- Travel, Tourism & Hospitality ›

Leisure Travel

Tourism industry in the Asia-Pacific region - statistics & facts

Tourism in southeast asia, the setback and outlook on the industry, key insights.

Detailed statistics

Inbound tourism visitor growth worldwide 2020-2025, by region

Total travel and tourism GDP contribution APAC 2022-2033, by country

Travel and tourism's direct contribution to employment APAC 2022, by country

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Travel, Tourism & Hospitality

Tourist arrivals SEA 2021, by country

Number of international tourist arrivals APAC 2013-2022, by subregion

Total travel and tourism GDP contribution Southeast Asia 2015-2033

Related topics

Recommended.

- Domestic tourism in Japan

- Travel and tourism industry in Australia

- Business travel and exhibition industry in China

- Online travel market in Vietnam

- Tourism and hotel industry in Singapore

Recommended statistics

- Basic Statistic Travel and tourism: share of global GDP 2019-2033

- Basic Statistic Total travel and tourism GDP contribution APAC 2022-2033, by country

- Basic Statistic Total travel and tourism GDP contribution Southeast Asia 2015-2033

- Premium Statistic Inbound visitor growth APAC 2021-2025, by subregion

- Premium Statistic Outbound visitor growth APAC 2021-2025, by subregion

- Premium Statistic Number of international tourist arrivals APAC 2013-2022, by subregion

Travel and tourism: share of global GDP 2019-2033

Share of travel and tourism's total contribution to GDP worldwide in 2019 and 2022, with a forecast for 2023 and 2033

Total contribution of travel and tourism to GDP in the Asia-Pacific region in 2022, with forecasts for 2023 and 2033, by country or territory (in billion U.S. dollars)

Total contribution of travel and tourism to the GDP in Southeast Asia from 2015 to 2022, with forecasts for 2023 and 2033 (in billion U.S. dollars)

Inbound visitor growth APAC 2021-2025, by subregion

Inbound visitor growth in the Asia-Pacific region from 2021 to 2025, by subregion

Outbound visitor growth APAC 2021-2025, by subregion

Outbound visitor growth in the Asia-Pacific region from 2021 to 2025, by subregion

Number of international tourist arrivals in Asia-Pacific region from 2013 to 2022, by subregion (in millions)

Economic impact

- Basic Statistic Travel and tourism's direct contribution to employment APAC 2022, by country

- Premium Statistic Travel services share of service exports APAC 2022, by country

- Premium Statistic Travel services share of service imports APAC 2022, by country

- Premium Statistic Online travel market scale APAC 2023, by country

Travel and tourism's direct contribution to employment APAC 2022, by country

Direct contribution of travel and tourism to employment in the Asia-Pacific region in 2022, by country or territory (in millions)

Travel services share of service exports APAC 2022, by country

Travel services exports as a share of service exports in the Asia-Pacific region in 2022, by country

Travel services share of service imports APAC 2022, by country

Travel services imports as a share of service imports in the Asia-Pacific region in 2022, by country or territory

Online travel market scale APAC 2023, by country

Online travel market size in the Asia-Pacific region in 2023, by country (in billion U.S. dollars)

Tourism expenditure

- Basic Statistic Value of international tourism spending APAC 2022, by country

- Basic Statistic Value of domestic tourism spending APAC 2022, by country

- Basic Statistic Value of domestic tourism expenditure Southeast Asia 2013-2022

- Premium Statistic Most expensive cities for business travel APAC Q4 2022, by daily cost

Value of international tourism spending APAC 2022, by country

Value of international tourism expenditure in the Asia-Pacific region in 2022, by country or territory (in billion U.S. dollars)

Value of domestic tourism spending APAC 2022, by country

Value of domestic tourism expenditure in the Asia-Pacific region in 2022, by country or territory (in billion U.S. dollars)

Value of domestic tourism expenditure Southeast Asia 2013-2022

Value of domestic tourism expenditure in Southeast Asia from 2013 to 2022 (in billion U.S. dollars)

Most expensive cities for business travel APAC Q4 2022, by daily cost

Most expensive cities for business travel in the Asia-Pacific region in fourth quarter of 2022, by daily cost (in U.S. dollars)

- Premium Statistic YoY change in monthly international tourist arrivals APAC 2023, by subregion

- Premium Statistic Tourist arrivals ASEAN 2013-2022

- Premium Statistic Tourist arrivals SEA 2021, by country

- Premium Statistic Tourist arrivals ASEAN 2021, by country or region of origin

YoY change in monthly international tourist arrivals APAC 2023, by subregion

Year-over-year (YoY) change in monthly number of international tourist arrivals in the Asia-Pacific region in 2023, by subregion

Tourist arrivals ASEAN 2013-2022

Tourist arrivals in the ASEAN region from 2013 to 2022 (in million arrivals)

Tourist arrivals in Southeast Asia in 2020 to 2021, by country (in 1,000s)

Tourist arrivals ASEAN 2021, by country or region of origin

Tourist arrivals in the ASEAN region in 2021, by country or region of origin (in 1,000s)

Occupancy rates

- Premium Statistic Monthly travel accommodation occupancy rate APAC 2020-2023

- Premium Statistic YoY change in monthly number of hotel bookings APAC 2023, by subregion

- Premium Statistic YoY change in monthly international seat capacity APAC 2023

- Premium Statistic YoY change in monthly domestic seat capacity APAC 2023

Monthly travel accommodation occupancy rate APAC 2020-2023

Monthly travel accommodation occupancy rate in the Asia-Pacific region from 2020 to 2023

YoY change in monthly number of hotel bookings APAC 2023, by subregion

Year-over-year (YoY) change in monthly number of hotel bookings in the Asia-Pacific region in 2023, by subregion

YoY change in monthly international seat capacity APAC 2023

Year-over-year (YoY) change in monthly international seat capacity in the Asia-Pacific region in 2023

YoY change in monthly domestic seat capacity APAC 2023

Year-over-year (YoY) change in monthly domestic seat capacity in the Asia-Pacific region in 2023

Online travel

- Premium Statistic Usage of online travel agencies Asia 2023, by country

- Premium Statistic Usage of online travel agencies for package holidays Asia 2023, by country

- Premium Statistic Usage of online travel agencies for transportation Asia 2023, by country

- Premium Statistic Usage of online travel agencies for accommodation Asia 2023, by country

- Premium Statistic Usage of online travel agencies for car rental Asia 2023, by country

- Premium Statistic Most used online travel agencies Asia 2023, by country

Usage of online travel agencies Asia 2023, by country

Share of consumers who have used online travel agencies before in Asia as of June 2023, by country or territory

Usage of online travel agencies for package holidays Asia 2023, by country

Share of online travel agency users who have booked package holidays in Asia as of June 2023, by country or territory

Usage of online travel agencies for transportation Asia 2023, by country

Share of online travel agency users who have purchased flight, train, or bus tickets in Asia as of June 2023, by country or territory

Usage of online travel agencies for accommodation Asia 2023, by country

Share of online travel agency users who have booked accommodation in Asia as of June 2023, by country or territory

Usage of online travel agencies for car rental Asia 2023, by country

Share of online travel agency users who have rented cars in Asia as of June 2023, by country or territory

Most used online travel agencies Asia 2023, by country

Most used online travel agencies in Asia as of June 2023, by country or territory

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

International tourism, number of arrivals - East Asia & Pacific

Selected Countries and Economies

East asia & pacific.

- Privacy Notice

- Access to Information

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here.

Travel Health Index: Asia Pacific Leads as Industry Growth Stabilizes

Saniya Zanpure , Skift

April 4th, 2024 at 11:05 AM EDT

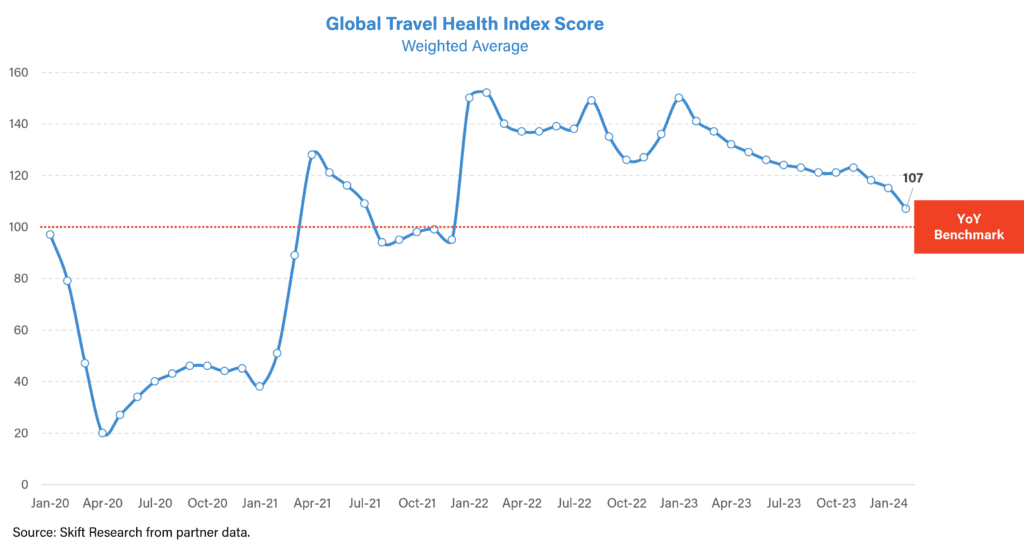

In February 2024, the travel industry maintained positive momentum with 7% year-on-year growth. Transitioning from double-digit growth to single-digits indicates a trend towards stability.

Saniya Zanpure

The travel industry continued to strengthen in February: The Skift Travel Health Index stood at 107, 7% growth over February 2023.

Growth had been in the double-digits and the new levels point to stabilization in the industry.

Asia Pacific’s Growth Levels are Normalizing

According to the latest Skift Travel Health Index: February 2024 Highlights , Asia Pacific, which has been on an upward trajectory since early 2023, leads the index.

A key driver of Asia Pacific’s growth is China reopening its borders for travel after three long years. The country started easing travel restrictions in January 2023 and fully opened tourism for foreigners by March 2023. With the full impact of open borders now realized, we’re witnessing a significant uptick in the region’s performance compared to last year.

However, while February 2024 marks a 13% growth for the Asia Pacific region, growth numbers are slightly reducing compared to the previous months, suggesting a stabilizing trend in the region.

Skift Travel Health Index Score by Region

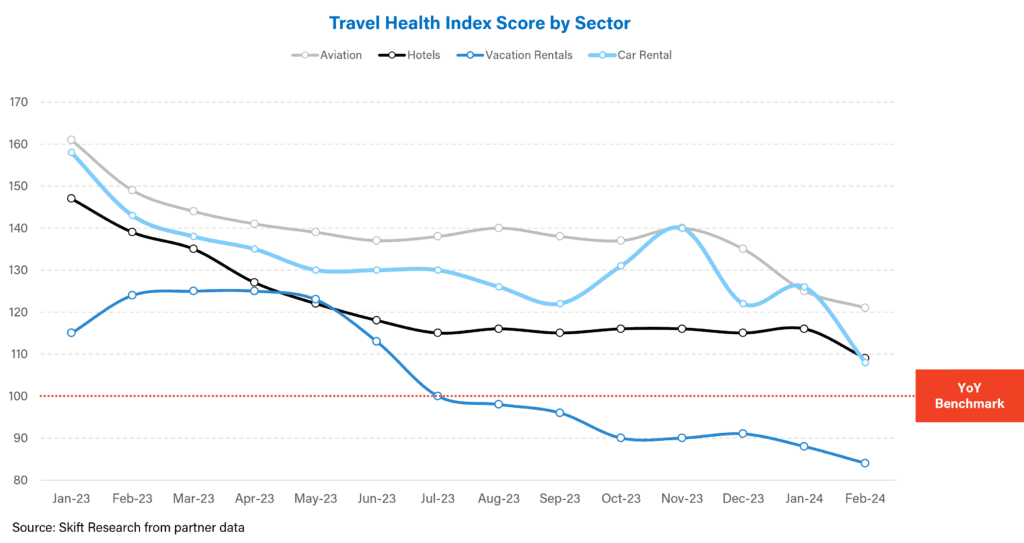

Vacation Rental Boom is Stabilizing

There is a noticeable softening trend in the performance of vacation rentals. Demand for vacation rentals soared through the pandemic with double-digit growth. However, recent data suggests a deceleration in this growth trajectory, indicating a shift towards moderation in demand levels.

While the sector’s performance remains above pre-pandemic levels, the softening trend aligns with the evolving market dynamics that suggest stabilized growth levels in the post-pandemic travel landscape.

For further insights, read the February 2024 Highlights and the Travel Health Index dashboard .

Skift Travel Health Index: February 2024 Highlights

For the first time since the pandemic, we are benchmarking travel performance year-on-year (YoY) in 2024. February 2024 highlights the continued strength of the travel industry this year, with the Skift Travel Health Index at 107, reflecting a 7% growth compared to February 2023.

Have a confidential tip for Skift? Get in touch

Tags: asia pacific , normalization , skift research , skift travel health index , stabilization , vacation rentals

Latest News

Revitalizing global tourism through rail: A sustainable journey

Kuala Lumpur Convention Centre unveils revamped meeting space

Emirates expands flight schedule for Eid Al Fitr holidays

RCI launches first Cruise Exchange Program in India

Radisson expands with ‘Guan Xin’ for Chinese travelers in EMEA

Maldives’ tourism revenue dips, shifts to guesthouses

Destination Explore partners with TA Network for digital revolution

Luneta Park transforms into Filipino Fiesta food haven

Trip.com launched free Shanghai layover city tours

TFWA Asia Pacific Exhibition and Conference: Global retail giants gather

PATA: Strong tourism growth predicted for Asia Pacific in 2023 and continuing to 2025

By the end of 2024, the 2019 benchmark level of IVAs will be exceeded even further under the mild scenario and by 6.7% under the medium scenario, with both positions increasing in strength to 2025.

BANGKOK – Updated forecasts for 39 Asia Pacific destinations, released by the Pacific Asia Travel Association (PATA), show a very strong increase in aggregate international visitor arrivals (IVAs) under each of three scenarios in 2023, with robust annual growth continuing to the end of 2025.

Sponsored by Visa and with data and insights from Euromonitor International , this suite of reports builds on the current forecasts by delving deeper into the changing dynamics of travel and tourism into and across the Asia Pacific region at the single destination level facilitating the development of appropriate strategies over the next three years.

Predicted international arrival numbers in 2023 range from 705 million under the mild scenario to 516 million under the medium scenario, and almost 390 million under the severe scenario, equating to visitor numbers in 2023 that exceed that of pre-pandemic 2019 by 3.3% under the mild scenario, but still nearly 25% short of it under the medium scenario, and some 43% behind it under the severe scenario.

By the end of 2024, the 2019 benchmark level of IVAs will be exceeded even further under the mild scenario and by 6.7% under the medium scenario, with both positions increasing in strength to 2025. Under the severe scenario, however, IVAs in 2025 are still predicted to fall short of the 2019 level by some 10%.

In this just released series of the “Asia Pacific Destination Forecasts 2023-2025” , PATA covers each of 39 destinations in much greater detail, with a focus on source markets and air capacity changes in each case. One source market of particular interest of course, is mainland China and these most recent forecasts indicate that very strong annual growth rates are expected in 2023 under each of the three scenarios, but not passing the 2019 volumes until 2024 under the mild and medium scenarios.

Despite very strong annual increases in arrivals from mainland China to Asia Pacific destinations, under the severe scenario, that number is still expected to lag the 2019 peak by around six percent by the end of 2025.

As Peter Semone , Chair of the Pacific Asia Travel Association (PATA) points out “while these forecasts are extremely encouraging, hurdles still remain, and the travel and tourism sector will require ongoing vigilance and operational flexibility as these issues present themselves over the coming years. While the COVID-19 outbreak is no longer at the global pandemic stage for example, it has not disappeared entirely, and we must come to grips with living with it for some time yet.”

He adds “In addition, the conflict in Ukraine, a softening global economic outlook with rising inflation and the increased costs of international travel will all have to be dealt with in ways that satisfy the increasingly diverse demands of the traveller of both today and tomorrow.”

David Fowler , Head of Cross-border & Sales Excellence, Asia Pacific, Visa, said, “PATA’s forecasts offer the travel industry with a much-needed and renewed sense of optimism after almost three years of border closures. Nonetheless, many headwinds lie ahead as traveller habits and preferences have changed substantially in a post-pandemic and hyper-digitalised world. The travel industry needs to understand the unique needs of travellers, many who are digital natives, in order to offer the flexible, novel and personalised travel experiences that they have come to expect.”

“Building data capabilities will continue to be a key area of investment for the travel ecosystem as it navigates the shifts in travel patterns through data insights, and in turn respond with data-backed customer engagement strategies. Visa has recently set up a new Centre of Excellence for travel in Asia Pacific dedicated to help clients and partners use data insights to maximise opportunities in the travel space. It is now more critical than ever that the travel industry is well-informed through data, so enterprises – especially smaller ones – and local communities can react faster as travel recovery accelerates across Asia Pacific.”

What you will learn from this report:

- Each of these 39 reports covers a specific destination in the Asia Pacific and individually provides:

- Annual forecasts of visitor arrival numbers into each destination between 2023 and 2025 by scenario and source region;

- Recovery rates for international visitor arrival (IVA) growth back to the 2019 benchmark;

- Annual changes in relative visitor share by top source market, year, and scenario;

- Seasonality pattern;

- Quarterly changes in scheduled international inbound air seat capacity to 3Q 2022; and

- Economic, income and expenditure outlook & trends, and domestic tourism.

Theodore Koumelis

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.

- Theodore Koumelis https://www.traveldailynews.asia/author/theodore-koumelis/ Luneta Park transforms into Filipino Fiesta food haven

- Theodore Koumelis https://www.traveldailynews.asia/author/theodore-koumelis/ Bangkok tops global tourism charts with vibrant festivities and accolades

- Theodore Koumelis https://www.traveldailynews.asia/author/theodore-koumelis/ ATPCO welcomes Ritchie Ramsamy as the new APAC Regional Director

- Theodore Koumelis https://www.traveldailynews.asia/author/theodore-koumelis/ Philippines and Austria strengthen tourism ties for mutual growth

Related posts

PATA now accepting submissions for prestigious “Face of the Future Award” 2024

Empowering Women Through Tourism: Insights from ADB’s Gender Specialist Chieko Yokota

PATA International Conference on Women in Travel: Key insights from H.E. Christina Garcia Frasco’s address

Pioneering PATA Women in Travel Conference empowers industry leaders

Previous article, next article, trip.com: global travellers looking for intra-regional summer getaways, amadeus partners with didi enterprise solutions to expand hospitality distribution content in china.

Sarawak enhances tourism through premier pickleball tournament

Harnessing AI for Business and Life: Insights from Prof. Pin Pin

Bangkok tops global tourism charts with vibrant festivities and accolades

ATPCO welcomes Ritchie Ramsamy as the new APAC Regional Director

AirAsia X launches direct Kuala Lumpur-Xi’an flight with full capacity

Cordis, Foshan: New upscale hotel opens in China’s Greater Bay Area

HoSkar Bangkok

Surge in Eid travelers at Tanjung Perak Port, Surabaya

Air Canada launches non-stop Singapore to Vancouver route

Travelex launches click-and-collect currency service in Hong Kong

MICHELIN Guide Thailand expands to Chon Buri: A culinary adventure by the sea

Indonesia implements strict airfare regulation ahead of Eid exodus

Philippines and Austria strengthen tourism ties for mutual growth

IHG announces second voco property in Seoul, expanding in South Korea

Korean Air launches seasonal flights to Taichung from Seoul

Thailand’s Vision 2025: A multifaceted approach to ignite tourism

Indonesia enhances tourist safety with evacuation zones for Eid holidays

Changshu launches culture and tourism festival with Peony celebrations

Fusion Hotel Group launches first Fusion Suites in Thailand

Pallavi Sharma appointed as the new Front Office Manager at Novotel Hyderabad

Thai AirAsia launches new direct flights from Bangkok to Okinawa

Taiwan’s strongest earthquake in 25 years shakes the travel industry

Philippines eyes sustained tourism growth, gits 1.2m international visitors in early 2024

Juneyao Air launches first direct Shanghai to Athens flight, expanding global reach

ICC Sydney launches Disability Inclusion Action Plan on World Autism Awareness Day

Alipay+ connects two million merchants in Japan, bolstering cherry blossom season

Mahindra Aerostructures and Airbus Atlantic ink $100m contract

Bangkok launches Maha Songkran World Water Festival 2024 for Thai New Year

China Southern Airlines launched new Beijing Daxing-Macao flight route

Radisson Hotel Group debuts first Radisson RED in Laos

Agoda reveals Asia’s cheapest destinations for upcoming holidays

Accor doubles presence in Japan with 22 new hotels opening

New $6 million funding boost for Indigenous Tourism in the Northern Territory

The Isan Project launches ‘Flowers of Thailand’ video, encouraging tourists to discover Thailand’s hidden gems

ONYX Hospitality Group expands Shama Brand with new launch in Rayong

TAT launches ‘Air-mazing Thailand’ to boost the country as Asia-Pacific aviation hub

Ascott Limited’s Strategic Vision for Tourism Growth in the Philippines: Insights from Loven Ramos

Club Med hosts first global event in Lijiang, showcasing China’s rich culture and scenic beauty

Trip.com Group and Capital A Berhad forge expanded partnership, enhancing travel offerings

Malaysia welcomes new direct flights from Chengdu and Shenzhen, aims to boost Chinese tourism

Pedals and Pathways: Unveiling the Rise of Cycling Tourism in Southeast Asia

Centara Hotels and Resorts earns GSTC certification for sustainable tourism

Live Webinar: Climate Change Impact on Destination Reputation

Perhentian Marriott Resort opens in Malaysia’s Terengganu

Singapore Airlines restores full service at Perth with four daily flights

Preferred Hotels & Resorts bolsters South Asia team with strategic sales appointments

NSW shatters tourism records with $51.4 billion visitor contribution in 2023

Mercure Hyderabad KCP welcomes Suraj Kumar Gupta as the new Front Office Manager

Embracing Slow Travel and Slow Food: Pioneering Sustainable and Meaningful Tourism

Vistara non-stop flights between Mumbai-Paris started on 28 March

Cambodia’s tranquil retreat Full Moon Island Resort on Koh Ampil

Air India Express expands operations to strengthen Kerala-Muscat air corridor

Chatrium Residence Sathon welcomed Michelin-starred talent to lead Albricias

Ant Int. and Capital A Berhad forge strategic collaboration to boost digitalization and sustainability

Accor’s PM&E division announced six new projects across Asia in Q1 2024

Lloyd’s Inn Kuala Lumpur opens today

Mastercard and Singapore Airlines forge strategic partnership for Southeast Asia

Thailand unveils 42nd Tourism Festival with Prime Minister’s vision

SOTC Travel partners with Mumbai Indians for T20 season

Seatrade Cruise Asia and Crew Connect Global co-locate in Manila

ITB Asia 2024

Asia-Pacific travel and tourism statistics in 2023

By Kevin Tjoe — 20 Oct 2022

studies travel statistics

Updated February 2023 – With countries heavily impacted by harsh border restrictions, the Asia-Pacific region was no exception. Countries such as Australia, New Zealand, and Indonesia closed their borders to international travelers and limited domestic movement, causing the tourism industry within these regions to be heavily affected.

Fortunately, in 2023 the APAC region has started to see a positive trend.From digital trends in tourism to the rise in sustainable travel, in this article, we will identify the most prominent trends in travel and tourism in 2022 within the Asia-Pacific region. These statistics will provide tour and activity operators with valuable insight to adapt their business to the latest trends.

The tourism and travel statistics below were gathered from a survey conducted by Rezdy.

The behaviors of travelers in the Asia-Pacific

With the close proximity between Asian-Pacific countries, it’s no surprise that travelers within this region love to travel. And with traveling in 2023 becoming a whole lot easier, find out how Asia-pacific travelers are exploring the world in 2023.

- According to recent Australian tourism statistics , Australian travellers spend 16% more time on average booking a trip in 2022 than they did in 201 9. ( Tripadvisor )

- Australians devote 60% of their time to planning trips ( Tripadvisor )

- Travelers in Singapore spend 68% of their time researching local travel review sites ( Tripadvisor )

- 6 in 10 Singaporeans are planning to travel as most countries’ restrictions have eased, with 40% have booked a trip ( Traveldailynews )

- 50% of Singaporean travelers are planning to take one trip while 30% are planning to take two trips during the summer ( Traveldailynews )

- Almost 1 in 2 (46%) would like to have a trip that lasts at least 6 days

- Travelers aged between 18-25 are also most keen on taking trips that last 6-9 days (31%), or a trip of 4-5 days (29%) ( Traveldailynews )

- Travelers aged between 26-35 are also most keen on taking trips that last 4-5 days (37%), or a trip of 6–9-days (32%) ( Traveldailynews )

- 42% of travelers said international travel is a high-priority spending area for the coming year, far higher than domestic travel, fashion, and eating out ( Traveldailynews )

The road to recovery

There’s no doubt that the tourism industry within the Asia-pacific region faced many downfalls as a result of countries enforcing strict travel restrictions. This was especially prevalent in countries such as Australia and New Zealand and popular tourist destinations like Bali, Indonesia. Fortunately, tourism has started to pick up once again in 2023 and the APAC experiences industry is finally on its road to recovery.

- New Zealand was the largest source country, accounting for 24% of all visitor arrivals in Australia. ( ABS )

- There were 1,191,830 visitor arrivals in Australia, almost 8 times higher than the previous year. ( ABS )

- Revenue in the Travel & Tourism market is projected to reach US$10.84bn in 2022. ( Statista )

- In the Travel & Tourism market, 75% of total revenue will be generated through online sales by 2026. ( Statista )

- The APAC travel industry is projected to grow at a compound annual growth rate (CAGR) of 6.4% between 2021 and 2024 – when it’s expected to hit 500 million arrivals by 2024 ( Euromonitor )

- APAC travel sales forecast by 2024 ( Euromonitor )

- APAC attractions and experiences sales forecast by 2024 ( Euromonitor )

- In the first two months of 2022, Southeast Asia has welcomed more than 580,000 international visitors in total, a substantial +102% increase year-on-year ( Hospitalitynet )

- Pacific Asia Travel Association (PATA) projected that international visitor arrivals into Asia will grow by 100% between 2022 and 2023 ( Traveldailynews )

- The Asia-P acific region (APAC) has the highest growth potential in the online travel booking industry – with China and India leading the way. This growth can be attributed to the growth of the middle-class income group, increase in disposable income, and wider access to the internet ( GBTA )

Inbound & outbound travel in 2022

As travel begins to resume within the Asia-Pacific region, find out which countries and destinations have been the most popular.

Top 5 countries traveling to Australia

( Traveldailynews )

Top destinations for APAC travelers

- Jeju Island

- Kuala Lumpur

The rise in sustainable travel

With the rising awareness surrounding sustainability and the impacts tourism has on the environment, green tourism is a hot topic. Find out what travelers in Asia-Pacific think of sustainable travel.

- 93% of Indian travelers affirm that sustainable travel is important to them ( Traveldailynews )

- 77% of Singaporean travelers show a strong belief in the need to prioritize sustainable travel ( Traveldailynews )

For more support and tips on how to increase sales in your travel business, subscribe to the Rezdy newsletter .

Looking for a booking software & channel manager to support your business growth in 2023? You’ve come to the right place! Start a FREE 21-day trial with Rezdy or book a free demo today.

Start a free 21 day trial with Rezdy

Enjoy 21 days to take a look around and see if we are a good fit for your business.

No obligations, no catches, no limits, nada

Industry News

Australia & New Zealand travel and tourism statistics in 2023

Global travel & tourism statistics 2023

- Global Locations -

Headquarters

Future Market Insights, Inc.

Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, United States

616 Corporate Way, Suite 2-9018, Valley Cottage, NY 10989, United States

Future Market Insights

1602-6 Jumeirah Bay X2 Tower, Plot No: JLT-PH2-X2A, Jumeirah Lakes Towers, Dubai, United Arab Emirates

3rd Floor, 207 Regent Street, W1B 3HH London United Kingdom

- Asia Pacific

IndiaLand Global Tech Park, Unit UG-1, Behind Grand HighStreet, Phase 1, Hinjawadi, MH, Pune – 411057, India

- Consumer Product

- Food & Beverage

- Chemicals and Materials

- Travel & Tourism

- Process Automation

- Industrial Automation

- Services & Utilities

- Testing Equipment

- Thought Leadership

- Upcoming Reports

- Published Reports

- Contact FMI

Asia-Pacific Tourism Market

Market Survey on Asia-Pacific Tourism Market Covering Sales Outlook, Up-to-date Key Trends, Market Size and Forecast, Analysis of Tour Package Sales, Visitor Expenditure Outlook, Number of Trip Analysis, Market Statistics on Number of Arrivals and Departures, Statistics on Length of Visit

An In-depth Market Insights of Asia-Pacific Tourism Market including Airlines, Hotel Companies, Car Rental, Train, Tour Operators, and Government Bodies Covering Countries like China, Japan, Korea, India, ASEAN, Australia, New Zealand, and Rest of APAC

- Report Preview

- Request Methodology

Asia-Pacific Tourism Market Outlook

As per the latest findings of Future Market Insights, Asia-Pacific tourism revenue is expected to be US$ 138,345.6 Million by the end of 2023. In the long-term, the Asia-Pacific region tourism is estimated to reach at around US$ 414,579.0 Million in 2033.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

2018 to 2022 Asia-Pacific Tourism Market Outlook Compared to 2023 to 2033 Forecast

The Asia-Pacific tourism market experienced a drop in market valuation with a CAGR of -15.3% during the period 2018 to 2022, driven by factors such as an outbreak of covid-19 and the closure of a large number of places across Asia-Pacific region.

According to the UN World Tourism Organization, international tourist arrivals in the Asia-Pacific region increased by 6% in 2018, and by another 4% in 2019. However, the outbreak of COVID-19 pandemic in 2020 caused a significant decline in the international tourist arrivals in the region and the market is yet to recover.

Despite the decline, countries like China, Japan, South Korea, and Thailand remained some of the most popular destinations in the region, attracting millions of tourists each year. Additionally, destinations such as Vietnam, Cambodia, and Laos have also seen significant growth in tourism. The market is expected to recover post the COVID-19 period and many countries are announcing travel bubbles and are working to attract tourists again.

However, while the Asia-Pacific tourism market experienced strong growth during 2018 to 2019, the pandemic caused a significant decline in 2020 and 2021, it is expected to recover in the coming years.

What are the Driving Factors Boosting the Asia-Pacific Tourism Market?

Travel to sites in the Asia Pacific area has been more accessible due to advancements in infrastructure and transportation

The growing middle class population in countries like China and India has led to an increase in disposable income and a greater desire to travel. As a result, more and more people from these countries are travelling internationally, including to destinations in the Asia Pacific region. Increased accessibility to travel, improvements in infrastructure and transportation, such as the expansion of airports and the development of high-speed trains, have made it easier for people to travel to destinations in the Asia Pacific region. The Asia Pacific region offers diverse range of attractions and this diversity of attractions helps to attract a wide range of travellers to the region.

Many countries in the Asia Pacific region have been actively promotion themselves as tourist destinations through marketing and promotional activities, including advertising campaigns and travel fairs. Many countries in the region have been politically stable, which makes them more attractive to tourists as they are less likely to be affected by civil unrest or other safety concerns. The increasing digitization and e-visa processes have made traveling easier and more efficient for tourists and help to attract more tourists to the region.

Positive word of mouth and social media have played a big role in promoting the region, with tourists sharing their experiences and photos online, encouraging others to visit. The region is known for its affordable prices, both for accommodation and for local food and shopping, which makes it an attractive option for budget-conscious travellers.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

What are the Key Trends Boosting the Asia-Pacific Tourism Market?

People looking for accessible, high-quality healthcare and wellness services are increasingly travelling

China has become one of the largest source markets for tourism in the Asia Pacific region, and this trend is expected to continue in the future. The popularity of budget travel, such as backpacking and couch surfing, is on the rise in the Asia Pacific region, as more people look for affordable ways to explore the region. More and more travelers are looking for sustainable and responsible travel options, and destinations in the Asia Pacific region are responding by promoting eco-friendly tourism and conservation efforts. Adventure tourism, such as hiking, skiing and diving, as well as niche tourism, such as gastronomy, culture, and sports tourism, is becoming more popular in the region.

Technology is playing an increasingly important role in the tourism industry in the Asia Pacific region, with more and more people using online platforms to plan, book and share their travel experiences. The Asia Pacific region has become a popular destination for medical and wellness, tourism, as people seek out affordable and high-quality healthcare and wellness services. While some destinations in the Asia Pacific region, such as Japan and Australia, are well-established tourist destinations, new destinations such as Vietnam and Cambodia are emerging as popular travel destinations.

Also, there is increase in local and independent travel as more and more travelers interested in authentic local cultures, more people are choosing independent travel and using local guides and operators, this helps in promoting local economies.

What are the Growth Opportunities In Asia-Pacific Tourism Sector?

Infrastructure improvements have boosted accessibility and the region's ability to host tourists.

Asia Pacific region has a large potential for attracting international tourists, particularly from developed regions such as the United States and Europe. Also, as the middle class continues to grow in countries such as China and India, there will be a corresponding increase in domestic tourism. Development in infrastructure such as airports, hotels and transportation systems, which will make it easier for tourists to visit. Infrastructural development has led to increased accessibility, increase in capacity of the region to accommodate tourists. The development of luxury hotels and resorts has attracted high-end tourists to the region, who are willing to spend more on their vacations.

The future of tourism in Asia Pacific must include diversification beyond the traditional demographic of international visitors. Domestic tourist expenditures in Asia Pacific reached an all-time high in 2019. Destinations must be promoted to domestic markets in order to encourage visitors to return in the near future.

Many countries in the region are looking to diversify their tourism product, such as developing eco-tourism, cultural tourism, and adventure tourism to attract a wider range of tourists. With the advent of virtual tours and 360-degree video, it has become easier for people to have an immersive experience of a destination before actually visiting, which in turn has led to an increase in tourism in the region.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Country-wise insights

How is government of india promoting the development of tourism.

Promoting ecotourism and adventure tourism through the development of infrastructure

Although the tourist industry is mostly driven by the private sector, it is nonetheless reliant on a complex web of government regulations, inter-country travel agreements, and infrastructure investments.

Many states in India have their own state-level tourism boards which work to promote the state as a tourist destination, and to develop policies and programs to support the tourism industry within states. Providing tax incentives for the development of tourist infrastructure, and investing in the development of tourist facilities.

According to data from the Ministry of Tourism, Government of India, the southern states of Andhra Pradesh, Karnataka, Kerala, Tamil Nadu, and Telangana collectively received around 85 million domestic tourists and 8.5 million foreign tourists in 2019. Kerala receiving over 15 million domestic tourists and 1.5 million foreign tourists in 2019. Promoting ecotourism and adventure tourism by developing facilities for activities such as trekking, rock climbing, and wildlife safaris, and by promoting conservation of natural resources.

How is China Diversifying Its Tourism Sector?

“China is investing in the growth of its cruise sector, which is projected to enhance tourism in coastal regions”

China is working to diversify its tourism sector by developing new types of tourism and promoting lesser-known destinations. This includes destinations such as the Silk Road, the Yellow Mountains, and the Three Gorges. They are working to promote its rich cultural and historical heritage as a tourist attraction. This includes developing facilities and infrastructure at historical sites, and promoting cultural festivals and events.

China is investing in the development of its cruise industry, which is expected to boost tourism in the coastal regions. Also enhancing the digitization of the tourism sector by promoting the use of digital technologies in the tourism industry to improve the overall tourist experience and make it more convenient for tourists to plan and book their trips.

Category-wise Insights

Which age group is more likely to travel in asia-pacific region.

The number of tourists aged 46 to 55 is likely to grow dramatically.

The age group that is most likely to travel for tourism in the Asia Pacific region varies depending on the country and type of tourism. However, younger adults and teenagers are more likely to travel for leisure, adventure, and backpacker tourism. They are more likely to be interested in exploring new cultures, trying new activities, and travelling on a budget. Middle-aged group travel for relaxation, visiting historical sites, and experiencing local culture.

Tourists aged 46 to 55 are expected to increase rapidly. This group is also drawn to religious and faith-based attractions and is interested in visiting a variety of religious sites.

Which Booking Channel do Tourists Prefer?

Online booking channels to lead the booking channel segmentation

There are a variety of booking channels for tourism in Asia, including online travel agencies (OTAs), such as Booking.com, Agoda, and Expedia, as well as airline and hotel websites. Additionally, many tour operators and local travel agencies offer booking services. In certain countries, it’s also possible to book accommodations and activities through popular messaging apps like WeChat and Line.

In other countries like India, offline booking channels such as travel agents and tour operators are quite popular. Ctrip, Hotels.com, TripAdvisor, Airbnb, and many more are some of the main booking channels but there are many local channels specific to certain countries in the region as well.

Competitive Landscape

The Asia-Pacific area has enormous potential for the development of the tourism industry; the UNWTO anticipates a CAAG rate of 5% for tourist arrivals between 2016 and 2030. By 2030, the region is projected to receive 535 million tourists, or 30% of all tourists worldwide.

Growth is anticipated to be fuelled by the middle class's continuous ascent and more money invested in the travel and tourism sector. Increased market openness, air connectivity, and travel facilitation promote growth. Therefore, it is crucial for the industry's stakeholders to stay current on the major factors influencing the growth of tourism, with the following factors having a special influence and impact.

The industry's established companies are employing distinctive techniques to seize market share in this very competitive environment. To guarantee that clients receive quality service and value for their money, the players want to maintain full control over all aspects of services and channel support.

Scope of Report

Asia-pacific tourism market by category, by direct suppliers:.

- Hotel Companies

- Tour Operators

- Government Bodies

By Indirect Suppliers:

- OTA (Online Travel Agency)

- Traditional Travel Agencies

- TMC’s (Travel Management Companies)

- Corporate Buyers

- Aggregators

By Activity Type:

- Medical Tourism

- Sports Tourism

- Culinary Tourism

- Adventure Tourism

By Demographic:

By tourism type:.

- International

By Booking Channel:

- Phone Booking

- Online Booking

- In Person Booking

By Tour Type:

- Individual travel

- Professional Groups

- Group travels

By Country:

Frequently asked questions, what drives the asia-pacific tourism market.

Asia Pacific travel booms on infrastructure, and transportation by driving sales.

What is the Key Trend in the Market?

People looking for high-quality healthcare and wellness services are increasingly traveling.

What is the Growth Forecast for the Asia-Pacific Tourism Market?

The market is forecast to register a CAGR of 11.6% through 2033.

What is the Current Market Valuation?

The market is estimated to generate revenue of US$ 138,345.6 million in 2023.

What is the Key Opportunity in the Asia-Pacific Tourism Market?

Infrastructure improvements boost accessibility and the region's ability to host tourists.

Table of Content

List of tables, list of charts.

Recommendations

Travel and Tourism

Saudi Arabia Hajj Tourism Industry

Published : March 2024

Singapore Tourism Industry

Usa and canada tourism market.

Published : February 2023

Desert Island Tourism Market

Published : October 2022

Explore Travel and Tourism Insights

Talk To Analyst

Your personal details are safe with us. Privacy Policy*

- Talk To Analyst -

This report can be customized as per your unique requirement

- Get Free Brochure -

Request a free brochure packed with everything you need to know.

- Customize Now -

I need Country Specific Scope ( -30% )

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

UN Tourism | Bringing the world closer

Asia and pacific countries advance shared vision of tourism for development.

Asia and Pacific Unite in Support of the International Code for the Protection of Tourists

Latest News

UNWTO Completes Gastronomy Tourism Project for Ub...

UNWTO Holds Executive Training Programme for Asia...

UNWTO and Pacific Asia Travel Association Focus o...

UNWTO Joins Global Tourism Economy Forum for Land...

From our members.

Ramadhan in Brunei Darussalam: A Fascinating Cultural Experience

Refreshing Fujian: Starting Point of the Maritime Silkroad

Dining event presented by four top-notch chefs to introduce the charm of high-quality food of Niigata prefecture, JAPAN

International Tourism Investment Forum 2023

UNWTO Asia Pacific Newsletter 46 Issue

UNWTO Tourism Highlights, 2017 Edition 日本語版

UNWTO/GTERC Annual Report on Asia Tourism Trends – 2017 Edition

Managing Growth and Sustainable Tourism Governance in Asia and the Pacific

2nd UN Tourism Regional Conference on the Empowerment of Women in Tourism in Asia and the Pacific

First UN Tourism Regional Forum on Gastronomy Tourism for Asia and the Pacific

36th CAP-CSA and First UN Tourism Regional Forum on Gastronomy Tourism for Asia and the Pacific

International Accessible Tourism Forum - Asia & the Pacific

Asia-Pacific travel and tourism statistics in 2023

Table of Contents

This article will give you an overview of the Asia-Pacific travel and tourism industry in 2023, covering the key trends, challenges, and opportunities shaping the market. You will also discover some of the most popular destinations, activities, and experiences travelers seek in this region.

Whether you are a travel agency, a tour operator, or a travel enthusiast, you will find valuable insights and tips to help you create more value for your customers and grow your business.

Are you curious to learn more about Asia-Pacific travel and tourism in 2023? Let’s dive in!

Overview of the Asia-Pacific travel and tourism industry

The Asia-Pacific travel and tourism industry is one of the most dynamic and diverse in the world, offering a wide range of opportunities for leisure and business travelers. In 2023, the industry is expected to see a strong recovery from the impact of the COVID-19 pandemic, thanks to the successful vaccination campaigns, the easing of travel restrictions, and the pent-up demand for travel.

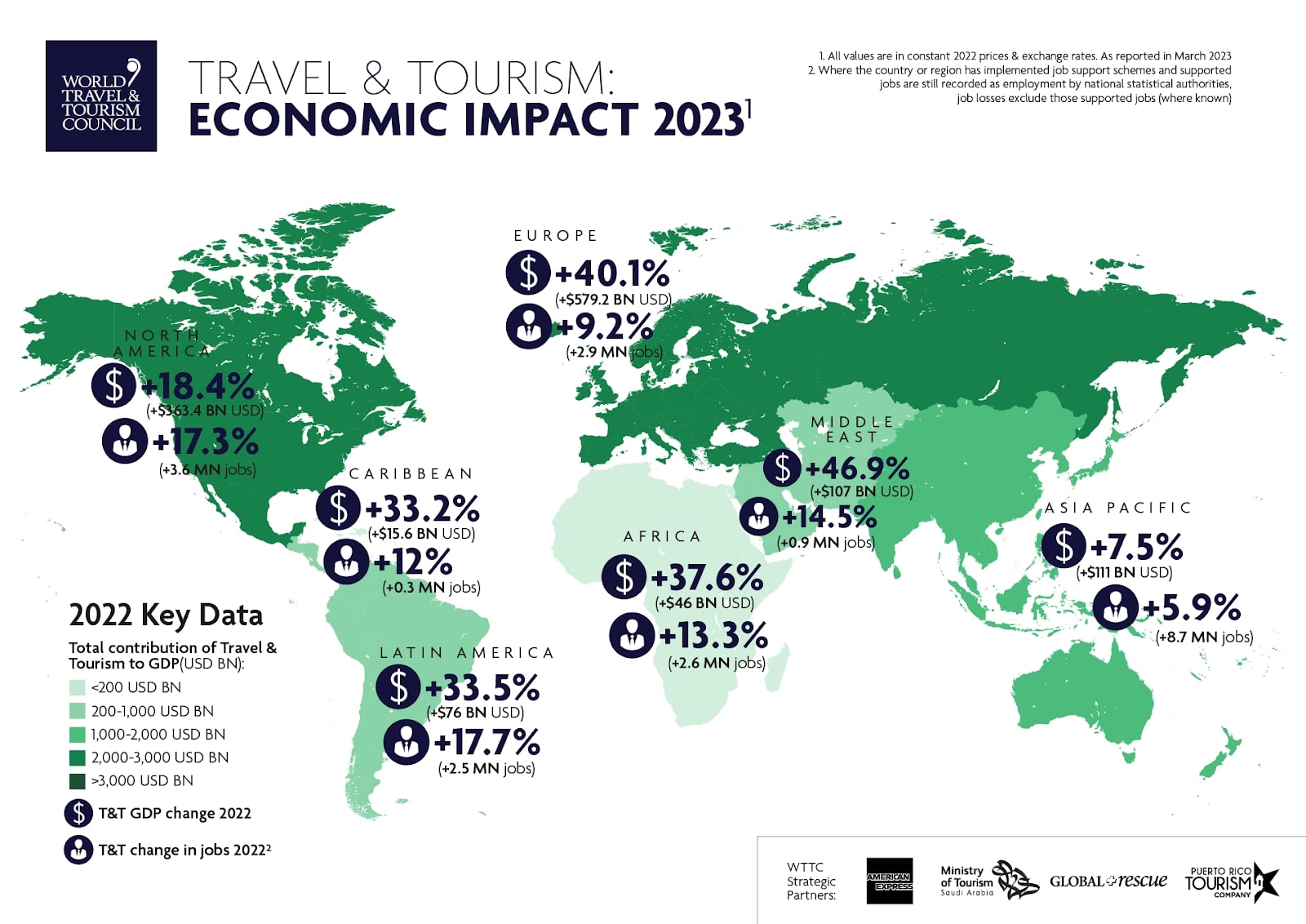

According to the World Travel & Tourism Council (WTTC) , Asia-Pacific is expected to be the only region in the world to recover by 2023, with tourism revenue contributing 32% more to the region’s GDP than before the pandemic. The WTTC also predicts that the region will add 65% of the new jobs in the global travel industry in the next decade, with China and India leading the way.

However, the recovery of the Asia-Pacific travel and tourism industry is challenging. The impact of the COVID-19 pandemic has been severe and uneven across the region, with some countries experiencing more losses and slower rebounds than others.

The pandemic has also changed the preferences and behaviors of travelers, who are now more concerned about health and safety, sustainability, and digitalization. The industry needs to adapt to these changes and provide travelers more value-added services and experiences.

How can you use these trends and challenges to grow your Asia-Pacific travel and tourism business? The next section will explore some of the most popular destinations, activities, and experiences travelers seek in this region.

Key statistics and insights by country

Cambodia is rich in culture, history, and natural beauty, attracting travelers who want to explore its ancient temples, vibrant cities, and rural landscapes. In 2023, Cambodia is expected to welcome 4 million international tourists, a significant increase from the 1.3 million tourists in 2020 and the 196,495 tourists in 20211. The main source markets for Cambodia are China, Vietnam, Indonesia, Thailand, and Taiwan.

Some of the most popular destinations and attractions in Cambodia are:

Exploring the Temples of Angkor : This is the highlight of any trip to Cambodia, as travelers can marvel at the historical significance and architectural wonders of the largest religious complex in the world. The temples of Angkor date back to the 9th to 15th centuries and showcase the Khmer civilization’s artistic and engineering achievements. Travelers can visit iconic temples such as Angkor Wat, Bayon, Ta Prohm, and Banteay Srei and enjoy cultural shows, markets, and museums in the nearby town of Siem Reap.

Visiting Phnom Penh : The capital city of Cambodia is a bustling metropolis that offers a mix of colonial charm, modern development, and local culture. Travelers can learn about the country’s tragic history at the Tuol Sleng Genocide Museum and the Killing Fields, admire the royal palace and the silver pagoda, shop at the central and Russian markets, and enjoy the nightlife along the riverside.

Experiencing rural Cambodia : There are many options for travelers who want to get off the beaten track and experience the authentic life of rural Cambodia. Travelers can visit floating villages on Tonle Sap Lake, cycle through rice fields and villages in Battambang, trek through jungles and waterfalls in Mondulkiri, relax on pristine beaches in Koh Rong and Koh Rong Sanloem, or volunteer at wildlife sanctuaries and community projects.

Japan is a country that offers a unique blend of tradition and modernity, with diverse attractions ranging from ancient temples and shrines to futuristic skyscrapers and technology.

In 2023, Japan is expected to host 32 million international tourists, a recovery from the 4.1 million tourists in 2020 and the 1.5 million tourists in 2021. The main source markets for Japan are China, South Korea, Taiwan, Hong Kong, and Thailand.

Some of the most popular destinations and attractions in Japan are:

Experiencing the Cherry Blossoms in Japan: One of the most iconic symbols of Japan is the cherry blossom or sakura, which blooms for a short period of time between late March and early May. Travelers can enjoy the beauty of these delicate flowers in various locations across Japan, such as Tokyo’s Ueno Park and Shinjuku Gyoen, Kyoto’s Arashiyama and Philosopher’s Path, Osaka’s Osaka Castle Park and Nara’s Nara Park. Travelers can also join hanami or flower viewing parties with locals, where they can picnic under the trees and appreciate the transient nature of life.

Visiting Tokyo : Japan’s capital city is a vibrant and dynamic metropolis that offers something for everyone. Travelers can explore different neighborhoods such as Shibuya’s crossing and fashion district, Harajuku’s youth culture and kawaii shops, Ginza’s luxury shopping and fine dining, Akihabara’s anime and electronics hub, Asakusa’s traditional temples and markets, Roppongi’s nightlife and art scene, and Odaiba’s entertainment island. Travelers can also visit famous landmarks such as Tokyo Tower, Tokyo Skytree, Tokyo Disneyland, and Tokyo Imperial Palace.

Discovering Japan’s culture and heritage: Japan has a rich and diverse culture that spans centuries of history and influences from other countries. Travelers can discover Japan’s culture and heritage through various activities such as visiting UNESCO World Heritage Sites such as Mount Fuji, Himeji Castle, and Hiroshima Peace Memorial, experiencing traditional arts and crafts such as origami, calligraphy, and pottery, learning about samurai and ninja history and legends, participating in tea ceremonies, wearing kimonos and staying in ryokans or traditional inns

Nepal is a country that offers stunning natural scenery, a diverse cultural heritage, and a friendly and hospitable people. Nepal is famous for being home to the highest mountain in the world, Mount Everest, as well as other majestic peaks of the Himalayas.

In 2023, Nepal is expected to welcome 1 million tourists, a recovery from 230,085 tourists in 2020 and 173,709 tourists in 2021. The main source markets for Nepal are India, China, the United States, the United Kingdom, and Sri Lanka.

Some of the most popular destinations and attractions in Nepal are:

Trekking to Everest Base Camp: This is the ultimate adventure for travelers who want to challenge themselves and witness the awe-inspiring views of the Himalayas. The trekking route to Everest Base Camp takes about 12 to 14 days and covers a distance of about 130 kilometers. Travelers can enjoy the diverse landscapes of valleys, glaciers, forests, and villages and encounter various wildlife, such as yaks, snow leopards, and red pandas. Travelers can also learn about the Sherpa culture and their connection to the mountains.

Exploring Kathmandu Valley: The capital city of Nepal and its surrounding areas are rich in cultural and historical attractions that showcase the country’s religious diversity and artistic heritage. Travelers can visit UNESCO World Heritage Sites such as Kathmandu Durbar Square, Patan Durbar Square, and Bhaktapur Durbar Square, where they can admire the ancient palaces, temples, and monuments. Travelers can also visit sacred sites such as Swayambhunath or Monkey Temple, Boudhanath Stupa, and Pashupatinath Temple, where they can witness Buddhist and Hindu rituals and ceremonies.

Experiencing adventure tourism and outdoor activities: Nepal is a paradise for travelers who love adventure tourism and outdoor activities, as it offers a variety of options to suit different levels of skills and interests. Travelers can experience rafting, kayaking, canoeing, bungee jumping, zip-lining, paragliding, mountain biking, rock climbing, wildlife safaris, and more. Travelers can also visit national parks such as Chitwan National Park and Sagarmatha National Park, where they can see endangered animals such as rhinos, tigers, elephants, and snow leopards.

Another important aspect of the Asia-Pacific travel and tourism industry is sustainable tourism practices that aim to minimize the negative impacts and maximize the positive impacts of tourism on the environment, society, and economy.

Sustainable tourism practices can help preserve a destination’s natural and cultural resources, enhance local communities quality of life, reduce greenhouse gas emissions and waste generation, and increase customer satisfaction and loyalty.

Some of the sustainable tourism practices that are implemented or promoted in the Asia-Pacific region are:

Green certification schemes: These schemes provide standards and guidelines for hotels, tour operators, attractions, and destinations to improve their environmental performance and reduce their carbon footprint. They also provide recognition and incentives for those who comply with the criteria and communicate their achievements to customers and stakeholders.

Some examples of green certification schemes in the Asia-Pacific region are Green Globe, EarthCheck, Green Key, and Travelife.

Community-based tourism: This type involves engaging local communities in planning, developing, managing, and benefiting from tourism activities in their areas. Community-based tourism can empower local people to preserve their culture and traditions, protect their natural resources, generate income and employment opportunities, and improve their social services and infrastructure.

Some examples of community-based tourism initiatives in the Asia-Pacific region are Ban Talae Nok Village in Thailand, Banteay Chhmar Community-Based Tourism Association in Cambodia, Toraja Heritage Hotel in Indonesia, and Barefoot College in India.

Responsible travel behavior: This refers to the actions and attitudes of travelers that contribute to the sustainability of tourism. Responsible travel behavior can include choosing eco-friendly transportation modes, accommodation options, and tour operators; respecting local customs and norms; supporting local businesses and products; avoiding animal exploitation; reducing water and energy consumption; minimizing waste generation; participating in conservation projects; and spreading awareness.

Some examples of organizations that promote responsible travel behavior in the Asia-Pacific region are Responsible Travel, Intrepid Travel, G Adventures, and World Animal Protection.

We hope you enjoyed learning about the Asia-Pacific travel and tourism industry in 2023 and got useful insights and tips for your business. This region is full of amazing opportunities and experiences for travelers looking for something different and memorable.

Whether it’s exploring the temples of Angkor in Cambodia, experiencing the cherry blossoms in Japan, or trekking to Everest Base Camp in Nepal, there is something for everyone in Asia-Pacific. And don’t forget to practice sustainable tourism and be a responsible traveler, so you can help protect this beautiful region and its people!

Thank you again for reading our article. We wish you all the best!

Unleash The Full Potential of Your Travel Agency Website with Traveler

- NEW VERSION 3.1.1 – Upsell and Trust Badges For Partner by traveler 16/11/2023

- How to Increase Bookings for Your B&B? by traveler 13/09/2023

- NEW VERSION 3.1.0 – New Update Solo Tour Demo, Mega Menu, Upsell Power and Trust Badges by traveler 11/09/2023

- How To Optimize Blog Content for Your Bed & Breakfast Business? by traveler 10/09/2023

- Top 5 Ways to Advertise Your Bed and Breakfast Business by traveler 10/09/2023

Related Posts

How to increase food & beverage revenue in your hotel.

How To Write A Perfect Travel Guide ?

Texting vs Calling: Which is Better for travel agency website?

- Privacy Policy

- Support Policy

- Refund policy

- Term and Conditions

Traveler design by ShineCommerce © All rights reserved

IMAGES

COMMENTS

Total contribution of travel and tourism to GDP in the Asia-Pacific region in 2022, with forecasts for 2023 and 2033, by country or territory (in billion U.S. dollars)

Annual Report on Asia-Pacific Tourism 2021. 29. Total travel and tourism-related exports declined 65% from USD 239.1 billion in 2019 to USD 82.9 billion in 2021. Through the first ten months of 2022, travel and tourism- related exports improved to 65% of exports during the first ten months of 2019.

BANGKOK, May 31, 2023 -- Updated forecasts for 39 Asia Pacific destinations, released by the Pacific Asia Travel Association (PATA) today, show a very strong increase in aggregate international visitor arrivals (IVAs) under each of three scenarios in 2023, with robust annual growth continuing to the end of 2025. Sponsored by Visa and with data and insights from Euromonitor International, this ...

International tourism, number of arrivals - East Asia & Pacific. World Tourism Organization, Yearbook of Tourism Statistics, Compendium of Tourism Statistics and data files. License : CC BY-4.0. LineBarMap. Also Show Share Details. Label. 1995 - 2019.

According to the Annual Tourism Monitor (ATM) 2020 released by PATA, the moderate gain of foreign arrivals (6.3%) dramatically dropped to -67% in early 2020 compared to same period of the previous year, indicating loss of more than 172M visitors. International visitor arrivals into Asia Pacific, early 2016 to early 2020.

By regions, Africa led growth in 2019 with a 5% increase in arrivals, followed by Europe and Asia and the Pacific (both +4%). The Americas and the Middle East saw a 2% increase. In 2019, Asia and the Pacific recorded 4% growth to reach 360 million international tourist arrivals, one-fourth of the world's total.

UNWTO GTERC Asia Tourism Trends, 2017 Edition Executive Summary 03 Asia and the Pacific sustained a robust growth in 2016. The statistics in this report show that the dynamic economies in Asia and the Pacific have continued to power the region both as an inbound and an outbound regional source market in the context of global tourism;

The speed of tourism recovery in Asia & Pacific in 2023 faces both upside and downside risks. The reversal of zero-COVID policy and easing of travel restrictions for inbound and outbound tourists in China could boost overall tourist inflows in the Asia & Pacific region in 2023 and make tourism recovery more broad-based.

This follows an unprecedented drop of 73% in 2020, the worst year on record for international tourism. By regions, Asia and the Pacific continued to suffer the largest declines with a 94% drop in international arrivals in the first quarter of 2021, compared to 2020.

The second UNWTO World Tourism Barometer of the year shows that the sector's swift recovery has continued into 2023. It shows that: Overall, international arrivals reached 80% of pre-pandemic levels in the first quarter of 2023. An estimated 235 million tourists travelled internationally in the first three months, more than double the same ...

According to the latest Skift Travel Health Index: February 2024 Highlights, Asia Pacific, which has been on an upward trajectory since early 2023, leads the index. A key driver of Asia Pacific ...

BANGKOK - Updated forecasts for 39 Asia Pacific destinations, released by the Pacific Asia Travel Association (PATA), show a very strong increase in aggregate international visitor arrivals (IVAs) under each of three scenarios in 2023, with robust annual growth continuing to the end of 2025.. Sponsored by Visa and with data and insights from Euromonitor International, this suite of reports ...

International Tourism and COVID-19. Export revenues from international tourism dropped 62% in 2020 and 59% in 2021, versus 2019 (real terms) and then rebounded in 2022, remaining 34% below pre-pandemic levels. The total loss in export revenues from tourism amounts to USD 2.6 trillion for that three-year period. Go to Dashboard.

Fortunately, in 2023 the APAC region has started to see a positive trend.From digital trends in tourism to the rise in sustainable travel, in this article, we will identify the most prominent trends in travel and tourism in 2022 within the Asia-Pacific region. These statistics will provide tour and activity operators with valuable insight to ...

As per the latest findings of Future Market Insights, Asia-Pacific tourism revenue is expected to be US$ 138,345.6 Million by the end of 2023. In the long-term, the Asia-Pacific region tourism is estimated to reach at around US$ 414,579.0 Million in 2033. Attribute. Details. Travel Gross Revenue (2023)

The UNWTO/GTERC Asia Tourism Trends - 2019 Edition, the sixth annual report in the series, highlights in its first chapter the rapidly growing tourism sector in Asia and the Pacific. The 2nd chapter examines the potential of the Chinese outbound tourism market, the world's largest in both numbers and expenditure, to South America, with ...

The UNWTO Statistics Department is committed to developing tourism measurement for furthering knowledge of the sector, monitoring progress, evaluating impact, promoting results-focused management, and highlighting strategic issues for policy objectives.. The department works towards advancing the methodological frameworks for measuring tourism and expanding its analytical potential, designs ...

Asia Pacific Journal of Tourism Research is the official journal of the Asia Pacific Tourism Association (Founded September 1995) and seeks to publish both empirically and theoretically based articles of high quality which advance and foster knowledge of tourism.. The Journal welcomes submissions of full length articles and critical reviews on major issues with relevance to tourism in the Asia ...

Tourism Statistics. Get the latest and most up-to-date tourism statistics for all the countries and regions around the world. Data on inbound, domestic and outbound tourism is available, as well as on tourism industries, employment and complementary indicators. All statistical tables available are displayed and can be accessed individually ...

UNWTO and Pacific Asia Travel Association Focus o... 30 Oct 2023. Asia and the Pacific Investment. UNWTO Joins Global Tourism Economy Forum for Land... 21 Sep 2023. From Our Members. More From Our Members. Asia and the Pacific RDAP Dept. Ramadhan in Brunei Darussalam: A Fascinating Cultural Experience.

According to the World Travel & Tourism Council (WTTC), Asia-Pacific is expected to be the only region in the world to recover by 2023, with tourism revenue contributing 32% more to the region's GDP than before the pandemic. The WTTC also predicts that the region will add 65% of the new jobs in the global travel industry in the next decade ...