Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Best Travel Insurance Options for Seniors [Ages 65, 70, and Over 80]

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3091 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

![medibank travel insurance for seniors The Best Travel Insurance Options for Seniors [Ages 65, 70, and Over 80]](https://upgradedpoints.com/wp-content/uploads/2021/05/Senior-couple-on-beach-at-sunset.jpeg?auto=webp&disable=upscale&width=1200)

Why Purchase Travel Insurance

The cost of travel insurance, preexisting conditions, travel insurance and medicare, covid-19 and travel insurance, world nomads — best for active seniors, allianz — best for annual multi-trip policies, best for covering covid-19 cancellations, best for preexisting conditions, best travel insurance options — age 80 and above, credit card travel insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Our senior years can be some of the most exciting years of our lives. If we’re fortunate, we’ll now have the time, and hopefully, the resources, to make our travel dreams come true.

As we age, however, traveling may pose some additional risks. We may be more likely to have health-related issues and therefore the need to seek medical attention during our journey. We may also have occasions where we need to cancel our plans due to health issues or the health of those around us.

Now, more than ever, we need to think seriously about purchasing travel insurance. The good news is that comprehensive travel insurance, regardless of your age, is widely available and relatively affordable. With that being said, chances are you could use a little help getting started with the process of finding and purchasing the right plan.

If you’re 65 years of age or older and thinking about purchasing travel insurance, don’t pull the trigger without reviewing the information in today’s article on travel insurance options for seniors.

Travel insurance can protect you from financial loss due to unforeseen events that can cause you to cancel your trip or disrupt your trip once it’s in progress. As we age and our health declines, we may be more likely to experience such an event.

Travel insurance can cover the following situations:

- You, a family member, or travel companion becomes seriously ill and you must cancel your trip

- You slip and fall while traveling abroad, require medical care, and are forced to stay in a foreign city until you can travel again

- You are on safari and break your ankle, requiring emergency evacuation to the nearest hospital

The types of coverage you can expect to find on travel insurance policies include the following:

- Emergency medical coverage

- Emergency evacuation

- Trip cancellation, trip interruption , and trip delay

- Baggage insurance and personal effects coverage

- Travel accident and accidental life insurance

You may also elect to add coverage such as cancel for any reason insurance (CFAR) , a waiver for preexisting conditions, or car rental insurance.

What You Need to Know About Age and Travel Insurance

It’s possible to purchase travel insurance at just about any age. If you’re healthy enough to travel, you’ll generally be able to find coverage. You’ll normally be paying more to purchase coverage as you get older, however, and most policies may have preexisting health stipulations.

As age increases, so does the cost of purchasing travel insurance . The good news, however, is that premiums tend to vary widely between companies who offer policies for older travelers, so it pays to compare.

The easiest way to compare policies is via insurance comparison sites such as SquareMouth , InsureMyTrip , or TravelInsurance.com . Travel comparison sites make it easy to compare travel insurance policy pricing and coverage options for all ages.

We’ve used these sites to find most of the comparison quotes provided in this article.

As we age, we’re more likely to have preexisting health conditions, which can be excluded from most travel insurance policies. Once again, the good news is that preexisting condition exclusions are generally limited to a specified timeframe previous to the effective date of your policy.

If you have shown symptoms or been treated within a specified time period before your trip, usually 90 to 120 days, your condition may not be covered for certain coverages such as trip interruption, cancellation, or emergency medical. Each company’s requirements may differ.

Also, on a positive note is that many insurers allow you to purchase a preexisting condition waiver when you purchase your policy.

Health insurance may or may not cover medical costs abroad. And even if there is coverage, evacuation costs may not be included. The same scenario exists with Medicare.

Medicare will not cover medical expenses incurred abroad . There are very limited situations where Medicare may grant coverage, such as if you reside in the U.S. and a foreign hospital (such as a Canadian hospital) is closer to your residence than the U.S. hospital, or you’re traveling through Canada to reach another U.S. state or territory. Also, several terms and conditions apply.

There are Medicare supplement policies you can purchase that can cover you while traveling abroad. You’ll pay a standard $250 deductible, have coverage for 80% of eligible expenses beyond that amount, and have a lifetime cap of $50,000 in coverage.

So even if you have Medicare, a Medicare supplement, or other health insurance policy, there can still be plenty of gaps in coverage when you’re traveling abroad.

For this reason, and the need for additional coverage such as trip cancellation, interruption, delay, baggage coverage, and more, it’s prudent to purchase travel insurance.

Bottom Line: Medicare will generally not cover medical expenses when you’re traveling outside of the U.S. and its territories and Medicare supplement and Advantage policies provide limited coverage. Travel insurance is a wise choice for covering medical expenses and for other travel-related events that could cause you to cancel your trip or disrupt your journey in progress.

As we advance in age, the chance we will need to cancel a trip due to health-related issues increases. Fortunately, most travel insurance policies cover trip cancellations due to illness. However, travel insurance policies do not cover voluntary cancellations such as canceling your trip due to the fear of getting sick.

Cancel for any reason insurance (CFAR), when added to a travel insurance policy, will allow you to cancel your trip for any reason you deem necessary. It will even cover you if you simply decide not to go.

While CFAR insurance allows you to cancel your trip for any reason, including COVID-19-related issues, the coverage will not reimburse 100% of your costs. The coverage can only be purchased when you purchase your travel insurance or for a short window following the purchase. CFAR insurance can also be expensive.

Our article on COVID-19-related trip cancellations goes into a lot more detail.

Best Travel Insurance Options — Ages 65 to 69

Priorities change as we change and as a result, we may have different insurance needs at age 65 than we do at age 80. Here are some examples of travel insurance plans that might be a fit for travelers age 65-69.

If you’re under age 70, you’ll find comprehensive travel insurance coverage with World Nomads . What sets World Nomads apart from other insurance providers is that they’re experts at insuring active travelers who participate in adventurous activities.

While World Nomads does not offer CFAR insurance, COVID-19 is not excluded as an illness for trip cancellation and emergency medical coverage.

World Nomads only insures those travelers under age 70 and refers older travelers to its partner TripAssure .

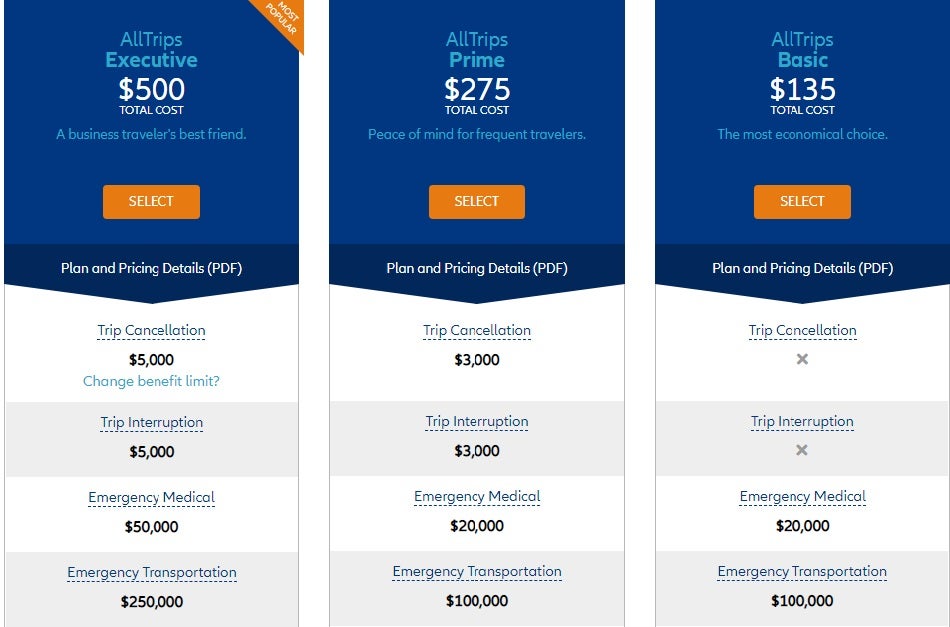

For a traveler 68 years of age, traveling to the Netherlands for 8 days, with a total trip cost of $3,000, here are some sample costs.

The main differences in these plans are that the Explorer Plan covers an expanded collection of over 200 covered adventurous activities, has higher limits for trip interruption/cancellation/delay and emergency evacuation, and includes rental car insurance.

Secure your own quote from World Nomads .

Allianz simplifies purchasing travel insurance with its offerings of travel insurance package policies. You can select from single trip policies with several levels of coverage options or annual multi-trip policies that cover every trip you make during the policy period, even ones you haven’t yet planned.

If you travel frequently, or even a few times each year, purchasing an annual, multi-trip plan could be a cost-effective way to protect all your trips.

To learn more about Allianz and its policy offerings , you’ll want to check out our review for details.

Hot Tip: Be sure to compare the price of an annual multi-trip travel insurance policy to a single-trip plan, even if you are only currently planning 1 trip. You may find a better value in the annual multi-trip policy and not have to purchase additional coverage if you should decide to travel again during the policy period.

Many policies will cover trip cancellation due to getting the virus, but none will cover cancellation due to the fear of getting the virus. To cover cancellations based on the fear of COVID-19, you’ll need a policy that allows you to add CFAR insurance .

The following are just a sampling of companies that offer this option on their policies.

- John Hancock

- Seven Corners

Please note that not every policy these companies offer allows you to add CFAR coverage.

For more information on travel insurance covering COVID-19 , we’ve put together an informative article.

Best Travel Insurance Options — Ages 70 to 79

There are a lot of reasons to embrace the wanderlust and travel in your 70s. By then, many have retired and perhaps have more money to spend on travel. There can also be a sense of urgency to travel while we’re still healthy.

As we’ve mentioned, however, as we age we are more apt to have health issues. Fortunately, this doesn’t mean we’ll be unable to purchase travel insurance. Even into our 70s, we’ll have plenty of travel insurance options, and coverage can still be affordable.

Since travel insurance is meant to protect you from unforeseen events, having a preexisting health condition may rule out any chance of coverage for that issue. However, several companies allow you to purchase a waiver so that preexisting health conditions can be covered.

Here are just a few companies that offer this waiver:

- Travel Guard

- Travel Insured

Each company has its own requirements for adding a preexisting condition waiver to your policy. You must purchase the policy within a specific time period, such as within 14 to 30 days after making your first trip deposit payment. You may also be required to insure the entire cost of your trip and your health must be medically stable when purchasing the coverage.

As a senior, it becomes more and more likely that we will actually have to use our travel insurance coverage as we age. However, even at age 80 or beyond, you’ll still find travel insurance widely available and relatively affordable. Some companies are willing to insure older travelers but charge higher premiums , so it’s wise to compare the pricing of several providers.

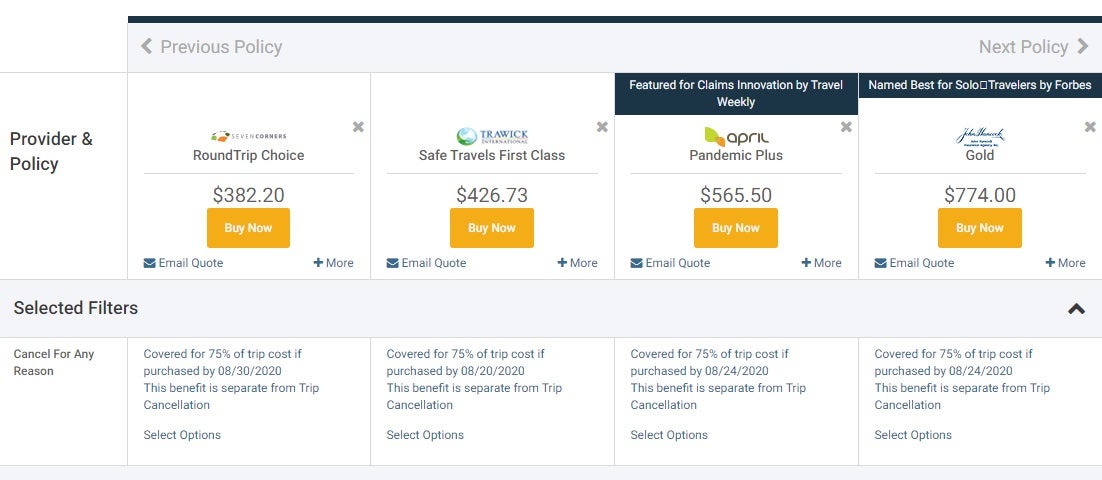

Above you’ll find a sampling of 4 SquareMouth quotes for single-trip travel insurance policies that include CFAR insurance for a traveler 80 years of age. The trip’s total cost was stated at $3,000 and was 8 days in length. Quotes ranged from $382 (Seven Corners) to well over $1,000 to insure the trip (not all quotes are shown). Coverage limits can also vary greatly, so it can be beneficial to compare policy limits.

If you’re looking to purchase travel insurance and you’re 80 years of age or older, it’s imperative to compare policies for the best pricing and coverage.

Hot Tip: Seniors ages 65 to 99 who are not interested in CFAR (cancel for any reason) insurance, may consider an annual multi-trip travel insurance plan. Allianz is a company that charges the same premium, regardless of age, for its annual plans for travelers ages 65 to 99 .

There is 1 type of travel insurance that will cover you, regardless of age . U.S.-issued credit cards come with various types of travel insurance coverages that apply to all primary cardholders.

Typical travel insurance coverage found on credit cards includes the following:

- Lost, stolen, or damaged luggage insurance

- Car rental insurance

- Roadside assistance

- Travel accident insurance

- Travel assistance hotline

Premium credit cards such as The Platinum Card ® from American Express and Chase Sapphire Reserve ® card also come with valuable emergency evacuation coverage. Additionally, the Chase Sapphire Preferred ® card is known for its comprehensive travel insurance benefits, including primary car rental insurance .

To learn more about which credit cards come with travel coverage, check out our article on the best credit cards for travel insurance benefits.

Bottom Line: The travel insurance benefits that come with U.S.-issued credit cards do not generally have age limits for coverage. However, many credit card travel benefits may be secondary to other insurance you might have. This means that you might first have to file a claim with your own insurance before the credit card insurance is valid.

As seniors, purchasing travel insurance should be a priority for protecting your investment and preventing losses you might incur due to unexpected medical expenses during your travels.

With wide availability, regardless of age, it’s not only a prudent economic move, but it’s also a move that delivers peace of mind before and during your trip.

Finally, always make sure to compare policies as coverages and prices vary widely between travel insurance providers.

You can learn more about the best travel insurance companies for travelers and the basics of travel insurance in our informative articles.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

Frequently Asked Questions

What is the best travel insurance for seniors over 65.

Since travel insurance is widely available, even for seniors over 65, the best policy can be found by comparing companies and policies.

Using a travel insurance comparison site such as SquareMouth, InsureMyTrip, or TravelInsurance.com can assist you in comparing coverages and costs between only highly-rated financially stable travel insurance companies.

If you travel more than once per year, consider an annual, multi-trip, policy that covers any trip you take during the policy period.

Does travel insurance cover COVID-19?

Travel insurance is meant to cover unforeseen events. Once COVID-19 was declared a pandemic, it became a known event and is not covered as a reason for canceling your trip plans.

However, there are situations where COVID-19-related claims can be covered. If you become ill with the virus before or during your trip, you may be covered for trip cancellation, trip interruption, or emergency medical.

Does travel insurance cover preexisting medical conditions?

A standard travel insurance policy does not cover ongoing preexisting health conditions. However, many companies will insure you if you have a condition that is stabilized with medicine and no recent treatment has been sought. Requirements vary by travel insurance provider.

Also, many companies allow you to purchase a waiver that will then cover you for preexisting conditions.

Does credit card travel insurance cover flight cancellations?

The trip cancellation, interruption, or delay coverage that comes with your credit card does not cover voluntary flight cancellations.

The coverage does cover some flight cancellations due to unforeseen events such as becoming ill prior to, or during your trip. Coverage varies by credit card issuer but you will find a list of specific covered events in your card’s guide to benefits.

You can also call the number on the back of your card and speak with the claim administer.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Travel Insurance for Seniors & Retirees: 5 Top Picks

Allianz Travel Insurance »

Trawick International »

GeoBlue »

IMG Travel Insurance »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance for Seniors and Retirees.

Table of Contents

- Rating Details

- Allianz Travel Insurance

- Trawick International

While anyone planning a trip overseas can benefit from having a travel insurance plan in place, older travelers need to prioritize this coverage more than others. The fact is, senior travelers and retirees have unique worries and risks to think about any time they travel far from home. These risks increase their need for travel health insurance and emergency medical coverage, as well as coverage for emergency medical evacuation that applies anywhere in the world.

Which travel insurance options work best for seniors? There are many travel insurance plans that were created with retirees in mind, although you'll want to compare them side by side. For example, you may want to look at coverage limits for medical expenses and coverage for preexisting conditions above all else.

U.S. News editors compared more than 20 of the top travel insurance companies to find the best plans for seniors. This list does the heavy lifting for you as you search for the best senior travel insurance of 2023, so read on to learn about the top picks.

- Allianz Travel Insurance: Best Annual Coverage

- Trawick International: Best Premium Travel Insurance for Seniors

- GeoBlue: Best Travel Medical Coverage for Expats

- IMG Travel Insurance: Best for Short-Term Travel Medical Coverage

- WorldTrips: Best for Flexibility

Best Travel Insurance for Seniors and Retirees in Detail

Available to senior travelers of all ages

Coverage for preexisting conditions is offered

Relatively low limits for emergency medical expenses

- Coverage for COVID-19

- Trip cancellation coverage up to $3,000

- Trip interruption coverage up to $3,000

- Emergency medical coverage up to $20,000

- Emergency medical evacuation coverage up to $100,000

- Baggage loss coverage up to $1,000

- Baggage delay insurance up to $200

- Travel delay coverage up to $600 ($200 daily limit)

- Rental car damage and theft coverage up to $45,000

- Travel accident coverage up to $25,000

- 24-hour hotline for assistance

- Concierge service

- Preexisting condition coverage (must be added to plan within 14 days of first trip deposit or payment)

Customize plan with optional CFAR coverage

Incredibly high limits for medical expenses and emergency evacuation

Coverage is for trips up to 30 days if you're age 80 and older

- Up to $15,000 in trip cancellation insurance

- Up to $22,500 in trip interruption coverage

- Up to $1,000 for trip delays ($200 daily limit for delays of 12-plus hours)

- Up to $1,000 for missed connections

- Up to $150,000 for emergency medical expenses

- Up to $1 million in emergency medical evacuation coverage

- $750 in emergency dental coverage

- $2,000 in coverage for baggage and personal effects

- $400 in baggage delay coverage

- 24/7 noninsurance assistance services

Get comprehensive health insurance that applies overseas

Preventive and routine care included

Age limits apply for new applicants and renewals

- Preventive and routine care

- Professional services like surgery

- Inpatient medical care

- Ambulatory and therapeutic services

- Rehabilitation and therapy

Get overseas medical coverage for single trips or multiple trips

Plans were created with seniors and retirees in mind

Lower maximum coverage limits for travelers ages 80 and older

Limited nonmedical travel insurance benefits

- Inpatient and outpatient medical coverage such as for physician visits, hospitalization and surgery

- Emergency and nonemergency medical evacuation coverage

- Coverage for emergency reunions

- Return of mortal remains

- Trip interruption coverage worth up to $5,000

- Lost luggage coverage worth up to $250 (up to $50 per item)

- Coverage for terrorism worth up to $50,000

- Accidental death and dismemberment coverage worth up to $25,000

Customize your deductible and premiums

Generous medical limits for travelers ages 65 to 79

Limited medical coverage for travelers older than 80

- Up to $1 million in emergency evacuation coverage

- Medical benefits like hospital room and board, chiropractic care, and more

- Coverage for repatriation of remains

- Up to $25,000 in personal liability coverage

- Up to $10,000 in trip interruption insurance

- Up to $1,000 in coverage for lost checked luggage

- Up to $100 per day in coverage for travel delays of 12-plus hours

- Up to $1,500 in coverage for bedside visits

- Up to $100,000 in coverage for emergency reunions

Frequently Asked Questions

You can purchase some travel insurance plans (but not all) if you're older than 80 years old. However, your premiums may be higher and you'll typically qualify for lower coverage limits overall. Make sure you compare the best travel insurance plans for seniors to find the right fit for your needs.

Since seniors and retirees are more likely to face a medical emergency during a trip, most travel insurance plans for seniors include coverage for emergency medical expenses and emergency medical evacuation. Coverages vary among plans, as do limits, so make sure to compare options before you book a trip overseas.

Why Trust U.S. News Travel

Holly Johnson is a professional travel writer who has covered international travel and travel insurance for more than a decade. Johnson has researched and compared all the top travel insurance options for her own family for trips to more than 50 countries around the world, and she has successfully filed claims during that time. Johnson lives in Indiana with her two children and her husband, Greg, a travel agent who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

9 Best Travel Insurance Companies of April 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

How to Get Airport Wheelchair Assistance (+ What to Tip)

Suzanne Mason and Rachael Hood

From planning to arrival, get helpful tips to make the journey easier.

- Travel Insurance

- Best Travel Insurance Providers for Seniors

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

Our Pick Of The Best Travel Insurance Providers For Seniors

Published: Jul 19, 2023, 1:05pm

Preparing for a holiday is a treat at any age, but all travellers, regardless of whether you’re backpacking or retired, need to tick off essential travel admin like purchasing travel insurance before the fun begins.

This ensures you can access life-saving medical treatment in an emergency overseas, when medical and hospital fees vary wildly. It can also help cover costs to get your trip back on the road after unforeseeable mishaps, or get you home safely if you need to cut the holiday short. This safety net can be especially important for more mature travellers with complex health and travel needs.

Not every insurance policy caters to people over a certain age, and others may impose benefit limits for certain activities for older travellers. Our dedicated Australian research team has dug through the fine print of policies open to seniors so we can outline the details of the best seniors travel insurance in Australia and who they may be best suited for. Leading policies are analysed across numerous data points, and ranked by our editorial team to reflect the most generous travel insurance suitable for seniors.

Note: The below list represents a selection of our top category picks, as chosen by Forbes Advisor Australia’s editors and journalists. The information provided is purely factual and is not intended to imply any recommendation, opinion, or advice about a financial product. Not every product or provider in the marketplace has been reviewed, and the list below is not intended to be exhaustive nor replace your own research or independent financial advice. For more information on how Forbes Advisor ranks and reviews products, including how we identified our top category picks, read the methodology selection below.

Related: Best Travel Insurance for Australians

Featured Partners

Travel Insurance Saver

Cover-more travel insurance (comprehensive), nib travel insurance (comprehensive), freely (comprehensive), allianz (comprehensive), bupa (comprehensive), boomers travel insurance (comprehensive), australia post (comprehensive), medibank travel insurance (comprehensive), racv travel insurance (comprehensive), cota (comprehensive).

Southern Cross Travel Insurance (Comprehensive)

Fast Cover (Comprehensive)

Our methodology, what is seniors travel insurance, types of travel insurance, senior travel insurance: what to look for, can seniors over 75 get travel insurance, pre-existing medical conditions: are you covered, travel insurance coverage for children and grandchildren, typical exclusions in seniors travel insurance, final thoughts, frequently asked questions (faqs).

- Best Comprehensive Travel Insurance

- Best Domestic Travel Insurance

- Best Cruise Travel Insurance

- Travel Insurance Cost

- Pregnancy Travel Insurance Guide

- Travel Insurance And Covid: Are You Covered?

- Travel Insurance For Bali

- Travel Insurance For Fiji

- Travel Insurance For The USA

- Travel Insurance For Thailand

- Travel Insurance For New Zealand

- Travel Insurance To India

Fast Cover Travel Insurance

On Fast Cover’s Secure Website

Medical cover

Unlimited, 24/7 Emergency Assistance

Cancellations

Unlimited, (Trip Disruption $50,000)

Key Features

25-Day Cooling Off Period, Australian Based Call Centre, 4.6 Star Product Review Rating

Cover-More Travel Insurance

On Cover-more’s secure website

Unlimited, with a $2000 limit to dental

Yes, amount chosen by customer

Option of Cruise Cover

Unlimited medical

Yes (some sub limits apply)

Yes (automatic)

The Travel Insurance Saver policy operates via nib’s underwriting service and therefore provides very similar benefits, minus the discount offered to nib health insurance members. Like the nib comprehensive policy, you’ll receive unlimited cover for medical expenses and anything that happens on a cruise as standard, as well as the freedom to choose the amount you’d like covered for cancellation costs (apart from the $2,000 limit on travel agent cancellation fees).

Many pre-existing medical conditions are included in the policy without the need for a medical assessment, including allergies, epilepsy, Hashimoto’s Disease and more, provided you meet the relevant criteria. But don’t forget the $8,000 limit on hospital compensation (at $50 per day), and that cover if you are permanently disabled while travelling is relatively low at $12,500. This policy also only covers $1 million in personal liability expenses.

- Cruise cover automatically included.

- Unlimited overseas medical expenses covered

- Lower permanent disability cover

99 (with acceptance criteria)

The comprehensive travel insurance offering from Cover-More is a suitable option for seniors (up to 99 years of age) seeking the peace of mind that cover for pre-existing medical conditions can provide. The policy’s wide range of automatically covered conditions includes carpal tunnel syndrome, plantar fasciitis, and some common heart conditions.

Be sure you meet any criteria related to these and other conditions, and please note that asthmatics over 60 aren’t automatically covered. We also liked the option to add on cruise cover, the generous $15,000 in coverage for luggage, $2.5 million in personal liability cover, $60,000 in funeral and repatriation expenses, and unlimited overseas medical cover. However, dental expenses are capped at $2,000.

- Many pre-existing medical conditions covered without assessment

- $15,000 luggage cover with item limit increases available

- $2,000 overseas dental expenses cap

The comprehensive travel insurance offering from nib provides generous cover that will suit many seniors’ travel plans, with additional flexibility. It’s a great option for nib health insurance customers who receive a 10% premium discount, or anyone travelling with their children who can also be covered by the policy (as long as they’re under 25). Medical expenses that may crop up on your overseas trip should be sorted with the unlimited cover, and cruise cover is included as standard. We also like that policyholders can choose the amount of coverage for cancellation costs, with the only limit being $2,000 on travel agent cancellation fees.

This policy gets another gold star for covering numerous pre-existing medical conditions as standard, including things like allergies, epilepsy, Hashimoto’s Disease and many others (as long as you fit the criteria). However, only $1 million is covered for personal liability expenses. Also note the $8,000 limit on hospital compensation (at $50 per day), and that the permanent disability cover of $12,500 is relatively low.

- 10% discount for nib health insurance members

- Cruise cover automatically included

If you’re a whizz with technology and under the age of 99, Freely could be your ideal travel insurance provider. You can purchase and manage a comprehensive policy suited to seniors via the Freely app which enables a convenient claims process and easy access to important policy documents. We appreciated that the unlimited overseas medical cover also includes dental expenses, and that cruise cover can be added onto the policy.

Personal liability is covered to $3 million, and if the worst were to happen—that you pass away or become permanently disabled while travelling—expenses related to this are covered up to $25,000. A number of medical conditions are automatically covered, from bunions to congenital blindness and deafness, just be sure you meet the criteria for each. However, there is only $5,000 allotted to cancellations, which should be factored in if you’re planning a costly trip with payments made ahead of time.

- Numerous pre-existing medical conditions covered without assessment

- Unlimited overseas medical and dental cover

- $5,000 limit on cancellation cover

Allianz Australia is a suitable choice for seniors looking for a reputable underwriter and some generous conditions. Chief among these is the ability to add cruise cover—a big plus among older travellers— and the fact there is no age limit on taking out a policy. We also liked the unlimited medical expenses, alongside personal liability coverage up to $5 million.

Another bonus: children and grandchildren are covered if they are travelling with you 100% of the time, are aged under 25 years and not in full time employment. However, coverage for pre-existing conditions required a medical assessment, and there is no cover for any expenses for medical evacuation, funeral expenses incurred overseas or return of remains unless it has been approved by Allianz Global Assistance.

- Cruise cover can be added

- No age limit to policy

- Pre-existing medical conditions require assessment

Travellers of all ages and life stages can take out Bupa’s comprehensive policy, but anyone who currently holds health insurance through the company can access a 15% discount as a loyalty bonus. Simply enter your membership number when prompted as you’re applying, and you’ll get a tidy discount across the policy, which includes unlimited medical, health and emergency cover.

Top marks as well for the handy add-ons, such as cruise cover and increased item limits for more valuable personal effects, as well as the $5 million personal liability cover and $60,000 for funeral and repatriation expenses. Please note that you will be required to do an online medical assessment for any coverage of pre-existing medical conditions.

- 15% discount for Bupa Health Insurance members

While the company’s name may elicit a cringe, Boomers Travel Insurance presents a high quality, flexible offering for travellers of any age that’s underwritten by the reputable Allianz Australia Insurance. The policy’s generous benefits include $10,000 in cover for luggage with the option to increase item limits for more valuable possessions, the option to add on cruise cover, and $5 million in personal liability cover.

It’s a great option for families, as children and grandchildren are also covered if they are joining you for your entire journey, as long as they are under 25 and not employed full-time. While the policy includes unlimited overseas medical, hospital and emergency expenses, it’s important to note that all pre-existing medical conditions need to be assessed and approved by the company when you apply for coverage.

- Luggage cover can be increased for valuable items

Yes (dental limits apply)

Seniors seeking out travel insurance that automatically covers a wide range of pre-existing medical conditions (without a medical assessment required) alongside generous benefits should consider Australia’s Post’s International Comprehensive Travel Insurance. Knowing you’ll be covered if a claim arises from conditions like hypertension, epilepsy, hiatus hernia and some autoimmune disorders provides extra peace of mind for anyone juggling health complications later in life (just be sure you meet the criteria for each condition).

There’s no age limit for policyholders, nor any limits on overseas medical and hospital care, as well as additional emergency expenses. We also liked the generous $5 million personal liability cover, and $12,000 in repairs or replacement for luggage (sub limits for certain items do apply). If you’re concerned about potential dental issues while travelling, do note there is a $2,000 cap on dental expenses. And if you’re an asthmatic over 60, this particular condition won’t be covered.

Medibank is one of the largest private health insurance providers in Australia, and its comprehensive travel insurance policy is similarly reliable for senior travellers. It is especially good value for anyone who already holds a health insurance policy with Medibank – those with standard health insurance memberships will receive a 15% discount, and Medibank Priority health members will see a 20% premium reduction.

It includes generous policy features like unlimited cover for overseas medical and cancellation expenses, $15,000 in luggage cover with flexible sub limits for specific items, and $5 million in personal liability cover. Cruise cover can be added as an optional extra for those travelling the high seas, and a wide range of pre-existing medical conditions are covered without policyholders having to apply or undergo a medical assessment. Keep in mind there is a $2,000 limit on overseas dental cover.

- 15% discount for Medibank health members.

- Many pre-existing medical condistions covered without a health assessment.

- $2,000 limit on dental cover.

Undisclosed

With unlimited overseas medical, dental and cancellation cover, the comprehensive travel insurance policy from RACV is an attractive policy for travellers of all ages. While the Victorian insurance company doesn’t specify an age limit on this policy, it provides cover suitable for seniors while offering a 15% discount to RACV members, no matter the type of insurance they hold with the company.

We appreciate the extremely generous $15 million personal liability cover, the $15,000 in luggage cover with flexible sub limits, and that a range of pre-existing medical conditions are covered without an assessment. Please note that travellers over 50 can’t be covered for diabetes, and those over 60 aren’t covered for asthma.

- Cruise cover can be added.

- 15% discount for RACV members.

- Age limits apply for some pre-existing medical conditions.

Yes (some conditions apply)

COTA has specialised in the seniors’ insurance space since 1992, and is currently underwritten by Pacific International Insurance. Major selling points that could serve older travellers well include the automatic inclusion of cruise cover, $12,000 in cover for lost or stolen luggage, and no age limits applied to the coverage.

While overseas medical expenses coverage is unlimited with this policy, we thought it important to note the caps on dental cover ($1,000) and hospital compensation (up to $8,000 with a limit of $50 per 24 hours). Medical evacuation and repatriation expenses are unlimited, but there is relatively low cover for permanent disability caused while travelling ($12,500). And if you require cover for pre-existing conditions, you’ll need to undergo an assessment.

- Caps on overseas hospital and dental expenses

Southern Cross Benefits is a reputable underwriter for this comprehensive policy available to travellers at any age . It includes generous benefits like $25,000 cover for lost luggage and unlimited medical and evacuation costs, although sub limits do apply (such as a $2,000 limit for dental expenses and a $100,000 limit on medical costs related to terrorism).

The $50,000 coverage for death, permanent disability and funeral expenses is notably higher than similar policies, but personal liability costs are only covered up to $1 million. While bank cards and other travel documents are covered up to $1,000 if lost, there is no cover for credit card fraud. Anyone with existing medical conditions or injuries will need to apply for these to be covered in case they are the cause of expenses while travelling.

- Generous death and disability cover

- No cover for credit card fraud

89 (with age and coverage limits on certain benefits)

Fast Cover caters to travellers aged up to 89 , but benefit limits and coverage restrictions can apply for anyone over 60, depending on which age bracket you sit within. Travellers up to 79 years of age have unlimited cover for overseas medical expenses, cancellations (although there is a $1,500 cap on travel agent fees), and trip disruption and resumption costs. Those aged 80-89 will need to pay a $2,000 excess for cancellations related to sickness or injury.

Also note that snow cover isn’t available to anyone aged 70 or older, the adventure pack age limit is 74, and dental cover for travellers of all ages is limited to $1,000. Happily, cruise cover can be an add-on at any age, personal liability is covered up to $5 million, and there are a large number of pre-existing medical conditions covered for people of all ages (as long as you satisfy the criteria related to those conditions).

- Many pre-existing medical conditions covered without assessment.

- Cruise cover can be added on.

- Age and cover limits apply to certain benefits for older travellers.

Our editorial team has complete control over analysing and rating the travel insurance policies you’re reading about today. We don’t aim to evaluate every policy on the market, but we go to great lengths to extensively research and report on the most popular choices among consumers.

To find the best travel insurance for seniors, we meticulously assessed the desirable policy attributes for this kind of insurance customer across 17 datapoints. These factors are weighted to reflect the importance of each. The four most important factors considered were limits around age, death and disability cover, unlimited medical cover and cruise cover.

As mentioned, we didn’t include price in this assessment, as quotes vary between travellers based on a huge range of factors, from their holiday itinerary to optional extras they want included and health and medical histories. Each of the elements we considered when finding the most senior-friendly travel insurance providers are outlined below.

- Emergency Assistance: Does the policy offer a 24-hour medical or emergency hotline?

- Credit card fraud: If you fall victim to credit card fraud while travelling, will your credit card be replaced and any stolen funds reimbursed?

- Pre-existing medical conditions: Does the policy cover pre-existing medical conditions, and are you required to undergo a medical assessment to be covered for these? The more conditions automatically covered, the better.

- Lost luggage: Will your lost luggage be covered? Higher overarching limits and extra flexibility to increase sub limits scores extra points.

- Cancellations: Does the policy cover cancellation fees, and what is the limit or any sub-limits?

- Cruise cover: Is cruise cover included as standard or can you add it on?

- Online discounts: Are there any discounts on offer?

- Maximum age covered: What is the maximum age covered in the comprehensive policy? Having no age restrictions is ideal, but otherwise the higher the better.

- Cover for medical expenses: Is it unlimited or is there a set total price for the medical expenses covered?

- Cover for dental expenses: Does the policy cover emergency dental work overs overseas? If so, is a limit specified?

- Covid cover: Is cover for expenses that arise from events and illnesses related to COVID-19 included in the policy? If so, what does this include, and are there any limits?

- Cover for children and grandchildren travelling with you: Are grandchildren or children covered for free under this policy? If they are, what terms and conditions must your family members meet to qualify?

- Personal liability: If you unintentionally injure someone else or damage their property, what is the maximum personal liability expense that the insurance company will pay out?

- Funeral costs: Are funeral costs covered, and up to what price? Limits on repatriation of remains from overseas should be considered here if they’re not included under a different policy point.

- Accidental death: What is the claim limit if the worst were to occur and you pass away from unforeseeable circumstances while travelling?

- Accidental disability: If you are permanently disabled after an accident while on holiday, what’s the maximum monetary support you can access?

- Customer service: What level of customer support does the insurance company offer? This could include live online chat and phone services, with these channels being available on weekends or outside business hours midweek.

About Star Rankings

You will note that we have included a star rating next to each product or provider. This rating was determined by the editorial team once all of the data points above were considered, and the pros and cons of each product attribute was reviewed. The star rating is solely the view of Forbes Advisor editorial staff. Commercial partners or advertisers have no bearing on the star rating or their inclusion on this list. Star ratings are only one factor to be considered, and Forbes Advisor encourages you to seek independent advice from an authorised financial adviser in relation to your own financial circumstances and investments before you decide to choose a particular financial product or service.

When you search for seniors travel insurance online, you can find specialised policies for people over a certain age. Many insurance companies that offer these define ‘senior’ as being over 75. However, some will have a higher minimum age and others will impose age-based coverage restrictions for anyone over 55.

The majority of travel insurance companies don’t provide tailored seniors cover, and instead recommend their comprehensive travel insurance policies to older travellers. These policies often have very high or even no age restrictions, and can cover a range of complex health and travel needs.

When our research team scoured the market to find travel insurance policies best suited to seniors, we analysed comprehensive offerings to assess how generous they were for seniors. Age limits, cover for unlimited medical expenses and the availability of cruise cover, a popular option among retirees, were all key considerations.

Remember: You will note that ForbesAdvisor has not analysed price as one of its metrics as this varies wildly between insurers and depends on a number of individual variables. Age is one of these variables, and, as a whole, senior travellers can expect to pay higher premiums for travel insurance. As always, it’s important to check the fine print so you know what you are, and aren’t, covered for.

While every travel insurance provider may offer different levels of coverage under different names, there are usually three types of international travel insurance: basic, essentials and comprehensive. The cost of travel insurance will change depending on the option you chose, with basic usually the cheapest and comprehensive the most expensive.

Speaking broadly, this is what the three policy tiers generally cover:

Basic: A policy under the basic banner will usually cover things like overseas emergency medical and hospital expenses, unavoidable cancellations, replacing lost or damaged luggage, and personal liability for if you accidentally injure someone or damage their property. Basic policies often come with age restrictions, so may not be suitable for seniors.

Essentials: This is generally a mid-range policy that includes everything covered by basic travel insurance, as well as cover for some riskier activities or higher benefit limits. Similarly, an essentials policy may not be open to people over a certain age.

Comprehensive: If you’re after all of the essentials, higher benefit limits, and more cover for a wider range of activities, then a comprehensive travel insurance policy may fit the bill. Many travel insurance companies may not offer a policy explicitly for seniors, but their comprehensive options—which usually cover broader medical care and have higher or no age limit—will suit most senior travellers.

If you’re travelling within the bounds of Australia, domestic travel insurance could also be useful. However, the inclusions and coverage in these policies aren’t always relevant to international travel insurance, and so shouldn’t be compared alongside the policies listed below.

Choosing an insurance policy is personal, as it depends on factors like your age, your health needs, the belongings you want protected while travelling and your specific holiday plans. So, you should always consider policies in line with your personal and financial circumstances. However, there are a few common elements of travel insurance that seniors should consider when comparing policies:

Unlimited medical, hospital and emergency cover: You’ll find many comprehensive policies list unlimited cover for overseas medical expenses. This is a vital component of travel insurance, as you can’t predict if you’ll encounter emergency health situations and the cost of treatment may be very high in some countries, especially America . Keep an eye out for any limits around dental expenses and hospital compensation limits.

Automatic cover for pre-existing medical conditions: Some policies will automatically cover a number of common illnesses and injuries, while others will ask you to apply for coverage for all existing medical conditions (or a combination of both). In both cases, your medical history will need to meet certain criteria for that condition to be covered. Having more conditions automatically covered by a policy makes the application process smoother for seniors with complex health needs, and means the insurance provider probably isn’t increasing premiums based on the your health status.

Cover for children and grandchildren you’re travelling with. Many comprehensive policies will provide cover for your children and grandchildren if they’re travelling with you at no extra cost. This is great for families, but usually comes with some caveats. Kids and grandkids will often need to be travelling with you for 100% of your trip to get coverage, will need to be under a certain age (often 25 or younger), and can’t be working full-time. Be sure to check your family meets all the criteria before assuming any extra travellers are covered under your policy.

Cruise cover: Cruising the globe is a popular adventure for many older travellers, but it comes with risks like any other activity. Things like on-board medical treatment, incidents that happen on shore-trips and medical evacuations from cruise liners can be extremely expensive, and they generally aren’t covered by a standard policy. Many comprehensive policies offer cruise cover as an optional extra to add onto your policy, and some include it as standard in coverage. If you’re headed for the high seas, investigate which option suits you best.

No age limits, age-based excesses or benefit exclusions: Many senior-specific travel insurance policies or comprehensive policies will allow people of all ages to take out insurance, which is essential for older travels. Keep an eye out for any additional excesses that may be applied to older travellers when making a claim, or any activities or pre-existing conditions that won’t be covered if your age exceeds the insurance company’s cap.

People over the age of 75 can take out travel insurance, but not every provider or policy will cover you. Basic policies usually have an age cap at 75 (or sometimes even lower), so seniors over 75 will need to take out comprehensive travel insurance or specific policies tailored to seniors.

Make sure you carefully examine the product disclosure statement (PDS) of each policy for any specific activities or benefits that have age restrictions or limits, as this can vary considerably between providers.

In every PDS, you’ll find a long list of pre-existing medical conditions that are or are not covered. While every policy is different, having certain health conditions may disqualify you from travel insurance cover at any age.

However, many common pre-existing conditions like diabetes, epilepsy, asthma and some heart conditions are automatically covered in many policies. This means if you make a claim that’s directly or indirectly related to these conditions, your insurance provider will likely cover you assuming you met the criteria for the claim.

Be sure to check any criteria around these conditions related to changes in medication, recent surgeries or other complications. And remember: some policies may apply age limits for specific conditions which they do cover. For example, older asthmatics often won’t be automatically covered, while younger travellers with the condition will.

Some providers allow you to apply for cover of pre-existing medical conditions that aren’t on the pre-approved list. You’ll generally need to undergo a medical assessment to apply, and if approved, you’ll likely be charged an extra premium or higher excess for the coverage.

Many seniors and comprehensive travel insurance policies will include cover for any of your children and grandchildren joining your travels. This is generally included as standard, but comes with strict criteria that your family must meet in order for them to be covered by your policy. In many cases, children and grandchildren are required to be:

- Travelling with you for 100% of your trip

- Under a certain age (often 25 or even younger)

- Not working full-time and, in some cases, be financially dependent on you

Younger travellers may have different travel insurance needs from seniors, so it’s important to ensure your policy covers everything that might impact your kids or grandkids while they’re travelling with you. And if your family continues their journey when you head home, they will need to take out their own insurance for the remainder of their trip in order to be covered.

All travel insurance policies have a number of activities or situations that aren’t covered, no matter your age. Seniors should always read policy documents carefully to see if there are any additional age restrictions on things like adventure sports or certain pre-existing medical conditions.

Some exclusions will be outside your control, but there are other actions you can take that may void your cover. Common seniors travel insurance exclusions include:

- Any pre-existing condition which has not been declared, whether it’s automatically covered or not.

- Any expenses caused by asthma if you’re over 60 (a common age-based medical restriction).

- If you are involved in any illegal activity.

- If you’re under the influence of alcohol or drugs during the relevant event.

- Travelling to a destination with Smartraveller warnings under a ‘do not travel’ classification.

- If you take part in risky activities that aren’t covered by your policy, like snow sports or high-altitude hiking.

- Anything that happens on a cruise ship if cruise cover is not included in your policy (either as an automatic inclusion or added as an optional extra).

- Pandemics and epidemics, unless specifically outlined in your policy, which you’ll find is often the case with expenses related to Covid-19.

There are numerous travel insurance options available to seniors, no matter your age nor your ability. The key to finding a suitable policy for you is in the fine print.

As you’re researching and comparing policies, be sure to pore over policy documents for limits to cover, specific age-based restrictions, options for additional cover versus automatic inclusions, and any policy features which will best suit the kind of international holiday you’re taking.

What is the best travel insurance for seniors over 70 in Australia?

The best travel insurance for any individual is a policy that offers the most relevant features within their budget. We’ve researched travel insurance policies that include features which are best suited to seniors, but everyone should compare and consider these policies to see if they meet their personal and financial needs.

Is travel insurance more expensive for over 75s?

As some risk factors are higher for older travellers—often those associated with existing medical conditions and injuries—you may find your travel insurance quotes increase with age. Every insurance provider has their own method for calculating premiums, so the level to which age does impact price will differ between quotes.

There’s no magic age where your premiums skyrocket, but some insurance companies do set their standards for ‘seniors travel insurance’ for people aged 75 and over.

What's the difference between single and multi-trip travel insurance?

With most travel insurance policies, you’ll need to select the dates you’ll be travelling within, and only bookings or events that happen in this timeframe will be covered. This is referred to as a single-trip policy. If you’re a regular globetrotter, you might consider multi-trip travel insurance. Otherwise known as annual travel insurance, this kind of policy can cover you for numerous holidays within a 12-month span.

Multi-trip insurance can be more affordable overall, but you’ll get the most value out of it if you have consistent travel habits, as you’re effectively paying at a set level for each trip. This means if you want more expensive features for just one trip—say, cover for your laptop while travelling or to go scuba diving—the increased premium is applied across all your travel for the year.

You’ll usually need to set the maximum duration for the trips you plan to take ahead of time, with most policies allowing for 60-day holidays and a few up to 90 days. You’ll also need to select the countries you’re likely to travel to in the year, as insurance companies need to assess the risks involved with each destination.

If you’re living it up in retirement and think you will travel often enough within the year to warrant this cover, make sure you don’t exceed the maximum trip length for any single excursion. You won’t be covered by your policy if you extend your trip.

Remember: some insurance providers only offer multi-trip policies to travellers under 75, so be sure to check you qualify.

What is a pre-existing medical condition?

Pre-existing medical conditions can include all manner of illnesses or injuries you know you have when you purchase an insurance policy. These may or may not be covered by your travel insurance, and some insurance providers will want to conduct a medical assessment before agreeing to cover you for these conditions.

I am going on a cruise. Will travel insurance cover me?

Yes, some comprehensive travel insurance policies offer coverage while you’re on a cruise as a standard inclusion. Most other providers will offer this kind of cover as an optional extra for an additional fee.

Olivia Gee is a Sydney-based writer and editor working across personal finance, lifestyle and sustainability. She is an insurance expert with ASIC RG146 Tier 2 Certification to provide general insurance advice. Her work has been published in Time Out, Money magazine and Guardian Australia, among other publications.

- Motorcycles

- Car of the Month

- Destinations

- Men’s Fashion

- Watch Collector

- Art & Collectibles

- Vacation Homes

- Celebrity Homes

- New Construction

- Home Design

- Electronics

- Fine Dining

- Costa Palmas

- L’Atelier

- Les Marquables de Martell

- Reynolds Lake Oconee

- Scott Dunn Travel

- Wilson Audio

- 672 Wine Club

- Sports & Leisure

- Health & Wellness

- Best of the Best

- The Ultimate Gift Guide

65 or Older? Here Are The Best Travel Insurance Plans for Seniors

The top-rated plans all have at least $100,000 in travel medical coverage and at least $250,000 in emergency medical evacuation coverage., erica lamberg, erica lamberg's most recent stories.

- 5 Tips for Buying Travel Insurance

- Travel Insurance for Sports Equipment: Everything You Need to Know

- The Travel Insurance You Need for a Multi-Destination Vacation

- Share This Article

We may receive payment from affiliate links included within this content. Our affiliate partners do not influence our editorial opinions or analysis. To learn more, see our Advertiser Disclosure .

With more than a year of travel adventures lost, it’s time to consider how you’ll explore the world again. Whether you’re going across the country or around the world, travel insurance for seniors can provide a valuable safety net if a trip goes wrong. Here are the best senior travel insurance plans based on our ratings of two dozen travel insurance policies.

Related Stories

What it’s like to stay at atlantis the royal, the most over-the-top hotel in dubai, how private jets allow travelers to skirt immigration around the world, this billionaire’s tuscan resort isn’t just the talk of the town—it is the town.

All the winning travel insurance plans below include coverage for Covid in trip cancellation and travel medical benefits

Nationwide Cruise Choice Plan

Why we picked it: Nationwide Cruise Choice Plan offers superior benefits at excellent prices for senior travelers.

This plan provides $100,000 per person for emergency medical expenses and $500,000 per person for emergency medical evacuation . You will also get non-medical evacuation coverage of $25,000 per person, which covers transportation if you have to move to a safe location due to a natural disaster or civil/political unrest.

Nationwide’s Cruise Choice Plan has top-notch baggage loss coverage of $2,500 per person. Other highlights include missed connection coverage of $1,500 per person after only a three hour wait and the option to add “cancel for any reason” coverage.

If you are looking for an upgrade, it’s worth taking a look at Nationwide’s Cruise Luxury plan.

Potential drawbacks: Travel delay coverage of $750 per person is low compared to top competitors.

Trawick International Safe Travels First Class Plan

Why we picked it: Trawick’s International Safe Travels First Class plan has excellent prices for seniors and a wide range of solid benefits.

The plan comes with $150,000 per person in emergency medical expenses and $1 million per person in medical evacuation coverage. You’ll also get $2,000 per person in baggage loss coverage and $1,000 per person for missed connections (cruises and tours only).

The plan has good travel delay coverage of $1,000 per person but only after a 12-hour delay. And if you’re the type of traveler who wants the ultimate flexibility, you can add “cancel for any reason” coverage to your policy.

Potential drawbacks: Baggage delays and travel delays are only reimbursed after a 12-hour delay. That’s a long time compared to some top competitors that require only six hours (or less).

Related: Best Senior Travel Insurance Plans Of 2021

AXA Assistance USA Gold Plan

Why we picked it: Great prices for senior travelers make AXA’s Gold plan an attractive option.

The plan comes with $100,000 per person in emergency medical expenses and $500,000 per person for emergency medical evacuation. You’ll also get non-medical evacuation coverage of $50,000 per person in case you need to move to safety because of a natural disaster or civil/political unrest.

AXA’s Gold plan has good baggage loss coverage of $1,500 per person. It has generous missed connection coverage of $1,000 per person if you miss your cruise or tour. The plan also includes concierge services.

Potential drawbacks: AXA’s Gold plan does not offer optional “cancel for any reason” coverage.

Cat 70 Travel Plan

Why we picked it: Superior coverage for medical expenses at very competitive prices for seniors makes the Cat 70 plan a solid choice for senior travelers.

Cat 70’s Travel plan pairs a whopping $500,000 per person in emergency medical expenses with $500,000 per person in emergency medical evacuation coverage. Travelers seeking trip cancellation flexibility can add “cancel for any reason” coverage.

Potential drawbacks: Compared to some top competitors, reimbursement is on the lower end for travel delay ($500 per person), lost baggage ($500 per person) and baggage delay ($200 per person after 24 hours).

HTH Worldwide TripProtector Classic Plan

Why we picked it: Excellent prices for seniors make the TripProtector Classic plan worthy of consideration.

TripProtector Classic comes with $250,000 per person in emergency medical expenses and $1 million per person in emergency medical evacuation coverage. The plan includes good travel delay benefits at $1,000 per person after a six-hour delay.

Senior travelers looking for even better benefits (at a higher cost) may want to upgrade to the Worldwide TripProtector Preferred plan.

Potential drawbacks: Baggage delay benefits might be insufficient at $200 per person after a 12-hour delay and you won’t have the option of adding “cancel for any reason” coverage.

Tin Leg Gold Plan

Why we picked it: Tin Leg’s Gold plan offers ample medical benefits at competitive prices for seniors.

With $500,000 per person for emergency medical expenses and $500,000 per person for emergency medical evacuation coverage, Tin Leg’s Gold plan has some of the highest medical benefits among top competitors.

You will also have the option to add “cancel for any reason” coverage.

Potential drawbacks: Reimbursement is low compared to top competitors for travel delay ($500 per person), baggage delay ($200 per person after a 24-hour delay) and baggage loss ($500 per person).

USI Affinity Travel Insurance Services Ruby Plan

Why we picked it: USI Affinity’s Ruby plan has solid medical benefits and very competitive prices for seniors who are traveling.

The plan comes with $250,000 per person in emergency medical expenses and $500,000 per person for emergency medical evacuation. If you want the flexibility to cancel your trip, you’ll have the option to add “cancel for any reason” coverage.

Potential drawbacks: Baggage delay ($300 per person) and baggage and personal items loss ($1,000 per person) are lower than top competitors and might be insufficient for senior travelers looking for higher coverage amounts.

Tips for Seniors Buying Travel Insurance

Travel insurance can be essential for many types of trips, but seniors are particularly vulnerable to travel-related problems. Most notably, travelers age 65+ should consider a travel insurance policy with medical insurance and medical evacuation benefits.

Understand Insurance Needs When Traveling Abroad

With the vaccine rollout and countries relaxing border restrictions, you may be thinking about taking that river cruise to Portugal or a wine tour in France.

It’s important to know that when you travel outside the United States a domestic health insurance plan will not generally travel with you. This includes Medicare.

A key focus for seniors should be travel insurance with high limits of travel medical insurance, says Jeremy Murchland, president of travel insurance company Seven Corners. “Some plans on the market limit coverage to only $25,000 or $50,000,” he says. “Depending on the type of care needed, this may not be enough to cover the cost.”

“Most Medicare plans will not cover a person outside of the U.S. or U.S. territories,” explains Gail Manganite, lead customer advocate for InsureMyTrip, a travel insurance comparison provider. She notes that there are some Medigap and supplemental plans that offer health coverage outside the U.S., but deductibles and copayments will still apply.

Find out if your current health insurance includes emergency medical coverage outside the country and what restrictions apply. Then you’ll know how much travel medical insurance you need to fill the gap.

If you want top-notch coverage, look for travel insurance plans that offer $500,000 in medical coverage.

Get Medical Coverage for Pre-Existing Conditions

You don’t want a pre-existing condition to flare up during a trip, but in case it happens, have a travel insurance plan that covers it. You do this by getting a pre-existing medical condition exclusion waiver.

The availability of this important waiver is time-limited: You’ll have to add it to a travel insurance plan within a specified number of days from the date you make your first trip payment. For example, Seven Corners’ RoundTrip Choice plan covers pre-existing conditions if you buy it within 20 days of the date of your initial trip payment.

But your plan might have a window of only 14 days to get pre-existing conditions covered.

Plan for Medical Evacuation Coverage

If you require an emergency airlift back to the United States, it could easily cost $100,000 or more for private, emergency transport. Emergency medical evacuation insurance pays to move you to a medical facility with appropriate and necessary care if the facility where you are located is unable to provide the level of care needed for your medical condition, says Murchland.

You can find travel insurance plans with up to $1 million in coverage for emergency medical evacuation.

Be Aware of “Cancel for Any Reason” Coverage

“Cancel for any reason” coverage is an add-on that you can tack on to some travel insurance plans. It will add about 40% to your travel insurance cost but gives you the widest flexibility to cancel the trip for any reason and get some reimbursement (typically 50% or 75%).

Without it, you’ll receive trip cancellation reimbursement only if you cancel for a reason listed in the base policy, such as an illness or injury that forces you to abandon travel plans. “Cancel for any reason” coverage will give you the option to cancel for reasons like a sudden fear of flying or simply changing your mind.

Consider Customer Service Options

Murchland says to pick a travel insurance company that has services that match your comfort level.

“For example, Seven Corners has found that a higher percentage of seniors wish to discuss a travel insurance plan over the phone and, in some cases, want assistance selecting a plan and executing a purchase,” he says. “In today’s world of chat bots and email, this is an important consideration for seniors who would prefer to talk with a person.”

Stay on Top of Your Insurance Timeline

Buying a travel insurance plan early and taking the time to read it can pay off later. In addition, a travel insurance agent can help you understand what the policy covers and find plans that fit your travel insurance concerns. It’s wise to:

- Buy your plan early (shortly after you make your first trip deposit) so you don’t miss out on key benefits like pre-existing conditions coverage.

- Review your plan information well before your trip . Understand what reasons are covered for trip cancellation insurance claims. If you want broader coverage, consider adding “cancel for any reason” coverage, which also needs to be added shortly after your first trip payment.

- Feel comfortable asking questions to ensure you understand your plan and how it works.

- Keep in mind that travel insurance plans offer 24/7 travel assistance help . If you run into trouble during your trip, make use of the professional help available for language translation, finding a pharmacy and much more.

Methodology

Using data provided by Squaremouth, a travel insurance comparison provider, we evaluated 24 travel insurance plans that have at least $100,000 in travel medical coverage and at least $250,000 in emergency medical evacuation coverage. Scores were based on:

- Travel insurance rates (50% of score) for a range of travelers age 65 and older, for trips in a variety of lengths, destinations and costs.

- Coverage benefits (50% of score) including travel medical expenses, cancel for any reason availability, Covid coverage, medical evacuation, baggage delay, baggage loss, missed connection, non-medical evacuation, travel delay.

Erica Lamberg is a personal finance and travel writer based in suburban Philadelphia. She is a regular contributor to USA Today, and her writing credits include NBC News, U.S. News & World Report, Business Insider, Oprah Magazine and Creditcards.com .

Read More On:

- FBS Marketplace

More Travel

What It’s Like to Stay at the Peninsula Istanbul, One of Turkey’s Buzziest New Luxe Hotels

Culinary Masters 2024

MAY 17 - 19 Join us for extraordinary meals from the nation’s brightest culinary minds.

Give the Gift of Luxury

Latest Galleries in Travel

The Dunlin, Auberge Resorts Collection in Photos

Oceaya in Photos

More from our brands, esprit restructuring globally, layoffs hit n.y headquarters, splash and sportico partner for $100k masters tiers contest, shelby lynne on celebrating the 25th anniversary of landmark ‘i am…’ record, and plotting a new album with karen fairchild: ‘it’s coming full circle’, artists rejected from polish pavilion to stage independent show in venice, the best running water bottles according to marathoners.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance for Seniors in April 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

As an older adult, you may look forward to traveling the world when you retire. Whether taking a single trip or traveling extensively, health concerns and sickness can derail even the best plans.