Buy Currency Online

How would you like to pay, buy currency page.

Xchange of America is the go-to destination for anyone looking to buy currency online. Our service has been used by individuals, companies, credit unions, banks, and a variety of other institutions for over 15 years because we offer quick, simple, and secure transactions, a variety of payment options, and a wide range of currencies to choose from. Foreign currencies are reliably shipped right to your door and can be delivered as soon as the next day, depending on payment method and processing times.

How to order foreign currency online

When you buy currency online at Xchange of America, you can select from over 40 different kinds of legal tender from countries all across the world. Don’t see what you need? Just give us a call, and we’ll see what we can do to accommodate your request.

Start by selecting the type of currency you want to purchase and then enter in how much of it you need. The price will then automatically be calculated so you know exactly how much the currency you want to purchase is worth in US dollars. If you need to buy multiple different currencies in one order, simply click on the “Add another currency” button to add more to your order. Then, you’ll choose how you want to pay for it.

At Xchange of America, we want to make the process as simple and convenient for you as we can. When you order foreign currency online from us, you can choose from one of several different payment options – credit/debit card, bank wire, e-check, cashier check/money order, or collect on delivery (COD). Credit/debit cards will always be the fastest payment option, however, all of our payment methods are secure & easy to use.

Buy currency online at Xchange of America today

Whether you need to buy currency online to your door in preparation for an amazing vacation or are looking to order foreign currency online for any other reason, Xchange of America is the best place to get your foreign currency shipped to your door that’s fast, secure & reliable!

Cashier Check Money Order

Collect On Delivery (COD)

Credit / Debit Card

Customer Service 7 days a week (888) 796-2962

- Turkish Lira

- Australian Dollars

- Canadian Dollars

- Polish Zloty

- VIEW ALL CURRENCIES

- canadian dollars

- ALL BUY BACKS

- US Dollar Card

- Multi-currency Card

Travel Money Comparison

Get the best exchange rates when you buy or sell foreign currency online

- buy Currency

- sell Currency

What Currency do you want to buy?

How much do you want to spend, what currency do you want to sell, how much do you want to sell, buy currency, sell currency, why use a travel money comparison site.

Have you ever started researching the best rates between different travel money providers?

We know it can be overwhelming: the different suppliers, their different offers and of course, the ever-changing currency exchange rates. It's a lot of information to process and compile!

Our comparison site takes the stress out of researching and does it all for you. FInd the travel money supplier that will get you the best rate today.

- ✓ Compare Travel Cash is a non-biased travel money comparison site.

- ✓ To ensure our independence, we always use transparent, objective and verifiable criteria in our comparisons.

- ✓ Our mission is to show you the best rates so you can save when buying your travel money.

- ✓ We constantly update our exchange rates as they change for each money exchange supplier, and whilst we try to do this in almost real-time, there will be times when our data is slightly out of date (in normal circumstances, not more than 5 minute). Our travel money comparison site is designed to save you money by showing you the latest rates.

- ✓ We check out all the companies we list, ensuring they are reputable suppliers and pass our standards before we list them.

- ✓ We value your privacy. We do not sell your data - you don't even need to give us your information to use our site. Even if you choose to, it is safe with us, we will never pass it on to third parties.

- ✓ You won't get cheaper rates if you go directly to the supplier, at times, we may have discounts and incentives that you would not get by going direct!

- ✓ We do sometimes make money - but we don't make it from you. We will never add fees or commissions to the travel money rates on the site.

Frequently asked questions

It's a great idea to buy your currency online to ensure you get the best exchange rate. You can often get much better deals online compared to what you can find on the high street or the airport. In fact ccording to recent surveys, 9 out of 10 tourists find that exchanging money at airports is the most expensive option.

The best thing about buying your travel money online through a comparison site is seeing all currency prices in one place, so whether you are buying euros , buying dollars or other currencies you get the best rate for your travel money and more importantly save time!

The quickest way to get the best currency exchange rate is by using our comparison tool . We compare the latest information from all the best travel money providers in the market to show you the best currency exchange rates.

Keep an eye out for the following when searching for the best currency exchange deals so you can choose the best option for buying your holiday money:

- High exchange rate - The higher the exchange rate number, the more holiday money you will get to the pound

- Delivery Charges - different currency providers charge different amounts for delivering your holiday money to your door

- Special offer - We will let you know if the providers are offering travel money deals

Commission is the fee that travel money providers charge for the service to exchange your money into foreign currency . The charge is usually included in the exchange rate they advertise. You will see that many foreign exchange companies advertise 0% commission, they are still charging you by including the charge in the rates.

All the travel money prices we quote include any fees and commissions, including delivery!

The simple answer is yes! Usually, the minimum order amount for foreign currency is £100, and the maximum is usually £7,500, although some providers allow you to exchange more.

Travel money is normally sent via special delivery service with Royal Mail. Travel cash orders worth more than £2,500 will be sent via a courier or multiple Royal Mail packages. This is for insurance reasons, making sure your travel money is safe.

This depends on the currency provider. Some providers offer next-day delivery, sending your travel money using Royal Mail's Special Delivery Guaranteed by 1pm service. There will be an extra cost for this and you can see how much when you compare the holiday money prices.

Don't forget, many foreign currency providers also allow you to pre-order currency and you can collect it in store, this means you can avoid delivery charges.

Most do, any holiday money that you have leftover after your trip abroad can be sold using a buy-back service that will convert it back to pounds. Our comparison tool will show you the providers offering the best buy-back rates .

Every few of minutes we compare the exchange rates and latest currency deals from the best travel money providers in the UK. You can see instantly who is offering the best deals and choose a service that suits your needs best.

Also, if you've come home from a trip abroad and have leftover currency, we compare many foreign currency buy back companies, showing the best rates to convert your foreign currency back into pounds.

Hundreds of customers order travel money through our site daily and have a great experience. However, as with ordering anything online, the process is never completely risk-free and you should always take care when transfering money to any company.

We undertake comprehensive checks on all of our providers and monitor them to make sure they meet our high standards and continue to do so. Having said that, no company is guaranteed not to come into trouble and we cannot guarantee the solvency of any of the providers listed on our website. We always recommend that you conduct your own due diligence before placing an order with any company.

There are many destinations where taking some local currency is extremely useful to make sure you are covered in places where credit cards are not accepted. Many of the smaller retailers globally will not allow credit cards, so cash is the only option.

Read our blog post on taking cash on holiday .

The best time to buy any travel money is when the pound is performing strongly relative to the currency you are buying, this means it will have a higher exchange rate, so will give you more currency for your money. The amount you receive is calculated by multiplying the exchange rate by the amount of pounds you want to spend, so the higher the exchange rate, the more foreign currency you get.

Exchange rates are constantly changing but we show you the historical exchange rate performance for each of the currencies so you can have more of an idea of whether now is a good time to buy your travel money.

Exchange rates tend to be very similar wherever you are in the world to those offered in the UK, however waiting until you are away means you may be stuck with poor exchange rates, fewer options of places to offer competitive rates or even worse, you may have to pay big additional fees and commissions. By buying your travel money in the UK there are no hidden fees, charges or nasty surprises, you know exactly how much you are getting.

Once you have found the best rate, place an order on the currency suppliers’ site, and pay for your currency.Each currency supplier has different payment options, including bank transfer, debit card, with some suppliers offering payment by Apple pay and Android pay. Once your order has been confirmed your order will be prepared and your currency sent to you by registered delivery, some suppliers even offer next-day delivery.

LATEST CURRENCY NEWS

The 8 Best Travel Money Belts of 2024: Secure Your Valuables on the Go

The best travel money belts of 2024 excel in comfort, style and security. These belts are not just fashionable, they are also equipped with the latest technology like RFID-blocking to protect your personal information from theft. Particularly noteworthy is a model that offers sizes adaptable to multiple waist measurements. After all, securing your cash and

The Perfect Carry-on Case for Airline Travel: Top Recommendations and Tips

The perfect carry-on case for airline travel fits within the usual size limits of 22 x 14 x 9 inches. This ensures it complies with most airlines’ overhead bin space restrictions. Despite this uniformity, some international airlines may have varying rules, so cross-checking with your specific airline before purchasing a case is a smart move.

What currency is used in Dublin, Ireland? A clear answer for travellers

Dublin, the capital city of Ireland, is a popular tourist destination known for its rich history, vibrant culture, and stunning architecture. As a result, many people who plan to visit Dublin may wonder what currency is used in the city. The official currency of Ireland is the Euro, which is used throughout the country, including

Join newsletter

- Best Euro Rate

- Best US Dollars Rate

- Best Turkish Lira Rate

- Best Australian Dollars Rate

- Best Thai Baht Rate

- Best UAE Dirham Rate

- Best Canadian Dollars Rate

- Best Polish Zloty Rate

- Best Croatian Kuna Rate

- Buy Travel Money

- Sell US Dollars

- Sell Turkish Lira

- Sell Australian Dollars

- Sell Thai Baht

- Sell UAE dirham

- Sell Canadian Dollars

- Sell Polish Zloty

- Currency buy backs

- Currency Online Group

- Sterling FX

- Covent Garden FX

- The Currency Club

- Tesco Money

- Sainburys Bank

- Virgin Money

- Natwest Travel

- Post Office

- Thomas Cook

- Marks and Spencer

- No1 Currency

- Rapid Travel Money

- Best Supermarket Euros

- Privacy Policy

@2024 Comparison Technology Ltd, 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ | Company Registration Number 12065287

CompareTravelCash.co.uk is a travel money comparison service that's designed to help you save money – whilst we do our best to ensure the site is 100% up-to-date, we cannot guarantee this. We advise you to carry out your own due diligence before buying or selling travel money.

Compare our best travel money deals

Get maximum value for your travel money, currency calculator.

Join our personal finance newsletter for top deals and insight

You can unsubscribe at any time - privacy notice .

Today’s best exchange rates

How do you get the best holiday money exchange rate, high exchange rates, delivery charges, special offers, pros and cons, five golden rules of travel money, 1. know how much cash you'll need.

Carrying around a large amount of cash isn't the safest thing to do. At the same time, not having enough cash can cause a lot headaches too. It's a good idea to take a little more than you think you'll need.

But it's also good sense to have a backup prepaid , debit or travel credit card that you can rely on - assuming you're going to a destination that widely accepts card transactions.

2. Shop around

Not all currency exchange companies are created equal. Some may have good exchange rates, but higher fees. Others may have higher rates, but no fees. You have to make sure which one offers the best value to you.

This is why it’s worth comparing the deals on offer from several companies before ordering your travel money. Factor in the fees and the exchange rate and see where you end up better off. Often the amount of money you're exchanging can be a deciding factor.

3. Don't buy your travel money at the airport

Airport holiday money providers have notoriously high prices because they offer a last-chance solution for those who are just about to board a plane. By planning ahead you can save a small fortune.

4. Don't carry too many large notes

Notes of large denominations can be tricky, as small shops and taxi cabs, which are more likely to require cash, might not have enough change to accept a large note.

Some retailers are also often wary of accepting large notes. Smaller notes and change can also be handy when it comes to tipping or buying small everyday items.

5. Don't use your credit card to buy travel money

Avoid buying foreign currency with a credit card as credit card providers treat the transaction as a 'cash advance' . Not only will you be charged daily interest, you're also likely to be hit with a fee.

Budgeting for your holiday

How much travel money you need to take depends on your plans . You'll need to budget for your holiday to make sure you don't run out of money before the end.

Deciding how much money to take depends on were you're going, whether debit or credit card usage is prevalent, and if you want to have some local currency on hand for emergencies.

Having some cash is extremely important , as there's always a possibility your cards could get declined or blocked for some reason, and it may take some time to resolve the issue.

Also, some countries still rely predominantly on cash transactions , so you should factor that into how much cash you decide to take.

What are the top alternatives to buying travel money?

Travel credit cards.

Travel credit cards - i.e. the ones with no foreign transaction fees - offer two key advantages over travel money:

Great exchange rates - when you spend on a travel credit card you get the Mastercard or Visa exchange rate, which is about the best you can find as a regular consumer

Purchase protection – for purchases costing between £100 and £30,000 you're covered by Section 75 of the consumer credit act , meaning if something goes wrong you can make a claim with your card provider should the vendor fail to pay up

However, not everywhere accepts travel credit cards and using them at a cash machine abroad can come with hefty fees. It can also be easier to overspend on a credit card, leaving you with debts on which interest is charged.

Travel money cards

Currency cards and travel bank accounts let you spend overseas without being charged a foreign transaction fee. Their key strengths are:

Great exchange rates - you card provider will pass on the Mastercard or Visa rate to you without adding extra charges

No charges for ATM use overseas - if you need extra cash on holiday, you can withdraw it without being charged by your provider. Watch out for local ATM fees though, as these might still apply

The downsides include that there can be limits on how much you can withdraw abroad using a travel money card, and that they're not accepted quite as widely as cash. Some travel current accounts also come with fees.

Prepaid travel cards

Prepaid travel cards can be loaded with currency and used abroad without paying foreign exchange fees. You can load a prepaid card with a specific foreign currency or a variety of different currencies, depending on your travel plans. The key advantages are:

Low or no fees to use abroad – prepaid travel card providers charge far less than traditional banks for overseas usage

Safer than carrying cash - you can cancel or freeze the card if it's lost or stolen, protecting your balance

However, you’ll need to watch out for general usage fees, which often apply when you load the card with cash and may also be charged monthly.

Can you get commission-free travel currency?

Yes and no. It depends on how you define it. Commission refers to the service fee that a currency exchange broker charges for exchanging your money.

Many companies advertise 0% commission to exchange money online or on the high street, but, instead of charging commission, they offer a less competitive exchange rate. This is why you need to compare the whole deal rather than just opting for a zero-fee travel money deal.

Are there restrictions on getting currency delivered?

When you buy your currency online, it's normally sent via Royal Mail's Special Delivery service. This means you have to sign for the package. Cash orders that exceed £2,500 will be sent in batches because that's the maximum value that can be insured for each delivery.

Can you get next-day delivery for currency?

Some travel money providers do offer next-day delivery. These brokers send out currency using Royal Mail's Special Delivery Guaranteed by 1pm service.

Our comparison shows which operators offer this option and how much they charge for it. With some companies, you also have the option to pre-order your travel money for collection in person from a local branch, meaning you don't have to pay for delivery.

Will anyone buy my currency back?

If you've got leftover travel money from a trip abroad, you can use a buy-back service to convert it back into pounds.

The buy-back rate tells you how much sterling you'll get back.

Remember to factor in the rate and delivery costs, and compare exchange rates. You can check out the best euro-to-pound exchange rate by looking at our comparison table.

About our comparison

Who do we include in this comparison.

We include every company that gives you the option of buying euros online. Discover how our website works .

How do we make money from our comparison?

We have commercial agreements with some of the companies in this comparison. We get paid commission if we help you take out one of their products or services. Find out more here .

You do not pay any extra and the deal you get is not affected.

Learn more about travel money

About the author

Didn't find what you were looking for?

Below you can find a list of currencies to exchange

Other products that you might need for your trip

We’ve been featured in

Customer Reviews

Very helpful

I love using money.co.uk for financial…

super helpful for newcomers!

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

Get competitive rates and 0% commission for your holiday cash

Foreign currency

Find our best exchange rates online and enjoy 0% commission on over 60 currencies. And you can choose collection from your nearest branch or delivery to your home

Go cashless with our prepaid Mastercard®. Take advantage of contactless payment, load up to 22 currencies and manage everything with our app, making travel simple and secure

Order travel money

- UAE Dirham AED

- Australian Dollar AUD

- Barbados Dollar BBD

- Bangladesh Taka BDT

- Bulgarian Lev BGN

- Bahrain Dinar BHD

- Bermuda Dollar BMD

- Brunei Dollar BND

- Canadian Dollar CAD

- Swiss Franc CHF

- Chilean Peso CLP

- Chinese Yuan CNY

- Colombian Peso COP

- Costa Rican Colon CRC

- Czech Koruna CZK

- Danish Kroner DKK

- Dominican Peso DOP

- Fiji Dollar FJD

- Guatemalan Quetzal GTQ

- Hong Kong Dollar HKD

- Hungarian Forint HUF

- Indonesian Rupiah IDR

- Israeli Sheqel ILS

- Icelandic Krona ISK

- Jamaican Dollar JMD

- Jordanian Dinar JOD

- Japanese Yen JPY

- Kenyan Shilling KES

- Korean Won KRW

- Kuwaiti Dinar KWD

- Cayman Island Dollar KYD

- Mauritius Rupee MUR

- Mexican Peso MXN

- Malaysian Ringgit MYR

- Norwegian Krone NOK

- New Zealand Dollar NZD

- Omani Rial OMR

- Peru Nuevo Sol PEN

- Philippino Peso PHP

- Polish Zloty PLN

- Romanian New Leu RON

- Saudi Riyal SAR

- Swedish Kronor SEK

- Singapore Dollar SGD

- Thai Baht THB

- Turkish Lira TRY

- Taiwan Dollar TWD

- US Dollar USD

- Uruguay Peso UYU

- Vietnamese Dong VND

- East Caribbean Dollar XCD

- French Polynesian Franc XPF

- South African Rand ZAR

- Brazilian Real BRL

- Qatar Riyal QAR

Delivery options, available branches and fees may vary by value and currency. Branch rates will differ from online rates. T&Cs apply .

Why get your holiday cash from Post Office?

- Order online, buy in branch, or choose delivery to your home or local branch

- 100% refund guarantee* if your holiday’s cancelled, at the same exchange rate, excluding bank and delivery charges. Just send your receipts and evidence of cancellation to us within 28 days of purchase. *T&Cs apply

- Order euros or US dollars to collect in branch in as little as 2 hours

Today’s online rates

Rate correct as of 18/04/2024

Travel Money Card (TMC) rates may differ. Branch rates may vary. Delivery methods may vary. Terms and conditions apply

Win £5000 with Post Office Travel Money Card

A chance to win £5000 when you top up a new or existing Travel Money Card*. Offer ends 12 May

*Exclusive to travel money cards. Promotion runs 4 March to 12 May 2024. 1 x £5,000 prize available to be won each week. Minimum equivalent spend of £50 applies.

Stay in control

Manage your holiday essentials together in one place on the move, from your Travel Money Card and travel insurance to extras like airport parking.

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Need some help?

Travel money card lost or stolen.

Please immediately call: 020 7937 0280

Available 24/7

Travel money help and support

Read our travel money FAQs or contact our team about buying currency online or in branch:

Visit our travel money support page

Other related services

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

Long-haul destinations offer the best value for UK holidaymakers this year, ...

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

One of the joys of summer are the many music festivals playing across the ...

Prepaid currency cards are a secure way to make purchases on trips abroad. They ...

For the first time in 16 years of our reports, Lisbon is not only the cheapest ...

The nation needs a holiday. And, with the summer season already underway, new ...

Hoi An in Vietnam is still the best-value long haul destination for UK ...

Our annual survey of European ski resorts compares local prices for adults and ...

Travelling abroad? These tips will help you get sorted with your foreign ...

We all look forward to our holidays. Unfortunately, though, more and more ...

The nation needs a holiday, and Brits look set to flock abroad this year. The ...

Kickstarting your festive prep with a short getaway this year? The Post Office ...

Thinking of heading off to Europe for a quick city break, but don’t want to ...

- Home ›

- Travel Money

Compare travel money exchange rates

Get the best exchange rate by comparing travel money deals from the UK's top foreign exchange providers

Why compare exchange rates?

It's important to shop around for the best currency deals if you want to maximise your holiday money. Right now, there's a 5.4% difference between the best and worst euro exchange rates available online. It may not sound like a lot, but that's an instant saving of £54 if you were buying £1000 worth - just by choosing the best place to exchange your cash. Less-common currencies offer even more potential savings: you could get 11.0% more Turkish lira by going with the best deal. For Indian rupees, the saving is 7.7%, and for Thai baht it's 13.0%. That's a lot of extra Mekhong!

However, exchange rates aren't the only important factor when it comes to getting the best currency deal. Commission, delivery fees and payment surcharges can all affect the amount of currency you'll receive, which is why it's important to use a comparison website to check the best deals for you.

Our travel money comparisons can help you to get a great deal on your currency. We compare the exchange rates from a wide range of different providers, along with their fees and any other charges, so you can see how their rates stack up after all costs have been included. You can choose how you want to pay and whether you want to pick your currency up in person or get it delivered to your door. We'll even show you exclusive online-only deals that aren't available on the high street! Comparing is quick and easy - just select the currency you want to buy, tell us how much you want to spend and we'll do the rest.

It's almost always cheaper to buy your currency online compared to buying in-store.

- Some of the most competitive currency suppliers are online-only. Their operating costs are generally lower than high street stores, so they can afford to offer you better exchange rates

- Most suppliers offer free home delivery when you spend a minimum amount

- Many high street currency suppliers such as supermarkets and the Post Office offer better rates if you place your order online beforehand. By reserving your order online, you can guarantee the supplier's online rate and still collect your currency in person at a time that suits you

If you're spending less than £300, it can be more cost-effective to buy your currency in-store because the delivery charge may cancel out any savings you might have made on the exchange rate if you bought online. However, some currency suppliers charge a handling or processing fee for small orders when you buy in-store, so it's worth checking beforehand if you're only spending a smaller amount.

We recommend you place your order at least three working days before you need your currency. Most currency suppliers will dispatch your order on the same day they receive your payment if you pay before lunchtime, otherwise they'll post it on the next working day. Your order will be sent via Royal Mail Special Delivery which is a fully tracked and insured service that's guaranteed by Royal Mail to arrive on the next working day.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

Insurance servicing

- Life insurance (opens in a new window)

- Home insurance (opens in a new window)

- Travel insurance (opens in a new window)

- Car insurance (opens in a new window)

Internet Banking

- Sign in to internet banking (opens in a new window)

- Register for internet banking (opens in a new window)

- M&S Travel Money

Buy Travel Money

Currency calculator.

Our currency calculator is a quick and easy way to check our latest foreign currency exchange rates.

What do I need to bring to collect my foreign currency?

The benefits of exchanging your holiday money with M&S Bank

Wide range of foreign currencies.

We offer a wide range of foreign currencies in our Bureaux, with more available to order online. It is easy to compare travel money with M&S Bank. See footnote * *

As well as the euro and US dollar , our range includes currencies such as the UAE dirham, Bulgarian lev , Turkish lira , Thai baht and Mexican peso .

Travel money sale now on!

Click & Collect sale on euro and US dollar available until 11 April 2023.

£150 minimum order. Exchange rates will still fluctuate daily during the sale period, but you’ll receive the best rate applicable on the date your order is placed. Rates shown when placing your order are sale rates. Offer subject to availability, buy back not included. Cancellation fee and full T&Cs apply.

SameDay Click & Collect

- Order between £150 and £2,500

- Euro and US dollars available to order and collect in over 450 stores *

- Order and collect euro , US dollars , Turkish lira , New Zealand dollar , Australian dollar , Thai baht , Canadian dollar , South African rand and UAE dirham, from our Bureau the same day

Find my nearest Click and Collect store

Click & Collect † See footnote †

- A wide range of currencies available to collect from our in store Bureaux See footnote * *

- Order and collect from the next day

Our best rates on euro and US dollar when you Click & Collect

To get an even better exchange rate on euro and US dollar , use our Click & Collect service. Pay now and lock in today's rate, then collect from a store at a time convenient for you.

CHANGE4CHANGE

If you would like to donate your unused foreign currency to charity we have Change4Change collection boxes in our Bureaux, with all the money we collect going to Breast Cancer Now. Since 2007, we have raised over £630,000 for the charity via your Change4Change donations.

Find a Bureau

Travel money buy-back service

When your holiday is over, we'll buy back your leftover holiday money at the buy-back rate on the day you return it to the Bureau de Change. That's all unused notes in any denomination we sell.

Find out more about M&S Travel Money Buy Back service

If you would like to donate your unused foreign currency to charity we have Change4Change collection boxes in our Bureau stores, with all the money we collect going to Breast Cancer Now. Since 2007, we have raised over £630,000 for the charity via your Change4Change donations.

Find a bureau

When your holiday is over, we'll buy back your leftover holiday money at the buy-back rate on the day you return it to the bureau de change. That's all unused notes in any denomination we sell. Proof of purchase may be required so please retain your receipt, just in case.

Up to 55 days' interest-free credit when purchasing with an M&S Credit Card See footnote ** **

Representative example: based on an assumed credit limit of £1,200, our 24.9% rate per annum (variable) for purchases gives a representative rate of 24.9% APR (variable). Credit is subject to status.

No cash advance fee when M&S Travel Money is purchased using an M&S Credit Card.

What you'll need to bring

To collect foreign currency you've purchased online, you will need:

- A valid UK photographic driving licence, passport or EU national identity card (Romanian & Greek National ID Cards are not accepted)

- Your card you used to place your order - both ID and payment card must have the same name

- Your order number (this can be found on your confirmation email)

To purchase foreign currency in one of our Bureaux, you will need:

- A valid UK photographic driving licence, passport or EU national identity card - both ID and payment card must have the same name

Find my nearest M&S Bureau de Change

Use the M&S Bank Bureau Finder to find your nearest M&S Bureau de Change and opening hours.

Find a Bureau de Change

Manage your existing travel insurance policy

Want to renew, change or cancel your policy or need to make a claim?

Find out more - about managing your travel insurance policy

Planning a holiday abroad?

Travelling to Europe or beyond? Check out our handy guide to help make your trip perfect.

Need some winter sun?

Planning a winter sunshine break? Use our handy guide to help with your planning.

Ready to hit the slopes?

Thinking about a skiing holiday in Europe, North America or Asia? Use our guide to help you with your trip.

Planning to travel with cash?

Our guide explains how much money you can take abroad.

Learn more about the euro

How many countries use the euro? When was the euro first introduced? Find out more.

Using your credit card abroad

Going on holiday? Get to grips with how you can use a credit card outside of the UK.

What is RFID blocking technology?

If you are concerned about having your passport or credit card skimmed whilst abroad learn more about RFID technology.

What influences exchange rates?

Discover what factors contribute to the exchange rates that you see today.

How to budget for long term travel

Going on a long-term trip? Read our guide on how to budget successfully to ensure you have the most memorable time possible.

Visiting a Christmas market?

Learn more about the many Christmas markets across Europe.

Frequently asked questions

Can i use a credit card to purchase travel money.

Yes, you can use a credit card to purchase travel money. However, please check with your card provider as they may apply fees or charges e.g. cash advance fees or other fees.

Our Bureaux accept the majority of UK issued major credit cards.

How much cash can I travel with?

You can learn more about taking cash in and out of Great Britain and declaring cash by visiting gov.uk .

Should I get foreign currency before I travel?

Buying your travel money before you travel can be an important part of pre-holiday preparation. You can use our Currency Converter to get the latest exchange rates across worldwide holiday destinations.

You can also check out our handy holiday checklist to help with planning ahead of your trip.

Where can I collect M&S Travel Money from?

You can collect M&S Travel Money from over 100 bureaux de change or from over 350 stores nationwide. You can find your nearest M&S Bureau de Change using our Bureau Finder .

Where can I get the best exchange rate?

Exchange rates change on a regular basis and vary depending on the currency you order. At M&S Bank, we offer our best rates for euro and US dollar via the Click & Collect service, where you can order your currency and collect from the next day in an M&S location local to you. If you order online before 4pm, you can collect the same day. For all other currencies, check our website for more information.

How much travel money can I order?

For orders placed via Click & Collect, there is a minimum £150 order and maximum of £2,500. For Bureau de Change walk-ups, there is no minimum order.

How do I confirm my Travel Money purchase using my M&S Credit Card?

There are three ways to verify your payments - you can use our M&S Banking App, a one-time passcode via text message or by using a card reader to verify your payment. Use our how-to videos or step-by-step guides to find out more.

Have a question about travel money or other travel products?

Ask our Virtual Assistant

Useful information

View exchange rates

Find out more about euro rates

Find out more about US dollar rates

Find out more about Australian dollar rates

Find out more about Canadian dollar rates

Find out more about New Zealand dollar rates

Find out about M&S Travel Insurance

Important documents

M&S Travel Money Terms and Conditions

M&S Travel Money Click & Collect Sale Terms and Conditions

You may require Adobe PDF reader to view these documents. Download Adobe Reader

* Subject to availability

** With the M&S Credit Card, you'll receive up to 55 days' interest-free credit when you pay your balance in full and on time each month.

† Next Day collection is subject to availability. Please confirm your collection date and location at the checkout.

Travel Money

- Clubcard Prices Clubcard Prices

Clubcard Prices are available for all currencies, just enter your Clubcard number on the next page. Full T&Cs below.

- Click & Collect Click & Collect

Collect for free from more than 350 Tesco stores with a Bureau de change.

- Home Delivery Home Delivery

Free delivery on orders worth £500 or more.

Exchange rates may vary during the day and will vary whether buying in store, online or via phone.

Select currency

Error: Please select if you have a Clubcard to continue

Do you have a Tesco Clubcard?

How much would you like?

Error: Please enter an amount between £75 and £2,500

Find a Store to get your Travel Money

With Click & Collect you can order your travel money online and pick it up from selected Tesco stores near you, or you can buy instantly from an in-store travel money bureau.

Enter a postcode or location

Search results

3 easy ways to purchase Travel Money

Click & collect.

- Order online and choose to collect from over 500 Tesco store locations Order online and choose to collect from over 500 Tesco store locations

- Pick a collection day that works for you Pick a collection day that works for you

- Order euro or US Dollars Order Euros or US Dollars before 2pm and you can pick-up from most stores the next day

About Click & Collect

Home delivery

- Order online by 2pm Mon-Thurs for next day delivery (excludes bank and public holidays), to most parts of the UK Order online by 2pm Mon-Thurs for next day delivery (excludes bank and public holidays), to most parts of the UK

- Free delivery for orders of £500 or more Free delivery for orders of £500 or more

- Secure delivery via Royal Mail Special Delivery Secure delivery via Royal Mail Special Delivery

About Home Delivery

Buy in-store

- Buy your foreign currency instantly in our travel money bureaux in selected Tesco stores across the UK Buy your foreign currency instantly in our travel money bureaux in selected Tesco stores across the UK

- Turn unspent travel money back into Pounds with our Buy Back service Turn unspent travel money back into Pounds with our Buy Back service

About Buy Back

Best Travel Money Provider 2023/24

Now in it’s 26th year and voted for by the public, the Personal Finance Awards celebrate the best business and products in the UK personal finance market. We’re delighted that you voted us as Best Travel Money Provider 2023/24.

Additional Information

Ordering and collection.

You can pick a collection date when you're ordering your money. Order before 2pm and you can pick up Euros and US Dollars from most Tesco Travel Money bureaux the next day. Other currencies can take up to five days. Alternatively, you can order any currency for next weekday delivery to most of the selected customer service desks.

Please make sure you collect your money within four days of your chosen date. If you don't, your order will be returned and your purchase will be refunded, minus a £10 administration charge.

Will I be charged if I cancel my order?

Collection fees

Click and collect from stores with a Bureaux de change:

- Free for all orders

For non-bureaux stores with a click and collect function:

- £2.50 for orders of £100.00 - £499.99

- Free for orders of £500 or more

What to bring

For security, travel money will need to be picked up by the person who placed the order.

- a valid photo ID – either a passport, EU ID card, or full UK driving license (we do not accept provisional driving licenses)

- your order reference number

- the card you used to place the order (you’ll also need to know the card’s PIN)

Home Delivery

We can send your travel money directly to you via secure Royal Mail Special Delivery. You can even pick the delivery date that suits you best.

We also offer next-day home delivery on all currencies to most parts of the UK if ordered before 2pm Monday-Thursday.

Check the Royal Mail site to find out if your postcode is eligible for next day delivery

Delivery costs

£4.99 for orders of £100 - £499.99 Free for orders of £500 or more

- You’ll need to make sure there’s someone at home to sign for your delivery.

- Bank holidays and public holidays will affect delivery times.

- We are unable to cancel or amend home delivery orders after they have been placed.

Clubcard Prices

Clubcard Prices are available on the sell rate only for currencies in stock online, on your date of purchase. The Clubcard Price will be better than the standard rate advertised online on the date of purchase. When purchasing online you must enter a valid Clubcard number to obtain the Clubcard Price rate. Exchange rates may vary whether buying in store, online or by phone.

Clubcard Prices apply to foreign currency notes in stock on your date of online purchase. Due to constant market and currency fluctuations, rates on the date of purchase cannot be compared to another day’s rates. The actual rate you receive may vary depending on market fluctuations. Clubcard data is captured by Travelex on behalf of Tesco Bank.

Check out the Tesco Bank privacy policy to find out more.

Buying foreign currency using a credit or debit card

No matter how you purchase your travel money, whether it be in store, online or over the phone, you will not be charged any card handling fee by us. However, regardless of your card type, your card provider may apply fees, e.g. cash advance fees or other fees, so please check with them before you purchase your travel money.

Click & Collect cancellations

You can cancel a Click & Collect order any time prior to collection. We'll refund you with the full Sterling amount that you paid for your order, unless you cancel less than 24 hours before your collection date, in which case we'll charge a £10 late cancellation fee.

We are unable to refund any fees charged by your card issuer, so please contact them if you have any further queries.

When you get home, we'll buy your travel money back

Let us turn your unspent holiday money into Pounds. It couldn't be simpler.

Just pop into one of our in-store Travel Money Bureaux when you get home. We buy back all the currencies we sell in most banknote values and also the Multi-currency Cash Passport™. Buy back rates may vary during the day.

It doesn't matter where you bought your travel money, even if it wasn't from a Tesco Travel Money Bureau, we'll still buy it back.

More about currency buy back

How our Price Match works

If you find a better exchange rate advertised by another provider within three miles of your chosen Tesco Travel Money Bureau, on the same day, we'll match it.

Price Match only applies in store on a like-for-like basis on sell transactions and does not apply to any exchange rate advertised online or by phone. This is not available in conjunction with any other offer. We reserve the right to verify the rate you have found and the three mile distance (using an appropriate route planning tool).

See full terms and conditions below.

Tesco Travel Money is provided by Travelex

Tesco Travel Money ordered in store is provided by Travelex Agency Services Limited. Registered No. 04621879. Tesco Travel Money ordered online or by telephone is provided by Travelex Currency Services Limited. Registered No. 03797356. Registered Office for both companies: Worldwide House, Thorpewood, Peterborough, PE3 6SB.

Multi-currency Cash Passport is issued by PrePay Technologies Limited pursuant to license by Mastercard® International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

How much travel money will I need?

Whether it’s a burger in Brisbane or a taxi in Toronto, get a feel for how far your travel money might go with our foreign currency guides. We’ll help you manage your travel budget like a pro.

Currency Experts

G - TMOZ - C&D Pizza Blog - Desktop Banner CTA (1).png

Why Travel Money

YOUR MONEY YOUR WAY

Travel money, hays travel foreign exchange, 4 great ways to buy your holiday money, click & collect.

Great rates & currency expertise come as standard with our Click & collect service & with no minimum spend, your holiday money is just a few clicks away.

This brings the total quotes to £000.00

£000.00 for currency

£000.00 for Buy Back Guarantee

Guarantee Peace of mind when buying your currency from Hays Travel

Save money on your unused currency with our Buyback Guarantee^

Return your unused currency for the same rate as you purchased it.

Available on all currencies sold in cash.

Available on multiple currency transactions

Available Instore & online

Terms & Conditions

Exchange Rates

Always great value and no minimum spend*

- Euro 1.1494

- US Dollar 1.22

- Australian Dollar 1.8701

- Bulgarian Lev 2.1556

- Canadian Dollar 1.6609

- Czech Koruna 27.4513

- Danish Krone 8.3282

- Hungarian Forint 437.1689

- Icelandic Krona 162.1638

- Indonesia Rupiah 18399.0841

- Mexican Peso 19.5332

- New Zealand Dollar 2.025

- Norwegian Krone 13.0256

- Polish Zloty 4.7622

- South African Rand 22.7671

- Sweden Krona 13.0039

- Swiss Franc 1.097

- Turkish Lira 37.0099

- Thai Baht 42.6324

- United Arab Emirates Dirham 4.2571

Travel Money Card

- Use anywhere Mastercard® prepaid is accepted worldwide.

- Carry less cash.

- Top up in 15 currencies including Euro, US Dollar, Australian Dollars and UAE Dirhams.

- Phone support available worldwide 24/7.

- Manage on the go via Hays Travel Currency Card App.

Connect to your google pay wallet

You can now link your Hays Travel Mastercard with Google Pay for swift and secure transactions wherever you go. Say goodbye to carrying physical cards and hello to effortless payments with just a tap of your phone. Simplify your travel experience today!

BUY YOUR HAYS TRAVEL MASTERCARD

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

It is free to use in millions of locations worldwide where Mastercard Prepaid is accepted: including restaurants, bars, and shops when you spend in a currency loaded on the card.

This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals wherever you see the Mastercard Acceptance Mark, and also 24/7 phone support.

Take your money card with you on every holiday, simply top up and go!

- BUY IN BRANCH

WHY CHOOSE HAYS TRAVEL?

For your next departure, buy your holiday money from Hays Travel. Always commission free currency with competitive online and high street exchange rates.

- Wide selection of currencies available

- Hundreds of nationwide Hays Travel branches offering on-demand Foreign Exchange; buy from branch to receive high quality customer service from the travel experts or order online for convenient home delivery

- 0% commission when we buy and sell foreign currency

Home Delivery

Ordering currency from the comfort of you own home has never been easier, with our great rates & over 60 currencies to choose from as well as next day delivery why not chose your currency to be delivered to your doorstep?

Holiday Money to your door

Order before 3pm for next working day home delivery via Royal Mail Special Delivery. *Customer must be home to sign for delivery. Over 60 currencies to select from. Free delivery on all orders £500 and over Convenient Saturday delivery available for no extra charge Minimum order value of £200 up to a maximum of £2500 Peace of mind, your local Hays Travel branch will buy back any leftover currency purchased through Hays Home Delivery commission free

Call Into a Branch

With over 400 branches to choose from arranging your holiday money has never been more convenient – Why not call into branch today where one of our experienced & Friendly Foreign Exchange Consultants will be on hand with our great rates, expert advice & fantastic service.

Bank on our branches for your Holiday Money

Over 400 branches Nationwide - Use our branch locator to find your nearest Hays Travel branch.

A wide selection of currencies & Hays Travel Money Cards available Instantly in-store

Competitive high street rates and always commission free

Exotic Currency Ordering service – Over 70 currencies available to order

Buyback Guarantee – Save money on your leftover Currency.

All major currencies Bought Back Commission Free

Experienced & Friendly Staff instore

- FIND YOUR NEAREST BRANCH

Buy Currency

Top up card.

Enter the currency you need, or if you don't know what currency you need for your trip, simply enter the country that you're travelling to

Rate last updated Thursday, 18 April 2024 02:33:01 BST

[fromExchangeAmount] [fromCurrencyCode] British Pound

[toExchangeAmount] [toCurrencyCode] [toCurrencyName]

You can choose to receive cash via home delivery or pick up from store.

Enter the card number of the prepaid card you would like to top up

Card validated

Select the currency you would like to load or top up to your card

Enter how much you'd like to load or top up, either in Pounds Sterling, or in the foreign currency amount for the currency you have selected

How do we compare? Every day we check the exchange rates of major banks and high street retailers and adjust our rates accordingly to ensure that we give you a highly competitive overall price on your foreign currency.

- [name] [amount]

You can now add your Travelex Money Card, powered by Mastercard ® to the Apple Wallet

Get started in a few easy steps

- Travel Money Card

Secure spending abroad made easy.

- Safe and secure

- Choice of 22 currencies

- Seamless spending with Apple Pay and Google Pay

- Manage your travel money effortlessly via the Travelex Money App

- In case your card is lost, stolen, or damaged, our 24/7 global assistance team is here for you

Buy foreign currency

Order the currency you need online for our best rates. Pick up in store (including airports) or get it delivered to your home.

- Store Finder

Locate your nearest UK Travelex store. Order your currency online and collect in-store.

Join our Mailing List

Be the first to know about exclusive sales, competitions, product news and more.

Find your foreign currency now

Whether you're going to Australia or Thailand, we've got you covered. With a choice of over 40 currencies and our Travelex Money Card, we make it easy for you to get your travel money. Have it delivered straight to your door next day or pick it up from any of our UK stores at major airports, ports and retail locations.

How it Works

Choose from 40+ currencies

Select to have your currency delivered to your home or collect at one of our stores across the UK

Relax knowing that your travel money has been taken care of by the world's leading foreign exchange specialist

The Travel Hub: Tips & Guides

Discover top tips, indulgent guides and no end of travel inspiration at The Travel Hub! From the hottest destinations to last minute travel and family fun, here's to making your next trip the best one yet.

Quick Links

- Exchange Rates

- Bureau de Change

- Max Your Foreign Currency

- Compare Your Travel Money

- Travellers Cheques

- Precious Metals

About Travelex

- Download Our App

Useful Information

- Help & FAQs

- Privacy Centre

- Terms & Conditions

- Travelex Money Card Terms & Conditions

- Statement of Compliance

- Website Terms of Use

- Safety & Security

- Modern Slavery Statement

Customer Support

Travelex foreign coin services limited.

Worldwide House Thorpe Wood Peterborough PE3 6SB

Reg Number: 02884875

Your safety is our priority. Click here for our latest Customer update

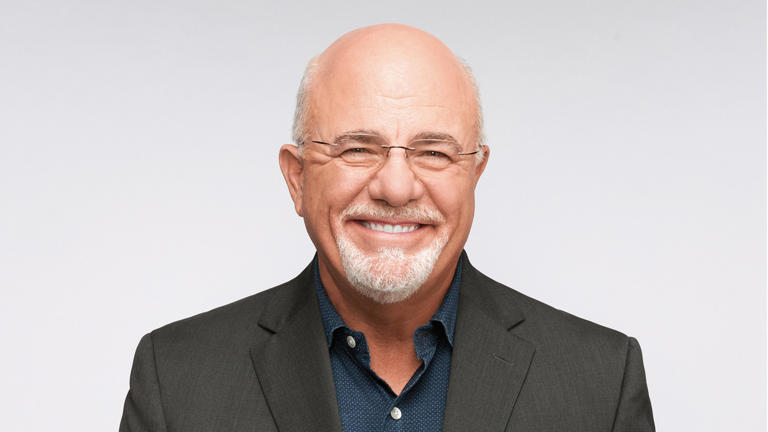

Dave Ramsey’s Tips for Saving Money on Travel

F or those with money to spend and the time to spend it, the sky’s the limit . However, for most Americans, money is tight and time is valuable . Vacationing is a luxury — if you can afford it, you can’t afford to overspend on it.

Find: 6 Vacation Splurges You’ll Almost Always Regret

See Our List: 100 Most Influential Money Experts

According to a recent Forbes consumer survey, an overwhelming 87% of respondents plan on travelling as much in 2023 as they did in 2022, and 49% expect to travel more. But as financial expert Dave Ramsey stated, you can’t let a vacation mindset derail your money goals.

Of course, Ramsey would prefer you to skip the vacation altogether if you are honestly trying to save money. “When your goal is to save money now, a vacation is the worst thing you could spend your money on,” he said, per The Motley Fool.

Discretionary expenses like travel take away from money you could be investing and, according to his Ramsey Solutions site, travelers tend to be carefree with their spending while on vacation, wasting an inordinate amount of money on silly purchases while away.

Take Our Poll: What Kind of Money Advice Would You Most Trust From a Celebrity Expert Such as Warren Buffett, Mark Cuban or Suze Orman?

However, many modern pundits suggest that spending money on experiences makes people happier than buying possessions or assets. With that in mind, even a “saving and investment first” expert like Ramsey has some tips on saving money on travel. Here are five things to keep in mind if you want to save money while you’re on holiday, per Ramsey’s site .

1. Stop Eating Out for Every Meal and Cut Out Expensive Snacks

As the restaurant industry may never return to its pre-pandemic state, eating out continues to be pricey. Going to restaurants is a major attraction for travelers and often the main attraction in world-famous foodie cities. While cooking on vacation runs antithetical to holiday fun, eating one meal per day where you are staying will help fight inflation’s significant impact on restaurants, from upscale eateries to less expensive truck stops or food chains.

Full meals are expensive, but at least they are usually planned and budgeted. Buying spur-of-the-moment snacks at amusement parks, sporting/entertainment events and popular tourist sites is done out of convenience and priced to trap vacationers looking to spend money. Skipping treats will save you plenty. Remember, every dollar you don’t spend at a restaurant or on a costly treat is a dollar you can spend elsewhere on your travels — or on saving for your next adventure.

2. Skip Flying to Drivable Destinations

The urge to fly away on vacation makes sense. You will maximize your time away by getting to your retreat quicker, and the mere fact that you’re flying makes the vacation rarer and more adventurous. However, don’t let your mind trick you into booking an airline ticket for a destination you can easily drive to.

According to Ramsey Solutions, “Filling up your gas tank a few times is cheaper than buying a lot of plane tickets. Then you’ll have more cash for the actual trip. Besides, some of the best bonding happens when you spend a few hours together on the road.”

3. Think Twice About Buying Pointless Souvenirs

It goes without saying that buying souvenirs is part and parcel of a fun holiday experience. However, traditional clothing that will never get worn, cheaply-made trinkets that will get thrown out upon arriving home, bulky items that are a pain to carry — these are things you should think twice about buying.

Leaving spare space in your suitcase for something usable and personal is a great idea, while spending for the sake of spending on vacation is a costly mistake. You should never deny what will make you happy, but you’ll return to a picture taken while away more frequently than an impulse buy cluttering up your house or apartment.

4. Don’t Stay Too Long or Do Too Much

Dragging out a vacation can eventually grate on your nerves and paying between $150 and $300 a night for too many days makes it hard to enjoy your time traveling. Citing psychologist Daniel Kahneman’s behavioral science work, Business Insider’s Chris Weller suggested that spending more on a longer vacation is probably not worth the expense. “You most likely aren’t ‘changing the story’ enough to create new memories about the experience,” he wrote. “Instead, it all eventually blends into one amorphous memory.”

Likewise, do you want your lasting memory of a trip away to be that of running yourself ragged just to prove you have been somewhere or done something? “I know the urge to see and do as much as possible is strong, especially when vacation days are limited, but it’s hard to enjoy each activity if you’re constantly in a rush,” said Marek Bron, a travel blogger at Indie Traveller . Bron suggests cutting your itinerary by a third. That way you give yourself more time to relax while traveling, decompress when you return and save money throughout.

5. Budget for Your Vacation and Check for Discounted Attractions

When traveling, it’s easy to fall into a vacation mindset and simply shell out for any expense without giving it a second thought.

Ramsey Solutions suggested that budgeting for your vacation, deciding when to travel, picking a destination and determining the cost of your trip before you leave will keep your spending in check — and will prevent clouding of your judgment when away. If your vacation involves paid events or local attractions, you should be scouting out ways to experience them by using discounts or coupons (or finding deals through visitor or tourist centers).

Keeping a bunch of travel tips in mind seems counterproductive to shifting into vacation mode, but enjoying your time away should be exciting and relaxing, not financially stressful.

More From GOBankingRates

- I'm a Real Estate Agent: Buy Real Estate in These 10 Cities To Be Rich in 10 Years

- See GOBankingRates' Top 100 Most Influential Money Experts and Get Advice

- 3 Things You Must Do When Your Savings Reach $50,000

- What's the Best Small Business in Your State? Vote For Your Favorite

This article originally appeared on GOBankingRates.com : Dave Ramsey’s Tips for Saving Money on Travel

Why Billionaires Are Buying Up Sports Teams

The economics of sports franchise ownership have exploded beyond imagination. The latest status symbol for owners: 80,000 seats and more toilets than you could dream of.

At the press conference introducing the Charlotte Hornets’ new owners last August, Gabe Plotkin and Rick Schnall strode onto the stage looking like gleeful Roy brothers in an alternate ending of Succession . Onlookers may have thought the investment titans had dunked on the GOAT—and perhaps they had. But in buying a majority stake in the team from Michael Jordan, they made the five-time MVP a vastly more valuable player, paying him $3 billion—an 11-fold return on the $275 million he paid in 2010.

If the public knew anything about these new owners, it was that Plotkin’s company lost nearly $7 billion in four days in 2021 during the GameStop short squeeze, an epic fail recounted in the movie Dumb Money (in which Seth Rogen plays Plotkin). Perhaps not coincidentally, Schnall did most of the speaking to the press and, amid a barrage of bromides, let slip an unwitting truth: “We can’t screw this up.”

While trying to acknowledge the pressure to deliver a winner, Schnall was also admitting an open secret among the billionaire class: If you have the resources to buy a sports team in a major league, particularly the NFL and NBA, you can’t fail.

It’s a gravity-defying proposition, in which you can win by losing. Under Jordan the Hornets suffered the longest playoff drought of any NBA team and barely won 40 percent of their games. In a football example, the Washington Commanders’ winning percentage since Daniel Snyder purchased the team in 1999 has been just as bad as the Hornets’, but that was only one in a bouquet of red flags. The team’s name was a racial epithet for decades. NFL and congressional inquiries found that its culture was rife with harassment, bullying, and intimidation, including, in many instances, by Snyder—who decamped to London under the cloud of a criminal fraud investigation. And still, selling a distressed property under duress, the man acknowledged as the worst owner in sports received the highest price in sports history, $6.1 billion.

Far from feeling fleeced, the buyers were ecstatic. And these emptors needed no caveats; Plotkin and Schnall had previously owned smaller shares in NBA teams, and Josh Harris, whose investment group purchased the Commanders, already owned the NBA’s Philadelphia 76ers and the New Jersey Devils in the NHL. They knew that since 2007 average valuations in the Big Four leagues (NBA, NFL, NHL, and MLB) have gone up between five and eight times, and no team in the modern era has ever folded. They knew that even as valuations have turned skyward, every sale in the past two years has exceeded the bullish appraisals. They also knew that the ranks of billionaires have nearly doubled in the last decade, so there would be no shortage of takers if they decide to sell. Team ownership requires not just great wealth but an incredible level of liquidity. “It’s not a leveraged buyout like we had in the ’80s. Debt limits in all the leagues are low,” says Michael Rapkoch, a capital advisor who founded Sports Value Consulting. “So the people buying teams have to put up mostly cash. Real money. Billions.”

So what does the ultra-high-net-worth individual who has everything buy himself? Not another superyacht but something genuinely unsinkable and grand enough to host 18,000 to 80,000 paying guests, plus millions more watching at home, eight or 41 or even 81 times a season. While financial advisors are obliged to tell clients that past performance is no guarantee of future results, that warning is like hearing “Watch your step” as you board your own Gulfstream G650. Soaring team values, investment security, and extreme scarcity make franchise ownership a magnet for magnates, the rare investment capable of making even dumb money look smart. “Over the last 10 years the frothiness of the market and the numbers are just mind-boggling,” says Kurt Badenhausen, the sports world’s preeminent valuations expert, who created industry-standard rankings at Forbes and now produces them for the business journal Sportico . “Bankers, investors, team owners—everybody’s blown away.” Rapkoch is one of the awestruck. “The market is expanding,” he says, “and we’re absolutely bullish on this industry.”

Longtime sports commentator Bob Costas has seen a confluence of forces fundamentally alter the proposition of team ownership. “The explosion in television revenues,” he says, “and other ways to monetize that investment—global marketing, the internet, streaming services, merchandising—none of those things existed 50 years ago. It’s an almost can’t-lose proposition.”

In 2021 Certuity, a boutique wealth management firm for ultra-high-net-worth people, opened an investment fund that gives its clients a small taste of sports team ownership. “We were looking for investments that were not as correlated or sensitive to moves in the economy, interest rates, or earnings,” says Dylan Kremer, Certuity’s chief investment officer. “Professional sports jumped to the top of the list.”

The other form of security that drives value, according to Rapkoch, is teams’ sheer ability to survive. “WeWork was worth, what, $49 billion? Now it’s gone. What happened to Kmart? AOL? The Washington Commanders will be here in 20 years. There’s no doubt about that.” Indeed, names may change, and franchises may relocate, but no Big Four team has folded in seven decades. And the leagues have crushed or consumed upstart rivals, leaving them high castles protected with, as Kremer calls it, “moats around the business.”

If You Build It

Times have changed since Jerry Jones scraped together everything he had to raise $90 million in cash for his $140 million purchase of the financially strapped Dallas Cowboys, now the world’s most valuable team at $9 billion. But as with that Cowboys purchase, in which the value of the stadium outstripped that of the team, the pendulum is swinging back toward real estate—only on an epic scale.

In November, a week after Mark Cuban announced he’d be leaving Shark Tank , the business titan shared the news of a deal that made the show’s other “shark” investors look like goldfish. He had reached an agreement to sell a majority share of the Dallas Mavericks to billionaire Miriam Adelson and the Dumont family, owners of the Las Vegas Sands Corporation, for $3.5 billion. Before founding Cost Plus Drugs, Cuban made his multibillion-dollar fortune selling Broadcast.com. Now he has netted an even more astronomical return: $3.2 billion on the $285 million he paid for the team in 2000. It’s telling what he held on to: oversight of all basketball decisions and his role as the public face of the team, on the sidelines haranguing the referees. And, most notably, a 27 percent stake.

Lost in the flashing dollar signs was the fact that Cuban was playing the long game, positioning himself for an even greater payday. “I still own 27 percent,” he said. “Twenty-seven percent of a watermelon is a whole lot better than 27 percent of a grape.” Cuban sees real estate as the fuel for growth potential: state-of-the-art arenas and stadiums in mixed-use developments that allow sports capitalists to rejuvenate entire neighborhoods while enriching themselves.

Sure, the Golden State Warriors’ winning four NBA championships from 2015 to 2022 helped the team’s value soar to more than $7.7 billion—the highest in the NBA—but it also helped pave the way for owner Joe Lacob to move the team across the bay from Oakland into the Chase Center, a building almost too luxe to host sporting events, with clean Scandinavian lines, an interior designed by Gensler, and a soaring lobby atrium described as “Saarinen-esque” by Architect magazine. The arena is the heart of a complex with more than 500,000 square feet of office space, another 100,000 for retail, and a public plaza with Seeing Spheres , an Instagrammable installation by Olafur Eliasson. Around it lies an 11-acre tract, owned by Lacob, where restaurants, a waterfront park, and vibrant foot traffic have replaced a gritty industrial yard.

That scale of development led Cuban, who has been vocal in his desire to construct a new arena for the Mavericks, to join forces with Adelson (net worth $36 billion) and Sands Corp., experts at developing resort casinos that function as self-contained city-states. “It’s a partnership,” he said. “They’re not basketball people. I’m not a real estate person.” The ultimate success of Cuban and Adelson’s shared vision depends on Texas legalizing gambling in the coming years. Still, knowing their combined resources and influence, Cuban speaks about it as if it’s a sure thing. “When we build a new arena, it will be in the middle of a resort and casino,” he said. “That’s the mission.”

It was only a matter of time before these modern-day Caesars, who have made a multibillion-dollar business out of bread and circuses, saw the profit-making potential of shiny new colosseums.

Changing the Rules

While people’s motivations for wanting to own a team may be new, the appeal is not. In 1921 industrialist William Wrigley Jr. used a fraction of his chewing gum fortune to buy the Chicago Cubs. Like a shiny hood ornament atop his family’s wealth-driving business, the team sold for $20.5 million 60 years later. (The Wrigleys’ corporation commanded $23 billion in cash in 2008.) In contrast, the Maras were a struggling immigrant family on New York’s Lower East Side until their $500 purchase of the New York Football Giants in 1925, which generated, first, financial security, and then an immense windfall: The team was valued at more than $7 billion in 2023. One Mara married into the NFL’s other royal family, the Rooneys, longtime owners of the Pittsburgh Steelers. Together the two houses have ascended to Hollywood fame (actors Kate and Rooney Mara) and the halls of power (the late Dan Rooney, Ambassador Extraordinary and Plenipotentiary to Ireland).

For those born into great privilege, the attitude was different, says Michael Gross, author of Flight of the WASP: The Rise, Fall, and Future of America’s Original Ruling Class . “You spent your wealth on a sports team,” the longtime chronicler of the moneyed class says. “You didn’t make wealth on a sports team.” Three decades after Gertrude Vanderbilt Whitney founded the Whitney Museum of Art to house her forward-thinking collection, her niece Joan Whitney Payson paid $1 million for a controlling interest in New York’s new National League baseball team. Leading a well-heeled group that included G. Herbert Walker Jr. (great-uncle of George W. Bush, who parlayed a minority stake in the Texas Rangers into a political career), Payson became the first woman to own a major American sports team (that wasn’t inherited). A baseball obsessive, she was hands-on from the start. After holding a naming party at her Italianate Upper East Side mansion, Payson announced the name—“Meet the Mets”—at the Savoy-Hilton Hotel, breaking a bottle of champagne on a baseball bat, as if christening a yacht.

Over the years, some men of means were drawn to sports teams to break not the bank but social barriers. Obsessed with attaining British citizenship and entering the upper echelons of UK society, Mohamed Al-Fayed purchased the London-based soccer team Fulham for $9 million in 1997, months before his son Dodi and Princess Diana were killed in a car accident. Fayed entertained the likes of Michael Jackson at matches and took the team up to the Premier League, but he gained neither citizenship nor acceptance. Nevertheless, Fulham’s value soared; when he sold it in 2013, Fayed reportedly fetched more than $225 million.

Russian oligarch Roman Abramovich took a similar shot on goal, hoping to rehabilitate his reputation as Vladimir Putin’s closest ally when he relocated to London and bought the storied Chelsea Football Club for $224 million in 2003. It proved effective enough, as he invested some $2 billion to improve the team, winning 18 trophies for the team and the affection of its fans. His old friend’s invasion of Ukraine put an end to all that. In May 2022, after the British government froze his assets, Abramovich bid farewell to Chelsea for $3.1 billion. At the time it was the highest price ever paid for a sports team—though he wasn’t allowed to pocket the profits.

Owning a pro sports team seemed like just the thing to raise the standing of six-foot-eight Mikhail Prokhorov from merely brash billionaire playboy. However, in the middle of purchasing the NBA’s New Jersey Nets in 2010 for $200 million (plus an additional $180 million in debt, and with a plan to move the team to Brooklyn), the Russian industrialist went on 60 Minutes to show off some of his other playthings: a Kalashnikov rifle, a model of his 200-foot superyacht (the actual vessel, he explained, made him seasick), and the 20 women waiting for him in his private VIP section of a Russian club. The NBA’s commissioner at the time, David Stern, gave a telling response when asked if his league’s newest owner was an individual with integrity, saying, “I think he’s a man who has passed a very tight security check.”

Eventually, saddled by sanctions and reportedly pressured by Putin to sell, Prokhorov unloaded his no longer shiny toy to Joe Tsai, co-founder of the tech giant Alibaba, for $2.35 billion (plus $1 billion for the Barclays Center arena) in 2019. At the time, that was the most ever paid for an American sports team, topping the previous mark of $2.2 billion set in 2017 by Tilman Fertitta’s acquisition of the Houston Rockets and equaled a year later when David Tepper purchased the NFL’s Carolina Panthers.

The Limit Does Not Exist

While those prices might look pedestrian in light of the recent skyrocketing valuations, those record sales helped change the perception of sports teams from places to park one’s fortune into a fast-accelerating driver of wealth.

In the intervening years league-wide media deals have also become more lucrative, as sports have proved to be the last must-see live events on TV and streaming services. “But not all leagues are equal,” says Certuity’s Kremer. While the NHL is making waves internationally, and valuations of Major League Soccer and women’s sports teams are climbing fast, the Big Four sports leagues are increasingly the Big Two. The most valuable teams are in the NFL for a reason: Badenhausen’s research found that in 2022 every team in the NFL made more money than the world’s most profitable soccer team, Manchester City. And the NBA has the highest ceiling. Whereas soccer is already popular in every corner of the world, the NBA’s business is surging globally, as interest in basketball has exploded in China, India, and sub-Saharan Africa.

As a result, NFL and NBA teams are now like Fabergé eggs encased in pigskin or orange leather, only rarer, with the megarich trampling one another to get their hands on one. Fabergé produced 69 eggs; the NFL and NBA have 62 teams combined. If the NBA eventually adds two expansion franchises, as expected, it is sure to spark another stampede of bidders—and the current owners will rake in their share of the spoils. Although there have been four sales of NFL teams in the last 11 years, on average the league’s owners hold on to their teams for 40 years. These golden tickets come around once in a lifetime.

Some use them more wisely than others. Real estate developer Stan Kroenke and his wife Ann Walton Kroenke (of the Walmart Waltons) have quietly assembled a ne plus ultra sports portfolio that includes English Premier League team Arsenal and not one but two crown jewels: the reigning NBA champion Denver Nuggets and the 2022 NFL champion L.A. Rams. Stan Kroenke has taken the Rams from Los Angeles to St. Louis and back to L.A., where they won Super Bowl LVI in their new home, SoFi Stadium. The state-of-the-art venue has open sides and a translucent roof adorned with 26,000 LED panels, making it a 22-acre billboard for planes approaching nearby LAX. The stadium holds 70,000 fans (it expands to 100,000 for some events), who can watch the game on a 70,000-square-foot display dubbed the Infinity Screen. The building has won awards and been tapped for such highly profitable events as the 2026 soccer World Cup and the opening ceremony of the 2028 summer Olympics.

Increasingly, these new stadiums and arenas resemble cathedrals of contemporary capitalism, with giant megapixel screens in place of stained glass and plush seats instead of pews. New York Knicks owner James Dolan, seeking something that would trump his own Madison Square Garden, turned westward to Las Vegas and built the Sphere (see page 39).