5 Mega Challenges Facing the Global Travel and Tourism Industry

The global travel and tourism industry sits smack in the eye of a perfect storm. On the one hand, demand is up. Planes are packed. Our wanderlust is lustier than ever. On the other hand, rising inflation, lagging infrastructure, geopolitical uncertainty, staffing shortages, and COVID’s lingering impact have all converged into the stuff of nightmares — for travelers and the travel industry alike.

As researchers and advisors to global tourism boards and brands across the travel and tourism ecosystem, we are seeing some of these challenges hit certain players harder than others. On the bright side, recovery is on the horizon. But some geographies and industry sectors will face steeper challenges as five major headwinds converge upon them. We’re seeing opportunities for brands to get ahead of the storm and put the wind at their back.

These are the top five challenges facing the travel and tourism industry today, along with our perspective on navigating the way forward.

Travel Insight #1: Inflation means trade-offs and discretionary travel may lose out

Just when tourism was on the rebound, rising inflation came nipping at the heels of a travel boom. Escalent’s forthcoming 2022 Holiday Shopping & Travel Study revealed only 42% of consumers feel confident they’ll achieve their 2022 holiday travel plans (down 24 percentage points from 2021), and 49% of consumers are uncertain their holiday plans will be achieved (up 23 percentage points from 2021).

For the travel and tourism industry, inflation is a huge concern since it drives up product prices and affects consumers’ willingness to spend on discretionary travel. According to Euromonitor, 63% of travel executives said inflation was having a moderate to extensive impact on their businesses. Subsequently, over half of global travel companies acted in kind, by raising all or some of their prices. This was even higher in the Americas, where 59% of the companies raised all or some of their prices. Meanwhile, 44% of businesses accepted that they would suffer from having a lower profit margin by absorbing the inflationary costs rather than passing them on to their consumers to limit impact on their travel plans.

During inflationary times, it is common to see brands cut back on their marketing and advertising spend. While this reduces costs short term, it can be a setback to building long-term brand trust. In times of uncertainty, consumers tend to gravitate towards certainty, something a trusted brand can confer. And a destination is a brand. The more trust you can build amid uncertainty, the better.

Travel Insight #2: The ripple effects of geopolitical disruption

Geopolitical instability is also a key concern for the travel and tourism industry. The outlook for global travel and tourism for inbound spending is expected to be at 45% of 2019 levels, according to Euromonitor’s travel forecast model. The war in Ukraine is estimated to have caused a $7 billion decline in global inbound tourism, while Russian outbound tourism has all but collapsed under economic sanctions, airspace closures and flight bans. The loss of big-spending Russian visitors will impact travel destinations globally, but especially in Europe, the Caribbean and Turkey.

What happens when your high-value source market can’t travel? The ripple effects of geopolitical disruption are felt across regional clusters, forcing travel and tourism entities to rethink their source markets and reset their tourism marketing and targeting strategy.

Travel Insight #3: The travel and tourism infrastructure is in trouble

The pent-up travel demand is causing additional strain on the existing infrastructure, particularly for the airline sector. Problems with safety protocols and compliance with new national and international health standards are predicted to be made worse by capacity constraints when the industry recovers. This is expected to result in (even) longer lines, (more) crowded terminals and operational bottlenecks.

Social distancing measures have been lifted in many countries, including the US. But measures are still in place in many airports around the world, thus reducing airport capacity. Airports that operated close to their saturation capacity before the COVID crisis can expect to reach their maximum saturation capacity at just 60%–75% of their pre-COVID peaks.

According to ACI World, as air transport demand recovers, passenger demand will put more pressure on existing airport infrastructures. This may have socio-economic consequences, if not addressed in time. If long-term capacity constraints are not addressed through capital investments, it is estimated to lead to a reduction of up to 5.1 billion passengers globally, by 2040. For every million passengers that airports cannot accommodate due to airport capacity constraints in 2040, there would be 10,500 fewer jobs and 346 million USD less in GDP contribution from the industry.

Airports are often the “first impression” of a destination. A traveler’s airport experience sets the stage for the rest of the journey. When greeted with chaos and delays, even the most intrepid traveler can sour on the experience. Recently the US has made modest steps towards infrastructure improvement, including the Infrastructure Investment Act passed in November 2021, which includes spending for airports. While its impact will not be immediately felt, many travel associations have applauded the passing of this long overdue legislation.

Travel Insight #4: There’s no quick fix for the staffing shortage

If you’ve stepped foot in an airport this summer, you already know. The travel industry is facing a severe staffing challenge, particularly for customer-facing roles at hotels and airlines. Industry CEOs acknowledge that they are struggling to add staff to meet demand.

Airlines, in particular, are struggling to fill staffing requirements. Boeing’s 2021 Pilot and Technician Outlook voices concern that many airline workers who were furloughed during COVID may have left the industry permanently. The commercial airline industry needs 612,000 new pilots, 626,000 new maintenance technicians and 886,000 new cabin crew members over the next 20 years. Hotels and hospitality are also struggling, making it harder to deliver on guests’ expectations. Many hotels are shifting housekeeping services to a by-request-only model and some are cutting back on food and beverage amenities, including room service and restaurants.

What’s the precautionary tale to take away from this staffing mess? It can take decades to build brand trust, and one canceled flight, one bad stay, to destroy it. How people experience your brand — no matter if it’s in the best of times or the worst of times — stays with them. Travelers expect consistency from major brands. It will take time and investment for many airline and hospitality brands to rebuild trust in the quality and consistency of their brand experience.

Travel Insight #5: COVID is with us for the long haul

COVID travel restrictions are still impacting many elements of world tourism, with countries like China continuing to impose stringent restrictions and quarantines on visitors as well as Chinese outbound travelers.

In Asia Pacific, 83% of travel businesses report that ongoing COVID restrictions continue to have a moderate to extensive impact. This compares with 59% in Western Europe, according to Euromonitor. Although less, compared to 2021 levels, COVID concerns among travelers persist. Ongoing concerns, including new variants, affect the travel decisions of 55% of travelers, according to another recent study. Travelers are planning their trips cautiously, and nearly 70% are avoiding certain destinations, with 56% preferring close destinations and 56% avoiding crowded places.

Just as sanctions have grounded Russian travelers, COVID restrictions are keeping Chinese travelers homebound. Popular destinations for Chinese tourists such as Japan, Thailand, Singapore and Australia continue losing out on billions in tourism revenue. And countries with strict quarantine requirements like Japan continue to struggle. Between June 10 and July 10 this year, Japan hosted only 1,500 international tourists, according to data from Japan’s Immigration Services Agency. That’s down 95% from the same period in 2019. Who wants to spend half their holiday in quarantine? Destinations like Japan have focused on promoting domestic travel, but with COVID with us for the long haul, doubling down on domestic travel marketing and promotions is not a sustainable strategy.

Turn disruption into opportunity with tourism industry research and consulting

Escalent specializes in travel and tourism market research, traveler behavior, tourism investment strategy and consultative support across the travel and tourism ecosystem. Learn more about our Travel & Tourism practice and let us help you ride out the storm and go forth with confidence.

SOURCES CITED

(forthcoming) Escalent 2022 Holiday Shopping and Travel Study Please contact us if you would like to be notified when the report is available. View press release .

Voice of the Industry: Travel Survey, Facing New Challenges, Euromonitor, May 2022

Travel: Quarterly Statement Q1 2022, Euromonitor, May 2022

Holiday Barometer among Europeans, North Americans, Asians & Oceanians, Ipsos, June 2022

Japan is open to travel. So why aren’t tourists coming back? CNN, July 31, 2022

Deloitte travel outlook, The winding path to recovery 2022

Half of US Hospitality Workers Won’t Return in Job Crunch, Bloomberg, July 2021

Staff Shortages: World Travel & Tourism Council Travel Survey, May 2022

Related Industry: Travel & Tourism

Related Solution: Brand Positioning , Customer Experience Management , Market Assessment

Related Expertise: Secondary Research

Vivek leads Escalent’s Travel & Tourism practice where he works with tourism boards, airlines, hotels and hospitality brands across the globe, including in China, Africa, Southeast Asia, and the Middle East. A featured thought leader at global travel and tourism forums such as ITB, TTRA, and PCMA, his expertise spans the Travel & Tourism value chain. Vivek is an experienced business executive with expertise in various business elements including operations, business development and P&L management. A seasoned insights leader, he advises clients on market assessment and entry strategy, market sizing and growth strategies. An engineer by training, he holds an MBA in Strategy & Marketing from the Indian Institute of Management. Vivek has a keen interest in human psychology and believes that a transparent, win-all proposition is the key to creating a sustainable people-centric business.

Subscribe to Our Newsletter

Keep me informed. I’d like to receive occasional newsletters, event notifications, and thought leadership materials.

17430 College Parkway Livonia, MI 48152

P: +1 734 542 7600

- Escalent on LinkedIn

- Escalent on Twitter

- Escalent on Facebook

- Escalent on YouTube

©2024 Escalent and/or its affiliates. All rights reserved. Reg. U.S. Pat. & TM Off

- Share full article

Advertisement

Supported by

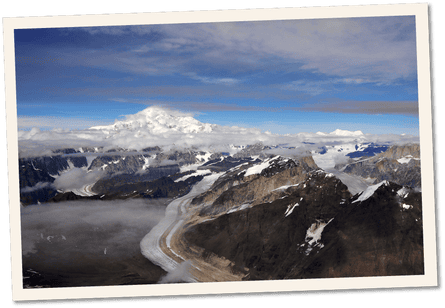

Travel Industry Takes Crucial First Step Toward Combating Climate Change

More than 300 travel companies, tourism boards and countries have signed the Glasgow Declaration on Climate Action in Tourism, the first step for a shared road map to cut carbon emissions.

By Ceylan Yeginsu

The travel industry has reached a turning point.

As thousands of scientists, government officials and business leaders met in Glasgow over the past two weeks for the pivotal United Nations climate conference , hundreds of members of the trillion-dollar tourism industry came together and made the first commitment toward a shared road map to cut carbon emissions in half by 2030 and reach “net zero” by 2050.

More than 300 global travel stakeholders, including tour operators, tourism boards and hotel chains, have signed the Glasgow Declaration on Climate Action in Tourism, requiring them to submit a concrete and transparent plan within 12 months. While the details have yet to be put forward, the companies and countries that signed on, from Germany railway company Deutsche Bahn AG to the country of Panama, will be expected to disclose their carbon emissions and offer clear strategies for how to reduce them. The process is being spearheaded by the U.N. World Tourism Organization and the World Travel & Tourism Council, two industry bodies that have previously sparred on climate matters.

“This is undoubtedly the biggest climate commitment our industry has come together for,” said Jeremy Smith, the co-founder of Tourism Declares a Climate Emergency , an initiative that supports climate action and provided the framework for the Glasgow Declaration.

“Our initiative launched two years ago because the industry had no collective plan, and we did well getting over 400 tourism organizations on board without funding,” he said. “But the Glasgow Declaration builds on our work. It’s the coming together of major players in our sector and it’s owned by everyone who has signed it, establishing collective responsibility.”

The travel industry is a large contributor to global carbon emissions, with a footprint estimated between 8 and 11 percent of total greenhouse gases, according to the World Travel & Tourism Council, or W.T.T.C . Aviation alone represents around 17 percent of total travel carbon emissions. Each year, a growing number of destinations and communities heavily dependent on tourism — countries like Thailand, India and Madagascar — are hit hard by the impacts of climate change, in the form of rising sea levels, drought, wildfires, deforestation and biodiversity loss.

The pandemic spotlighted the adverse impact of industry growth and overtourism on Venice, Bali and other popular destinations, forcing some places to take stock and pivot toward more sustainable and environmentally friendly business models. Yet with most operators and destinations reeling from the industry shutdown last year, it is unclear how many of those plans will be prioritized over the need for fast recovery.

“We need a cultural change and we need to move beyond the traditional growth-oriented mind-sets to see a more sustainable, responsible and climate-neutral tourism ecosystem,” said Patrick Child, deputy director general of environment at the European Commission.

52 Places to Love in 2021

We asked readers to tell us about the spots that have delighted, inspired and comforted them in a dark year. Here, 52 of the more than 2,000 suggestions we received, to remind us that the world still awaits.

‘A lot of apathy’

The declaration has four main targets: measurement, requiring companies to disclose all travel- and tourism-related emissions; decarbonization, by setting targets aligned with climate science; regeneration, to restore and protect natural ecosystems; and collaboration, to ensure best practices are shared and financing is available to follow through.

A recent analysis by the W.T.T.C. of 250 travel businesses found that only 42 percent had publicly announced climate targets and many of them were not based on the latest science. The council last week published a road map for different industries within travel, providing concrete guidance on how to reach “net zero” targets by 2050.

“There has been a lot of apathy, with some people not quite sure about what they need to do and how to do it, or some thinking they are not significant enough, and that’s why it’s really important for larger organizations to show the way,” said Darrell Wade, the co-founder and chairman of Intrepid Travel , the only global tour company with a climate target verified by the Science Based Targets initiative , which promotes best practices in emissions reductions in line with climate science.

Joining Deutsche Bahn and Panama in signing the Glasgow Declaration are big companies like Accor, Skyscanner, The Travel Corporation and Iberostar Group , as well as countries that are already affected by climate change, including Norway and Barbados. Signatories hope that more destinations will participate in the coming weeks.

Throughout his experience in the Tourism Declares a Climate Emergency initiative, Mr. Smith found it easier to get smaller, more agile companies and smaller countries involved. When it came to larger companies, there were more barriers and obstacles, he said.

“When you reach a destination, or even a city, it becomes even harder because there are multiple different players with different interests at the scale of a country,” he said. “It takes time.”

Panama, one of only three carbon-negative countries in the world (meaning that it absorbs more carbon emissions than it emits), has taken a lead role in establishing initiatives for economic growth in tourism, which also benefit and preserve local communities and resources.

“Our main plan for our sustainable tourism market is to empower local communities, particularly Indigenous people, so that they can generate an income through tourism that allows them to preserve their ancestral way of life, allowing them to sustainably manage their natural resources like forests and coral reefs,” said Ivan Eskildsen, Panama’s tourism minister.

He pointed to an example of a trail that was built in a national park that was designed to involve local communities in the active management of the area. “Over 30 percent of our land and sea are preserved national parks, so it’s humanly impossible to supervise all these areas,” he said. “The community can benefit economically from these areas and will also be prone to stay and take care of it instead of only coming there for short-term income.”

Visit Scotland, that country’s national tourism organization, which helped draft the declaration, has also taken a lead role. The organization has reduced its own carbon emission by 74 percent since 2008, and more than 850 local businesses have been given green tourism awards for their sustainability efforts.

Challenges persist

While the Glasgow Declaration has garnered great momentum and established common objectives, challenges lie ahead, especially when it comes to setting a global standard for reporting emissions figures for such a wide range of sectors within the industry, from tour operators to destinations, and airlines to cruise ships.

Signatories are expected to hold each other accountable and set common standards throughout international supply chains. Once action plans have been submitted within the next year, a reporting framework will be necessary. Anyone who fails to submit a road map within that time frame will be removed from the declaration.

“It is really important to bring value chains together,” said Catherine Dolton, the chief sustainability officer at IHG Hotels and Resorts. “Hotel developers, hotel owners, investors, franchisees, as well as the operators, are all impacting sustainability at different stages of the hotel life cycle.”

Visibly absent from the list of signatories were members of the cruise industry. The sector made a separate pledge to pursue carbon-neutral cruising by 2050 and reduce emissions 40 percent by 2030 in an annual environmental report, published last week by the industry trade group, Cruise Line International Association. While the report makes detailed commitments to reducing the cruise industry’s carbon footprint using new technology and alternative fuels, it does not address other environmental issues such as discharge of waste.

“Despite technical advances and some surveillance programs, cruising remains a major source of air, water (fresh and marine) and land pollution affecting fragile habitats, areas and species, and a potential source of physical and mental human health risks,” according to a recent report by the Marine Pollution Bulletin Journal.

Though there was some disappointment about the limited participation of some industries in the pledge, the overall sentiment was one of optimism and a belief that the declaration would lead to real change and less “greenwashing,” a term used to describe companies that try to portray themselves as more environmentally minded than they actually are.

“I’ve long been quite pessimistic about travel and tourism’s approach toward climate change,” said Mr. Wade of Intrepid Travel, which recently published a tool kit, available online, to help travel businesses measure and reduce their carbon emissions. “But now I’m really very optimistic because there is broad-level support from the industry to actually reduce emissions, and it’s the first time I’ve seen real concrete commitments from industry and governments.”

Follow New York Times Travel on Instagram , Twitter and Facebook . And sign up for our weekly Travel Dispatch newsletter to receive expert tips on traveling smarter and inspiration for your next vacation. Dreaming up a future getaway or just armchair traveling? Check out our 52 Places list for 2021 .

Ceylan Yeginsu is a London-based reporter. She joined The Times in 2013, and was previously a correspondent in Turkey covering politics, the migrant crisis, the Kurdish conflict, and the rise of Islamic State extremism in Syria and the region. More about Ceylan Yeginsu

Reimagining the $9 trillion tourism economy—what will it take?

Tourism made up 10 percent of global GDP in 2019 and was worth almost $9 trillion, 1 See “Economic impact reports,” World Travel & Tourism Council (WTTC), wttc.org. making the sector nearly three times larger than agriculture. However, the tourism value chain of suppliers and intermediaries has always been fragmented, with limited coordination among the small and medium-size enterprises (SMEs) that make up a large portion of the sector. Governments have generally played a limited role in the industry, with partial oversight and light-touch management.

COVID-19 has caused an unprecedented crisis for the tourism industry. International tourist arrivals are projected to plunge by 60 to 80 percent in 2020, and tourism spending is not likely to return to precrisis levels until 2024. This puts as many as 120 million jobs at risk. 2 “International tourist numbers could fall 60-80% in 2020, UNWTO reports,” World Tourism Organization, May 7, 2020, unwto.org.

Reopening tourism-related businesses and managing their recovery in a way that is safe, attractive for tourists, and economically viable will require coordination at a level not seen before. The public sector may be best placed to oversee this process in the context of the fragmented SME ecosystem, large state-owned enterprises controlling entry points, and the increasing impact of health-related agencies. As borders start reopening and interest in leisure rebounds in some regions , governments could take the opportunity to rethink their role within tourism, thereby potentially both assisting in the sector’s recovery and strengthening it in the long term.

In this article, we suggest four ways in which governments can reimagine their role in the tourism sector in the context of COVID-19.

1. Streamlining public–private interfaces through a tourism nerve center

Before COVID-19, most tourism ministries and authorities focused on destination marketing, industry promotions, and research. Many are now dealing with a raft of new regulations, stimulus programs, and protocols. They are also dealing with uncertainty around demand forecasting, and the decisions they make around which assets—such as airports—to reopen will have a major impact on the safety of tourists and sector employees.

Coordination between the public and private sectors in tourism was already complex prior to COVID-19. In the United Kingdom, for example, tourism falls within the remit of two departments—the Department for Business, Energy, and Industrial Strategy (BEIS) and the Department for Digital, Culture, Media & Sport (DCMS)—which interact with other government agencies and the private sector at several points. Complex coordination structures often make clarity and consistency difficult. These issues are exacerbated by the degree of coordination that will be required by the tourism sector in the aftermath of the crisis, both across government agencies (for example, between the ministries responsible for transport, tourism, and health), and between the government and private-sector players (such as for implementing protocols, syncing financial aid, and reopening assets).

Concentrating crucial leadership into a central nerve center is a crisis management response many organizations have deployed in similar situations. Tourism nerve centers, which bring together public, private, and semi-private players into project teams to address five themes, could provide an active collaboration framework that is particularly suited to the diverse stakeholders within the tourism sector (Exhibit 1).

We analyzed stimulus packages across 24 economies, 3 Australia, Bahrain, Belgium, Canada, Egypt, Finland, France, Germany, Hong Kong, Indonesia, Israel, Italy, Kenya, Malaysia, New Zealand, Peru, Philippines, Singapore, South Africa, South Korea, Spain, Switzerland, Thailand, and the United Kingdom. which totaled nearly $100 billion in funds dedicated directly to the tourism sector, and close to $300 billion including cross-sector packages with a heavy tourism footprint. This stimulus was generally provided by multiple entities and government departments, and few countries had a single integrated view on beneficiaries and losers. We conducted surveys on how effective the public-sector response has been and found that two-thirds of tourism players were either unaware of the measures taken by government or felt they did not have sufficient impact. Given uncertainty about the timing and speed of the tourism recovery, obtaining quick feedback and redeploying funds will be critical to ensuring that stimulus packages have maximum impact.

2. Experimenting with new financing mechanisms

Most of the $100 billion stimulus that we analyzed was structured as grants, debt relief, and aid to SMEs and airlines. New Zealand has offered an NZ $15,000 (US $10,000) grant per SME to cover wages, for example, while Singapore has instituted an 8 percent cash grant on the gross monthly wages of local employees. Japan has waived the debt of small companies where income dropped more than 20 percent. In Germany, companies can use state-sponsored work-sharing schemes for up to six months, and the government provides an income replacement rate of 60 percent.

Our forecasts indicate that it will take four to seven years for tourism demand to return to 2019 levels, which means that overcapacity will be the new normal in the medium term. This prolonged period of low demand means that the way tourism is financed needs to change. The aforementioned types of policies are expensive and will be difficult for governments to sustain over multiple years. They also might not go far enough. A recent Organisation for Economic Co-operation and Development (OECD) survey of SMEs in the tourism sector suggested more than half would not survive the next few months, and the failure of businesses on anything like this scale would put the recovery far behind even the most conservative forecasts. 4 See Tourism policy responses to the coronavirus (COVID-19), OECD, June 2020, oecd.org. Governments and the private sector should be investigating new, innovative financing measures.

Revenue-pooling structures for hotels

One option would be the creation of revenue-pooling structures, which could help asset owners and operators, especially SMEs, to manage variable costs and losses moving forward. Hotels competing for the same segment in the same district, such as a beach strip, could have an incentive to pool revenues and losses while operating at reduced capacity. Instead of having all hotels operating at 20 to 40 percent occupancy, a subset of hotels could operate at a higher occupancy rate and share the revenue with the remainder. This would allow hotels to optimize variable costs and reduce the need for government stimulus. Non-operating hotels could channel stimulus funds into refurbishments or other investment, which would boost the destination’s attractiveness. Governments will need to be the intermediary between businesses through auditing or escrow accounts in this model.

Joint equity funds for small and medium-size enterprises

Government-backed equity funds could also be used to deploy private capital to help ensure that tourism-related SMEs survive the crisis (Exhibit 2). This principle underpins the European Commission’s temporary framework for recapitalization of state-aided enterprises, which provided an estimated €1.9 trillion in aid to the EU economy between March and May 2020. 5 See “State aid: Commission expands temporary framework to recapitalisation and subordinated debt measures to further support the economy in the context of the coronavirus outbreak,” European Commission, May 8, 2020, ec.europa.eu. Applying such a mechanism to SMEs would require creating an appropriate equity-holding structure, or securitizing equity stakes in multiple SMEs at once, reducing the overall risk profile for the investor. In addition, developing a standardized valuation methodology would avoid lengthy due diligence processes on each asset. Governments that do not have the resources to co-invest could limit their role to setting up those structures and opening them to potential private investors.

3. Ensuring transparent, consistent communication on protocols

The return of tourism demand requires that travelers and tourism-sector employees feel—and are—safe. Although international organizations such as the International Air Transport Association (IATA), and the World Travel & Tourism Council (WTTC) have developed a set of guidelines to serve as a baseline, local regulators are layering additional measures on top. This leads to low levels of harmonization regarding regulations imposed by local governments.

Our surveys of traveler confidence in the United States suggests anxiety remains high, and authorities and destination managers must work to ensure travelers know about, and feel reassured by, protocols put in place for their protection. Our latest survey of traveler sentiment in China suggests a significant gap between how confident travelers would like to feel and how confident they actually feel; actual confidence in safety is much lower than the expected level asked a month before.

One reason for this low level of confidence is confusion over the safety measures that are currently in place. Communication is therefore key to bolstering demand. Experience in Europe indicates that prompt, transparent, consistent communications from public agencies have had a similar impact on traveler demand as CEO announcements have on stock prices. Clear, credible announcements regarding the removal of travel restrictions have already led to increased air-travel searches and bookings. In the week that governments announced the removal of travel bans to a number of European summer destinations, for example, outbound air travel web search volumes recently exceeded precrisis levels by more than 20 percent in some countries.

The case of Greece helps illustrate the importance of clear and consistent communication. Greece was one of the first EU countries to announce the date of, and conditions and protocols for, border reopening. Since that announcement, Greece’s disease incidence has remained steady and there have been no changes to the announced protocols. The result: our joint research with trivago shows that Greece is now among the top five summer destinations for German travelers for the first time. In July and August, Greece will reach inbound airline ticketing levels that are approximately 50 percent of that achieved in the same period last year. This exceeds the rate in most other European summer destinations, including Croatia (35 percent), Portugal (around 30 percent), and Spain (around 40 percent). 6 Based on IATA Air Travel Pulse by McKinsey. In contrast, some destinations that have had inconsistent communications around the time frame of reopening have shown net cancellations of flights for June and July. Even for the high seasons toward the end of the year, inbound air travel ticketing barely reaches 30 percent of 2019 volumes.

Digital solutions can be an effective tool to bridge communication and to create consistency on protocols between governments and the private sector. In China, the health QR code system, which reflects past travel history and contact with infected people, is being widely used during the reopening stage. Travelers have to show their green, government-issued QR code before entering airports, hotels, and attractions. The code is also required for preflight check-in and, at certain destination airports, after landing.

4. Enabling a digital and analytics transformation within the tourism sector

Data sources and forecasts have shifted, and proliferated, in the crisis. Last year’s demand prediction models are no longer relevant, leaving many destinations struggling to understand how demand will evolve, and therefore how to manage supply. Uncertainty over the speed and shape of the recovery means that segmentation and marketing budgets, historically reassessed every few years, now need to be updated every few months. The tourism sector needs to undergo an analytics transformation to enable the coordination of marketing budgets, sector promotions, and calendars of events, and to ensure that products are marketed to the right population segment at the right time.

Governments have an opportunity to reimagine their roles in providing data infrastructure and capabilities to the tourism sector, and to investigate new and innovative operating models. This was already underway in some destinations before COVID-19. Singapore, for example, made heavy investments in its data and analytics stack over the past decade through the Singapore Tourism Analytics Network (STAN), which provided tourism players with visitor arrival statistics, passenger profiling, spending data, revenue data, and extensive customer-experience surveys. During the COVID-19 pandemic, real-time data on leading travel indicators and “nowcasts” (forecasts for the coming weeks and months) could be invaluable to inform the decisions of both public-sector and private-sector entities.

This analytics transformation will also help to address the digital gap that was evident in tourism even before the crisis. Digital services are vital for travelers: in 2019, more than 40 percent of US travelers used mobile devices to book their trips. 7 Global Digital Traveler Research 2019, Travelport, marketing.cloud.travelport.com; “Mobile travel trends 2019 in the words of industry experts,” blog entry by David MacHale, December 11, 2018, blog.digital.travelport.com. In Europe and the United States, as many as 60 percent of travel bookings are digital, and online travel agents can have a market share as high as 50 percent, particularly for smaller independent hotels. 8 Sean O’Neill, “Coronavirus upheaval prompts independent hotels to look at management company startups,” Skift, May 11, 2020, skift.com. COVID-19 is likely to accelerate the shift to digital as travelers look for flexibility and booking lead times shorten: more than 90 percent of recent trips in China were booked within seven days of the trip itself. Many tourism businesses have struggled to keep pace with changing consumer preferences around digital. In particular, many tourism SMEs have not been fully able to integrate new digital capabilities in the way that larger businesses have, with barriers including language issues, and low levels of digital fluency. The commission rates on existing platforms, which range from 10 percent for larger hotel brands to 25 percent for independent hotels, also make it difficult for SMEs to compete in the digital space.

Governments are well-positioned to overcome the digital gap within the sector and to level the playing field for SMEs. The Tourism Exchange Australia (TXA) platform, which was created by the Australian government, is an example of enabling at scale. It acts as a matchmaker, connecting suppliers with distributors and intermediaries to create packages attractive to a specific segment of tourists, then uses tourist engagement to provide further analytical insights to travel intermediaries (Exhibit 3). This mechanism allows online travel agents to diversify their offerings by providing more experiences away from the beaten track, which both adds to Australia’s destination attractiveness, and gives small suppliers better access to customers.

Governments that seize the opportunity to reimagine tourism operations and oversight will be well positioned to steer their national tourism industries safely into—and set them up to thrive within—the next normal.

Download the article in Arabic (513KB)

Margaux Constantin is an associate partner in McKinsey’s Dubai office, Steve Saxon is a partner in the Shanghai office, and Jackey Yu is an associate partner in the Hong Kong office.

The authors wish to thank Hugo Espirito Santo, Urs Binggeli, Jonathan Steinbach, Yassir Zouaoui, Rebecca Stone, and Ninan Chacko for their contributions to this article.

Explore a career with us

Related articles.

Make it better, not just safer: The opportunity to reinvent travel

Hospitality and COVID-19: How long until ‘no vacancy’ for US hotels?

A new approach in tracking travel demand

UN Tourism | Bringing the world closer

Secretary-general’s policy brief on tourism and covid-19, share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

Tourism and COVID-19 – unprecedented economic impacts

The Policy Brief provides an overview of the socio-economic impacts from the pandemic on tourism, including on the millions of livelihoods it sustains. It highlights the role tourism plays in advancing the Sustainable Development Goals, including its relationship with environmental goals and culture. The Brief calls on the urgency of mitigating the impacts on livelihoods, especially for women, youth and informal workers.

The crisis is an opportunity to rethink how tourism interacts with our societies, other economic sectors and our natural resources and ecosystems; to measure and manage it better; to ensure a fair distribution of its benefits and to advance the transition towards a carbon neutral and resilient tourism economy.

The brief provides recommendations in five priority areas to cushion the massive impacts on lives and economies and to rebuild a tourism with people at the center. It features examples of governments support to the sector, calls for a reopening that gives priority to the health and safety of the workers, travelers and host communities and provides a roadmap to transform tourism.

- Tourism is one of the world’s major economic sectors. It is the third-largest export category (after fuels and chemicals) and in 2019 accounted for 7% of global trade .

- For some countries, it can represent over 20% of their GDP and, overall, it is the third largest export sector of the global economy.

- Tourism is one of the sectors most affected by the Covid-19 pandemic, impacting economies, livelihoods, public services and opportunities on all continents. All parts of its vast value-chain have been affected.

- Export revenues from tourism could fall by $910 billion to $1.2 trillion in 2020. This will have a wider impact and could reduce global GDP by 1.5% to 2.8% .

- Tourism supports one in 10 jobs and provides livelihoods for many millions more in both developing and developed economies.

- In some Small Island Developing States (SIDS), tourism has accounted for as much as 80% of exports, while it also represents important shares of national economies in both developed and developing countries.

100 to 120 MILLON

direct tourism jobs at risk

Massive Impact on Livelihoods

- As many as 100 million direct tourism jobs are at risk , in addition to sectors associated with tourism such as labour-intensive accommodation and food services industries that provide employment for 144 million workers worldwide. Small businesses (which shoulder 80% of global tourism) are particularly vulnerable.

- Women, who make up 54% of the tourism workforce, youth and workers in the informal economy are among the most at-risk categories.

- No nation will be unaffected. Destinations most reliant on tourism for jobs and economic growth are likely to be hit hardest: SIDS, Least Developed Countries (LDCs) and African countries. In Africa, the sector represented 10% of all exports in 2019.

US$ 910 Billon to US$ 1.2 Trillon

in export from tourism - international visitors' spending

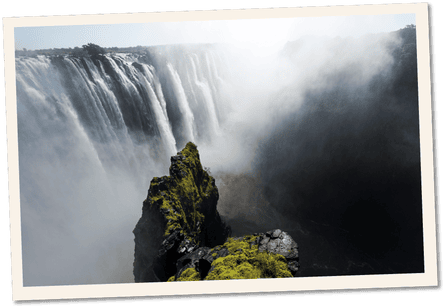

Preserving the Planet -- Mitigating Impacts on Nature and Culture

- The sudden fall in tourism cuts off funding for biodiversity conservation . Some 7% of world tourism relates to wildlife , a segment growing by 3% annually.

- This places jobs at risk and has already led to a rise in poaching, looting and in consumption of bushmeat , partly due to the decreased presence of tourists and staff.

- The impact on biodiversity and ecosystems is particularly critical in SIDS and LDCs. In many African destinations, wildlife accounts for up to 80% of visits, and in many SIDS, tourism revenues enable marine conservation efforts.

- Several examples of community involvement in nature tourism show how communities, including indigenous peoples, have been able to protect their cultural and natural heritage while creating wealth and improve their wellbeing. The impact of COVID-19 on tourism places further pressure on heritage conservation as well as on the cultural and social fabric of communities , particularly for indigenous people and ethnic groups.

- For instance, many intangible cultural heritage practices such as traditional festivals and gatherings have been halted or postponed , and with the closure of markets for handicrafts, products and other goods , indigenous women’s revenues have been particularly impacted.

- 90% of countries have closed World Heritage Sites, with immense socio-economic consequences for communities reliant on tourism. Further, 90% of museums closed and 13% may never reopen.

1.5% to 2.8 of global GDP

Five priorities for tourism’s restart.

The COVID-19 crisis is a watershed moment to align the effort of sustaining livelihoods dependent on tourism to the SDGs and ensuring a more resilient, inclusive, carbon neutral, and resource efficient future.

A roadmap to transform tourism needs to address five priority areas:

- Mitigate socio-economic impacts on livelihoods , particularly women’s employment and economic security.

- Boost competitiveness and build resilience , including through economic diversification, with promotion of domestic and regional tourism where possible, and facilitation of conducive business environment for micro, small and medium-sized enterprises (MSMEs).

- Advance innovation and digital transformation of tourism , including promotion of innovation and investment in digital skills, particularly for workers temporarily without jobs and for job seekers.

- Foster sustainability and green growth to shift towards a resilient, competitive, resource efficient and carbon-neutral tourism sector. Green investments for recovery could target protected areas, renewable energy, smart buildings and the circular economy, among other opportunities.

- Coordination and partnerships to restart and transform sector towards achieving SDGs , ensuring tourism’s restart and recovery puts people first and work together to ease and lift travel restrictions in a responsible and coordinated manner.

a lifelive for

SIDS, LDCs and many AFRICAN COUNTRIES

tourism represents over 30% of exports for the majority of SIDS and 80% for some

Moving Ahead Together

- As countries gradually lift travel restrictions and tourism slowly restarts in many parts of the world, health must continue to be a priority and coordinated heath protocols that protect workers, communities and travellers, while supporting companies and workers, must be firmly in place.

- Only through collective action and international cooperation will we be able to transform tourism, advance its contribution to the 2030 Agenda and its shift towards an inclusive and carbon neutral sector that harnesses innovation and digitalization, embraces local values and communities and creates decent job opportunities for all, leaving no one behind. We are stronger together.

RESOURCES FOR CONSEVATION

of natural and cultural heritage

Related links

- Policy Brief: Tourism and COVID-19

- The Impact of COVID-19 on Tourism

- António Guterres - Video

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

U.S. Department of Commerce

- Fact Sheets

Was this page helpful?

Fact sheet: 2022 national travel and tourism strategy, office of public affairs.

The 2022 National Travel and Tourism Strategy was released on June 6, 2022, by U.S. Secretary of Commerce Gina M. Raimondo on behalf of the Tourism Policy Council (TPC). The new strategy focuses the full efforts of the federal government to promote the United States as a premier destination grounded in the breadth and diversity of our communities, and to foster a sector that drives economic growth, creates good jobs, and bolsters conservation and sustainability. Drawing on engagement and capabilities from across the federal government, the strategy aims to support broad-based economic growth in travel and tourism across the United States, its territories, and the District of Columbia.

The federal government will work to implement the strategy under the leadership of the TPC and in partnership with the private sector, aiming toward an ambitious five-year goal of increasing American jobs by attracting and welcoming 90 million international visitors, who we estimate will spend $279 billion, annually by 2027.

The new National Travel and Tourism Strategy supports growth and competitiveness for an industry that, prior to the COVID-19 pandemic, generated $1.9 trillion in economic output and supported 9.5 million American jobs. Also, in 2019, nearly 80 million international travelers visited the United States and contributed nearly $240 billion to the U.S. economy, making the United States the global leader in revenue from international travel and tourism. As the top services export for the United States that year, travel and tourism generated a $53.4 billion trade surplus and supported 1 million jobs in the United States.

The strategy follows a four-point approach:

- Promoting the United States as a Travel Destination Goal : Leverage existing programs and assets to promote the United States to international visitors and broaden marketing efforts to encourage visitation to underserved communities.

- Facilitating Travel to and Within the United States Goal : Reduce barriers to trade in travel services and make it safer and more efficient for visitors to enter and travel within the United States.

- Ensuring Diverse, Inclusive, and Accessible Tourism Experiences Goal : Extend the benefits of travel and tourism by supporting the development of diverse tourism products, focusing on under-served communities and populations. Address the financial and workplace needs of travel and tourism businesses, supporting destination communities as they grow their tourism economies. Deliver world-class experiences and customer service at federal lands and waters that showcase the nation’s assets while protecting them for future generations.

- Fostering Resilient and Sustainable Travel and Tourism Goal : Reduce travel and tourism’s contributions to climate change and build a travel and tourism sector that is resilient to natural disasters, public health threats, and the impacts of climate change. Build a sustainable sector that integrates protecting natural resources, supporting the tourism economy, and ensuring equitable development.

Travel and Tourism Fast Facts

- The travel and tourism industry supported 9.5 million American jobs through $1.9 trillion of economic activity in 2019. In fact, 1 in every 20 jobs in the United States was either directly or indirectly supported by travel and tourism. These jobs can be found in industries like lodging, food services, arts, entertainment, recreation, transportation, and education.

- Travel and tourism was the top services export for the United States in 2019, generating a $53.4 billion trade surplus.

- The travel and tourism industry was one of the U.S. business sectors hardest hit by the COVID-19 pandemic and subsequent health and travel restrictions, with travel exports decreasing nearly 65% from 2019 to 2020.

- The decline in travel and tourism contributed heavily to unemployment; leisure and hospitality lost 8.2 million jobs between February and April 2020 alone, accounting for 37% of the decline in overall nonfarm employment during that time.

- By 2021, the rollout of vaccines and lifting of international and domestic restrictions allowed travel and tourism to begin its recovery. International arrivals to the United States grew to 22.1 million in 2021, up from 19.2 million in 2020. Spending by international visitors also grew, reaching $81.0 billion, or 34 percent of 2019’s total.

More about the Tourism Policy Council and the 2022 National Travel and Tourism Strategy

Created by Congress and chaired by Secretary Raimondo, the Tourism Policy Council (TPC) is the interagency council charged with coordinating national policies and programs relating to travel and tourism. At the direction of Secretary Raimondo, the TPC created a new five-year strategy to focus U.S. government efforts in support of the travel and tourism sector which has been deeply and disproportionately affected by the COVID-19 pandemic.

Read the full strategy here

National Geographic content straight to your inbox—sign up for our popular newsletters here

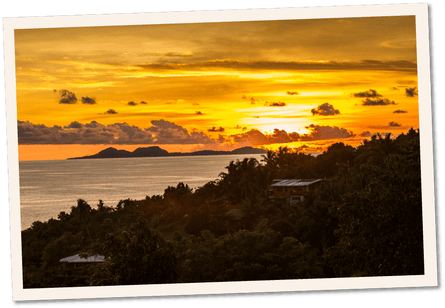

What's the problem with overtourism?

With visitor numbers around the world increasing towards pre-pandemic levels, the issue of overtourism is once again rearing its head.

When locals in the charming Austrian lakeside village of Hallstatt staged a blockade of the main access tunnel, brandishing placards asking visitors to ‘think of the children’, it highlighted what can happen when places start to feel overrun by tourists. Hallstatt has just 800 residents but has opened its doors to around 10,000 visitors a day — a population increase of over 1,000%. And it’s just one of a growing number of places where residents are up in arms at the influx of travellers.

The term ‘overtourism’ is relatively new, having been coined over a decade ago to highlight the spiralling numbers of visitors taking a toll on cities, landmarks and landscapes. As tourist numbers worldwide return towards pre-pandemic levels, the debate around what constitutes ‘too many’ visitors continues. While many destinations, reliant on the income that tourism brings, are still keen for arrivals, a handful of major cities and sites are now imposing bans, fines, taxes and time-slot systems, and, in some cases, even launching campaigns of discouragement in a bid to curb tourist numbers.

What is overtourism?

In essence, overtourism is too many people in one place at any given time. While there isn’t a definitive figure stipulating the number of visitors allowed, an accumulation of economic, social and environmental factors determine if and how numbers are creeping up.

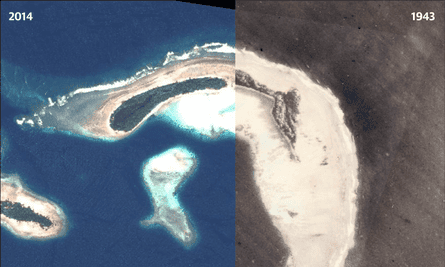

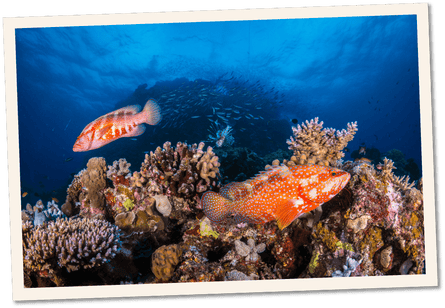

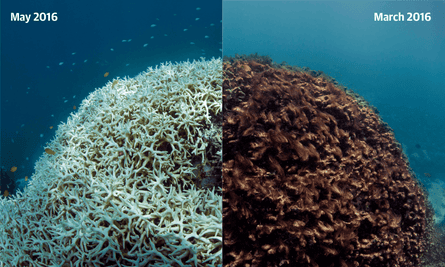

There are the wide-reaching effects, such as climate change. Coral reefs, like the Great Barrier Reef and Maya Bay, Thailand, made famous by the Leonardo DiCaprio film, The Beach , are being degraded from visitors snorkelling, diving and touching the corals, as well as tour boats anchoring in the waters. And 2030 transport-related carbon emissions from tourism are expected to grow 25% from 2016 levels, representing an increase from 5% to 5.3% of all man-made emissions, according to the United Nations World Tourism Organisation (UNWTO). More localised issues are affecting locals, too. Renters are being evicted by landlords in favour of turning properties into holiday lets, and house prices are escalating as a result. As visitors and rental properties outnumber local residents, communities are being lost. And, skyrocketing prices, excessive queues, crowded beaches, exorbitant noise levels, damage at historical sites and the ramifications to nature as people overwhelm or stray from official paths are also reasons the positives of tourism can have a negative impact.

Conversely, ‘undertourism’ is a term applied to less-frequented destinations, particularly in the aftermath of the pandemic. The economic, social and environmental benefits of tourism aren't always passed on to those with plenty of capacity and, while tourist boards are always keen for visitors to visit their lesser-known attractions, it’s a more sustainable and rewarding experience for both residents and visitors.

What’s the main problem with it?

Overcrowding is an issue for both locals and tourists. It can ruin the experience of sightseeing for those trapped in long queues, unable to visit museums, galleries and sites without advance booking, incurring escalating costs for basics like food, drink and hotels, and faced with the inability to experience the wonder of a place in relative solitude. The absence of any real regulations has seen places take it upon themselves to try and establish some form of crowd control, meaning no cohesion and no real solution.

Justin Francis, co-founder and CEO of Responsible Travel, a tour operator that focuses on more sustainable travel, says “Social media has concentrated tourism in hotspots and exacerbated the problem, and tourist numbers globally are increasing while destinations have a finite capacity. Until local people are properly consulted about what they want and don’t want from tourism, we’ll see more protests.”

A French start up, Murmuration, which monitors the environmental impact of tourism by using satellite data, states that 80% of travellers visit just 10% of the world's tourism destinations, meaning bigger crowds in fewer spots. And, the UNWTO predicts that by 2030, the number of worldwide tourists, which peaked at 1.5 billion in 2019, will reach 1.8 billion, likely leading to greater pressure on already popular spots and more objection from locals.

Who has been protesting?

Of the 800 residents in the UNESCO-listed village of Hallstatt, around 100 turned out in August to show their displeasure and to push for a cap on daily visitors and a curfew on tour coach arrivals.

Elsewhere, residents in Venice fought long and hard for a ban on cruise ships, with protest flags often draped from windows. In 2021, large cruise ships over 25,000 tonnes were banned from using the main Giudecca Canal, leaving only smaller passenger ferries and freight vessels able to dock.

In France, the Marseille Provence Cruise Club introduced a flow management system for cruise line passengers in 2020, easing congestion around the popular Notre-Dame-de-la-Garde Basilica. A Cruise Lines International Association (CLIA) spokesperson said, “Coaches are limited to four per ship during the morning or afternoon at the Basilica to ensure a good visitor experience and safety for residents and local businesses. This is a voluntary arrangement respected by cruise lines.”

While in Orkney, Scotland, residents have been up in arms at the number of cruise ships docking on its shores. At the beginning of 2023, the local council confirmed that 214 cruise ship calls were scheduled for the year, bringing around £15 million in revenue to the islands. Following backlash from locals, the council has since proposed a plan to restrict the number of ships on any day.

What steps are being taken?

City taxes have become increasingly popular, with Barcelona increasing its nightly levy in April 2023 — which was originally introduced in 2012 and varies depending on the type of accommodation — and Venice expects to charge day-trippers a €5 fee from 2024.

In Amsterdam this summer, the city council voted to ban cruise ships, while the mayor, Femke Halsema, commissioned a campaign of discouragement, asking young British men who planned to have a 'vacation from morals’ to stay away. In Rome, sitting at popular sites, such as the Trevi Fountain and the Spanish Steps, has been restricted by the authorities.

And in Kenya’s Maasai Mara, meanwhile, the Narok County governor has introduced on-the-spot fines for off-roading. He also plans to double nightly park fees in peak season.

What are the forecasts for global tourism?

During the Covid pandemic, tourism was one of the hardest-hit industries — according to UNWTO, international tourist arrivals dropped 72% in 2020. However, traveller numbers have since been rapidly increasing, with double the number of people venturing abroad in the first three months of 2023 than in the same period in 2022. And, according to the World Travel Tourism Council, the tourism sector is expected to reach £7.5 trillion this year, 95% of its pre-pandemic levels.

While the tourism industry is forecast to represent 11.6% of the global economy by 2033, it’s also predicted that an increasing number of people will show more interest in travelling more sustainably. In a 2022 survey by Booking.com, 64% of the people asked said they would be prepared to stay away from busy tourist sites to avoid adding to congestion.

Are there any solutions?

There are ways to better manage tourism by promoting more off-season travel, limiting numbers where possible and having greater regulation within the industry. Encouraging more sustainable travel and finding solutions to reduce friction between residents and tourists could also have positive impacts. Promoting alternative, less-visited spots to redirect travellers may also offer some benefits.

Harold Goodwin, emeritus professor at Manchester Metropolitan University, says, “Overtourism is a function of visitor volumes, but also of conflicting behaviours, crowding in inappropriate places and privacy. Social anthropologists talk about frontstage and backstage spaces. Tourists are rarely welcome in backstage spaces. To manage crowds, it’s first necessary to analyse and determine the causes of them.

Francis adds: “However, we must be careful not to just recreate the same problems elsewhere. The most important thing is to form a clear strategy, in consultation with local people about what a place wants or needs from tourism.”

As it stands, overtourism is a seasonal issue for a small number of destinations. While there is no one-size-fits-all solution, a range of measures are clearly an option depending on the scale of the problem. For the majority of the world, tourism remains a force for good with many benefits beyond simple economic growth.

Related Topics

- OVERTOURISM

- SUSTAINABLE TOURISM

You May Also Like

How can tourists help Maui recover? Here’s what locals say.

One of Italy’s most visited places is an under-appreciated wine capital

For hungry minds.

In this fragile landscape, Ladakh’s ecolodges help sustain a way of life

Cinque Terre’s iconic ‘path of love’ is back. Don’t love it to death

25 breathtaking places and experiences for 2023

See the relentless beauty of Bhutan—a kingdom that takes happiness seriously

Is World Heritage status enough to save endangered sites?

- Environment

History & Culture

- History & Culture

- History Magazine

- Mind, Body, Wonder

- Coronavirus Coverage

- Paid Content

- Terms of Use

- Privacy Policy

- Your US State Privacy Rights

- Children's Online Privacy Policy

- Interest-Based Ads

- About Nielsen Measurement

- Do Not Sell or Share My Personal Information

- Nat Geo Home

- Attend a Live Event

- Book a Trip

- Inspire Your Kids

- Shop Nat Geo

- Visit the D.C. Museum

- Learn About Our Impact

- Support Our Mission

- Advertise With Us

- Customer Service

- Renew Subscription

- Manage Your Subscription

- Work at Nat Geo

- Sign Up for Our Newsletters

- Contribute to Protect the Planet

Copyright © 1996-2015 National Geographic Society Copyright © 2015-2024 National Geographic Partners, LLC. All rights reserved

- Hospitality Investor

- Hotel Management

- R&R Forum

- Digital Content Hub

- Architecture and Design

- Profitability

- Serviced Apartments

- Senior Living

- Student Accommodation

- Northern Europe

- Southern Europe

- Asia-Pacific

- Capital Talks

- Whitepapers

Five big challenges facing the travel and tourism industry in 2024

Will Chinese tourists look inwards or finally outwards in 2024? Could an unprecedented number of elections globally influence who travels and when? Can Paris make a permanent gain out of the Olympics and will conflict continue to derail some tourism economies?

Amid it all, could Gen Z change the shape of tourism by asserting an environmentally consciousness about travel decisions?As investors and developers piece together the global influences that will shape the hospitality real estate market in 2024, we pick out five defining macro-themes for the year ahead.

Visas: China looks outward and inward

It is nearly a year since China fully reopened its borders to foreign visitors, and almost a year since Beijing withdrew advice warning against overseas travel. Yet travel to and from China has not recovered to pre-pandemic levels, though domestic travel has surged.

“If you use 2019 as a benchmark, travel and tourism contributed 11.6% to the Chinese economy,” says Julia Simpson, president and chief executive of the World Travel & Tourism Council (WTTC).In that year, the travel and tourism industry employed 82 million people in China and was valued at $1.8 trillion, while recent analysis released by WTTC and Oxford Economics shows a dip to a 7.9% contribution in 2023, employing about 74 million people and worth $1.48 trillion.

Yet, with the hold-up of issuing new visas an ongoing issue, inward traffic is becoming a major factor."This data clearly shows the appetite to travel remains incredibly strong. Chinese travellers want to explore the world once again and international travellers are eager to return,” says Simpson.

According to data published in January by travel booking site Trip.com, the top five international destinations for Chinese tourists in 2023 were: Thailand; Japan; South Korea; Singapore and Malaysia.China recently entered into a reciprocal agreement with Thailand for permanent waiver of visa requirements for citizens of the two countries from March 2024 and previously implemented visa-free travel for five European countries (France, Germany, Italy, The Netherlands and Spain) and Malaysia, allowing ordinary passport holders to stay in China for up to 15 days without a visa. China has also streamlined entry regulations for US citizens.

Impact: The great Chinese exodus is yet to materialise and it may be a year when inward and inter-continental travel continues to dominate, boosting the Chinese travel economy.

Elections: The year of the vote

More than two billion people across 50 countries are expected to go the polls this year, accounting for countries that are home to nearly half the world’s population – a scale that has never happened in a single year before.

Among the polls are seven out of the world’s 10 most populous nations: Bangladesh kicked off the election calendar on January 7; plus India, the United States, Indonesia, Pakistan, Russia and Mexico.

While the impact should be contained around the election period, data on previous US elections suggest that the industry can expect a lag around crucial polling.US-based travel agency consortium Virtuoso, which has around 2,300 company partners, sold $30 billion worth of transactions in 2019. Evaluating the impact of the last three American presidential elections on travel bookings, Virtuoso’s VP global public relations Misty Belles found that the company’s usual double-digit growth was curtailed to roughly 3% in election years, with over $4 billion in projected missed revenue for the previous election in 2020.

No matter why travel dips during election cycles, the impact doesn’t end on results day, she says. Lags in spending continue through the ‘lame duck’ period of the outgoing President and the early days of a new administration, regardless of who resides in the White House. After the first 100 days of a new presidential term, travellers typically set their sights on summer vacations.

Impact: With an unprecedented number of people heading to the polls and the likelihood of some tight elections, the effect on travel is unpredictable but could cause an autumn lag in the UK and US.

Sports events: Everything to play for

This summer’s football Euros and impending African Cup of Nations will add to the global sports calendar in 2024 but of course the big one is the Paris Olympics. Hosting major events is expensive but potentially hugely profitable, with an extra three million people expected in Paris, increasing tourism spending by up to €4 billion according to market research provider Euromonitor International.

Alexander Göransson, senior consultant at Euromonitor International, points out that the Games are expected to attract 15 million spectators, including locals and domestic day trippers.

Göransson says that experience from previous Games shows that Olympic visitors spend more than regular visitors and that accommodation providers will be the main winners, although high prices may put people off. “There is a lot being written about hoteliers significantly hiking their prices during the Paris Olympics, typically by an order of three relative to August 2023 and summer 2024 before and after the games. This is also in line with some checks on booking platforms for like-for-like hotels. The average rate is currently reported to be €699 during the games versus €169 in August 2023,” Göransson says.

However, he notes that only 1.5 million tickets have been sold to non-French residents, circa 10% of the total.

“In the context of hotels this will be interesting as given the vast majority of visitors will be from France, there will be more daytrips, but more importantly a lot of French visitors will have friends and relatives in Paris who they can stay with, which given the Olympic mark-ups is likely,” he adds. “I would not rule out that there may be some last-minute price cutting. When the games were in London price increases were more modest, where prices less than doubled.”

Impact: Euromonitor International expects a steady increase in inbound visitors to France and its capital city from 2025.

Conflict: Contained but major regional impacts

The war in Ukraine and the ongoing operations in Gaza by Israel have had little impact on global travel, but have hit the regions and those around them heavily. That is likely to be the ongoing story of 2024.

Following last summer’s strong tourism demand, international tourist arrivals to Europe are only 3.2% below 2019 levels, and nights are down by 1.3% for the January-September period, according to the most recent European Travel Commission (ETC) figures.

However, while Southern European and Mediterranean destinations, notably Serbia (+15%), Montenegro (+14%), Portugal (+11%), Turkey (+8%), Malta, and Greece (both +7%) have benefitted, among Eastern European countries neighbouring Russia and Ukraine, and those that are normally reliant on Russian travellers, have registered the sharpest declines: Estonia (-27%), Latvia (-30%), and Lithuania (-33%).While the number of tourists visiting Israel rose in 2023 compared with 2022, visitor numbers plunged in October after the Hamas attacks and remained low for the rest of the year, the Israeli Tourism Ministry said.

Overall in 2023, 3 million tourists entered Israel, up from 2.7 million in 2022, but December was the worst month with just 52,800 tourists, compared with typically over 300,000 per month. S&P Global Ratings believes Lebanon, Egypt, and Jordan are most exposed, due to their geographic proximity and the potential for some aspects of the conflict to expand across their borders. Last year, tourism contributed 26% of Lebanon's current account receipts. For Jordan and Egypt, the figure was 21% and 12%, and for Israel, 3%.

Impact: While conflicts seem not to have dissuaded travellers generally, those countries heavily impacted already are unlikely to see any change.

Sustainability: Travellers demand eco-options

Nothing new in the rise of sustainability but analyst Mintel believes that in 2024 travel brands can tap into the sustainable accommodation sector by promoting a range of differing cost options.

A number of operators are promoting more sustainable choices for consumers, by unveiling ‘sustainable holiday’ tabs in which travellers can browse through a range of different hotel options, all accredited by the Global Sustainable Tourism Council (GSTC).

Mintel says that it is imperative for travel brands to step up and take accountability for their environmental impact, particularly as issues surrounding sustainability permeate into every aspect of daily lives.

“Based on the success of the food industry’s nutrition traffic light system, consumers want brands to use a similar system that makes it easy to understand the environmental impact of the products they’re thinking of buying and helps them make more sustainable choices,” says Richard Cope, senior trends consultant, Mintel Consulting.

Travel platform Booking.com also notes that “sweltering conditions” are accelerating a rise in travellers chasing cooler climes to travel to. In a UK survey, 42% reported that climate change will impact the way they plan their holiday in 2024, while 43% said that as temperatures soar close to home, they will use their holiday to cool down elsewhere.

In 2024, in exchange for contributing to conservation efforts, sustainable itineraries will give travellers exclusive access to the places that they are helping preserve, Booking.com speculates, while sustainable travel apps will offer rewards such as experiences with locals in off-the-beaten-path areas or visiting remote locations that tourists otherwise have limited access to.

Impact: From ESG and real estate to the consumer mind-set, sustainability

Travel, Tourism & Hospitality

Global tourism industry - statistics & facts

What are the leading global tourism destinations, digitalization of the global tourism industry, how important is sustainable tourism, key insights.

Detailed statistics

Total contribution of travel and tourism to GDP worldwide 2019-2033

Number of international tourist arrivals worldwide 1950-2023

Global leisure travel spend 2019-2022

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Leading global travel markets by travel and tourism contribution to GDP 2019-2022

Travel and tourism employment worldwide 2019-2033

Related topics

Recommended.

- Hotel industry worldwide

- Travel agency industry

- Sustainable tourism worldwide

- Travel and tourism in the U.S.

- Travel and tourism in Europe

Recommended statistics

- Basic Statistic Total contribution of travel and tourism to GDP worldwide 2019-2033

- Basic Statistic Travel and tourism: share of global GDP 2019-2033

- Basic Statistic Leading global travel markets by travel and tourism contribution to GDP 2019-2022

- Basic Statistic Global leisure travel spend 2019-2022

- Premium Statistic Global business travel spending 2001-2022

- Premium Statistic Number of international tourist arrivals worldwide 1950-2023

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Basic Statistic Travel and tourism employment worldwide 2019-2033

Total contribution of travel and tourism to gross domestic product (GDP) worldwide in 2019 and 2022, with a forecast for 2023 and 2033 (in trillion U.S. dollars)

Travel and tourism: share of global GDP 2019-2033

Share of travel and tourism's total contribution to GDP worldwide in 2019 and 2022, with a forecast for 2023 and 2033

Total contribution of travel and tourism to GDP in leading travel markets worldwide in 2019 and 2022 (in billion U.S. dollars)

Leisure tourism spending worldwide from 2019 to 2022 (in billion U.S. dollars)

Global business travel spending 2001-2022

Expenditure of business tourists worldwide from 2001 to 2022 (in billion U.S. dollars)

Number of international tourist arrivals worldwide from 1950 to 2023 (in millions)

Number of international tourist arrivals worldwide 2005-2023, by region

Number of international tourist arrivals worldwide from 2005 to 2023, by region (in millions)

Number of travel and tourism jobs worldwide from 2019 to 2022, with a forecast for 2023 and 2033 (in millions)

- Premium Statistic Global hotel and resort industry market size worldwide 2013-2023

- Premium Statistic Most valuable hotel brands worldwide 2023, by brand value

- Basic Statistic Leading hotel companies worldwide 2023, by number of properties

- Premium Statistic Hotel openings worldwide 2021-2024

- Premium Statistic Hotel room openings worldwide 2021-2024

- Premium Statistic Countries with the most hotel construction projects in the pipeline worldwide 2022

Global hotel and resort industry market size worldwide 2013-2023

Market size of the hotel and resort industry worldwide from 2013 to 2022, with a forecast for 2023 (in trillion U.S. dollars)

Most valuable hotel brands worldwide 2023, by brand value

Leading hotel brands based on brand value worldwide in 2023 (in billion U.S. dollars)

Leading hotel companies worldwide 2023, by number of properties

Leading hotel companies worldwide as of June 2023, by number of properties

Hotel openings worldwide 2021-2024

Number of hotels opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Hotel room openings worldwide 2021-2024

Number of hotel rooms opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Countries with the most hotel construction projects in the pipeline worldwide 2022

Countries with the highest number of hotel construction projects in the pipeline worldwide as of Q4 2022

- Premium Statistic Airports with the most international air passenger traffic worldwide 2022

- Premium Statistic Market value of selected airlines worldwide 2023

- Premium Statistic Global passenger rail users forecast 2017-2027

- Premium Statistic Daily ridership of bus rapid transit systems worldwide by region 2023

- Premium Statistic Number of users of car rentals worldwide 2019-2028

- Premium Statistic Number of users in selected countries in the Car Rentals market in 2023

- Premium Statistic Carbon footprint of international tourism transport worldwide 2005-2030, by type

Airports with the most international air passenger traffic worldwide 2022

Leading airports for international air passenger traffic in 2022 (in million international passengers)

Market value of selected airlines worldwide 2023

Market value of selected airlines worldwide as of May 2023 (in billion U.S. dollars)

Global passenger rail users forecast 2017-2027

Worldwide number of passenger rail users from 2017 to 2022, with a forecast through 2027 (in billion users)

Daily ridership of bus rapid transit systems worldwide by region 2023

Number of daily passengers using bus rapid transit (BRT) systems as of April 2023, by region

Number of users of car rentals worldwide 2019-2028

Number of users of car rentals worldwide from 2019 to 2028 (in millions)

Number of users in selected countries in the Car Rentals market in 2023

Number of users in selected countries in the Car Rentals market in 2023 (in million)

Carbon footprint of international tourism transport worldwide 2005-2030, by type

Transport-related emissions from international tourist arrivals worldwide in 2005 and 2016, with a forecast for 2030, by mode of transport (in million metric tons of carbon dioxide)

Attractions

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Basic Statistic Monuments on the UNESCO world heritage list 2023, by type

- Basic Statistic Selected countries with the most Michelin-starred restaurants worldwide 2023

Leading museums by highest attendance worldwide 2019-2022

Most visited museums worldwide from 2019 to 2022 (in millions)

Most visited amusement and theme parks worldwide 2019-2022

Leading amusement and theme parks worldwide from 2019 to 2022, by attendance (in millions)

Monuments on the UNESCO world heritage list 2023, by type

Number of monuments on the UNESCO world heritage list as of September 2023, by type

Selected countries with the most Michelin-starred restaurants worldwide 2023

Number of Michelin-starred restaurants in selected countries and territories worldwide as of July 2023

Online travel market

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Estimated EV/Revenue ratio in the online travel market 2024, by segment