history, and we will have to continue evolving to meet the challenges that come next. Even if how we do our work changes, however, the mission that drives us will always be the same.

Just as we were when we opened our doors, Ohio State is a university for all Ohioans and all people who want to come together to make a difference and lead.

I hope this testimony has demonstrated my commitment to this fundamental idea. Our success is Ohio’s success – again, for our students and families, as well as our communities.

I look forward to continuing to work with you, and I am happy to answer any questions you may have at this time.

Testimony as delivered

Full submitted testimony.

Search form

Does ohio state receive any discounts for travel related expenses.

Yes, note the following discounts programs:

- Airline Discounts: Ohio State has negotiated discounts with American Airlines, United Airlines, Southwest Airlines, and Delta Airlines. Flights for OSU business travel are eligible to these discounts when they are booked using the university’s contracted travel agencies. Discounts are based upon market pair and/or service class designations. Book with the university’s contracted travel agency via a full service agent or online .

- Rental Car Discounts: Ohio State has negotiated pricing (inclusive of the required insurances) with Enterprise, National and Hertz. Reservations made for university business must be reserved through the rental car agency website for most reservations or through Concur when reserving rentals associated with airfare.

- Printer-friendly version

Betting line sees big shift in Oregon Ducks vs. Ohio State Buckeyes 2024 matchup

The 2024 college football season is still several months away, but there is one date circled on the calendar this far out.

October 12, 2024.

On that day, the Ohio State Buckeyes will travel to Eugene to face the Oregon Ducks , and we will get what will undoubtedly be one of the best regular season games of the year, and a potential preview of the 2024 Big Ten Championship Game.

It will be Ryan Day vs. Dan Lanning, Will Howard vs. Dillon Gabriel, and Quinshon Judkins vs. Jordan James. A matchup with this much intrigue has already gotten people talking, and sportsbooks were early to set a betting line, with FanDuel Sportsbook listing the Ducks as a 1.5-point favorite back in January.

Recently, though, we saw a shift in the betting odds. Now, FanDuel has the visiting Buckeyes listed as a 1.5-point favorite following the spring football season. Ohio State is also -115 on the moneyline, with Oregon at -104, and the over/under has been set at 57.5.

Regardless of who comes out on top, this projects to be an incredible matchup with some of the best players in the nation on a big stage. It also has a good chance to be a conference championship preview, and could very well be a College Football Playoff preview as well.