Detailed Guide To Travel Agency Accounting

- Post author By varun

- Post date December 1, 2022

As far and wide the services of a travel agency expand, so is the elaborateness of its accounting procedures. Being a business model operating with multiple parties under unique financing arrangements, these agencies need to keep the flow of funds fairly sorted. This needs to be done for a clear bookkeeping and accounting of money received or paid. And so, understanding the procedure and details of accounting becomes quite a necessity for someone planning to run or establish a travel agency.

Even though the availability of travel management platforms like Pathfndr has simplified accounting for these agencies, it is imperative to know the thick and thin of travel agency accounting if planning to run a travel agency.

Accountancy for travel agencies is a dedicated information system designed to provide the necessary details. These details can be related to the company’s monetary stature, its transactions, financial executions, and everything else related to its management.

The success of travel agency management is critically based on efficient recording, accuracy of such record maintenance and the financial statement preparation. For suitable formulation of strategic business decisions and plans, travel agency accounting can be the concrete support needed.

Travel agency accounting is also needed to assess the fair status of the company. It can be simply said to be a process that enables profitability assessment of the agency as well as its financial status in both short and long run. Platforms like Pathfndr only assist with the elaborate accounting system that a travel agency may need to follow.

Below given is a detailed guide on the types of books maintained for travel agency accounting along with the financial statement preparation requirements and other pertinent details related to the procedure. Meanwhile, it can be useful to check out the role that travel agency management platforms like Pathfndr can play in maintaining the books of travel agency accounting for these companies.

Books That Need to be Created for Travel Accounting

Travel agencies need to prepare a host of books, statements, and journals for the purpose of essential travel accounting. These companies would need to create one or more of the following records and statements to keep the travel agency accounting right in place.

Journal for cash receipt

A cash receipt journal allows you to record the receipt of all revenue generated for the travel agency. The journal is recorded for an annual period and receives entries for all transactions made in cash, cheques, and credit cards.

Whether the business receives payments for tour package sale and any commissions received from a partner operator, which can include airlines, bus operators, hotels, and the likes.

While you would need to make these entries manually, using an online travel management platform like Pathfndr simplifies these records as they are directly accounted for through necessary tools used on these platforms.

Sales journal

A sales journal is used to account for all transactions that a travel agency makes in credit. In case your travel agency extends credit facilities to partner operators and customers, the entries would form a part of the sales journal.

Usually, travel agencies operating on a large scale use these journals. With access to the likes of Pathfndr, all credit sale records are updated automatically to this journal.

Accounts receivable

A journal of accounts receivables is used to record transactions that the travel agency makes in credit in lieu of products and services received from supplying partners. It sums up the amount that the business would owe to its suppliers, sellers, and producers for the period involved.

Journal for cash disbursal

The total outflow of cash from the travel agency’s entirety of finances is recorded in the cash disbursement journal. A majority of this journal’s entry is made with respect to its operating cost for the period, including the likes of rents, administrative expenses, selling and/or distribution expenses, legal expenses and salaries/wages paid.

Also known as the cost journal, entries to this travel agency accounting record are mostly made for cheques and drafts issued. But all of these essential entries are simplified through automation processes that platforms like Pathfndr provide.

Payroll journal

A payroll journal is an altogether separate journal that is maintained as a record of salaries/wages and other financial benefits paid to its employees. It gives a detailed insight on the total employees working with the agency, the total outflow made in the form of salaries and wages, compensations, insurance protection provided, medical facilities, compensations, and other benefits that may be available to its employees.

Chief book of accounts

The chief book of accounts is primarily a ledger book and a summed point of accounting record for all the balance entries that the company may have. It is a critical bookkeeping record that can direct identification and verification towards all revenue sources, a total of cash and credit sales, commissions earned, and such other crucial travel agency accounting aspects.

The use of Electronic Data Processing or EDP systems in almost all travel agencies operating today simplifies all these entries, their identification and verification for performance evaluation. Platforms like Pathfndr are fast changing how these EDPs are integrated into the travel agency accounting system.

Travel Accounting System

A travel accounting system follows a design that aims to record all items related to the business’s balance sheet as well as its income statement. These items spread across the likes of the agency’s assets, liabilities, incomes, revenues, gains, losses, expenses, as well as the capital invested.

An automated travel accounting system is integrated into the operation of travel management platforms like Pathfndr to simplify the recording and identification of these accounting items of the business. It can thus be greatly useful to create your travel agency’s official website on these platforms with dedicated domains and other customized functionalities.

Below given is a list of items that are included in the accounting statements prepared as per the travel accounting system with their short descriptions.

Capital invested

The capital of a business in general, including a travel agency, comprises the contributions from the owners of the entity, company, partnership, or firm. The capital of the company comprises both paid and unpaid contribution of the owners to the company. It can be summed up as the net worth of the travel agency that it owes to the owners. Depending on the type of the company a travel agency is established as, the capital and ownership can either be considered as separate or as one and the same.

Irrespective of the ownership-entity divide, the items comprising the capital of the travel agency must be accounted for individually. In the case of a company form of travel agency, the capital can include its shares and debentures. For travel agencies formed as partnership firms, the contributions of individual partners comprises the capital of the agency. In case of individual owners, their entire investment comprises the capital of the travel business.

A travel agency runs on definite resources that it utilizes to generate revenue. Such resources are invested into the business to generate benefits from operations in the future. These resources that contribute to benefit generation over the time are known as assets of the company.

The identification of assets is intended to increase the business’s cash flow in the long run through cyclic usage. A travel agency’s, or any company’s for that matter, assets can be identified under two classes, namely fixed and current assets. It is crucial to identify these assets separately for the purpose of travel agency accounting .

Liabilities

A liability of a travel agency can be identified as a claim against the assets that it utilizes for revenue generation and profitability. These can also be understood as the future sacrifice of economic benefits that the business undertakes for asset generation or for providing services, ultimately leading to debt creation charged on these assets. Like assets, liabilities of a travel agency are also identified under two types, and are known as long-term and short-term (current) liabilities.

Be it assets, liabilities, or any other item of the accounting system that the travel agency needs to maintain can be easily identified under the aegis of travel management platforms like Pathfndr. These records are summed up at the end of each accounting period and can be accessed through website accounting automation processes run through Pathfndr.

Revenue/gains/income

The total value of services/products that a travel agency provides, the interest received from clients, commissions from partner operators and such other contributions that form a part of the total incoming monetary value can be identified under this accounting head. Revenue of the company is the total value of sales made, out of which the gains are identified as revenue minus the expenditure incurred.

The total cost that a travel agency incurs, including the cost in the long as well as short term, for running the business can be accounted for under the expenses head of the travel agency accounting system. Expenditures are also identified as the sum of cash outflow made by the agency in return of services or products received towards the entity’s operation in short as well as long run.

While maintaining the travel agency accounting system can be quite extensive for an agency, the use of travel management systems like Pathfndr can make the entire process of handling the business’s accounts simple and convenient, requiring minimal manual efforts and time.

Financial Statements That Need to be Prepared

For any accounting system, including that of travel agency accounting , the output of the records need to be formally created based on the identified and accepted statements. These statements are popularly known as the financial statements of the travel agency and are categorized under income statements and position statements.

Income statement: An income statement of a travel agency is also maintained as a profit and loss account for the company. It is created to assess the overall profitability of the company for an identified period based on the income and expenditure made for the said duration. It is an important part of travel agency accounting.

Position statement: A position statement of a travel agency is created to assess its overall financial health. It is a periodic statement, and is often created at the end of the definite term identified for the accounting cycle. It usually comprises the assets and liabilities of the travel agency on a said date and helps identify the resources used and their financing.

In the overall consideration of travel agency accounting system maintenance for the travel agency, creating a dedicated department and hiring the skilled personnel for the purpose can be an extensive process. It also involves resource allocation and can be a tedious process overall.

As an alternative, a travel agency can seek to automate the entire travel agency accounting system through necessary tools in place. One of the best ways to implement this automation is to create the business website through Pathfndr, a travel management platform that comes preset with all the tools necessary for accounting and bookkeeping of the agency.

The automated processing tools are well-designed to automatically record and compute the accounting results as and when desired. So, the travel agency does not have to go through an extensive travel agency accounting process periodically.

Travel agency accounting is a crucial aspect that a travel agency needs to take care of at all times, irrespective of its scale and geography of operation. The availability of travel management platforms like Pathfndr and their integration of automated accounting tools amps up the overall financial management of the company.

Creating your agency’s travel website through these platforms can benefit in so many more ways than just adequate and timely recording and assessment of the financial aspect of the business.

IFRScommunity.com

IFRS Forums and IFRS Knowledge Base

Principal vs Agent, or Reporting Revenue Gross vs Net (IFRS 15)

Last updated: 15 January 2024

The concepts of ‘principal’ and ‘agent’ are commonly referred to when discussing the gross vs. net presentation of revenue. Under IFRS 15.B35-B36, a principal recognises revenue and expenses in gross amounts, whereas an agent merely recognises fees or commissions, irrespective of whether gross cash flows pass through the agent.

Understanding principal and agent roles

This is how these roles are defined in IFRS 15:

- Principal – the party that controls the goods or services before they are transferred to customers,

- Agent – the party that arranges for the goods or services to be provided by another party without taking control over those goods or services.

IFRS 15.B34 mandates entities to determine whether they are acting as a principal or an agent for each good and service provided to a customer.

Two-step framework

IFRS 15.B34A proposes a two-step framework to aid in this assessment:

- Identify the specific goods or services to be provided to the customer.

- Evaluate whether the reporting entity controls the identified goods or services before they are transferred to the customer.

The first step is particularly relevant for services and intangible assets.

As previously mentioned, a principal is a party that controls a good or service before it is transferred to a customer. In contrast, an agent merely arranges for the provision of goods or services by another party, without exercising control over those goods or services before their transfer to a customer.

Determining control over a good or service

IFRS 15.B37 provides useful indicators for determining if a reporting entity controls a good or service before its transfer to the customer. These include:

- Primary responsibility for ensuring the good or service meets customer specifications,

- Inventory risk, and

- Discretion in establishing the price for the specific good or service.

It’s important to note that exposure to credit risk is not considered a factor in this assessment. The IASB has concluded this to be mostly irrelevant, as agents, much like principals, often face credit risk.

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Use of subcontractors

IFRS 15.B35A provides further guidance to be applied when another party is involved in delivering goods or services to a customer.

Principal vs agent considerations in relation to services

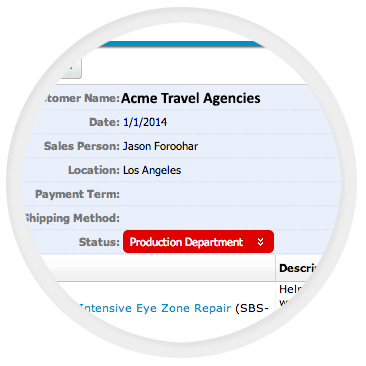

Challenges often arise when assessing the principal versus agent considerations for services that the entity will not directly provide. For instance, when a travel agent sells an airline ticket to a tourist, is it always considered an agent under IFRS 15 since the flight will be delivered by the airline? The answer is not necessarily. IFRS 15.B34A clearly states that the good or service provided to the customer could be a right to a good or service to be provided in the future by another party. For example, if a travel agent purchases airline tickets in advance and then sells them to a tourist, it can consider itself a principal and recognise gross revenue.

Principal vs agent – examples

Refer to Examples 45, 46, 46A, 47, 48, and 48A accompanying IFRS 15 for further clarification. Additionally, refer to this agenda decision where the IFRS Interpretations Committee illustrates how to apply the above principles to software resellers.

More about IFRS 15

See other pages relating to IFRS 15:

© 2018-2024 Marek Muc

The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Excerpts from IFRS Standards come from the Official Journal of the European Union (© European Union, https://eur-lex.europa.eu). You can access full versions of IFRS Standards at shop.ifrs.org. IFRScommunity.com is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org.

Questions or comments? Join our Forums

Travel Agency Accounting

Today, accounting is recognized as an information system and is designed to communicate the right information to the internal as well as external users. Accounting involves recording, classification and summarizing the accounting information directed toward the determination of financial strength and weakness of a travel agency.

To manage a travel agency / tour operator profitably demands accurate recording and preparation of financial statements. These are essential in determining the true and fair status of the business and for making strategic plan and decisions.

Travel Accounting System

The basic objective of accounting is to ascertain the profitability and finance position of a travel agency operation. To achieve this, every travel agency prepares the following journals and statements:

- Sales Journal

- Cash Receipt

- Account Receivable

Cash Disbursement

- IATA ledger

- General Ledger

- Profit and Loss Account

- Balance Sheet

Sale Journal

In this journal, all credit sales are recorded. Sometimes, a travel agency provides extends credit facilities to its clients i.e., leisure and commercial clients. It, in fact, makes a cash loan to its clients. However, it has been noticed that only large-scale travel agencies can afford to extend credit to corporate customers, but even then, a thorough credit check is required before a credit amount is opened.

To maintain the up-to-date record of all credit sale, travel company prepare a sales journal.

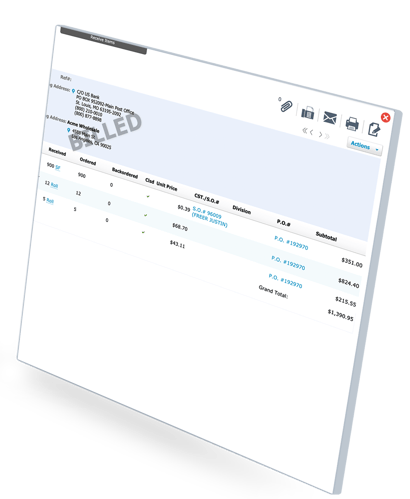

Cash Receipt Journal

It is used to record all revenues received by the travel agency during the period. In other words, transactions concerning cash, credit cards, cheques are recorded in this journal. For example sale of the tour package, the commission received from the hotel, airlines and other vendors are recorded in it.

When a travel agency purchases tourism products, services from the supplier on credit, the amount owed to producers/suppliers/sellers are referred to as an account receivable.

Cash outflows are recorded in cash disbursement journal. Cash outflow means the operating expenses of the travel agency like rent, salaries, telephone expenses, administrative expense, financial and legal expenses, selling and distribution expenses etc.

These are mostly paid by cheques or through bank drafts. Cash disbursement journal is also called Cost Journal . Thus, cost journal is used to record the payments made by a travel company to its employees and others.

IATA Ledger

The IATA ledger is known as ‘ Chief Book of Accounts’ and is the destination point of entries made in the journals or sub-journals. It is used to balance the accounts of the travel agency. In accounting, ‘Balance Account’ means continuous and consistent check and verification of the accuracy of a travel agency’s accounting system.

The main objectives of IATA ledger are:

- Identification of travel agencies revenue sources.

- Determination of total sales (cash and credit).

- Determination of total commission earned by the travel agency.

- Find out the total amount owned to IATA.

- Evaluate the performance of each travel agency ( which is recognized by IATA).

The procedure of posting IATA Ledger is very simple and easy to understand. Today, almost every travel agency is using Electronic Data Processing System (EDP) to maintain an up-to-date record of each cash as well as credit card transactions.

The procedure of posting Cash and Credit Card Transaction in the IATA Ledger is:

- Enter the date, items, and invoice number.

- Enter the gross amount of cash and credit-card transaction.

- Calculate the commission and enter in the agency commission column.

- Subtract the commission form the gross sale and enter the result in the Net Amount column.

- If any amount is due then record it in the due column.

Pay Roll Journal

In this journal, a travel agency maintains the record of salaries and other benefits (financial) given to its employs like the number of employees on the payroll, total salaries, insurance premiums, compensations, housing facilities, medical facilities and other benefits to the employees.

Practically, the total from each journal is compiled monthly and posted to the general ledger. In this ledger, all types of the account are maintained/transferred from the various individual journals to provide ready information for the preparation of the financial statements.

ASTA Accounting System

In 1979, Touche Ross and Co. , developed the ASTA Travel Agency Accounting System to facilitate travel agent and tour operators specifically for ARC and IATA reporting. All items in the balance sheet and income statement are numbered from 100 to 699. Each three-digit number convert the information for the users.

Basically, an accounting system is designed to record the agency’s assets, liabilities, capital, revenues/income/gains, and expenses or losses etc. A brief discussion of these follows:

Assets are economic resources which are owned and used by the travel agency and are expected to benefits in future operations. Hence, assets can be expected eventually to increase the cash inflow of the travel agency. Assets are two types:

- Current assets

- Fixed assets

Liabilities

These are the claims against travel agency assets. Practically, liabilities are future sacrifices of economic benefits arising agency’s debts to transfers assets or provide services to other as a result of past business transactions. These are of two kinds

- Current or short period liabilities

- Long-term liabilities

Capitals represent the amount of paid or contributed by owners, shareholders to the agency. More precisely

Capital = Assets – Liabilities

It is equal to the difference between the values of what is owned by the agency and the value of what is owed by the travel agency. Capital represents the net worth of the agency to owners.

Income/Gains

It is the monetary value of goods and services sold by the travel agency such as the sale of the tour, airlines commission and interest received etc. Revenues are cash inflows of the agency for the services rendered to the clients during a specific period.

Expenses represent the cost of doing travel agency business. Basically, these are cash outflows and are paid by the agency to obtain or purchases goods and services from the providers. Other expenses are included in it like as salary, administrative expenses, financial and legal expenses etc.

Financial Statements

Financial statements are the formal output of any accounting system and are prepared to provide accurate, timely understandable, objective and comparable accounting information to the users. Today, these statements are considered as a base for making rational decisions concerning the future of the travel agency.

Types of Financial Statements

Financial statements are mainly categorized into two types. These are as follows:

Income Statement

Position statement.

It is also known as profit and loss account and is prepared to provide information on an agency’s profitability over a given time period. It is the statement of the revenues earned and other gains made during a year; matched with the amounts spend to earn these revenues.

It shows whether the travel agency earned a profit i.e. the excess of income over expenditure or has suffered a loss i.e. the excess of expenditure over income.

An income statement contains a summary of figures relating to the cost of tours sold; various operating and non-operating expenses and provisions for expenses. These are then compared with sales and various operating and non-operating revenues.

The income statement provides important data for the financial planning, profit planning and debt-paying ability of the travel agency. Essentially, this statement provides vital financial information to the internal as well as external users.

It represents the financial health of a travel agency at a given time and therefore, it is often called a ‘ statement of financial position ‘. A position statement may be defined as statements prepared with a view to measuring the true financial position of a travel agency on a certain fixed date . It is prepared by the transferring all balance that belongs either to personnel or to real accounts.

These balance either represents assets or liabilities existing at the last date of the accounting period. In the technical world, it provides details about the resources of a travel agency and how these resources financed, either by lending funds or by investing capital in the business.

Users of Financial Statements

Financial statements are the mirrors which reflect the financial position and operating strength or weakness of a travel agency. These statements are useful to owners, creditors, suppliers, management, government, and other outside parties. Users of the financial statements are as follows:

The owner is mainly concerned with the managing the investment and long-run success of the travel agency. They are also interacted to know whether their money is used for those purposes for which they have invested it. The income and position statements tend to be the primary source of information to the owner.

2# Creditors

They represent persons, banking and financial institutions which have loaned funds to the travel agency. They are interested in knowing entity’s debt-paying ability for a short or a long term.

3# Suppliers

Suppliers in the travel business are not similar to the creditors. They are the producers/principals such as airlines, hotels , tour operators , transport operators, cruise liners for whom the travel agency collects revenues or collects product lines to formulate tourism product or tour package.

These suppliers are interested in knowing the agency’s debt-paying ability. Even some suppliers demand bank verification and audited financial statements etc.

4# Management

Management uses accounting information as an input to make rational decisions and to achieve profitability objective. Apart from financial statements, management needs some other reports too like the – booking commission report, employees and suppliers reports.

Ironically, management is interested only in knowing the existing profits, EPS, chances of survivals, a possibility of growth and diversification, relative performance, so that it can chalk out suitable strategies for its travel agency/operator.

5# Employees

Basically, employees are concerned with job satisfaction, job security, promotion, welfare schemes and other financial incentives given by the travel agency. So they want information on the profitability and the future prospects of a travel agency.

6# Financial Advisors

These advisors make their living by advising clients how and where they should invest their shaving. However, before they offer any advice they need financial information about the company which they may recommend to invest money.

7# Government

The financial statements are used to assess the liability of a travel agency and are also used to determine the overall performance of the travel industry. These statements provide valuable information to an authority for the determination of tax liability.

Government act as a base for farming and amending the regulatory structure of travel agency business.

Financial Analysis and Control Techniques Used in Travel Agency Business

It is observed that financial statements convey much useful financial information to internal management and outside users, and for this reason, it has become imperative to discuss the various tool for analyzing financial statements and control techniques used in travel agency business.

The emphasis is focused on the application of tools and techniques which are key indicators of a travel agency’s financial health and are considered vital for wise decisions to improve an agency’s profitability, financial soundness, and strong financial strategies.

Accounting Ratios

Accounting ratios are known as ‘ financial ratios ‘ and are considered key indicators for measuring the agency’s profitability and financial performance. They may be calculated at one point of time or may cover several time period to identify trends in several years. It is also used to compare one’s own position with an average industry.

According to Wixon and Kelly in 1970, “ an accounting ratio is an expression of the quantitative relationship between two numbers. It is a simple arithmetical expression of the relationship of one amount to another like 100 to 200 or 600 to 700 etc .”

The main ratios which are widely used to analyze an agency’s performance are:

Liquidity Ratio

Current ratio.

- Quick Ratio

Profitability Ratio

- Profit Margin

- Return in Assets

- Return on Investment

Activity Ration

- Fixed Assets

- Accounts Receivable

- Account Payable

Leverage Ratio

- Capital-gearing Ratio

- Financial Leverage

- Operating Leverage

- Debt Equity Ratio

It means an agency must be able to pay its short period debts and obligations from its short period financial resources to remain in the business. The most common used liquidity ratio is the current ratio.

This ratio compares the agency’s current assets to current liabilities. A high current ratio indicates that the travel agency is liquid and has the ability to pay its current obligations in time as and when they are due.

Activity ratios measures how effectively a travel agency manages its resources. Practically, funds are invested in various assets of a business to enhance sales and earn profits. The greater the return which can be derived from the assets, the more attractive the investment and the more profitable the agency.

These ratios are also called ‘ turnover rations ‘ because they reveal how rapidly resources are converted into revenues. High ratios are generally associated with good asset management. The activity ratios are:

Account Receivable indicates the number of times the average receivables are turned over during a year. The higher the value of turnover, the more efficient is the management of account receivable and vice versa.

Account Payables indicates how much time a travel agency is likely to take in repaying its account payables/creditors in a very short period. The less the number of times, the more is the credit period that a travel agency enjoys.

The main objective of travel agency business is profit maximization. Essentially the existence, continuance, and expansion of travel business depend, to a large extent, on the travel agency’s capacity to earn good amount of profit every year.

Profitability ratios are a fair indication of sound management of a travel agency. The main profitability ratios are profit martin/net profit to sales ratio, return on assets and return on investment.

Capital Structure Ratio

It measures the relationship between long-term debts and owner’s equity. Generally, debt financing increases the risk of investment in the business. So a higher leverage ratio is associated with higher risk and vice versa. However, there are times when a travel agency can make use of borrowed capital than equity.

The debt-equity ratio and debt servicing ration are used to measures the capital structure of an agency. The debt-equity ratio compares the total debt with total owner’s equity of an agency.

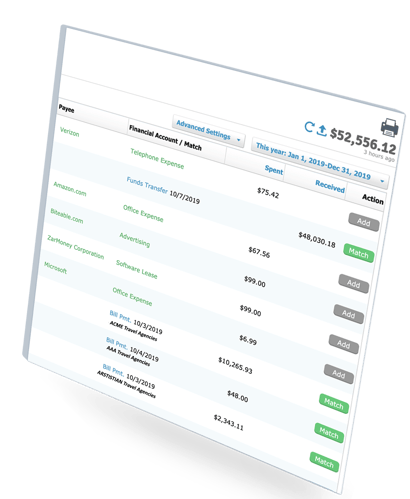

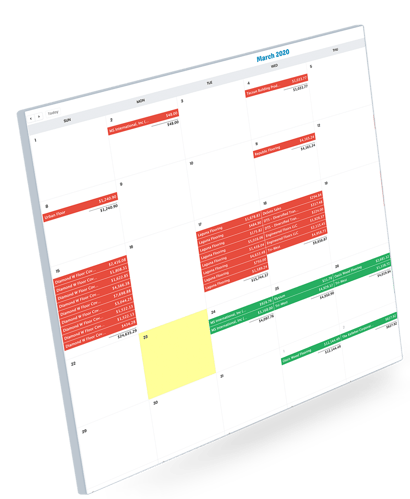

Cash Flow Analysis

Cash flow analysis is a measurement of the amount of money that a travel agency has in navel at any point in time. It enumerates the net effect of the various transactions on cash and takes into account the receipts and disbursements of cash. It also summarizes and causes of changes in the cash position of a travel agency between the different dates of balance sheets.

The long-term survival of any travel agency depends on its ability to generate cash from its main trading activities. The cash flow analysis is prepared by using the information contained in a travel agency last two year’s annual reports.

Practically, cash flow analysis is based on the profitability and liquidity of the travel agency and it helps the users to assess and identify:

- Travel agencies’ ability to generate future net cash inflow from the operations.

- An agency’s need for external financing.

- The reason for the difference between net income and net cash flow from the operational activities of the agency.

- The effects of cash and non-cash investing and financing transactions.

Moreover, by analyzing cash flow, the owners, shareholders and the management know exactly where the travel agency stands at any given time, on the other hand, credits, or suppliers, and the financial institutions use cash flow analysis to determine whether the travel agency can repay loans or has the debt paying capacity.

Break Even Point

A travel agency is said to be ‘break’ even when its total revenues are equal to total costs . It is a point where there is no profit or loss and at this point, the contribution is equal to fixed costs.

Budgetary Control

The keystone of planning and control activities in the travel agency is the budgetary control system, which is a major part of the day-to-day operations of the accounting system. It is applied to a system/technique of a management and accounting control by which all travel agency operations and activities are forecasted and actual results, are compared with budget estimates.

The process of budgetary control involves the establishment of budgets, relating the responsibilities of executives to the requirements of a policy, and the continuous comparison of actual result with budgeted results, either to secure by individual action the objectives of that policy or to provide a basis for its revision.

Practically, budgetary control technique is a useful accounting tool for translating strategic objectives/goals into realities. It also provides the management useful parameters for measuring the travel agency’s performance so that agency management can be tape corrective and timely actions if actual results are below the planned ones.

Some advantages of the budgetary control system are following as:

- It helps the management of an agency to conduct its business in a more efficient and effective manner.

- It lays emphasis on staff organization.

- It is helpful in measuring the efficiency of the whole organization and each department individually.

- It promotes the feeling of cost consciousness.

- It forces the manager to concentrate on the future.

August 16, 2023

Travel Agency Accounting: What Agency Owner Needs to Know

Travel agencies provide countless people with the opportunity for amazing, once-in-a-lifetime experiences. Owners and tour operators are experts in organizing incredible vacations, but may be less familiar with the financial side of the business, including the accounting process. As it is a crucial part of running a business, let’s dive deeper into how you can manage your financial reports more efficiently and strengthen your decision-making due to accurate numbers.

What is travel agency accounting, and why does it matter?

Accounting is the system of recording, organizing, and overseeing a business’s economic transactions. In tourism, accounting and bookkeeping allow travel agencies to oversee various financial operations, including selling travel packages, booking hotels, and managing travel expenses. To illustrate the importance of accounting for travel agencies, we’ll consider the example of an agency owner named Katherine.

Katherine’s tourism agency brought in many clients because she enjoyed meeting people, planning couples’ vacations, and making money. She loved coordinating trips for her clients, but she disliked having to record economic transactions. What was the result?

Because Katherine lacked the financial data and reports, she ended up missing out on tax deductions and paid more in taxes than she should have. She also had no idea how much capital the company actually had, and would occasionally overspend. Moreover, when Kate wanted to grow her business, she didn’t have accounting data to help her understand if she could afford to hire additional employees. Because Kate took a lax approach to collecting financial data, she was unable to make effective decisions and her business was left in a more uncertain situation.

If you own a travel agency, you can avoid these complications. A precise and effective accounting system will guarantee that you have reliable financial data at hand, helping you to optimize operations, strategize for the future, and prevent problems at tax time.

How to manage travel agency accounting

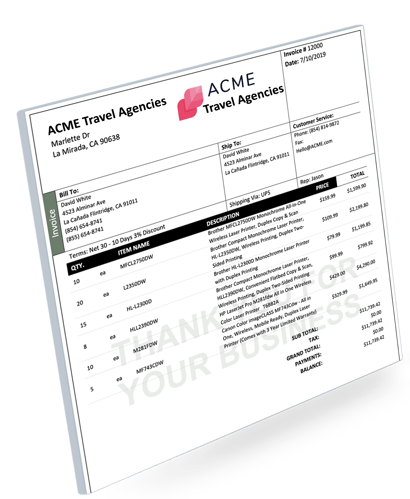

Travel agency accounting involves recording every transaction in which money flows into or out of the business. A travel agency brings in revenue when it sells tickets, hotel reservations, tour packages, and other services that ensure a comfortable journey. An agency’s expenditures, on the other hand, often include staff wages, advertising campaigns, travel spending, and maintenance of vehicles and equipment. Because there are so many transactions to oversee, it is important to establish an effective approach to bookkeeping for travel agencies.

Determine your accounting system

Before you can record transactions, you need to decide whether to use cash or accrual accounting. These methods are very different. Cash basis accounting only records transactions when funds enter or leave your account. This method, while intuitive, gives you only a limited understanding of your financial situation.

Accrual accounting considers transactions as they actually occur, regardless of when money changes hands. Suppose your customers book a $1,500 tour one month but plan to pay the next month. You should record this transaction at the time of booking, rather than when the customers have paid. This approach to accounting gives you a more comprehensive understanding of your financial position. It is also the only GAAP compliant method, which means it must be used for any official purposes.

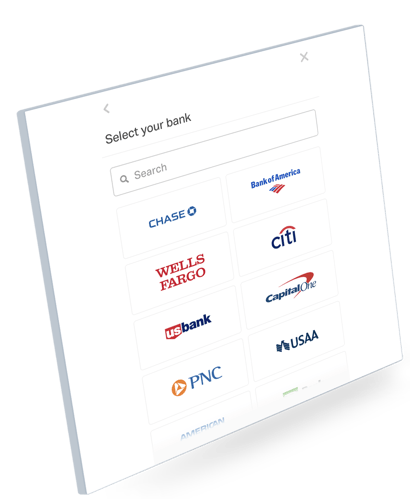

Bookkeeping setup and bank account opening

Next, you need to select a method for recording operations. Consider the following criteria:

- Do you plan to do bookkeeping offline or online? An online, cloud-based system is the most popular and convenient solution.

- Will you do the accounting yourself or work with a financial specialist?

- What software are you planning to implement?

Before answering these questions, take into account the estimated size of your business. For smaller travel agencies, you may be able to handle your own bookkeeping to a certain extent. For larger businesses, you will need to recruit professional assistance and use the appropriate software.

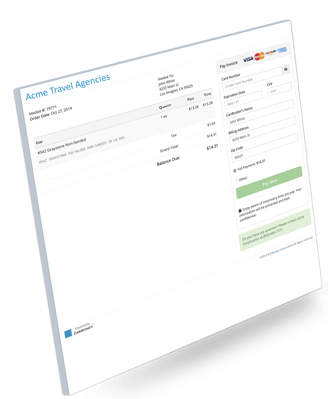

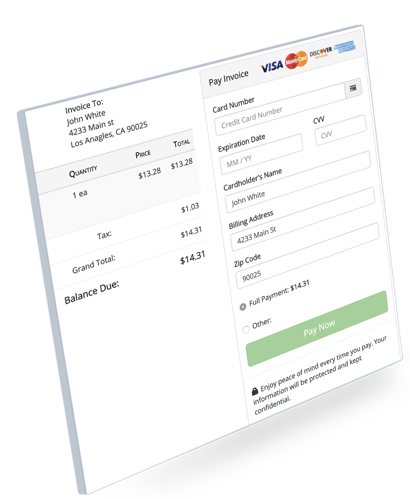

Define payment methods

Consider how you want customers to pay bills – via cash, bank cards, or transfers. These options must be specified before the accounting process can begin, as your financial specialist will need to register and check all systems that you use to settle with counterparties. By sticking to this predefined list of payment methods, you can massively simplify your financial reporting workload.

Keep financial records

To effectively manage your books, you need to record every single transaction. Most travel agencies encounter daily transactions with customers, so you will need to consistently track the movement of funds. This financial data will help you to create the following reports:

- The income and expense statement. This document shows your profit and loss for a specific period. It allows you to identify how the agency is using its capital, as well as determine the current ratio of its assets to its liabilities.

- The cash flow report. This document demonstrates a firm’s liquidity, and warns of possible problems with cash that may prevent investment or the payment of bills.

- The balance sheet shows the company’s economic position in a certain period. It shows your assets, liabilities, and personal capital, which helps you to assess the state of your business and make decisions for its future development.

Careful monitoring and record-keeping is required to keep track of all revenue, expenditures, and other operations. You should check your books every few weeks to ensure that your information is accurate and up to date.

Financial statements for travel agencies

Financial statements reflect your travel agency’s current economic situation, including its strengths and weaknesses. They also inform stakeholders, external and internal, in the following ways:

- Owners: you should use your financial statements to make informed decisions about the company’s prospects for long-term growth, such as attracting investors. You can also control the flow of funds for specific purposes. Entrepreneurs often focus on the profit and loss statement.

- Lenders: these are individuals and financial institutions that lend money to businesses, including travel agencies. In order to assess whether an investment is worthwhile, investors will consult financial statements to see if the agency can pay off its debts in the short and long term.

- Suppliers: in tourism, this category includes carriers, tour operators, hotels, and other partners. In order to work with you, these counterparties will want to verify that your agency is solvent.

Prominent investors often consult with financial advisors for advice about how to maximize their investment. In order to recommend investment in your travel agency, these advisors need financial statements to back up their recommendation.

Tips to organize travel agency accounting

It is crucial to properly organize your finances. After all, it’s nearly impossible to grow your business if you don’t know what is going on financially. Consider a few recommendations from experts on effective financial management:

- Create separate accounts: your agency’s finances must be completely separate from any personal finances, including accounts and credit cards. Otherwise, you significantly complicate the accounting process.

- Classify expenses correctly: discuss with a tax professional how to reduce your tax base with deductions. For example, maybe you can earn a deduction for the food you offer to tourists during the tour or the cost of traveling from to the tour’s starting point. Knowing the laws allows you to classify each operation, which can help lower your tax burden.

Some entrepreneurs try to conduct their own travel agency accounting, but they don’t always have the time to consider every transaction. Instead of this risky approach, you should consult with financial professionals who can provide all the necessary accounting services, including business integration with bookkeeping platforms, account receivable and payable control, and more.

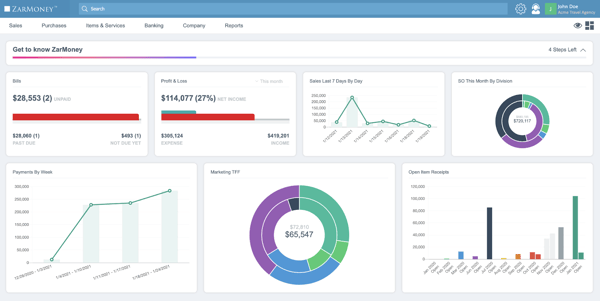

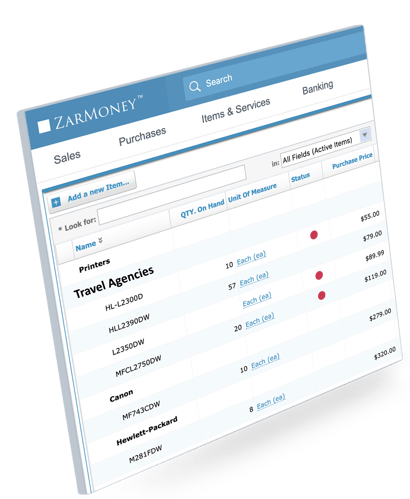

The best bookkeeping software for travel agencies

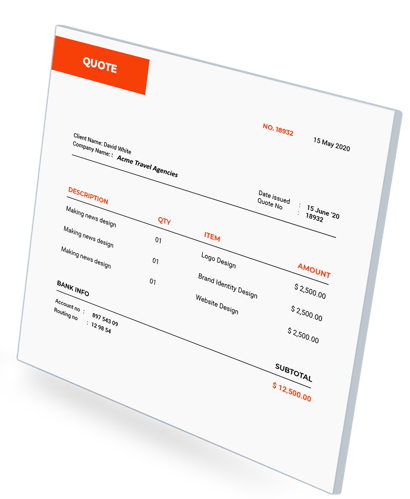

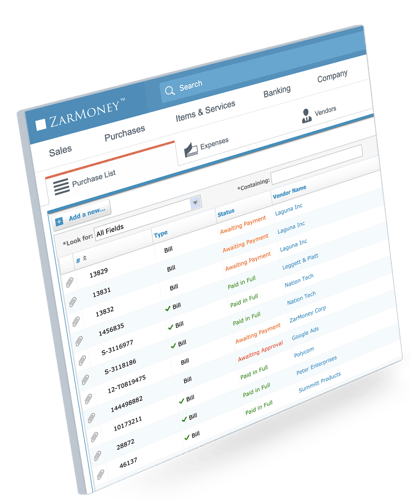

If you are in the travel business, you should find the best bookkeeping platform to suit your needs. You will need a program that provides a full range of features tailored to the needs of travel agencies. Some reputable platforms include:

- QuickBooks Online: this program is like the Swiss Army knife of financial software. It offers a suite of functions, from invoicing processing, budgetary control, and tax calculation, giving you everything you need for effective financial management in one platform.

- Xero: this is another cloud-based software that offers the same tools as QuickBooks, but with a more user-friendly interface. For added convenience, this system syncs with other digital products, such as travel booking apps and payment platforms.

When choosing software for your agency, you need to consider your budget. The market offers a range of free, inexpensive, and more costly software options. If you operate a smaller travel agency, you may not need the most intensive software.

Get support of professionals

Proper bookkeeping is critical to success as a travel agent. Accurate records of transactions facilitate financial reporting, improve cash flow management, and ensure compliance with tax laws.

BooksTime provides the precise and up-to-date financial data that tourism agencies need to operate effectively. Our seasoned accounting experts can take care of the entire process, or provide custom solutions for specific tasks, such as the preparing financial statements or setting up accounting software. Let our team optimize your finances so you can focus on organizing unforgettable vacations. Just let us know what bookkeeping services you need!

This article is not intended to provide tax, legal, or investment advice, and BooksTime does not provide any services in these areas. This material has been prepared for informational purposes only, and should not be relied upon for tax, legal, or investment purposes. These topics are complex and constantly changing. The information presented here may be incomplete or out of date. Be sure to consult a relevant professional. BooksTime is not responsible for your compliance or noncompliance with any laws or regulations.

Share This Article

Author: Charles Lutwidge

Talk To A Bookkeeping Expert

A bookkeeping expert will contact you during business hours to discuss your needs.

Bookkeeping For Travel Agencies: A Guide To Financial Clarity And Success 2023

Get Your First Month of Bookkeeping Services for FREE!

{{Quote.NameError}}

{{Quote.LastNameError}}

{{Quote.PhoneError}}

{{Quote.EmailError}}

{{Quote.LeadCommentsError}}

{{Quote.ValidationError}}

Travel agencies play a pivotal role in the multifaceted landscape of various sectors and industries, ranging from transportation and hospitality to meticulous planning. Seamlessly managing the intricate web of responsibilities demands precise attention, particularly when it comes to navigating the labyrinth of financial complexities that emerge from their presence in diverse locations. Efficiently orchestrating the financial intricacies of such businesses commences with a robust accounting system.

Effective bookkeeping not only ensures a streamlined operation but also serves as the bedrock for sustained business growth. As a travel agency proprietor, the dynamic nature of the industry, characterized by ever-evolving trends and client needs, likely resonates with you. In the relentless pursuit of progress, spending countless hours deciphering cash flows, tracking expenses, analyzing revenue, and other critical financial metrics is undoubtedly a daunting prospect.

However, such challenges should not hinder your focus on steering the ship of your enterprise and capitalizing on the vast potential for expansion. Recognizing the indispensable significance of sound financial management , our comprehensive guide seeks to demystify the intricate terrain of accounting and bookkeeping tailored explicitly for the unique demands of travel agencies. By delving into the fundamental nuances of this indispensable process, we endeavor to equip you with invaluable insights, empowering you to streamline your business operations and cultivate sustainable growth.

Bookkeeping: Your Business’s Ticket for Successful Financial Landing

Effective bookkeeping is a fundamental pillar in the financial architecture of any thriving enterprise. Within the realm of modern business, meticulously recording and organizing all financial transactions is an indispensable facet known as bookkeeping. Its significance is not confined to mere administrative tasks; rather, it serves as the bedrock for informed decision-making and sustained fiscal health. By diligently documenting the ebb and flow of funds, tracking revenues, payroll disbursements, tax payments, and other monetary movements, businesses can gain comprehensive insights into their financial landscape.

For all stakeholders, ranging from discerning investors to vigilant regulators, the efficacy of financial data management cannot be overstated. The meticulous maintenance of transparent and detailed records is the key to not just tracking a company’s financial standing, but also fostering an environment of trust and accountability. The transparency afforded by comprehensive bookkeeping instills confidence in the stakeholders, engendering a sense of trust in the financial stability and operational integrity of the company.

Beyond Operations

The quintessential role played by bookkeeping extends beyond the realm of operational logistics. It serves as the lighthouse guiding a company through the tumultuous waters of regulatory compliance. By maintaining meticulous records and adhering to standardized bookkeeping practices, companies ensure seamless compliance with the labyrinthine regulations stipulated by the Internal Revenue Service (IRS) and other financial governing bodies. The repercussions of non-compliance can be onerous, resulting in legal entanglements and reputational damage. Effective bookkeeping not only mitigates these risks but also fosters a culture of prudence and integrity within the organization.

In the dynamic landscape of modern business, bookkeeping transcends the boundaries of a mere administrative function. It assumes the role of a compass, guiding businesses through the tempestuous terrain of financial uncertainties. Through the systematic recording and organization of financial data, bookkeeping arms businesses with the tools necessary to navigate the intricate web of financial complexities.

Furthermore, the importance of bookkeeping is underscored by its pivotal role in enabling businesses to gauge their financial health accurately. By meticulously summarizing the inflows and outflows of resources, businesses can derive invaluable insights into their operational efficiencies and identify potential areas for optimization. Periodic analyses of the meticulously maintained books of accounts yield comprehensive reports such as balance sheets, income statements, and cash flow statements, empowering businesses to chart strategic pathways for growth and expansion. These reports not only provide a panoramic view of the financial landscape but also serve as the springboard for setting realistic and strategic business goals.

As businesses expand their horizons and venture into new markets, the role of bookkeeping assumes an even more significant dimension. It becomes the bridge connecting operational efficacy with financial prudence, facilitating informed decision-making and fostering sustainable growth. The adage that ‘knowledge is power’ holds particularly true in the context of business, and bookkeeping serves as the conduit through which this knowledge is distilled into actionable insights and strategic foresight.

Significance of Bookkeeping for Travel Agencies

In the dynamic world of business, irrespective of its industry, scale, location, or ownership, bookkeeping stands as a cornerstone of financial management . This fundamental practice plays a pivotal role in maintaining an organized and comprehensive record of financial transactions, and travel agencies are no exception to this rule. As a travel agency owner, embracing regular bookkeeping is imperative for several compelling reasons.

Organizing Crucial Financial Information

- The financial records of your travel agency are a mirror reflecting the true health of your organization. Whether you’re seeking loans, grants, or conducting basic business analysis, having your financial information meticulously organized is paramount.

- Without proper bookkeeping, your transaction data is scattered, making it nearly impossible to determine your capital, profits, and areas that require attention. Bookkeeping bridges these gaps by consolidating your financial information into an easily readable format.

Informing Business Decisions

- Successful business ownership entails being a constant decision-maker, often in a high-pressure, fast-paced environment. Effective bookkeeping , followed by accounting, empowers you to make well-informed decisions.

- In the realm of travel agencies, decisions can range from hiring more employees, expanding geographically, diversifying services, securing additional office space, exploring new marketing channels, providing raises to your employees, or offering enticing customer discounts. The list is endless, and a deep dive into your financial records facilitates these decisions, enabling you to gauge your business’s financial capacity at any given moment.

Filing Taxes Accurately

- When the word ‘taxes’ is mentioned, deductions often come to mind. Accurate tax filing hinges on meticulous financial records. Inaccurate bookkeeping can transform tax season into a stressful and perplexing ordeal.

- Organized bookkeeping means you possess detailed records of your travel agency’s receipts, invoices, and balance sheets. This, in turn, simplifies the process of tax filing and can also help identify potential tax exemptions, thereby potentially reducing your tax liability.

Performance Analysis and Budgeting

- Effective financial planning and budgeting are underpinned by a comprehensive understanding of your past performance. Well-organized, clear, and up-to-date records, facilitated by diligent bookkeeping, allow you to assess past performance and formulate future strategies accordingly.

- For your travel agency, meaningful performance metrics may encompass annual revenue, revenue growth in comparison to the previous year, ROI on various marketing expenditures, and fluctuations in service costs over time. Sound financial planning requires budgeting for expenses ranging from personnel to marketing, investments, growth initiatives, and everything in between, which necessitates accurate bookkeeping.

Attracting Investors

- Scaling your travel agency often requires external investments in the form of capital, equity, grants, or debt. However, potential investors demand a lucid understanding of your business’s financials before committing funds.

- In the absence of comprehensive accounting records, investors cannot gauge the potential success or pitfalls of your travel agency, rendering them hesitant to invest. Venture capitalists and angel investors typically insist on up-to-date books as a prerequisite for funding. Without meticulous bookkeeping, securing vital investments becomes an arduous endeavor.

Simplify Your Travel Agency Bookkeeping with Remote Books Online

In conclusion, proficient bookkeeping stands as a foundational cornerstone of sound financial management for travel agencies . It serves as the bedrock for maintaining meticulously organized financial records, facilitating well-informed decision-making, seamlessly navigating intricate tax obligations, conducting comprehensive performance evaluations, and fostering a conducive environment for essential investments.

As a discerning proprietor of a travel agency, the incorporation of regular and rigorous bookkeeping practices transcends being a mere preference; it represents an unequivocal necessity for steering your enterprise towards an upward trajectory of expansion, profitability, and long-term viability. Operating within the realm of a fast-paced and dynamic industry such as travel, managing the intricate accounts single-handedly can readily become an overwhelming endeavor, particularly when one is actively pursuing business growth and scaling initiatives.

Gone are the antiquated days of manual accounting practices, replete with cumbersome registers and ledger books. Contemporary cloud-based accounting and bookkeeping solutions have ushered in an era of operational ease, streamlining crucial business functions in unprecedented ways.

Enter Remote Books Online, a comprehensive and specialized answer to all your financial management imperatives . Our tailored cloud-based bookkeeping and accounting services are precisely calibrated to meet the specific demands of your travel agency enterprise, effectively alleviating the burdens associated with bookkeeping, tax compliance, expense tracking, payment management, and an array of other intricate financial tasks. We pledge to handle these intricacies with meticulous care and attention to detail.

Embrace the transformational potential of Remote Books Online and redirect your energies towards the cultivation of astute business decisions, secure in the knowledge that your financial department is in the most capable of hands.

Get Your First Month of Bookkeeping for FREE!

First month bookkeeping free, get a quote.

- Bookeeping services for $95/Month

- Monthly rates include accounting software subscription fee.

- Books done by Certified QBO advisors.

Travel Agency Accounting: COA Template & Account Hierarchy

Travel agencies play a vital role in the tourism industry, offering services such as flight bookings, hotel reservations, and tour packages. Effective financial management is essential for the success of any travel agency, and a critical component of this process is the Chart of Accounts (COA). In this article, we will discuss the importance of a COA for travel agencies, provide an example template, and outline the account hierarchy.

What is a Chart of Accounts (COA)?

A Chart of Accounts (COA) is an organized list of all financial accounts used by a business to record and report its financial transactions. The COA serves as the foundation for the company's accounting system, enabling accurate tracking and reporting of financial activities. For travel agencies, a well-structured COA can provide insights into profitability, cost management, and areas for improvement.

Example COA Template for Travel Agencies

The following is an example COA template designed specifically for travel agencies. Keep in mind that every business is unique, and your COA should be tailored to your specific needs and requirements.

1. Assets

1.1. Current Assets

1.1.1. Cash

1.1.2. Accounts Receivable

1.1.3. Prepaid Expenses

1.2. Non-Current Assets

1.2.1. Property, Plant, and Equipment

1.2.2. Intangible Assets

2. Liabilities

2.1. Current Liabilities

2.1.1. Accounts Payable

2.1.2. Accrued Expenses

2.1.3. Deferred Revenue

2.2. Non-Current Liabilities

2.2.1. Long-term Debt

2.2.2. Deferred Tax Liabilities

3.1. Owner's Capital

3.2. Retained Earnings

4.1. Commission Income

4.2. Service Fees

4.3. Tour Package Sales

4.4. Other Income

5. Expenses

5.1. Cost of Services

5.1.1. Supplier Payments

5.1.2. Tour Package Costs

5.2. Operating Expenses

5.2.1. Salaries and Wages

5.2.2. Rent and Utilities

5.2.3. Marketing and Advertising

5.2.4. Travel and Entertainment

5.2.5. Insurance

5.2.6. Depreciation and Amortization

5.3. Interest Expense

5.4. Income Tax Expense

Account Hierarchy in Travel Agency Accounting

Account hierarchy is essential for maintaining consistency and accuracy in financial reporting. A typical account hierarchy for travel agencies consists of the following levels:

Category: The highest level in the hierarchy, representing the main divisions of the financial statement (assets, liabilities, equity, revenue, and expenses).

Subcategory: A more detailed level within the main categories, further segregating accounts based on their nature or function (e.g., current assets, non-current assets, operating expenses).

Account: The most detailed level, representing individual financial accounts used to record specific transactions (e.g., cash, accounts payable, commission income).

A well-organized Chart of Accounts is crucial for effective financial management in travel agencies. By creating a customized COA tailored to the specific needs of your travel agency and establishing a clear account hierarchy, you will ensure accurate financial record-keeping , facilitate reporting, and provide valuable insights for decision-making.Travel agencies have unique accounting needs, such as tracking commissions, managing supplier payments, and handling deferred revenue. It is essential to consider these specific requirements when developing your COA. You may also want to include accounts for refunds, cancellations, and loyalty program expenses, as these are common financial events in the travel industry.As your travel agency grows and evolves, it is essential to review and update your COA periodically to accommodate changes in your financial structure, new service offerings, or shifts in business strategy. This will help maintain a robust and effective accounting system that supports the ongoing success of your travel agency.By implementing a well-designed COA and maintaining an organized account hierarchy, you can improve your travel agency's financial transparency, ensure compliance with accounting standards, and make informed decisions based on accurate financial data. As a result, you'll be better equipped to manage your business's finances, allocate resources efficiently, and identify opportunities for growth and improvement in the competitive travel industry.

Call: +91 7384718607

Logging in will help you easily save and manage your your itineraries and bookings.

Dont have an Account? REGISTER here

Signing up will help you easily save and manage your itineraries and bookings

Already have an Account? LOGIN here

Forgot Password

Enter your email ID. We will email instructions on how to reset your password.

Maintaining accounting for travel agents

Share using:

http://www.tourgenie.com/travel-diaries/travel-blogs/maintaining-accounting-for-travel-agents

- Comment

- Share

Accounting is a major factor in any kind of business. It is designed to communicate, record, and pass the correct information to the internal as well as external users and recognized as an information system. The classification, recording, and summarizing accounting information to determine the financial strength and weakness of an agency is done through accounting . It is no doubt an important area in a travel agency business.

A travel agency profitably demands all accurate information, recordings, and preparations of its financial statements. As mentioned earlier, accounting plays a vital role in determining the correct and fair status of the travel agency business and also helps in making strategic plans and decisions. If you run a business or are thinking of running a travel agency soon, you must be preparing for some kind of investment to make for your business. It is really important to keep a record of every penny you use for starting or running your business to calculate the amount you have spent and the profit you had from it. The basic objective of accounting is to get the information of the profit and finance position of your travel business. To achieve this objective you are required to prepare and keep journals and some statements as listed below.

Maintaining Sales Journal by Travel Agencies

Sometimes some travel agents in a travel operation extend credit facilities for its customers like leisure and commercial clients—all these credit sales of travel business are recorded in a sales journal. A travel agency also makes some cash loans to its clients at certain points, which are also recorded in the sales journal. However not every travel agency can afford to extend credit. It has been recorded that only large-scale travel businesses do so for their corporate customers although a thorough check for credit is required prior to opening of a credit amount. A sales journal is extremely important for a travel agency during accounting .

Accounting for travel agents

Accounting Record of Cash Receipt

Keeping a record of receipts is extremely important for travel agencies during accounting . One of the important categories of accounting is to record all revenues received by the travel agency during the period of running the business. The transactions concerning cash, cards like debit or credits, and cheques for tour packages, commissions received by travel business from hotels and airlines, and other sources like vendors are all recorded in an accounting journal.

Account Receivable in Accounting

Account receivable is the term referred to the amount owned to producers, sellers, or suppliers for the purchase done by a travel agency for tourism services and travel products on credit. It is one of the important data for accounting to be recorded in the travel business.

Keeping a Record of Cash Disbursement for Accounting

Also called a cost journal, in cash disbursement journal all cash outflows of travel business are recorded. It is important to keep track of all the operating expenses of a travel agency for ease in accounting . The salaries of employees of the travel business, rents, telephone expenses, financial and legal expenses and administrative cash outflow, selling and distribution expenses, etc should all be recorded in the cash disbursement section of a travel operation.

Cash and cards transactions

Travel Ledger—The Chief Book of Accounts in Accounting

The chief book of accounts is the destination point of entries in journals and sub journals used for balancing the accounts of travel agency business. Balancing the accounts in accounting means the continuous and consistent check and verifications of accuracy of the accounting system of a travel agency. There are certain objectives of travel ledger in accounting for a travel agency as listed below.

- The identification of the revenue sources of travel agency

- Determining total sales in both cash and credits

- Determining total commission earned by travel agency through various sources

- Determining and finding out the total amount owned to travel ledger

- Evaluation of performances of all travel agencies recognized by travel ledger

Almost all travel agencies use Electronic Data Processing System or EDP these days for maintaining their accounting data resulting in an up to date record of each cash and credit transactions. The procedure of posting travel ledger is also really simple and understandable. All you have to do is enter the date, items, invoice number prior to entering the gross amount of cash and card transaction. Then calculate the commission and feed the travel agency commission column with that value. Now you have to subtract the commission from gross and enter the result in net amount column if any due is remaining simply put it in the due column.

Payroll Journal of Travel Agency for Accounting

Here, all the records of salaries and other benefits relating to finance are maintained by a travel agency. All these records include the number of employees and their salaries, insurance premiums, compensations, the total budget for salaries, housing facilities, medical facilities, etc. In any travel business, all the records from every journal are complied monthly and posted in a general ledger.

Any travel agency business requires a good accounting system for cash flow, profit and loss statistics, financial statements, which are basically the reflection of financial position and operating strength or weakness of a travel business, the establishment of budgets, etc. Accounting also helps in relating the responsibilities of executives, and a continuous comparison of the position of the travel agency can also be made by providing the agency useful parameters in measuring travel business’s performance. The travel agency management will be able to tape correct information and timely actions through the accounting system. An accounting system in a travel agency helps to conduct its business efficiently and effectively as a whole.

Going the Digital Way

When it comes to data collating, calculation, and safety, online travel management software is the answer.

There are many such software in the market that you can check out and subscribe to. If you want to stay ahead of the competition, going digital and online is your best bet.

Also check:

How to start a travel agency

Itinerary software for travel agents

What is customer relationship management - all you need to know

No Comments

Your details are safe with us

Trending Blogs

General Read More

Leisure Read More

Adventure Rush Read More

Latest blogs.

History Read More

A call to all travel junkies

Share your amazing travel stories & inspire someone today, become a tourgenie contributor, write for our blog, want to explore more activities.

Trek to Goecha La

Ziro Music Festival

Lhuentshe Tshechu Festival Tour

- ABOUT TOURGENIE

- BLOG FOR US

- ENTRY & EXIT POINTS

- TERMS & CONDITIONS

- Arunachal Pradesh

- TRAVEL AGENT

Near Co-Operative, Middle Sichey Gangtok, East Sikkim, India, 737101

+91 7384718607

- US +1 347 618 6478

- [email protected]

- Accounting Software Selector

Bookkeeping Services for Travel Agencies

- Industries We Service

A more lucrative travel agency is based on timely and accurate financial reporting.

Independent agents, franchisees, and owners of tourist agencies benefit from our bookkeeping services for travel agencies so they may manage their operations with ease.

Travel-specific cashflow requirements, expenses, and revenue can all play a role in a travel agency's bookkeeping.

Years of experience have been accumulated by our staff in assisting small and midsize business owners in managing their finances successfully.

We will work with you to expand your company and overcome any obstacles you may encounter.

To accommodate our client’s needs and financial constraints, we design a unique service plan. Our primary goal is to increase your company's profitability.

Here are reasons why you need to think about experts that provide accounting for a travel agency.

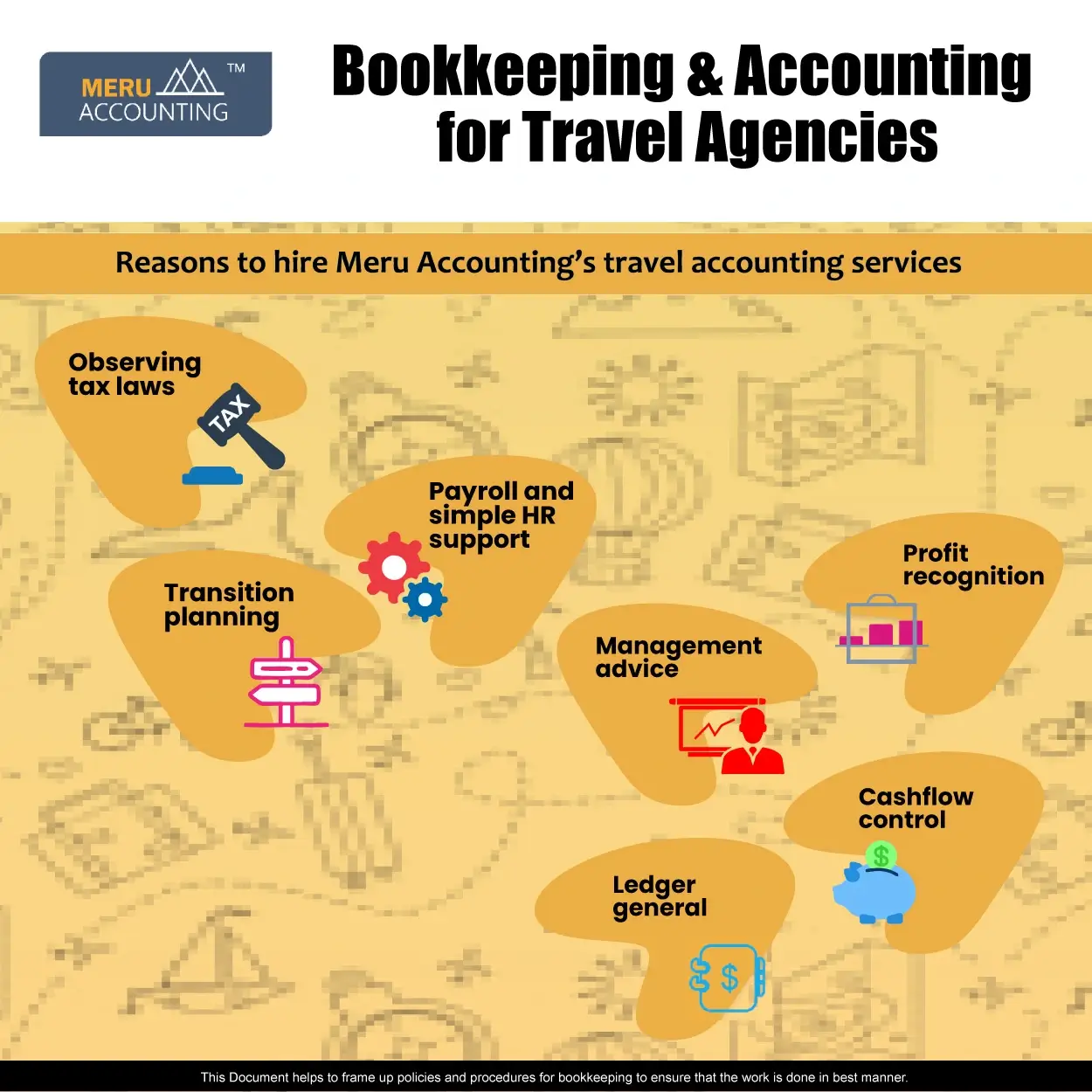

Services Provided in Accounting for Travel Agency

As a cost-effective and practical alternative for the travel and tourist industry, we provide part-time and virtual CFO and controller services.

Observing Tax Laws

Adequate Bookkeeping for travel agency efficiently manages your tax filing for sales and use taxes as well as employer withholding taxes. Your payroll and sales tax filings can be handled quickly and efficiently by our qualified bookkeepers.

Payroll and Simple HR Support

You can save money by using our payroll and basic HR services instead of paying internal staff to process payroll and issue checks by hiring people to do bookkeeping for travel agency .

Transition Planning

To guarantee a seamless transfer, we support family-run travel and tourism firms and help them include a succession plan in their daily operations.

Profit Recognition

The most effective revenue recognition tactics are used by our experts. For this, we also employ the effective cash method.

Management Advice

The best management consulting services are offered by Adequate Bookkeeping, helping small business owners get the best results.

Cash Flow Control

A successful travel and tourism business must effectively manage its cash flow. We keep track of incoming costs, payments, and net cash flow from sales using the most recent accounting software.

Ledger General

Using the greatest accounting software, we update your general ledger on a regular basis. This general ledger is used to keep track of debts, assets, and the effects of daily and weekly transactions.

Our travel accounting services offer the precise and comprehensive financial data that travel agencies require to survive and function. You can hire us to handle your bookkeeping if you want the desired results.

Additionally, we assist you with more particular duties like producing profit and loss statements. Our experts are skilled in using any online accounting platform, including Xero, Zoho Books, and QuickBooks, with efficiency.

Why Choose Accounts Junction?

If cloud-based accounting is unfamiliar to you, we will also give you the support you need and outline the advantages of choosing it.

We have extensive knowledge in offering the best bookkeeping and accounting services to the travel and tourist sector. Our aggressive pricing strategy reduces the number of overhead expenses.

Benefits of Bookkeeping for Travel Agencies:

1. financial performance analysis:.

- Track income and expenses to analyze the financial performance of your travel agency.

- Identify trends, assess profitability, and make informed decisions for growth.

2. Effective Cash Flow Management:

- Maintain accurate records of incoming funds and outgoing payments.

- Monitor cash flow to ensure liquidity, timely payments, and positive supplier relationships.

3. Simplified Tax Compliance:

- Proper record-keeping throughout the year simplifies tax return preparation.

- Avoid errors, omissions, and penalties by having all necessary documentation readily available.

4. Facilitates Financing Options:

- Organized financial records enhance your credibility when seeking financing.

- Lenders require detailed financial information for loan approval, expansion, or investment.

5. Operational Efficiency:

- Bookkeeping streamlines administrative processes and improves overall efficiency.

- Save time and resources by having organized financial records readily accessible.

6. Budgeting and Forecasting:

- Accurate financial records help in setting budgets and making realistic forecasts.

- Plan for expenses, marketing campaigns, and future investments effectively.

7. Cost Control and Expense Reduction:

- Analyze expenses and identify areas where costs can be reduced.

- Optimize spending to increase profitability and operational efficiency.

8. Business Performance Evaluation:

- Use financial data to evaluate the success of marketing strategies and product offerings.

- Determine the profitability of specific services, destinations, or customer segments.

9. Compliance and Audit Preparedness:

- Proper bookkeeping ensures compliance with regulatory requirements.

- Minimize the risk of audits and penalties by maintaining accurate records.

10. Business Decision-Making:

- Make informed decisions based on real-time financial data.

- Evaluate the financial viability of new projects or ventures.

In conclusion, Accounts Junction stands as an indispensable ally for travel agencies, offering a comprehensive suite of bookkeeping services that streamline financial operations and enhance overall efficiency. Through our tailored solutions, precise record-keeping, and expert financial insights, travel agencies can focus on delivering exceptional travel experiences while leaving the complexities of financial management in capable hands. With Accounts Junction as a reliable partner, travel agencies can confidently navigate the dynamic landscape of the travel industry, secure in the knowledge that their financial affairs are managed with utmost professionalism and precision. By fostering a strong foundation of financial stability, Accounts Junction empowers travel agencies to thrive and grow, ensuring a seamless journey towards continued success.

How does Accounts Junction help in bookkeeping for travel agencies?

1. revenue tracking:.

Accounts Junction allows travel agencies to track different sources of revenue. Our firm establishes separate income from flight bookings, hotel reservations, tour packages, and other travel-related services. This helps in accurately recording and analyzing revenue streams.

2. Expense Allocation:

Accounts Junction assists in allocating expenses to specific categories within a travel agency. This can include costs related to accommodations, transportation, marketing, staff salaries, or office supplies. By properly categorizing expenses, it becomes easier to track spending, monitor budget adherence, and identify areas for cost control.

3. Cost of Goods Sold (COGS):

For travel agencies that provide tangible products such as travel packages or promotional items, Accounts Junction aids in calculating the cost of goods sold. By connecting expenses related to the production or procurement of these goods with revenue generated from their sales, COGS can be accurately determined for financial reporting and analysis.

4. Commission Tracking:

Travel agencies often earn commissions from airlines, hotels, and other service providers. Accounts Junction helps in tracking and recording these commissions separately, allowing for a clear view of income derived from commission-based arrangements. This assists in assessing the profitability of different partnerships and adjusting commission structures if necessary.

5. Financial Analysis: