19th July, 2021

Work travel expenses: What you can (and can’t) claim

Knowing exactly what deductions apply to travel expenses can save a heap of hassle at tax time.

The Australian Taxation Office (ATO) has released a new ruling that clarifies what expenses employees can deduct for work-related travel.

The new ruling, Income tax: When are deductions allowed for employees’ transport expenses? was released this week, bringing together and clarifying the rules for business advisors and their clients alike.

Key takeaways:

- The ATO’s new ruling sheds light on what travel expenses employees can and cannot claim

- Travel between work locations (neither of which are your home), is typically tax deductible

- Incidental work-related travel, such as a receptionist who makes a stop to pick up office newspapers on their way to work, can’t be claimed on tax

Travel from home to a regular place of work generally isn’t deductible. The ruling states that even if you travel to work by plane, receive a travel allowance or make incidental business-related stops on the way to work, you still cannot claim your travel expenses.

But moving between two separate work locations – like driving from your office to a construction site, or from your business to a meeting at a client’s office – can be claimed.

Tax specialist and accountant, Leo Hollestelle said the ruling is well timed ahead of the busy End of Financial Year period.

“It’s timely that these views are brought together and codified into a single ruling,” said Hollestelle. “Tax advisors will be able to more easily familiarise themselves with the rules and in turn advise their clients on it.”

What are work-related expenses?

Work-related expenses are expenses that you incur in the course of gaining or producing your assessable income.

What work-related travel expenses can I claim?

Transport expenses you incur while travelling between work locations are usually deductible. The travel must occur while gaining or producing your assessable income.

While you can’t usually deduct expenses for travelling between your home and work, you might also be able to deduct the cost of travel from your home to somewhere other than your regular place of work. This might be, for example, to attend a client’s premises or one of your employer’s other offices.

To work out if travel expenses are work-related, things like these are taken into consideration:

- Does the travel fit within your duties of employment?

- Do the travel expenses arise out of your employment and not your personal circumstances?

- Is the travel relevant to the practical demands of carrying out your work duties?

- Has your employer asked you to travel?

- Has the travel occurred during normal work time?

What work-related travel expenses can’t I claim?

Transport expenses that you incur for travel between your home and a regular place of work are not deductible.

If there is a close connection between travel and your private or domestic life, this will usually not be considered deductible. For example, if you travel to your regular place of work from another location in which you undertake private activities, for example a library or a holiday house, the cost of the travel is not deductible.

If you happen to live a significant distance from your regular place of work, your travel expenses are usually considered private and not deductible.

You may also not deduct expenses that are capital, private or domestic in nature. Transport expenses that may be considered capital in nature include, for example, the cost of purchasing a car. Ask your advisor whether such expenses may be recognised under another tax provision.

How much can you claim for work-related expenses?

You can only claim the actual cost of the expenses themselves. These will need to be proven with receipts and/or other written documentation. Your advisor will be able to help you with this.

READ: How to save tax in Australia – 15 tax minimisation strategies

How to calculate work-related travel expenses

You can claim deductions for work-related travel expenses in your tax return , but how you do this depends on the expenses themselves. (See also Claiming overseas-travel expenses , below.)

If your expenses relate to a car you own, lease or hire, you may be able to use the logbook method or the kilometres method .

READ: How long does it take to get a tax return?

Working-away-from-home tax deductions

If your employment requires you to travel away from home overnight, because of your employment (and not because of private circumstances like where you choose to live, for example), the transport expenses incurred in travelling to your alternative work location will usually be considered deductible.

Claiming overseas-travel expenses

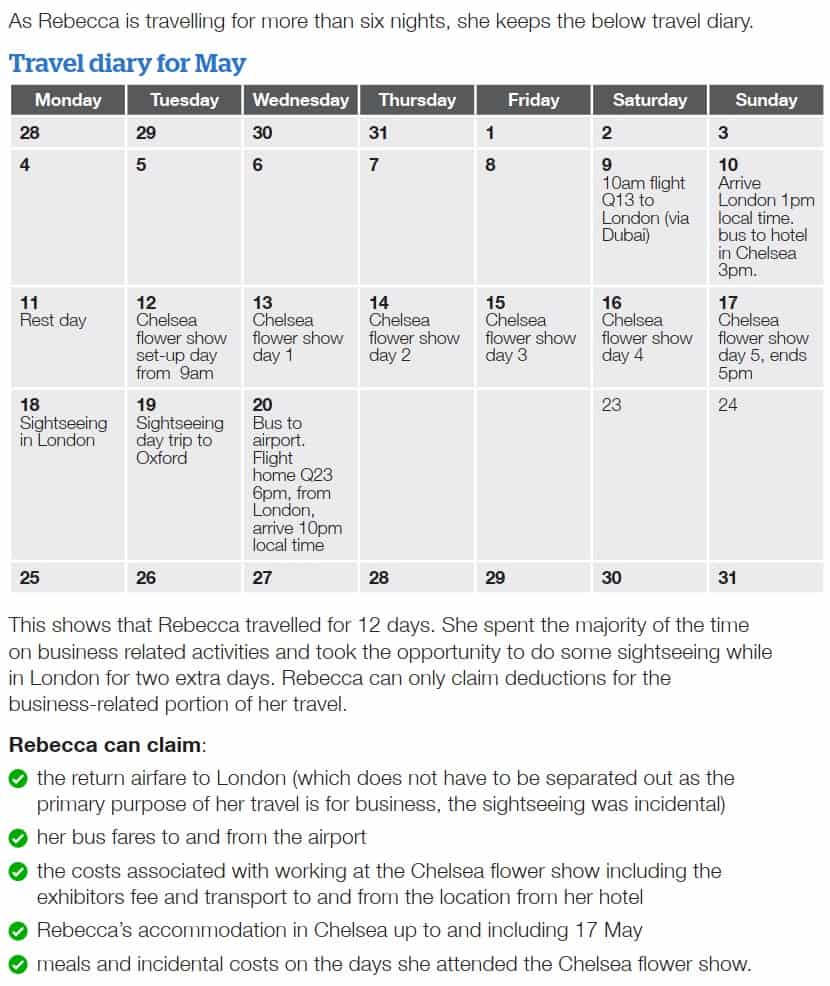

If you travel overseas for work, you might be able to deduct expenses relating to flights, accommodation, meals, transport or other minor things (like taxis or using hotel wifi). You’ll need to keep records such as receipts and you may also need to keep a travel diary.

Where’s your regular place of work?

Interestingly, there are several exceptions that – if claimed correctly – can give you an edge come tax time. This is especially true when it comes to defining what a “regular work location” actually is.

For example, imagine you currently work for a business with an office 15-minutes from your home.

But you’re asked to cover a long-service vacancy for six months at another of your business’s offices one hour away. Because this new office becomes your regular place of work for a sustained period of time, travel to and from it cannot be claimed on tax.

But, if your period of work was only for three months, then it could be argued that the second office never became a regular place of work.

Therefore, travel could potentially be claimed on tax.

This is a call to take care in making any assumptions about what you can actually claim. As the ATO ruling states, ‘the full facts and circumstances of the specific working arrangement in place must always be considered in determining the nature and deductibility of the transport expenses incurred’.

And that’s something to keep in mind when it comes to all travel-related tax claims this tax time, as it could be this ruling also indicates an increase in scrutiny for travel-related claims.

“While the ruling is very much in line with the Commissioner’s existing views on travel expenses, the timing is worth noting,” said Hollestelle.

“After a year where many employees have been working from home, it may be the ATO is concerned there will be both workers and employers seeking to make dubious claims in the tax period ahead.”

What else do I need to know?

Find more guidance on transport and travel expenses on the ATO website.

Always seek advice on your individual situation from an accredited business advisor or tax specialist to find out exactly how tax changes and updates might impact your business.

Need an advisor? Find one today with MYOB’s Find an Advisor directory .

You might also like

Your key tax dates for end of financial year and beyond, 28th mar, 2024 by myob team, it’s your first year in business — eofy explained, 25th mar, 2024 by myob team, 7 key things to get on top of for end of financial year, subscribe to be updated on all things myob.

Removing from your favourites..

Tell us what you think

Help us improve our website

Provide feedback

Please rate your experience.

Please leave a comment. We will use your feedback to help improve this website, however we are unable to action or respond to any queries or requests for assistance.

Claiming small business tax deductions

- Course overview

- Knowledge check

- Quick links

- Action plan

Business travel expenses

There are some important rules for travel expenses. Travel expenses incurred before you start your business are not usually deductible and a deductible trip needs to demonstrate a clear connection to your business activities.

Where expenditure is part business and part private, you need to apportion your claim. This means you exclude the private component from your claim. For example, air fares are usually deductible, provided the primary purpose of the trip is business. If the trip was for business and pleasure, you must apportion the cost. You can claim accommodation and meal expenses for the business part of the trip, but you can’t claim for a holiday before or after that.

Records are important to substantiate your claim. They could include receipts, boarding passes and a diary. You must keep a travel diary of your activities if you are away 6 or more consecutive nights on business travel.

Accounting for private use of assets

Expenses you can never deduct, expenses you can deduct over time, stock and asset records, expenses you can deduct immediately, other deductions records, motor vehicle deductions, motor vehicle deductions records, related courses, course feedback.

Join the Waitlist

Our mobile app is currently under development but we’ve created a waitlist to let you know as soon as it comes out.

Your Complete Guide to Work Related Business Trip Tax Deduction

Many of us use our personal vehicles for work related travel. Similarly, many of us may need to travel for attending short business meetings or staying overnight to attend business events. During business trips, employees incur certain expenses which can be claimed as business trip tax deductions.

Jaxon, our go-to business related tax expert, will help you navigate through the complex work-related tax deduction guidelines set by the ATO. Whether you use your personal vehicle for work related travel or you use other means to travel and conduct business activities, you can claim business related travel expenses in both situations.

Before we dive into the specifics of work related travel claims, we need to understand who is eligible for a business trip tax deduction.

You must meet the following criteria in order to claim business trip tax deductions:

- Your employer has not reimbursed business travel expenses

- The expenses should be related to the work activities

- Your claim falls under ATO eligible travel related deduction categories

Business Trip Tax Deduction – Using Your Car for Work

Many of us use our car for business travelling. You can not claim a deduction for using your car to go to the office from your home (unless you carry work equipment).

You can claim personal vehicle expenses such as fuel, maintenance, insurance and toll under the following conditions:

- Using your car for work-related trips like client meetings, business events, conferences

- Using your car to go from your home office to another work location such as a client’s office or a temporary project site

- Making business related deliveries of tools or supplies in your car

- Carrying business tools and equipment in your car to your workplace

Related Read: Work from Home Tax Deduction In Australia: Check Your Eligibility

When Can You Claim Business Trip Tax Deduction?

Overnight business travel:.

If you or your employee are staying overnight during business travel, you can claim deductions for expenses incurred during that time.

Business-related Conferences and Events:

You can claim deductions for attending business conferences, seminars, or industry-specific events. These events must support the primary business activities.

Temporary Work Assignments:

When you are temporarily assigned work away from your regular workplace, you can claim travel tax deductions. This applies when you are temporarily shifting to a different location and travelling to the project site.

Travelling to Multiple Business Locations:

If your visit various business locations in a day or over a period of time, you can claim these travel expenses. It will include transportation costs, meals, and any other expenses directly related to your business activities during those visits.

Self-Employed Professionals:

Self employed professionals like freelancers or consultants can also claim travel tax deductions. If you travel for business activities, such as meeting clients, attending meetings, or scouting new opportunities, you can claim these expenses.

In Short, You Can Claim The Following Business Travel Expenses:

- Airfare for business-related trips.

- Accommodation Expenses for hotels, motels, or other business related travel lodging.

- Transportation Costs include train, tram, bus, taxi, or ride-sharing fares.

- Car Rental Fees for business travel.

- Personal Vehicle Expenses for business travel . You claim fuel, tolls, parking fees, and maintenance costs.

- Meals during overnight stays during work-related stays. ATO imposes certain limitations for specific meal deductions.

- Checked Baggage Fees or additional luggage you carry on your business trip.

- Communication Costs such as internet and mobile phone bills.

- Event Registration Fees for attending business-related conferences, seminars, or workshops.

- Business Supplies Expenses for stationery or equipment.

- Laundry and Dry Cleaning Costs during your business trip.

- Business-related Entertainment costs during client meetings or internal activities.

- Professional Services Fees are paid to consultants, translators, or other professionals.

- Tax agent visitation costs.

Which Expenses You Can Not Claim as Business Trip Deduction?

You can not claim expenses for the following categories:

- Personal Travel Expenses.

- Non-Work-Related Entertainment Costs.

- Family or Friends’ Travel Expenses.

- Souvenirs and Gifts Costs.

- Traffic Fines and Penalties

- Personal Travel Insurance Premiums.

- Commuting Expenses to go from home to your regular workplace.

- Lavish and unreasonable Meal Expenses during business trips.

- Pre-Business Startup Travel Costs.

- Personal Travel Upgrades.

Important To Things to Remember About Employment Allowances

If your employee is giving you work-related travel meals and accommodation allowances, then you can not really claim these expenses on your tax return . Most people believe that they can claim a reasonable amount from their expenses, but that’s not how it works. ATO closely scrutinizes work related accommodation and meal expense claims. ATO may penalize you for inaccurate claims provided your employer has given you work related allowances or expense reimbursements.

Two Common Methods for Claiming Business Trip Tax Deductions

Let’s talk about the two widely used methods for calculating business trip tax deductions. There are two ways you can claim eligible work related travel expenses:

Standard Cents Per Kilometer Method

ATO uses the standard and simplified Cents Per Kilometer method for business trip tax deduction calculation. Under this method, you can claim a fixed rate per kilometre of business travel.

You can claim up to a maximum limit set by the ATO for the current financial year.

For example, in the 2022-2023 financial year, the ATO rate wa s 72 cents per kilometre.

The best thing about this method is, you don’t need receipts!

However, you will need to explain the method you used to determine the business trip kilometres travelled to the ATO.

Travel Logbook

The logbook method is a little more time-taking and requires more diligent record-keeping. However, accurate travel logbook records can lead to significant tax deductions .

ATO requires you to keep a work-travel diary or logbook if:

- Your Vehicle expense deductions exceed the ($ 5000 ) limit under the Cents per Kilometre Method.

- You are a sole trader or business partner travelling for more than 6 consecutive nights

The logbook represents a continuous work-related travel record for up to 12 weeks.

After the initial 12-week period, the logbook data remains valid for up to 5 years.

You will need to start a new logbook to fix inaccuracies or make changes.

Here is how the logbook method works:

- Keep a logbook for a continuous 12-week period. Record all your business journeys during this time. Log the starting and ending odometer readings for each business trip.

- After the 12-week period, calculate the proportion of vehicles for business use. You can do this by comparing the total business kilometres travelled to the total kilometres driven during that time.

- Apply the calculated business-use percentage to all your vehicle expenses (such as fuel, servicing, insurance and depreciation) for business related use for the entire year.

Keep accurate records of all expense receipts and invoices for all your motor vehicle expenses. This record will serve as evidence to support your claims during your annual tax return.

Suggested Read: How Long Does Tax Return Take in Australia?

Here is Another Simpler Method

Hire a registered tax agent to help you gauge your travel related claims eligibility. Alternatively, you can use an AI-powered tax app to keep track of your work related travel expenses and see eligible deductions.

Taxly.AI works as your personal and business related tax assistant. Use it to keep detailed work related travel records and track your expenses for accurate tax returns.

Join our Newsletter

Subscribe to our weekly newsletter to stay up to date on Tax related information.

How to Claim Employee Travel Expenses – ATO Conditions and Guidelines

A business must pay for an employee’s travel expenses in order to claim the corresponding business trip deduction. It means that employees must not be paying for business travel expenses out of their pocket.

There are three ways in which a business can pay employee travel expenses:

- Directly pay expenses to employees in their business account

- Pay employees in the form of a travel allowance

- Reimburse the employee for work related travel expenses

Is Your Business Liable to Fringe Benefits Tax (FBT)?

Fringe benefits tax (FBT) may apply when your business pays for or reimburses employee travel expenses.

Certain exemptions and concessions can reduce a business’s FBT liability. For example, you don’t need to worry about FBT if you reimburse an employee for their travel expenses related to attending a work conference. Why? Because the employee could have claimed this under business trip deduction expense during their income tax return.

When may be liable for FBT?

If an employee extends their travel for personal reasons and you reimburse them for those private costs, you could be liable for FBT. So, keep your business and personal expense records separate!

Company directors who pay for employees’ private expenses should be aware of Division 7A’s implications.

Different considerations apply if you pay a living-away-from-home travel allowance to your employees,

Here Are The Key Takeaways

Keep detailed records of travel related expenses, such as receipts, invoices and odometer logs to claim travel related expenses.

You can claim business trip deductions using two standard methods: the Cents per Kilometre Method and the Logbook Method. You can claim business-related airfare, transportation costs, accommodation, meals (for overnight stays), and certain other work related expenses.

Keep in mind that not all expenses incurred during travel are eligible for tax deductions. Personal expenses, non-work-related entertainment, and family or friends’ travel costs are generally not deductible.

When claiming employee travel expenses, the business must actually pay for the expenses to be eligible for deductions. If a business pays for an employee’s personal expenses during extended business related travel, you may be liable to Fringe Benefits Tax (FBT).

Always keep your personal and work related travel expense record separate to avoid any tax inaccuracies and penalties.

Related Links: How do I Find my Tax File Number in Australia?

Jaxon Rylah, an Australian of diverse heritage, brings a wealth of expertise to his role as an Author at Taxly.ai. With over 5 years of experience in the field, Jaxon's deep understanding of accounting principles and regulations allows him to provide...

View all posts

I seamlessly blend creativity and strategic thinking to craft compelling content that captivates your audience and leaves them wanting for more. I meticulously optimize every word for maximum visibility and reach.

Categories:

Comments are closed

Recent Posts

- Actual Cost Method – All You Need to Know

- U.S. Expat Taxes Australia – Key Requirements

- ADF Tax Deductions Complete Guide 2024

- Apprentice Tax Deductions Guide [2024]

- How to Minimise Capital Gains Tax on Investment Property Sale?

- Tax Deductions

- Tax Returns

- Client Survey

- Payment Portal

- Footy Tipping

Travel Expenses Fact Sheet

In order to claim travel expenses as a tax deduction, you need to ensure that the correct substantiation is maintained. The type and length of the business / work-related travel will affect the documentation you require.

The main issues to consider are:

Principal Reason – Business vs Private Travel

Travel expenses are deductible when they are incurred for business or work-related purposes.

Free Initial Contact Meetings

See us before traveling for ultimate peace of mind about deductibility and achieving the best tax outcome. Book your complimentary initial meeting today, hear back from us within 24 hours.

Email Address

Phone Number

Allowable Deductions

If the other conditions of claiming a deduction for travel are met, examples of tax deductible travel expenses include:

- Accommodation

Deductions cannot be claimed for the following travel-related expenses in any circumstances:

- Travel insurance

Substantiation Requirements

In order to claim the allowable deductions outlined above, you must keep written evidence (receipts) in certain circumstances. This will depend on the amount of the deduction that is being claimed and you receive a travel allowance.

Each year the ATO sets a reasonable travel allowance that covers accommodation, meals and incidentals incurred while travelling for work purposes.

- For domestic travel where a travel allowance is received – no written evidence is required for deductions claimed up to the ATO reasonable travel allowance amount (otherwise written evidence is required for all expenses).

- For domestic travel where no allowance is received – written evidence is required to claim any deduction.

- For overseas travel where a travel allowance is received – No written evidence is required for a deduction claimed up to the ATO reasonable travel allowance amount for meals and incidentals (otherwise written evidence is required for all expenses). Written evidence is required for accommodation expenses as it is not included in the allowance.

- For overseas travel where no allowance is received – written evidence is required to claim any deduction.

Travel Diary Requirements

As well as the substantiation requirements outlined above, when you are away from home for 6 or more consecutive nights (whether domestic or overseas), a travel diary must be maintained in order to claim a deduction for travel expenses. At the very least, the diary should include details for each business activity performed including:

- The nature of the activity

- The date, time and duration of the activity

- The location of the activity

Download this fact sheet as a PDF.

Automated page speed optimizations for fast site performance

Claiming tax deductions for business travel

by Affinity | Mar 5, 2020 | Business eNews

Businesses can claim a tax deduction for expenses on work related travel. However there are additional issues that need to be considered when a holiday is planned to coincide with the work trip, or there is so other private activity during the trip (e.g. catching up with family and friends).

Tax deductible expenses

A business can claim a deduction for travel expenses related to the business including:

- train, tram, bus, taxi, or ride-sourcing fares

- car hire fees and the costs incurred (such as fuel, tolls and car parking) when using a hire car for business purposes

- accommodation

- meals, if away overnight.

To claim expenses for overnight travel, the person must have a permanent home elsewhere and the business must require the person to away from home overnight.

Non-tax deductible expenses

The following expenses cannot be claimed as a tax deduction:

- a holiday or visit to family or friends that is combined with the business travel

- the expenses associated with taking a family member on the trip

- souvenirs and gifts

- sightseeing and entertainment

- visas, passports or travel insurance.

Claiming for airfares

The tax-deductibility of airfares may be reduced when business and private travel is combined.

Assume a person travels to London for a two-week trade show and stays a few extra days for sightseeing. The ATO says that if the “primary purpose” of the trip is for business, the entire cost of the return airfares is a tax deduction as well as related costs like travel to and from the airport. In this example, the additional sightseeing is purely incidental.

If the person is planning a significantly longer holiday so that the primary purpose of the trip is not just the business activity, the airfares would need to be apportioned between business and private travel. And if the primary purpose is clearly private with some incidental work activities, the airfares are generally not tax deductible.

Tax treatment of accommodation expenses

Tax deductions for accommodation are limited to those nights that the person is required to be away for business purposes. This will depend on the facts of the trip.

In the London example above, a tax deduction can’t be claimed for accommodation, meals and transport costs for the few extra nights involved in sightseeing even though the full airfares are tax deductible.

On the other hand, if the person has to be away for an extended period of time and some days don’t involve work activities, the full accommodation costs may still be tax deductible.

The ATO gives the example of being interstate for two full weeks to complete a project on-site for a client. The accommodation costs on the middle weekend (when the person is not working at the client’s site) would still be deductible. Of course, private weekend activities like sightseeing, entertainment and dinner with friends would not be tax deductible.

How to claim employee travel expenses

For employee related travel (including working directors), the business must actually pay for the travel expense to be able to claim it as a tax deduction. The business can pay for the expense by:

- paying it directly from a business account

- paying a travel allowance to the employee

- reimbursing the employee for their expenses.

Fringe benefits tax (FBT) may apply if the business pays for or reimburses the employees for their travel expenses where there is a private component of the trip. There are certain exemptions and concessions that may apply to reduce the FBT liability. For example, the business won’t have an FBT liability if it reimburses an employee for their travel expenses to attend a work conference, which the employee would have been able to claim as an outright deduction if not reimbursed.

The business will be liable for FBT if the employee extended their travel for private purposes and the employee was reimbursed for these private costs. When FBT is paid on the private component of the travel, the business is entitled to claim 100% of the costs of the trip.

Where the business pays employees a travel allowance or a living-away-from-home allowance, different tax considerations apply.

Travel diaries

(i) Sole traders and partners in a partnership

Where a sole trader or a partner in a partnership travels for six or more consecutive nights, they must keep a travel diary or similar document before the travel ends or as soon as possible afterwards. The travel diary must record the following details:

- the date and approximate time the business activity began

- how long the business activity lasted

- the name of the place where the business activity occurred.

The travel diary can be in any format as long as it contains sufficient detail to justify the claim.

(ii) Companies and trusts

If the business is run through a company or trust structure, the ATO says it’s not compulsory for an employee to keep a diary, but it’s highly recommended.

Record-keeping

Businesses must keep records for five years to substantiate business travel expenses including:

- tax invoices

- boarding passes

- travel diaries

- details of how any private portion was determined.

This information is provided as a guide only and is not intended to constitute advice whether legal or professional. You should obtain appropriate advice concerning your particular circumstances.

** Information current as at publishing date.

How can we help, ask an expert online.

Book a meeting

Request a call back

Ask a question to our accounting experts and receive an email response

Work-related travel expenses – What can you claim

It does not matter if you are an employee, an employer, a sole trader or run a small business; there might occur some situations when you need to travel for business purposes. The costs incurred in such conditions are classified as work-related expenses.

Work-related travel expenses are usually tax deductible. However, the Australian Taxation Office gets thousands of incorrect claims every year for work travel expenses. As a result, they have started keeping a close eye on the expenses that are being claimed to make sure they are valid.

Understanding how to qualify for such deductions and which expenses can be used to help you optimise your travel costs as well as save money on your taxes is a necessity today. So here’s a guide to help you know everything when it comes to business travel expenses.

What are work-related travel expenses?

According to the ATO, while travelling for work, any purchase you make in regard to this travel is usually claimable as a travel expense on the tax return. The travel can be driving your car to the client’s office situated kilometres away (from your office) or visiting a temporary location for work. Along with this, interstate and overseas travel expenses are also deductible.

Work-related travel expenses include ticket costs or fares for any modes of transportation, tolls, parking, etc, along with meal expenses and accommodation. There are some restrictions as well on what you can claim. We will look into that in the later part of this blog.

Here’s what you can claim:

- Accommodation expenses

- Incidental expenses (like laundry)

- Taxi, bus, train and air fares

- Road and bridge tolls

- Car hire charges

- Parking fees

- Meal expenses (only for overnight travel for work)

- Bags used solely for a work trip

Claiming work-related driving costs

When it comes to travel tax deductions, transport costs are extremely popular. Except for the travel from work to home and vice versa, the cost of work-related travel in your personal car or on a means of public transport is claimable.

What can you claim?

You can claim a deduction for the cost of:

- Travelling between two separate workplaces for different jobs

- Travelling from your workplace to meetings or events offsite

- Travelling from one job to a second job if and when required

- Travelling to a different location, if you work at more than one location for your employer

- For those working from home for a specific period of the day and working in the office for the rest of the working hours (but only for the same employer), the cost of travelling to the workplace is claimable.

You can’t claim a deduction for the cost of:

- The everyday travel from your residence to the workplace and back

- If you work from home for one employer but not for the other employer, your cost of travelling to a second job can’t be claimed.

- Any additional task or work you do on your way back home, for instance, picking up your package

Car parking – Is it a travel expense?

Suppose you had an out-of-office company event or meeting. In order to park your car, you had to pay for parking as you used your own car to get there. In this case, you can claim the cost of the trip and the parking costs.

However, you cannot and should not claim parking or car expenses if you have been reimbursed by your employer.

You cannot claim the cost of everyday parking as well if you drive to work and have to pay for parking near the workplace.

What documentation of work-related travel expenses should you keep for your tax return?

You should keep everything that is relevant to your tax returns. Work-related vehicle charges can be claimed by receipts or tax invoices, which serve as documents supporting a specific order.

However, remember, those fade over time. A logbook can be very useful when claiming employment-related trips.

Travel diary – Do you have to keep one?

Anybody who has to stay away from home for more than six nights consecutively should keep a travel diary. But what should be recorded in a travel diary?

In the travel diary, you can keep a record of what you were doing, where you were and the start and end times of the activities you were engaged in.

It is always a good idea to keep a record of your travel expenses, even when keeping a diary isn’t really required. Since there’s a possibility of you forgetting details about all the expenses made in the months, it can cost you a huge amount in your refund at tax time.

What can’t be claimed?

Since we have discussed what work-related travel expenses can be claimed, now take a look at the expenses that can’t be:

Unless your employer has assigned you to carry bulky tools to work (due to lack of an appropriate place to store them at the workplace), you should not claim a tax deduction on your journey from home to work and back home.

Also, claiming the travel expenses for which you have been reimbursed by your employer is also prohibited.

In case you decide to bring your family along for a business trip, you cannot claim accommodation costs or any travel expenses for them.

Ask your tax agent to know more about what can be claimed or cannot be. If you are looking for good tax accountants in Melbourne, Clear Tax Accountants can help you reduce your tax responsibilities and provide the right advice for your tax matters.

Travel allowance

Usually, the travel allowance you receive from your employer is considered taxable income. Thus, it needs to be listed on your income statement. In simpler terms, if you receive a travel allowance, it is going to be included on your tax return as taxable income.

If you spend the money paid to you as travel allowance, claiming a tax deduction against it when the tax time comes is possible. There is a common misconception that the entire allowance can be claimed as a tax deduction even if you haven’t spent all of it. This is not true at all.

Travel records – What to keep

What travel records are worth keeping? There is practically no record that is not worth keeping. You should have all the receipts and records for all the travel expenses related to work, even if you were reimbursed for it.

Record keeping will help you ask your tax agent if you can claim certain work-related travel expenses (in case you are doubtful).

Remember, you can’t claim something if you do not have anything to prove it!

What if you travel for work and then spend an extra few days on holiday at the end of the trip?

When your travel is split between leisure and work, you need to split all your travel expenses between the two as well. You must keep the following two rules in mind in these circumstances:

- The primary purpose of the trip has to be work-related

- You cannot claim any part of the said trip that wasn’t work-related

To understand it better, consider that you had to go on a three-day work-related trip. But you decided to extend your trip by two more days. Since only the first three days were for work, you can claim work-related travel expenses for those days.

You cannot claim the cost for the next two days because you spent the money on your leisure. The accommodation costs incurred in the first three days, the fares of the taxi for travelling to and from (only work-related) and the meal expenses for that time are claimable but not for the remaining two days.

If you want to claim a deduction for any work-related travel expense, you will have to keep a few restrictions in mind. Keeping detailed records of work-related travel expenses will increase your chances of receiving a tax refund.

Disclaimer : The information on this website is for general purposes only and should not be relied upon for making legal or other decisions. The advice provided in this article is general in nature and is not subject to the personal financial situation and needs of any individual. Clear Tax tries to keep the information accurate and up-to-date; however, you should bear in mind with changing circumstances, the accuracy and reliability of the information will not necessarily remain the same. The information is by no means a substitute for financial advice.

Jobs That Claim Most Tax Deductions in Australia

Did you know that there are some jobs that usually claim way higher deductions than other professions? Depending upon the profession you have chosen, you may get more or less deductions to claim. For an average Australian, a little over $3000 is claimable under the common tax deductions in Australia. However, for the following occupations,…

Unpacking the Research and Development (R&D) Tax Incentive in Australia

The R&D Tax incentive or the Research and Development tax incentive is a self-assessed Australian Government assistance program. The aim of this program is to encourage companies to take up R&D (research and development) activities in Australia. R&D activities are considered too risky to undertake without the financial support provided by this program. R&D has…

Compensation payments: Avoiding contribution issues

Superannuation fund trustees who receive compensation from financial institutions and insurance providers must consider how receipt of these payments may impact a member’s contribution caps.

- [email protected]

- 03 8657 7640

- Client Login UGC Portfolio Saxo Hub 24 Macquarie Client Macquarie Adviser

Private Wealth

28 Apr 2021

Deducting travel expenses: New ATO ruling for what you can (and can’t) claim

Knowing exactly what deductions apply to travel expenses can save a heap of hassle at tax time.

The Australian Taxation Office (ATO) has released a new ruling that clarifies what expenses employees can deduct for work-related travel.

The new ruling, Income tax: When are deductions allowed for employees’ transport expenses? was released this week, bringing together and clarifying the rules for business advisors and their clients alike.

Key takeaways:

The ATO’s new ruling sheds light on what travel expenses employees can and cannot claim

Travel between work locations (neither of which are your home), is typically tax deductible

Incidental work-related travel, such as a receptionist who makes a stop to pick up office newspapers on their way to work, can’t be claimed on tax

Travel from home to a regular place of work generally isn’t deductible. The ruling states that even if you travel to work by plane, receive a travel allowance or make incidental business-related stops on the way to work, you still cannot claim your travel expenses.

But moving between two separate work locations – like driving from your office to a construction site, or from your business to a meeting at a client’s office – can be claimed.

Tax specialist and accountant, Leo Hollestelle said the ruling is well timed ahead of the busy End of Financial Year period.

“It’s timely that these views are brought together and codified into a single ruling,” said Hollestelle. “Tax advisors will be able to more easily familiarise themselves with the rules and in turn advise their clients on it.”

Where’s your regular place of work?

Interestingly, there are several exceptions that – if claimed correctly – can give you an edge come tax time. This is especially true when it comes to defining what a “regular work location” actually is.

For example, imagine you currently work for a business with an office 15-minutes from your home.

But you’re asked to cover a long-service vacancy for six months at another of your business’s offices one hour away. Because this new office becomes your regular place of work for a sustained period of time, travel to and from it cannot be claimed on tax.

But, if your period of work was only for three months, then it could be argued that the second office never became a regular place of work.

Therefore, travel could potentially be claimed on tax.

This is a call to take care in making any assumptions about what you can actually claim. As the ATO ruling states, ‘the full facts and circumstances of the specific working arrangement in place must always be considered in determining the nature and deductibility of the transport expenses incurred’.

And that’s something to keep in mind when it comes to all travel-related tax claims this tax time, as it could be this ruling also indicates an increase in scrutiny for travel-related claims.

“While the ruling is very much in line with the Commissioner’s existing views on travel expenses, the timing is worth noting,” said Hollestelle.

“After a year where many employees have been working from home, it may be the ATO is concerned there will be both workers and employers seeking to make dubious claims in the tax period ahead.”

Want to find out exactly how tax changes and updates might impact your business? Contact us today on .

Source: MYOB February 2021

Reproduced with the permission of MYOB. This article by MYOB Team was originally published at https://www.myob.com/au/blog/travel-expenses-ato-clarifies-what-you-can-claim/

Important: This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, we do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, we do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person.

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

The post Deducting travel expenses: New ATO ruling for what you can (and can’t) claim appeared first on FPG Independent Social & Individual Website Feeds .

Recent stories

22 Apr 2024

Reviewing Your Investment Portfolio

At United Global Capital, we believe that the foundation of a successful investment journey is a well-maintained strategy. Regularly reviewing…

Retirement and Superannuation

18 Apr 2024

Find Your Lost Super

It’s surprisingly easy to lose track of your superannuation. Changes in employment, address, or personal details can lead to superannuation…

Personal Finance, Private Wealth

16 Apr 2024

Estate Planning: Five Key Elements for Consideration

Planning for the future, especially in terms of estate planning, is a crucial step in safeguarding the legacy you wish…

Personal Finance

11 Apr 2024

How To Build An Emergency Fund Fast

In an ever-unpredictable world, financial preparedness is more crucial than ever. Emergencies – be they medical crises, unexpected home repairs,…

Essential Strategies for Achieving Investment Success

Understanding and achieving investment success is a highly personal journey, as the definition of success varies from one individual to…

Blog | All Posts | All Topics

Work-related travel expenses: How to track them and what to claim for your business

Many business owners and employees travel, so you’ll likely need to record work-related travel expenses. The good news is that business travel expenses are often tax deductible, so tracking them can help you save money on taxes. Tax deductions can lower your taxable income, so you could pay less in taxes overall.

In this post, we’ll cover everything businesses need to know to track, record, and claim work-related travel expenses, including:

- What are work-related travel expenses?

Business travel expenses you can claim

What you can’t claim, records you need to claim business travel expenses, how to track work-related travel expenses, what are work-related travel expenses .

Work-related travel expenses may include costs for business travel, accommodation, or meals. However, not all travel expenses qualify as work-related.

Many small businesses run into issues with the Australian Tax Office when they deduct travel expenses. It can be confusing to determine what counts as a qualified business travel expense and what doesn’t.

One of the key issues employers run into is understanding the line that separates personal and business expenses. So, the ATO established clear definitions for the types of expenses that qualify to be tax deductible.

To qualify as a work-related travel expense, you or your employees must be:

- Travelling away from your home and staying away overnight

- Able to prove that the travel was necessary for your business

Some of the common travel expenses businesses can deduct are costs for:

- Rental cars and additional fees for parking, fuel, tolls, etc.

- Public transport (bus, trains, etc.)

- Taxis or ride-share (Uber)

- Airfare (tickets and baggage costs)

- Accommodations (hotels)

- Overnight meals

You can’t deduct travel expenses that aren’t necessary for conducting business. In other words, you can’t deduct your holiday. However, you can deduct the travel costs to go to another city and meet with a client. In that case, you may deduct transport, hotel, and even some meal costs.

Other types of non-deductible travel expenses include:

- Leisure activities while on a business trip

- Holidays during business travel

- Travel insurance, visas, and other documents

- Gifts and entertainment

If you combine a business trip with holiday, then you can only claim the portion of the trip that was for business. For example, if you live in Perth and attend a work conference in Sydney, you can claim those costs. But, if you decide to stay in Sydney a few days after to sightsee, then the extra days and money doesn’t qualify.

To qualify part of those expenses, you’ll need to show how you separated the work from personal costs.

Businesses may cover employees’ work-related travel expenses through travel allowances. However, there are specific guidelines for how much an employee may spend daily on travel allowances, which we’ll cover later in this post.

To claim travel expenses, you’ll need to keep records. If you can prove something was a qualified business travel expense, you should have no issues with your tax return.

Businesses should keep these records for five years:

- Meal and other receipts

- Tax invoices

- Ticket stubs

- Boarding passes

- Travel diaries

You may be able to show proof that something is a work-related travel expense through:

- Signed contracts

- Meetings with documentation

- Email confirmations

Businesses can cover work-related travel expenses for employees and track them. To do this, you generally have three options:

- Pay for expenses directly with a company card or business bank account

- Set up a reimbursement program for travel expenses

- Pay employees a travel allowance

If your business covers travel expenses through any of the above methods, then employees can’t claim those on their personal taxes. Instead, you may be able to claim them and deduct the cost from business taxes.

Keep in mind if you offer travel allowances that they might trigger the fringe benefits tax, which is a separate income tax. For example, some businesses offer an employee a living-away-from-home allowance instead of a travel allowance. Because the employee is away from home to work for long periods, it might be considered a fringe benefit.

Businesses need to keep accurate records on those travel expenses. Here are some tips to help you track work-related travel expenses.

1. Educate employees on what they can claim

You can reduce errors and missing records by training employees on how to track travel expenses before they go on a trip. Even a simple checklist of what travel expenses you cover and don’t will be helpful.

Again, if you offer travel allowances, inform employees of the daily limits or reasonable amounts for meal, accommodation, and incidental expenses. The reasonable amounts vary depending on location and other factors, so consult ATO’s guidelines .

Additionally, your employees should keep all of their receipts and documents while travellingon business.

2. Track expenses and keep records

The ATO requires that businesses keep records for five years as proof of travel claims. There are several expense tracking apps that make it easier to save receipts and other documents.

The ATO app also has a myDeductions tool for sole traders. Larger small-to-medium enterprises will want to invest in a more robust tool. Accounting software like Xero and MYOB also have expense tracking features.

3. Log a travel diary

If you’re a sole trader or partner and travel for work for more than six consecutive nights, the ATO requires you to keep a travel diary. It’s a logbook of what you do and spend money on while traveling.

A travel diary can be in any format as long as it shows:

- The days you travelled

- What you did each day

- The times you did it

These entries should all correlate with the records you keep—this acts as an activity timeline with records.

Keeping a travel diary even for trips shorter than six nights might be beneficial. If you ask your travelling employees to keep a travel diary, you’ll have an extra way to verify their claimed expenses.

4. Track expenses with a bookkeeper

The ATO is particular about what you can and can’t claim for travel expenses, and it can be costly if you track them incorrectly. At the same time, business travel expenses can become complicated to track, deduct, and report. When your business is fast-growing and you have over 100 employees to track, this is especially true.

Online bookkeeping services like Visory can help you track, record, and report your travel expenses. Once you need to lodge your business taxes, you’ll have organised books that include all the documents the ATO may need.

To learn how Visory can help you manage work-related travel expenses, and all your back-office finance needs, chat with one of our bookkeeping experts . Once you schedule a time to chat, we’ll get to know your business and identify the best services for you.

You might also like

Advances in technology influencing small business

Good Cash Control – A Non-Negotiable for Business

Single Touch Payroll – Are you compliant?

Simplify your business with visory..

Realise the change our platform can make. With a free month trial, we’ll do your bookkeeping and deliver financial statements for you to keep.

Meet an Expert

1800 VISORY [email protected]

Bookkeeping

Reporting & Insights

Accounts Payable

Accounts Receivable

Online Bookkeeping

Catch Up Bookkeeping

Customer Stories

Financial Health Check

How it Works

Growing Businesses

Professional Services

Construction

Private Clients

Find a Bookkeeper

Item D2 - Work-related travel expenses

This item is for travel expenses incurred when performing work as an employee. They include:

- public transport, air travel and taxi fares

- bridge and road tolls, parking fees and short-term car hire

- meals, accommodation and incidental expenses while away overnight for work

- expenses for motorcycles and vehicles with a carrying capacity of one tonne or more, or nine or more passengers, such as utility trucks and panel vans

- actual expenses, such as petrol, repair and maintenance costs that you incur to travel in a car that is owned or leased by someone else.

Complete item D2 for work-related travel expenses during the current income year.

From 1 July 2018, if you have work-related travel expenses, the ATO requires you to lodge a Deductions schedule ( DDCTNS , AE Tax schedule code ds).

We've removed the dissection grid provided in previous years.

To open the DDCTNS at this item, click label B and click into the first details field.

You can have up to 20 entries. To add a row, press Ctrl+Insert . To delete a row, press Ctrl+Delete .

If you've allocated amounts to item D2 in the Motor vehicle worksheet (mve) or the Depreciation worksheet (d) we'll pass these to D2 .

When you close the worksheet, MYOB Tax updates the value at label B .

Please note, these errors can depend on your browser setup.

If this problem persists, please contact our support.

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

myTax 2022 Work-related travel expenses

How to complete myTax if you have work-related expenses.

Last updated 31 May 2022

Complete this section if you incurred travel expenses in performing your work as an employee.

Things to know

To claim a deduction for a work-related expense:

- you must have spent the money yourself and weren't reimbursed

- it must be directly related to earning your income

- you must have a record to prove it (usually a receipt).

If the expense was for both work and private purposes, you can only claim a deduction for the work-related portion.

If your total claim for work-related expenses is more than $300, you must have written evidence to prove your claims.

Work-related travel expenses include:

- public transport, air travel and taxi fares

- short-term car hire

- meal, accommodation and incidental expenses you incur while away overnight for work

- actual expenses such as petrol, repair and maintenance costs, that you incur to travel in a car that is owned or leased by someone else

- cars (don't claim these at 'Work-related car expenses')

- motorcycles and vehicles with a carrying capacity of one tonne or more, or nine or more passengers

- expenses for motorcycles and vehicles with a carrying capacity of one tonne or more, or nine or more passengers, such as utility trucks and panel vans.

You can claim

You can claim the cost of trips you undertake while performing your work duties. This may also include trips between your home and your workplace if:

- you used the vehicle because you had to carry bulky tools or equipment that are essential to perform your employment duties and could not leave at your workplace (for example, an extension ladder or cello)

- your home was a base of employment (that is, you were required to start your work at home and travel to a workplace to continue your work for the same employer)

- you had shifting places of employment (that is, you regularly worked at more than one site each day before returning home).

Work-related travel expenses also include the cost of trips:

- between two separate places of employment when you have a second job, providing one of those places is not your home

- from your normal workplace or your home to an alternative workplace that is not a regular workplace (for example, a client’s premises) while you are on duty

- from an alternative workplace that is not a regular workplace back to your normal workplace or directly home.

If the travel was partly private, you can claim only the work-related part.

Claim at this section any work-related travel expenses incurred in earning assessable foreign employment income shown on an income statement or PAYG payment summary – foreign employment .

If you received an award transport payment from your employer, you can claim a deduction for work-related transport expenses these payments cover.

To claim meal, accommodation and incidental expenses incurred when you travelled away overnight for work you must:

- have been required to travel as part of performing your work duties

- only be working away from home for a relatively short period or periods of time (not living away from home)

- not have incurred the expenses because of a choice you made about where to live

- have a permanent home at a location away from the work location to which you are travelling

- have paid the expenses yourself and not been reimbursed for them.

Travel expenses includes information about:

- evidence you need if you wish to claim meal, accommodation and incidental expenses you incurred when you travelled away overnight for work

- if you received a travel allowance to cover accommodation, food, drink or incidental expenses.

If your employer provided a car for you or your relatives’ exclusive use (including under a salary sacrifice arrangement) and you or your relatives were entitled to use it for non-work purposes:

- other maintenance

- bridge and road tolls.

Parking at or travelling to a regular workplace is not ordinarily considered to be a work-related use of the car.

If you no longer own or use an item costing over $300 (such as a ute or van with a carrying capacity of a tonne or more) and you previously claimed a deduction for its decline in value, you may need to make a balancing adjustment.

For information on:

- Taxation Ruling TR 2021/1 Income tax: when are deductions allowed for employees' transport expenses?

- Taxation Ruling TR 2021/4 Income tax and fringe benefits tax: employees: accommodation and food and drink expenses, travel allowances, and living-away-from-home allowances

- shifting places of employment, see Taxation Ruling TR 95/34 Income tax: employees carrying out itinerant work – deductions, allowances and reimbursements for transport expenses .

- reasonable allowance amounts, see Taxation Determination TD 2021/6 Income tax: what are the reasonable travel and overtime meal allowance expense amounts for the 2021–22 income year? together with Taxation Ruling TR 2004/6 Income tax: substantiation exception for reasonable travel and overtime meal allowance expenses.

Related page

Claiming deductions You may be able to claim deductions for work-related expenses you incurred while performing your job as an employee.

You can't claim

You can't claim normal trips between your home and your workplace, even if:

- you did minor work-related tasks at home or between home and your workplace

- you travelled between your home and workplace more than once a day

- you were on call

- there was no public transport near work

- you worked outside normal business hours

- your home was a place where you ran your own business and you travelled directly to a place of employment where you worked for somebody else.

Do not show at this section

Don't show the following at this section:

- Expenses (apart from bridge and road tolls, and parking fees) relating to a car you owned, leased or hired under a hire purchase agreement where the expense is not related to motorcycles and vehicles with a carrying capacity of one tonne or more, or nine or more passengers, such as utility trucks and panel vans, go to Work-related car expenses

- Expenses you incurred in earning assessable foreign employment income not shown on an income statement or PAYG payment summary – foreign employment , go to Foreign employment

- losses at Other work-related expenses

- profits at Other income

Any balancing adjustment amounts calculated in the Depreciation and capital allowance tool will show automatically.

Completing this section

You must have written evidence for the whole of your claim.

We pre-fill your tax return with work-related travel expense information you uploaded from myDeductions. Check them and add any work-related travel expenses that have not pre-filled.

To claim work-related travel expenses, you must first show income from salary and wages or foreign employment income in the Income statements and payment summaries section.

To personalise your return to show work-related travel expenses, at Personalise return select:

- You had deductions you want to claim.

- Work-related expenses.

To claim your work-related travel expenses, at Prepare return select 'Add/Edit' at the Deductions banner.

At the Work-related travel expenses banner:

- enter Your description . To assist in record keeping, add a short description of your expense.

- enter the Amount . The Depreciation and capital allowances tool can help you to work out any decline in value deduction. It can also work out any deductible balancing adjustment when you stop holding a depreciating asset. Access this tool in the Deductions section. Fields from this tool can't be adjusted in myTax. To make any adjustments, or to add new assets to the tool, select the 'Use the depreciation and capital allowances tool' link.

- Select Save .

- Select Save and continue when you have completed the Deductions section.

You need to keep records for five years (in most cases) from the date you lodge your tax return.

Our myDeductions tool is free to use and is available through the ATO app. The tool makes it easier and more convenient to keep records of your expenses and income in one place, including photos of your receipts and invoices.

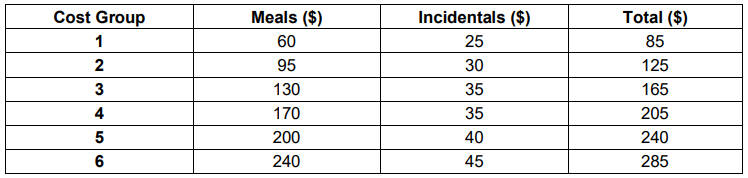

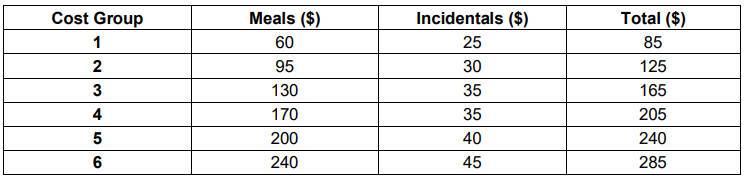

ATO Reasonable Travel Allowances

‘Reasonable’ allowances received in accordance with ATO’s reasonable travel allowances schedules are not required to be declared as income, and can be excluded from the expense substantiation requirements.

Per diem rate schedules of amounts considered reasonable are set out in Tax Determinations published by the Tax Office annually.

Tax Ruling TR 2004/6 describes the substantiation exception for expenses which are in line with the prescribed reasonable allowance amounts.

2021, 2022, 2023 and 2024 rates and for prior years are set out below.

The annual determinations set out updated ATO reasonable allowances for each financial year for:

- overtime meal expenses – for food and drink when working overtime

- domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work

- overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

On this page:

2017- 18-Addendum

More information

Substantiation rules

Substantiation in practice

Alternative: Business travel expense claims

Distinguishing Travelling, Living Away and Accounting for Fringe Benefits

See also: Super for long-distance drivers – ATO

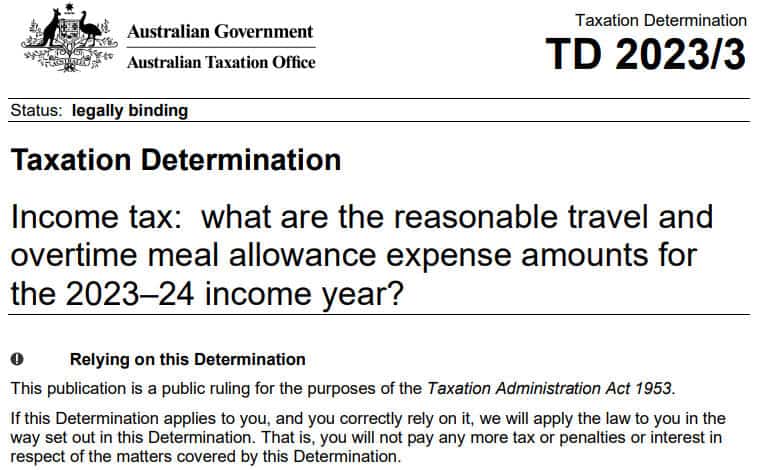

Allowances for 2023-24

The full document in PDF format: 2023-24 Determination TD TD 2023/3 (pdf).

The 2023-24 reasonable amount for overtime meal expenses is $35.65.

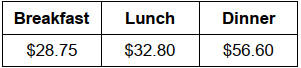

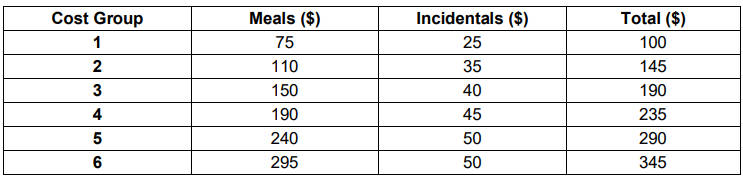

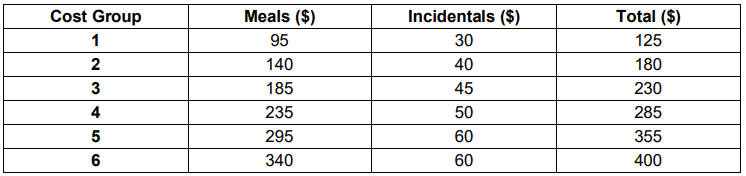

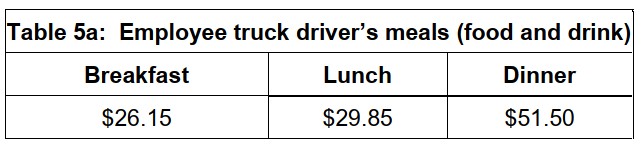

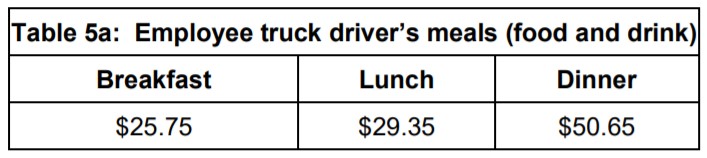

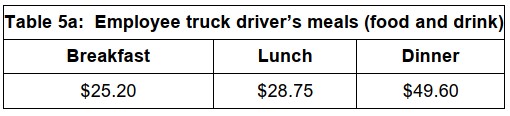

Reasonable amounts given for meals for employee truck drivers (domestic travel) are as follows:

- breakfast $28.75

- lunch $32.80

- dinner $56.60

For full details including domestic and overseas allowances in accordance with salary levels, refer to the full determination document:

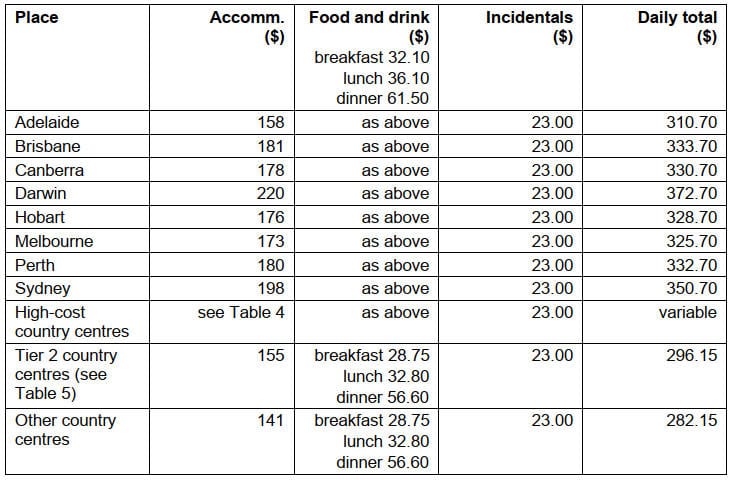

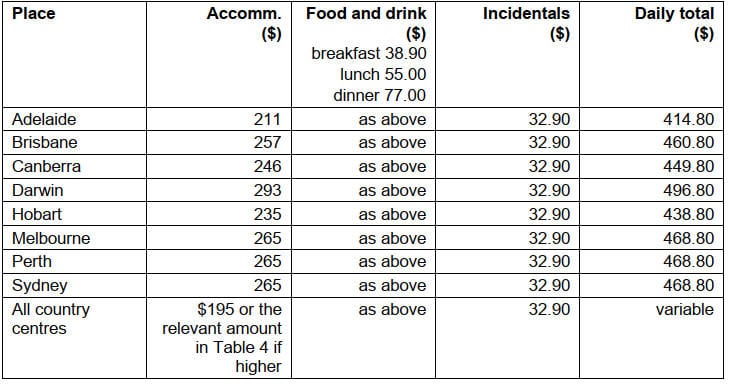

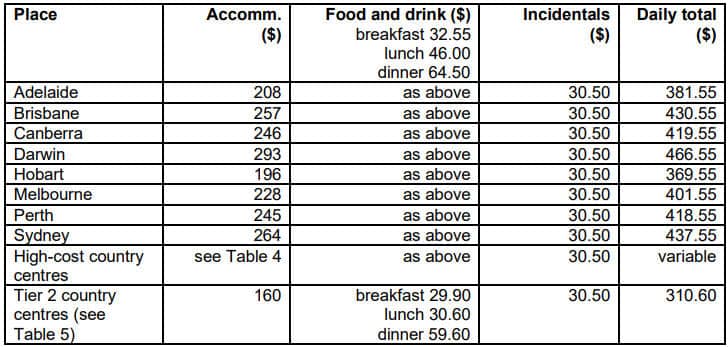

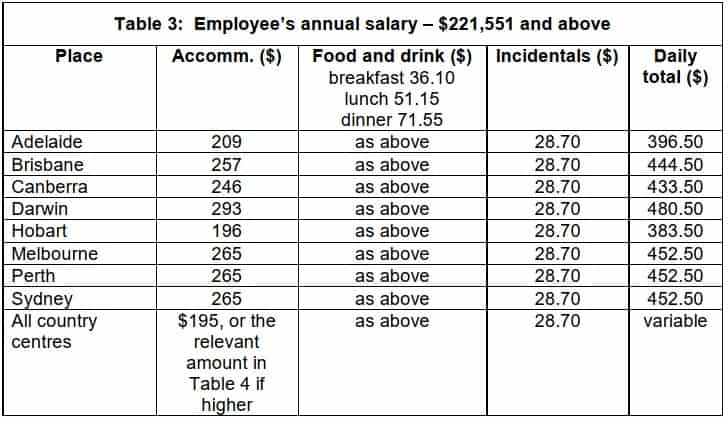

2023-24 Domestic Travel

Table 1:Salary $138,790 or less

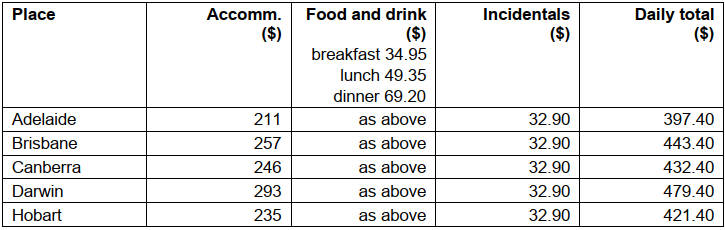

Table 2: Salary $138,791 to $247,020

Table 3: Salary $247,021 or more

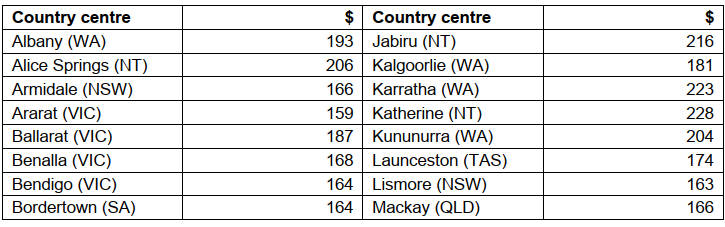

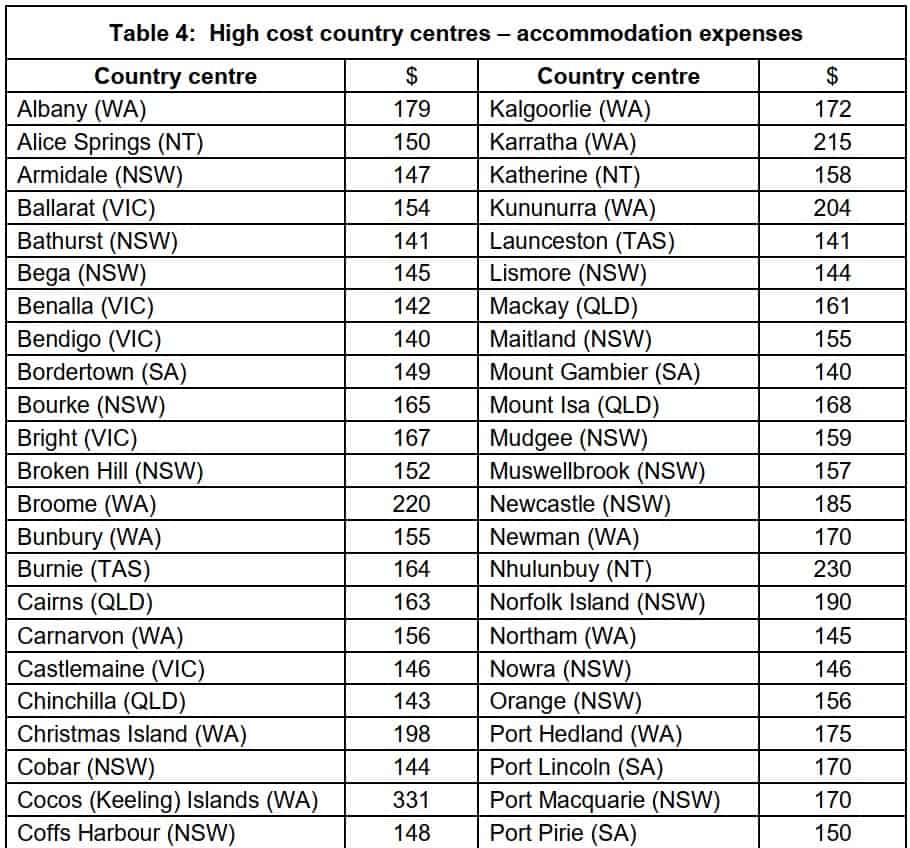

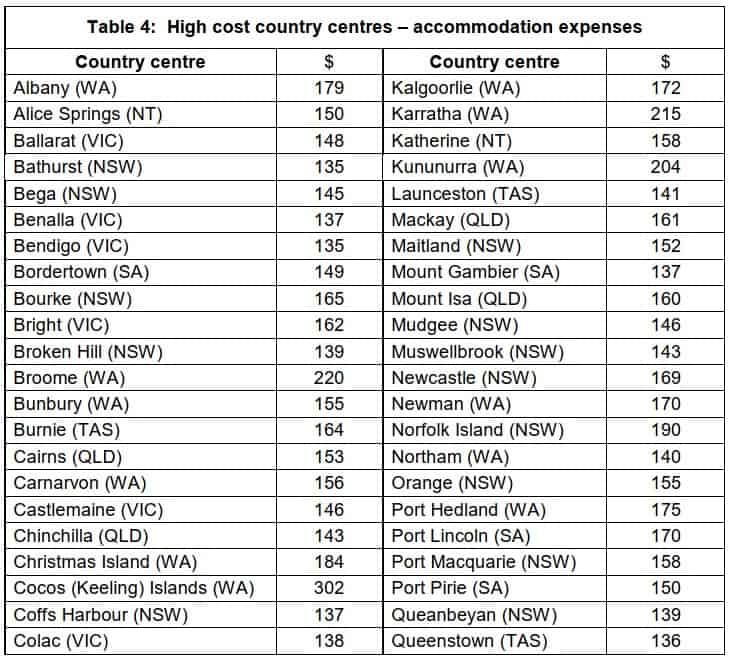

Table 4: High cost country centres accommodation expenses

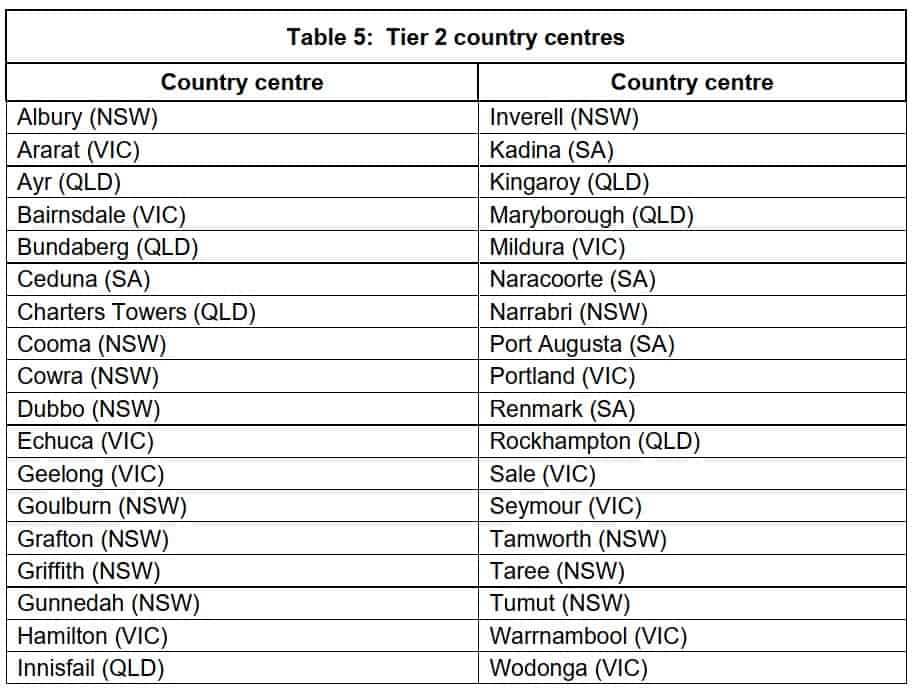

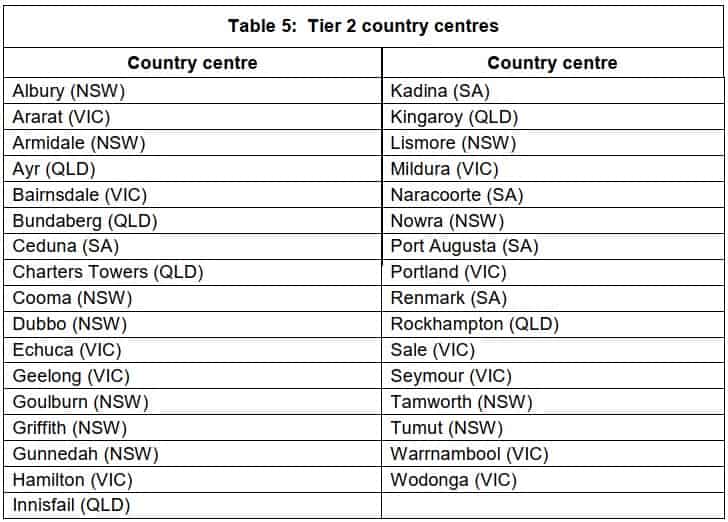

Table 5: Tier 2 country centres

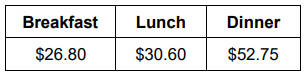

Table 5a: Employee truck driver’s meals (food and drink)

2023-24 Overseas Travel

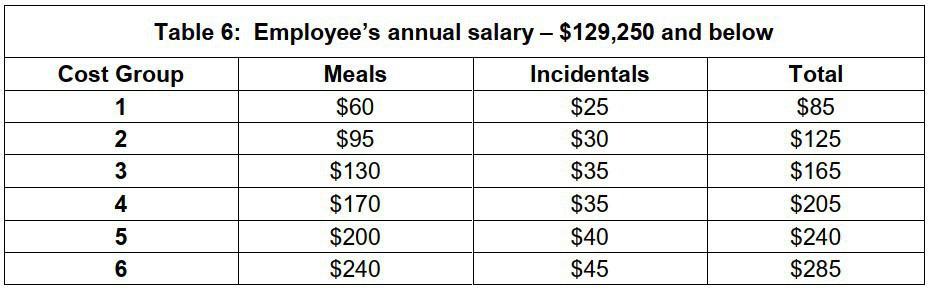

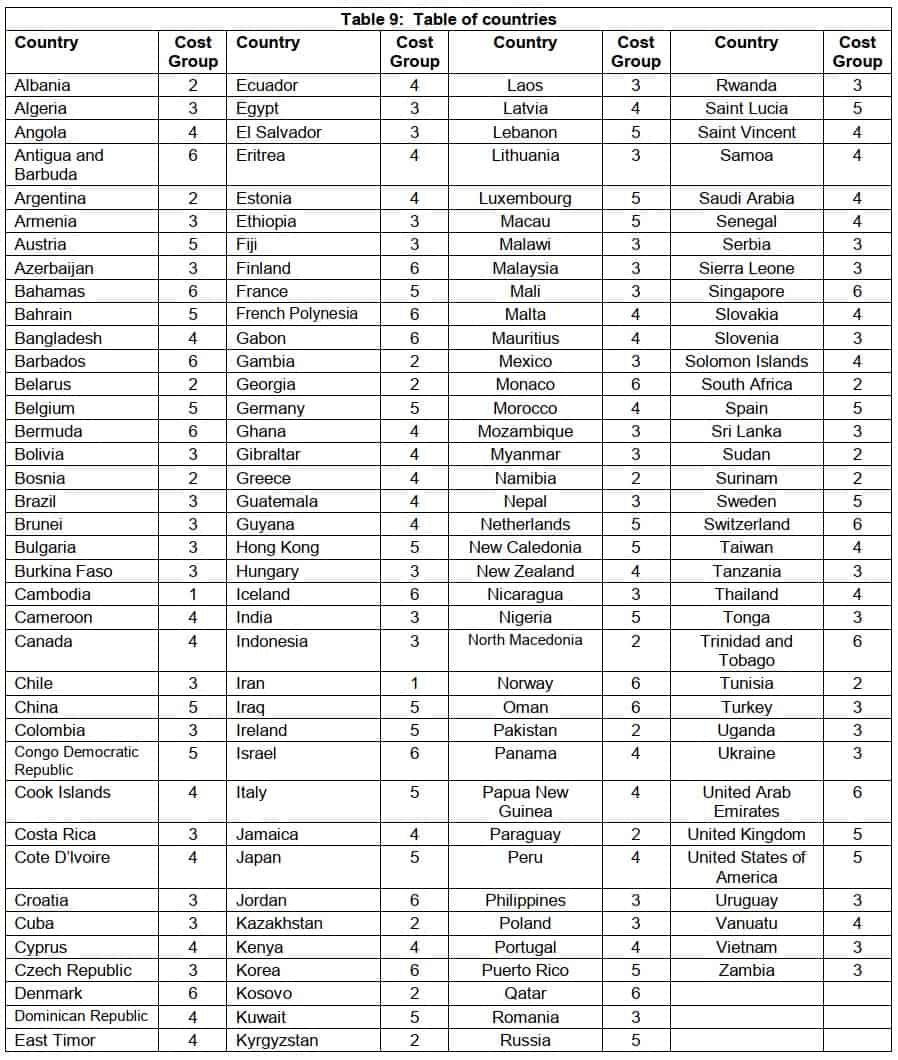

Table 6: Salary $138,790 or less

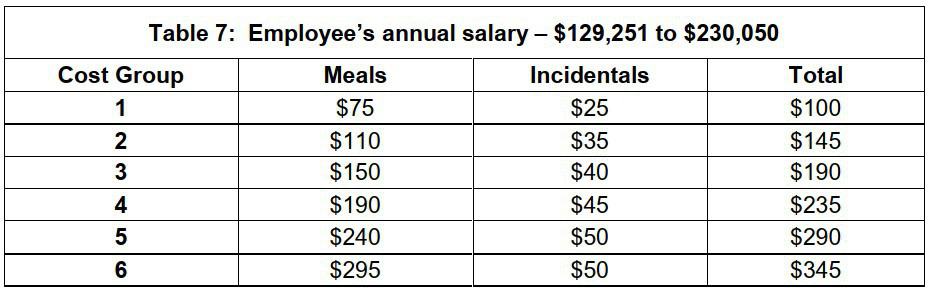

Table 7: Salary $138,791 to $247,020

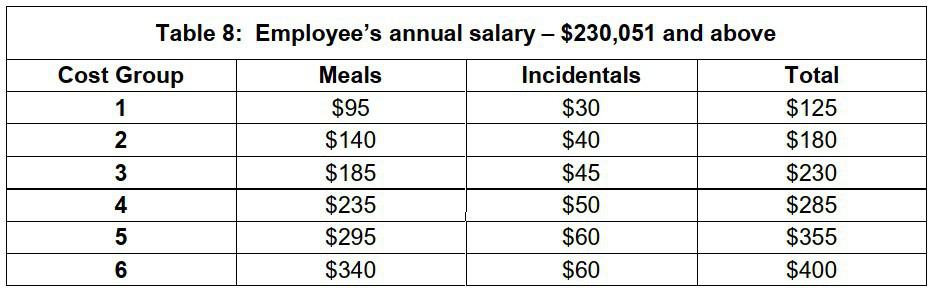

Table 8: Salary $247,021 or more

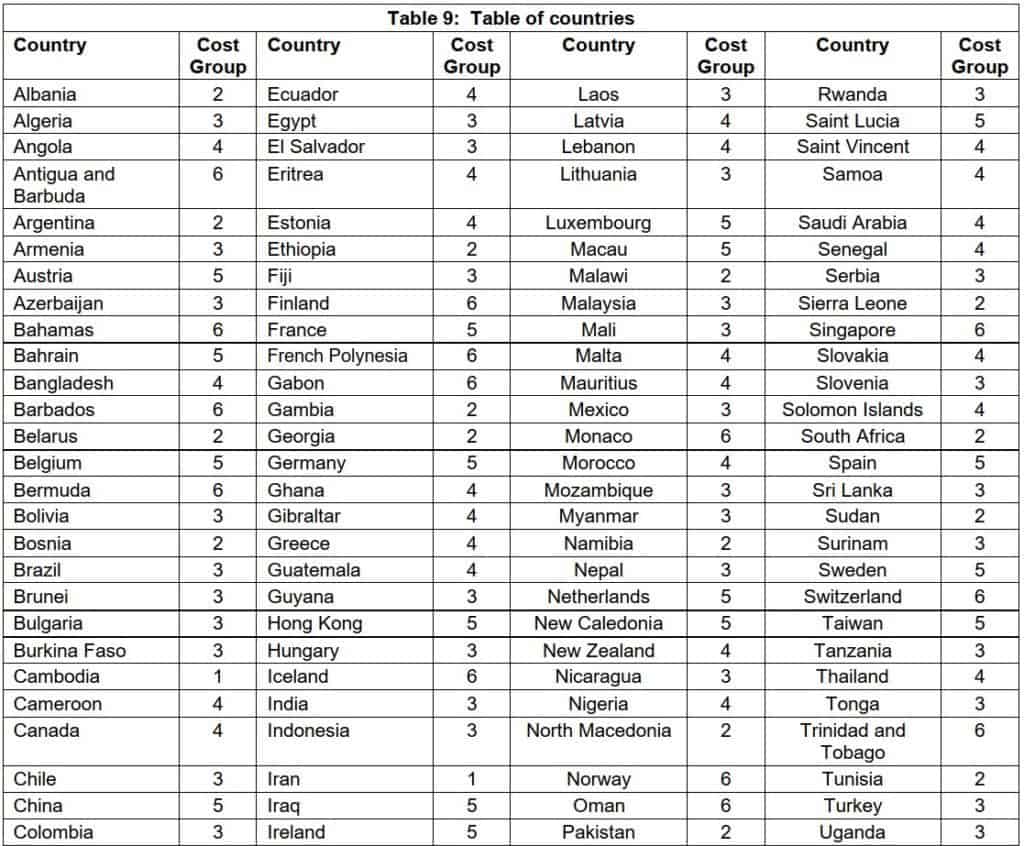

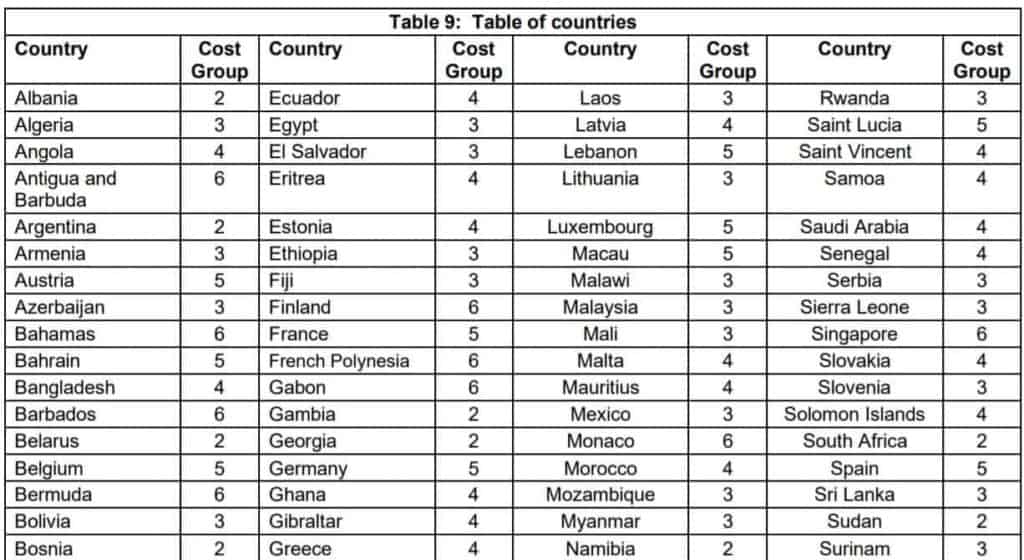

Table 9: Table of countries

Table 1:Reasonable amounts for domestic travel expenses – employee’s annual salary $138,790 or less

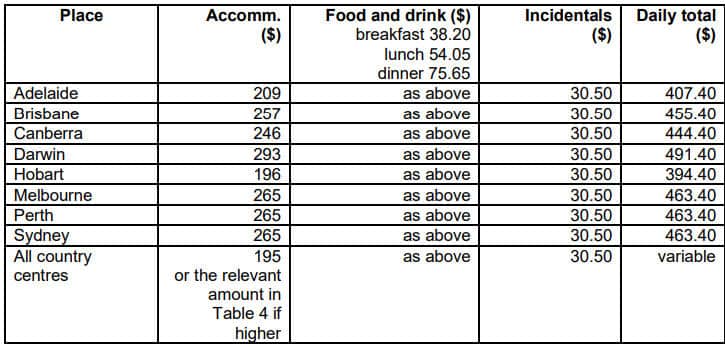

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $138,791 to $247,020

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $247,021 or more

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,790 or less

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,791 to $247,020

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $247,021 or more

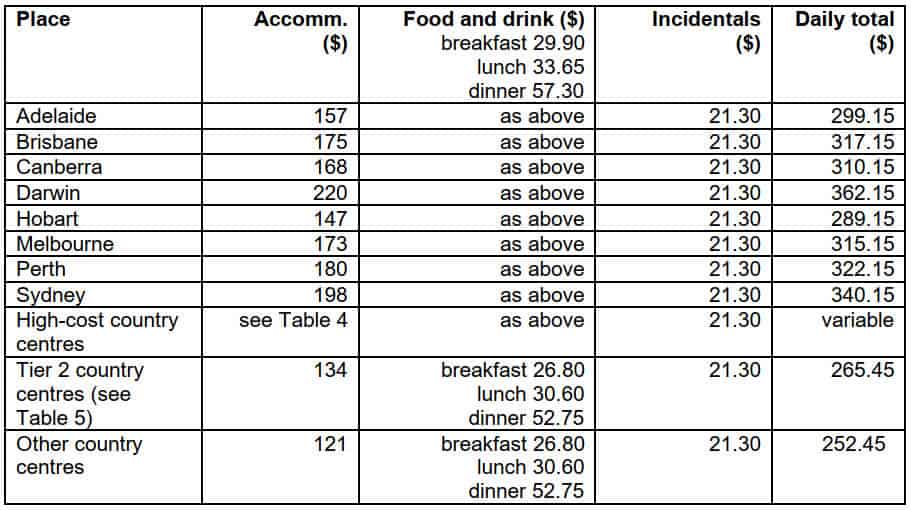

Allowances for 2022-23

The full document in PDF format: 2022-23 Determination TD 2022/10 (pdf).

The 2022-23 reasonable amount for overtime meal expenses is $33.25.

Reasonable amounts given for meals for employee truck drivers are as follows:

- breakfast $26.80

- lunch $30.60

- dinner $52.75

2022-23 Domestic Travel

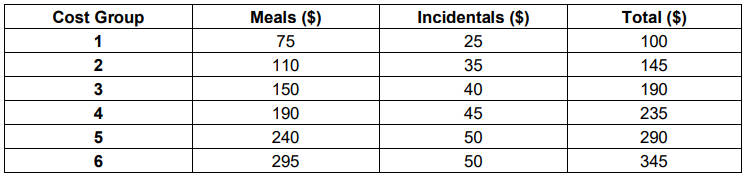

Table 1: Salary $133,450 and below

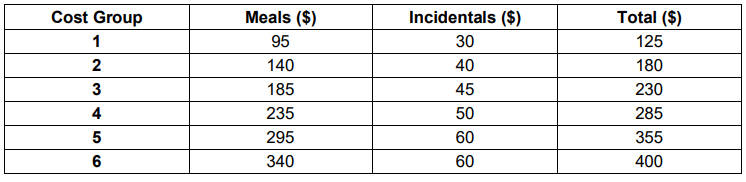

Table 2: Salary $133,451 to $237,520

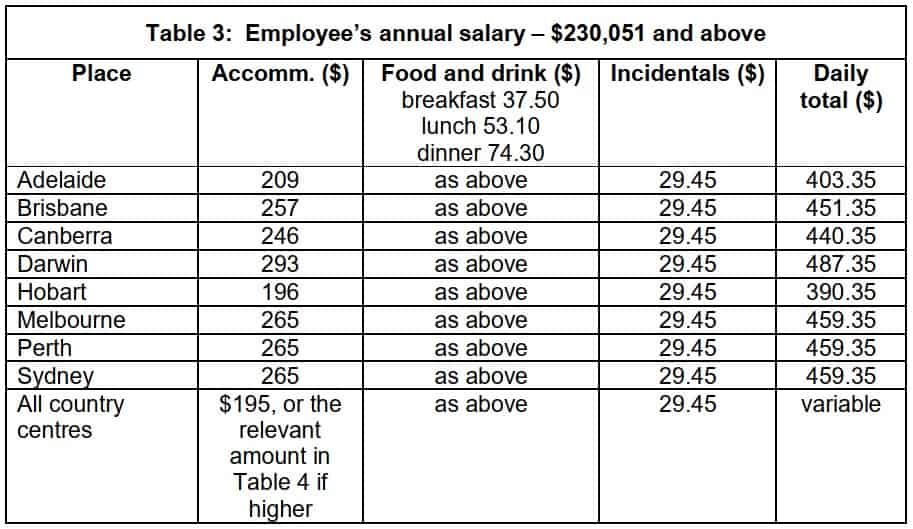

Table 3: Salary $237,521 and above

2022-23 Overseas Travel

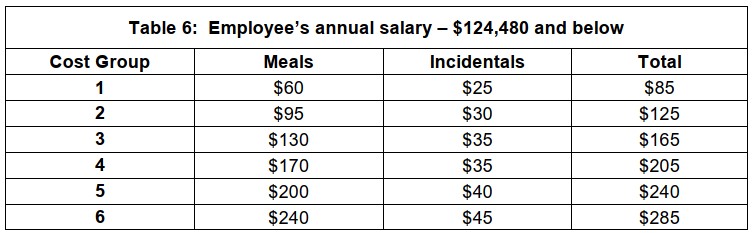

Table 6: Salary $133,450 and below

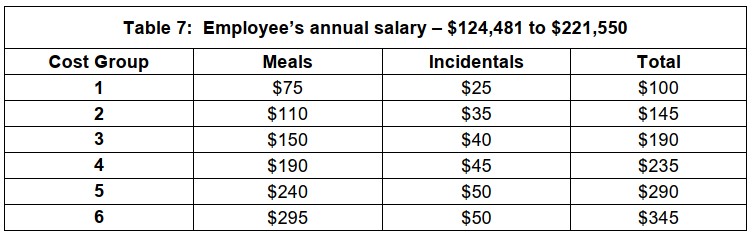

Table 7: Salary – $133,451 to $237,520

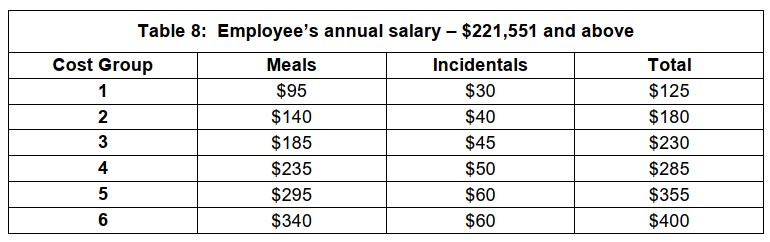

Table 8: Salary – $237,521 and above

Table 1: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,450 and below

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,451 to $237,520

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $237,521 and above

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,450 and below

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,451 to $237,520

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $237,521 and above

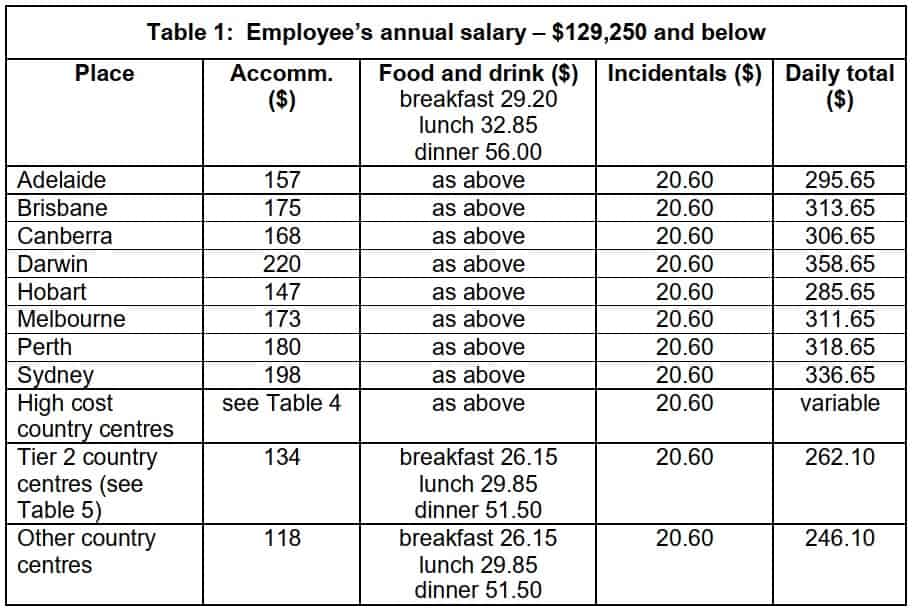

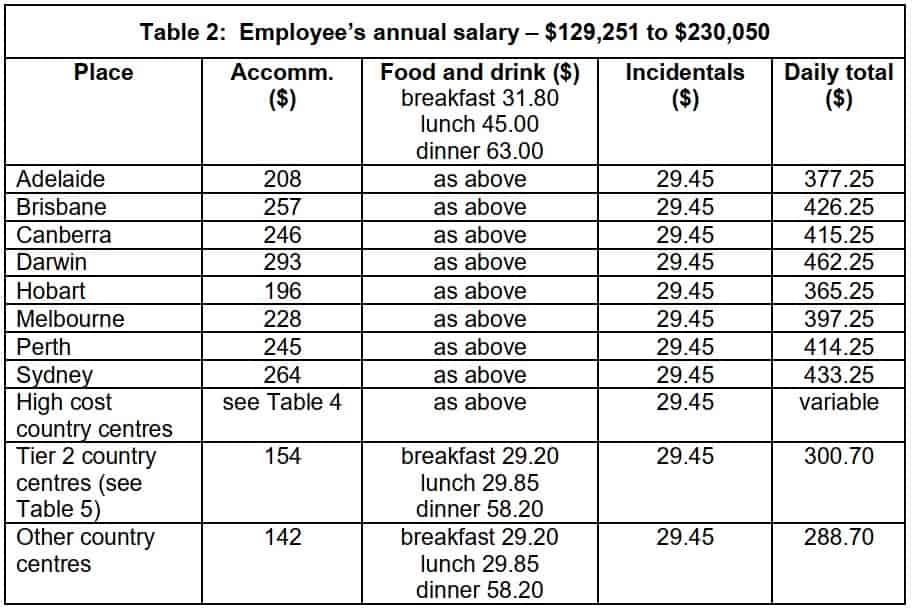

Allowances for 2021-22

The full document in PDF format: 2021-22 Determination TD 2021/6 (pdf).

The document displayed with links to each sections is set out below.

For the 2021-22 income year the reasonable amount for overtime meal expenses is $32.50

2021-22 Domestic Travel

Table 1: Salary $129,250 and below

Table 2: Salary $129,251 to $230,050

Table 3: Salary $230,051 and above

2021-22 Overseas Travel

Table 6: Salary $129,250 and below

Table 7: Salary – $129,251 to $230,050

Table 8: Salary – $230,051 and above

2021-22 Domestic Table 1: Employee’s annual salary – $129,250 and below

2021-22 Domestic Table 2: Employee’s annual salary – $129,251 to $230,050

2021-22 Domestic Table 3: Employee’s annual salary – $230,051 and above

2021-22 Domestic Table 4: High cost country centres – accommodation expenses

2021-22 Domestic Table 5: Tier 2 country centres

2021-22 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2021-22 Overseas Table 6: Employee’s annual salary – $129,250 and below

2021-22 Overseas Table 7: Employee’s annual salary – $129,251 to $230,050

2021-22 Overseas Table 8: Employee’s annual salary – $230,051 and above

2021-22 Overseas Table 9: Table of countries

Allowances for 2020-21

Download full document in PDF format: 2020-21 Determination TD 2020/5 (pdf).

The document displayed with links to each section is set out below.

For the 2020-21 income year the reasonable amount for overtime meal expenses is $31.95 .

2020-21 Domestic Travel

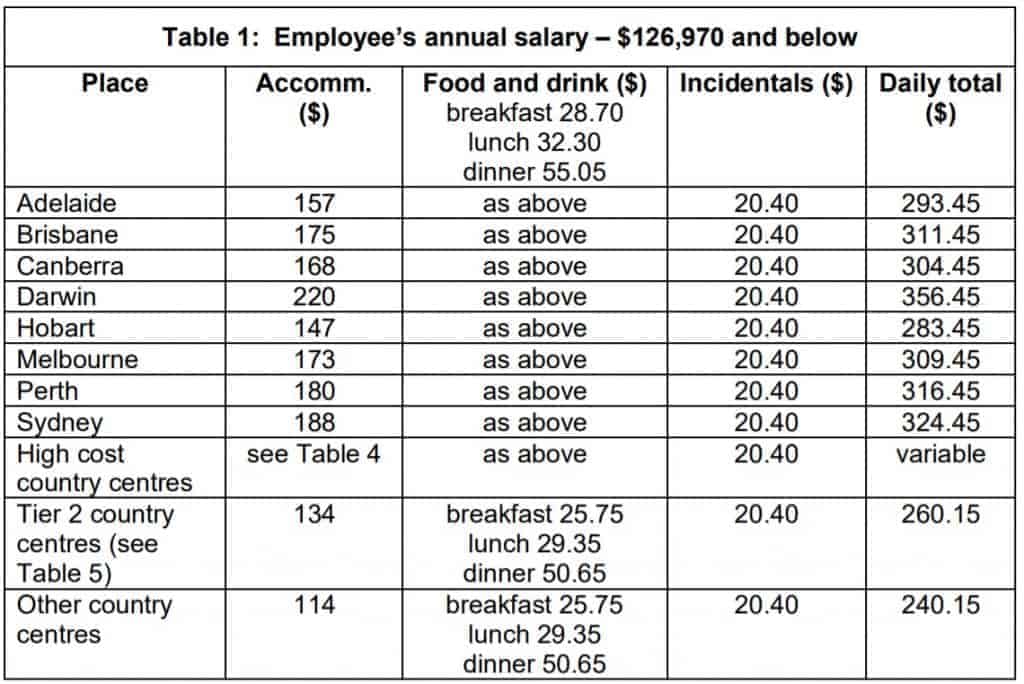

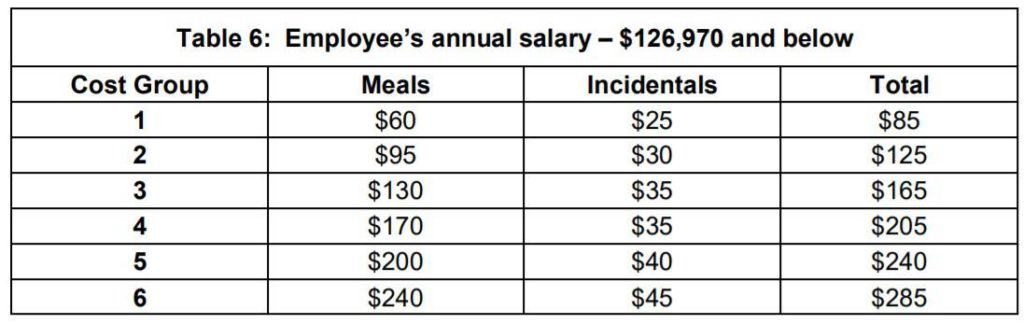

Table 1: Salary $126,970 and below

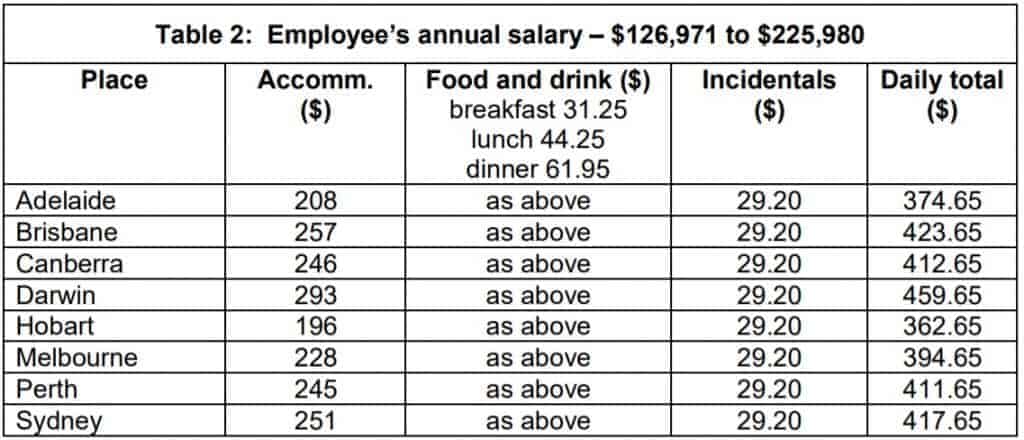

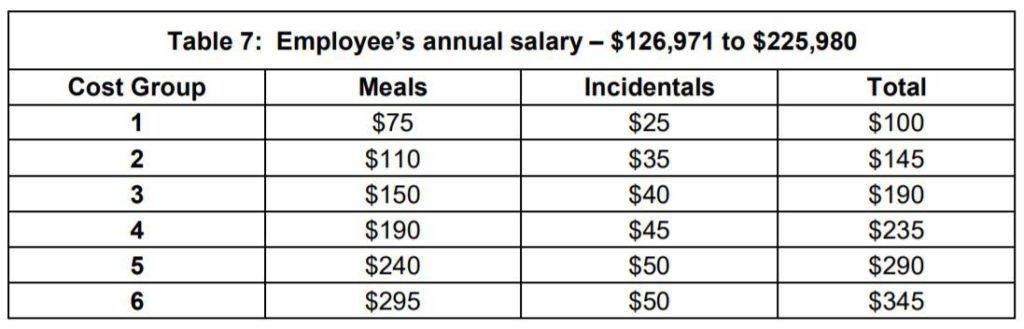

Table 2: Salary $126,971 to $225,980

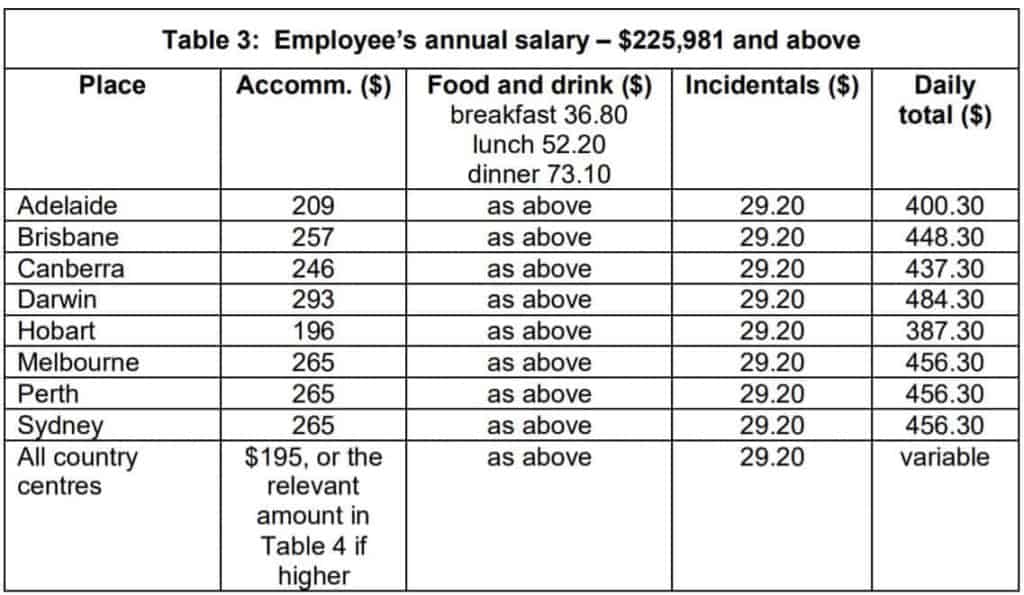

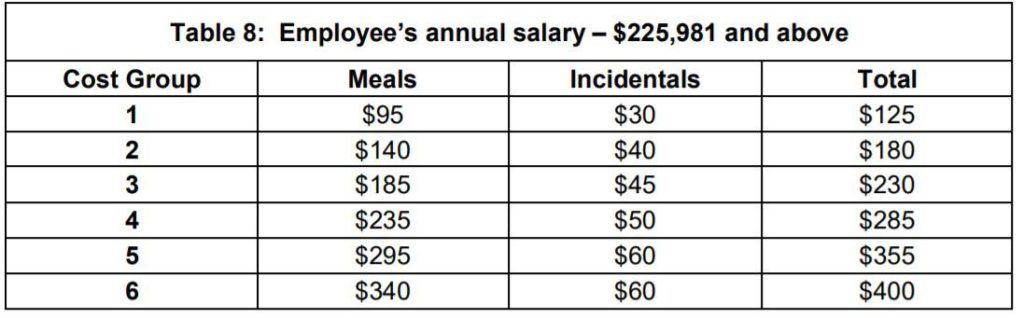

Table 3: Salary $225,981 and above

2020-21 Overseas Travel

Table 6: Salary $126,970 and below

Table 7: Salary – $126,971 to $225,980

Table 8: Salary – $225,981 and above

2020-21 Domestic Travel 2020-21 Domestic Table 1: Employee’s annual salary – $126,970 and below

2020-21 Domestic Table 2: Employee’s annual salary – $126,971 to $225,980

2020-21 Domestic Table 3: Employee’s annual salary – $225,981 and above

2020-21 Domestic Table 4: High cost country centres – accommodation expenses

2020-21 Domestic Table 5: Tier 2 country centres

2020-21 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2020-21 Overseas Travel 2020-21 Overseas Table 6: Employee’s annual salary – $126,970 and below

2020-21 Overseas Table 7: Employee’s annual salary – $126,971 to $225,980

2020-21 Overseas Table 8: Employee’s annual salary – $225,981 and above

2020-21 Overseas Table 9: Table of countries

Allowances for 2019-20

The determination in sections:

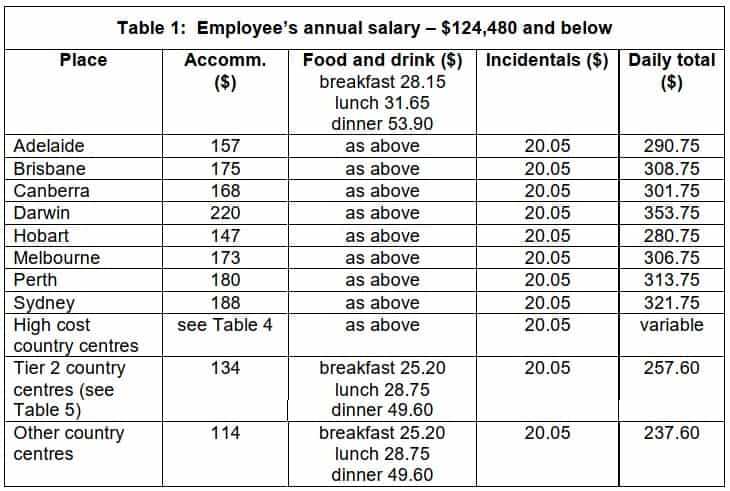

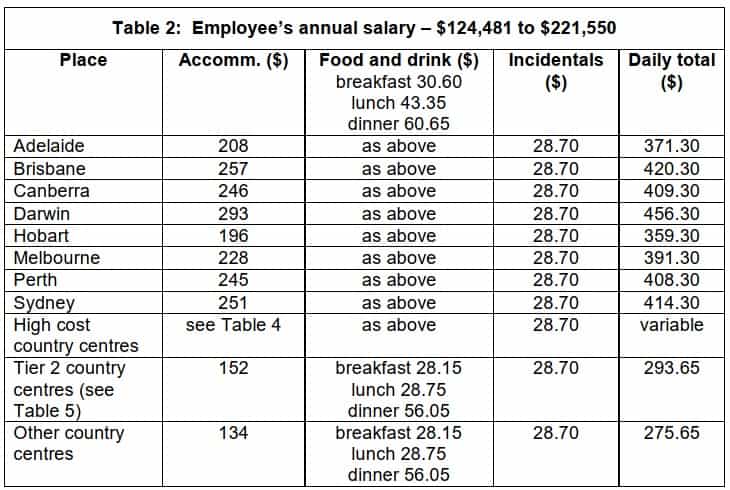

Domestic Travel

Table 1: Employee’s annual salary – $124,480 and below

Table 2: Employee’s annual salary – $124,481 to $221,550

Table 3: Employee’s annual salary – $221,551 and above

Table 4: High cost country centres – accommodation expenses

Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel

Table 6: Employee’s annual salary – $124,480 and below

Table 7: Employee’s annual salary – $124,481 to $221,550

Table 8: Employee’s annual salary – $221,551 and above

For the 2019-20 income year the reasonable amount for overtime meal expenses is $31.25.

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2019 for the 2019-20 income year are contained in Tax Determination TD 2019/11 (issued 3 July 2019).

Download the PDF or view online here .

Domestic Travel Table 1: Employee’s annual salary – $124,480 and below

Domestic Travel Table 2: Employee’s annual salary – $124,481 to $221,550

Domestic Travel Table 3: Employee’s annual salary – $221,551 and above

Domestic Travel Table 4: High cost country centres – accommodation expenses

Domestic Travel Table 5: Tier 2 country centres

Domestic Travel Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel Table 6: Employee’s annual salary – $124,480 and below

Overseas Travel Table 7: Employee’s annual salary – $124,481 to $221,550

Overseas Travel Table 8: Employee’s annual salary – $221,551 and above

Overseas Travel Table 9: Table of countries

Substantiation and Compliance

Taxation Ruling TR 2004/6 explains the the way in which the expenses can be claimed within the substantiation rules, including the requirement to obtain written evidence and exemptions to that requirement.

Allowances which are ‘reasonable’ , i.e. comply with the Reasonable Allowance determination amounts and with TR 2004/6 are not required to be declared as income and are excluded from the expense substantiation requirements.

These substantiation rules only apply to employees. Non-employees must fully substantiate their travel expense claims. Expenses for non-working accompanying spouses are excluded.

Key points :

To be claimable as a tax deduction, and to be excluded from the expense substantiation requirements, travel and overtime meal allowances must:

- be for work-related purposes; and

- be supported by payments connected to the relevant expense

- for travel allowance expenses, the employee must sleep away from home

- if the amount claimed is more than the ‘reasonable’ amount set out in the Tax Determination, then the whole claim must be substantiated

- employees can be required to verify the facts relied upon to claim a tax deduction and/or the exclusion from the substantiation requirements

- an allowance conforming to the guidelines doesn’t need to be declared as income or claimed in the employee’s tax return, unless it has been itemised on the statement of earnings. Amounts of genuine reasonable allowances provided to employees(excludng overseas accommodation) are not required to be subjected to tax withholdings or itemised on an employee’s statement of earnings.

- claims which don’t match the amount of the allowance need to be declared.

The Tax Office has issued guidance on their position.

[11 August 2021] Taxation Ruling TR 2021/4 reviews the tax treatment of accommodation and food and drink expenses, and provides 14 examples which distinguish non-deductible living expenses from deductible travelling on work expenses. FBT implications for the ‘otherwise deductible’ rule and travel and LAFHA allowances are also considered.

[11 August 2021] Practical Compliance Guideline PCG 2021/3 (which finalises draft PCG 2021/D1 ) provides the ATO’s compliance approach to determining if allowances or benefits provided to an employee are travelling on work, or living at a location.

For FBT purposes an employee is deemed to be travelling on work if they are away for no more than 21 consecutive days, and fewer than 90 days in the same work location in a FBT year.

See also: Travel between home and work and LAFHA Living Away From Home

The issue of annual determination TD 2017/19 for the 2017-18 year marked a tightening of the Tax Office’s interpretation of the necessary conditions for the relief of allowances from the substantiation rules, which would otherwise require full documentary evidence (e.g. receipts) and travel records. (900-50(1))

For a full discussion of the issues, this article from Bantacs is recommended: Reasonable Allowance Concessions Effectively Abolished By The ATO .

Prior to 2017-18

In summary: Prior to 2017-18 the Tax Office rulings stated the general position that provided a travel allowance was ‘reasonable’ (i.e. followed the ATO-determined amounts) then substantiation with written evidence was not required. “In appropriate cases”, however employees may have been required to show how their claim was calculated and that the expense was actually incurred.

What changed

The relevant wording was changed in the 2017-18 determination to now require that more specific additional evidence be available if requested. This additional evidence is not prescribed in the tax rules, but represents a higher administrative standard being applied by the Tax Office.

The required evidence includes being able to show:

- you spent the money on work duties (e.g. away from home overnight for work)

- how the claim was worked out (e.g. diary record)

- you spent the money yourself (e.g. credit card statement, banking records)

- you were not reimbursed (e.g. letter from employer)

Other requirements highlighted by the Bantacs article include:

- a representative sample of receipts may be required to show that a reasonable allowance (or part of it) has actually been spent (TD 2017/19 para 20)

- hostels or caravan parks are not considered eligible for the accommodation component of a reasonable allowance because they are not the right kind of “commercial establishment”, examples of which are hotels, motels and serviced apartments (para 14)

- reasonable amounts for meals can only be for meals within the specific hours of travel (not days), and can only be for breakfast, lunch or dinner (para 15), and therefore could exclude, for example, meals taken during a period of night work.

Tip : The reasonable amount for incidentals still applies in full to each day of travel covered by the allowance, without the need to apportion for any part day travel on the first and last day. (para 16).

Alternative: business travel expense claims

With the burden of proof on ‘reasonable allowance’ claims potentially quite high, an alternative is to opt for a travel expense claim made out under the general substantiation rules for employees, or under the general rules for deductibility for businesses.

The kind of business travel expenses referred to here could include:

Airfares Accommodation Meals Car hire Incidentals (e.g. taxi fares)

The Tax Office has an article describing how to meet the requirements for claiming travel expenses as a tax deduction. See: Claiming a tax deduction for business travel expenses

Travel diary

A travel diary is required by sole traders and partners for overnight expenses and recommended for everyone else (including companies and trusts).