- Primary navigation

- Main Content

It’s been three long years, and finally the time has come for us to dust off our passports and start packing our bags again. The threat of COVID-19 is still with us, however. So how should we choose our travel insurance to ensure we are well covered?

Protection against COVID-19

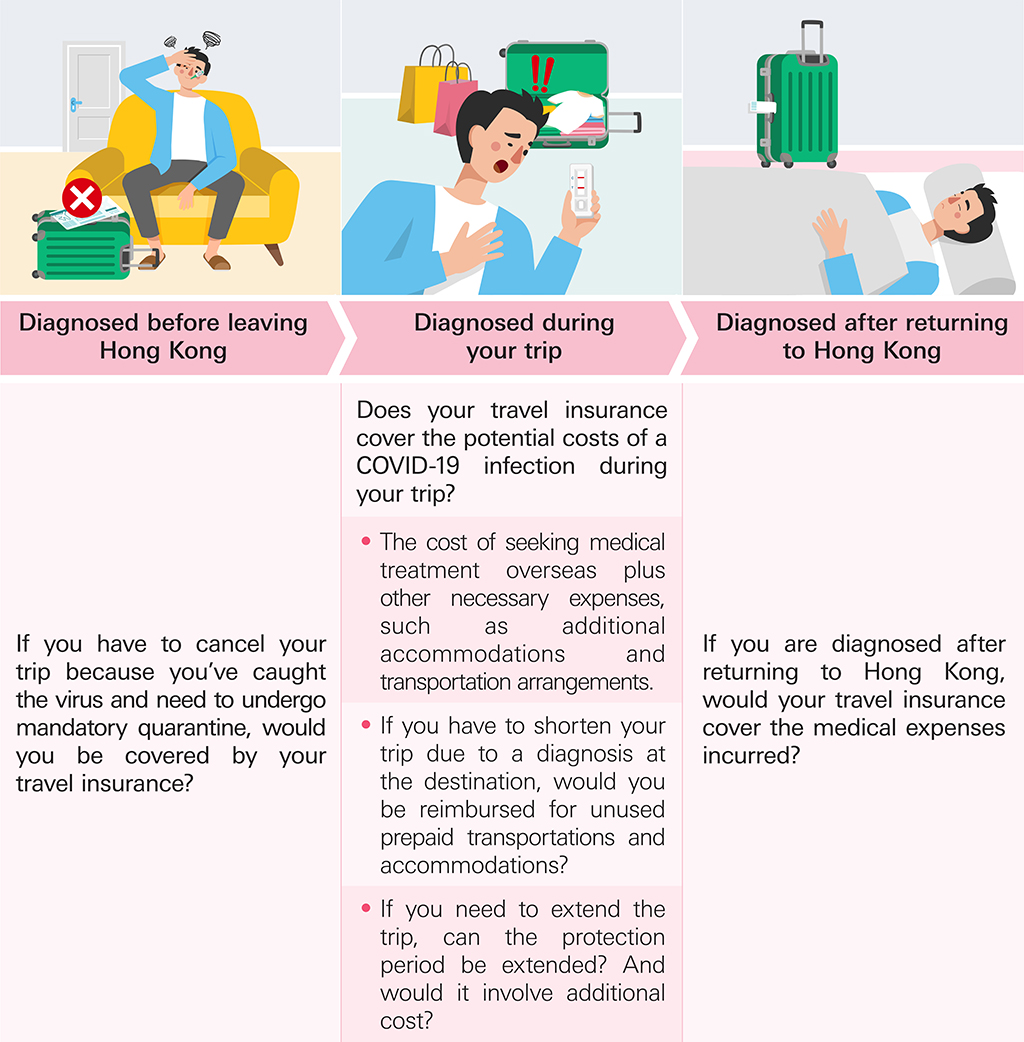

Pay particular attention to whether a travel insurance policy offers COVID-19 coverage. Possible scenarios include:

There are plans on the market that cover all the above scenarios, protecting you all the way from before your departure, to after your return home. You should choose a plan based on your specific needs.

Yet, travel insurance isn’t only about COVID-19 protections. Check to see if the scope of coverage includes the following too:

Enjoy global medical coverage with a VHIS plan

Once the borders completely reopen, you’d probably transit back into frequent traveller mode, whether for business or pleasure. You may even have plans for moving or studying abroad. If you will be staying overseas for extended periods of time, a medical protection plan that covers overseas medical expenses is a must-have in addition to travel insurance. Choosing a Voluntary Health Insurance Scheme (VHIS) that can cater to your needs is crucial. Some of the plans would protect you against medical expenses in the Greater China area, Asia or even other parts of the world. On top of the global medical coverage, there are other reasons for getting a VHIS policy:

The past three years have been a stark reminder that the future can be unpredictable. Only by preparing adequate protection for ourselves and our families can we make sure that no sudden illness or mishap would disrupt our plans.

Travel Insurance Checklist 2022

Post a comment.

- Privacy and Security

- Terms of Use

- Hyperlink Policy

© Copyright.The Hongkong and Shanghai Banking Corporation Limited 2002-2024. All rights reserved

This website is designed for use in Hong Kong. Cross-border disclosure Cross-border disclosure This link will open in a new window

Hong Kong Travel Insurance Comparison: A Complete Overview

Are you looking for the top travel insurance products in Hong Kong? With plenty of options out there, it could be a headache when choosing the right one. No matter if you’re flying to Japan, South Korea, Thailand, Taiwan, or even Singapore, y our long-awaited trip deserves the best protection, and we’ve done the hard work to get you covered with the perfect fit.

So, MoneySmart is here to rescue you from the hassle of sifting through travel insurance products. From pricing to coverage, claiming process, and special offers, we’ve dug deep to present you with the cream of the crop. So, let the adventure begin worry-free!

Read on to find out more details about how to choose the right travel insurance that fits your needs!

Table of contents: Hong Kong travel insurance comparison

What does travel insurance cover, how to compare travel insurance policies, hong kong travel insurance price overview, which travel insurance policy offers the highest coverage for medical and accident expenses, which travel insurance policy offers the highest coverage for skiing, scuba diving, or parachuting, which travel insurance policy offers the highest coverage for personal property.

- Frequently asked questions: Travel Insurance

Travel insurance coverage can differ depending on the insurance provider and policy. In general, travel insurance can help cover expenses related to trip cancellations, medical emergencies, lost or stolen baggage, and travel interruptions.

In general, travel insurance covers the 3 main types of coverage for medical and accident expenses:

- Medical coverage includes costs for accidents or illnesses during the trip, like fees for overseas doctors and follow-up visits after returning to Hong Kong.

- Personal accident coverag e provides reimbursement for death, permanent disability, and severe burns resulting from accidents during the trip.

- Emergency support coverage includes emergency medical evacuation or repatriation, visits for relatives, and more.

Comparing insurance policies is complicated. There are so many areas you can be insured in, but not all are equal in importance. So how do you know which aspects to compare?

Review your trip quickly and identify the most likely scenarios to occur

First of all, you definitely want to make sure that you’re covered in the scenarios that are more likely to occur on your trip. Sure, it’s nice to know you’re being covered for kidnapping or terrorist attacks, but statistically speaking you’re more likely to come down with a bout of food poisoning or lose your luggage. So, review your trip quickly and find out the most likely situations to happen during your trip.

Here are key areas to look out for when deciding on the best value for travel insurance:

- Medical coverage : Unless you’re invincible, there’s always the chance you’ll fall ill or get involved in an accident. Medical coverage can pay for your overseas medical expenses, as well as medical expenses incurred upon your return to Hong Kong.

- Travel mishaps : Lost luggage, missed flights, trip delays and cancellations can happen on even the most meticulously-planned of trips.

- Loss or damage to personal belongings : Get compensated if you are pickpocketed, your belongings get damaged in transit and so on.

Find your best fitted travel insurance plan

Review each plan you have come across and find out your best fitted plan. For instance, some plans may have a higher coverage on medical expenses, but not so much on personal perperty protection. After knowing which one you want, look at the premiums.

Taking an adult going on a 7-day trip to Japan as an example, the lowest premium travel plan is offered by Alliance (HK$196), while most others range from around HK$200 to HK$300.

Here you can find most popular travel insurance plans in Hong Kong. In order to compare all Hong Kong travel insurance options, we will use a 7-day insured trip to Japan of an adult as an example:

(The premium is for reference only. For the latest rate, check the travel insurance quote here.)

The premium cost ranges from HK$84.8 to HK$463. It is important to note that when comparing premiums, you should consider if the coverage provided by the travel insurance plan meets your needs and expectations. And if you’re not sure which one to choose from h ere are the 4 basic travel insurance policies in Hong Kong.

So, which travel insurance policy offers the highest coverage for medical and accident expenses? Here is the comparison of travel insurance for a 7-day single trip to Japan :

Allianz Travel – Bronze Plan [for ages 2 to 54]: HK$1,000,000 medical coverage available

The Allianz Travel – Bronze Plan offers a basic plan at a low price, providing HK$1,000,000 in medical coverage. It is important to note that this plan only covers medical expenses and does not include any other coverage.

Allianz Travel - Bronze Plan [for ages 0 to 54]

【2024 "Let's Chill" Lucky draw】Over HK$50,000 gifts are Waiting For You! Included HK$15,000 valued Club Med Travel Vouchers, HK$10,898 Samsung Galaxy S24 Ultro 512GB, etc. Click HERE for more details.

Key Features

Up to HKD 1,000,000 medical expenses

24/7 Emergency assistance services

Easy, fast, online claims process

Loadings applied: Ages 55 to 59 +100%; ages 60 to 64 +250%; ages 65 or above +500%

STARR Companies TraveLead Extra Plan: HK$1,000,000 medical coverage with trip cancellation and loss/damage of luggage coverage

STARR Companies TraveLead Extra Plan has a slightly higher price, but it offers additional coverage for trip cancellation (up to HK$25,000) and compensation for loss or damage to luggage (HK$10,000).

STARR Companies TraveLead Extra Plan

【MoneySmart Exclusive Offer】 1. 20% discount on Starr Travel Insurance 2. HK$20 AIRSIM Prepaid Card 3. Customers who successfully apply for a Starr Travel Insurance product during the promotional period will be entitled to 200 SmartPoints, if the premium reaches HK$300 or above will be entitled to 600 SmartPoints! (Equivalent to HK$60 Rewards amount) Learn More about how SmartPoints works here .

Coronavirus Disease (COVID-19) Extension (For Single-Trip and Annual Travel Policy)

Staycation Benefit (For Annual Travel Policy Only)

Travel Delay coverage up to HK$1,500

Overseas Medical Expenses coverage up to HK$1,000,000

Accidental Death or Total Permanent Disability coverage up to HK$1,000,000

Dah Sing Insurance JourneySure Travel Insurance – Gold: HK$50 YATA cash coupon available for products over HK$200

Dah Sing Insurance JourneySure Travel Insurance offers excellent medical coverage of HK$500,000, trip cancellation coverage of HK$20,000, and compensation for loss or damage to baggage up to HK$15,000. What sets it apart is the special offer of a HK$50 YATA coupon for products over HK$200.

With the coupon, you can enjoy nearly a 25% discount on a HK$200 travel insurance product.

Dah Sing Insurance JourneySure Travel Insurance - Gold

【MoneySmart Exclusive Offer】 1. Using promo code "MS202401" to enjoy 25% discount on Dah Sing Travel Insurance 2. Enjoy One Complimentary HK$100 HKTV Mall e-Coupon when apply for an Dah Sing Travel Insurance with premium HK$400 or above

Cover insurable loss of trip cancellation or curtailment due to the issuance of Amber, Red and Black Outbound Travel Alerts, Travel Agent or the operator of the Public Common Carrier bankrupt or winding up

Comprehensive delay coverage providing trip delay allowance, reimburse the paid and forfeited cost of Transport Ticket, Accommodation, group tour fees, admission fees of overseas sports, musical or other performance events

Cover leisure or amateur activities during the journey, including skiing, water skiing, rafting, parachuting, bungee jump, scuba diving, rock climbing and mountaineering

Loss of Income Protection caused by accidental bodily injury

Cover Golfer “Hold-in-One”

Zero excess for all coverage

Loss due to act of terrorism

Worldwide Emergency Assistance Services, includes unlimited benefit amount for Emergency Medical Evacuation

Personal Belongings , loss of money & camera Cover, enhanced sum insured for Camera

Family Plan covers maximum 2 parents and unlimited number of legal child(ren) aged under 18 for premium of 2 only

Rental Vehicle Excess Cover

Free and Automatic Extension of the Policy for 14 days in case the Insured Journey is forced to be extended beyond the control of the Insured Person

Personal Liability maximum HK$2,000,000

Dah Sing Insurance members can enjoy 20% premium discount

When planning for riskier activities that have a higher chance of accidents, it is important to consider getting insurance coverage specifically for those activities, including skiing, scuba diving, and parachuting.

Note that some travel insurance policies have limitations on coverage, including restrictions on height and depth. For example, if a skiing location exceeds a certain height, the travel insurance may not cover the activity. We strongly recommend thoroughly reviewing the details of insurance policies.

When searching for travel insurance policies that provide the highest coverage for skiing, scuba diving, and parachuting, there are several options to consider.

Here is the comparison of travel insurance for a 7-day single trip to Japan:

STARR Companies TraveLead Essential Plan

The STARR Companies TraveLead Essential Plan covers most high-risk activities such as skiing and scuba diving without any height or depth restrictions, providing medical coverage up to HK$500,000.

This plan is the most affordable option among all the travel insurance plans. However, it only includes medical coverage and does not offer any additional coverage. Perfect for those who want to get medical coverage only.

Coronavirus Disease ( COVID-19 ) Extension (For Single-Trip and Annual Travel Policy )

Overseas Medical Expenses coverage up to HK$500,000

Accidental Death or Total Permanent Disability coverage up to HK$600,000

BOCG Insurance Universal Voyage Travel Insurance – Silver Plan (Asia)

Apart from covering skiing, scuba diving, and parachuting, the BOCG Insurance Universal Voyage Travel Insurance – Silver Plan (Asia) also provides coverage for personal liability (HK$1,500,000), vehicle rental coverage (HK$2,500), and loss of home contents (HK$10,000).

MoneySmart Travel Insurance 101: What is loss of home contents?

Loss of home contents refers to the coverage provided by the insurance policy for the loss or damage of personal belongings and possessions while the insured person is traveling. This coverage typically includes items such as clothing, electronics, jewellery, and other personal items that may be lost, stolen, or damaged during the trip.

This is a comprehensive travel insurance product that covers not only medical expenses but also provides additional coverage for personal liability, vehicle rental, and loss of home contents.

-with no line.png)

BOCG Insurance Universal Voyage Travel Insurance - Silver Plan (Asia)

【MoneySmart Exclusive Offer】 1. 20% discount on BOCG Travel Insurance 2. Enjoy One Complimentary HK$75 Uber e-Coupon when apply for an BOCG Travel Insurance with premium HK$300 or above

Double Indemnity of Personal Accident, up to HK$1,200,000 (only applicable to Single Travel Plan).

Maximum limit for medical expenses up to HK$500,000, including the treatment expenses incurred inHong Kong within 3 months after the insured person’s return from abroad and Trauma Counselling Protection are also provided.

Protection for Dangerous Activities1, including bungee jumping, parachuting, rafting, diving, trekking & hot-air ballooning(not applicable to professional sportsmen or people engaged in competition).

If “Black Alert” is issued which results in travel delay, cancellation and curtailment etc., the irrecoverable deposits or charges will be payable. (For details, please refer to the list of Outbound Travel Alert)

If Compulsory Quarantined due to Infectious Disease or issuance of any Outbound Travel Alert2 to the destination, the period of insurance will be automatically extended.

Rental Vehicle Excess Protection, cover limit up to HK$2,500 (per event).

24-hour Worldwide Emergency Assistance , offers you medical emergency assistance service, overseas hospital admission deposit guarantee and medical evacuation to suitable hospital or country of residence.

Dah Sing Insurance JourneySure Travel Insurance – Diamond

Dah Sing Insurance JourneySure Travel Insurance – Diamond has a slightly higher premium due to its comprehensive coverage, which includes higher compensation for medical coverage, trip cancellation, loss or damage of baggage, and coverage for high-risk activities like skiing, scuba diving, and parachuting (excluded: rock climbing or mountaineering above 5,000m or scuba diving below 30 m depth).

Additionally, vehicle rental is also covered.

While it may be slightly more expensive than other travel insurance products, it offers a special promotion of a HK$50 YATA coupon, which can provide up to a 25% discount, making it a better deal.

Dah Sing Insurance JourneySure Travel Insurance - Diamond

Cruise Interruption Cover additional transport ticket and excursions tour cancellation

Losing your phone, wallet, or any other personal property can ruin your trip, but if you get travel insurance beforehand, you can be assured of being compensated for your loss!

When it comes to claims for property loss, there are certain things you need to do to meet the insurance company’s requirements. For instance, if you encounter theft or damage to your property, you should report it to the local police within 24 hours and get a written report.

And when you make a claim, you’ll need to provide receipts for the items that were lost or damaged. Make sure the receipts have the purchase date, price, model, and category of each item. Also, keep in mind that the insurance company might subtract the depreciation value of the property when calculating the coverage amount.

Here is a comparison of the travel insurance offering the highest coverage for property losses:

Zurich Get “Z” Go+ Deluxe Plan: The highest coverage for lost property

The Zurich Get “Z” Go+ Deluxe Plan offers the highest compensation for lost property, up to HK$25,000. If you have valuable property that needs to be covered, this insurance plan is worth considering.

BOCG Insurance Universal Voyage Travel Insurance – Silver Plan (Asia) also provides coverage for lost property with compensation of up to HK$6,000. Additionally, the travel insurance policy covers up to HK$500,000 in overseas medical expenses.

Blue Cross TravelSafe Plus Global Diamond Plan

Now you can have peace of mind knowing that your lost property is covered by the Blue Cross TravelSafe Plus Global Diamond Plan. It offers up to HK$20,000 for baggage loss.

Last tip: Get your insurance as early as possible

Buying your travel insurance in haste robs you of the chance to compare the various options and get a value-for-money policy that offers enough coverage at a reasonable price. You definitely don’t want to spend too much on a policy, or get one that’s so thin it barely covers you for anything. So spend a bit of time to pick the best policy for you, taking a careful consideration of various factors, including your destination, trip duration, and planned activities.

Travel insurance protects you not just the time when you’re on holiday to enjoy life, but also the weeks before you leave Hong Kong. So, the only way you can have a trip with the peace in mind is to buy your travel insurance in advance—not in the cab, on your smartphone as you rush to the airport! Don’t forget to check out the latest offers from MoneySmart travel insurance selection.

Frequently asked questions: Travel insurance

What is travel insurance.

Travel insurance is a type of insurance that provides coverage for unexpected events that may occur while traveling, such as trip cancellation, medical emergencies, lost or stolen baggage, and travel interruption.

Do I really need travel insurance?

A: It is highly recommended to purchase travel insurance before embarking on any trip, especially if you are traveling internationally. Travel insurance can provide financial protection for unexpected events that may occur while traveling.

What does travel insurance typically cover?

Related articles.

If you haven’t made up your mind, you can check out the t ravel insurance guide : things to consider before purchasing.

Autumn is around the corner, check where you can see the best Japan autumn leaves now! (With top spots recommendation and transportation guide!)

Want to stay ahead of the crowd? Visit the MoneySmart blog for more financial tips!

MoneySmart—Your One-Stop Financial Products Platform

Homepage: www.moneysmart.hk/en/

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions , Privacy Policy , Cookies Policy and Personal Information Collection Statement .

Search by category

Popular searches.

- Mobile account opening

- Mobile Cheque Deposit (MCD)

- Faster Payment System (FPS)

- +FUN Dollars

- Foreign exchange

- Hang Seng Mobile App – Simple Mode

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit " Security Information Centre " for more security tips.

Travelsure Protection Plan

Multiple coverage protection to safeguard your trip.

Special notice about Hang Seng Bank’s bancassurance partnership A new insurance partnership between Hang Seng Bank Limited and Chubb Insurance Hong Kong Limited came into effect on 10 July 2023 and the insurance partnership with QBE General Insurance (Hong Kong) Limited (“QBE”) has ended on 9 July 2023. Any policies issued by QBE expiring on or after 9 July 2023 will not be renewed. You can review your insurance coverage before the expiration of policy to make sure you have a timely replacement. View arrangement details

Flash trip to China? Travelsure Protection Plan (Single Trip Cover) provides the medical expenses coverage during your trip. Premium from HKD41/day.

Plan overview

Travelsure Protection Plan (“Travel Insurance”) offers Single Trip Cover, Annual Global Cover and Annual China Cover to meet your different travel insurance needs. It also offers various protection, including trip cancellation or delay, participating in winter or water sports and more.

This Travel Insurance is underwritten by Chubb Insurance Hong Kong Limited ("Chubb").

Logon to continue applying

Quote, apply and pay

Key features

Up to hkd1,000,000 medical and personal accident coverage.

This Travel Insurance covers the medical expenses and emergency assistance arising from sickness or accident during the trip, include:

- Overseas Hospital Admission Deposit up to HKD20,000 (under Chubb Assistance – 24 Hour Worldwide Assistance Services)

- Hospital Cash benefit for hospitalisation due to Bodily Injury or Sickness (not applicable to Annual China Cover Basic Plan)

- Follow-up Medical Expenses up to 90 days after return to Hong Kong, for the treatment of the same Bodily Injury or Sickness arose during the trip

- Expenses for Trauma Counselling within 90 days from the occurrence of a traumatic event, when the Insured is the victim and sustains Bodily Injury due to that traumatic event

- Expenses for Mobility Extension for the equipment and installation/modification if the Insured sustains Permanent Total Disability arising from Bodily Injury during the trip

- Hotel accommodation and transport expenses provided that the Insured Person is recommended by Physician to convalesce immediately before continuing with the Journey after hospital confinement overseas and the original scheduled ticket is forfeited

- Transport and escort services expenses for the escorting the child back to Hong Kong, and Compassionate Visit expenses covering the transport and accommodation expenses for visiting the Insured Person who is unfit to travel, endangered or suffers from death due to Bodily Injury or Sickness (under Chubb Assistance – 24 Hour Worldwide Assistance Services)

- Accidental death, loss of limb(s), eyesight, hearing, speech or Permanent Total Disability and

- Compassionate Death Cash for sustaining Bodily Injury on the Journey leading to Accidental death or Sickness leading to death within 12 months

Up to HKD3,000 loss of Personal Cash & HKD10,000 Travel Documents coverage

This Travel Insurance covers (not applicable to Annual China Cover Basic Plan):

- Loss of cash, banknotes or cheques (excluding digital currency); and

- Replacement cost of travel documents and/or travel tickets; and

- Additional transport and/or accommodation expenses for arranging the replacement travel documents and/or travel tickets

Up to HKD50,000 Credit Card Protection (Hang Seng Credit Card exclusive)

Within the 12 months following Bodily Injury during the Journey causing Accidental death or Permanent Total Disability, this policy will reimburse the Hang Seng Credit Card bill of the Insured Person spent at the date of the accident, including credit card interest and charges at the date of the accident. The premium of this policy must be paid with the Hang Seng Credit Card of the Insured Person.

Up to HKD15,000 Personal Property coverage

This Travel Insurance covers the loss, theft or damage to your personal belongings during the trip, including baggage, laptop, mobile phone (20% excess is applied), etc. Losses must be reported to the police within 24 hours and written police report is required. For losses occurred in transport, the Public transport Carrier must be notified and written report is required.

Up to HKD1,000 Baggage Delay coverage

This coverage (applicable to Single Trip Standard Plan / Annual Global Plan only) includes the cost of purchasing essential toiletries and clothing when checked-in baggage is delayed, misdirected or temporarily misplaced by a Public Transport Carrier for at least 10 consecutive hours from the time of arrival at destination's transport terminal.

Up to HKD30,000 Trip Cancellation and Curtailment coverage

This Travel Insurance (not applicable to Annual China Cover Basic Plan) offers reimbursement of the pre-paid and unused tour or transportation fare, accommodation deposit and / or cost of admission ticket to major sporting event, musical concert, museum or theme park arising from trip cancellation and/or curtailment due to specific events.

Up to HKD2,000 Travel Delay or HKD10,000 Re-routing coverage

This Travel Insurance plan covers (not applicable to Annual China Cover Basic Plan and only one of the compensations is available):

Travel delay

- Cash Benefit for the first 6 hours and every 8 hours of travel delay; or

- Reimbursement for the additional or forfeited accommodation expenses outside Hong Kong if the delay exceeds 24 consecutive hours

Re-routing In the event of delay of a Public Transport for at least 8 consecutive hours or the unexpected issuance of Black Alert at the destination after commencement of the journey, and the journey has to be re-routed, this insurance will cover:

- The lost transport and/or accommodation expenses paid in advance or forfeited by the Insured Person after departing from Hong Kong; or

- Reasonable additional transport and/or accommodation incurred by an Insured Person to enable him or her to arrive at their scheduled destination

- Re-routing due to Black Alert is not covered in Annual China Cover Standard Plan

Up to HKD5,000 Rental Vehicle Excess coverage

This coverage (applicable to Single Trip / Annual Global Plan only) includes reimburse the insurance excess that is legally liable to be paid by the Insured Person, due to the loss or damage to a rental vehicle caused by an accident while under the Insured Person's control during the Journey.

Coverage overview

Mainland China and Macau - Basic Plan

Asia [1] and worldwide - Standard Plan

Not Applicable

Not Applicable

Global Cover

China Cover - Basic Plan

China Cover - Standard Plan

5,000 (20% excess is applicable for each and every Mobile Phone claim)

Note(s): The information above is for reference only, you can refer to the plan coverage and Policy Wording for details.

Product information

Eligibility, travelsure protection plan - single trip coverage.

Ms. Leung slipped in the lift lobby at the hotel while she was staying in Korea.

Before the trip

She applied for Travelsure Protection Plan – Single Trip Coverage

Upon hospital admission in Korea

- Her travel companion called the Chubb Assistance hotline to refer and arrange for a translator to communicate with the doctor, as they did not speak Korean

- It was diagnosed that her injury was rather severe

- The doctor advised her to get back to Hong Kong for immediate medical treatment

- The Chubb Assistance team then arranged medical repatriation for her, including the ambulance and flight arrangements back to Hong Kong

When waiting for the flight back to Hong Kong at the airport

Her mobile phone and tablet computer were stolen

When the insurance is claimed

Ms. Leung successfully claimed the following losses:

- Medical expenses in Korea

- Non-refundable prepaid cost of Booked Holidays arising from the trip curtailment

- Extra travelling expenses for medical repatriation

- Follow up medical treatment in Hong Kong

- The loss of her mobile phone and tablet computer

Total compensated amount: HKD 81,000

TravelSure Protection Plan - Annual Global Coverage

Ms. Chau was about to take off for a trip, but had to cancel due to the sudden death of an immediate family member from an acute disease.

She applied for Travelsure Protection Plan – Annual Global Coverage

Before the take off for the trip

She suffered the loss of a loved one, and her travel plan was disrupted and cancelled

She was fully compensated for the non-refundable prepaid costs of the air tickets and hotel accommodation

Total compensated amount: HKD 21,000

The payment was directly credited through autopay into her designated bank account

- This Policy is only valid for travels originating from Hong Kong

- The insured age of the Single Trip Coverage has no upper limit; the Annual Trip Coverage is only available to those under 75 years old (at the policy effective date)

Popular questions

No, customers must purchase Travelsure Protection Plan prior to your departure from Hong Kong.

Yes, Travelsure Protection Plan provides cover for business travel (limited to administrative, clerical and non-manual works only).

No. Travelsure Protection Plan does not cover injury or death caused by any labour work. So you should approach the insurer who issued your helper's employee insurance for an extension of the protection to overseas work.

Yes, Travel Insurance is designed for people going abroad as a visitor for leisure or on business trips. The scope of coverage is different from a life insurance plan.

Application

Single trip cover: there is no age limit. Annual cover: The Insured Person(s) must be between 18 to 74 years old, while child(ren) must be under 18 years old (at the policy Commencement Date or Renewal Date). Point to note when applying for child(ren) under 18 years old who do(es) not travel with parent:

- Please select "Friends/relatives" to proceed online application.

No. The travel warning issued by the World Health Organisation against a certain country or region shall have no bearing upon the protection provided by this plan. However, it is suggested that an insured should closely observe the development of the relevant situation as any orders promulgated subsequently by the government may affect the insured's journey and the protection under this plan.

Coverage related

Annual Coverage:

The insurance period of annual coverage is 1 year from the policy effective or renewal date.

Maximum coverage period for each journey (there is no limit on the number of journeys during the insurance period) is the earliest of:

- up to 60 days (inclusive of the date of departure); or

- 3 hours after the Insured Person passed through Hong Kong immigration control point on their return to Hong Kong; or

- At the end of the Period of Insurance

The maximum insurance period of single trip coverage is 6 months.

Under Basic Plan of the Annual China Cover, if the Insured Person sustains bodily injury caused by an assault during a robbery while traveling in mainland China (excluding Hong Kong SAR) or Macau SAR, which leads to death or permanent disability, the original Personal Accident benefit of HKD200,000 will be doubled to HKD400,000.

Insured Person can enjoy policy benefits under issuance of "Black Alert" or "Red Alert" in the planned destination:

(Applicable to Single Trip Coverage and Annual Global Coverage only) Before the trip:

- Trip Cancellation benefit up to HKD30,000

During the trip:

- Trip Curtailment benefit up to HKD30,000 ; or

- Re-routing (Black Alert only) up to HKD10,000; and

- Free 10-day policy extension

For "Black Alert", the Insured Person can be reimbursed the relevant loss up to the maximum Sum Insured. For "Red Alert", reimbursement will be up to 50% of the relevant loss and the maximum Sum Insured.

As long as the condition is covered under the policy, you can enjoy the insurance protection when admitted to non-designated hospitals outside the hospital list. But, please note that the guarantee of hospital admittance deposit in the case for admission to non-designated hospitals is up to HKD20,000. You must also obtain the original copy of the hospital or medical receipt with the diagnosis certified by the attending doctor and settle such medical expenses first. And then file a claim when you return to Hong Kong.

The China Emergency Card is applicable to hospital admission only. If you only visit an out-patient clinic, you need to pay the consultation fee, get a receipt and medical certificate, and then file a claim when you return to Hong Kong. Make sure the medical practitioner treating you is licensed by the competent medical authorities.

Emergency assistance and China Emergency Card

If you need any emergency assistance during your trip, please call our Chubb Assistance – 24 Hour Emergency Assistance Hotline at (852) 3723 3030 .

You'll receive an email from Chubb with instructions on how to get your China Emergency Card and how to add the Card to your Apple Wallet or Android PassWallet.

In such event, you should:

- Check the hospital list and call the Chubb 24-Hour Emergency Hotline at (852) 3723 3030 for assistance.

- Chubb Assistance China Emergency Card

- Travel document, e.g. Re-entry Permit, HKID or Passport

- Keep all hospital receipts and pass them onto Chubb Insurance Hong Kong Limited for claims handling within 30 days after you are discharged

All information provided on the hospital list is subject to change without prior notice. Please contact the 24-hour Chubb Emergency Hotline for assistance.

For cases involving hospitalisation, you must present the China Emergency Card to be eligible for the fast-track admission service. Otherwise you will have to pay the expenses first and then file a claim or contact our 24-hour emergency service for assistance.

Yes, all you need to do is just re-install the China Emergency Card to the original or new mobile device. There is no card replacement cost.

Managing policy

No, application for the Travelsure Protection Plan for the purpose of emigration will not be accepted and the policy will become invalid when you emigrate to an overseas country or territory.

Prior to the expiry date of the policy, you can call the Customer Services Hotline at (852) 3191 6668 (Mondays to Fridays, 9 a.m. to 5:30 p.m., closed on Saturdays, Sundays and Public Holidays) to apply for a policy extension. Chubb Team will review and process the policy extension request. The policy will only be effective when such application has been approved and the premium for the extended period has been paid.

To ensure a continuous coverage, your policy will be renewed automatically upon the expiry date for 1 year and the annual premium will be debited from the credit card provided. The renewal insurability is subject to the terms and conditions in the renewal notice and policy wording. If you do not wish to renew the policy, you should notify Chubb after receiving the renewal notice.

No, you should submit your claim to the Travel Industry Compensation Fund for compensation.

No, cancellation of the journey as a result of administration arrangements of the travel agency are not covered by the Travel Insurance.

In the event of trip cancellation due to unexpected outbreak of natural disaster (such as landslide, earthquake, volcanic eruption, tsunami, typhoon or hurricane) at the scheduled destination arising within 7 days before the departure date of the journey, the Travel Insurance will pay the Insured Person the Booked Holidays forfeited.

Such coverage is not applicable to Annual China Cover - Basic Plan.

Make a claim

Claim procedures.

Find details on how to submit your claim and more.

Download form

You can find all forms and documents here for our insurance policies.

Useful information

- Plan Coverage

- Plan premium

- Declaration (Single Trip Cover)

- Declaration (Annual China Cover/Annual Global Cover)

- Policy Wording(Single Trip Cover)

- Policy Wording (Annual China Cover)

- Policy Wording (Annual Global Cover)

- Hospital List & Contact Number [for Annual China cover ONLY]

- Outbound Travel Alert (OTA) currently in force

Need more help?

Call us for enquiry.

(852) 29989888

Leave us a message

You may be interested in

Other point(s) to note.

- The above general insurance plan ("this Plan") is underwritten by Chubb Insurance Hong Kong Limited (“Chubb”) which is authorised and regulated in Hong Kong SAR by the Insurance Authority. Chubb reserves the right of final approval of the policy issuance. Hang Seng Bank Limited ("Hang Seng Bank") is registered as an insurance agency by the Insurance Authority (License No.: FA3168) and authorised by Chubb for distribution of this Plan. This Plan is a product of Chubb and not Hang Seng Bank. Upon application to this Plan, insurance premium will be payable to Chubb, and Chubb will provide Hang Seng Bank with commission and performance bonus as remuneration for distribution of this Plan. The existing staff remuneration policy on sales offered by Hang Seng Bank takes into account various aspects of the staff performance instead of focusing solely on the sales amount.

- In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between Hang Seng Bank and the customer out of the selling process or processing of the related transaction, Hang Seng Bank is required to enter into a Financial Dispute Resolution Scheme process with the customer; however, any dispute over the contractual terms of the insurance product, underwriting, claims and policy service should be resolved directly between Chubb and the customer.

- The above information is intended to be a general summary for reference only. Please refer to the policy wording for exact terms, conditions and details of the exclusions.

- Including mainland China, Bangladesh, Brunei, Cambodia, Guam, India, Indonesia, Japan, Korea, Laos, Macau SAR, Malaysia, Mongolia, Myanmar, Nepal, Pakistan, Philippines, Saipan, Singapore, Taiwan, Thailand, Tinian and Vietnam.

- Terms and Conditions apply.

- Inbound Travel Insurance - Premier Plan

- Personal AccidentSafe Insurance

- Fire Insurance

- Employees' Compensation Insurance

- BusinessSafe Insurance

- Tycoon Medical Insurance Plan

- CareForYou Flexi Plan for VHIS (Not available for new application)

- Employee Medical Care Plan (formerly known as “Employees Medical Contract”)

- Blue Cross Employee Critical Illness Care Plan New

- Cancer Screening Programme

- Preventive Checkup and Immunisation Programme

- U Care Medical Checkup Scheme

- VHIS Conversion New

- Change of Particulars

- Premium Payment Exchange Rate

- Download Files Insurance-related forms and documents, including application forms, product brochures, terms and conditions, and more

- List of Panel Hospitals

- 24-Hour Emergency Roadside Assistance

- Windscreen Repairers Network

- Travel Insurance Domestic Helper Insurance

- Pet Insurance Other General Insurance

- Motor Insurance Home Insurance

- Claim Procedures & Claim Forms

- CareForYou Flexi Plan for VHIS(Not available for new application)

- Insurance-related forms and documents, including application forms, product brochures, terms and conditions, and more

- Travel Insurance

- Domestic Helper Insurance

- Pet Insurance

- Other General Insurance

- Motor Insurance

- Home Insurance

- Super Agent

High-end VHIS

Travel Protection

Home Protection

Helper Protection

Decoration Protection

SmartPro Drive

Sports Protection

Travel Smart

- Plan Features

- Benefit Details

- Product Leaflet

- Terms & Conditions

- Travel Protection under COVID-19

About Blue Cross

Legal notices, © copyright. blue cross (asia-pacific) insurance limited 2024. all rights reserved..

This website uses cookies for the purpose of enhancing your user experience. You can find more information on the types of cookies we collect, what we use these for, and how to manage your cookie settings in our Cookie Policy and Privacy Policy Statement .

Chat now with BC Buddy

The Straits Times

- International

- Print Edition

- news with benefits

- SPH Rewards

- STClassifieds

- Berita Harian

- Hardwarezone

- Shin Min Daily News

- Tamil Murasu

- The Business Times

- The New Paper

- Lianhe Zaobao

- Advertise with us

HSBC’s major shareholder Ping An exploring ways to cut $17.9 billion stake, sources say

SHANGHAI - Ping An Insurance Group is weighing options that would allow it to reduce its 8 per cent stake in HSBC Holdings, according to people familiar with the matter.

One option an internal team at the Chinese insurance giant is considering is further share sales, similar to the US$50 million sale it disclosed last week, as it seeks to reduce its US$13.3 billion (S$17.9 billion) position in Europe’s largest lender, the people said.

A sovereign wealth fund or ultra-rich investor in the Middle East taking a sizeable stake is another possibility, some of the people said. It is unclear whether there have yet been formal talks about a larger sale of the stake and how feasible it would be, although members of the insurer’s board are currently visiting the Gulf, two of the people said.

The openness to reducing its stake reflects Ping An’s desire to lock in some profits from its investment and a recognition that the more dramatic changes it has pushed for at HSBC stand little chance of succeeding for now.

HSBC shares have risen about 15 per cent in the past year in London, and earlier in May, hit their highest level since 2018. They fell 0.7 per cent on May 16, after reversing earlier gains.

A representative for Ping An Asset Management, the firm’s investment unit, declined to comment. HSBC declined to comment.

Ping An has had a contentious relationship with HSBC in recent years as it campaigned for the bank to embark on a series of reforms, including spinning off its Asian arm. Those efforts were largely defeated at a meeting of the bank’s shareholders in 2023.

In May, the insurer lodged a futile protest vote against chief executive Noel Quinn at the company’s annual shareholder meeting, just days after he surprised the business world with the announcement that he would retire from the lender.

HSBC is now leaning towards appointing its next CEO from a shortlist of internal candidates, including chief financial officer Georges Elhedery and Nuno Matos, head of wealth and personal banking, according to a Bloomberg News report this week.

During the insurer’s ownership of the stake, HSBC has had four CEOs who have all had to navigate the deterioration of ties between China and the US.

Asset managers are increasingly looking to sidestep those tensions as they make new investments. Singapore’s Temasek, a major investor in HSBC’s rival Standard Chartered Bank, has said it will focus on investing in companies with large, domestic-focused businesses as it seeks to avoid those risks.

In May, Ping An’s asset management arm sold US$50 million of HSBC shares, decreasing the insurer’s stake in HSBC from 8.01 per cent to 7.98 per cent. It was the first time Ping An disclosed that it has disposed of shares since the company began its campaign against the bank.

Ping An emerged as a major shareholder in HSBC in 2017. In September 2020, the company scooped up 10.8 million shares of HSBC at an average cost of HK$28.2859 apiece. At the time, the lender’s shares were under pressure because it was participating in a US probe of Huawei.

The firm’s stock has soared since then as investors cheered Mr Quinn’s efforts to shed non-core assets and boost returns. BLOOMBERG

Join ST's Telegram channel and get the latest breaking news delivered to you.

- Shareholders

- Divestments

Read 3 articles and stand to win rewards

Spin the wheel now

Our website doesn't support your browser so please upgrade .

Premier Worldwide Travel Insurance

Relax with HSBC Premier Worldwide Travel Insurance

Enjoy worldwide travel insurance for you and your loved ones.

Cover is provided by Aviva Insurance Limited. You must complete an application to be covered. Please read the Premier Worldwide Travel Insurance Product Information Document (PDF, 152KB) for a summary of terms, conditions, limitations and applicable exclusions.

For the latest coronavirus travel guidance, see what’s covered under HSBC Travel Insurance .

If you already have Premier Worldwide Travel Insurance, find out how you can manage your policy or make a claim.

Premier Worldwide Travel Insurance is only available to HSBC UK Premier bank account holders. It is not available on savings or other accounts. Subject to application.

What's included

Worldwide cover for you, your partner, your dependent children and grandchildren.

The cover is for you (the HSBC account holder) and your domestic partner - if you're both under 70 years of age on the start date of your trip - and any dependent children or grandchildren travelling with you.

Your children are also covered if they're staying with a close relative, travelling with a relative who's over the age of 23, or going on a school/college trip independently with a teacher.

Children covered by this policy must be under 23. Grandchildren covered by the policy must be under the age of 23 and don’t have to live with you.

All insured persons must be residents of the UK, Channel Islands or Isle of Man.

To be covered for medical claims, you must be registered with a doctor in the UK, Channel Islands or Isle of Man.

Holidays in the UK

Holidays taken in the UK, Channel Islands or Isle of Man are covered if they involve a stay of at least 2 consecutive nights.

They must also have either of the following:

- pre-booked holiday accommodation in commercially-run premises

- pre-paid bookings on public transport, including flights and ferries

Please see our definition of ‘pre-booked holiday accommodation’ in your policy document.

Business trips

You're covered to travel outside the UK in connection with an insured person’s job to carry out non-manual work such as administrative tasks, meetings and conferences.

We don't cover any claim in connection with an insured person’s job where the trip involves:

- manual or physical work of any kind

- working with children

- providing healthcare, policing, security or military service

- an insured person’s role as a politician, religious leader, professional entertainer or sportsperson

While this isn’t a specific cruise policy, cruises are covered as standard since they're simply another type of holiday. However, there is no cover for some items that cruise policies may specifically cover, e.g. missed ports, unused excursions, and change of itinerary.

Medical conditions

You'll need to call the HSBC Medical Risk Assessment Helpline on 0800 051 7457 before booking your trip if you, or any insured person, has in the last 12 months, experienced any of the following for a condition not on the accepted conditions list in your policy wording:

- been prescribed medication, including newly prescribed or repeat medication

- received or is awaiting medical treatment, tests or investigations

- been referred to, or is under the care of, a specialist/consultant

- been admitted to hospital or had surgery

You must also tell us if any of the above happen regarding conditions you have already declared, if there are any changes to prescribed medication or if any of the conditions deteriorate.

All pre-existing medical conditions must be on the 'accepted conditions' list in your policy wording to be covered, otherwise they must be disclosed to and accepted in writing by the insurer.

What's not covered

Pre-existing conditions.

Pre-existing conditions are not covered at any time under the policy unless listed on the accepted conditions list, or were disclosed to and accepted in writing by the HSBC Medical Risk Assessment Helpline. You may be able to get cover for these from a specialist insurer. MoneyHelper has a list of these insurers – you can check its travel directory or call 0800 138 7777 .

Undiagnosed symptoms

Undiagnosed symptoms are not covered. There is no cover for any claim where you knew that you or your travelling companion may be unable to travel or may need to come home early at the time you opened your HSBC Premier Account or booked your trip (whichever is later). For example, if one of you fell ill.

Things to know

Are you eligible for premier worldwide travel insurance.

Please ensure you can answer yes to the following questions:

Do you hold an HSBC Premier account?

Are you under 70 years of age?

Are you resident in the UK (not including the Channel Islands or the Isle of Man)?

- Are any dependent children/grandchildren under 23 years of age, on the start date of the trip?

Your application must have been accepted by HSBC for cover to apply.

When does the cover start and end?

Cover starts from the date your travel insurance application is accepted. It remains in place until the account is closed, its converted to a different account, you cancel your policy, or you are no longer eligible for cover – whichever is sooner.

How to make a claim

For details of how and when to make a claim, please visit our travel Insurance claims page.

Make a travel insurance claim

Policy documents

- Premier Worldwide Travel Insurance Product Information Document (PDF, 152KB) Premier Worldwide Travel Insurance Product Information Document (PDF, 152KB) Download

- HSBC Travel Insurance Policy Wording: HSBC Private Banking, HSBC Premier (retained Jade benefits), and HSBC Premier Accounts (PDF, 528KB) HSBC Travel Insurance Policy Wording: HSBC Private Banking, HSBC Premier (retained Jade benefits), and HSBC Premier Accounts (PDF, 528KB) Download

- Privacy Notice (PDF, 160KB) Privacy Notice (PDF, 160KB) Download

- Premier (retained Jade benefits) Travel Insurance Product Information Document (PDF, 257KB) Premier (retained Jade benefits) Travel Insurance Product Information Document (PDF, 257KB) Download

How do I find out if I already have travel insurance with my HSBC bank account?

Premier Travel Insurance is available to HSBC UK Premier customers only. That means customers with an HSBC Premier bank account, an HSBC Premier (retained Jade Benefits) or an HSBC Private Banking account.

HSBC UK Premier customers: You should have travel insurance with your account if you're under 70, are resident in the UK and have successfully completed an application

HSBC Premier (retained Jade Benefits) or an HSBC Private Banking customers: You should have travel insurance with your account if you're under 80, are resident in the UK and have successfully completed an application.

You can request confirmation of your travel insurance on Aviva's website at aviva.co.uk/hsbctravelproof

Do you need to notify us before you use your HSBC debit or credit card outside the UK?

No, you no longer need to notify us before you travel. To find out more about managing your money whilst you travel, see using your card abroad .

I've lost my invitation to apply for HSBC Premier Travel Insurance. How do I apply?

Call us on 03457 70 70 70 . We'll provide you with the link to apply once we've verified your account information.

Our lines are open 08:00 to 20:00 every day.

Do I have to apply for HSBC Premier Travel Insurance at the same time as I open my bank account?

No. You can apply at any time as long as you meet the eligibility criteria and hold a Premier account.

You can call us on 03457 70 70 70 and we'll provide you with the link to apply.

You won't be covered if you don't complete a successful application.

Can I get help to complete my application for HSBC Premier Travel Insurance?

If you need help, please call us on 03457 70 70 70 to make an appointment for a member of our team to complete the application with you over the phone.

I have a joint account. Can I complete the application for HSBC Premier Travel Insurance for both of us?

Yes, although only one account holder should complete the application. If you don’t have permission to provide the other account holder’s details, you won’t be able to complete the application online and will need to call us on 03457 70 70 70 to book an appointment (for which both account holders will need to be available). Our lines are open 08:00 to 20:00 every day.

When can my HSBC Premier Travel Insurance cover start?

Assuming you're eligible, your cover will start as soon as you submit your application.

When will I receive my HSBC Premier Travel Insurance policy documents?

It can take up to a week to process your application and issue your welcome pack and policy documents. If you'd like to review your policy documents now, you can find them in the insurance section at hsbc.co.uk/legal .

How can I get written confirmation I am covered by HSBC Premier Travel Insurance?

If you need confirmation of your cover, you can request it on Aviva's website . If you applied for cover in the past 7 days, please call us on 03457 70 70 70 .

My HSBC Premier Travel Insurance mentions restricted cover. What does this mean?

If your recent HSBC Worldwide Travel Insurance application displayed a restricted cover decision, this is because you, or someone to be covered by the policy, is either:

- not registered with a doctor in the UK; and/or

- has a pre-existing medical condition

There is no cover for any medical claims for anyone not registered with a doctor in the UK.

To change this please register with a doctor in the UK. Once registered, please read the ‘Your Health’ section in your Policy Wording for full details of when and what you must declare.

Anyone with a pre-existing medical condition not shown on the ‘Accepted conditions’ list in your Policy Wording will need to complete a screening. To do this please call the Medical Risk Assessment Team on 0800 051 7457 . There is no cover for any pre-existing medical conditions until this has been completed.

Explore more

See all insurance options, things to consider when booking a holiday, how to make an insurance claim, customer support.

Money Report

HSBC falls 3% amid reports that top shareholder Ping An is looking to trim its stake

By lim hui jie,cnbc • published may 16, 2024 • updated on may 16, 2024 at 10:09 pm.

- Citing people familiar with the matter, Bloomberg said that "one option an internal team at the Chinese insurance giant is considering is further share sales, similar to the $50 million sale it disclosed last week."

- Ping An has butted heads with HSBC's management in recent years, most notably supporting a shareholder motion in 2023 that sought to spin off its Asia business and establish fixed dividends.

Shares of HSBC Holdings fell over 3% in Hong Kong on Friday after reports that its top shareholder Ping An Insurance might be looking to cut its stake in the British bank.

24/7 Los Angeles news stream: Watch NBC4 free wherever you are

Despite the fall, HSBC's share price is still at its highest since August 2018, trading at about 68 Hong Kong dollars per share.

Citing people familiar with the matter, Bloomberg reported the Chinese insurer is looking at possibly reducing its stake in the bank further "as it seeks to reduce its $13.3 billion position in Europe's largest lender."

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

There are several options including "further share sales, similar to the $50 million sale it disclosed last week."

Ping An sold HSBC shares worth 391.49 million Hong Kong dollars ($50.19 million) on May 7, cutting its stake from 8.01% to 7.98%.

The sale marked the first disposal of shares from Ping An since it backed a 2023 shareholder motion that sought to spin off its Asia business and establish fixed dividends. That motion was eventually defeated.

World's top golfer Scottie Scheffler arrested on charges of assaulting officer at PGA championship event

As Tesla layoffs continue, here are 600 jobs the company cut in California

"A sovereign wealth fund or ultra-rich investor in the Middle East taking a sizable stake is another possibility," Bloomberg said, citing unnamed sources.

Also on CNBC

- CNBC Daily Open: Dow briefly tops 40,000, meme stocks down but not out

- Walmart's earnings report gave shareholders exactly what they hoped for, says UBS' Michael Lasser

- Here's where we've trimmed our portfolio and are reallocating money, says Wells Fargo's Wren

This article tagged under:

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Top hsbc shareholder ping an exploring ways to cut $13 billion stake.

(Bloomberg) -- Ping An Insurance Group Co. is weighing options that would allow it to reduce its 8% stake in HSBC Holdings Plc, according to people familiar with the matter.

Most Read from Bloomberg

China Attempts to End Property Crisis With Broad Rescue Package

With a BlackRock CEO, $9 Trillion Vanguard Braces for Turbulence

US Inflation Data Was Accidentally Released 30 Minutes Early

Putin and Xi Vow to Step Up Fight to Counter US ‘Containment’

Jamie Dimon Sees ‘Lot of Inflationary Forces in Front of Us’

One option an internal team at the Chinese insurance giant is considering is further share sales, similar to the $50 million sale it disclosed last week, as it seeks to reduce its $13.3 billion position in Europe’s largest lender, the people said, declining to be identified as the deliberations are private.

A sovereign wealth fund or ultra-rich investor in the Middle East taking a sizable stake is another possibility, some of the people said. It’s unclear whether there have yet been formal talks about a larger sale of the stake and how feasible it would be, although members of the insurer’s board are currently visiting the Gulf, two of the people said.

The openness to reducing its stake reflects Ping An’s desire to lock in some profits from its investment and a recognition that the more dramatic changes it has pushed for at HSBC currently stand little chance of succeeding.

Ping An Asset Management, the firm’s investment unit, reiterated on Friday that HSBC is a long-term financial investment. “The bank has maintained unique competitive advantage in Asia,” it said in an e-mailed statement. “We’re confident of its long term development.”

HSBC declined to comment.

HSBC shares have risen about 15% in the past year in London and earlier this month hit their highest level since 2018. They fell 0.7% on Thursday, after reversing earlier gains.

HSBC shares declined 3% as of 11:55 a.m. in Hong Kong on Friday, while Ping An gained 1.3%.

Should Ping An “decide to reduce its position, we believe this would likely be over a prolonged period in order to maximise value, which would therefore mitigate the impact of any overhang risk,” Andrew Coombs, Michael Zhang and Rajkumar Choudhary at Citigroup Inc., wrote in a note.

Ping An has had a contentious relationship with HSBC in recent years as it campaigned for the bank to embark on a series of reforms, including spinning off its Asian arm. Those efforts were largely defeated at a meeting of the bank’s shareholders last year.

Earlier this month, the insurer lodged a futile protest vote against Chief Executive Officer Noel Quinn at the company’s annual shareholder meeting just days after he surprised the business world with the announcement that he would retire from the lender.

HSBC is now leaning towards appointing its next CEO from a shortlist of internal candidates, including Chief Financial Officer Georges Elhedery and Nuno Matos, head of wealth and personal banking, Bloomberg News reported this week.

Read more: HSBC’s Noel Quinn Ends 37-Year CEO Dream With Surprise Departure

During the insurer’s ownership of the stake, HSBC has had four chief executives who have all had to navigate the deterioration of ties between China and the US.

Asset managers are increasingly looking to sidestep those tensions as they make new investments. Temasek, a major investor in HSBC’s rival Standard Chartered Plc, has said it will focus on investing in companies with large, domestic-focused businesses as it seeks to avoid those risks.

This month, Ping An’s asset management arm sold $50 million of HSBC shares, decreasing the insurer’s stake in HSBC from 8.01% to 7.98%. It was the first time Ping An disclosed that it’s disposed of the stock since the company began its campaign against the bank.

Ping An emerged as a major shareholder in HSBC in 2017. In September 2020, the company scooped up 10.8 million shares of HSBC at an average cost of HK$28.2859 apiece. At the time, the lender’s shares were under pressure because it was participating in a US probe of Huawei.

Citi estimates Ping An’s average purchase price of HSBC shares at close to about HK$50 vs current the share price of about HK$70.

The firm’s stock has soared since then as investors cheered Quinn’s efforts to shed non-core assets and boost returns.

--With assistance from Dinesh Nair and Pei Li.

(Updates with Ping An Asset Management’s comment in fifth paragraph.)

Most Read from Bloomberg Businessweek

Neuralink’s First Patient: ‘It Blows My Mind So Much’

How the ‘Harvard of Trading’ Ruined Thousands of Young People’s Lives

Milei Targets Labor Law That’s Set to Hand Banker $10 Million Severance

The DNA Test Delusion

Europe’s Banks Find Breaking Up With Russia Is Hard to Do

©2024 Bloomberg L.P.

Recommended Stories

China expected to stand pat on lending rates in may.

China is widely expected to hold benchmark lending rates steady on Monday, a Reuters survey showed, although expectations are growing for a cut in the mortgage reference rate as the authorities scramble to boost housing. The loan prime rate (LPR), normally charged to banks' best clients, is calculated each month after 20 designated commercial banks submit proposed rates to the People's Bank of China. Among the other six respondents, four predicted a steady one-year LPR but a five- to 20-basis-point reduction to the five-year tenor, while the remaining two projected similar cuts to both rates.

China’s Special Bond Sale Sees Demand In Line With 2024 Trend

(Bloomberg) -- China kicked off issuance of this year’s special sovereign bonds with a 30-year auction that drew demand of 3.9 times the amount on offer.Most Read from BloombergChina Attempts to End Property Crisis With Broad Rescue PackageWith a BlackRock CEO, $9 Trillion Vanguard Braces for TurbulenceUS Inflation Data Was Accidentally Released 30 Minutes EarlyPutin and Xi Vow to Step Up Fight to Counter US ‘Containment’Jamie Dimon Sees ‘Lot of Inflationary Forces in Front of Us’Forty billion y

Biden Seeks to Bolster Solar Manufacturers With Tax and Trade Moves

(Bloomberg) -- The Biden administration is initiating a suite of policies it says will help foster a deeper domestic supply chain for solar panels, following pleas from US manufacturers confronting a surge of tariff-free imports. Most Read from BloombergChina Attempts to End Property Crisis With Broad Rescue PackageWith a BlackRock CEO, $9 Trillion Vanguard Braces for TurbulenceUS Inflation Data Was Accidentally Released 30 Minutes EarlyPutin and Xi Vow to Step Up Fight to Counter US ‘Containmen

China rolls out new measures to fix its property crisis, spur growth

China announced a slate of fresh measures Friday to reinvigorate its ailing property industry after the latest data showed housing prices have slumped nearly 10% since the start of the year. Among other things, the central bank said it would reduce the minimum down payment for mortgages and remove the floor on interest rates for first and second homes. China’s housing market has slumped after a crackdown on excessive borrowing by property developers several years ago, dragging along a wide range of other businesses — such as home furnishing, appliances and construction — and slowing growth in the world’s No. 2 economy.

Shanghai eases data-export curbs sought by Tesla, other firms, document shows

SHANGHAI (Reuters) -Shanghai has compiled a list of data that can be transferred overseas without security assessments, according to a government document seen by Reuters, a much anticipated move as China tries to lure foreign investment to boost a sluggish economy. Foreign firms including financials and automakers such as Elon Musk's Tesla have been lobbying the Chinese authorities to allow cross-border sharing of information after Beijing tightened control of data generated domestically in a national security drive. The 2022 rules require all "important" offshore transfer of data related to operations within the country to clear security reviews by the Cyberspace Administration of China.

Hong Kong allows China's digital yuan to be used in local shops

Hong Kong will allow mainland China's pilot digital currency to be used in shops in the city, the head of its de facto central bank said on Friday, marking a step forward for Beijing's efforts to internationalise the yuan amid rising geopolitical tensions. The programme, backed by Beijing, will allow mainland Chinese and Hong Kong residents to open digital yuan wallets via a mobile app developed by China's central bank and will permit them to make payments in retail shops and some online stores in Hong Kong and in mainland China.

China’s Aluminum Smelters Boost Output to Record on High Demand

(Bloomberg) -- China’s aluminum output climbed to a record to feed robust demand as manufacturing and exports power the country’s increasingly unbalanced economic recovery this year.Most Read from BloombergChina Attempts to End Property Crisis With Broad Rescue PackageWith a BlackRock CEO, $9 Trillion Vanguard Braces for TurbulenceUS Inflation Data Was Accidentally Released 30 Minutes EarlyPutin and Xi Vow to Step Up Fight to Counter US ‘Containment’Jamie Dimon Sees ‘Lot of Inflationary Forces i

France Works to Regain Control of Parts of New Caledonia

(Bloomberg) -- The French government is moving to regain full control of the Pacific territory of New Caledonia, High Commissioner Louis Le Franc said, as extra security forces arrive in the archipelago to end a week of violent protests by pro-independence groups.Most Read from BloombergChina Attempts to End Property Crisis With Broad Rescue PackageWith a BlackRock CEO, $9 Trillion Vanguard Braces for TurbulenceUS Inflation Data Was Accidentally Released 30 Minutes EarlyPutin and Xi Vow to Step

EU demands clarity from Microsoft on AI risks in Bing

BRUSSELS (Reuters) -The European Commission could fine Microsoft if it doesn't provide adequate information on risks stemming from generative AI features in search engine Bing by May 27. The Commission said on Friday that it is worried about the dissemination of deep fakes and automated manipulation of services that can mislead voters. It said it was stepping up enforcement actions on the matter, as it had not received a reply to a request for information sent on March 14.

Morning bid: Dow flirts with 40k, China fights homes bust

After a week of worldwide stock market records, Friday seems set for a breather - with attention switching to the deepening Chinese housing bust and sweeping government plans to stop the rot there. Thursday's saw the blue-chip Dow Jones briefly top the 40,000 milestone as the S&P500, Nasdaq and MCSI all-country index all clocked all-time intraday highs too. Signs of U.S. disinflation resuming and the wider economy cooling all stoked hopes that Federal Reserve interest rate cuts are indeed coming - with annual corporate profit growth and year-to-date stock index gains revving up into double digits.

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 26 Feb 2024, new safety measure in the Android version of the HSBC HK App will be launched to protect you from malware. Learn more .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy .

- HSBC Online Banking

- Register for Personal Internet Banking

- Stock Trading

- Business Internet Banking

FX Viewpoint Flash: RMB: Higher US tariffs on Chinese strategic products

16 May 2024

Key takeaways

- The US will increase tariffs on a range of strategic goods from China including EVs, solar cells, and lithium-ion batteries.

- Our economists think that the higher duties will have a limited impact on bilateral trade.

- This could be another source of upward pressure for USDRMB, but probably not the straw that breaks the camel’s back.

The US will raise duties on USD18bn worth of imports from China over the next two years

The Biden administration has completed the statutory four-year review of US Section 301 tariffs applied against China – which were first introduced by the Trump administration in 2018. As a result of the review, it will retain existing Section 301 tariffs and will raise duties on USD18bn worth of imports from China over 2024-26. Notably, the Biden administration will quadruple existing additional tariffs on Chinese electric vehicles (EVs) to 100%, double duties on semiconductors and certain solar products to 50%, and increase additional tariffs on lithium-ion batteries to 25% (from 7.5%). Additional tariffs on steel and aluminium will increase to 25% (from 0% to 7.5% currently). The first tranche of higher duties is expected to take effect in August and some machinery used in domestic production (namely for solar manufacturing) could be excluded.

China’s Ministry of Commerce (MoFCOM) responded to the US actions by stating its “ firm opposition ” and that “ China will take resolute measures to defend its rights and interest ” (MoFCOM, 14 May 2024).

The tariff announcement will have a limited impact on bilateral trade, in our economists’ view

In our economists’ view, the higher tariffs are unlikely to have a significant impact on overall US-China trade flows, given: (1) most of these goods were already subject to additional duties, (2) the targeted goods comprise just 4% of total US imports from China, (3) it was widely expected that existing Section 301 tariffs would be retained, and (4) the increased duties will be phased in. Our economists also think that this announcement has limited direct impact on the Chinese economy over the near term . However, the turn towards more trade protectionist measures suggests that geopolitical tensions remain elevated despite an improvement in dialogue channels over the last few quarters

USD-RMB did not really respond to the tariff announcement

As for USD-RMB, it did not really respond to the tariff announcement. Indeed, USD-RMB did not actually respond much in early 2018, when US tariffs were first suggested for specific products (under Sections 201 and 232). Only when the total value of goods targeted became much larger amid the various rounds of Section 301 tariffs – about USD360bn eventually or around 70% of China’s exports to the US (based on 2017 trade data), USD-RMB rose by 13% from 6.35 to 7.20 between 2Q18 and 3Q19. So, USD-RMB could face upward risk if US tariffs become much wider in scope.

USD-RMB is likely to remain largely stable, with the help of FX policy

The Chinese authorities seem to prioritise socio-economic stability, preserving FX reserves and RMB internationalisation. USD-RMB is likely to remain largely stable, supported by the People’s Bank of China’s FX policy , but the challenges are clearly mounting, from equity outflow pressures and FX demand-supply imbalance onshore, to dividend season, among other factors.

Related Insights

FX Viewpoint: The GBP to take a turn for the worse

FX Viewpoint: USD-JPY: Signs of intervention?

FX Viewpoint Flash: Fed hold hits USD

FX Viewpoint: USD to grind higher over the near term

Disclosure appendix.

Important disclosures

This document is for information purposes only and it should not be regarded as an offer to sell or as a solicitation of an offer to buy the securities or other investment products mentioned in it and/or to participate in any trading strategy. Information in this document is general and should not be construed as personal advice, given it has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on it, consider the appropriateness of the information, having regard to their objectives, financial situation and needs. If necessary, seek professional investment and tax advice.

Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment products mentioned in this document and take into account their specific investment objectives, financial situation or particular needs before making a commitment to purchase investment products.

The value of and the income produced by the investment products mentioned in this document may fluctuate, so that an investor may get back less than originally invested. Certain high-volatility investments can be subject to sudden and large falls in value.

that could equal or exceed the amount invested. Value and income from investment products may be adversely affected by exchange rates, interest rates, or other factors. Past performance of a particular investment product is not indicative of future results.

HSBC and its affiliates will from time to time sell to and buy from customers the securities/instruments (including derivatives) of companies covered in HSBC Research on a principal or agency basis.

Whether, or in what time frame, an update of this analysis will be published is not determined in advance.

Additional disclosures

1. This report is dated as at 16 May 2024.

2. All market data included in this report are dated as at close 15 May 2024, unless a different date and/or a specific time of day is indicated in the report.

3. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

4. You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.