- Publications

- Key Findings

- Interactive Data and Economy Profiles

- Full report

Travel & Tourism Development Index 2021: Rebuilding for a Sustainable and Resilient Future

1.2 Data and methodology

Most of the dataset for the TTDI is statistical data from international organizations, with the remainder based on survey data from the World Economic Forum’s annual Executive Opinion Survey, which is used to measure concepts that are qualitative in nature or for which internationally comparable statistics are not available for enough countries.

The sources of statistical data include, but are not limited to, AirDNA, Bloom Consulting, Euromonitor International, IATA, ICAO, the International Labour Organization (ILO), the International Telecommunications Union (ITU), the International Union for the Conservation (IUCN), STR, Tripadvisor, UNESCO, UN Statistics Division, UNWTO, the World Health Organization (WHO), World Bank, CIA World Factbook, WTO, WTTC and the World Database on Protected Areas (WDPA). The overall TTDI score is computed through successive aggregations of scores, from the indicator level (e.g. the lowest, most disaggregated level) through the pillar levels, using a simple average (i.e. the arithmetic mean) to combine the components. Scores on each indicator are first normalized and rated on a common scale.

Salam Groovy Japan Salam Groovy Japan

First muslim-friendly snack souvenir shop in japan opens in osaka, muslim-friendly ramen restaurant ‘ayam-ya’ beloved by many muslims, get halal souvenir for muslim tourists in japan with easy pickup, japan’s first halal-oriented beauty salon opens to meet growing need, fukuoka city offers halal and vegan restaurant map, finding halal food and prayer spaces made easy with japan’s halodish, hotel chinzanso tokyo welcomes muslims: japanese garden & cuisine experience, halal kobe beef & dinosaurs unique bayside hotel welcoming muslims, hotel plaza kobe, the halal ninja way fun experience for muslims by hi-partners, japan no.1 in global tourism competitiveness ranking, wef survey.

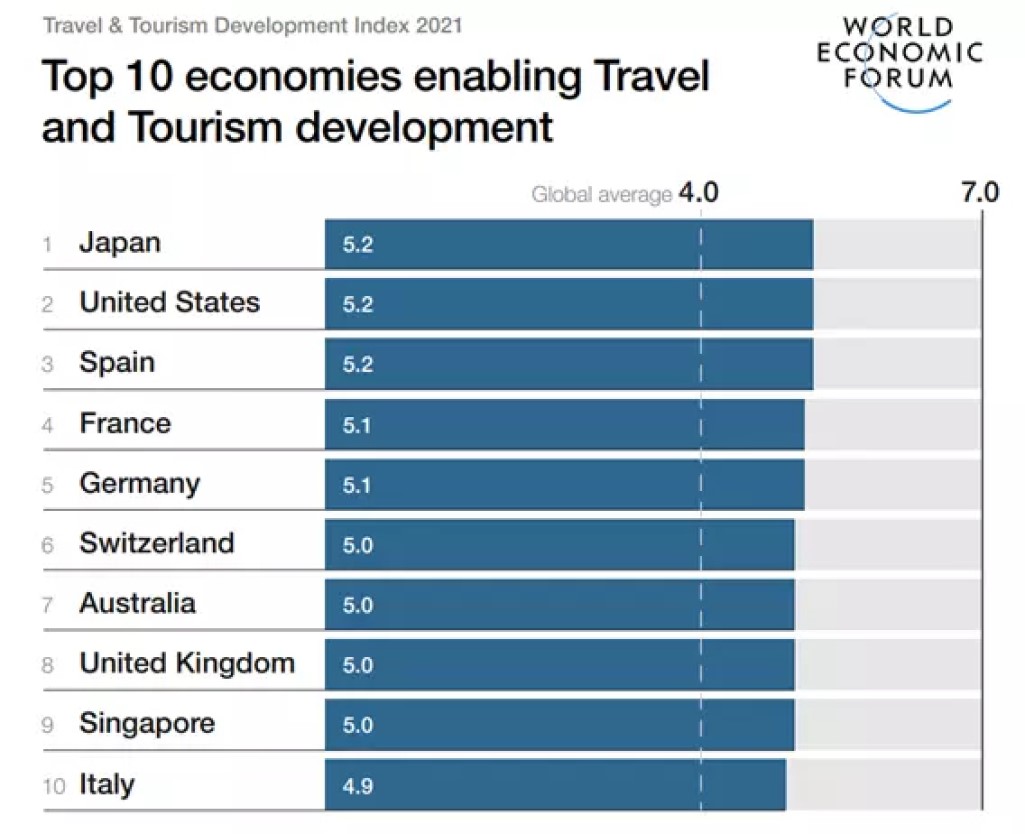

At the World Economic Forum (WEF) in Davos, Switzerland, Japan is rated as “the country with the most favourable conditions for a recovery in travel and tourism”. It ranked first in the Travel and Tourism Competitiveness Index 2021 for the first time, gracing the cover of the prestigious report. The ranking continues followed by the USA, Spain, France and Germany.

The COVID-19 pandemic left the global tourism industry in a devastating state. In 2020 alone, for example, the entire world suffered losses of USD 4.5 trillion with 62 million job losses.

So far, the global tourism industry is seeing a recovery, thanks to vaccine roll-out and the easing of lockdowns conducted in many countries. At the same time, the situation, however remains unpredictable. Countries are still travelling only 67% of the time compared to pre-pandemic times in 2019.

Not just that. The global situation is more chaotic than it was 3 years ago. This is due to the ongoing unstable factors in the travel sector environment, such as the Russian invasion of Ukraine, supply chain disruptions triggered by the pandemic, and labour shortages.

The WEF calculates and ranks the Travel and Tourism Development Index for 117 countries and territories. Japan won high marks for its highly developed transport and other infrastructure, globalised cities and many tourism resources, including UNESCO cultural heritage sites.

It is the first time Japan won first place since the survey began in 2007. The ranking takes place every 2 years based on these criteria: tourism resources, transport infrastructure, public safety, etc. In the previous ranking in 2019, Japan took 4th place. However, this time the calculation method is different from before. If the WEF used the same method as this time, Japan would rank second in the previous ranking.

But in the case of Halal Tourism, Japan still needs to put an effort to be fully ready to accommodate Muslims. The reality is many issues are at hand, such as adapting to diverse food needs and setting up prayer spots.

For the 2025 Osaka-Kansai Expo, an event drawing the most interest from the Japan tourism industry, the relevant ministries and agencies are receiving many requests for environmental improvements. It includes expanding menu displays using pictograms, developing new specialities/souvenirs and bento (boxed meals) catering to different food needs.

We have a network of Japanese companies keen to expand into the Halal market in Malaysia & Indonesia. If you are interested in connecting with sustainable technology companies in Japan, simply JOIN the network from below. We will match the right one for you!

To read this content please select one of the options below:

Please note you do not have access to teaching notes, key factors in tourism management to improve competitiveness in latin america.

Academia Revista Latinoamericana de Administración

ISSN : 1012-8255

Article publication date: 7 December 2021

Issue publication date: 5 July 2022

This paper analyzes tourism competitiveness in Latin America, providing a country-level ranking of tourism competitiveness. The study also identifies which areas of management to focus on in order to increase competitiveness in each case.

Design/methodology/approach

The study is based on the variables used by the World Economic Forum (WEF) to measure tourism competitiveness. The DP2 distance method is used to create a synthetic indicator. This method helps identify which areas best explain differences in competitiveness between countries.

In tourism, the most competitive Latin American countries are Costa Rica, Chile, Panama, Mexico and Uruguay. The areas that best explain the differences between countries relate to cultural and natural resources, the implementation of information and communication technologies (ICTs), international openness and transport infrastructure. These are therefore priority areas for tourism managers.

Practical implications

This paper provides detailed analysis for each country. The situation in each country is presented in terms of the key areas highlighted by the analysis. This approach can aid the individual decisions of companies and public managers, thus enhancing tourism competitiveness. This greater competitiveness can strengthen the tourism sector, which is crucial in uncertain times.

Originality/value

Based on a synthetic indicator, this research offers the first country-level analysis of tourism competitiveness in Latin America. The study is also novel in its ability to detect the areas where action should be taken to improve tourism competitiveness. This analysis offers an alternative to the WEF Travel and Tourism Competitiveness Index (TTCI), which has certain weaknesses. The results can help enhance tourism competitiveness in Latin American countries through the specific recommendations presented in this paper.

Este documento analiza la competitividad del turismo en América Latina, proporcionando un ranking a nivel país. El estudio también identifica en qué áreas de gestión deben enfocarse los esfuerzos para aumentar la competitividad en cada caso.

Diseño/metodología/enfoque

La investigación se basa en las variables propuestas por el Foro Económico Mundial (WEF) para medir la competitividad del turismo. El método de distancia DP 2 se utiliza para crear un indicador sintético. Este método ayuda a identificar qué factores explican en mayor medida las diferencias de competitividad entre países.

Los países latinoamericanos más competitivos en cuanto a la actividad turística son Costa Rica, Chile, Panamá, México y Uruguay. Los factores que mejor explican las diferencias entre países se relacionan con los recursos culturales y naturales, la implementación de tecnologías de la información y la comunicación (TIC), la apertura internacional y las infraestructuras de transporte. Por tanto, estas serían las áreas prioritarias de trabajo para los gestores turísticos.

Implicaciones para la práctica

Este documento proporciona un análisis detallado de cada país. La situación individual se presenta mediante un análisis de las áreas clave destacadas como responsables en mayor medida de la competitividad. Este enfoque puede ayudar a las decisiones tomadas por los gestores de las empresas y los administradores públicos, mejorando así la competitividad del turismo. Esta mayor competitividad puede fortalecer el sector turístico, que es crucial en tiempos de incertidumbre.

Originalidad/valor

Basado en un indicador sintético, esta investigación ofrece el primer análisis a nivel país de la competitividad turística en América Latina. El estudio también es novedoso por su capacidad para detectar los ámbitos en los que se debe actuar para mejorar la competitividad turística. Este análisis ofrece una alternativa al Índice de Competitividad de Viajes y Turismo (TTCI) del Foro Económico Mundial (WEF), que tiene ciertas debilidades. Los resultados pueden ayudar a mejorar la competitividad del turismo en los países de América Latina a través de las recomendaciones específicas presentadas en este documento.

- Synthetic indicator

- Competitiveness

- Latin America

- Indicador sintético

- Competitividad

- América Latina

Acknowledgements

The authors of this work wish to acknowledge the support of the CiTUR – Centro de Investigação, Desenvolvimento e Inovação em Turismo, ESGHT – Universidade do Algarve, Faro, Portugal.

Guaita Martínez, J.M. , Serdeira Azevedo, P. , Martín Martín, J.M. and Puertas Medina, R.M. (2022), "Key factors in tourism management to improve competitiveness in Latin America", Academia Revista Latinoamericana de Administración , Vol. 35 No. 2, pp. 131-147. https://doi.org/10.1108/ARLA-07-2021-0131

Emerald Publishing Limited

Copyright © 2021, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

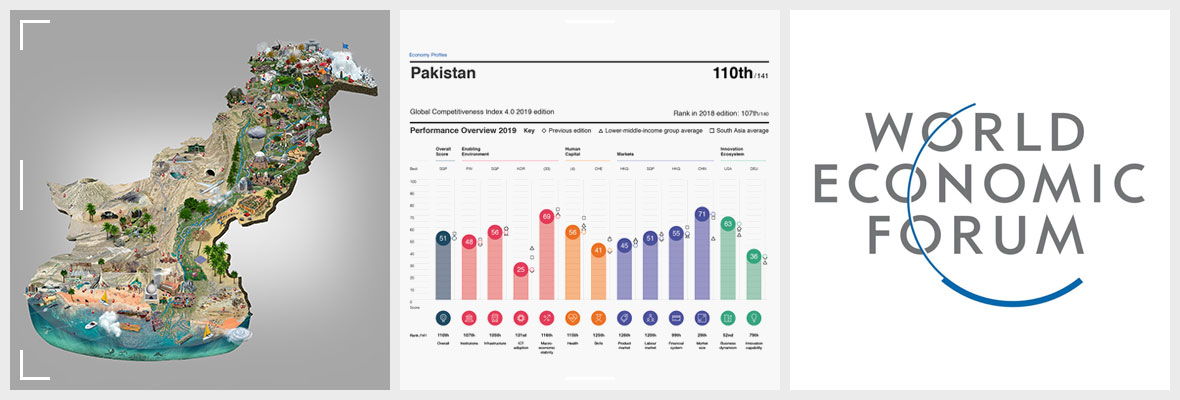

Travel and Tourism Competitiveness of Pakistan 2019

The PM routinely mentions the potential of tourism in Pakistan, given its diverse topology, immense cultural depth, and rich visual history. Multiple factors, mainly concerning the level of security and economic development, have contributed to the low level of tourism that the country has seen for many years now; not to mention that the tourism sector has historically performed well below the country’s potential.

It is, therefore, important for policy-makers to understand where the country stands, concerning the competitiveness of the travel and tourism (T&T) sector , not only in terms of its various dimensions but also in the comparative sense about other countries. Here, one important resource to gain this perspective is in the shape of the ‘ Travel and Tourism Competitiveness Index’ (TTCI) produced by the World Economic Forum (WEF) in its biennial report ‘ Travel and Tourism Competitiveness Report’ ; with the most recent one published in September 2019, covering 140 economies, including Pakistan.

This report should serve as a wake-up call for policymakers about the poor state of affairs is an important sector of the economy; especially since the country is the lowest-ranked in the Asia-Pacific countries .

Also read: Pakistan Gains 6 Points In WEF T&T Index 2021

According to the report, ‘it provides a strategic benchmarking tool for businesses and governments to develop the T&T sector . By allowing cross-country comparison and benchmarking countries’ progress on the drivers of T&T competitiveness , it informs policies and investment decisions related to T&T business and industry development . The report provides a unique insight into the strengths and areas for development of each country to enhance its industry competitiveness, and a platform for multi-stakeholder dialogue at the country-level to formulate policies and actions.

Here, TTCI is composed of four sub-indexes, 14 pillars, and 90 individual indicators.

A) Enabling environment and within it

- Business environment

- Safety and security

- Health and hygiene

- Human resources and labour market

- ICT (information and communications technology) readiness

B) T&T policy and enabling conditions, which include,

- Prioritization of travel and tourism,

- International openness

- Price competitiveness

- Environmental sustainability;

C) Infrastructure, which includes the following pillars,

- Air transport infrastructure

- Ground and port infrastructure

- Tourist service infrastructure;

D) Natural and cultural resources, and within it

- Natural resources

- Cultural resources

- Business travel

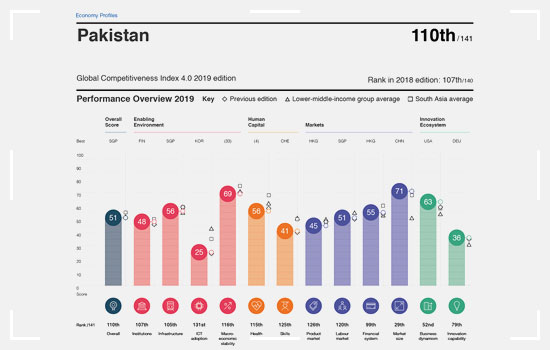

This is a very comprehensive way to measure the strength of a country to attract and sustain travel and tourism and focuses on performing involved institutions, governance structures, and performing markets. Sadly, the situation of Pakistan’s T&T sector is very weak as per the TTCI 2019 , which ranks the country at 121, out of 140; Although a thin silver line is that the country’s rank improved by three positions from that of TTCI 2017 when it was 124th .

The Report shows that Pakistan concerning its T&T sector falls in the bottom 25% (or quartile) of countries, most of which belong to ‘low to lower-middle-income economies, with 26 coming from Sub-Saharan Africa. Lower levels of economic development translate into particularly poor competitive conditions for T&T. Even compared to the third-lowest quartile, the bottom 35 countries score significantly lower on most pillars, in particular, overall infrastructure, international openness, ICT readiness, and health and hygiene. Also similar to the third-lowest quartile, nations in this group score below average for natural and cultural resources. As a result, the bottom 35 economies account for just 1.8% of T&T GDP and 2.5% of tourist arrivals of the economies ranked in this report.’

In the Asia-Pacific region, Pakistan is the lowest-ranked country overall at 121 per TTCI 2019 ; whereas among other countries in the region, India is 34th among the 140 countries, Vietnam 63rd, Sri Lanka 77th, Nepal 102nd, and Bangladesh 120th. The report shows that ‘Pakistan… remains the least competitive country in South Asia for T&T, including the region’s least favorable safety and security (134th) conditions.’

In terms of four sub-indexes, Pakistan’s performance is overall poor as per the TTCI 2019 , where for

- Enabling environment ranked at a 119th position

- Travel & tourism policy and enabling conditions, it holds the 122nd position,

- Infrastructure, is at the 99th position,

- Natural and cultural resources ranked 87th

Hence, its position in all sub-index is either close to 100th rank or above it.

Gauging the performance of the T&T sector of Pakistan , a deeper examination of the level of pillars within each of the four sub-indexes reveals very useful detailed information. Here, regarding the first sub-index of an enabling environment, the position of Pakistan, in terms of the involved pillars, as per the TTCI 2019 , is:

- Business Environment (93rd),

- Safety and Security (134th),

- Health and Hygiene (101st),

- Human Resources and Labor Market (135th),

- ICT readiness (123rd).

Hence, the enabling environment lacks tremendously, in turn, identifying the institutions as a very weak link in the overall performance of the T&T sector.

In the second sub-index, T&T policy, and enabling conditions, the ranking on the involved pillars for Pakistan is prioritization of travel & tourism (119th), international openness (122nd), price competitiveness (37th), in which the country performs relatively a lot higher than other pillars, and is based on the following indicators,

- Ticket taxes and airport charges

- Hotel price index

- Purchasing power parity

- Fuel price levels and environmental sustainability (129th),

It shows a very weak state of affairs by related government authorities and the private sector and also points to a high level of environment-related vulnerability in which the country finds itself, and is based on the following indicators,

- The stringency of environmental regulations

- Enforcement of environmental regulations

- Sustainability of travel and tourism industry development

- Particulate matter concentration

- Number of environmental treaty ratifications

- Baseline water stress

- Threatened species

- Forest cover change

- Wastewater treatment

- Fish stock status.

Regarding the third sub-index, infrastructure, the rankings on the involved pillars is as follows:

- air transport infrastructure (96th),

- ground and port infrastructure (73rd),

- and tourist service infrastructure (112th),

and which includes the following indicators,

- Hotel rooms

- Quality of tourism infrastructure

- Presence of major car rental companies

- Automated teller machines per adult population.

The ranking on the pillar included in the fourth sub-index of natural and cultural resources is:

- Natural Resources (110th),

- Business Travel (56th).

This report should serve as a wake-up call for the policymakers concerning the poor state of affairs is an important sector of the economy; especially also since the country is the lowest-ranked in the Asia-Pacific region countries.

Since 2017, Saba Ghani has been serving as the talented and dedicated chief content writer for Pakistan Tour and Travel & EMHI Solutions. With her exceptional writing skills and in-depth knowledge of the travel industry, she has been instrumental in crafting engaging and informative content that captivates the audience. You can catch her at [email protected] or Twitter

Related posts

Air Taxi in Pakistan – Fly to Your Destination with Peace

Best 20 Places In KPK To Visit

Ultimate Guide To Dino Valley Islamabad

Share your social moments, #pakistantours, follow us on instagram.

Offering Pakistan Tour And Travel plans from Islamabad , Lahore & Karachi

Call Us: +92335 5577443

Whatsapp: +92335 5577443, office # e2, 5th floor, khalifa heights, near chaklala road, committee chowk rawalpindi, pakistan, destination.

- Naran Kaghan Tours

- Hunza Valley Tours

- Murree Tour Packages

- Lahore Tour Packages

- Azad Kashmir Tours

- Swat Valley Tours

- Skardu Valley Tours

Honeymoon package pakistan

- Pakistan Couple Tours 2024

- Neelum Valley Tour Packages

- Fairy Meadows Tour Package – 15 % Off Fairy Meadows Tours

- Azad Kashmir Tour Packages 2024

- Skardu Tour Packages by air & by road

© 2014- 2023 Pakistan Tour and Travel . All Rights Reserved.. Developed By: Emhi Solutions

- Culture - Sports

- Environment

- Destinations

- Media Center Mega Story Infographics Photos Videos Podcast

- Ho Chi Minh City

Vietnam has highest increase in tourism development index

Related News

Hanoi welcomes nearly 31,500 foreign tourists during SEA Games 31

Vietnam untying knots to boost tourism recovery

Vietnam climbs 8 places in global tourism development index

HCM City hosts first-ever fruit festival

World’s longest glass bridge inaugurated in Son La province

Da Nang eyes top spot in Southeast Asia MICE tourism

Measures needed to promote Dien Bien's tourism potential

Vietnam among Koreans’ most favourite destinations in 2024 summer

Southwestern Tay Ninh province acts to lure visitors

Quang Ninh aims to become international tourism hub

Hanoi’s Tran Nhat Duat pedestrian bridge with contemporary art installations put into use

Ninh Thuan strengthening regional and national connections to develop tourism

Developing cultural tourism in Dien Bien province

Vietnam develops railway tourism associated with “awakening” heritage

Vietnam posts 271.4 trillion VND in four-month tourism revenue

Eight million tourists recorded during just-ended holidays

Over 61,000 people visit President Ho Chi Minh mausoleum on national holidays

Vietnam ranks second in number of tourists to Laos in Q1

Tourists flock to Hanoi during five-day holidays

Vietnam - Land of famous landmarks and scenic beauty

First low-carbon tourism certificate granted in Hoi An

Southern localities tapping unique strengths to promote tourism development

Ba Ria - Vung Tau joins in on green tourism trend

Vietnam welcomes over 6 million int'l visitors in four months

- Logout Login

- Adventure Holidays

- Weekend Getaways

- Driving Holidays

- Travel News

India ranks 34th in World Travel Tourism Competitiveness Index

Times of India Times Travel Editor | TRAVEL NEWS , INDIA Created : Sep 6, 2019, 11.23 AM IST

According to the reports, tourism in India is seeing an upward trend as India ranks 34th position on world travel and tourism competitiveness index. With this, India moves up six places up, and this has been driven by the rich natural and cultural resources, alongside strong price competitiveness. The report stated, “India, which accounts for the majority of South Asia's T&T (travel and tourism) GDP, remains the sub-region's most competitive T&T economy, moving up six places to rank 34th globally. India showed the greatest percentage improvement to its overall Travel & Tourism Competitiveness Index (TTCI) score, which has helped it become the only lower-middle income country in the top 35.” China, Mexico, Malaysia, Thailand, Brazil, and India currently stand out in the Cultural Resources and Business Travel Pillar as per the report. All of these nations are not high-income economies but still rank in the top 35. The report further stated that India has better air infrastructure, ranked at 33rd; group and port infrastructure ranked at 28th; international openness ranked at 51st; and natural resources ranked at 14th; and cultural resources ranked at 8th place. India improved on many fronts, such as business environment, overall T&T policy, enabling conditions, infrastructure, and information and communications technology. In the departments of environment, tourist service infrastructure, and environmental sustainability, India still needs improvement.

Join Us On Facebook Close

Share your india trip experience.

MOST READ MOST REVIEWED

Popular Galleries

Places on Earth that turn hottest during summers!

5 UNESCO World Heritage Sites in Maharashtra you must explore in this life!

8 national parks to visit in India before they shut for the season

- 1 India ranks 34th in World Travel Tourism Competitiveness Index

- 2 Do you know Tomb of Cyrus in Iran is the world’s oldest earthquake resistant structure?

- 3 This Ganeshutsav, visit the mystery Ganesha statue on Dholkal Hill in Chhattisgarh

- 4 Delhi Government to pitch again for UNESCO World Heritage City tag

- 5 A unique museum of sweets and selfies opens up in Budapest

- 6 Ever heard of Bangle or Coconut Ganapati idols? They’re a reality at these pandals

- 7 Mumbai rains update: hundreds of people stranded in Mumbai Airport

- 8 Mysuru and Hampi likely to get double-decker buses for sightseeing by December

- 9 125 years ago, a halwai made this famous Ganpati temple in Pune

- 10 Do you know about the Wall of Tears in Hawaii?

Follow us on

Latest news.

- Abbott Mountain: A hidden gem in Uttarakhand's Himalayas

- Varkala Cliff: Kerala's majestic seaside wonder and a geo-heritage site

Congratulations!

You have been successfully added to the mailing list of Times of India Travel. To complete the subscription process, kindly open your inbox and click on the confirmation link which has been emailed to you.

Share with friends

Thank You for sharing! Your friend will receive the guide link on email mentioned.

- (For more than one recipient, type addresses separated by commas)

According to the reports, tourism in India is seeing an upward trend as India ranks 34th position on world travel and tourism competitiveness index. With this, India moves up six places up, and this h...

- Social Media

The Travel & Tourism Competitiveness Index...

Embed Size (px):

Transcript of The Travel & Tourism Competitiveness Index...

Travel & Tourism at a Tipping PointThe travel & tourism (T&T) industry plays a vital role in the global economy and community. In 2018, the industry helped generate 10.4% of world GDP and a similar share of employment, and has shown enormous resilience over the last decade. Fueling this expansion and relative resilience is the ongoing growth of the middle-class in Asia and other parts of the world. In the coming decade, industry contribution to GDP is expected to rise by nearly 50%.1 In light of this expansion, policy-makers, industry leaders and other stakeholders will have to pay closer attention to T&T competitiveness to capture this growing market. While government and business actors alike will need to consider what competitiveness levers they can activate to retain or gain market share, special consideration needs to be given to sustaining tourism infrastructure, services and assets. As numbers of business and leisure travelers increase the world over, improvements in competitiveness will need to be undertaken alongside careful planning for tourism management and carrying capacity of destinations. The results of the TTCI serve as a tool for policy-makers, T&T businesses and other stakeholders to understand and advance the necessary dialogues and actions that will ensure the longevity of this critical sector.

The 2019 Travel & Tourism Competitiveness Index (TTCI) assesses 140 economies for T&T competitiveness in four subindexes: Enabling Environment, T&T Policy and Enabling Conditions, Infrastructure, and Natural and Cultural Resources (see About the Travel & Tourism Competitiveness Index 2019 for more details). The economies covered by the index account for nearly 98% of global direct T&T GDP and a similar proportion of international tourist arrivals.2 In this section we discuss what it takes to be competitive in T&T and the implications for longer-term economic development and longevity of the industry. The second section, 2019 Results and Analysis, presents overall results for the 2019 TTCI, along with analysis of ranking quartile groups. While there is some country/economy and regional analysis in Part 1, more in-depth regional analyses, including data analysis and tables, are presented in Part 2. Further TTCI information can also be accessed by visiting the Travel & Tourism Competitiveness Report 2019 online (http://reports.weforum.org/ttcr).

The Travel & Tourism Competitiveness Index 2019

T&T competitiveness requires a holistic approachThe TTCI is deliberately designed to reflect and measure the diversity of factors that influence a country’s ability to compete globally in travel and tourism. Each of the 14 pillars that make up the index, if addressed with appropriate policy-making and sufficient investment, has the potential to drive competitiveness and returns in tourism arrivals and receipts.

What is explored to a lesser degree is the nuanced interdependence of the pillars and their combined impact on the longer-term sustainability of the industry. The results of this year’s report present an opportunity to explore this in more detail. At the outset, the data suggests that a holistic, systems-led approach to tourism strategy is required to truly perform successfully on the global rankings. In particular, economies need to achieve a strong performance on all of the pillars to rise to the top of the index. Typically, the highest-scoring economies tend to beat global averages on the majority of the pillars, while the opposite is true for the bottom-scoring economies. Only Mexico, Brazil and India have been able to rank among the top 25% of ranked economies on the TTCI by outperforming the global average in as little as seven of the 14 pillars. These economies have exceptional natural and cultural resources, which they combine effectively with relatively strong price competitiveness.

Yet even depending on a smaller number of pillars, such as Natural Resources, still requires a systems-led approach. The assets that this pillar measures cannot be bought or created, but if not managed well can be destroyed rapidly. The ability to generate demand and derive value from them relies heavily on the ability to set and enforce environmental policies (measured in the Environmental Sustainability pillar) , as well as the ability to effectively manage their “consumption”. If adequate focus is not given to preserving these assets, they will, as with any depleted resource, cease to contribute to the overall competitiveness performance of the country.

Other interdependencies are equally clear. Developed infrastructure and international openness are required to boost connectivity of destinations, which allows for a greater number of travellers to visit. A favourable business environment makes it easier for T&T businesses to operate in a country, while a skilled workforce leads to better customer service, productivity and capability to leverage increasingly vital communication and technology tools. Concerns over

Explore additional features of the report at http://reports.weforum.org/ttcr 3

Box 1: Global Health Security and T&T: A Case for Cross-Industry CollaborationThe number and kind of infectious disease outbreaks (e.g. influenza, Ebola, Zika, SARS, MERS-CoV, antibiotic resistant bacteria, etc.) have increased significantly over the past 30 years and, as global trade and travel increase, the international spread of disease is expected to grow. In today’s globalized world, a pathogen can travel from a remote village to major cities on all continents in under 36 hours, but unjustified or ineffective restrictions on travel or trade during outbreaks can have a massive economic impact on affected countries.

For example, efforts by countries to ban flights from nations with H1N1 outbreaks in 2009 were ultimately revealed to be ineffective in containing the virus; and the estimated loss associated with the H1N1 outbreak for the Mexican tourism industry was $5 billion. Similarly, between 2002 and 2004, as a result of Severe Acute Respiratory Syndrome (SARS), Hong Kong saw a 41% reduction in tourism GDP, Singapore 43% and China a 25% reduction as well as a loss of 2.8 million jobs.

The World Economic Forum convenes experts from international health organizations and travel and tourism business leaders to mitigate the impact of outbreaks on the industry and subsequently on national GDPs through its Epidemics Readiness Accelerator (ERA). Together, efforts are underway to improve decision-making, coordination and communications within and between both the public and private sectors, relating to risk, travel advisories and border measures.

Box 2: Protecting the Ocean Ecosystem: A Case for Public-Private CollaborationOnly 7% of the ocean is protected through Marine Protected Areas (MPAs). However, this figure varies based on the criteria used. Further, many MPAs are either only legally designated, poorly managed and enforced, or represent standalone efforts with little integration between them. Yet these ‘national parks in the sea’ should be seen as part of an economy’s infrastructure, helping to ensure a sustainable tourism industry and a supply of food from the sea. Addressing this, and increasing levels of protection, is key to restoring ocean ecosystems while generating and safeguarding the businesses, communities, jobs and livelihoods that rely on healthy seas.

The Friends of Ocean Action brings together leaders from government, business, civil society, international organizations, science and technology to fast-track solutions to the most pressing challenges facing the ocean. One way to advance the health of ocean ecosystems is to promote the achievement of ambitious marine protection targets by driving concerted, public-private cooperation across geographies and sectors on the establishment of MPAs. The Friends of Ocean Action’s efforts include: engaging in key relevant policy fora to support the international community in increasing global MPA coverage; partnering with key stakeholders to set-up and champion a game-changing new MPA platform and building a business case for MPAs that will mobilize a strong coalition of world business champions ready to contribute to reaching a new 30% MPA target by 2030.

healthcare, hygiene, safety and security conditions can also prove detrimental to generating T&T demand and investment, especially from abroad. Given the complexity and interconnectedness of these factors, it is impossible for industry corporations or tourism agencies to tackle these issues in isolation. They require cross-industry collaboration, public-private engagement and a better understanding of the global context beyond T&T. See Boxes 1 and 2 for real-world examples of such collaborations.

Strong T&T translates into overall economic developmentOnce economies begin performing well along a broad range of pillars—and in so doing begin to surpass the global average in T&T competitiveness—trends show that visitor numbers tend to climb considerably (Figure 1). However, because T&T competitiveness depends on aspects such as business conditions, strong labour markets, technology and infrastructure, less developed economies tend to lag their more advanced peers in overall scores. Because enabling conditions such as these are beneficial to economies on a whole, T&T stakeholders, both public

Note: International tourist arrivals excludes Liberia, (2017 or latest available). Top performers for each region are highlighted.

Sources: World Economic Forum and World Tourism Organization (UNWTO).

Figure 1: Travel & Tourism Competitiveness Index 2019 and international tourist arrivals

International tourist arrivals (millions)

TTCI 2019 score (1–7 scale)

United Arab Emirates

United States

Explore additional features of the report at http://reports.weforum.org/ttcr4

The Travel and Tourism Competitiveness Report 2019

and private, can use this to justify investment in the sector as it has reinforcing effects on the economy overall.

The difference in average TTCI score for high-income economies and the average TTCI score for low to lower-middle income economies is approximately 38%. However, the average score between these economic groups within the Natural Resources pillar narrows to just below 11%. This is due to the obvious reason that natural assets are distributed among countries with varying economic conditions. Therefore, many lower-income economies that have an abundance of natural assets would do well to consider investing in efforts to drive economic development through the vehicle of a thriving travel and tourism sector, especially given that they may lack the foundations necessary to pursue other emerging economic pathways such as advanced manufacturing. An example from Africa is the marked increase in visa openness that is in large part a response to the need to drive T&T on the continent but has the obvious benefit of stimulating trade and development on a larger scale.3

Moreover, assets like natural and cultural resources, have the potential to attract capital investment; suggested by the correlation between T&T capital investment and Natural and Cultural Resources subindex scores, which is approximately 76%.

Figure 2 shows the correlation between TTCI pillars and international tourist arrivals for low to lower-middle income and high-income economies. From this data, it is clear that low to lower-middle income countries have a stronger relationship than their high-income counterparts do between arrivals and pillars such as Business Environment, Human Resources, ICT Readiness, International Openness and overall Infrastructure. This indicates that improving in these areas may have a more marked impact on T&T demand

for lower-income countries than for high-income ones. On the opposite end, Figure 2 also shows that more advanced countries are more likely to compete on natural and cultural resources, probably due to reduced differentiation for business environment, ICT readiness and other aspects associated with higher levels of economic development.

Favourable enabling environments and improved infrastructure that can be achieved through properly managed T&T-led development may translate into increased economic productivity and overall national competitiveness. Figure 3 (on page 6) shows the relationship between T&T competitiveness and the Global Competitiveness Index 4.0 (GCI 4.0), which measures the set of institutions, policies and factors that determine an economy’s level of productivity. Because of shared foundations of competitiveness, there is a clear relationship between T&T and general competitiveness. Consequently, pursuing T&T competitiveness through such foundations can lead to a more productive economy, which in turn, may lead to reduced poverty levels, income and inequality.4

Anticipating the tipping pointThe results of the 2019 TTCI that are presented and analyzed in the following section of Part 1 indicate that both developing and developed nations have advanced in competitiveness, with improved scores in areas such as price competitiveness, air transport infrastructure, ICT readiness, T&T prioritization and international openness. And as Figure 1 shows, T&T competitiveness does often lead to substantial increases in travel and tourism demand. Given the forecasted growth in T&T in the coming decade, understanding the consequences and impact of T&T competitiveness is important so that public and private stakeholders can together design pathways for sustainable management of the sector over time.

Figure 2: Correlation between TTCI pillars and international tourist arrivals, by income level

Business Environment

Safety & Security

Health & Hygiene

Human Resources & Labour Mkt.

ICT Readiness

Prioritization of T&T

Int’l. Openness

Price Compt’ness.

Environ. Sustainability

Air Transport

Infrastructure

Ground & Port

Tourist Service

Natural Resources

Cult. Resources &

Business Travel

Notes: Light-coloured bars indicate high-income economies, dark-coloured bars indicate low- and lower-middle-income economies. Log of international tourist arrivals (2017 or latest available). Excludes arrivals for Liberia.

Correlation coefficient

Explore additional features of the report at http://reports.weforum.org/ttcr 5

For example, developing nations may be exposed to surges in visitors that end up overwhelming local infrastructure, cause shortages in housing supply and degrade the very cultural and natural assets that attracted tourists in the first place. Thailand had to recently close down its famous Maya Bay cove after a rise in visitors caused extensive ecological damage.5 More developed economies, even with robust and reliable, air, road and port and T&T infrastructure, may not adequately anticipate the impact that growing demand for travel could have. As a result, certain destinations may be ill prepared to deal with higher tourist numbers that are a result of their competitiveness. In Italy—which ranks 10th for tourist service infrastructure and 4th for natural and cultural resources—Venice has announced that it plans redirecting cruise ships away from the city’s central islands, following public discontent.6 Economies would be wise to begin paying more attention to the role that digital demand for natural and cultural tourism might play in our increasingly digital societies. For instance, the top 10 economies for cultural and entertainment digital demand account for a third of the tourist arrivals among economies in this year’s rankings.7 While this does not prove that increased digital demand necessarily leads to more arrivals, it does show that trends in online searches often mirror trends in numbers of visitors, especially on the upper end of the ranking. Thus, it is vital that policy-makers pay attention to these trends. Failure to adequately address issues related to rising tourism numbers has the potential to negatively impact future competitiveness, making nations victims of their own success. Therefore, more research and data will be required to measure when competitiveness leads to diminishing returns and to understand the feedback loops which may then drive down competitiveness. In the

meantime, strategies tied to dealing with rising tourism numbers are already being developed. For instance, the UNWTO provides potential strategies for sustainable tourism in urban environments, which include promoting time-based visitor dispersion, including during off-peak seasons, developing infrastructure with the needs of locals and tourists in mind, improving the monitoring of arrivals and setting up platforms for discussions with local residents.8

It is also imperative that countries balance their focus on T&T as one component of a diversified economic plan. While T&T is certainly a strong driver of economic development for a number of states, policy-makers and T&T businesses need to work hand in hand to make sure investment in T&T is shared with local communities and takes into account future needs of the industry. Creating an economy over-reliant on tourism that purely depends on natural and cultural resources and low-cost labour does not set a path for sustainable growth. The tourism industry of the future will be technology-driven and rely more on skilled workforces.9 Decision-makers should take care to integrate efforts to drive T&T competitiveness within a holistic economic strategy that balances the near-term economic promises of the rapidly growing travel and tourism sector with consideration for the long-term resilience of its resources: human, natural and cultural.

2019 Results and AnalysisGlobal resultsDespite trade tensions and nationalism crowding the news, global connectivity continues to advance, at least when it comes to T&T. Enhanced air transport infrastructure, higher ICT readiness scores and improved international openness all contribute to an industry that promotes, and takes advantage of, the desire of modern citizens to engage and exchange culturally, economically and academically. The TTCI 2019 results show that out of the 132 economies covered in both the 2019 and 2017 editions, 101 improved their score. While mature, high-income economies continue to score higher on average, middle-income countries showed the greatest improvement in competitiveness, with the subregions of Eurasia, the Balkans and Eastern Europe, South Asia and North Africa accounting for the greatest changes. Despite these differences, steady improvement across the board was observed. Across a broad range of economies, income segments and regions, improved competitiveness can be attributed primarily to performance on the following six pillars (a) Air Transport Infrastructure (b) ICT Readiness (c) Price Competitiveness, (d) International Openness (e) T&T Prioritization and (f) Safety and Security.

Cheaper travel for allA significant part of the recent progress in T&T competitiveness has come from enhanced air transport infrastructure. Air Transport Infrastructure was the second-most improved pillar in the index thanks to increased airline service offerings in the majority of countries, and rising route capacity across the global network. Between 2015 and 2018, scheduled available seat kilometres increased by nearly 30% for economies ranked in both the 2017 and 2019

Source: World Economic Forum, 2018 and 2019.

Figure 3: Correlation between travel & tourism and overall competitiveness

20 40 60 80 1002

GCI 4.0 2018 score (0–100 scale)

MexicoBrazil

● High income● Upper-middle income● Lower-middle income● Low income

Explore additional features of the report at http://reports.weforum.org/ttcr6

report editions. Moreover, flying and travel in general has been made more affordable thanks to lower global fuel prices and reduced ticket taxes and airport charges. In line with these trends and the further democratization of travel, Price Competitiveness (pillar 8) has seen the most measurable improvement of all the pillars over the last two years.

Destinations going digitalHigher scores in ICT readiness indicate that technology-enabled connectivity continues to proliferate. ICT readiness results have been bolstered by the rising number of individuals using the internet and mobile internet subscriptions—a reminder of how important mobile service offerings will become for the T&T sector in the next few years. On average, the number of mobile broadband internet subscriptions per 100 people has climbed by more than one-quarter since the 2017 report. As a result, more nations are now better positioned to take advantage of the growing popularity of online T&T service offerings, platforms, information distribution and marketing opportunities.

Prioritizing the T&T sectorEconomies across the world are increasingly recognizing the importance of T&T, demonstrated by a steadfast rise in the Prioritization of T&T (pillar 6). This notable broad improvement in T&T prioritization has been characterized by more effective marketing and branding strategies, as competition—globally, regionally and even within subregions—for the growing number of tourists heats up. Moreover, perceptions of government prioritization of T&T rose as did government funding for the industry.

Opening doors to safe and secure tourismThe improvement in International Openness (pillar 7) was led by countries not classified as high-income, especially those economies that implemented policies related to the lowering of visa requirements. In particular, Middle East and North Africa, Sub-Sharan Africa and Eurasia—areas historically known for low levels of international openness—have come closer to narrowing their gap with the global mean. In subregions like Eurasia, South America, Western Africa and the Middle East, growth in air travel and international openness has coincided with enhanced safety and security conditions, indicating that recent stabilization may have reduced traveller safety concerns. North Africa experienced a similar phenomenon with increased air travel and safety and security conditions; however, reduced international openness could potentially dampen the impact.

Critical checkpoints for the industryDespite improvements across region, subregion and income level, a number of challenges remain for the T&T industry. First, given the forecasted growth in T&T in the coming decade, far more investment is required in infrastructure in order to build capacity to welcome more visitors while adequately serving the needs of citizens. For example, despite the growth in air travel and openness, global average perceptions of air transport infrastructure quality have improved at a far slower rate (at a global average 1.4% and 0.4% for high-income economies since the last report), and airport density statistics have fallen. In addition, while some progress has been made in improving ground and port infrastructure, especially in Asia-Pacific,

the overall growth trend for Ground and Port Infrastructure (pillar 11) has been slower. Furthermore, from a global perspective, perceptions of the quality and efficiency of ground transport infrastructure and services have on average remained near stagnant. Consequently, the risk of future air and ground transport bottlenecks is likely to rise, hurting both the industry and local economies.

Ensuring sustainable tourismThe preservation of natural and cultural resources is another challenge the industry must overcome. Results show that the number of UNESCO cultural and natural sites, as well as intangible cultural heritage listings, keeps growing, indicating greater commitment to preserving some of the key attractions driving people to visit destinations. Encouragingly, Environmental Sustainability (pillar 9) scores have been boosted by the increase in environmental treaty ratifications and improved perceptions that T&T is being developed in a sustainable manner, all of which bodes well for natural resources and nature-based tourism. While this is promising, the enforcement of treaties and protected lands might not be enough to preserve natural resources, given that air pollution, deforestation and species endangerment have continued to rise over the last two years. Since the last edition of the report, the global average score for perceptions of the stringency and enforcement of environmental regulations improved by just 0.4%. Sadly, these perceptions declined the most in Sub-Saharan Africa, a region that already struggles to better utilize its natural assets. As a result, it is vital that T&T stakeholders recognize their role in environmental protection, or they run the risk of losing out on future nature tourism.

Performance by quartileTop 25%The top quartile (or top 35) of economies on the TTCI rankings dominate the industry, accounting for about 84% of global T&T GDP and nearly 70% of all international tourist arrivals.10 All but six of them are high-income economies, 20 are from Europe, 10 are from Asia-Pacific, four from the America’s and one (the United Arab Emirates) is from the Middle East and North Africa region. Typically, what separates this quartile from the others is how well many of its members do across all pillars. The top 25% tend to greatly outscore the global average on all pillars apart from Price Competitiveness. The high concentration of advanced economies in the top quartile means that this group is characterized by strong business environments, good safety and healthcare conditions and high ICT readiness. They are also comparatively more open to receiving international visitors than other countries. However, their greatest advantages come from well-developed infrastructure and natural and cultural resources.

The top 25% of scorers beat the global mean for air transport infrastructure by an average of 54.1%. However, the quartile has an even more impressive lead when it comes to cultural resources and business travel, at 73% above the global mean. Economies in this group have nearly 60% of the UNESCO World Cultural Heritage sites and host over 75% of international association meetings. The Cultural Resources and Business Travel pillar also exhibits the most variation in scores among the top 35 economies, making it a key point of competition. China, Mexico, Malaysia,

Explore additional features of the report at http://reports.weforum.org/ttcr 7

Thailand, Brazil and India—which are not high-income economies but rank in the top 35 on the TTCI—stand out in this quartile through their combination of rich natural and cultural resources and strong price competitiveness.

Due perhaps to its composition of the most mature T&T economies, the top quartile improved at a slower rate than other groupings. Nonetheless, 29 of the top 35 economies increased in competitiveness since 2017. These increases were mostly due to improvements in T&T policy and enabling conditions and air transport infrastructure as well as moderate gains in ICT readiness. The three most improved economies in this quartile are India (40th to 34th), Korea, Rep. (19th to 16th) and Denmark (31st to 21st). India showed the greatest percentage improvement to its overall TTCI score, which has helped it become the only lower-middle income country in the top 35. Aside from the aforementioned high ranking of its natural and cultural assets and price competitiveness, India also greatly improved its business environment (89th to 39th), overall T&T policy and enabling conditions (79th to 69th), infrastructure (58th to 55th) and ICT readiness (112th to 105th). Of all the other quartiles, the top 25% was the only one to improve its average performance on the Business Environment pillar, with India, China (92nd to 53rd), and the United States (16th to 4th) showing the greatest percentage increases.

The top 10 scoring economies remain unchanged, consisting—in descending order by global rank—of Spain, France, Germany, Japan, the United States, the United Kingdom, Australia, Italy, Canada and Switzerland. Of these, only the United Kingdom lost its position since 2017 (5th to 6th), switching places with the more competitive United States (6th to 5th).

Figure 4: Pillar performance overview, 2019

— Global average— Top quartile— Second quartile— Third quartile— Bottom quartile

Pillar score (1–7 scale)

Middle 50%As one moves down the TTCI rankings into the middle half of economies (ranks 36–105), the variance between pillar scores begins to rise. Countries here consist of many emerging market economies, with growing middle classes and tourism industries, and a selection of more developed economies that typically lack the numerous attractive natural and cultural resources that the top scorers possess. With a large concentration of less mature economies, countries in the middle of the ranking score lower for business environment, human resources and labour market and ICT readiness, creating more obstacles for T&T operations and investment. Further, compared to the top 25% of scorers, middle-ranking economies trail in international openness and especially in infrastructure and cultural and natural resources. On the other hand, price competitiveness does pick up.

However, because of their emerging-market status, economies in this grouping offer higher rates of return for T&T investors willing to deal with less favourable enabling environments, especially as many of these economies become more internationally open and investment in infrastructure and destination assets improve. This is evidenced by TTCI results showing that the middle 50% had the greatest improvement in T&T competitiveness. Economies in the upper-middle quartile (ranks 36 to 70) have the greatest rates of improvement on air, ground and tourist infrastructure and price competitiveness. This quartile does include many economies that do have rich natural and cultural resources, but are held back by underdeveloped infrastructure, security concerns or policy or structural issues. For instance, Argentina, Peru, South Africa, Indonesia and Colombia all score in the top 20 on the Natural and Cultural Resources subindex, but none rank higher than 69th (Argentina) on the Enabling Environment subindex.

Source: World Economic Forum.

Explore additional features of the report at http://reports.weforum.org/ttcr8

Of the 35 economies that rank between 36th and 70th, 29 increased their overall T&T competitiveness. Egypt (74th to 65th), Montenegro (72nd to 67th) and Romania (68th to 56th) had the strongest percentage increase in TTCI scores, improving on most pillars. As previously noted, it was this quartile that outpaced the rest of the world when it comes to enhancement of overall infrastructure. Poland improved the most on air transport infrastructure (70th to 56th), Cyprus had the best growth on ground and port infrastructure (51st to 32nd) and Georgia had the biggest percentage rise on tourist service infrastructure (70th to 41st). For those countries ranked 71st to 105th, Serbia (95th to 83th), Albania (98th to 86th) and Ukraine (88th to 78th) experienced the most significant improvement in TTCI scores.

Bottom 25%The bottom quartile consists mostly of low to lower-middle income economies, with 26 coming from Sub-Saharan Africa. Lower levels of economic development do translate into particularly poor competitive conditions for T&T. Even compared to the third-lowest quartile, the bottom 35 countries score significantly lower on most pillars—in particular, overall infrastructure, international openness, ICT readiness and health and hygiene. Also similar to the third-lowest quartile, nations in this group score below average for natural and cultural resources. As a result, the bottom 35 economies account for just 1.8% of T&T GDP and 2.5% of tourist arrivals of the economies ranked in this report.11

Though they’ve started from a low base, economies in this quartile did show improvement on T&T policy and enabling conditions, safety and security, ICT readiness, and air and ground infrastructure. They had the largest improvement on international openness, which is likely to lead to greater connectivity. Four of the 10 economies that showed the biggest reduction in visa requirements in the overall rankings are in Sub-Saharan Africa. Benin had the world’s largest drop in requirements (122nd to 7th), which contributed to the global TTCI’s greatest improvement on international openness in all 140 economies (133rd to 92nd). Bangladesh (125th to 120th), Pakistan (124th to 121st) and Lesotho (128th to 124th) led the quartile in overall growth in T&T competitiveness. However, all three still require substantial improvement in competitiveness to move up in rank and out of the bottom quartile.

Notes 1 World Travel & Tourism Council, Tourism Satellite Account Research,

2 World Travel & Tourism Council, Tourism Satellite Account Research, and World Tourism Organization 2018, UNWTO database, latest available data, UNWTO, Madrid.

3 Visa Openness Index, Africa Visa Openness Report 2018, 2018.

4 World Economic Forum, “In Depth: Are prosperity, people and planet compatible?”, in The Global Competitiveness Report 2018, 2018.

5 “Thailand: Tropical bay from ‘The Beach’ to close until 2021”, BBC, 9 May 2019, https://www.bbc.com/news/world-asia-48222627.

6 Mezzofiore, G. and R. Picheta, “Venice will stop letting huge cruise ships dock in its historic center”, CNN, 8 August 2019, https://www.cnn.com/travel/article/venice-cruise-ships-lagoon-scli-intl/index.html.

7 Bloom Consulting, Country Brand Ranking, Tourism Edition, https://www.bloom-consulting.com/en/country-brand-ranking, and World Tourism Organization 2018, UNWTO database, latest available data, UNWTO, Madrid.

8 World Tourism Organization (UNWTO), Overtourism’? Understanding and Managing Urban Tourism Growth beyond Perceptions Volume 2: Case Studies | Executive Summary, 2019.

9 World Economic Forum, “Industry Profile: Aviation, Travel & Tourism” in The Future of Jobs Report 2018, 2018.

10 World Travel & Tourism Council, Tourism Satellite Account Research, 2019, and World Tourism Organization 2018, UNWTO database, latest available data, UNWTO, Madrid.

ReferencesBloom Consulting, Country Brand Ranking, Tourism Edition, https://www.

bloom-consulting.com/en/country-brand-ranking, and World Tourism Organization 2018, UNWTO database, latest available data, UNWTO, Madrid.

Mezzofiore, G. and R. Picheta, “Venice will stop letting huge cruise ships dock in its historic center”, CNN, 8 August 2019, https://www.cnn.com/travel/article/venice-cruise-ships-lagoon-scli-intl/index.html.

“Thailand: Tropical bay from ‘The Beach’ to close until 2021”, BBC, 9 May 2019, https://www.bbc.com/news/world-asia-48222627.

Visa Openness Index, Africa Visa Openness Report 2018, 2018.

World Bank, World Bank Country and Lending Groups, https://datahelpdesk.worldbank.org/knowledgebase/articles/906519.

World Economic Forum, “In Depth: Are prosperity, people and planet compatible?”, in The Global Competitiveness Report 2018, 2018.

———, “Industry Profile: Aviation, Travel & Tourism” in The Future of Jobs Report 2018, 2018.

———, The Travel & Tourism Competitiveness Report 2017: Paving the way for a more sustainable and inclusive future, 2017.

World Tourism Organization (UNWTO), Overtourism’? Understanding and Managing Urban Tourism Growth beyond Perceptions Volume 2: Case Studies | Executive Summary, 2019.

———, Tourism Congestion Management at Natural and Cultural Sites, UNWTO, Madrid, 2004.

———, World Tourism Barometer Excerpt, vol.17, iss. 1, January 2019, http://cf.cdn.unwto.org/sites/all/files/pdf/unwto_barom19_01_january_excerpt.pdf.

World Travel & Tourism Council, Tourism Satellite Account Research, 2019.

World Travel & Tourism Council, Tourism Satellite Account Research, 2019 and World Tourism Organization 2018, UNWTO database, latest available data, UNWTO, Madrid.

Explore additional features of the report at http://reports.weforum.org/ttcr 9

Global Destination Competitiveness tourism

ESA tourism competitiveness - Strategic Access

The Travel & Tourism Competitiveness Report 2015

The Competitiveness Challenge For Tourism Enterprises · PDF fileThe Competitiveness Challenge For Tourism Enterprises ... while restaurants/mobile food service activities and ...

Tourism Destination Competitiveness

Enhancing Tourism Competitiveness through … Tourism Competitiveness through Improved Air Connectivity Presented by: UNWTO / ICF International International Tourism Fair ...

Competitiveness and Innovation in Tourism and Telecom

WEF Travel Tourism Competitiveness 2011

The Travel & Tourism Competitiveness Report 2011

Travel & Tourism Competitiveness Report 2013

Travel & Tourism Competitiveness Index · 2020. 7. 28. · The Travel and Tourism Competitiveness Index (TTCI) ranks 140 countries on their relative strengths in global tourism and

THE CHALLENGES OF COMPETITIVENESS IN THE CARIBBEAN TOURISM …

2018mishal.com.pk/.../Pakistan-Performance-on-Global-Competitiveness-I… · The Global Competitiveness Report 2018 Computation of Global Competitiveness Index 4.0 The GCI 4.0 is

The Global Competitiveness Index 4.0 Methodology and ...

Wef Travel Tourism Competitiveness Report 2011

ESRC - Tourism Online Reputation & Competitiveness

Insight Report The Travel & Tourism Competitiveness Report 2013

MODELLING DESTINATION COMPETITIVENESS - Home - Sustainable Tourism

Enhancing Tourism Competitiveness through Improved Air Connectivity

Travel and Tourism Competitiveness Report Part 3/3

- Cookie policy

- Privacy Policy

Copyright © 2022 FDOCUMENTS

IMAGES

COMMENTS

The Travel & Tourism Competitiveness Report (TTCR) 2021 is the latest edition of the 15-year-old TTCR series, a flagship publication of the World Economic Forum's Platform for Shaping the Future of Mobility. ... Travel & Tourism Development Index 2021: Rebuilding for a Sustainable and Resilient Future. Published: 24 May 2022 Interactive Data ...

With international tourist arrivals reaching 1.4 billion in 2018, the travel and tourism industry will continue to drive global connectivity - and as the World Economic Forum's 2019 Travel and Tourism Competitiveness Report shows, investment in infrastructure is required now if countries hope to make the most of this growing opportunity

The disruption of the tourism sector needs to be measured to increase tourism competitiveness. This study aims to map tourism competitiveness with the Travel and Tourism Competitiveness Index (TTCI) pillar after the Covid-19 pandemic. Of the 14 pillars of TTCI released by the World Economic Forum, only eight pillars with 56 indicators are used that are relevant to the condition and ...

UAE Ranks 51 / 140 -Key Indicators and Performance Overview. International tourist arrivals. 15,790,000. T&T industry Share of GDP (% GDP) 5.5. International tourism inbound receipts. US $21,048.3 million. T&T industry employment. 335,300 jobs. Average receipts per arrival.

Michael et al. (2019) used the hierarchical regression to evaluate the tourism competitiveness with a standardized beta coefficient (β) to measure 14 pillars of destination competitiveness developed by the World Economic Forum along with the Tourism and Travel Competitiveness Index (TTCI, 2017). This method requires a big sample size and the ...

journal of management and business: research and practice 2021 13(2) i issn 1339-9381 litavcová, e. | síč, j. 1 travel and tourism competitiveness index 2019 -

The Travel & Tourism Competitiveness Report (TTCR) 2021 is the latest edition of the 15-year-old TTCR series, a flagship publication of the World Economic Forum's Platform for Shaping the Future of Mobility. ... Travel & Tourism Development Index 2021: Rebuilding for a Sustainable and Resilient Future Download PDF. Contents 1.2 Data and ...

Rodríguez-Díaz B, Pulido-Fernández JI (2021) Analysis of the worth of the weights in a new travel and tourism competitiveness index. Journal of Travel Research 60(2): 267-280. ... WEF (2019) The travel & tourism competitiveness report 2019. Cologny: World economic forum. Available at: ...

The Travel and Tourism Competitiveness Index (T&TCI) seems to be the most used measure of a destination's competitiveness, even though the methodology underlying its calculation is characterized ...

At the World Economic Forum (WEF) in Davos, Switzerland, Japan is rated as "the country with the most favourable conditions for a recovery in travel and tourism". It ranked first in the Travel and Tourism Competitiveness Index 2021 for the first time, gracing the cover of the prestigious report.The ranking continues followed by the USA, Spain, France and Germany.

at the present time. This study offers a cultural explanation of the travel and tourism competitiveness (TTC) of a. country by investigating the relationship between destination competitiveness ...

Findings. In tourism, the most competitive Latin American countries are Costa Rica, Chile, Panama, Mexico and Uruguay. The areas that best explain the differences between countries relate to cultural and natural resources, the implementation of information and communication technologies (ICTs), international openness and transport infrastructure.

Here, one important resource to gain this perspective is in the shape of the ' Travel and Tourism Competitiveness Index' (TTCI) produced by the World Economic Forum (WEF) in its biennial report ' Travel and Tourism Competitiveness Report'; with the most recent one published in September 2019, covering 140 economies, including Pakistan.

The TTDI 2021 is an evolution of the 15-year-old Travel & Tourism Competitiveness Index (TTCI) series, according to the WEF. ... Vietnam climbed eight places against 2019 in the biennial travel ...

The objective of this research is to present an analysis of the indicators of sustainable competitiveness implemented in tourism microenterprises of the state of Baja California, using the model travel and tourism competitive index developed by the Word Economic Forum in 2019, which allows it to design competitive strategies related to good ...

In 2019, Venezuela received a Travel & Tourism Competitiveness Index (TTCI) score of 3.1 out of seven. It shows a decrease in comparison to 2017, when the TTCI score of this Latin American country ...

competitiveness. This study aims to map tourism competitiveness with the Travel and Tourism Competitiveness Index (TTCI) pillar after the Covid-19 pandemic. Of the 14 pillars of TTCI released by the World Economic Forum, only eight pillars with 56 indicators are used that are relevant to the condition and

India ranks 34th in World Travel Tourism Competitiveness Index. Times of India. Times Travel Editor | TRAVEL NEWS, INDIA Created : Sep 6, 2019, 11.23 AM IST. According to the reports, tourism in ...

Travel & Tourism at a Tipping Point The travel & tourism (T&T) industry plays a vital role in the global economy and community. In 2018, the industry helped generate 10.4% of world GDP and a similar share of employment, and has shown enormous resilience over the last decade. Fueling this expansion and relative resilience is the ongoing growth of the middle-class in Asia and other parts of the ...

In 2019 Indonesia's Travel and Tourism Competitiveness Index (TTCI) ranking was 40, but after conversion using the TTDI framework, methodology, and indicators, the rank dropped to 44.

The yen has lost 10% of its value against the greenback so far this year, after sliding 8% in 2023, according to Refinitiv data. It's the worst performing currency among the Group of 10 leading ...