What Does Spirit Travel Insurance Cover? A Complete Guide

Booking a trip with Spirit Airlines? Getting travel insurance can protect you against financial losses if something unexpected happens before or during your travels. But what exactly does Spirit’s offered travel insurance through TravelGuard cover? This comprehensive guide will explain all the key benefits and coverage details.

Overview of Spirit Travel Insurance

Spirit Airlines provides travelers the option to purchase travel insurance through TravelGuard when booking on their website. There are two main plans offered:

Travel Guard Basic Policy: This is a more affordable plan that provides basic trip cancellation/interruption coverage plus some extras.

Travel Guard Deluxe Policy: The deluxe plan is more comprehensive with additional benefits like emergency medical coverage, baggage delay, and more.

Both policies are underwritten by National Union Fire Insurance Company of Pittsburgh. You can get a quote for the exact rate during booking based on your trip details like destination, length of travel, and age of travelers.

What Does the Basic Spirit Travel Insurance Plan Include?

Here are the key benefits and coverage included in the Travel Guard basic policy offered by Spirit Airlines:

Trip Cancellation: Get reimbursed for 100% of your insured prepaid, non-refundable trip expenses if you need to cancel for a covered reason such as illness, injury, or death of you, a traveling companion or family member.

Trip Interruption: Get reimbursed for 100% of covered costs if you need to cut a trip short for a covered reason. Also includes reimbursement for additional transportation costs to return home.

Travel Delay: Provides benefit of $200 per person ($600 max) if your common carrier transportation is delayed for 5+ hours for a covered reason.

Missed Connection: Get reimbursed for unused, non-refundable expenses as well as additional transportation to join your trip if you miss a connection due to a delay of 3+ hours for a covered reason.

Baggage Delay: Receive $100 per day ($300 max) to cover purchase of essential items if your baggage is delayed by a common carrier for 12+ hours.

24 Hour AD&D: Pays $10,000 for accidental death and dismemberment that occurs during your trip.

Key Exclusions: Pre-existing medical conditions, mental/nervous disorders, pregnancy, and extreme/hazardous sports are excluded.

What’s Included in the Deluxe Travel Insurance Plan?

In addition to all of the basic plan benefits above, here are the key additions covered by the Travel Guard deluxe policy:

Emergency Medical/Dental: Covers emergency medical treatment if you become sick or injured on your trip. Pays up to $25,000. Dental care for relief of sudden pain is covered up to $500.

Emergency Medical Evacuation: Provides coverage up to $100,000 if you need to be transported to the nearest adequate medical facility for treatment during your trip.

Baggage & Personal Effects: Reimburses you up to $500 if your luggage or personal effects are lost, damaged or stolen during your trip.

Baggage Delay Increased Benefit: Baggage delay coverage increased to up to $200 per day ($600 max).

Accident Sickness Medical Expense: Provides an additional $25,000 coverage for medical treatment of an injury or illness that occurs during your trip.

Travel Medical Assistance: Gives you access to 24/7 travel medical assistance services during your travels.

Pre-Existing Condition Exclusion Waiver: For an extra cost, this waiver can be added to cover cancellation/interruption/medical claims related to pre-existing medical conditions.

What’s Not Covered by Spirit Travel Insurance?

As with any travel insurance policy, there are exclusions. Some key things that are not covered include:

- Pre-existing medical conditions (unless waiver is purchased)

- Mental health disorders, pregnancy, and childbirth

- High risk/extreme sports like skydiving, hang-gliding, rock climbing, etc.

- Self-inflicted injuries or suicide

- Drug/alcohol related injuries or illnesses

- Anything illegal or criminal acts

- War, civil disorder, unrest

- Care provided by a family member

- Normal pregnancy or childbirth

It’s important to understand exclusions before buying a policy. Also note that Spirit’s offered plans do not include coverage like:

- Cancel for any reason

- Rental car damage

- Trip cancellation due to work reasons or obligations

When Should I Buy Spirit Travel Insurance?

Spirit recommends purchasing travel insurance at the time of your initial trip booking for maximum coverage. However, you can add it up until the final payment due date for your reservation to still get cancellation/interruption protections.

Just keep in mind that pre-existing conditions that arise after the policy is purchased will not be covered. Buying earlier ensures you’re covered for any issues that may come up leading up to your travels.

Does Spirit Travel Insurance Cover COVID?

Unfortunately, Spirit’s offered travel insurance plans do not cover claims related to COVID-19 or other pandemics .

Cancellations due to you or a family member testing positive for COVID would not be covered. However, if you need to cancel for another covered reason defined in the policy like an injury or illness unrelated to COVID, you’d still be covered.

Interruption claims due to an unexpected positive COVID test during travel would also not be covered.

What Does Travel Insurance Cost on Spirit Airlines?

Travel insurance rates when booking with Spirit will vary based on the cost of your trip, length of travel, ages of travelers, and specific plan selected. The deluxe plan costs more than the basic plan.

Here are some sample rates for a $500 roundtrip flight from Los Angeles to Las Vegas for 2 adults ages 30-34:

- Basic Plan: $28

- Deluxe Plan: $52

For a 10-day $3,000 trip to Europe for a 50 year old:

- Basic Plan: $144

- Deluxe Plan: $252

The best way to see actual pricing is to get a free personalized quote during the online booking process. Rates are presented before you complete a purchase.

Do I Get Travel Insurance from Spirit Airlines?

Spirit Airlines only offers TravelGuard insurance plans during the booking process online. Travel insurance is optional – you are not required to purchase it.

Some key factors to consider:

- Review what is and isn’t covered and exclusions.

- Evaluate the total trip cost and how much potential financial risk you want to take on.

- Consider your personal health and family medical history.

- Determine if you have coverage from other sources like credit cards, existing insurance plans, etc.

For expensive or international trips, travel insurance can provide valuable financial protections. But for domestic economy flights, the extra expense may not be worth it depending on your situation. Assess your specific needs.

Can I Buy Travel Insurance Separately?

Yes, you can certainly buy travel insurance for your Spirit flight or vacation from a source other than Spirit Airlines directly. Some options include:

Directly through another insurer like TravelGuard, Allianz, Travelex, etc.

Using an online insurance comparison site like SquareMouth or InsureMyTrip to get quotes from multiple providers.

From a travel agent or third party booking site.

Shopping around is wise to compare plans and pricing. Just make sure to purchase shortly after booking to get maximum pre-departure benefits.

Key Tips for Spirit Travel Insurance

Read the full policy document to understand coverage details and exclusions.

Consider travel medical coverage for international trips or if you have health concerns.

Look into “cancel for any reason” upgrade if you want the most flexibility.

Compare Spirit’s plans to other insurer rates for potential savings.

Purchase insurance right after booking your flight and hotel for optimal coverage.

Understand COVID-19 is not covered before buying a policy.

Getting travel insurance for Spirit Airlines reservations can provide valuable financial protection. Just make sure to evaluate your specific needs and compare all available options before purchasing a plan.

Do Not Buy Spirit Travel Insurance – AARDY

Does Spirit insurance cover cancellation?

What is usually covered by travel insurance?

What does insurance cover on a plane ticket?

What insurance does Spirit Airlines use?

Related posts:

- Are Retaining Walls Covered by Homeowners Insurance?

- How to Cancel National General Insurance

- Understanding Travelers Insurance Company’s NAIC Number

- Driving Without Insurance in Florida: Penalties, Risks, and What to Do

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Winter is here! Check out the winter wonderlands at these 5 amazing winter destinations in Montana

- Plan Your Trip

- Safety & Insurance

What Does Spirit Airlines Travel Insurance Cover

Published: December 18, 2023

Modified: December 28, 2023

by Blanch Ferrante

Introduction

Welcome to the world of travel insurance with Spirit Airlines! As you prepare for your next adventure, it’s essential to consider the potential unforeseen circumstances that could impact your trip. Spirit Airlines offers travel insurance to provide you with peace of mind and financial protection in case of unexpected events. Understanding the coverage offered by Spirit Airlines travel insurance can help you make informed decisions and ensure a smooth and worry-free travel experience.

Whether you’re embarking on a relaxing beach getaway, an adventurous hiking expedition, or a business trip, having travel insurance can safeguard you from various travel-related risks. From trip cancellations to baggage delays and medical emergencies, Spirit Airlines travel insurance is designed to mitigate the financial impact of these unforeseen events, allowing you to focus on enjoying your journey.

In this comprehensive guide, we will delve into the specifics of what Spirit Airlines travel insurance covers, empowering you to navigate the intricacies of travel protection with confidence. Let’s embark on a journey to explore the comprehensive coverage provided by Spirit Airlines travel insurance and discover how it can safeguard your travel experience.

What is Spirit Airlines Travel Insurance?

Spirit Airlines travel insurance is a valuable safeguard that provides coverage for a wide array of travel-related risks. When you purchase Spirit Airlines travel insurance, you are investing in protection against unforeseen events that could disrupt or impact your trip. This insurance is designed to offer financial reimbursement and assistance in various scenarios, ensuring that you can navigate unexpected challenges with greater ease and confidence.

By opting for Spirit Airlines travel insurance, you gain access to a range of benefits that can mitigate the financial repercussions of trip disruptions, medical emergencies, and other unforeseen incidents. Whether you encounter a flight cancellation, experience a medical emergency during your trip, or face luggage-related issues, having travel insurance can be invaluable in alleviating the associated financial burdens.

Spirit Airlines travel insurance is tailored to address the diverse needs of travelers, providing peace of mind and support throughout your journey. From trip cancellations and baggage delays to medical emergencies and travel inconveniences, this insurance serves as a safety net, offering reassurance and practical assistance when you need it most.

When you purchase Spirit Airlines travel insurance, you are making a proactive decision to protect your travel investment and well-being. With its comprehensive coverage and commitment to addressing travelers’ needs, Spirit Airlines travel insurance stands as a reliable resource for navigating the uncertainties of travel, allowing you to embark on your adventures with greater confidence and security.

Coverage for Trip Cancellation

One of the significant benefits of Spirit Airlines travel insurance is its coverage for trip cancellation. In the event that you need to cancel your trip due to unforeseen circumstances, such as illness, injury, or a family emergency, this insurance provides financial protection. If your trip is canceled for a covered reason, you may be eligible for reimbursement of non-refundable trip expenses, including airfare, accommodations, and other prepaid travel arrangements.

When unexpected situations arise, forcing you to cancel your travel plans, having coverage for trip cancellation can alleviate the financial burden and allow you to recoup a significant portion of your pre-paid expenses. This aspect of Spirit Airlines travel insurance offers peace of mind, knowing that you have a safety net in place to address unforeseen events that could disrupt your trip.

It’s important to review the specific terms and conditions of trip cancellation coverage, as certain reasons for trip cancellation may be excluded or require documentation to support the claim. Understanding the scope of coverage for trip cancellation empowers you to make informed decisions and ensures that you are prepared to navigate unexpected circumstances with greater ease.

By including coverage for trip cancellation in its travel insurance offerings, Spirit Airlines demonstrates its commitment to supporting travelers in mitigating the financial impact of unforeseen events. This aspect of the insurance serves as a valuable resource, providing reassurance and financial protection in the face of unexpected trip disruptions.

Coverage for Trip Interruption

Spirit Airlines travel insurance encompasses coverage for trip interruption, offering valuable protection in the event that your trip is disrupted after departure. If you encounter unforeseen circumstances during your trip that necessitate cutting it short, such as a family emergency or a significant travel delay, this coverage can provide financial assistance and support.

In the event of a covered trip interruption, you may be eligible for reimbursement of additional transportation expenses incurred to return home or rejoin your trip, as well as reimbursement for the unused, non-refundable portion of your travel arrangements. This aspect of the insurance serves as a crucial safety net, mitigating the financial impact of unexpected trip interruptions and enabling you to navigate such situations with greater ease.

Understanding the specific terms and conditions of trip interruption coverage is essential, as certain circumstances may be excluded or require documentation to support the claim. By familiarizing yourself with the details of this coverage, you can make informed decisions and ensure that you are equipped to address unforeseen events that could necessitate trip interruption.

With its comprehensive coverage for trip interruption, Spirit Airlines travel insurance demonstrates its commitment to supporting travelers throughout the entirety of their journeys. This aspect of the insurance provides peace of mind, knowing that you have financial protection in place to address unexpected trip disruptions and facilitate a smoother travel experience.

Coverage for Baggage Delay

Spirit Airlines travel insurance includes coverage for baggage delay, offering valuable assistance in the event that your checked baggage is delayed by the airline. This coverage is designed to mitigate the inconvenience and financial impact of baggage delays, providing support to help you address immediate needs while waiting for your belongings to be returned.

If your checked baggage is delayed for a specified period upon your arrival at your travel destination, you may be eligible for reimbursement of expenses incurred to purchase essential items, such as clothing and toiletries. This aspect of the insurance serves as a practical resource, alleviating the inconvenience of baggage delays and enabling you to manage the situation with greater ease.

Understanding the specific terms and conditions of baggage delay coverage is essential, as there are typically limitations on the eligible expenses and the duration of the delay required to qualify for reimbursement. By familiarizing yourself with the details of this coverage, you can make informed decisions and ensure that you are prepared to address potential baggage delays during your travels.

With its inclusion of coverage for baggage delay, Spirit Airlines travel insurance demonstrates its commitment to providing comprehensive support for travelers facing unexpected inconveniences. This aspect of the insurance offers peace of mind, knowing that you have financial assistance available to help you manage the impact of baggage delays and continue your travels with greater convenience and comfort.

Coverage for Emergency Medical Expenses

Spirit Airlines travel insurance encompasses coverage for emergency medical expenses, offering essential protection in the event that you require medical treatment during your trip. This coverage is designed to provide financial assistance for necessary medical services, helping to alleviate the potential burden of unexpected healthcare costs while traveling.

In the event of a covered medical emergency during your trip, such as an illness or injury that requires medical attention, this insurance can offer reimbursement for eligible medical expenses. These expenses may include hospital stays, emergency room visits, physician services, prescription medications, and other essential medical treatments required to address the unforeseen health issue.

Understanding the specific terms and conditions of coverage for emergency medical expenses is crucial, as there may be limitations on pre-existing conditions, coverage exclusions, and requirements for medical documentation. By familiarizing yourself with the details of this coverage, you can make informed decisions and ensure that you are prepared to address potential medical emergencies during your travels.

With its comprehensive coverage for emergency medical expenses, Spirit Airlines travel insurance demonstrates its commitment to supporting travelers’ well-being and providing peace of mind in the face of unforeseen health challenges. This aspect of the insurance offers valuable reassurance, knowing that you have financial protection in place to address unexpected medical needs while traveling.

Coverage for Emergency Medical Evacuation

Spirit Airlines travel insurance includes coverage for emergency medical evacuation, providing essential support in the event that you require emergency transportation to a medical facility or repatriation to your home country due to a serious medical condition or injury during your trip. This coverage is designed to offer financial assistance and logistical support in critical situations, ensuring that you can access necessary medical care and transportation services when faced with a medical emergency away from home.

In the event of a covered medical emergency that necessitates evacuation or repatriation, this insurance can facilitate and cover the expenses associated with arranging and coordinating the transportation, including air ambulance services, medically equipped flights, and ground transportation to medical facilities. Additionally, the coverage may extend to include expenses related to repatriation of mortal remains in the unfortunate event of a fatality.

Understanding the specific terms and conditions of coverage for emergency medical evacuation is crucial, as there may be limitations on the covered reasons for evacuation, coordination procedures, and requirements for medical certification. By familiarizing yourself with the details of this coverage, you can make informed decisions and ensure that you are prepared to address potential medical emergencies that require evacuation or repatriation.

With its inclusion of coverage for emergency medical evacuation, Spirit Airlines travel insurance demonstrates its commitment to providing comprehensive support for travelers facing critical medical situations while away from home. This aspect of the insurance offers valuable reassurance, knowing that you have financial and logistical assistance available to facilitate emergency medical transportation and ensure access to appropriate medical care during your travels.

Coverage for Travel Delay

Spirit Airlines travel insurance includes coverage for travel delay, offering valuable support in the event that your trip is delayed due to unforeseen circumstances, such as inclement weather, airline mechanical issues, or other unexpected events. This coverage is designed to mitigate the inconvenience and financial impact of prolonged travel delays, providing assistance to help you manage the situation and resume your journey with greater ease.

If your trip is delayed for a specified period due to a covered reason, you may be eligible for reimbursement of additional expenses incurred during the delay, such as meals, accommodations, and transportation. This aspect of the insurance serves as a practical resource, alleviating the inconvenience of extended travel delays and enabling you to navigate the situation with greater comfort and financial support.

Understanding the specific terms and conditions of coverage for travel delay is essential, as there are typically limitations on the covered reasons for delays, the duration of the delay required to qualify for reimbursement, and the eligible expenses. By familiarizing yourself with the details of this coverage, you can make informed decisions and ensure that you are prepared to address potential travel delays during your journeys.

With its comprehensive coverage for travel delay, Spirit Airlines travel insurance demonstrates its commitment to providing support for travelers facing unexpected disruptions to their travel itineraries. This aspect of the insurance offers peace of mind, knowing that you have financial assistance available to help you manage prolonged travel delays and continue your journeys with greater convenience and comfort.

Coverage for Accidental Death and Dismemberment

Spirit Airlines travel insurance includes coverage for accidental death and dismemberment, providing essential protection in the event of a tragic accident during your trip. This coverage is designed to offer financial assistance and support to you or your beneficiaries in the event of an unforeseen accident resulting in loss of life, limb, sight, speech, or hearing.

In the unfortunate event of an accidental death or dismemberment during your trip, this insurance can provide a benefit payment to the designated beneficiaries or the affected individual, offering financial support to help address the associated challenges and expenses. The coverage may extend to include benefits for loss of life, limb, sight, speech, or hearing due to covered accidents that occur while traveling.

Understanding the specific terms and conditions of coverage for accidental death and dismemberment is crucial, as there may be limitations on the covered scenarios, benefit amounts, and eligibility criteria. By familiarizing yourself with the details of this coverage, you can make informed decisions and ensure that you are prepared to address potential unforeseen accidents during your travels.

With its inclusion of coverage for accidental death and dismemberment, Spirit Airlines travel insurance demonstrates its commitment to providing comprehensive protection for travelers, addressing the potential financial impact of tragic accidents during trips. This aspect of the insurance offers valuable reassurance, knowing that you or your loved ones have financial support available in the event of an unforeseen and tragic accident while traveling.

As you embark on your travel adventures with Spirit Airlines, understanding the comprehensive coverage provided by Spirit Airlines travel insurance is crucial for ensuring a smooth and secure journey. From trip cancellations and baggage delays to medical emergencies and unforeseen accidents, the insurance offers a safety net to mitigate the financial impact of unexpected events, providing valuable support and peace of mind throughout your travels.

By familiarizing yourself with the specific details of each coverage, including trip cancellation, trip interruption, baggage delay, emergency medical expenses, emergency medical evacuation, travel delay, and accidental death and dismemberment, you can make informed decisions and prepare for potential challenges that may arise during your trip. This proactive approach empowers you to navigate unforeseen circumstances with confidence, knowing that you have the necessary financial protection and assistance at your disposal.

As you plan your travels, consider the potential risks and uncertainties that could impact your trip, and evaluate how Spirit Airlines travel insurance can serve as a valuable resource in addressing these challenges. Whether you’re embarking on a leisurely vacation, a business trip, or a family getaway, having travel insurance can provide peace of mind and support, allowing you to focus on creating lasting memories and enjoying your travel experiences to the fullest.

Ultimately, Spirit Airlines travel insurance stands as a reliable companion for travelers, offering comprehensive coverage and dedicated support to address a wide range of unforeseen events. By prioritizing your well-being and financial security, Spirit Airlines travel insurance enhances the overall travel experience, ensuring that you can navigate potential challenges with greater ease and confidence, allowing you to make the most of your journeys with peace of mind.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

Travel Erudition

Is spirit travel insurance worth it?

Before you purchase any travel insurance, it’s important to understand what it covers and doesn’t cover. Travel insurance can help protect you from financial losses due to cancelled plans, lost baggage, or medical emergencies. However, travel insurance does not cover everything. For example, it generally does not cover pre-existing medical conditions or adventurers activities like skiing or rock climbing.

Some people believe that spirit travel insurance is worth the cost because it provides peace of mind while traveling. Others believe that it is not necessary because most credit cards offer some form of travel insurance. Ultimately, the decision of whether or not to purchase spirit travel insurance is up to the individual.

There is no definitive answer to this question as it depends on individual circumstances. Some people may find that spirit travel insurance is worth the cost, while others may not feel that it is necessary. Ultimately, it is up to the individual to decide whether or not they feel that the benefits of spirit travel insurance justify the cost.

Is trip insurance from the airline worth it?

Though you may pay 5 to 10 percent of your trip cost for travel insurance, travel insurance is often worth the investment for its potential to help reimburse you for hundreds of thousands of dollars of covered travel-related expenses like emergency evacuation, medical bills, and costs related to trip cancellation and interruption.

AIG Travel Guard is one of the leading travel insurance providers in the United States. They offer a variety of plans to suit the needs of any traveler, whether you’re looking for basic coverage or comprehensive protection. Their policies cover a wide range of contingencies, from trip cancellation and interruption to medical emergencies and evacuation. And with 24/7 assistance available, you can rest assured that help is just a phone call away if you need it.

What happens if Spirit cancels my flight

If Spirit Airlines cancels the flight, they must refund the price of ticket to passengers. But if you decide to voluntarily cancel your scheduled flight, you are not entitled to a refund.

Airline companies offer travel insurance for an extra fee per person. The coverage contains a bunch of fine print that explains trip cancellations are covered up to a certain amount, baggage and lost personal items up to a certain amount, and baggage delay up to a certain amount.

What travel insurance will not cover?

This is an important thing to keep in mind when traveling, as most travel insurance policies will not cover any accidents or theft that occur while you are under the influence of drugs or alcohol. Be sure to stay safe and sober while traveling to avoid any potential problems.

There are a few things to keep in mind when considering travel insurance:

– Make sure to read the fine print and understand the coverage offered

– Check to see if your existing health insurance will cover you while you’re traveling

– Consider the cost of the insurance relative to the cost of your trip

Can you add insurance to Spirit flight after booking?

If you need insurance for your flight, it’s important to purchase it at the same time that you book your tickets. Most airlines will not allow you to add insurance after the fact, so it’s important to plan ahead. Unfortunately, this means that you can’t usually add insurance if you didn’t think you need it at the time of booking.

If you’re looking for a no-frills flying experience, Southwest Airlines is a good option. However, keep in mind that you won’t get any free food or drink inflight, and the seats are a bit less comfortable than other airlines.

Does Spirit credit card cover travel insurance

If you’re looking for a credit card that offers travel insurance, the Spirit Airlines Credit Card is a great option. You’ll get trip cancellation and interruption protection for severe illness or weather-related reasons, and if you or a family member traveling with you are unexpectedly and seriously sick or injured, you’ll be covered.

If a Guest cancels a reservation within 24 hours or less from booking, for a flight that is seven or more days away, they are eligible for a full refund in the original form of payment.

Does Spirit give refunds for flights?

If you need to change or cancel your reservation, you can do so through the My Trips tab on Spirit.com. Unfortunately, we do not offer refundable fares, but this helps us keep prices low for all of our passengers.

If you’re flying within the U.S., your best bet for an on-time flight is Spirit Airlines, which boasts a 68% on-time arrival rate. However, 27% of Spirit flights are delayed and 5% are canceled, so there’s still a chance your flight could be affected.

How much is cancellation insurance for a flight

If you are planning a trip, you should expect to pay 4-10% of the total cost of the trip for travel insurance. This will vary depending on the factors such as the cost of the trip, the length of the trip, and your age.

There are a lot of great options for medical coverage when you’re traveling. We’ve compiled a list of our top picks for the best medical coverage for your next trip. GeoBlue is our top pick for the best overall medical coverage. They offer a wide range of coverage and have a great reputation. Travelex is another great option for medical coverage. They offer a variety of plans and coverage levels to fit your needs. Allianz Travel Insurance is also a great choice for medical coverage. They have a variety of plans and coverage levels to choose from. InsureMyTrip is another great option for medical coverage. They offer a wide variety of plans and coverage levels to fit your needs. World Nomads is another great choice for medical coverage. They offer a wide variety of plans and coverage levels to fit your needs. HTH Travel Insurance is also a great choice for medical coverage. They have a wide range of coverage options and a great reputation. Nationwide is another great option for medical coverage. They offer a wide range of coverage and have a great reputation.

When should you start your travel insurance?

If you’re thinking of taking out travel insurance, it’s a good idea to do it as soon as you’ve booked your holiday. This is because if you have to cancel your trip for any reason (e.g. you get injured or fall ill), you’ll be covered.

Godlin’s research shows that the top travel insurance claims are for trip cancellation, medical expenses for emergency illnesses and injuries, and reimbursement of certain trip costs if a trip is interrupted. This data is useful for understanding what types of events are most likely to occur during travel and what types of coverage may be most useful for travelers.

Final Words

There is no one definitive answer to this question as it depends on individual circumstances. However, some factors to consider when making your decision include whether you are likely to experience any medical or financial difficulties while traveling, and whether the benefits of the insurance policy are worth the cost.

Based on the research, it can be concluded that purchasing travel insurance, particularly spirit travel insurance, can be beneficial in certain situations. If a traveler is worried about potential risks while traveling, such as theft, lost luggage, or medical emergencies, then spirit travel insurance can provide some peace of mind. In the event that something does go wrong, having insurance can help to cover the costs of unexpected expenses. However, it is important to compare different policies and coverage options to make sure that the spirit travel insurance policy is the best fit for the individual traveler.

Scott Johnson

Scott Johnson is passionate about traveling. He loves exploring new cultures and places, and discovering the world around him. He believes that travel can open up new perspectives and opportunities for growth and development. Scott has visited many countries in Europe, Africa, South America, and Asia, and he continues to seek out new destinations for his adventures.

Leave a Comment Cancel reply

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Is Travel Insurance Worth It in April 2024?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does travel insurance cover?

What does travel insurance not cover, when is travel insurance not necessary, when is trip insurance worth it, where to buy travel insurance, how much does travel insurance cost, should you rely on credit card travel insurance instead, so, is travel insurance worth it.

Travel can be expensive. Insurance protects your nonrefundable vacation investment if the unexpected occurs. But is travel insurance worth it?

The answer will depend on whether your trip is refundable, where you're going, whether you'll have health coverage at your destination and how much coverage you already get from your credit card. Here are some key topics to understand when deciding if travel insurance is right for you.

Travel insurance (or trip insurance) covers a number of travel-related risks, from flight cancellations to lost bags to medical emergencies.

Accidental death insurance .

Baggage delay and lost luggage insurance .

Cancel for Any Reason insurance .

Emergency evacuation insurance .

Medical insurance .

Rental car insurance .

Trip cancellation insurance .

Trip interruption insurance .

The dollar amount of your coverage depends on the policy you bought and where and when you bought it. Most travel insurance providers offer several different policies to choose from, with higher or lower levels of coverage and higher or lower prices to match.

» Learn more: What to know before buying travel insurance

You can buy policies that cover a single trip, multiple trips or a full year. You can buy an individual policy or one that covers your entire family. There are many companies that offer policies, with Allianz and Travel Guard among the best-known. Here is a chart showing the benefits and coverage levels available on some Allianz policies.

NerdWallet recently analyzed various travel insurance policies to help you choose the plan that best aligns with your travel goals. Check out our results here: Best Travel Insurance Companies Right Now .

» Learn more: Does travel insurance cover medical expenses?

Incidents not covered by your travel insurance vary by policy and provider.

Pre-existing medical conditions are often excluded from coverage, meaning your benefits don't apply to claims related to that condition. Some policies cover pre-existing medical conditions if you meet certain criteria, for example if you purchased the policy within 14 days of paying for your trip and if you were well enough to travel when you booked your trip.

» Learn more: The best travel credit cards might surprise you

Plan on mountain-climbing or engaging in other dangerous activities on your trip? Many policies won't cover you if something goes wrong unless you buy a policy that specifically includes adventure sports. World Nomads travel insurance , for example, offers the Explorer plan, which includes coverage for cave diving, cliff jumping, heli-skiing and many other activities that are considered risky.

Other incidents excluded from a trip insurance policy may involve war, acts of terrorism and the use of alcohol, which can cause your injuries to be designated as "self-inflicted," or the use of drugs, which may be illegal.

If you want full flexibility to cancel your trip you'll need to find a policy that allows you to purchase a Cancel For Any Reason (CFAR) add-on. This additional benefit does exactly what the name implies and allows you to cancel your trip for any reason. Typically, you'll get around 75% of your prepaid nonrefundable trip expenses back, although exact timing and percentages vary by policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

Travel insurance primarily covers two aspects of your trip — your nonrefundable reservations and your medical expenses while traveling.

If all of your reservations can be canceled without penalty, then trip cancellation or trip interruption coverage isn't necessary. But even if your trip isn't 100% refundable, insurance may not be necessary. For example, a cheap flight and hotel stay may not be worth covering, though you may still want to purchase travel insurance for medical situations.

Medical coverage typically is not necessary if you have a U.S.-based health insurance policy and you're traveling within the U.S. In those cases, you probably already have adequate coverage for illness or injury.

There are a few reasons that travel insurance can be worthwhile: to protect your nonrefundable trip costs, your luggage or your health.

When should you get trip cancellation and/or trip interruption insurance?

If you would lose the money you paid for your flights, accommodations, rental car, or activities if you had to cancel or go home early, travel insurance that specifically includes trip cancellation and trip interruption is probably a good idea. If your trip is canceled or interrupted for a covered reason, this protection will cover your reservations.

For example, if you're planning to travel to a destination that could have weather-related issues, like hurricanes in the Caribbean, travel insurance may protect your noncancelable reservations. Some policies also provide emergency evacuation to escape dangerous situations. However, if you try to purchase travel insurance after the storm poses a risk, the insurance probably will not protect you.

When should you get baggage delay and/or lost luggage coverage?

Imagine if you go on a one week trip and your checked baggage is lost or delayed. While you’re waiting to get your luggage, baggage delay insurance will reimburse you for any essentials (i.e. toiletries, medicine, socks, clothing, etc.) that you may need to purchase because you don’t have your own things.

But what if the worst case scenario happens and your bag is just lost or stolen? Lost luggage insurance will reimburse you for your misplaced bag, up to a specified dollar amount.

If you’re only traveling with a carry-on, you don’t need these two types of coverage.

When should you purchase travel medical insurance?

U.S.-based health insurance policies generally offer coverage anywhere within the U.S. But if you get sick or hurt when you travel internationally, some policies like Medicare may not cover you.

Even if your health insurance covers you outside the country, doctors at your destination may not accept it. Without travel insurance, you could be stuck paying for these bills out of pocket, then seeking reimbursement from your healthcare provider.

When should you purchase CFAR?

Most travel insurance policies won’t help you get your expenses if you cancel for a “non-covered” reason, like when your plans change or you simply don’t want to go anymore. That’s when it might be good to purchase CFAR.

If you’ve booked a trip but think that you may need to cancel for a reason that’s not covered by trip cancellation, the CFAR add-on will allow you to get up to 50-75% of your nonrefundable trip costs back as long as you cancel at least 2 - 3 days before the trip starts. The add-on must also be purchased within a specific time of the initial trip deposit (usually 14 - 21 days).

What can be an example of a cancellation that’s reimbursable under CFAR? Let’s say you book a trip with your significant other but you break up a week before the trip and don’t want to go alone. Or you book a trip really far in advance but when the date nears, you realize that you don’t want to go anymore. CFAR will be helpful for you in these instances.

When should you purchase travel insurance even though you already have a credit card that provides it?

If you already have some travel insurance protections (e.g., trip cancellation, trip interruption, baggage delay) from your credit card, but you feel that the limits are insufficient, consider purchasing a comprehensive travel insurance plan or a standalone travel medical insurance policy to protect you in case of medical emergencies on your trip.

» Learn more: The majority of Americans plan to travel this year, according to recent NerdWallet study

If you booked your trip through a travel agent, you can likely purchase coverage through them. That includes online travel booking engines like Expedia. If you're taking a cruise , you're usually offered the chance to purchase coverage during the booking process. Similarly, airlines may offer you certain types of coverage when you book a flight through their website. If you have an award booking , you have travel insurance options too.

Another option: Purchase travel insurance directly through the website of a travel insurance company, like Allianz , AXA or Travel Guard .

» Learn more: Airline travel insurance versus independent travel insurance: Which is right for you?

The cost of travel insurance is based on the specifics of your trip. The best way to get a price is to request a quote through the websites of travel insurance providers. Or you can compare multiple insurers in one place with a consolidator like InsureMyTrip.com or SquareMouth .

Many travel credit cards provide certain types of coverage in case your flight is delayed or canceled, your rental car is damaged, or your luggage is lost or delayed.

Here are a few credit cards offering travel protections that could serve as an alternative to travel insurance. But even with these cards, the benefits have a lot of fine print.

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Travel accident: Up to $500,000.

• Rental car insurance: Up to $75,000.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Travel accident: Up to $1 million.

• Rental car insurance: Up to the actual cash value of the car.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

These are attractive benefits, but the coverage may not be as broad as you would get buying insurance. For example, AmEx cards only cover round-trip travel, so if you don’t have a return flight booked yet, you might want to consider additional coverage.

Secondly, only the Chase Sapphire Reserve® provides emergency medical and dental coverage. The other cards don’t.

Plus, these cards can come with steep annual fees that may be more than you would pay for a travel insurance policy. So don't sign up for a card just to cover one trip unless you've compared costs.

» Learn more: The best credit cards for travel insurance benefits

If you've paid a considerable sum for a nonrefundable vacation, travel insurance is likely a good idea. International travelers who need coverage in case they get sick or injured should also consider buying a policy. If troubles arise, you'll be glad that you're protected.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- TODAY’S TOP FARES

- WEEKEND DEALS

- SEARCH FARES FROM A CITY

- SEARCH FARES TO A CITY

- SEE CHEAPEST MONTH TO FLY

- SEARCH & COMPARE FLIGHT DEALS

- SET UP FARE PRICE ALERTS

- ALL AIRLINE DEALS

- ALASKA DEALS

- AMERICAN AIRLINE DEALS

- DELTA DEALS

- JETBLUE DEALS

- SOUTHWEST DEALS

- UNITED DEALS

- ALASKA AIRLINES

- ALLEGIANT AIR

- AMERICAN AIRLINES

- DELTA AIRLINES

- FRONTIER AIRLINES

- HAWAIIAN AIRLINES

- SOUTHWEST AIRLINES

- SPIRIT AIRLINES

- SUN COUNTRY AIRLINES

- UNITED AIRLINES

- AIRLINE BAGGAGE FEES

- AIRLINE CODES GUIDE

- SEE ALL BLOG POSTS

- RECENT FARE SALES

- TRAVEL TIPS & ADVICE

- TRAVEL GEAR

- SEE MY ALERTS

- MY ALERTS Get Money-Saving Alerts Sign Into Your Account Get Alerts By proceeding, you agree to our Privacy and Cookies Statement and Terms of Use Or Sign In

- SEARCH HOTEL DEALS BY DESTINATION

- SEARCH FAVORITE HOTEL BRANDS

- SET UP ALERTS

Your airline wants to sell you insurance -- but what's it worth?

See recent posts by George Hobica

People who never before considered travel insurance might look back on this turbulent summer as the one that pushed them over the edge. And if you’ve shopped around for an airline ticket lately, you can’t help but have noticed that somewhere in the process your airline has offered to sell you what looks to be a fairly cheap insurance policy, usually for $9, $12, $15 or a similarly affordable amount, per trip.

Should you bite? Not until you read the policy carefully, and getting a copy before you buy requires quite a bit of mouse clicking.

All airline-sold policies, such as this one sold by Northwest, have one serious flaw: they don’t cover the airline’s default. And most don’t cover pre-existing medical conditions under any circumstances.

Some may not even cover airline-caused delays in their trip interruption clauses.

And in any case, travel insurance, whether bought from an airline or online travel agency, or the insurer directly, often is less protective than it sounds.

Trip interruption, for example, is very narrowly defined. Usually, it covers only an interruption after your trip has begun, so if you’ve put down a $1000 deposit for a trip and a month before departure the airline “interrupts” your plans by announcing that it no longer serves your origin or destination cities, then you’re on your own. Same thing for trip cancellation: you can cancel your trip for a limited number of covered reasons, but if the airline cancels your route, that's not covered. Interesting loophole in one policy we saw: if a family member (say, your son) gets injured in an amateur sporting event (say, a football game) you won't be covered if you decide to cancel your trip.

Spirit Airlines, for example, sells insurance for $12 per domestic flight, which seems very reasonable. There’s one major problem however: you’re not covered if Spirit should go belly up.

Compare that with a policy bought directly from a major travel insurance company.

AIG Travel Guard's “Essential” plan costs about $24, depending on various factors, for a typical domestic trip by air, but as with Spirit’s insurance, there’s no coverage for default. For that, you’d need to upgrade to an Essential Expanded policy, and then to abide by a "14 Day Wait" clause, which means that the airline would have to default more than 14 days after the date coverage went into effect.

For full default coverage with fewer (but by no means no) loopholes, you need to buy AIG Travel Guard's more expensive standard and then add an upgrade that includes coverage not only for situations in which the airline might suddenly disappear, but also acts of terrorism and pre-existing medical conditions.

Bottom line? To be really protected, a better insurance policy covering a typical trip by air (and just the air travel portion, not hotels or a cruise) might cost more than $40. A far cry from Spirit’s $12, but look at the differences in the two policies.

Spirit's can be called, politely, minimal. There's a flat $300 for cancellation or interruption -- read on, you'll see this is absurdly low -- $500 for travel delays (doled out at amounts of up to $100 per day), a $500 reimbursement for loss of baggage or travel documents, and a $100 pay-out for baggage delay.

AIG's " My Travel Guard " policy, on the other hand, covers the entire quoted trip cost in case of cancellation or interruption, $1,000 in case of stranding for return air, $500 for unreasonable delays (maximum of $100 per day), $10,000 for medical expenses in the case of accident or sickness, $100,000 for emergency evacuation and -- how grim! -- the repatriation of remains, $500 compensation for loss of baggage, $100 for baggage delay, plus, the option to purchase a plethora of upgrades.

WHY DO I EVEN NEED ADDITIONAL INSURANCE?

Many people believe that additional coverage isn't necessary, that they already have plenty.

While Travelocity's plan is flimsy like Spirit's, you've got to give them credit for at least one thing -- addressing the matter of whether or not purchasing the coverage they sell is even necessary. Points to remember: People tend to think their credit cards include ample coverage. You may be right, but you may be wrong. Additionally, does your health insurance cover you outside of the United States? Does it include an emergency evacuation plan? One notable point at which Travelocity stumbles, though, is with its trip cancellation policy (that is, if you have to cancel for some reason.) Travelocity will refund the full cost of the trip, sure -- up to $2,000, as it points out incessantly throughout one policy document (note that it says "total trip cost" in one place and "total trip cost up to $2,000" in others. Other policies only cover up to $500 per flight domestically or $800 for international travel.

AIG's policy, detailed above, covers the entire quoted trip cost at the time of purchase. Even AirTran's otherwise fairly flimsy policy, sold via a company called Stonebridge, does not state a limit.

There are other important differences between Travelocity's policy and a typical travel insurance policy directly from the source. However, essentially you're seeing a pattern here. Like elsewhere, say, at Orbitz, insurance purchased from a third party is always going to be cheaper than if you bought directly, but the policy will always be relatively weak -- no matter which agency's name is attached to the plan that the third-party is selling. (In Travelocity's case, it's selling through BerkleyCare, a division of AON).

MEET THE RENT-A-PLAN

It's easy to find the holes in third-party coverage -- sometimes you don't even have to look through the policy document, which is nearly always readily available for your reading pleasure.

Things get a little more blurry when you're looking at the policies sold by the major carriers. These policies are typically a little more meaty than those sold by lowfare airlines and online travel agencies.

American, Continental , US Airways and United all partner with AccessAmerica, and in American's case, not only do the plans seem like they're for real, better still, they sell for as little as $16-17 per trip for an average domestic trip. American’s “Comprehensive Trip Protector” sells for 6.25% of your total ticket cost. And while it includes things like $500 for baggage delay coverage, which is along the lines of what you'd get directly from a major travel insurance company, the maximum trip cancellation/interruption protection is $3,000 per trip, and emergency medical transport to $50,000. Plus, there’s no protection from default (not that we expect American to cease flying anytime soon, so maybe it’s an irrelevant point.)

As the old saying goes: you get what you pay for.

More Stories You'll Love

Jetblue's big winter sale—ends tomorrow.

- Alaska Airlines' New Year Sale: Flights From $49

Airline Hub Guide: Which U.S. Cities Are Major Hubs and Why it Matters

- How to Consolidate Your Frequent Flyer Points in 5 Easy Steps

Trending Stories

The 8 most important travel tips for couples, 7 best wireless headphones for 2021, the best cyber monday flight deals 2021, the best black friday flight deals 2021, today's top stories.

10 Things Not to Wear on a Plane

How Not to Embarrass Yourself in the TSA Line

$99 First-Class Ticket Sale on Breeze Airways

6 Travel Predictions for 2022

- Terms of Use

- Update Preferences

- Privacy and Cookies Statement

- Cookie Policy

- Cookie Consent

a travel and style blog

15 Things Travelers Should Know Before Flying Spirit Airlines for the First Time

*in an ominous voice* It’s time.

I’ve shared my thoughts on Avelo .

I’ve shared my thoughts on Contour .

I’ve shared my thoughts on Frontier .

Today I’m sharing my thoughts on Spirit.

I first flew the budget carrier back in 2018, from Orlando to Asheville and back, and my flight more or less went off without a hitch. It helped that I’d previously flown Allegiant, and thus had some exposure to the ULCC (that’s Ultra-Low Cost Carrier ) flying experience.

Since then, I’ve flown Spirit more times than I care to admit. It doesn’t feel unfair to say the airline would be most travelers’ last choice (if money were no object, I doubt many would choose Spirit over a legacy carrier, wouldn’t you agree?), but the opportunity to save valuable travel dollars is what gets me on board, every time.

With all of this first-hand experience under my belt, plus a recent refresher thanks to a $75 fare to Boston , I thought it was high time to put together my review of Spirit Airlines.

New to flying Spirit? Here are fifteen things you need to know before flying Spirit for the first time:

1. You won’t be the only one

I’ve had enough conversations with seatmates to know that new passengers fly the airline every day. Even if you feel frustrated by the airline’s many quirks, you can find comfort in knowing you’re not alone. In casual conversations with the airline’s crew, I’ve also learned that for many, this is their first flight ever . If that’s you, I’m honored to be your guide today and help make your first adventure a breeze (so you can keep on flying to new destinations !). And if it’s not your first time flying ever? This is a good reminder to treat your fellow passengers with grace.

2. Bob and weave those extra charges

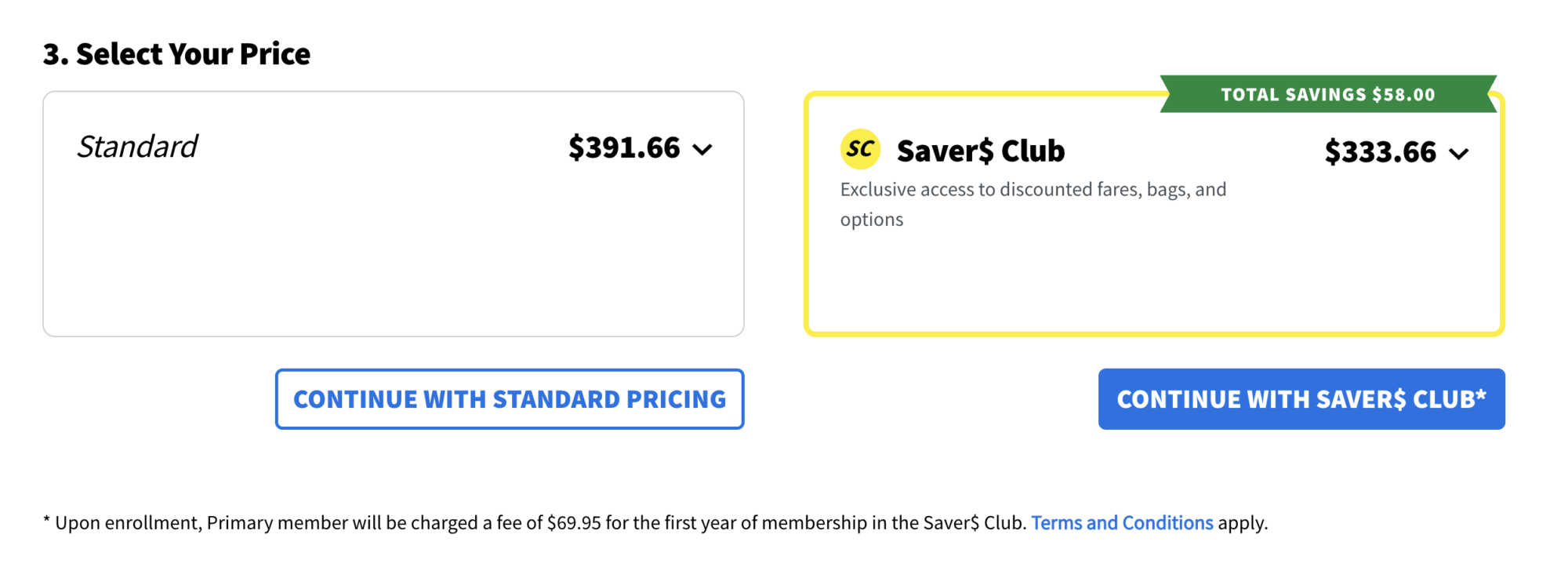

Trying to purchase tickets on Spirit’s website turns my internal “scam alert” signal on. From sneaky buttons to try to get you to enroll in the Spirit Saver$ Club (recurring annual fee: $69.95) to pop-up windows flashing with rental car deals, I find that the purchasing process is incredibly off-putting. Read the fine print carefully on every screen (believe me, there are so many screens).

3. Know these money-saving tips for bags and seats

Because you’re an informed flyer, you probably already know that the price you see for a Spirit flight is only the base fare to get you from A to B. What once were considered travel essentials (you know, things like luggage and a seat assignment) are now considered add-ons. Now, I won’t tell you how and when to spend your money – if you like traveling with multiple suitcases or have a favorite seat picked out and are willing to shell out for those items, go for it!

But for my fellow travelers who prefer to save that money to spend on other things, I have a few insider tips for saving on these categories. Baggage costs on Spirit can add up quickly (as in, doubling the price of your ticket), but all travelers are entitled to bring one personal item up to 18 x 14 x 8 inches for free. For my fellow travelers who carry a purse, you’ll need to place it inside your personal item or face a hefty fee at the gate.

My recommendation is to purchase a bag that maximizes these dimensions ( this is the one I personally use and highly recommend ), and learn to pack light for your trip. Can’t quite squeeze everything into a backpack? Consider sharing a carry-on or checked bag with your travel companion, and pay for your bag when you buy your tickets for the best price.

As for seats, the only way to guarantee that you will be seated with your party is to pay for them (Spirit’s family seating policy states, “If Guests with children aged 13 and under do not opt to pre-select seats at the time of booking, our gate agents and Flight Attendants will work to provide adjacent seats when possible.”

The when possible is critical to note here – it’s not a guarantee). However, only on rare occasions have Michael and I been assigned separate seats on a Spirit flight, typically only in the event of a plane change or cancelation (more on that in a moment). My advice for travelers who are willing to sit apart if needed? Save your money and skip the seat!

4. Is it really as cheap as it seems?

Before booking your Spirit flight, double-check that the final price of your ticket (with any add-ons) is actually cheaper than the competitor’s fare. If you’re adding bags and seats, it might not be!

5. Be prepared for tons of emails

In the days leading up to your departure, be prepared for 1-2 emails per day from Spirit advertising services for sale. From bags to rental cars to hotels to bidding on a better seat, they’ll appear in your inbox. I’ve grown so used to deleting email after email from Spirit that I’ve nearly deleted my boarding pass (whoops!).

6. Play “Check-In Chicken” ( if you dare )

Didn’t pay for seats? You can play what Michael and I call “Check-In Chicken.” For passengers who did not purchase seats, Spirit typically assigns seats from the back of the plane to the front. Starting at the 24-hour mark (when check-in opens), I periodically scope out the remaining seats on my flight to pick the perfect time to check-in. Only once enough seats in the rear of the plane disappear do I actually check-in for the flight. It’s risky on a full flight – flights can be overbooked – but I value hopping right off the plane and getting out to explore my destination quickly.

After checking in, be sure to print your boarding pass at home or download the Spirit app to access a digital version. If you need to have a customer service agent print your pass for you, it will set you back a whopping $25 each. Note : In the event you are unable to access your boarding pass this way, an agent should print one for you for free. I recommend keeping this page bookmarked just in case.

7. Be prepared to be uncomfortable

Thin, hollow seats with tiny tray tables and little room for your feet – that about captures the in-flight experience on Spirit. The airline prioritizes fitting as many passengers as possible onto each of their planes, and the result is getting to feel like a sardine for a few hours. My back is always so cranky after a ULCC flight that I’ve had to set a personal max flight time of four hours on any budget airline. To ease the discomfort, I try to get as many steps in as possible before and after my flight and add in a little stretching when I can.

8. Pack your creature comforts

If your flight is long enough, in-flight snack and beverage service will be offered on your flight – but like everything else, it’s not included (even water – it feels like it should be complimentary, but it’s not). Consider packing a meal or snack and filling up your reusable water bottle to save money and the environment.

While you’re at it, toss in your noise-canceling headphones – in my experience, there tend to be more kids on a budget flight than on a legacy carrier flight (I mean, I get it – I wouldn’t want to pay mainline carrier fares for an entire family, either!). Spirit flights in particular seem to be the noisiest, and carving out a little peace and quiet goes a long way to making the experience marginally more comfortable.

9. Pockets are your friends

In addition to helping you maximize your luggage space ( fishing vests and other multi-pocket garments are popular with budget travelers for this reason), garments with pockets are incredibly helpful in-flight, as many Spirit planes lack a seat back pocket. No one wants to have to chase down an errant AirPod midflight!

10. Flight attendants with attitude

And by that, I’m not talking about a bad attitude (though everyone has an off day now and again); I’m talking about how seemingly more often than not, Spirit flights often have a few sassy flight attendants on board. Dealing with grumpy passengers all day long can’t be any fun – flight attendants who recognize the frustrations of budget travel and flip it on its head add a little levity to the experience.

11. Like flying in a commercial

Picture this: you’re just forty-five minutes away from your destination and you’re deeply engrossed in your page-turner of an eBook when a voice comes over the intercom offering an amazing deal for passengers. Your ears perk up (snacks?? Maybe it’s free snacks?!), only to feel crushing disappointment as you realize the flight attending is advertising Spirit’s credit card offerings to an incredibly captive audience. You avoid eye contact and the waving pamphlet because you are uncomfortable and have no interest in being incentivized to sit in one of these seats again.

12. A delayed flight? That’s not a surprise…

Spirit’s annual on-time performance (OTP) record falls significantly short of the national average . Make sure to leave plenty of cushion in your itinerary in case your flight is delayed – as a general rule, flights that are scheduled for earlier in the day are more likely to be on time.

13. Flight canceled? Good luck.

Despite traveling quite frequently, I’m fortunate to have experienced very few cancelations along the way. Still, the contrast between how a legacy carrier handled a cancelation ( hotels, meals, and a hefty check – aided by strict EU regulations, of course) versus how Spirit handled a cancelation ( stranded for multiple nights with no assistance) is quite stark.

While it feels good to vent to the internet about your bad experience, I also want to add a few helpful tips should you ever find yourself with a “canceled” notification from Spirit (though I sincerely hope you never do!).

Before you even start booking flights, make sure you have a great travel credit card in your wallet. Had I not booked my trip with my Chase card , I would have been stuck with the bill for the additional nights I stayed in Raleigh after my Spirit flight was canceled (they refunded about $500 in expenses incurred). Travel insurance can also be a good help here (purchased before your trip!).

But when it comes to actually dealing with the airline itself, skip the lengthy (often hours-long) telephone hold times. Instead, head over to the brand’s official account on X (formerly known as Twitter) to get the quickest, and often least painful response. You’ll also have the benefit of getting everything in writing, just in case you need any documentation down the line.

14. They fly internationally.

Most of the ULCCs in the United States have limited international flight offerings, but Spirit has a hearty network of flights between the U.S., Latin America, and the Caribbean. I’ve only flown internationally with Spirit once (to Cartagena ), but the flying experience was about the same as flying domestically with Spirit: not great, but so much cheaper than the next airline. This leads me to…

15. Be prepared to go back on your word

After your first Spirit flight, these two things are pretty much guaranteed to happen:

- You’ll walk off the plane, shaking your head and muttering, “Never again.”

- Next time you’re booking a flight, you’ll spot a Spirit flight that’s so cheap you go back on your word.

I suppose it could always be worse (hey, at least it’s not Frontier !).

Questions for you

Have you ever flown on Spirit Airlines? What else do you think travelers should know before they book their first flight?

If you’re new to Spirit, what other questions do you have about the flying experience?

Why not fly on over to one of these related posts next?

- How to Find Cheap Flights

- 14 Things You Should Know Before You Fly Frontier Airlines for the First Time

- 13 Things You Should Know Before You Book a Flight With Avelo Airlines

- 10 Things You Need to Know Before You Fly on Contour Airlines

- 20 Questions You Should Ask a Potential Travel Partner Before You Leave Home

- How to Split Travel Costs When One Person Makes More Money

- What Happens When You Cancel a Non-refundable Trip?

- Dinner Party Survival Kit: 20 Travel-Themed Conversation Starters

- 5 Easy Things You Can Do Today to Save for Your Next Trip

- A Travel Blogger’s Review of the Solgaard Carry-On Closet

- How to Pack the Away Carry-On

- I won a trip! (Now what?)

- Checking In: Hotel Reviews

- All Travel Guides Sorted by Destination

- Exclusive Discounts + Promo Codes

- All of My Personal Item Packing Lists

28 Comments on “ 15 Things Travelers Should Know Before Flying Spirit Airlines for the First Time ”

If they should happen to “rip” the entire wheel assembly off your checked bag… GOOD luck getting reimbursed! Happened to me and they offered me $20. I sent the check to the CEO and told him apparently they needed the money more than me!

I still haven’t braved a Spirit flight, but we have flown Avelo a few times and enjoy it because the airport they fly from is 15-20 mins from our house vs 1 hour 15.

That’s good to hear about Avelo! I’ve only flown them once before, but they just launched service closer to Charlotte and I just booked my second trip. I feel like both of these airlines are fairly comparable in terms of in-flight experience and pricing, but Spirit operates many more routes overall (helpful in case of cancellation!).

You forgot to mention, Spirit, has never had a fatal accident since its inception as an airline. If you’re going to point out all the negative. Maybe you should point that out as well. How many other airlines can say that?

You have a flight that sometimes costs less than a sandwich at the airport. No reclining seats….at least the guy in front of you does not have his head in your lap! I’ve flown with spirit more than 30 times, never paid for a seat and never not sat next to my partner! Cant say the same for southwest!Get the right size bag, check one big bag between two peopleif needed in advance only $30! Newest fleet in the USA. Learn spirits rules and fly cheaply and smugly!

I agree. Plus most airlines also charge for checked bags and choosing your seats. I also found with their bag pricing policies, fewer people check a larger suitcase making decorating a lot quicker on spirit

Hey Peter, Thanks for your info. Was wondering how to check a big bag in advance. I want to travel with my golf clubs. Can you carry on a hanging bag without being charged? Thanks for your help!

Also, Spirit has upgraded services in Michigan that are not yet in other larger airports… For example, checking in your own luggage without going to the agent….. Cool!!! And timely!!

Bill, I never knew that about Spirit, but was happy to hear that. I have been flying Spirit for many, many years. To me their prices have been awesome. Yes I no longer get round trip tickets for $26.00 Detroit to Florida. But I do pay their yearly fee, which has saved me a lot of money. I usually travel with just an under the seat carry on which helps on pricing. This week I just booked a non stop trip Det. To Dallas, each one ways. Total Cost was $85.00 +6000 miles from my membership & I had to check a bag each way because I was staying longer. Family in both states has saved me a lot of money!!!

This is so true. She should get the facts before dissing SPIRIT AIRLINES. I personally travel very frequently with them. The only unfortunate thing that can sometimes make the flight not as pleasant is the ratchet clientele, because low fares draws alot of low class ratchet passengers

Look I passed out flying Spirit pissed the entire seat. Sorry to the next person who got that seat because they sure didn’t do anything to clean it up. This was my first flight on Spirit but not my first time flying. Never again! Low price or not. NEVER AGAIN. They didn’t even have anyone qualified to help me, another passenger had to step in. Thank God for this angel.

Two words regarding spirit airlines: Never Again.

If you fly on Spirit, you’ll become one.

Shitt and third class service cheap crue uneducated high school diploma holder running spirits airlines worst experience first and lost time bus service is way better

i booked a round trip flight to charlotte for a wedding. Booked on February. Wednesday May 29 arriving 5 pm. Returning June 1st leaving 5 pm. just got notice of flight changes. will arrive at 1159. How will i get my car rental and check in at hotel at that hour. Returning flight Bumped up a day May 31st at noon. WHAT?? i’ll miss part of the wedding. a 30 hr difference. A different day. I’d only be in Charlotte 1 day. ridiculous. they better refund me or find me another flight.

I flew on this airline once and never again. I fly often and would rather pay the extra charges for good to great service. The flight attendants were rude and non approachable. I would rather pay more and have a polite attendant than have a well groomed nasty make or female yo serve me. I getting ready to book a flight to Africa and going to be real picky about airlines.

My daughter, husband and myself were on a flight back from Vegas to Baltimore. My daughters son lived in an autism facility in Philadelphia at that time and before we took off she got a phone call from children’s hospital of Philadelphia telling her they found multiple tumors in her son and to get there as quickly as we could. The flight attendants, pilot did everything they could to get us a straight flight to Baltimore but unfortunately we had a layover in Atlanta and they couldn’t find a straight thru flight even with another carrier. They sat us upfront and comforted us the entire way offering snacks, drinks, etc. we did get to chop at 2 am after flying and driving all afternoon and night. These flight crews were wonderful to us and thank god my grandsons tumors were treatable with chemo and he is in remission. So there are some wonderful people who work for this airline. Also my grandson was not in hospital when we went on trip 3 days prior to this event or we never would have gone away. And one last thing Andy is home with his family and doing great.

And….. Spirit has more never planned than other around……

Spirit, like other airlines, has its Pros and cons….. If you are a light traveler you save a bundle with Spirit…. Take the batter essentials that fit the FREE Carry On and you are good to go…..

I am 60 years old. I took my first flight ever on spirit from Richmond, Virginia to Las Vegas. I had an awesome time. Everybody was friendly and polite and I’d recommend it to anybody.

Well, I am sorry to hear these tons of bad experiences, but I have to share my experience, traveling for years with Spirit, AXM – ORD round trip intntl, and domestic ORD – LGA. It is not the most comfy plane in the economy but (traveling in a group of 5) we have always sit together, baggage as expected never damaged, never delayed even with stop over. Hopefully Spirit implements the necessary actions to improve their service, as in terms of costs it is competitive, and you understand 5 travelling would not be possible with another airline.

I have several complaints about Spirit. I’ve flown them numerous times because, of course, I can’t pass up the cheap tickets. The latest was Feb 29th when I booked a 1 way to Vegas for my boyfriend and got the big seat in front for him as he has a sciatic issue and needed a wheelchair to even get to the gate. He finds out when he’s boarding that he was getting kicked out of that seat so some 20 something can have it and placed in 5 D instead. He’s a big guy anyway, was very uncomfortable the whole flight, not offered a reason or refund/ compensation and aggravated even more his sciatic nerve. Another time I flew to Sea Tac and due to weather was delayed so was offered a layover in Vegas which I took. Was given a voucher for a hotel room and when arriving at this so called hotel/ motel in a very bad part of lLas Vegas, was told that they do not honor this voucher and never had. I had to search for a hotel room after midnight that would take me. Another time , boyfriend and I flew to New Orleans and got the big seats in front, of course, paying for them. Come to find out, they had changed the flight , making it a 1 stop in Atlanta and when we disembarked and then returned to the plane to board again, found we lost our big seats to someone else who bought them. So we paid 60 bucks each for an hour of flying then had to go to the middle of the plane for the rest of the trip. This should be enough reason to stop flying on this airline.

I fly Spirit only because of the high prices from the other airlines have and I pay months in advance. I’ll pay for my seat but I can carry about 5 days in an adult size backpack. I found most hotels have an iron and if not 1 hour drycleaners work. See you in the sky or on a layover 🤙👍

Did you know that with Spirit, at times, you can buy tickets at the airport cheaper than online?

I never had any problems with them. Discomfort for a few hours so I can spend my money on an experience is better for me. They’ve always been a great airline service in my opinion. Sure these are all good points, but if you live by the “You get what you paid for” motto…then don’t fuss.