Canada Work & Travel Insurance

Planning on moving to Canada? Get Backpacker Travel Insurance whether you are going to work, study or simply take a gap year in the other side of the Atlantic with your 2 year working holiday visa. Keep in mind that you will need travel insurance for the duration of your stay and you must present a copy of your policy when you enter the country.

We offer insurance for up to 2 consecutive years that meets all the requirements of the International Experience Canada (IEC), including medical and repatriation costs. It also includes many other benefits of a regular backpacker insurance policy, such as cover for work, sports, missed departure and baggage. Get a quote now and enjoy your time in Canada!

2 Year Policy from €486.75* Or customise your policy for any length of time up to 2 years.

*Online Premier price for 2 years Canada Only cover for one person under 50 years.

From €129.99* 6 Months, 1 & 2 Year policies available.

*Online Premier price for 6 Months Worldwide incl. USA/Canada cover for one person aged under 50 years.

Key Benefits of Travel Insurance for Canada

Emergency assistance service.

The Emergency Assistance Service is available to you 24/7 with worldwide and multi-lingual support.

Worldwide Coverage

You still will be covered with the policy if you decide to go on a quick trip up to maximum 21 days to The United States of America.

Medical Cover & Repatriation

The policy provides cover for Emergency Medical expenses including hospitalisation and repatriation expenses.

If your plan is to work in Canada, the policy can provide cover for a number of different occupations.

Winter Sports

If you are planning on hitting the Canadian mountains, you can add Winter Cover to your policy for an Additional Premium.

Instant Cover

With BackpackerTravelInsurance.ie you get instantly covered once you have not already departed or commenced your trip.

Please see the policy wording for full terms, conditions and exclusions.

Why choose BackpackerTravelInsurance.ie?

Super competitive prices.

In addition to affordable insurance policies, we provide two levels of cover, Premier and Premier Plus.

Easy Claims Process

Claims procedure is made as simple and straightforward as possible and there is a claims adjuster based in Ireland.

Multi Award Winning Company

Backpackertravelinsurance.ie is part of Cover-More Blue Insurance Services Limited, winner of numerous Best Travel Insurance Provider awards.

High Customer Satisfaction

We have received many 5 star reviews on Trustpilot.

Safe and Secure

BackpackerTravelInsurance.ie website is SSL certified and all the transactions are encrypted.

Trustworthy Underwriter

Policies are underwritten by MAPFRE ASSISTANCE Agency Ireland.

We have received many 5 star reviews on Trustpilot, an independent third-party review platform.

What our Customers Say About Us

Contact us for more information.

- BackpackerTravelInsurance.ie,

- Blanchardstown Corporate Park 2,

- Blanchardstown, Dublin 15.

- 0818 286 455

- 01 513 5997

- [email protected]

- Opening hours:

The Best Travel Insurance for Canada: IEC Working Holiday

The International Experience Canada (IEC) Working Holiday program offers young people the chance to live and work in Canada for up to two years. It is an amazing opportunity but there is a couple of rules to abide by when taking part in the IEC.

One of these is the program requirement to have comprehensive health insurance while in Canada.

This article will help you find the best travel insurance for Canada. I moved to Canada on the IEC program and I’ve helped thousands of people do the same since then.

Last updated November 2023 . This post includes some affiliate links – if you make a purchase via one of these, we may receive a small percentage of the sale.

The importance of travel insurance for Canada

As mentioned, it is a mandatory part of the IEC program to have health insurance for the length of your stay in Canada.

If you go to Canada without appropriate IEC travel insurance, you may receive a shortened work permit and/or be refused one altogether.

Those who do receive a shortened work permit are unable to extend or adjust the work permit later. This happens to more people than you would think!

As per the IEC rules , your health insurance for Canada must cover:

- medical care,

- hospitalization, and

- repatriation (returning you to your country in the event of severe illness, injury or death).

Be sure to buy the best travel insurance for Canada.

Taking part in the IEC program is a once-in-a-lifetime opportunity for most people – don’t waste this opportunity.

Thinking beyond the IEC requirement for insurance, you should also be aware that medical care in Canada can be very expensive.

Emergency room visits for relatively simple injuries can easily run up a bill of thousands of dollars.

Saving money on buying travel insurance for Canada can turn out to be an expensive mistake.

Options for IEC travel insurance

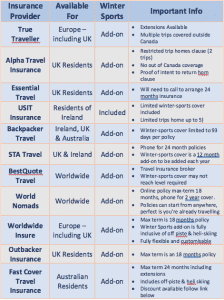

Read on for my research into the best IEC travel insurance for Canada.

Please research each company to ensure that the coverage is right for you. The specifics of the coverage can change at any time. Read the policy wording to make sure that you are covered.

UK and EU citizens – True Traveller

I used True Traveller insurance for my working holiday in Canada.

Travel insurance policies with True Traveller are available up to 24 months in length. Policies can be started if you are already travelling.

Unlimited visits home are also allowed, with the insurance cover being suspended when in your home country. Winter sports coverage is available and there are no minimum residency requirements.

92 activities are covered as standard with True Traveller, including horse riding and bungee jumping. If you need coverage for more activities (such as rock climbing), an additional activity pack can be selected.

An alternative to True Traveller for UK citizens is Go Walkabout . Working Holiday cover is available for 2 years with 3 years available soon. Unlimited visits home are allowed with ski coverage available for an additional premium (Activity Pack 4).

Australian citizens – Fast Cover and HeyMondo

With Fast Cover , an initial IEC 12-month policy can be purchased and then extended for another 12 months on the departure date.

Optional winter sports coverage is available for an additional fee. Fast Cover policies cannot be started when already abroad.

HeyMondo offers single trip policies up to 12 months in length. Coverage for Covid-19 is included as standard as well as up to $10 million for emergency medical and dental expenses.

To have coverage for a full 24 month IEC working holiday, simply purchase 2 x one-year policies before leaving for Canada. For the second policy, you’ll need to tick the ‘already travelling’ box for it to be valid.

There is a 5% discount available for HeyMondo if you use the below link when purchasing. Note that HeyMondo does not offer winter sports coverage.

Alternatively, look at BestQuote (note lower medical coverage), Cover More (phone call required to buy a 2 year policy) or World Nomads.

New Zealand citizens – HeyMondo

HeyMondo includes coverage for Covid and up to $10 million of medical expenses. There is, however, no ski cover available.

For 23 months of coverage with HeyMondo, you’ll need to purchase a 12 month policy and then another 11 month policy. Make sure to tick the ‘already travelling’ box when purchasing the second policy.

Alternatively, look at BestQuote (note lower medical coverage) or World Nomads.

For citizens of 100+ countries – BestQuote

BestQuote are travel insurance specialists, partnered with some of the largest and most reputable insurance providers in Canada. Through them, it is possible to review, compare and purchase IEC specific insurance policies with up to 2 years of coverage.

The 2 year IEC policies cover basic (non-competitive) ski cover as standard. Some options also include coverage for Covid19 related claims.

There are various medical coverage amounts available (most starting at $100,000), and adjustable excess levels as well. Please note that this medical coverage is lower than the other insurance providers mentioned on this page.

Buying the best IEC Travel Insurance

There is not one perfect working holiday travel insurance policy for Canada. Everyone has different requirements and circumstances.

The best working holiday travel insurance for Canada is the one that suits your own needs.

Before purchasing travel insurance for Canada, you may want to check factors such as:

- The type of activities that are covered. Climbing, kayaking and even hiking may have an additional premium

- Whether it is possible to return home for a short time and still have valid insurance coverage on return . Some policies become invalidated as soon as you reach home

- Residency requirements to purchase. Some IEC travel insurance policies require a minimum time spent resident in your home country before purchase

- Whether the policy can be started abroad if you are already travelling elsewhere. Most insurers are limited to only covering those who haven’t left home yet

- Winter sports coverage options. Even if you do not plan to work a ski season or live in a mountainous area, things can change

- The excess (deductible) on the policy. This is the amount you have to pay when making a claim

Finding Travel Insurance for Canada

Canada’s IEC program offers some of the longest working holiday options available in the world.

For this reason, one of the biggest problems with buying the best IEC travel insurance is finding a company that offers two-year travel insurance for Canada.

It can be such a rare occurrence that some working holiday companies advise their clients that there is no such thing. This is absolutely not true.

Another thing to remember is that the cheapest travel insurance for Canada may not be the best travel insurance for you. Be sure to look at the coverage limits and whether the policy is suitable for your travel plans.

Working Holiday Travel Insurance for Canada: The Small Print

Always read the policy wording to decide which IEC travel insurance provider and policy is right for you. As noted above, the best travel insurance for Canada isn’t necessarily perfect for everyone.

All details of IEC travel insurance providers mentioned above are correct at the time of writing but are subject to change.

The above companies also offer standard travel insurance for short-term holidays as well as working holiday insurance for Canada.

Found this post helpful? Subscribe to our IEC newsletter ! Working holiday advice and updates delivered straight to your inbox, with a FREE printable IEC packing list

Check out these other posts about working holidays in Canada

IEC Working Holiday Canada Extension Guide

IEC Working Holiday Canada: Arrival Checklist

Working Holiday Visa 2024 Canada IEC: Ultimate Application Guide

One half of the Canadian/British couple behind Off Track Travel, Gemma is happiest when hiking on the trail or planning the next big travel adventure. JR and Gemma are currently based in the beautiful Okanagan Valley, British Columbia, Canada

Sunday 14th of May 2023

Hey Gemma, we are NZ residents coming to Canada on an IEC, coming through the US first. We have insurance confirmed for the first 12-months of our travel. Ideally we want to book the second year of our insurance, however, our current insurance company won't do that - they will only extend near the end of our current policy.. Do you know any options for us that would provide insurance for that second year (i.e., provide a policy so far in advance). Alternatively, do you know if it is doable/easy to get our visas extended/updated once we are able to confirm a further 12-months of travel insurance? Hope this makes sense!! Thank you :)

Sunday 21st of May 2023

Hi Annelise,

For your first question, I would look at World Nomads or BestQuote (the latter mentioned in this article). For your second question, you MUST have 23 months of insurance on entry into Canada to receive your full 23 month work permit. There is no way to extend your work permit if you did not have the appropriate insurance on arrival in Canada OR apply again. So make sure you have the full 23 months before you arrive in Canada!

Tuesday 5th of November 2019

Hi Gemma! Currently helping my British fiance figure out flights since he has been accepted for IEC. A little anxious that he will not receive his full 24 month permit if we buy return flights (since return flights only go aprox. 10 months ahead). Should we just splurge and buy the stupidley expensive one way ticket, or can we purchase a round trip ticket and just not use the return ticket? Do the border agents even ask for a return ticket or do they just expect that we won't have one since its an open 24 month work permit? Do you think he would just be able to tell the border agent, if asked, that he does have a return flight 3 days after his arrival flight but plans to cancel it because it's cheaper, then proceed to show the agent proof of funds for a return flight?

Monday 11th of November 2019

The good news is that you don't need a return ticket at all, just proof to be able to purchase one if needed. And for that, a credit card can be shown. Hope that helps!

Thursday 16th of May 2019

Hi Gemma, the question I have, do you have to pay the one year insurance all upfront or is it possible to pay monthly? My travel insurance offered it and I am wondering now if this would be accepted.

Saturday 18th of May 2019

Hi Jessica,

It needs to be upfront, not monthly. A monthly policy can be cancelled at any time so hence is not proof of insurance for the entire length of your trip.

Wednesday 14th of June 2017

Hi Gemma I am going to Canada from New Zealand and looking for travel insurance options...and a bit lost. The link for 'Down Under Insurance' under New Zealand doesn't seem to work, even when I searched it on Google. Would you please be able to recommend a travel insurance company / companies for someone going from New Zealand for the full 23 month period? Thank you :)

Thursday 15th of June 2017

The link to Down Under insurance goes directly to the booking page. As mentioned in the description on my page, you will need to call them to purchase the 23/24 month IEC policy. Alternatively, you could also book 2 x 1 year policies with World Nomads who are also linked on this page.

Saturday 14th of January 2017

Hi Gemma, I have been granted an IEC visa, I want it to be valid for the two years but I don't want to necessary stay there for two years. The idea is I go for 3/4 months say, before returning home. However, I would like to keep my options open and be able to return to Canada in the two year period. I also don't want to be paying for insurance for the full two years if I am not there. I assume It's possible to enter and leave Canada as many times as I like during the two year period?

I applied on my U.K. Passport but I have been living in Australia as a resident, and have become an Australian citizen since being granted my IEC Visa so will be travelling from oz(my Australian address and residency was on my IEC application). So another option I am looking at is if it's possible to reapply on an Australian passport now I can obtain one, even thought I have been granted the IEC on my uk passport. The reason being is I have to enter Canada by end of June 2017, however I am still in two minds financially as paying off debts and it would be more suitable for me to leave at a later date(I was granted my IEC a lot quicker then anticipated). I will be 31 in November 17 so would have to apply by then with Australian passport.

Otherwise 3rd option is to go on a holiday before end of June to validate and get the two years granted and then return later(rather then quitting my job and going for 3/4 months as per option one), but again that will go back to my intial question on insurance options to get a visa for two years to come and go as I please, and also if it's possible to enter and re-enter during the two years.

Thanks for any input or advice. Sorry it's long winded but wanted to include all the facts. You run a great site and I have been finding your ebook on whv in Canada most helpful. :-)

Tuesday 17th of January 2017

Wow, a lot of questions! OK, let's see if I don't miss anything. You can enter and re-enter Canada with the IEC subject to normal entry requirements (i.e. it is not technically a visa and as such does not guarantee entry). The usual problem with entering and leaving is with insurance. Most insurance policies do not allow you to return to your home country for 10 or more days. Some do not even allow you to return at all without invalidating the policy. To receive the full 2 year work permit on arrival it is necessary to have 2 years insurance - if you do not, then you risk being given a work permit to the length of your insurance (or no permit at all if you don't have any insurance).

Australian insurance by the way (as in, coverage for Australians) is VERY expensive, much more expensive than insurance for UK residents/citizens. Be aware though that you may not be eligible for many UK insurance policies as you have not been resident there for a while.

It seems like you have two options -

Go to Canada before your POE expires, activate your work permit with two years insurance. If you need to go home directly afterwards, that is OK, provided your insurance provider allows it (as mentioned, not many do and only for a short time). True Traveller allows you to return home for an indefinite time period without invalidating your policy is True Traveller. With your living situation, they are also one of the few UK insurers that you may be eligible to get a policy with.

Second option is to apply for the Australian quota. I would do this before September as the pools closed in early autumn last year. You must receive an invite before your 31st birthday to be eligible.

IEC Travel Insurance

If you’re going to be travelling to Canada through International Experience Canada (IEC) then one of the requirements to be allowed to enter Canada is that you have IEC travel insurance (IEC health insurance).

But what exactly does the IEC travel insurance need to cover and how can you make sure to get the best deal?

We’ll cover everything you need to know in this article.

International Experience Canada

Iec travel insurance, iec travel insurance requirements, when do i need to purchase iec travel insurance, best iec travel insurance, what to look for in iec travel insurance, iec travel insurance cost, working in quebec.

If you’re figuring out what to do about IEC travel insurance, I’m sure you’re already familiar with what the International Experience Canada program is.

But just to confirm the context around the insurance:

IEC is what Canada calls its working holiday visas program for people aged between 18 and 35.

There are three different types of visa covered by IEC and which ones you can apply for depends on your country of citizenship.

The most common visa is the working holiday visa which is an open work permit. The working holiday visa lets you come to Canada without a job offer and work for almost any employer in Canada.

There are various requirements for each type of visa but, regardless of which visa you get, the IEC insurance requirements are the same.

If you get an IEC visa then one of the requirements you need to meet to be allowed to actually enter Canada on that visa is having IEC travel insurance, or IEC health insurance.

The IEC travel insurance that is required for entry into Canada on an IEC visa is insurance that covers you for medical matters, it’s not travel insurance that covers things like lost baggage.

So a more accurate term for the insurance you need is probably IEC health insurance.

There are a number of requirements that your IEC health insurance needs to cover, otherwise you might be denied entry to Canada.

In terms of the policy coverage, the IEC heath insurance must cover:

- Medical care

- Hospitalization

- Repatriation which includes getting you to a medical facility, and returning you or your remains to your home country

The insurance policy must be for the full duration of the time you plan to spend in Canada. So if you want to stay in Canada for the full two years (or three years for some countries), the policy will need to cover two (or three) years.

If the policy is shorter than two years, when you arrive in Canada the border agent will only give you a permit for the duration of the policy – so your work permit will expire on the day your health insurance does.

Keep in mind you won’t be able to extend your work permit at a later date. So if you want to have the option of staying in Canada for the full length that your visa allows, you need to already have insurance that covers that full time period when you land in Canada.

This is where it’s a good idea to buy insurance that allows you to do partial refunds. So if you leave Canada before you’ve used the whole duration of the policy you can get a refund for the unused duration.

Many of the Canadian insurers offered on the price comparison website we recommend offer partial refunds on time that’s not been used.

One last point on getting insurance to cover your full length of stay – if you can’t get one insurance policy that covers the full time, it’s acceptable to get two consecutive policies instead.

It’s important to note that having IEC travel insurance is not required to apply to IEC or to be approved for the visa. But it is required before you arrive in Canada.

So when you arrive in Canada the border agent will check your insurance and if everything isn’t in order you might be denied entry to Canada.

As with most insurance, there isn’t one insurer I can recommend that is always going to be the best or the cheapest.

What’s best for you will depend on your circumstances and what you want from a policy.

That’s why I recommend the best way of finding your insurance is to use a price comparison website .

The site I use for travel insurance when my family is visiting Canada is BestQuote .

It compares across a whole host of insurers and provides you with various options.

The results page also nicely displays the key components of each policy so you can quickly see which options look good for you.

You can then go ahead and purchase the policy through the BestQuite website.

You can check them out here .

When you’re comparing quotes, some of the key things to look out for are:

Coverage amount . What is the maximum amount the policy will pay out if you need to claim on it? Keep in mind the headline maximum figure will be further broken down into maximum amounts for individual things.

Coverage . What elements does the policy actually cover? Obviously you’ll want to make sure it covers the minimum requirements for IEC travel insurance as outlined above. But also make sure it covers anything else you think you might need and the coverage amount per item is sufficient. A big one here (with this being Canada!) is to consider if you want winter sports coverage.

The deductible . This is how much you’ll need to pay out your own pocket before the insurer will cover the rest. This can range from zero up to thousands, so pick which is right for you. Basically the higher the deductible the lower the insurance premium.

If you’re wanting some ballpark figures of what IEC health insurance might cost I’ve outlined a few ranges below.

I’ve given the costs for a 27 year old, but the insurance cost doesn’t really vary significantly for anyone in the visa age range.

Here’s what some typical IEC travel insurance policies will cost:

- $1,200. 2-year IEC travel insurance policy for a 27 year old, with $100,000 coverage and $0 deductible. No pre-existing medical conditions and no winter sports.

- $2,700. Same criteria as above but with a stable pre-existing medical condition.

- $1,025. 2-year IEC travel insurance policy for a 27 year old, with $100,000 coverage and $250 deductible . No pre-existing medical conditions and no winter sports.

- $1,450. 2-year IEC travel insurance policy for a 27 year old, with $100,000 coverage and $250 deductible. No pre-existing medical conditions and winter sports included .

You can use a price comparison website to quickly get an idea of the cost of IEC health insurance for your circumstances.

Some countries have agreements with the province of Quebec that makes you eligible for health coverage. In which case you wouldn’t need IEC travel insurance that covers the medical care component of the requirements.

But the agreement doesn’t cover the repatriation part of the IEC travel insurance requirements so you’ll still need to buy separate insurance for that part. You can find out more if your country has agreements with Quebec here .

* All of the products and services I recommend on Canada for Newbies are independently selected based upon what I’ve personally found to be useful. I f you buy insurance through BestQuote using one of the links in this article, I might earn a small affiliate commission. Rest assured it won’t cost you anything and I would never recommend something I don’t believe in or use myself.

So that’s my overview of IEC health insurance. I hope you’ve found it useful.

Please feel free to drop me a comment on anything below.

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on X (Opens in new window)

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

Signup for new content and exclusive extras in your inbox.

Our partner, Cigna, offers newcomers peace of mind. Get a free quote !

IEC Health Insurance

Find the best health insurance providers for your 2024 IEC Working Holiday in Canada.

By Hugo O'Doherty

Updated 5 days ago

Do you need IEC health insurance?

Rate article, share article, if you’re moving to canada under the international experience canada (iec) program, you need to take out the right iec health insurance policy..

Getting appropriate IEC health insurance is a crucial step in your pre-arrival journey, but knowing exactly what type of insurance you need and what your options are can be a headache. This guide will help you understand exactly what IEC health insurance is, and which providers can cover you so you can get on with the fun stuff — living and working in Canada!

The 2024 IEC season is open as of December 11, 2023.

IRCC is currently conducting rounds of invitations from the IEC candidate pool each week. You can learn more about the weekly draws in our IEC news hub .

Check if you're eligible for the 2024 IEC program

What you'll find on this page

Do you have IEC health insurance?

This is the insurance you need for the 2024 iec working holiday.

You have heard or read that you need travel insurance before arriving in Canada under the IEC program. This is confusing. Once upon a time, the Government of Canada actually used the term ‘travel insurance’ in some communications to IEC candidates. Insurance providers and publishers hopped on this and marketed policies or developed guides specifying the need for travel insurance.

More recently, the Government has been clearer in its messaging, specifying that IEC health insurance is what you should be looking for. This makes sense, because the minimum coverage you need is related to healthcare, not travel. More on that in the next section.

Insurance providers, however, may continue to market insurance policies under the banner of IEC travel insurance, rather than IEC health insurance, even though the coverage may be health-related (confusing, eh?). So, it’s essential to look at what you’re potentially buying, as it needs to cover certain health-related eventualities.

What does IEC health insurance need to cover?

Your IEC health insurance must cover:

- medical care,

- hospitalization, and

- repatriation (returning you to your country in the event of severe illness, injury, or death).

Don’t purchase a policy that does not clearly cover all of the above .

Thankfully, the Government of Canada is clear on what your IEC health insurance needs to cover at a minimum.

In addition, many IEC participants may choose to purchase additional coverage for certain possible outcomes. One example is additional winter sports coverage.

Pro tip: make sure sports coverage covers health outcomes specifically, as some insurance providers may market such additional coverage that only covers outcomes such as lost , stolen , or damaged property . (Don’t be that person who racked up a mega-hospital bill but had “winter sports” coverage that covered only property).

And, while winter sports coverage may be advised for those hitting the slopes, note that it is not a requirement.

Where to get IEC health insurance

The Government of Canada has put this task squarely on you to figure out, with the Immigration Department (known as IRCC) stating on its website :

‘ We can’t recommend specific insurance companies or plans, but you can search online for something that meets your needs .’

That’s where Moving2Canada helps. For more than 10 years we have worked with a selection of great IEC health insurance providers that offer competitive policies underwritten by reputable brands. When you come knocking asking for IEC insurance, they know exactly what you’re looking for and will be able to sort you out. Plus, these providers generally offer excellent customer service , a key attribute if you need to make a claim at a later date.

Our recommended IEC health insurance providers

Select the region you’ll be in when you’re buying your travel insurance for Canada, or your health insurance.

BestQuote Travel Insurance

A full service Canadian travel insurance broker offering the widest selection of travel insurance plans for visitors to Canada. Available plans may include health coverage, coverage for up to 24 months, and coverage related to pre-existing medical conditions. Plans are available before or after leaving home. Get your quote from BestQuote today !

True Traveller

For years True Traveller has been a popular option for Europeans seeking mandatory insurance for International Experience Canada (IEC) including the Working Holiday program. True Traveller’s IEC insurance includes medical care, hospitalization, and repatriation which exceeds IRCC’s requirements. Get your quote from True Traveller today !

BestQuote Travel Insurance A full service Canadian travel insurance broker offering the widest selection of travel insurance plans for visitors to Canada. Available plans may include health coverage, coverage for up to 24 months, and coverage related to pre-existing medical conditions. Plans are available before or after leaving home. Get your quote from BestQuote today !

Fast Cover Travel Insurance The company of choice for Australian IEC participants seeking travel insurance for Canada. Options for 12 and 24 months, and a range of products from medical only to comprehensive, snow sports, and adventure activities. Duo policies, for couples or two friends travelling together, get 5% off. Get a quote from Fast Cover .

New Zealand

Rest of the world (including canada), when to buy iec health insurance.

The Government of Canada recommends that you buy this insurance only after you receive your port of entry (POE) letter, which is a key document you need in order to travel to Canada and obtain your work permit.

If your IEC health insurance policy is valid for less than the maximum potential validity of your work permit, you will be issued a work permit that expires at the same time as your insurance. If this happens, you will not be able to apply to change the conditions of your work permit at a later date.

Why you need IEC health insurance

Wait a moment, doesn’t Canada have a world-renowned, publicly-funded healthcare system? Yes, indeed it does. But, like many other temporary residents in Canada, IEC participants don’t get access to publicly-funded healthcare. Access to the public healthcare system is reserved for Canadian citizens, permanent residents, and some temporary residents (not including IEC participants).

Compare prices for IEC health insurance options with a free quote comparison from BestQuote .

Can you get provincial coverage while on IEC?

Now, there is anecdotal evidence that some IEC participants have in fact obtained publicly-funded healthcare after arriving in Canada . Each Canadian province and territory has its own healthcare system and rules for eligibility. Generally, temporary workers with a work permit of more than six months can be eligible for provincial health insurance . This, however, does not negate the need for IEC participants to have private IEC health insurance before arriving in Canada .

Ontario Health Insurance Plan (OHIP)

If you decide to settle in Ontario, you may be eligible for OHIP if you respect the following criteria :

- Hold a valid work permit,

- Work in a full-time job for an Ontario-based employer for at least 6 months,

- Have your primary place of residence located in Ontario,

- Be physically present in Ontario for a minimum of 153 days within any 12-month period.

- Be physically present in Ontario for at least 153 of the first 183 days immediately after establishing residency within the province.

Medical Service Plan (MSP) in British Columbia

While in BC, you may be eligible for the Medical Services Plan (MSP) . To qualify, you must:

- Reside in BC for at least 6 consecutive months,

- Hold a valid work permit for at least 6 consecutive months,

- Be employed for a minimum of 6 months with a minimum of 18 hours per week.

Alberta Health Car Insurance Plan (AHCIP)

Alberta will also allow you to apply for local health coverage if you :

- Reside in the province and intend to stay for at least 12 months,

- Hold a work permit running for at least 6 months.

Régie de l’Assurance Maladie du Québec (RAMQ)

The same goes for Quebec. To be eligible for RAMQ you will need to prove that you:

IMPORTANT REMINDER:

- Your eligibility can vary based on individual circumstances,

- Even if you do get access to publicly-funded care, you still NEED to retain private IEC health insurance coverage through the validity period of your IEC work permit. The Government is clear on this, stating on its website ‘ Having a valid provincial health card is not enough. Repatriation is not covered by provincial health insurance. ’In any event, your family probably won’t thank you when they have to remortgage the house to drag your body halfway around the world (not that you’d be able to hear their complaints anyway).

More resources to prepare for your IEC:

- Most common questions answered about IEC

- How much does it really cost to move to Canada through IEC?

- Biometrics for IEC

- Make sure you understand everything about police certificates

- How to correctly format and size your documents for your application

- What documents will you need to add after you submit your application

How does IEC health insurance differ from travel insurance?

While previously referred to as travel insurance, IEC health insurance is specifically geared towards healthcare needs rather than general travel aspects. It must cover medical care , hospitalization , and repatriation , which are not typically the focus of standard travel insurance policies.

Is repatriation coverage mandatory in IEC health insurance?

Yes , repatriation coverage is a mandatory component of IEC health insurance. It covers expenses for returning you to your country in cases of severe illness, injury, or death.

Can I purchase IEC health insurance after arriving in Canada?

It’s advised to purchase IEC health insurance before arriving in Canada . The Government of Canada recommends having this insurance as part of the pre-arrival process for the IEC program.

How long should my IEC health insurance policy be valid for?

Your IEC health insurance policy should be valid for the entire duration of your stay in Canada . If the policy is valid for less than your work permit’s potential validity, your work permit will be issued to match the insurance coverage period.

Do IEC participants have access to Canada's public healthcare system?

No, IEC participants do not generally have access to Canada’s publicly-funded healthcare system. Access is typically reserved for Canadian citizens , permanent residents , and some temporary residents, excluding those on IEC .

Can IEC health insurance be extended if I decide to stay longer in Canada?

The possibility of extending IEC health insurance depends on the policy terms and the insurance provider. Participants should consult their insurance provider to understand the options for extension.

About the author

Hugo O'Doherty

Popular topics.

Search results

results for “ ”

Immigration

Learn everything you need to know about Canadian immigration

If you need help with your immigration, one of our recommended immigration consultant partners can help.

Calculate your estimated CRS score and find out if you're in the competitive range for Express Entry.

Take the quiz

Your guide to becoming a student in Canada

Take our quiz and find out what are the top programs for you.

Watch on YouTube

This guide will help you choose the best bank in Canada for your needs.

Get your guide

News & Features

latest articles

Our Partners

Privacy overview.

Language selection

- Français fr

International Experience Canada: About the process

From Immigration, Refugees and Citizenship Canada

- 1. About the process

- 2. Who can apply

- 3. How the pools work

- 4. Create a profile

- 5. Get invited to apply

- 6. How to apply

- 7. After you apply

IEC participants: Requirements for travel to Canada

Due to current travel restrictions, only fully vaccinated IEC participants can come to Canada right now. Certain agriculture and food processing workers may be exempt.

Learn more about requirements and exemptions .

Processing time – 2024 season ?

Error loading the number of days. Try again.

Processing starts once you’ve submitted all required documents, including biometrics .

Processing times

Processing times will vary based on:

- Type of application submitted;

- Volume of applications received;

- How easily we can verify information;

- How well and how quickly you respond to any requests or concerns;

- Whether the application is complete.

Many more people want to immigrate to Canada than the Government of Canada can bring in each year under our annual immigration plan. Applications received after the maximum has been met may have to wait longer to be processed.

Learn more about how Citizenship and Immigration Canada calculates processing times .

Are you Canadian? Learn how you can work and travel abroad with IEC .

International Experience Canada (IEC) gives youth the opportunity to travel and work in Canada for up to 2 years.

There are 3 different kinds of work and travel experiences available:

This category is for you if

- you don’t have a job offer

- you want to work for more than one employer in Canada

- you want to work in more than one location

- you’d like to earn some money so that you can travel

The type of work permit you get for Working Holiday is an open work permit . This lets you work for almost any employer in Canada ( some exceptions apply ).

You’ll need to get a medical exam first for some jobs .

- you have a job offer in Canada that counts toward your professional development

- you’ll work for the same employer in the same location during your stay in Canada

Under this category, work must be

- not self-employed

The type of work permit you get in the Young Professionals category is an employer-specific work permit .

Your employer must meet all labour laws in the province or territory where you plan to work, including minimum wage requirements.

The job you’re offered must count toward your “professional development.” To count, the job must be classified under Training, Education, Experience and Responsibilities (TEER) category 0, 1, 2 or 3 of the NOC .

A TEER 4 job may qualify if it’s in your field of study. When you apply, you’ll need to submit your post-secondary

- certificate or

It must be translated into English or French.

- you’re a student registered at a post-secondary institution

- you have a job offer for a work placement or internship in Canada

- you need to do this work placement or internship to complete your studies

The type of work permit you get in the International Co-op (Internship) category is an employer-specific work permit . The internship you’re offered in Canada must be directly linked to your field of studies.

Wages and labour standards must follow the labour laws in the province or territory you will be working in. The labour code of the province or territory will determine if an internship needs to be paid or not.

If you’re a citizen of a partner country , you may be able to apply to one or more of these 3 categories.

You can apply to IEC yourself or you can use a recognized organization (RO) for support before and during your experience. ROs are Canadian-based organizations that help foreign national and Canadian youth work and travel internationally through IEC. In limited circumstances, certain ROs can help small numbers of youth from non-partner countries participate in IEC.

Recognized organizations are different from representatives , who can help with your immigration or citizenship application.

Learn more about working and travelling in Canada using an RO .

Your rights as a foreign worker

IEC participants are protected by Canadian labour laws .

Your employer

- must pay you the minimum wage for your work

- must ensure your workplace is safe

- can’t take your passport or work permit away from you

If your employer isn’t respecting these rights, report them to us .

IEC participants can’t work for non-compliant employers who are currently banned.

Application process at a glance

Watch our video for a step-by-step walkthrough of the application process.

Page details

IEC Travel Insurance Options

June 2016 The Wintersports Knowledge Base 1 minute read By Rik Dyson

Choosing an IEC Travel Insurance Policy

Essential requirements, choosing the right insurer, questions to ask, 24 month travel insurance providers.

Choosing a 2 year IEC Travel Insurance Policy

The IEC working holiday visa for Canada is 24 months for most countries, which means you need a 2 year IEC travel insurance policy. In this article, we’ll tell you what to look out for, the essential requirements of travel insurance, questions to ask, and at the very end, we list and link to the companies which offer 24-month travel insurance policies.

- The policy must cover the entire length of your stay. The immigration officer who issues your work permit on arrival will only issue a visa for the length of your travel insurance policy. So, if you’re trying to save money and only opt for a 1-year policy, be aware that you will only be issued a 1-year work permit, and it can’t be extended once it’s issued.

- Your IEC travel insurance policy must cover medical care, hospitalization and repatriation to your home country.

- Comprehensive winter sports cover is essential for all Winter Sports Company clients. We recommend taking a high level of winter sports cover, especially if you expect to ski or snowboard in the back-country or snow park.

- You are looking for a ‘long-stay’ or a ‘single trip’ policy. A multi-trip policy is standard travel insurance for holidays but usually, it only insures you for trips 30 days or less and is not suitable for IEC travel insurance.

- The added extras – consider everything! This insurance may save you tens of thousands of dollars in the long run.

Insurance companies all have different terms and conditions – before you commit to a policy, read the fine print. For example, some policies may include a clause of proof of intent to return to your home country at the end of your visa. If you can’t prove this, any claims you make may be rejected.

Trips home and further travelling – some companies have a condition written into their policies that you can only travel outside of Canada once or twice (this includes trips home). If you are planning further travel or may extend your stay after your visa expires, look for an IEC travel insurance policy with ‘extensions possible’.

Pre-existing medical conditions will need to be declared and checked to see if they are covered in your policy. If you need medical attention during travel, paying more for insurance to cover pre-existing conditions will be worthwhile.

Don’t forget, Travel Insurance companies are smart – and they will investigate. This can include checking your travel records and medical records to refuse pay-outs if you break the terms of your insurance.

What is the level of cover before I travel?

It is a good idea to opt for a policy with cancellation cover from the date you purchase insurance until the day you travel – most policies will include this as standard.

How are claims handled?

Some insurance companies require you to pay for things upfront and then claim reimbursement. Others deal with claims directly – be clear on this policy. It will cause you less stress if you have an unexpected trip to the hospital and you know what proof you need to make a claim.

Where can I view my documents?

You need a printed proof of insurance for IEC to enter the country. Most insurance companies offer digital proof of insurance – so save it to your computer.

Does the policy have financial failure protection?

This means you can claim if a company that is providing you with part of your trip goes into liquidation.

Is there a free-phone claims line, and what is the number for calling outside the country?

Put this number in your phone – then you have quick access to it in emergencies.

Am I covered for trips outside of Canada?

If you think you’ll take impromptu trips south of the border to the USA, or holidays further afield, make sure your insurance covers these.

What is your policy on trips home?

Some insurers do not allow trips home, others only allow a couple, and some allow unlimited trips back and forth. Be wise and realistic; returning to your home country may seem unlikely. However, you don’t want to void your insurance if you need to make a trip home for a family emergency.

Are luggage and personal items covered?

This includes ski and snowboard equipment – if you’ve got a lot of expensive stuff, find out if it’s covered and how much for.

Can I make changes to my policy?

Do you think you might extend your trip or want to add an extra level of cover at a later date? If so, check if this is possible – some insurance policies are iron clad after the initial cooling off period.

What is your policy on pre-existing medical conditions?

If you need cover for existing conditions, ask as many questions as possible about it, and get something in writing before you commit to the policy.

Is there an excess waiver, and how much is it?

Insurance companies usually offer an excess waiver which means if you need to claim, you don’t have to pay anything towards your claim.

Is this the best price you can do?

This is always worth an ask! Travel insurance can be expensive, but never be afraid to phone up. Ask if there is an active discount code or if you can have a discount for booking insurance well in advance.

True Traveller BigCat Travel insurance Fast Cover Travel Insurance

For short term travel and winter sports cover, check out our insurance page .

Canada , IEC , Insurance , Internships , Visa , Work Permit

Author: Rik Dyson

Privacy overview.

- Trustpilot Reviews

- Instructor Courses

- Internships

- Career Break

- Progression

- Instructor courses

- All Mountain Experience

- Ski Patrol | Snowboard Patrol

- Knowledge Base

- Snow Ready Fitness Program

- Sun Peaks – Canada

- Panorama- B.C Canada

- Hidden Valley-Canada

- Fairmont Hot Springs – Canada

- Verbier- Switzerland

- Queenstown – New Zealand

Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis dapibus rutrum vulputate. Mauris sed eros nec est vehicula mattis ac vitae ligula. Maecenas vitae tristique sapien, vitae pellentesque lectus.

Get a free one hour consultation

IEC Travel Insurance – The Best 2 Year Visa Cover From Europe

By: Author Sunset Travellers

Posted on Last updated: January 27, 2022

Categories Canada , Travel , Travel Advice

If you are looking for the best IEC visa travel insurance from Europe, you are in the right place.

We spent two years on a working holiday visa in Canada from Europe.

We know how difficult it might be to find the best IEC visa cover that suits your needs.

With all the changes happening around the world, it is essential to have the best possible insurance cover that doesn’t cost a fortune either.

After lengthy visa processes, paying all the fees, booking flights and most likely shipping some belongings , there’s so much you can invest in travel insurance.

We’ve been there, so we completely understand you.

We travelled to many places around the world, but all the IEC visa requirements got us very stressed.

Well, then, let’s get to the point.

As the Canadian government website states, the insurance for an International Experience Canada visa must cover:

- medical care;

- hospitalization; and

- repatriation.

For International Experience Canada, you must have health insurance for the entire time in Canada.

They also recommend buying the insurance only after receiving your port of entry (POE) letter.

Remember that you may be refused entry if you don’t have insurance!

If your insurance policy is valid for less time than your expected stay in Canada, you may receive a work permit that expires at the same time as your insurance.

Therefore make sure to buy the best IEC travel insurance for Canada.

Taking part in the IEC program can be by far one of the most amazing experiences you’ll have, so don’t waste this opportunity.

Thinking beyond the IEC travel insurance requirements, you should also be aware that medical care in Canada can be costly.

Emergency room visits for relatively simple injuries can quickly add up to thousands of dollars.

Saving money on buying IEC travel insurance for Canada can turn out to be an expensive mistake.

We found TrueTraveller to be the best IEC travel insurance for Canada from Europe with all of the above in mind.

Suppose you are looking for two years IEC visa travel insurance for Canada from Ireland, the United Kingdom, Germany, Poland or any other EU country. In that case, True Traveller has the right cover for you.

If you’re going to Canada on an IEC Visa , you’ll need travel insurance that satisfies the requirements of the Canadian Immigrations authorities, and which you can extend as well if you need to.

True Traveller insurance has many benefits over some other policies, including:

- medical and repatriation cover;

- cover available for up to 2 years;

- you can claim whilst you’re still in Canada; no need to wait to return home

- you can extend your policy without returning home first;

- free home visits allowed;

- 92 activities covered as standard;

- 40 optional activities in the Adventure Pack.

Steve and I used TrueTraveller for our two year IEC travel insurance and always recommend them to others.

Coming from Ireland and Poland to Canada was very stressful for us. We were therefore glad to have a proper cover when crossing the border.

Having the 2-year travel insurance for Canada really made our experience stress-free.

We also enjoyed all the activities like snowboarding, knowing we are insured with True Traveller.

Arriving in Canada with no travel insurance can invalidate your IEC Visa.

Local Provincial Insurance is no substitute for international travel insurance. This type of insurance is usually only available to permanent residents of Canada. It also doesn’t include medical repatriation.

We found True Traveller the best and cheapest IEC insurance for Canada from Europe.

Hit this link to get a free quote with TrueTraveller.

As always, please double-check up to date visa requirements on the Canadian government website .

Thanks for reading,

Steve and Sabina

Notify me of follow-up comments by email.

Notify me of new posts by email.

- 1300 409 322 Australian Based Call Centre

IEC Working Holiday Travel Insurance

The following information applies to policies purchased from 30th October 2023 onwards. For policies purchased prior to 30th October 2023: you can find the PDS relevant to you in your policy confirmation email, by logging into My Policy , or you can contact us for assistance.

Step-by-step guide for a 2 year IEC Policy

Step 1. get a quote for 12 months.

You can get a quote for your travel either through our website or over the phone by calling 1300 409 322 - noting this will be for a maximum of 12 months in the initial quote stage. Getting 2 years of travel insurance to meet visa requirements is explained in Step 4.

Step 2. Decide your level of cover

Compare the benefits of either Comprehensive, Standard Saver or Basic. Then assess if you require a Snowsports cover (for Skiing and Snowboarding). Please note all of our overseas policies offer unlimited Overseas Emergency Medical & Hospital Expenses PLUS Overseas Emergency Medical Evacuation & Repatriation.

Step 3. Finalise your Policy

We can help you finalise the Policy over the phone via a credit/debit card OR you can utilise our website for additional payment options such as PayPal (Pay-in-4 may be available), Apple Pay or Google Pay.

Step 4. Extend your cover for an additional 12 months

I f it is less than one month until your departure, you will be able to extend immediately. Login to Your Policy and select "Extend your Policy", you may select up to a further 12 months. If more convenient, you can also call our helpful Australian based call centre by calling 1300 409 322 or reply to your policy confirmation email and we can arrange this extension for you.

If it is more than 1 month until your departure, you will have to wait until 1 month until your departure date to contact us or you can do it then yourself by logging into Your Policy .

Step 5. Print out your Policy Documents

We will email your updated documents - be sure to print out and/or take a screenshot on your phone of your Certificate Of Insurance which includes all your policy Benefits and limits, so you can present it to Canadian Immigration upon arrival!

What is IEC Travel Insurance for Canada?

Every year thousands of Australians head to Canada on the International Experience Canada (IEC) program for a one or two-year working holiday.

Between hitting the slopes in numerous snow resorts, trekking and hiking in scenic Jasper National Park, exploring the Rocky Mountain ranges, white water rafting on the Yukon or kayaking on one of Canada’s thousands of pristine lakes, there’s so much to do and see you’ll certainly never be bored on your days off work!

The IEC program only accepts a limited number of participants each year, so it’s important to make sure you meet the strict visa and work permit requirements so that you don’t miss out. Travel insurance that covers the duration of your IEC visa is one of those requirements.

Fast Cover’s working holiday travel insurance for IEC visas, provides cover for travellers who want to experience living and working in Canada for up to two years as part of the IEC program.

Why do I need IEC Canada Insurance for my Working Holiday Visa?

Travel insurance is required for the IEC visa because it can provide cover for some of the various unforeseen and unexpected emergencies you might experience while travelling in Canada.

Australians travelling to Canada to undertake a 2-year Working Holiday Visa as part of the IEC program are required to have International travel insurance that includes medical, hospitalisation and repatriation cover for the duration of their visa.

All Fast Cover Comprehensive , Snow Sports Plus , Standard Saver and Basics policy options include 24-hour Overseas Emergency Medical Assistance as well as unlimited Overseas Emergency Medical and Hospital Expenses cover for IEC travellers, as well as:

- Repatriation: cover for medical transport and related expenses if you become seriously ill or injured overseas and need to be returned home to Australia for treatment.

- Up to $20,000 AUD cover for the repatriation of your remains to Australia if the worst should happen and you die overseas.

Some of our policies include benefits for cancellation , luggage , travel delays, and cover for lost or stolen credit card or travel documents.

If you’re in an emergency while on your working holiday in Canada, our emergency assistance team can help direct you to local medical providers, coordinate alternative transport, and act as a guarantor for overseas emergency medical expenses if required.

Note that the Australian Government recommends travel insurance to be taken out by all travellers to cover them for unexpected emergency medical expenses overseas.

For more information and the latest requirements about the International Experience Canada insurance, visit the Canadian Immigration and Citizenship website.

Is there health insurance for visitors to Canada?

Canada does have a public health care service available for Canadian Citizens and permanent residents. To access it, you’ll need to apply for provincial health insurance and serve the waiting period which is generally up to 3 months but you should check with the province you reside in. Alternatively, your employer may provide it for you once you have served your probationary period. So, once you get a job, ask your boss about getting universal healthcare. Once you’ve been approved, you’ll be issued with a card which you are required to present when you attend a medical clinic or hospital.

However, you should be aware that Canada’s public health insurance may not provide the level of cover required for your IEC visa.

Common expenses that may not be covered by provincial health care include:

Sporting injuries while in Canada

Participating in Snow Sports is a very common activity for travellers on an International Experience Canada visa.

IEC visa insurance can provide assistance if you’re injured whilst participating in not only winter sports like skiing and snowboarding, but injuries from other covered sports or riding a motorcycle, moped or scooter. If you end up with a broken bone or become injured while participating in activities that we provide cover for including surfing, scuba diving or hiking , you have a 24/7 team of medical assistance experts that you can call to assist you in the event of an emergency.

Your luggage or belongings being lost, stolen or damaged during your working holiday

If your bag is lost, stolen or damaged, the Luggage and Personal Effects benefit can provide cover for your loss.

If someone grabs your bag while you’re travelling or tries to rip your possessions out of your hands, there may be provision to claim under your IEC Canada insurance. Make sure that you obtain a police report as soon as it is reasonable to do so, but preferably within 24 hours of the theft to submit with your claim.

Be wary, keep your stuff in sight and reach at all times!

Emergency medical repatriation for IEC visa holders

If you’re injured or sick when you’re travelling, we have a 24/7 emergency medical assistance team that will be able to organise repatriation for you to return home to Australia for treatment, if they deem it necessary.

The emergency team can arrange for you to be accompanied by a registered and approved nurse if required, and there’s also cover for an immediate family member to fly to Canada and fly back home to Australia if needed.

Travel Insurance with cover for Personal liability

Fast Cover Travel Insurance policies also include Personal Liability Insurance .

This benefit can provide cover should a claim be made against you for the death or injury of a person, or the physical loss or damage to property.

Travel insurance may be able to assist in the payment of compensation and legal expenses whilst you work in Canada.

Top 5 things you should know about IEC Travel Insurance:

1. Cover for repatriation

It’s a requirement by Canadian immigration that travellers participating in the International Experience Canada program are covered for repatriation, hospital and medical. Good news is that all Fast Cover policies provide cover for repatriation and overseas emergency hospital and medical expenses.

2. Two years’ worth of insurance

Another requirement for International Experience Canada policies is that it covers you for the length of your visa. Fast Cover policies can be purchased for up to 1 year and extended for up to another year, ensuring you receive cover for the duration of your two-year working holiday visa.

3. Ability to return home without voiding your IEC insurance

Not all IEC travel insurance policies allow you to return home for a reason that isn’t covered under your policy without voiding your insurance policy. Fast Cover policies allow you to return home to attend a wedding or birthday, or simply because you’re homesick, and resume your trip, as long as you have at least 14 days remaining on your policy. Of course, your return expenses in these situations aren’t covered under your policy, but your policy will still remain valid up until the return date as listed on your certificate of insurance.

4. Travel insurance that covers snow sports and more adventurous adventure activities

Our policies have an ability to upgrade to the Snow Sports Plus policy if you will be skiing or snowboarding or an optional Adventure Pack for the more adventurous traveller.

5. Travel insurance with pre-existing medical cover

When purchasing travel insurance for working in Canada, you can complete a medical screening for your existing medical conditions. Check out our Medical Conditions page for more information about medical screening for your existing medical and pregnancy conditions including information about the General Exclusions that may apply*.

Can I get cover for skiing, snowboarding or other snow sports?

Yes! If you want to do any skiing, snowboarding or other snow sports while in Canada or overseas, you can purchase our Snow Sports Plus policy which provides cover for:

- On-piste skiing and snowboarding

- Off-piste skiing and snowboarding with a professional instructor

- Big foot skiing and snowboarding

- Cross-country trail skiing

- Glacier skiing and snowboarding

- Cat and heli-skiing

- Ice skating

- Ice luge-ing

- Snowmobiling

- Tobogganing

If you will only be skiing or snowboarding for a short length of time (less than a month or two), you may purchase a Comprehensive , Standard Saver or Basics policy to provide cover for your IEC visa, and then purchase a Snow Sports Plus policy to cover the time that you will be skiing or snowboarding.

What other sports and activities are covered?

Just because you’re on a work permit doesn’t mean it’s all work and no play!

Canada’s many lakes, national parks and rugged wilderness means there’s no shortage of outdoor activities and adventure sports for you to try while you’re there.

To help you make the most out of your days off work, Fast Cover covers a bunch of exciting sports and activities that are particularly popular in Canada. For travellers who are looking for something a little more thrilling to do during their time off, we also have an optional Adventure Pack add-on to cover more risky activities.

Covered sports and activities include:

- Bungee jumping

- Canyon swinging

- Canoeing and kayaking in rivers, rapids, lakes and canals up to Grade III

- Walking, hiking, trekking or tramping up to 3,000 metres

- Dog sledding

- Scuba diving up to 10 metres

- Ice skating on a rink

- Indoor rock climbing

- White water rafting up to Grade III

- Gym activities

Adventure Pack sports and activities include:

- Animal conservation and handling

- Canoeing and kayaking in rivers, rapids, lakes and canals up to Grade V

- Hiking, trekking or tramping up to 6,000 metres

- Quad biking

- Scuba diving up to 30 metres

- Outdoor rock climbing

- Tandem skydiving, hang gliding, parachuting and paragliding

- White water rafting up to Grade V

How much will my IEC Canada insurance cost?

To get an idea of the approximate cost for a two-year policy, just double the quote you have for the first 12 months. However, keep in mind that insurance prices can change over time.

To help you save on your travel insurance, Fast Cover will honour any discounts you received on the initial purchase when you extend your policy for the second year.

Can I return home to Australia for a visit without voiding my insurance?

Yes, you can!

We understand that for many young travellers, committing to one or two years working abroad without being allowed to return home can seem a bit daunting.

We also thought it was pretty unfair, so all of our policies allow for unlimited trips home to Australia during your working holiday.

It also doesn’t have to be for a medical emergency or something unexpected. You might just want to come back for a visit, or to attend a special event like a birthday, wedding or spend Christmas with your family. And that’s completely fine too!

Your policy will simply be suspended from the time you return to your home in Australia until the time you leave your home to continue your trip. And you don’t even need to let us know.

There’s only a couple of conditions to keep in mind:

- You must have 14 days remaining to the end date on your Certificate of Insurance.

- We will not pay any costs in relation to your return to Australia unless the costs are covered by this policy.

Following the resumption of your trip, your policy will remain valid until the end date shown on your Certificate of Insurance or your permanent return home, whichever comes first.

Can I get a refund on the second year once I have my IEC visa?

No, sorry. If you’ve already started travelling or exercised a right under the policy to obtain your working visa, we cannot cancel and refund the second year of your policy.

If purchasing travel insurance to cover the entire duration of your working holiday is a condition of entry into the IEC program, cancelling your policy after arriving in Canada might invalidate your work permit and result in the cancellation of your working visa. You may even face deportation if you have already entered the country.

What if I only have a one-year IEC insurance when I arrive in Canada - can I still get a two-year visa?

If you wish to stay in Canada for two-years, the IEC website does state that before you arrive in Canada, you need to have travel insurance for the duration of your stay, to be eligible for a 2 year working holiday visa.

It’s your responsibility to make the necessary enquiries regarding your IEC visa and the eligibility requirements. We’re not able to cover your cancellation costs if you’re refused a visa or issued with only a one-year visa because you entered Canada with a one-year travel insurance policy.

Can I get a partial refund on my insurance if I return home early?

No, sorry. If you voluntarily choose to cancel your trip and return home early, we can’t provide a refund for the remaining time left on your policy or cancel the second year extension of your policy. The price charged for everyone’s policy has been calculated so that we can pay the claims of your fellow travellers.

If you’re not sure how long you want to stay overseas, it might be a better option for you to purchase a one-year policy initially and then extend it at a later date. However, you should keep in mind that if you enter Canada with a one-year IEC visa insurance, you may only be issued with a one-year working holiday visa.

If you’re returning home early due to an unexpected illness, injury or other claimable event, you may wish to make a claim under your policy for related expenses.

Can Aussies working in Canada travel to other countries on their IEC visa insurance?

You can enter all the countries that you plan to visit when you get a quote. You can even contact us while you're in Canada to add even more countries to your policy, at no extra cost!

If you're not sure of the other countries that you plan to visit yet, or simply want to keep your options open, we can handle that too - you can simply select the 'Worldwide' region, which will provide cover for you to visit other countries or regions.

Also, a policy for Canada belongs to the 'Worldwide' region, which means it includes cover for countries in all the lower regions at no extra cost as well. This means that if you felt like visiting the United States , Singapore, New Zealand or Fiji on the way home, or even popping over to Europe, you can! Of course, this side travel still needs to be within the specified travel dates of your policy.

Please note that we are not able to provide cover for every country, and this can be due to reasons which includes but are not limited to:

- An Overall Advice Level of ‘Do not travel’ issued by the Department of Foreign Affairs and Trade (DFAT) and published on smartraveller .

- A General Exclusion that applies to all benefits in the PDS , which states to the extent permissible by law, we will not pay under any circumstances if you travel to Cuba, Iran or North Korea.

- A specific decision to not cover travel to certain destinations as a result of current extraordinary circumstances and/or due to underwriting eligibility criteria.

The circumstances in each country are constantly monitored and updated, so if you’re not sure if we are able to provide you with cover for the country that you plan to visit, you should check on our website, or contact us to check if we are able to provide you with cover for the country that you are visiting.

What is the Best Travel Insurance for Canada Working Holidays?

When assessing the right policy for you and your travel needs, it’s always best to review the benefits included in the insurance policy, and any that are required for your working holiday visa. This way, you’ll be able to find the right IEC travel insurance policy for your IEC trip.

Did you know that Fast Cover won 9 awards in 2023 alone ? The awards include “Travel Insurance of the year 2023”, “Outstanding Customer Service 2023”, “Best Quality Travel Insurance 2023”, 'Best Value Domestic Travel Insurance” from WeMoney Awards* , just to name a few.

*†Fast Cover has a referral arrangement with this company.

Below are the benefits included in these multi award-winning policies:

2 year travel insurance for Canada

Fast Cover policies can cover you for up to two years while living and working in Canada. Travel insurance is your resource to better deal with many of the unexpected situations you might experience while travelling on the IEC visa, including 24 hour emergency assistance, emergency hospital expenses and repatriation cover.

Repatriation cover while on a working holiday in Canada

Repatriation put simply means ‘to return you back to your home country’. Our repatriation cover is able to bring you back to Australia if you become sick, injured, or die overseas.

Range of policy options for Australians working in Canada

Fast Cover provides Travel Insurance policies ranging from Basic policies to Comprehensive Travel Insurance and also a Snow Sports Plus option for the avid skiers or boarders.

Travel Insurance with 24 hour emergency assistance

When overseas, you’ll have access to your 24/7 emergency medical assistance team. Whether you have an emergency or you're just not sure about something while overseas, you can call the 24 hour emergency assistance team.

IEC Travel Insurance with medical & hospital cover

This benefit provides cover for unexpected overseas medical expenses such as doctor’s consultations, prescribed medications for any acute medical conditions that arise such as antibiotics, the cost of staying in hospital and medical treatment such as surgeries. In serious cases, you may also be repatriated home to Australia if necessary.

Skiing and snowboarding cover while on a visa in Canada

Our Snow Sports Plus policy provides travel Insurance for Skiing and Snow Boarding while in Canada. This Travel Insurance policy includes cover for off-piste (with a professional instructor), heli-skiing, cat-skiing, back-country skiing with a professional snow sport instructor and snow mobiling.

Cover for luggage and personal effects while working overseas

If your bag is lost, stolen or damaged we may be able to assist under the Luggage and Personal Effects benefit . If someone grabs your bag while you’re travelling or tries to rip your possessions out of your hands, there may be provision to claim under your IEC Canada travel insurance policy. Remember that there are thieves that target tourists around local shopping centres or upmarket areas.

Adventure sports and activities cover while travelling in Canada

In addition to the list of included Sports and Activities, Fast Cover policies have an optional Adventure Pack for the adventure seeking travellers, which can cover activities such as abseiling, amateur contact sports, hiking, quad biking, white water rafting, and zip lining.

Motorcycle riding while in Canada

The Fast Cover Motorcycle Pack can provide cover for riding motorcycles. mopeds or scooters overseas, as long as you have a n Australian Provisional or higher motorcycle licence, and are licenced to ride in the country you’re visiting.

If you’re going to be a passenger on a motorcycle, the person in control of the motorcycle must hold a current licence (Provisional or higher) valid for the same class of motorcycle, mope or scooter that is valid for riding in Canada.

You should check local laws to determine what local or international licences may be required.

pre-existing medical conditions for your IEC Canada insurance

Check out our Medical Conditions page for more information about medical screening for your existing medical and pregnancy conditions including information about the General Exclusions that may apply*.

Trip disruption expenses if your IEC working holiday is interrupted

If you purchase a Comprehensive, Standard Saver or Snow Sports Plus policy, and your holiday is disrupted because you, your travelling companion or a family member back home is sick or injured, a natural disaster occurs or your travel documents have been stolen, you may be able to claim for additional accommodation, travel or travel document replacement costs.

Real-life IEC Claims Stories ~

Hannah's hospital shock.

Hannah, an 18-year-old snowboarder from NSW, was on a working holiday in Canada when she was admitted to hospital with severe abdominal pain. Further tests found she had an inflammatory bowel disease which required emergency medical treatment. The Fast Cover Emergency Assistance team stepped in to manage Hannah's care and acted as a guarantor for the payment of her hospital bills. Hannah's Snow Sports Plus policy set her back just over $1,000 but covered over $48,000 AUD worth of medical treatment and her recovery in hospital.

Shirelle’s Policy Pays Off – Twice!

Shirelle and her partner travelled to Canada on the IEC. They had scored great jobs at the Big White Ski Resort and planned to hit the slopes on their days off. However, just a few weeks into their holiday, Shirelle woke up with severe pain in her jaw. The pain was so bad she couldn’t eat or sleep! A dentist confirmed she required an emergency wisdom tooth extraction at a cost of around $500 USD. Shirelle contacted the Fast Cover Emergency Assistance helpline, submitted her claim and was fully reimbursed. Unfortunately, that was not the end of their troubles overseas, as Shirelle’s partner’s mother also unexpectedly passed away. Once again, they were reimbursed for their flights home to Australia for the funeral, as well as returning to Canada, covering almost $5,000 AUD.

~Traveller details have been changed to protect their privacy. Claims examples are from Fast Cover travel insurance customers from 1 July 2013 to 30 June 2016.

How can I find the right IEC Canada travel insurance policy?