19th July, 2021

Work travel expenses: What you can (and can’t) claim

Knowing exactly what deductions apply to travel expenses can save a heap of hassle at tax time.

The Australian Taxation Office (ATO) has released a new ruling that clarifies what expenses employees can deduct for work-related travel.

The new ruling, Income tax: When are deductions allowed for employees’ transport expenses? was released this week, bringing together and clarifying the rules for business advisors and their clients alike.

Key takeaways:

- The ATO’s new ruling sheds light on what travel expenses employees can and cannot claim

- Travel between work locations (neither of which are your home), is typically tax deductible

- Incidental work-related travel, such as a receptionist who makes a stop to pick up office newspapers on their way to work, can’t be claimed on tax

Travel from home to a regular place of work generally isn’t deductible. The ruling states that even if you travel to work by plane, receive a travel allowance or make incidental business-related stops on the way to work, you still cannot claim your travel expenses.

But moving between two separate work locations – like driving from your office to a construction site, or from your business to a meeting at a client’s office – can be claimed.

Tax specialist and accountant, Leo Hollestelle said the ruling is well timed ahead of the busy End of Financial Year period.

“It’s timely that these views are brought together and codified into a single ruling,” said Hollestelle. “Tax advisors will be able to more easily familiarise themselves with the rules and in turn advise their clients on it.”

What are work-related expenses?

Work-related expenses are expenses that you incur in the course of gaining or producing your assessable income.

What work-related travel expenses can I claim?

Transport expenses you incur while travelling between work locations are usually deductible. The travel must occur while gaining or producing your assessable income.

While you can’t usually deduct expenses for travelling between your home and work, you might also be able to deduct the cost of travel from your home to somewhere other than your regular place of work. This might be, for example, to attend a client’s premises or one of your employer’s other offices.

To work out if travel expenses are work-related, things like these are taken into consideration:

- Does the travel fit within your duties of employment?

- Do the travel expenses arise out of your employment and not your personal circumstances?

- Is the travel relevant to the practical demands of carrying out your work duties?

- Has your employer asked you to travel?

- Has the travel occurred during normal work time?

What work-related travel expenses can’t I claim?

Transport expenses that you incur for travel between your home and a regular place of work are not deductible.

If there is a close connection between travel and your private or domestic life, this will usually not be considered deductible. For example, if you travel to your regular place of work from another location in which you undertake private activities, for example a library or a holiday house, the cost of the travel is not deductible.

If you happen to live a significant distance from your regular place of work, your travel expenses are usually considered private and not deductible.

You may also not deduct expenses that are capital, private or domestic in nature. Transport expenses that may be considered capital in nature include, for example, the cost of purchasing a car. Ask your advisor whether such expenses may be recognised under another tax provision.

How much can you claim for work-related expenses?

You can only claim the actual cost of the expenses themselves. These will need to be proven with receipts and/or other written documentation. Your advisor will be able to help you with this.

READ: How to save tax in Australia – 15 tax minimisation strategies

How to calculate work-related travel expenses

You can claim deductions for work-related travel expenses in your tax return , but how you do this depends on the expenses themselves. (See also Claiming overseas-travel expenses , below.)

If your expenses relate to a car you own, lease or hire, you may be able to use the logbook method or the kilometres method .

READ: How long does it take to get a tax return?

Working-away-from-home tax deductions

If your employment requires you to travel away from home overnight, because of your employment (and not because of private circumstances like where you choose to live, for example), the transport expenses incurred in travelling to your alternative work location will usually be considered deductible.

Claiming overseas-travel expenses

If you travel overseas for work, you might be able to deduct expenses relating to flights, accommodation, meals, transport or other minor things (like taxis or using hotel wifi). You’ll need to keep records such as receipts and you may also need to keep a travel diary.

Where’s your regular place of work?

Interestingly, there are several exceptions that – if claimed correctly – can give you an edge come tax time. This is especially true when it comes to defining what a “regular work location” actually is.

For example, imagine you currently work for a business with an office 15-minutes from your home.

But you’re asked to cover a long-service vacancy for six months at another of your business’s offices one hour away. Because this new office becomes your regular place of work for a sustained period of time, travel to and from it cannot be claimed on tax.

But, if your period of work was only for three months, then it could be argued that the second office never became a regular place of work.

Therefore, travel could potentially be claimed on tax.

This is a call to take care in making any assumptions about what you can actually claim. As the ATO ruling states, ‘the full facts and circumstances of the specific working arrangement in place must always be considered in determining the nature and deductibility of the transport expenses incurred’.

And that’s something to keep in mind when it comes to all travel-related tax claims this tax time, as it could be this ruling also indicates an increase in scrutiny for travel-related claims.

“While the ruling is very much in line with the Commissioner’s existing views on travel expenses, the timing is worth noting,” said Hollestelle.

“After a year where many employees have been working from home, it may be the ATO is concerned there will be both workers and employers seeking to make dubious claims in the tax period ahead.”

What else do I need to know?

Find more guidance on transport and travel expenses on the ATO website.

Always seek advice on your individual situation from an accredited business advisor or tax specialist to find out exactly how tax changes and updates might impact your business.

Need an advisor? Find one today with MYOB’s Find an Advisor directory .

You might also like

It’s your first year in business — eofy explained, 25th mar, 2024 by myob team, 7 key things to get on top of for end of financial year, tax minimisation tips and deductions, 8th nov, 2023 by myob team, subscribe to be updated on all things myob.

Work-related travel expenses – What can you claim

It does not matter if you are an employee, an employer, a sole trader or run a small business; there might occur some situations when you need to travel for business purposes. The costs incurred in such conditions are classified as work-related expenses.

Work-related travel expenses are usually tax deductible. However, the Australian Taxation Office gets thousands of incorrect claims every year for work travel expenses. As a result, they have started keeping a close eye on the expenses that are being claimed to make sure they are valid.

Understanding how to qualify for such deductions and which expenses can be used to help you optimise your travel costs as well as save money on your taxes is a necessity today. So here’s a guide to help you know everything when it comes to business travel expenses.

What are work-related travel expenses?

According to the ATO, while travelling for work, any purchase you make in regard to this travel is usually claimable as a travel expense on the tax return. The travel can be driving your car to the client’s office situated kilometres away (from your office) or visiting a temporary location for work. Along with this, interstate and overseas travel expenses are also deductible.

Work-related travel expenses include ticket costs or fares for any modes of transportation, tolls, parking, etc, along with meal expenses and accommodation. There are some restrictions as well on what you can claim. We will look into that in the later part of this blog.

Here’s what you can claim:

- Accommodation expenses

- Incidental expenses (like laundry)

- Taxi, bus, train and air fares

- Road and bridge tolls

- Car hire charges

- Parking fees

- Meal expenses (only for overnight travel for work)

- Bags used solely for a work trip

Claiming work-related driving costs

When it comes to travel tax deductions, transport costs are extremely popular. Except for the travel from work to home and vice versa, the cost of work-related travel in your personal car or on a means of public transport is claimable.

What can you claim?

You can claim a deduction for the cost of:

- Travelling between two separate workplaces for different jobs

- Travelling from your workplace to meetings or events offsite

- Travelling from one job to a second job if and when required

- Travelling to a different location, if you work at more than one location for your employer

- For those working from home for a specific period of the day and working in the office for the rest of the working hours (but only for the same employer), the cost of travelling to the workplace is claimable.

You can’t claim a deduction for the cost of:

- The everyday travel from your residence to the workplace and back

- If you work from home for one employer but not for the other employer, your cost of travelling to a second job can’t be claimed.

- Any additional task or work you do on your way back home, for instance, picking up your package

Car parking – Is it a travel expense?

Suppose you had an out-of-office company event or meeting. In order to park your car, you had to pay for parking as you used your own car to get there. In this case, you can claim the cost of the trip and the parking costs.

However, you cannot and should not claim parking or car expenses if you have been reimbursed by your employer.

You cannot claim the cost of everyday parking as well if you drive to work and have to pay for parking near the workplace.

What documentation of work-related travel expenses should you keep for your tax return?

You should keep everything that is relevant to your tax returns. Work-related vehicle charges can be claimed by receipts or tax invoices, which serve as documents supporting a specific order.

However, remember, those fade over time. A logbook can be very useful when claiming employment-related trips.

Travel diary – Do you have to keep one?

Anybody who has to stay away from home for more than six nights consecutively should keep a travel diary. But what should be recorded in a travel diary?

In the travel diary, you can keep a record of what you were doing, where you were and the start and end times of the activities you were engaged in.

It is always a good idea to keep a record of your travel expenses, even when keeping a diary isn’t really required. Since there’s a possibility of you forgetting details about all the expenses made in the months, it can cost you a huge amount in your refund at tax time.

What can’t be claimed?

Since we have discussed what work-related travel expenses can be claimed, now take a look at the expenses that can’t be:

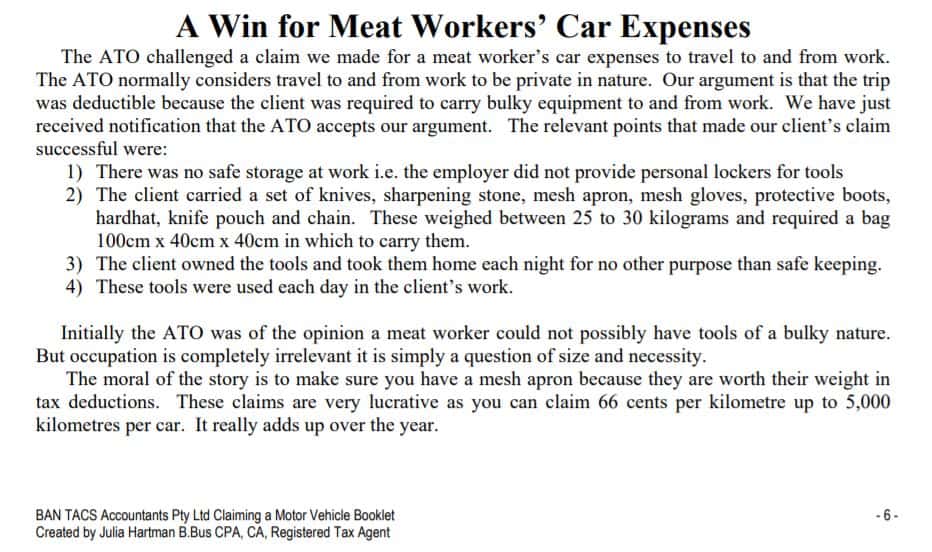

Unless your employer has assigned you to carry bulky tools to work (due to lack of an appropriate place to store them at the workplace), you should not claim a tax deduction on your journey from home to work and back home.

Also, claiming the travel expenses for which you have been reimbursed by your employer is also prohibited.

In case you decide to bring your family along for a business trip, you cannot claim accommodation costs or any travel expenses for them.

Ask your tax agent to know more about what can be claimed or cannot be. If you are looking for good tax accountants in Melbourne, Clear Tax Accountants can help you reduce your tax responsibilities and provide the right advice for your tax matters.

Travel allowance

Usually, the travel allowance you receive from your employer is considered taxable income. Thus, it needs to be listed on your income statement. In simpler terms, if you receive a travel allowance, it is going to be included on your tax return as taxable income.

If you spend the money paid to you as travel allowance, claiming a tax deduction against it when the tax time comes is possible. There is a common misconception that the entire allowance can be claimed as a tax deduction even if you haven’t spent all of it. This is not true at all.

Travel records – What to keep

What travel records are worth keeping? There is practically no record that is not worth keeping. You should have all the receipts and records for all the travel expenses related to work, even if you were reimbursed for it.

Record keeping will help you ask your tax agent if you can claim certain work-related travel expenses (in case you are doubtful).

Remember, you can’t claim something if you do not have anything to prove it!

What if you travel for work and then spend an extra few days on holiday at the end of the trip?

When your travel is split between leisure and work, you need to split all your travel expenses between the two as well. You must keep the following two rules in mind in these circumstances:

- The primary purpose of the trip has to be work-related

- You cannot claim any part of the said trip that wasn’t work-related

To understand it better, consider that you had to go on a three-day work-related trip. But you decided to extend your trip by two more days. Since only the first three days were for work, you can claim work-related travel expenses for those days.

You cannot claim the cost for the next two days because you spent the money on your leisure. The accommodation costs incurred in the first three days, the fares of the taxi for travelling to and from (only work-related) and the meal expenses for that time are claimable but not for the remaining two days.

If you want to claim a deduction for any work-related travel expense, you will have to keep a few restrictions in mind. Keeping detailed records of work-related travel expenses will increase your chances of receiving a tax refund.

Disclaimer : The information on this website is for general purposes only and should not be relied upon for making legal or other decisions. The advice provided in this article is general in nature and is not subject to the personal financial situation and needs of any individual. Clear Tax tries to keep the information accurate and up-to-date; however, you should bear in mind with changing circumstances, the accuracy and reliability of the information will not necessarily remain the same. The information is by no means a substitute for financial advice.

Home as a place of business during COVID: CGT implications

This, in turn, has resulted in such people being able to claim a range of deductions for various “running expenses” associated with working from home.

Can You Claim Deductions Without Receipts?

As a taxpayer, you must always keep the receipts of the items or services that you spent money on for business purposes. However, there might be some cases where you end up misplacing or losing the receipts. Does that mean you cannot claim deductions on these? There are still some chances for you to claim…

An In-Depth Review of Excise Duties in Australia

Taxes have a huge role to play when it comes to managing a country's economy. Australia, just like other nations, has a variety of taxes that generate revenue and regulate industries. Among those multiple taxes, one that a lot of people are curious about is the excise tax or excise duty. There are a lot…

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

Car and travel expenses 2023

You may be able to claim deductions for work-related car expenses and work-related travel expenses.

Last updated 24 May 2023

Things you need to know

Work-related car expenses and work-related travel expenses are expenses you incur in the course of performing your job as an employee. You claim deductions for them at questions D1 and D2 .

You can claim

You claim a deduction for work-related expenses at question D1 Work-related car expenses 2023 for a car you either:

- leased or hired under a hire purchase agreement (and the expense is not a travel expense, which you show at question D2 Work-related travel expenses 2023 ).

You can claim the following work-related car and travel expenses at question D2 Work-related travel expenses 2023 :

- expenses for vehicles with a carrying capacity of one tonne or more, or 9 or more passengers (for example, utility trucks and panel vans)

- expenses for motorcycles

- short-term car hire

- public transport fares

- bridge and road tolls

- parking fees

- petrol, oil and repair costs relating to work-related travel you did in a car owned or leased by someone else

- meal, accommodation, and incidental expenses you incurred while away overnight for work.

The deductions include the cost of trips you undertake in the course of performing your work duties, which may also include trips between your home and your workplace if:

- you used your car because you had to carry bulky tools or equipment that you used for work and could not leave at your workplace (for example, an extension ladder or cello)

- your home was a base of employment (that is, you were required to start your work at home and travel to a workplace to continue your work for the same employer)

- you had shifting places of employment (that is, you regularly worked at more than one site each day before returning home).

Work-related car and travel expenses also include the cost of trips:

- between 2 separate places of employment when you have a second job, providing one of those places is not your home

- from your normal workplace or your home to an alternative workplace that is not a regular workplace (for example, a client’s premises) while you are on duty

- from an alternative workplace that is not a regular workplace back to your normal workplace or directly home.

If the travel was partly private, you can claim only the work-related part.

For more information, see Cars, transport and travel .

You cannot claim

You cannot claim normal trips between your home and your workplace, even if:

- you did minor work-related tasks at home or between home and your workplace

- you travelled between your home and workplace more than once a day

- you were on call

- there was no public transport near work

- you worked outside normal business hours

- your home was a place where you ran your own business and you travelled directly to a place of employment where you worked for somebody else.

Award transport payments

If you received an award transport payment that was paid under an industrial law or award in force on 29 October 1986, see Award transport payments .

Where to go next

- Go to question D1 Work-related car expenses 2023 .

- Return to main menu Individual tax return instructions 2023 .

- Go back to Claiming deductions 2023 .

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

Etax - Online Tax Return 2024

Tax returns are easy at Etax

Work related travel expenses – what can you claim?

Let’s explain how to turn work related travel expenses into dollars in your pocket at tax time.

What exactly is a work-related travel expense?

If you travel for work, any purchases you make related to that travel, can usually be claimed as a work related travel expense on your tax return.

Of course, there are a few restrictions on what you can claim, and we’ll explain those a little later.

Work related travel expenses can boost your tax refund!

The following travel-related expenses are tax deductible if you are eligible to claim them (check eligibility rules further down this page):

- Accommodation

- Incidental expenses (laundry, etc.)

- Air, bus, train and taxi/rideshare fares

- Bridge and road tolls

- Parking fees

- Car hire charges

- Meals (if your travel included an overnight stay)

- Bags used only for work travel

Can I claim for work related driving costs or public transport?

Transport costs are one of the most common travel tax deductions. Generally, you can claim work related travel in your car or on public transport. However, you cannot claim travel from home to work or vice versa.

Allowable claims:

- Travel between two separate workplaces (or jobs).

- Travel from your workplace to offsite meetings or events.

- If you work from home for part of the day, then travel to your workplace for that same employer.

- Travel from your home to an alternative workplace if required.

- If you work at more than one location for the same employer, you can claim the cost of travelling between locations.

Travel you can’t you claim:

- The cost of travel from home to your everyday place of work (and back again).

- If you run an errand on the way to or from work. Eg. pick up the mail or a package.

- If you work overtime or out of hours.

- When your home is your place of work for one job, and you travel to a different location to work another job.

Is car parking a travel expense?

You can claim for work related parking expenses as long as the trip you took fits into the ‘Allowable claims’ list above.

For example, if you pay for parking to attend an out of office company meeting or event and you use your own car to get there, you can claim the trip and the parking costs.

However, you can’t claim the cost of normal, everyday parking if you drive to work and pay for parking near your workplace.

Important: You can’t claim any car or parking expenses if you were reimbursed by your employer.

Do I need to keep a travel diary?

If you are away from home for more than 6 consecutive nights, you should keep a travel diary to record where you were, what you were doing and the start and end times of your activities.

Example travel diary entries:

- 6:00am Flight to Sydney – arrive 8.30am

- 8.30am – 9:00am Uber from Sydney Airport to Darling Harbour

- 9:30am – 4:00pm Trade Conference

- Overnight at The Hyatt, Darling Harbour.

If you don’t have a travel diary handy, no problem! Download a travel diary template from the Etax Downloadable Resources page.

It’s a good idea to keep a record of your travel and expenses, even when you aren’t required to keep a diary. It’s very easy to forget details about expenses months after they happen and this can cost you big dollars in your refund at tax time!

What about my travel allowance? Is it taxable?

If you receive a travel allowance from your employer, it is usually considered taxable income and is listed on your income statement. This means it is included on your tax return as taxable income.

The good news is, as long as you spent the money you were paid as a travel allowance, you can claim a tax deduction against it at tax time.

A common mistake is to assume that you can claim the entire allowance as a tax deduction even if you didn’t spend it all. This isn’t necessarily the case.

You can only claim the total amount you spent on work related travel. For example, if you received $1500 worth of travel allowances from your employer during the year, but the cost of your travel was $1,000, you can only claim $1,000 worth of travel deductions on your return.

Important: Only claim travel deductions you have evidence for, as the ATO can ask for proof for any of your expenses.

What travel records should I keep?

You should keep ALL travel expense records and receipts, even if you receive an allowance. It’ll help ensure you claim everything you’re entitled to at tax time.

Remember, if you’re not sure whether you can claim an expense, keep the receipt and ask your Etax accountant.

Don’t forget the motto: You can’t claim it if you can’t prove it!

Photograph your receipts or other purchase records and keep everything in one folder. Create a backup folder too, just to be on the safe side.

Etax clients can upload travel expense receipts straight into their secure online account at etax.com.au . That way everything is ready and waiting in their account at tax time!

What if I travel for work and then spend an extra few days on holidays at the end of the trip?

If your travel is split between work and leisure, then all of your expenses also need be split between work and leisure. There are two key rules here:

- The primary purpose of your trip must be work related, and

- You can’t claim any part of a trip that is not work related.

Example: Work Conference in Another State

Julie travelled to Melbourne for a week-long conference. She then stayed in Melbourne on Friday and Saturday night to see the sights and catch up with friends.

Julie can claim in full:

- Accommodation costs for Monday to Friday.

- Uber fares from the hotel to the conference and back each day.

- Meals during the week.

Julie was away for 7 days, of which 5 (or 71.5%) of the trip was work related. She can also claim 71.5% of:

- Her flights to and from Melbourne.

- Her Ubers to and from the airports.

Julie can’t claim leisure expenses:

- Accommodation costs for Friday and Saturday night.

- Meals from Friday night to Sunday.

- Uber trips to her friend’s house.

- Car hire and expenses for a trip she made to the Great Ocean Road.

Here are some additional examples of what is not allowed by the ATO:

- If you travel with your partner or children, you can’t claim any travel or accommodation costs for them.

- An add-on flight that is not related to your work trip. For example: If you had a work trip in Mackay, you can’t claim a flight you took to visit Cairns after your work in Mackay finished.

- Attending a small work event while on holiday. For example: You are on holiday for 3 weeks in Europe and while you’re there you take the opportunity to attend a 2-day work related conference. You can claim the costs of the conference, however, you can’t claim any travel or accommodation costs related to the trip because the trip’s primary purpose is a holiday, not business.

If you have any questions regarding your work related travel expenses, feel free to get in touch. Our accountants are always happy to set you on the right track for the best possible tax refund!

More posts about tax deductions:

- How To Claim Car Expenses with a Logbook

- Mobile Phone Bills are Valid Tax Deductions (if you call for work)

- Claiming self education expenses

- Can you claim your work uniform as a deduction

- Ironing out laundry expenses

Popular Articles

- 5 Smart Ways to Spend Your Tax Refund

- Tax Deductions for Nurses (with infographic)

- Being made redundant could re-ignite your career

- 10 Easy Ways to Pay Less Tax

- Manage Your Receipts and Boost Your Tax Refund

- How To Use a Car Logbook

- Claim Work-Related Travel Expenses

- How Much Super Will Be Enough?

- Deductions for Rental Property Owners

- Simple Ways to Improve Your Tax Refund

Finish your tax return in minutes

Forgot your password click here for login help, verified security.

Registered Tax Agent TPB Registration #69399005

Accredited members etax accountants is a cpa practice, quality assurance.

Information Security

Popular Pages

► Get Started (new users)

► Login (existing users)

Password & Login Help

myTax, e-tax, tax agents…?

Tax Help in 40 Languages

About Tax Agents

Tax Online: Your Options

Etax Reviews

myGov Tax Return and Etax

myTax vs Etax.com.au

Find Tax Deductions

The Etax Blog: Tax Tips

Important Links

What’s New at Etax

2023 Tax Return

Tax Deduction Basics

The Etax Mobile App

Online Safety

Terms and Conditions

Security | Privacy

Income Statement

Where’s My PAYG?

Download Etax Resources

Late Tax Returns

Non-Lodgment Advice

Tax Checklists

Etax Careers

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

Quarantine and testing expenses when travelling for work

Deductions for expenses you incur if you're travelling for work during COVID-19 and must quarantine.

Last updated 25 April 2023

Eligibility to claim quarantine and testing expenses

If you travel and stay away from your home overnight on a work trip, you can claim expenses you incur for:

- being required to quarantine because of COVID-19

- taking a COVID-19 test, such as a polymerase chain reaction (PCR) test or rapid antigen test (RAT).

Quarantine expenses

If you must quarantine either during or after overnight work-related travel, your quarantine is an extension of that travel. In these circumstances, the quarantine is part of your employment duties and you can claim a deduction for accommodation, meal and incidental expenses you incur while you are quarantining.

If your overnight travel is not work-related, your quarantine expenses are private in nature. You can't claim a deduction for these expenses.

You also can't claim a deduction for quarantine expenses you incur when you either:

- travel to or from a work location and need to quarantine

- need to quarantine for another purpose (for example, returning from a private holiday), even if you worked, or were able to work, from the quarantine location.

If you incur expenses for both work purposes and private purposes, you will need to apportion your expenses. You can only claim the expenses that relate to your work activities.

Example: quarantine after overnight work-related travel

Mai was travelling for work for a sales tour of Victoria for 3 weeks. On her return to Sydney, Mai must quarantine for 2 weeks in a hotel.

As Mai is only travelling for work duties, she can claim a deduction for costs she incurs while in quarantine for her:

- accommodation

- food and drinks

- incidental expenses.

Example: quarantine expenses after holiday travel

Rojesh lives and works in Brisbane. He travels to Sydney for a holiday for 2 weeks.

Sydney was designated a COVID-19 hotspot during his trip. When he returns to Brisbane, he must quarantine for 2 weeks in a hotel and can't return to work. He pays for his accommodation, food and drink expenses during this 2-week period.

While Rojesh is in quarantine he is able to work using his laptop and keep normal business hours. Even though he is working while in quarantine, Rojesh can't claim a deduction for his accommodation, food and drink expenses.

His expenses are private in nature as his travel was not for work purposes.

Example: returning from overseas working holiday

Phillip takes a year of his long service leave to live and work in the United Kingdom. When his leave ends he returns to Adelaide.

When he arrives in Adelaide, he must quarantine in a hotel for 2 weeks. While in quarantine Phillip works for his Australian employer using his laptop.

As Phillip is returning to live in Australia, the expenses he incurs while in quarantine are not a result of travelling for work. Therefore, his quarantine expenses are private in nature and he can't claim a deduction.

For information about records you need, see:

- Keeping travel expense records

- Record keeping exceptions for travel allowance expenses .

COVID-19 testing expenses

You may require a COVID-19 test by the destination jurisdiction in order to:

- enter the overseas country or state

- return to Australia or your home state.

Travel expenses include incidental expenses that are minor but necessary expenses associated with your overnight work-related travel. The cost of a COVID-19 test is an incidental expense when the travel is in the course of your employment. In these circumstances, the cost of a COVID-19 test is a deductible expense.

If you do not have to pay for the COVID-19 test or your costs are reimbursed, you can't claim a deduction

If your travel is for both work and private purposes, you may need to apportion your expenses .

Example: travel expenses are deductible

Therese is employed as the state manager of a company that operates clothing stores. Each year, the state managers attend an 8-day overseas trip to Italy to meet with buyers and distributors. Therese decides to attend the meetings.

Before entry into Italy and return to Australia, Therese buys 2 COVID-19 tests as she will need proof of a negative COVID-19 test taken within the last 3 days. Therese has receipts for the expenses.

As the travel is in the course of Therese’s employment, the cost she incurs on the COVID-19 tests is in the course of performing her income-producing activities. Therese is travelling for work and can claim a deduction for the cost of the COVID-19 tests.

- 07 3367 3155

Walker Hill Group

Home » Blog » Work related travel expenses – what can you claim from the ATO?

Work related travel expenses – what can you claim from the ATO?

As Accountants, Walker Hill are often asked questions in relation to work related travel expenses. Whether you are a sole trader, employer, employee or run a small business, these questions tend to be amongst our most frequently asked during tax time. Following are some tax tips around work related travel expenses.

Work related expenses, travel and otherwise, can boost your tax refund. If you travel for work, you can claim expenses on purchases you make related to that travel. These are to be claimed as work related travel expenses on your tax return.

Like most work related costs, a travel allowance and most travel expenses are usually tax deductible. Of course, there are a few restrictions on what you can claim for a better tax refund.

So, what can you claim a deduction for? Here are a few examples of a work related travel expense:

- Accommodation

- Bridge/road tolls

- Air, bus, train and taxi fares

- Parking fees

- Car hire charges

- Meals (only if travel is included an overnight stay)

- Bags or suitcases used specifically for work travel

Travel expenses vs transport expenses

Determining the difference between a work related travel expense and a transport expense can be tricky, as often these two overlap.

Transport costs are one of the most popular tax deductions. Generally, work related travel in your car or on public transport is claimable with the exception of travel from home to work and back again.

Generally, you can claim a transport deduction for travel done:

- from your workplace/place of business to meetings or events offsite

- between two separate workplaces for different jobs

- from one job to your second job/an alternative workplace if and when required (you can claim the cost of travelling between locations)

Costs incurred that you cannot claim include the cost of travel from home to your everyday place of work and back, if you run an errand on the way to or from work like picking up mail or dropping client documents off physically or if your home is your place of work for one job and you travel to a different location for separate work.

What about car parking?

You can claim for work related parking expenses as long as the trip you took was also allowable as a deduction (for more on deductions, see above!). Normally, every day parking if you drive to work and pay for parking isn’t eligible to claim as a tax deduction, but this would be different if you were to, for example, carry bulky tools, or pay for parking where you have attended a meeting in a different location outside of your usual workplace.

Do I need a log book?

If you are away from home/your regular work location for more than six nights in a row, as an employee or business owner you should be keeping a travel diary to record locations, start and end times of your activities and what they were. This also allows you to track and recall incidental expenses like road tolls and meals.

If you don’t have a travel diary handy, no problem! There are plenty of templates online and we love the ease of ATO compliant logbook apps available for free to track travel and associated costs incurred. You can even pre-fill aspects of the trip and where the ATO require proof for any of your expenses, you can use this tool to keep a record of everything. Receipts or invoices detailing travel expenses can ensure that the details of your work related travel will be easy to remember, and prove, months later.

A travel allowance from your employer it is usually considered taxable income and is listed on your payment summary. As long as you spent the money you were paid as an allowance, you can claim it as a tax deduction. Remember you can only claim the total of your actual expenses, and not necessarily the entire allowance, as work related travel expenses.

Accommodation tends to be the easiest to prove and record. Provide detailed records of all accommodation and any extra expenses incurred when travelling for work.

What documentation of work related travel expenses should I keep for my tax return?

Supply anything you think might be relevant to you tax return. Work related car expenses can be claimed through receipts or tax invoices – these act as written evidence of the specific purchase.

Walker Hill has seen our fair share of paper records and receipts (especially our Bookkeepers!), but remember, these can fade or be lost over time. We recommend an app like HubDoc to keep your receipts and tax invoices all in one place and ready for your Tax Agent.

A log book is also highly recommended to claim work related travel.

What expenses are not allowed to be claimed?

There are certain travel expenses and circumstances where travel costs are not deductible on tax returns.

For example, you can’t claim a tax deduction for any travel expense incurred that your employer has already reimbursed you for. Although you can claim the cost of travel between two different workplaces, as mentioned above you generally can’t claim your journey from home to work and back again (although there are exceptions involving the transport of bulky tools).

How do I claim travel deductions?

Travel expense deductions, travel allowances and travel records can seem confusing to keep track of, but simply put, you cannot claim any part of a work trip that is not directly related to your work. The primary purpose of your trip must be work related to claim it on your tax return. If you travel with your partner, friends or family, you can’t claim any travel or accommodation costs for them. Similarly, you can’t claim a flight, meal expenses or accommodation unrelated to your work purposes that you have paid.

If you still have questions regarding your work related travel expenses, do not hesitate to contact Walker Hill. We are passionate about clarifying all things tax for you and are always happy to set you on the right track for the best possible refunds for you, your business and your family.

Recent Posts .

- View all Blog Posts

Categories .

Actionable business advice delivered direct to your inbox

- Comments This field is for validation purposes and should be left unchanged.

Digital Marketing

Walker Hill

- Level 2/80 Petrie Terrace QLD 4000

- [email protected]

Travel for Work? Here’s What You Need to Know About Claiming Expenses

If you ever need to travel as part of your employment or in the course of operating your business, you may have some claimable deductions waiting for you come tax time. Whether you receive a travel allowance, are fully funded, or pay all the work-related travel expenses yourself, there are likely some legitimate tax deductions you can claim. So, if you’re keen to lower your tax burden, read on to ensure you’re making the most of your travel costs.

What Are Work-Related Travel Expenses?

If you’re out of pocket when you travel for work, common expenses you may claim include:

- Airline, bus, trains, tram, taxi fares, and any ride-sourcing fares

- Car hire plus associated fees, fuel costs, road tolls, and car parking fees

- Accommodation

- Meals if you stay away from home overnight

Pro Tax Tip: If you’ve had to purchase a suitcase, bag, or laptop case for your travel, keep those receipts. That expense is a valid claim. Not confident with your record-keeping system? We’ve got you! Check out our guide to keeping tax records to maximise your deductions .

Claiming Travel Expenses

Travel could be your main expense. This includes whether you’ve incurred costs for daily travel, travel taken overnight or many nights, or an overseas trip. Your travel could simply be going from your workplace to a conference or seminar, or travelling to a client’s residence for a meeting. You can even claim the expenses of travelling from one office location to another on the same day.

Just keep in mind that there are a few instances where you can’t claim travel expenses:

- To claim overnight costs, you must have a permanent residence elsewhere. You can’t claim costs if you’re moving to live in another location;

- You can’t claim travel to and from your home to your workplace, except under very specific circumstances. Check with your tax accountant to see if your circumstances pass the test;

- You can’t claim running a personal errand to and from the office;

- You can’t claim travel expenses if you’ve worked overtime or out of hours;

- You can’t claim travel costs if you’ve been reimbursed by your employer or had free use of facilities provided by your employer.

Click here to read how to claim car expenses

CHAT WITH A FRIENDLY ITP TAX ACCOUNTANT TODAY

What Is Overnight Travel ?

The Australian Taxation Office (ATO) considers it overnight travel if you are away from your home and need to stay overnight at a place that is not normally a residence of yours. This type of travel applies when the normal place where you work and perform your duties hasn’t changed location, and you stay for a short term in a hotel or similar.

To claim overnight travel as a business expense, you can’t travel with your family or friends, nor can you claim overnight travel for any personal reason such as wanting to be closer to a workplace or living at another location while working.

The types of overnight travel expenses you may claim include:

- Accommodation – the cost of staying at a hotel, motel, serviced apartment, caravan, or booking on platforms like Airbnb

- Transport expenses to and from the location

- Charges for phone and internet

- Meals and drinks

- Car parking fees

- Bus tickets

How to Keep a Travel Diary

When it comes to claiming work-related travel expenses, the more documentation you can provide, the better. Just as you need to keep a log book to claim car expenses , you should keep a travel diary to document your travel expenses.

Here are the key points you’ll need to include:

- The name of the place where the business activity occurred

- The date and time the business activity began and ended

- A description of your business activity

- How long the activity lasted

Pro Tax Tip: If your business activity was a mix of personal and business, you’ll need to apportion and claim only the business costs. If this sounds like more complexity than you’re willing to take on, contact your nearest ITP branch . One of our skilled tax accountants can handle all the complex calculations for you, maximising your deductions without the stress and hassle.

Travel Diary Example

Pro Tax Tip: As a business owner, if you’re entitled to input tax credits under GST , you can claim a tax deduction in your income tax return of the GST-exclusive amount.

Are Travel Allowances Taxable?

If you receive a travel allowance, you’ll need to add that to your taxable income. The amount should show up on your income statement when you lodge your tax return. If it doesn’t show up, you’ll need to add it manually. You’ll then claim back whatever money you’ve spent on work-related travel expenses at tax time.

Pro Tax Tip: Since it’s added to your taxable income and is seen as an income stream, you can’t claim the entire allowance as a tax deduction. Instead, you can only claim your allowable expenses.

How to Record Travel Expenses

You can only claim expenses that you’ve already incurred, that you’re personally out-of-pocket for, and that you can prove you’ve incurred the expense. As well as a travel diary, the ATO will expect other forms of proof. This could be in the form of receipts, tax invoices, contracts, and other financial reports. You can’t claim a travel expense unless you can prove it, so it’s vital that you dial in your record-keeping system.

You can keep electronic evidence as long as it’s a clear and true representation of the original. Don’t forget to keep a backup folder in case your electronic files are lost or corrupted.

You want to claim all the travel expenses you can. After all, the difference could mean hundreds if not thousands of dollars in your tax return. Need a little help negotiating your travel expenses? After spending more than 50 years helping Australians lodge their tax returns, there’s not a lot ITP’s Accounting Professionals don’t know about tax. Even better, our fees are fully tax deductible. Phone 1800 367 487 to chat with a friendly professional today.

Change Location

Find awesome listings near you.

Track mileage automatically

Work-related travel expenses for employees, in this article, what are work related travel expenses, can i claim travel expenses for work, are travel expenses deductible, ato rates for work-related travel expenses.

Many employees need to travel elsewhere from their usual place of work as part of their jobs. This could be to visit a client, go to another branch of your employer’s organisation, attend a conference or even for training. Any costs that are required to travel as part of your job are work-related travel expenses.

Travel expenses include the fares or ticket costs for any modes of transportation, parking, tolls etc. as well as accommodation and meal expenses.

Are you using your personal vehicle for work-related transport? With the Driversnote logbook app you can create and share your vehicle log book with the ATO or your employer with ease.

These travel expenses are incurred whenever you have to pay for the cost of work-related travel. Documentary evidence of every expense is required in most situations by the ATO, or by your employer if you are reimbursed for your costs.

Kilometre tracking made easy

Trusted by millions of drivers

You can claim any work-related travel expenses as a deduction when you pay for them with your own money. If, however, you are reimbursed for any work-related travel expenses by your employer, then they become a tax deduction for the employer rather than for you and you will be taxed at the normal marginal rate on your wage.

If you pay for any work-related travel expenses with your own money, they are then tax deductible and as such will reduce your taxable income by the amount. However, if you are reimbursed by your employer, then they are no longer deductible by you as the employer will have paid for them and can then claim them as a tax deduction themselves.

Note that you can only deduct travel expenses if you are staying away from home overnight. If you are interested in finding out how to claim expenses for using your personal vehicle for business purposes, see our ATO guide on claiming business km .

If there is a personal element that is combined with business travel, then only the business-related component may be claimed as a tax deduction. Any work-related travel expenses need to be able to be verified if requested by the ATO. These records need to be kept for five years from the date the tax return is lodged.

When you incur costs for your job and are not reimbursed by your employer, such as work-related travel expenses, this reduces your taxable income with the ATO by the total amount of the valid claims. As such, this reduces the amount of tax you pay at the marginal rate.

For example, if you were to earn $75,000 and incurred $5,000 of work-related expenses, assuming appropriate documentation and evidence to support your claim, then your taxable income would be $70,000, and you would pay tax at the marginal rate on $70,000 instead of on your salary of $75,000.

How to automate your mileage logbook

Latest posts

- ATO Cents per KM Rate 2023-24

- Claiming Motor Vehicle Depreciation for the Self-employed

- Sole Trader Tax Deductions You Should Always Claim

Automate your logbook

Related posts, ato mileage guide.

Learn about the rules of reimbursing employees for their car expenses or deducting expenses as an employee or self-employed individual.

ATO Compliant Log Book Template

If you are claiming vehicle expenses for business purposes, you must keep proper records in order for the ATO to approve your claim. We will walk you through...

Find the Best Car Log Book App

The days of manually documenting a week's worth of information and struggling to remember the work errand you were running around 6:30 p.m. last Thursday are long gone, thanks to mobile apps that track your trips and produce compliant mileage logs.

Choose your Country or region

Personal Tax Specialists

Work related travel expenses.

Work-related travel expenses are generally tax deductible. Because the Australian Tax Office (ATO) receives thousands of incorrect claims each year for work travel expenses, they keep a close eye on what is claimed to determine if it is, in fact, a valid work-related travel expense and tax deductible.

There are dozens of work-related travel expenses that are legally tax deductible. It is worth appointing a registered tax agent to help you to make sure you claim everything available to you!

What work travel expenses are deductible?

To claim a deduction for a work-related travel expense , you must meet the following “3 golden rules”:

- You must have spent the money yourself and weren’t reimbursed.

- The expenses must directly relate to earning your income.

- You must have a record to prove it (usually a receipt).

Work-related travel expenses are only deductible for work trips made during working hours and overnight travel for work .

This does not include work-related travel expenses related to your daily commute from home to work and back; these are unfortunately not tax deductible.

You may not claim work-related travel expenses if your employer has paid them on your behalf.

Legitimate overnight work-related travel expenses may include items like flights, vehicle hire, fuel, accommodation, meals (e.g. food and drinks), and incidental expenses (e.g. car parking fees, bus tickets, internet or phone). It is important to keep records to prove that these expenses occurred.

If you are away from home for more than six nights, you may also need to keep travel records, such as a travel diary. This is in addition to your receipts.

Here is a more detailed list of examples of work-related travel expenses :

- Hotel, motel, or other accommodations

- Meals (food and drinks)

- Train, taxi, boat, bus, tram, ferry, or other vehicle fees

- Ride-sharing and ride-sourcing

- Bridge and road tolls

- Parking fees

- Quarantine and testing

- Phone and internet

How does a travel allowance work?

The travel allowance is a payment made to an employee to cover work-related travel expenses while they travel overnight for work purposes. If a travel allowance forms part of an employee’s salary or wages, tax has to be withheld.

If you receive a travel allowance for work-related travel expenses , then certain rules and exceptions to record keeping may apply. The ATO travel allowance provides for deductions that are applicable if they are within the reasonable amounts that the Commissioner publishes.

The reasonable travel allowance amounts are published each year on the ATO’s website for both domestic and overseas travel.

The same work-related travel expenses noted above would apply if you received a travel allowance from your employer. The expenses that you may be able to claim would only be applicable if you had to pay for travel expenses yourself.

If you went on overseas business trips during the financial year, an overseas business trip tax deduction may apply. You would be eligible to claim the work-related travel expenses for items such as airfares, accommodations, food, and drinks provided where you have written evidence of these expenses.

If you plan on taking a few extra days to enjoy the sites and explore the country, then you would only be eligible to claim for the portion that was strictly for work purposes.

Therefore, a travel diary is important. It clarifies what the expenses related to work are and avoids any doubts that the ATO might have. Keep in mind that if your overseas trip lasts more than six nights, you should keep a travel diary or itinerary that documents the dates, places, times, and durations of your activities while traveling.

How much work travel can you claim without receipts?

Claiming work-related travel expenses without a receipt or having the supporting proof documents can be problematic, but, in some cases, you can claim up to $300 in business expenses without a receipt. Providing a receipt is more straightforward; there are less questions raised about whether your claim is valid or not.

To find out more about what expenses you can claim on your tax return, read our tax time update .

Claiming deductions may sound tricky, but submitting through a registered tax agent like Personal Tax Specialists will save you money. Our 100% online 5-step process makes lodging your tax simple and our registered tax agents will help you claim all the deductions you’re entitled to.

Lodge your tax return online

Submit the form and we’ll get you started with our simple, 5 step process.

Let's get started!

Submit your return online. With our 5-step process you can complete your tax return at your convenience. It’s simple, quick and secure. No need to book a time with an accountant. Just follow the steps, submit the form and our expert tax agents will take care of your submission and ensure you’re claiming all the deductions you should be. Click to get started.

The process is simple and easy for anyone to follow. No complicated tax jargon or faulty apps. It just works.

Useful Links

- Our Process

- © Copyright 2023 | All rights reserved

- | Managed by MITCO Digital

A Quick Reference For Australian Tax Rates And Related Information

- Tax Deductions »

- Work Related Car Expenses »

- Travel between home and work »

Travel between home and work

As a general principle, a direct journey between home and place of work (and the direct return trip) is considered not to be in the course of doing work, and is therefore not tax deductible.

However there are a number of specific circumstances which cause a journey between home and work to be treated as a work-related cost. This summary is not advice – talk to your accountant before taking action.

Travelling expenses for employees

Tr 2021/1 : income tax: when are deductions allowed for employees’ transport expenses.

This ruling sets out when an employee can deduct the cost of travel by airline, train, taxi, car, bus, boat, or other vehicle.

The ruling explains that ordinary travel between home and a regular place of work is not deductible. Expenses of an employee in travelling between work locations usually are deductible. There are, however exceptions.

This Ruling also applies for FBT purposes and the ‘otherwise deductible’ rule.

Taxation Ruling TR 2021/4 reviews the tax treatment of accommodation and food and drink expenses, and provides 14 examples which distinguish non-deductible living expenses from deductible travelling on work expenses. FBT implications for the ‘otherwise deductible’ rule and travel and LAFHA allowances are also considered.

Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location – ATO compliance approach

Practical Compliance Guideline PCG 2021/3 (which finalises draft PCG 2021/D1 ) provides the ATO’s compliance approach to determining if allowances or benefits provided to an employee are travelling on work, or living at a location.

For FBT purposes an employee is deemed to be travelling on work if they are away for no more than 21 consecutive days, and fewer than 90 days in the same work location in a FBT year.

Transport of bulky equipment

Home to work travel is claimable if there is no safe storage at work and therefore of necessity (not just convenience) you transport heavy or bulky equipment (such as a ladder or musical instruments), between home and work.

How heavy does it need to be? In excess of 20kgs is an indication; But review decisions have looked at additional factors such as the type of equipment and its bulk, and whether the equipment itself realistically requires its own transport (with the taxpayer simply hitching a ride), in order to decide whether the trip between home and work takes on a predominantly tax-deductible purpose.

An example of the Tax Office interpreting and enforcing these rules in the case of Curtis Island Bechtel employees can be reviewed here . The correct treatment of meals allowances and claims for internet and telephone expenses are also discussed there.

Examples of bulky equipment used by an inter-city long haulage truck driver are here . They include such items as a portable fridge and sleeping gear, for which (crucially) there is no storage capacity at the employer’s depot.

And here’s another example – see “ A Win for Meat Workers’ Car Expenses ” (page 6)

Abnormal workplace

Broadly, an abnormal or alternative workplace is not where you usually work or are based.

- the trip between your normal and any alternative workplace while still on duty (e.g. client’s premises, another branch or office) is deductible, as is the return trip to either the normal workplace or directly home.

- from your home to an alternative workplace for work purposes and then back to your normal workplace or directly home is all treated as work-related travel

- trips directly between different jobs (i.e. you are off-duty during the trip in between) are claimable, but not the first or last leg to or from home unless some other factors (e.g. “on the way” below) are involved.

Home as the base

- if home is your base of work or employment, work-related travel starts from home

- workers whose work is “itinerant” – meaning “shifting places of work” – can claim the cost of travel between their home and places of work and back. See tax ruling TR 95/34

‘On the way’

Work related tasks on the way to or from work will only be the basis of a claim for the whole trip if the task was significant – involving for example, a break in the journey. Minor or incidental tasks (like dropping off the mail) are not enough, although any “extra” distance travelled to do so may be claimable. See MT 2027 Fringe benefits tax: private use of cars : home to work travel

For more information generally and examples see ATO: Trips you can and can’t claim

Employees’ accommodation and food and drink expenses travel allowances, and living-away-from-home allowances

- ATO guidance on costs of travelling – PWC

- Car expense claims

- Car depreciation

This page was last modified 2023-06-27

Small Business Trends

10 tax deductions for travel expenses (2023 tax year).

Tax season can be stressful, especially if you’re unaware of the tax deductions available to you. If you’ve traveled for work throughout the year, there are a number of deductions for travel expenses that can help reduce your taxable income in 2024 and save you money.

Read on for 10 tax deductions for travel expenses in the 2023 tax year.

Are business travel expenses tax deductible?

Business travel expenses incurred while away from your home and principal place of business are tax deductible. These expenses may include transportation costs, baggage fees, car rentals, taxis, shuttles, lodging, tips, and fees.

It is important to keep receipts and records of the actual expenses for tax purposes and deduct the actual cost.

What kinds of travel expenses are tax deductible?

To deduct business travel expenses, they must meet certain criteria set by the IRS.

The following are the primary requirements that a travel expense must meet in order to be eligible for a tax deduction:

- Ordinary and necessary expenses: The expense must be common and accepted in the trade or business and be helpful and appropriate for the business.

- Directly related to trade or business: The expense must be directly related to the trade or business and not of a personal nature.

- Away from home overnight: The expense must have been incurred while away from both the taxpayer’s home and the location of their main place of business (tax home) overnight.

- Proper documentation: The taxpayer must keep proper documentation, such as receipts and records, of the expenses incurred.

Eligible Business Travel Tax Deductions

Business travel expenses can quickly add up. Fortunately, many of these expenses are tax deductible for businesses and business owners.

Here is an overview of the types of business travel expenses that are eligible for tax deductions in the United States:

Accommodation Expenses

Accommodation expenses can be claimed as tax deductions on business trips. This includes lodging at hotels, rental costs of vacation homes, and other lodgings while traveling.

Meal Expenses

Food and beverage expenses incurred on a business trip may be deducted from taxes. This includes meals while traveling and meals during meetings with clients or contractors.

Transportation Expenses

Deducting business travel expenses incurred while on a business trip may also be claimed.

This includes flights, train tickets, car rentals, gas for personal vehicles used for the business trip, toll fees, parking fees, taxi rides to and from the airport or train station, and more.

Expenses of operating and maintaining a car

Expenses of operating and maintaining a car used for business travel may also be claimed as tax deductions.

This includes fuel, insurance, registration costs, actual costs of repairs, and maintenance fees. Fees paid to hire a chauffeur or driver may also be deducted.

Operating and maintaining house-trailers

Operating and maintaining house trailers for business travel may be eligible for tax deductions, provided that the use of such trailers is considered “ordinary” and “necessary” for your business.

This includes any costs associated with renting or owning a trailer, such as fuel costs, repair and maintenance fees, insurance, and registration charges.

Internet and phone expenses

Internet and phone expenses associated with business travel can also be claimed as tax deductions. This includes the cost of any internet service, such as Wi-Fi or data plans, and phone services, such as roaming charges or international calls.

Any communication devices purchased for business use, such as smartphones and laptops, may also be eligible for tax deductions.

Computer rental fees

Rental fees for computers and other computing devices used during business travel may also be deducted from taxes. This includes any applicable charges for purchasing, leasing, or renting a computer, as well as the related costs of connecting to the Internet and other digital services.

All such expenses must be necessary for the success of the business trip in order to qualify for a tax deduction.

Travel supplies

Travel supplies, such as suitcases and other bags, are also eligible for tax deductions when used for business travel. Any costs associated with keeping the items protected, such as locks and tracking devices, can also be claimed as tax deductions.

Other necessary supplies, such as office equipment or reference materials, may also be eligible for deductions.

Conference fees and events

Conference fees and events related to business travel may also be eligible for tax deductions. This includes fees associated with attending a conference, such as registration, accommodation, and meals.

Any costs related to the organization of business events, such as venue hire and catering, may also be claimed as tax deductions.

Cleaning and laundry expenses

Business travel expenses associated with cleaning and laundry may also be claimed as tax deductions. This includes a portion of the cost of hotel and motel services, such as cleaning fees charged for laundering clothing, as well as any other reasonable expenses related to keeping clean clothes while traveling away from home.

Ineligible Travel Expenses Deductions

When it comes to business expenses and taxes, not all travel expenses are created equal. Some expenses are considered “Ineligible Travel Expenses Deductions” and cannot be claimed as deductions on your income taxes.

Here is a list of common travel expenses that cannot be deducted, with a brief explanation of each:

- Personal Vacations: Expenses incurred during a personal vacation are not deductible, even if you conduct some business while on the trip. In addition, expenses related to personal pleasure or recreation activities are also not eligible for deductions.

- Gifts: Gifts purchased for business reasons during travel are not deductible, even if the gifts are intended to benefit the business in some way.

- Commuting: The cost of commuting between your home and regular place of business is not considered a deductible expense.

- Meals: Meals consumed while traveling on business can only be partially deducted, with certain limits on the amount.

- Lodging: The cost of lodging is a deductible expense, but only if it is deemed reasonable and necessary for the business trip.

- Entertainment: Entertainment expenses, such as tickets to a show or sporting event, are not deductible, even if they are associated with a business trip.

How to Deduct Travel Expenses

To deduct travel expenses from income taxes, the expenses must be considered ordinary and necessary for the operation of the business. This means the expenses must be common and accepted business activities in your industry, and they must be helpful, appropriate, and for business purposes.

In order to claim travel expenses as a deduction, they must be itemized on Form 2106 for employees or Schedule C for self-employed individuals.

How much can you deduct for travel expenses?

While on a business trip, the full cost of transportation to your destination, whether it’s by plane, train, or bus, is eligible for deduction.

Similarly, if you rent a car for transportation to and around your destination, the cost of the rental is also deductible. For food expenses incurred during a business trip, only 50% of the cost is eligible for a write-off.

How do you prove your tax deductions for travel expenses?

To prove your tax deductions for travel expenses, you should maintain accurate records such as receipts, invoices, and any other supporting documentation that shows the amount and purpose of the expenses.

Some of the documentation you may need to provide include receipts for transportation, lodging, and meals, a detailed itinerary or schedule of the trip, an explanation of the bona fide business purpose of the trip, or proof of payment for all expenses.

What are the penalties for deducting a disallowed business expense?

Deducting a disallowed business expense can result in accuracy-related penalties of 20% of the underpayment, interest charges, re-assessment of the tax return, and in severe cases, fines and imprisonment for tax fraud. To avoid these penalties, it’s important to understand expense deduction rules and keep accurate records.

Can you deduct travel expenses when you bring family or friends on a business trip?

It is not usually possible to deduct the expenses of taking family or friends on a business trip. However, if these individuals provided value to the company, it may be possible. It’s advisable to speak with an accountant or financial expert before claiming any deductions related to bringing family and friends on a business trip.

Can you deduct business-related expenses incurred while on vacation?

Expenses incurred while on a personal vacation are not deductible, even if some business is conducted during the trip. To be eligible for a deduction, the primary purpose of the trip must be for business and the expenses must be directly related to conducting that business.

Can you claim a travel expenses tax deduction for employees?

Employers can deduct employee travel expenses if they are ordinary, necessary, and adequately documented. The expenses must also be reported as taxable income on the employee’s W-2.

What are the limits on deducting the cost of meals during business travel?

The IRS permits a 50% deduction of meal and hotel expenses for business travelers that are reasonable and not lavish. If no meal expenses are incurred, $5.00 daily can be deducted for incidental expenses. The federal meals and incidental expense per diem rate is what determines the standard meal allowance.

YOU MIGHT ALSO LIKE:

- nondeductible expenses

- standard deduction amounts

- Hipmunk small business

Image: Envato Elements

Your email address will not be published. Required fields are marked *

© Copyright 2003 - 2024, Small Business Trends LLC. All rights reserved. "Small Business Trends" is a registered trademark.

IMAGES

VIDEO

COMMENTS

If the expense was for both work and private purposes, you can only claim a deduction for the work-related portion. If your total claim for work-related expenses is more than $300, you must have written evidence to prove your claims. Work-related travel expenses include: public transport, air travel and taxi fares. short-term car hire.

Trips while working and between workplaces. You can claim a tax deduction for the cost of transport on trips to: perform your work duties - for example, if you travel from your regular place of work to meet with a client. attend work-related conferences or meetings away from your regular place of work. deliver items or collect supplies.

Expenses you can claim. Your business can claim a deduction for travel expenses related to your business, whether the travel is taken within a day, overnight, or for many nights. Expenses you can claim include: airfares. train, tram, bus, taxi, or ride-sourcing fares. car hire fees and the costs you incur (such as fuel, tolls and car parking ...

This question is about travel expenses you incur in performing your work as an employee. They include: public transport, air travel and taxi fares. bridge and road tolls, parking fees and short-term car hire. meal, accommodation and incidental expenses you incur while away overnight for work. expenses for motorcycles and vehicles with a ...

A travel allowance expense is a deductible travel expense: you incur when you're travelling away from your home overnight to perform your employment duties. that you receive an allowance to cover. for accommodation, meals (food or drink), or incidentals. You incur a travel allowance expense when you either: actually pay an amount for an expense.

The ATO's new ruling sheds light on what travel expenses employees can and cannot claim. Travel between work locations (neither of which are your home), is typically tax deductible. Incidental work-related travel, such as a receptionist who makes a stop to pick up office newspapers on their way to work, can't be claimed on tax.

Eligibility to claim travel. You can claim a deduction for travel expenses (accommodation, meals and incidental expenses) if you travel and stay away from your home overnight in the course of performing your employment duties. You can't claim travel expenses if you don't stay away from your home overnight. You are travelling overnight for work ...

Along with this, interstate and overseas travel expenses are also deductible. Work-related travel expenses include ticket costs or fares for any modes of transportation, tolls, parking, etc, along with meal expenses and accommodation. There are some restrictions as well on what you can claim. We will look into that in the later part of this blog.

You can claim the following work-related car and travel expenses at question D2 Work-related travel expenses 2023: expenses for vehicles with a carrying capacity of one tonne or more, or 9 or more passengers (for example, utility trucks and panel vans) expenses for motorcycles. short-term car hire. public transport fares.

In brief. On 17 February 2021, the Australian Taxation Office (ATO) released the following new guidance in relation to whether an employee is "travelling on work" or otherwise, and the income tax and fringe benefits tax (FBT) treatment of associated travel expenses: Draft Taxation Ruling TR 2021/D1: Income tax and fringe benefit tax ...

This isn't necessarily the case. You can only claim the total amount you spent on work related travel. For example, if you received $1500 worth of travel allowances from your employer during the year, but the cost of your travel was $1,000, you can only claim $1,000 worth of travel deductions on your return.

The travel occurs in work time; and; The travel occurs when the employee is under the direction and control of the employer. The ruling applies both before and after its date of issue. TR 2021/D1 Income Tax and Fringe Benefits Tax: employees: accommodation and food and drink expenses, travel allowances, and living-away-from-home allowances

Travel expenses include incidental expenses that are minor but necessary expenses associated with your overnight work-related travel. The cost of a COVID-19 test is an incidental expense when the travel is in the course of your employment. In these circumstances, the cost of a COVID-19 test is a deductible expense.

Here are a few examples of a work related travel expense: Accommodation. Bridge/road tolls. Air, bus, train and taxi fares. Parking fees. Car hire charges. Meals (only if travel is included an overnight stay) Bags or suitcases used specifically for work travel.

If you receive a travel allowance, you'll need to add that to your taxable income. The amount should show up on your income statement when you lodge your tax return. If it doesn't show up, you'll need to add it manually. You'll then claim back whatever money you've spent on work-related travel expenses at tax time.

There are two options when it comes to vehicle travel for work tax deductions. As of April 2023, there is a flat rate of 78 cents per kilometre, and you can claim up to 5,000 km. You will need to keep a log of your travel to determine how far you travel for work purposes. Use a logbook if you travel and detail your running expenses, from ...

A travel allowance is a predetermined amount of money provided by an employer to an employee to cover the expenses associated with traveling for work-related purposes. The ATO considers a travel allowance to be tax-free if it meets the following conditions: The travel is required as part of the employee's job duties, The travel involves an ...

13 April 2023. In August 2021, the Australian Taxation Office (ATO) finalised Taxation Ruling TR 2021/4 and PCG 2021/3, which provide guidance on the income tax deductibility of accommodation, food and drink expenses incurred in connection with travel. To the extent that an employer provides these types of benefits to employees, these rulings ...

On 17 February 2021, the Australian Taxation Office (ATO) released the following new guidance in relation to whether an employee is "travelling on work" or otherwise, and the income tax and fringe benefits tax (FBT) treatment of associated travel expenses: • Draft Taxation Ruling TR 2021/D1: Income tax and fringe benefit tax: employees:

When you incur costs for your job and are not reimbursed by your employer, such as work-related travel expenses, this reduces your taxable income with the ATO by the total amount of the valid claims. As such, this reduces the amount of tax you pay at the marginal rate. For example, if you were to earn $75,000 and incurred $5,000 of work-related ...