DohaGuides WhatsApp Channel

How To Get Health Insurance For Visitors To Qatar (2024)

Doha Guides Team regularly reviews this article to ensure the content is up-to-date and accurate. The last editorial review and update were on 16 January 2024.

According to a recent announcement by Qatar’s Ministry of Public Health (MoPH), visitors to Qatar are required to have a health insurance policy starting from 1 February 2023.

Qatar’s Law No. (22) of 2021 regulating healthcare services in Qatar stipulates that visitors must be covered by a mandatory health insurance scheme. The mandatory health insurance scheme will be implemented in phases, and the first phase has started on 1 February 2023 .

This article will discuss everything you need to know about health insurance for visitors to Qatar , including the cost, coverage, authorised providers and how visitors can buy health insurance.

Is Health Insurance For Visitors To Qatar Mandatory?

Why is qatar introducing a health insurance policy, how to get visitors’ health insurance, moph approved health insurance.

- Cost of Visitor's Health Insurance Policy:

Validity Period of Health Insurance For Visitors To Qatar

- Coverage Under Visitor's Health Insurance Policy

Criteria for Accepting International Health Policy

Moph helpline, frequently asked questions.

Starting 1 February 2023, all visitors to Qatar applying for a visitor’s visa are required to have health insurance policies. This is mandatory for all types of visit visas including Family Visit Visa , GCC Residents Visit Visa , and Visa On Arrival .

AUGUST 2023 UPDATE: According to Qatar Government’s Hukoomi helpline, visitors traveling on an instant visa and staying in Qatar for less than 30 days do not need to obtain Health insurance . However it is highly recommended to have insurance as it can be helpful in case of an emergency.

GCC citizens are exempted from the mandatory health insurance while entering Qatar.

According to MOPH, the health and well-being of visitors are of paramount importance. Therefore the Government has established the necessary regulations to ensure that visitors are protected against accidents and medical emergency-related conditions during their stay.

By implementing a sustainable and effective healthcare system, and by regulating healthcare expenditures, the scheme aims to regulate health insurance and ensure continuous improvements.

Visitors Applying For Visit Visa Online

- Visitors applying for a visit visa online via the Metrash App will be directed to the MOPH website.

- There, they can select one of the insurance companies registered with the Ministry to purchase the visitors’ policy after completion of all other relevant visa requirements.

- Once the insurance policy is issued by the selected insurance company, the Ministry of Interior will issue the appropriate visit visa.

The Visitor will receive the Health Insurance Policy from the website of the Insurance companies. The policy can be printed, kept and shown when needed.

Visitors Eligible For Visa On Arrival

To ensure speedy completion of your procedures upon arrival at the various border crossings (airport, land and seaports), visitors are advised to purchase a visitor insurance policy before arriving at these ports from the MOPH link provided below and follow the same procedures mentioned.

The registered insurance companies are listed on the Ministry of Public Health’s website. Visitors can choose any one of the listed insurance companies through the links available on MOPH website:

Here is the link to the page on the MOPH website.

The registered insurance companies (in alphabetical order) are:

- Al Khaleej Takaful Insurance

- Beema Damaan Islamic Insurance Company

- Doha Insurance Group

- Doha Takaful

- General Takaful

- Islamic Insurance

- Qatar General Insurance & Reinsurance Co. Q.P.S.C.

- Qatar Insurance Company

- QLM Life & Medical Insurance Company

MoPH has indicated that for visitors who hold international health insurance, the insurance policy must include Qatar, be valid during their stay in the country and be issued by one of the insurance companies approved in Qatar.

Cost of Visitor’s Health Insurance Policy:

The standard premium for a single insurance policy will be QAR 50 for 30 days (USD 13.73). For the extension of a visit visa beyond 30 days, the visitor will have to buy an additional policy.

In addition, visitors can obtain additional health insurance policies, and the premiums for these policies will vary depending on the insurance company’s prices.

Health insurance premiums cannot be refunded after the purchase of the policy if the stay duration is less than the period of the visa.

The effective date of coverage is the date of entry of the visitor at any border.

If the visitor wishes to extend his/her stay in the State of Qatar, then he/she must purchase a new health insurance policy. The minimum duration of the visitor’s insurance policy is 30 days, it is not possible to purchase a policy with less than this duration.

The basic visitor insurance policy in case of a single-entry visa expires upon leaving the State of Qatar through any air, sea or land ports.

There is an insurance policy for multiple-entry visas and it remains valid from the date of entry until the policy expires.

Coverage Under Visitor’s Health Insurance Policy

The mandatory health insurance for visitors will only cover emergency medical treatments and accidents .

Emergency Medical Treatment:

- Up to QAR 150,000 for the policy period and within the State of Qatar.

- Emergency medical assistance with a sub-limit of QAR 35,000, includes:

- Emergency ambulance transportation within the State of Qatar, and where necessary.

COVID-19 and Quarantine:

- Sub-limit up to QAR 50,000.

- Covid-19 treatment for positive cases.

- Quarantine expenses (for confirmed cases) are up to QAR 300 per day.

Repatriation:

In the event of the visitor’s death within the State of Qatar, the cost of repatriation is covered up to an amount of QAR 10,000.

Is there a waiting period for this policy to be active?

No, there will be no waiting period for the visitor’s health insurance policy.

Does the policy require any copayment or deductible?

No copayment or deductible will be required for any covered services as per the terms and conditions stipulated in the visitor’s health insurance policy.

In addition to the listed insurance companies, Qatar MOI may accept some international health insurance companies, subject to the fulfilment of the following conditions and requirements set by the Ministry of Public Health to be accepted for entry visa issuance:

- To be issued by one of the insurance companies included in the approved list by the Ministry of Public Health.

- Its geographical coverage includes the State of Qatar.

- To be valid and cover the period of stay in the country.

- To cover emergency services and accidents with an annual limit of 150,000 Riyals or more, without deductibles or excesses.

- To include a QR code.

The policy can be uploaded to the website of the Ministry of Interior or a paper copy to be submitted to the competent officer at the border crossing.

In case of any queries about the mandatory health insurance policy, you can call the MOPH Helpline on 16000 (inside Qatar) . Extension number 1 is dedicated to health insurance. International visitors can call 00974-44069963. For complaints, you can email: [email protected]

Is travel insurance mandatory for Qatar visit visa?

Yes, travel insurance is mandatory for all visitors to Qatar with effect from 1 February 2023.

How much is the travel insurance fee for Qatar visit visa?

The premium for the Mandatory Visitors’ Health Insurance policy is QAR 50 per month.

Does the Visitor Health Insurance Policy cover me in GCC or other countries?

No. The Visitor Health Insurance coverage is limited to the State of Qatar only.

What documents are needed in case of emergency treatment?

Passport & Insurance Policy Documents will be required for emergency treatment.

Does the basic insurance policy for visitors cover emergencies during travel?

The basic visitor insurance policy coverage begins upon the visitor entering the State of Qatar.

Related Articles:

- How Hayya Card Holders Can Visit Qatar in 2023

- Qatar Visa On Arrival For Indians: Complete Guide

- GCC Residents Visit Visa (With List of Professions)

- Qatar Family Visit Visa: Requirements and Procedure

- Qatar Family Residence Visa Procedure

Copyright © DohaGuides.com – Full or partial reproduction of this article is prohibited.

95 thoughts on “How To Get Health Insurance For Visitors To Qatar (2024)”

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

My family staying in Qatar since 7th March 2024 and I want to extend Hayya Tourist Visa A1 for My Family. Do I need to buy only a new Health Insurance Policy online through Qatar Insurance Company or any medical check up also requires..

Greetings, my mother is currently in A1 Hayya visa status since March 4th, and today her visit visa got approved. Kindly guide me in converting my A1 Hayes visa into a visit visa.

Hi Kavitha, You can try visiting the Airport Immigration office (near Qatar Airways Cargo). Sometimes they would allow visa change type inside country by paying QR 500 (no guarantee). If they don’t allow, you will have to exit to Saudi Arabia and come back on new visa. Here is how: https://www.dohaguides.com/visa-changing-process-via-abu-samra-land-border/

Dear ALL, I am writing to inform you that I have recently obtained approval from METRASH for my mother’s application. I have also received a confirmation SMS regarding this matter. However, I am encountering difficulties when attempting to make the payment for the VISA fees (amounting to QR 200), as I am receiving an error message stating that the health insurance has not been paid.

I have thoroughly checked the METRASH platform, but there appears to be no available option to make the insurance payment. Consequently, I would like to inquire whether it is necessary for me to visit the MOI website and pay the insurance fee for one month separately. Moreover, I would appreciate clarification on whether such payment will be automatically updated in the system, subsequently allowing me to proceed with the payment of the VISA fees (QR 200). I kindly request a prompt response to this matter.

Hi OB, For health insurance, you are not paying through Metrash. It should be paid directly to the insurance company and it will be updated in the system (through visa number). When you receive the visa approval SMS there will be a link to the MOPH website from where you can select an insurance company and buy insurance directly. This will take some time (less than 24 hours) to update in the MOI system. The visa payment and visa print option will work after this only. If you are having technical difficulties, you can call 109.

Dear DOHA GUIDE TEAM, The message i received from MOI mentioning its approved didnt have any links thats the ISSUE

Hi OB, You can use this link and select any provider: https://www.moph.gov.qa/arabic/derpartments/policyaffairs/hfid/hirs/insurancecompanies/Pages/default.aspx Make sure to enter the correct passport number and name.

I would like to visit Qatar with my family by road for a short visit of two days. Is health insurance mandatory? I am a GCC resident with an Indian passport Please guide

Hi Shruthi, Health insurance is recommended but not mandatory for short trips less than 30 days.

Hello DG, I bought Insurance policy for my Son last month and the Policy start date is Dec.17 this year but He was not able to travel on the that day. He is travelling here to Qatar with Visit visa only this coming Dec 29. What should I do to change the policy start date to Dec. 29?

Hi Jr, You need to contact your insurance provider. They can change in the system.

Hi DG, The application for family visit visa is approved, how many months should I purchase for health insurance?

Hi Mariam, Minimum is one month. If you plan to apply for an extension, you can buy up to 6 months. You can also buy for one month now and purchase additional duration later.

Good day DG, With the new regulations posted by MoI with the mandatory health insurance for family resident visa (yearly), how many months should I purchased? And how? I have already an approved resident visa for my husband. Still he is in the Philippines. During the application it does not say that insurance is mandatory. How should i go about it now? Thank you.

Hi Anne, Currently there is no clarification about insurance for already approved visa. This may be applicable to new applications only. If you want you can purchase one month insurance for QR 50.

Thanks for this. By the way how to purchase 1 month insurance for 50qr? Thank you.

Hi Anne, This is the official website: https://www.moph.gov.qa/english/derpartments/policyaffairs/hfid/hirs/insurancecompanies/Pages/default.aspx You can click on any insurance company and purchase. The rate is the same for all companies.

Hello, I am planning to travel to Qatar for 3 weeks between November 3rd and 26 on a Hayya entry visa. What should my insurance coverage be? The 30 days option or the Hayya option?

Hayya option is extending my validity until January 24, 2024 and I plan to only stay in Qatar for three weeks. I prefer not to pay the extra 100 riyals

Hi Jasim, If your return ticket is within 30 days take 30 days insurance. Normally it is accepted.

hello, i plan to visit my sister in doha from 1st nov 23 to 10th nov 23 with my two children and mother. Do i still need health insurance for ten days stay?

Hi Asma, As per the updated rules, health insurance is not needed for visits less than 30 days. However some airline staff don’t know this rule and will ask for insurance. If you are being insisted you can purchase insurance using your mobile for QR 50 (within 5 minutes). Note: If you are taking Family Visit Visa insurance is compulsory (your sponsor will get an SMS to take insurance).

Hello I hope this helps someone. I emailed Hukoomi to ask if Mandatory Health Insurance is needed for short visits. They replied:-

“Dear Valued Customer, Thank you for contacting us on Hukoomi, Please note that visitors traveling on an instant visa and staying in Qatar for less than 30 days do not need to obtain Health insurance. We are always happy to serve you, Thank you for contacting us. Best Regards,”

Hi Zubair, Thanks for the information. We have added this to the article. Hope it helps others.

Hello, I am planning to visit Qatar with my wife and two kids and stay for only 11 days

Do I need Health insurance to apply for visa entry.

Hi Momo, As per official sources, health insurance is only mandatory if staying for more than 30 days. However most airlines are asking for this during check-in. We recommend taking health insurance.

Dear DG Team, Please advise.. Travel Insurance and Health Insurance both are mandatory for the Guest who coming to Qatar on Hayya ? Thank you.

Hi Rifkhan, Only health insurance (from MOPH approved provider) is required.

We hold Australian Passports and will arrive in Doha next month in Transit to Sydney. Since we have 20 hours of transit time before the connecting flight to Sydney, we want to do a 3-hour transit tour in Doha. Are we allowed to do that? Our baggage will be interlined so we do not have to clear our baggage through customs. Please advise whether we need to obtain a transit visa and also health insurance prior to arrival in Doha, Hamad International Airport.

Hi Colin, As Australian citizens you can get visa on arrival. Usually they will not ask health insurance for short duration trips. If required you can buy online from the airport itself.

I travel to Qatar regularly for work. How can I purchase a multiple entry medical insurance for a 12-month period. Its quite frustrating having to purchase a new policy every month, especially when I have international medical insurance. The company I use, is not a Qatar based company, and is not on the registered on your list. I saw on the website there is an option for an annual policy, but there is no guidance as to which company does this. The one company I tried, said you had to be a Qatari resident. Is there a link you could send me to assist with this?

Thanks, Claire

I am coming on GCC Hayya visa which is single entry and for 1 month, thus do I need health insurance, so how can I get the insurance for 1 month?

Moreover, if I have an insurance issued in my residing country which covers qatar, will I still require one?

Hi Ahamed, You will need to take health insurance from any local provider listed on the MOPH website .

HI Doha Guide team, Thanks for the info but Once we go on Local Health insurance provider website , There are two options 1. Visit 2. Hayya

which one to choose to issue a health insurance for Visa of 30days

Hi Gautam, Select “Visit”. If you select “Hayya”, it would automatically select date till January 2024.

I need to know about the visa on arrival, i am UAE resident with Indian passport and engineer visa. I will be travelling on June 23. what are the visa requirements? will i be eligible for visa on arrival or do i need to apply visa on the hayya portal and ask my family in Qatar to add me in their hayya portal as a guest? thank you.

Hi Aaquib, You can get GCC Residents Visa On Arrival (as you are engineer) or apply online in advance and travel with the entry permit so that you don’t have to worry about approval. Here are the details: https://www.dohaguides.com/qatar-visa-on-arrival-for-gcc-residents/

This is May 2023 and our visit to Qatar is for several days in October 2023. Can we get our 30 day one month health insurance now ahead of time so that we can cross it off our list…but not have it become effective until October? Or do we have to wait until closer to our trip? Thank you.

Hi Linda, Please wait till September. It can be done online quickly and you never know when rules change.

Hi DG, Good Day! My family is coming with Hayya Card and they will stay here next 3months. I would like to know if they need insurance until January 2024 or for 3 months? Please advise. Regards,

Hi Smijesh, Even though the Hayya portal says insurance is required till January, most airlines are accepting travellers with insurance until return flight date. We never know when they will become strict about this. If they insist on insurance for full duration, you can take additional insurance online while at the airport.

Hi DG, Appreciate your quick response.

You are welcome Smijesh!

I would like to ask regarding the Visa on Arrival. Am planning to go on June 30 and will be back on July 1 also. I am a UAE resident and a Philippine passport holder. Kindly advise what are the requirements needed as of today April 10,2023.

Hi Gemma, Philippines is not included in the list of countries eligible for regular visa on arrival. You can check if your profession is eligible for GCC Residents Visa On Arrival: https://www.dohaguides.com/qatar-visa-on-arrival-for-gcc-residents/ If your profession is not eligible, please contact the Qatar Government Helpline at +974-44069999 or [email protected] .

Hi I book my eid holidays, 4 day in Qatar, I still need a health insurance? I only stayed 4 days in Qatar, kindly reply thank you

Hi Sara, Health insurance is required even for 1 day.

i made a mistake in insurance name. can it be solved?

Hi Saad, You can contact your insurance provider and they can fix it.

Start typing and press enter to search

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

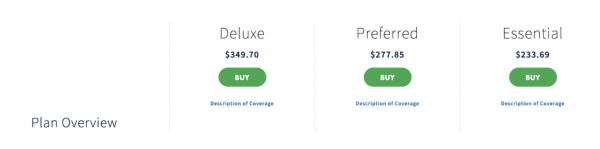

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Processing your request

- Confirmation

Notification

- Select your outbound flight

Purchase travel insurance

Select language

Top searched pages

- Ok to board

- Manage booking

- Flight status

- Claim miles

- Visit our Frequently Asked Questions (FAQs)

- Book a flight

- Meet and greet

- Home check-in

- Airport transfer

- Book with a promo code

- Book a Flight + Hotel

- Manage your booking

- Upgrade to Business Class

- Online check-in

- Add baggage

- Select seat

- Add travel insurance

- Additional services

- Select an extra legroom seat

- Book a hotel

- Park and fly New

- Book a tour

- Sporting equipment

- Visa-on-arrival destinations

Quick links

- Fare types and rules

- Visas and passports

- Visa requirements by country

- Ways to pay

- Business Class

- Economy Class

- Accessibility and assistance services

- Boeing 737 MAX

- Onboard experience

- eShop by flydubai

- Hand baggage

- Checked baggage

- Forbidden items

- Delayed or damaged baggage

- Special baggage

- Airport baggage rates

- Belt pick-up and delivery

- Terminal 3 (DXB) operations

- Umrah/Hajj season flights

- Flights operated by Smartwings

- Flying while pregnant

- Wheelchair and mobility assistance

- Interline baggage allowance and rules

Flying with us

- All destinations

- Central Asia

- Indian Subcontinent

- Middle East

- Southeast Asia

- Flights to Tbilisi

- Flights to Pattaya

- Flights to Milan

- Flights to Istanbul

- Flights to Colombo

- Flights to Riyadh

- Holidays by flydubai

- Lowest fares

- Travel ideas

- Connecting flights

Where we fly

Popular getaways, new destinations.

- Spending Miles

- Membership tiers

- Programme partners

- Skywards FAQs

- Contact Skywards

- Skywards T&Cs

- Member login

- Join Skywards

- Add Skywards number

Emirates Skywards

Discover more.

- Operational updates

- Payment partners

- Voucher partners

- flydubai corporate travel

- Partner with flydubai

- Travel agents login

- Tax invoice

Enter your details below to add travel insurance

Please enter last name

Please enter booking reference number

Please select the checkbox to confirm

Due to the widespread media reports of Coronavirus (COVID-19), and the World Health Organization (WHO) announcement declaring COVID-19 a pandemic, COVID-19 is a foreseen or known event. If you are purchasing a new policy, certain coverages may not apply. Read full details .

Travel Guard for flydubai

Travel Guard for flydubai is the travel insurance provided by flydubai's travel partner, AIG Inc. It can cover you if:

- you have to cancel your trip

- you need emergency medical treatment while you're away

- you need to fly home early

How do I buy Travel Guard for flydubai?

You can take out your travel insurance when you book your flydubai flight:

- flydubai.com

- through the flydubai Customer Centre

- through one of flydubai's Travel Shops

Who can buy Travel Guard for flydubai ?

You can buy for yourself and for other travelers. You must be a resident of the country where travel insurance policy is issued. People, who you want to cover, must be:

- a resident of the country where they are starting their journey with you and you must be a resident of the country where the travel insurance policy is issued; and

- over 2 years old .

Frequently asked questions

The basic information about policy benefits (with the maximum insured limits in US dollars) is shown in the table below. These are not complete terms and conditions of cover. For full coverage information please read the policy terms and conditions.

* ‘Deductible’ refers to the amount of money you’d need to pay yourself before you can start claiming under the benefit.

You’ll be covered when you fly from any of the following countries with flydubai:

- the United Arab Emirates

This Policy will not cover any loss, injury, damage or legal liability caused by, sustained or arising directly or indirectly from planned or actual travel in, to, or through Belarus , Cuba , Iran , North Korea , Russia , Syria , Sudan , Ukraine or the Crimea Region and actual travel in, to, or through Afghanistan or Iraq .

You can read the full terms and conditions of your insurance policy by clicking on the country you’re starting your journey from in the list above. The terms and conditions will also be provided to you for acknowledgment at the time of purchasing a travel policy.

No, just make sure you have your policy number with you.

Your coverage period will be shown on your policy. Generally, you will be covered for as long as your trip lasts, up to a maximum of 90 days , starting from the day you travel.

If you’re only travelling one way , you will be covered for up to 7 days from the day you arrive at your destination on a flydubai flight.

You will only be covered when you fly with flydubai.

Trip Cancellation solely for concern or fear of travel associated with sickness, epidemic or pandemic (including COVID-19) is not covered.

If you contract COVID-19 prior to your departure, you could be covered for trip cancellation if there is a confirmed diagnosis, including proof of illness from your doctor, that states you are medically unable to travel at the time of departure.

If you become ill with COVID-19 while on a covered trip, you could be covered for medical expenses and trip curtailment benefits, if there is a confirmed diagnosis, including proof of illness from a doctor.

This and any other coverage is subject to the terms and conditions of your insurance policy.

If you test positive for COVID-19 while travelling, and as a result are unexpectedly placed into a mandatory quarantine, travel insurance will pay up to the amount specified in the schedule of benefits for reasonable and necessary accommodation costs, meals or other expenses directly related to quarantine.

This benefit will not apply where quarantine measures are mandatory for all arriving passengers or quarantine mandates exist for all passengers from a particular country/region of origin.

‘Quarantine’ means a restriction on movement or travel placed by a medical or governmental authority, in order to stop the spread of a communicable disease.

To find out how to make a claim please refer to your policy documents that you would have received by email. There you will find the contact details of the local insurance office in the country that you purchased the insurance policy from.

Important information

- If you want to make a claim for a lost item, you need to report your claim within 30 days of losing the item for your claim to be valid.

Here are the documents you may need to send to the claims department (along with your completed claim form) if you want to make a claim. Further documents maybe requested upon claim review:

You are eligible for a refund of your premium under the following conditions:

- You have not started your trip; and

- You have not filed a claim.

To raise a refund request please email: [email protected] .

Yes, you can make changes to the travel dates of your policy provided it is done before the original start date of travel and it is within the same travel duration. If your travel dates are shorter than the original duration, the original policy will still be valid. Your cover will end on the policy expiry date or the date you return back to your country of residence, which is earlier.

Trip cancellation benefit does not provide any coverage if flydubai cancels or postpones your flight.

You need to report your claim no more than 30 days after the end of your insurance policy period.

Claim processing can take up to 14 working days after you send all requested documents to the insurer providing coverage.

You’ll be advised in writing of your right to appeal the claims decision and of the procedures for lodging an appeal with the local insurance company.

For 24-hour emergency assistance , you can call +1 817 826 7279 (US) or email [email protected]

For policy enquiries or to submit a claim , please refer to your Certificate of Insurance and Terms & Conditions to find our local representative contact details.

If you’ve already taken out travel insurance with Travel Guard for flydubai, you can download a copy of your certificate insurance here .

No, trip cancellation solely for concern or fear of travel associated with sickness, epidemic or pandemic (including COVID-19) is not covered.

If the cancellation of your trip is not covered, you may be eligible for an insurance premium refund.

For more information on refund, see the question below "Can I cancel my insurance and get my premium refunded?"

If you contract COVID-19 prior to your departure, you could be covered for Trip Cancellation if there is a confirmed diagnosis, including proof of illness from your doctor, that states you are medically unable to travel at the time of departure.

If you become ill with COVID-19 while on a covered trip, you could be covered for Medical Expense and Trip Curtailment benefits, if there is a confirmed diagnosis, including proof of illness from a doctor.

This coverage is subject to the terms and conditions of your insurance policy.

If you are quarantined as a result of COVID-19, and you purchased your policy prior to March 11, 2020, you could be covered under the Trip Curtailment benefit, subject to the terms and conditions of your insurance policy.

- You have not started your trip, and

The browser you are using may not be compatible with our website.

Please upgrade to the latest version of Google Chrome, Mozilla Firefox, Internet Explorer or download another web browser.

Google Chrome

Mozilla Firefox

Internet Explorer

- KQIC Kuwait

- QIC Europe Limited

- QIC Real Estate

- Antares Group

- Travel Insurance

Travel Insurance is more than a piece of paper

We’ve got you protected, covers that protects you and your family.

- Travel without Trouble – pay for where you travel

Buying your travel insurance

In case of a claim, get quote today.

Get a Quote

[foobar id=”5087″]

Buying your travel insurance should be more than just having the papers required for visiting Schengen countries – it is about providing the feeling of security for you and your family if things go wrong

Travel insurance with QIC gives you the security of knowing you and your family are in good hands, should something happen

Get Travel insurance with covid-19 cover and enjoy a safe trip

If you contract COVID-19 while on a covered trip, we will pay the cost of the medical treatment , and you may be covered for trip cancellation in the event of confirmed infection with Covid-19, 14 days prior to your departure

Refer for covid 19- extension wordings for a detailed description of covers

Click here for policy wordings

If you lost your baggage

If your bags don’t show up when you do – or they are damaged – we will compensate you for the things you need in order to enjoy your travels uninterrupted

If your trip is cancelled or shortened

Do you have to cancel because you’re sick or for another reason beyond your control? No worries! We will reimburse a fixed amount to cover your incurred travel expenses

If you have Medical expenses

Need to go to the hospital while traveling? We’ll cover your expenses caused by accidents, illness

From lost or damaged luggage to accidents caused by terrorism and more – QIC has got you covered!

Medical Expenses

Treatments and hospitalization in case of illness while travelling

Personal Accidents

Accidents during your trip, including injuries, disability, and death

Third-Party Damage

Damages you might cause to others or to their properties

Loss of Passport

Reimbursement for getting a replacement travel document

Covid-19 Cover

Medical, hospitalization, quarantine and trip cancelation fees in case of a COVID-19 infection

Loss of Baggage

Compensation for lost luggage in airports or transit areas

Trip Cancelation

Covers non-refundable expenses in case your trip got canceled

Terrorism Attacks

Damages and injuries due to terrorism acts in abroad

Optional Extra: Winter Sports Extension

Covers you in case of accidents occurring while skiing and guarantees you a memorable, hassle-free winter vacation Click here for policy wordings

Get a quote today and get 20% discount on your travel insurance .

Travel without trouble – pay for where you travel.

Travelcare Plus covers you for travel destinations across the world including USA, Canada as well as Schengen countries. All you have to do is select the travel destination (as categorized below) and pay the premium accordingly.

- Regional – includes GCC, Arab countries, India, Pakistan, Sri Lanka, Bangladesh, Korea, Philippines, Indonesia, Nepal and Bhutan.

- Worldwide excluding USA and Canada- With this extensive cover, travellers could be covered for loss of baggage or any other travel related inconveniences like loss of Passport.

- Worldwide- This cover has been designed for travellers who will be visiting the USA/Canada.

- Fly Europe – This cover has been specially designed for travellers who are required to buy insurance to avail a visa for Schengen countries. This policy only covers for Medical Expenses up to USD 50,000.

TravelCare Plus policy wordings

*Annual Policy is for mutiple trips for maximum of 90 days

At QIC, our customers’ convenience and the quality of services we provide at an equitable cost are of utmost importance

We understand the hassle one goes through when visiting a branch to manage insurances or make calls for subscriptions etc.

We are, therefore, proud to offer you qic.online , where you can purchase your travel insurance at the click of a button

To make it even simpler, you can download our QIC App manage your insurances easily from your smartphone

Android App

QIC Call Center: 8000 742 – open Sunday through Thursday from 7 AM – 8 PM, Saturday from 9 AM – 5 PM

Product Manager: Rayane Malak QIC Retail Department Email: rayane.malak@qic.com.qa

Having a claim to register – is always a hassle; we know this. We have therefore done our utmost to make registering and managing claims with us as easy and fast as possible

You can read much more about our Travel Insurance claims process here and you can always call us on 8000 742 for assistance or email us at personal.claims@qic.com.qa

Brilliance. Excellence. Success.

Qatar Insurance Company Q.S.P.C. Tamin Street, West Bay, PO Box: 666, Doha, Qatar

A.M. Best Europe assigned financial strength rating of A- (Excellent) and issuer credit rating of “a-” (Excellent) to QIC and its subsidiary Anteres-Re Read More

Standard & Poor's (S&P) confirmed its ‘A-’ issuer credit and financial strength ratings on QIC, with a stable outlook. Read More

Get Connected

Personal Insurance /Retail Life & Medical Media Careers Customer Service

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Office No. 402, 4 th floor, QFC Tower 1, West bay, Doha, Qatar, P.O. Box 23043

Tel: +974 4496 74 28

Administration

Handling of the administration for Qatar policies for all lines of business:

E-mail: [email protected]

To report a new claim, for questions concerning the handling of your file:

Toll Free: 00 800 971126 E-mail: [email protected]

For information and questions regarding our products, your cover, our service our for a quote with calculation of the premium, the general and specific conditions, and/or other relevant documents with contractual or pre-contractual information, please contact your broker.

What are you looking for?

List of recognized travel health insurance.

List of Health Insurance Companies

The following insurance companies offer travel health insurances valid for the Schengen States. They cover the required minimum amount of 30,000.00 Euros for medical treatment as well as repatriation to the home country in case of illness or even death. Please ensure your insurance policy definitely covers all Schengen States.

The insurance company must have a branch (not a call center!) in at least one Schengen State.

LIST OF INSURANCE COMPANIES IN QATAR AUTHORISED TO ISSUE TRAVEL HEALTH INSURANCES FOR SCHENGEN VISA APPLICANTS

- AIG MEA Limited/Chartis Memsa

- ISA (International Security Assistance)

- General Takaful (as part of the MAPFRE Asistencia Group)

- Al-Khaleej Takafoul Group (as part of Evasan)

- QIC (Qatar Insurance Company)

- Q Life & Medical Insurance Company LLC

- GULF INSURANCE GROUP (GULF) B.S.C © (former: AXA – Insurance)

- QIIC (Qatar Islamic Insurance Company)

- Daman Health Insurance Qatar

- Metlife Alico

- Columbus Direct Middle East

- Doha Insurance

- SAICO Health (Saudi Arabian Insurance Co, Damana MIG)/Cigna

- Oman Insurance Company

- Libano-Suisse Insurance Company

- Seib Insurance & Reinsurance LLC

- Al Koot Insurance

- Sharq Insurance LLC

- Arabia Insurance

- QATAR GENERAL (in collaboration with MAPFRE Asistencia Group)

Please note: You are obliged to provide a Schengen travel health insurance, covering a minimum amount of 30.000,00 Euros inclusive of medical examinations, hospitalization and repatriation as well as corresponding care expenses that may arise during any single trip to the Schengen States.

Although the information on this website has been prepared with utmost care, we do not accept any responsibility for inaccuracies contained herein.

*Above insurance companies have provided proof of obligatory requirements to the German Embassy. Insurance companies wishing to be added to this list may contact the Embassy via [email protected] .

- Top of page

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

- Forms Centre

- Self-Service

Beware of phishing scams. For more information, please visit our Safety Tips page.

The GST rate will increase to 9% on 1 January 2024. Visit this page for more information.

Travel Guard ® Direct

√ Up to $80 in eCapitaVouchers (Single Trip Plan)

√ $50 eCapitaVouchers (Annual Multi-Trip Plan)

√ $220 worth of Plaza Premium Lounge Access Passes (Annual Multi-Trip Plan)

√ Key in promo code AIGTGD

√ Promo till 30 April 2024

Make a claim

- Renew Annual Travel

- Make Changes to Your Travel Policy

- Request for Proof of Cover Letter

Current Promotion

Annual Multi-Trip Plan

Enjoy $50 ecapitavouchers, $220 worth of plaza premium lounge access passes , single trip plan, up to $80 ecapitavouchers , use promo code: aigtgd.

Promotion is valid till 30 April 2024. T&Cs apply.

AIG Travel Assistance Services

Get 24/7 travel assistance exclusively to AIG policyholders. We operate globally across 8 service centres, with a team that is proficient in over 40 languages , providing comprehensive support for travel or medical emergencies abroad.

Top 3 reasons to buy Travel Guard® Direct

QUICK QUOTE

To get a quick quote, select the destination you are travelling to:.

SINGLE TRIP COVERAGE

The maximum length of each insured trip is 182 days.

ANNUAL COVERAGE

The Insured Policyholder(s) will be covered for an unlimited number of trips made during the Policy Period. The maximum length of each insured trip is 90 days

Policy Type

The policy type shows which people are insured under the policy. You can choose from either Individual or Family cover.

If you choose Individual cover this policy insures you only.

If you choose Family cover this policy insures you and/or your spouse and/or your children.

- Under a Per Trip policy, the family must depart from and return to Singapore on the same itinerary together as a family for cover to apply.

- Under an Annual Multi-Trip policy, cover will apply to you or your spouse whilst travelling separately of each other; however your children must be accompanied by you and/or your spouse for the entire trip for cover to apply.

Group/ Couple

Select this option if you have individuals travelling together on the same dates and to the same destination.

For Group/ Couple up to a maximum of 10 individual policies on the same transaction.

Region 2 Destinations

Brunei Darussalam, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Vietnam

Argentina, Bahrain, Bangladesh, Belize, Bolivia, Brazil, Chile, China (excluding Tibet), Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Guyana, Honduras, Hong Kong SAR - China, India, Kuwait, Macau SAR - China, Maldives, Mexico, Mongolia, Nicaragua, Oman, Pakistan, Panama, Paraguay, Peru, Qatar, Sri Lanka, Suriname, Taiwan - China, Thailand, United Arab Emirates, Uruguay, Venezuela

Region 3 Destinations

Region 1, Region 2, Australia, Japan, South Korea, New Zealand, Nepal, Tibet - China and the rest of the world.

(Exclude Cuba, Iran, Syria, North Korea or the Crimea region)

Modal Message

Please select coverage type

travelCoverageType

We do not provide Annual Multi Trip for Group

travelPolicyType

Please select policy type

Please select destination(s)

Please select region of travel

Please provide start date

Please provide end date

Please select if you are going on a cruise

Please select if only 1 adult is travelling

Please provide age

less than or equal to

Please provide valid age

greater than or equal to

Please enter age of at least 2 travellers

Please select no of travellers

Key Benefits

Before you buy, travel alerts, testimonials.

COVID-19 Benefits & FAQ

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites ( www.AIG.sg or www.gia.org.sg or www.sdic.org.sg ).

Case Study Illustration

Learn more about AIG's Travel Guard Direct

- Policy Wording (issued on/after 24 September 2022)

- Policy Wording (issued on/before 23 September 2022)

Enquiries: 6419 3000 24-hour overseas emergency assistance hotline : 6733 2552 Travel claims : 6224 3698

Enquire online

Send an enquiry

Policy Changes

Make changes to your policy

You might like

AIG On the Go driving app

Score your driving performance and get up to 15% off your AIG vehicle insurance premium.

Ranked #1 Travel Insurance for Schengen Visa

Travel insurance, let’s get you started on your travel insurance journey.

Picture this – you’re about to set off on an exciting holiday. You’ve got your travel visa, your tickets, hotel bookings and everything else in order. You land at your destination and find that your luggage has been misplaced. Or worse, you’re the victim of theft and you are left in a foreign country without your passport or any cash! Dealing with these situations can be expensive and difficult – especially if you’re in a country where you don’t speak the language. But that’s precisely why travel insurance is so crucial!

Travel insurance is the assurance that your journey will be protected and insured from possible risks that may come unexpectedly on unknown lands. Travel insurance is a unique product that offers you financial help in case something were to go wrong while you’re travelling. It covers a range of scenarios, including medical and dental emergencies, theft of your money or passport loss , flight cancellation and misplaced or lost luggage.

Depending on where you’re going, the purpose of your visit and how often you travel, you can select a travel insurance policy that best suits your needs. A single-trip travel insurance plan is ideal if you’re travelling domestically or internationally and only travel once in a while, a single trip travel insurance can be purchased for yourself or for your family, for more information, check our family travel insurance . If you travel often for work, you may want to opt for a multi-trip travel insurance plan or an annual travel insurance plan. This way, you can save on the hassle of applying for a new travel insurance policy before each trip. We also offer customised travel insurance plans for senior citizens and students who are heading abroad to continue their education. No matter what your travel needs, we’ll find a travel insurance policy for you

Travel Insurance With COVID-19 Covered*

Start every journey with a travel insurance plan, what’s covered under tata aig travel insurance, our travel insurance policy will help you take care of a number of situations, ensuring the mental peace you truly deserve:, covid-19 covered.

Accident & Sickness Medical Expense Under the Accident & Sickness Medical Expense, Travel insurance with COVID-19 covered compensates for the medical expenses incurred by the insured because of being diagnosed with COVID-19 outside the Republic of India during the trip duration & is hospitalized. The policy provides coverage against Medical expenses upto the limit mentioned in the policy schedule.

Trip Cancellation Compensation benefit under Trip Cancellation is offered if the insured, the insured’s Travel Companion or The Immediate family of the insured or the Insured’s Travel Companion are diagnosed with COVID-19 before commencing their international trip. They cannot travel until they have received a negative COVID-19 report. If one has a valid travel insurance plan and they cancel a booked trip as a result of COVID-19, we will reimburse you the unused and non-refundable amount of your prior bookings, such as hotel booking, and ticket costs. You would be eligible for these benefits only if you booked and paid for such services before being diagnosed with COVID-19.

Trip Curtailment/Interruption Benefits If you are travelling with Travel insurance with COVID-19 covered and you, your Travel Companion, your immediate family or your Travel companion’s immediate family are diagnosed with COVID-19 during your trip, as a result of which, your trip has to be cut short, we will reimburse the trip interruption expenses. These expenses will be inclusive of the pre-paid and unused portion of travel and accommodation expenses, which are non-refundable; additional accommodation and travel expenses incurred due to trip interruption, subject to the sum insured limit.

Automatic extension Given the current circumstances, it is too early to predict if a lockdown will be enforced in the future. Consider the possibility of being trapped on vacation overseas because the country announced a statewide lockdown due to COVID-19. Flight delays or cancellations are extremely dangerous under such circumstances. Tata AIG Travel insurance coverage will cover your trip extension for a maximum period of 7 days if a lockdown is imposed in the destination country and no alternative mode of transport is available. Subject to Terms & conditions.

Baggage Covers

Delayed Baggage Almost everybody has a story about a time when they travelled and their luggage was accidentally sent elsewhere or unnecessarily delayed. If this happens and you have our travel insurance policy, you can rest easy. Your travel insurance plan will help cover the cost of any necessary personal items that you need to purchase until your bag can reach you.

Lost Baggage Having your baggage delayed is one thing, but if your bag is lost or stolen, managing the situation can be incredibly difficult. Luckily, our travel insurance policy can help you deal with this issue. Depending on the travel insurance policy terms, we will help reimburse you for the items in your luggage.

Journey Covers

Lost Passport Obtaining a new passport in a foreign country isn’t always easy. Your international travel insurance policy will help you with the necessary and reasonable expenses that are attached to getting a new passport made.

Assistance While Travelling If things go a bit wrong when you’re out of the city, you may need some assistance. Our travel insurance plan will help provide you with all necessary assistance required, right from legal help to getting lost luggage and passports replaced. Our travel policy will even help with emergency travel services, cash transfers and advances.

Personal Liability Accidents can happen at any time under any circumstance. If you happen to be involved in an accident where somebody else is harmed or injured, it could cost you quite dearly. Our travel insurance policy will help cover any damage caused to any third-party individual or property while you’re travelling. It’s important to remember that the travel policy will not cover your family members or individuals who live with you.

Hijack Help Our travel insurance policy will offer something known as distress allowance in case the flight that you’re travelling on is hijacked.

Delayed Flights Bad weather or a local strike could delay your flight by more than 12 hours. If this is the case, you might have to book another night’s stay at a hotel or incur some other additional expenses. Our travel insurance policy will help you take care of these expenses if your flight happens to be delayed.

Policy Extension Your travel insurance policy term often depends on the length of your trip. But, there are certain situations in which your flight may be cancelled or delayed for several days. We will automatically extend the term of cover of our travel insurance policy for seven days in case your flight is cancelled or delayed and you don’t have any other travel options available.

Trip Curtailment or Cancellation In case there’s an emergency and you have to travel back or cancel your entire trip, don’t worry. Our travel insurance plan will reimburse you for any unused, non-refundable hotel and travel expenses.

Medical Covers

Medical Emergencies Your travel insurance policy will help you deal with the financial implications that come with meeting with an accident or falling ill while you’re travelling. The policy will cover everything right from a regular illness that requires hospitalisation to dental emergencies and even fatalities. If you happen to fall ill or meet with an accident at the tail-end of your journey, you don’t have to worry. If you’re in hospital and your policy expires, we will continue to cover you for the next 60 days or until you are discharged, whichever is earlier.

Medical Evacuation Your travel insurance policy is your friend in times of need. If you require emergency medical evacuation to the nearest hospital, this policy will take care of that. In case you need to be evacuated and brought back to India for medical treatment, the travel insurance policy will look after that as well.

Accidental Death and Repatriation We don’t want to think about it, but it’s possible that an accident or medical emergency abroad could end up being fatal. TATA AIG’s travel insurance policy will provide your nominee with the full sum insured amount if this happens. We will also take care of the cost of repatriating the insured individual’s remains back to their city of residence.

Compassionate Visit If you need somebody to help you out when you’re in hospital, we’ll provide a two-way ticket for a family member to come and take care of you.

Interruption of Study If you’ve purchased a student travel insurance policy , this is especially for you. If have to interrupt your education because you or a family member are ill, we’ll reimburse you any unused tuition fee.

*Kindly check the policy wordings for a complete understanding of the product offerings, inclusions and exclusions.

Advantages Of TATA AIG Travel Insurance

When you’re travelling abroad, we’ll help you take care of the cost of treatment for COVID-19 if you test positive in the middle of your trip & re quires hospitalization

Affordable International Policies

Our travel insurance policies will not cost you too much. You can enjoy care-free travel for as little as INR 40.82 per day when you’re travelling internationally.

Affordable Domestic Policies

Explore the many beauties scattered across India and get travel insurance cover for just INR 26 per day!

Instant Policy Purchase

You can buy a TATA AIG travel insurance policy online with just a few easy clicks. We don’t need extensive paperwork on a health check-up!

Hassle-Free Claim Procedure

We actually mean it when we say we make travel insurance claims simple. Tata AIG understands how much money and time you have already invested in your travel. That is why we have kept all of our procedures extremely easy, fast, and paperless since we believe that everything should be digital. As a result, there is no need for hardcopy evidence. For us, a simple upload on our portal works.

24/7 Customer Assistance

A decent travel insurance coverage is unaffected by time zones. Whatever time it is in your corner of the world, competent support is only a phone call away owing to our in-house claim settlement and customer assistance team. We are ever-ready to assist you every step of the way.

What Our Customers Are Saying

Ease of doing business

Online policy, very fast and immediately policy certificate, great n superb experience

The website is friendly and easy to use.

Seamless experience

The buying of the policy had to wait till we received the Covid-19 Negative from diagnostics though we both have taken first and second Vaccination Doses.

The buying process has been exceedingly convenient.

Hope your claims payment (if at all we need any) is as good and fast as the buying of the policy has been.

I TRUST in TATA AIG and have insured my cars too.

Really smooth...and great clean interface... God forbid we have to use the policy during travel...I hope the support for same is as good or better.

Value for money

User friendly site

Trust in TATA product. Keep the faith in the Indian customer.

Good processing and excellent insurance

I am not sure if there is any other insurance company in india which is providing Covid 19 coverage for travel insurance

Ease of processing very good. Policy document provided all the details given while filling the online application form

Best of the rest

Easy and convenient

Great Buying Experience

its very fast, easy to get. No hassles

The Perfect Travel Insurance Plan

A good and user-friendly travel insurance package will make your vacation a memorable one. It protects you at various stages, with financial coverage being the primary focus. Selecting the finest travel insurance package for your family and yourself should not be rushed. Choose intelligently and save money by not taking the first choice you see for hassle-free and safe travel. A travel insurance policy acts as a cushion to absorb the impact of a misstep, making your vacation more enjoyable and memorable.

This is why TATA AIG offers multiple travel insurance plans. We have specialised travel insurance policies for domestic and international travel. Additionally, we have customised travel insurance policies for senior citizens and students who are heading abroad to expand their horizons. Let’s take a look at what each travel insurance policy offers, so you can find the right one for you. To know what to look for in a Travel Insurance, check our Best Travel Insurance Plan Guide. To Understand the various types of Travel Insurance Plans we offer & to understand how to compare in between them, check our Compare Travel Insurance resource.

International Travel Insurance

Travelling to a foreign country, whether for work or vacation , doesn’t have to be stressful. With our international travel insurance policies, you can rest easy knowing that we’ll help you out should anything go wrong. Right from small inconveniences, such as having your bag arrives late, to serious issues like medical emergencies and evacuation, TATA AIG’s international travel insurance plan will be with you at every step of the journey. We highly recommend this travel insurance policy for everybody headed outside the country. If you’re likely to make multiple trips in a single year, we recommend our multi-trip travel insurance plan.

Domestic Travel Insurance

Just because you aren’t travelling abroad, it doesn’t mean you don’t need travel insurance. This travel insurance plan will help you deal with various situations while you’re travelling across India. Right from reimbursing you for the cost of lost tickets to taking care of you after an accident while you’re out of town, this travel insurance policy is your ideal travel partner! If you travel very often, we recommend that you opt for our multi-trip travel insurance policy. This makes it easier for you to go on quick trips without having to apply for a new travel insurance plan each time.

Student Travel Insurance

We would like to support you as you follow your dreams. This is precisely why we’ve created a specialised student travel insurance policy. If you’re between the ages of 16 and 35 and you’re about to head abroad to further your education, this is the travel insurance plan for you. Apart from the usual travel insurance cover, this policy additionally provides cover for unique situations, such as reimbursing students the tuition fee if they’re unable to complete a semester due to a medical emergency. This travel insurance plan also provides cover for compassionate visits, ensuring you don’t have to be alone if you’re hospitalised!

Senior Citizen Travel Insurance

Why should young people have all the fun? Travel insurance for senior citizens is suitable for people over the age of 70, much like health insurance is adapted to the age factor. The elderly enjoy travelling after retirement, and they frequently travel alone or in pairs. This sort of plan shields them against unforeseen events. Senior citizens over the age of 70 can travel and enjoy the world just as much as their children and grandchildren. Our senior citizen travel insurance policy has been created keeping their needs in mind. This travel insurance plan offers additional cover for medical emergencies, including dental coverage, emergency medical evacuation and the repatriation of remains.

What’s Not Covered By TATA AIG's Travel Insurance Plan?

Even while we would prefer to cover all conceivable risks, many circumstances are simply not practical. We prefer total openness with our consumers. So here is what our travel insurance plans don't cover:

Baggage Exclusions

- Loss of baggage will not be covered in cases where you have shipped the items separately or before your travel date.

- It will also not be covered in cases where your travel insurance policy does not cover the geographic region. For example, under a student travel insurance policy, if the bags are lost in India, it will be not be covered.

- If you do not report that your luggage, documents or personal belongings have been stolen to the relevant authorities, you cannot make a legitimate claim for them against your travel insurance policy.

Journey Exclusions

Under certain circumstances, we will not be able to settle claims against your travel insurance policy. These circumstances include:

- Involvement in illegal activities, including felony, theft, deceit or other malicious acts.

- Participation in adventure sports, like skydiving, scuba diving, or mountain diving will not be covered under our travel insurance plans.

- Undertaking manual labour or work that could potentially harm you or be dangerous for your health.

Medical Exclusions

Your claim request against your travel insurance plan will not be entertained if

- You have travelled against the advice of your doctor

- You suffer from a complication or require assistance due to a pre-existing health condition

- You have injuries that are self-inflicted

- Your claim is for pregnancy or a related issue, including birth control or surgical procedures

- The issue is related to a sexually transmitted disease, mental disorder, and injuries due to the consumption of alcohol or drugs that were not medically prescribed.

Did Not Find What You Were Looking For?

When, where and how to choose travel insurance, purchasing a travel insurance policy requires a lot of thought and consideration. to help you with your decision, here’s a look at some important factors you must consider before choosing a travel insurance policy:, destination.

Your travel insurance policy will depend largely on your destination. For starters, you must decide whether you’re travelling internationally or domestically. Based on this, you can narrow down your options. If you’re travelling internationally, it’s important that you check the travel insurance requirement of various countries. For example, certain countries will not issue you a travel visa unless you can show that you have sufficient cover in your travel insurance policy.

Travel Frequency

The kind of travel insurance policy you buy will depend on how often you intend to travel. If you travel very frequently, a multi-trip travel insurance plan might be ideal for you. These plans allow you to enjoy multiple trips without you having to apply for a new travel insurance policy each time. On the other hand, if you only travel once in a while, then a single trip travel insurance policy might be better for you. You can easily apply for your travel insurance policy online and have it issued without the need for a pre-policy check-up.

Duration Of The Trip

While picking a travel insurance plan, you must keep the length of your trip in mind. It’s a good idea to pick a travel insurance policy of a duration that slightly exceeds your actual trip dates. Ideally, you should be able to find a plan that offers cover for more days without it affecting your premium. This way, if you have to extend your trip for a few days, you don’t risk losing your cover.

People Travelling

If you’re travelling alone, you can purchase a travel insurance policy just for yourself without any worries. If you’re travelling with your family, you should add each member to your insurance policy. Make sure you tell us how many of you are travelling before you purchase the policy and we’ll do the needful. This makes it much easier for you to keep track of everybody’s paperwork.

Claim Limit

This is possibly one of the most important factors that will influence your decision. Every travel insurance policy has a limit as to how much they will pay for various claims . For example, you will receive a specified sum in case your bags are lost or stolen. Even in medical emergencies, you must keep your sum insured amount and claim limit in mind. If you have a low claim limit, it may not be enough to take care of all kinds of medical emergencies while you’re travelling. Depending on where you’re going and how long you’re travelling for, you should pick a suitable sum insured for your travel insurance policy. A higher sum insured will lead to a higher premium, but it will come in handy if you require to file a claim while you’re travelling.

How To Buy Travel Insurance Online?

Purchasing a travel insurance policy requires a lot of thought and consideration. To help you with your decision, here’s a look at some important factors you must consider before choosing a travel insurance policy: To understand the factors that effect your travel insurance premium, check our Travel Insurance Premium Calculator

If you like, you can read about our various plans and take a look at what each offers. Or, you can decide to purchase travel insurance right away.

If you’re heading to multiple cities or countries, don’t worry. We offer plans for that as well. Type in all the countries or cities you’re visiting and how long you’ll be travelling for. We’ll use this information to curate the best travel insurance policy options for you.

If you’re travelling alone, you just need to enter your date of birth. If you’re travelling with family members, you can add them to the same travel insurance policy. You have the option to add your spouse, children and parents to the policy as well. Let us know who you’re travelling with and their dates of birth as well.