- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

How to use the chase sapphire preferred hotel credit, the chase sapphire preferred's hotel credit goes a long way toward paying off the card's annual fee..

The Chase Sapphire Preferred® Card currently has an elevated intro offer of 75,000 bonus points after you spend $4,000 on the card in the first three months from account opening. This card has a $95 annual fee , but, you can earn back over half of that cost every year by taking advantage of a single easy-to-overlook perk — the annual hotel credit.

Sapphire Preferred card members can receive a $50 annual Chase Travel Hotel credit every account anniversary year for hotels booked through the Chase Travel SM portal . Here's what you need to know about how to use this credit and when it makes sense.

Chase Sapphire Preferred bonus and perks

What is the chase sapphire preferred $50 hotel credit, how to use the chase sapphire preferred's $50 hotel credit, when does it make sense to use the chase sapphire preferred's $50 hotel credit, alternative cards with hotel credits, bottom line, chase sapphire preferred® card.

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Welcome bonus

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

Regular APR

21.49% - 28.49% variable on purchases and balance transfers

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater

Foreign transaction fee

Credit needed.

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

The Sapphire Preferred's intro bonus offer is currently 15,000 points higher than the standard offer. This makes it a great time to apply because you're getting the same ongoing card benefits along with the additional upfront value.

This card earns Chase Ultimate Rewards® points, which are some of the best travel rewards thanks to their versatility. You can redeem Chase points for cash back or similar redemptions for one cent each. And if you use your Chase points to book travel through Chase Ultimate Rewards, you'll get a 25% boost in value as a Sapphire Preferred cardholder (1.25 cents per point).

You can really ratchet up your points' value by taking advantage of Chase's transfer partners . Chase points transfer to 14 airline and hotel loyalty programs at a 1:1 ratio. Through these programs, you can book business-class award flights or luxury hotels and dramatically increase the value of your rewards. This includes plenty of one-way Star Alliance business-class flights from North America to Europe for only 60,000 to 70,000 Aeroplan miles, flights that normally costs thousands of dollars.

The Sapphire Preferred also comes with a long list of travel and purchase insurance benefits. You'll get trip delay reimbursement, primary rental car collision coverage , purchase protection, extended warranty coverage and more.

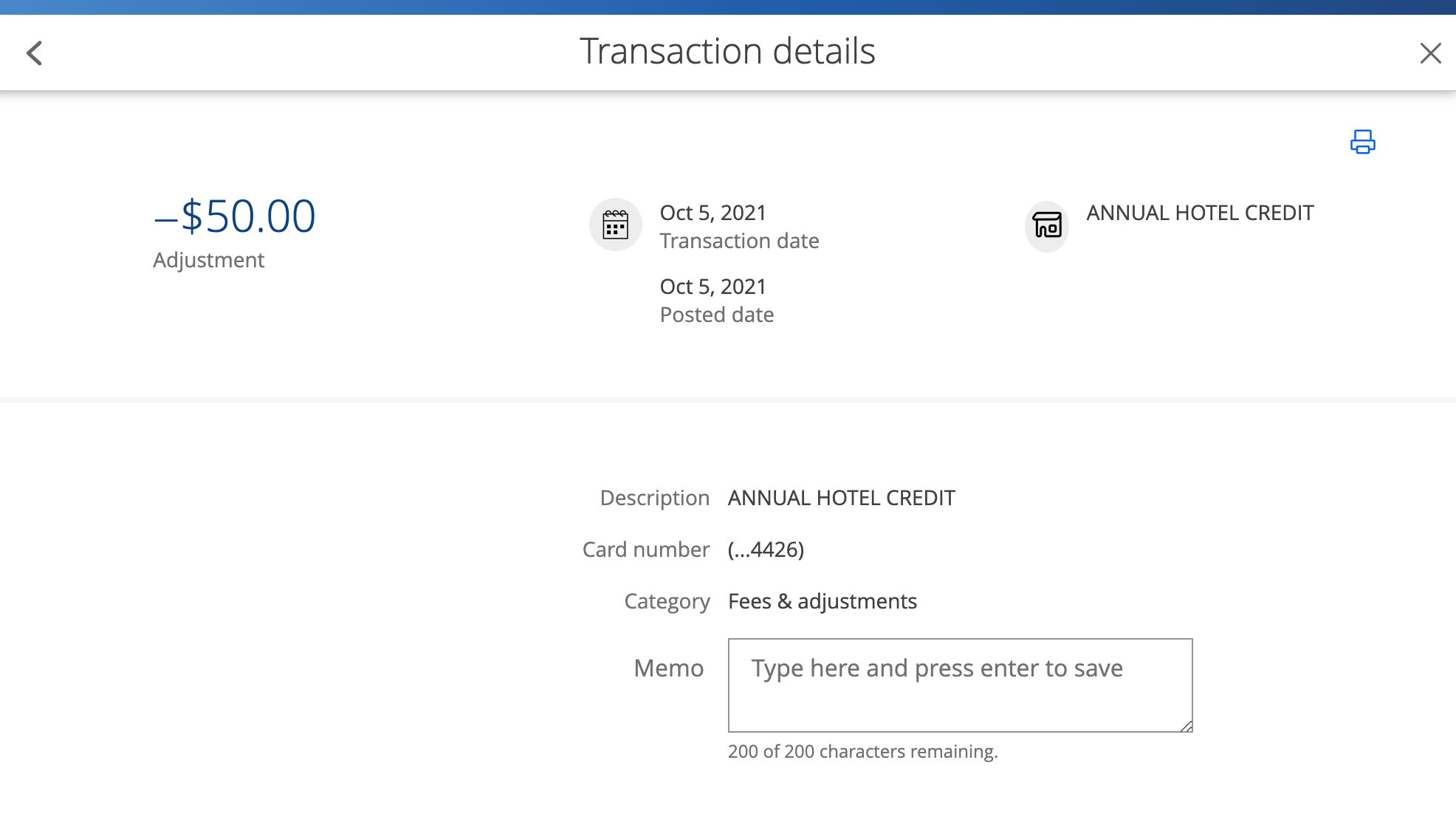

The Chase Sapphire Preferred annual hotel credit can earn you an automatic statement credit of up to $50 every card anniversary year. To qualify for the credit, you need to book a hotel through Chase Travel SM and pay for the booking with your Sapphire Preferred card.

The $50 in hotel purchases that earn you the credit will not earn Chase points. Once a qualifying transaction is posted to your account, the statement credit should get credited within one or two billing cycles.

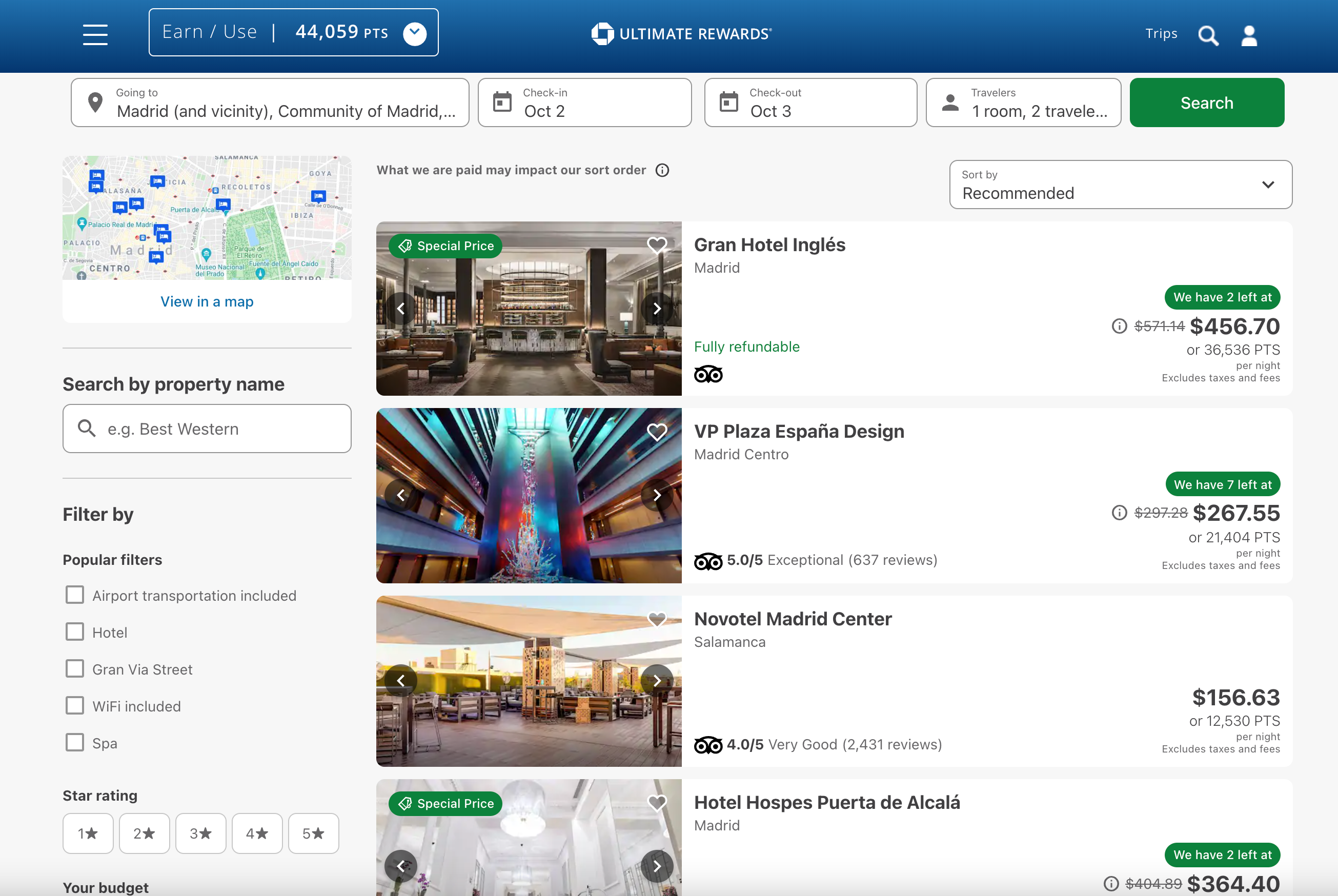

To use the Sapphire Preferred annual hotel credit, you book a hotel stay through Chase Travel SM . This platform works like booking through another online travel agency like Expedia , Priceline or Kayak . Simply search for the dates and the location where you need a hotel and book from the available options.

To use the hotel credit, first log in to your Chase credit card account and navigate to the Ultimate Rewards page. Next, select the "Travel" drop-down menu and click "Book travel."

Choose "Hotels" and enter the information for your trip. Once you start a search, you can filter the results by star rating, brand, cost and more.

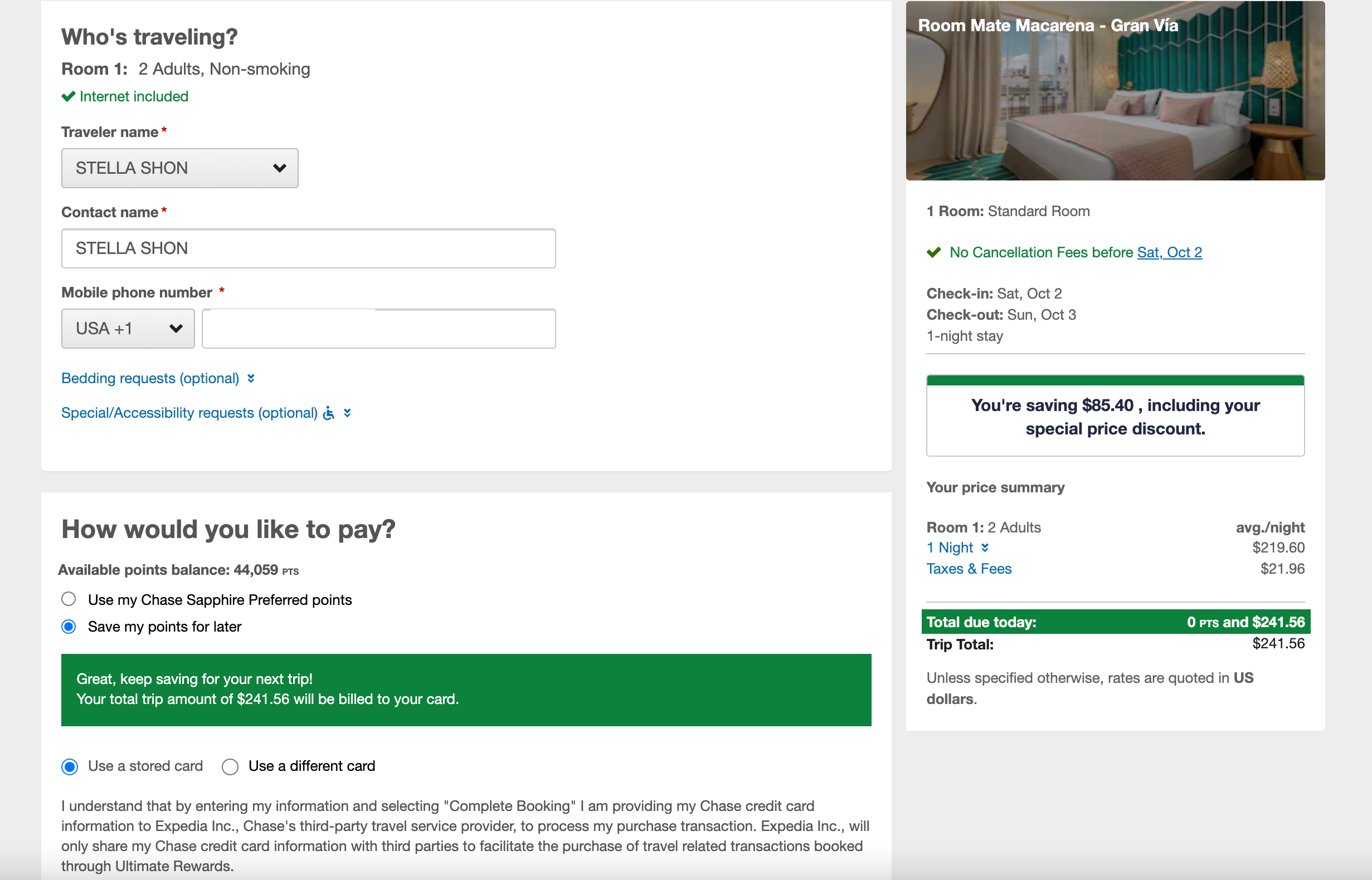

After you've selected the hotel and specific room type, you'll be able to see the final cost in dollars and points.

To earn the full $50, you need to charge at least $50 on your card. If you want to pay with points, just be sure to redeem points for all but $50 of the cost. You can easily adjust how many points you're using for the booking in the "Points redeemed" box, just be sure to click the update button when you change the number of points you want to use.

From here follow the steps to enter the traveler information and payment card info before you finalize the reservation. Be sure to pay with your Chase Sapphire Preferred card. If you don't book with your Sapphire Preferred, you won't earn the credit.

The Sapphire Preferred hotel credit is straightforward — just book a hotel through Chase Travel SM to qualify for the offer. However, you should compare prices for the same dates, hotel and room type to ensure you're getting the best price when booking with Chase. As long as you aren't paying more for the booking, taking advantage of this credit makes sense.

If elite status perks are worth more to you for a particular stay, you may want to consider trying to maximize this credit on a different booking. That's because when you book hotels through a third-party site such as Chase Travel SM you typically won't earn elite status credit. You also won't normally receive elite status benefits, such as free breakfast or room upgrades.

If you're looking for hotel credits and benefits, a co-branded hotel credit card will typically offer the most value, but the perks will be tied to a specific brand. For statement credit perks that are more universal, you'll likely need to consider a general travel credit card.

The Capital One Venture X Rewards Credit Card (see r ates and fees ) offers an annual travel credit of up to $300 for bookings made through Capital One Travel. This credit applies to hotels, but also flights, rental cars and more. When you combine this travel credit with the card's annual 10,000-mile bonus, it's not hard to justify keeping this premium credit card .

Capital One Venture X Rewards Credit Card

10 Miles per dollar on hotels and rental cars, 5 Miles per dollar on flights when booked via Capital One Travel; unlimited 2X miles on all other eligible purchases

Earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

19.99% - 29.99% variable APR

$0 at the Transfer APR, 4% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you

Foreign transaction fees

See rates and fees . Terms apply.

Read our Capital One Venture X Rewards Credit Card review.

The U.S. Bank Altitude® Reserve Visa Infinite® Card has an incredibly easy-to-use travel and dining credit worth up to $325 every year. To qualify for the credit you don't need to book through a specific site. Instead, you just pay for travel or dining with the card and you'll earn the credit on the first $325 in eligible spending.

U.S. Bank Altitude® Reserve Visa Infinite® Card

5X points on prepaid hotels and car rentals booked through the Altitude Rewards Center; 3X points on every $1 on eligible travel and mobile wallet spending

Earn 50,000 bonus points (worth about $750 in travel) after spending $4,500 within the first 90 days of account opening

22.24% to 29.24% (Variable)

3% of the amount of each transfer, with a $5 minimum

See rates and fees , terms apply.

For a limited time, the Chase Sapphire Preferred has an excellent increase welcome offer. However, it also has an extensive array of ongoing benefits for cardholders. These benefits include an annual $50 hotel credit that applies to hotel bookings you make through Chase Travel SM .

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every credit card article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit cards . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- These are the best homeowners insurance companies in Florida Liz Knueven

- First-time homebuyer grants: What you need to know Kelsey Neubauer

- Earn elevated perks during Amex's Platinum Card anniversary celebration Andreina Rodriguez

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Chase Sapphire Preferred Card

Chase Sapphire Preferred Card – How To Use the $50 Hotel Credit [2024]

Senior Content Contributor

487 Published Articles

Countries Visited: 24 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3198 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

![chase travel hotel credit Chase Sapphire Preferred Card – How To Use the $50 Hotel Credit [2024]](https://upgradedpoints.com/wp-content/uploads/2022/07/AdobeStock_361110877.jpeg?auto=webp&disable=upscale&width=1200)

Table of Contents

Overview of the chase sapphire preferred card, what is the chase sapphire preferred card $50 hotel credit, how do you use the chase sapphire preferred card $50 hotel credit, is the chase sapphire preferred card $50 hotel credit worth it, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Despite having such a strong value proposition, the Chase Sapphire Preferred ® Card continues to improve itself over time. Its annual fee has stayed the same over the years, even though Chase has offered more bonus categories and benefits.

One such benefit is a $50 hotel credit, which is pretty incredible considering the fact that the card’s annual fee is under $100.

In this guide, we’ll be examining this benefit in detail and how to maximize it as effectively as possible.

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s over $900 when you redeem through Chase Travel SM .

- Enjoy benefits such as 5x on travel purchased through Chase Travel SM , 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel SM . For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Chase Ultimate Rewards

Key Benefits of the Chase Sapphire Preferred Card

Before we get into the specifics of the $50 hotel credit, let’s discuss why we love the Chase Sapphire Preferred card , our favorite beginner rewards credit card, so much.

For new cardmembers, there’s a fantastic welcome bonus , as well as the ability to earn up to 5x Ultimate Rewards points (some of the most valuable points in the world):

- 5x points on travel purchased through Chase Travel

- 5x points on Lyft purchases through March 31, 2025

- 5x points on select Peloton purchases over $250 (through March 31, 2025)

- 3x points on dining, select streaming services, and online grocery purchases (excluding Target, Walmart, and wholesale clubs)

- 2x points on all other travel purchases

- 1x points everywhere else

The Chase Sapphire Preferred card also has a unique 10% cardmember anniversary bonus , which earns you a 10% bonus on your total spend in the past cardmember year.

With Ultimate Rewards points being wort h around 2 cents per point, you’ll earn a maximum return on spending of 10%, based on a maximum earning structure of 5x points.

Even better, the Chase Sapphire Preferred card comes with some of the best travel insurance , a complimentary DoorDash DashPass subscription (activate by December 31, 2023), purchase protection , extended warranty, no foreign transaction fees, and no-additional fee authorized user cards .

Of course, the Chase Sapphire Preferred card comes with that lovely $50 hotel credit, which is valid for any hotel stays booked through Chase Travel , also known as the Chase travel portal.

No enrollment or registration is necessary — as long as your hotel accommodation purchase is made through Ultimate Rewards, you’ll get a $50 statement credit every cardmember year (not calendar year). If you opened your Chase Sapphire Preferred card before the benefit was added in August 2021, you won’t be eligible for the credit until your account anniversary, after you’ve paid your annual fee.

The statement credit will automatically post to your account within 2 days after your purchase posts, and the credit will show up on your billing statement in 1 to 2 billing cycles.

Hot Tip: If you’re a new cardmember, you’ll be entitled to your $50 hotel credit as soon as you are approved for the card . This is in contrast with many other statement credit benefits where you have to wait an entire year before you can enjoy a statement credit.

By definition, you are entitled to a $50 hotel credit starting from your account opening date through the first statement date after your cardmember anniversary, and then 12 monthly billing cycles after that every year.

Using the Chase Sapphire Preferred card’s $50 hotel credit is easy. Even though stays have to be booked through Chase Travel, the portal itself is super easy to use.

First, visit Chase Travel and log into your Chase account.

Then, select your Chase Sapphire Preferred card.

After that, you’ll see a search box in the middle of the screen. Be sure Hotels is selected. Enter your destination, check-in and checkout date, and the number of guests. Click Search .

Select the hotel you’d like to book by clicking on the name of the hotel .

Then, select the room you’d like to book and click Add to itinerary .

You’ll be redirected to the Trip Details page. Confirm all of the dates and prices, and click Begin Checkout .

You’ll be prompted to fill in the guest form. Enter all the information required and click Save Changes and Continue .

Next, fill out the payment information and click Complete Checkout .

After you make your reservation, you’ll see the charge post as pending on your credit card account. After that, wait up to 2 days, and you should see your credit post . Easy enough, right?

Purchases That Do Not Trigger the Hotel Credit

So, the next logical question is what doesn’t count towards the $50 hotel credit?

The good news is that the answer is very straightforward : any hotel stays that are booked outside of the Chase Travel portal will not count. For example, booking a hotel stay at The Ritz-Carlton, Orlando Grande Lakes directly through Marriott or the hotel website will not qualify for the $50 hotel credit.

So if you want to use the $50 hotel credit, you’ll want to make 100% sure that you’re booking your hotel stay through Chase Travel.

Bottom Line: Stays booked directly through the hotel do not qualify for the $50 hotel credit. To get the $50 hotel credit, book your stay through the Chase Travel portal and pay with your Chase Sapphire Preferred card.

Truthfully, this is one of those benefits that come with the Chase Sapphire Preferred card anyway, so it seems foolish not to use it.

Similar benefits from other competitor credit cards usually come with restrictions; but with this card, as long as you book through Chase Travel, your hotel booking should qualify.

That’s great news because even a $50 hotel stay could qualify for the full hotel credit! So, yes, the Chase Sapphire Preferred card $50 hotel credit is well worth it.

The value proposition for the Chase Sapphire Preferred card has never been stronger. Chase has continued to offer additional rewards categories, new perks, and state-of-the-art rewards without increasing annual fees or introducing new restrictions.

One such perk is the $50 hotel credit. And with the ability to earn up to 5x points with purchases on the Chase Sapphire Preferred card, the stellar travel insurance you get through this card, and the 10% anniversary bonus, the Chase Sapphire Preferred card feels like the gift that keeps on giving.

And to sweeten the deal even further, there’s a fabulous welcome bonus you can take advantage of. It’s hard to believe that this incredible product has such a mild annual fee!

Frequently Asked Questions

How do i use my chase preferred card travel credit.

You can use your Chase Sapphire Preferred card’s $50 hotel credit by booking a stay through the Chase travel portal. After 1 to 2 days, your credit should post to your account. It’s that easy!

How do I book a hotel with the Chase Sapphire Preferred card?

It’s easy to book a hotel with the Chase Sapphire Preferred card. Just log into your Chase account , enter your travel details when searching for Hotels , select the property, and book the reservation with your Chase Sapphire Preferred card.

What hotels work with Chase?

Chase’s travel portal is very similar to Expedia or Hotels.com. It is capable of booking almost any hotel out there, including budget hotels, boutique hotels, chain hotels, luxury hotels, and everything in between.

Will I earn Ultimate Rewards points on my $50 credit hotel purchase?

According to Chase’s terms for the Chase Sapphire Preferred card, “Annually, the first $50 in Ultimate Rewards hotel purchases will not earn rewards points.”

Was this page helpful?

About Stephen Au

Stephen is an established voice in the credit card space, with over 70 to his name. His work has been in publications like The Washington Post, and his Au Points and Awards Consulting Services is used by hundreds of clients.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![chase travel hotel credit Chase Sapphire Preferred Card – Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2020/09/sapphire-preferred.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

How to use the $50 hotel credit on the Chase Sapphire Preferred

Update: Some offers mentioned below are no longer available. View the current offers here .

It's no secret that we think the Chase Sapphire Preferred® Card is an excellent travel credit card thanks to an affordable $95 annual fee and plenty of benefits to boot.

One of those perks being the $50 annual hotel statement credit for reservations booked through Chase Travel℠.

While $50 may not seem like much to some, this credit certainly shouldn't be overlooked since maximizing this benefit alone covers more than half of the card's annual fee, essentially reducing that cost to $45. And you can take advantage of this benefit with only a quick one-night getaway.

You must book through the Chase Travel portal

This benefit is not a $50 statement credit for any hotel you book and pay for with your card. You must specifically make your reservation through Chase Travel℠ . According to the perk's terms:

$50 Annual Chase Travel Hotel Credit: A statement credit will automatically be applied to your account when your card is used for hotel accommodation purchases made through Chase Travel, up to an annual maximum accumulation of $50. Annual means the year beginning with your account open date through the first statement date after your account anniversary, and the 12 monthly billing cycles after that each year. Annually, the first $50 in Chase Travel hotel purchases will not earn rewards points. Statement credit(s) will appear on your monthly credit card billing statement within 1-2 billing cycles after your purchase posts to your account.

Be warned that when you book your hotel stay through Chase Travel℠, you likely won't earn any hotel points or elite night credits nor enjoy any elite perks you might be entitled to when booking directly with the hotel.

You can always call a participating property after booking to add your loyalty program number (or try to add it at check-in), but be aware that you shouldn't expect to earn points, nor should you expect to have any elite perks honored.

That said, there's still value to be found with booking through the Chase Travel portal, as you can use it to book boutique or independent hotels that don't have a loyalty program anyway.

Making hotel bookings through Chase Travel℠ to unlock the $50 statement credit is relatively easy.

First, log in to the Chase travel portal. If you have multiple Chase cards, make sure that your Sapphire Preferred is selected in the upper left corner. Then, you'll want to select "Travel" on the menu to the left to launch the portal.

You can search for any hotel based on city or airport code.

After perusing the options, I found a hotel that was about $240 per night. I selected my room and then proceeded to checkout. In the payment options, be sure to select "Save my points for later" and pay with your Sapphire Preferred instead of redeeming your Ultimate Rewards points to book this stay.

It was as easy as that — I then had a confirmed booking, and the pending charge was immediately posted to my statement.

How long does it take for the Chase Sapphire Preferred hotel credit to post to my account?

Now for the burning question: How long does the $50 statement credit take to post to your account? Although the charge for the hotel posted on Sept. 27, I didn't receive my $50 statement credit until two days after my stay was over — Oct. 5.

TPG senior editorial director Nick Ewen had a similar experience when he booked a last-minute, one-night stay in Tampa. The $135.07 purchase through Chase Travel posted Nov. 5. The $50 credit hit his account Nov. 9 — the day after his checkout.

However, according to the terms of the benefit, you should see the $50 credit post within one to two billing cycles. As a result, if you're booking weeks (or months) in advance, you should receive the statement credit before your stay.

Is the $50 Chase Sapphire Preferred hotel credit worth it?

This benefit is similar to the $100 annual hotel credit per calendar year on the Citi Premier® Card (a competing card that also comes with a $95 annual fee; see rates and fees). However, that hotel credit is much more difficult to use, as you have to spend at least $500 (on a single hotel stay, excluding taxes and fees) and book through the Citi ThankYou portal for it to apply.

Meanwhile, the $50 hotel credit on the Chase Sapphire Preferred has virtually no restrictions — save for the fact that you need to book on the Chase Travel portal.

Bottom line

Chase continues to make the Sapphire Preferred a valuable and trusted option for cardholders. This annual $50 hotel statement credit alone ensures that I'll keep this card for the foreseeable future.

Although not a high dollar amount, a $50 discount can still be considerable, especially when the card's annual fee is only $95 per year. Once you consider all the card's other benefits , it's hard not to justify adding the Sapphire Preferred to your wallet.

Apply here: Chase Sapphire Preferred with 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

For rates and fees of the Citi Premier Card, click here.

- Airport lounges

- Dining & experiences

- Not a cardmember? Learn more

Explore all the benefits of Sapphire Reserve

Rewards to inspire your next adventure.

The Chase Sapphire Reserve card makes every purchase rewarding. Make your journey memorable with travel perks, private dinners, and VIP access at sought-after events. Explore your complete Guide to Benefits or learn more about your benefits below.

01 Travel

Get closer to your happy place

Earn points as you seek out new destinations. Book a hotel, make the most of airfare, hail rides around town and more.

$300 Travel Credit

Get reimbursed for up to $300 in travel purchases you make with your Sapphire Reserve card 1 each year. Each year, your first $300 in travel purchases will not earn rewards points. 2

Book through The Edit SM

Experience distinct benefits at a curated collection of hotels and resorts when you book through The Edit by Chase Travel SM , an exclusive benefit for Sapphire Reserve cardmembers. 7

10x on hotels through Chase Travel

Earn 10x total points on hotels (excluding The Edit) and car rentals purchased through Chase Travel after the first $300 is spent on travel purchases annually. 1

5x points on flights through Chase Travel

Earn 5x total points on flights purchased travel through Chase Travel after the first $300 is spent on travel purchases annually. 1

3x points on travel

Enjoy the trip even more with bonus points on travel purchases like airfare and hotels. 1

Unlimited points

There is no limit to the number of points you can earn. Points don’t expire as long as your account is open. 1

Enjoy more premium travel rewards

When you travel with Sapphire, plan on benefits ranging from generous statement credits to access to luxury properties worldwide.

Global Entry or TSA PreCheck ® or NEXUS fee credit

Receive a statement credit of up to $100 every four years as reimbursement for the application fee charged to your Sapphire Reserve card. 5

No blackout dates or restrictions

Book travel through Chase Travel and if a seat’s available, it’s yours.

No foreign transaction fees

Pay no foreign transaction fees when you use your card outside the United States. 6 For example, if you spend $5,000 internationally, you would avoid $150 in foreign transaction fees.

Elite hotel benefits at Relais & Châteaux

Enjoy great benefits like a VIP welcome and complimentary breakfast daily at select properties with Relais & Châteaux, a prestigious collection of luxury properties in over 60 countries. Call the Visa Infinite Concierge at 1-877-660-0905 for more details and to book your stay. 8

Special car rental privileges

Enroll in leading car rental rewards programs from National Car Rental, Avis and Silvercar. Log in to Chase Travel to access the special car rental privileges section of your travel benefits page to book with your card. Enjoy enhanced benefits, such as upgrades and car rental discounts, savings on luxury and premium rental car rates, plus promotions and other offers. 9

Ennismore hotel benefits

Your card gets you VIP access to benefits at Delano, Hyde, Mondrian, Morgans Originals and SLS hotels and resorts around the world. Cardmembers can stay a little longer with a complimentary 4th night, receive room upgrades and late check outs, along with priority access to cabana reservations, a $30 food and beverage credit and much more. 10

Free Lyft Pink

Get 2 complimentary years of Lyft Pink All Access when activated by Dec 31, 2024—a value of $199/year. 3 This includes member-exclusive pricing, free Priority Pickup upgrades, discounts on bikeshare and more. Membership auto-renews.

Don't forget as a Sapphire Reserve cardmember you'll still earn 10x total points on Lyft rides through March 2025. 4 That’s 7x points in addition to the 3x points you already earn on travel. That’s 7x points in addition to the 3x points you already earn on travel. Activate Lyft Pink All Access

02 Dining

Indulge in worldwide dining experiences

Whether visiting your local bistro or a restaurant on your bucket list, there are always special dining rewards with Sapphire Reserve.

Private dining series

Sit down for a memorable meal at some of the most sought-after restaurants in the country.

3x points on dining

Earn triple the points at restaurants, including takeout and eligible delivery services with your Sapphire Reserve card. 1 From Sunday brunch to a birthday dinner, meals out mean more rewards.

DoorDash & Caviar benefits

Takeout tastes even better with a complimentary DashPass membership on both DoorDash and Caviar. You’ll pay no delivery fee and lower service fees on eligible orders for a minimum of one year. Activate by Dec. 31, 2024 12 . Plus, as a DashPass member get a $5 monthly DoorDash credit automatically applied at checkout 13 .

Instacart benefits from Sapphire

Skip the trip and have your groceries delivered to your doorstep with 1 year of complimentary Instacart+. 14 In addition, Instacart+ members earn up to $15 in statement credits each month through July 2024. 15 Membership auto-renews. Terms apply.

03 Ultimate Rewards ®

Get the most from your rewards

Enjoy the flexibility of booking airfare, hotels and car rentals through Chase Travel or transfer points to other travel programs.

More value with travel redemption

Your points are worth 50% more when you redeem them for airfare, hotels, car rentals and cruise lines through Chase Travel—our easy-to-use portal that helps you maximize your travel spending. For example, 50,000 points are worth $750 toward travel. 16

Worldwide travel assistance

Whether you need help booking travel or modifying a reservation count on the full-service support of the Chase Travel team.

1:1 point transfer to leading frequent travel programs

Transfer points to participating frequent travel programs at a full 1:1 value—that means 1,000 points equals 1,000 partner miles/points.

No travel restrictions or blackout dates on airline tickets booked through Chase Travel.

1 point per $1 spent on all other purchases

In addition to earning 3 points per dollar on travel and dining at restaurants, you’ll earn 1 point for every dollar you spend on all your other purchases. 1

Flexibility

You can book airfare, hotels and car rentals through Chase Travel using your Sapphire Reserve card, your points or a combination of both—it's up to you.

More ways to get the most from your rewards

Redeem your points for statement credits, gift cards or choose from other flexible ways to make your points work for you.

Shop through Chase ®

Shop online with brands you already love. Earn 1x–15x bonus points at more than 450 popular retailers with Shop through Chase. 16

25% more value with Pay Yourself Back ®

Redeem points for statement credits toward your annual fee and eligible purchases for gas, wholesale clubs, and pet supplies & services by June 31, 2024.

Choose from a selection of over 150 gift cards from some of your favorite retailers and more.

Pay with points

Use your points to pay for all or part of your purchases with popular brands like Apple ® 19 and Amazon.com. 20

04 Lounges

Relax with airport lounge access

With access to Chase Sapphire Lounge by The Club and Priority Pass lounges, each trip becomes an invitation to indulge before you get there.

Enjoy complimentary Priority Pass TM Select membership

Departing for your destination is more relaxing with access to 1,300+ Priority Pass airport lounges in 600+ cities around the world, plus every Sapphire Lounge by The Club, after a one- time enrollment in Priority Pass Select.

Visit Sapphire Lounge by The Club

Relax and refresh at a Sapphire Lounge and enjoy locally inspired menus, a curated selection of beverages, an atmosphere to remember and more. Sapphire Reserve cardmembers, ensure you're enrolled in your complimentary Priority Pass Select membership for lounge access.

The Reserve Suites by Chase

Reserve cardmembers, treat yourself to The Reserve Suites at Sapphire Lounge by The Club at LaGuardia Airport in Terminal B. Enjoy caviar service on arrival, specially curated wine lists by Parcelle, exclusive menus by Jeffrey's Grocery, private bathrooms with spa showers and more. Chase Sapphire Reserve cardmembers can book a suite for a fee up to 72 hours prior to flight departure. Find details on the Chase Mobile ® app in Benefits & Travel. The Reserve Suites are limited and subject to availability.

05 Protection

Travel with peace of mind 22

When you take to the air or hit the road, we make security a priority. Here are some of the protection services built into your Sapphire Reserve card benefits.

Trip Cancellation / Interruption Insurance

If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours and hotels.

Auto Rental Collision Damage Waiver

Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary and provides reimbursement up to $75,000 for theft and collision damage for rental cars in the U.S. and abroad.

Emergency Evacuation and Transportation

If you or a member of your immediate family are injured or become sick during a trip far from home that results in an emergency evacuation, you can be covered for medical services and transportation up to $100,000.

Trip Delay Reimbursement

If your common carrier travel is delayed more than 6 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.

Travel Accident Insurance

When you pay for your air, bus, train or cruise transportation with your card, you are eligible to receive accidental death or dismemberment coverage of up to $1,000,000.

Baggage Delay Insurance

Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 5 days.

Roadside Assistance

If you have a roadside emergency, you can call for a tow, jumpstart, tire change, locksmith or gas. You’re covered up to $50 per incident 4 times a year.

Sapphire Reserve Benefits Guide

These are just some of the protection services built into your Sapphire Reserve card benefits. Your Guide to Benefits has more of what you need to know about your travel and purchase protection benefits.

Account security and protection

Your Sapphire Reserve card is equipped with the enhanced account and purchase protection you deserve.

Zero Liability Protection 23

Zero Liability Protection means you won’t be held responsible for unauthorized charges made with your card or account information. If you see an unauthorized charge, simply call the number on the back of your card.

Fraud protection

We help safeguard your credit card purchases using sophisticated fraud monitoring. We monitor for fraud 24/7 and can text, email or call you if there are unusual purchases on your credit card.

Fraud alerts

We monitor for fraud 24/7 and can text, email or call you if there are unusual purchases on your credit card. 24 Please sign in to chase.com and review your personal details to ensure your mailing address, phone and/or email are up to date.

Return Protection

You can be reimbursed for eligible items that the store won’t take back within 90 days of purchase, up to $500 per item, $1,000 per year. 22

Extended Warranty Protection

Extends the time period of the manufacturer's U.S. warranty by an additional year on eligible warranties of 3 years or less. 22

Chip-enabled for enhanced security and wider acceptance

A credit card with an embedded chip provides enhanced security and wider acceptance when you make purchases at chip-enabled card readers in the U.S. and abroad.

Purchase Protection

Covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per year. 22

06 Events

Exclusive access to events and experiences

Sapphire cardmembers enjoy priority ticketing and the best seats in the house for a wide range of events.

Reserved by Sapphire SM

Explore one-of-a-kind experiences from private dinners hosted by award-winning chefs to VIP access at the most sought after events. See where your Sapphire Reserve card can take you.

Events and experiences lounges

Enjoy comfortable seating at Chase Sapphire events in prime locations, complimentary food and drinks, plus a range of amenities, such as a dining concierge, charging stations, Wi-Fi and more.

Early-access tickets

Beat the crowds. Get your tickets to concerts and sporting events before they sell out.

Priority seating

Get up close to the court or the stage. Sapphire Reserve cardmembers can experience events from the best seats in the house.

07 Wellness

Earn 10x total points on Peloton

Work out your way — from HIIT rides to walks and hikes to strength training, and more: Get 10x total points on Peloton equipment and accessory purchases over $150 with a max earn of 50,000 points. Shop Peloton Bikes, Tread, Guide, or Row. Offer ends Mar. 31, 2025. 25

Shop Peloton

08 Services

Personalized assistance for Sapphire cardmembers

Turn to Sapphire for help coordinating travel, restaurant reservations, access to entertainment and more complimentary assistance and referrals.

24/7 access to customer service

Talk to a dedicated specialist whenever you need assistance. Simply call the number on the back of your card.

Visa Infinite Concierge Service 26

Contact Visa Infinite Concierge at 1-877-660-0905 for help with dinner reservations or Broadway, music and sporting event tickets.

Travel and emergency assistance

If you run into a problem away from home, call the Benefit Administrator for legal and medical referrals or other travel and emergency assistance. (You will be responsible for the cost of any goods or services obtained.)

Easily get more from your Sapphire experience

From mobile account access to contactless payment, cardmembers can enjoy many safe and convenient features.

Manage your account with ease

Create an account on chase.com and download the Chase Mobile ® app 27 to check account and points balances, pay bills and more.

Tap-to-pay contactless checkout

Simply tap to pay with your contactless Chase Sapphire card. Just look for the Contactless Symbol at checkout, then tap your contactless card on the checkout terminal. It's fast, easy and secure!

Add an authorized user

Maximize your reward earning potential by adding an authorized user to your account. 28

Go paperless

Get your statement online. Safely access up to 6 years of statements online. It's secure, convenient and reduces clutter.

Convenient ways to pay

Load your card into a digital wallet for a quick and secure way to pay with your mobile device and receive all the benefits and rewards of using your Sapphire Reserve card.

Earn points automatically

Grow your points balance by using your card as the primary payment method for:

- Online checkout Add your card to your favorite shopping apps and online merchants to conveniently build up your points balance.

- Monthly bills Use your card to make auto payments for monthly bills (e.g., cell phone and utility bills). 29

Redeem for travel

Use points toward your next getaway—they’re worth 50% more when you redeem them for travel through Chase Travel.

Pay Yourself Back ®

Your points have more value when you redeem them for statement credits after making eligible purchases on gas, wholesale clubs, and pet supplies & services by June 31, 2024.

Chase Dining SM

Order takeout at popular eateries around town or make reservations at restaurants, wineries and bars across the country.

There's so much for you

More Sapphire Offers

There’s so much more to make yours—top benefits, offers and experiences for Sapphire Reserve cardmembers.

Reserved by Sapphire SM

Your Sapphire Reserve card opens new doors to more flavors, sights and sounds. Explore the extraordinary lineup of experiences—including culinary, sports, music and entertainment.

Refer-A-Friend

Earn up to 75,000 bonus points per year by referring friends to either Chase Sapphire ® card.

Already a Sapphire cardmember?

Sign in to view your account, access exclusive content and take advantage of your Sapphire benefits.

Not a Sapphire cardmember yet?

We’re glad you’re here. Learn more about getting a Sapphire card.

Es posible que esta comunicación contenga información acerca de usted o su cuenta. Si tiene alguna pregunta, por favor, llame al número que aparece en el reverso de su tarjeta.

View the details of the Sapphire Reserve benefits offered on this page.

©2024 JPMorgan Chase & Co. JPMorgan Chase Bank, N.A. Member FDIC

Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

How to redeem hotel rewards.

Get the most from your hotel rewards credit cards by understanding how to redeem points and advancing in loyalty programs. Hotel credit cards allow you to enjoy perks when you stay at a hotel.

How to redeem your hotel rewards

Earn points each time you make a purchase with your hotel rewards credit card. You can then redeem those points through:

Reward program portals

Sign in to your hotel rewards or credit card rewards portal to redeem your points for travel purchases, discount opportunities and partner hotel chains.

Partner hotel chains

If you don't want to use your points with your hotel chain, you may be able to transfer your points to a partner hotel for discounted or free nights.

Loyalty programs

Use points to achieve hotel membership status so you can enjoy extra perks with your stay, such as free WiFi, complimentary breakfast, early check-in and late checkout.

How to login to your rewards program and redeem

Redeem your hotel rewards by following these steps:

- Log into your credit card or loyalty account online.

- Access your rewards portal.

- Browse redemption options on the rewards portal or partner sites.

- Pick the rewards that benefit you the most.

Ways to redeem hotel rewards

Whether you earn your hotel rewards through a hotel loyalty program or by spending on your travel rewards credit card, you can redeem a few different types of rewards:

Discounted or free hotel nights

Many hotel rewards will encourage you to spend your reward points on free or discounted hotel nights. Compare hotel loyalty programs to see how many points you usually need for a free night. The number of points needed can vary based on the property, time of year and location.

Discounted travel perks

From deals on rental cars and airfare to discounts on mattresses or electronics, many hotel loyalty programs can get good deals with their travel partners that they pass off to you within their rewards program.

Retail merchandise

It's more likely that hotel rewards are typically redeemed for hotel stays, but many hotel loyalty programs include redemptions from retail partners. Be sure to look through your loyalty program's redemption options to see if they offer perks that appeal to you.

Transferred points

Some hotel rewards programs will allow you to transfer your points to airline miles or into other loyalty programs.

Cash back or gift cards

Many loyalty programs allow you to convert your rewards points into gift cards from partner retailers, which you can use to share as presents or for rainy days. You may also be able to cash in your reward points, allowing you to earn cash back for your points.

How hotel rewards credit cards can increase your reward points

Travel credit cards and hotel credit cards can help you earn points faster on purchases made with the co-branded hotel or on travel-related purchases.

Co-branded hotel credit cards

A co-branded hotel rewards credit card is affiliated with a specific hotel chain and may offer a higher accumulation of points for the money you spend at that hotel. Hotel credit cards offer redemption options specific to that brand and are a good option for travelers who frequent a favorite hotel chain.

Travel credit cards

General travel rewards credit cards are not affiliated with any particular hotel chain and offer more flexible options for redeeming rewards across hotels and travel organizations. Travel rewards cards might also offer accelerated rewards points for travel-related spending not tied to a specific brand or chain.

Use loyalty programs and hotel credit cards to increase your perks

You can earn points and perks every time you stay at your favorite hotel by joining the loyalty program and using a hotel credit card for your spending. While there may be exclusive price deals on hotels within your loyalty program, you may be able to earn perks that you can enjoy during your stay as well. When you use a hotel credit card for expenses at your hotel, including restaurants and amenities, some cards offer bonus points for your spending.

Types of on-site hotel perks

You can earn a range of hotel perks and benefits, including:

- Complimentary breakfast or refreshments

- Free stays and room upgrades

- Complimentary Wi-Fi

- Club-level access

- 24/7 concierge

- Early check-in and late checkout

When to redeem your hotel rewards points

With proven strategies and the right timing, you can generate the most value from your hotel rewards. Hotel credit cards offer many redemption options, including free and discounted nights, gift cards, on-property services and transferring points to partner airlines. It's also important to keep track of expiring offers and qualifications.

Mistakes to avoid when redeeming your rewards

In order to earn hotel points and rewards, it's important that you make purchases with your card. Look out for opportunities that can help you redeem points and rewards, but steer clear of these common mistakes when redeeming hotel rewards:

Missing cash and points payment options

Many people believe you can only book a night paid for by your points if you have enough to fully cover it. Some hotels let you book a night with a combination of points and cash, so you don't have to wait to redeem those rewards.

Ignoring added fees

Rewards points don't always cover extra charges such as resort fees, which could get tacked onto each night of your trip. Be sure to ask your hotel about these added charges.

Only searching for long blocks of time

If you're looking to book a long stay and you want to use discounted or free nights that you earned, search night-by-night. If you search for multiple nights in a row, award nights or available upgrades within that stretch may not show up, and you could miss out on opportunities to save.

Understanding the most efficient ways to redeem hotel rewards can help you maximize your points, choose the best travel rewards credit cards and earn perks and benefits that upgrade your travel experiences.

- card travel tips

- credit card benefits

What to read next

Rewards and benefits frequent flyer programs: a guide.

Frequent flyer programs offer a variety of perks. Learn more about what frequent flyer programs are and what to consider when choosing one.

rewards and benefits Are frequent flyer credit cards worth it?

Frequent flyer credit cards help frequent flyers earn and redeem points or miles towards the cost of their future travel plans. Learn more about their risks and rewards.

rewards and benefits Chase Sapphire Events at Miami Art Week

Learn about the exclusive events a Chase Sapphire Reserve cardmember can experience at Miami Art Week.

rewards and benefits How to choose a credit card to earn travel points

There are many things to consider when choosing a credit card with travel points - how travel points work, how to earn them, and so on. Learn more here.

Chase's Sapphire Reserve and Preferred, 2 of the best travel credit cards of all time, are offering intro bonuses worth up to $1,125

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

- The Chase Sapphire Preferred and Reserve are two of the best travel rewards credit cards ever.

- Right now, new applicants can earn 75,000 Ultimate Rewards points — up to 50% more than usual.

- 75,000 points are worth up to $1,125 in Chase travel or significantly more through travel partners.

It's time to plan your summer travels — and a new credit card sign-up bonus could earn you more than $1,100 in travel rewards.

For a limited time, new applicants of the Chase Sapphire Preferred® Card or Chase Sapphire Reserve® can earn 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. These points are worth $900 or $1,125 toward travel purchased through Chase, depending on which card you get.

Chase's Sapphire credit cards are specifically designed with travelers and foodies in mind. These sleek metal credit cards come in two flavors: the everyday favorite Chase Sapphire Preferred® Card and premium-tier Chase Sapphire Reserve®.

Chase Sapphire Preferred and Reserve: the main differences

Both cards earn Chase Ultimate Rewards and come with generous travel insurance benefits, no foreign transaction fees, bonus points on dining and travel expenses, and travel credits each year. You can redeem Ultimate Rewards points through Chase Travel℠ , or transfer them to more than a dozen airline and hotel chains for even better deals.

The Chase Sapphire Preferred® Card is Business Insider's top choice for the best travel rewards credit card for value, and the Chase Sapphire Reserve® earns an honorable mention. Chase Ultimate Rewards points are worth 1.8 cents apiece according to Business Insider's valuations, and can be worth significantly more if transferred to Chase's airline and hotel transfer partners .

The Chase Sapphire Reserve® costs $550 each year but comes with many benefits including a $300 travel credit, airport lounge access, monthly DoorDash and Instacart credits, and the best credit card travel insurance you'll find.

Chase Sapphire Reserve® cardholders can redeem Ultimate Rewards points for 1.5 cents apiece through Chase's travel booking portal, so the 75,000-point welcome offer is worth $1,125.

The Chase Sapphire Preferred® Card has a much lower annual fee of $95, with lesser benefits to match. Cardholders get a $50 annual credit toward hotels booked through Chase Travel℠, quarterly DoorDash and Instacart credits, and generous travel insurance benefits.

Chase Sapphire Preferred® Card cardholders can redeem Ultimate Rewards points for 1.25 cents apiece through Chase's travel booking portal, so the 75,000-point welcome offer is worth $900.

Which Reserve card is better for you?

At the end of the day, you can't go wrong with either card. You'll get the most return for your investment by signing up for the Chase Sapphire Preferred® Card, especially during this limited-time promotion, because the sign-up bonus is worth more than 9x what you'll pay in annual fees. But the Chase Sapphire Reserve® offers top-tier travel benefits that can be worth thousands of dollars per year for frequent travelers.

You can't sign up for both cards for double the bonus, however, since cardholders can only have one Chase Sapphire card at a time. You also can't earn the welcome bonus if you've earned a bonus from either the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve® within the last 48 months.

Not sure which product is best for you? Read our comparison of the Chase Sapphire Preferred vs. Reserve , or read our Chase Sapphire Preferred review and Chase Sapphire Reserve review to learn more about each card. And if you aren't eligible for another Chase Sapphire credit card, read our guide to the best Chase credit cards to find your next best option.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

14 Best Travel Credit Cards of May 2024

Best travel cards main takeaways.

- Money has evaluated hundreds of credit cards, comparing their fees, benefits, welcome offers, travel insurance policies and more.

- The top credit cards for travel offer high rewards on travel purchases, which can be redeemed for airfare, hotel nights, cash back, statement credits or more.

- Our picks feature the best travel cards for every budget and include no-annual-fee, low-annual-fee, premium and business cards.

Why Trust Us?

Our editorial team has spent well over a thousand hours analyzing, evaluating and comparing the top credit card offers in the market. We carefully vet each card’s fine print in order to understand their features, limitations and potential benefits for consumers. We review cards independently, ensuring our content is accurate and guided by editorial integrity. Read our full methodology to learn more.

- 46 travel credit cards evaluated

- 10+ data points used, including ongoing fees, reward programs and welcome offers

- 100+ sources reviewed

Money.com has partnered with CardRatings.com for our coverage of credit card products. Money and CardRatings may receive a commission from card issuers. This site does not include all card companies or all available card offers. O ur top picks are listed strictly in alphabetical order.

Our Top Picks for Best Travel Credit Cards

Best no-annual-fee travel credit cards.

- Bank of America® Travel Rewards Credit Card – Best no-annual-fee travel card for flat rate rewards

- Bilt Mastercard® – Best no-annual-fee travel card for paying rent

- Capital One VentureOne Rewards Credit Card – Best no-annual-fee card for travel partners

- Chase Freedom Unlimited® – Best no-annual-fee travel card for domestic travel

- Discover it® Miles – Best no-annual-fee travel card for simple rewards

- Wells Fargo Autograph℠ Card – Best no-annual-fee travel card for everyday spending

Best low-fee-annual-fee travel credit cards

- Capital One Venture Rewards Credit Card – Best travel card for flat-rate rewards

- Chase Sapphire Preferred® Card – Best travel card for flexible rewards

Best premium travel credit cards

- American Express® Gold Card – Best travel card for dining

- Capital One Venture X Rewards Credit Card – Best low-cost premium travel card

- Chase Sapphire Reserve® – Best premium travel credit card

- The Platinum Card® from American Express – Best travel card for lounge access

Best business travel credit cards

- The Business Platinum Card® from American Express – Best business travel card

Best airline travel credit cards

- United℠ Explorer Card: Best airline credit card

Best Travel Credit Cards Reviews

Our top picks are listed in alphabetical order.

Best No-Annual-Fee Travel Credit Cards

- No annual fee

- No foreign transaction fees

- Earns 1.5x points on all purchases

- No bonus category for travel

- Few benefits compared to other cards

- Limited redemption options

Why we chose it: The Bank of America® Travel Rewards Credit Card is an easy-to-use card best suited for travel reward beginners or those who are already Bank of America customers.

Some cardholders can earn up to 75% more points if they are Bank of America Preferred Rewards members — that’s up to 2.62 points for every dollar spent.

However, the card doesn’t offer hotel and airline point transfer partners, travel insurance or extended warranty and purchase protection. Additionally, you can only redeem your points as statement credit to cover travel and dining purchases.

All information about Bank of America® Travel Rewards Credit Card has been collected independently by Money.com

- No annual or foreign currency conversion fee (Click herehttps://www.wellsfargo.com/credit-cards/bilt/terms/">here; for rates and fees)

- Use it to pay your rent and earn rewards without incurring any processing fees

- You can earn double points on all purchase categories (except rent payments) on the first of every month (up to 10,000 points)

- Earn 2x points on travel (when booked directly through an airline, hotels, car rental agencies and cruise lines)

- No welcome bonus or introductory APR period

- Points redeemed for statement credits are worth 0.55 cents each

- You must make at least five transactions in a statement period to earn points

- Rent payments can only be made to one rental property per month

Why we chose it: The Bilt Mastercard® lets you earn travel rewards on rent payments without incurring any processing fees — unlike most credit cards that typically charge around 2.5% to 2.9% per rent payment.

You can use the card to pay rent without worrying about surcharges. Once you get approved for the card, all you have to do is set up an account through the Bilt app or website and use your assigned routing and account number to pay rent through your usual payment portal. You can also use your card even if your landlord only accepts checks, and Bilt will send a check on your behalf.

Additionally, Bilt doubles the card’s rewards rates on the first of every month, which means you can earn 6x points on dining, 4x points on travel and 2x points on other purchases (up to 10,000 points per month). However, this bonus doesn’t apply to rent rewards.

On the downside, the Bilt Mastercard® doesn’t offer a welcome bonus, and points redeemed for statement credits are only worth 0.55 cents each.

- Can transfer your miles to 16 travel partners

- Earns 5x miles per dollar on hotels and rental cars booked through Capital One Travel

- Doesn't earn bonus points on airfare

- No domestic travel partners

Why we chose it: The Capital One VentureOne Rewards Credit Card is a great option if you’re looking for a no-annual fee travel credit card with a simple rewards structure.

You can use your miles to book travel through the Capital One Travel portal or as a statement credit to cover travel purchases made from airlines, hotels, rail lines, car rental agencies and more.

You can also transfer your points to one of Capital One’s 16 travel partners, which include international airlines such as Avianca and British Airways. This option is notable since travel credit cards with no annual fee don’t typically offer the option to transfer your reward to airline and hotel partners.

However, the card’s list of bonus categories is limited compared to some other no-annual-fee credit cards, and Capital One doesn’t offer bonus points on airfare booked through Capital One Travel.

- Includes trip cancellation/interruption and car rental insurance

- Features a high flat cash back rate combined and popular bonus categories

- 3% foreign transaction fee

Why we chose it: The Chase Freedom Unlimited® is the best credit card for traveling domestically. It offers a 1.5% flat cash back rate on most purchases plus it has several appealing bonus categories, including travel and dining.

This card charges a 3% foreign transaction fee, that is, on any transactions made in currency other than US dollars. However, if you mostly travel within the U.S., this card is an excellent option.

For one, you’ll earn an additional 1.5% on each of the card’s bonus categories during the first year of card membership (or up to the first $20,000 spent).

Also, although using this card abroad is not recommended, you can still use it to book international trips while you’re home, and you’ll earn 5% cash back if you book it through Chase Travel℠.

You can redeem your rewards for cash back, travel, gift cards and even transfer them to other cards that earn Chase Ultimate Rewards® points. It’s also worth noting that this card is one of the few no-annual-fee credit cards with rental car coverage and trip cancellation and interruption insurance.

- No annual or foreign transaction fees

- Discover matches the total miles you earned at the end of the first year

- Earns 1.5x miles on all purchases

- See your FICO score on the Discover mobile app, online and on statements

- Few benefits compared to other travel cards

- Doesn't include extended warranty or purchase protection

Why we chose it: The Discover it® Miles Credit Card is a no-frills card ideal for travelers who don’t want to keep track of bonus categories, earning caps or redemption values.

The card earns a flat 1.5x miles on all eligible purchases without any annual caps. You can redeem your miles for statement credits and account deposits at a rate of 1 cent per mile. You can also use your rewards through Amazon and PayPal checkout with the same value.

Also, the card’s welcome bonus is easily one of the best in the market: Discover matches every mile you’ve earned at the end of your first membership year — without any spending requirements.

However, while the Discover it® Miles Credit Card is a great starter travel card, its lack of bonus categories could hinder your reward-earning potential in the long run. Additionally, Discover cards aren’t as widely accepted internationally as Visa Signature and World Mastercard, for example.

All information about the Discover it® Miles Credit Card has been collected independently by Money.com.

- Earn 3x points on restaurants, travel, gas stations, select streaming services and cell phone plans

- Includes cell phone protection plan

- No airline or hotel transfer partners

- Doesn't include travel insurance

- Netflix and HBO are not eligible for streaming bonus

Why we chose it: The Wells Fargo Autograph℠ Card is the best travel reward card for everyday spending, offering high rewards on several popular spending categories, including travel, dining, gas, streaming services and cell phone plans.

Its travel bonus category is particularly noteworthy because you can earn points regardless of where you make your reservations, whether it’s directly with an airline or through a third-party travel site like Booking.com. (Most travel credit cards limit travel rewards to bookings made exclusively through the card issuer’s travel portal.)

The card also includes rental car insurance and a cell phone protection plan when you use it to pay your monthly bill.

All information about the Wells Fargo Autograph℠ Card has been collected independently by Money.com.

Best Low-Annual-Fee Travel Credit Cards

- Earn 2x miles per dollar on most purchases

- Up to $100 credit for Global Entry or TSA PreCheck(R)

- Includes travel accident and car rental insurance

- Fewer bonus categories than other cards with a similar annual fee ($95)

- Doesn't offer travel rewards for flights

- Car rental insurance is secondary

Why we chose it: The Capital One Venture Rewards Credit Card is the best credit card for travel miles if you want to earn a high reward rate and not worry about bonus categories.

The Capital One Venture Rewards is ideal for those who want to get the most out of their spending without worrying about tracking bonus categories and spending caps.

You can redeem your miles on the Capital One travel portal and as statement credits to cover travel purchases at a value of one cent per mile. Additionally, you may transfer your miles to more than 15 airline and hotel partners.

However, keep in mind that Capital One doesn’t have domestic travel partners, which can be a drawback if you mainly travel within the U.S.

- Points are worth 25% more when redeemed for travel purchases through Chase TravelSM

- Receive a point bonus each account anniversary

- Includes primary rental car insurance

- Earn 3x per $1 on dining, including eligible delivery and takeout meals, select streaming services and grocery purchases

- $95 annual fee

- Doesn't offer a Global Entry/TSA PreCheck(R) application fee credit

Why we chose this card: The Chase Sapphire Preferred® Card is the best travel credit card for frequent travelers who want to earn valuable rewards while paying a low annual fee.

The card features six reward categories that offer outstanding rewards on flights, hotels, restaurants and more. You can redeem your points for statement credits, account deposits, gift cards and more. But you can get the most bang for your buck by redeeming them for travel purchases through the Chase Travel℠ portal, which increases your point’s usual one-cent value by 25%.

You can redeem your points for statement credits, account deposits, gift cards and more. But you can get the most bang for your buck by redeeming them for travel purchases through Chase Travel℠, which increases your point’s usual one-cent value by 25%.

You can also transfer your points to one of Chase’s 14 travel partners at a 1:1 ratio (one Chase point equals one hotel point or airline mile). These include popular airlines and hotels like JetBlue, Southwest, United, Marriott and Hyatt.

Best Premium Travel Credit Cards

- Earns 4x points on restaurants worldwide, takeout and food delivery within the U.S.

- Up to $120 in annual dining credits, issued as a $10 statement credit per month for select restaurants (enrollment required)

- Up to $120 as Uber Cash annually ($10 per month) for food delivery orders and rides in the U.S. after you add the American Express(R) Gold Card to your Uber account

- Earn 4x points at U.S. supermarkets (on up to $25,000 per calendar year, then 1x)

- High annual fee ($250)

- Includes few travel perks and insurance policies compared to similarly priced cards

Terms apply. Please click here for applicable rates and fees.

Why we chose it: The American Express® Gold Card is ideal for foodies, offering a high reward rate at restaurants worldwide and U.S. supermarkets, takeout and food delivery. (Terms apply.)

The American Express® Gold Card also offers statement credits worth up to $240 combined — almost enough to offset the card’s $250 annual fee. These include:

- Up to $120 every year in dining credits ($10 per month) for select restaurants and food delivery services. The list includes Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and Shake Shack (Enrollment required)

- Automatically get $10 monthly in Uber Cash to use on Uber Eats or Uber rides in the U.S. (after you add the American Express® Gold Card to your account)

- $100 credit for dining, spa services and other activities when you book a two-night minimum stay at a hotel from The Hotel Collection through American Express Travel

- Terms apply

However, note that the American Express® Gold Card offers fewer travel perks than some other premium cards — for instance, it doesn’t offer trip cancellation and interruption insurance or TSA PreCheck® or CLEAR® Plus fee credits.

- 10,000 bonus miles every year

- Statement credit of up to $300 for bookings made through Capital One Travel

- Up to a $100 credit on Global Entry or TSA PreCheck(R)

- Skip the line and get car upgrades when renting a car with Hertz

- High annual fee ($395)

- Fewer bonus categories than other premium cards

- No domestic airline transfer partners

Why we chose it: The Capital One Venture X Rewards Credit Card is the best credit card for travel miles if you want to earn a high reward rate and not worry about bonus categories.

The Capital One Venture X also includes noteworthy perks such as:

- 10,000 bonus miles every year (starting on your first anniversary)

- $300 annual credit for bookings through Capital One Travel

- Up to a $100 credit for Global Entry or TSA PreCheck®

- Access for you and two guests to 1,300+ lounges worldwide with Priority Pass™ Select and Plaza Premium Group

- Authorized users at no extra cost (many cards have an annual fee of $75 or more for each additional user)

All in all, the Venture X is a solid option that can easily compete with other premium travel cards, especially considering its more affordable annual fee.

- Up to $300 in statement credits each anniversary year to cover travel purchases

- Transfer your points to 14 travel partners (including United, Southwest, JetBlue and Marriott)

- Points worth 50% more when redeemed for travel expenses through Chase TravelSM

- Comprehensive travel insurance coverage, including emergency dental insurance

- High annual fee ($550)

- Doesn't include a cell phone protection plan

Why we chose it: The Chase Sapphire Reserve® is the best credit card for travelers looking for a high reward rate on travel and additional benefits like comprehensive travel insurance and airport lounge access worldwide.

Your points are worth 50% more when you redeem them for travel through the Chase Travel℠ portal. This means each point is worth 1.5 cents per point instead of one cent, like most travel cards. Also, the Chase Sapphire Reserve® provides several high-end benefits such as:

- $300 annual travel credit to cover travel-related purchases like airfare, hotels, car rentals, rideshares, buses, trains, tolls and/or parking

- Access for you and two guests to 1,300+ airport lounges worldwide (after a one-time enrollment in Priority Pass™ Select)

- Statement credit of up to $100 every four years for Global Entry, TSA PreCheck® or Nexus

The Sapphire Reserve does have a $550 annual fee. But if you take advantage of the $300 annual credit and other perks, the benefits can definitely outweigh its cost.

- Access to the widest network of airport lounges of any card

- Complimentary elite status in the Marriott and Hilton hotel loyalty programs

- Hundreds of dollars in annual statement credits for travel, dining and more

- High annual fee ($695)

- Doesn't include baggage delay, travel accident and primary rental car insurance

- Limited bonus categories

Terms apply. Click here for rates and fees.

Why we chose this card: The Platinum Card® from American Express offers a list of premium benefits that no other travel card offers, including the widest network of airport lounges and room upgrades at Hilton and Marriott hotels. (Terms apply.)

The Platinum Card® from American Express features an impressive list of high-end travel benefits, including:

- Complimentary access to over 1,400 airport lounges, including Priority Pass, Delta SkyClub and Amex’s own Centurion lounges (enrollment required)

- Gold status in the Marriott and Hilton loyalty programs, which makes you eligible for room upgrades, free breakfast and late checkouts (enrollment required)