Detailed Guide To Travel Agency Accounting

- Post author By varun

- Post date December 1, 2022

As far and wide the services of a travel agency expand, so is the elaborateness of its accounting procedures. Being a business model operating with multiple parties under unique financing arrangements, these agencies need to keep the flow of funds fairly sorted. This needs to be done for a clear bookkeeping and accounting of money received or paid. And so, understanding the procedure and details of accounting becomes quite a necessity for someone planning to run or establish a travel agency.

Even though the availability of travel management platforms like Pathfndr has simplified accounting for these agencies, it is imperative to know the thick and thin of travel agency accounting if planning to run a travel agency.

Accountancy for travel agencies is a dedicated information system designed to provide the necessary details. These details can be related to the company’s monetary stature, its transactions, financial executions, and everything else related to its management.

The success of travel agency management is critically based on efficient recording, accuracy of such record maintenance and the financial statement preparation. For suitable formulation of strategic business decisions and plans, travel agency accounting can be the concrete support needed.

Travel agency accounting is also needed to assess the fair status of the company. It can be simply said to be a process that enables profitability assessment of the agency as well as its financial status in both short and long run. Platforms like Pathfndr only assist with the elaborate accounting system that a travel agency may need to follow.

Below given is a detailed guide on the types of books maintained for travel agency accounting along with the financial statement preparation requirements and other pertinent details related to the procedure. Meanwhile, it can be useful to check out the role that travel agency management platforms like Pathfndr can play in maintaining the books of travel agency accounting for these companies.

Books That Need to be Created for Travel Accounting

Travel agencies need to prepare a host of books, statements, and journals for the purpose of essential travel accounting. These companies would need to create one or more of the following records and statements to keep the travel agency accounting right in place.

Journal for cash receipt

A cash receipt journal allows you to record the receipt of all revenue generated for the travel agency. The journal is recorded for an annual period and receives entries for all transactions made in cash, cheques, and credit cards.

Whether the business receives payments for tour package sale and any commissions received from a partner operator, which can include airlines, bus operators, hotels, and the likes.

While you would need to make these entries manually, using an online travel management platform like Pathfndr simplifies these records as they are directly accounted for through necessary tools used on these platforms.

Sales journal

A sales journal is used to account for all transactions that a travel agency makes in credit. In case your travel agency extends credit facilities to partner operators and customers, the entries would form a part of the sales journal.

Usually, travel agencies operating on a large scale use these journals. With access to the likes of Pathfndr, all credit sale records are updated automatically to this journal.

Accounts receivable

A journal of accounts receivables is used to record transactions that the travel agency makes in credit in lieu of products and services received from supplying partners. It sums up the amount that the business would owe to its suppliers, sellers, and producers for the period involved.

Journal for cash disbursal

The total outflow of cash from the travel agency’s entirety of finances is recorded in the cash disbursement journal. A majority of this journal’s entry is made with respect to its operating cost for the period, including the likes of rents, administrative expenses, selling and/or distribution expenses, legal expenses and salaries/wages paid.

Also known as the cost journal, entries to this travel agency accounting record are mostly made for cheques and drafts issued. But all of these essential entries are simplified through automation processes that platforms like Pathfndr provide.

Payroll journal

A payroll journal is an altogether separate journal that is maintained as a record of salaries/wages and other financial benefits paid to its employees. It gives a detailed insight on the total employees working with the agency, the total outflow made in the form of salaries and wages, compensations, insurance protection provided, medical facilities, compensations, and other benefits that may be available to its employees.

Chief book of accounts

The chief book of accounts is primarily a ledger book and a summed point of accounting record for all the balance entries that the company may have. It is a critical bookkeeping record that can direct identification and verification towards all revenue sources, a total of cash and credit sales, commissions earned, and such other crucial travel agency accounting aspects.

The use of Electronic Data Processing or EDP systems in almost all travel agencies operating today simplifies all these entries, their identification and verification for performance evaluation. Platforms like Pathfndr are fast changing how these EDPs are integrated into the travel agency accounting system.

Travel Accounting System

A travel accounting system follows a design that aims to record all items related to the business’s balance sheet as well as its income statement. These items spread across the likes of the agency’s assets, liabilities, incomes, revenues, gains, losses, expenses, as well as the capital invested.

An automated travel accounting system is integrated into the operation of travel management platforms like Pathfndr to simplify the recording and identification of these accounting items of the business. It can thus be greatly useful to create your travel agency’s official website on these platforms with dedicated domains and other customized functionalities.

Below given is a list of items that are included in the accounting statements prepared as per the travel accounting system with their short descriptions.

Capital invested

The capital of a business in general, including a travel agency, comprises the contributions from the owners of the entity, company, partnership, or firm. The capital of the company comprises both paid and unpaid contribution of the owners to the company. It can be summed up as the net worth of the travel agency that it owes to the owners. Depending on the type of the company a travel agency is established as, the capital and ownership can either be considered as separate or as one and the same.

Irrespective of the ownership-entity divide, the items comprising the capital of the travel agency must be accounted for individually. In the case of a company form of travel agency, the capital can include its shares and debentures. For travel agencies formed as partnership firms, the contributions of individual partners comprises the capital of the agency. In case of individual owners, their entire investment comprises the capital of the travel business.

A travel agency runs on definite resources that it utilizes to generate revenue. Such resources are invested into the business to generate benefits from operations in the future. These resources that contribute to benefit generation over the time are known as assets of the company.

The identification of assets is intended to increase the business’s cash flow in the long run through cyclic usage. A travel agency’s, or any company’s for that matter, assets can be identified under two classes, namely fixed and current assets. It is crucial to identify these assets separately for the purpose of travel agency accounting .

Liabilities

A liability of a travel agency can be identified as a claim against the assets that it utilizes for revenue generation and profitability. These can also be understood as the future sacrifice of economic benefits that the business undertakes for asset generation or for providing services, ultimately leading to debt creation charged on these assets. Like assets, liabilities of a travel agency are also identified under two types, and are known as long-term and short-term (current) liabilities.

Be it assets, liabilities, or any other item of the accounting system that the travel agency needs to maintain can be easily identified under the aegis of travel management platforms like Pathfndr. These records are summed up at the end of each accounting period and can be accessed through website accounting automation processes run through Pathfndr.

Revenue/gains/income

The total value of services/products that a travel agency provides, the interest received from clients, commissions from partner operators and such other contributions that form a part of the total incoming monetary value can be identified under this accounting head. Revenue of the company is the total value of sales made, out of which the gains are identified as revenue minus the expenditure incurred.

The total cost that a travel agency incurs, including the cost in the long as well as short term, for running the business can be accounted for under the expenses head of the travel agency accounting system. Expenditures are also identified as the sum of cash outflow made by the agency in return of services or products received towards the entity’s operation in short as well as long run.

While maintaining the travel agency accounting system can be quite extensive for an agency, the use of travel management systems like Pathfndr can make the entire process of handling the business’s accounts simple and convenient, requiring minimal manual efforts and time.

Financial Statements That Need to be Prepared

For any accounting system, including that of travel agency accounting , the output of the records need to be formally created based on the identified and accepted statements. These statements are popularly known as the financial statements of the travel agency and are categorized under income statements and position statements.

Income statement: An income statement of a travel agency is also maintained as a profit and loss account for the company. It is created to assess the overall profitability of the company for an identified period based on the income and expenditure made for the said duration. It is an important part of travel agency accounting.

Position statement: A position statement of a travel agency is created to assess its overall financial health. It is a periodic statement, and is often created at the end of the definite term identified for the accounting cycle. It usually comprises the assets and liabilities of the travel agency on a said date and helps identify the resources used and their financing.

In the overall consideration of travel agency accounting system maintenance for the travel agency, creating a dedicated department and hiring the skilled personnel for the purpose can be an extensive process. It also involves resource allocation and can be a tedious process overall.

As an alternative, a travel agency can seek to automate the entire travel agency accounting system through necessary tools in place. One of the best ways to implement this automation is to create the business website through Pathfndr, a travel management platform that comes preset with all the tools necessary for accounting and bookkeeping of the agency.

The automated processing tools are well-designed to automatically record and compute the accounting results as and when desired. So, the travel agency does not have to go through an extensive travel agency accounting process periodically.

Travel agency accounting is a crucial aspect that a travel agency needs to take care of at all times, irrespective of its scale and geography of operation. The availability of travel management platforms like Pathfndr and their integration of automated accounting tools amps up the overall financial management of the company.

Creating your agency’s travel website through these platforms can benefit in so many more ways than just adequate and timely recording and assessment of the financial aspect of the business.

Accounting Procedures for Travel Agencies

- Small Business

- Accounting & Bookkeeping

- Accounting Procedures

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

Revenue Manager Duties

Tax benefits of independent contractors, what is cash basis profit & loss.

- The Difference Between the Balance of Assets & Its Related Accumulated Depreciation

- How to Start Dell Recovery on an Intel Pentium M

When you start a travel agency, you need to keep accurate accounting records for your business. These records help you keep track of your agency's performance and are necessary for preparing your tax return. The most important accounting procedures for a travel agency are the cash flow statement, the general ledger and the income statement.

Cash Flow Management

One of the most basic goals of your accounting procedures is to keep track of your agency's cash flow. While running a travel agency with multiple daily transactions, it can be easy to lose track of your sales and your incoming payments. Through the use of your accounting software, you can keep track of your company's net cash flow from sales and expenses. This keeps track of the cash management of your business and helps identify any financial problems. Make sure that your agents post all business transactions in your accounting records.

General Ledger

Another accounting tool for a travel agency is the general ledger. The general ledger gives an overview of your company's current position. This ledger keeps track of your agency's assets, everything your company owns and what it owes. The accounting impact of all business transactions should be recorded on your general ledger through your accounting software. Most businesses update their ledgers daily or weekly. It is crucial to update your general ledger regularly so you can keep track of your agency's financial status.

Recognizing Revenue

An important accounting procedure for any business is the process of revenue recognition. This principle establishes when a business has officially earned revenue and can declare the earnings on its accounting statements and for taxes. A travel agency, as a service industry, must use the cash method for recognizing revenue. Your agency must recognize revenue as earned as soon as a payment is received. It does not matter when you complete your service to the customer, as soon as you receive payment, you must recognize the payment as revenue.

Income Statement

The last accounting procedure for running a travel agency is the maintenance of an income statement. The income statement records your total income and expenses to calculate your net profit over a period of time. The income statement serves a similar purpose as the cash flow statement. While the cash flow statement only keeps track of cash, the income statement measures the profits of your business. When you start your agency, the cash flow statement is more important as you get the handle of your company's daily cash flow. In the long-run, your income statement is more important as it gives a better description of your company's total profitability.

- Accounting Coach: Basic Accounting Concepts

- Accounting Study Guide: Accrual Basis vs. Cash Basis Accounting

- Net MBA: General Ledger Entries

David Rodeck has been writing professionally since 2011. He specializes in insurance, investment management and retirement planning for various websites. He graduated with a Bachelor of Science in economics from McGill University.

Related Articles

What is ledger maintenance, financial report requirements for a nonprofit, bookkeeping for a dba or sole proprietorship, what are posting & closing month end reports in accounting, how to erase all credit card information on facebook, how to calculate gas mileage compensation, how to open a travel agent business, how to place a corporation in an inactive status, travel agency objectives, most popular.

- 1 What Is Ledger Maintenance?

- 2 Financial Report Requirements for a Nonprofit

- 3 Bookkeeping for a DBA or Sole Proprietorship

- 4 What Are Posting & Closing Month End Reports in Accounting?

Travel Agency Accounting

Today, accounting is recognized as an information system and is designed to communicate the right information to the internal as well as external users. Accounting involves recording, classification and summarizing the accounting information directed toward the determination of financial strength and weakness of a travel agency.

To manage a travel agency / tour operator profitably demands accurate recording and preparation of financial statements. These are essential in determining the true and fair status of the business and for making strategic plan and decisions.

Travel Accounting System

The basic objective of accounting is to ascertain the profitability and finance position of a travel agency operation. To achieve this, every travel agency prepares the following journals and statements:

- Sales Journal

- Cash Receipt

- Account Receivable

Cash Disbursement

- IATA ledger

- General Ledger

- Profit and Loss Account

- Balance Sheet

Sale Journal

In this journal, all credit sales are recorded. Sometimes, a travel agency provides extends credit facilities to its clients i.e., leisure and commercial clients. It, in fact, makes a cash loan to its clients. However, it has been noticed that only large-scale travel agencies can afford to extend credit to corporate customers, but even then, a thorough credit check is required before a credit amount is opened.

To maintain the up-to-date record of all credit sale, travel company prepare a sales journal.

Cash Receipt Journal

It is used to record all revenues received by the travel agency during the period. In other words, transactions concerning cash, credit cards, cheques are recorded in this journal. For example sale of the tour package, the commission received from the hotel, airlines and other vendors are recorded in it.

When a travel agency purchases tourism products, services from the supplier on credit, the amount owed to producers/suppliers/sellers are referred to as an account receivable.

Cash outflows are recorded in cash disbursement journal. Cash outflow means the operating expenses of the travel agency like rent, salaries, telephone expenses, administrative expense, financial and legal expenses, selling and distribution expenses etc.

These are mostly paid by cheques or through bank drafts. Cash disbursement journal is also called Cost Journal . Thus, cost journal is used to record the payments made by a travel company to its employees and others.

IATA Ledger

The IATA ledger is known as ‘ Chief Book of Accounts’ and is the destination point of entries made in the journals or sub-journals. It is used to balance the accounts of the travel agency. In accounting, ‘Balance Account’ means continuous and consistent check and verification of the accuracy of a travel agency’s accounting system.

The main objectives of IATA ledger are:

- Identification of travel agencies revenue sources.

- Determination of total sales (cash and credit).

- Determination of total commission earned by the travel agency.

- Find out the total amount owned to IATA.

- Evaluate the performance of each travel agency ( which is recognized by IATA).

The procedure of posting IATA Ledger is very simple and easy to understand. Today, almost every travel agency is using Electronic Data Processing System (EDP) to maintain an up-to-date record of each cash as well as credit card transactions.

The procedure of posting Cash and Credit Card Transaction in the IATA Ledger is:

- Enter the date, items, and invoice number.

- Enter the gross amount of cash and credit-card transaction.

- Calculate the commission and enter in the agency commission column.

- Subtract the commission form the gross sale and enter the result in the Net Amount column.

- If any amount is due then record it in the due column.

Pay Roll Journal

In this journal, a travel agency maintains the record of salaries and other benefits (financial) given to its employs like the number of employees on the payroll, total salaries, insurance premiums, compensations, housing facilities, medical facilities and other benefits to the employees.

Practically, the total from each journal is compiled monthly and posted to the general ledger. In this ledger, all types of the account are maintained/transferred from the various individual journals to provide ready information for the preparation of the financial statements.

ASTA Accounting System

In 1979, Touche Ross and Co. , developed the ASTA Travel Agency Accounting System to facilitate travel agent and tour operators specifically for ARC and IATA reporting. All items in the balance sheet and income statement are numbered from 100 to 699. Each three-digit number convert the information for the users.

Basically, an accounting system is designed to record the agency’s assets, liabilities, capital, revenues/income/gains, and expenses or losses etc. A brief discussion of these follows:

Assets are economic resources which are owned and used by the travel agency and are expected to benefits in future operations. Hence, assets can be expected eventually to increase the cash inflow of the travel agency. Assets are two types:

- Current assets

- Fixed assets

Liabilities

These are the claims against travel agency assets. Practically, liabilities are future sacrifices of economic benefits arising agency’s debts to transfers assets or provide services to other as a result of past business transactions. These are of two kinds

- Current or short period liabilities

- Long-term liabilities

Capitals represent the amount of paid or contributed by owners, shareholders to the agency. More precisely

Capital = Assets – Liabilities

It is equal to the difference between the values of what is owned by the agency and the value of what is owed by the travel agency. Capital represents the net worth of the agency to owners.

Income/Gains

It is the monetary value of goods and services sold by the travel agency such as the sale of the tour, airlines commission and interest received etc. Revenues are cash inflows of the agency for the services rendered to the clients during a specific period.

Expenses represent the cost of doing travel agency business. Basically, these are cash outflows and are paid by the agency to obtain or purchases goods and services from the providers. Other expenses are included in it like as salary, administrative expenses, financial and legal expenses etc.

Financial Statements

Financial statements are the formal output of any accounting system and are prepared to provide accurate, timely understandable, objective and comparable accounting information to the users. Today, these statements are considered as a base for making rational decisions concerning the future of the travel agency.

Types of Financial Statements

Financial statements are mainly categorized into two types. These are as follows:

Income Statement

Position statement.

It is also known as profit and loss account and is prepared to provide information on an agency’s profitability over a given time period. It is the statement of the revenues earned and other gains made during a year; matched with the amounts spend to earn these revenues.

It shows whether the travel agency earned a profit i.e. the excess of income over expenditure or has suffered a loss i.e. the excess of expenditure over income.

An income statement contains a summary of figures relating to the cost of tours sold; various operating and non-operating expenses and provisions for expenses. These are then compared with sales and various operating and non-operating revenues.

The income statement provides important data for the financial planning, profit planning and debt-paying ability of the travel agency. Essentially, this statement provides vital financial information to the internal as well as external users.

It represents the financial health of a travel agency at a given time and therefore, it is often called a ‘ statement of financial position ‘. A position statement may be defined as statements prepared with a view to measuring the true financial position of a travel agency on a certain fixed date . It is prepared by the transferring all balance that belongs either to personnel or to real accounts.

These balance either represents assets or liabilities existing at the last date of the accounting period. In the technical world, it provides details about the resources of a travel agency and how these resources financed, either by lending funds or by investing capital in the business.

Users of Financial Statements

Financial statements are the mirrors which reflect the financial position and operating strength or weakness of a travel agency. These statements are useful to owners, creditors, suppliers, management, government, and other outside parties. Users of the financial statements are as follows:

The owner is mainly concerned with the managing the investment and long-run success of the travel agency. They are also interacted to know whether their money is used for those purposes for which they have invested it. The income and position statements tend to be the primary source of information to the owner.

2# Creditors

They represent persons, banking and financial institutions which have loaned funds to the travel agency. They are interested in knowing entity’s debt-paying ability for a short or a long term.

3# Suppliers

Suppliers in the travel business are not similar to the creditors. They are the producers/principals such as airlines, hotels , tour operators , transport operators, cruise liners for whom the travel agency collects revenues or collects product lines to formulate tourism product or tour package.

These suppliers are interested in knowing the agency’s debt-paying ability. Even some suppliers demand bank verification and audited financial statements etc.

4# Management

Management uses accounting information as an input to make rational decisions and to achieve profitability objective. Apart from financial statements, management needs some other reports too like the – booking commission report, employees and suppliers reports.

Ironically, management is interested only in knowing the existing profits, EPS, chances of survivals, a possibility of growth and diversification, relative performance, so that it can chalk out suitable strategies for its travel agency/operator.

5# Employees

Basically, employees are concerned with job satisfaction, job security, promotion, welfare schemes and other financial incentives given by the travel agency. So they want information on the profitability and the future prospects of a travel agency.

6# Financial Advisors

These advisors make their living by advising clients how and where they should invest their shaving. However, before they offer any advice they need financial information about the company which they may recommend to invest money.

7# Government

The financial statements are used to assess the liability of a travel agency and are also used to determine the overall performance of the travel industry. These statements provide valuable information to an authority for the determination of tax liability.

Government act as a base for farming and amending the regulatory structure of travel agency business.

Financial Analysis and Control Techniques Used in Travel Agency Business

It is observed that financial statements convey much useful financial information to internal management and outside users, and for this reason, it has become imperative to discuss the various tool for analyzing financial statements and control techniques used in travel agency business.

The emphasis is focused on the application of tools and techniques which are key indicators of a travel agency’s financial health and are considered vital for wise decisions to improve an agency’s profitability, financial soundness, and strong financial strategies.

Accounting Ratios

Accounting ratios are known as ‘ financial ratios ‘ and are considered key indicators for measuring the agency’s profitability and financial performance. They may be calculated at one point of time or may cover several time period to identify trends in several years. It is also used to compare one’s own position with an average industry.

According to Wixon and Kelly in 1970, “ an accounting ratio is an expression of the quantitative relationship between two numbers. It is a simple arithmetical expression of the relationship of one amount to another like 100 to 200 or 600 to 700 etc .”

The main ratios which are widely used to analyze an agency’s performance are:

Liquidity Ratio

Current ratio.

- Quick Ratio

Profitability Ratio

- Profit Margin

- Return in Assets

- Return on Investment

Activity Ration

- Fixed Assets

- Accounts Receivable

- Account Payable

Leverage Ratio

- Capital-gearing Ratio

- Financial Leverage

- Operating Leverage

- Debt Equity Ratio

It means an agency must be able to pay its short period debts and obligations from its short period financial resources to remain in the business. The most common used liquidity ratio is the current ratio.

This ratio compares the agency’s current assets to current liabilities. A high current ratio indicates that the travel agency is liquid and has the ability to pay its current obligations in time as and when they are due.

Activity ratios measures how effectively a travel agency manages its resources. Practically, funds are invested in various assets of a business to enhance sales and earn profits. The greater the return which can be derived from the assets, the more attractive the investment and the more profitable the agency.

These ratios are also called ‘ turnover rations ‘ because they reveal how rapidly resources are converted into revenues. High ratios are generally associated with good asset management. The activity ratios are:

Account Receivable indicates the number of times the average receivables are turned over during a year. The higher the value of turnover, the more efficient is the management of account receivable and vice versa.

Account Payables indicates how much time a travel agency is likely to take in repaying its account payables/creditors in a very short period. The less the number of times, the more is the credit period that a travel agency enjoys.

The main objective of travel agency business is profit maximization. Essentially the existence, continuance, and expansion of travel business depend, to a large extent, on the travel agency’s capacity to earn good amount of profit every year.

Profitability ratios are a fair indication of sound management of a travel agency. The main profitability ratios are profit martin/net profit to sales ratio, return on assets and return on investment.

Capital Structure Ratio

It measures the relationship between long-term debts and owner’s equity. Generally, debt financing increases the risk of investment in the business. So a higher leverage ratio is associated with higher risk and vice versa. However, there are times when a travel agency can make use of borrowed capital than equity.

The debt-equity ratio and debt servicing ration are used to measures the capital structure of an agency. The debt-equity ratio compares the total debt with total owner’s equity of an agency.

Cash Flow Analysis

Cash flow analysis is a measurement of the amount of money that a travel agency has in navel at any point in time. It enumerates the net effect of the various transactions on cash and takes into account the receipts and disbursements of cash. It also summarizes and causes of changes in the cash position of a travel agency between the different dates of balance sheets.

The long-term survival of any travel agency depends on its ability to generate cash from its main trading activities. The cash flow analysis is prepared by using the information contained in a travel agency last two year’s annual reports.

Practically, cash flow analysis is based on the profitability and liquidity of the travel agency and it helps the users to assess and identify:

- Travel agencies’ ability to generate future net cash inflow from the operations.

- An agency’s need for external financing.

- The reason for the difference between net income and net cash flow from the operational activities of the agency.

- The effects of cash and non-cash investing and financing transactions.

Moreover, by analyzing cash flow, the owners, shareholders and the management know exactly where the travel agency stands at any given time, on the other hand, credits, or suppliers, and the financial institutions use cash flow analysis to determine whether the travel agency can repay loans or has the debt paying capacity.

Break Even Point

A travel agency is said to be ‘break’ even when its total revenues are equal to total costs . It is a point where there is no profit or loss and at this point, the contribution is equal to fixed costs.

Budgetary Control

The keystone of planning and control activities in the travel agency is the budgetary control system, which is a major part of the day-to-day operations of the accounting system. It is applied to a system/technique of a management and accounting control by which all travel agency operations and activities are forecasted and actual results, are compared with budget estimates.

The process of budgetary control involves the establishment of budgets, relating the responsibilities of executives to the requirements of a policy, and the continuous comparison of actual result with budgeted results, either to secure by individual action the objectives of that policy or to provide a basis for its revision.

Practically, budgetary control technique is a useful accounting tool for translating strategic objectives/goals into realities. It also provides the management useful parameters for measuring the travel agency’s performance so that agency management can be tape corrective and timely actions if actual results are below the planned ones.

Some advantages of the budgetary control system are following as:

- It helps the management of an agency to conduct its business in a more efficient and effective manner.

- It lays emphasis on staff organization.

- It is helpful in measuring the efficiency of the whole organization and each department individually.

- It promotes the feeling of cost consciousness.

- It forces the manager to concentrate on the future.

August 16, 2023

Travel Agency Accounting: What Agency Owner Needs to Know

Travel agencies provide countless people with the opportunity for amazing, once-in-a-lifetime experiences. Owners and tour operators are experts in organizing incredible vacations, but may be less familiar with the financial side of the business, including the accounting process. As it is a crucial part of running a business, let’s dive deeper into how you can manage your financial reports more efficiently and strengthen your decision-making due to accurate numbers.

What is travel agency accounting, and why does it matter?

Accounting is the system of recording, organizing, and overseeing a business’s economic transactions. In tourism, accounting and bookkeeping allow travel agencies to oversee various financial operations, including selling travel packages, booking hotels, and managing travel expenses. To illustrate the importance of accounting for travel agencies, we’ll consider the example of an agency owner named Katherine.

Katherine’s tourism agency brought in many clients because she enjoyed meeting people, planning couples’ vacations, and making money. She loved coordinating trips for her clients, but she disliked having to record economic transactions. What was the result?

Because Katherine lacked the financial data and reports, she ended up missing out on tax deductions and paid more in taxes than she should have. She also had no idea how much capital the company actually had, and would occasionally overspend. Moreover, when Kate wanted to grow her business, she didn’t have accounting data to help her understand if she could afford to hire additional employees. Because Kate took a lax approach to collecting financial data, she was unable to make effective decisions and her business was left in a more uncertain situation.

If you own a travel agency, you can avoid these complications. A precise and effective accounting system will guarantee that you have reliable financial data at hand, helping you to optimize operations, strategize for the future, and prevent problems at tax time.

How to manage travel agency accounting

Travel agency accounting involves recording every transaction in which money flows into or out of the business. A travel agency brings in revenue when it sells tickets, hotel reservations, tour packages, and other services that ensure a comfortable journey. An agency’s expenditures, on the other hand, often include staff wages, advertising campaigns, travel spending, and maintenance of vehicles and equipment. Because there are so many transactions to oversee, it is important to establish an effective approach to bookkeeping for travel agencies.

Determine your accounting system

Before you can record transactions, you need to decide whether to use cash or accrual accounting. These methods are very different. Cash basis accounting only records transactions when funds enter or leave your account. This method, while intuitive, gives you only a limited understanding of your financial situation.

Accrual accounting considers transactions as they actually occur, regardless of when money changes hands. Suppose your customers book a $1,500 tour one month but plan to pay the next month. You should record this transaction at the time of booking, rather than when the customers have paid. This approach to accounting gives you a more comprehensive understanding of your financial position. It is also the only GAAP compliant method, which means it must be used for any official purposes.

Bookkeeping setup and bank account opening

Next, you need to select a method for recording operations. Consider the following criteria:

- Do you plan to do bookkeeping offline or online? An online, cloud-based system is the most popular and convenient solution.

- Will you do the accounting yourself or work with a financial specialist?

- What software are you planning to implement?

Before answering these questions, take into account the estimated size of your business. For smaller travel agencies, you may be able to handle your own bookkeeping to a certain extent. For larger businesses, you will need to recruit professional assistance and use the appropriate software.

Define payment methods

Consider how you want customers to pay bills – via cash, bank cards, or transfers. These options must be specified before the accounting process can begin, as your financial specialist will need to register and check all systems that you use to settle with counterparties. By sticking to this predefined list of payment methods, you can massively simplify your financial reporting workload.

Keep financial records

To effectively manage your books, you need to record every single transaction. Most travel agencies encounter daily transactions with customers, so you will need to consistently track the movement of funds. This financial data will help you to create the following reports:

- The income and expense statement. This document shows your profit and loss for a specific period. It allows you to identify how the agency is using its capital, as well as determine the current ratio of its assets to its liabilities.

- The cash flow report. This document demonstrates a firm’s liquidity, and warns of possible problems with cash that may prevent investment or the payment of bills.

- The balance sheet shows the company’s economic position in a certain period. It shows your assets, liabilities, and personal capital, which helps you to assess the state of your business and make decisions for its future development.

Careful monitoring and record-keeping is required to keep track of all revenue, expenditures, and other operations. You should check your books every few weeks to ensure that your information is accurate and up to date.

Financial statements for travel agencies

Financial statements reflect your travel agency’s current economic situation, including its strengths and weaknesses. They also inform stakeholders, external and internal, in the following ways:

- Owners: you should use your financial statements to make informed decisions about the company’s prospects for long-term growth, such as attracting investors. You can also control the flow of funds for specific purposes. Entrepreneurs often focus on the profit and loss statement.

- Lenders: these are individuals and financial institutions that lend money to businesses, including travel agencies. In order to assess whether an investment is worthwhile, investors will consult financial statements to see if the agency can pay off its debts in the short and long term.

- Suppliers: in tourism, this category includes carriers, tour operators, hotels, and other partners. In order to work with you, these counterparties will want to verify that your agency is solvent.

Prominent investors often consult with financial advisors for advice about how to maximize their investment. In order to recommend investment in your travel agency, these advisors need financial statements to back up their recommendation.

Tips to organize travel agency accounting

It is crucial to properly organize your finances. After all, it’s nearly impossible to grow your business if you don’t know what is going on financially. Consider a few recommendations from experts on effective financial management:

- Create separate accounts: your agency’s finances must be completely separate from any personal finances, including accounts and credit cards. Otherwise, you significantly complicate the accounting process.

- Classify expenses correctly: discuss with a tax professional how to reduce your tax base with deductions. For example, maybe you can earn a deduction for the food you offer to tourists during the tour or the cost of traveling from to the tour’s starting point. Knowing the laws allows you to classify each operation, which can help lower your tax burden.

Some entrepreneurs try to conduct their own travel agency accounting, but they don’t always have the time to consider every transaction. Instead of this risky approach, you should consult with financial professionals who can provide all the necessary accounting services, including business integration with bookkeeping platforms, account receivable and payable control, and more.

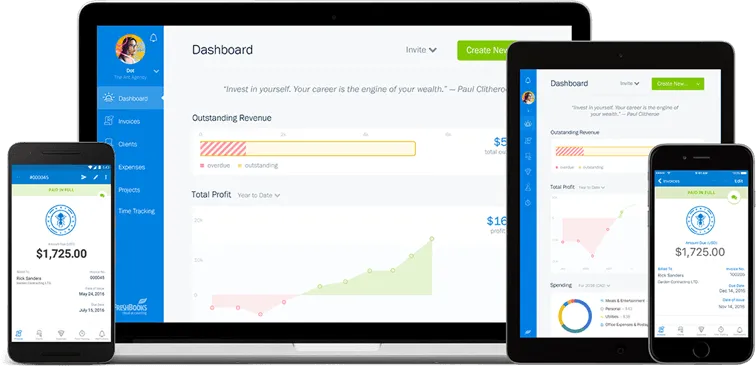

The best bookkeeping software for travel agencies

If you are in the travel business, you should find the best bookkeeping platform to suit your needs. You will need a program that provides a full range of features tailored to the needs of travel agencies. Some reputable platforms include:

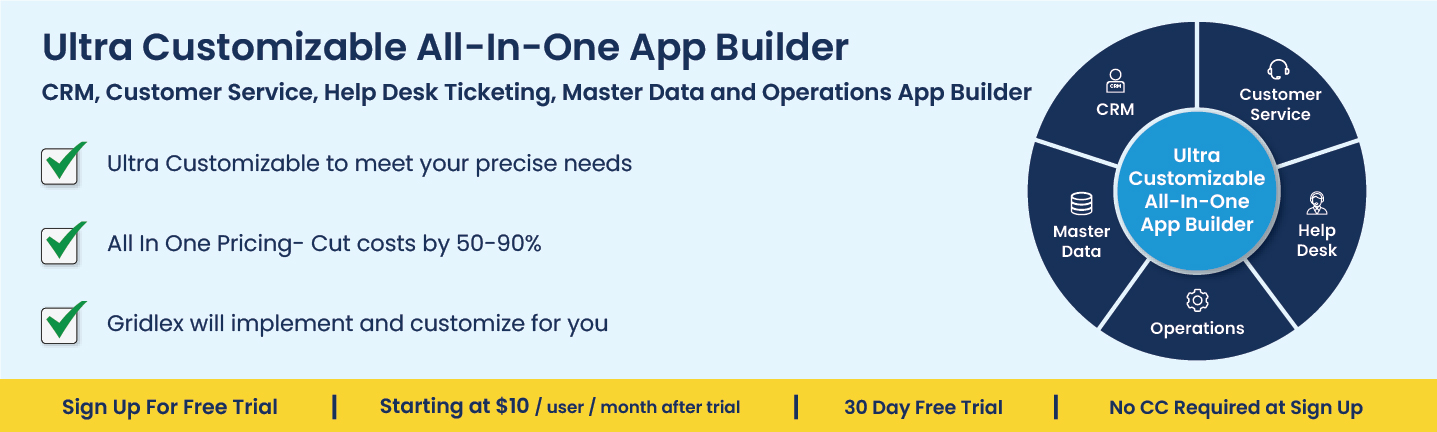

- QuickBooks Online: this program is like the Swiss Army knife of financial software. It offers a suite of functions, from invoicing processing, budgetary control, and tax calculation, giving you everything you need for effective financial management in one platform.

- Xero: this is another cloud-based software that offers the same tools as QuickBooks, but with a more user-friendly interface. For added convenience, this system syncs with other digital products, such as travel booking apps and payment platforms.

When choosing software for your agency, you need to consider your budget. The market offers a range of free, inexpensive, and more costly software options. If you operate a smaller travel agency, you may not need the most intensive software.

Get support of professionals

Proper bookkeeping is critical to success as a travel agent. Accurate records of transactions facilitate financial reporting, improve cash flow management, and ensure compliance with tax laws.

BooksTime provides the precise and up-to-date financial data that tourism agencies need to operate effectively. Our seasoned accounting experts can take care of the entire process, or provide custom solutions for specific tasks, such as the preparing financial statements or setting up accounting software. Let our team optimize your finances so you can focus on organizing unforgettable vacations. Just let us know what bookkeeping services you need!

This article is not intended to provide tax, legal, or investment advice, and BooksTime does not provide any services in these areas. This material has been prepared for informational purposes only, and should not be relied upon for tax, legal, or investment purposes. These topics are complex and constantly changing. The information presented here may be incomplete or out of date. Be sure to consult a relevant professional. BooksTime is not responsible for your compliance or noncompliance with any laws or regulations.

Share This Article

Author: Charles Lutwidge

Talk To A Bookkeeping Expert

A bookkeeping expert will contact you during business hours to discuss your needs.

Travel Agency Accounting: COA Template & Account Hierarchy

Travel agencies play a vital role in the tourism industry, offering services such as flight bookings, hotel reservations, and tour packages. Effective financial management is essential for the success of any travel agency, and a critical component of this process is the Chart of Accounts (COA). In this article, we will discuss the importance of a COA for travel agencies, provide an example template, and outline the account hierarchy.

What is a Chart of Accounts (COA)?

A Chart of Accounts (COA) is an organized list of all financial accounts used by a business to record and report its financial transactions. The COA serves as the foundation for the company's accounting system, enabling accurate tracking and reporting of financial activities. For travel agencies, a well-structured COA can provide insights into profitability, cost management, and areas for improvement.

Example COA Template for Travel Agencies

The following is an example COA template designed specifically for travel agencies. Keep in mind that every business is unique, and your COA should be tailored to your specific needs and requirements.

1. Assets

1.1. Current Assets

1.1.1. Cash

1.1.2. Accounts Receivable

1.1.3. Prepaid Expenses

1.2. Non-Current Assets

1.2.1. Property, Plant, and Equipment

1.2.2. Intangible Assets

2. Liabilities

2.1. Current Liabilities

2.1.1. Accounts Payable

2.1.2. Accrued Expenses

2.1.3. Deferred Revenue

2.2. Non-Current Liabilities

2.2.1. Long-term Debt

2.2.2. Deferred Tax Liabilities

3.1. Owner's Capital

3.2. Retained Earnings

4.1. Commission Income

4.2. Service Fees

4.3. Tour Package Sales

4.4. Other Income

5. Expenses

5.1. Cost of Services

5.1.1. Supplier Payments

5.1.2. Tour Package Costs

5.2. Operating Expenses

5.2.1. Salaries and Wages

5.2.2. Rent and Utilities

5.2.3. Marketing and Advertising

5.2.4. Travel and Entertainment

5.2.5. Insurance

5.2.6. Depreciation and Amortization

5.3. Interest Expense

5.4. Income Tax Expense

Account Hierarchy in Travel Agency Accounting

Account hierarchy is essential for maintaining consistency and accuracy in financial reporting. A typical account hierarchy for travel agencies consists of the following levels:

Category: The highest level in the hierarchy, representing the main divisions of the financial statement (assets, liabilities, equity, revenue, and expenses).

Subcategory: A more detailed level within the main categories, further segregating accounts based on their nature or function (e.g., current assets, non-current assets, operating expenses).

Account: The most detailed level, representing individual financial accounts used to record specific transactions (e.g., cash, accounts payable, commission income).

A well-organized Chart of Accounts is crucial for effective financial management in travel agencies. By creating a customized COA tailored to the specific needs of your travel agency and establishing a clear account hierarchy, you will ensure accurate financial record-keeping , facilitate reporting, and provide valuable insights for decision-making.Travel agencies have unique accounting needs, such as tracking commissions, managing supplier payments, and handling deferred revenue. It is essential to consider these specific requirements when developing your COA. You may also want to include accounts for refunds, cancellations, and loyalty program expenses, as these are common financial events in the travel industry.As your travel agency grows and evolves, it is essential to review and update your COA periodically to accommodate changes in your financial structure, new service offerings, or shifts in business strategy. This will help maintain a robust and effective accounting system that supports the ongoing success of your travel agency.By implementing a well-designed COA and maintaining an organized account hierarchy, you can improve your travel agency's financial transparency, ensure compliance with accounting standards, and make informed decisions based on accurate financial data. As a result, you'll be better equipped to manage your business's finances, allocate resources efficiently, and identify opportunities for growth and improvement in the competitive travel industry.

Bookkeeping For Travel Agencies: All You Need to Know

If you run a travel agency, you can relate to the nuances of the ever-changing trends and needs of the industry. In the middle of such a dynamic business environment, the last thing you would want to do is spend hours figuring out the cash flows, expenses, revenue, and other financial figures.

Travel agencies serve numerous sectors and industries together. From transport to hospitality and all the planning that goes in between, numerous aspects need to be taken care of to run an agency smoothly. Handling finances for such businesses, especially with their presence in multiple locations – can easily become overwhelming for the stakeholders. It all starts with accounting, and if bookkeeping for travel agencies is handled effectively, smooth sailing of the business is assured.

After all, you have a business to run and massive opportunities to grow.

Handling business finances, however, cannot be ignored. But you don’t need to worry about the complexities that arrive with accounting or bookkeeping for travel agencies. This blog will break down the entire bookkeeping process for your travel agency business. We will also introduce you to a solution that will simplify your business accounting to a large extent.

What Is Bookkeeping?

The process of recording and maintaining all of your company’s financial transactions into organized accounts is referred to as bookkeeping. Bookkeeping is an integral part of accounting. Accurate and regular accounting is essential for every business – big or small, to make key financial decisions like investing and operating.

As bookkeeping involves maintaining day-to-day transactions – all the inflows and outflows including revenue, payroll, payment of taxes, expense tracking , interest payments against loans, investments, and more are recorded in the books of accounts.

For all the parties related to a business – owners, investors, financial institutions, or even the government, effective financial data management is the key to tracking the business’s financial status. Not to forget, the stakeholders should also be aware of all the transactions taking place in the company.

Here are the primary reasons that convey the importance of bookkeeping for all businesses:

- Accounting, which refers to measuring, processing, and communicating financial information of a company – totally depends on accurate and up-to-date bookkeeping.

- Summarizing the income and expenditure to make the right decisions for your company’s positive growth is done by periodic analysis of the books of accounts. Additionally, documents like balance sheets, income statements, and cash flow statements help you set up realistic and strategic business goals.

- Filing your taxes is not a straightforward task. Effective bookkeeping ensures that you comply with the Internal Revenue Services’s (IRS) regulations and financial governing systems. Hence, you can avoid any possible legal issues.

Also Read: Bookkeeping vs Accounting: Key Differences You Need to Know

Why Do Travel Agencies Need Bookkeeping?

We discussed the ins and outs of bookkeeping and why it is important for all businesses regardless of their industry, scale, location, or ownership.

Let’s now dive into the accounting needs of travel agencies and find out the various reasons why you as a business owner, need bookkeeping regularly.

1. Organizing crucial financial information

The financial records of your company reflect the biggest truth of your organization. Imagine you have to apply for loans or grants to grow your travel agency – your financial performance is the key there. Even basic business analysis and planning need financial information organized in one place.

In case proper books are not maintained, the transaction data of your travel business lies spread out all over the place. You cannot figure out what capital you’re holding, your profits, and which part of the business needs to be worked upon. Bookkeeping solves all of these by making the financial information readable.

2. Informing your business decisions

Running a business requires you to be a 24x7 decision-maker. Effective bookkeeping, followed by accounting helps you make better decisions easily.

Suppose in your travel agency; you might need to make decisions like:

- Hiring more employees

- Expanding your business geographically

- Hopping into more sectors and services related to travel and tourism

- Getting new office space for your growing team

- Marketing your business through new channels

- Giving your employees a raise

- Offers and discounts for customers

The list is endless, and an inside-out analysis of your financial records enables you to make informed decisions. Hence, you can determine if your business can afford all of your expenses or investments at a given point in time.

3. Filing taxes accurately

What comes to your mind when you hear ‘taxes’? Is it ‘ deductions ’?

No, we are not into the business of reading minds, but it’s usually the first thing business owners think about. Filing taxes can be confusing and stressful if not supported with accurate financial records. And regular, error-free bookkeeping can also help you identify all possible exemptions.

Not to forget – the extensive amount of time tax filing can consume. On the other hand, organized bookkeeping means having detailed records of your travel agency receipts, invoices, and balance sheets. In that case, getting your accounts audited would probably need much lesser time.

4. Performance analysis and budgeting

How do you set budgets for all the different verticals of your business? Will it be not right to say that it largely depends on your previous year’s performance?

Well-organized, clear, and updated records supported by effective bookkeeping allow you to review past performance and create future plans accordingly . For your travel agency, some meaningful metrics for analyzing performance can be:

- Annual revenue

- Revenue growth from the previous year

- ROI on different marketing expenditures

- The difference in costs of services now as compared to costs previously

A critical part of financial planning is budgeting from hiring to marketing, investments, growth, and everything in between needs you to set a budget upfront. So accurate bookkeeping is a core need for your business.

5. Getting Investors

Raising funds from external investors is a great option if you want to scale your travel agency services business. The funding can be in the form of capital, equity, grants, debt, or others. But your potential investors need to have a clear outlook and understanding of the business’s financials.

Unless you have detailed accounting records of your business, an investor cannot predict the success or failure of your travel agency – and hence cannot invest. Most VCs or Angel investors seek up-to-date books immediately, and you won’t have much to prepare. There’s no way you can raise funding without bookkeeping.

How to do Bookkeeping for Travel Agencies?

Step 1: decide on the method of bookkeeping.

Before you even start taking any records of transactions happening in your travel agency, you need to choose between the two methods of accounting:

- Cash basis accounting

- Accrual basis accounting

The difference between the two is quite straightforward – the cash-based system only records transactions when you get the money in your hand. It is the preferable method of bookkeeping and accounting for small businesses, and is much easier to comprehend too.

Accrual basis accounting, on the other hand, involves recording transactions as and when they take place, regardless of whether the amount has been received by you or not. The primary concern, in this case, is recording the transaction.

Step 2: Set Up Your Accounting and Open a New Bank Account

The next step is deciding on the mode of recording transactions for your travel agency bookkeeping. You need to finalize the following:

- Will the books be maintained offline or online? Cloud-based bookkeeping is highly recommended.

- Will you maintain the books yourself, or hire someone - either full-time or part-time?

- Are you willing to outsource the maintenance of your books to an accounting partner company?

- Will you be using an accounting software solution?

Analyze the scale of your travel agency business and answer these questions to move on to the next steps.

Ensure you open a new bank account for your travel agency business if you don’t already have one. Don’t perform business transactions from your personal bank account.

Step 3: Decide on the Methods of Receiving Payments

Establish your methods of receiving payments. If you opt for methods like cash, credit card, bank transfer, or others – define all of them before beginning your bookkeeping.

The methods you choose for receiving customer payments for your travel agency are recorded and verified accordingly. So it’s vital that you stick to the pre-determined modes of performing transactions. It makes your operations and finances simpler too.

Step 4: Start Recording Transactions Regularly

The key to effective bookkeeping is to record transactions regularly and, most preferably, daily. Most travel agencies have customer bookings happening daily, so it’s crucial to record them daily. Both your revenue and expenses should be recorded to balance the books.

- **(link: https://fincent.com/blog/business-cash-flow-overview-examples-and-types-of-cash-flows text: Manage cash flow): **Record the net cash flow from sales and expenses. This helps you keep track of cash management for your business and helps avoid any financial problems.

- **Maintain general ledger: **This records everything your travel agency owns and what it owes. It’s another tool that should be updated regularly as it impacts your company’s financial status.

- **Manage income statement: **This records your total income and the net expenses for your travel agency, which further helps evaluate the net profit over time. ** **

Recording your transactions in a timely manner also helps you create and map other accounting documents, along with (link: https://fincent.com/blog/what-is-income-tax-liability-and-how-do-you-calculate-it text: calculating tax liabilities).

Step 5: Maintain and Review Books

Now that you are recording all the transactions and practising bookkeeping regularly for your travel agency, the next step is maintaining and reviewing your books promptly.

To ensure that all the sales, expenses, and other transactions are being recorded correctly, you should track your business and your accounting activities. And it’s vital to thoroughly review your books at least once a month.

Simplify Your Travel Agency Bookkeeping with Fincent

Running a fast-paced and dynamic business like a travel agency and handling the accounts alone can be overwhelming at times, especially when you are looking to expand your agency and scale the business.

Gone are the days when you needed to handle your accounts manually in registers and ledger books. Effective cloud-based bookkeeping and accounting solutions now make your job a lot easier and ensure ease of doing business.

Fincent is your one-stop solution for all financial management needs. With cloud-based bookkeeping and accounting curated for your travel agency business, you can stop worrying about bookkeeping, filing your taxes, tracking expenses, collecting and making payments, and much more. We handle it all.

(link: https://fincent.com/bookkeeping-for-agency text: Sign up) for your ultimate finance department and focus on making better business decisions.

Related articles

How To Prevent Penalties for 4th Quarter Estimated Tax Payments

Timely 4th quarter estimated tax payments are crucial to avoid penalties and maintain financial stability. Understanding criteria, accurate calculations, and prompt payments are key for individuals with irregular income.

How To Build Business Credit for Your Startup

Build business credit strategically for startup success. A robust credit history separates finances, enhances credibility, and unlocks diverse financing. It offers negotiating power, limits liability, and fosters growth. Follow gradual steps for a secure financial future.

Travel agency accounting: Travel Agency Accounting: Master The Basics

The key to effective bookkeeping is to record transactions regularly and, most preferably, daily. Most travel agencies have customer bookings happening daily, so it’s crucial to record them daily. We can help you get set up with online accounting software for the first time or clean up your existing books in QuickBooks for a travel agency or another platform. If you’re new to cloud-based accounting we’ll explain the benefits and provide as much or as little support as you need. QuickBooks™ allows travel agencies to accurately keep track of all income and expenses, while creating easy to follow reports of all this information.

Apart from financial statements, management needs some other reports too like the – booking commission report, employees and suppliers reports. The income statement provides important data for the financial planning, profit planning and debt-paying ability of the travel agency. Essentially, this statement provides vital financial information to the internal as well as external users. Financial statements are the formal output of any accounting system and are prepared to provide accurate, timely understandable, objective and comparable accounting information to the users.

What are the most important accounting procedures for a travel agency?

Yet, as a small business owner, you’re most likely going to have to be doing the bookkeeping (as well as the sales, marketing, and customer service). So let me give you a heads up on how to start your agency with a strong financial infrastructure. Cash flow analysis is a measurement of the amount of money that a travel agency has in navel at any point in time. It enumerates the net effect of the various transactions on cash and takes into account the receipts and disbursements of cash. It also summarizes and causes of changes in the cash position of a travel agency between the different dates of balance sheets. Profitability ratios are a fair indication of sound management of a travel agency.

- The income and position statements tend to be the primary source of information to the owner.

- One of the best accounting software programs that your travel business might benefit from is QuickBooks.

- In the technical world, it provides details about the resources of a travel agency and how these resources financed, either by lending funds or by investing capital in the business.

- Thus it’s very essential to know the nitty-gritty of the financial position of the firm.

Read this blog to learn the different strategies and general principles to consider for small business owners to pay themselves. Running a fast-paced and dynamic business like a travel agency and handling the accounts alone can be overwhelming at times, especially when you are looking to expand your agency and scale the business. A critical part of financial planning is budgeting from hiring to marketing, investments, growth, and everything in between needs you to set a budget upfront. A great financial plan includes extensive cash flow audits, expense analysis, negotiation with suppliers/vendors/partners and a good handle on business interruption insurance. Giersch Group advisors will develop a solid financial plan for your business. Set up your accounting software in a day through our checklist, for converting a client from your legacy software to Xero.

Otherwise, manual operations will make you re-enter data on each check while taking the chance of omitting some of the ledger entries. She worked with thousands of agents in her role as a former host agency director before leaving in 2012 to start HAR. She’s insatiably curious, loves her pups Fennec and Orion, and — in case you haven’t noticed — is pretty quirky and free-spirited. The government is going to want to know how much commission you brought in from your travel sales so you need to keep track of that, among tons of other things.

Accounting for Travel Agencies: A Specific Job!

A position statement may be defined as statements prepared with a view to measuring the true financial position of a travel agency on a certain fixed date. It is prepared by the transferring all balance that belongs either to personnel or to real accounts. Ensure you open a new bank account for your travel agency business if you don’t already have one. The financial records of your company reflect the biggest truth of your organization. Imagine you have to apply for loans or grants to grow your travel agency – your financial performance is the key there. Even basic business analysis and planning need financial information organized in one place.

The Balance Small Business has a recent article explaining the differences between an accountant, CPA, and bookkeeper if you’ve got 3 minutes. Account Receivable indicates the number of times the average receivables are turned over during a year. The higher the value of turnover, the more efficient is the management of account receivable and vice versa. We offer free 30-minute consultations online or at our offices in Milwaukee, Brookfield, or Madison, Wisconsin. Our 100% virtual services are available to businesses anywhere in the nation – just contact us online or give us a call to get started.

Income/Gains

Unless you have detailed accounting records of your business, an investor cannot predict the success or failure of your travel agency – and hence cannot invest. Most VCs or Angel investors seek up-to-date books immediately, and you won’t have much to prepare. In case proper books are not maintained, the transaction data of your travel business lies spread out all over the place. You cannot figure out what capital you’re holding, your profits, and which part of the business needs to be worked upon.

Kudos to you for thinking about your financial infrastructure from the get-go. That said, it’s complicated, and making the best decisions right now about financial structure can save you money in the long run. If you want more personalized support in regard to finances and all things starting an agency, check out HAR’s new course, The Complete Guide to Starting a Travel Agency. A travel agency is said to be ‘break’ even when its total revenues are equal to total costs. It is a point where there is no profit or loss and at this point, the contribution is equal to fixed costs. Basically, employees are concerned with job satisfaction, job security, promotion, welfare schemes and other financial incentives given by the travel agency.

Bookkeeping For Travel Agencies: All You Need to Know

Managing the Travel Agency Accounting for each of the above differs to a large extent. There are a lot of things in traveling that we have to keep in the right places while accounting. It means an agency must be able to pay its short period debts and obligations from its short period financial resources to remain in the business.

The income and position statements tend to be the primary source of information to the owner. An income statement contains a summary of figures relating to the cost of tours sold; various operating and non-operating expenses and provisions for expenses. These are then compared with sales and various operating and non-operating revenues.

It is the monetary value of goods and services sold by the travel agency such as the sale of the tour, airlines commission and interest received etc. Revenues are cash inflows of the agency for the services rendered to the clients during a specific period. Cash outflow means the operating expenses of the travel agency like rent, salaries, telephone expenses, administrative expense, financial and legal expenses, selling and distribution expenses etc. When a travel agency purchases tourism products, services from the supplier on credit, the amount owed to producers/suppliers/sellers are referred to as an account receivable. Gone are the days when you needed to handle your accounts manually in registers and ledger books. Effective cloud-based bookkeeping and accounting solutions now make your job a lot easier and ensure ease of doing business.

One of the best accounting software programs that your travel business might benefit from is QuickBooks. As a travel agency owner, keeping track of your financials is crucial to the success of your business. There are several key accounting reports that you should pay close attention to stay on top of your finances and make informed business decisions. Accounting ratios are known as ‘financial ratios‘ and are considered key indicators for measuring the agency’s profitability and financial performance. They may be calculated at one point of time or may cover several time period to identify trends in several years. No, we are not into the business of reading minds, but it’s usually the first thing business owners think about.

So they want information on the profitability and the future prospects of a travel agency. Analyze the scale of your travel agency business and answer these questions to move on to the next steps. Accrual basis accounting, on the other hand, involves recording transactions as and when they take place, regardless of whether the amount has been received by you or not. Effective bookkeeping, followed by accounting helps you make better decisions easily. We discussed the ins and outs of bookkeeping and why it is important for all businesses regardless of their industry, scale, location, or ownership. If your travel agency hires an external travel accountant, he or she would love to use such a great system that reduces the workload related to his/her accounting tasks.

Imagine if I went into my bank and told them I had started up a new agency and would like to open a business checking account. They’re going to want some proof showing my agency is a legal business and that I’m the owner of said agency. The debt-equity ratio and debt servicing ration are used to measures the capital structure of an agency. The debt-equity ratio compares the total debt with total owner’s equity of an agency. It shows whether the travel agency earned a profit i.e. the excess of income over expenditure or has suffered a loss i.e. the excess of expenditure over income. It is equal to the difference between the values of what is owned by the agency and the value of what is owed by the travel agency.

How To Master The Art Of Putting Yourself Out There

Content Put The Phone Away And Just Talk To People The Rudest Things You Can Do During A Work Zoom Meeting How To Master The Art Of Putting Yourself Out There When Youre Afraid Of Putting Yourself Out There Ways To Overcome The Fear Of Putting Yourself Out There This is the first impression others […]

National Mom And Pop Business Owners Day

Content Happy Cake Pops Day! Happy Clam Day! Happy Canada Day Pops!! Father’s Day Messages From Son Oh Happy Day She lives in Columbus, Ohio with her husband and two small, ice cream-obsessed daughters. Download Started – To use the music, please read the policy page if you haven’t already. Emotional, motivating and inspiring …

The Difference Between A Suspense Account And A Clearing Account

If the borrower continues to make partial payments each month then this process is repeated over and over again. Eventually, it will lead to late payments showing up on your credit report – possibly every single month – because you’ll be 30 days late in perpetuity. The following month, if the borrower makes another partial […]

- US +1 347 618 6478

- [email protected]

- Accounting Software Selector

Bookkeeping Services for Travel Agencies

- Industries We Service

A more lucrative travel agency is based on timely and accurate financial reporting.

Independent agents, franchisees, and owners of tourist agencies benefit from our bookkeeping services for travel agencies so they may manage their operations with ease.

Travel-specific cashflow requirements, expenses, and revenue can all play a role in a travel agency's bookkeeping.

Years of experience have been accumulated by our staff in assisting small and midsize business owners in managing their finances successfully.

We will work with you to expand your company and overcome any obstacles you may encounter.

To accommodate our client’s needs and financial constraints, we design a unique service plan. Our primary goal is to increase your company's profitability.

Here are reasons why you need to think about experts that provide accounting for a travel agency.

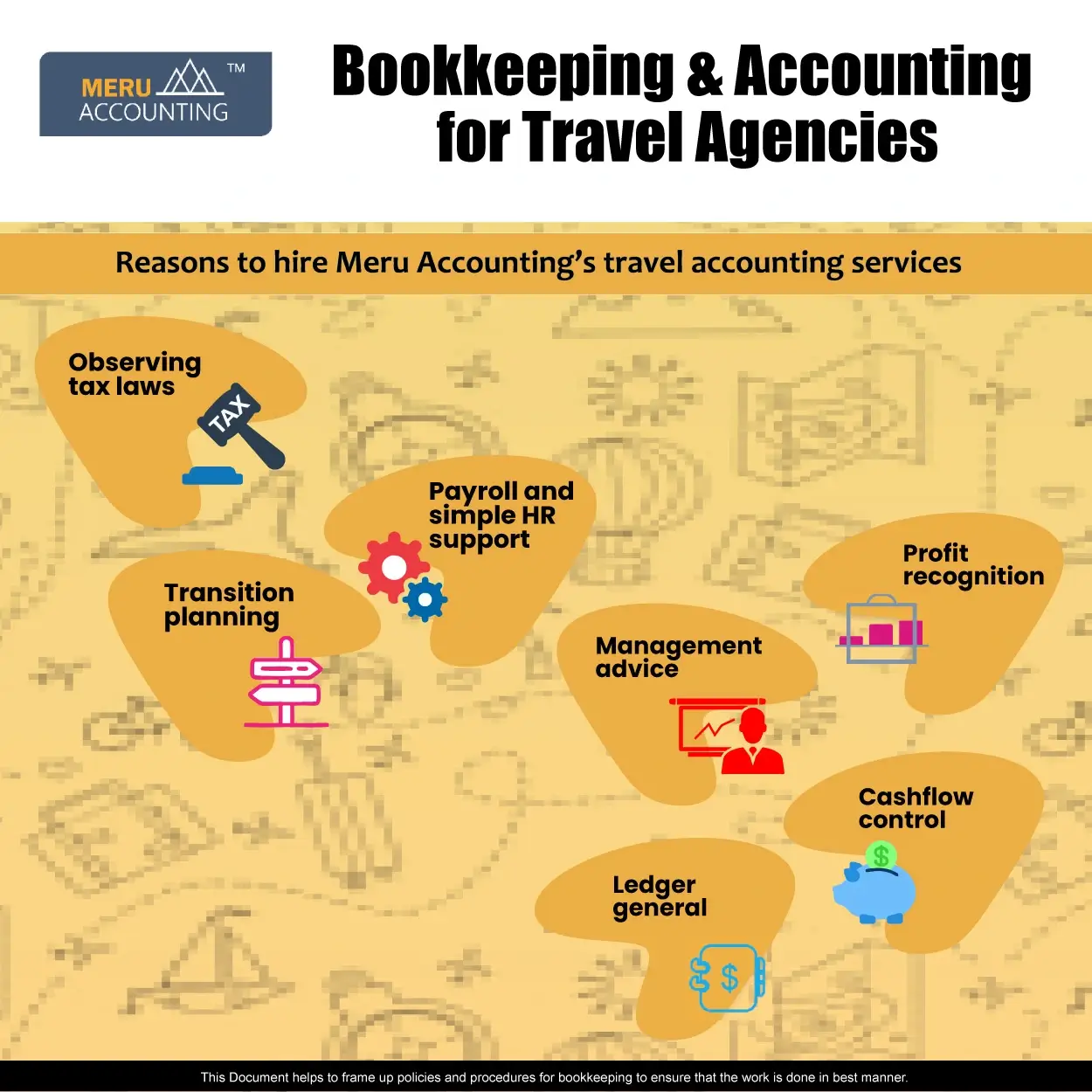

Services Provided in Accounting for Travel Agency

As a cost-effective and practical alternative for the travel and tourist industry, we provide part-time and virtual CFO and controller services.

Observing Tax Laws

Adequate Bookkeeping for travel agency efficiently manages your tax filing for sales and use taxes as well as employer withholding taxes. Your payroll and sales tax filings can be handled quickly and efficiently by our qualified bookkeepers.

Payroll and Simple HR Support

You can save money by using our payroll and basic HR services instead of paying internal staff to process payroll and issue checks by hiring people to do bookkeeping for travel agency .

Transition Planning

To guarantee a seamless transfer, we support family-run travel and tourism firms and help them include a succession plan in their daily operations.

Profit Recognition

The most effective revenue recognition tactics are used by our experts. For this, we also employ the effective cash method.

Management Advice

The best management consulting services are offered by Adequate Bookkeeping, helping small business owners get the best results.

Cash Flow Control

A successful travel and tourism business must effectively manage its cash flow. We keep track of incoming costs, payments, and net cash flow from sales using the most recent accounting software.

Ledger General

Using the greatest accounting software, we update your general ledger on a regular basis. This general ledger is used to keep track of debts, assets, and the effects of daily and weekly transactions.

Our travel accounting services offer the precise and comprehensive financial data that travel agencies require to survive and function. You can hire us to handle your bookkeeping if you want the desired results.

Additionally, we assist you with more particular duties like producing profit and loss statements. Our experts are skilled in using any online accounting platform, including Xero, Zoho Books, and QuickBooks, with efficiency.

Why Choose Accounts Junction?

If cloud-based accounting is unfamiliar to you, we will also give you the support you need and outline the advantages of choosing it.

We have extensive knowledge in offering the best bookkeeping and accounting services to the travel and tourist sector. Our aggressive pricing strategy reduces the number of overhead expenses.

Benefits of Bookkeeping for Travel Agencies:

1. financial performance analysis:.

- Track income and expenses to analyze the financial performance of your travel agency.

- Identify trends, assess profitability, and make informed decisions for growth.

2. Effective Cash Flow Management: